Finance II.pptx

- Количество слайдов: 10

Assignment II By Khayrullin, Porseva, Androshchuk

• • • Definition Walt Disney The MSG Netflix 21 st Century Fox References Focus on

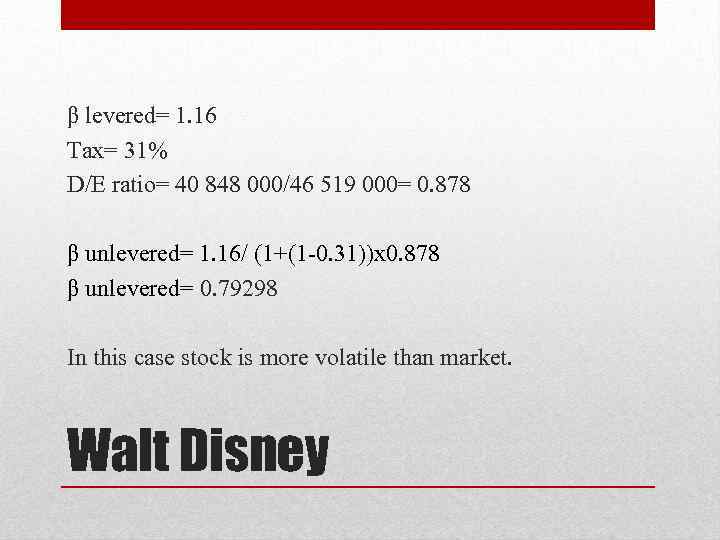

β levered= 1. 16 Tax= 31% D/E ratio= 40 848 000/46 519 000= 0. 878 β unlevered= 1. 16/ (1+(1 -0. 31))x 0. 878 β unlevered= 0. 79298 In this case stock is more volatile than market. Walt Disney

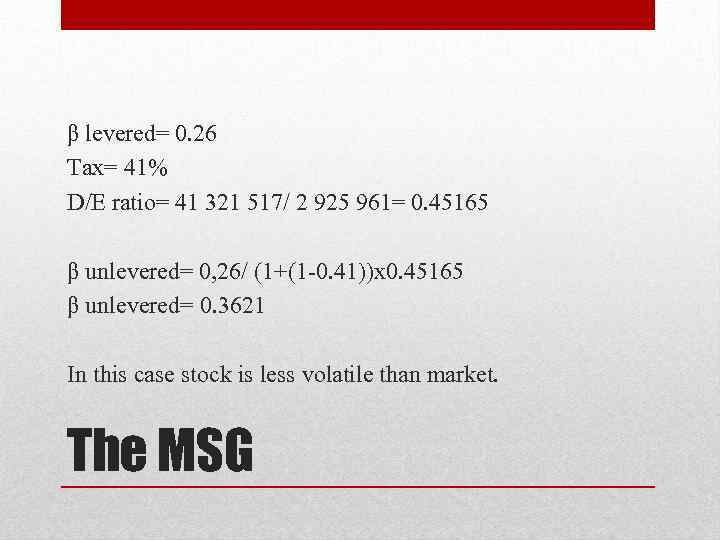

β levered= 0. 26 Tax= 41% D/E ratio= 41 321 517/ 2 925 961= 0. 45165 β unlevered= 0, 26/ (1+(1 -0. 41))x 0. 45165 β unlevered= 0. 3621 In this case stock is less volatile than market. The MSG

β levered= 1. 59 Tax= 36% D/E ratio= 1. 11 β unlevered= 1. 59/ (1+(1 -0. 36))x 1. 11 β unlevered= 0. 8734 In this case stock is less volatile than market. Netflix

β levered= 0. 94 Tax= 38% D/E ratio= 1. 244 β unlevered= 0. 94/ (1+(1 -0. 38))*1. 244 β unlevered=0. 4664 In this case stock is less volatile than market. st Century Fox 21

• Disney= 0. 79 • MSG= 0. 36 • Netflix= 0. 87 • Fox= 0. 47 The Beta is a quantitative measure of the volatility of a given stock relative to the volatility of the overall market. A score greater than 1 means the stock is more volatile than the market; lower than one means less volatile. Comparison

• All companies have Beta is less than one and greater than zero, it means the share price will also move with the market, however the share price will be less risky and unstable. • All companies are big. According to the Beta, the least risk are to invest to the MSG and Fox (0. 36 and 0. 48 correspondently). Higher risk is to Disney and Netflix (0, 79 and 0, 87), but it’s still good for investing. Inference

• Disney Betas • Disney Tax • Disney D/E • MSG Betas • MSG Tax References

• Netflx Betas • Netflix Tax • Netflix D/E • Fox Tax • Fox Betas • Fox D/E • Definition References

Finance II.pptx