Team_5.pptx

- Количество слайдов: 7

Asset pricing on emerging markets Igor Chalov Igor Arshavskiy Elena Vasilyeva Kseniya Dzyubenko Evgeniya Gayntseva TEAM 5 2012

Asset pricing on emerging markets Igor Chalov Igor Arshavskiy Elena Vasilyeva Kseniya Dzyubenko Evgeniya Gayntseva TEAM 5 2012

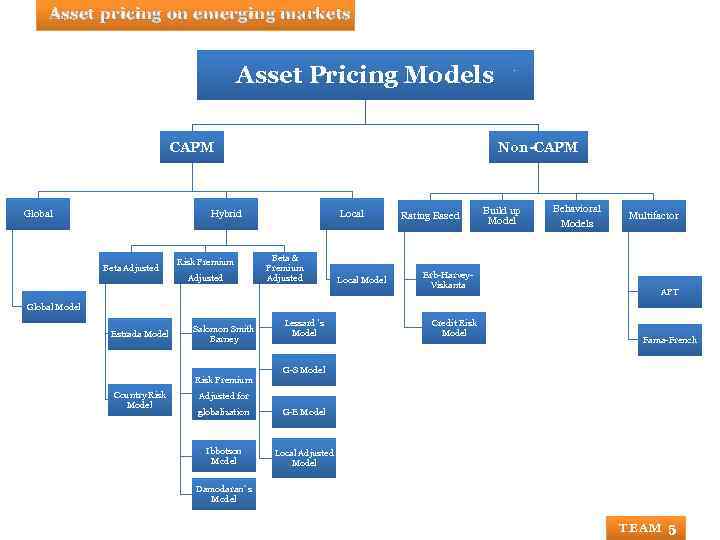

Asset pricing on emerging markets Asset Pricing Models CAPM Global Non-CAPM Hybrid Beta Adjusted Risk Premium Adjusted Local Beta & Premium Adjusted Local Model Rating Based Erb-Harvey. Viskanta Build up Model Behavioral Models Multifactor APT Global Model Estrada Model Salomon Smith Barney Risk Premium Country Risk Model Lessard´s Model Credit Risk Model Fama-French G-S Model Adjusted for globalization G-E Model Ibbotson Model Local Adjusted Model Damodaran`s Model TEAM 5

Asset pricing on emerging markets Asset Pricing Models CAPM Global Non-CAPM Hybrid Beta Adjusted Risk Premium Adjusted Local Beta & Premium Adjusted Local Model Rating Based Erb-Harvey. Viskanta Build up Model Behavioral Models Multifactor APT Global Model Estrada Model Salomon Smith Barney Risk Premium Country Risk Model Lessard´s Model Credit Risk Model Fama-French G-S Model Adjusted for globalization G-E Model Ibbotson Model Local Adjusted Model Damodaran`s Model TEAM 5

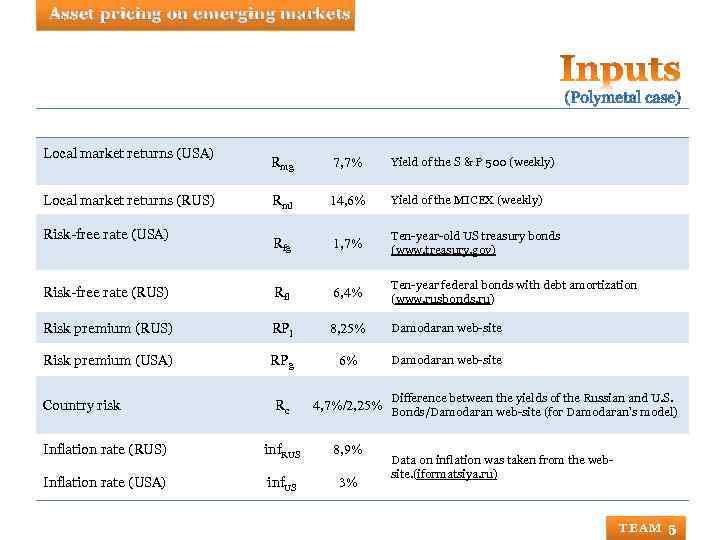

Asset pricing on emerging markets Local market returns (USA) Rmg 7, 7% Yield of the S & P 500 (weekly) Rml 14, 6% Yield of the MICEX (weekly) Rfg 1, 7% Ten-year-old US treasury bonds (www. treasury. gov) Risk-free rate (RUS) Rfl 6, 4% Ten-year federal bonds with debt amortization (www. rusbonds. ru) Risk premium (RUS) RPl 8, 25% Damodaran web-site Risk premium (USA) RPg 6% Damodaran web-site Local market returns (RUS) Risk-free rate (USA) Country risk Rc Difference between the yields of the Russian and U. S. 4, 7%/2, 25% Bonds/Damodaran web-site (for Damodaran’s model) Inflation rate (RUS) inf. RUS 8, 9% Inflation rate (USA) inf. US 3% Data on inflation was taken from the website. (iformatsiya. ru) TEAM 5

Asset pricing on emerging markets Local market returns (USA) Rmg 7, 7% Yield of the S & P 500 (weekly) Rml 14, 6% Yield of the MICEX (weekly) Rfg 1, 7% Ten-year-old US treasury bonds (www. treasury. gov) Risk-free rate (RUS) Rfl 6, 4% Ten-year federal bonds with debt amortization (www. rusbonds. ru) Risk premium (RUS) RPl 8, 25% Damodaran web-site Risk premium (USA) RPg 6% Damodaran web-site Local market returns (RUS) Risk-free rate (USA) Country risk Rc Difference between the yields of the Russian and U. S. 4, 7%/2, 25% Bonds/Damodaran web-site (for Damodaran’s model) Inflation rate (RUS) inf. RUS 8, 9% Inflation rate (USA) inf. US 3% Data on inflation was taken from the website. (iformatsiya. ru) TEAM 5

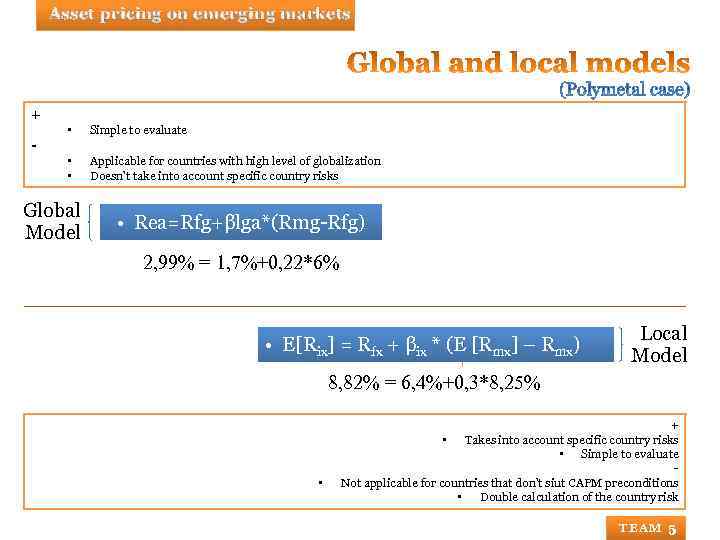

Asset pricing on emerging markets + • Simple to evaluate • • Applicable for countries with high level of globalization Doesn’t take into account specific country risks - Global Model • Rea=Rfg+βlga*(Rmg-Rfg) 2, 99% = 1, 7%+0, 22*6% • E[Rix] = Rfx + βix * (E [Rmx] – Rmx) Local Model 8, 82% = 6, 4%+0, 3*8, 25% + Takes into account specific country risks • Simple to evaluate Not applicable for countries that don’t siut CAPM preconditions • Double calculation of the country risk • • TEAM 5

Asset pricing on emerging markets + • Simple to evaluate • • Applicable for countries with high level of globalization Doesn’t take into account specific country risks - Global Model • Rea=Rfg+βlga*(Rmg-Rfg) 2, 99% = 1, 7%+0, 22*6% • E[Rix] = Rfx + βix * (E [Rmx] – Rmx) Local Model 8, 82% = 6, 4%+0, 3*8, 25% + Takes into account specific country risks • Simple to evaluate Not applicable for countries that don’t siut CAPM preconditions • Double calculation of the country risk • • TEAM 5

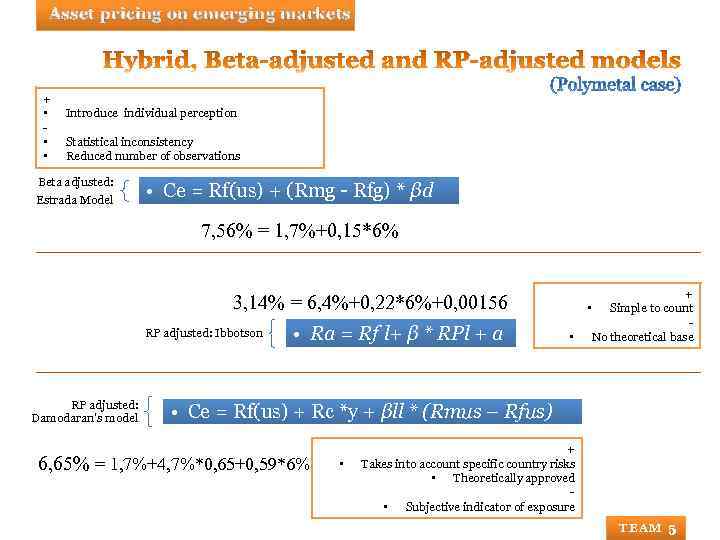

Asset pricing on emerging markets + • • • Introduce individual perception Statistical inconsistency Reduced number of observations Beta adjusted: Estrada Model • Ce = Rf(us) + (Rmg - Rfg) * βd 7, 56% = 1, 7%+0, 15*6% 3, 14% = 6, 4%+0, 22*6%+0, 00156 RP adjusted: Ibbotson RP adjusted: Damodaran's model • Ra = Rf l+ β * RPl + a • + • Simple to count No theoretical base • Ce = Rf(us) + Rc *y + βll * (Rmus – Rfus) 6, 65% = 1, 7%+4, 7%*0, 65+0, 59*6% • + Takes into account specific country risks • Theoretically approved • Subjective indicator of exposure TEAM 5

Asset pricing on emerging markets + • • • Introduce individual perception Statistical inconsistency Reduced number of observations Beta adjusted: Estrada Model • Ce = Rf(us) + (Rmg - Rfg) * βd 7, 56% = 1, 7%+0, 15*6% 3, 14% = 6, 4%+0, 22*6%+0, 00156 RP adjusted: Ibbotson RP adjusted: Damodaran's model • Ra = Rf l+ β * RPl + a • + • Simple to count No theoretical base • Ce = Rf(us) + Rc *y + βll * (Rmus – Rfus) 6, 65% = 1, 7%+4, 7%*0, 65+0, 59*6% • + Takes into account specific country risks • Theoretically approved • Subjective indicator of exposure TEAM 5

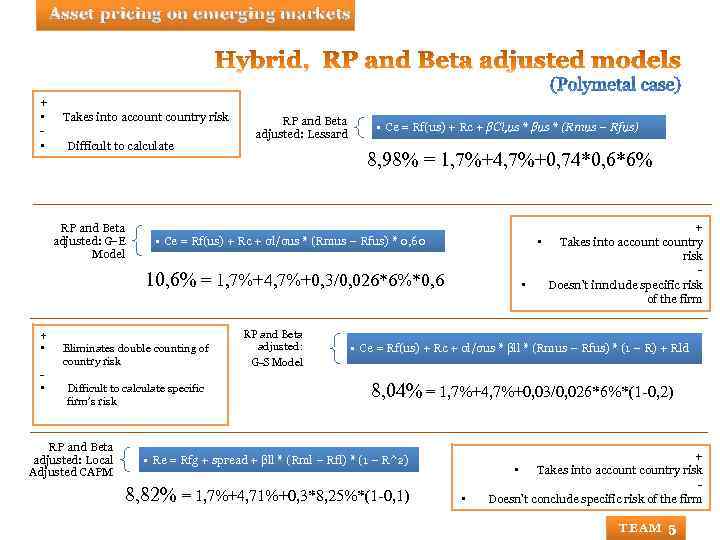

Asset pricing on emerging markets + • • Takes into accountry risk Difficult to calculate RP and Beta adjusted: G-E Model RP and Beta adjusted: Lessard • Ce = Rf(us) + Rc + βCl, us * βus * (Rmus – Rfus) 8, 98% = 1, 7%+4, 7%+0, 74*0, 6*6% + • Takes into accountry risk • Doesn’t innclude specific risk of the firm • Ce = Rf(us) + Rc + σl/σus * (Rmus – Rfus) * 0, 60 10, 6% = 1, 7%+4, 7%+0, 3/0, 026*6%*0, 6 + • • Eliminates double counting of country risk Difficult to calculate specific firm’s risk RP and Beta adjusted: Local Adjusted CAPM RP and Beta adjusted: G-S Model • Ce = Rf(us) + Rc + σl/σus * βll * (Rmus – Rfus) * (1 – R) + Rld 8, 04% = 1, 7%+4, 7%+0, 03/0, 026*6%*(1 -0, 2) • Re = Rfg + spread + βll * (Rml – Rfl) * (1 – R^2) 8, 82% = 1, 7%+4, 71%+0, 3*8, 25%*(1 -0, 1) • + • Takes into accountry risk Doesn’t conclude specific risk of the firm TEAM 5

Asset pricing on emerging markets + • • Takes into accountry risk Difficult to calculate RP and Beta adjusted: G-E Model RP and Beta adjusted: Lessard • Ce = Rf(us) + Rc + βCl, us * βus * (Rmus – Rfus) 8, 98% = 1, 7%+4, 7%+0, 74*0, 6*6% + • Takes into accountry risk • Doesn’t innclude specific risk of the firm • Ce = Rf(us) + Rc + σl/σus * (Rmus – Rfus) * 0, 60 10, 6% = 1, 7%+4, 7%+0, 3/0, 026*6%*0, 6 + • • Eliminates double counting of country risk Difficult to calculate specific firm’s risk RP and Beta adjusted: Local Adjusted CAPM RP and Beta adjusted: G-S Model • Ce = Rf(us) + Rc + σl/σus * βll * (Rmus – Rfus) * (1 – R) + Rld 8, 04% = 1, 7%+4, 7%+0, 03/0, 026*6%*(1 -0, 2) • Re = Rfg + spread + βll * (Rml – Rfl) * (1 – R^2) 8, 82% = 1, 7%+4, 71%+0, 3*8, 25%*(1 -0, 1) • + • Takes into accountry risk Doesn’t conclude specific risk of the firm TEAM 5

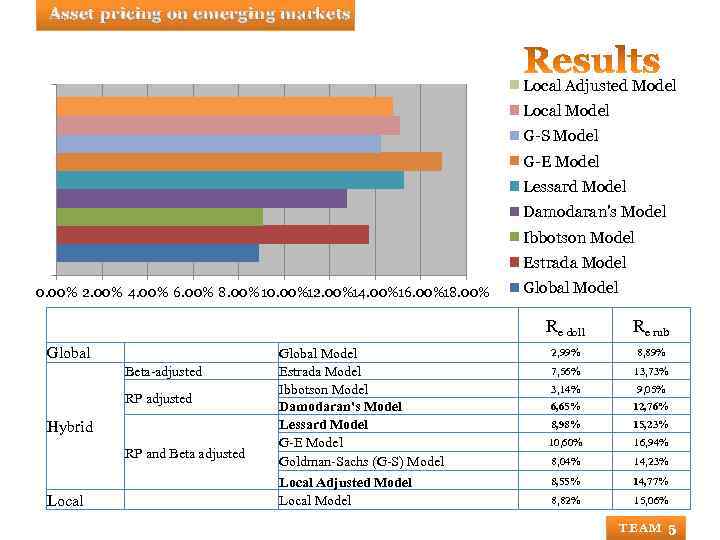

Asset pricing on emerging markets Local Adjusted Model Local Model G-S Model G-E Model Lessard Model Damodaran's Model Ibbotson Model Estrada Model 0. 00% 2. 00% 4. 00% 6. 00% 8. 00% 10. 00%12. 00%14. 00%16. 00%18. 00% Global Model Re doll Global Beta-adjusted RP adjusted Hybrid RP and Beta adjusted Local Global Model Estrada Model Ibbotson Model Damodaran's Model Lessard Model G-E Model Goldman-Sachs (G-S) Model Local Adjusted Model Local Model Re rub 2, 99% 8, 89% 7, 56% 13, 73% 3, 14% 9, 05% 6, 65% 12, 76% 8, 98% 15, 23% 10, 60% 16, 94% 8, 04% 14, 23% 8, 55% 14, 77% 8, 82% 15, 06% TEAM 5

Asset pricing on emerging markets Local Adjusted Model Local Model G-S Model G-E Model Lessard Model Damodaran's Model Ibbotson Model Estrada Model 0. 00% 2. 00% 4. 00% 6. 00% 8. 00% 10. 00%12. 00%14. 00%16. 00%18. 00% Global Model Re doll Global Beta-adjusted RP adjusted Hybrid RP and Beta adjusted Local Global Model Estrada Model Ibbotson Model Damodaran's Model Lessard Model G-E Model Goldman-Sachs (G-S) Model Local Adjusted Model Local Model Re rub 2, 99% 8, 89% 7, 56% 13, 73% 3, 14% 9, 05% 6, 65% 12, 76% 8, 98% 15, 23% 10, 60% 16, 94% 8, 04% 14, 23% 8, 55% 14, 77% 8, 82% 15, 06% TEAM 5