22473011e88229d782789cc18e161eea.ppt

- Количество слайдов: 43

Asset Management is not about presenting problems. It is about solving them. – Penny Burns How to Implement Asset Management Plans “Buildings” Aligning Services, Assets and Financial Resources

Agenda • • • Context - The Sustainable Foundation Asset Management Plans – How to! Focus – Buildings

Canadian Landscape • Feds & Provinces • Funding programs require evidence of AM progress & plans • Ontario legislation = a compliance exercise? • General public expectations = more significant role: • Customer levels of service, Canadian Infra Report card • Build upon existing AM efforts: • Infra. Guide, IIMM/NAMS, PAS 55, ISO 55000. • PSAB: • PS 3150, SORP #3 – Assessment of TCAs, • Measuring Financial Performance in Public Sector Financial Statements ? ? ? • CNAM, AMBC/GFOABC, AM Alberta& Saskatchewan, OCSI (Ontario) & CERIU (Quebec) • FCM/UBCM – looking at developing a National AM Program

The Sustainable Foundation In the beginning 1. Cost = Green field development vs Brown field development 2. Three/four year mandates vs 100 year asset life cycles 3. Raw lands sales are New Assets built by finite and not a sustainable practice developers then given to municipalities Current state $170 Billion Infrastructure gap and growing

Current State Demand for Services – growing & costing more Infrastructure - Aging Funding - Constrained

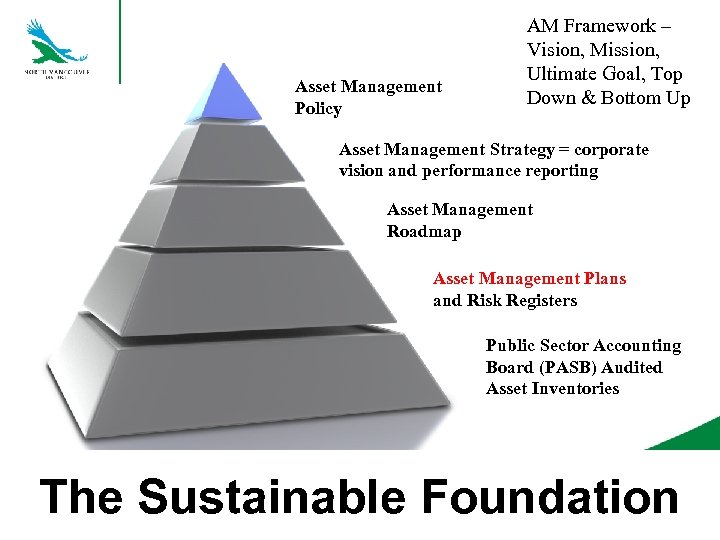

Asset Management Policy AM Framework – Vision, Mission, Ultimate Goal, Top Down & Bottom Up Asset Management Strategy = corporate vision and performance reporting Asset Management Roadmap Asset Management Plans and Risk Registers Public Sector Accounting Board (PASB) Audited Asset Inventories The Sustainable Foundation

What = ISO 55000 Series How = Financial Sustainability Indicators (LGASA) and Long Term Financial Planning Best Practices (GFOA) How = National Asset Management Strategy (NAMS) or whatever you use How = International Infrastructure Management Manual (IIMM) How = Public Sector Accounting Board (PASB) Audited Asset Inventories The Sustainable Foundation

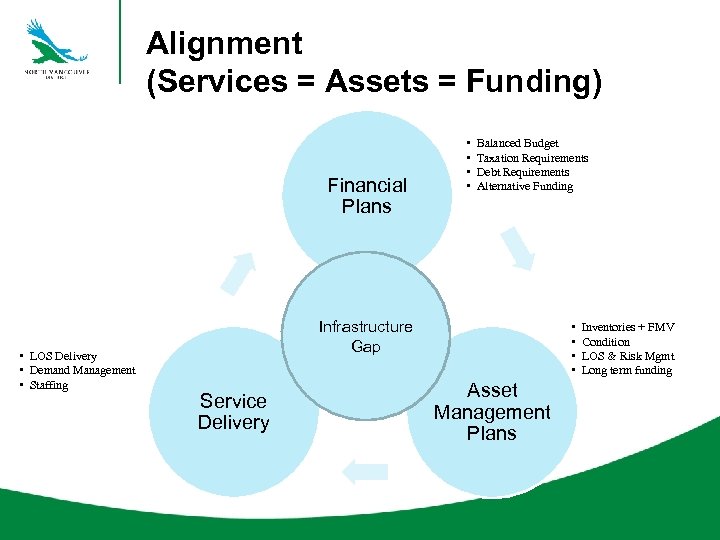

Alignment (Services = Assets = Funding) Financial Plans • • Balanced Budget Taxation Requirements Debt Requirements Alternative Funding Sustainable • LOS Delivery • Demand Management • Staffing Infrastructure Levels of Gap • • Service Delivery Asset Management Plans Inventories + FMV Condition LOS & Risk Mgmt Long term funding

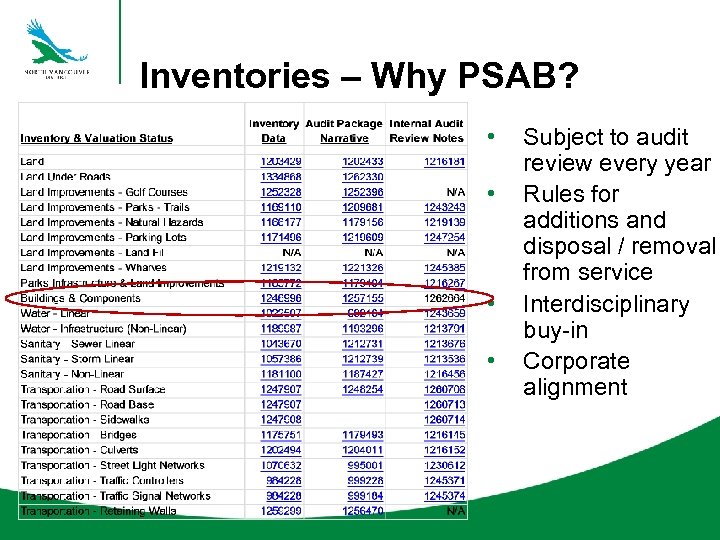

Inventories – Why PSAB? • • Subject to audit review every year Rules for additions and disposal / removal from service Interdisciplinary buy-in Corporate alignment

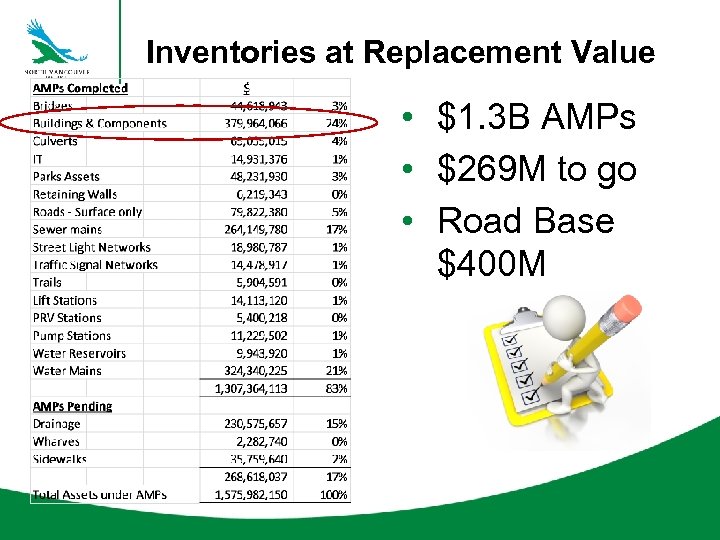

Inventories at Replacement Value • $1. 3 B AMPs • $269 M to go • Road Base $400 M

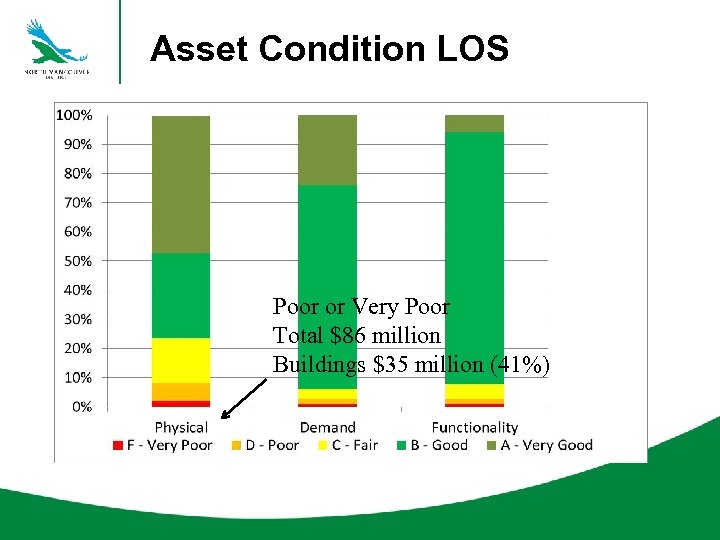

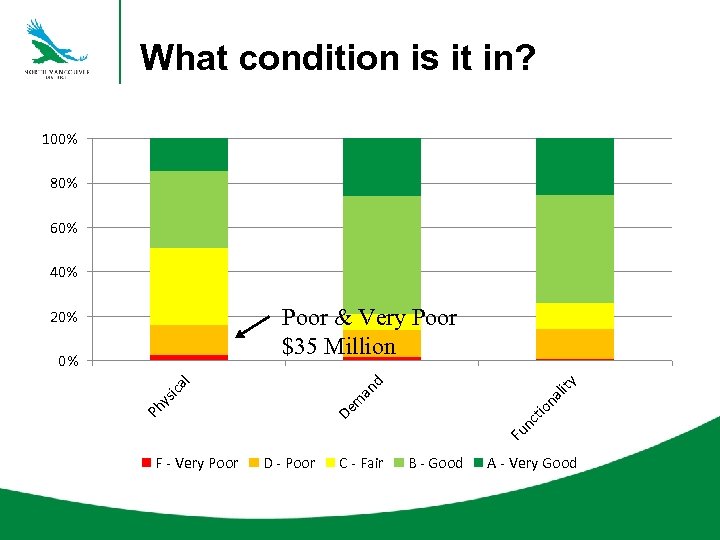

Asset Condition LOS Poor or Very Poor Total $86 million Buildings $35 million (41%)

Buildings Asset Management Plan • • Executive Summary! Stakeholder & Benefits What is the Asset? What do We Own? What is it Worth? What Need to Be Done and When? How Much will it Cost? What is Next?

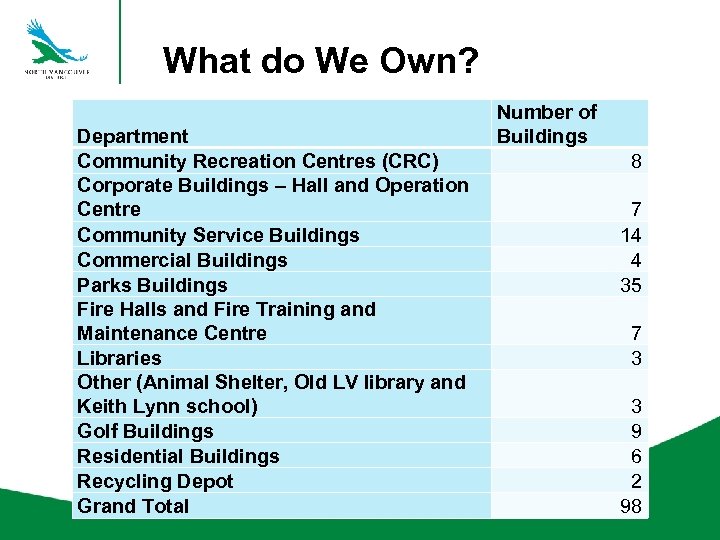

Executive Summary • • High level description of the assets • 98 of buildings • Like-for-Like replacement value = $380 M Describe Current State • Portfolio = physical condition • Profile criticality, risk, funding/financial resource gaps • Life cycle cost needs for a minimum ten years • State what the AMP will do and will not do to address • Next Steps (Don’t expect most to get past the Executive Summary)

Stakeholders and Benefits • Many people are affected by standards and performance: • Identify stakeholders • Tell them what they will get from this AMP = benefits

What is the Asset? • Describe in some depth: • The assets and components (if any) • Explain physical life versus economic life (if relevant) • What is needed for success • What is in and out of scope

Buildings and Components • • Breadth and depth of the asset portfolio Purpose: “To accommodate the statutory based activities for the District as well as to support cultural, economic, and community development activities which, while not part of the District’s core business, have historically been carried out by the District. ” • Describe major components • What is in scope and out of scope

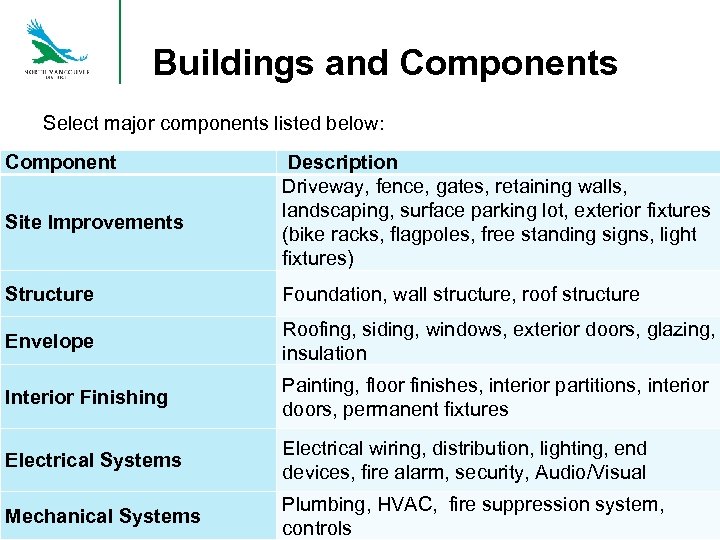

Buildings and Components Select major components listed below: Component Site Improvements Description Driveway, fence, gates, retaining walls, landscaping, surface parking lot, exterior fixtures (bike racks, flagpoles, free standing signs, light fixtures) Structure Foundation, wall structure, roof structure Envelope Roofing, siding, windows, exterior doors, glazing, insulation Interior Finishing Painting, floor finishes, interior partitions, interior doors, permanent fixtures Electrical Systems Electrical wiring, distribution, lighting, end devices, fire alarm, security, Audio/Visual Mechanical Systems Plumbing, HVAC, fire suppression system, controls

What do We Own? Department Community Recreation Centres (CRC) Corporate Buildings – Hall and Operation Centre Community Service Buildings Commercial Buildings Parks Buildings Fire Halls and Fire Training and Maintenance Centre Libraries Other (Animal Shelter, Old LV library and Keith Lynn school) Golf Buildings Residential Buildings Recycling Depot Grand Total Number of Buildings 8 7 14 4 35 7 3 3 9 6 2 98

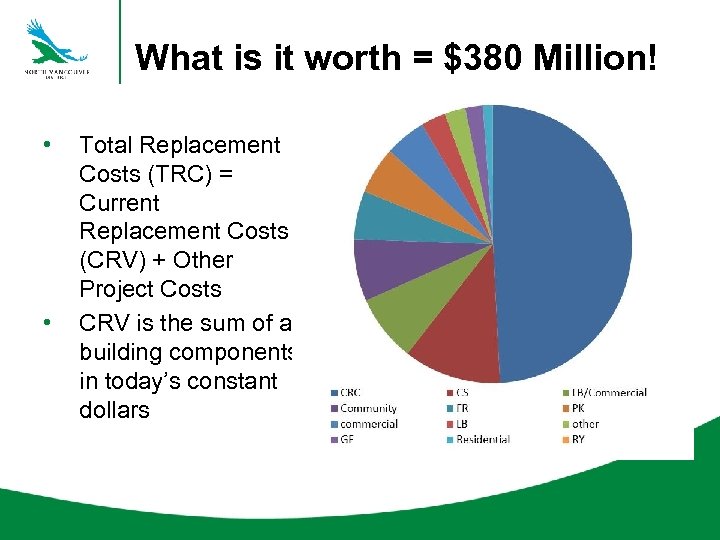

What is it worth = $380 Million! • • Total Replacement Costs (TRC) = Current Replacement Costs (CRV) + Other Project Costs CRV is the sum of all building components in today’s constant dollars

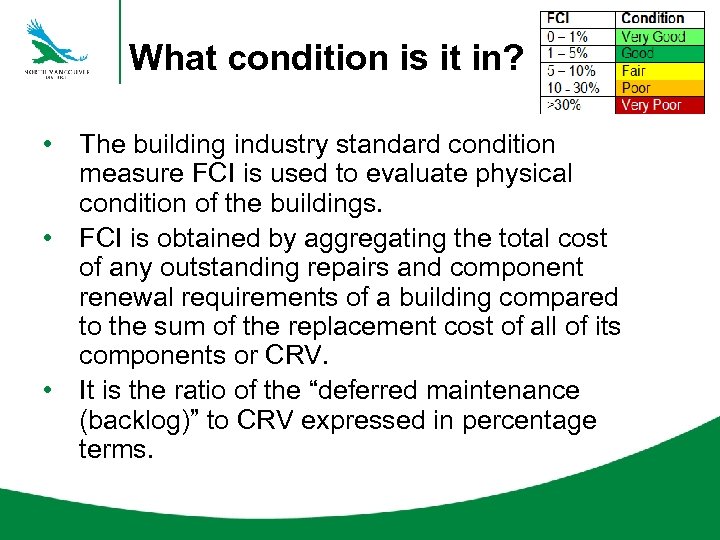

What condition is it in? • The building industry standard condition measure FCI is used to evaluate physical condition of the buildings. • FCI is obtained by aggregating the total cost of any outstanding repairs and component renewal requirements of a building compared to the sum of the replacement cost of all of its components or CRV. • It is the ratio of the “deferred maintenance (backlog)” to CRV expressed in percentage terms.

What condition is it in? 100% 80% 60% 40% y na lit tio nc Fu Ph De m an ys ica l 0% d Poor & Very Poor $35 Million 20% F - Very Poor D - Poor C - Fair B - Good A - Very Good

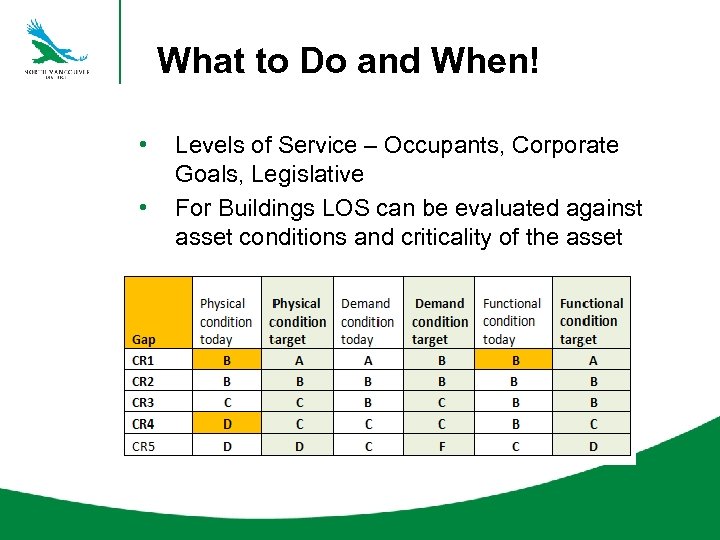

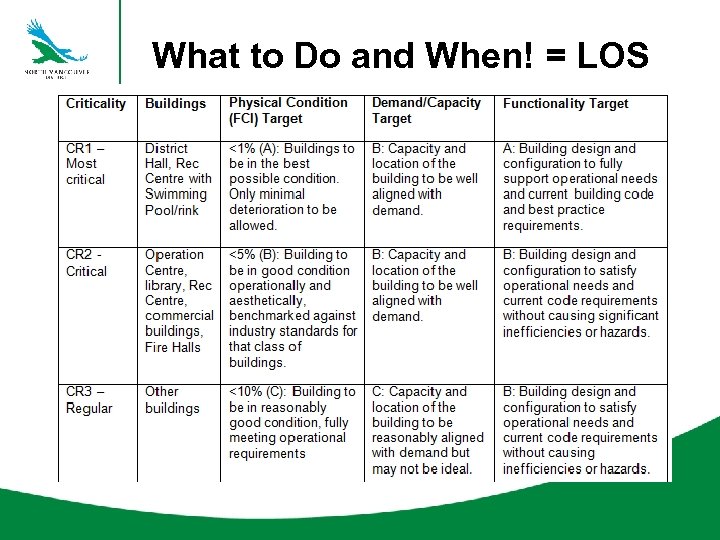

What to Do and When! • • Levels of Service – Occupants, Corporate Goals, Legislative For Buildings LOS can be evaluated against asset conditions and criticality of the asset

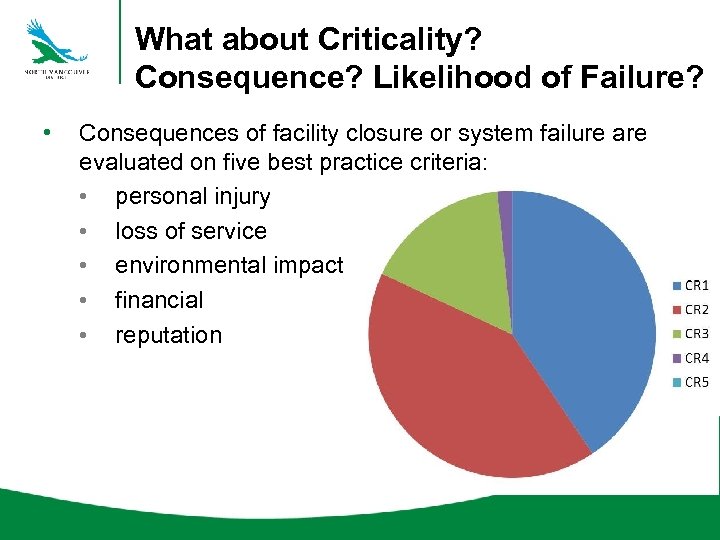

What about Criticality? Consequence? Likelihood of Failure? • Consequences of facility closure or system failure are evaluated on five best practice criteria: • personal injury • loss of service • environmental impact • financial • reputation

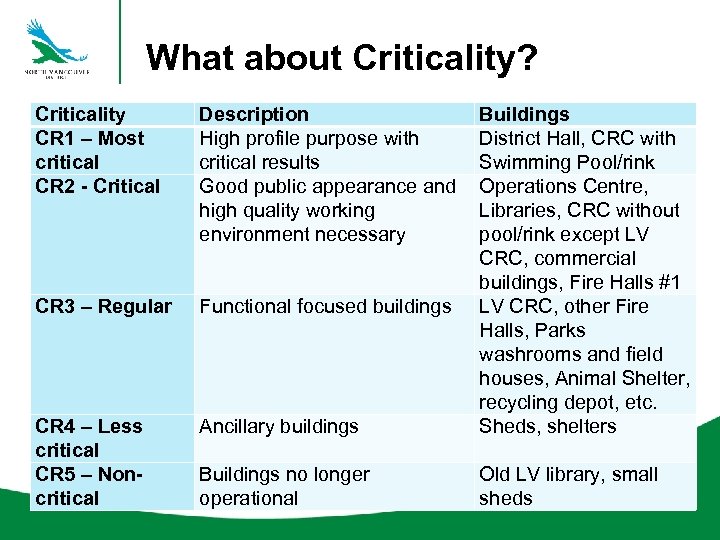

What about Criticality? Criticality CR 1 – Most critical CR 2 - Critical Description High profile purpose with critical results Good public appearance and high quality working environment necessary CR 3 – Regular Functional focused buildings CR 4 – Less critical CR 5 – Noncritical Ancillary buildings Buildings District Hall, CRC with Swimming Pool/rink Operations Centre, Libraries, CRC without pool/rink except LV CRC, commercial buildings, Fire Halls #1 LV CRC, other Fire Halls, Parks washrooms and field houses, Animal Shelter, recycling depot, etc. Sheds, shelters Buildings no longer operational Old LV library, small sheds

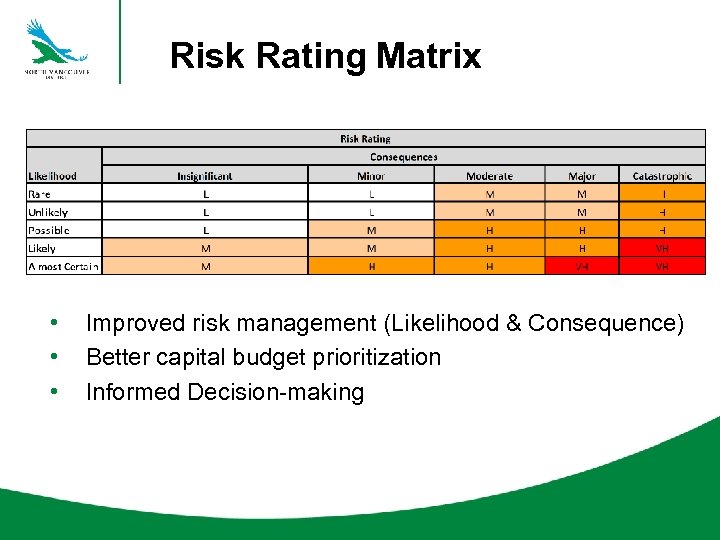

Risk Rating Matrix • • • Improved risk management (Likelihood & Consequence) Better capital budget prioritization Informed Decision-making

Risk Registers !!!

What to Do and When! = LOS

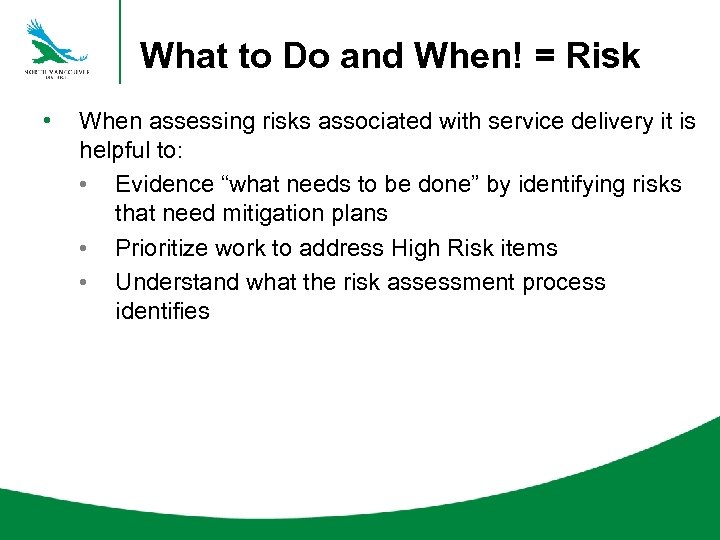

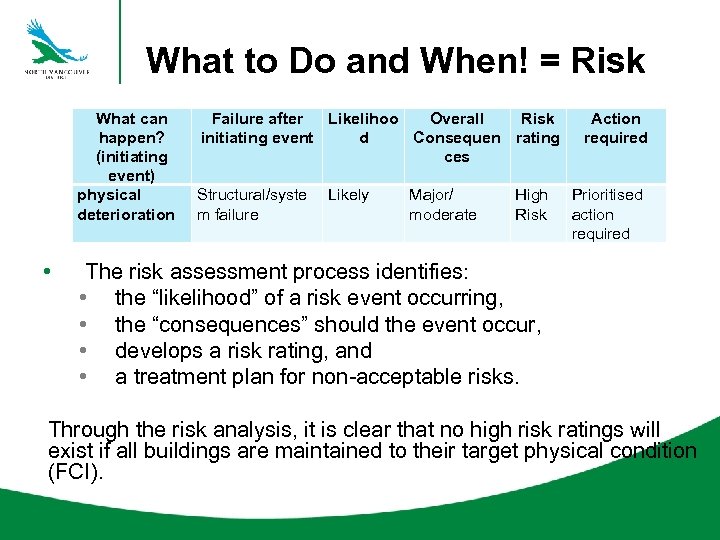

What to Do and When! = Risk • When assessing risks associated with service delivery it is helpful to: • Evidence “what needs to be done” by identifying risks that need mitigation plans • Prioritize work to address High Risk items • Understand what the risk assessment process identifies

What to Do and When! = Risk What can happen? (initiating event) physical deterioration • Failure after Likelihoo Overall Risk initiating event d Consequen rating ces Structural/syste m failure Likely Major/ moderate High Risk Action required Prioritised action required The risk assessment process identifies: • the “likelihood” of a risk event occurring, • the “consequences” should the event occur, • develops a risk rating, and • a treatment plan for non-acceptable risks. Through the risk analysis, it is clear that no high risk ratings will exist if all buildings are maintained to their target physical condition (FCI).

What to Do and When! = Life Cycle Management The underlying philosophy of life cycle management is to maintain the defined level of service at the lowest possible cost over the asset’s life. The lowest life cycle cost is achieved by managing the assets with the right strategies at the right time Accountants = Cradle to Grave Engineering/Ops = Construction to Demolition

What to Do and When! = Life Cycle Management • Acquisition, Replacement (Construction) = business case A business case for adding a building should be required no matter how the building is to be acquired, since the on-going operation and maintenance costs, over the lifecycle of the building alone averages 80% of total costs while construct a new building averages 20%. • Contributed Assets = require attention re: operating and maintenance costs.

What to Do and When! = Life Cycle Management • Operation, maintenance and alteration costs: • are incurred in relatively small annual amounts and over a long period of time. • have historically attracted far less attention from the organisation and the public. • In fiscally-constrained environments, such expenditures risk being driven lower (efficient without being effective) • If such decisions continue over long period of time, assets deteriorate and manifest as infrastructure gaps.

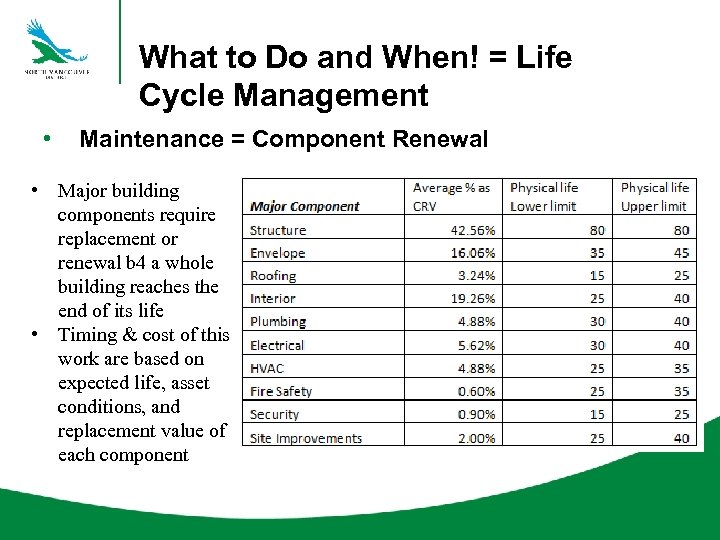

What to Do and When! = Life Cycle Management • Maintenance = Component Renewal • Major building components require replacement or renewal b 4 a whole building reaches the end of its life • Timing & cost of this work are based on expected life, asset conditions, and replacement value of each component

How Much will it Cost? Two key indicators for service delivery sustainability: 1. Can we afford annual lifecycle costs? 2. How much cash required to pay for them? • Project expenditures outlays over next 10 years • $16 Million PA or In total, the next 10 year projected outlays are $206 million with $149 million in capital, $57 million in operating

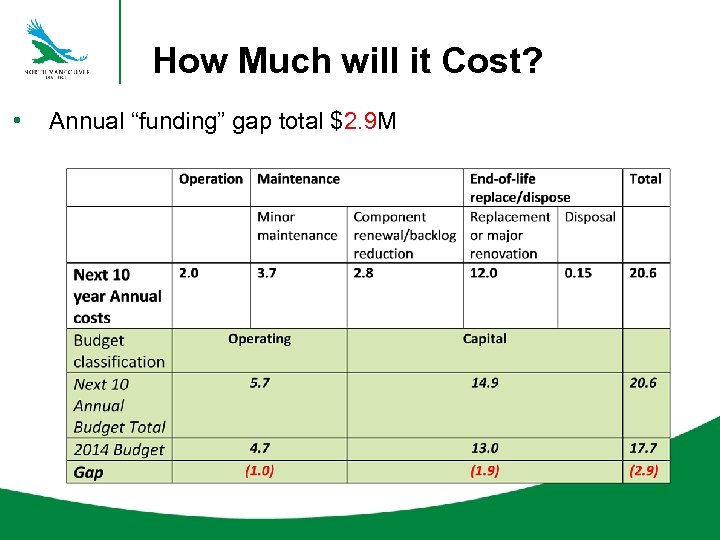

How Much will it Cost? • Annual “funding” gap total $2. 9 M

What is Next? • • • Integration with Long Term Financial Plan Confirm Levels of Service for each building Update all data for 2015 AMP

Long Term Financial Plans • • How can you have a robust long term financial plan without good asset management plans? LTFP block funds the “built environment” 80% • High risk gaps are addressed by informed decisions using AMP

Turning the Corner… What Does It Take? • • Developing champions at all levels • Belief that we can continuously improve • Acknowledge the Limiting Forces of Success • Collective learning capabilities that emphasize “measuring to learn” • (Senge) Change management competence Group Trust & Interdisciplinary team work

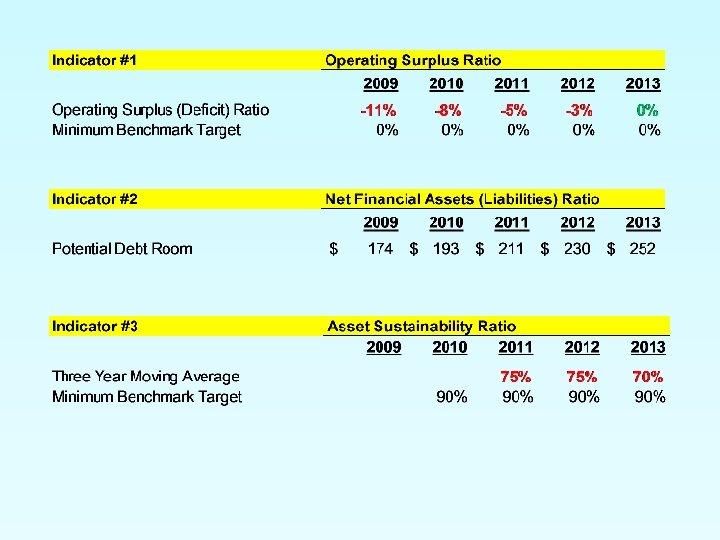

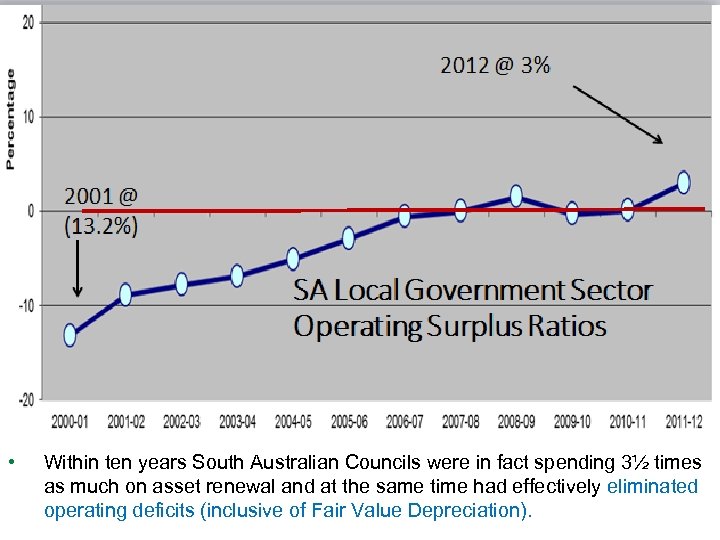

Sustainability Measures “Fair Value” Financial Performance • Financial Position • Asset Performance • 0% to 15% Operating surplus ratio (inclusive of Fair Value Depreciation) = sufficiently funded to sustain built environment (100%) Maximum Net financial liabilities ratio (the significance of net amount owed compares to revenue) = okay to borrow strategically 90% to 110% Asset sustainability funding ratio/Asset renewal funding ratio (the extent to which assets are being replaced over the required funding in Asset Management Plans).

SA Local Government Sector Financial Indicators Report 2013 • Within ten years South Australian Councils were in fact spending 3½ times as much on asset renewal and at the same time had effectively eliminated operating deficits (inclusive of Fair Value Depreciation).

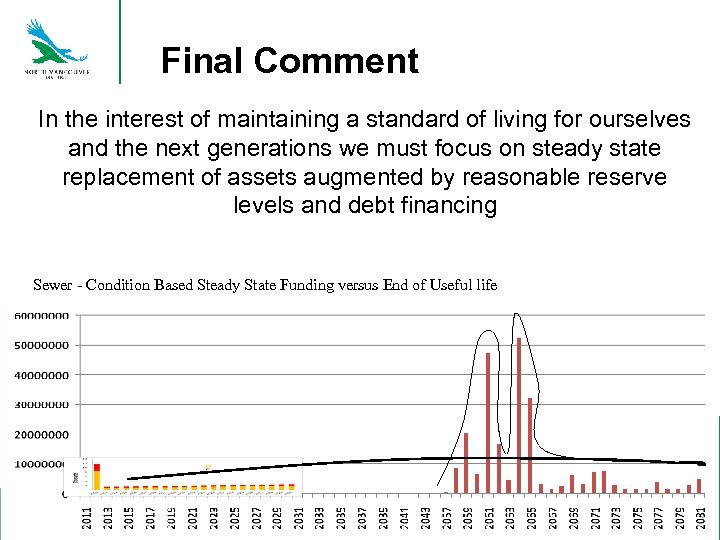

Final Comment In the interest of maintaining a standard of living for ourselves and the next generations we must focus on steady state replacement of assets augmented by reasonable reserve levels and debt financing Sewer - Condition Based Steady State Funding versus End of Useful life

22473011e88229d782789cc18e161eea.ppt