5494a78ee3e95e984ce363f8b5feb620.ppt

- Количество слайдов: 59

Assessment, Re-assessment & Appeal in cases of Bogus LTCG/STCG; Client Code Modifications and Cash Trail

Penny Stocks – Old Decisions The oldest decision – From Mumbai Tribunal ØMukesh R. Marolia vs. ACIT [2006] 6 SOT 247 (Mum) Finding The sequence of the events and ultimate realisation is quite amazing. That itself is a provocation for the Assessing officer to jump into a conclusion that the transactions were bogus. But, whatever it may be, an assessment has to be completed on the basis of records and materials available before the assessing authority. Personal knowledge and excitement on events, should not lead the assessing officer to a state of affairs where salient evidences are overlooked. In the present case, howsoever unbelievable it might be, every transaction of the assessee has been accounted, documented and supported. Even the evidences collected from the concerned parties have been ultimately turned in favour of the assessee. Therefore, it is very difficult to brush aside the contentions of the assessee that he had purchased shares and he had sold shares and ultimately he had purchased a flat utilising the sale proceeds of those shares.

Penny Stocks – Old Decisions The oldest decision – From Kolkata Tribunal ØITO vs. Raj Kumar Agarwal, ITA No. 1330/K/07, Order dated 10. 08. 2007 Facts Purchase –sale of 8, 500 shares of Nageshwar Investment Ltd. At Calcutta Stock Exchange Cost: Rs. 17, 170/-; S. V. : Rs. 7, 32, 360/Payment & Receipt by account payee cheques A. O. ’s enquiry: - Purchase transactions not on online system - Some sale transaction also not on online system - Broker responded positively in response to notice u/s 133(6) A. O. treated receipts of Rs. 7, 32, 360/- as unexplained cash credits u/s 68.

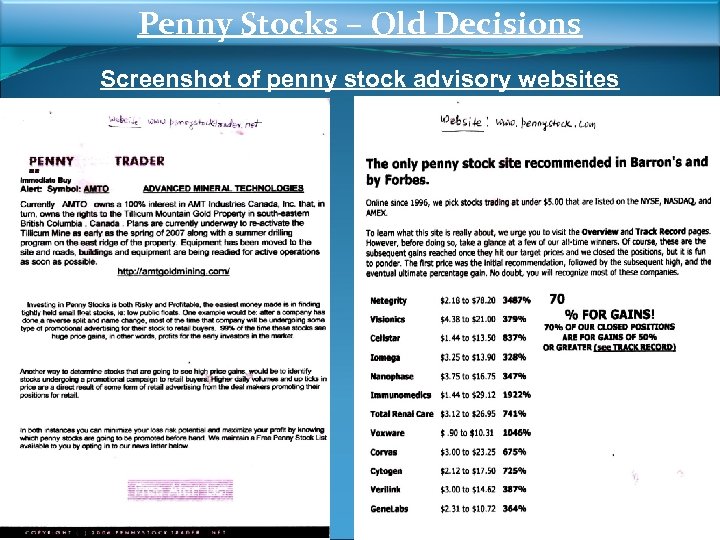

Penny Stocks – Old Decisions Documents submitted before A. O. & Appellate Authorities ● Contract Notes: Purchase/Sale Bills ● Bank Statements ● Demat A/c ● CSE Rule Book— Off market transactions permitted ● Website screen shots of International penny stock advisory websites (before ITAT)

Penny Stocks – Old Decisions Finding of ITAT – The A. O. has failed to bring on record any evidence to establish that the evidence filed by the assessee as well as the share broker were fabricated or false. The share broker is a registered broker and he has confirmed the transaction by mentioning the Registration No. , Contract Notes No. , Settlement Nos. Etc. It is not the case of the revenue that there is no such broker or the distinctive nos of the shares of M/s Nageshwar Investments Ltd. Do not exist or the transactions of purchase and sale of such shares recorded through bank and demat form are fictitious. The A. O. has simply acted on the information gathered from the Calcutta Stock Exchange. The assessee’s counsel has explained that this was “off market transaction”; i. e. transaction took place out of the stock exchange, hence there would be no record relating to these transactions with stock exchange. This submission of the Learned Counsel has not been controverted before us.

Penny Stocks – Old Decisions Screenshot of penny stock advisory websites

Penny Stocks – Old Decisions How to become a Penny Stock Millionaire https: //www. youtube. com/watch? v=3 NZta. IFq. FYw

Penny Stocks – Old Decisions Ø In Raj Kumar Agarwal’s case, reliance was placed on CHC decisions in the case of – ● CIT vs. Carbo Industrial Holdings Ltd. 244 ITR 422 (Cal. ) ● CIT vs. Emerald Commercial Ltd. 250 ITR 539 (Cal. ) Ø Findings in Carbo Industrial Holdings – Payment by account payee cheque has not been disputed. Payment on purchase and sale and payment received by account payee cheque was on two different dates, If the share broker, even after issue of summons, does not appear for that reason, the claim of the assessee should not be denied, specially in cases when the existence of the broker is not in dispute nor the payment is in dispute. Merely because some broker failed to appear, the assessee should not be punished for the default of the broker and we are in full agreement with the Tribunal that on mere suspicion the claim of the assessee should not be denied.

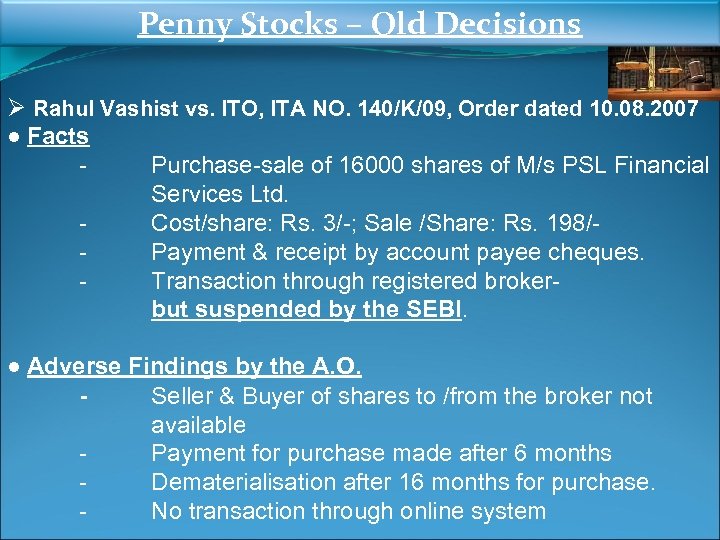

Penny Stocks – Old Decisions Ø Rahul Vashist vs. ITO, ITA NO. 140/K/09, Order dated 10. 08. 2007 ● Facts Purchase-sale of 16000 shares of M/s PSL Financial Services Ltd. Cost/share: Rs. 3/-; Sale /Share: Rs. 198/Payment & receipt by account payee cheques. Transaction through registered brokerbut suspended by the SEBI. ● Adverse Findings by the A. O. Seller & Buyer of shares to /from the broker not available Payment for purchase made after 6 months Dematerialisation after 16 months for purchase. No transaction through online system

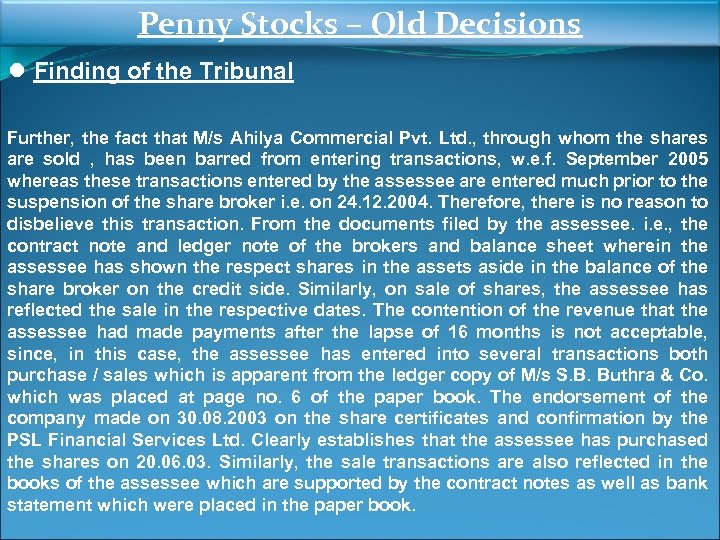

Penny Stocks – Old Decisions ● Finding of the Tribunal Further, the fact that M/s Ahilya Commercial Pvt. Ltd. , through whom the shares are sold , has been barred from entering transactions, w. e. f. September 2005 whereas these transactions entered by the assessee are entered much prior to the suspension of the share broker i. e. on 24. 12. 2004. Therefore, there is no reason to disbelieve this transaction. From the documents filed by the assessee. i. e. , the contract note and ledger note of the brokers and balance sheet wherein the assessee has shown the respect shares in the assets aside in the balance of the share broker on the credit side. Similarly, on sale of shares, the assessee has reflected the sale in the respective dates. The contention of the revenue that the assessee had made payments after the lapse of 16 months is not acceptable, since, in this case, the assessee has entered into several transactions both purchase / sales which is apparent from the ledger copy of M/s S. B. Buthra & Co. which was placed at page no. 6 of the paper book. The endorsement of the company made on 30. 08. 2003 on the share certificates and confirmation by the PSL Financial Services Ltd. Clearly establishes that the assessee has purchased the shares on 20. 06. 03. Similarly, the sale transactions are also reflected in the books of the assessee which are supported by the contract notes as well as bank statement which were placed in the paper book.

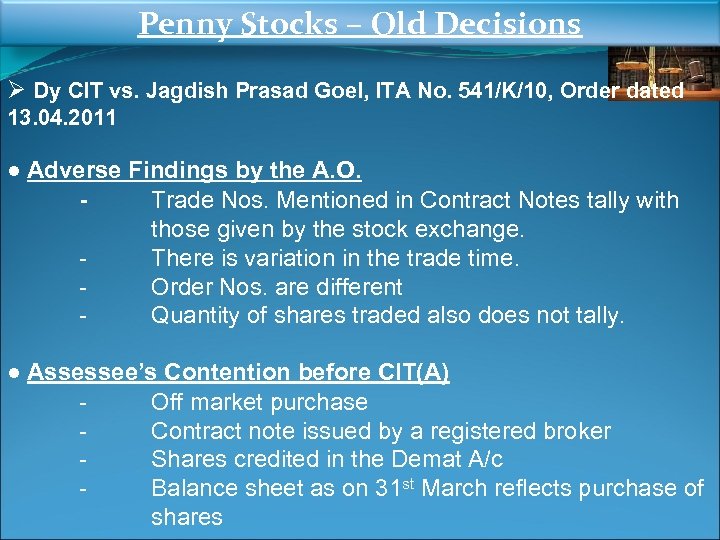

Penny Stocks – Old Decisions Ø Dy CIT vs. Jagdish Prasad Goel, ITA No. 541/K/10, Order dated 13. 04. 2011 ● Adverse Findings by the A. O. Trade Nos. Mentioned in Contract Notes tally with those given by the stock exchange. There is variation in the trade time. Order Nos. are different Quantity of shares traded also does not tally. ● Assessee’s Contention before CIT(A) Off market purchase Contract note issued by a registered broker Shares credited in the Demat A/c Balance sheet as on 31 st March reflects purchase of shares

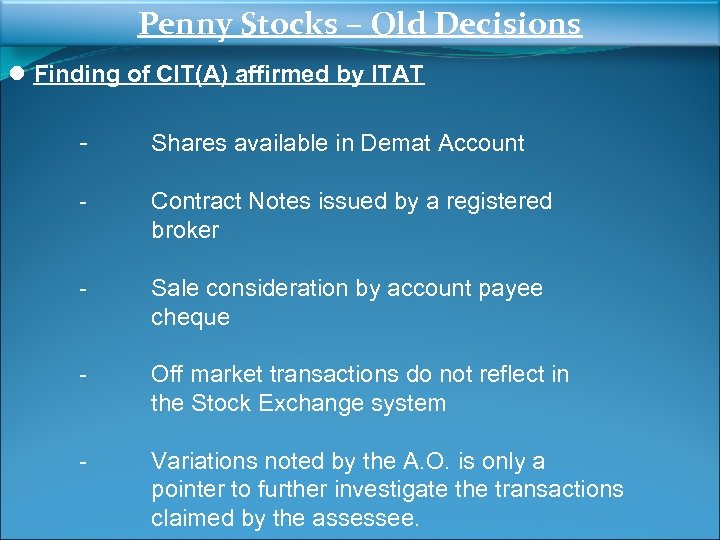

Penny Stocks – Old Decisions ● Finding of CIT(A) affirmed by ITAT - Shares available in Demat Account - Contract Notes issued by a registered broker - Sale consideration by account payee cheque - Off market transactions do not reflect in the Stock Exchange system - Variations noted by the A. O. is only a pointer to further investigate the transactions claimed by the assessee.

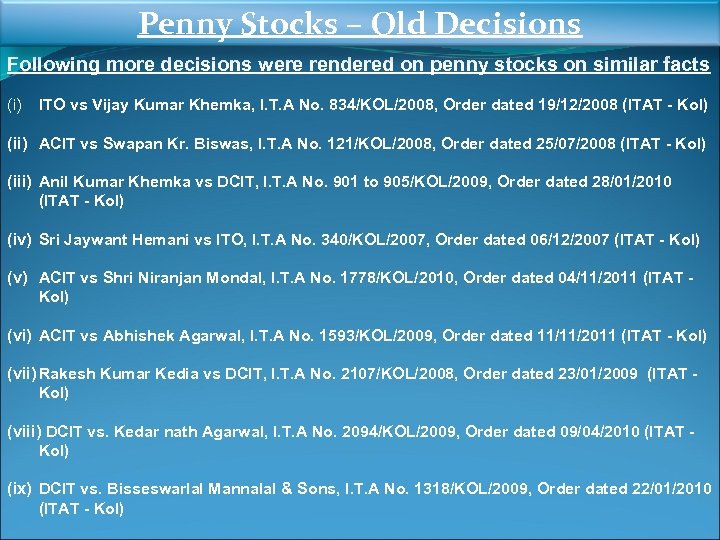

Penny Stocks – Old Decisions Following more decisions were rendered on penny stocks on similar facts (i) ITO vs Vijay Kumar Khemka, I. T. A No. 834/KOL/2008, Order dated 19/12/2008 (ITAT - Kol) (ii) ACIT vs Swapan Kr. Biswas, I. T. A No. 121/KOL/2008, Order dated 25/07/2008 (ITAT - Kol) (iii) Anil Kumar Khemka vs DCIT, I. T. A No. 901 to 905/KOL/2009, Order dated 28/01/2010 (ITAT - Kol) (iv) Sri Jaywant Hemani vs ITO, I. T. A No. 340/KOL/2007, Order dated 06/12/2007 (ITAT - Kol) (v) ACIT vs Shri Niranjan Mondal, I. T. A No. 1778/KOL/2010, Order dated 04/11/2011 (ITAT - Kol) (vi) ACIT vs Abhishek Agarwal, I. T. A No. 1593/KOL/2009, Order dated 11/11/2011 (ITAT - Kol) (vii) Rakesh Kumar Kedia vs DCIT, I. T. A No. 2107/KOL/2008, Order dated 23/01/2009 (ITAT - Kol) (viii) DCIT vs. Kedar nath Agarwal, I. T. A No. 2094/KOL/2009, Order dated 09/04/2010 (ITAT - Kol) (ix) DCIT vs. Bisseswarlal Mannalal & Sons, I. T. A No. 1318/KOL/2009, Order dated 22/01/2010 (ITAT - Kol)

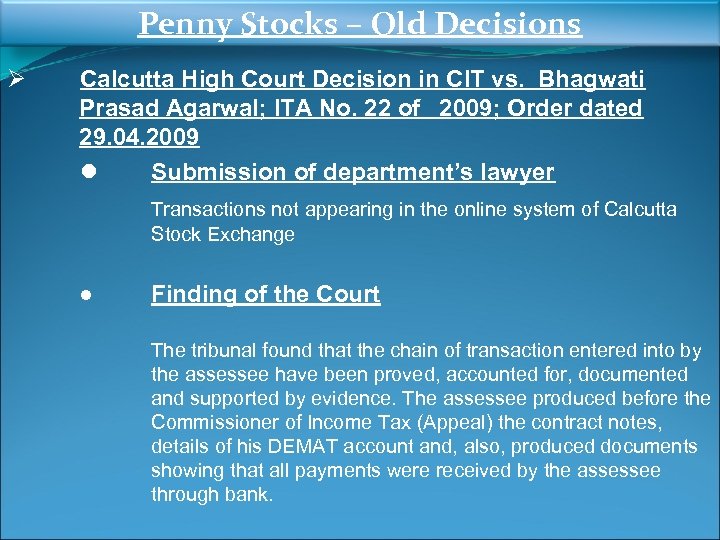

Penny Stocks – Old Decisions Ø Calcutta High Court Decision in CIT vs. Bhagwati Prasad Agarwal; ITA No. 22 of 2009; Order dated 29. 04. 2009 ● Submission of department’s lawyer Transactions not appearing in the online system of Calcutta Stock Exchange ● Finding of the Court The tribunal found that the chain of transaction entered into by the assessee have been proved, accounted for, documented and supported by evidence. The assessee produced before the Commissioner of Income Tax (Appeal) the contract notes, details of his DEMAT account and, also, produced documents showing that all payments were received by the assessee through bank.

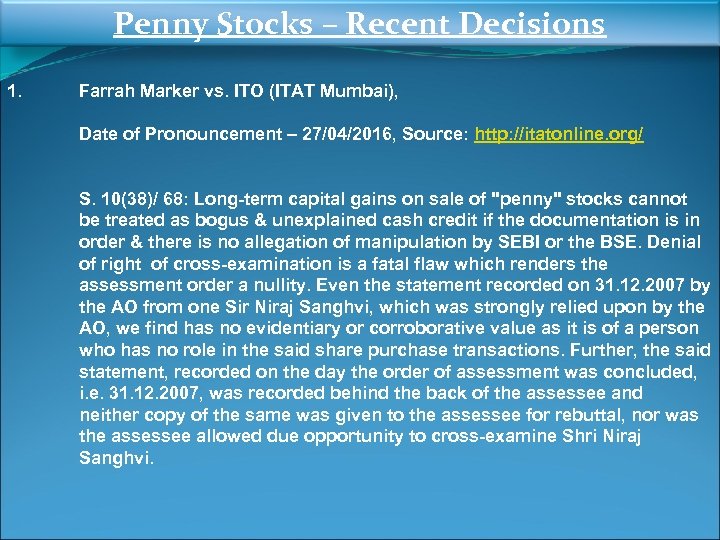

Penny Stocks – Recent Decisions 1. Farrah Marker vs. ITO (ITAT Mumbai), Date of Pronouncement – 27/04/2016, Source: http: //itatonline. org/ S. 10(38)/ 68: Long-term capital gains on sale of "penny" stocks cannot be treated as bogus & unexplained cash credit if the documentation is in order & there is no allegation of manipulation by SEBI or the BSE. Denial of right of cross-examination is a fatal flaw which renders the assessment order a nullity. Even the statement recorded on 31. 12. 2007 by the AO from one Sir Niraj Sanghvi, which was strongly relied upon by the AO, we find has no evidentiary or corroborative value as it is of a person who has no role in the said share purchase transactions. Further, the said statement, recorded on the day the order of assessment was concluded, i. e. 31. 12. 2007, was recorded behind the back of the assessee and neither copy of the same was given to the assessee for rebuttal, nor was the assessee allowed due opportunity to cross-examine Shri Niraj Sanghvi.

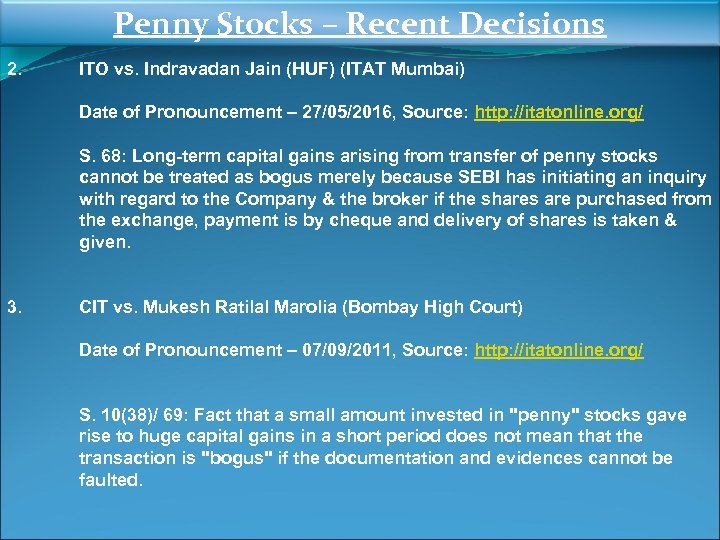

Penny Stocks – Recent Decisions 2. ITO vs. Indravadan Jain (HUF) (ITAT Mumbai) Date of Pronouncement – 27/05/2016, Source: http: //itatonline. org/ S. 68: Long-term capital gains arising from transfer of penny stocks cannot be treated as bogus merely because SEBI has initiating an inquiry with regard to the Company & the broker if the shares are purchased from the exchange, payment is by cheque and delivery of shares is taken & given. 3. CIT vs. Mukesh Ratilal Marolia (Bombay High Court) Date of Pronouncement – 07/09/2011, Source: http: //itatonline. org/ S. 10(38)/ 69: Fact that a small amount invested in "penny" stocks gave rise to huge capital gains in a short period does not mean that the transaction is "bogus" if the documentation and evidences cannot be faulted.

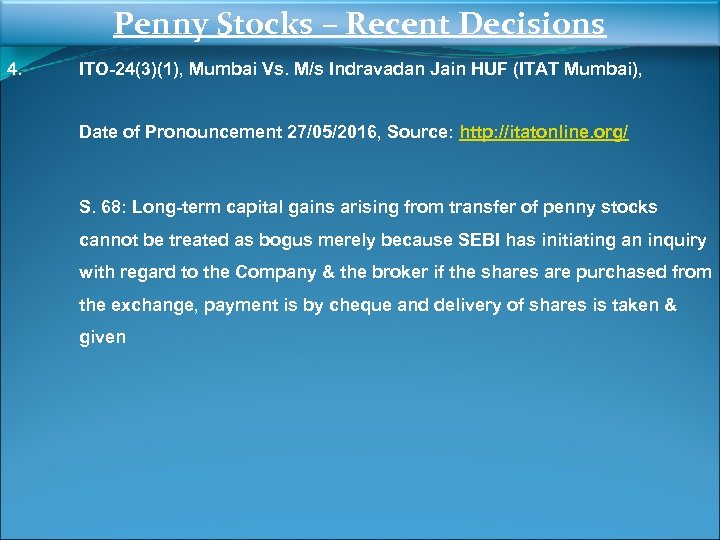

Penny Stocks – Recent Decisions 4. ITO-24(3)(1), Mumbai Vs. M/s Indravadan Jain HUF (ITAT Mumbai), Date of Pronouncement 27/05/2016, Source: http: //itatonline. org/ S. 68: Long-term capital gains arising from transfer of penny stocks cannot be treated as bogus merely because SEBI has initiating an inquiry with regard to the Company & the broker if the shares are purchased from the exchange, payment is by cheque and delivery of shares is taken & given

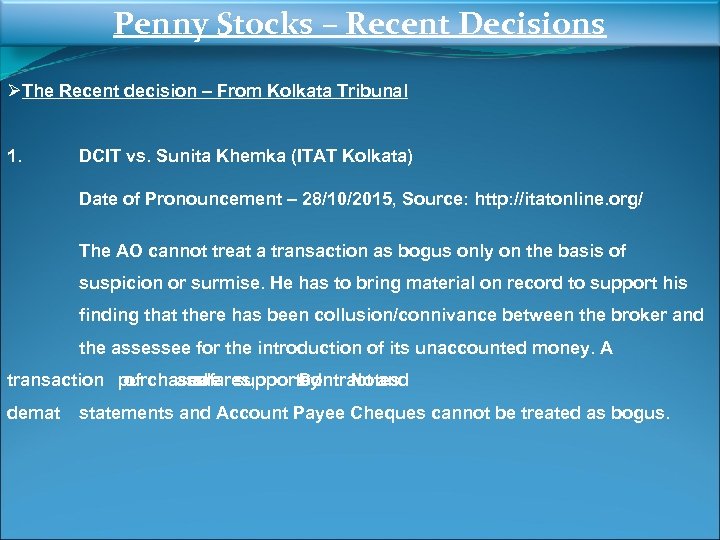

Penny Stocks – Recent Decisions ØThe Recent decision – From Kolkata Tribunal 1. DCIT vs. Sunita Khemka (ITAT Kolkata) Date of Pronouncement – 28/10/2015, Source: http: //itatonline. org/ The AO cannot treat a transaction as bogus only on the basis of suspicion or surmise. He has to bring material on record to support his finding that there has been collusion/connivance between the broker and the assessee for the introduction of its unaccounted money. A transaction purchase of and supported Notes sale shares, of Contract and by demat statements and Account Payee Cheques cannot be treated as bogus.

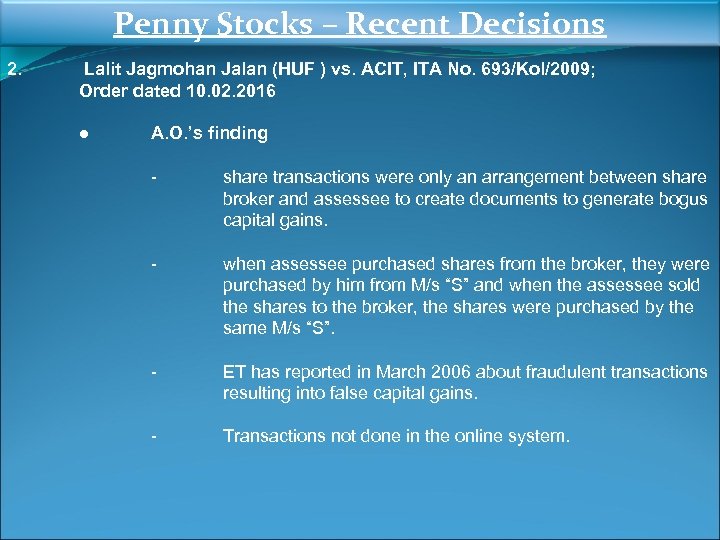

Penny Stocks – Recent Decisions 2. Lalit Jagmohan Jalan (HUF ) vs. ACIT, ITA No. 693/Kol/2009; Order dated 10. 02. 2016 ● A. O. ’s finding - share transactions were only an arrangement between share broker and assessee to create documents to generate bogus capital gains. - when assessee purchased shares from the broker, they were purchased by him from M/s “S” and when the assessee sold the shares to the broker, the shares were purchased by the same M/s “S”. - ET has reported in March 2006 about fraudulent transactions resulting into false capital gains. - Transactions not done in the online system.

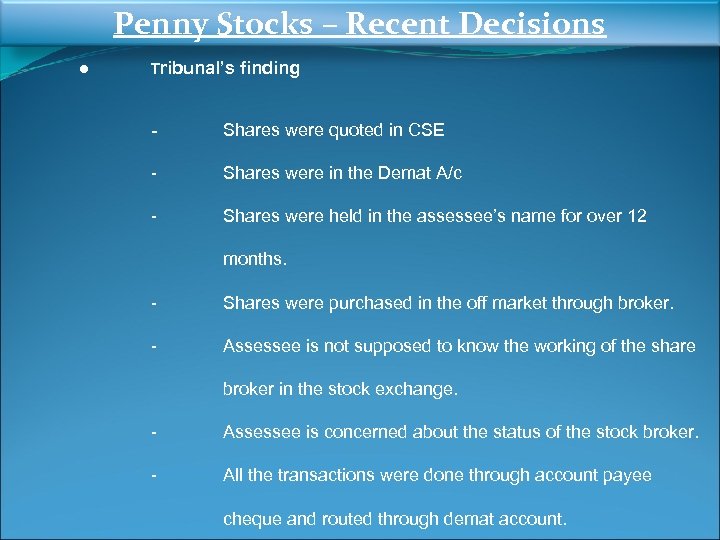

Penny Stocks – Recent Decisions ● Tribunal’s finding - Shares were quoted in CSE - Shares were in the Demat A/c - Shares were held in the assessee’s name for over 12 months. - Shares were purchased in the off market through broker. - Assessee is not supposed to know the working of the share broker in the stock exchange. - Assessee is concerned about the status of the stock broker. - All the transactions were done through account payee cheque and routed through demat account.

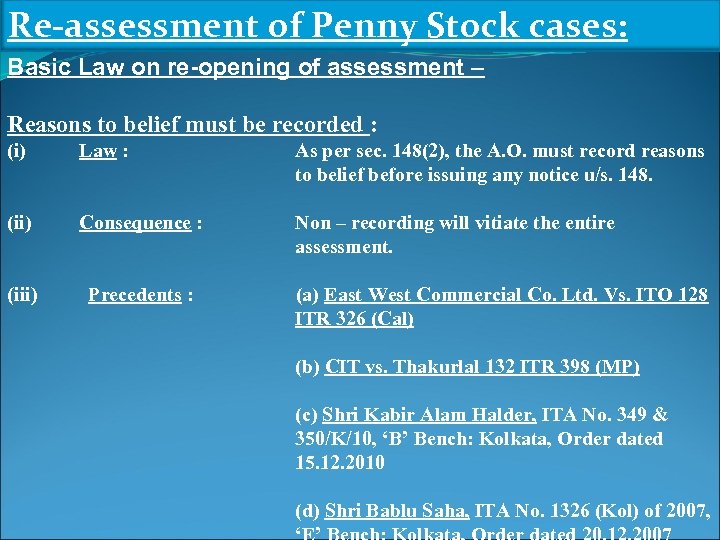

Re-assessment of Penny Stock cases: Basic Law on re-opening of assessment – Reasons to belief must be recorded : (i) Law : As per sec. 148(2), the A. O. must record reasons to belief before issuing any notice u/s. 148. (ii) Consequence : Non – recording will vitiate the entire assessment. (iii) Precedents : (a) East West Commercial Co. Ltd. Vs. ITO 128 ITR 326 (Cal) (b) CIT vs. Thakurlal 132 ITR 398 (MP) (c) Shri Kabir Alam Halder, ITA No. 349 & 350/K/10, ‘B’ Bench: Kolkata, Order dated 15. 12. 2010 (d) Shri Bablu Saha, ITA No. 1326 (Kol) of 2007,

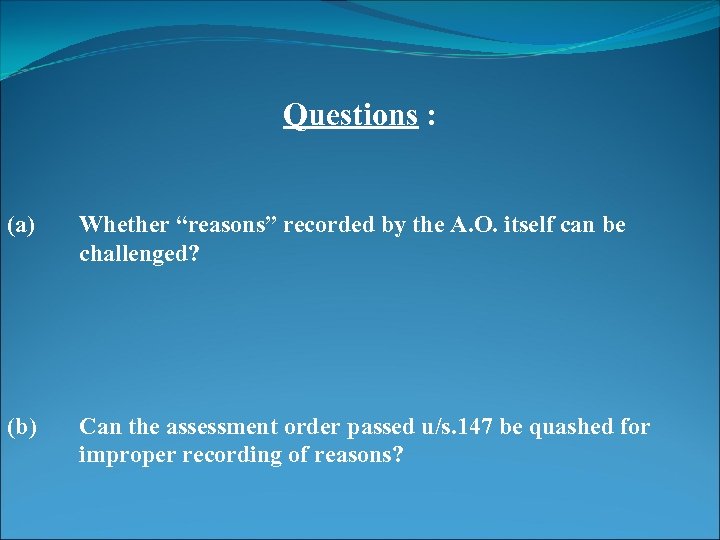

Questions : (a) Whether “reasons” recorded by the A. O. itself can be challenged? (b) Can the assessment order passed u/s. 147 be quashed for improper recording of reasons?

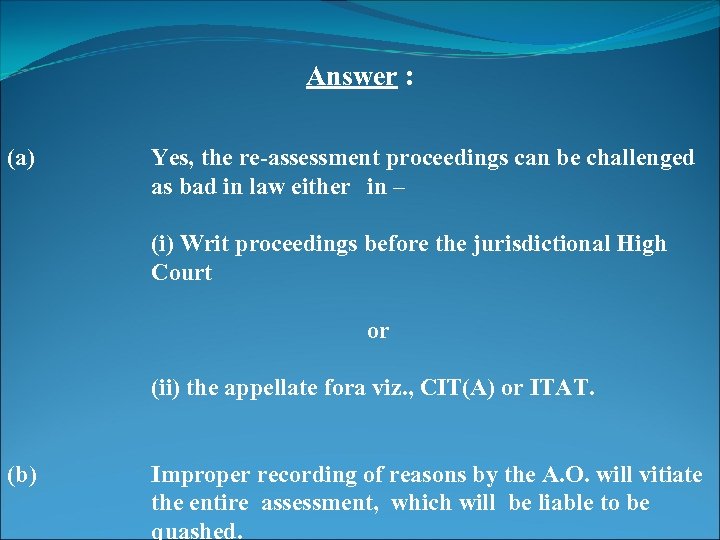

Answer : (a) Yes, the re-assessment proceedings can be challenged as bad in law either in – (i) Writ proceedings before the jurisdictional High Court or (ii) the appellate fora viz. , CIT(A) or ITAT. (b) Improper recording of reasons by the A. O. will vitiate the entire assessment, which will be liable to be quashed.

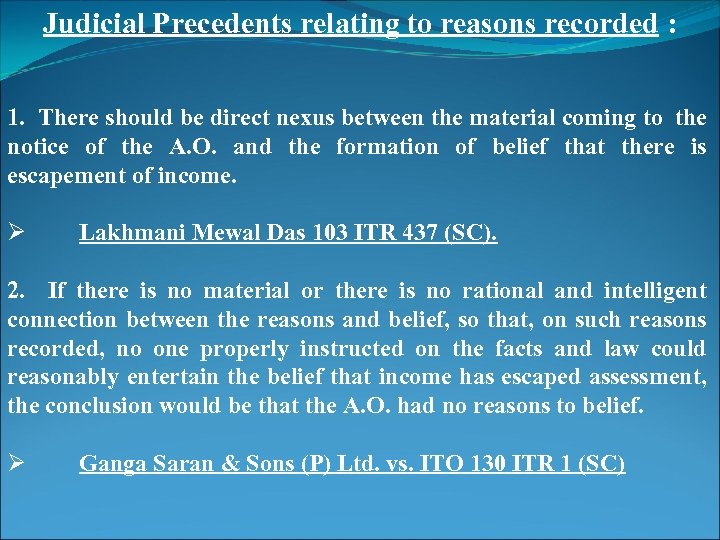

Judicial Precedents relating to reasons recorded : 1. There should be direct nexus between the material coming to the notice of the A. O. and the formation of belief that there is escapement of income. Ø Lakhmani Mewal Das 103 ITR 437 (SC). 2. If there is no material or there is no rational and intelligent connection between the reasons and belief, so that, on such reasons recorded, no one properly instructed on the facts and law could reasonably entertain the belief that income has escaped assessment, the conclusion would be that the A. O. had no reasons to belief. Ø Ganga Saran & Sons (P) Ltd. vs. ITO 130 ITR 1 (SC)

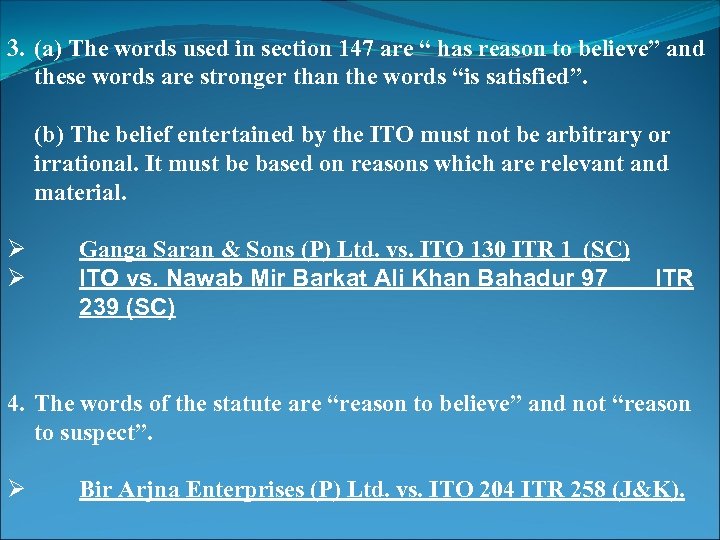

3. (a) The words used in section 147 are “ has reason to believe” and these words are stronger than the words “is satisfied”. (b) The belief entertained by the ITO must not be arbitrary or irrational. It must be based on reasons which are relevant and material. Ø Ø Ganga Saran & Sons (P) Ltd. vs. ITO 130 ITR 1 (SC) ITO vs. Nawab Mir Barkat Ali Khan Bahadur 97 239 (SC) ITR 4. The words of the statute are “reason to believe” and not “reason to suspect”. Ø Bir Arjna Enterprises (P) Ltd. vs. ITO 204 ITR 258 (J&K).

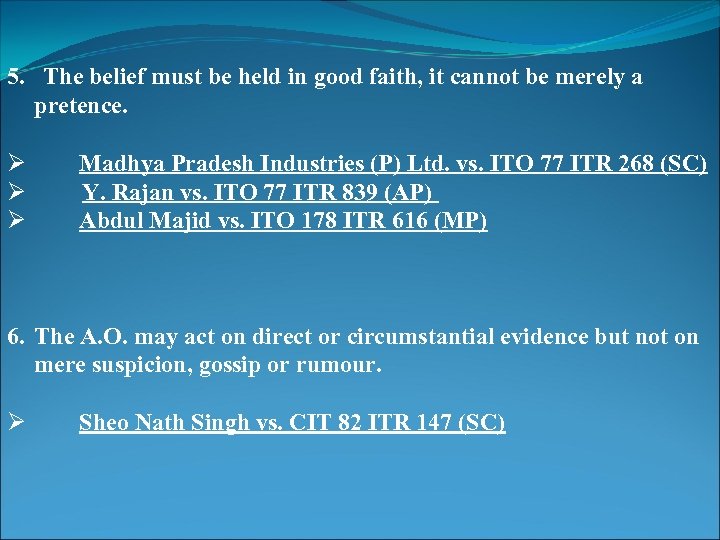

5. The belief must be held in good faith, it cannot be merely a pretence. Ø Ø Ø Madhya Pradesh Industries (P) Ltd. vs. ITO 77 ITR 268 (SC) Y. Rajan vs. ITO 77 ITR 839 (AP) Abdul Majid vs. ITO 178 ITR 616 (MP) 6. The A. O. may act on direct or circumstantial evidence but not on mere suspicion, gossip or rumour. Ø Sheo Nath Singh vs. CIT 82 ITR 147 (SC)

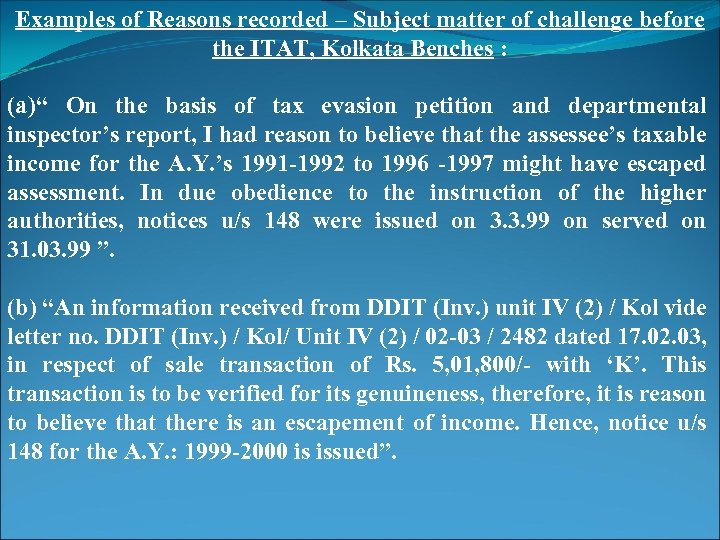

Examples of Reasons recorded – Subject matter of challenge before the ITAT, Kolkata Benches : (a)“ On the basis of tax evasion petition and departmental inspector’s report, I had reason to believe that the assessee’s taxable income for the A. Y. ’s 1991 -1992 to 1996 -1997 might have escaped assessment. In due obedience to the instruction of the higher authorities, notices u/s 148 were issued on 3. 3. 99 on served on 31. 03. 99 ”. (b) “An information received from DDIT (Inv. ) unit IV (2) / Kol vide letter no. DDIT (Inv. ) / Kol/ Unit IV (2) / 02 -03 / 2482 dated 17. 02. 03, in respect of sale transaction of Rs. 5, 01, 800/- with ‘K’. This transaction is to be verified for its genuineness, therefore, it is reason to believe that there is an escapement of income. Hence, notice u/s 148 for the A. Y. : 1999 -2000 is issued”.

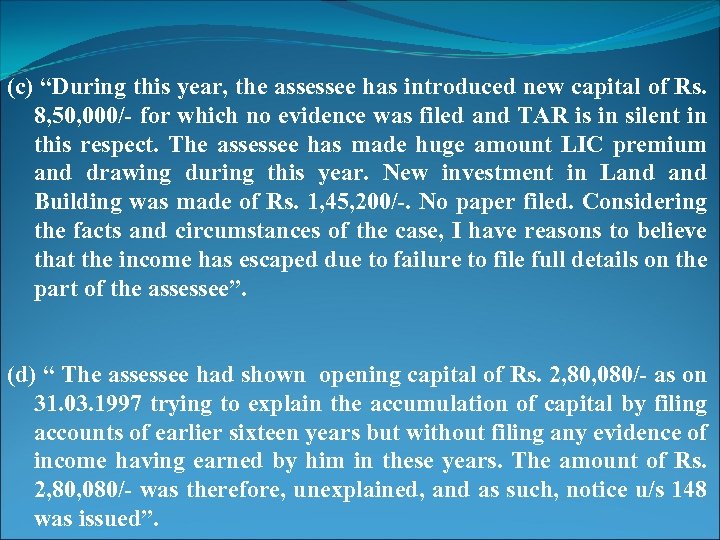

(c) “During this year, the assessee has introduced new capital of Rs. 8, 50, 000/- for which no evidence was filed and TAR is in silent in this respect. The assessee has made huge amount LIC premium and drawing during this year. New investment in Land Building was made of Rs. 1, 45, 200/-. No paper filed. Considering the facts and circumstances of the case, I have reasons to believe that the income has escaped due to failure to file full details on the part of the assessee”. (d) “ The assessee had shown opening capital of Rs. 2, 80, 080/- as on 31. 03. 1997 trying to explain the accumulation of capital by filing accounts of earlier sixteen years but without filing any evidence of income having earned by him in these years. The amount of Rs. 2, 80, 080/- was therefore, unexplained, and as such, notice u/s 148 was issued”.

(e)“ The department received a tax evasion petition that the assessee had not disclosed income from private practice. Some nursing homes were mentioned in the petition, where he was allegedly attending patients. In view of the above information, there is reason to believe that the assessee’s income had escaped assessment within the meaning of section 147 of the Act”

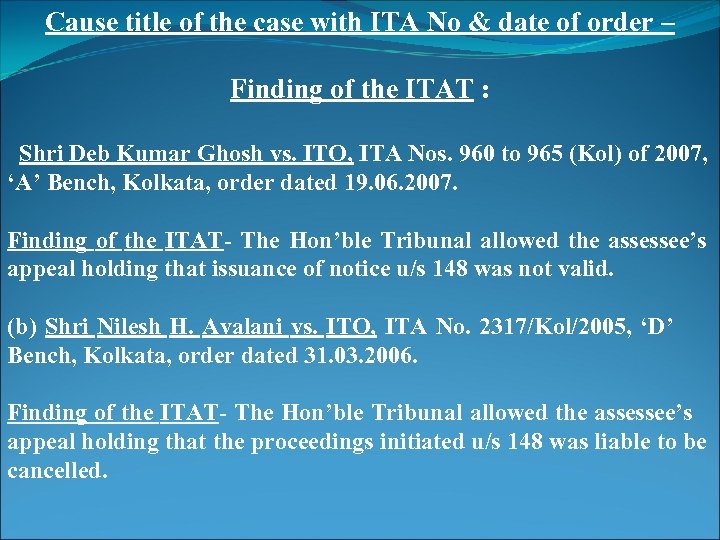

Cause title of the case with ITA No & date of order – Finding of the ITAT : Shri Deb Kumar Ghosh vs. ITO, ITA Nos. 960 to 965 (Kol) of 2007, ‘A’ Bench, Kolkata, order dated 19. 06. 2007. Finding of the ITAT- The Hon’ble Tribunal allowed the assessee’s appeal holding that issuance of notice u/s 148 was not valid. (b) Shri Nilesh H. Avalani vs. ITO, ITA No. 2317/Kol/2005, ‘D’ Bench, Kolkata, order dated 31. 03. 2006. Finding of the ITAT- The Hon’ble Tribunal allowed the assessee’s appeal holding that the proceedings initiated u/s 148 was liable to be cancelled.

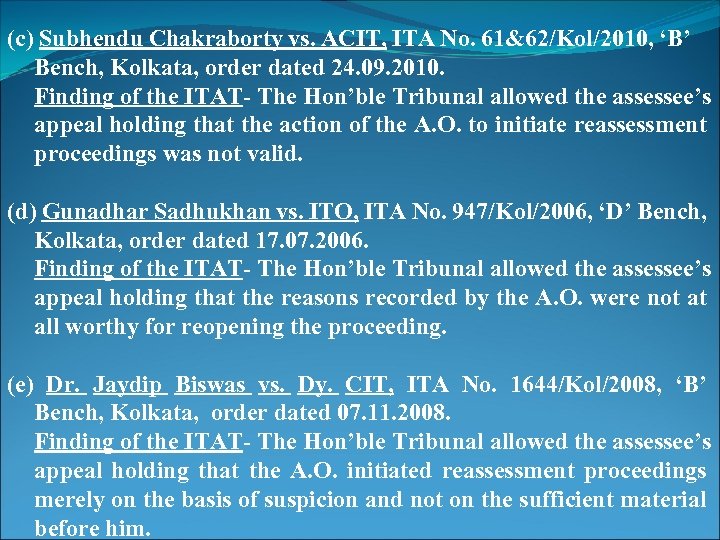

(c) Subhendu Chakraborty vs. ACIT, ITA No. 61&62/Kol/2010, ‘B’ Bench, Kolkata, order dated 24. 09. 2010. Finding of the ITAT- The Hon’ble Tribunal allowed the assessee’s appeal holding that the action of the A. O. to initiate reassessment proceedings was not valid. (d) Gunadhar Sadhukhan vs. ITO, ITA No. 947/Kol/2006, ‘D’ Bench, Kolkata, order dated 17. 07. 2006. Finding of the ITAT- The Hon’ble Tribunal allowed the assessee’s appeal holding that the reasons recorded by the A. O. were not at all worthy for reopening the proceeding. (e) Dr. Jaydip Biswas vs. Dy. CIT, ITA No. 1644/Kol/2008, ‘B’ Bench, Kolkata, order dated 07. 11. 2008. Finding of the ITAT- The Hon’ble Tribunal allowed the assessee’s appeal holding that the A. O. initiated reassessment proceedings merely on the basis of suspicion and not on the sufficient material before him.

Sample Grounds challenging the re-opening proceedings : For that the reopening of assessment initiated u/s 147 of the Act is bad in law and the assessment framed in pursuance thereto is a nullity and liable to be quashed.

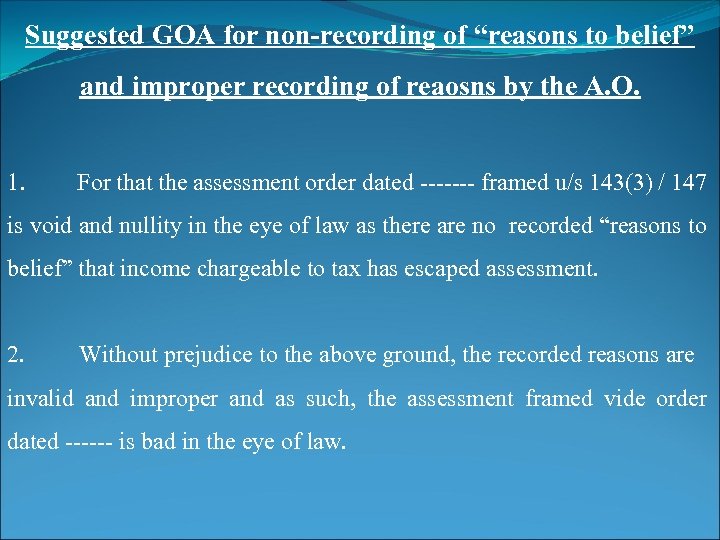

Suggested GOA for non-recording of “reasons to belief” and improper recording of reaosns by the A. O. 1. For that the assessment order dated ------- framed u/s 143(3) / 147 is void and nullity in the eye of law as there are no recorded “reasons to belief” that income chargeable to tax has escaped assessment. 2. Without prejudice to the above ground, the recorded reasons are invalid and improper and as such, the assessment framed vide order dated ------ is bad in the eye of law.

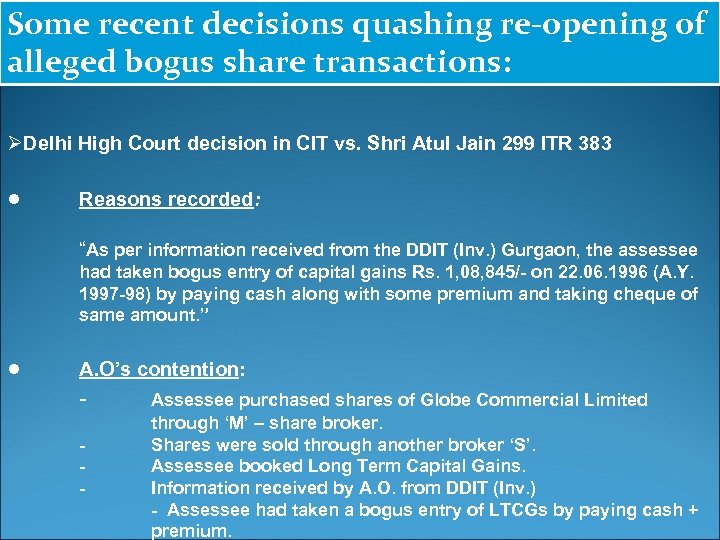

Some recent decisions quashing re-opening of alleged bogus share transactions: ØDelhi High Court decision in CIT vs. Shri Atul Jain 299 ITR 383 ● Reasons recorded: “As per information received from the DDIT (Inv. ) Gurgaon, the assessee had taken bogus entry of capital gains Rs. 1, 08, 845/- on 22. 06. 1996 (A. Y. 1997 -98) by paying cash along with some premium and taking cheque of same amount. ” ● A. O’s contention: - Assessee purchased shares of Globe Commercial Limited through ‘M’ – share broker. Shares were sold through another broker ‘S’. Assessee booked Long Term Capital Gains. Information received by A. O. from DDIT (Inv. ) - Assessee had taken a bogus entry of LTCGs by paying cash + premium.

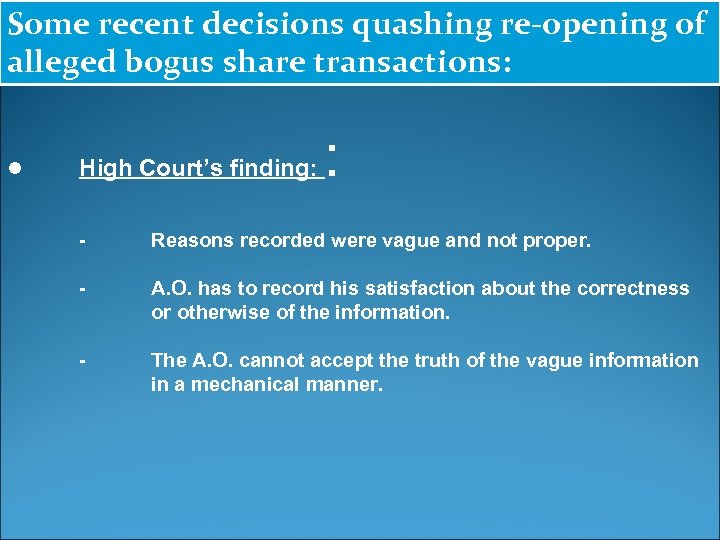

Some recent decisions quashing re-opening of alleged bogus share transactions: ● High Court’s finding: : - Reasons recorded were vague and not proper. - A. O. has to record his satisfaction about the correctness or otherwise of the information. - The A. O. cannot accept the truth of the vague information in a mechanical manner.

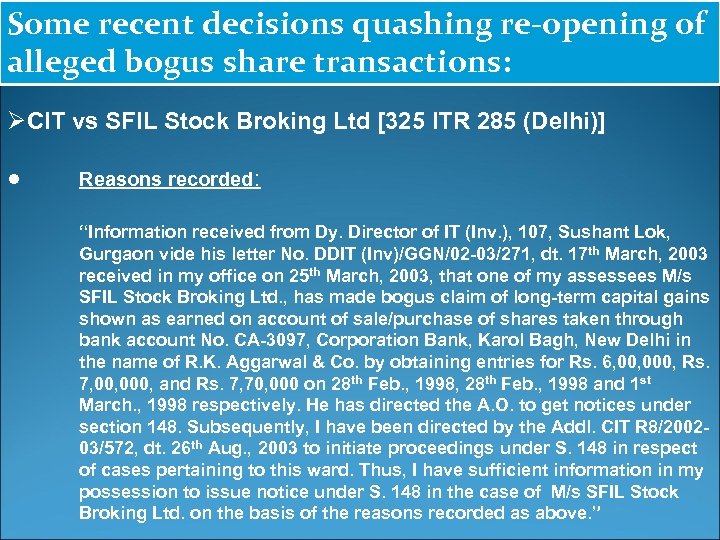

Some recent decisions quashing re-opening of alleged bogus share transactions: ØCIT vs SFIL Stock Broking Ltd [325 ITR 285 (Delhi)] ● Reasons recorded: “Information received from Dy. Director of IT (Inv. ), 107, Sushant Lok, Gurgaon vide his letter No. DDIT (Inv)/GGN/02 -03/271, dt. 17 th March, 2003 received in my office on 25 th March, 2003, that one of my assessees M/s SFIL Stock Broking Ltd. , has made bogus claim of long-term capital gains shown as earned on account of sale/purchase of shares taken through bank account No. CA-3097, Corporation Bank, Karol Bagh, New Delhi in the name of R. K. Aggarwal & Co. by obtaining entries for Rs. 6, 000, Rs. 7, 000, and Rs. 7, 70, 000 on 28 th Feb. , 1998, 28 th Feb. , 1998 and 1 st March. , 1998 respectively. He has directed the A. O. to get notices under section 148. Subsequently, I have been directed by the Addl. CIT R 8/200203/572, dt. 26 th Aug. , 2003 to initiate proceedings under S. 148 in respect of cases pertaining to this ward. Thus, I have sufficient information in my possession to issue notice under S. 148 in the case of M/s SFIL Stock Broking Ltd. on the basis of the reasons recorded as above. ”

Some recent decisions quashing re-opening of alleged bogus share transactions: ● Findings of the High Court: - A. O. has merely referred to the information and two directions as “reason to belief” - These cannot be the reason for proceeding u/s 147. - From the “reasons” it is not discernible that the A. O. had applied his mind to the information and independently arrived at a belief. - Tribunal has arrived at the correct conclusion of facts.

ØGujarat High Court in the case of Varshaben Sanatbhai Patel vs. ITO (unreported) ● Reasons recorded: “On verification of details available on records, it is noticed that assessee has made bogus purchase of Rs 30, 65, 639/-, during the Financial Year 2008 -09 i. e. A. Y. 2009 -10. By claiming bogus purchase in the trading and P & L A/c as an expenses, the assessee has shown less profit to the extent of the amount of Bogus Purchases. ” .

● Findings of the High Court: - - Subsequently, it transpires, A. O. has placed reliance upon the material from an external source. - This aspect is not reflected in the reasons recorded. The A. O. has stated that on verification of the “details available on record” but there are no specific averments as regards which details are available on record. The A. O. cannot supplement the reasons in the affidavit or by the order rejecting the objections.

Derivative Losses vis-a-vis client code modifications: ◊ Why Derivative Losses are under the glare of suspicion? ◊ Answer: Derivative Losses are exception to the speculative transaction vide clause (d) and (e) of Section 43(5)

▪ Clause (d) “an eligible transaction in respect of trading in derivatives referred to in clause [(ac)] of section 2 of the Securities Contracts (Regulation) Act, 1956 (42 of 1956) carried out in a recognised stock exchange” ▪ Clause (e) “an eligible transaction in respect of trading in commodity derivatives carried out in a recognised association [which is chargeable to commodities transaction tax under Chapter VII of the Finance Act, 2013 (17 of 2013)]”.

Whether client code modifications (CCM) permitted by SEBI? ? ? )? ? ?

ANSWER: q market closing to rectify any punching errors is a common practice in the stock/commodity markets. q However, the Exchanges discourage, at the behest of SEBI, such practice and impose penalty if the code modification is beyond the limit prescribed. q According to the media reports, thousands of crores worth of client code change by stock brokers took place between 2009 and 2011, which caught the attention of the tax department. q modifications had fallen by 99% to 120 crore every month it tightened screws against the malpractice. after

ØSEBI circulars ● SEBI vide Circular no. CIR/MRD/DP/29/2014 dated 21. 10. 2014 allows NSE to waive off the penalty for CCM where evidence is produced to prove that the modification was on account of genuine error.

ØRecent Decision on CCM Recently, in the case of ACIT vs Kunvarji Finance (P) Ltd [IT(SS)A Nos. 615 to 618/Ahd/2010 dated 19. 03. 2015] [source: www. itatonline. org], it was held that where client code was modified for a small percentage of total transactions on the same day, there cannot be any malafide intention. In such cases, the addition made on a notional basis is liable to be deleted

Cash Trail in the Hands of the Beneficiary ● Possible cases where adverse inference is drawn – - Loan Transactions - Share Capital Transactions - Sale of Investments

Cash Trail in the Hands of the Beneficiary ● Settled law – Source of source need not be proved 1. Nemi Chand Kothari vs CIT 264 ITR 254 ( Gau) “ Creditor may receive any amount from sources known to the creditor only and if he fails to show he has received the amount, in question, or if he fails to show the creditworthiness of his sub-creditor, such an amount may be treated as the income from undisclosed source of the creditor or of the sub-creditor, as the case may be, but such failure, on the part of the creditor cannot, in the absence of any clinching evidence, be treated as the income of the assessee derived from undisclosed source. ”

Cash Trail in the Hands of the Beneficiary 2. Jalan Timbers vs. CIT (1997) 223 ITR 11 (Gau) “It is true that by proving the identity the assessee cannot be said to have discharged its onus. In the instant case, the amounts were shown in the IT return of the assessee. Besides, the creditors had also shown in the returns about the giving of the loan to the assessee. Strangely, the ITO while making the assessment in respect of the three creditors above named accepted the returns. This itself will go to show that the amount received by the assessee was at least prima facie genuine. As the ITO had accepted the returns of the three creditors it should go to mean that the amounts given by those creditors were also genuine.

Cash Trail in the Hands of the Beneficiary 3. Dy. CIT vs. Rohini Builders 256 ITR 360 (Guj. ) “If the capacity of the creditors is proved by showing that amounts were received by the assessee by account payee cheques drawn from bank accounts of the creditors, then the assessee was not expected to prove the genuineness of the cash deposited in the bank account of those creditors because under the law the assessee can be asked to prove the source of the credits in its books of account but not the source of the source”.

Cash Trail in the Hands of the Beneficiary 4. Aravali Trading Co. V. ITO 187 Taxman 338 (Raj) “Accordingly the Tribunal, and the AO had seriously erred and misdirected themselves in law by not correctly appreciating the legal principle about necessity of establishing such nexus once the assessee has discharged his onus by proving the existence of the depositors and the depositors having accepted their deposits with the assessee. Once this onus is discharged the presumption raised under s. 68 stands rebutted and it becomes burden of Revenue to prove that source of such deposits is traceable to assessee before the same can be treated as undisclosed income of the assessee concerned. ”

Cash Trail in the Hands of the Beneficiary 5. CIT V. First Point Finance Ltd. 286 ITR 477 (Raj) ( Share Capital) No material has been brought on record except inferring that the investors in the opinion of the Assessing Officer were not creditworthy to link the assessee with such investment of money made by those persons. The case squarely falls within the ratio laid down in the Steller Investment Ltd. [2001] 251 ITR 263 (SC) wherein it was stated as noticed above that in such cases merely because the creditors have failed to prove their source of investment, the same cannot be added in the income of the assessee but it ought to be added by finding persons who had their names. There is no presumption that the assessee is the benami owner of the investment made by the existing person.

Cash Trail in the Hands of the Beneficiary 6. ACIT vs. Surya Kanta Dalmia (2005) 97 ITD 235 (CAL) “Sec. 68 came up for consideration before various High Courts and it has been held that the assessee has to prove three conditions: (1) identity of the creditor; (2) capacity of such creditor to advance money; and (3) genuineness of the transactions. If all the aforesaid three conditions are proved, the burden shifts on the Revenue to prove that the amount belongs to the assessee. It has been held by the various High Courts that the assessee cannot be asked to prove source of source or the origin of origin vide S. Hastimal v. CIT (1963) 49 ITR 273 (Mad), Tolaram Daga v. CIT (1966) 59 ITR 632 (Assam), Sarogi Credit Corpn. v. CIT 1975 CTR (Pat) 1 : (1976) 103 ITR 344 (Pat). This view finds support from the recent decision of Hon'ble Allahabad High Court in the case of CIT v. Jauharimal Goel (2005) 147 Taxman 448 (All)”.

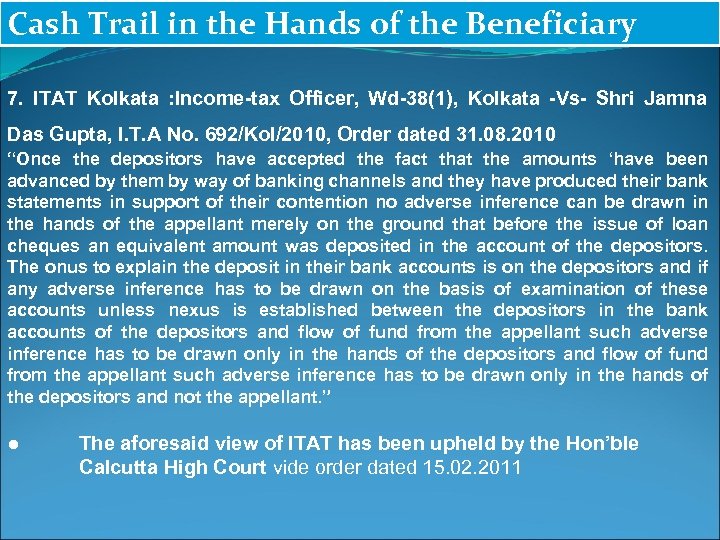

Cash Trail in the Hands of the Beneficiary 7. ITAT Kolkata : Income-tax Officer, Wd-38(1), Kolkata -Vs- Shri Jamna Das Gupta, I. T. A No. 692/Kol/2010, Order dated 31. 08. 2010 “Once the depositors have accepted the fact that the amounts ‘have been advanced by them by way of banking channels and they have produced their bank statements in support of their contention no adverse inference can be drawn in the hands of the appellant merely on the ground that before the issue of loan cheques an equivalent amount was deposited in the account of the depositors. The onus to explain the deposit in their bank accounts is on the depositors and if any adverse inference has to be drawn on the basis of examination of these accounts unless nexus is established between the depositors in the bank accounts of the depositors and flow of fund from the appellant such adverse inference has to be drawn only in the hands of the depositors and not the appellant. ” ● The aforesaid view of ITAT has been upheld by the Hon’ble Calcutta High Court vide order dated 15. 02. 2011

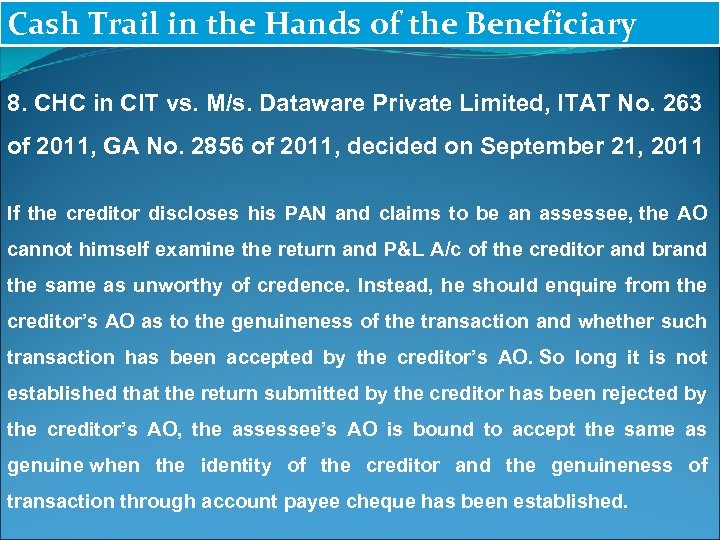

Cash Trail in the Hands of the Beneficiary 8. CHC in CIT vs. M/s. Dataware Private Limited, ITAT No. 263 of 2011, GA No. 2856 of 2011, decided on September 21, 2011 If the creditor discloses his PAN and claims to be an assessee, the AO cannot himself examine the return and P&L A/c of the creditor and brand the same as unworthy of credence. Instead, he should enquire from the creditor’s AO as to the genuineness of the transaction and whether such transaction has been accepted by the creditor’s AO. So long it is not established that the return submitted by the creditor has been rejected by the creditor’s AO, the assessee’s AO is bound to accept the same as genuine when the identity of the creditor and the genuineness of transaction through account payee cheque has been established.

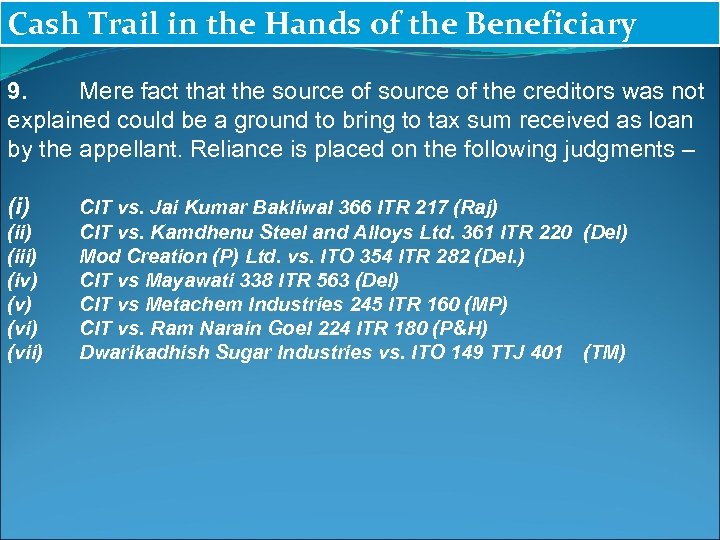

Cash Trail in the Hands of the Beneficiary 9. Mere fact that the source of the creditors was not explained could be a ground to bring to tax sum received as loan by the appellant. Reliance is placed on the following judgments – (i) (iii) (iv) (vi) (vii) CIT vs. Jai Kumar Bakliwal 366 ITR 217 (Raj) CIT vs. Kamdhenu Steel and Alloys Ltd. 361 ITR 220 (Del) Mod Creation (P) Ltd. vs. ITO 354 ITR 282 (Del. ) CIT vs Mayawati 338 ITR 563 (Del) CIT vs Metachem Industries 245 ITR 160 (MP) CIT vs. Ram Narain Goel 224 ITR 180 (P&H) Dwarikadhish Sugar Industries vs. ITO 149 TTJ 401 (TM)

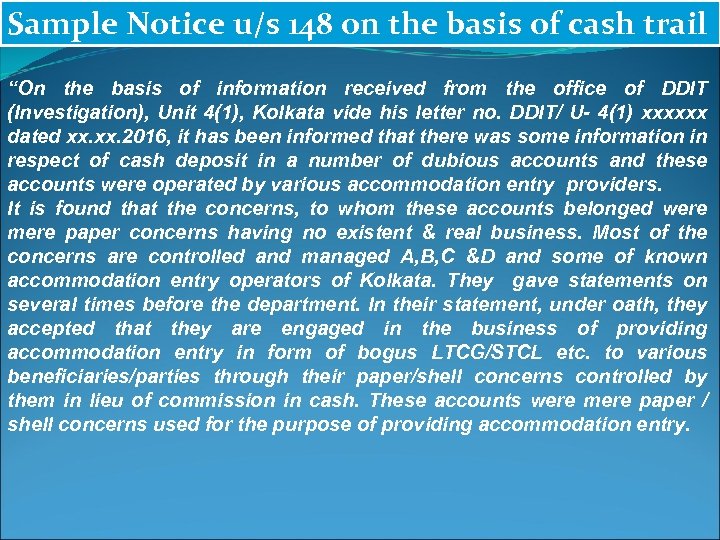

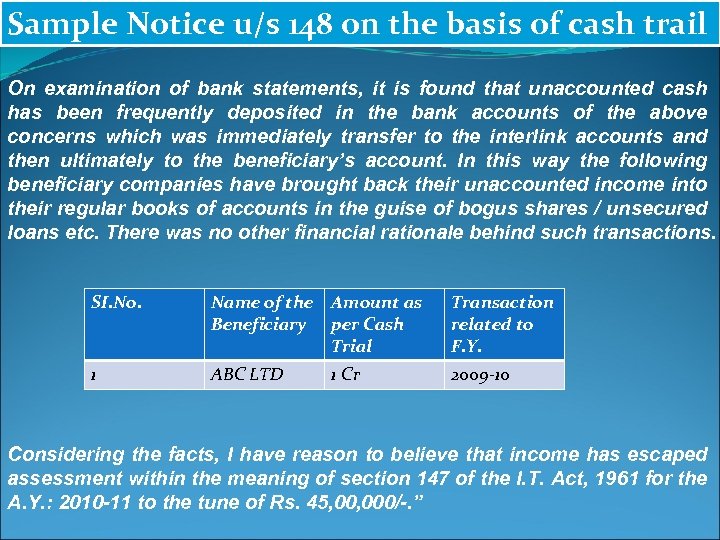

Sample Notice u/s 148 on the basis of cash trail “On the basis of information received from the office of DDIT (Investigation), Unit 4(1), Kolkata vide his letter no. DDIT/ U- 4(1) xxxxxx dated xx. 2016, it has been informed that there was some information in respect of cash deposit in a number of dubious accounts and these accounts were operated by various accommodation entry providers. It is found that the concerns, to whom these accounts belonged were mere paper concerns having no existent & real business. Most of the concerns are controlled and managed A, B, C &D and some of known accommodation entry operators of Kolkata. They gave statements on several times before the department. In their statement, under oath, they accepted that they are engaged in the business of providing accommodation entry in form of bogus LTCG/STCL etc. to various beneficiaries/parties through their paper/shell concerns controlled by them in lieu of commission in cash. These accounts were mere paper / shell concerns used for the purpose of providing accommodation entry.

Sample Notice u/s 148 on the basis of cash trail On examination of bank statements, it is found that unaccounted cash has been frequently deposited in the bank accounts of the above concerns which was immediately transfer to the interlink accounts and then ultimately to the beneficiary’s account. In this way the following beneficiary companies have brought back their unaccounted income into their regular books of accounts in the guise of bogus shares / unsecured loans etc. There was no other financial rationale behind such transactions. SI. No. Name of the Beneficiary Amount as per Cash Trial Transaction related to F. Y. 1 ABC LTD 1 Cr 2009 -10 Considering the facts, I have reason to believe that income has escaped assessment within the meaning of section 147 of the I. T. Act, 1961 for the A. Y. : 2010 -11 to the tune of Rs. 45, 000/-. ”

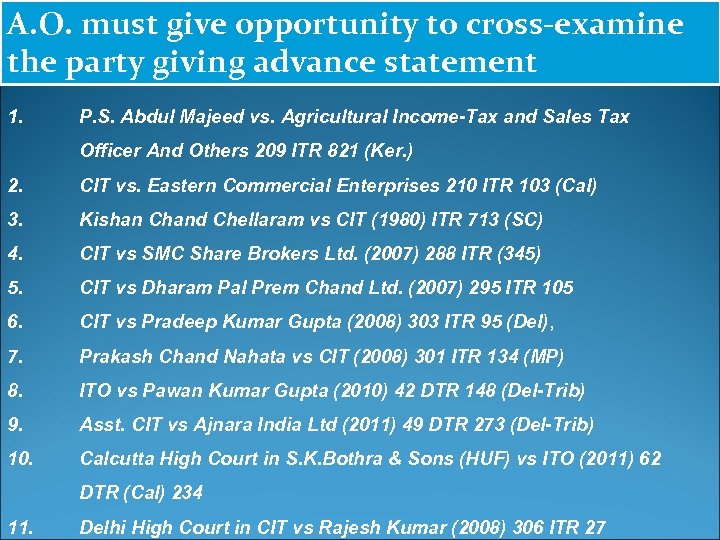

A. O. must give opportunity to cross-examine the party giving advance statement 1. P. S. Abdul Majeed vs. Agricultural Income-Tax and Sales Tax Officer And Others 209 ITR 821 (Ker. ) 2. CIT vs. Eastern Commercial Enterprises 210 ITR 103 (Cal) 3. Kishan Chand Chellaram vs CIT (1980) ITR 713 (SC) 4. CIT vs SMC Share Brokers Ltd. (2007) 288 ITR (345) 5. CIT vs Dharam Pal Prem Chand Ltd. (2007) 295 ITR 105 6. CIT vs Pradeep Kumar Gupta (2008) 303 ITR 95 (Del), 7. Prakash Chand Nahata vs CIT (2008) 301 ITR 134 (MP) 8. ITO vs Pawan Kumar Gupta (2010) 42 DTR 148 (Del-Trib) 9. Asst. CIT vs Ajnara India Ltd (2011) 49 DTR 273 (Del-Trib) 10. Calcutta High Court in S. K. Bothra & Sons (HUF) vs ITO (2011) 62 DTR (Cal) 234 11. Delhi High Court in CIT vs Rajesh Kumar (2008) 306 ITR 27

Thanks!!! Namaskar!!! You can contact me atsubash_sushma@yahoo. in

5494a78ee3e95e984ce363f8b5feb620.ppt