5e0a8e89c269a6f0da42cc7fa34ef5b4.ppt

- Количество слайдов: 37

Assessment of Cost of Service to Agriculture Consumers New Delhi June 17, 2010

Assessment of Cost of Service to Agriculture Consumers New Delhi June 17, 2010

Structure of Presentation Module 1: Introductory Module 2: Agricultural background of utilities Module 3: Important Consideration in assessing agriculture Co. S Module 4: Model for determination of cost of service Module 5: Conclusions

Structure of Presentation Module 1: Introductory Module 2: Agricultural background of utilities Module 3: Important Consideration in assessing agriculture Co. S Module 4: Model for determination of cost of service Module 5: Conclusions

Module 1 Introductory

Module 1 Introductory

Key objective of the study To formulate methodology to determine the cost of service for agricultural consumers and examination of issues related to it taking into account quality of supply, including hours of supply, voltage fluctuations, reliability of supply etc.

Key objective of the study To formulate methodology to determine the cost of service for agricultural consumers and examination of issues related to it taking into account quality of supply, including hours of supply, voltage fluctuations, reliability of supply etc.

Selection of utilities Utilities selected have significant agricultural load

Selection of utilities Utilities selected have significant agricultural load

Approach to the study Selection of Utilities Development of Model Gujarat UGVCL PGVCL Andhra Pradesh APCPDCL APNPDCL Karnataka National & International Literature Review Developing an Excel Based Model Identification of Data Requirements BESCOM Haryana UHBVN Improvising Model with feedback from FOIR Standing Committee Finalization of Model In consultation with Standing Committee Respective SERC

Approach to the study Selection of Utilities Development of Model Gujarat UGVCL PGVCL Andhra Pradesh APCPDCL APNPDCL Karnataka National & International Literature Review Developing an Excel Based Model Identification of Data Requirements BESCOM Haryana UHBVN Improvising Model with feedback from FOIR Standing Committee Finalization of Model In consultation with Standing Committee Respective SERC

Module 2 Agricultural background of utilities

Module 2 Agricultural background of utilities

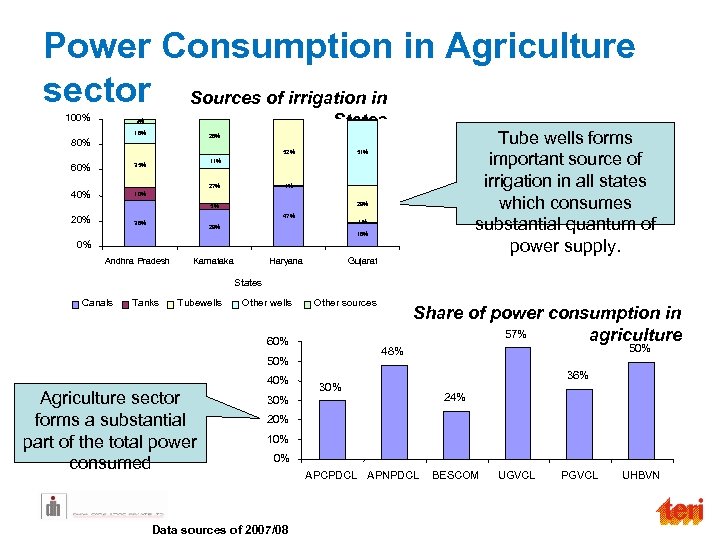

Power Consumption in Agriculture sector Sources of irrigation in 100% States 1% 3% 16% 52% 60% 51% 11% 35% 40% Tube wells forms important source of irrigation in all states which consumes substantial quantum of power supply. 28% 80% 10% 27% 1% 29% 5% 47% 20% 36% 1% 29% 18% 0% Andhra Pradesh Karnataka Haryana Gujarat States Canals Tanks Tubewells Other sources 60% Agriculture sector forms a substantial part of the total power consumed 50% 48% 50% 40% Share of power consumption in 57% agriculture 30% 36% 24% 20% 10% 0% Data sources of 2007/08 APCPDCL APNPDCL BESCOM UGVCL PGVCL UHBVN

Power Consumption in Agriculture sector Sources of irrigation in 100% States 1% 3% 16% 52% 60% 51% 11% 35% 40% Tube wells forms important source of irrigation in all states which consumes substantial quantum of power supply. 28% 80% 10% 27% 1% 29% 5% 47% 20% 36% 1% 29% 18% 0% Andhra Pradesh Karnataka Haryana Gujarat States Canals Tanks Tubewells Other sources 60% Agriculture sector forms a substantial part of the total power consumed 50% 48% 50% 40% Share of power consumption in 57% agriculture 30% 36% 24% 20% 10% 0% Data sources of 2007/08 APCPDCL APNPDCL BESCOM UGVCL PGVCL UHBVN

Module 3 Important Consideration in assessing agriculture Co. S

Module 3 Important Consideration in assessing agriculture Co. S

Important considerations in assessing Agriculture Co. S…. i v Agriculture gets supply during odd hours of the day Ø In most cases agriculture category gets supply during odd hours Ø Few exceptions are there. E. g. UGVCL- Time schedule for supply to agriculture is announced weekly and is divided into various group which receives 8 hours of power during the day on rotational basis v Administered peak for agriculture Ø Usually agriculture category does not receive round the clock supply. Supply is regulated and rostered leading to “Administered Peak” Ø Flexibility in usage hours could further increase class peak and coincident peak

Important considerations in assessing Agriculture Co. S…. i v Agriculture gets supply during odd hours of the day Ø In most cases agriculture category gets supply during odd hours Ø Few exceptions are there. E. g. UGVCL- Time schedule for supply to agriculture is announced weekly and is divided into various group which receives 8 hours of power during the day on rotational basis v Administered peak for agriculture Ø Usually agriculture category does not receive round the clock supply. Supply is regulated and rostered leading to “Administered Peak” Ø Flexibility in usage hours could further increase class peak and coincident peak

Important considerations in assessing Agriculture Co. S…. ii v Low growth of agriculture power demand Ø Growth in agriculture consumption lower than other categories Ø Higher cost of power purchase due to growth of overall demand need not be allocated to agriculture v Poor quality of power supply to agriculture Ø Often characterised with poor voltage profile and unreliable supply Ø Tariff design for agriculture consumers should take this into consideration

Important considerations in assessing Agriculture Co. S…. ii v Low growth of agriculture power demand Ø Growth in agriculture consumption lower than other categories Ø Higher cost of power purchase due to growth of overall demand need not be allocated to agriculture v Poor quality of power supply to agriculture Ø Often characterised with poor voltage profile and unreliable supply Ø Tariff design for agriculture consumers should take this into consideration

Important considerations in assessing Agriculture Co. S…. iii v Diversity in agriculture power demand over the year Ø Wide variations in demand across seasons &cropping pattern Ø Methodology to determine Co. S to reflect the seasonality in agriculture demand v Estimation of losses incurred in supplying to agriculture category Ø Agriculture category has substantial unmetered consumption Ø Losses are not known appropriately (including the breakup in terms of technical and commercial component) Ø Proper treatment to losses in methodology for assessing Co. S

Important considerations in assessing Agriculture Co. S…. iii v Diversity in agriculture power demand over the year Ø Wide variations in demand across seasons &cropping pattern Ø Methodology to determine Co. S to reflect the seasonality in agriculture demand v Estimation of losses incurred in supplying to agriculture category Ø Agriculture category has substantial unmetered consumption Ø Losses are not known appropriately (including the breakup in terms of technical and commercial component) Ø Proper treatment to losses in methodology for assessing Co. S

Module 4 Model for determination of cost of service

Module 4 Model for determination of cost of service

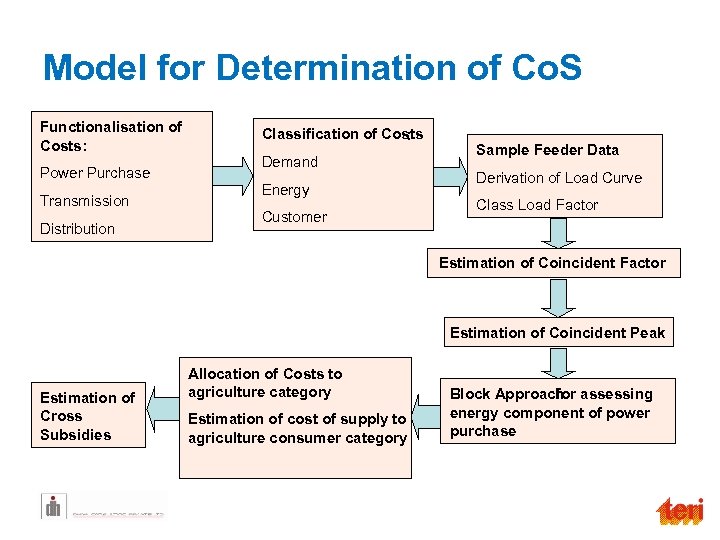

Model for Determination of Co. S Functionalisation of Costs: Power Purchase Transmission Distribution Classification of Costs : Demand Energy Customer Sample Feeder Data Derivation of Load Curve Class Load Factor Estimation of Coincident Peak Estimation of Cross Subsidies Allocation of Costs to agriculture category Estimation of cost of supply to agriculture consumer category Block Approach for assessing energy component of power purchase

Model for Determination of Co. S Functionalisation of Costs: Power Purchase Transmission Distribution Classification of Costs : Demand Energy Customer Sample Feeder Data Derivation of Load Curve Class Load Factor Estimation of Coincident Peak Estimation of Cross Subsidies Allocation of Costs to agriculture category Estimation of cost of supply to agriculture consumer category Block Approach for assessing energy component of power purchase

Information Requirement Ø Ø Ø Ø Ø Utility system load details Power purchase details (base year and relevant year) Energy details of the utility Profit & loss accounts of the utility Balance sheet and its respective schedules of the utility Revenue details of the utility Detailed composition of all costs incurred by the utility Details of technical and commercial losses in agricultural category Voltage level wise classification of cost Load data of the sample feeders Sources for Data Collection ØSecondary sources such as Tariff orders, Profit & Los Accounts, Trial balance, Balance sheet etc. ØDiscussions with the concerned utilities and State Electricity Regulatory Commission. ØLoad studies are based on sample survey in consultation with the concerned utilities.

Information Requirement Ø Ø Ø Ø Ø Utility system load details Power purchase details (base year and relevant year) Energy details of the utility Profit & loss accounts of the utility Balance sheet and its respective schedules of the utility Revenue details of the utility Detailed composition of all costs incurred by the utility Details of technical and commercial losses in agricultural category Voltage level wise classification of cost Load data of the sample feeders Sources for Data Collection ØSecondary sources such as Tariff orders, Profit & Los Accounts, Trial balance, Balance sheet etc. ØDiscussions with the concerned utilities and State Electricity Regulatory Commission. ØLoad studies are based on sample survey in consultation with the concerned utilities.

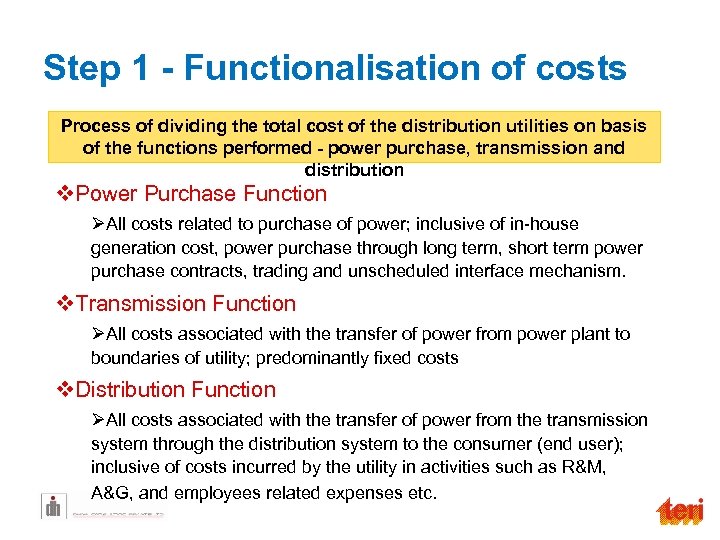

Step 1 - Functionalisation of costs Process of dividing the total cost of the distribution utilities on basis of the functions performed - power purchase, transmission and distribution v. Power Purchase Function ØAll costs related to purchase of power; inclusive of in-house generation cost, power purchase through long term, short term power purchase contracts, trading and unscheduled interface mechanism. v. Transmission Function ØAll costs associated with the transfer of power from power plant to boundaries of utility; predominantly fixed costs v. Distribution Function ØAll costs associated with the transfer of power from the transmission system through the distribution system to the consumer (end user); inclusive of costs incurred by the utility in activities such as R&M, A&G, and employees related expenses etc.

Step 1 - Functionalisation of costs Process of dividing the total cost of the distribution utilities on basis of the functions performed - power purchase, transmission and distribution v. Power Purchase Function ØAll costs related to purchase of power; inclusive of in-house generation cost, power purchase through long term, short term power purchase contracts, trading and unscheduled interface mechanism. v. Transmission Function ØAll costs associated with the transfer of power from power plant to boundaries of utility; predominantly fixed costs v. Distribution Function ØAll costs associated with the transfer of power from the transmission system through the distribution system to the consumer (end user); inclusive of costs incurred by the utility in activities such as R&M, A&G, and employees related expenses etc.

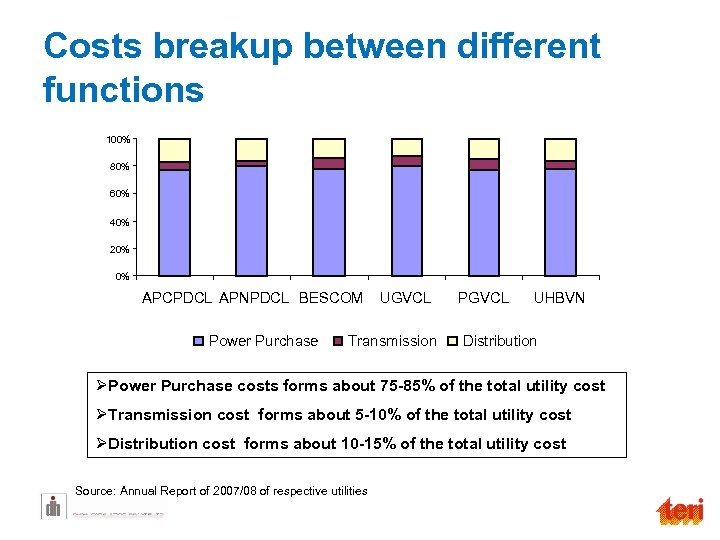

Costs breakup between different functions 100% 80% 60% 40% 20% 0% APCPDCL APNPDCL BESCOM Power Purchase UGVCL Transmission PGVCL UHBVN Distribution ØPower Purchase costs forms about 75 -85% of the total utility cost ØTransmission cost forms about 5 -10% of the total utility cost ØDistribution cost forms about 10 -15% of the total utility cost Source: Annual Report of 2007/08 of respective utilities

Costs breakup between different functions 100% 80% 60% 40% 20% 0% APCPDCL APNPDCL BESCOM Power Purchase UGVCL Transmission PGVCL UHBVN Distribution ØPower Purchase costs forms about 75 -85% of the total utility cost ØTransmission cost forms about 5 -10% of the total utility cost ØDistribution cost forms about 10 -15% of the total utility cost Source: Annual Report of 2007/08 of respective utilities

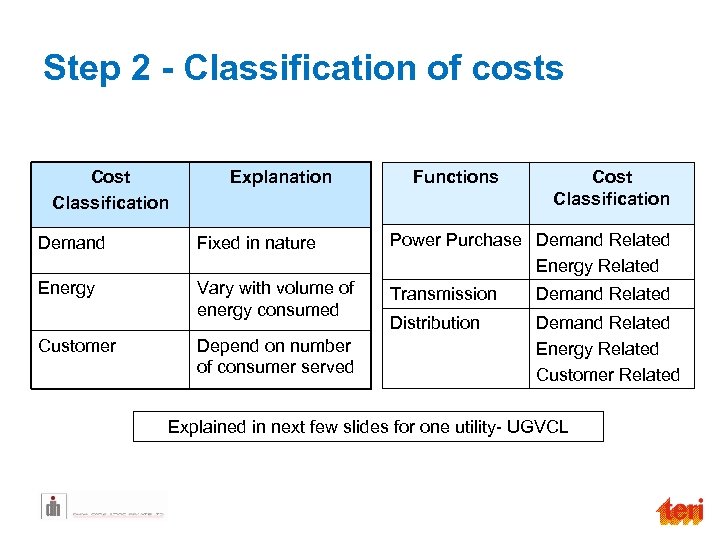

Step 2 - Classification of costs Cost Classification Explanation Functions Cost Classification Demand Fixed in nature Power Purchase Demand Related Energy Vary with volume of energy consumed Transmission Demand Related Distribution Demand Related Energy Related Customer Depend on number of consumer served Explained in next few slides for one utility- UGVCL

Step 2 - Classification of costs Cost Classification Explanation Functions Cost Classification Demand Fixed in nature Power Purchase Demand Related Energy Vary with volume of energy consumed Transmission Demand Related Distribution Demand Related Energy Related Customer Depend on number of consumer served Explained in next few slides for one utility- UGVCL

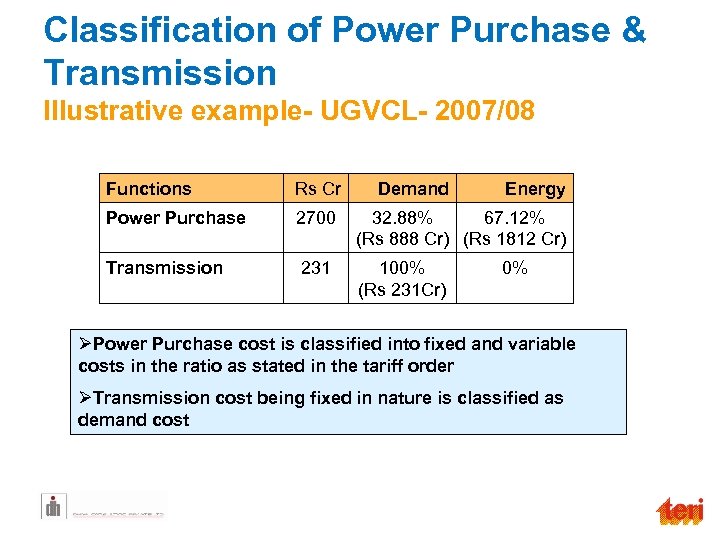

Classification of Power Purchase & Transmission Illustrative example- UGVCL- 2007/08 Functions Rs Cr Demand Energy Power Purchase 2700 32. 88% 67. 12% (Rs 888 Cr) (Rs 1812 Cr) Transmission 231 100% (Rs 231 Cr) 0% ØPower Purchase cost is classified into fixed and variable costs in the ratio as stated in the tariff order ØTransmission cost being fixed in nature is classified as demand cost

Classification of Power Purchase & Transmission Illustrative example- UGVCL- 2007/08 Functions Rs Cr Demand Energy Power Purchase 2700 32. 88% 67. 12% (Rs 888 Cr) (Rs 1812 Cr) Transmission 231 100% (Rs 231 Cr) 0% ØPower Purchase cost is classified into fixed and variable costs in the ratio as stated in the tariff order ØTransmission cost being fixed in nature is classified as demand cost

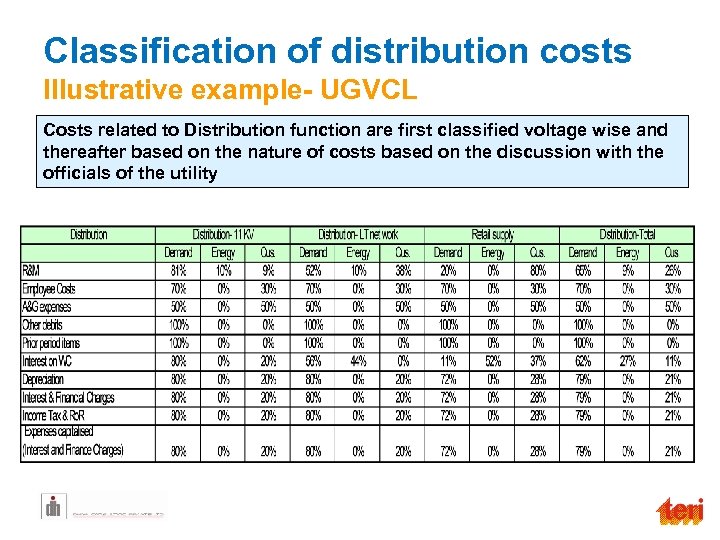

Classification of distribution costs Illustrative example- UGVCL Costs related to Distribution function are first classified voltage wise and thereafter based on the nature of costs based on the discussion with the officials of the utility

Classification of distribution costs Illustrative example- UGVCL Costs related to Distribution function are first classified voltage wise and thereafter based on the nature of costs based on the discussion with the officials of the utility

Classification of distribution costs (in Rs Cr) Illustrative example- UGVCL

Classification of distribution costs (in Rs Cr) Illustrative example- UGVCL

Step 3 - Sample Feeder Analysis v Identification of sample feeders Ø Predominantly agriculture load (80%) Ø Representative of the different circle to capture the geographical spread v Identification of sample days for data collection Ø 18 days uniformly spread across the entire year to capture the seasonality in agricultural demand of the utility. Ø 1 day of utility peak day v Derivation of load curve from the above data v Estimation of Class Load Factor Ø Average Demand/ Peak demand v Estimation of load loss factor Ø Empirical formula by EPRI to estimate energy losses Ø (0. 3 *Load Factor +0. 7 (Load Factor)^2

Step 3 - Sample Feeder Analysis v Identification of sample feeders Ø Predominantly agriculture load (80%) Ø Representative of the different circle to capture the geographical spread v Identification of sample days for data collection Ø 18 days uniformly spread across the entire year to capture the seasonality in agricultural demand of the utility. Ø 1 day of utility peak day v Derivation of load curve from the above data v Estimation of Class Load Factor Ø Average Demand/ Peak demand v Estimation of load loss factor Ø Empirical formula by EPRI to estimate energy losses Ø (0. 3 *Load Factor +0. 7 (Load Factor)^2

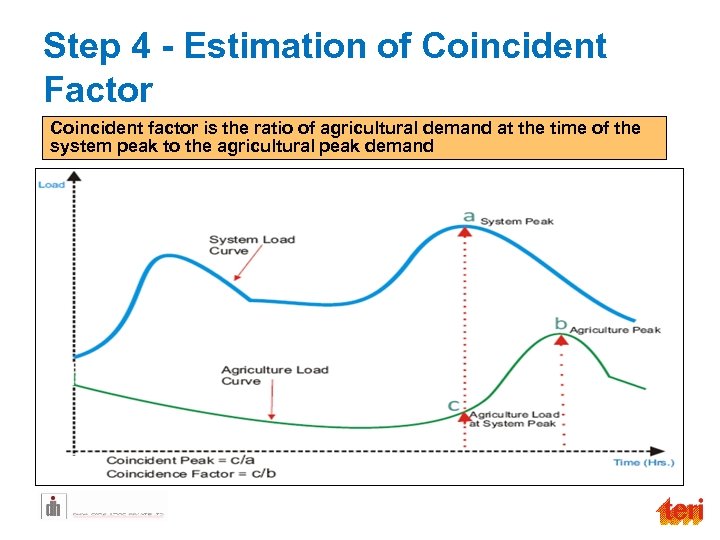

Step 4 - Estimation of Coincident Factor Coincident factor is the ratio of agricultural demand at the time of the system peak to the agricultural peak demand

Step 4 - Estimation of Coincident Factor Coincident factor is the ratio of agricultural demand at the time of the system peak to the agricultural peak demand

Estimation of CF using average peak • Agriculture category faces administered peak with lack of voluntary consumption, thus usage of single peak gives biased results • States witness large variation in monthly peak, thus usage of average peak will capture the overall seasonality during the year. Steps in Calculating Coincident Factor Ø Ascertain the time and magnitude of system peak for each of the 12 months separately Ø Establish the corresponding load from the sample feeder data (average if there are more than two readings for the month) Ø From the above, take a simple average of above 12 monthly readings. Ø This average divided by the feeder sample peak gives the CF

Estimation of CF using average peak • Agriculture category faces administered peak with lack of voluntary consumption, thus usage of single peak gives biased results • States witness large variation in monthly peak, thus usage of average peak will capture the overall seasonality during the year. Steps in Calculating Coincident Factor Ø Ascertain the time and magnitude of system peak for each of the 12 months separately Ø Establish the corresponding load from the sample feeder data (average if there are more than two readings for the month) Ø From the above, take a simple average of above 12 monthly readings. Ø This average divided by the feeder sample peak gives the CF

Illustration- UGVCL Estimation of CF Selected Days for sample collection Sample Feeder Data for 24 Hours of a day Months Peak Timings Corresp onding Feeder data Oct 12: 00 PM 5. 19 Nov 9: 00 AM 3. 60 Dec 11: 00 AM 4. 81 Jan 5: 00 AM 4. 47 Months Peak Timings Correspon ding Feeder data Apr 8: 00 AM 3. 62 May 6: 00 AM 5. 33 Jun 7: 00 AM 3. 34 Jul 8: 00 AM 2. 25 Aug 8: 00 AM 0. 89 Feb 2: 00 PM 4. 98 Sep 9: 00 AM 1. 72 Mar 12: 00 AM 1. 93 Average 3. 51 Max feeder load = 9. 25 MW CF= Agri demand during system peak/ Max peak = 3. 51/9. 25 = 37. 97%

Illustration- UGVCL Estimation of CF Selected Days for sample collection Sample Feeder Data for 24 Hours of a day Months Peak Timings Corresp onding Feeder data Oct 12: 00 PM 5. 19 Nov 9: 00 AM 3. 60 Dec 11: 00 AM 4. 81 Jan 5: 00 AM 4. 47 Months Peak Timings Correspon ding Feeder data Apr 8: 00 AM 3. 62 May 6: 00 AM 5. 33 Jun 7: 00 AM 3. 34 Jul 8: 00 AM 2. 25 Aug 8: 00 AM 0. 89 Feb 2: 00 PM 4. 98 Sep 9: 00 AM 1. 72 Mar 12: 00 AM 1. 93 Average 3. 51 Max feeder load = 9. 25 MW CF= Agri demand during system peak/ Max peak = 3. 51/9. 25 = 37. 97%

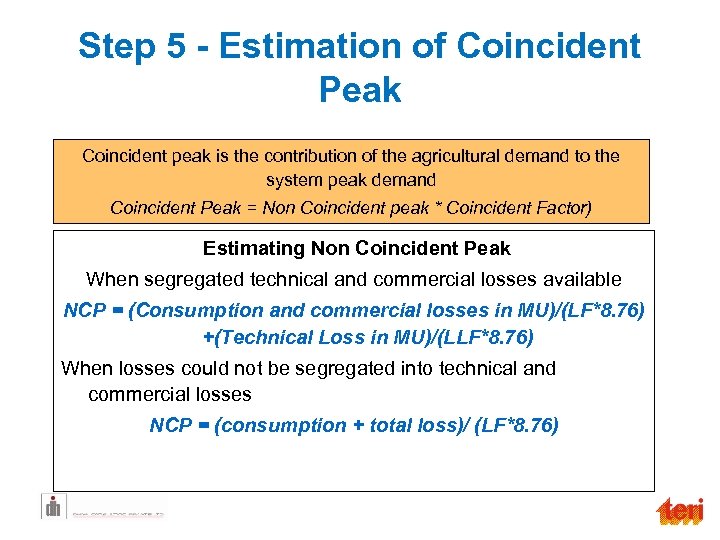

Step 5 - Estimation of Coincident Peak Coincident peak is the contribution of the agricultural demand to the system peak demand Coincident Peak = Non Coincident peak * Coincident Factor) Estimating Non Coincident Peak When segregated technical and commercial losses available NCP = (Consumption and commercial losses in MU)/(LF*8. 76) +(Technical Loss in MU)/(LLF*8. 76) When losses could not be segregated into technical and commercial losses NCP = (consumption + total loss)/ (LF*8. 76)

Step 5 - Estimation of Coincident Peak Coincident peak is the contribution of the agricultural demand to the system peak demand Coincident Peak = Non Coincident peak * Coincident Factor) Estimating Non Coincident Peak When segregated technical and commercial losses available NCP = (Consumption and commercial losses in MU)/(LF*8. 76) +(Technical Loss in MU)/(LLF*8. 76) When losses could not be segregated into technical and commercial losses NCP = (consumption + total loss)/ (LF*8. 76)

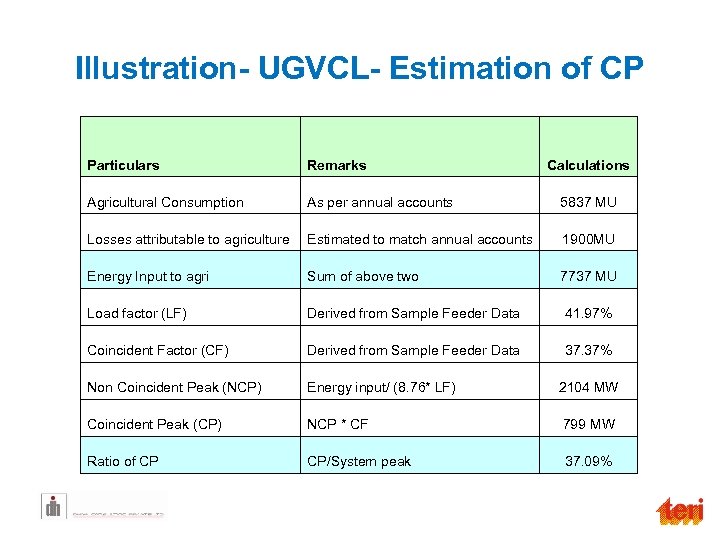

Illustration- UGVCL- Estimation of CP Particulars Remarks Agricultural Consumption As per annual accounts Calculations 5837 MU Losses attributable to agriculture Estimated to match annual accounts 1900 MU Energy Input to agri Sum of above two 7737 MU Load factor (LF) Derived from Sample Feeder Data 41. 97% Coincident Factor (CF) Derived from Sample Feeder Data 37. 37% Non Coincident Peak (NCP) Energy input/ (8. 76* LF) 2104 MW Coincident Peak (CP) NCP * CF 799 MW Ratio of CP CP/System peak 37. 09%

Illustration- UGVCL- Estimation of CP Particulars Remarks Agricultural Consumption As per annual accounts Calculations 5837 MU Losses attributable to agriculture Estimated to match annual accounts 1900 MU Energy Input to agri Sum of above two 7737 MU Load factor (LF) Derived from Sample Feeder Data 41. 97% Coincident Factor (CF) Derived from Sample Feeder Data 37. 37% Non Coincident Peak (NCP) Energy input/ (8. 76* LF) 2104 MW Coincident Peak (CP) NCP * CF 799 MW Ratio of CP CP/System peak 37. 09%

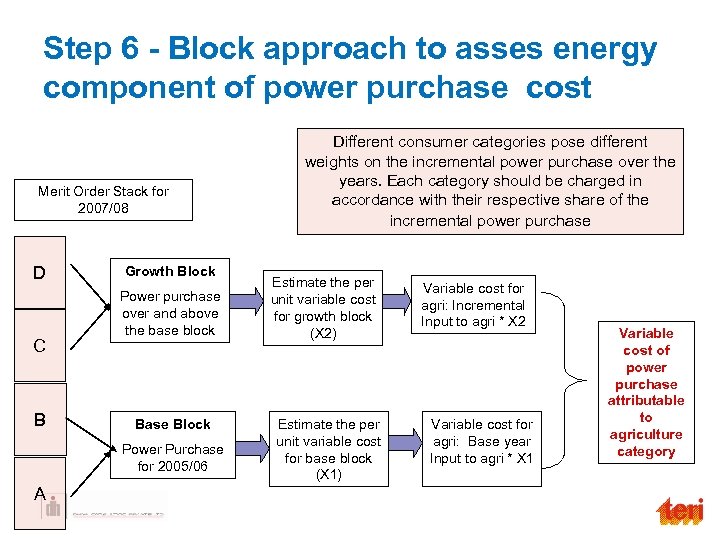

Step 6 - Block approach to asses energy component of power purchase cost Merit Order Stack for 2007/08 D C B Growth Block Power purchase over and above the base block Base Block Power Purchase for 2005/06 A Different consumer categories pose different weights on the incremental power purchase over the years. Each category should be charged in accordance with their respective share of the incremental power purchase Estimate the per unit variable cost for growth block (X 2) Estimate the per unit variable cost for base block (X 1) Variable cost for agri: Incremental Input to agri * X 2 Variable cost for agri: Base year Input to agri * X 1 Variable cost of power purchase attributable to agriculture category

Step 6 - Block approach to asses energy component of power purchase cost Merit Order Stack for 2007/08 D C B Growth Block Power purchase over and above the base block Base Block Power Purchase for 2005/06 A Different consumer categories pose different weights on the incremental power purchase over the years. Each category should be charged in accordance with their respective share of the incremental power purchase Estimate the per unit variable cost for growth block (X 2) Estimate the per unit variable cost for base block (X 1) Variable cost for agri: Incremental Input to agri * X 2 Variable cost for agri: Base year Input to agri * X 1 Variable cost of power purchase attributable to agriculture category

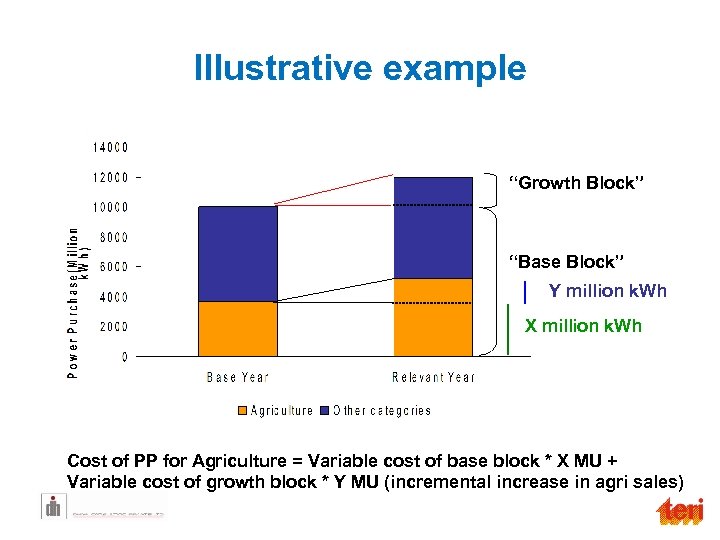

Illustrative example “Growth Block” “Base Block” Y million k. Wh X million k. Wh Cost of PP for Agriculture = Variable cost of base block * X MU + Variable cost of growth block * Y MU (incremental increase in agri sales)

Illustrative example “Growth Block” “Base Block” Y million k. Wh X million k. Wh Cost of PP for Agriculture = Variable cost of base block * X MU + Variable cost of growth block * Y MU (incremental increase in agri sales)

Step 7 - Allocation of classified costs Allocation of Demand Costs ØFor all functions demand cost is allocated on basis of coincident peak demand Allocation of Energy Costs: ØFor power purchase energy cost component is allocated on the basis of block approach (previous slide) ØFor transmission & distribution function, energy cost component is allocated on the basis of ratio of agricultural consumption to the total consumption of the utility Allocation of Customer Costs: ØFor three functions, customer related cost is allocated on the basis of the ratio of number of agricultural consumers to the total consumers of the utility. Sum total of the different cost (demand, energy and customer related cost) allocated to the agri consumers gives the total cost of supplying power to agricultural consumers as incurred by the particular utility.

Step 7 - Allocation of classified costs Allocation of Demand Costs ØFor all functions demand cost is allocated on basis of coincident peak demand Allocation of Energy Costs: ØFor power purchase energy cost component is allocated on the basis of block approach (previous slide) ØFor transmission & distribution function, energy cost component is allocated on the basis of ratio of agricultural consumption to the total consumption of the utility Allocation of Customer Costs: ØFor three functions, customer related cost is allocated on the basis of the ratio of number of agricultural consumers to the total consumers of the utility. Sum total of the different cost (demand, energy and customer related cost) allocated to the agri consumers gives the total cost of supplying power to agricultural consumers as incurred by the particular utility.

Illustration- UGVCL- Allocation of cost Power Purchase Cost Transmission charges Total Cost Distribution Total Demand Energy Functionalised & Classified Cost of UGVCL( Rs Cr) 887. 63 1811. 73 231. 50 296. 96 19. 41 114. 66 3361. 88 Allocation of Cost to Agricultural Category (Rs Cr) 329. 21 1073. 93 85. 86 110. 14 11. 55 27. 86 1638. 55 0. 56 1. 84 0. 15 0. 19 0. 02 0. 05 2. 81 Per unit Cost to agriconsumers (Rs /Kwh) Block approach Customer Demand On basis of Coincident peak Energy Customer Demand Energy Customer In ratio of energy sent to Agricultural consumers to total power purchase In ratio of Agricultural consumer to total

Illustration- UGVCL- Allocation of cost Power Purchase Cost Transmission charges Total Cost Distribution Total Demand Energy Functionalised & Classified Cost of UGVCL( Rs Cr) 887. 63 1811. 73 231. 50 296. 96 19. 41 114. 66 3361. 88 Allocation of Cost to Agricultural Category (Rs Cr) 329. 21 1073. 93 85. 86 110. 14 11. 55 27. 86 1638. 55 0. 56 1. 84 0. 15 0. 19 0. 02 0. 05 2. 81 Per unit Cost to agriconsumers (Rs /Kwh) Block approach Customer Demand On basis of Coincident peak Energy Customer Demand Energy Customer In ratio of energy sent to Agricultural consumers to total power purchase In ratio of Agricultural consumer to total

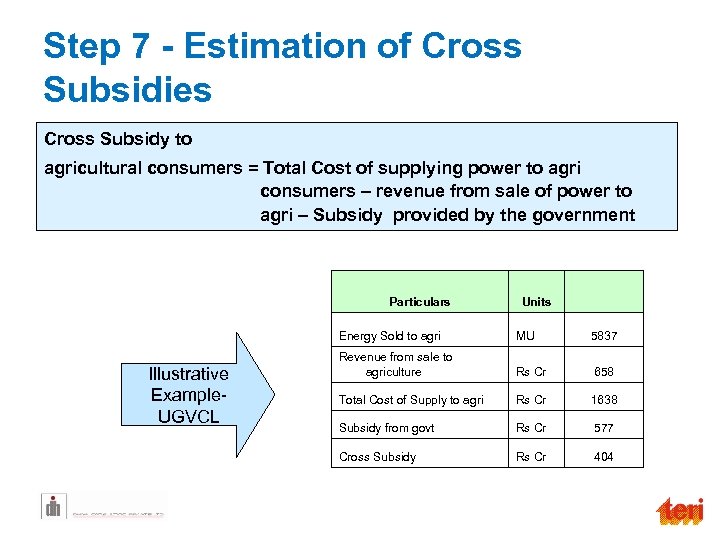

Step 7 - Estimation of Cross Subsidies Cross Subsidy to agricultural consumers = Total Cost of supplying power to agri consumers – revenue from sale of power to agri – Subsidy provided by the government Particulars Units Energy Sold to agri Illustrative Example- UGVCL MU 5837 Revenue from sale to agriculture Rs Cr 658 Total Cost of Supply to agri Rs Cr 1638 Subsidy from govt Rs Cr 577 Cross Subsidy Rs Cr 404

Step 7 - Estimation of Cross Subsidies Cross Subsidy to agricultural consumers = Total Cost of supplying power to agri consumers – revenue from sale of power to agri – Subsidy provided by the government Particulars Units Energy Sold to agri Illustrative Example- UGVCL MU 5837 Revenue from sale to agriculture Rs Cr 658 Total Cost of Supply to agri Rs Cr 1638 Subsidy from govt Rs Cr 577 Cross Subsidy Rs Cr 404

Module 5 Conclusions

Module 5 Conclusions

Conclusions……i v Move towards the actual cost to serve pricing principle Ø It would introduce transparency in rate designing and hence in subsidy/ cross subsidy assessment v Special attention to be taken in allocating power purchase costs Ø Power purchase costs form significant share (75 -80%) in overall costs (fixed and variable) Ø Further, fixed costs ranges between 20% to 50% of the total PP cost (depending on vintage/type/technology of plant) v Agriculture Co. S to also reflect quality and reliability of supply Ø Reliabity of supply -Agriculture consumers mostly get restricted supply Ø When consumers pre informed: No discount on cost of supply Ø When consumers not pre informed: Discount on cost of supply

Conclusions……i v Move towards the actual cost to serve pricing principle Ø It would introduce transparency in rate designing and hence in subsidy/ cross subsidy assessment v Special attention to be taken in allocating power purchase costs Ø Power purchase costs form significant share (75 -80%) in overall costs (fixed and variable) Ø Further, fixed costs ranges between 20% to 50% of the total PP cost (depending on vintage/type/technology of plant) v Agriculture Co. S to also reflect quality and reliability of supply Ø Reliabity of supply -Agriculture consumers mostly get restricted supply Ø When consumers pre informed: No discount on cost of supply Ø When consumers not pre informed: Discount on cost of supply

Conclusions……ii Ø Quality of supply – Often characterised by poor voltage profile Ø Modify the total cost of power purchase on account of agriculture consumers considering the average voltage deviations beyond permissible limit Ø Aggregating the penalty levied on licensees due to poor quality supply and, thereby, moderating the power purchase cost v Use of appropriate load curves Ø Need of load research study for assessment of power demand of consumer class Ø Sample feeders selected to have predominant load of agricultural consumers v Need to capture seasonal diversity in estimation of CF Ø Agriculture demand varies across year due to different seasons, cropping pattern and rainfall

Conclusions……ii Ø Quality of supply – Often characterised by poor voltage profile Ø Modify the total cost of power purchase on account of agriculture consumers considering the average voltage deviations beyond permissible limit Ø Aggregating the penalty levied on licensees due to poor quality supply and, thereby, moderating the power purchase cost v Use of appropriate load curves Ø Need of load research study for assessment of power demand of consumer class Ø Sample feeders selected to have predominant load of agricultural consumers v Need to capture seasonal diversity in estimation of CF Ø Agriculture demand varies across year due to different seasons, cropping pattern and rainfall

Conclusions……iii Ø Capture the diversity in agriculture demand by taking into account sample load data spread across the year v Estimation of CF to be based on average monthly peak Ø Agriculture faces administered peak Ø Consumption curve for agriculture would be different had they been provided 24 hrs access to power Ø Use of single “peak” for estimating Co. S imposes higher burden on this category and does not take into account the effect of seasonality v Need to change the assets/expenditure accounting practices Ø Utilities should maintain the voltage wise inventory of assets

Conclusions……iii Ø Capture the diversity in agriculture demand by taking into account sample load data spread across the year v Estimation of CF to be based on average monthly peak Ø Agriculture faces administered peak Ø Consumption curve for agriculture would be different had they been provided 24 hrs access to power Ø Use of single “peak” for estimating Co. S imposes higher burden on this category and does not take into account the effect of seasonality v Need to change the assets/expenditure accounting practices Ø Utilities should maintain the voltage wise inventory of assets

Thank You

Thank You