cf59db360dfed5e61a8e4eb00a3cffe5.ppt

- Количество слайдов: 33

Assessing the WLAN business opportunity June 2003

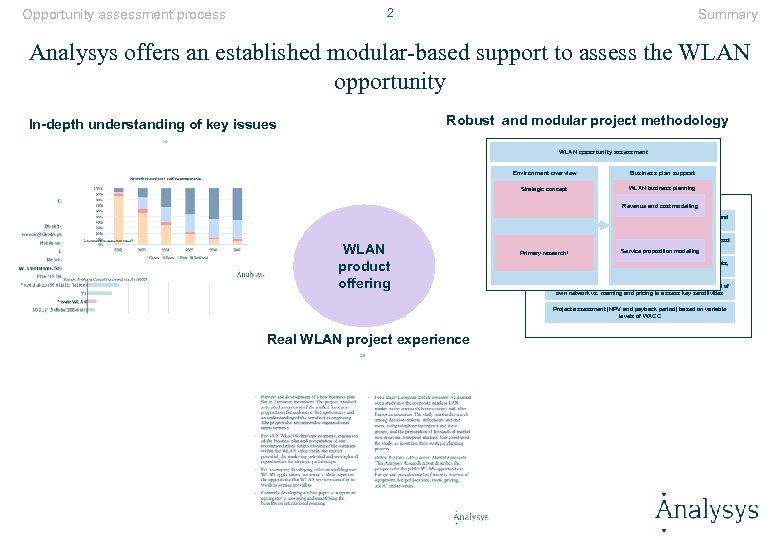

2 Opportunity assessment process Summary Analysys offers an established modular-based support to assess the WLAN opportunity Robust and modular project methodology In-depth understanding of key issues WLAN opportunity assessment Environment overview Business plan support Strategic concept WLAN business planning Revenue and cost modelling Key features of the business model already developed Six user segments with the option of six subscription packages and four prepay pricing packages for each segment WLAN product offering Twelve different hot spot types with three different revenue and cost share propositions with the hot spot owners Service proposition modelling Primary research 1 Link between end-user usage patterns and backhaul requirements, including different backhaul options (ADSL, Frame relay) Multiple scenarios for user levels, speed of hot spot roll-out, level of own network vs. roaming and pricing to assess key sensitivities Project assessment (NPV and payback period) based on variable levels of WACC Real WLAN project experience

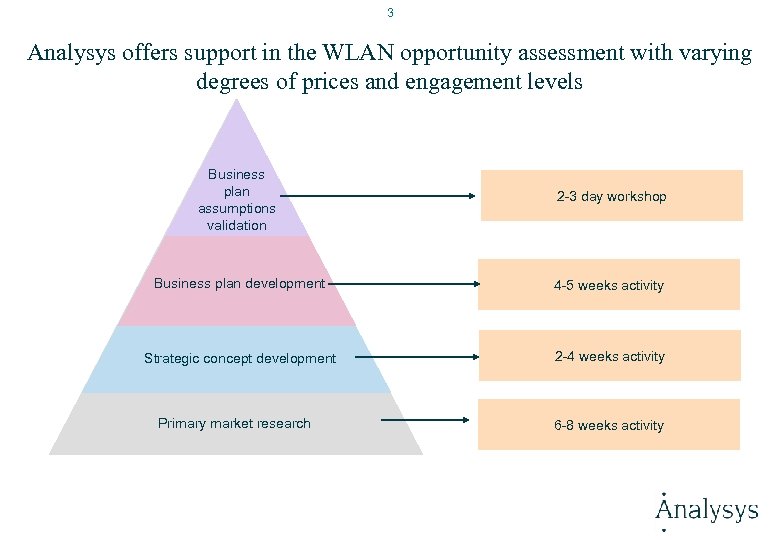

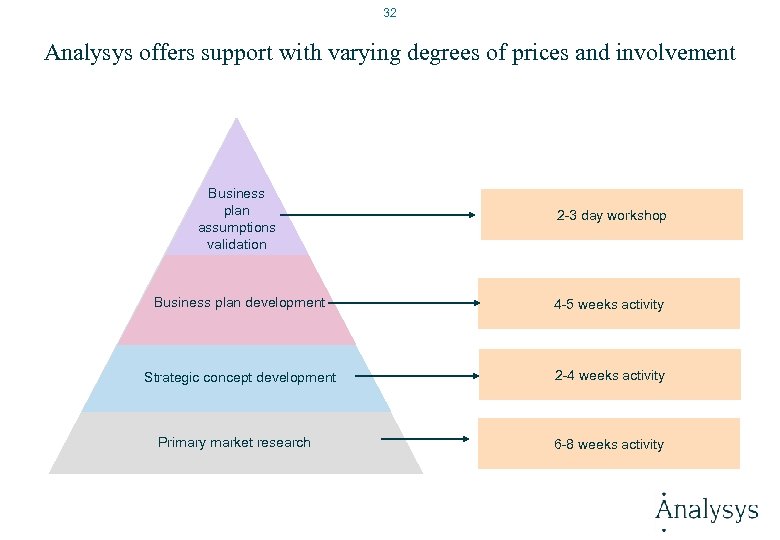

3 Analysys offers support in the WLAN opportunity assessment with varying degrees of prices and engagement levels Business plan assumptions validation 2 -3 day workshop Business plan development 4 -5 weeks activity Strategic concept development 2 -4 weeks activity Primary market research 6 -8 weeks activity

4 Analysys overview Key developments in WLAN Key issues in the WLAN opportunity Areas of WLAN consulting support

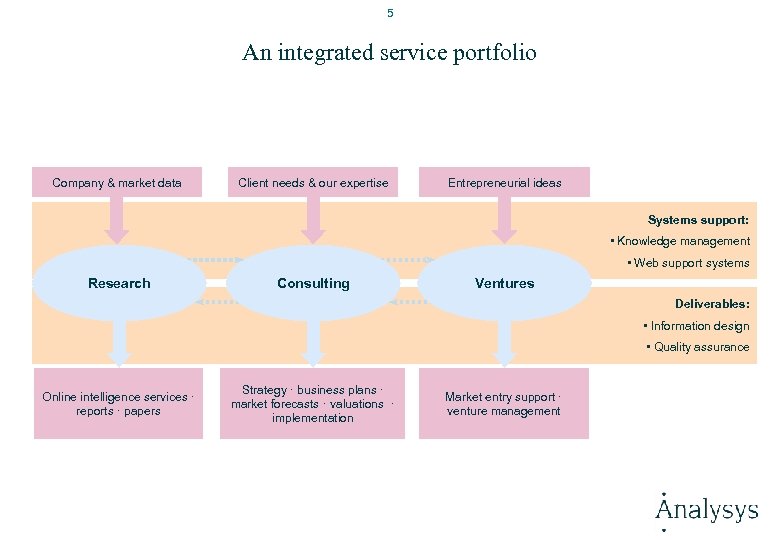

5 An integrated service portfolio Company & market data Client needs & our expertise Entrepreneurial ideas Systems support: • Knowledge management • Web support systems Research Consulting Ventures Deliverables: • Information design • Quality assurance Online intelligence services · reports · papers Strategy · business plans · market forecasts · valuations · implementation Market entry support · venture management

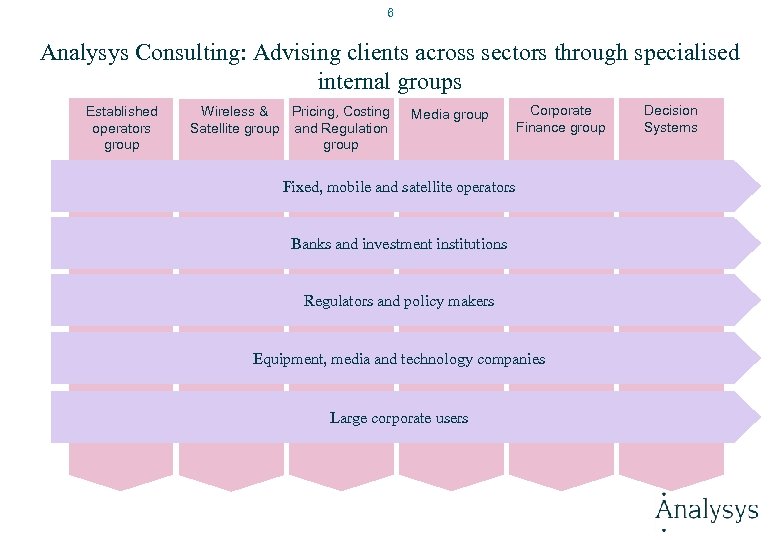

6 Analysys Consulting: Advising clients across sectors through specialised internal groups Established operators group Wireless & Pricing, Costing Satellite group and Regulation group Media group Corporate Finance group Fixed, mobile and satellite operators Banks and investment institutions Regulators and policy makers Equipment, media and technology companies Large corporate users Decision Systems

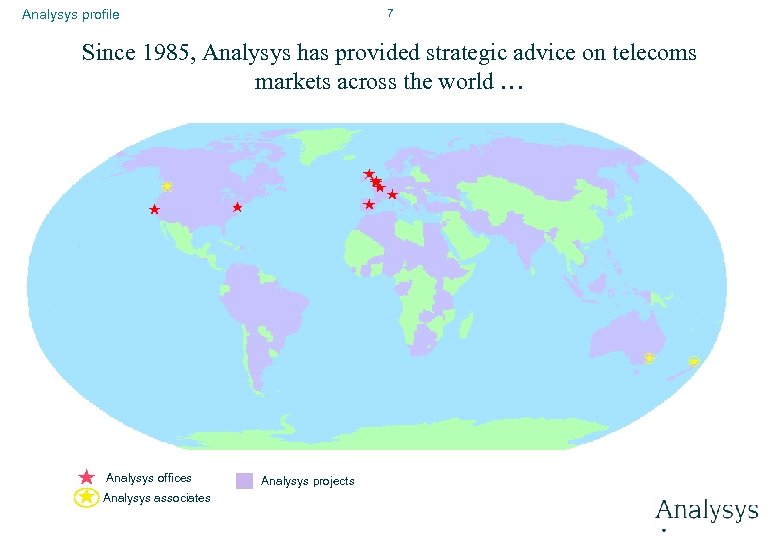

7 Analysys profile Since 1985, Analysys has provided strategic advice on telecoms markets across the world … Analysys offices Analysys associates Analysys projects

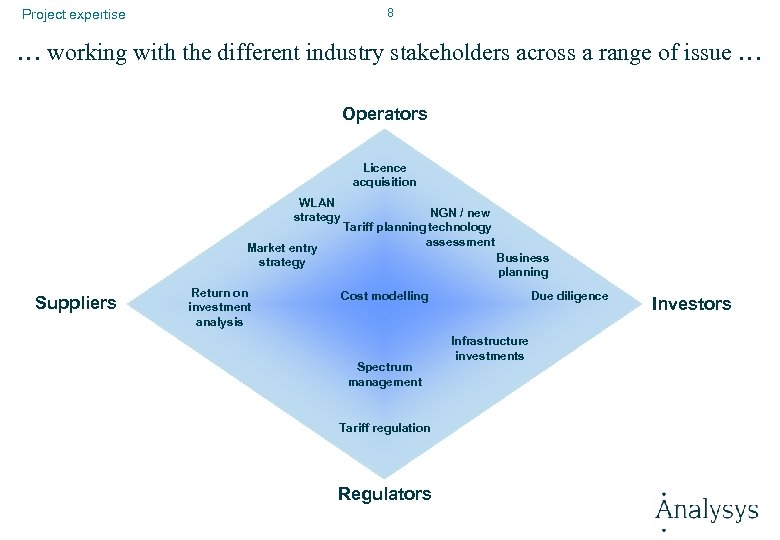

8 Project expertise … working with the different industry stakeholders across a range of issue … Operators Licence acquisition WLAN strategy Market entry strategy Suppliers Return on investment analysis NGN / new Tariff planning technology assessment Business planning Cost modelling Spectrum management Tariff regulation Regulators Due diligence Infrastructure investments Investors

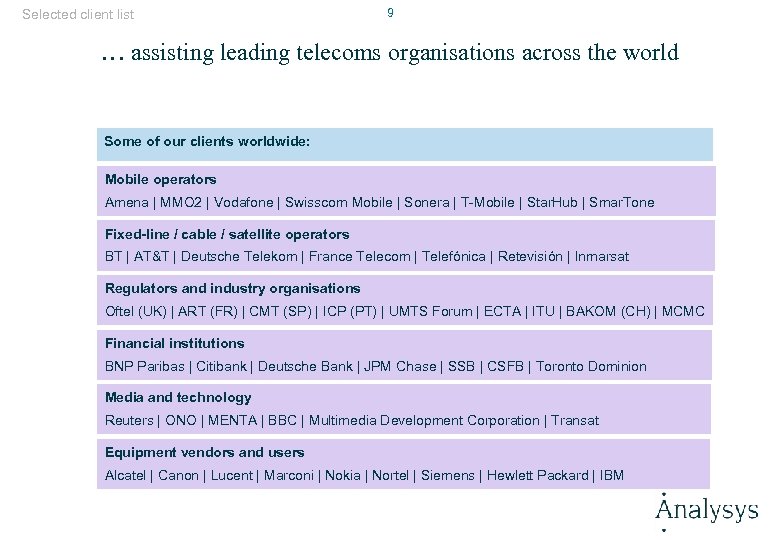

Selected client list 9 … assisting leading telecoms organisations across the world Some of our clients worldwide: Mobile operators Amena | MMO 2 | Vodafone | Swisscom Mobile | Sonera | T-Mobile | Star. Hub | Smar. Tone Fixed-line / cable / satellite operators BT | AT&T | Deutsche Telekom | France Telecom | Telefónica | Retevisión | Inmarsat Regulators and industry organisations Oftel (UK) | ART (FR) | CMT (SP) | ICP (PT) | UMTS Forum | ECTA | ITU | BAKOM (CH) | MCMC Financial institutions BNP Paribas | Citibank | Deutsche Bank | JPM Chase | SSB | CSFB | Toronto Dominion Media and technology Reuters | ONO | MENTA | BBC | Multimedia Development Corporation | Transat Equipment vendors and users Alcatel | Canon | Lucent | Marconi | Nokia | Nortel | Siemens | Hewlett Packard | IBM

10 Analysys overview Key developments in WLAN Key issues in the WLAN opportunity Areas of WLAN consulting support

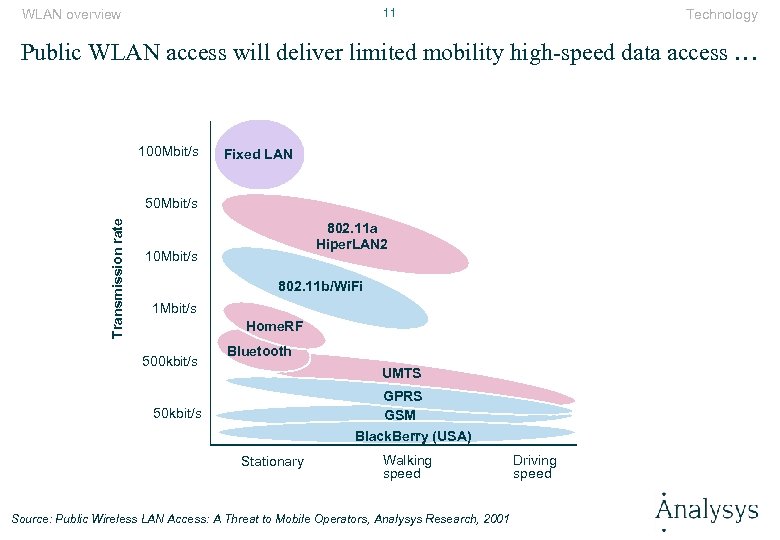

11 WLAN overview Technology Public WLAN access will deliver limited mobility high-speed data access … 100 Mbit/s Fixed LAN Transmission rate 50 Mbit/s 802. 11 a Hiper. LAN 2 10 Mbit/s 802. 11 b/Wi. Fi 1 Mbit/s 500 kbit/s Home. RF Bluetooth UMTS GPRS GSM 50 kbit/s Black. Berry (USA) Blackberry (US) Stationary Walking speed Source: Public Wireless LAN Access: A Threat to Mobile Operators, Analysys Research, 2001 Driving speed

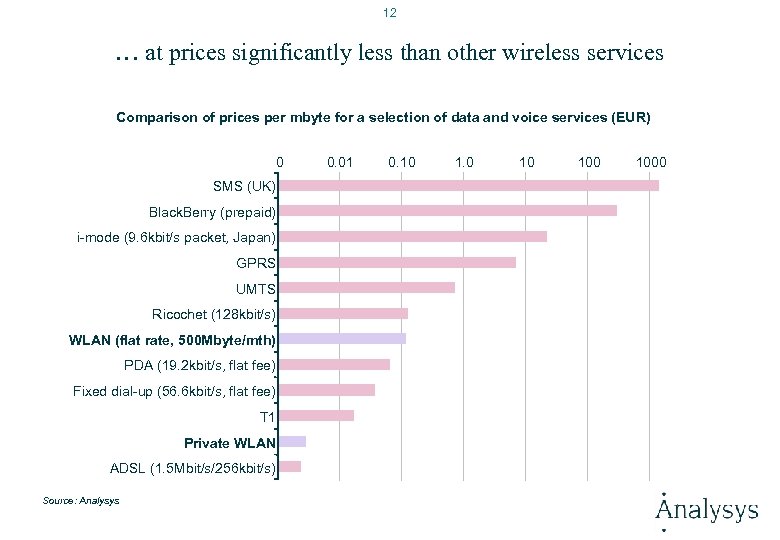

12 … at prices significantly less than other wireless services Comparison of prices per mbyte for a selection of data and voice services (EUR) 0 SMS (UK) Black. Berry (prepaid) i-mode (9. 6 kbit/s packet, Japan) GPRS UMTS Ricochet (128 kbit/s) WLAN (flat rate, 500 Mbyte/mth) PDA (19. 2 kbit/s, flat fee) Fixed dial-up (56. 6 kbit/s, flat fee) T 1 Private WLAN ADSL (1. 5 Mbit/s/256 kbit/s) Source: Analysys 0. 01 0. 10 1. 0 10 1000

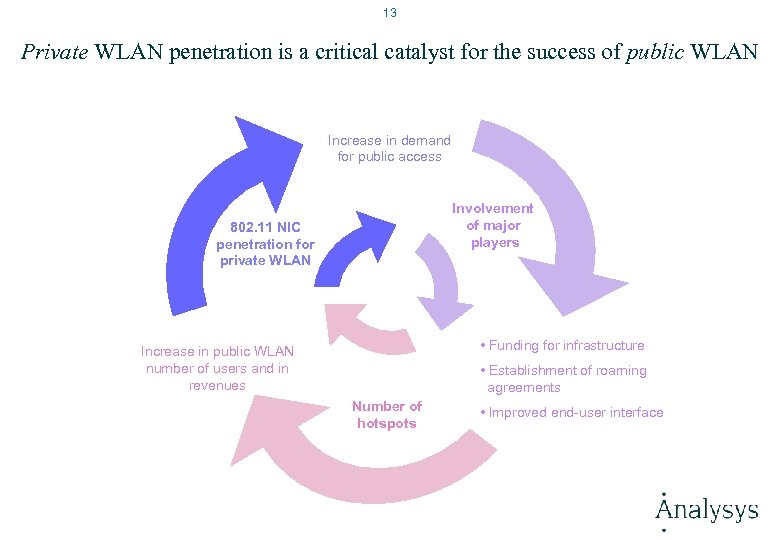

13 Private WLAN penetration is a critical catalyst for the success of public WLAN Increase in demand for public access Involvement of major players 802. 11 NIC penetration for private WLAN • Funding for infrastructure Increase in public WLAN number of users and in revenues • Establishment of roaming agreements Number of hotspots • Improved end-user interface

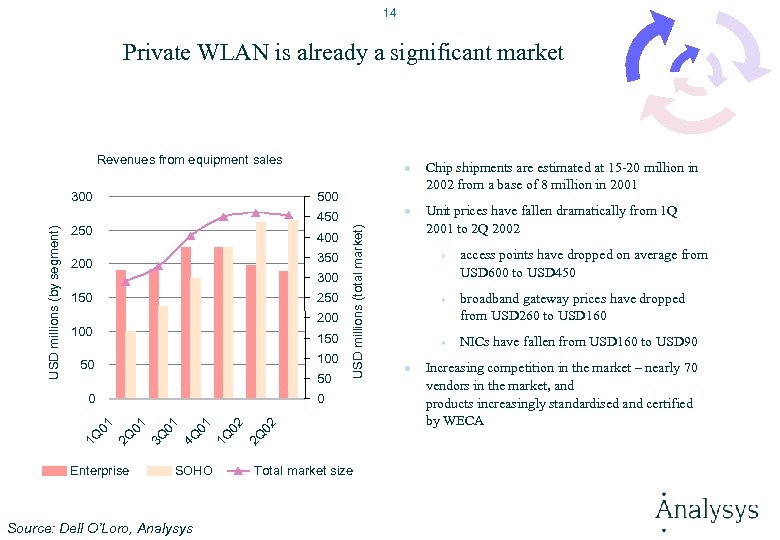

14 Private WLAN is already a significant market Revenues from equipment sales 500 250 400 350 200 300 150 200 150 100 50 50 Enterprise SOHO Source: Dell O’Loro, Analysys 02 2 Q 02 1 Q 01 4 Q 01 3 Q 01 0 2 Q 01 0 1 Q l 450 USD millions (total market) USD millions (by segment) 300 l Total market size Chip shipments are estimated at 15 -20 million in 2002 from a base of 8 million in 2001 Unit prices have fallen dramatically from 1 Q 2001 to 2 Q 2002 w w w l access points have dropped on average from USD 600 to USD 450 broadband gateway prices have dropped from USD 260 to USD 160 NICs have fallen from USD 160 to USD 90 Increasing competition in the market – nearly 70 vendors in the market, and products increasingly standardised and certified by WECA

15 Some major players are already involved… BT Openzone has a major thrust Natario launching in Manchester Cloud has announced plans to launch 3000 sites Telia Home Run is run independently of the mobile operator Copenhagen airport running its own WLAN service TDC Mobile targeting 100 hot spots China Mobile aggressively developing hot spot strategy Services are available in most major US airports and increasingly at hotel and café chains – 3400 hotspots Key players include Wayport, Voicestream/T-Mobile and AT&T/Intel: (Cometa) Swisscom acquisitions of WLAN AG and Megabeam has resulted in the first pan-European WLAN network Five country operators have formed a WLAN roaming alliance in South East Asia

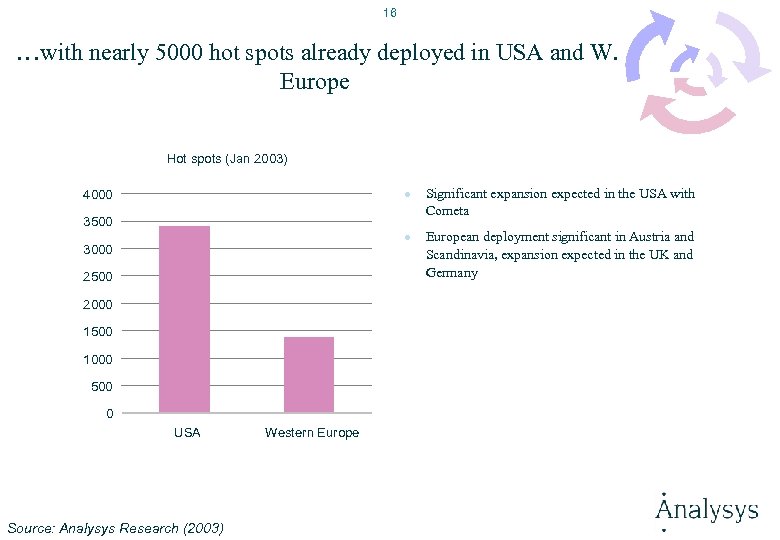

16 …with nearly 5000 hot spots already deployed in USA and W. Europe Hot spots (Jan 2003) 4000 l 3500 l 3000 2500 2000 1500 1000 500 0 USA Source: Analysys Research (2003) Western Europe Significant expansion expected in the USA with Cometa European deployment significant in Austria and Scandinavia, expansion expected in the UK and Germany

17 Analysys overview Key developments in WLAN Key issues in the WLAN opportunity Areas of WLAN consulting support

18 The nature of the public WLAN business Business users are expected to be the key drivers for initial WLAN take-up Nature of hot spots expected to be a key driver for revenues Role of WLAN in overall telecoms portfolio needs to be considered Backhaul costs form a significant part of network related costs Different types of operators have different areas of competitive advantage

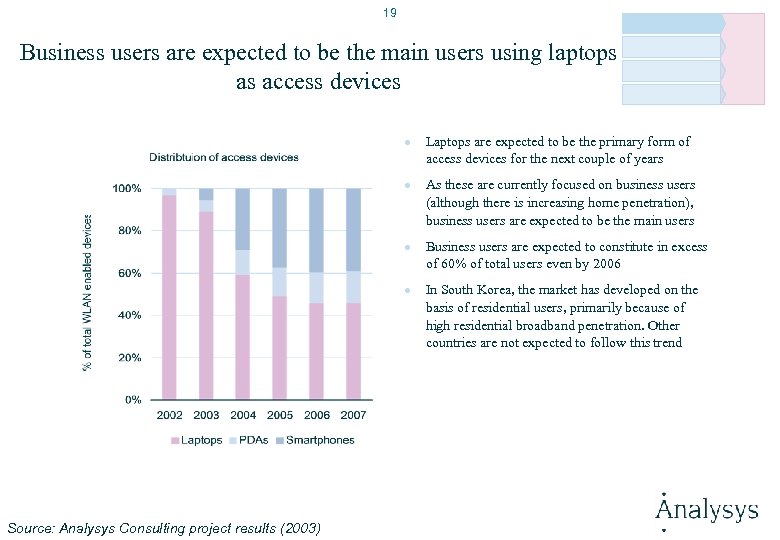

19 Business users are expected to be the main users using laptops as access devices l l Source: Analysys Consulting project results (2003) Laptops are expected to be the primary form of access devices for the next couple of years As these are currently focused on business users (although there is increasing home penetration), business users are expected to be the main users Business users are expected to constitute in excess of 60% of total users even by 2006 In South Korea, the market has developed on the basis of residential users, primarily because of high residential broadband penetration. Other countries are not expected to follow this trend

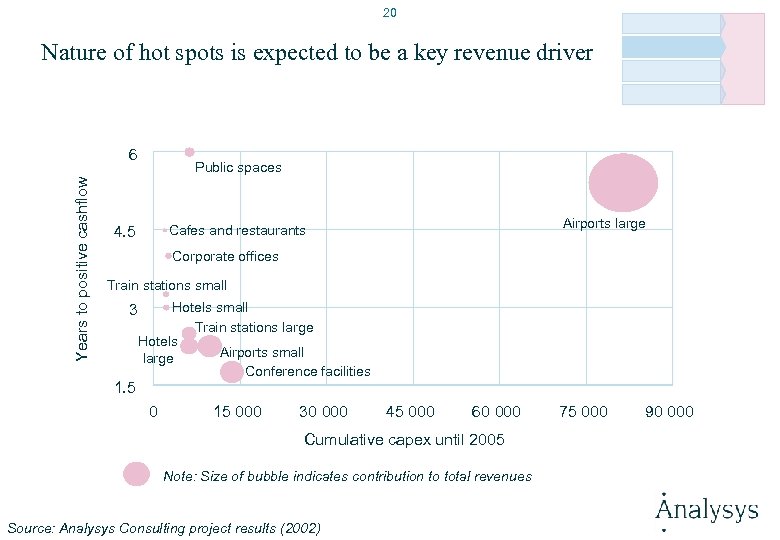

20 Nature of hot spots is expected to be a key revenue driver Years to positive cashflow 6 Public spaces Airports large Cafes and restaurants 4. 5 Corporate offices Train stations small 3 1. 5 Hotels small Train stations large Hotels Airports small large Conference facilities 0 15 000 30 000 45 000 60 000 Cumulative capex until 2005 Note: Size of bubble indicates contribution to total revenues Source: Analysys Consulting project results (2002) 75 000 90 000

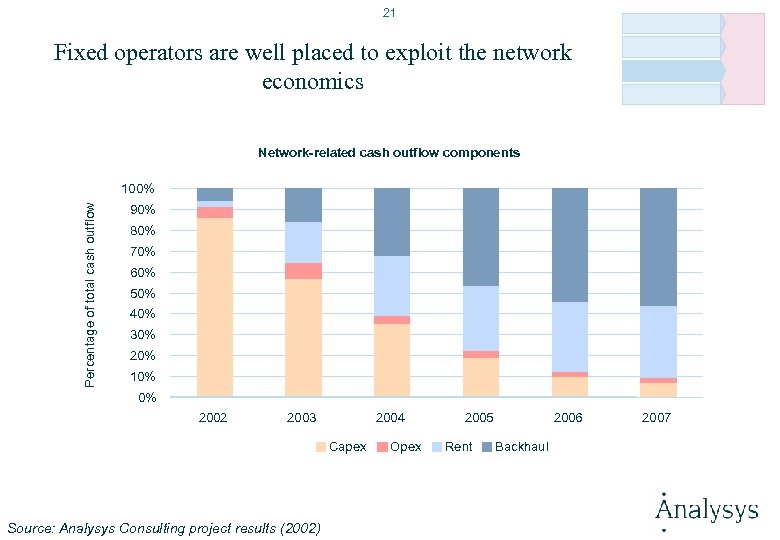

21 Fixed operators are well placed to exploit the network economics Network-related cash outflow components Percentage of total cash outflow 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2002 2003 2004 Capex Source: Analysys Consulting project results (2002) Opex 2005 Rent 2006 Backhaul 2007

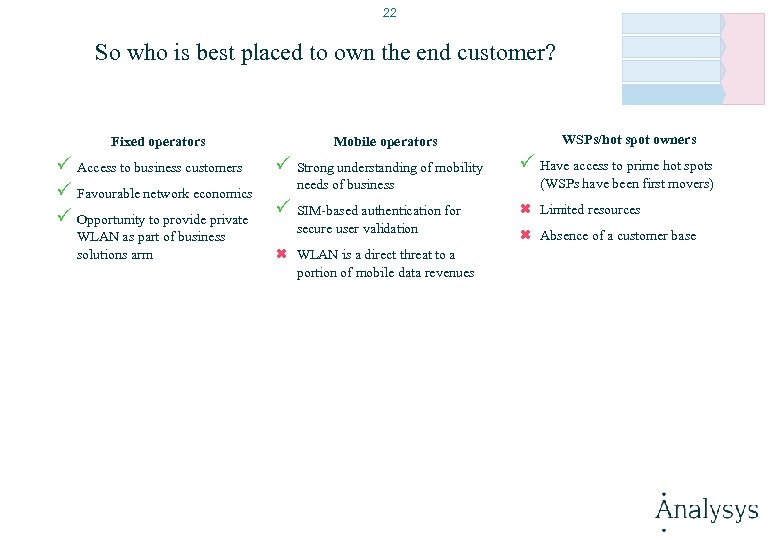

22 So who is best placed to own the end customer? Fixed operators P Access to business customers P Favourable network economics P Opportunity to provide private WLAN as part of business solutions arm Mobile operators P Strong understanding of mobility needs of business P SIM-based authentication for secure user validation Ó WLAN is a direct threat to a portion of mobile data revenues WSPs/hot spot owners P Have access to prime hot spots (WSPs have been first movers) Ó Limited resources Ó Absence of a customer base

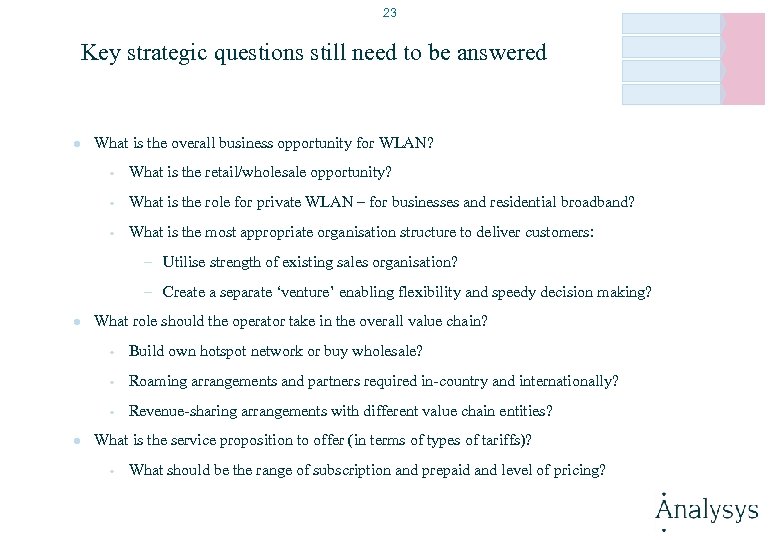

23 Key strategic questions still need to be answered l What is the overall business opportunity for WLAN? w What is the retail/wholesale opportunity? w What is the role for private WLAN – for businesses and residential broadband? w What is the most appropriate organisation structure to deliver customers: – Utilise strength of existing sales organisation? – Create a separate ‘venture’ enabling flexibility and speedy decision making? l What role should the operator take in the overall value chain? w w Roaming arrangements and partners required in-country and internationally? w l Build own hotspot network or buy wholesale? Revenue-sharing arrangements with different value chain entities? What is the service proposition to offer (in terms of types of tariffs)? w What should be the range of subscription and prepaid and level of pricing?

24 Analysys overview Key developments in WLAN Key issues in the WLAN opportunity Areas of WLAN consulting support

25 Analysys brings relevant experience in WLAN from live and commercial networks and technologies … l l Review and development of a new business plan for an European incumbent. The project involved a detailed assessment of the market forecasts, propositions for end-users / hot spot owners and an understanding of the sensitivities on pricing. The project also recommended organisational improvements l l Currently developing a white paper to support an aggregator in the USA in assessing and quantifying the benefits on WLAN roaming For a US WLAN technology company, evaluation of the business plan and presentation of our recommendations for positioning of the company within the WLAN value chain, the market potential, the marketing potential and we explored opportunities for strategic partnerships For a company developing software enabling new WLAN applications, we wrote a white paper on the opportunity that WLAN services can offer to wireless service providers l Supporting a fixed and mobile operator in Europe in validating key assumptions in the business plan For a major European mobile operator, we carried out a study into the corporate wireless LAN market in the operator's home country and other European countries. The study involved research among decision-makers, influencers and end users, using telephone interviews and focus groups, and the preparation of forecasts of market size in several European markets. Our client used the study, as input into their strategic planning process. Public Wireless LAN Access: Market Forecasts. This Analysys Research report describes the prospects for the public WLAN opportunity in Europe and provides market forecasts in terms of equipment, hotspot locations, users, pricing, ARPU and revenues.

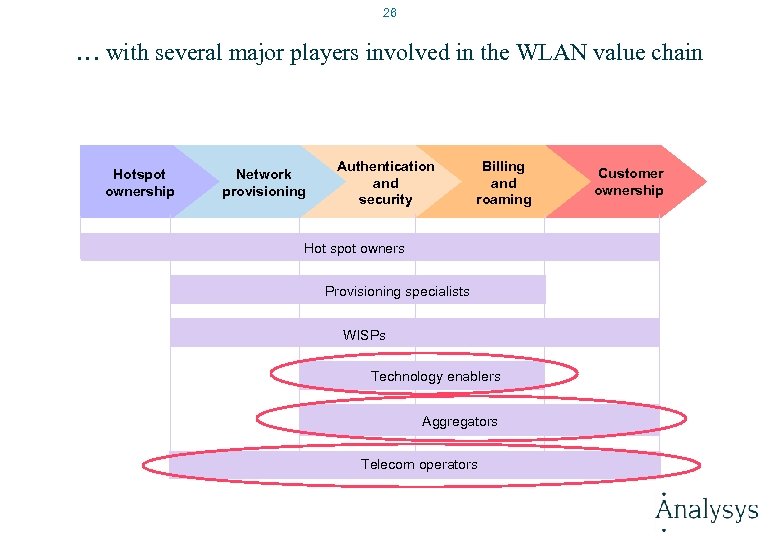

26 … with several major players involved in the WLAN value chain Hotspot ownership Network provisioning Authentication and security Billing and roaming Hot spot owners Provisioning specialists WISPs Technology enablers Aggregators Telecom operators Customer ownership

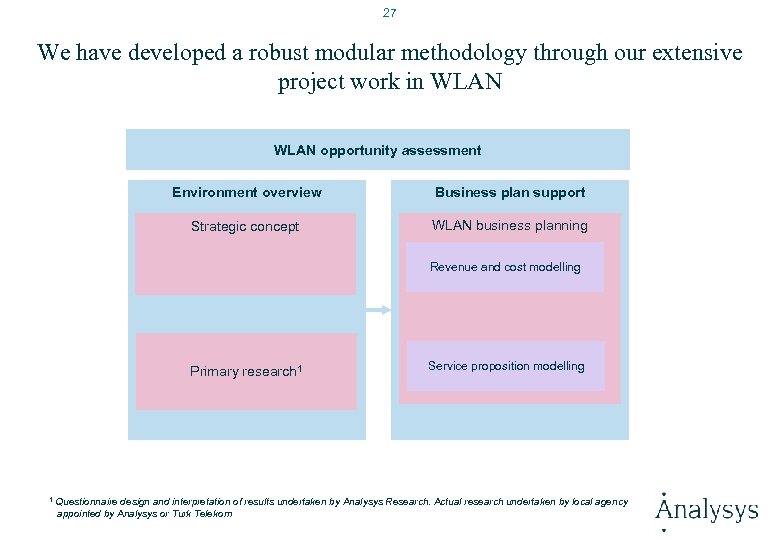

27 We have developed a robust modular methodology through our extensive project work in WLAN opportunity assessment Environment overview Business plan support Strategic concept WLAN business planning Revenue and cost modelling Primary research 1 1 Service proposition modelling Questionnaire design and interpretation of results undertaken by Analysys Research. Actual research undertaken by local agency appointed by Analysys or Turk Telekom

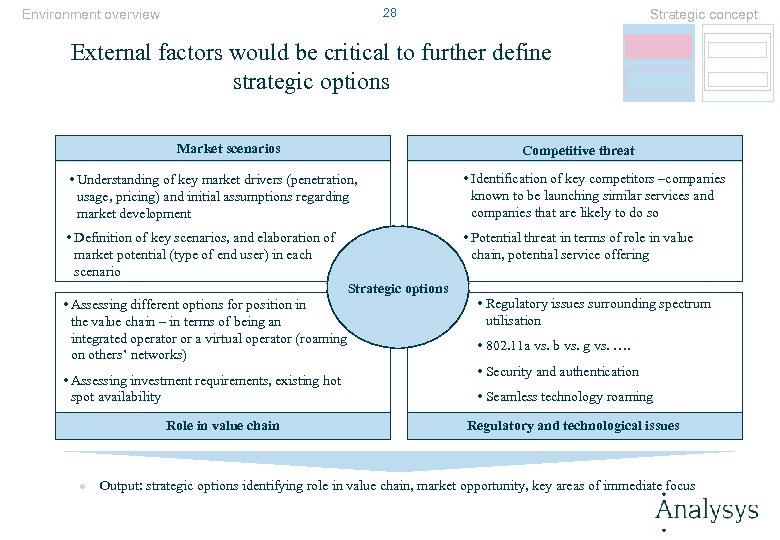

28 Environment overview Strategic concept External factors would be critical to further define strategic options Market scenarios Competitive threat • Understanding of key market drivers (penetration, usage, pricing) and initial assumptions regarding market development • Identification of key competitors –companies known to be launching similar services and companies that are likely to do so • Definition of key scenarios, and elaboration of market potential (type of end user) in each scenario • Potential threat in terms of role in value chain, potential service offering Strategic options • Assessing different options for position in the value chain – in terms of being an integrated operator or a virtual operator (roaming on others’ networks) • Assessing investment requirements, existing hot spot availability Role in value chain l • Regulatory issues surrounding spectrum utilisation • 802. 11 a vs. b vs. g vs. …. • Security and authentication • Seamless technology roaming Regulatory and technological issues Output: strategic options identifying role in value chain, market opportunity, key areas of immediate focus

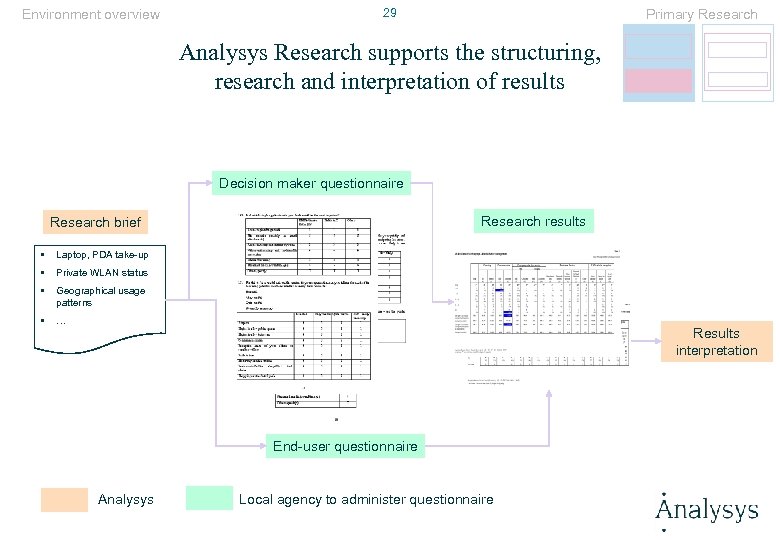

Environment overview 29 Primary Research Analysys Research supports the structuring, research and interpretation of results Decision maker questionnaire Research results Research brief • Laptop, PDA take-up • Private WLAN status • Geographical usage patterns • … Results interpretation End-user questionnaire Analysys Local agency to administer questionnaire

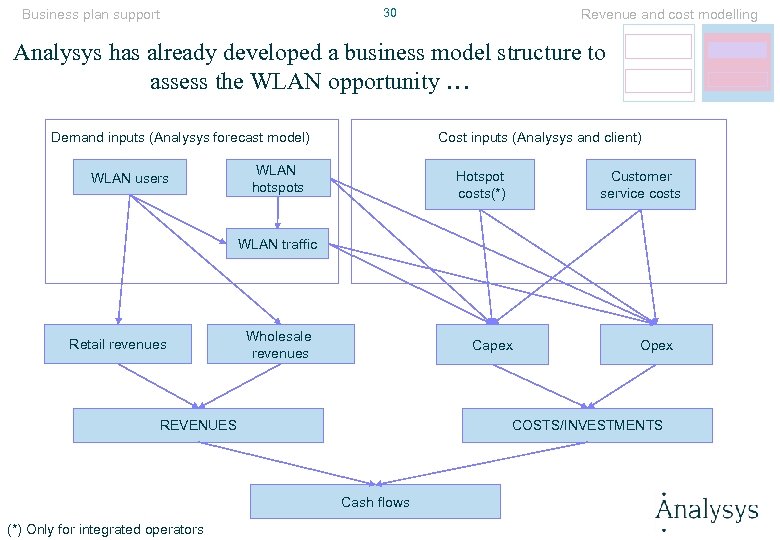

30 Business plan support Revenue and cost modelling Analysys has already developed a business model structure to assess the WLAN opportunity … Demand inputs (Analysys forecast model) WLAN users Cost inputs (Analysys and client) WLAN hotspots Hotspot costs(*) Customer service costs WLAN traffic Retail revenues Wholesale revenues Capex REVENUES COSTS/INVESTMENTS Cash flows (*) Only for integrated operators Opex

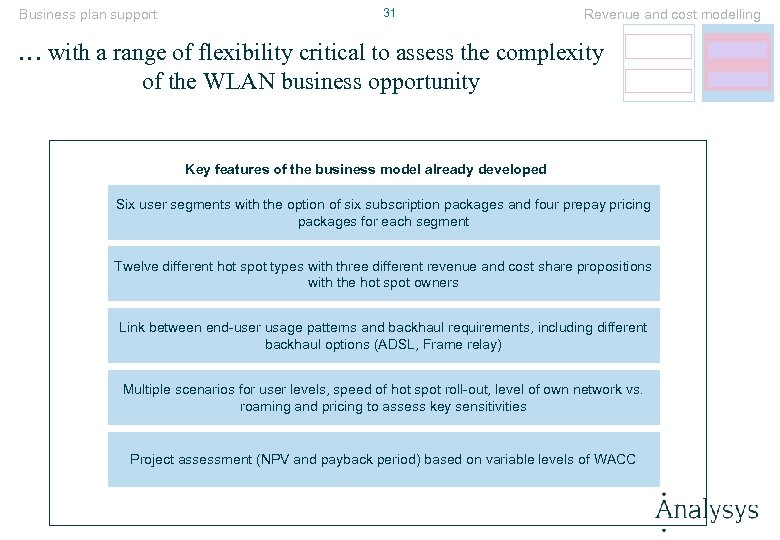

Business plan support 31 Revenue and cost modelling … with a range of flexibility critical to assess the complexity of the WLAN business opportunity Key features of the business model already developed Six user segments with the option of six subscription packages and four prepay pricing packages for each segment Twelve different hot spot types with three different revenue and cost share propositions with the hot spot owners Link between end-user usage patterns and backhaul requirements, including different backhaul options (ADSL, Frame relay) Multiple scenarios for user levels, speed of hot spot roll-out, level of own network vs. roaming and pricing to assess key sensitivities Project assessment (NPV and payback period) based on variable levels of WACC

32 Analysys offers support with varying degrees of prices and involvement Business plan assumptions validation 2 -3 day workshop Business plan development 4 -5 weeks activity Strategic concept development 2 -4 weeks activity Primary market research 6 -8 weeks activity

33 For further queries or consulting support, please contact: Amrish Kacker Senior Consultant amrish. kacker@analysys. com Analysys Consulting Limited 24 Castle St, Cambridge, CB 3 0 AJ, UK Tel: +44 1223 460 600 Fax: +44 1224 460 866 www. analysys. com

cf59db360dfed5e61a8e4eb00a3cffe5.ppt