b896ce601a333b24ab5577a29aa41c34.ppt

- Количество слайдов: 44

Assessing Shareholder Value Creation in the P&C Industry Emerson Cammack Lecture Series University of Illinois October 19, 2007 This presentation contains confidential information. Allstate's policies prohibit you from disclosing or discussing such information with anyone –except other employees who need the information to do their work. Do not reproduce or redistribute this presentation. Make sure you store this presentation in a secure manner or destroy it. Remember that Allstate employees are prohibited from trading on the basis of material nonpublic information.

Assessing Shareholder Value Creation in the P&C Industry Emerson Cammack Lecture Series University of Illinois October 19, 2007 This presentation contains confidential information. Allstate's policies prohibit you from disclosing or discussing such information with anyone –except other employees who need the information to do their work. Do not reproduce or redistribute this presentation. Make sure you store this presentation in a secure manner or destroy it. Remember that Allstate employees are prohibited from trading on the basis of material nonpublic information.

Today’s Discussion • Industry analysis • Financial and market analysis • Investor analysis • Governance and management analysis 1

Today’s Discussion • Industry analysis • Financial and market analysis • Investor analysis • Governance and management analysis 1

Industry analysis Whether they misclassify risk or allow risk pricing to be driven by the market instead of underwriting discipline … is the fundamental driver of low returns in this industry. – Mc. Kinsey & Company, The Journey, Revisited 2

Industry analysis Whether they misclassify risk or allow risk pricing to be driven by the market instead of underwriting discipline … is the fundamental driver of low returns in this industry. – Mc. Kinsey & Company, The Journey, Revisited 2

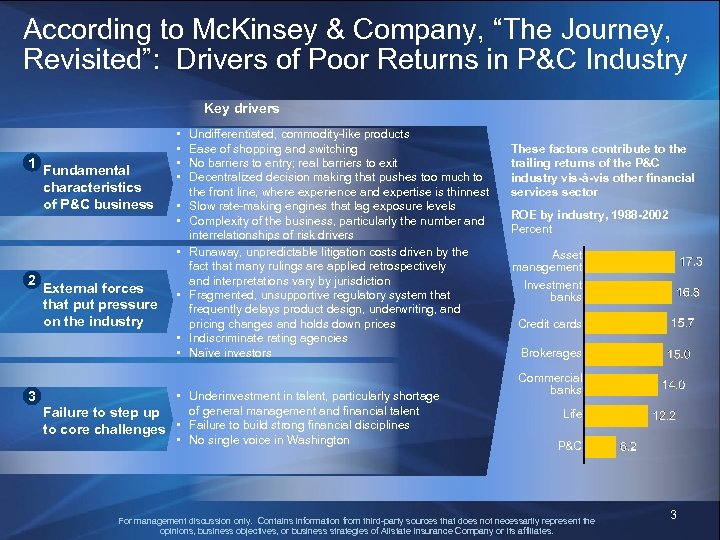

According to Mc. Kinsey & Company, “The Journey, Revisited”: Drivers of Poor Returns in P&C Industry Key drivers 1 Fundamental characteristics of P&C business • • 2 External forces that put pressure on the industry • • • 3 Undifferentiated, commodity-like products Ease of shopping and switching No barriers to entry; real barriers to exit Decentralized decision making that pushes too much to the front line, where experience and expertise is thinnest Slow rate-making engines that lag exposure levels Complexity of the business, particularly the number and interrelationships of risk drivers Runaway, unpredictable litigation costs driven by the fact that many rulings are applied retrospectively and interpretations vary by jurisdiction Fragmented, unsupportive regulatory system that frequently delays product design, underwriting, and pricing changes and holds down prices Indiscriminate rating agencies Naïve investors • Underinvestment in talent, particularly shortage of general management and financial talent Failure to step up to core challenges • Failure to build strong financial disciplines • No single voice in Washington These factors contribute to the trailing returns of the P&C industry vis-à-vis other financial services sector ROE by industry, 1988 -2002 Percent Asset management Investment banks Credit cards Brokerages Commercial banks Life P&C For management discussion only. Contains information from third-party sources that does not necessarily represent the opinions, business objectives, or business strategies of Allstate Insurance Company or its affiliates. 3

According to Mc. Kinsey & Company, “The Journey, Revisited”: Drivers of Poor Returns in P&C Industry Key drivers 1 Fundamental characteristics of P&C business • • 2 External forces that put pressure on the industry • • • 3 Undifferentiated, commodity-like products Ease of shopping and switching No barriers to entry; real barriers to exit Decentralized decision making that pushes too much to the front line, where experience and expertise is thinnest Slow rate-making engines that lag exposure levels Complexity of the business, particularly the number and interrelationships of risk drivers Runaway, unpredictable litigation costs driven by the fact that many rulings are applied retrospectively and interpretations vary by jurisdiction Fragmented, unsupportive regulatory system that frequently delays product design, underwriting, and pricing changes and holds down prices Indiscriminate rating agencies Naïve investors • Underinvestment in talent, particularly shortage of general management and financial talent Failure to step up to core challenges • Failure to build strong financial disciplines • No single voice in Washington These factors contribute to the trailing returns of the P&C industry vis-à-vis other financial services sector ROE by industry, 1988 -2002 Percent Asset management Investment banks Credit cards Brokerages Commercial banks Life P&C For management discussion only. Contains information from third-party sources that does not necessarily represent the opinions, business objectives, or business strategies of Allstate Insurance Company or its affiliates. 3

Financial and market analysis All intelligent investing is value investing – acquiring more than you are paying for. You must value the business in order to value the stock. – Charles T. Munger, Vice Chairman, Berkshire Hathaway 4

Financial and market analysis All intelligent investing is value investing – acquiring more than you are paying for. You must value the business in order to value the stock. – Charles T. Munger, Vice Chairman, Berkshire Hathaway 4

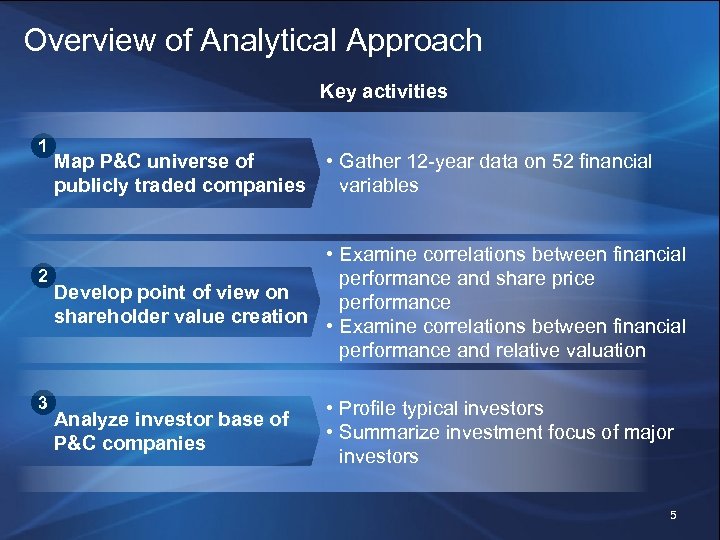

Overview of Analytical Approach Key activities 1 Map P&C universe of • Gather 12 -year data on 52 financial publicly traded companies variables • Examine correlations between financial 2 performance and share price Develop point of view on performance shareholder value creation • Examine correlations between financial performance and relative valuation 3 Analyze investor base of P&C companies • Profile typical investors • Summarize investment focus of major investors 5

Overview of Analytical Approach Key activities 1 Map P&C universe of • Gather 12 -year data on 52 financial publicly traded companies variables • Examine correlations between financial 2 performance and share price Develop point of view on performance shareholder value creation • Examine correlations between financial performance and relative valuation 3 Analyze investor base of P&C companies • Profile typical investors • Summarize investment focus of major investors 5

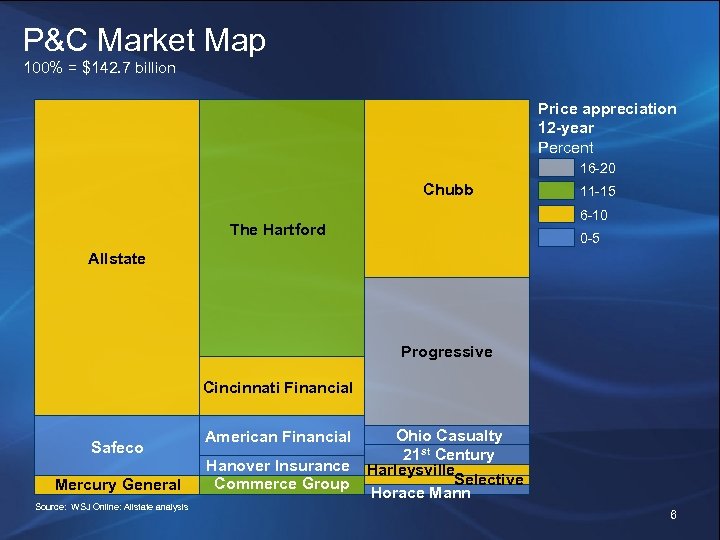

P&C Market Map 100% = $142. 7 billion Price appreciation 12 -year Percent 16 -20 Chubb 11 -15 6 -10 The Hartford 0 -5 Allstate Progressive Cincinnati Financial Safeco Mercury General Source: WSJ Online: Allstate analysis American Financial Hanover Insurance Commerce Group Ohio Casualty 21 st Century Harleysville Selective Horace Mann 6

P&C Market Map 100% = $142. 7 billion Price appreciation 12 -year Percent 16 -20 Chubb 11 -15 6 -10 The Hartford 0 -5 Allstate Progressive Cincinnati Financial Safeco Mercury General Source: WSJ Online: Allstate analysis American Financial Hanover Insurance Commerce Group Ohio Casualty 21 st Century Harleysville Selective Horace Mann 6

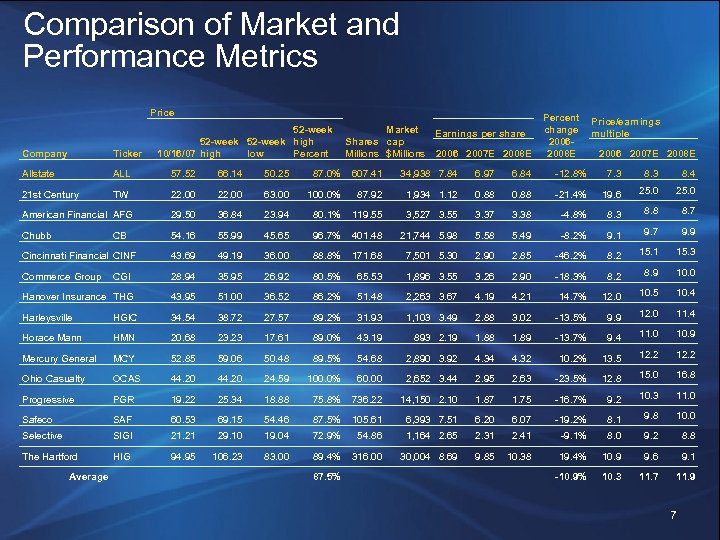

Comparison of Market and Performance Metrics Price 52 -week high 10/16/07 high low Percent Market Earnings per share Shares cap Millions $Millions 2006 2007 E 2008 E Percent Price/earnings change multiple 2006 2007 E 2008 E Company Ticker Allstate ALL 57. 52 66. 14 50. 25 87. 0% 607. 41 34, 938 7. 84 6. 97 6. 84 -12. 8% 7. 3 8. 4 21 st Century TW 22. 00 63. 00 100. 0% 87. 92 1, 934 1. 12 0. 88 -21. 4% 19. 6 25. 0 American Financial AFG 29. 50 36. 84 23. 94 80. 1% 119. 55 3, 527 3. 55 3. 37 3. 38 -4. 8% 8. 3 8. 8 8. 7 Chubb 54. 16 55. 99 45. 65 96. 7% 401. 48 21, 744 5. 98 5. 58 5. 49 -8. 2% 9. 1 9. 7 9. 9 Cincinnati Financial CINF 43. 69 49. 19 36. 00 88. 8% 171. 68 7, 501 5. 30 2. 90 2. 85 -46. 2% 8. 2 15. 1 15. 3 Commerce Group 28. 94 35. 95 26. 92 80. 5% 65. 53 1, 896 3. 55 3. 26 2. 90 -18. 3% 8. 2 8. 9 10. 0 Hanover Insurance THG 43. 95 51. 00 36. 52 86. 2% 51. 48 2, 263 3. 67 4. 19 4. 21 14. 7% 12. 0 10. 5 10. 4 Harleysville HGIC 34. 54 38. 72 27. 57 89. 2% 31. 93 1, 103 3. 49 2. 88 3. 02 -13. 5% 9. 9 12. 0 11. 4 Horace Mann HMN 20. 68 23. 23 17. 61 89. 0% 43. 19 893 2. 19 1. 88 1. 89 -13. 7% 9. 4 11. 0 10. 9 Mercury General MCY 52. 85 59. 06 50. 48 89. 5% 54. 68 2, 890 3. 92 4. 34 4. 32 10. 2% 13. 5 12. 2 Ohio Casualty OCAS 44. 20 24. 59 100. 0% 60. 00 2, 652 3. 44 2. 95 2. 63 -23. 5% 12. 8 15. 0 16. 8 Progressive PGR 19. 22 25. 34 18. 88 75. 8% 736. 22 14, 150 2. 10 1. 87 1. 75 -16. 7% 9. 2 10. 3 11. 0 Safeco SAF 60. 53 69. 15 54. 46 87. 5% 105. 61 6, 393 7. 51 6. 20 6. 07 -19. 2% 8. 1 9. 8 10. 0 Selective SIGI 21. 21 29. 10 19. 04 72. 9% 54. 86 1, 164 2. 65 2. 31 2. 41 -9. 1% 8. 0 9. 2 8. 8 The Hartford HIG 94. 95 106. 23 83. 00 89. 4% 316. 00 30, 004 8. 69 9. 85 10. 38 19. 4% 10. 9 9. 6 9. 1 -10. 9% 10. 3 11. 7 11. 9 CB Average CGI 87. 5% 7

Comparison of Market and Performance Metrics Price 52 -week high 10/16/07 high low Percent Market Earnings per share Shares cap Millions $Millions 2006 2007 E 2008 E Percent Price/earnings change multiple 2006 2007 E 2008 E Company Ticker Allstate ALL 57. 52 66. 14 50. 25 87. 0% 607. 41 34, 938 7. 84 6. 97 6. 84 -12. 8% 7. 3 8. 4 21 st Century TW 22. 00 63. 00 100. 0% 87. 92 1, 934 1. 12 0. 88 -21. 4% 19. 6 25. 0 American Financial AFG 29. 50 36. 84 23. 94 80. 1% 119. 55 3, 527 3. 55 3. 37 3. 38 -4. 8% 8. 3 8. 8 8. 7 Chubb 54. 16 55. 99 45. 65 96. 7% 401. 48 21, 744 5. 98 5. 58 5. 49 -8. 2% 9. 1 9. 7 9. 9 Cincinnati Financial CINF 43. 69 49. 19 36. 00 88. 8% 171. 68 7, 501 5. 30 2. 90 2. 85 -46. 2% 8. 2 15. 1 15. 3 Commerce Group 28. 94 35. 95 26. 92 80. 5% 65. 53 1, 896 3. 55 3. 26 2. 90 -18. 3% 8. 2 8. 9 10. 0 Hanover Insurance THG 43. 95 51. 00 36. 52 86. 2% 51. 48 2, 263 3. 67 4. 19 4. 21 14. 7% 12. 0 10. 5 10. 4 Harleysville HGIC 34. 54 38. 72 27. 57 89. 2% 31. 93 1, 103 3. 49 2. 88 3. 02 -13. 5% 9. 9 12. 0 11. 4 Horace Mann HMN 20. 68 23. 23 17. 61 89. 0% 43. 19 893 2. 19 1. 88 1. 89 -13. 7% 9. 4 11. 0 10. 9 Mercury General MCY 52. 85 59. 06 50. 48 89. 5% 54. 68 2, 890 3. 92 4. 34 4. 32 10. 2% 13. 5 12. 2 Ohio Casualty OCAS 44. 20 24. 59 100. 0% 60. 00 2, 652 3. 44 2. 95 2. 63 -23. 5% 12. 8 15. 0 16. 8 Progressive PGR 19. 22 25. 34 18. 88 75. 8% 736. 22 14, 150 2. 10 1. 87 1. 75 -16. 7% 9. 2 10. 3 11. 0 Safeco SAF 60. 53 69. 15 54. 46 87. 5% 105. 61 6, 393 7. 51 6. 20 6. 07 -19. 2% 8. 1 9. 8 10. 0 Selective SIGI 21. 21 29. 10 19. 04 72. 9% 54. 86 1, 164 2. 65 2. 31 2. 41 -9. 1% 8. 0 9. 2 8. 8 The Hartford HIG 94. 95 106. 23 83. 00 89. 4% 316. 00 30, 004 8. 69 9. 85 10. 38 19. 4% 10. 9 9. 6 9. 1 -10. 9% 10. 3 11. 7 11. 9 CB Average CGI 87. 5% 7

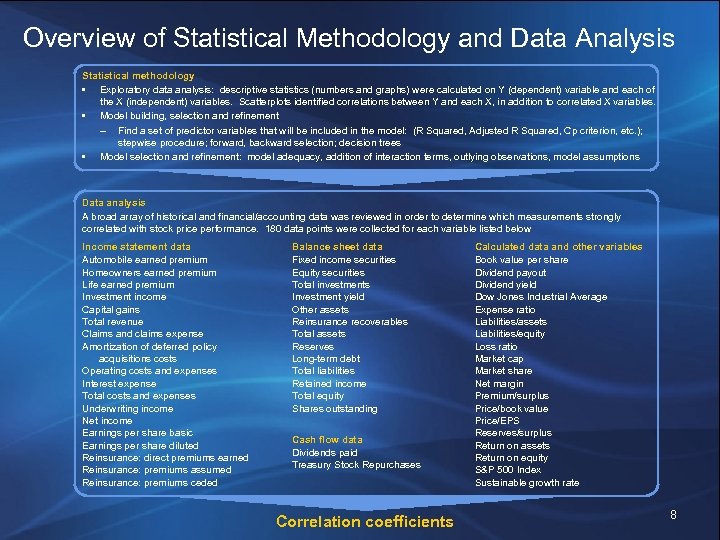

Overview of Statistical Methodology and Data Analysis Statistical methodology • Exploratory data analysis: descriptive statistics (numbers and graphs) were calculated on Y (dependent) variable and each of the X (independent) variables. Scatterplots identified correlations between Y and each X, in addition to correlated X variables. • Model building, selection and refinement – Find a set of predictor variables that will be included in the model: (R Squared, Adjusted R Squared, Cp criterion, etc. ); stepwise procedure; forward, backward selection; decision trees • Model selection and refinement: model adequacy, addition of interaction terms, outlying observations, model assumptions Data analysis A broad array of historical and financial/accounting data was reviewed in order to determine which measurements strongly correlated with stock price performance. 180 data points were collected for each variable listed below Income statement data Automobile earned premium Homeowners earned premium Life earned premium Investment income Capital gains Total revenue Claims and claims expense Amortization of deferred policy acquisitions costs Operating costs and expenses Interest expense Total costs and expenses Underwriting income Net income Earnings per share basic Earnings per share diluted Reinsurance: direct premiums earned Reinsurance: premiums assumed Reinsurance: premiums ceded Balance sheet data Fixed income securities Equity securities Total investments Investment yield Other assets Reinsurance recoverables Total assets Reserves Long-term debt Total liabilities Retained income Total equity Shares outstanding Cash flow data Dividends paid Treasury Stock Repurchases Correlation coefficients Calculated data and other variables Book value per share Dividend payout Dividend yield Dow Jones Industrial Average Expense ratio Liabilities/assets Liabilities/equity Loss ratio Market cap Market share Net margin Premium/surplus Price/book value Price/EPS Reserves/surplus Return on assets Return on equity S&P 500 Index Sustainable growth rate 8

Overview of Statistical Methodology and Data Analysis Statistical methodology • Exploratory data analysis: descriptive statistics (numbers and graphs) were calculated on Y (dependent) variable and each of the X (independent) variables. Scatterplots identified correlations between Y and each X, in addition to correlated X variables. • Model building, selection and refinement – Find a set of predictor variables that will be included in the model: (R Squared, Adjusted R Squared, Cp criterion, etc. ); stepwise procedure; forward, backward selection; decision trees • Model selection and refinement: model adequacy, addition of interaction terms, outlying observations, model assumptions Data analysis A broad array of historical and financial/accounting data was reviewed in order to determine which measurements strongly correlated with stock price performance. 180 data points were collected for each variable listed below Income statement data Automobile earned premium Homeowners earned premium Life earned premium Investment income Capital gains Total revenue Claims and claims expense Amortization of deferred policy acquisitions costs Operating costs and expenses Interest expense Total costs and expenses Underwriting income Net income Earnings per share basic Earnings per share diluted Reinsurance: direct premiums earned Reinsurance: premiums assumed Reinsurance: premiums ceded Balance sheet data Fixed income securities Equity securities Total investments Investment yield Other assets Reinsurance recoverables Total assets Reserves Long-term debt Total liabilities Retained income Total equity Shares outstanding Cash flow data Dividends paid Treasury Stock Repurchases Correlation coefficients Calculated data and other variables Book value per share Dividend payout Dividend yield Dow Jones Industrial Average Expense ratio Liabilities/assets Liabilities/equity Loss ratio Market cap Market share Net margin Premium/surplus Price/book value Price/EPS Reserves/surplus Return on assets Return on equity S&P 500 Index Sustainable growth rate 8

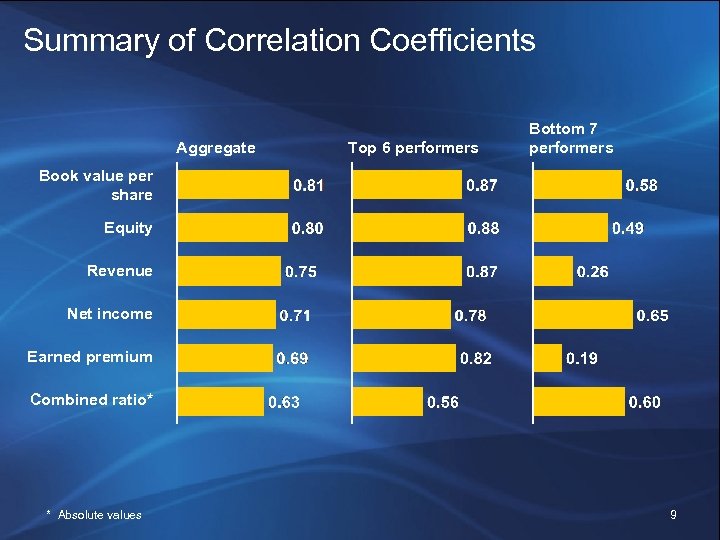

Summary of Correlation Coefficients Aggregate Top 6 performers Bottom 7 performers Book value per share Equity Revenue Net income Earned premium Combined ratio* * Absolute values 9

Summary of Correlation Coefficients Aggregate Top 6 performers Bottom 7 performers Book value per share Equity Revenue Net income Earned premium Combined ratio* * Absolute values 9

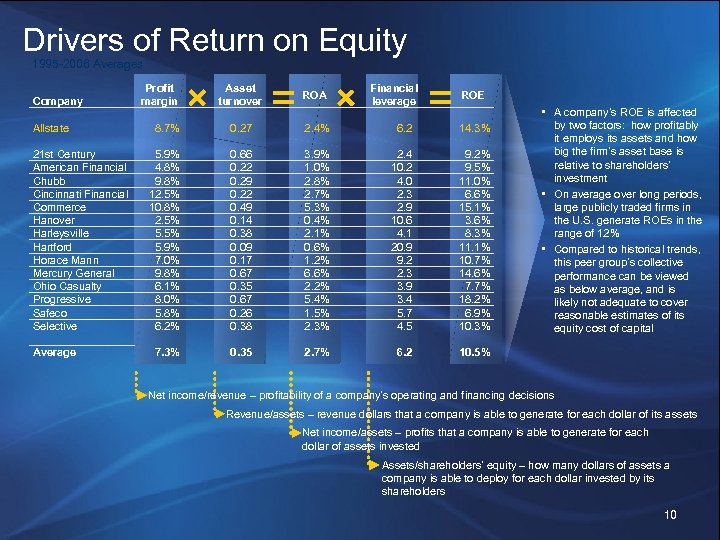

Drivers of Return on Equity 1995 -2006 Averages Company Allstate 21 st Century American Financial Chubb Cincinnati Financial Commerce Hanover Harleysville Hartford Horace Mann Mercury General Ohio Casualty Progressive Safeco Selective Average Profit margin Asset turnover ROA 8. 7% 0. 27 2. 4% 6. 2 14. 3% 5. 9% 4. 8% 9. 8% 12. 5% 10. 8% 2. 5% 5. 9% 7. 0% 9. 8% 6. 1% 8. 0% 5. 8% 6. 2% 0. 66 0. 22 0. 29 0. 22 0. 49 0. 14 0. 38 0. 09 0. 17 0. 67 0. 35 0. 67 0. 26 0. 38 0. 35 3. 9% 1. 0% 2. 8% 2. 7% 5. 3% 0. 4% 2. 1% 0. 6% 1. 2% 6. 6% 2. 2% 5. 4% 1. 5% 2. 3% 2. 4 10. 2 4. 0 2. 3 2. 9 10. 6 4. 1 20. 9 9. 2 2. 3 3. 9 3. 4 5. 7 4. 5 6. 2 9. 2% 9. 5% 11. 0% 6. 6% 15. 1% 3. 6% 8. 3% 11. 1% 10. 7% 14. 6% 7. 7% 18. 2% 6. 9% 10. 3% 7. 3% 2. 7% Financial leverage ROE • A company’s ROE is affected by two factors: how profitably it employs its assets and how big the firm’s asset base is relative to shareholders’ investment • On average over long periods, large publicly traded firms in the U. S. generate ROEs in the range of 12% • Compared to historical trends, this peer group’s collective performance can be viewed as below average, and is likely not adequate to cover reasonable estimates of its equity cost of capital 10. 5% Net income/revenue – profitability of a company’s operating and financing decisions Revenue/assets – revenue dollars that a company is able to generate for each dollar of its assets Net income/assets – profits that a company is able to generate for each dollar of assets invested Assets/shareholders’ equity – how many dollars of assets a company is able to deploy for each dollar invested by its shareholders 10

Drivers of Return on Equity 1995 -2006 Averages Company Allstate 21 st Century American Financial Chubb Cincinnati Financial Commerce Hanover Harleysville Hartford Horace Mann Mercury General Ohio Casualty Progressive Safeco Selective Average Profit margin Asset turnover ROA 8. 7% 0. 27 2. 4% 6. 2 14. 3% 5. 9% 4. 8% 9. 8% 12. 5% 10. 8% 2. 5% 5. 9% 7. 0% 9. 8% 6. 1% 8. 0% 5. 8% 6. 2% 0. 66 0. 22 0. 29 0. 22 0. 49 0. 14 0. 38 0. 09 0. 17 0. 67 0. 35 0. 67 0. 26 0. 38 0. 35 3. 9% 1. 0% 2. 8% 2. 7% 5. 3% 0. 4% 2. 1% 0. 6% 1. 2% 6. 6% 2. 2% 5. 4% 1. 5% 2. 3% 2. 4 10. 2 4. 0 2. 3 2. 9 10. 6 4. 1 20. 9 9. 2 2. 3 3. 9 3. 4 5. 7 4. 5 6. 2 9. 2% 9. 5% 11. 0% 6. 6% 15. 1% 3. 6% 8. 3% 11. 1% 10. 7% 14. 6% 7. 7% 18. 2% 6. 9% 10. 3% 7. 3% 2. 7% Financial leverage ROE • A company’s ROE is affected by two factors: how profitably it employs its assets and how big the firm’s asset base is relative to shareholders’ investment • On average over long periods, large publicly traded firms in the U. S. generate ROEs in the range of 12% • Compared to historical trends, this peer group’s collective performance can be viewed as below average, and is likely not adequate to cover reasonable estimates of its equity cost of capital 10. 5% Net income/revenue – profitability of a company’s operating and financing decisions Revenue/assets – revenue dollars that a company is able to generate for each dollar of its assets Net income/assets – profits that a company is able to generate for each dollar of assets invested Assets/shareholders’ equity – how many dollars of assets a company is able to deploy for each dollar invested by its shareholders 10

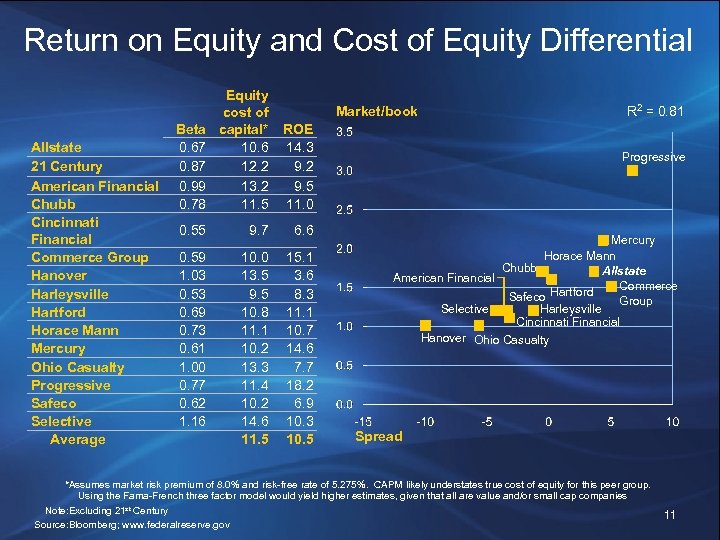

Return on Equity and Cost of Equity Differential Allstate 21 Century American Financial Chubb Cincinnati Financial Commerce Group Hanover Harleysville Hartford Horace Mann Mercury Ohio Casualty Progressive Safeco Selective Average Beta 0. 67 0. 87 0. 99 0. 78 Equity cost of capital* ROE 10. 6 14. 3 12. 2 9. 2 13. 2 9. 5 11. 0 0. 55 9. 7 6. 6 0. 59 1. 03 0. 53 0. 69 0. 73 0. 61 1. 00 0. 77 0. 62 1. 16 10. 0 13. 5 9. 5 10. 8 11. 1 10. 2 13. 3 11. 4 10. 2 14. 6 11. 5 15. 1 3. 6 8. 3 11. 1 10. 7 14. 6 7. 7 18. 2 6. 9 10. 3 10. 5 Market/book R 2 = 0. 81 Progressive Mercury Horace Mann Chubb Allstate American Financial Commerce Safeco Hartford Group Selective Harleysville Cincinnati Financial Hanover Ohio Casualty Spread *Assumes market risk premium of 8. 0% and risk-free rate of 5. 275%. CAPM likely understates true cost of equity for this peer group. Using the Fama-French three factor model would yield higher estimates, given that all are value and/or small cap companies Note: Excluding 21 st Century Source: Bloomberg; www. federalreserve. gov 11

Return on Equity and Cost of Equity Differential Allstate 21 Century American Financial Chubb Cincinnati Financial Commerce Group Hanover Harleysville Hartford Horace Mann Mercury Ohio Casualty Progressive Safeco Selective Average Beta 0. 67 0. 87 0. 99 0. 78 Equity cost of capital* ROE 10. 6 14. 3 12. 2 9. 2 13. 2 9. 5 11. 0 0. 55 9. 7 6. 6 0. 59 1. 03 0. 53 0. 69 0. 73 0. 61 1. 00 0. 77 0. 62 1. 16 10. 0 13. 5 9. 5 10. 8 11. 1 10. 2 13. 3 11. 4 10. 2 14. 6 11. 5 15. 1 3. 6 8. 3 11. 1 10. 7 14. 6 7. 7 18. 2 6. 9 10. 3 10. 5 Market/book R 2 = 0. 81 Progressive Mercury Horace Mann Chubb Allstate American Financial Commerce Safeco Hartford Group Selective Harleysville Cincinnati Financial Hanover Ohio Casualty Spread *Assumes market risk premium of 8. 0% and risk-free rate of 5. 275%. CAPM likely understates true cost of equity for this peer group. Using the Fama-French three factor model would yield higher estimates, given that all are value and/or small cap companies Note: Excluding 21 st Century Source: Bloomberg; www. federalreserve. gov 11

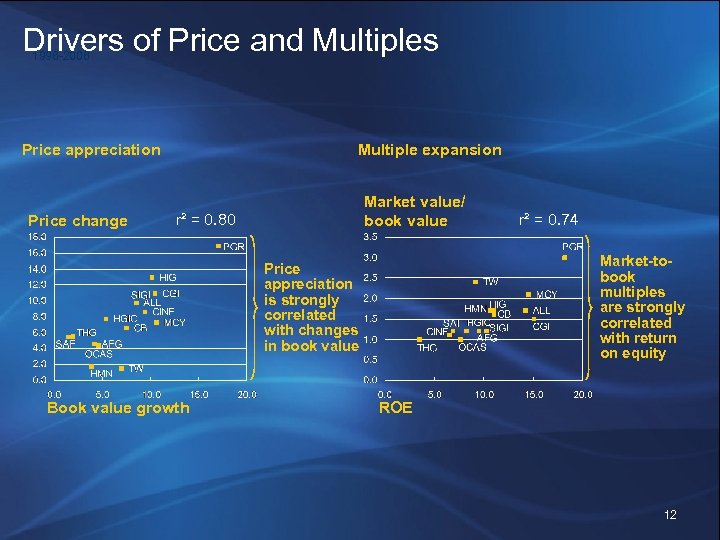

Drivers of Price and Multiples 1996 -2006 Price appreciation Price change Multiple expansion Market value/ book value r² = 0. 80 Market-tobook multiples are strongly correlated with return on equity Price appreciation is strongly correlated with changes in book value Book value growth r² = 0. 74 ROE 12

Drivers of Price and Multiples 1996 -2006 Price appreciation Price change Multiple expansion Market value/ book value r² = 0. 80 Market-tobook multiples are strongly correlated with return on equity Price appreciation is strongly correlated with changes in book value Book value growth r² = 0. 74 ROE 12

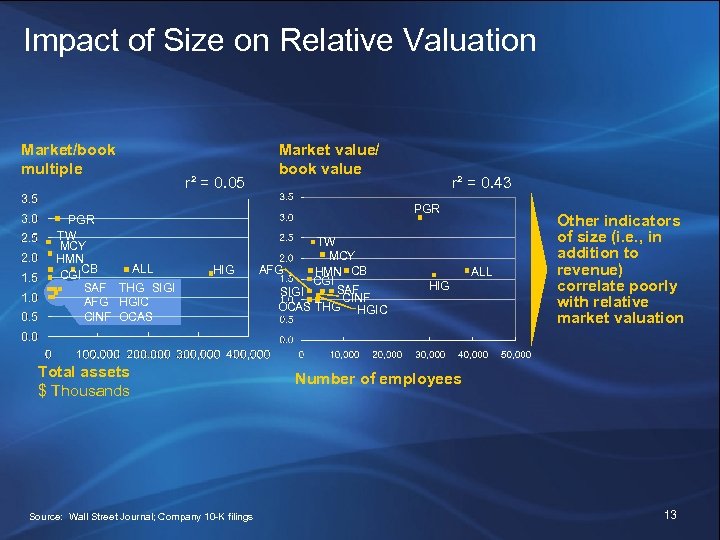

Impact of Size on Relative Valuation Market/book multiple PGR TW MCY HMN CB ALL CGI SAF THG SIGI AFG HGIC CINF OCAS r² = 0. 05 Market value/ book value r² = 0. 43 PGR HIG Total assets $ Thousands Source: Wall Street Journal; Company 10 -K filings TW MCY AFG HMN CB CGI SAF SIGI CINF OCAS THG HGIC ALL HIG Other indicators of size (i. e. , in addition to revenue) correlate poorly with relative market valuation Number of employees 13

Impact of Size on Relative Valuation Market/book multiple PGR TW MCY HMN CB ALL CGI SAF THG SIGI AFG HGIC CINF OCAS r² = 0. 05 Market value/ book value r² = 0. 43 PGR HIG Total assets $ Thousands Source: Wall Street Journal; Company 10 -K filings TW MCY AFG HMN CB CGI SAF SIGI CINF OCAS THG HGIC ALL HIG Other indicators of size (i. e. , in addition to revenue) correlate poorly with relative market valuation Number of employees 13

Investor analysis One of the biggest risks in owning growth stocks is not that their growth will stop, but merely that it will slow down. And in the long run, that is not merely a risk, but a virtual certainty. – Benjamin Graham, The Intelligent Investor 14

Investor analysis One of the biggest risks in owning growth stocks is not that their growth will stop, but merely that it will slow down. And in the long run, that is not merely a risk, but a virtual certainty. – Benjamin Graham, The Intelligent Investor 14

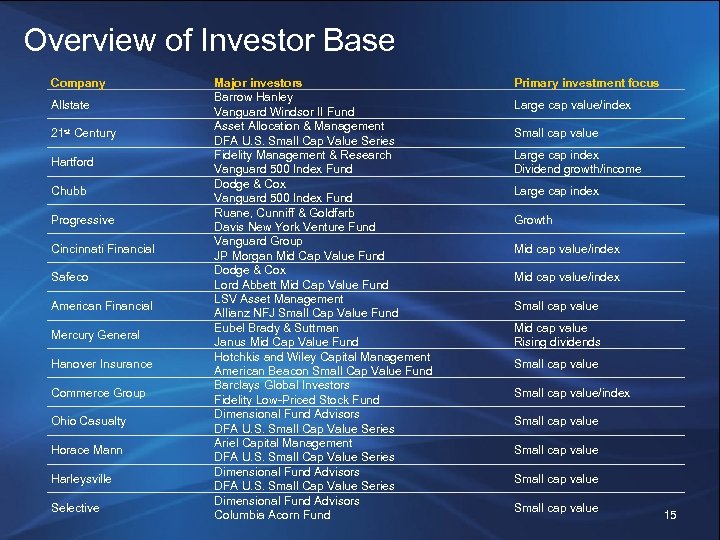

Overview of Investor Base Company Allstate 21 st Century Hartford Chubb Progressive Cincinnati Financial Safeco American Financial Mercury General Hanover Insurance Commerce Group Ohio Casualty Horace Mann Harleysville Selective Major investors Barrow Hanley Vanguard Windsor II Fund Asset Allocation & Management DFA U. S. Small Cap Value Series Fidelity Management & Research Vanguard 500 Index Fund Dodge & Cox Vanguard 500 Index Fund Ruane, Cunniff & Goldfarb Davis New York Venture Fund Vanguard Group JP Morgan Mid Cap Value Fund Dodge & Cox Lord Abbett Mid Cap Value Fund LSV Asset Management Allianz NFJ Small Cap Value Fund Eubel Brady & Suttman Janus Mid Cap Value Fund Hotchkis and Wiley Capital Management American Beacon Small Cap Value Fund Barclays Global Investors Fidelity Low-Priced Stock Fund Dimensional Fund Advisors DFA U. S. Small Cap Value Series Ariel Capital Management DFA U. S. Small Cap Value Series Dimensional Fund Advisors Columbia Acorn Fund Primary investment focus Large cap value/index Small cap value Large cap index Dividend growth/income Large cap index Growth Mid cap value/index Small cap value Mid cap value Rising dividends Small cap value/index Small cap value 15

Overview of Investor Base Company Allstate 21 st Century Hartford Chubb Progressive Cincinnati Financial Safeco American Financial Mercury General Hanover Insurance Commerce Group Ohio Casualty Horace Mann Harleysville Selective Major investors Barrow Hanley Vanguard Windsor II Fund Asset Allocation & Management DFA U. S. Small Cap Value Series Fidelity Management & Research Vanguard 500 Index Fund Dodge & Cox Vanguard 500 Index Fund Ruane, Cunniff & Goldfarb Davis New York Venture Fund Vanguard Group JP Morgan Mid Cap Value Fund Dodge & Cox Lord Abbett Mid Cap Value Fund LSV Asset Management Allianz NFJ Small Cap Value Fund Eubel Brady & Suttman Janus Mid Cap Value Fund Hotchkis and Wiley Capital Management American Beacon Small Cap Value Fund Barclays Global Investors Fidelity Low-Priced Stock Fund Dimensional Fund Advisors DFA U. S. Small Cap Value Series Ariel Capital Management DFA U. S. Small Cap Value Series Dimensional Fund Advisors Columbia Acorn Fund Primary investment focus Large cap value/index Small cap value Large cap index Dividend growth/income Large cap index Growth Mid cap value/index Small cap value Mid cap value Rising dividends Small cap value/index Small cap value 15

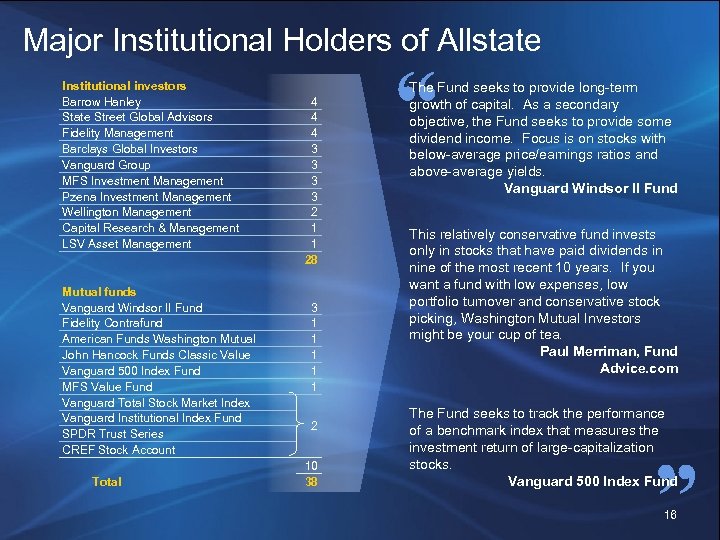

Major Institutional Holders of Allstate Institutional investors Barrow Hanley State Street Global Advisors Fidelity Management Barclays Global Investors Vanguard Group MFS Investment Management Pzena Investment Management Wellington Management Capital Research & Management LSV Asset Management Mutual funds Vanguard Windsor II Fund Fidelity Contrafund American Funds Washington Mutual John Hancock Funds Classic Value Vanguard 500 Index Fund MFS Value Fund Vanguard Total Stock Market Index Vanguard Institutional Index Fund SPDR Trust Series CREF Stock Account Total 4 4 4 3 3 2 1 1 28 3 1 1 1 2 10 38 The Fund seeks to provide long-term growth of capital. As a secondary objective, the Fund seeks to provide some dividend income. Focus is on stocks with below-average price/earnings ratios and above-average yields. Vanguard Windsor II Fund This relatively conservative fund invests only in stocks that have paid dividends in nine of the most recent 10 years. If you want a fund with low expenses, low portfolio turnover and conservative stock picking, Washington Mutual Investors might be your cup of tea. Paul Merriman, Fund Advice. com The Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. Vanguard 500 Index Fund 16

Major Institutional Holders of Allstate Institutional investors Barrow Hanley State Street Global Advisors Fidelity Management Barclays Global Investors Vanguard Group MFS Investment Management Pzena Investment Management Wellington Management Capital Research & Management LSV Asset Management Mutual funds Vanguard Windsor II Fund Fidelity Contrafund American Funds Washington Mutual John Hancock Funds Classic Value Vanguard 500 Index Fund MFS Value Fund Vanguard Total Stock Market Index Vanguard Institutional Index Fund SPDR Trust Series CREF Stock Account Total 4 4 4 3 3 2 1 1 28 3 1 1 1 2 10 38 The Fund seeks to provide long-term growth of capital. As a secondary objective, the Fund seeks to provide some dividend income. Focus is on stocks with below-average price/earnings ratios and above-average yields. Vanguard Windsor II Fund This relatively conservative fund invests only in stocks that have paid dividends in nine of the most recent 10 years. If you want a fund with low expenses, low portfolio turnover and conservative stock picking, Washington Mutual Investors might be your cup of tea. Paul Merriman, Fund Advice. com The Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. Vanguard 500 Index Fund 16

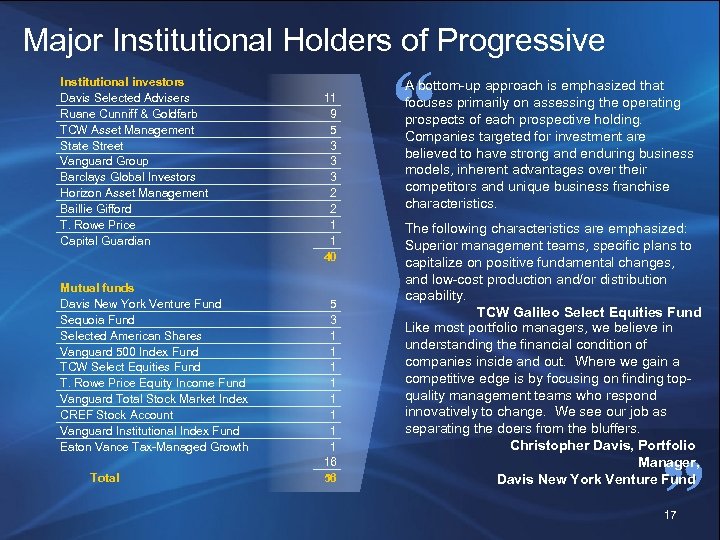

Major Institutional Holders of Progressive Institutional investors Davis Selected Advisers Ruane Cunniff & Goldfarb TCW Asset Management State Street Vanguard Group Barclays Global Investors Horizon Asset Management Baillie Gifford T. Rowe Price Capital Guardian Mutual funds Davis New York Venture Fund Sequoia Fund Selected American Shares Vanguard 500 Index Fund TCW Select Equities Fund T. Rowe Price Equity Income Fund Vanguard Total Stock Market Index CREF Stock Account Vanguard Institutional Index Fund Eaton Vance Tax-Managed Growth Total 11 9 5 3 3 3 2 2 1 1 40 5 3 1 1 1 1 16 56 A bottom-up approach is emphasized that focuses primarily on assessing the operating prospects of each prospective holding. Companies targeted for investment are believed to have strong and enduring business models, inherent advantages over their competitors and unique business franchise characteristics. The following characteristics are emphasized: Superior management teams, specific plans to capitalize on positive fundamental changes, and low-cost production and/or distribution capability. TCW Galileo Select Equities Fund Like most portfolio managers, we believe in understanding the financial condition of companies inside and out. Where we gain a competitive edge is by focusing on finding topquality management teams who respond innovatively to change. We see our job as separating the doers from the bluffers. Christopher Davis, Portfolio Manager, Davis New York Venture Fund 17

Major Institutional Holders of Progressive Institutional investors Davis Selected Advisers Ruane Cunniff & Goldfarb TCW Asset Management State Street Vanguard Group Barclays Global Investors Horizon Asset Management Baillie Gifford T. Rowe Price Capital Guardian Mutual funds Davis New York Venture Fund Sequoia Fund Selected American Shares Vanguard 500 Index Fund TCW Select Equities Fund T. Rowe Price Equity Income Fund Vanguard Total Stock Market Index CREF Stock Account Vanguard Institutional Index Fund Eaton Vance Tax-Managed Growth Total 11 9 5 3 3 3 2 2 1 1 40 5 3 1 1 1 1 16 56 A bottom-up approach is emphasized that focuses primarily on assessing the operating prospects of each prospective holding. Companies targeted for investment are believed to have strong and enduring business models, inherent advantages over their competitors and unique business franchise characteristics. The following characteristics are emphasized: Superior management teams, specific plans to capitalize on positive fundamental changes, and low-cost production and/or distribution capability. TCW Galileo Select Equities Fund Like most portfolio managers, we believe in understanding the financial condition of companies inside and out. Where we gain a competitive edge is by focusing on finding topquality management teams who respond innovatively to change. We see our job as separating the doers from the bluffers. Christopher Davis, Portfolio Manager, Davis New York Venture Fund 17

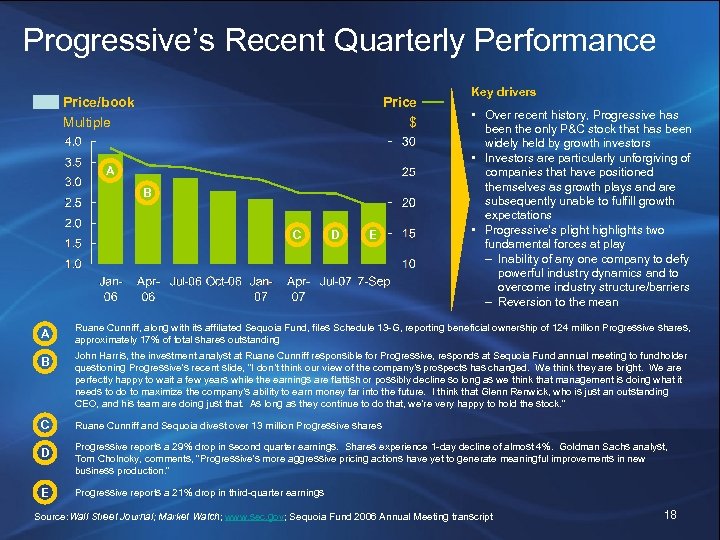

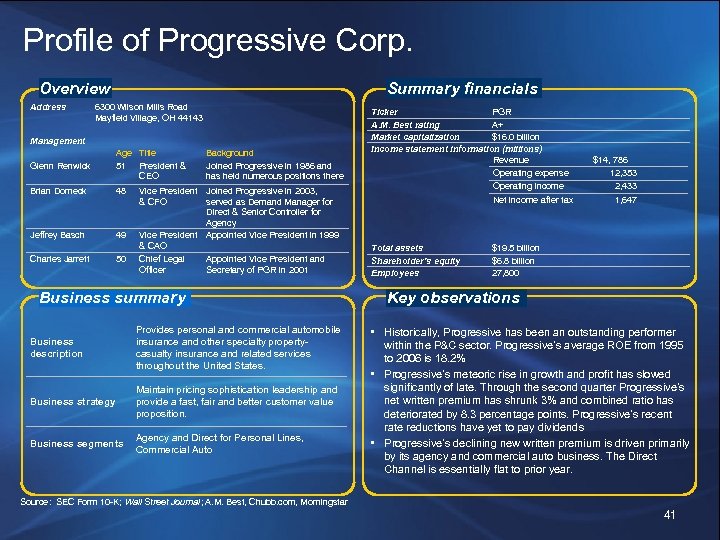

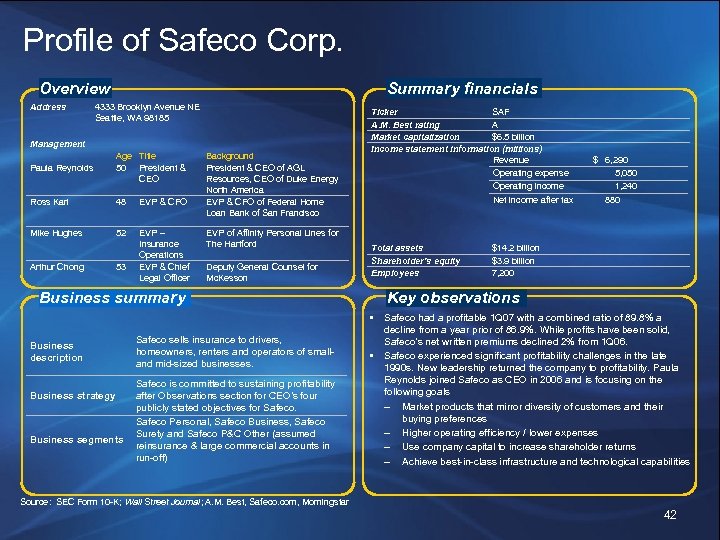

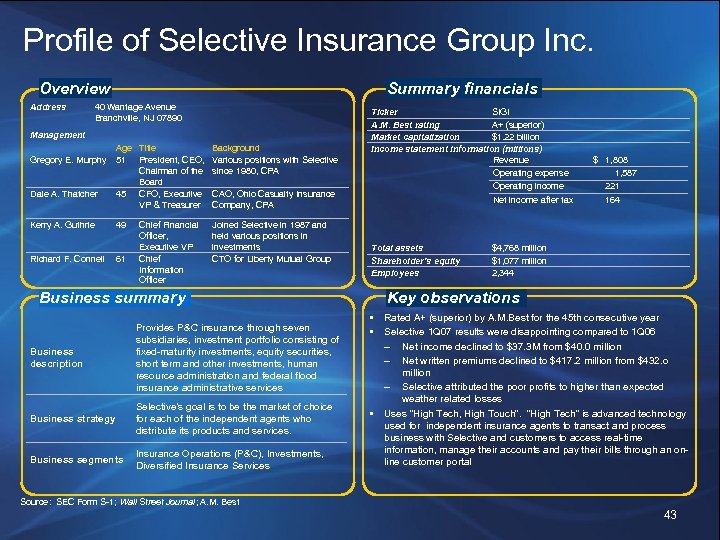

Progressive’s Recent Quarterly Performance Price/book Multiple Price $ A B C D E Key drivers • Over recent history, Progressive has been the only P&C stock that has been widely held by growth investors • Investors are particularly unforgiving of companies that have positioned themselves as growth plays and are subsequently unable to fulfill growth expectations • Progressive’s plight highlights two fundamental forces at play – Inability of any one company to defy powerful industry dynamics and to overcome industry structure/barriers – Reversion to the mean Ruane Cunniff, along with its affiliated Sequoia Fund, files Schedule 13 -G, reporting beneficial ownership of 124 million Progressive shares, approximately 17% of total shares outstanding John Harris, the investment analyst at Ruane Cunniff responsible for Progressive, responds at Sequoia Fund annual meeting to fundholder questioning Progressive’s recent slide, “I don’t think our view of the company’s prospects has changed. We think they are bright. We are perfectly happy to wait a few years while the earnings are flattish or possibly decline so long as we think that management is doing what it needs to do to maximize the company’s ability to earn money far into the future. I think that Glenn Renwick, who is just an outstanding CEO, and his team are doing just that. As long as they continue to do that, we’re very happy to hold the stock. ” Ruane Cunniff and Sequoia divest over 13 million Progressive shares Progressive reports a 29% drop in second quarter earnings. Shares experience 1 -day decline of almost 4%. Goldman Sachs analyst, Tom Cholnoky, comments, “Progressive’s more aggressive pricing actions have yet to generate meaningful improvements in new business production. ” Progressive reports a 21% drop in third-quarter earnings Source: Wall Street Journal; Market Watch; www. sec. gov; Sequoia Fund 2006 Annual Meeting transcript 18

Progressive’s Recent Quarterly Performance Price/book Multiple Price $ A B C D E Key drivers • Over recent history, Progressive has been the only P&C stock that has been widely held by growth investors • Investors are particularly unforgiving of companies that have positioned themselves as growth plays and are subsequently unable to fulfill growth expectations • Progressive’s plight highlights two fundamental forces at play – Inability of any one company to defy powerful industry dynamics and to overcome industry structure/barriers – Reversion to the mean Ruane Cunniff, along with its affiliated Sequoia Fund, files Schedule 13 -G, reporting beneficial ownership of 124 million Progressive shares, approximately 17% of total shares outstanding John Harris, the investment analyst at Ruane Cunniff responsible for Progressive, responds at Sequoia Fund annual meeting to fundholder questioning Progressive’s recent slide, “I don’t think our view of the company’s prospects has changed. We think they are bright. We are perfectly happy to wait a few years while the earnings are flattish or possibly decline so long as we think that management is doing what it needs to do to maximize the company’s ability to earn money far into the future. I think that Glenn Renwick, who is just an outstanding CEO, and his team are doing just that. As long as they continue to do that, we’re very happy to hold the stock. ” Ruane Cunniff and Sequoia divest over 13 million Progressive shares Progressive reports a 29% drop in second quarter earnings. Shares experience 1 -day decline of almost 4%. Goldman Sachs analyst, Tom Cholnoky, comments, “Progressive’s more aggressive pricing actions have yet to generate meaningful improvements in new business production. ” Progressive reports a 21% drop in third-quarter earnings Source: Wall Street Journal; Market Watch; www. sec. gov; Sequoia Fund 2006 Annual Meeting transcript 18

Governance and management analysis It’s the people, stupid. – Ram Shriram, Early Google Investor 19

Governance and management analysis It’s the people, stupid. – Ram Shriram, Early Google Investor 19

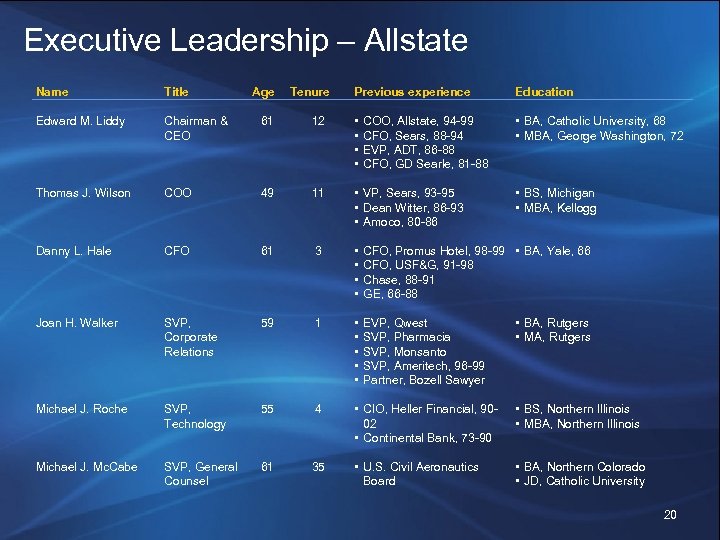

Executive Leadership – Allstate Name Title Age Edward M. Liddy Chairman & CEO 61 Thomas J. Wilson COO Danny L. Hale Tenure Previous experience Education 12 • • • BA, Catholic University, 68 • MBA, George Washington, 72 49 11 • VP, Sears, 93 -95 • Dean Witter, 86 -93 • Amoco, 80 -86 CFO 61 3 • • CFO, Promus Hotel, 98 -99 • BA, Yale, 66 CFO, USF&G, 91 -98 Chase, 88 -91 GE, 66 -88 Joan H. Walker SVP, Corporate Relations 59 1 • • • EVP, Qwest SVP, Pharmacia SVP, Monsanto SVP, Ameritech, 96 -99 Partner, Bozell Sawyer Michael J. Roche SVP, Technology 55 4 • CIO, Heller Financial, 9002 • Continental Bank, 73 -90 • BS, Northern Illinois • MBA, Northern Illinois Michael J. Mc. Cabe SVP, General Counsel 61 35 • U. S. Civil Aeronautics Board • BA, Northern Colorado • JD, Catholic University COO, Allstate, 94 -99 CFO, Sears, 88 -94 EVP, ADT, 86 -88 CFO, GD Searle, 81 -88 • BS, Michigan • MBA, Kellogg • BA, Rutgers • MA, Rutgers 20

Executive Leadership – Allstate Name Title Age Edward M. Liddy Chairman & CEO 61 Thomas J. Wilson COO Danny L. Hale Tenure Previous experience Education 12 • • • BA, Catholic University, 68 • MBA, George Washington, 72 49 11 • VP, Sears, 93 -95 • Dean Witter, 86 -93 • Amoco, 80 -86 CFO 61 3 • • CFO, Promus Hotel, 98 -99 • BA, Yale, 66 CFO, USF&G, 91 -98 Chase, 88 -91 GE, 66 -88 Joan H. Walker SVP, Corporate Relations 59 1 • • • EVP, Qwest SVP, Pharmacia SVP, Monsanto SVP, Ameritech, 96 -99 Partner, Bozell Sawyer Michael J. Roche SVP, Technology 55 4 • CIO, Heller Financial, 9002 • Continental Bank, 73 -90 • BS, Northern Illinois • MBA, Northern Illinois Michael J. Mc. Cabe SVP, General Counsel 61 35 • U. S. Civil Aeronautics Board • BA, Northern Colorado • JD, Catholic University COO, Allstate, 94 -99 CFO, Sears, 88 -94 EVP, ADT, 86 -88 CFO, GD Searle, 81 -88 • BS, Michigan • MBA, Kellogg • BA, Rutgers • MA, Rutgers 20

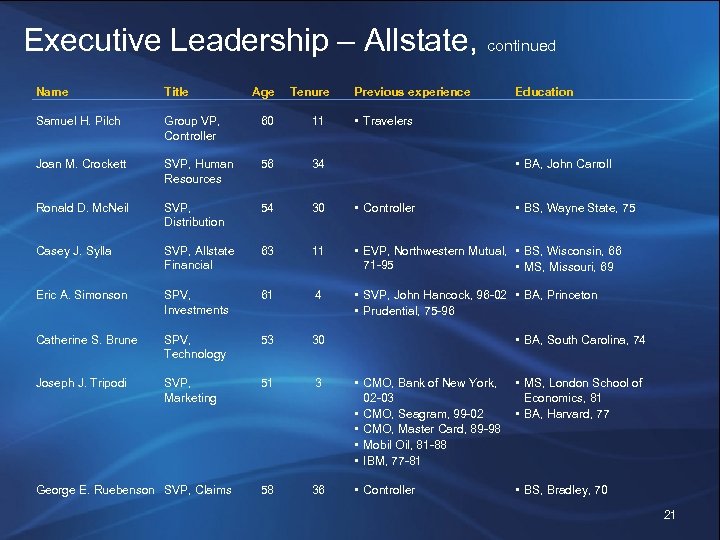

Executive Leadership – Allstate, continued Name Title Samuel H. Pilch Group VP, Controller 60 11 Joan M. Crockett SVP, Human Resources 56 34 Ronald D. Mc. Neil SVP, Distribution 54 30 • Controller Casey J. Sylla SVP, Allstate Financial 63 11 • EVP, Northwestern Mutual, • BS, Wisconsin, 66 71 -95 • MS, Missouri, 69 Eric A. Simonson SPV, Investments 61 4 • SVP, John Hancock, 96 -02 • BA, Princeton • Prudential, 75 -96 Catherine S. Brune SPV, Technology 53 30 Joseph J. Tripodi SVP, Marketing 51 3 • CMO, Bank of New York, 02 -03 • CMO, Seagram, 99 -02 • CMO, Master Card, 89 -98 • Mobil Oil, 81 -88 • IBM, 77 -81 • MS, London School of Economics, 81 • BA, Harvard, 77 58 36 • Controller • BS, Bradley, 70 George E. Ruebenson SVP, Claims Age Tenure Previous experience Education • Travelers • BA, John Carroll • BS, Wayne State, 75 • BA, South Carolina, 74 21

Executive Leadership – Allstate, continued Name Title Samuel H. Pilch Group VP, Controller 60 11 Joan M. Crockett SVP, Human Resources 56 34 Ronald D. Mc. Neil SVP, Distribution 54 30 • Controller Casey J. Sylla SVP, Allstate Financial 63 11 • EVP, Northwestern Mutual, • BS, Wisconsin, 66 71 -95 • MS, Missouri, 69 Eric A. Simonson SPV, Investments 61 4 • SVP, John Hancock, 96 -02 • BA, Princeton • Prudential, 75 -96 Catherine S. Brune SPV, Technology 53 30 Joseph J. Tripodi SVP, Marketing 51 3 • CMO, Bank of New York, 02 -03 • CMO, Seagram, 99 -02 • CMO, Master Card, 89 -98 • Mobil Oil, 81 -88 • IBM, 77 -81 • MS, London School of Economics, 81 • BA, Harvard, 77 58 36 • Controller • BS, Bradley, 70 George E. Ruebenson SVP, Claims Age Tenure Previous experience Education • Travelers • BA, John Carroll • BS, Wayne State, 75 • BA, South Carolina, 74 21

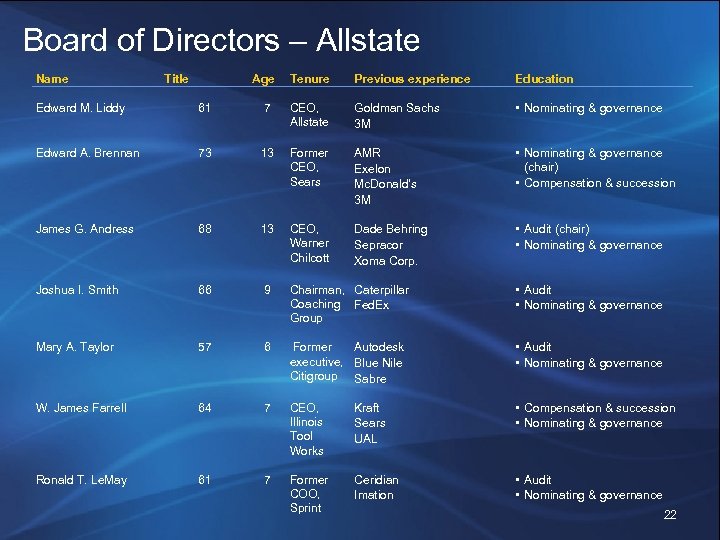

Board of Directors – Allstate Name Title Age Tenure Previous experience Education Edward M. Liddy 61 7 CEO, Allstate Goldman Sachs 3 M • Nominating & governance Edward A. Brennan 73 13 Former CEO, Sears AMR Exelon Mc. Donald’s 3 M • Nominating & governance (chair) • Compensation & succession James G. Andress 68 13 CEO, Warner Chilcott Dade Behring Sepracor Xoma Corp. • Audit (chair) • Nominating & governance Joshua I. Smith 66 9 Chairman, Caterpillar Coaching Fed. Ex Group • Audit • Nominating & governance Mary A. Taylor 57 6 Former Autodesk executive, Blue Nile Citigroup Sabre • Audit • Nominating & governance W. James Farrell 64 7 CEO, Illinois Tool Works Kraft Sears UAL • Compensation & succession • Nominating & governance Ronald T. Le. May 61 7 Former COO, Sprint Ceridian Imation • Audit • Nominating & governance 22

Board of Directors – Allstate Name Title Age Tenure Previous experience Education Edward M. Liddy 61 7 CEO, Allstate Goldman Sachs 3 M • Nominating & governance Edward A. Brennan 73 13 Former CEO, Sears AMR Exelon Mc. Donald’s 3 M • Nominating & governance (chair) • Compensation & succession James G. Andress 68 13 CEO, Warner Chilcott Dade Behring Sepracor Xoma Corp. • Audit (chair) • Nominating & governance Joshua I. Smith 66 9 Chairman, Caterpillar Coaching Fed. Ex Group • Audit • Nominating & governance Mary A. Taylor 57 6 Former Autodesk executive, Blue Nile Citigroup Sabre • Audit • Nominating & governance W. James Farrell 64 7 CEO, Illinois Tool Works Kraft Sears UAL • Compensation & succession • Nominating & governance Ronald T. Le. May 61 7 Former COO, Sprint Ceridian Imation • Audit • Nominating & governance 22

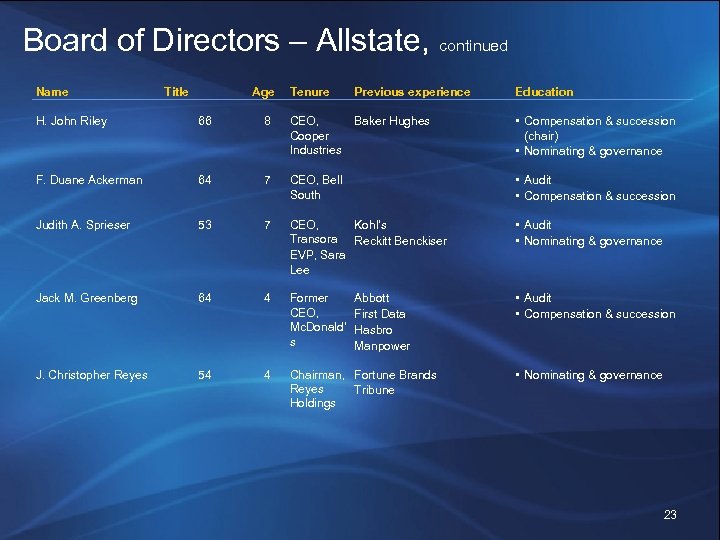

Board of Directors – Allstate, continued Name Title Age Tenure Previous experience Education Baker Hughes • Compensation & succession (chair) • Nominating & governance H. John Riley 66 8 CEO, Cooper Industries F. Duane Ackerman 64 7 CEO, Bell South • Audit • Compensation & succession Judith A. Sprieser 53 7 CEO, Kohl’s Transora Reckitt Benckiser EVP, Sara Lee • Audit • Nominating & governance Jack M. Greenberg 64 4 Former CEO, Mc. Donald’ s • Audit • Compensation & succession J. Christopher Reyes 54 4 Chairman, Fortune Brands Reyes Tribune Holdings Abbott First Data Hasbro Manpower • Nominating & governance 23

Board of Directors – Allstate, continued Name Title Age Tenure Previous experience Education Baker Hughes • Compensation & succession (chair) • Nominating & governance H. John Riley 66 8 CEO, Cooper Industries F. Duane Ackerman 64 7 CEO, Bell South • Audit • Compensation & succession Judith A. Sprieser 53 7 CEO, Kohl’s Transora Reckitt Benckiser EVP, Sara Lee • Audit • Nominating & governance Jack M. Greenberg 64 4 Former CEO, Mc. Donald’ s • Audit • Compensation & succession J. Christopher Reyes 54 4 Chairman, Fortune Brands Reyes Tribune Holdings Abbott First Data Hasbro Manpower • Nominating & governance 23

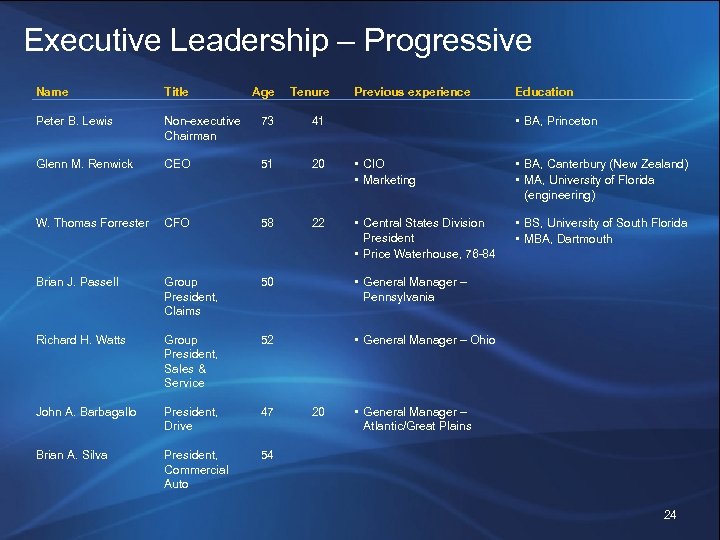

Executive Leadership – Progressive Name Title Age Tenure Peter B. Lewis Non-executive Chairman 73 41 Glenn M. Renwick CEO 51 20 • CIO • Marketing • BA, Canterbury (New Zealand) • MA, University of Florida (engineering) W. Thomas Forrester CFO 58 22 • Central States Division President • Price Waterhouse, 76 -84 • BS, University of South Florida • MBA, Dartmouth Brian J. Passell Group President, Claims 50 • General Manager – Pennsylvania Richard H. Watts Group President, Sales & Service 52 • General Manager – Ohio John A. Barbagallo President, Drive 47 Brian A. Silva President, Commercial Auto 54 20 Previous experience Education • BA, Princeton • General Manager – Atlantic/Great Plains 24

Executive Leadership – Progressive Name Title Age Tenure Peter B. Lewis Non-executive Chairman 73 41 Glenn M. Renwick CEO 51 20 • CIO • Marketing • BA, Canterbury (New Zealand) • MA, University of Florida (engineering) W. Thomas Forrester CFO 58 22 • Central States Division President • Price Waterhouse, 76 -84 • BS, University of South Florida • MBA, Dartmouth Brian J. Passell Group President, Claims 50 • General Manager – Pennsylvania Richard H. Watts Group President, Sales & Service 52 • General Manager – Ohio John A. Barbagallo President, Drive 47 Brian A. Silva President, Commercial Auto 54 20 Previous experience Education • BA, Princeton • General Manager – Atlantic/Great Plains 24

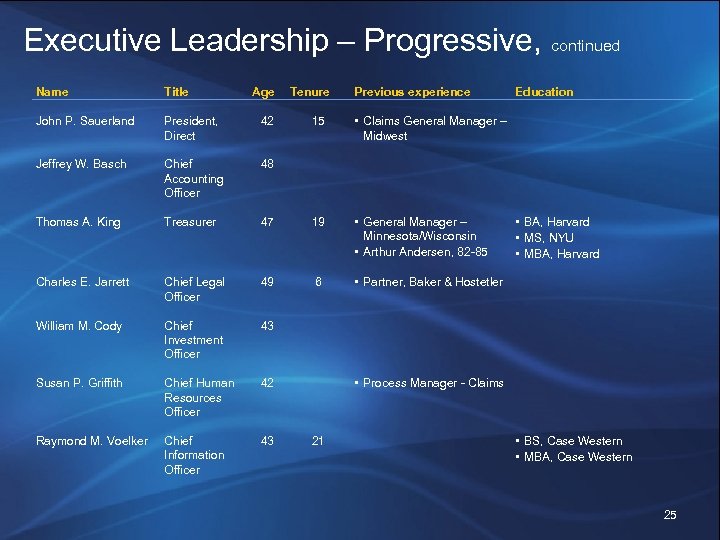

Executive Leadership – Progressive, continued Name Title Age John P. Sauerland President, Direct 42 Jeffrey W. Basch Chief Accounting Officer 48 Thomas A. King Treasurer Charles E. Jarrett Tenure Previous experience 15 • Claims General Manager – Midwest 47 19 • General Manager – Minnesota/Wisconsin • Arthur Andersen, 82 -85 Chief Legal Officer 49 6 • Partner, Baker & Hostetler William M. Cody Chief Investment Officer 43 Susan P. Griffith Chief Human Resources Officer 42 Raymond M. Voelker Chief Information Officer 43 Education • BA, Harvard • MS, NYU • MBA, Harvard • Process Manager - Claims 21 • BS, Case Western • MBA, Case Western 25

Executive Leadership – Progressive, continued Name Title Age John P. Sauerland President, Direct 42 Jeffrey W. Basch Chief Accounting Officer 48 Thomas A. King Treasurer Charles E. Jarrett Tenure Previous experience 15 • Claims General Manager – Midwest 47 19 • General Manager – Minnesota/Wisconsin • Arthur Andersen, 82 -85 Chief Legal Officer 49 6 • Partner, Baker & Hostetler William M. Cody Chief Investment Officer 43 Susan P. Griffith Chief Human Resources Officer 42 Raymond M. Voelker Chief Information Officer 43 Education • BA, Harvard • MS, NYU • MBA, Harvard • Process Manager - Claims 21 • BS, Case Western • MBA, Case Western 25

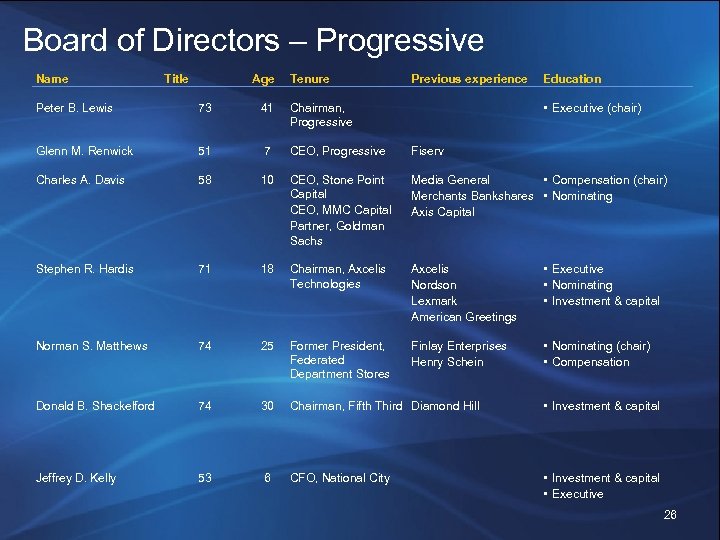

Board of Directors – Progressive Name Title Age Tenure Previous experience Education • Executive (chair) Peter B. Lewis 73 41 Chairman, Progressive Glenn M. Renwick 51 7 CEO, Progressive Fiserv Charles A. Davis 58 10 CEO, Stone Point Capital CEO, MMC Capital Partner, Goldman Sachs Media General • Compensation (chair) Merchants Bankshares • Nominating Axis Capital Stephen R. Hardis 71 18 Chairman, Axcelis Technologies Axcelis Nordson Lexmark American Greetings • Executive • Nominating • Investment & capital Norman S. Matthews 74 25 Former President, Federated Department Stores Finlay Enterprises Henry Schein • Nominating (chair) • Compensation Donald B. Shackelford 74 30 Chairman, Fifth Third Diamond Hill • Investment & capital Jeffrey D. Kelly 53 6 CFO, National City • Investment & capital • Executive 26

Board of Directors – Progressive Name Title Age Tenure Previous experience Education • Executive (chair) Peter B. Lewis 73 41 Chairman, Progressive Glenn M. Renwick 51 7 CEO, Progressive Fiserv Charles A. Davis 58 10 CEO, Stone Point Capital CEO, MMC Capital Partner, Goldman Sachs Media General • Compensation (chair) Merchants Bankshares • Nominating Axis Capital Stephen R. Hardis 71 18 Chairman, Axcelis Technologies Axcelis Nordson Lexmark American Greetings • Executive • Nominating • Investment & capital Norman S. Matthews 74 25 Former President, Federated Department Stores Finlay Enterprises Henry Schein • Nominating (chair) • Compensation Donald B. Shackelford 74 30 Chairman, Fifth Third Diamond Hill • Investment & capital Jeffrey D. Kelly 53 6 CFO, National City • Investment & capital • Executive 26

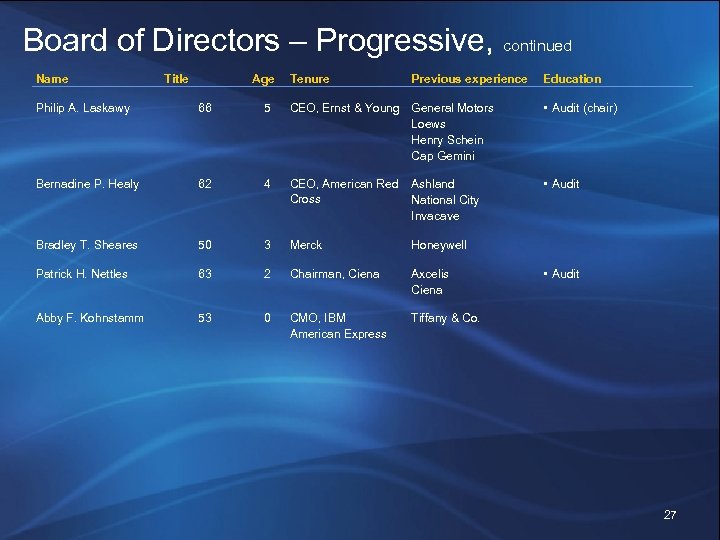

Board of Directors – Progressive, continued Name Title Age Tenure Previous experience Education Philip A. Laskawy 66 5 CEO, Ernst & Young General Motors Loews Henry Schein Cap Gemini • Audit (chair) Bernadine P. Healy 62 4 CEO, American Red Ashland Cross National City Invacave • Audit Bradley T. Sheares 50 3 Merck Honeywell Patrick H. Nettles 63 2 Chairman, Ciena Axcelis Ciena Abby F. Kohnstamm 53 0 CMO, IBM American Express Tiffany & Co. • Audit 27

Board of Directors – Progressive, continued Name Title Age Tenure Previous experience Education Philip A. Laskawy 66 5 CEO, Ernst & Young General Motors Loews Henry Schein Cap Gemini • Audit (chair) Bernadine P. Healy 62 4 CEO, American Red Ashland Cross National City Invacave • Audit Bradley T. Sheares 50 3 Merck Honeywell Patrick H. Nettles 63 2 Chairman, Ciena Axcelis Ciena Abby F. Kohnstamm 53 0 CMO, IBM American Express Tiffany & Co. • Audit 27

Assessing Shareholder Value Creation in the P&C Industry Appendix October 19, 2007 This presentation contains confidential information. Allstate's policies prohibit you from disclosing or discussing such information with anyone –except other employees who need the information to do their work. Do not reproduce or redistribute this presentation. Make sure you store this presentation in a secure manner or destroy it. Remember that Allstate employees are prohibited from trading on the basis of material nonpublic information.

Assessing Shareholder Value Creation in the P&C Industry Appendix October 19, 2007 This presentation contains confidential information. Allstate's policies prohibit you from disclosing or discussing such information with anyone –except other employees who need the information to do their work. Do not reproduce or redistribute this presentation. Make sure you store this presentation in a secure manner or destroy it. Remember that Allstate employees are prohibited from trading on the basis of material nonpublic information.

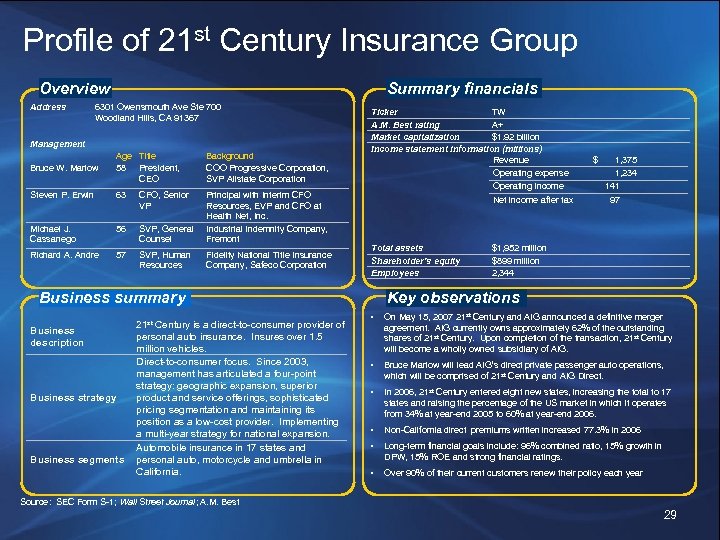

Profile of 21 st Century Insurance Group Overview Address Summary financials 6301 Owensmouth Ave Ste 700 Woodland Hills, CA 91367 Management Bruce W. Marlow Age Title 58 President, CEO Background COO Progressive Corporation, SVP Allstate Corporation Steven P. Erwin 63 CFO, Senior VP Michael J. Cassanego 56 SVP, General Counsel Principal with Interim CFO Resources, EVP and CFO at Health Net, Inc. Industrial Indemnity Company, Fremont Richard A. Andre 57 SVP, Human Resources Fidelity National Title Insurance Company, Safeco Corporation Ticker TW A. M. Best rating A+ Market capitalization $1. 92 billion Income statement information (millions) Revenue Operating expense Operating income Net income after tax Total assets Shareholder’s equity Employees Business summary Business description Business strategy Business segments 21 st Century is a direct-to-consumer provider of personal auto insurance. Insures over 1. 5 million vehicles. Direct-to-consumer focus. Since 2003, management has articulated a four-point strategy: geographic expansion, superior product and service offerings, sophisticated pricing segmentation and maintaining its position as a low-cost provider. Implementing a multi-year strategy for national expansion. Automobile insurance in 17 states and personal auto, motorcycle and umbrella in California. $ 1, 375 1, 234 141 97 $1, 952 million $899 million 2, 344 Key observations • On May 15, 2007 21 st Century and AIG announced a definitive merger agreement. AIG currently owns approximately 62% of the outstanding shares of 21 st Century. Upon completion of the transaction, 21 st Century will become a wholly owned subsidiary of AIG. • Bruce Marlow will lead AIG’s direct private passenger auto operations, which will be comprised of 21 st Century and AIG Direct. • In 2006, 21 st Century entered eight new states, increasing the total to 17 states and raising the percentage of the US market in which it operates from 34% at year-end 2005 to 60% at year-end 2006. • Non-California direct premiums written increased 77. 3% in 2006 • Long-term financial goals include: 96% combined ratio, 15% growth in DPW, 15% ROE and strong financial ratings. • Over 90% of their current customers renew their policy each year Source: SEC Form S-1; Wall Street Journal; A. M. Best 29

Profile of 21 st Century Insurance Group Overview Address Summary financials 6301 Owensmouth Ave Ste 700 Woodland Hills, CA 91367 Management Bruce W. Marlow Age Title 58 President, CEO Background COO Progressive Corporation, SVP Allstate Corporation Steven P. Erwin 63 CFO, Senior VP Michael J. Cassanego 56 SVP, General Counsel Principal with Interim CFO Resources, EVP and CFO at Health Net, Inc. Industrial Indemnity Company, Fremont Richard A. Andre 57 SVP, Human Resources Fidelity National Title Insurance Company, Safeco Corporation Ticker TW A. M. Best rating A+ Market capitalization $1. 92 billion Income statement information (millions) Revenue Operating expense Operating income Net income after tax Total assets Shareholder’s equity Employees Business summary Business description Business strategy Business segments 21 st Century is a direct-to-consumer provider of personal auto insurance. Insures over 1. 5 million vehicles. Direct-to-consumer focus. Since 2003, management has articulated a four-point strategy: geographic expansion, superior product and service offerings, sophisticated pricing segmentation and maintaining its position as a low-cost provider. Implementing a multi-year strategy for national expansion. Automobile insurance in 17 states and personal auto, motorcycle and umbrella in California. $ 1, 375 1, 234 141 97 $1, 952 million $899 million 2, 344 Key observations • On May 15, 2007 21 st Century and AIG announced a definitive merger agreement. AIG currently owns approximately 62% of the outstanding shares of 21 st Century. Upon completion of the transaction, 21 st Century will become a wholly owned subsidiary of AIG. • Bruce Marlow will lead AIG’s direct private passenger auto operations, which will be comprised of 21 st Century and AIG Direct. • In 2006, 21 st Century entered eight new states, increasing the total to 17 states and raising the percentage of the US market in which it operates from 34% at year-end 2005 to 60% at year-end 2006. • Non-California direct premiums written increased 77. 3% in 2006 • Long-term financial goals include: 96% combined ratio, 15% growth in DPW, 15% ROE and strong financial ratings. • Over 90% of their current customers renew their policy each year Source: SEC Form S-1; Wall Street Journal; A. M. Best 29

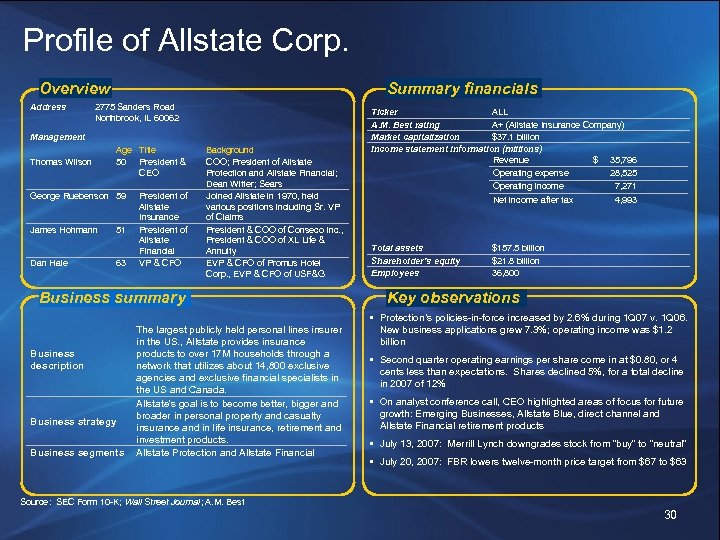

Profile of Allstate Corp. Overview Address Summary financials 2775 Sanders Road Northbrook, IL 60062 Management Thomas Wilson Age Title 50 President & CEO George Ruebenson 59 James Hohmann Dan Hale 51 63 President of Allstate Insurance President of Allstate Financial VP & CFO Background COO; President of Allstate Protection and Allstate Financial; Dean Witter; Sears Joined Allstate in 1970, held various positions including Sr. VP of Claims President & COO of Conseco Inc. , President & COO of XL Life & Annuity EVP & CFO of Promus Hotel Corp. , EVP & CFO of USF&G Business summary Business description Business strategy Business segments The largest publicly held personal lines insurer in the US. , Allstate provides insurance products to over 17 M households through a network that utilizes about 14, 800 exclusive agencies and exclusive financial specialists in the US and Canada. Allstate's goal is to become better, bigger and broader in personal property and casualty insurance and in life insurance, retirement and investment products. Allstate Protection and Allstate Financial Ticker ALL A. M. Best rating A+ (Allstate Insurance Company) Market capitalization $37. 1 billion Income statement information (millions) Revenue $ 35, 796 Operating expense 28, 525 Operating income 7, 271 Net income after tax Total assets Shareholder’s equity Employees 4, 993 $157. 5 billion $21. 8 billion 36, 800 Key observations • Protection’s policies-in-force increased by 2. 6% during 1 Q 07 v. 1 Q 06. New business applications grew 7. 3%; operating income was $1. 2 billion • Second quarter operating earnings per share come in at $0. 80, or 4 cents less than expectations. Shares declined 5%, for a total decline in 2007 of 12% • On analyst conference call, CEO highlighted areas of focus for future growth: Emerging Businesses, Allstate Blue, direct channel and Allstate Financial retirement products • July 13, 2007: Merrill Lynch downgrades stock from “buy” to “neutral” • July 20, 2007: FBR lowers twelve-month price target from $67 to $63 Source: SEC Form 10 -K; Wall Street Journal; A. M. Best 30

Profile of Allstate Corp. Overview Address Summary financials 2775 Sanders Road Northbrook, IL 60062 Management Thomas Wilson Age Title 50 President & CEO George Ruebenson 59 James Hohmann Dan Hale 51 63 President of Allstate Insurance President of Allstate Financial VP & CFO Background COO; President of Allstate Protection and Allstate Financial; Dean Witter; Sears Joined Allstate in 1970, held various positions including Sr. VP of Claims President & COO of Conseco Inc. , President & COO of XL Life & Annuity EVP & CFO of Promus Hotel Corp. , EVP & CFO of USF&G Business summary Business description Business strategy Business segments The largest publicly held personal lines insurer in the US. , Allstate provides insurance products to over 17 M households through a network that utilizes about 14, 800 exclusive agencies and exclusive financial specialists in the US and Canada. Allstate's goal is to become better, bigger and broader in personal property and casualty insurance and in life insurance, retirement and investment products. Allstate Protection and Allstate Financial Ticker ALL A. M. Best rating A+ (Allstate Insurance Company) Market capitalization $37. 1 billion Income statement information (millions) Revenue $ 35, 796 Operating expense 28, 525 Operating income 7, 271 Net income after tax Total assets Shareholder’s equity Employees 4, 993 $157. 5 billion $21. 8 billion 36, 800 Key observations • Protection’s policies-in-force increased by 2. 6% during 1 Q 07 v. 1 Q 06. New business applications grew 7. 3%; operating income was $1. 2 billion • Second quarter operating earnings per share come in at $0. 80, or 4 cents less than expectations. Shares declined 5%, for a total decline in 2007 of 12% • On analyst conference call, CEO highlighted areas of focus for future growth: Emerging Businesses, Allstate Blue, direct channel and Allstate Financial retirement products • July 13, 2007: Merrill Lynch downgrades stock from “buy” to “neutral” • July 20, 2007: FBR lowers twelve-month price target from $67 to $63 Source: SEC Form 10 -K; Wall Street Journal; A. M. Best 30

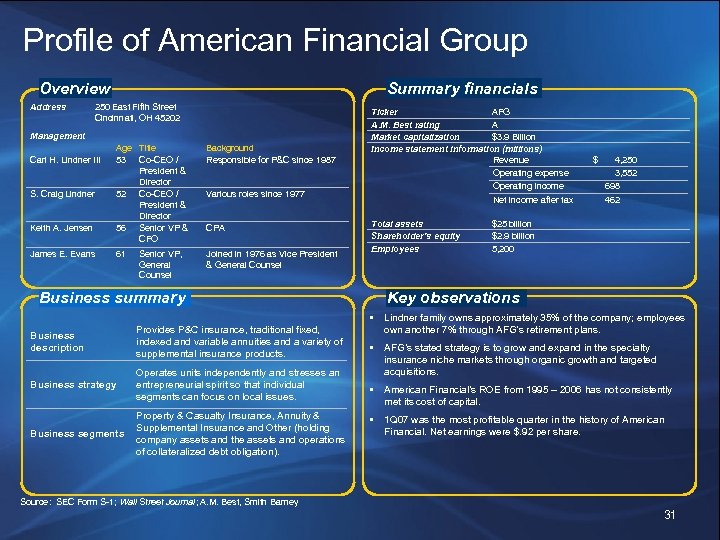

Profile of American Financial Group Overview Address Summary financials 250 East Fifth Street Cincinnati, OH 45202 Management Carl H. Lindner III S. Craig Lindner Keith A. Jensen James E. Evans Age Title 53 Co-CEO / President & Director 52 Co-CEO / President & Director 56 Senior VP & CFO Background Responsible for P&C since 1987 61 Joined in 1976 as Vice President & General Counsel Senior VP, General Counsel Various roles since 1977 CPA Business summary Business description Provides P&C insurance, traditional fixed, indexed and variable annuities and a variety of supplemental insurance products. Business strategy Operates units independently and stresses an entrepreneurial spirit so that individual segments can focus on local issues. Business segments Property & Casualty Insurance, Annuity & Supplemental Insurance and Other (holding company assets and the assets and operations of collateralized debt obligation). Ticker AFG A. M. Best rating A Market capitalization $3. 9 Billion Income statement information (millions) Revenue Operating expense Operating income Net income after tax Total assets Shareholder’s equity Employees $ 4, 250 3, 552 698 462 $25 billion $2. 9 billion 5, 200 Key observations • Lindner family owns approximately 35% of the company; employees own another 7% through AFG’s retirement plans. • AFG’s stated strategy is to grow and expand in the specialty insurance niche markets through organic growth and targeted acquisitions. • American Financial’s ROE from 1995 – 2006 has not consistently met its cost of capital. • 1 Q 07 was the most profitable quarter in the history of American Financial. Net earnings were $. 92 per share. Source: SEC Form S-1; Wall Street Journal; A. M. Best, Smith Barney 31

Profile of American Financial Group Overview Address Summary financials 250 East Fifth Street Cincinnati, OH 45202 Management Carl H. Lindner III S. Craig Lindner Keith A. Jensen James E. Evans Age Title 53 Co-CEO / President & Director 52 Co-CEO / President & Director 56 Senior VP & CFO Background Responsible for P&C since 1987 61 Joined in 1976 as Vice President & General Counsel Senior VP, General Counsel Various roles since 1977 CPA Business summary Business description Provides P&C insurance, traditional fixed, indexed and variable annuities and a variety of supplemental insurance products. Business strategy Operates units independently and stresses an entrepreneurial spirit so that individual segments can focus on local issues. Business segments Property & Casualty Insurance, Annuity & Supplemental Insurance and Other (holding company assets and the assets and operations of collateralized debt obligation). Ticker AFG A. M. Best rating A Market capitalization $3. 9 Billion Income statement information (millions) Revenue Operating expense Operating income Net income after tax Total assets Shareholder’s equity Employees $ 4, 250 3, 552 698 462 $25 billion $2. 9 billion 5, 200 Key observations • Lindner family owns approximately 35% of the company; employees own another 7% through AFG’s retirement plans. • AFG’s stated strategy is to grow and expand in the specialty insurance niche markets through organic growth and targeted acquisitions. • American Financial’s ROE from 1995 – 2006 has not consistently met its cost of capital. • 1 Q 07 was the most profitable quarter in the history of American Financial. Net earnings were $. 92 per share. Source: SEC Form S-1; Wall Street Journal; A. M. Best, Smith Barney 31

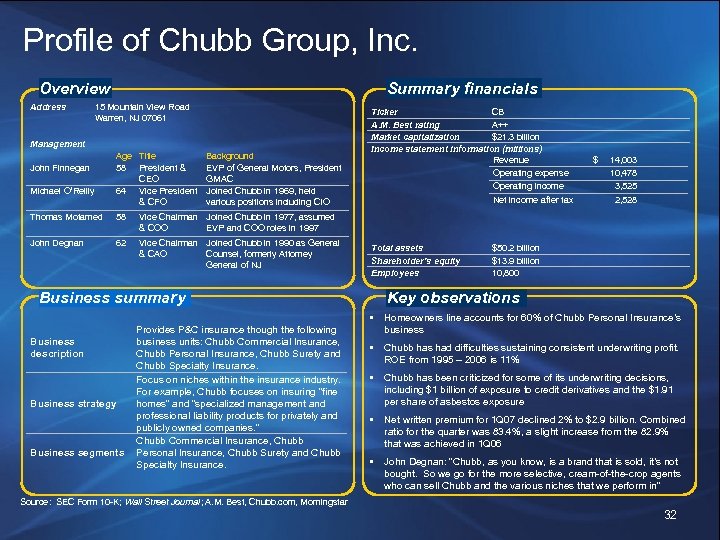

Profile of Chubb Group, Inc. Overview Address Summary financials 15 Mountain View Road Warren, NJ 07061 Management John Finnegan Michael O’Reilly Age Title 58 President & CEO 64 Vice President & CFO Background EVP of General Motors, President GMAC Joined Chubb in 1969, held various positions including CIO Thomas Motamed 58 62 Vice Chairman Joined Chubb in 1990 as General & CAO Counsel, formerly Attorney General of NJ Net income after tax $ 14, 003 10, 478 3, 525 2, 528 Vice Chairman Joined Chubb in 1977, assumed & COO EVP and COO roles in 1997 John Degnan Ticker CB A. M. Best rating A++ Market capitalization $21. 3 billion Income statement information (millions) Revenue Operating expense Operating income Business summary Business description Business strategy Business segments Provides P&C insurance though the following business units: Chubb Commercial Insurance, Chubb Personal Insurance, Chubb Surety and Chubb Specialty Insurance. Focus on niches within the insurance industry. For example, Chubb focuses on insuring “fine homes” and “specialized management and professional liability products for privately and publicly owned companies. ” Chubb Commercial Insurance, Chubb Personal Insurance, Chubb Surety and Chubb Specialty Insurance. Total assets Shareholder’s equity Employees $50. 2 billion $13. 9 billion 10, 800 Key observations • Homeowners line accounts for 60% of Chubb Personal Insurance’s business • Chubb has had difficulties sustaining consistent underwriting profit. ROE from 1995 – 2006 is 11% • Chubb has been criticized for some of its underwriting decisions, including $1 billion of exposure to credit derivatives and the $1. 91 per share of asbestos exposure • Net written premium for 1 Q 07 declined 2% to $2. 9 billion. Combined ratio for the quarter was 83. 4%, a slight increase from the 82. 9% that was achieved in 1 Q 06 • John Degnan: “Chubb, as you know, is a brand that is sold, it’s not bought. So we go for the more selective, cream-of-the-crop agents who can sell Chubb and the various niches that we perform in” Source: SEC Form 10 -K; Wall Street Journal; A. M. Best, Chubb. com, Morningstar 32

Profile of Chubb Group, Inc. Overview Address Summary financials 15 Mountain View Road Warren, NJ 07061 Management John Finnegan Michael O’Reilly Age Title 58 President & CEO 64 Vice President & CFO Background EVP of General Motors, President GMAC Joined Chubb in 1969, held various positions including CIO Thomas Motamed 58 62 Vice Chairman Joined Chubb in 1990 as General & CAO Counsel, formerly Attorney General of NJ Net income after tax $ 14, 003 10, 478 3, 525 2, 528 Vice Chairman Joined Chubb in 1977, assumed & COO EVP and COO roles in 1997 John Degnan Ticker CB A. M. Best rating A++ Market capitalization $21. 3 billion Income statement information (millions) Revenue Operating expense Operating income Business summary Business description Business strategy Business segments Provides P&C insurance though the following business units: Chubb Commercial Insurance, Chubb Personal Insurance, Chubb Surety and Chubb Specialty Insurance. Focus on niches within the insurance industry. For example, Chubb focuses on insuring “fine homes” and “specialized management and professional liability products for privately and publicly owned companies. ” Chubb Commercial Insurance, Chubb Personal Insurance, Chubb Surety and Chubb Specialty Insurance. Total assets Shareholder’s equity Employees $50. 2 billion $13. 9 billion 10, 800 Key observations • Homeowners line accounts for 60% of Chubb Personal Insurance’s business • Chubb has had difficulties sustaining consistent underwriting profit. ROE from 1995 – 2006 is 11% • Chubb has been criticized for some of its underwriting decisions, including $1 billion of exposure to credit derivatives and the $1. 91 per share of asbestos exposure • Net written premium for 1 Q 07 declined 2% to $2. 9 billion. Combined ratio for the quarter was 83. 4%, a slight increase from the 82. 9% that was achieved in 1 Q 06 • John Degnan: “Chubb, as you know, is a brand that is sold, it’s not bought. So we go for the more selective, cream-of-the-crop agents who can sell Chubb and the various niches that we perform in” Source: SEC Form 10 -K; Wall Street Journal; A. M. Best, Chubb. com, Morningstar 32

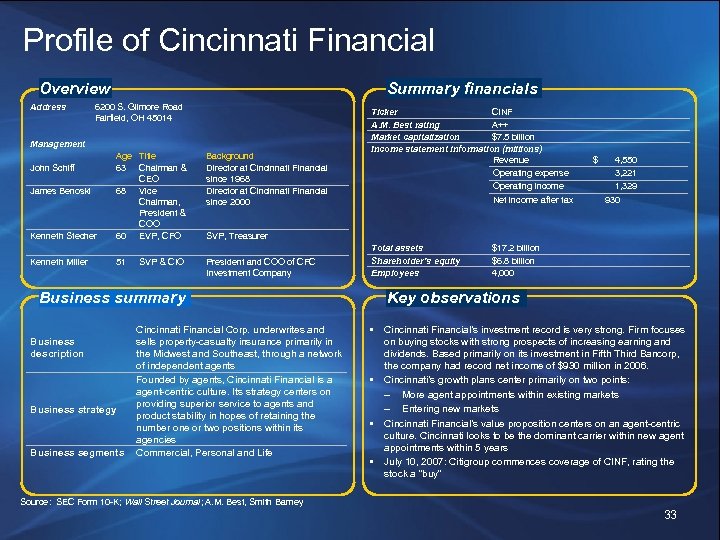

Profile of Cincinnati Financial Overview Address Summary financials 6200 S. Gilmore Road Fairfield, OH 45014 Management John Schiff James Benoski Kenneth Stecher Kenneth Miller Age Title 63 Chairman & CEO 68 Vice Chairman, President & COO 60 EVP, CFO 51 SVP & CIO Background Director at Cincinnati Financial since 1968 Director at Cincinnati Financial since 2000 Business strategy Business segments Net income after tax $ 4, 550 3, 221 1, 329 930 SVP, Treasurer President and COO of CFC Investment Company Business summary Business description Ticker CINF A. M. Best rating A++ Market capitalization $7. 5 billion Income statement information (millions) Revenue Operating expense Operating income Cincinnati Financial Corp. underwrites and sells property-casualty insurance primarily in the Midwest and Southeast, through a network of independent agents Founded by agents, Cincinnati Financial is a agent-centric culture. Its strategy centers on providing superior service to agents and product stability in hopes of retaining the number one or two positions within its agencies Commercial, Personal and Life Total assets Shareholder’s equity Employees $17. 2 billion $6. 8 billion 4, 000 Key observations • Cincinnati Financial’s investment record is very strong. Firm focuses on buying stocks with strong prospects of increasing earning and dividends. Based primarily on its investment in Fifth Third Bancorp, the company had record net income of $930 million in 2006. • Cincinnati’s growth plans center primarily on two points: – More agent appointments within existing markets – Entering new markets • Cincinnati Financial’s value proposition centers on an agent-centric culture. Cincinnati looks to be the dominant carrier within new agent appointments within 5 years • July 10, 2007: Citigroup commences coverage of CINF, rating the stock a “buy” Source: SEC Form 10 -K; Wall Street Journal; A. M. Best, Smith Barney 33

Profile of Cincinnati Financial Overview Address Summary financials 6200 S. Gilmore Road Fairfield, OH 45014 Management John Schiff James Benoski Kenneth Stecher Kenneth Miller Age Title 63 Chairman & CEO 68 Vice Chairman, President & COO 60 EVP, CFO 51 SVP & CIO Background Director at Cincinnati Financial since 1968 Director at Cincinnati Financial since 2000 Business strategy Business segments Net income after tax $ 4, 550 3, 221 1, 329 930 SVP, Treasurer President and COO of CFC Investment Company Business summary Business description Ticker CINF A. M. Best rating A++ Market capitalization $7. 5 billion Income statement information (millions) Revenue Operating expense Operating income Cincinnati Financial Corp. underwrites and sells property-casualty insurance primarily in the Midwest and Southeast, through a network of independent agents Founded by agents, Cincinnati Financial is a agent-centric culture. Its strategy centers on providing superior service to agents and product stability in hopes of retaining the number one or two positions within its agencies Commercial, Personal and Life Total assets Shareholder’s equity Employees $17. 2 billion $6. 8 billion 4, 000 Key observations • Cincinnati Financial’s investment record is very strong. Firm focuses on buying stocks with strong prospects of increasing earning and dividends. Based primarily on its investment in Fifth Third Bancorp, the company had record net income of $930 million in 2006. • Cincinnati’s growth plans center primarily on two points: – More agent appointments within existing markets – Entering new markets • Cincinnati Financial’s value proposition centers on an agent-centric culture. Cincinnati looks to be the dominant carrier within new agent appointments within 5 years • July 10, 2007: Citigroup commences coverage of CINF, rating the stock a “buy” Source: SEC Form 10 -K; Wall Street Journal; A. M. Best, Smith Barney 33

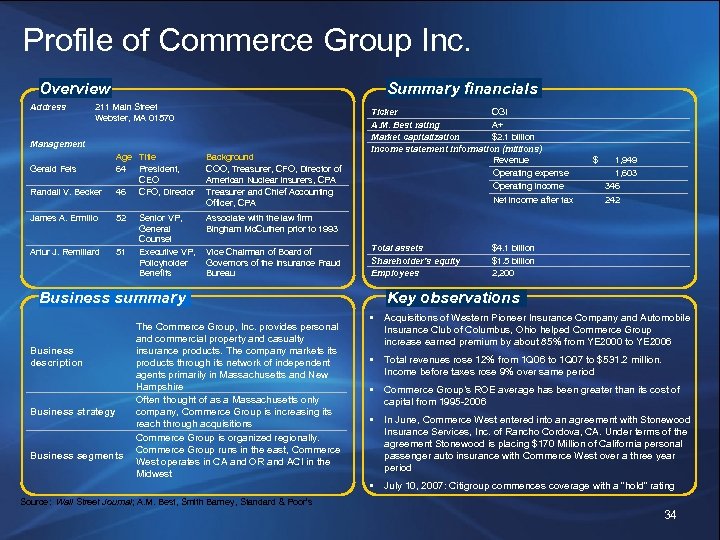

Profile of Commerce Group Inc. Overview Address Summary financials 211 Main Street Webster, MA 01570 Management Randall V. Becker Age Title 64 President, CEO 46 CFO, Director Background COO, Treasurer, CFO, Director of American Nuclear Insurers, CPA Treasurer and Chief Accounting Officer, CPA James A. Ermilio 52 Associate with the law firm Bingham Mc. Cuthen prior to 1993 Artur J. Remillard 51 Ticker CGI A. M. Best rating A+ Market capitalization $2. 1 billion Income statement information (millions) Revenue Operating expense Operating income Gerald Fels Senior VP, General Counsel Executive VP, Policyholder Benefits Vice Chairman of Board of Governors of the Insurance Fraud Bureau Business summary Business description Business strategy Business segments The Commerce Group, Inc. provides personal and commercial property and casualty insurance products. The company markets its products through its network of independent agents primarily in Massachusetts and New Hampshire Often thought of as a Massachusetts only company, Commerce Group is increasing its reach through acquisitions Commerce Group is organized regionally. Commerce Group runs in the east, Commerce West operates in CA and OR and ACI in the Midwest Net income after tax Total assets Shareholder’s equity Employees $ 1, 949 1, 603 346 242 $4. 1 billion $1. 5 billion 2, 200 Key observations • Acquisitions of Western Pioneer Insurance Company and Automobile Insurance Club of Columbus, Ohio helped Commerce Group increase earned premium by about 85% from YE 2000 to YE 2006 • Total revenues rose 12% from 1 Q 06 to 1 Q 07 to $531. 2 million. Income before taxes rose 9% over same period • Commerce Group’s ROE average has been greater than its cost of capital from 1995 -2006 • In June, Commerce West entered into an agreement with Stonewood Insurance Services, Inc. of Rancho Cordova, CA. Under terms of the agreement Stonewood is placing $170 Million of California personal passenger auto insurance with Commerce West over a three year period • July 10, 2007: Citigroup commences coverage with a “hold” rating Source: Wall Street Journal; A. M. Best, Smith Barney, Standard & Poor’s 34

Profile of Commerce Group Inc. Overview Address Summary financials 211 Main Street Webster, MA 01570 Management Randall V. Becker Age Title 64 President, CEO 46 CFO, Director Background COO, Treasurer, CFO, Director of American Nuclear Insurers, CPA Treasurer and Chief Accounting Officer, CPA James A. Ermilio 52 Associate with the law firm Bingham Mc. Cuthen prior to 1993 Artur J. Remillard 51 Ticker CGI A. M. Best rating A+ Market capitalization $2. 1 billion Income statement information (millions) Revenue Operating expense Operating income Gerald Fels Senior VP, General Counsel Executive VP, Policyholder Benefits Vice Chairman of Board of Governors of the Insurance Fraud Bureau Business summary Business description Business strategy Business segments The Commerce Group, Inc. provides personal and commercial property and casualty insurance products. The company markets its products through its network of independent agents primarily in Massachusetts and New Hampshire Often thought of as a Massachusetts only company, Commerce Group is increasing its reach through acquisitions Commerce Group is organized regionally. Commerce Group runs in the east, Commerce West operates in CA and OR and ACI in the Midwest Net income after tax Total assets Shareholder’s equity Employees $ 1, 949 1, 603 346 242 $4. 1 billion $1. 5 billion 2, 200 Key observations • Acquisitions of Western Pioneer Insurance Company and Automobile Insurance Club of Columbus, Ohio helped Commerce Group increase earned premium by about 85% from YE 2000 to YE 2006 • Total revenues rose 12% from 1 Q 06 to 1 Q 07 to $531. 2 million. Income before taxes rose 9% over same period • Commerce Group’s ROE average has been greater than its cost of capital from 1995 -2006 • In June, Commerce West entered into an agreement with Stonewood Insurance Services, Inc. of Rancho Cordova, CA. Under terms of the agreement Stonewood is placing $170 Million of California personal passenger auto insurance with Commerce West over a three year period • July 10, 2007: Citigroup commences coverage with a “hold” rating Source: Wall Street Journal; A. M. Best, Smith Barney, Standard & Poor’s 34

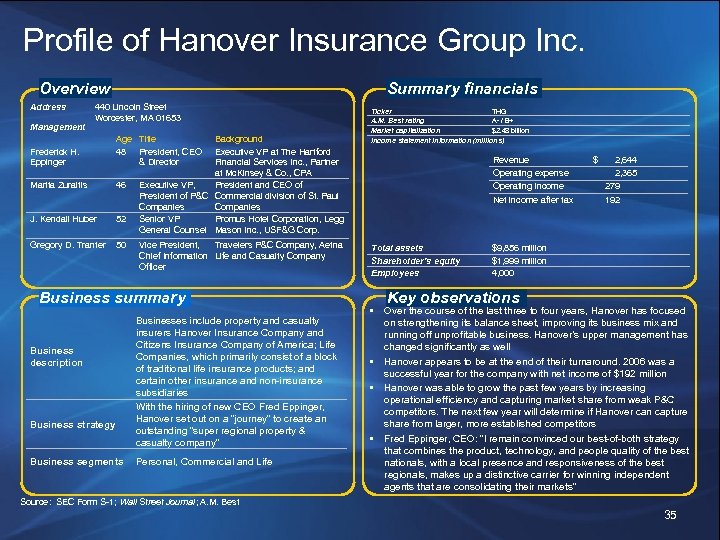

Profile of Hanover Insurance Group Inc. Overview Address Management Summary financials 440 Lincoln Street Worcester, MA 01653 Frederick H. Eppinger Age Title 48 President, CEO & Director Marita Zuraitis 46 J. Kendall Huber 52 Gregory D. Tranter 50 Background Executive VP at The Hartford Financial Services Inc. , Partner at Mc. Kinsey & Co. , CPA Executive VP, President and CEO of President of P&C Commercial division of St. Paul Companies Senior VP Promus Hotel Corporation, Legg General Counsel Mason Inc. , USF&G Corp. Vice President, Travelers P&C Company, Aetna Chief Information Life and Casualty Company Officer Business summary Business description Business strategy Business segments Businesses include property and casualty insurers Hanover Insurance Company and Citizens Insurance Company of America; Life Companies, which primarily consist of a block of traditional life insurance products; and certain other insurance and non-insurance subsidiaries With the hiring of new CEO Fred Eppinger, Hanover set out on a “journey” to create an outstanding “super regional property & casualty company” Personal, Commercial and Life Ticker THG A. M. Best rating A- / B+ Market capitalization $2. 48 billion Income statement information (millions) Revenue Operating expense Operating income Net income after tax Total assets Shareholder’s equity Employees $ 2, 644 2, 365 279 192 $9, 856 million $1, 999 million 4, 000 Key observations • Over the course of the last three to four years, Hanover has focused on strengthening its balance sheet, improving its business mix and running off unprofitable business. Hanover’s upper management has changed significantly as well • Hanover appears to be at the end of their turnaround. 2006 was a successful year for the company with net income of $192 million • Hanover was able to grow the past few years by increasing operational efficiency and capturing market share from weak P&C competitors. The next few year will determine if Hanover can capture share from larger, more established competitors • Fred Eppinger, CEO: “I remain convinced our best-of-both strategy that combines the product, technology, and people quality of the best nationals, with a local presence and responsiveness of the best regionals, makes up a distinctive carrier for winning independent agents that are consolidating their markets” Source: SEC Form S-1; Wall Street Journal; A. M. Best 35

Profile of Hanover Insurance Group Inc. Overview Address Management Summary financials 440 Lincoln Street Worcester, MA 01653 Frederick H. Eppinger Age Title 48 President, CEO & Director Marita Zuraitis 46 J. Kendall Huber 52 Gregory D. Tranter 50 Background Executive VP at The Hartford Financial Services Inc. , Partner at Mc. Kinsey & Co. , CPA Executive VP, President and CEO of President of P&C Commercial division of St. Paul Companies Senior VP Promus Hotel Corporation, Legg General Counsel Mason Inc. , USF&G Corp. Vice President, Travelers P&C Company, Aetna Chief Information Life and Casualty Company Officer Business summary Business description Business strategy Business segments Businesses include property and casualty insurers Hanover Insurance Company and Citizens Insurance Company of America; Life Companies, which primarily consist of a block of traditional life insurance products; and certain other insurance and non-insurance subsidiaries With the hiring of new CEO Fred Eppinger, Hanover set out on a “journey” to create an outstanding “super regional property & casualty company” Personal, Commercial and Life Ticker THG A. M. Best rating A- / B+ Market capitalization $2. 48 billion Income statement information (millions) Revenue Operating expense Operating income Net income after tax Total assets Shareholder’s equity Employees $ 2, 644 2, 365 279 192 $9, 856 million $1, 999 million 4, 000 Key observations • Over the course of the last three to four years, Hanover has focused on strengthening its balance sheet, improving its business mix and running off unprofitable business. Hanover’s upper management has changed significantly as well • Hanover appears to be at the end of their turnaround. 2006 was a successful year for the company with net income of $192 million • Hanover was able to grow the past few years by increasing operational efficiency and capturing market share from weak P&C competitors. The next few year will determine if Hanover can capture share from larger, more established competitors • Fred Eppinger, CEO: “I remain convinced our best-of-both strategy that combines the product, technology, and people quality of the best nationals, with a local presence and responsiveness of the best regionals, makes up a distinctive carrier for winning independent agents that are consolidating their markets” Source: SEC Form S-1; Wall Street Journal; A. M. Best 35

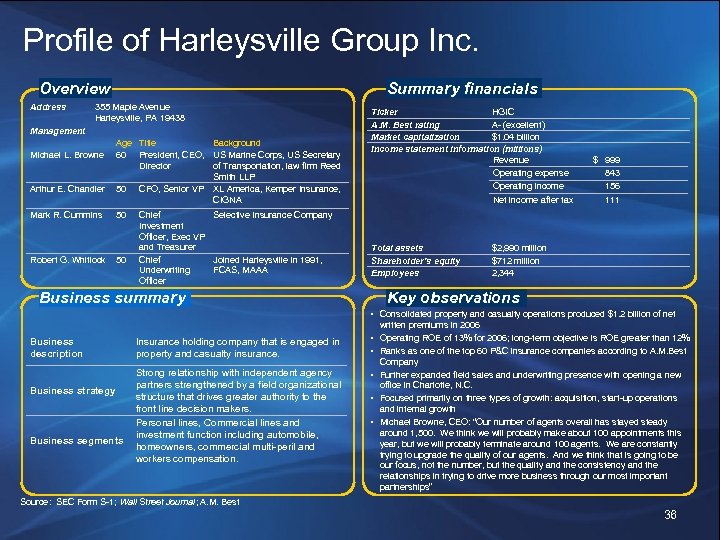

Profile of Harleysville Group Inc. Overview Address Summary financials 355 Maple Avenue Harleysville, PA 19438 Management Michael L. Browne Arthur E. Chandler Age Title Background 60 President, CEO, US Marine Corps, US Secretary Director of Transportation, law firm Reed Smith LLP 50 CFO, Senior VP XL America, Kemper Insurance, CIGNA Mark R. Cummins 50 Robert G. Whitlock 50 Chief Selective Insurance Company Investment Officer, Exec VP and Treasurer Chief Joined Harleysville in 1991, Underwriting FCAS, MAAA Officer Ticker HGIC A. M. Best rating A- (excellent) Market capitalization $1. 04 billion Income statement information (millions) Revenue Operating expense Operating income Net income after tax Total assets Shareholder’s equity Employees Business summary $ 999 843 156 111 $2, 990 million $712 million 2, 344 Key observations • Consolidated property and casualty operations produced $1. 2 billion of net Business description Business strategy Business segments Insurance holding company that is engaged in property and casualty insurance. • • Strong relationship with independent agency partners strengthened by a field organizational structure that drives greater authority to the front line decision makers. Personal lines, Commercial lines and investment function including automobile, homeowners, commercial multi-peril and workers compensation. • • • written premiums in 2006 Operating ROE of 13% for 2006; long-term objective is ROE greater than 12% Ranks as one of the top 60 P&C insurance companies according to A. M. Best Company Further expanded field sales and underwriting presence with opening a new office in Charlotte, N. C. Focused primarily on three types of growth: acquisition, start-up operations and internal growth Michael Browne, CEO: “Our number of agents overall has stayed steady around 1, 500. We think we will probably make about 100 appointments this year, but we will probably terminate around 100 agents. We are constantly trying to upgrade the quality of our agents. And we think that is going to be our focus, not the number, but the quality and the consistency and the relationships in trying to drive more business through our most important partnerships” Source: SEC Form S-1; Wall Street Journal; A. M. Best 36