427c65c443d9a84af4b09117f2424469.ppt

- Количество слайдов: 21

Asian Markets: Strategy for Internationalisation Presented by Mohd Ridzal Sheriff Head, Group Business Development 10 August 2005 Bursa Malaysia Berhad and its Group of Companies (“the Company”) reserve all proprietary rights to the contents of this Presentation. No part of this Presentation may be used or reproduced in any form without the Company’s prior written permission. This Presentation is provided for information purposes only. Neither the Company nor the Presenter make any warranty, express or implied, nor assume any legal liability or responsibility for the

Contents v Incorporation of Malaysian Derivatives Exchanges v Rationalisation of Malaysian Derivatives Market Institutions v Bursa Malaysia: Transformation Process v Bursa Malaysia: A Single Exchange v Market Statistics v Malaysian Government Policies v Recent Developments in Malaysia v Key Developments by Bursa Malaysia FIA Aisia Derivatives Conference 2

Incorporation of Malaysian Derivatives Exchanges v 1980 Establishment of the Kuala Lumpur Commodity Exchange (KLCE) with CPO Futures v 1995 The Kuala Lumpur Options and Financial Futures Exchange (KLOFFE) was established and KLSE CI Futures contract was launched v 1996 Malaysia Monetary Exchange (MME) was established and the 3 Month KLIBOR Futures was launched FIA Aisia Derivatives Conference 3

Rationalisation of Malaysian Derivatives Market Institutions (1) v 1998 KLCE merged with MME to form COMMEX v 1999 KLOFFE purchased by the Kuala Lumpur Stock Exchange v June 2001 Incorporation of MDEX – Merger of KLOFFE and COMMEX FIA Aisia Derivatives Conference 4

Rationalisation of Malaysian Derivatives Market Institutions (2) v June 2002 Approval of the transfer of MDCH from MDEX to Securities Clearing Automated Network Services (SCANS), a wholly owned subsidiary of the Kuala Lumpur Stock Exchange v August 2002 The sale of MDCH to SCANS was completed FIA Aisia Derivatives Conference 5

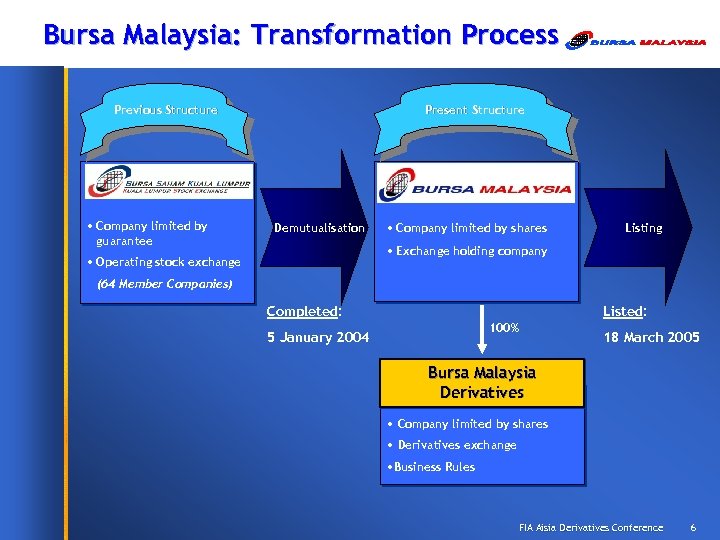

Bursa Malaysia: Transformation Process Previous Structure • Company limited by guarantee Present Structure Demutualisation • Company limited by shares Listing • Exchange holding company • Operating stock exchange (64 Member Companies) Completed: Listed: 100% 5 January 2004 18 March 2005 Bursa Malaysia Derivatives • Company limited by shares • Derivatives exchange • Business Rules FIA Aisia Derivatives Conference 6

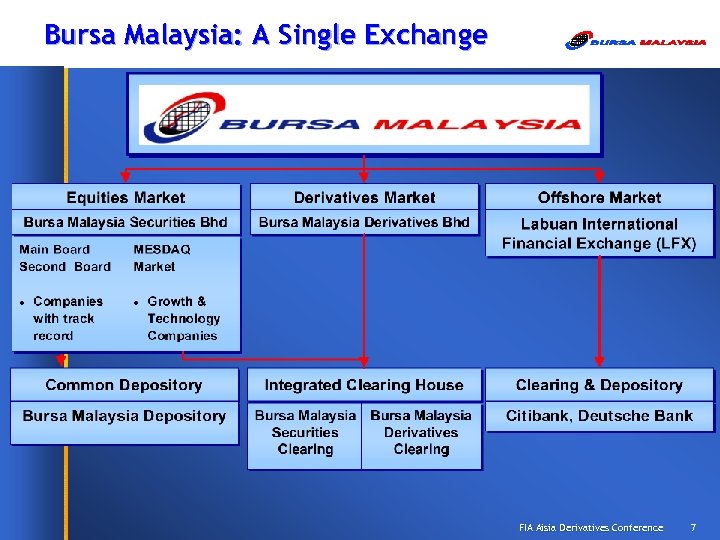

Bursa Malaysia: A Single Exchange FIA Aisia Derivatives Conference 7

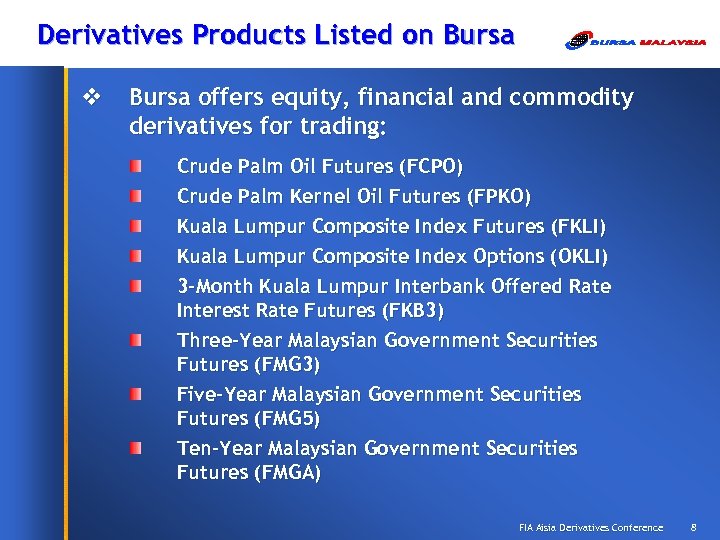

Derivatives Products Listed on Bursa v Bursa offers equity, financial and commodity derivatives for trading: Crude Palm Oil Futures (FCPO) Crude Palm Kernel Oil Futures (FPKO) Kuala Lumpur Composite Index Futures (FKLI) Kuala Lumpur Composite Index Options (OKLI) 3 -Month Kuala Lumpur Interbank Offered Rate Interest Rate Futures (FKB 3) Three-Year Malaysian Government Securities Futures (FMG 3) Five-Year Malaysian Government Securities Futures (FMG 5) Ten-Year Malaysian Government Securities Futures (FMGA) FIA Aisia Derivatives Conference 8

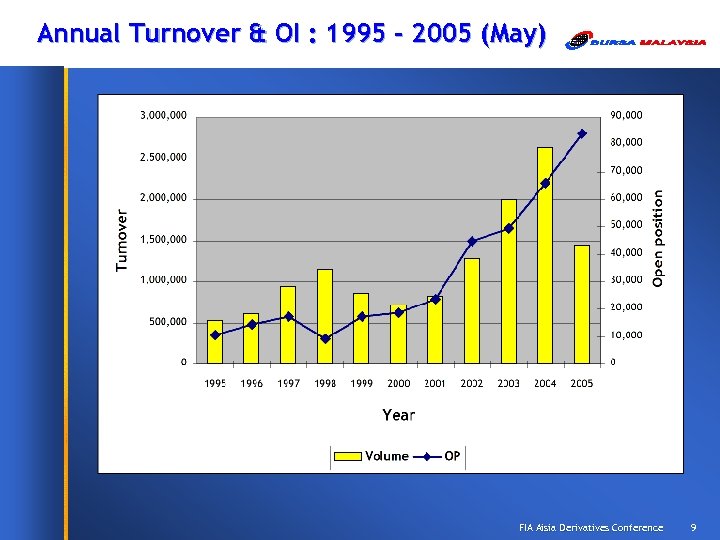

Annual Turnover & OI : 1995 – 2005 (May) FIA Aisia Derivatives Conference 9

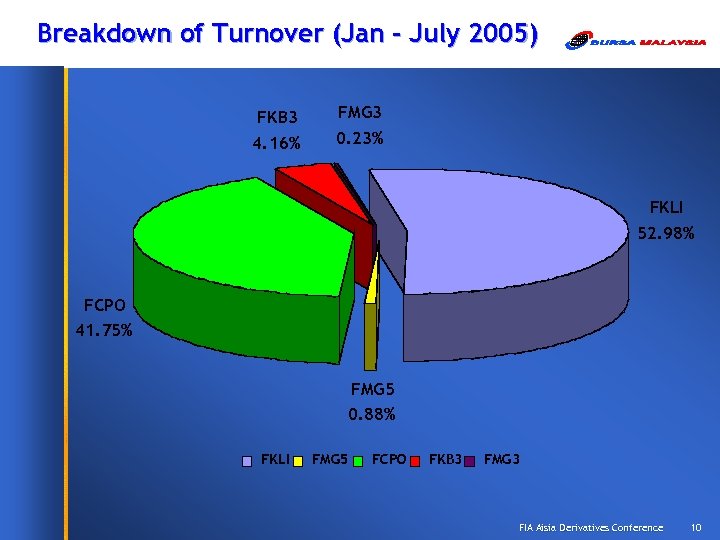

Breakdown of Turnover (Jan – July 2005) FKB 3 4. 16% FMG 3 0. 23% FKLI 52. 98% FCPO 41. 75% FMG 5 0. 88% FKLI FMG 5 FCPO FKB 3 FMG 3 FIA Aisia Derivatives Conference 10

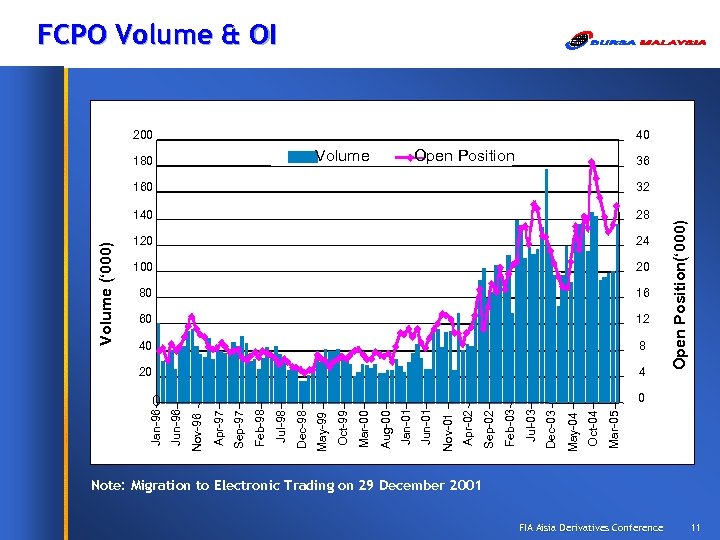

FCPO Volume & OI 200 40 Volume 180 Open Position 36 28 120 24 100 20 80 16 60 12 40 8 20 4 Mar-05 Oct-04 May-04 Dec-03 Jul-03 Feb-03 Sep-02 Apr-02 Nov-01 Jun-01 Jan-01 Aug-00 Mar-00 Oct-99 May-99 Dec-98 Jul-98 Feb-98 Sep-97 Apr-97 Nov-96 0 Jun-96 Jan-96 0 Open Position(‘ 000) 32 140 Volume (‘ 000) 160 Note: Migration to Electronic Trading on 29 December 2001 FIA Aisia Derivatives Conference 11

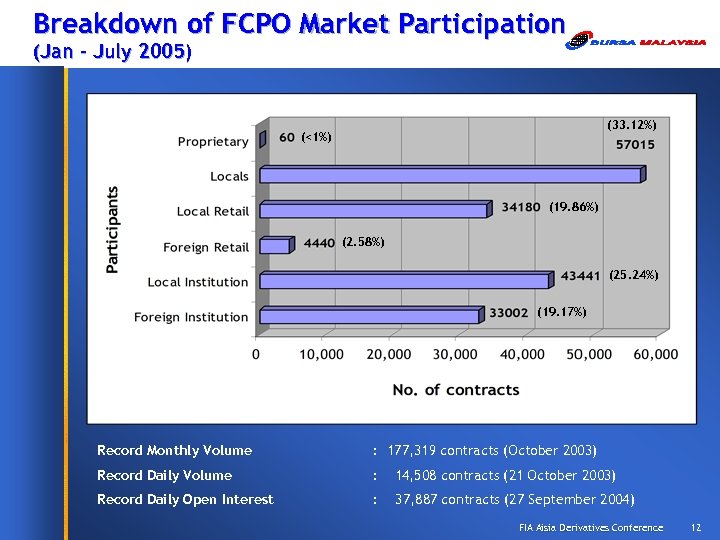

Breakdown of FCPO Market Participation (Jan – July 2005) (33. 12%) (<1%) (19. 86%) (2. 58%) (25. 24%) (19. 17%) Record Monthly Volume : 177, 319 contracts (October 2003) Record Daily Volume : 14, 508 contracts (21 October 2003) Record Daily Open Interest : 37, 887 contracts (27 September 2004) FIA Aisia Derivatives Conference 12

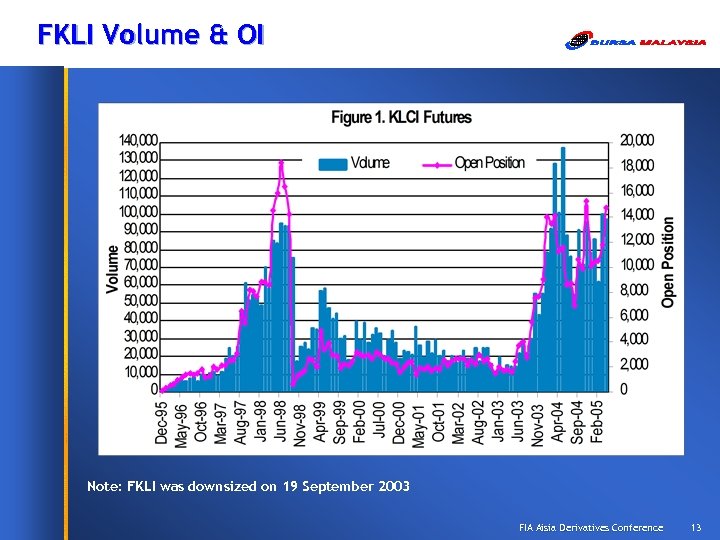

FKLI Volume & OI Note: FKLI was downsized on 19 September 2003 FIA Aisia Derivatives Conference 13

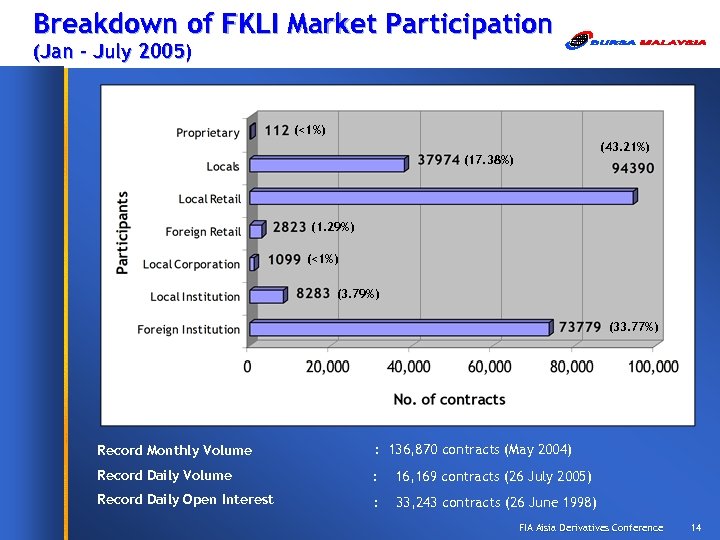

Breakdown of FKLI Market Participation (Jan – July 2005) (<1%) (43. 21%) (17. 38%) (1. 29%) (<1%) (3. 79%) (33. 77%) Record Monthly Volume : 136, 870 contracts (May 2004) Record Daily Volume : 16, 169 contracts (26 July 2005) Record Daily Open Interest : 33, 243 contracts (26 June 1998) FIA Aisia Derivatives Conference 14

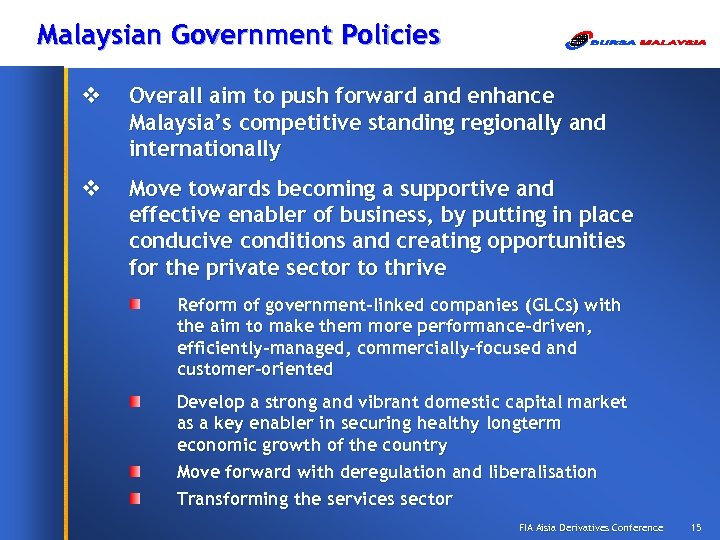

Malaysian Government Policies v Overall aim to push forward and enhance Malaysia’s competitive standing regionally and internationally v Move towards becoming a supportive and effective enabler of business, by putting in place conducive conditions and creating opportunities for the private sector to thrive Reform of government-linked companies (GLCs) with the aim to make them more performance-driven, efficiently-managed, commercially-focused and customer-oriented Develop a strong and vibrant domestic capital market as a key enabler in securing healthy longterm economic growth of the country Move forward with deregulation and liberalisation Transforming the services sector FIA Aisia Derivatives Conference 15

Liberalisation of the Capital Market v The following measures were announced by the Malaysian Government in September 2004, and incorporated in the 2005 Budget: 100% foreign ownership in futures broking industry Issuance of up to 5 new licences to foreign stockbrokers Issuance of up to 5 new licences to foreign fund managers No restrictions on the number of foreign dealer representatives FIA Aisia Derivatives Conference 16

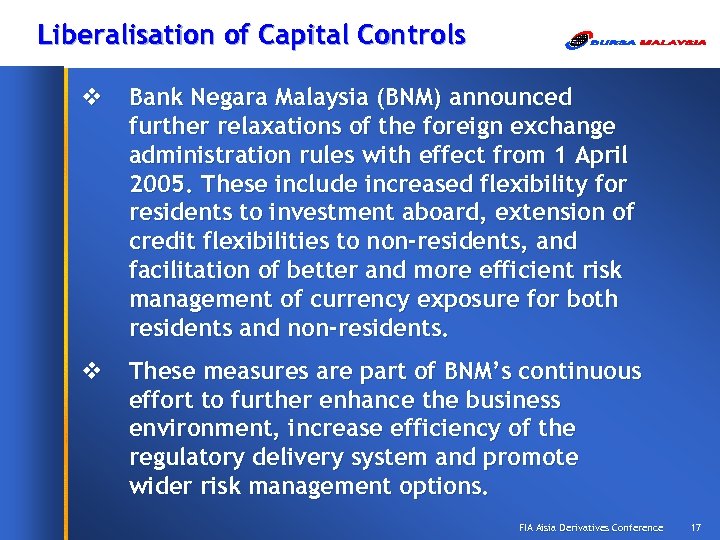

Liberalisation of Capital Controls v Bank Negara Malaysia (BNM) announced further relaxations of the foreign exchange administration rules with effect from 1 April 2005. These include increased flexibility for residents to investment aboard, extension of credit flexibilities to non-residents, and facilitation of better and more efficient risk management of currency exposure for both residents and non-residents. v These measures are part of BNM’s continuous effort to further enhance the business environment, increase efficiency of the regulatory delivery system and promote wider risk management options. FIA Aisia Derivatives Conference 17

De-peg of the Ringgit v BNM announced on 21 July 2005 that the exchange rate of the Ringgit will be allowed to operate in a managed float, with its value being determined by economic fundamentals. v BNM will monitor the exchange rate against a currency basket to ensure that the exchange rate remains close to its fair value. FIA Aisia Derivatives Conference 18

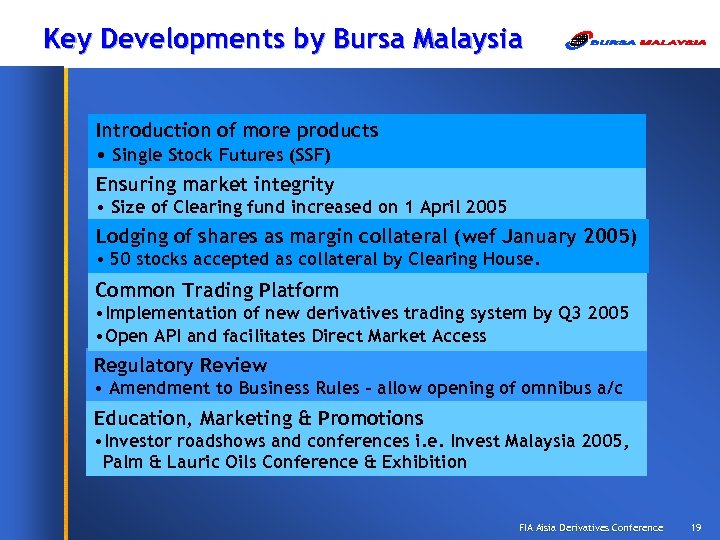

Key Developments by Bursa Malaysia Introduction of more products • Single Stock Futures (SSF) Ensuring market integrity • Size of Clearing fund increased on 1 April 2005 Lodging of shares as margin collateral (wef January 2005) • 50 stocks accepted as collateral by Clearing House. Common Trading Platform • Implementation of new derivatives trading system by Q 3 2005 • Open API and facilitates Direct Market Access Regulatory Review • Amendment to Business Rules - allow opening of omnibus a/c Education, Marketing & Promotions • Investor roadshows and conferences i. e. Invest Malaysia 2005, Palm & Lauric Oils Conference & Exhibition FIA Aisia Derivatives Conference 19

Q&A FIA Aisia Derivatives Conference 20

Derivatives Marketing Bursa Malaysia Bhd 10 th Floor, Exchange Square Bukit Kewangan www. bursamalaysia. com derivatives@bursamalaysia. com + 603 2034 7188 FIA Aisia Derivatives Conference 21

427c65c443d9a84af4b09117f2424469.ppt