1e58c2463f0bc6ab332a19bb65894394.ppt

- Количество слайдов: 12

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore Transfer pricing vs. Customs valuation Kiok Hyung Program manager, ACVA Corporate Post Clearance Audit Division Korea Customs Service

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore Transfer pricing vs. Customs valuation Kiok Hyung Program manager, ACVA Corporate Post Clearance Audit Division Korea Customs Service

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore Table of Content • • KCS Customs controls MNCs in import International taxation PCA for international transactions ACVA Taxation Adjustments Practices

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore Table of Content • • KCS Customs controls MNCs in import International taxation PCA for international transactions ACVA Taxation Adjustments Practices

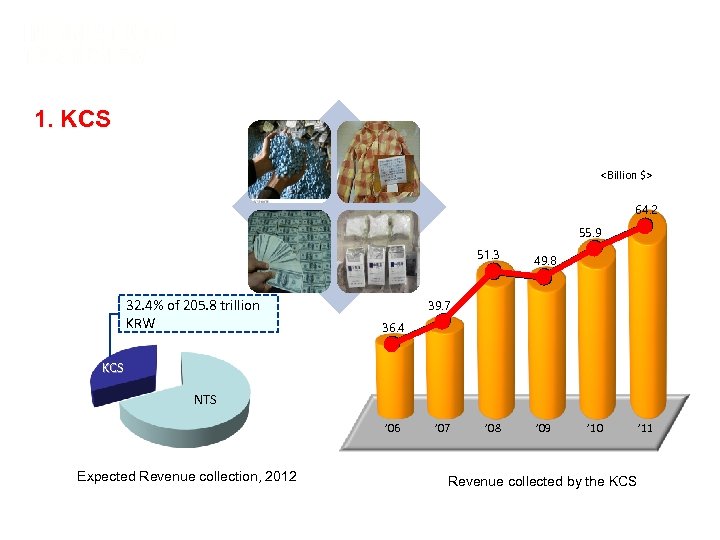

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 1. KCS

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 1. KCS

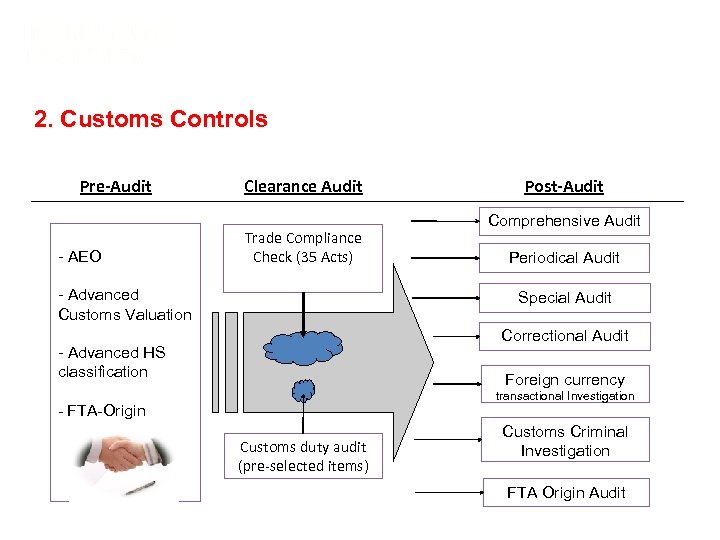

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 2. Customs Controls Pre-Audit - AEO Clearance Audit Trade Compliance Check (35 Acts) - Advanced Customs Valuation Post-Audit Comprehensive Audit Periodical Audit Special Audit Correctional Audit - Advanced HS classification Foreign currency transactional Investigation - FTA-Origin Customs duty audit (pre-selected items) Customs Criminal Investigation FTA Origin Audit

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 2. Customs Controls Pre-Audit - AEO Clearance Audit Trade Compliance Check (35 Acts) - Advanced Customs Valuation Post-Audit Comprehensive Audit Periodical Audit Special Audit Correctional Audit - Advanced HS classification Foreign currency transactional Investigation - FTA-Origin Customs duty audit (pre-selected items) Customs Criminal Investigation FTA Origin Audit

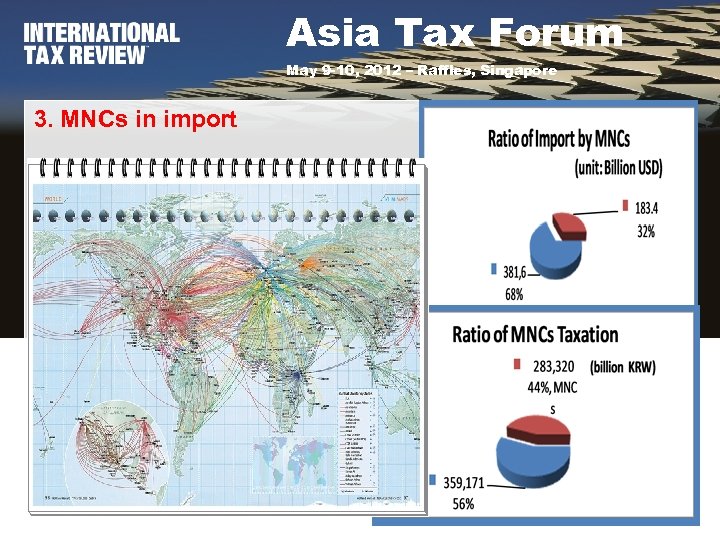

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 3. MNCs in import

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 3. MNCs in import

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 4. International taxation Category Internal Tax Customs Duties Remarks Tax Audit National Tax Service Korea Customs Service Post audit APA ACVA Advance Ruling Service Taxation Adjustment (Advance Pricing Arrangement) (Advanced Customs Valuation Arrangement) Adjustment & mitigation Advance audit July 01, 2012

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 4. International taxation Category Internal Tax Customs Duties Remarks Tax Audit National Tax Service Korea Customs Service Post audit APA ACVA Advance Ruling Service Taxation Adjustment (Advance Pricing Arrangement) (Advanced Customs Valuation Arrangement) Adjustment & mitigation Advance audit July 01, 2012

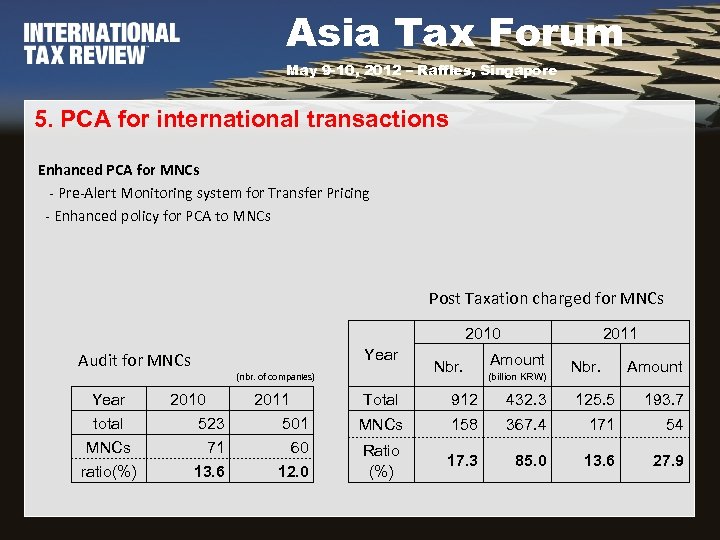

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 5. PCA for international transactions Enhanced PCA for MNCs - Pre-Alert Monitoring system for Transfer Pricing - Enhanced policy for PCA to MNCs Post Taxation charged for MNCs 2010 Audit for MNCs Year total MNCs ratio(%) 2010 523 71 13. 6 Year (nbr. of companies) 2011 501 60 12. 0 Nbr. 2011 Amount (billion KRW) Nbr. Amount Total 912 432. 3 125. 5 193. 7 MNCs 158 367. 4 171 54 Ratio (%) 17. 3 85. 0 13. 6 27. 9

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 5. PCA for international transactions Enhanced PCA for MNCs - Pre-Alert Monitoring system for Transfer Pricing - Enhanced policy for PCA to MNCs Post Taxation charged for MNCs 2010 Audit for MNCs Year total MNCs ratio(%) 2010 523 71 13. 6 Year (nbr. of companies) 2011 501 60 12. 0 Nbr. 2011 Amount (billion KRW) Nbr. Amount Total 912 432. 3 125. 5 193. 7 MNCs 158 367. 4 171 54 Ratio (%) 17. 3 85. 0 13. 6 27. 9

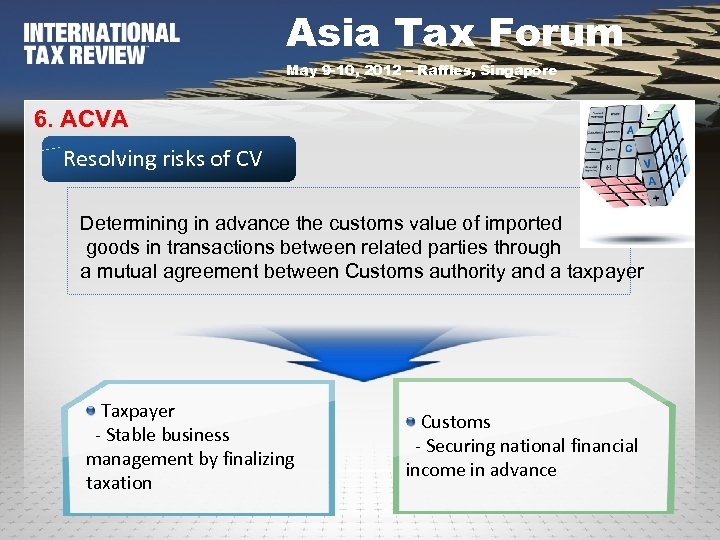

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 6. ACVA Resolving risks of CV Determining in advance the customs value of imported goods in transactions between related parties through a mutual agreement between Customs authority and a taxpayer Taxpayer - Stable business management by finalizing taxation Customs - Securing national financial income in advance

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 6. ACVA Resolving risks of CV Determining in advance the customs value of imported goods in transactions between related parties through a mutual agreement between Customs authority and a taxpayer Taxpayer - Stable business management by finalizing taxation Customs - Securing national financial income in advance

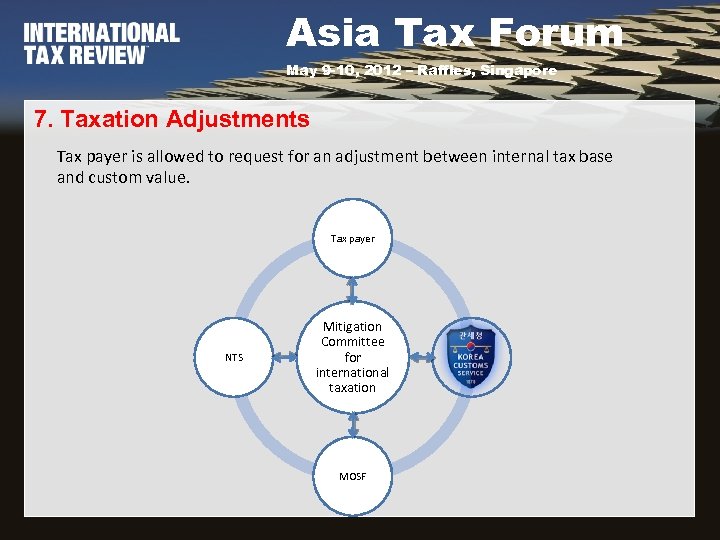

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 7. Taxation Adjustments Tax payer is allowed to request for an adjustment between internal tax base and custom value. Tax payer NTS Mitigation Committee for international taxation MOSF

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 7. Taxation Adjustments Tax payer is allowed to request for an adjustment between internal tax base and custom value. Tax payer NTS Mitigation Committee for international taxation MOSF

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 8. Practices MNC A Imp orte r Import price Initial declarati on Post adjustme nt A 100 c. u. 230 c. u. C 170 c. u. Whole sale price 220 c. u. 210 c. u. (unknown) Customs Valuation 180? c. u. 170 c. u. Exporter vs. Tax authority NTC Cost of sales 80 c. u. ↑ - Corp. i)Export tax 18 price c. u. ii)Profit or 0 c. u. - -

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore 8. Practices MNC A Imp orte r Import price Initial declarati on Post adjustme nt A 100 c. u. 230 c. u. C 170 c. u. Whole sale price 220 c. u. 210 c. u. (unknown) Customs Valuation 180? c. u. 170 c. u. Exporter vs. Tax authority NTC Cost of sales 80 c. u. ↑ - Corp. i)Export tax 18 price c. u. ii)Profit or 0 c. u. - -

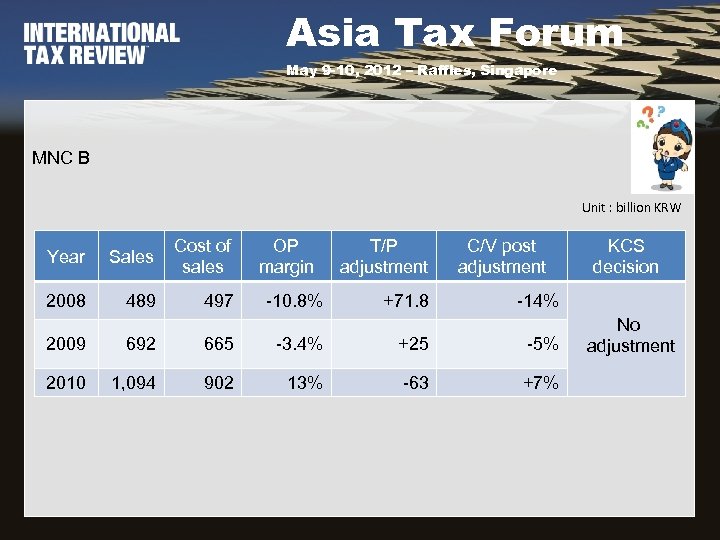

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore MNC B Unit : billion KRW Year Sales Cost of sales 2008 489 497 OP margin -10. 8% T/P adjustment +71. 8 C/V post adjustment KCS decision -14% 2009 692 665 -3. 4% +25 -5% 2010 1, 094 902 13% -63 +7% No adjustment

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore MNC B Unit : billion KRW Year Sales Cost of sales 2008 489 497 OP margin -10. 8% T/P adjustment +71. 8 C/V post adjustment KCS decision -14% 2009 692 665 -3. 4% +25 -5% 2010 1, 094 902 13% -63 +7% No adjustment

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore kiokhyung@gmail. com, valuationa@customs. go. kr

Asia Tax Forum May 9 -10, 2012 – Raffles, Singapore kiokhyung@gmail. com, valuationa@customs. go. kr