c8328d3f9b2fc3b77d967dc7f4b34883.ppt

- Количество слайдов: 15

Army Pay & Allowances How much will you make?

Army Pay & Allowances How much will you make?

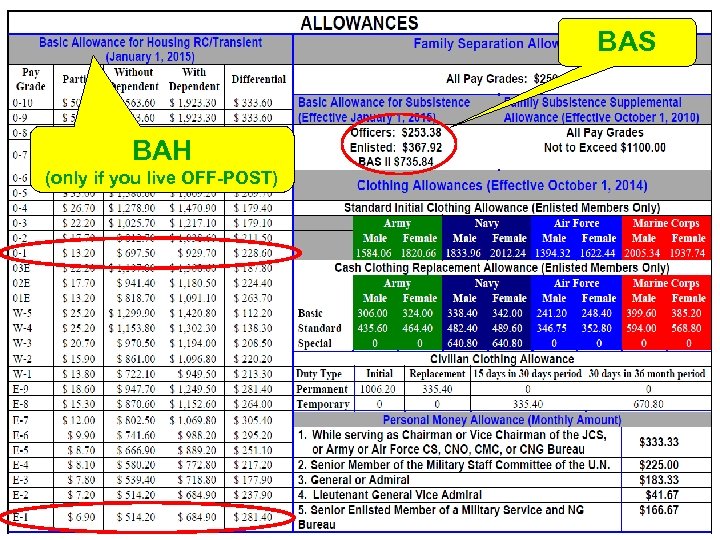

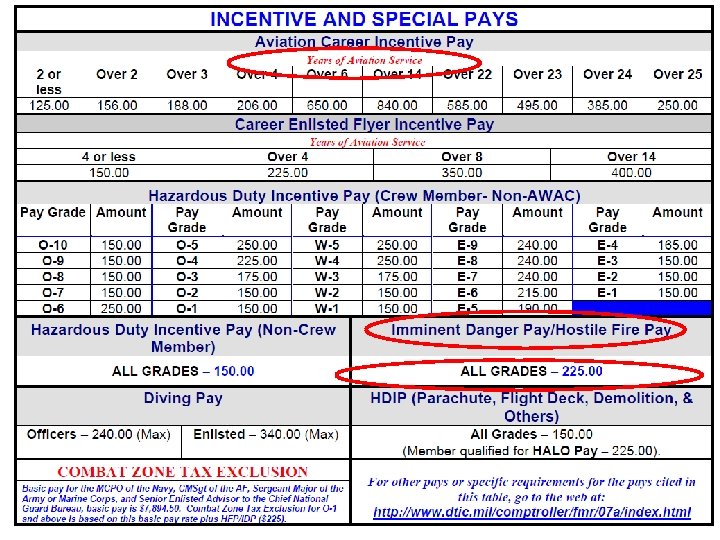

Types of Pay & Allowances Ø Basic (Base) Pay = Salary (monthly); depends upon Pay Grade (Rank) & Years of Service. Ø Basic Allowance for Subsistence (BAS) = Additional pay for food/rations, etc. Ø Basic Allowance for Housing (BAH); formerly BAQuarters • Only those who live Off-Post (not in government housing or BOQ). • Based upon rates with and with-out dependents. • Includes deviations based upon cost of living (Variable Housing Allowance). • Non-Taxable. Ø Special Duty/Skills & Incentive Pay: • Flight Pay (on “Flight Status”) = $125 - $840 per month. • Jump Pay (on “Jump Status”) = $150 per month • Hostile Fire Pay/Imminent Danger Pay (Combat Pay) = $225 per month. • Demolition Pay & Dive Pay (must be in duty position). Ø Cost of Living Adjustment (COLA) = Pay adjustment for living overseas in a high-cost area (includes Hawaii).

Types of Pay & Allowances Ø Basic (Base) Pay = Salary (monthly); depends upon Pay Grade (Rank) & Years of Service. Ø Basic Allowance for Subsistence (BAS) = Additional pay for food/rations, etc. Ø Basic Allowance for Housing (BAH); formerly BAQuarters • Only those who live Off-Post (not in government housing or BOQ). • Based upon rates with and with-out dependents. • Includes deviations based upon cost of living (Variable Housing Allowance). • Non-Taxable. Ø Special Duty/Skills & Incentive Pay: • Flight Pay (on “Flight Status”) = $125 - $840 per month. • Jump Pay (on “Jump Status”) = $150 per month • Hostile Fire Pay/Imminent Danger Pay (Combat Pay) = $225 per month. • Demolition Pay & Dive Pay (must be in duty position). Ø Cost of Living Adjustment (COLA) = Pay adjustment for living overseas in a high-cost area (includes Hawaii).

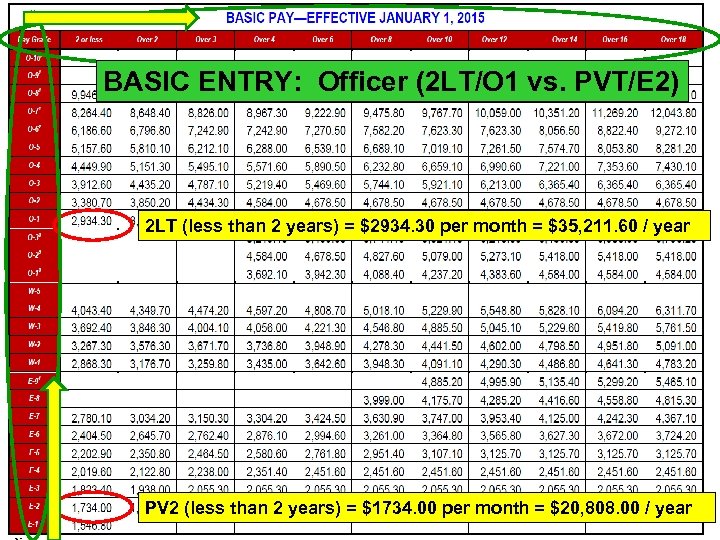

BASIC ENTRY: Officer (2 LT/O 1 vs. PVT/E 2) 2 LT (less than 2 years) = $2934. 30 per month = $35, 211. 60 / year PV 2 (less than 2 years) = $1734. 00 per month = $20, 808. 00 / year

BASIC ENTRY: Officer (2 LT/O 1 vs. PVT/E 2) 2 LT (less than 2 years) = $2934. 30 per month = $35, 211. 60 / year PV 2 (less than 2 years) = $1734. 00 per month = $20, 808. 00 / year

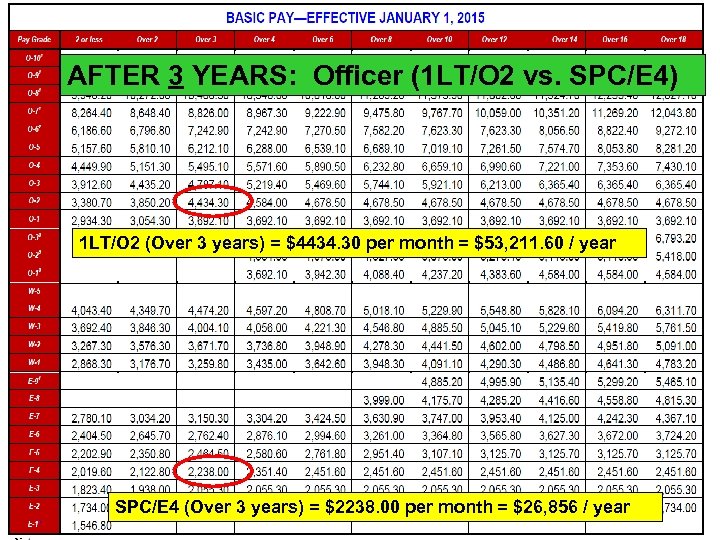

AFTER 3 YEARS: Officer (1 LT/O 2 vs. SPC/E 4) 1 LT/O 2 (Over 3 years) = $4434. 30 per month = $53, 211. 60 / year SPC/E 4 (Over 3 years) = $2238. 00 per month = $26, 856 / year

AFTER 3 YEARS: Officer (1 LT/O 2 vs. SPC/E 4) 1 LT/O 2 (Over 3 years) = $4434. 30 per month = $53, 211. 60 / year SPC/E 4 (Over 3 years) = $2238. 00 per month = $26, 856 / year

BAS BAH (only if you live OFF-POST)

BAS BAH (only if you live OFF-POST)

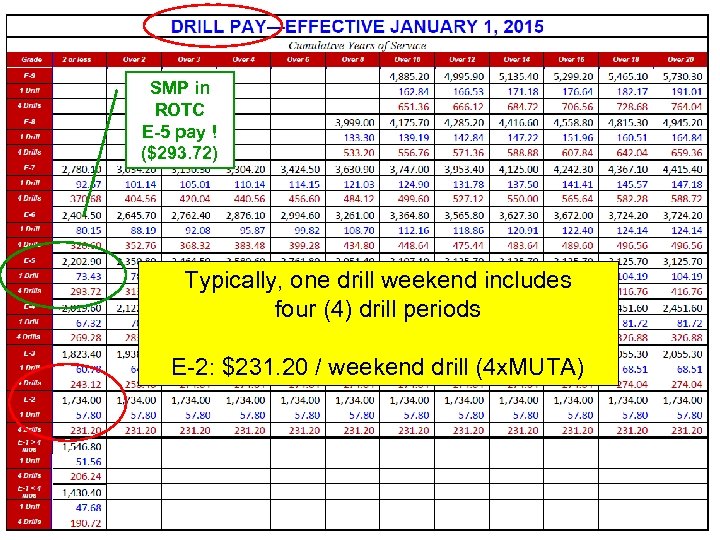

SMP in ROTC E-5 pay ! ($293. 72) Typically, one drill weekend includes four (4) drill periods E-2: $231. 20 / weekend drill (4 x. MUTA)

SMP in ROTC E-5 pay ! ($293. 72) Typically, one drill weekend includes four (4) drill periods E-2: $231. 20 / weekend drill (4 x. MUTA)

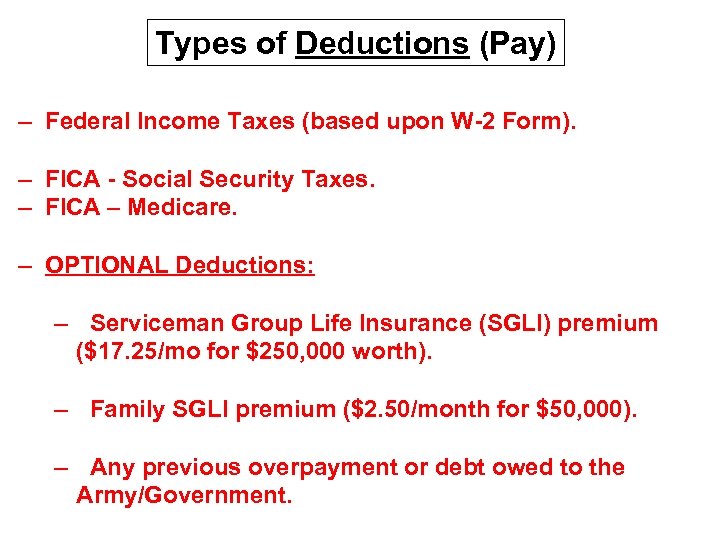

Types of Deductions (Pay) – Federal Income Taxes (based upon W-2 Form). – FICA - Social Security Taxes. – FICA – Medicare. – OPTIONAL Deductions: – Serviceman Group Life Insurance (SGLI) premium ($17. 25/mo for $250, 000 worth). – Family SGLI premium ($2. 50/month for $50, 000). – Any previous overpayment or debt owed to the Army/Government.

Types of Deductions (Pay) – Federal Income Taxes (based upon W-2 Form). – FICA - Social Security Taxes. – FICA – Medicare. – OPTIONAL Deductions: – Serviceman Group Life Insurance (SGLI) premium ($17. 25/mo for $250, 000 worth). – Family SGLI premium ($2. 50/month for $50, 000). – Any previous overpayment or debt owed to the Army/Government.

Types of Allotments (Pay) – U. S. Savings Bonds ($25 = $50). – Investments (Mutual Funds). – Life Insurance (additional Commercial life insurance). – Army Emergency Relief (AER); helps Soldiers in your unit. – Combined Federal Campaign (CFC); charitable contributions. – Alimony/Child Support.

Types of Allotments (Pay) – U. S. Savings Bonds ($25 = $50). – Investments (Mutual Funds). – Life Insurance (additional Commercial life insurance). – Army Emergency Relief (AER); helps Soldiers in your unit. – Combined Federal Campaign (CFC); charitable contributions. – Alimony/Child Support.

Additional “INCOME” NO Medical or Dental expenses while on Active Duty (you). - Pay minimal amount for spouse & children coverage. MOVING Expenses (FREE military moves – don’t have to pay movers): - Per Diem (daily rate for meals & incidentals). - Temporary Lodging Expenses (off-set having to use a hotel/motel). - Mileage Reimbursement (per mile). - Dislocation Allowance (money to defer costs of moving). - Do-It-Yourself (DITY) move (make $$ by saving the government $$). TAX Savings (not included in taxable income): - BAH & BAS is NON-taxable! - Other special income is typically NON-taxable - Only Base Pay is taxable. “Business Trips” (TDY) – is paid for (lodging, meals, incidentals, & transportation) Tuition Assistance (TA) for Education.

Additional “INCOME” NO Medical or Dental expenses while on Active Duty (you). - Pay minimal amount for spouse & children coverage. MOVING Expenses (FREE military moves – don’t have to pay movers): - Per Diem (daily rate for meals & incidentals). - Temporary Lodging Expenses (off-set having to use a hotel/motel). - Mileage Reimbursement (per mile). - Dislocation Allowance (money to defer costs of moving). - Do-It-Yourself (DITY) move (make $$ by saving the government $$). TAX Savings (not included in taxable income): - BAH & BAS is NON-taxable! - Other special income is typically NON-taxable - Only Base Pay is taxable. “Business Trips” (TDY) – is paid for (lodging, meals, incidentals, & transportation) Tuition Assistance (TA) for Education.

Additional Benefits 30 days of LEAVE (vacation) per year (accumulated @ 2. 5 days/month). - can accumulate up to 60 days. Federal Holidays OFF (often a 4 -day weekend). Liberal PASS policy (time-off) for good conduct or special considerations. RECREATION: Gyms, pools, recreation facilities, ball-fields, bowling alley’s, auto-craft shops, wood-working shops, arts & crafts shops, golf courses, shooting ranges, horse stables, fishing ponds/lakes, movie theaters…. SCHOOLS: Elementary & Middle Schools for children. CHURCHES on-post. PX & COMMISSARY.

Additional Benefits 30 days of LEAVE (vacation) per year (accumulated @ 2. 5 days/month). - can accumulate up to 60 days. Federal Holidays OFF (often a 4 -day weekend). Liberal PASS policy (time-off) for good conduct or special considerations. RECREATION: Gyms, pools, recreation facilities, ball-fields, bowling alley’s, auto-craft shops, wood-working shops, arts & crafts shops, golf courses, shooting ranges, horse stables, fishing ponds/lakes, movie theaters…. SCHOOLS: Elementary & Middle Schools for children. CHURCHES on-post. PX & COMMISSARY.

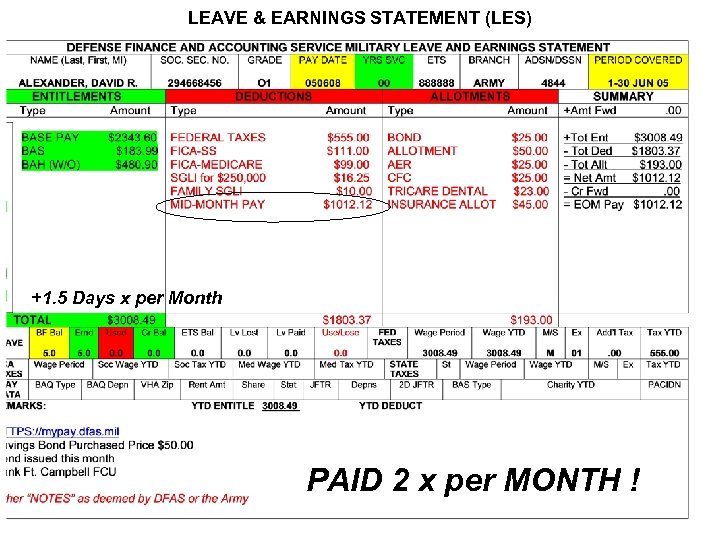

LEAVE & EARNINGS STATEMENT (LES) +1. 5 Days x per Month PAID 2 x per MONTH !

LEAVE & EARNINGS STATEMENT (LES) +1. 5 Days x per Month PAID 2 x per MONTH !

Direct Deposit • You will be required to establish a Direct Deposit account (checking or savings) for ALL your Military pay to be deposited into. • You may elect to keep that account throughout your career (I did) or move it as you move from location to location (PCS). • Recommend that you also open a “local” account (checking and/or savings/ATM) when you PCS to a new duty station (if you keep your DD somewhere else). • Recommend elect to receive a Mid-Month Pay & and End-of-Month Pay option. • Even TDY/travel, and other payments will be DD. • My Example: $125 into Savings every pay / rest into Checking.

Direct Deposit • You will be required to establish a Direct Deposit account (checking or savings) for ALL your Military pay to be deposited into. • You may elect to keep that account throughout your career (I did) or move it as you move from location to location (PCS). • Recommend that you also open a “local” account (checking and/or savings/ATM) when you PCS to a new duty station (if you keep your DD somewhere else). • Recommend elect to receive a Mid-Month Pay & and End-of-Month Pay option. • Even TDY/travel, and other payments will be DD. • My Example: $125 into Savings every pay / rest into Checking.

Leadership Responsibilities Ø Review the LES of your Soldiers: • Check & verify the number of LEAVE days (“Use/Lose” or “In-the-Hole”). • Check & verify the Mid-Month & End-of. Month Pay (“No Pay Due”). • Unit Commander’s Finance Report (UCFR). Save your LES’s

Leadership Responsibilities Ø Review the LES of your Soldiers: • Check & verify the number of LEAVE days (“Use/Lose” or “In-the-Hole”). • Check & verify the Mid-Month & End-of. Month Pay (“No Pay Due”). • Unit Commander’s Finance Report (UCFR). Save your LES’s

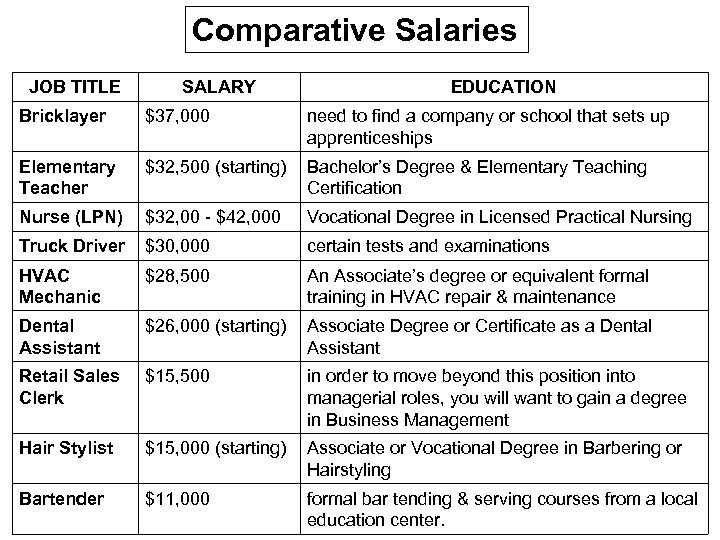

Comparative Salaries JOB TITLE SALARY EDUCATION Bricklayer $37, 000 need to find a company or school that sets up apprenticeships Elementary Teacher $32, 500 (starting) Bachelor’s Degree & Elementary Teaching Certification Nurse (LPN) $32, 00 - $42, 000 Vocational Degree in Licensed Practical Nursing Truck Driver $30, 000 certain tests and examinations HVAC Mechanic $28, 500 An Associate’s degree or equivalent formal training in HVAC repair & maintenance Dental Assistant $26, 000 (starting) Associate Degree or Certificate as a Dental Assistant Retail Sales Clerk $15, 500 in order to move beyond this position into managerial roles, you will want to gain a degree in Business Management Hair Stylist $15, 000 (starting) Associate or Vocational Degree in Barbering or Hairstyling Bartender $11, 000 formal bar tending & serving courses from a local education center.

Comparative Salaries JOB TITLE SALARY EDUCATION Bricklayer $37, 000 need to find a company or school that sets up apprenticeships Elementary Teacher $32, 500 (starting) Bachelor’s Degree & Elementary Teaching Certification Nurse (LPN) $32, 00 - $42, 000 Vocational Degree in Licensed Practical Nursing Truck Driver $30, 000 certain tests and examinations HVAC Mechanic $28, 500 An Associate’s degree or equivalent formal training in HVAC repair & maintenance Dental Assistant $26, 000 (starting) Associate Degree or Certificate as a Dental Assistant Retail Sales Clerk $15, 500 in order to move beyond this position into managerial roles, you will want to gain a degree in Business Management Hair Stylist $15, 000 (starting) Associate or Vocational Degree in Barbering or Hairstyling Bartender $11, 000 formal bar tending & serving courses from a local education center.