b021c8391e459ec4ddb4085be49bbec7.ppt

- Количество слайдов: 32

Armenian State University of Economics Yerevan, Armenia Careers Lecture Thursday 7 December 2017

Armenian State University of Economics Yerevan, Armenia Careers Lecture Thursday 7 December 2017

Presentation Structure • A bit about me (Bruce Hearn) and my background…. • What is an Investment Bank? • Pros and Cons of a career in Finance • How to search for jobs in Finance industry • Useful tips….

Presentation Structure • A bit about me (Bruce Hearn) and my background…. • What is an Investment Bank? • Pros and Cons of a career in Finance • How to search for jobs in Finance industry • Useful tips….

A bit about me (Bruce Hearn) and my background….

A bit about me (Bruce Hearn) and my background….

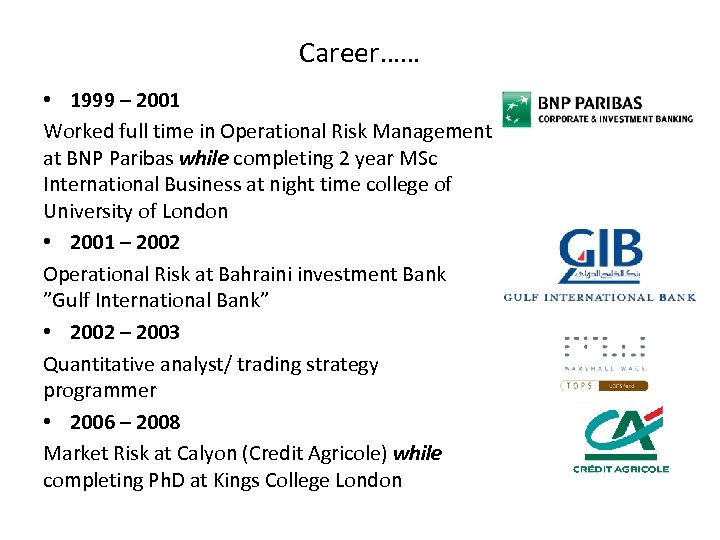

Career…… • 1999 – 2001 Worked full time in Operational Risk Management at BNP Paribas while completing 2 year MSc International Business at night time college of University of London • 2001 – 2002 Operational Risk at Bahraini investment Bank ”Gulf International Bank” • 2002 – 2003 Quantitative analyst/ trading strategy programmer • 2006 – 2008 Market Risk at Calyon (Credit Agricole) while completing Ph. D at Kings College London

Career…… • 1999 – 2001 Worked full time in Operational Risk Management at BNP Paribas while completing 2 year MSc International Business at night time college of University of London • 2001 – 2002 Operational Risk at Bahraini investment Bank ”Gulf International Bank” • 2002 – 2003 Quantitative analyst/ trading strategy programmer • 2006 – 2008 Market Risk at Calyon (Credit Agricole) while completing Ph. D at Kings College London

Structure of Investment Banks • Major investment banking divisions include: – Investment Banking • Intermediary between the capital markets • Advice and analysis on M&A and Capital Structure • Equity and Fixed Income Underwriting – Asset Management • Provide asset management services to investors and institutions – Sales and Trading • Sales and Trading of Equity (Stocks), Fixed Income Securities (Bonds), Derivatives (Options). – Research • Provide research on public stocks and bonds

Structure of Investment Banks • Major investment banking divisions include: – Investment Banking • Intermediary between the capital markets • Advice and analysis on M&A and Capital Structure • Equity and Fixed Income Underwriting – Asset Management • Provide asset management services to investors and institutions – Sales and Trading • Sales and Trading of Equity (Stocks), Fixed Income Securities (Bonds), Derivatives (Options). – Research • Provide research on public stocks and bonds

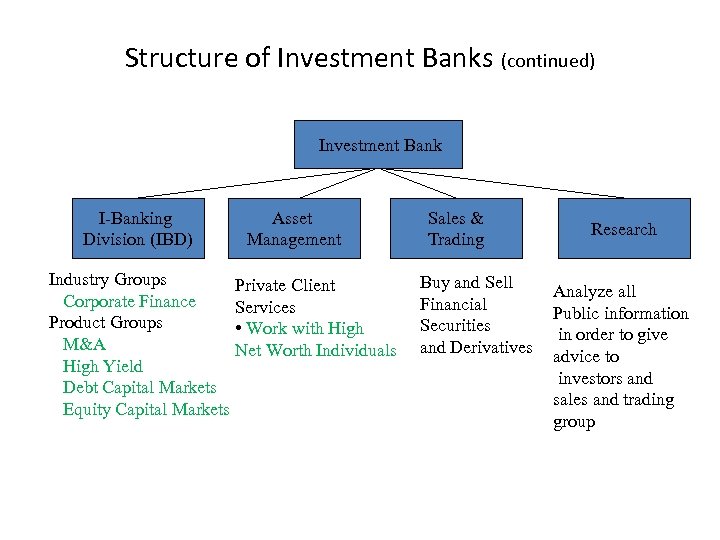

Structure of Investment Banks (continued) Investment Bank I-Banking Division (IBD) Asset Management Industry Groups Private Client Corporate Finance Services Product Groups • Work with High M&A Net Worth Individuals High Yield Debt Capital Markets Equity Capital Markets Sales & Trading Buy and Sell Financial Securities and Derivatives Research Analyze all Public information in order to give advice to investors and sales and trading group

Structure of Investment Banks (continued) Investment Bank I-Banking Division (IBD) Asset Management Industry Groups Private Client Corporate Finance Services Product Groups • Work with High M&A Net Worth Individuals High Yield Debt Capital Markets Equity Capital Markets Sales & Trading Buy and Sell Financial Securities and Derivatives Research Analyze all Public information in order to give advice to investors and sales and trading group

Examples of Careers: ”Trading” (BNP Paribas)

Examples of Careers: ”Trading” (BNP Paribas)

Pros and Cons of a career in Finance

Pros and Cons of a career in Finance

Pros Money – high compensation and bonuses Blue chip brand on CV High level of skills and efficiency Highly useful transferable skills – for example to ”transfer” to another firm (as part of your longer term career) or your own entrepreneurial startup • Professional vocational qualifications (CFA, ACCA, CIMA as well as further academic credentials – such as MBA or specialist quantitative Masters degrees) • •

Pros Money – high compensation and bonuses Blue chip brand on CV High level of skills and efficiency Highly useful transferable skills – for example to ”transfer” to another firm (as part of your longer term career) or your own entrepreneurial startup • Professional vocational qualifications (CFA, ACCA, CIMA as well as further academic credentials – such as MBA or specialist quantitative Masters degrees) • •

Cons • Very long/ extreme working hours – Normal day starts in office at 6 am – Normal day finishes in office at 12 midnight (or entertaining clients) – 6 day working week (including Saturdays) • Risk of ”burn out” – casual observation is Investment Bankers & Financiers are young (under 40 years old)

Cons • Very long/ extreme working hours – Normal day starts in office at 6 am – Normal day finishes in office at 12 midnight (or entertaining clients) – 6 day working week (including Saturdays) • Risk of ”burn out” – casual observation is Investment Bankers & Financiers are young (under 40 years old)

Academic Research into unusual places…. . (in 2001 a research trip to Namibia followed by a televised conference of my research in South Africa)

Academic Research into unusual places…. . (in 2001 a research trip to Namibia followed by a televised conference of my research in South Africa)

Followed by Academic Publications in Research Journals

Followed by Academic Publications in Research Journals

What is an Investment Bank?

What is an Investment Bank?

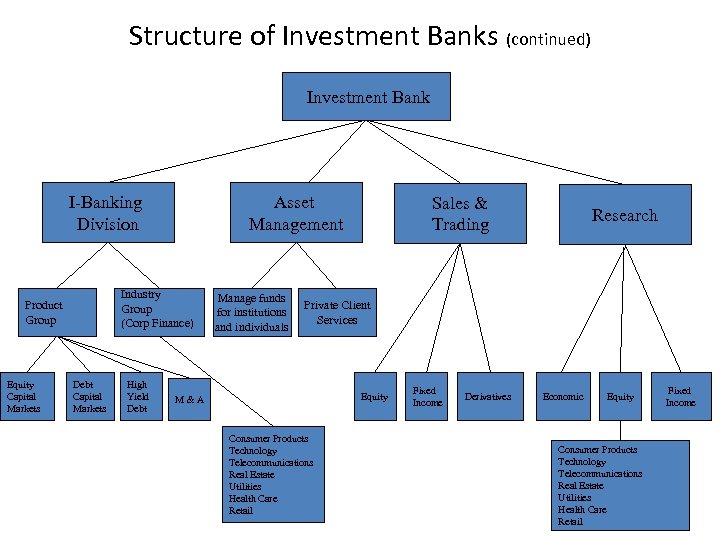

Structure of Investment Banks (continued) Investment Bank I-Banking Division Industry Group (Corp Finance) Product Group Equity Capital Markets Asset Management Debt Capital Markets High Yield Debt Manage funds for institutions and individuals Sales & Trading Research Private Client Services Equity M&A Consumer Products Technology Telecommunications Real Estate Utilities Health Care Retail Fixed Income Derivatives Economic Equity Consumer Products Technology Telecommunications Real Estate Utilities Health Care Retail Fixed Income

Structure of Investment Banks (continued) Investment Bank I-Banking Division Industry Group (Corp Finance) Product Group Equity Capital Markets Asset Management Debt Capital Markets High Yield Debt Manage funds for institutions and individuals Sales & Trading Research Private Client Services Equity M&A Consumer Products Technology Telecommunications Real Estate Utilities Health Care Retail Fixed Income Derivatives Economic Equity Consumer Products Technology Telecommunications Real Estate Utilities Health Care Retail Fixed Income

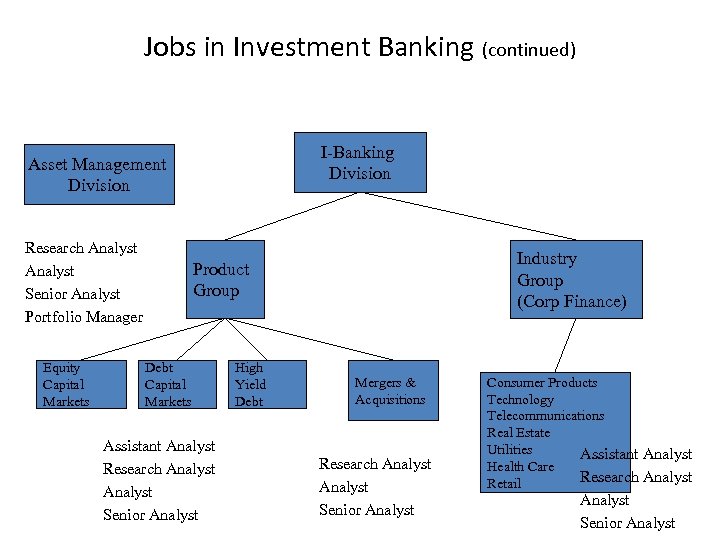

Jobs in Investment Banking (continued) I-Banking Division Asset Management Division Research Analyst Senior Analyst Portfolio Manager Equity Capital Markets Industry Group (Corp Finance) Product Group Debt Capital Markets Assistant Analyst Research Analyst Senior Analyst High Yield Debt Mergers & Acquisitions Research Analyst Senior Analyst Consumer Products Technology Telecommunications Real Estate Utilities Assistant Analyst Health Care Research Analyst Retail Analyst Senior Analyst

Jobs in Investment Banking (continued) I-Banking Division Asset Management Division Research Analyst Senior Analyst Portfolio Manager Equity Capital Markets Industry Group (Corp Finance) Product Group Debt Capital Markets Assistant Analyst Research Analyst Senior Analyst High Yield Debt Mergers & Acquisitions Research Analyst Senior Analyst Consumer Products Technology Telecommunications Real Estate Utilities Assistant Analyst Health Care Research Analyst Retail Analyst Senior Analyst

Examples of Careers: ”Operations” (Goldman Sachs)

Examples of Careers: ”Operations” (Goldman Sachs)

Examples of Careers: ”Investment Banking” (Goldman Sachs)

Examples of Careers: ”Investment Banking” (Goldman Sachs)

Examples of Careers: ”Derivatives” (BNP Paribas)

Examples of Careers: ”Derivatives” (BNP Paribas)

How to search for jobs in Finance industry

How to search for jobs in Finance industry

Paths for graduates…. • Graduate recruitment programs – Only take a tiny fraction of graduates – Despite the glossy brochures and online websites • Headhunting/Recruitment agencies – Major source of recruitment into firms • Direct application to companies – Equally a major source of recruitment although this involves Human Resources and not hiring line managers • Careers/Job fairs/forums – Smaller segment but similar to graduate recruitment

Paths for graduates…. • Graduate recruitment programs – Only take a tiny fraction of graduates – Despite the glossy brochures and online websites • Headhunting/Recruitment agencies – Major source of recruitment into firms • Direct application to companies – Equally a major source of recruitment although this involves Human Resources and not hiring line managers • Careers/Job fairs/forums – Smaller segment but similar to graduate recruitment

Graduate recruitment programs • These are most well publicised recruitment tools • Glossy brochures overwhelmingly dominate careers offices of universities • Ultra-sleek websites • Events include 5 star bookings of hotel suites for presentations and events in bespoke training ”villages” such as Deutsche Bank in Frankfurt • Only one problem – it accounts for a tiny fraction of a percent of overall graduate population!!!!

Graduate recruitment programs • These are most well publicised recruitment tools • Glossy brochures overwhelmingly dominate careers offices of universities • Ultra-sleek websites • Events include 5 star bookings of hotel suites for presentations and events in bespoke training ”villages” such as Deutsche Bank in Frankfurt • Only one problem – it accounts for a tiny fraction of a percent of overall graduate population!!!!

Headhunting/Recruitment agencies • Pros – these deal directly with line manager (cut out HR altogether except formality) • Pros – often highly experienced in recruitment markets, know ”how to sell”, and ”know their clients needs • Pros – often can quickly match candidate with approriate job – based on skills and ”personality fit” • Pros – excellent CV and interview advice • Cons – You need relevant work experience to be attractive to them

Headhunting/Recruitment agencies • Pros – these deal directly with line manager (cut out HR altogether except formality) • Pros – often highly experienced in recruitment markets, know ”how to sell”, and ”know their clients needs • Pros – often can quickly match candidate with approriate job – based on skills and ”personality fit” • Pros – excellent CV and interview advice • Cons – You need relevant work experience to be attractive to them

Examples of specialist headhunters • Robert Walters (a FTSE 100 firm): – http: //www. robertwalters. com/ • Morgan Mckinley: – http: //www. morganmckinley. com/ • Robert Half International: – http: //www. roberthalf. com/ • Walker Hamill: – http: //www. walkerhamill. com/ • Hays Banking: – http: //www. hays. co. uk/job/banking-jobs/ • Michael Page – US and London: http: //www. michaelpage. com/ – Nordic: http: //www. michaelpagenordic. com/index. html#

Examples of specialist headhunters • Robert Walters (a FTSE 100 firm): – http: //www. robertwalters. com/ • Morgan Mckinley: – http: //www. morganmckinley. com/ • Robert Half International: – http: //www. roberthalf. com/ • Walker Hamill: – http: //www. walkerhamill. com/ • Hays Banking: – http: //www. hays. co. uk/job/banking-jobs/ • Michael Page – US and London: http: //www. michaelpage. com/ – Nordic: http: //www. michaelpagenordic. com/index. html#

…. . and useful careers websites (based primarily on recruitment consultancies) • e. Financial. Careers: – http: //www. efinancialcareers. com/ • City Jobs (UK): – http: //www. cityjobs. com/ …. . usefully you can sign up to these websites and receive emails every day with lists of new graduate-level jobs posted

…. . and useful careers websites (based primarily on recruitment consultancies) • e. Financial. Careers: – http: //www. efinancialcareers. com/ • City Jobs (UK): – http: //www. cityjobs. com/ …. . usefully you can sign up to these websites and receive emails every day with lists of new graduate-level jobs posted

Direct application to companies • Pros – handling experienced HR personnel – This can often lead to their giving you very tailor-made advice • Pros – cost effective for companies to rely on such direct recruitment as it cuts out the additional costs of headhunters/recruitment consultants (this often amounts to thousands of pounds) • Cons – rigorous emphasis on relevant work experience • Cons – you do without the sales skills of recruitment consultants/headhunters in negotiation

Direct application to companies • Pros – handling experienced HR personnel – This can often lead to their giving you very tailor-made advice • Pros – cost effective for companies to rely on such direct recruitment as it cuts out the additional costs of headhunters/recruitment consultants (this often amounts to thousands of pounds) • Cons – rigorous emphasis on relevant work experience • Cons – you do without the sales skills of recruitment consultants/headhunters in negotiation

A caveat…… (1) How do you get around ”relevant work experience” requirement? …. This is a huge problem (2) Answer – really do your research…… (3) Talk to everyone you possibly can about what life and working conditions are like in various divisions and industries (4) Research what different divisions actually do using internet (5) Read up as much as you can (6) Ultimately know as much as you can about your desired areas

A caveat…… (1) How do you get around ”relevant work experience” requirement? …. This is a huge problem (2) Answer – really do your research…… (3) Talk to everyone you possibly can about what life and working conditions are like in various divisions and industries (4) Research what different divisions actually do using internet (5) Read up as much as you can (6) Ultimately know as much as you can about your desired areas

Careers/Job fairs/forums • Many companies see these as a prelude to formal graduate recruitment process • Pros – easy to interview and meet many companies within a matter of a few hours • Pros – good to get better idea of company culture • Pros – fascinating insight into other candidates you are competing with (know your market type idea) • Cons – only the very beggining/start of a process that is ultimately continued at the company itself

Careers/Job fairs/forums • Many companies see these as a prelude to formal graduate recruitment process • Pros – easy to interview and meet many companies within a matter of a few hours • Pros – good to get better idea of company culture • Pros – fascinating insight into other candidates you are competing with (know your market type idea) • Cons – only the very beggining/start of a process that is ultimately continued at the company itself

Examples of Careers Fairs • Latin American (and Spanish speakers): – http: //www. latpro. com/ • Japanese-speakers: – http: //www. discointer. com/careers/career_forum. php – http: //www. careerforum. net/event/? lang=E • Continental Europe and Scandinavia: – https: //www. euro-career. com/ • UK: – https: //www. ucl. ac. uk/careers/events/fairs – http: //londongradfair. co. uk/ – http: //www. springgradfair. co. uk/

Examples of Careers Fairs • Latin American (and Spanish speakers): – http: //www. latpro. com/ • Japanese-speakers: – http: //www. discointer. com/careers/career_forum. php – http: //www. careerforum. net/event/? lang=E • Continental Europe and Scandinavia: – https: //www. euro-career. com/ • UK: – https: //www. ucl. ac. uk/careers/events/fairs – http: //londongradfair. co. uk/ – http: //www. springgradfair. co. uk/

Useful tips….

Useful tips….

Interview and general advice

Interview and general advice

• Do your research on department or bank you are applying • From prior research gain a solid understanding of products used • From prior research thoroughly understand/be fluent in differences between your ”chosen” department and other related departments – So……for example……what is difference between ”credit risk” and ”market risk” or ”FX risk” • Tailor-make your CV and application for *each* individual job you apply to - - DO NOT simply use ”standard” versions – Obviously this means *a lot* of work on your part….

• Do your research on department or bank you are applying • From prior research gain a solid understanding of products used • From prior research thoroughly understand/be fluent in differences between your ”chosen” department and other related departments – So……for example……what is difference between ”credit risk” and ”market risk” or ”FX risk” • Tailor-make your CV and application for *each* individual job you apply to - - DO NOT simply use ”standard” versions – Obviously this means *a lot* of work on your part….

• If you don’t have relevant work experience in *that* area……. then highlight those skills you do have that are of relevance • Be open minded to gaining valuable entry level experience first that will ultimately lead to you obtaining a graduate role in your next round of applications/job hunting • Finally……be persistent – it does pay off • Good luck……

• If you don’t have relevant work experience in *that* area……. then highlight those skills you do have that are of relevance • Be open minded to gaining valuable entry level experience first that will ultimately lead to you obtaining a graduate role in your next round of applications/job hunting • Finally……be persistent – it does pay off • Good luck……