f98a7c79f57e8ac13940e5e148fa33c9.ppt

- Количество слайдов: 11

Armenia Present Situation as Experienced by Traders Tbilisi, Georgia, May, 2004

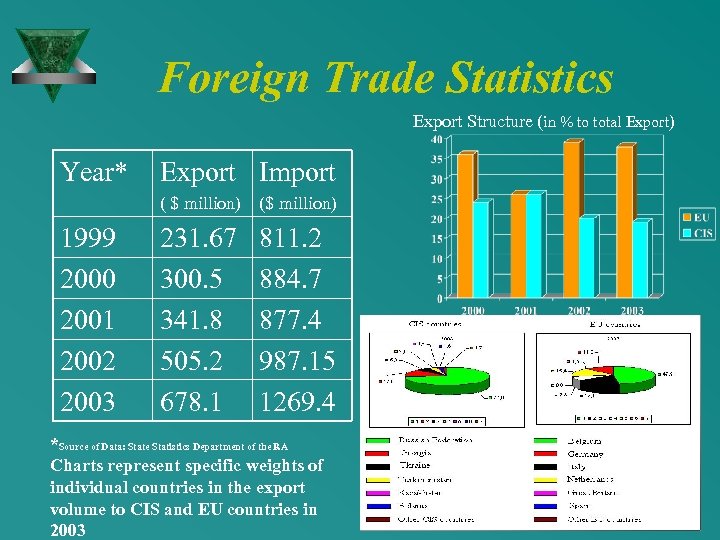

Foreign Trade Statistics Export Structure (in % to total Export) Year* Export Import ( $ million) ($ million) 1999 2000 2001 2002 2003 231. 67 300. 5 341. 8 505. 2 678. 1 811. 2 884. 7 877. 4 987. 15 1269. 4 *Source of Data: State Statistics Department of the RA Charts represent specific weights of individual countries in the export volume to CIS and EU countries in 2003

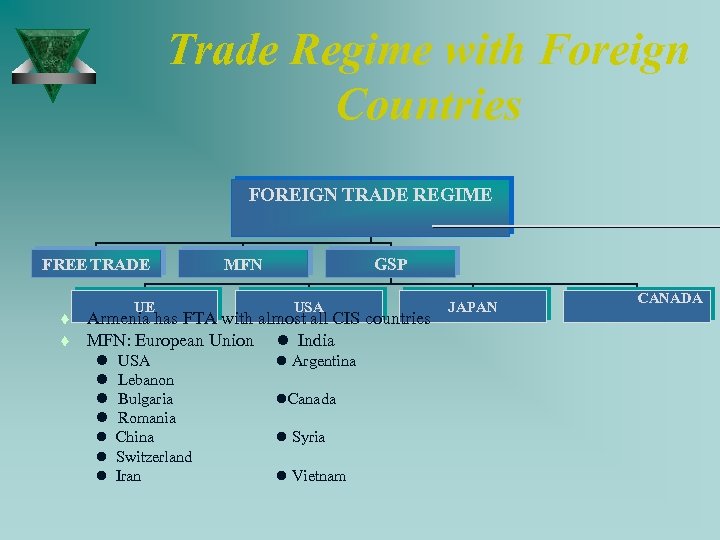

Trade Regime with Foreign Countries FOREIGN TRADE REGIME FREE TRADE t t UE MFN GSP USA Armenia has FTA with almost all CIS countries MFN: European Union India USA Lebanon Bulgaria Romania China Switzerland Iran Argentina Canada Syria Vietnam JAPAN CANADA

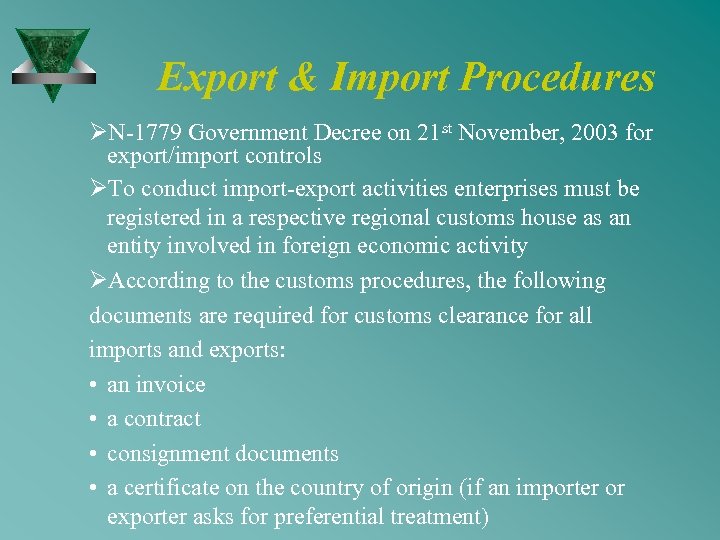

Export & Import Procedures ØN-1779 Government Decree on 21 st November, 2003 for export/import controls ØTo conduct import-export activities enterprises must be registered in a respective regional customs house as an entity involved in foreign economic activity ØAccording to the customs procedures, the following documents are required for customs clearance for all imports and exports: • an invoice • a contract • consignment documents • a certificate on the country of origin (if an importer or exporter asks for preferential treatment)

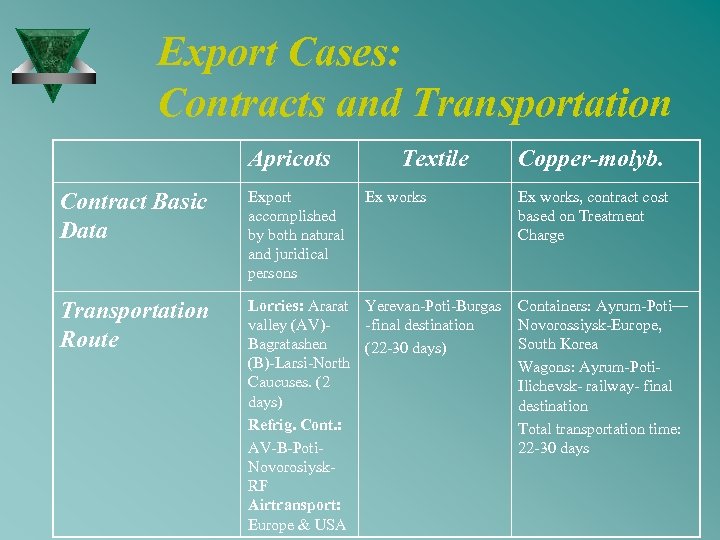

Export Cases: Contracts and Transportation Apricots Textile Contract Basic Data Export accomplished by both natural and juridical persons Ex works Transportation Route Lorries: Ararat Yerevan-Poti-Burgas valley (AV)-final destination Bagratashen (22 -30 days) (B)-Larsi-North Caucuses. (2 days) Refrig. Cont. : AV-B-Poti. Novorosiysk. RF Airtransport: Europe & USA Copper-molyb. Ex works, contract cost based on Treatment Charge Containers: Ayrum-Poti— Novorossiysk-Europe, South Korea Wagons: Ayrum-Poti. Ilichevsk- railway- final destination Total transportation time: 22 -30 days

Export Cases: Customs & Taxes Apricots Textiles Copper-molibd. Customs Procedures No pre-declaration for natural persons, inspection lasts several minutes. Temporary admission of materials –reexport of final product (change of customs code) Predeclaration-1 day Shipment/Inspection-5 -6 days Declaration-1 day Certificates Certificate for origin is required for judicial persons. Phitosanitary Certificate Approval from the Ministry of T& ED Certificate of Origin Certificate of conformity Taxes Export is duty free and VAT exempted

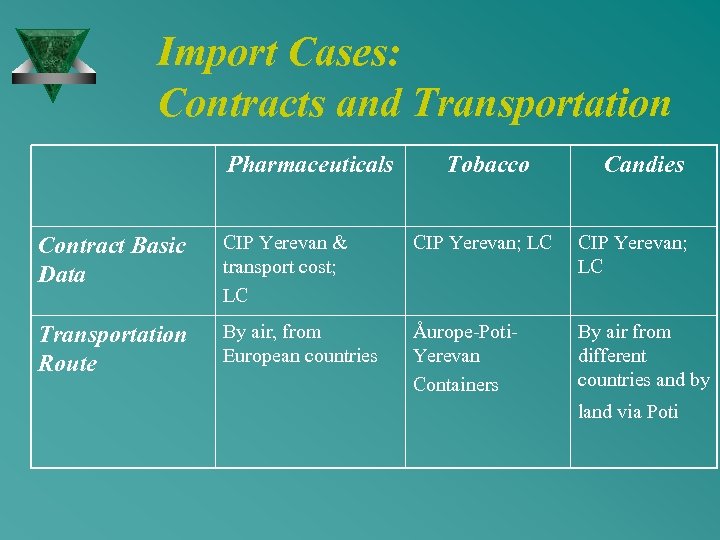

Import Cases: Contracts and Transportation Pharmaceuticals Tobacco Candies Contract Basic Data CIP Yerevan & transport cost; LC CIP Yerevan; LC Transportation Route By air, from European countries Åurope-Poti. Yerevan Containers By air from different countries and by land via Poti

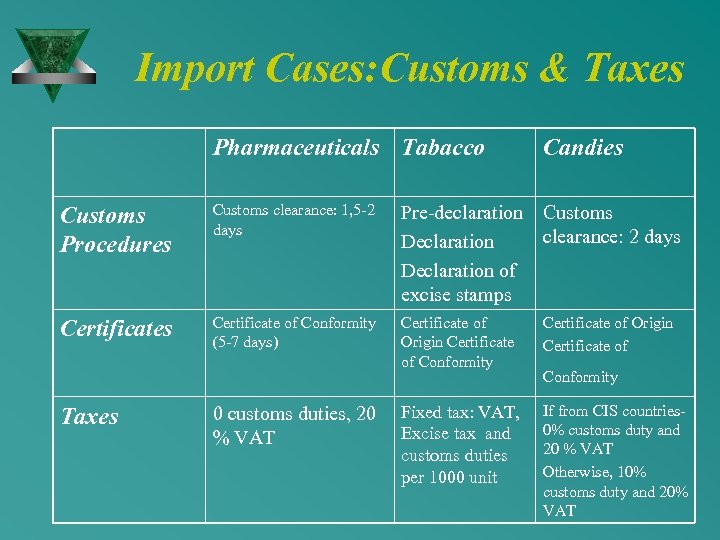

Import Cases: Customs & Taxes Pharmaceuticals Tabacco Candies Customs Procedures Customs clearance: 1, 5 -2 days Pre-declaration Customs clearance: 2 days Declaration of excise stamps Certificate of Conformity (5 -7 days) Certificate of Origin Certificate of Conformity Certificate of Origin Certificate of Fixed tax: VAT, Excise tax and customs duties per 1000 unit If from CIS countries 0% customs duty and 20 % VAT Otherwise, 10% customs duty and 20% VAT Taxes 0 customs duties, 20 % VAT Conformity

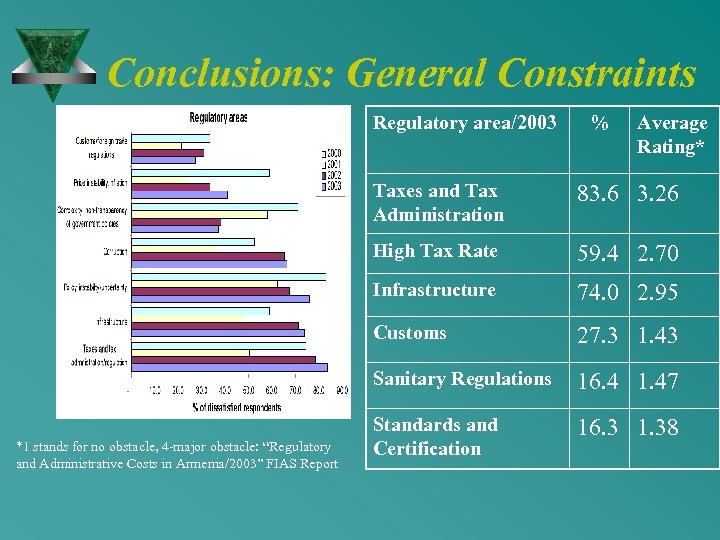

Conclusions: General Constraints Regulatory area/2003 % Average Rating* Taxes and Tax Administration High Tax Rate 59. 4 2. 70 Infrastructure 74. 0 2. 95 Customs 27. 3 1. 43 Sanitary Regulations *1 stands for no obstacle, 4 -major obstacle: “Regulatory and Administrative Costs in Armenia/2003” FIAS Report 83. 6 3. 26 16. 4 1. 47 Standards and Certification 16. 3 1. 38

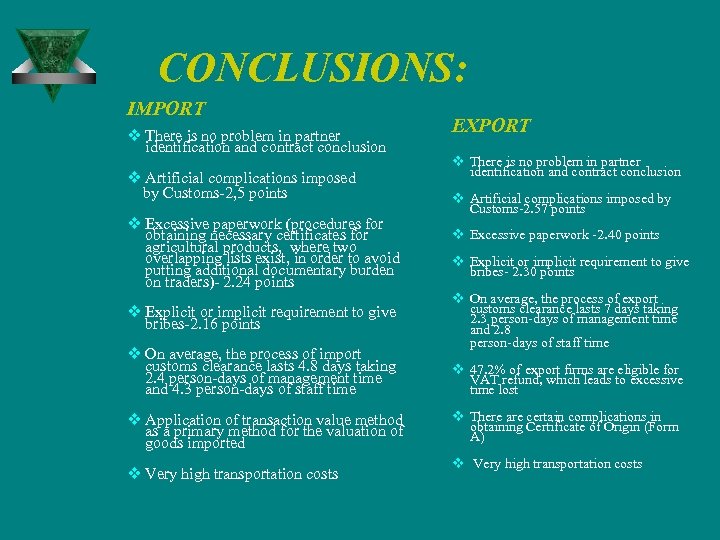

CONCLUSIONS: IMPORT v There is no problem in partner identification and contract conclusion v Artificial complications imposed by Customs-2, 5 points v Excessive paperwork (procedures for obtaining necessary certificates for agricultural products, where two overlapping lists exist, in order to avoid putting additional documentary burden on traders)- 2. 24 points v Explicit or implicit requirement to give bribes-2. 16 points v On average, the process of import customs clearance lasts 4. 8 days taking 2. 4 person-days of management time and 4. 3 person-days of staff time v Application of transaction value method as a primary method for the valuation of goods imported v Very high transportation costs EXPORT v There is no problem in partner identification and contract conclusion v Artificial complications imposed by Customs-2. 57 points v Excessive paperwork -2. 40 points v Explicit or implicit requirement to give bribes- 2. 30 points v On average, the process of export customs clearance lasts 7 days taking 2. 3 person-days of management time and 2. 8 person-days of staff time v 47. 2% of export firms are eligible for VAT refund, which leads to excessive time lost v There are certain complications in obtaining Certificate of Origin (Form A) v Very high transportation costs

Thank You Tbilisi, Georgia, May, 2004

f98a7c79f57e8ac13940e5e148fa33c9.ppt