a63745a46b2bf379565640f854565008.ppt

- Количество слайдов: 29

ARE WE THERE YET? THE “NEW NORMAL” ECONOMY AND WHAT IT MEANS FOR INVESTORS Brett Hammond, Ph. D. Managing Director and Chief Investment Strategist, TIAA-CREF January 26, 2011

ARE WE THERE YET? THE “NEW NORMAL” ECONOMY AND WHAT IT MEANS FOR INVESTORS Brett Hammond, Ph. D. Managing Director and Chief Investment Strategist, TIAA-CREF January 26, 2011

2

2

2010 HOW NORMAL? 3

2010 HOW NORMAL? 3

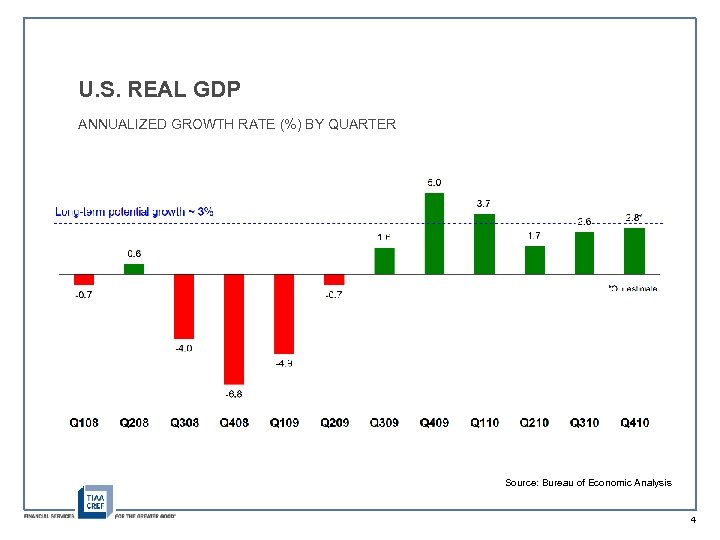

U. S. REAL GDP ANNUALIZED GROWTH RATE (%) BY QUARTER Source: Bureau of Economic Analysis 4

U. S. REAL GDP ANNUALIZED GROWTH RATE (%) BY QUARTER Source: Bureau of Economic Analysis 4

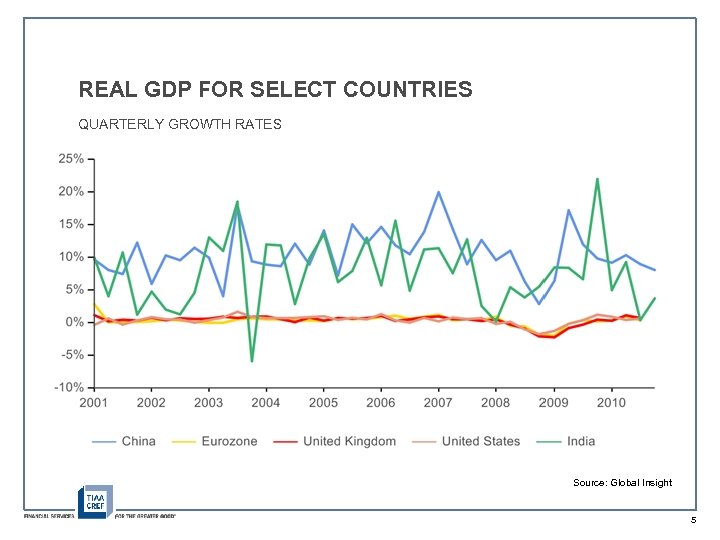

REAL GDP FOR SELECT COUNTRIES QUARTERLY GROWTH RATES Source: Global Insight 5

REAL GDP FOR SELECT COUNTRIES QUARTERLY GROWTH RATES Source: Global Insight 5

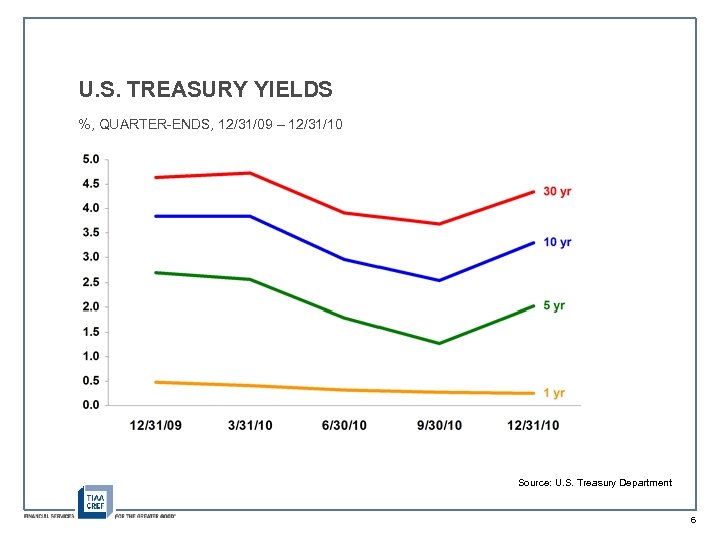

U. S. TREASURY YIELDS %, QUARTER-ENDS, 12/31/09 – 12/31/10 Source: U. S. Treasury Department 6

U. S. TREASURY YIELDS %, QUARTER-ENDS, 12/31/09 – 12/31/10 Source: U. S. Treasury Department 6

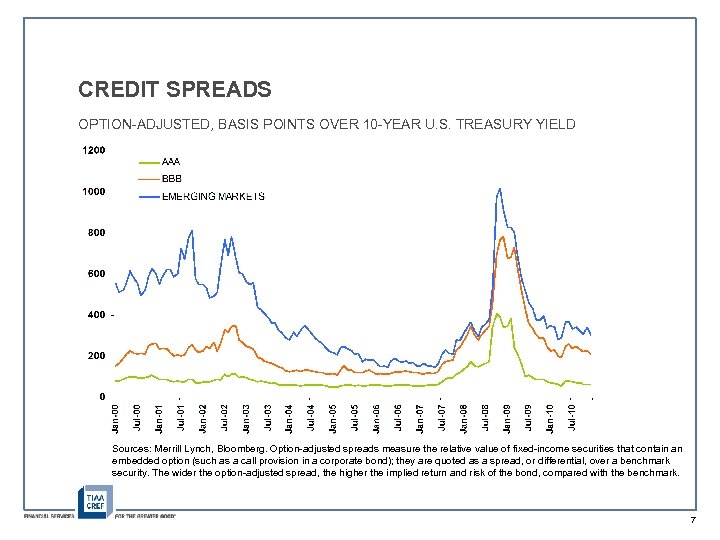

CREDIT SPREADS OPTION-ADJUSTED, BASIS POINTS OVER 10 -YEAR U. S. TREASURY YIELD Sources: Merrill Lynch, Bloomberg. Option-adjusted spreads measure the relative value of fixed-income securities that contain an embedded option (such as a call provision in a corporate bond); they are quoted as a spread, or differential, over a benchmark security. The wider the option-adjusted spread, the higher the implied return and risk of the bond, compared with the benchmark. 7

CREDIT SPREADS OPTION-ADJUSTED, BASIS POINTS OVER 10 -YEAR U. S. TREASURY YIELD Sources: Merrill Lynch, Bloomberg. Option-adjusted spreads measure the relative value of fixed-income securities that contain an embedded option (such as a call provision in a corporate bond); they are quoted as a spread, or differential, over a benchmark security. The wider the option-adjusted spread, the higher the implied return and risk of the bond, compared with the benchmark. 7

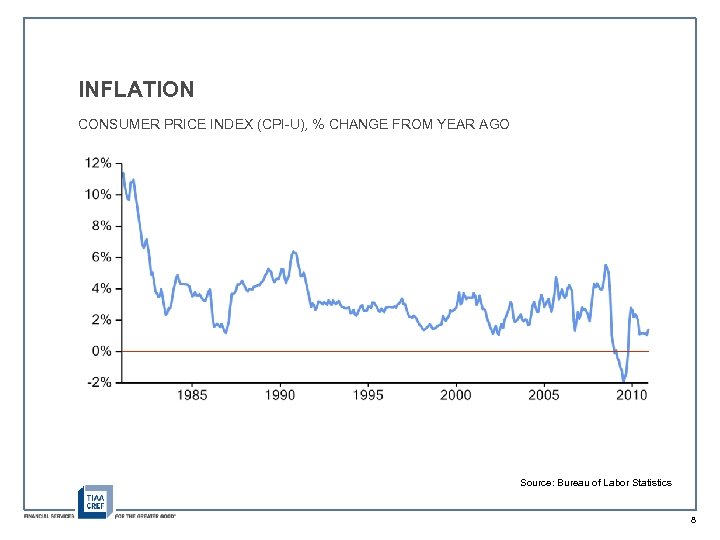

INFLATION CONSUMER PRICE INDEX (CPI-U), % CHANGE FROM YEAR AGO Source: Bureau of Labor Statistics 8

INFLATION CONSUMER PRICE INDEX (CPI-U), % CHANGE FROM YEAR AGO Source: Bureau of Labor Statistics 8

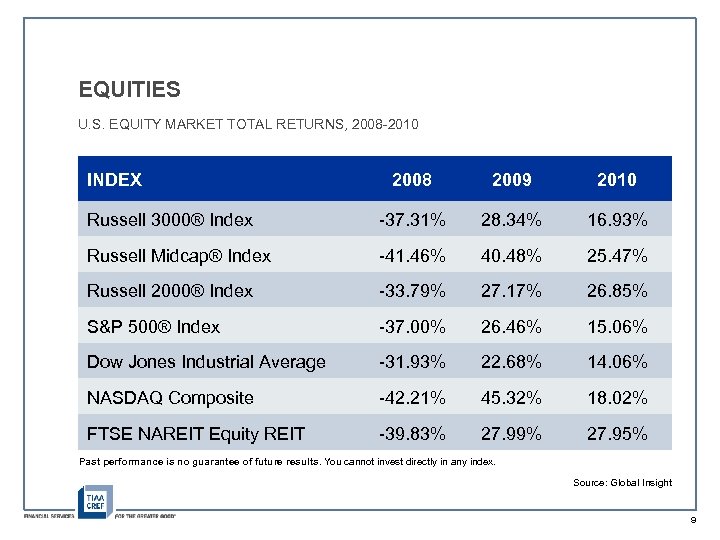

EQUITIES U. S. EQUITY MARKET TOTAL RETURNS, 2008 -2010 INDEX 2008 2009 2010 Russell 3000® Index -37. 31% 28. 34% 16. 93% Russell Midcap® Index -41. 46% 40. 48% 25. 47% Russell 2000® Index -33. 79% 27. 17% 26. 85% S&P 500® Index -37. 00% 26. 46% 15. 06% Dow Jones Industrial Average -31. 93% 22. 68% 14. 06% NASDAQ Composite -42. 21% 45. 32% 18. 02% FTSE NAREIT Equity REIT -39. 83% 27. 99% 27. 95% Past performance is no guarantee of future results. You cannot invest directly in any index. Source: Global Insight 9

EQUITIES U. S. EQUITY MARKET TOTAL RETURNS, 2008 -2010 INDEX 2008 2009 2010 Russell 3000® Index -37. 31% 28. 34% 16. 93% Russell Midcap® Index -41. 46% 40. 48% 25. 47% Russell 2000® Index -33. 79% 27. 17% 26. 85% S&P 500® Index -37. 00% 26. 46% 15. 06% Dow Jones Industrial Average -31. 93% 22. 68% 14. 06% NASDAQ Composite -42. 21% 45. 32% 18. 02% FTSE NAREIT Equity REIT -39. 83% 27. 99% 27. 95% Past performance is no guarantee of future results. You cannot invest directly in any index. Source: Global Insight 9

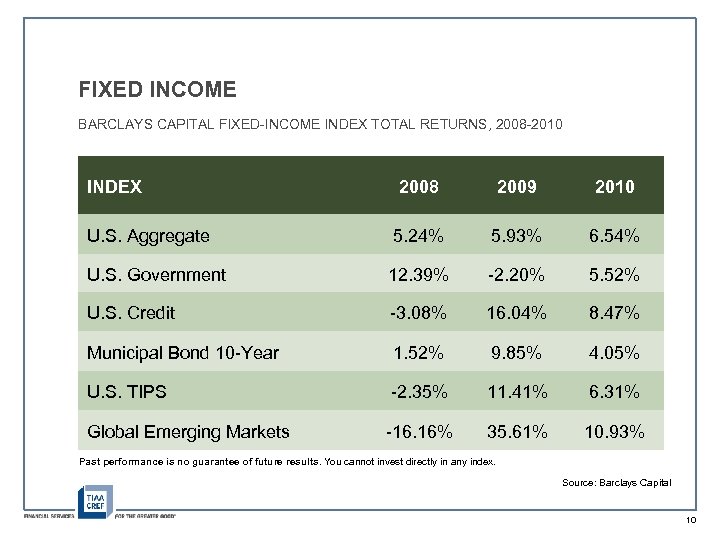

FIXED INCOME BARCLAYS CAPITAL FIXED-INCOME INDEX TOTAL RETURNS, 2008 -2010 INDEX 2008 2009 2010 U. S. Aggregate 5. 24% 5. 93% 6. 54% U. S. Government 12. 39% -2. 20% 5. 52% U. S. Credit -3. 08% 16. 04% 8. 47% Municipal Bond 10 -Year 1. 52% 9. 85% 4. 05% U. S. TIPS -2. 35% 11. 41% 6. 31% Global Emerging Markets -16. 16% 35. 61% 10. 93% Past performance is no guarantee of future results. You cannot invest directly in any index. Source: Barclays Capital 10

FIXED INCOME BARCLAYS CAPITAL FIXED-INCOME INDEX TOTAL RETURNS, 2008 -2010 INDEX 2008 2009 2010 U. S. Aggregate 5. 24% 5. 93% 6. 54% U. S. Government 12. 39% -2. 20% 5. 52% U. S. Credit -3. 08% 16. 04% 8. 47% Municipal Bond 10 -Year 1. 52% 9. 85% 4. 05% U. S. TIPS -2. 35% 11. 41% 6. 31% Global Emerging Markets -16. 16% 35. 61% 10. 93% Past performance is no guarantee of future results. You cannot invest directly in any index. Source: Barclays Capital 10

11

11

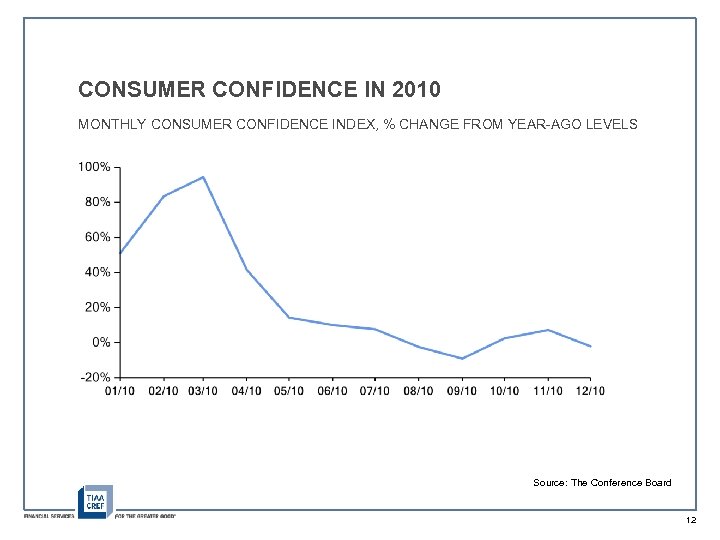

CONSUMER CONFIDENCE IN 2010 MONTHLY CONSUMER CONFIDENCE INDEX, % CHANGE FROM YEAR-AGO LEVELS Source: The Conference Board 12

CONSUMER CONFIDENCE IN 2010 MONTHLY CONSUMER CONFIDENCE INDEX, % CHANGE FROM YEAR-AGO LEVELS Source: The Conference Board 12

WHAT’S NOT NORMAL? 13

WHAT’S NOT NORMAL? 13

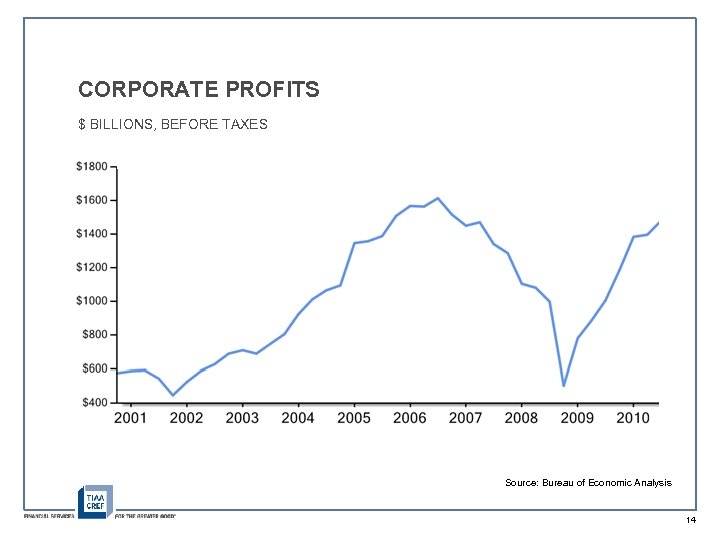

CORPORATE PROFITS $ BILLIONS, BEFORE TAXES Source: Bureau of Economic Analysis 14

CORPORATE PROFITS $ BILLIONS, BEFORE TAXES Source: Bureau of Economic Analysis 14

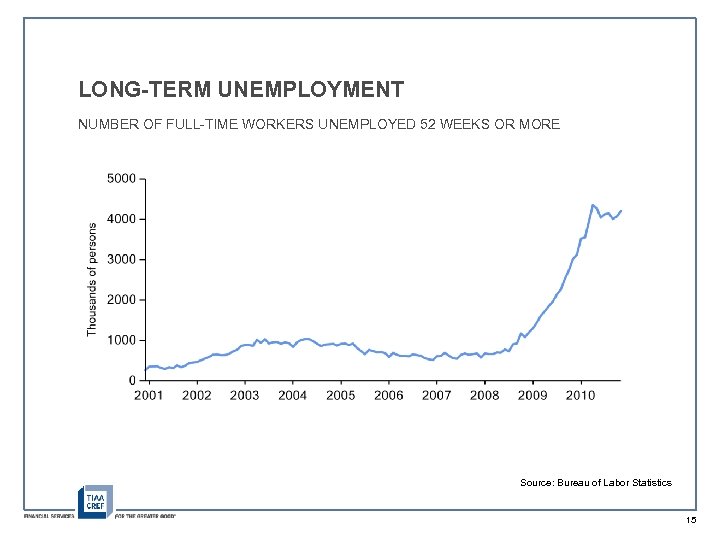

LONG-TERM UNEMPLOYMENT NUMBER OF FULL-TIME WORKERS UNEMPLOYED 52 WEEKS OR MORE Source: Bureau of Labor Statistics 15

LONG-TERM UNEMPLOYMENT NUMBER OF FULL-TIME WORKERS UNEMPLOYED 52 WEEKS OR MORE Source: Bureau of Labor Statistics 15

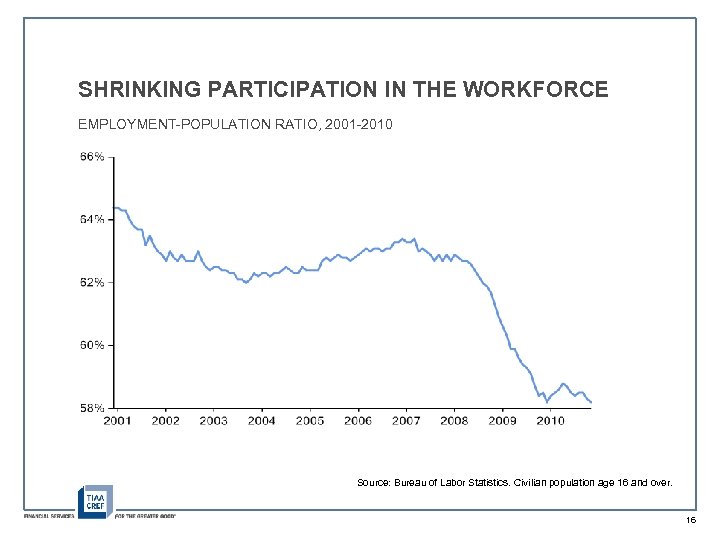

SHRINKING PARTICIPATION IN THE WORKFORCE EMPLOYMENT-POPULATION RATIO, 2001 -2010 Source: Bureau of Labor Statistics. Civilian population age 16 and over. 16

SHRINKING PARTICIPATION IN THE WORKFORCE EMPLOYMENT-POPULATION RATIO, 2001 -2010 Source: Bureau of Labor Statistics. Civilian population age 16 and over. 16

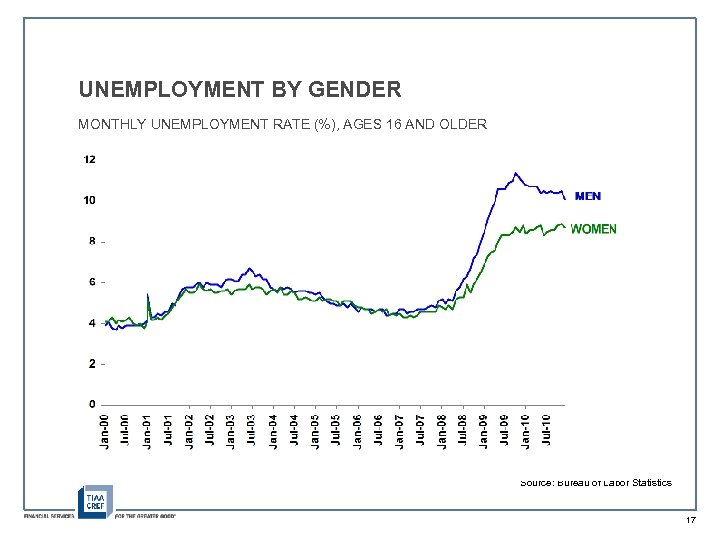

UNEMPLOYMENT BY GENDER MONTHLY UNEMPLOYMENT RATE (%), AGES 16 AND OLDER Source: Bureau of Labor Statistics 17

UNEMPLOYMENT BY GENDER MONTHLY UNEMPLOYMENT RATE (%), AGES 16 AND OLDER Source: Bureau of Labor Statistics 17

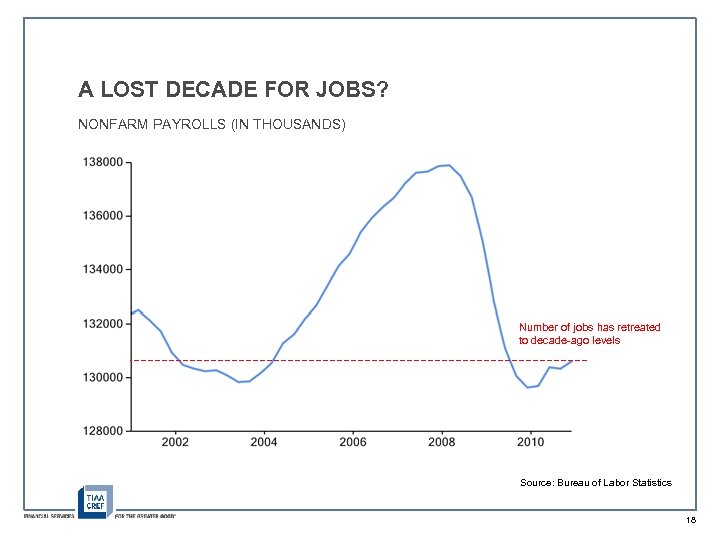

A LOST DECADE FOR JOBS? NONFARM PAYROLLS (IN THOUSANDS) Number of jobs has retreated to decade-ago levels Source: Bureau of Labor Statistics 18

A LOST DECADE FOR JOBS? NONFARM PAYROLLS (IN THOUSANDS) Number of jobs has retreated to decade-ago levels Source: Bureau of Labor Statistics 18

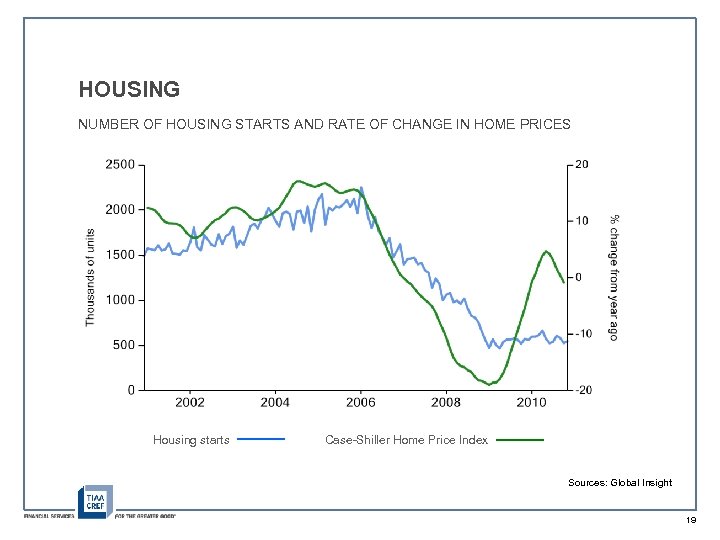

HOUSING NUMBER OF HOUSING STARTS AND RATE OF CHANGE IN HOME PRICES Housing starts Case-Shiller Home Price Index Sources: Global Insight 19

HOUSING NUMBER OF HOUSING STARTS AND RATE OF CHANGE IN HOME PRICES Housing starts Case-Shiller Home Price Index Sources: Global Insight 19

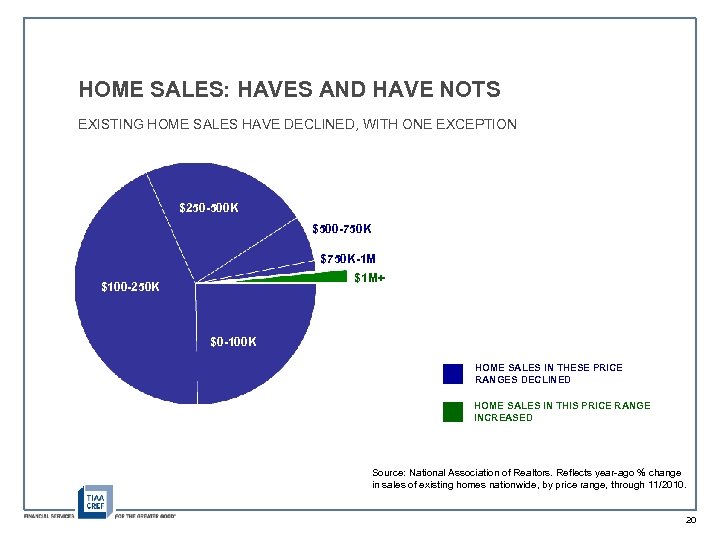

HOME SALES: HAVES AND HAVE NOTS EXISTING HOME SALES HAVE DECLINED, WITH ONE EXCEPTION $250 -500 K $500 -750 K $750 K-1 M $1 M+ $100 -250 K $0 -100 K HOME SALES IN THESE PRICE RANGES DECLINED HOME SALES IN THIS PRICE RANGE INCREASED Source: National Association of Realtors. Reflects year-ago % change in sales of existing homes nationwide, by price range, through 11/2010. 20

HOME SALES: HAVES AND HAVE NOTS EXISTING HOME SALES HAVE DECLINED, WITH ONE EXCEPTION $250 -500 K $500 -750 K $750 K-1 M $1 M+ $100 -250 K $0 -100 K HOME SALES IN THESE PRICE RANGES DECLINED HOME SALES IN THIS PRICE RANGE INCREASED Source: National Association of Realtors. Reflects year-ago % change in sales of existing homes nationwide, by price range, through 11/2010. 20

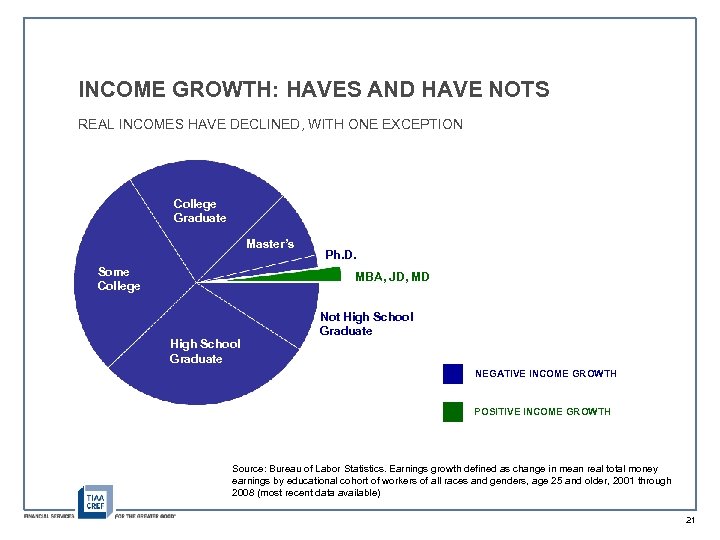

INCOME GROWTH: HAVES AND HAVE NOTS REAL INCOMES HAVE DECLINED, WITH ONE EXCEPTION College Graduate Master’s Some College Ph. D. MBA, JD, MD High School Graduate Not High School Graduate NEGATIVE INCOME GROWTH POSITIVE INCOME GROWTH Source: Bureau of Labor Statistics. Earnings growth defined as change in mean real total money earnings by educational cohort of workers of all races and genders, age 25 and older, 2001 through 2008 (most recent data available) 21

INCOME GROWTH: HAVES AND HAVE NOTS REAL INCOMES HAVE DECLINED, WITH ONE EXCEPTION College Graduate Master’s Some College Ph. D. MBA, JD, MD High School Graduate Not High School Graduate NEGATIVE INCOME GROWTH POSITIVE INCOME GROWTH Source: Bureau of Labor Statistics. Earnings growth defined as change in mean real total money earnings by educational cohort of workers of all races and genders, age 25 and older, 2001 through 2008 (most recent data available) 21

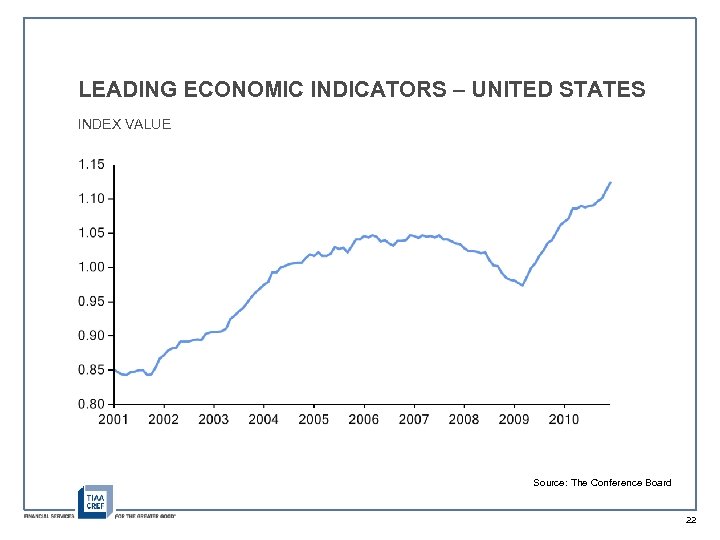

LEADING ECONOMIC INDICATORS – UNITED STATES INDEX VALUE Source: The Conference Board 22

LEADING ECONOMIC INDICATORS – UNITED STATES INDEX VALUE Source: The Conference Board 22

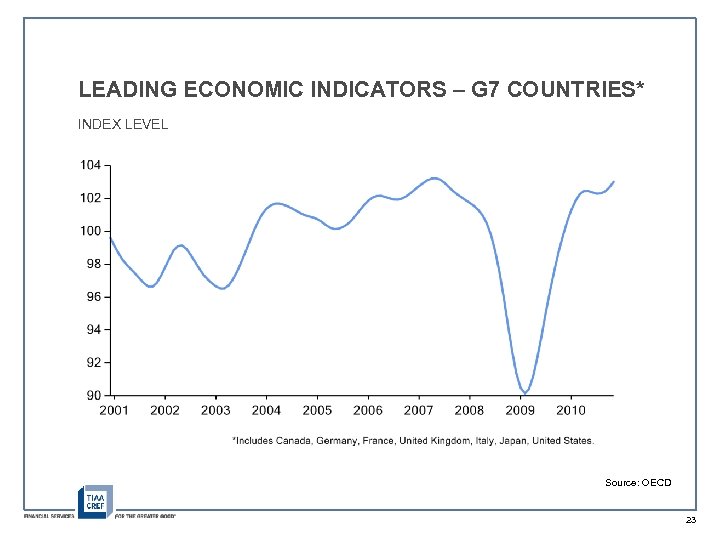

LEADING ECONOMIC INDICATORS – G 7 COUNTRIES* INDEX LEVEL Source: OECD 23

LEADING ECONOMIC INDICATORS – G 7 COUNTRIES* INDEX LEVEL Source: OECD 23

Source: Bureau of Labor Statistics 24

Source: Bureau of Labor Statistics 24

25

25

26

26

ASSET CLASS OUTLOOK • Equities • Fixed Income • Real Estate • Commodities 27

ASSET CLASS OUTLOOK • Equities • Fixed Income • Real Estate • Commodities 27

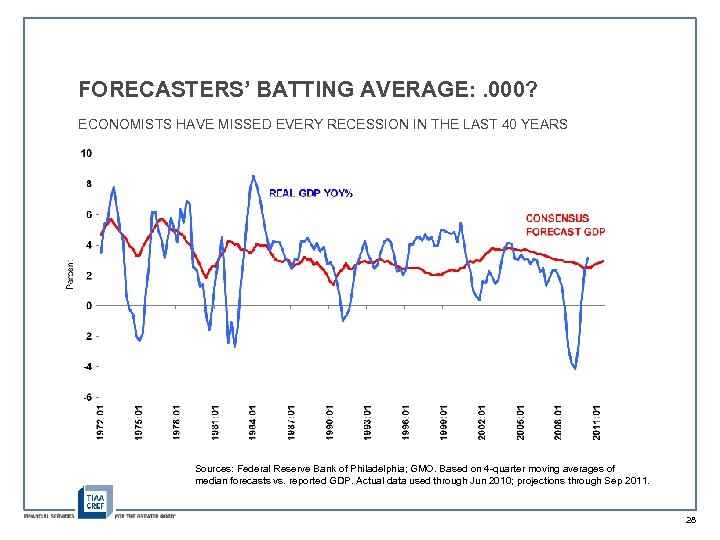

FORECASTERS’ BATTING AVERAGE: . 000? ECONOMISTS HAVE MISSED EVERY RECESSION IN THE LAST 40 YEARS Sources: Federal Reserve Bank of Philadelphia; GMO. Based on 4 -quarter moving averages of median forecasts vs. reported GDP. Actual data used through Jun 2010; projections through Sep 2011. 28

FORECASTERS’ BATTING AVERAGE: . 000? ECONOMISTS HAVE MISSED EVERY RECESSION IN THE LAST 40 YEARS Sources: Federal Reserve Bank of Philadelphia; GMO. Based on 4 -quarter moving averages of median forecasts vs. reported GDP. Actual data used through Jun 2010; projections through Sep 2011. 28

This material has been prepared by and represents the views of Brett Hammond, and does not reflect the views of any TIAA-CREF affiliate. These views may change in response to changing economic and market conditions. The material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service. TIAA-CREF personnel in its investment management area provide investment advice and portfolio management services through the following entities: Teachers Advisors, Inc. , TIAA-CREF Investment Management, LLC, and Teachers Insurance and Annuity Association. TIAA, TIAA-CREF, Teachers Insurance and Annuity Association, TIAA-CREF Asset Management and FINANCIAL SERVICES FOR THE GREATER GOOD are registered trademarks of Teachers Insurance and Annuity Association. C 49967 © 2011 Teachers Insurance and Annuity Association - College Retirement Equities Fund (TIAA-CREF), New York, NY 10017 29

This material has been prepared by and represents the views of Brett Hammond, and does not reflect the views of any TIAA-CREF affiliate. These views may change in response to changing economic and market conditions. The material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service. TIAA-CREF personnel in its investment management area provide investment advice and portfolio management services through the following entities: Teachers Advisors, Inc. , TIAA-CREF Investment Management, LLC, and Teachers Insurance and Annuity Association. TIAA, TIAA-CREF, Teachers Insurance and Annuity Association, TIAA-CREF Asset Management and FINANCIAL SERVICES FOR THE GREATER GOOD are registered trademarks of Teachers Insurance and Annuity Association. C 49967 © 2011 Teachers Insurance and Annuity Association - College Retirement Equities Fund (TIAA-CREF), New York, NY 10017 29