1f652d4edd01a13563cb61e86a0e200b.ppt

- Количество слайдов: 30

Are Emerging Markets Catching Up with the Developed Markets in Terms of Consumption? WAHEEDUZZAMAN, A. N. M. (2011), “ARE EMERGING MARKETS CATCHING UP WITH THE DEVELOPED MARKETS IN TERMS OF CONSUMPTION? " JOURNAL OF GLOBAL MARKETING, 24 (2), 136 -151.

Are Emerging Markets Catching Up with the Developed Markets in Terms of Consumption? WAHEEDUZZAMAN, A. N. M. (2011), “ARE EMERGING MARKETS CATCHING UP WITH THE DEVELOPED MARKETS IN TERMS OF CONSUMPTION? " JOURNAL OF GLOBAL MARKETING, 24 (2), 136 -151.

Introduction Antoine van Agtmael, an officer of the International Finance Corporation, is credited to have coined the term “Emerging Markets” in 1981. He wrote a bestseller “The Emerging Markets Century” in 2007 published by The Free Press Consumption Revolution Emerging Markets-has grown very fast in the last 3 o years Consumption in Developed Nations-has slowed market saturation

Introduction Antoine van Agtmael, an officer of the International Finance Corporation, is credited to have coined the term “Emerging Markets” in 1981. He wrote a bestseller “The Emerging Markets Century” in 2007 published by The Free Press Consumption Revolution Emerging Markets-has grown very fast in the last 3 o years Consumption in Developed Nations-has slowed market saturation

Rise of Emerging Markets May have begun during the colonial period, most growth is recent, 1980 -plus Reasons for their growth globalization supported by stabilization 1970's Political Reforms in 1980's Opening Up/Liberalization of Markets 1980's End of Cold War/Fall of Berlin Wall 1989 Internet Technology/Computer Revolution 1990's Networking of the multinationals

Rise of Emerging Markets May have begun during the colonial period, most growth is recent, 1980 -plus Reasons for their growth globalization supported by stabilization 1970's Political Reforms in 1980's Opening Up/Liberalization of Markets 1980's End of Cold War/Fall of Berlin Wall 1989 Internet Technology/Computer Revolution 1990's Networking of the multinationals

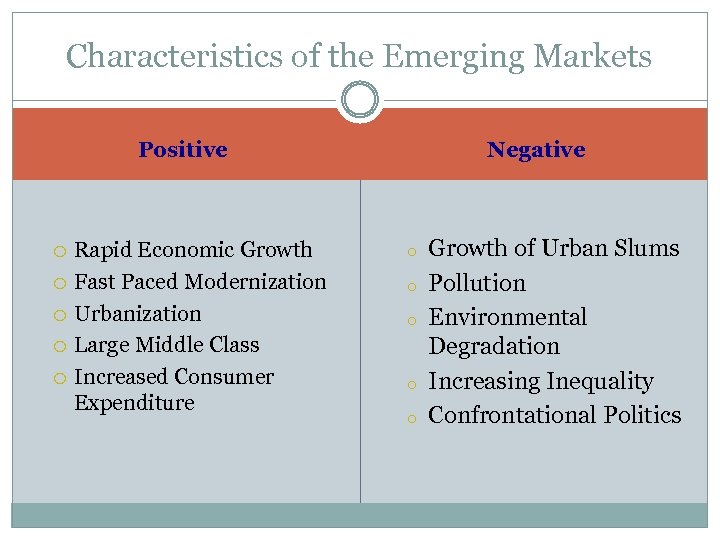

Characteristics of the Emerging Markets Negative Positive Rapid Economic Growth Fast Paced Modernization Urbanization Large Middle Class Increased Consumer Expenditure o o o Growth of Urban Slums Pollution Environmental Degradation Increasing Inequality Confrontational Politics

Characteristics of the Emerging Markets Negative Positive Rapid Economic Growth Fast Paced Modernization Urbanization Large Middle Class Increased Consumer Expenditure o o o Growth of Urban Slums Pollution Environmental Degradation Increasing Inequality Confrontational Politics

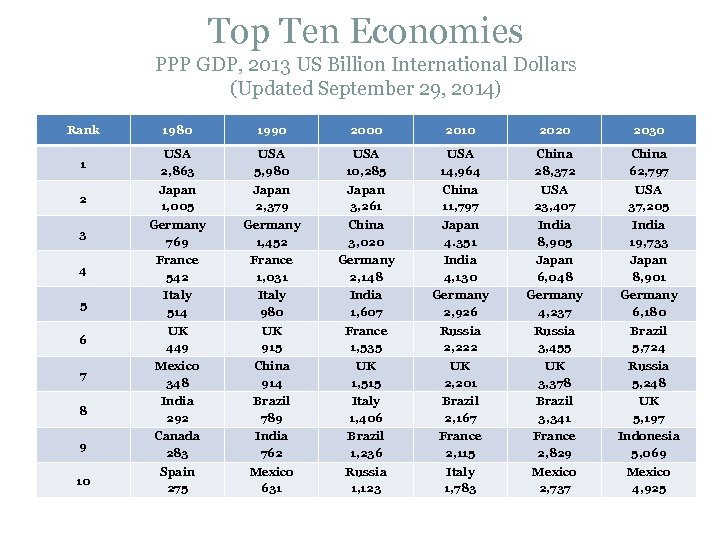

Top Ten Economies PPP GDP, 2013 US Billion International Dollars (Updated September 29, 2014) Rank 1980 1990 2000 2010 2020 2030 1 USA 2, 863 USA 5, 980 USA 10, 285 USA 14, 964 China 28, 372 China 62, 797 2 Japan 1, 005 Japan 2, 379 Japan 3, 261 China 11, 797 USA 23, 407 USA 37, 205 3 Germany 769 Germany 1, 452 China 3, 020 Japan 4. 351 India 8, 905 India 19, 733 4 France 542 France 1, 031 Germany 2, 148 India 4, 130 Japan 6, 048 Japan 8, 901 5 Italy 514 Italy 980 India 1, 607 Germany 2, 926 Germany 4, 237 Germany 6, 180 6 UK 449 UK 915 France 1, 535 Russia 2, 222 Russia 3, 455 Brazil 5, 724 7 Mexico 348 China 914 UK 1, 515 UK 2, 201 UK 3, 378 Russia 5, 248 8 India 292 Brazil 789 Italy 1, 406 Brazil 2, 167 Brazil 3, 341 UK 5, 197 9 Canada 283 India 762 Brazil 1, 236 France 2, 115 France 2, 829 Indonesia 5, 069 10 Spain 275 Mexico 631 Russia 1, 123 Italy 1, 783 Mexico 2, 737 Mexico 4, 925

Top Ten Economies PPP GDP, 2013 US Billion International Dollars (Updated September 29, 2014) Rank 1980 1990 2000 2010 2020 2030 1 USA 2, 863 USA 5, 980 USA 10, 285 USA 14, 964 China 28, 372 China 62, 797 2 Japan 1, 005 Japan 2, 379 Japan 3, 261 China 11, 797 USA 23, 407 USA 37, 205 3 Germany 769 Germany 1, 452 China 3, 020 Japan 4. 351 India 8, 905 India 19, 733 4 France 542 France 1, 031 Germany 2, 148 India 4, 130 Japan 6, 048 Japan 8, 901 5 Italy 514 Italy 980 India 1, 607 Germany 2, 926 Germany 4, 237 Germany 6, 180 6 UK 449 UK 915 France 1, 535 Russia 2, 222 Russia 3, 455 Brazil 5, 724 7 Mexico 348 China 914 UK 1, 515 UK 2, 201 UK 3, 378 Russia 5, 248 8 India 292 Brazil 789 Italy 1, 406 Brazil 2, 167 Brazil 3, 341 UK 5, 197 9 Canada 283 India 762 Brazil 1, 236 France 2, 115 France 2, 829 Indonesia 5, 069 10 Spain 275 Mexico 631 Russia 1, 123 Italy 1, 783 Mexico 2, 737 Mexico 4, 925

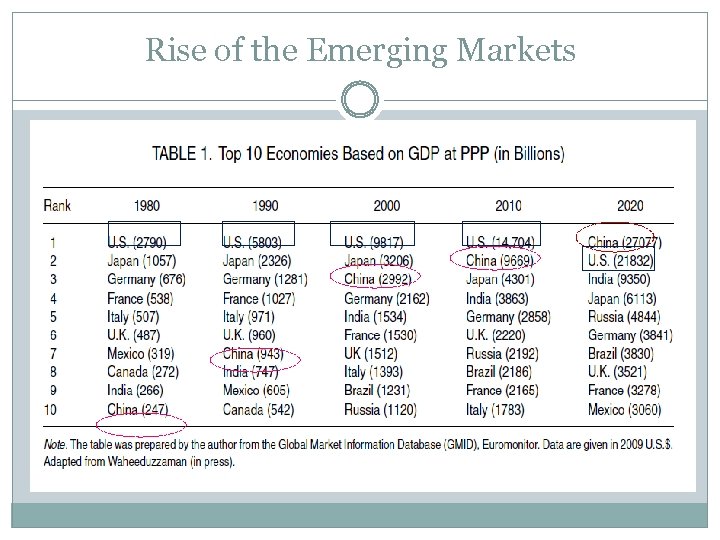

Rise of the Emerging Markets

Rise of the Emerging Markets

List of Emerging Markets Source Naming and List of Countries The Economist Emerging Market Indicators: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, South Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, and Turkey. [27 countries] Morgan Stanley MSCI Emerging Market Index: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, South Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey, and Venezuela. [26 countries] U. S. Department of Commerce Big Emerging Markets: Brazil, China, Egypt, India, Indonesia, Mexico, Poland, Philippines, Russia, South Africa, South Korea, and Turkey. [12 countries] Goldman Sachs/ Euromonitor The Next Eleven: Bangladesh, Egypt, Indonesia, Iran, South Korea, Mexico, Nigeria, Pakistan, Philippines, Turkey, and Vietnam. [11 countries] MSU-CIBER Market Potential Index: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hong Kong, Hungary, India, Indonesia, Israel, South Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, and Turkey. [27 countries]

List of Emerging Markets Source Naming and List of Countries The Economist Emerging Market Indicators: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, South Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, and Turkey. [27 countries] Morgan Stanley MSCI Emerging Market Index: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, South Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey, and Venezuela. [26 countries] U. S. Department of Commerce Big Emerging Markets: Brazil, China, Egypt, India, Indonesia, Mexico, Poland, Philippines, Russia, South Africa, South Korea, and Turkey. [12 countries] Goldman Sachs/ Euromonitor The Next Eleven: Bangladesh, Egypt, Indonesia, Iran, South Korea, Mexico, Nigeria, Pakistan, Philippines, Turkey, and Vietnam. [11 countries] MSU-CIBER Market Potential Index: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hong Kong, Hungary, India, Indonesia, Israel, South Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, and Turkey. [27 countries]

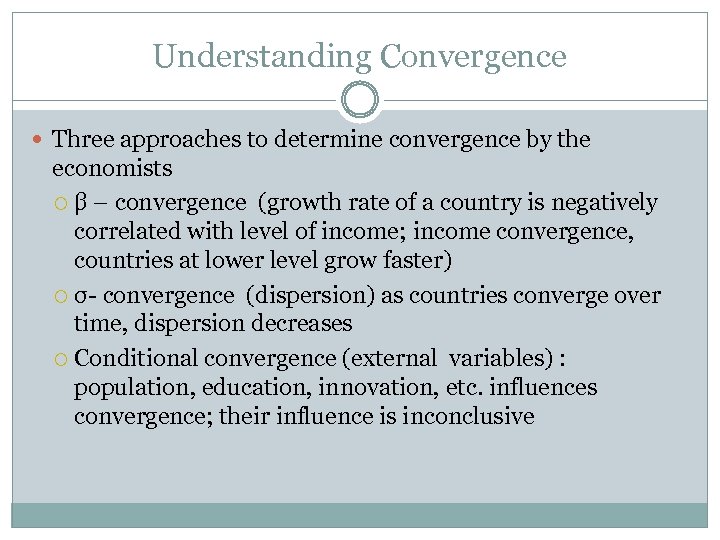

Understanding Convergence Three approaches to determine convergence by the economists β – convergence (growth rate of a country is negatively correlated with level of income; income convergence, countries at lower level grow faster) σ- convergence (dispersion) as countries converge over time, dispersion decreases Conditional convergence (external variables) : population, education, innovation, etc. influences convergence; their influence is inconclusive

Understanding Convergence Three approaches to determine convergence by the economists β – convergence (growth rate of a country is negatively correlated with level of income; income convergence, countries at lower level grow faster) σ- convergence (dispersion) as countries converge over time, dispersion decreases Conditional convergence (external variables) : population, education, innovation, etc. influences convergence; their influence is inconclusive

Convergence in International Marketing Meaning substantially different from the economists In international marketing closest theoretical association can be found in two lines of research inquiry Standard Adaptation (S-A) – Focuses on 4 P’s of marketing “More standardized” = “More Convergence” Diffusion Research Innovators (leader) Imitators (follower) This study follows the economists’ notion of convergence

Convergence in International Marketing Meaning substantially different from the economists In international marketing closest theoretical association can be found in two lines of research inquiry Standard Adaptation (S-A) – Focuses on 4 P’s of marketing “More standardized” = “More Convergence” Diffusion Research Innovators (leader) Imitators (follower) This study follows the economists’ notion of convergence

Study Focus and Objective Discuss the growth of emerging nations and their importance in the global economy Define consumption convergence and elaborate on models that explain the phenomenon Investigate consumption convergence in emerging and developed markets during a 30 -year period and determine the extent of convergence Determine the influence of socioeconomic variables on consumption convergence in emerging nations Suggest the implications of the study in international marketing and offer directions for future research

Study Focus and Objective Discuss the growth of emerging nations and their importance in the global economy Define consumption convergence and elaborate on models that explain the phenomenon Investigate consumption convergence in emerging and developed markets during a 30 -year period and determine the extent of convergence Determine the influence of socioeconomic variables on consumption convergence in emerging nations Suggest the implications of the study in international marketing and offer directions for future research

Methodology-1 G 7 (Developed) countries: Canada, France, Germany, Italy, Japan, United Kingdom, and United States. Big Emerging Markets (12 countries): Brazil, China, Egypt, India, Indonesia, Mexico, Poland, Philippines, Russia, South Africa, South Korea, and Turkey. BRIC nations: Brazil, Russia, India, and China. Time period: 1980 -2009 Data source: Most data came from the Global market Information Database, Euromonitor; The World bank, Heritage Foundation, Freedom House, and the United Nations

Methodology-1 G 7 (Developed) countries: Canada, France, Germany, Italy, Japan, United Kingdom, and United States. Big Emerging Markets (12 countries): Brazil, China, Egypt, India, Indonesia, Mexico, Poland, Philippines, Russia, South Africa, South Korea, and Turkey. BRIC nations: Brazil, Russia, India, and China. Time period: 1980 -2009 Data source: Most data came from the Global market Information Database, Euromonitor; The World bank, Heritage Foundation, Freedom House, and the United Nations

Methodology-2 Convergence hypothesis based on 8 consumption variables First categories: Consumer expenditure - FOOD, HGS Second categories: Actual Consumption - CAL, PROT - DSW, MCW, REF, WSM. Exogenous influence variables: PCI, PCEC, LIFE, PCTRD Time period: 1980 -2009

Methodology-2 Convergence hypothesis based on 8 consumption variables First categories: Consumer expenditure - FOOD, HGS Second categories: Actual Consumption - CAL, PROT - DSW, MCW, REF, WSM. Exogenous influence variables: PCI, PCEC, LIFE, PCTRD Time period: 1980 -2009

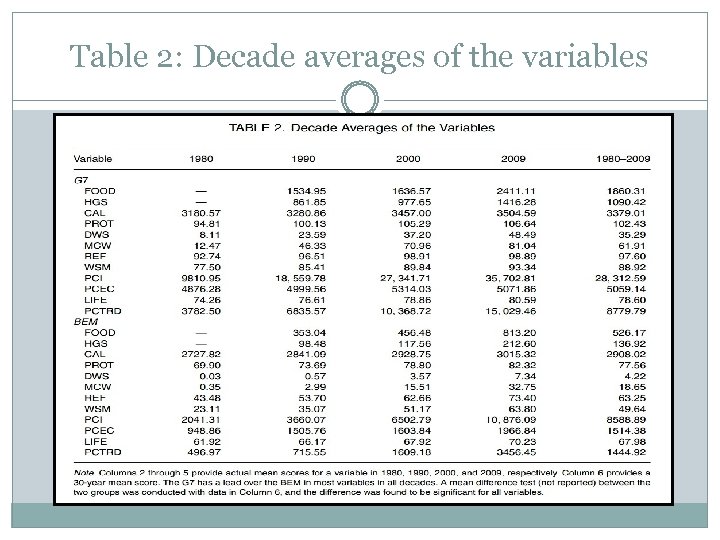

Table 2: Decade averages of the variables

Table 2: Decade averages of the variables

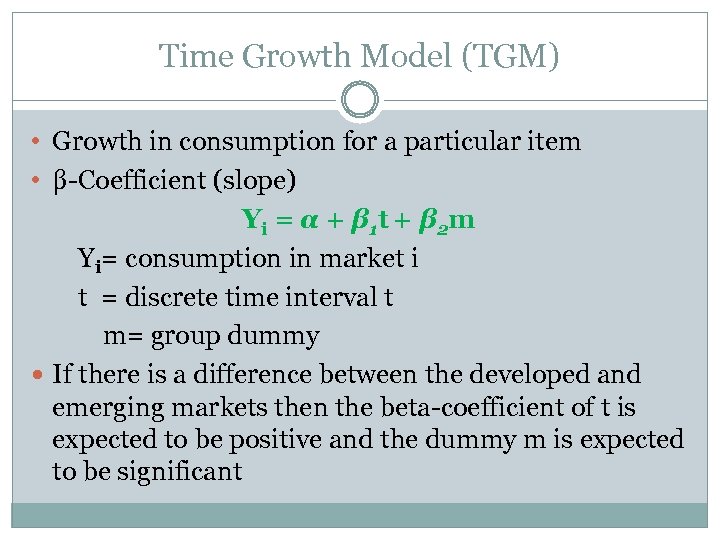

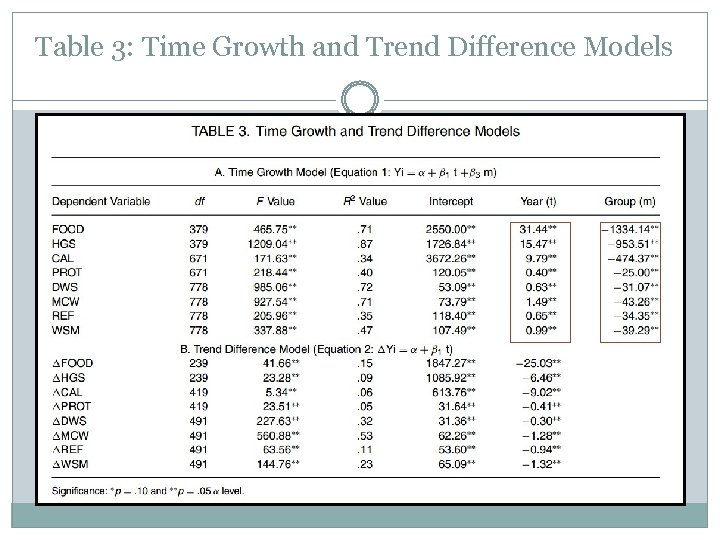

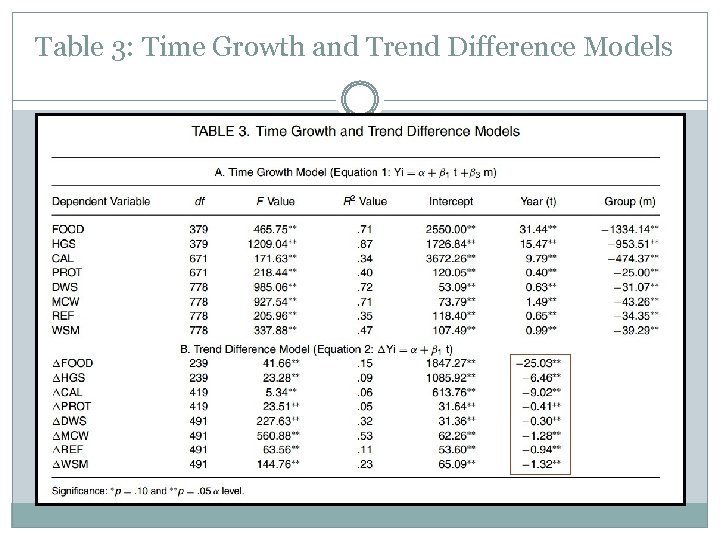

Time Growth Model (TGM) • Growth in consumption for a particular item • β-Coefficient (slope) Y i = α + β 1 t + β 2 m Yi= consumption in market i t = discrete time interval t m= group dummy If there is a difference between the developed and emerging markets then the beta-coefficient of t is expected to be positive and the dummy m is expected to be significant

Time Growth Model (TGM) • Growth in consumption for a particular item • β-Coefficient (slope) Y i = α + β 1 t + β 2 m Yi= consumption in market i t = discrete time interval t m= group dummy If there is a difference between the developed and emerging markets then the beta-coefficient of t is expected to be positive and the dummy m is expected to be significant

Table 3: Time Growth and Trend Difference Models

Table 3: Time Growth and Trend Difference Models

Findings-Time Growth Model All models are significant (see the F-values) and the R-Squares are also reasonably good Consumption has increased significantly over time, t shows a good rise Difference between G 7 and BEM consumption is significant (dummy m is significant) We got what we expected

Findings-Time Growth Model All models are significant (see the F-values) and the R-Squares are also reasonably good Consumption has increased significantly over time, t shows a good rise Difference between G 7 and BEM consumption is significant (dummy m is significant) We got what we expected

Trend Difference Model (TDM) Indicates convergence and divergence in consumption over time ∆ Yi = F(YD-Yi)= α + β 1 t YD: mean score of consumption in G 7 Yi: in merging market i t: discrete time interval t In case of convergence, the difference between developed and emerging nations will decrease, i. e. , the beta-coefficients of t is likely to be negative

Trend Difference Model (TDM) Indicates convergence and divergence in consumption over time ∆ Yi = F(YD-Yi)= α + β 1 t YD: mean score of consumption in G 7 Yi: in merging market i t: discrete time interval t In case of convergence, the difference between developed and emerging nations will decrease, i. e. , the beta-coefficients of t is likely to be negative

Table 3: Time Growth and Trend Difference Models

Table 3: Time Growth and Trend Difference Models

Findings-Trend Difference Model (TDM) All models are significant (see the F-values) and the R-Squares are also reasonable The consumption convergence between G 7 and BEM is real, but very slow. ∆FOOD: BEM – catch up by $25. 03 every year ∆HGS: $6. 5 per year Convergence on ∆CAL > ∆PROT

Findings-Trend Difference Model (TDM) All models are significant (see the F-values) and the R-Squares are also reasonable The consumption convergence between G 7 and BEM is real, but very slow. ∆FOOD: BEM – catch up by $25. 03 every year ∆HGS: $6. 5 per year Convergence on ∆CAL > ∆PROT

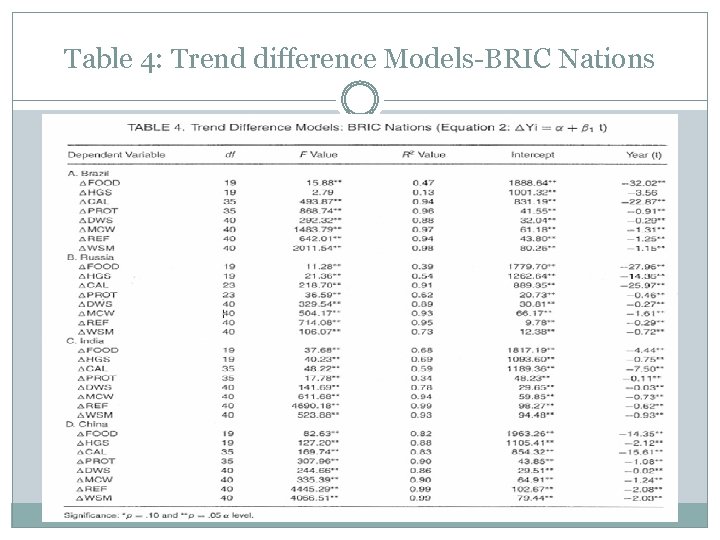

Table 4: Trend difference Models-BRIC Nations

Table 4: Trend difference Models-BRIC Nations

Findings-TDM-BRIC Nations All models are significant (see the F-values) and the R-Squares are very high The consumption convergence is taking place. However, the rate of convergence varies among nations Brazil and Russia have better convergence on FOOD and CAL consumption Durable consumption such as refrigerator and washing machine, China has the lead

Findings-TDM-BRIC Nations All models are significant (see the F-values) and the R-Squares are very high The consumption convergence is taking place. However, the rate of convergence varies among nations Brazil and Russia have better convergence on FOOD and CAL consumption Durable consumption such as refrigerator and washing machine, China has the lead

Socioeconomic Influence Model (SIM) ∆ Yi = F(YD – Yi) = α + β 1 X 1 + β 2 X 2 + β 3 X 3 + β 4 X 4 YD: mean score of consumption in G 7, Yi : consumption in emerging market i, X 1: PCI in market I, X 2: PCEC, X 3: LIFE, X 4: PCTRD Explain why the convergence is taking place

Socioeconomic Influence Model (SIM) ∆ Yi = F(YD – Yi) = α + β 1 X 1 + β 2 X 2 + β 3 X 3 + β 4 X 4 YD: mean score of consumption in G 7, Yi : consumption in emerging market i, X 1: PCI in market I, X 2: PCEC, X 3: LIFE, X 4: PCTRD Explain why the convergence is taking place

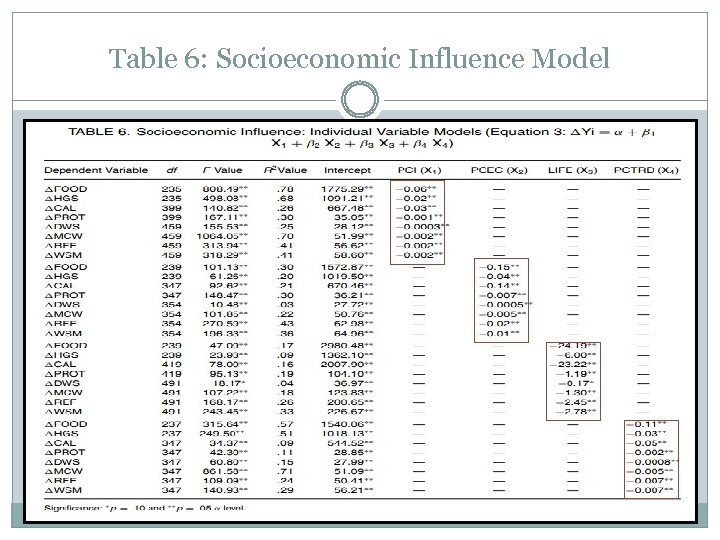

Table 6: Socioeconomic Influence Model

Table 6: Socioeconomic Influence Model

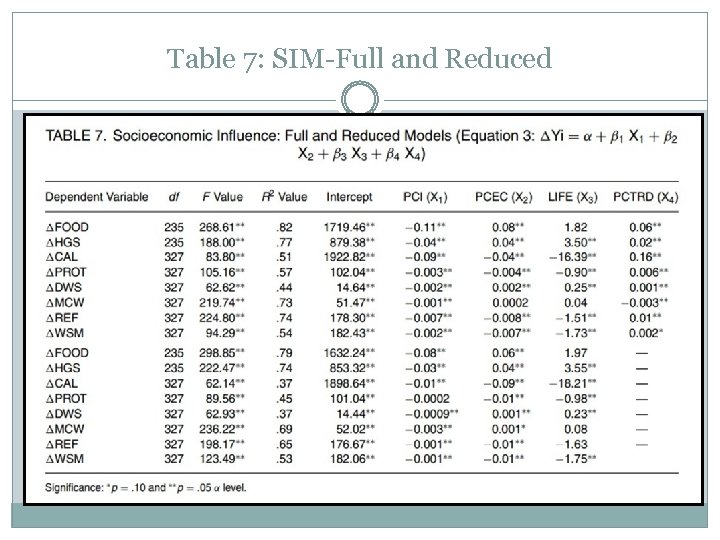

Table 7: SIM-Full and Reduced

Table 7: SIM-Full and Reduced

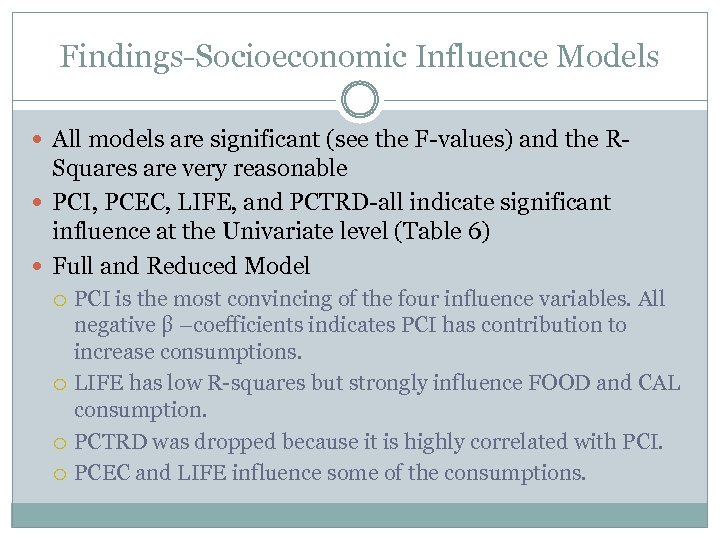

Findings-Socioeconomic Influence Models All models are significant (see the F-values) and the R- Squares are very reasonable PCI, PCEC, LIFE, and PCTRD-all indicate significant influence at the Univariate level (Table 6) Full and Reduced Model PCI is the most convincing of the four influence variables. All negative β –coefficients indicates PCI has contribution to increase consumptions. LIFE has low R-squares but strongly influence FOOD and CAL consumption. PCTRD was dropped because it is highly correlated with PCI. PCEC and LIFE influence some of the consumptions.

Findings-Socioeconomic Influence Models All models are significant (see the F-values) and the R- Squares are very reasonable PCI, PCEC, LIFE, and PCTRD-all indicate significant influence at the Univariate level (Table 6) Full and Reduced Model PCI is the most convincing of the four influence variables. All negative β –coefficients indicates PCI has contribution to increase consumptions. LIFE has low R-squares but strongly influence FOOD and CAL consumption. PCTRD was dropped because it is highly correlated with PCI. PCEC and LIFE influence some of the consumptions.

Summary of Findings This study investigates consumption convergence between developed and emerging nations using three types of models. Previous studies only examined economic development and marketing but NOT consumption convergence. Consumption convergence between G 7 and BEM is taking place , but at a very slow rate: $25 in FOOD, $6. 5 in HGS, 9 calories and 0. 5 gram protein, and only 1% for durable consumption category. Brazil and Russia are leading in consumer expenditure and basic consumption. China leads in durable consumption. PCI as the most influence in consumption. Life expectancy has more influence than energy consumption.

Summary of Findings This study investigates consumption convergence between developed and emerging nations using three types of models. Previous studies only examined economic development and marketing but NOT consumption convergence. Consumption convergence between G 7 and BEM is taking place , but at a very slow rate: $25 in FOOD, $6. 5 in HGS, 9 calories and 0. 5 gram protein, and only 1% for durable consumption category. Brazil and Russia are leading in consumer expenditure and basic consumption. China leads in durable consumption. PCI as the most influence in consumption. Life expectancy has more influence than energy consumption.

Implications Time Growth Models Forecasting, determine difference among countries Help understanding the lead-lag hypothesis Determine entry strategy-order of countries to enter Trend Difference Models Determine market saturation by setting TGMs to zero, managers can estimate the level of saturation Determine the penetration strategy based on market saturation Socioeconomic Influence Models Socioeconomic variables can be used for market segmentation and country profiling Causal variables forecasting-income, energy consumption, trade and life expectancy

Implications Time Growth Models Forecasting, determine difference among countries Help understanding the lead-lag hypothesis Determine entry strategy-order of countries to enter Trend Difference Models Determine market saturation by setting TGMs to zero, managers can estimate the level of saturation Determine the penetration strategy based on market saturation Socioeconomic Influence Models Socioeconomic variables can be used for market segmentation and country profiling Causal variables forecasting-income, energy consumption, trade and life expectancy

Conclusion – Interpret with Caution The models are inherenly economic in nature and results are data-driven. Consumption has both economic and social/cultural aspects. Social cultural experience cannot be always expressed by numbers. It is affected by our culture, attitude, group membership, economic freedom and the dynamics of the society in which we live Also, consider the impact of globalization, social media, Internet, tourism and multinationals

Conclusion – Interpret with Caution The models are inherenly economic in nature and results are data-driven. Consumption has both economic and social/cultural aspects. Social cultural experience cannot be always expressed by numbers. It is affected by our culture, attitude, group membership, economic freedom and the dynamics of the society in which we live Also, consider the impact of globalization, social media, Internet, tourism and multinationals

Future Research Investigate using other time frames, more variables and countries Plan economic strategies for different countries It is open for discussion…. .

Future Research Investigate using other time frames, more variables and countries Plan economic strategies for different countries It is open for discussion…. .

Discussion Questions Discuss the models of consumption convergence presented in the study. Distinguish their similarities and differences. Write a critique of the study. How would you extend the study? Offer future directions on the topic.

Discussion Questions Discuss the models of consumption convergence presented in the study. Distinguish their similarities and differences. Write a critique of the study. How would you extend the study? Offer future directions on the topic.