47039d0b5ea0530a16d19891df21237c.ppt

- Количество слайдов: 22

Arbitrage in Combinatorial Exchanges Andrew Gilpin and Tuomas Sandholm Carnegie Mellon University Computer Science Department

Combinatorial exchanges • Trading mechanism for bundles of items • Expressive preferences – Complementarity, substitutability • More efficiency compared to traditional exchanges • Examples: FCC, Bond. Connect 2

Other combinatorial exchange work • Clearing problem is NP-complete – Much harder than combinatorial auctions in practice – Reasonable problem sizes solved with MIP and specialpurpose algorithms [Sandholm et al] – Still active research area • Mechanism design [Parkes, Kalagnanam, Eso] – Designing rules so that exchange achieves various economic and strategic goals • Preference elicitation [Smith, Sandholm, Simmons] 3

Uncovered additional problem: Arbitrage • Arbitrage is a risk-free profit opportunity • Agents have endowment of money and items, and wish to increase their utility by trading • How well can an agent without any endowment do? – Where are the free lunches in combinatorial exchanges? 4

![Related research: Arbitrage in frictional markets • Frictional markets [Deng et al] – Assets Related research: Arbitrage in frictional markets • Frictional markets [Deng et al] – Assets](https://present5.com/presentation/47039d0b5ea0530a16d19891df21237c/image-5.jpg)

Related research: Arbitrage in frictional markets • Frictional markets [Deng et al] – Assets traded in integer quantities – Max limit on assets traded at a fixed price • Many theories of finance assume no arbitrage opportunity • But, computing arbitrage opportunities in frictional markets is NP-complete • What about combinatorial markets? 5

Outline • Model • Existence – Possibility – Impossibility • • • Curtailing arbitrage Detecting arbitraging bids Generating arbitraging bids Side constraints Conclusions 6

Model • M = {1, …, m} items for sale • Combinatorial bid is tuple: = demand of item i (negative means supply) = price for bid j (negative means ask) • We assume OR bidding language – As we will see later, this is WLOG 7

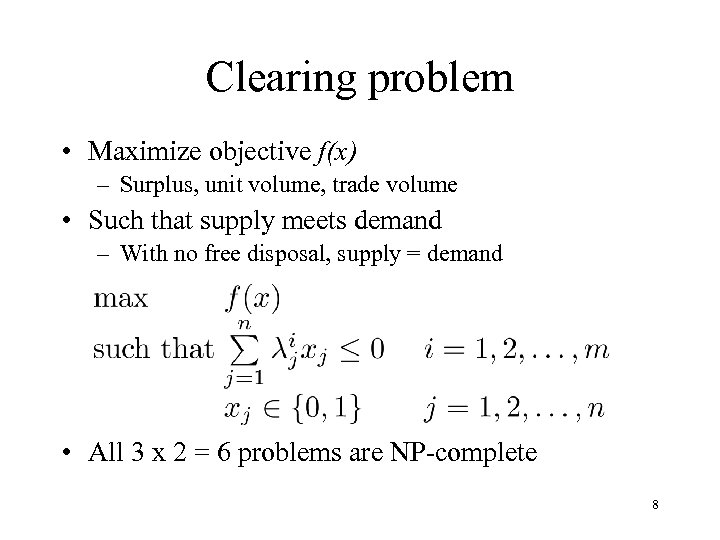

Clearing problem • Maximize objective f(x) – Surplus, unit volume, trade volume • Such that supply meets demand – With no free disposal, supply = demand • All 3 x 2 = 6 problems are NP-complete 8

Arbitraging bids in a combinatorial exchange • Arbitrage is a risk-free profit opportunity – So price on bid is negative • Agent has no endowment – Bid only demands, no supply 9

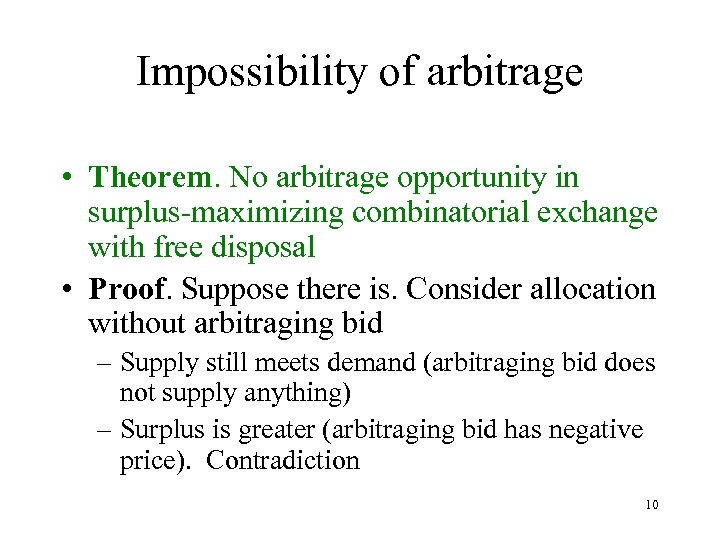

Impossibility of arbitrage • Theorem. No arbitrage opportunity in surplus-maximizing combinatorial exchange with free disposal • Proof. Suppose there is. Consider allocation without arbitraging bid – Supply still meets demand (arbitraging bid does not supply anything) – Surplus is greater (arbitraging bid has negative price). Contradiction 10

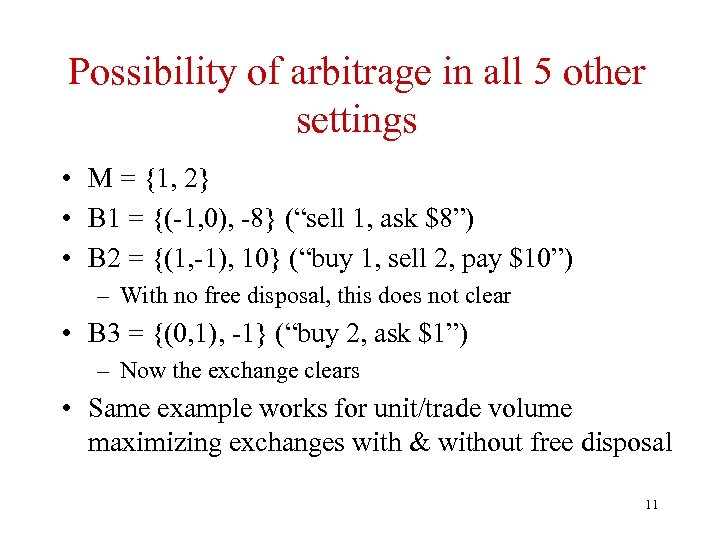

Possibility of arbitrage in all 5 other settings • M = {1, 2} • B 1 = {(-1, 0), -8} (“sell 1, ask $8”) • B 2 = {(1, -1), 10} (“buy 1, sell 2, pay $10”) – With no free disposal, this does not clear • B 3 = {(0, 1), -1} (“buy 2, ask $1”) – Now the exchange clears • Same example works for unit/trade volume maximizing exchanges with & without free disposal 11

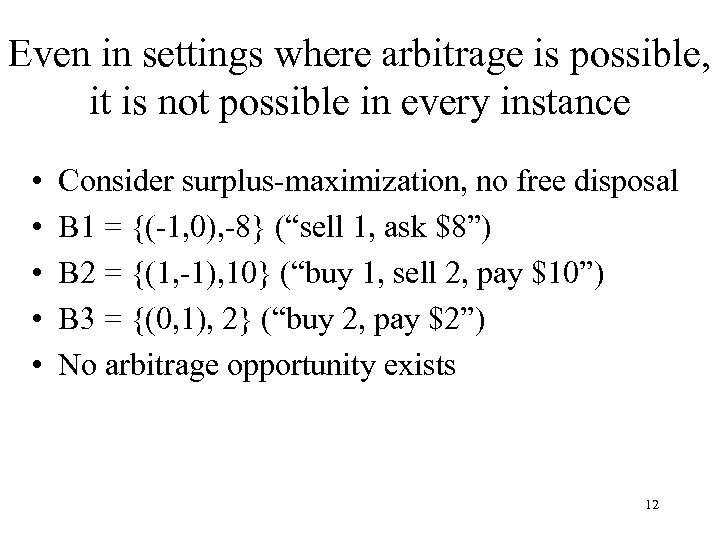

Even in settings where arbitrage is possible, it is not possible in every instance • • • Consider surplus-maximization, no free disposal B 1 = {(-1, 0), -8} (“sell 1, ask $8”) B 2 = {(1, -1), 10} (“buy 1, sell 2, pay $10”) B 3 = {(0, 1), 2} (“buy 2, pay $2”) No arbitrage opportunity exists 12

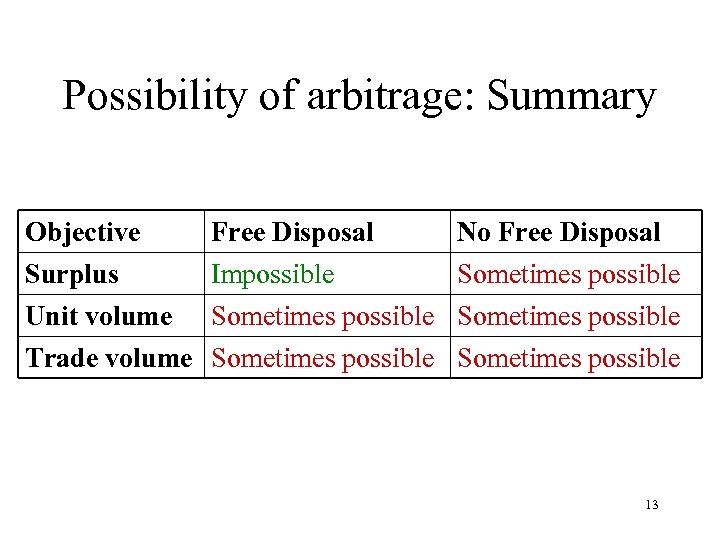

Possibility of arbitrage: Summary Objective Surplus Unit volume Free Disposal No Free Disposal Impossible Sometimes possible Trade volume Sometimes possible 13

Curtailing arbitrage opportunities • Unit/trade volume-maximizing exchanges ignore prices • Consider two bids: – B 1 = {(1, 0), 5} (“buy 1, pay $5”) – B 2 = {(1, 0), -5} (“buy 1, ask $5”) • In a unit/trade volume-maximizing exchange, these bids are equivalent • Can we do something better? 14

Curtailing arbitrage opportunities… • Run original clearing problem first • Then, run surplus-maximizing clearing with unit/trade volume constrained to maximum • This prevents situation from previous slide from occurring 15

Detecting arbitraging bids • Arbitraging bid can be detected trivially – Simply check for arbitrage conditions • Theorem. Determining whether a new arbitrageattempting bid is in an optimal allocation is NPcomplete – even if given the optimal allocation before that bid was submitted – Proof. Via reduction from SUBSET SUM – Good news: Hard for arbitrager to generate-and-test arbitrage-attempting bids 16

Relationship between feedback to bidders and arbitrage • Feedback – NONE – OWN-WINNING-BIDS – ALL-BIDS • Feedback ALL-BIDS provides enough information to bidders for them to arbitrage 17

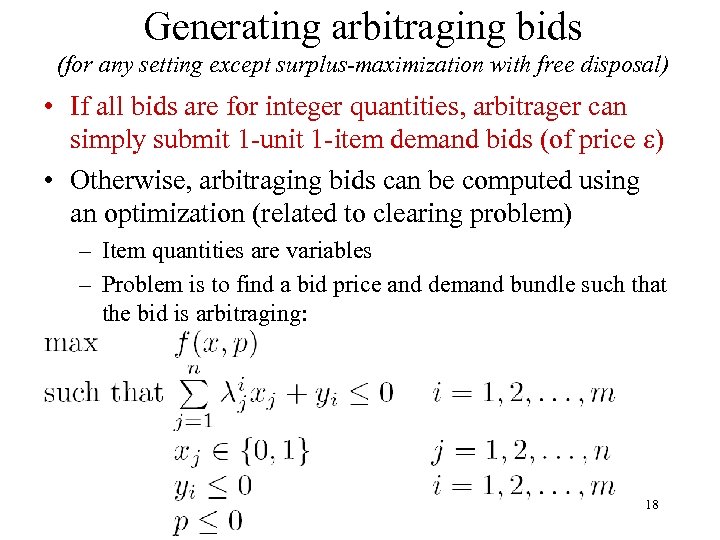

Generating arbitraging bids (for any setting except surplus-maximization with free disposal) • If all bids are for integer quantities, arbitrager can simply submit 1 -unit 1 -item demand bids (of price ) • Otherwise, arbitraging bids can be computed using an optimization (related to clearing problem) – Item quantities are variables – Problem is to find a bid price and demand bundle such that the bid is arbitraging: 18

Side constraints • Recall: Arbitrage impossible in surplusmaximization with free disposal • Exchange administrator may place side constraints on the allocation, e. g. : – volume/capacity constraints – min/max winner constraints • With certain side constraints, arbitrage becomes possible … 19

Side constraints: Example • Side constraint: Minimum of 3 winners • Suppose: – Only two bidders have submitted bids – Without side constraint, exchange clears with surplus S • Third bidder could place arbitraging bid with price at least –S • Thus, arbitrage possible in a surplus-maximizing CE with free disposal and side constraints 20

Bidding languages • So far we have assumed OR bidding language • All results hold for XOR, OR-of-XORs, XOR-of-ORs, OR* – Does not hurt since OR is special case – Does not help since arbitraging bids do not need to express substitutability 21

Conclusions • Studied arbitrage in combinatorial exchanges – Surplus-maximizing, free disposal: Arbitrage impossible – All 5 other settings: Arbitrage sometimes possible • Introduced combinatorial exchange mechanism that eliminates particularly undesirable form of arbitrage • Arbitraging bids can be detected trivially • Determining whether a given arbitrage-attempting bid arbitrages is NP-complete (makes generate-and-test hard) • Giving all bids as feedback to bidders supports arbitrage • If demand quantities are integers, easy to generate a herd of bids that yields arbitrage – If not, arbitrage is an integer program • Side constraints can give rise to arbitrage opportunities even in surplus-maximization with free disposal • The usual logical bidding languages do not affect arbitrage possibilities 22

47039d0b5ea0530a16d19891df21237c.ppt