702449521f417bb0f4f528b9c0fbdf86.ppt

- Количество слайдов: 22

AQUILA NETWORKS PLC A Midlands Electricity Company United Kingdom Angela Mann Revenue Protection Services

AQUILA NETWORKS PLC A Midlands Electricity Company United Kingdom Angela Mann Revenue Protection Services

Since 1990 • April 1990 - Customers using 1 MW and above • April 1994 - Customers with a demand of 100 k. W to 1 MW - Competition in provision of metering services • September 1998 to May 1999 - Customers with up to annual usage 12, 000 k. Wh 2

Since 1990 • April 1990 - Customers using 1 MW and above • April 1994 - Customers with a demand of 100 k. W to 1 MW - Competition in provision of metering services • September 1998 to May 1999 - Customers with up to annual usage 12, 000 k. Wh 2

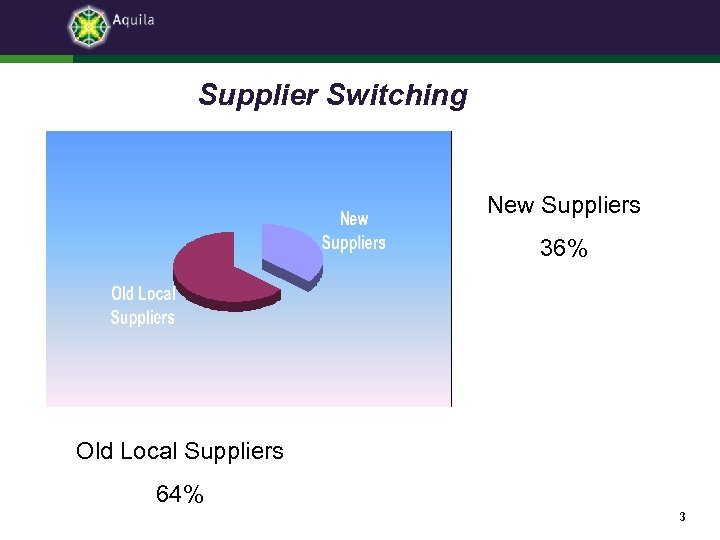

Supplier Switching New Suppliers 36% Old Local Suppliers 64% 3

Supplier Switching New Suppliers 36% Old Local Suppliers 64% 3

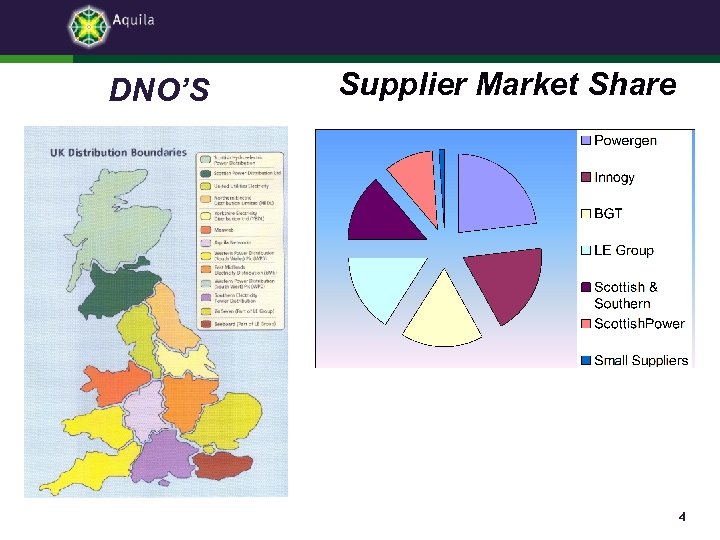

DNO’S Supplier Market Share 4

DNO’S Supplier Market Share 4

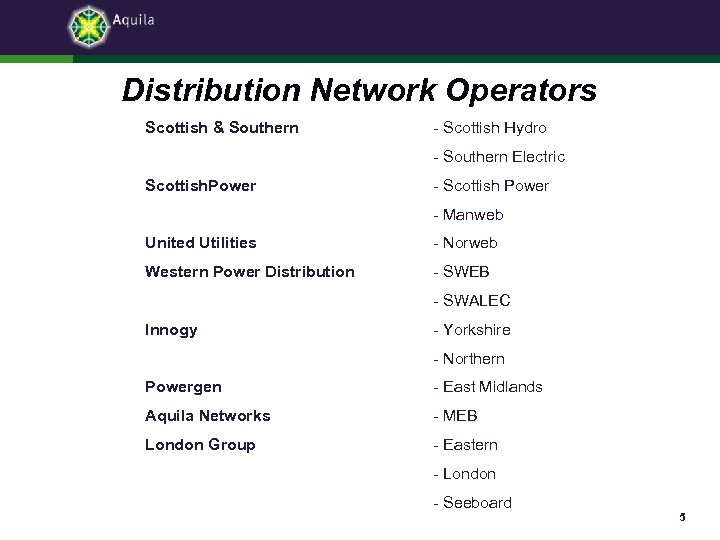

Distribution Network Operators Scottish & Southern - Scottish Hydro - Southern Electric Scottish. Power - Scottish Power - Manweb United Utilities - Norweb Western Power Distribution - SWEB - SWALEC Innogy - Yorkshire - Northern Powergen - East Midlands Aquila Networks - MEB London Group - Eastern - London - Seeboard 5

Distribution Network Operators Scottish & Southern - Scottish Hydro - Southern Electric Scottish. Power - Scottish Power - Manweb United Utilities - Norweb Western Power Distribution - SWEB - SWALEC Innogy - Yorkshire - Northern Powergen - East Midlands Aquila Networks - MEB London Group - Eastern - London - Seeboard 5

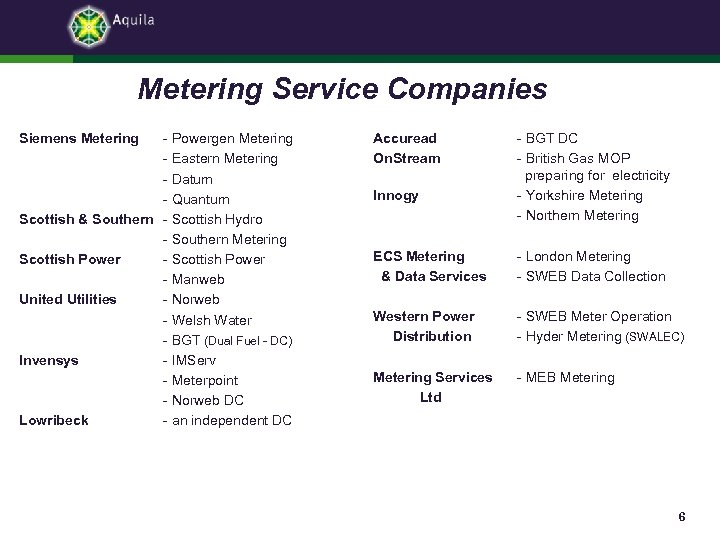

Metering Service Companies Siemens Metering - Powergen Metering - Eastern Metering - Datum - Quantum Scottish & Southern - Scottish Hydro - Southern Metering Scottish Power - Manweb United Utilities - Norweb - Welsh Water - BGT (Dual Fuel - DC) Invensys - IMServ - Meterpoint - Norweb DC Lowribeck - an independent DC Accuread On. Stream Innogy - BGT DC - British Gas MOP preparing for electricity - Yorkshire Metering - Northern Metering ECS Metering & Data Services - London Metering - SWEB Data Collection Western Power Distribution - SWEB Meter Operation - Hyder Metering (SWALEC) Metering Services Ltd - MEB Metering 6

Metering Service Companies Siemens Metering - Powergen Metering - Eastern Metering - Datum - Quantum Scottish & Southern - Scottish Hydro - Southern Metering Scottish Power - Manweb United Utilities - Norweb - Welsh Water - BGT (Dual Fuel - DC) Invensys - IMServ - Meterpoint - Norweb DC Lowribeck - an independent DC Accuread On. Stream Innogy - BGT DC - British Gas MOP preparing for electricity - Yorkshire Metering - Northern Metering ECS Metering & Data Services - London Metering - SWEB Data Collection Western Power Distribution - SWEB Meter Operation - Hyder Metering (SWALEC) Metering Services Ltd - MEB Metering 6

And the Supplier has a choice! 7

And the Supplier has a choice! 7

And the lights go out! 8

And the lights go out! 8

What’s the problem, Mrs O’Reilly? 9

What’s the problem, Mrs O’Reilly? 9

And the lights stay out! ! 10

And the lights stay out! ! 10

And the cavalry arrive? 11

And the cavalry arrive? 11

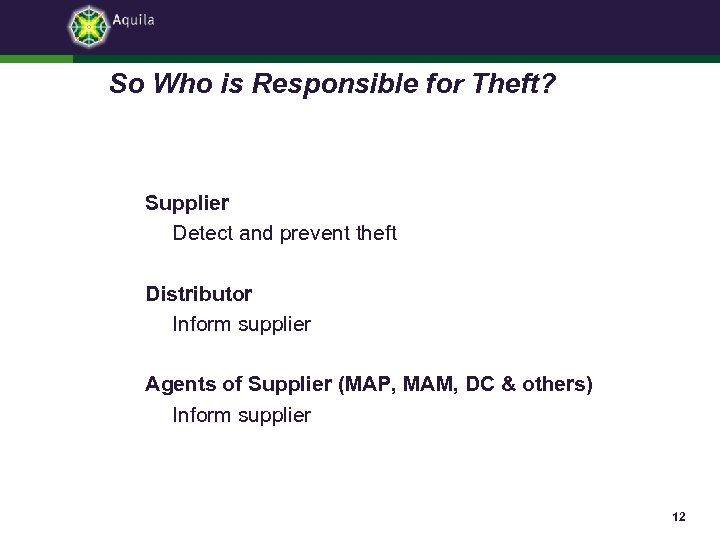

So Who is Responsible for Theft? Supplier Detect and prevent theft Distributor Inform supplier Agents of Supplier (MAP, MAM, DC & others) Inform supplier 12

So Who is Responsible for Theft? Supplier Detect and prevent theft Distributor Inform supplier Agents of Supplier (MAP, MAM, DC & others) Inform supplier 12

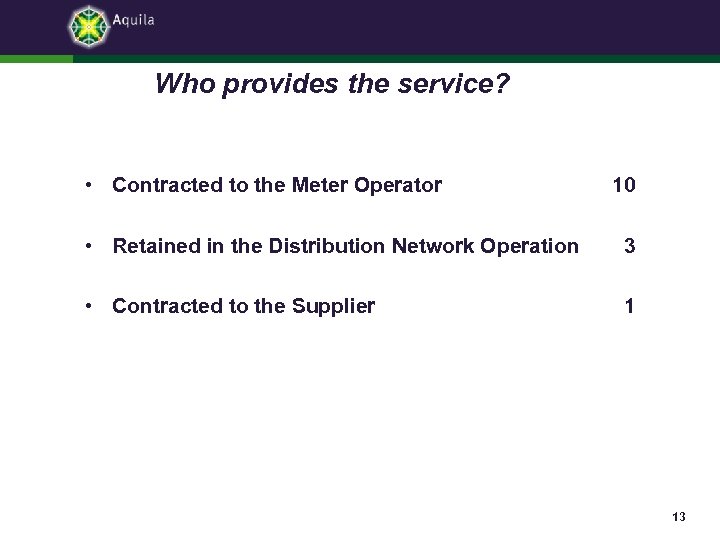

Who provides the service? • Contracted to the Meter Operator 10 • Retained in the Distribution Network Operation 3 • Contracted to the Supplier 1 13

Who provides the service? • Contracted to the Meter Operator 10 • Retained in the Distribution Network Operation 3 • Contracted to the Supplier 1 13

And who exactly loses? Energy Costs + Distribution Costs + Supply Costs + Suppliers Margin 14

And who exactly loses? Energy Costs + Distribution Costs + Supply Costs + Suppliers Margin 14

Aquila Networks plc 1990 - Public Limited Company 1996 - GPU & Cinergy = Avon Energy Holdings 1999 - Supply business sold to npower - GPU buy Cinergy’s share of Avon Energy 2000 - GPU merge with First Energy 2002 - Aquila buy 79. 9% interest - First Energy retain ownership of 20. 1% 2003 - Up for sale! 15

Aquila Networks plc 1990 - Public Limited Company 1996 - GPU & Cinergy = Avon Energy Holdings 1999 - Supply business sold to npower - GPU buy Cinergy’s share of Avon Energy 2000 - GPU merge with First Energy 2002 - Aquila buy 79. 9% interest - First Energy retain ownership of 20. 1% 2003 - Up for sale! 15

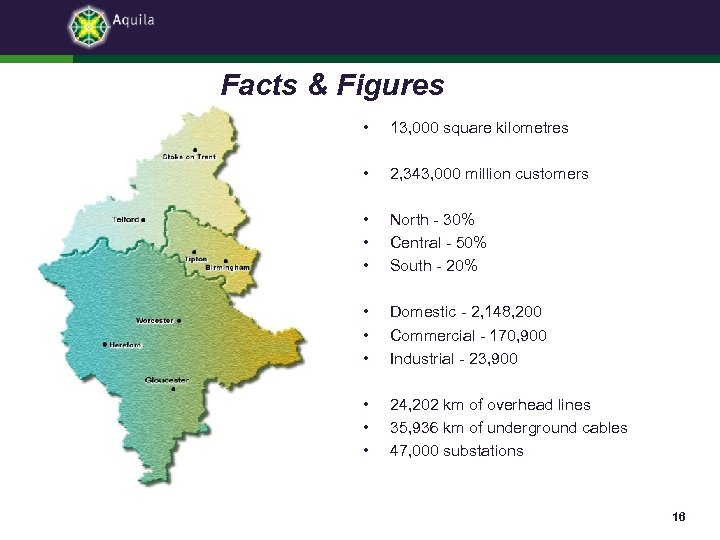

Facts & Figures • 13, 000 square kilometres • 2, 343, 000 million customers • • • North - 30% Central - 50% South - 20% • • • Domestic - 2, 148, 200 Commercial - 170, 900 Industrial - 23, 900 • • • 24, 202 km of overhead lines 35, 936 km of underground cables 47, 000 substations 16

Facts & Figures • 13, 000 square kilometres • 2, 343, 000 million customers • • • North - 30% Central - 50% South - 20% • • • Domestic - 2, 148, 200 Commercial - 170, 900 Industrial - 23, 900 • • • 24, 202 km of overhead lines 35, 936 km of underground cables 47, 000 substations 16

Revenue Protection in Aquila Pre 1987 - bad debt 1987 - company wide initiative - 7 regions, 7 managers - reporting to central point 17

Revenue Protection in Aquila Pre 1987 - bad debt 1987 - company wide initiative - 7 regions, 7 managers - reporting to central point 17

Today’s Team Revenue Protection Services Recoup costs and losses Keeping customers safe Licence obligations and electricity regulations 18

Today’s Team Revenue Protection Services Recoup costs and losses Keeping customers safe Licence obligations and electricity regulations 18

Changes • The lack of customer respect for seals would lead one to believe that seals function as tags to indicate where access can be obtained. • The companies must realise that they now have to deal with customers who have acquired considerable electrical knowledge, electrical connections are no longer a mystery to them. 19

Changes • The lack of customer respect for seals would lead one to believe that seals function as tags to indicate where access can be obtained. • The companies must realise that they now have to deal with customers who have acquired considerable electrical knowledge, electrical connections are no longer a mystery to them. 19

Changes • It has been found that in practically all cases, a customer, if he finds he can interfere with the meter’s registrations, uses two to three times as much energy as he would under normal circumstances • A great many persons who tamper with the meter or service, do not feel that interfering with the registration of the meter is dishonest 20

Changes • It has been found that in practically all cases, a customer, if he finds he can interfere with the meter’s registrations, uses two to three times as much energy as he would under normal circumstances • A great many persons who tamper with the meter or service, do not feel that interfering with the registration of the meter is dishonest 20

Changes • The effectiveness of seals will depend upon the policy of the utility in dealing with customers who insist upon breaking them. • The question of maintaining public relations is also involved and would appear to be over-emphasised. • The amount of losses is inversely proportional to the amount of activity on the part of the company towards the elimination of tampering. 21

Changes • The effectiveness of seals will depend upon the policy of the utility in dealing with customers who insist upon breaking them. • The question of maintaining public relations is also involved and would appear to be over-emphasised. • The amount of losses is inversely proportional to the amount of activity on the part of the company towards the elimination of tampering. 21

Changes? 22

Changes? 22