9c56e8fdb094dd031c3db6d54ea09d46.ppt

- Количество слайдов: 9

APWC 2012 Annual General Meeting 2012 Half Year Results October 5, 2012 www. apwcc. com

APWC 2012 Annual General Meeting 2012 Half Year Results October 5, 2012 www. apwcc. com

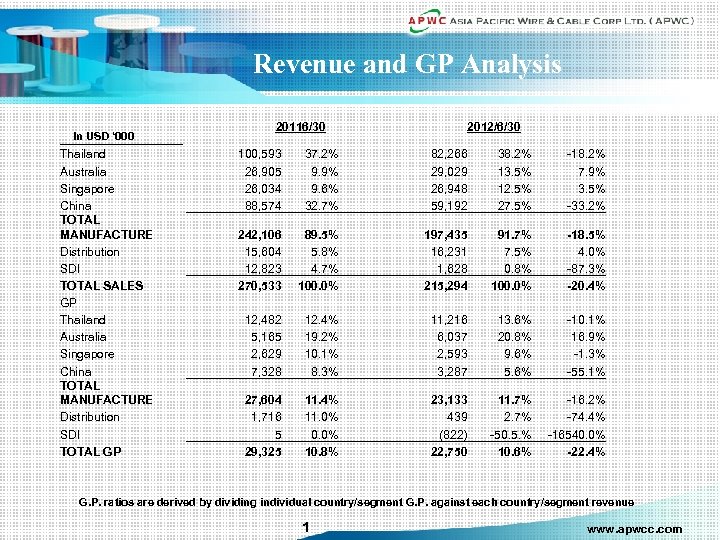

Revenue and GP Analysis In USD ‘ 000 Thailand Australia Singapore China TOTAL MANUFACTURE Distribution SDI TOTAL SALES GP Thailand Australia Singapore China TOTAL MANUFACTURE Distribution SDI TOTAL GP 20116/30 2012/6/30 100, 593 26, 905 26, 034 88, 574 37. 2% 9. 9% 9. 6% 32. 7% 82, 266 29, 029 26, 948 59, 192 38. 2% 13. 5% 12. 5% 27. 5% -18. 2% 7. 9% 3. 5% -33. 2% 242, 106 15, 604 12, 823 270, 533 89. 5% 5. 8% 4. 7% 100. 0% 197, 435 16, 231 1, 628 215, 294 91. 7% 7. 5% 0. 8% 100. 0% -18. 5% 4. 0% -87. 3% -20. 4% 12, 482 5, 165 2, 629 7, 328 12. 4% 19. 2% 10. 1% 8. 3% 11, 216 6, 037 2, 593 3, 287 13. 6% 20. 8% 9. 6% 5. 6% -10. 1% 16. 9% -1. 3% -55. 1% 27, 604 1, 716 5 29, 325 11. 4% 11. 0% 0. 0% 10. 8% 23, 133 439 (822) 22, 750 11. 7% 2. 7% -50. 5. % 10. 6% -16. 2% -74. 4% -16540. 0% -22. 4% G. P. ratios are derived by dividing individual country/segment G. P. against each country/segment revenue 1 www. apwcc. com

Revenue and GP Analysis In USD ‘ 000 Thailand Australia Singapore China TOTAL MANUFACTURE Distribution SDI TOTAL SALES GP Thailand Australia Singapore China TOTAL MANUFACTURE Distribution SDI TOTAL GP 20116/30 2012/6/30 100, 593 26, 905 26, 034 88, 574 37. 2% 9. 9% 9. 6% 32. 7% 82, 266 29, 029 26, 948 59, 192 38. 2% 13. 5% 12. 5% 27. 5% -18. 2% 7. 9% 3. 5% -33. 2% 242, 106 15, 604 12, 823 270, 533 89. 5% 5. 8% 4. 7% 100. 0% 197, 435 16, 231 1, 628 215, 294 91. 7% 7. 5% 0. 8% 100. 0% -18. 5% 4. 0% -87. 3% -20. 4% 12, 482 5, 165 2, 629 7, 328 12. 4% 19. 2% 10. 1% 8. 3% 11, 216 6, 037 2, 593 3, 287 13. 6% 20. 8% 9. 6% 5. 6% -10. 1% 16. 9% -1. 3% -55. 1% 27, 604 1, 716 5 29, 325 11. 4% 11. 0% 0. 0% 10. 8% 23, 133 439 (822) 22, 750 11. 7% 2. 7% -50. 5. % 10. 6% -16. 2% -74. 4% -16540. 0% -22. 4% G. P. ratios are derived by dividing individual country/segment G. P. against each country/segment revenue 1 www. apwcc. com

Locations and Facilities As of June 30, 2012 372 CHINA 27. 5% Headquarters • • • Pacific Electric Wire & Cable (Shenzhen) Co. , Ltd. Shanghai Yayang Electric Co. , Ltd. Shandong Pacific Rubber Cable Co. , Ltd. Shandong Hua. Yu Fiber Optics Cable CCH (Crown Century Holding) Hong Kong Ningbo Pacific Wire Co. , Ltd. 14 THAILAND 828 SINGAPORE • Charoong Thai Wire & Cable Public Co. , Ltd. • Siam Fiber Optics Co. , Ltd. • Siam Pacific Electric Wire & Cable Co. , Ltd. 38. 2% 149 13. 3% • Sigma Cable Co. , Pte Ltd. • Sigma-Epan International Pte. , Ltd. Others: Distributed products of 7. 5% include Sigma Cable, SEI, Australia, and CTW. Factories/op units Employee headcount 77 AUSTRALIA 13. 5% TOTAL HEADCOUNT: 1, 440 2 • Australia Pacific Electric Cables Pty. , Ltd. Power cable SDI project engineering Distributed products Fiber optic cable Enameled wire Electronic wire % Revenue contribution (1 H 09) www. apwcc. com

Locations and Facilities As of June 30, 2012 372 CHINA 27. 5% Headquarters • • • Pacific Electric Wire & Cable (Shenzhen) Co. , Ltd. Shanghai Yayang Electric Co. , Ltd. Shandong Pacific Rubber Cable Co. , Ltd. Shandong Hua. Yu Fiber Optics Cable CCH (Crown Century Holding) Hong Kong Ningbo Pacific Wire Co. , Ltd. 14 THAILAND 828 SINGAPORE • Charoong Thai Wire & Cable Public Co. , Ltd. • Siam Fiber Optics Co. , Ltd. • Siam Pacific Electric Wire & Cable Co. , Ltd. 38. 2% 149 13. 3% • Sigma Cable Co. , Pte Ltd. • Sigma-Epan International Pte. , Ltd. Others: Distributed products of 7. 5% include Sigma Cable, SEI, Australia, and CTW. Factories/op units Employee headcount 77 AUSTRALIA 13. 5% TOTAL HEADCOUNT: 1, 440 2 • Australia Pacific Electric Cables Pty. , Ltd. Power cable SDI project engineering Distributed products Fiber optic cable Enameled wire Electronic wire % Revenue contribution (1 H 09) www. apwcc. com

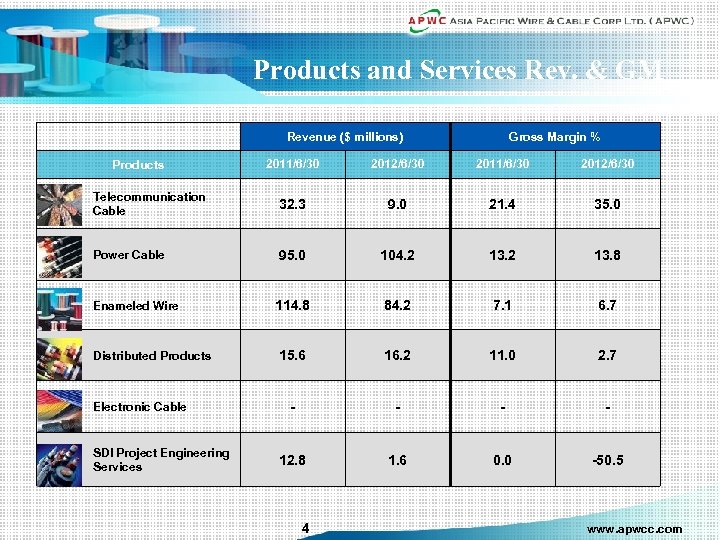

Products and Services Rev. & GM Revenue ($ millions) Gross Margin % 2011/6/30 2012/6/30 Telecommunication Cable 32. 3 9. 0 21. 4 35. 0 Power Cable 95. 0 104. 2 13. 8 114. 8 84. 2 7. 1 6. 7 15. 6 16. 2 11. 0 2. 7 - - 12. 8 1. 6 0. 0 -50. 5 Products Enameled Wire Distributed Products Electronic Cable SDI Project Engineering Services 4 www. apwcc. com

Products and Services Rev. & GM Revenue ($ millions) Gross Margin % 2011/6/30 2012/6/30 Telecommunication Cable 32. 3 9. 0 21. 4 35. 0 Power Cable 95. 0 104. 2 13. 8 114. 8 84. 2 7. 1 6. 7 15. 6 16. 2 11. 0 2. 7 - - 12. 8 1. 6 0. 0 -50. 5 Products Enameled Wire Distributed Products Electronic Cable SDI Project Engineering Services 4 www. apwcc. com

Summary Income Statement (USD '000) 2010 (audited) 2011/6/30 2012/6/30 Total Sales $446, 594 $270, 533 (a) 215, 294 Cost of Sales (389, 571) (241, 208) (192, 544) Gross Profit 57, 023 29, 325 (a) 22, 750 Income from Operations 28, 652 12, 714 11, 048 Income Before Taxes 31, 832 12, 051 12, 422 (b) Net Income (Loss) attributable to APWC 14, 140 5, 138 5, 294 $1. 02 $0. 37 0. 38 Basic and Diluted Income (Loss) per Share (USD) a. Sales up to 2011/6/30 included SPFO revenue of 16. 6 million, gross profit of 2. 9 million. b. SP recognizes other income of Thai Baht 143. 4 million (US$ 4, 527 K) from settlement of flood loss. 4 www. apwcc. com

Summary Income Statement (USD '000) 2010 (audited) 2011/6/30 2012/6/30 Total Sales $446, 594 $270, 533 (a) 215, 294 Cost of Sales (389, 571) (241, 208) (192, 544) Gross Profit 57, 023 29, 325 (a) 22, 750 Income from Operations 28, 652 12, 714 11, 048 Income Before Taxes 31, 832 12, 051 12, 422 (b) Net Income (Loss) attributable to APWC 14, 140 5, 138 5, 294 $1. 02 $0. 37 0. 38 Basic and Diluted Income (Loss) per Share (USD) a. Sales up to 2011/6/30 included SPFO revenue of 16. 6 million, gross profit of 2. 9 million. b. SP recognizes other income of Thai Baht 143. 4 million (US$ 4, 527 K) from settlement of flood loss. 4 www. apwcc. com

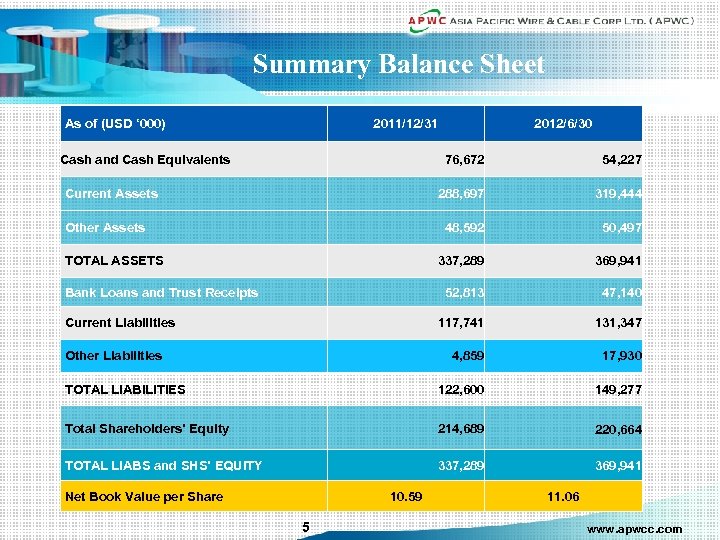

Summary Balance Sheet As of (USD ‘ 000) 2011/12/31 Cash and Cash Equivalents 2012/6/30 76, 672 54, 227 288, 697 319, 444 48, 592 50, 497 337, 289 369, 941 52, 813 47, 140 117, 741 131, 347 4, 859 17, 930 TOTAL LIABILITIES 122, 600 149, 277 Total Shareholders’ Equity 214, 689 220, 664 TOTAL LIABS and SHS’ EQUITY 337, 289 369, 941 Current Assets Other Assets TOTAL ASSETS Bank Loans and Trust Receipts Current Liabilities Other Liabilities Net Book Value per Share 10. 59 5 11. 06 www. apwcc. com

Summary Balance Sheet As of (USD ‘ 000) 2011/12/31 Cash and Cash Equivalents 2012/6/30 76, 672 54, 227 288, 697 319, 444 48, 592 50, 497 337, 289 369, 941 52, 813 47, 140 117, 741 131, 347 4, 859 17, 930 TOTAL LIABILITIES 122, 600 149, 277 Total Shareholders’ Equity 214, 689 220, 664 TOTAL LIABS and SHS’ EQUITY 337, 289 369, 941 Current Assets Other Assets TOTAL ASSETS Bank Loans and Trust Receipts Current Liabilities Other Liabilities Net Book Value per Share 10. 59 5 11. 06 www. apwcc. com

Summary Analyses (i) • Gross Margin Ratio Erosion Ø GM ratio down from 10. 8% to 10. 6%, a 1. 9% decreased than that of last year’s. Major reasons being: • • Decrease in copper price by 14% year over year Decrease in distributed product margin from 11. 0% to 2. 7% • Decrease in SG&A expenses by 1. 5 million (detail next slide) 6 www. apwcc. com

Summary Analyses (i) • Gross Margin Ratio Erosion Ø GM ratio down from 10. 8% to 10. 6%, a 1. 9% decreased than that of last year’s. Major reasons being: • • Decrease in copper price by 14% year over year Decrease in distributed product margin from 11. 0% to 2. 7% • Decrease in SG&A expenses by 1. 5 million (detail next slide) 6 www. apwcc. com

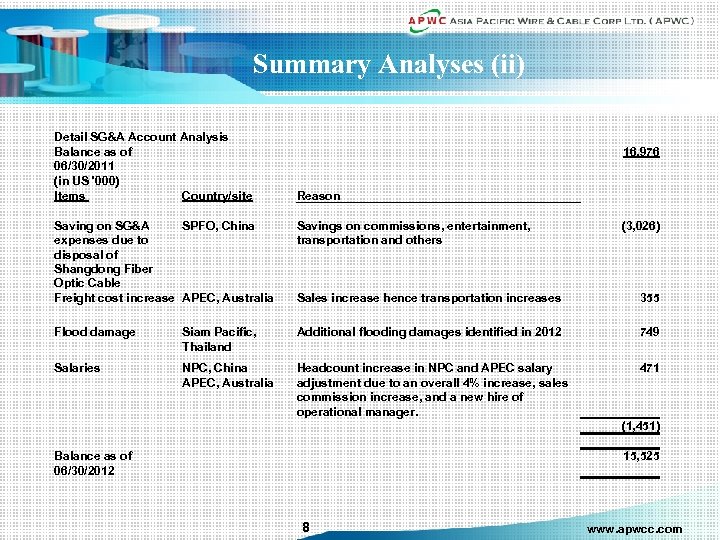

Summary Analyses (ii) Detail SG&A Account Analysis Balance as of 06/30/2011 (in US '000) Country/site Items 16, 976 Reason Saving on SG&A SPFO, China expenses due to disposal of Shangdong Fiber Optic Cable Freight cost increase APEC, Australia Savings on commissions, entertainment, transportation and others (3, 026) Sales increase hence transportation increases 355 Flood damage Siam Pacific, Thailand Additional flooding damages identified in 2012 749 Salaries NPC, China APEC, Australia Headcount increase in NPC and APEC salary adjustment due to an overall 4% increase, sales commission increase, and a new hire of operational manager. 471 (1, 451) 15, 525 Balance as of 06/30/2012 8 www. apwcc. com

Summary Analyses (ii) Detail SG&A Account Analysis Balance as of 06/30/2011 (in US '000) Country/site Items 16, 976 Reason Saving on SG&A SPFO, China expenses due to disposal of Shangdong Fiber Optic Cable Freight cost increase APEC, Australia Savings on commissions, entertainment, transportation and others (3, 026) Sales increase hence transportation increases 355 Flood damage Siam Pacific, Thailand Additional flooding damages identified in 2012 749 Salaries NPC, China APEC, Australia Headcount increase in NPC and APEC salary adjustment due to an overall 4% increase, sales commission increase, and a new hire of operational manager. 471 (1, 451) 15, 525 Balance as of 06/30/2012 8 www. apwcc. com

This Presentation of APWC was developed by the Company and CCG and is intended solely for informational purposes and is not to be construed as an offer to sell or the solicitation of an offer to buy the Company’s stock. This presentation is based upon information available to the public, as well as other information from sources which management believes to be reliable, but is not represented by APWC or CCG as being fully accurate nor does it purport to be complete. Opinions expressed herein are those of management as of the date of publication and are subject to change without notice.

This Presentation of APWC was developed by the Company and CCG and is intended solely for informational purposes and is not to be construed as an offer to sell or the solicitation of an offer to buy the Company’s stock. This presentation is based upon information available to the public, as well as other information from sources which management believes to be reliable, but is not represented by APWC or CCG as being fully accurate nor does it purport to be complete. Opinions expressed herein are those of management as of the date of publication and are subject to change without notice.