86afd84c99881a7b6c41153f7f5bae23.ppt

- Количество слайдов: 56

APUSH ECONOMIC REVIEW K. Martin

APUSH ECONOMIC REVIEW K. Martin

Mercantilism - Theory An understanding that 1 st Generation of colonist held with mother country. (Later arrivals did not agree. ) u Theory u – A step beyond the feudal idea which held land, labor, and capital stagnant. u Land generally not for sale (primogeniture, entailment) u Skilled labor governed by guilds: Unskilled labor tied to the land (belief in inherent class) u FAIR price required and set by guilds; law against usury

Mercantilism - Theory An understanding that 1 st Generation of colonist held with mother country. (Later arrivals did not agree. ) u Theory u – A step beyond the feudal idea which held land, labor, and capital stagnant. u Land generally not for sale (primogeniture, entailment) u Skilled labor governed by guilds: Unskilled labor tied to the land (belief in inherent class) u FAIR price required and set by guilds; law against usury

Mercantilism - Object is the power and wealth of the NATION STATE (Mother Country) 1. Wealth =‘s accumulation of Gold through a favorable balance of trade/payments. 2. Protective tariffs and trade restrictions to help national industries and agriculture. 3. Acquisition of colonies which supply raw materials and buy finished products. 4. Assumption of an uneducated, perpetually poor laboring class

Mercantilism - Object is the power and wealth of the NATION STATE (Mother Country) 1. Wealth =‘s accumulation of Gold through a favorable balance of trade/payments. 2. Protective tariffs and trade restrictions to help national industries and agriculture. 3. Acquisition of colonies which supply raw materials and buy finished products. 4. Assumption of an uneducated, perpetually poor laboring class

Mercantilism. Effect on American Colonies u u u The role of the colonies – Navigation Acts Provide raw materials – fur, tar, pitch, tobacco, lumber, farm goods No manufacturing which would compete with BR monopolies Trade enumerated articles only with England (unless BR had no interest in product) Use BR vessels for trade (Built up BR sea power) Pay duties on imported or exported goods

Mercantilism. Effect on American Colonies u u u The role of the colonies – Navigation Acts Provide raw materials – fur, tar, pitch, tobacco, lumber, farm goods No manufacturing which would compete with BR monopolies Trade enumerated articles only with England (unless BR had no interest in product) Use BR vessels for trade (Built up BR sea power) Pay duties on imported or exported goods

Mercantilism. Effect on American Colonies u u u 1. The Flow of Money goes OUT. There is a perpetual shortage of currency. Result=Barter and trade with foreign money. Colonies not allowed to coin money. Barter restricts transactions and is inefficient – – Double coincidence of wants is necessary How do you make change?

Mercantilism. Effect on American Colonies u u u 1. The Flow of Money goes OUT. There is a perpetual shortage of currency. Result=Barter and trade with foreign money. Colonies not allowed to coin money. Barter restricts transactions and is inefficient – – Double coincidence of wants is necessary How do you make change?

Mercantilism. Bartering Continued 2. Colonist are always in debt to banks and merchants in England. 3. Natural Result = Smuggling and illegal trade.

Mercantilism. Bartering Continued 2. Colonist are always in debt to banks and merchants in England. 3. Natural Result = Smuggling and illegal trade.

Benign or Salutary Neglect u 1. 2. 3. 4. Foreign wars kept England distracted and led to lax enforcement of the Navigation laws. (Am 5 th most important colony) Smuggling Higher standard of living than in England by 1776 ($, space, health) Confidence in self-sufficiency Resentment of restrictions imposed that altered more profitable trade patters.

Benign or Salutary Neglect u 1. 2. 3. 4. Foreign wars kept England distracted and led to lax enforcement of the Navigation laws. (Am 5 th most important colony) Smuggling Higher standard of living than in England by 1776 ($, space, health) Confidence in self-sufficiency Resentment of restrictions imposed that altered more profitable trade patters.

Benign or Salutary Neglect u 1. 2. 3. Rights of Englishmen- Magna Carta, Common Law, Parliament, English Bill of Rights Parliament must approve all new taxes BR theory of “virtual representation” Colonial belief that only their own assemblies could levy internal (direct) taxes.

Benign or Salutary Neglect u 1. 2. 3. Rights of Englishmen- Magna Carta, Common Law, Parliament, English Bill of Rights Parliament must approve all new taxes BR theory of “virtual representation” Colonial belief that only their own assemblies could levy internal (direct) taxes.

MARKET ECONOMY u u 1. THEORY – Adam Smith's Inquiry into the Nature and Causes of the Wealth of Nations (1776) Assertions Labor, not nature, is the source of value a. b. 2. Man appropriates the fruits of nature by investing his labor in them. Private property is justified by invested labor Self interest is the primary economic motivation a. b. Man will work harder or make innovations to benefit himself The market allows him to seek benefits

MARKET ECONOMY u u 1. THEORY – Adam Smith's Inquiry into the Nature and Causes of the Wealth of Nations (1776) Assertions Labor, not nature, is the source of value a. b. 2. Man appropriates the fruits of nature by investing his labor in them. Private property is justified by invested labor Self interest is the primary economic motivation a. b. Man will work harder or make innovations to benefit himself The market allows him to seek benefits

Market Economy Assertions 3. The profit motive is the invisible hand which regulates the market place a. Competition keeps prices from going too far from production cost. Specialization and division of labor increase productivity and allow more profit b. self-interests motivates the producer to provide what society wants. c. the laws of supply and demand create a “self regulating” market 4. The role of government is to provide for and finance defense, justice, public goods. u

Market Economy Assertions 3. The profit motive is the invisible hand which regulates the market place a. Competition keeps prices from going too far from production cost. Specialization and division of labor increase productivity and allow more profit b. self-interests motivates the producer to provide what society wants. c. the laws of supply and demand create a “self regulating” market 4. The role of government is to provide for and finance defense, justice, public goods. u

Market Conflicts with Mercantilism required strict regulation of markets for the benefit of the nation state. Self-sufficiency was necessary for each state, and therefore monopolies and protective tariffs would be reasonable. u Smith’s market economy called for “laissez Faire” government policy which allowed competition in a free market. Greater productivity would produce a higher living standard and thus increase the wealth of the nation. u

Market Conflicts with Mercantilism required strict regulation of markets for the benefit of the nation state. Self-sufficiency was necessary for each state, and therefore monopolies and protective tariffs would be reasonable. u Smith’s market economy called for “laissez Faire” government policy which allowed competition in a free market. Greater productivity would produce a higher living standard and thus increase the wealth of the nation. u

CONSTITUTIONAL ISSUES Which government authority will have the power to determine the rules of commerce? u Who will levy taxes and tariffs? u What rights will the owners of businesses have? u What rights if any do workers have? (early on – none) u Who will print or coin money and how will it be determined u How will government fund its functions? u

CONSTITUTIONAL ISSUES Which government authority will have the power to determine the rules of commerce? u Who will levy taxes and tariffs? u What rights will the owners of businesses have? u What rights if any do workers have? (early on – none) u Who will print or coin money and how will it be determined u How will government fund its functions? u

HAMILTON’S PLAN u Based on belief in a market economy; cynical view of human nature. **Hamilton’s father in law buys bonds for pennies on the $ **

HAMILTON’S PLAN u Based on belief in a market economy; cynical view of human nature. **Hamilton’s father in law buys bonds for pennies on the $ **

Assumption of State and National Revolutionary War Debts u 1. 2. 3. 4. Redemption of bonds, warrants, etc at par – meaning you get face value. Establishes credit Allows huge profits for speculators Creates support for Federal government by owners of newly issued bond financing payments Objections of states which had paid off most of their own debt (EX: VA- that why VA gets most of Capital)

Assumption of State and National Revolutionary War Debts u 1. 2. 3. 4. Redemption of bonds, warrants, etc at par – meaning you get face value. Establishes credit Allows huge profits for speculators Creates support for Federal government by owners of newly issued bond financing payments Objections of states which had paid off most of their own debt (EX: VA- that why VA gets most of Capital)

Assumption of State and National Revolutionary War Debts u 1. 2. 3. A protective tariff Conflicts with Smith’s theory Encourages “infant industries” Strengthens the nation by providing jobs and self-sufficiency

Assumption of State and National Revolutionary War Debts u 1. 2. 3. A protective tariff Conflicts with Smith’s theory Encourages “infant industries” Strengthens the nation by providing jobs and self-sufficiency

Assumption of State and National Revolutionary War Debts Sale of government lands at low prices 1. Agriculture supports cities 2. Prosperous farmers buy industrial products *Until the 16 th Amendment – US gov’t totally funded by the sale of public lands at low $ and tariffs. u

Assumption of State and National Revolutionary War Debts Sale of government lands at low prices 1. Agriculture supports cities 2. Prosperous farmers buy industrial products *Until the 16 th Amendment – US gov’t totally funded by the sale of public lands at low $ and tariffs. u

Assumption of State and National Revolutionary War Debts u 1. 2. 3. Creation of the BANK of the United States (BUS) Established with public and private funding Discounts bills of exchange and promissory notes of merchants, accepts deposits, issues sound currency, controls the $ supply, holds gov’t deposits, sells gov’t securities, lends $ to gov’t Raises serious constitutional questions “Implied Powers”

Assumption of State and National Revolutionary War Debts u 1. 2. 3. Creation of the BANK of the United States (BUS) Established with public and private funding Discounts bills of exchange and promissory notes of merchants, accepts deposits, issues sound currency, controls the $ supply, holds gov’t deposits, sells gov’t securities, lends $ to gov’t Raises serious constitutional questions “Implied Powers”

Assumption of State and National Revolutionary War Debts u 1. 2. 3. Objections to the plan on the basis of: Belief in limited power of the federal government (Jeffersonian’s) Prediction that this would be an agricultural not industrial nation Detrimental effects of protective tariffs on non-industrial areas. (Bad for the south)

Assumption of State and National Revolutionary War Debts u 1. 2. 3. Objections to the plan on the basis of: Belief in limited power of the federal government (Jeffersonian’s) Prediction that this would be an agricultural not industrial nation Detrimental effects of protective tariffs on non-industrial areas. (Bad for the south)

MARSHALL COURT u u Marbury v. Madison (1803) – Judicial Review Dartmouth v. Woodward (1819) – Sanctity of Contracts (applied to business charters too!) Corporations exists due to this. Mc. Cullouch v. Maryland (1819) – States cannot tax the national gov’t agencies. The BUS is constitutional. Gibbons v. Ogden (1824) – Only federal gov’t can regulate interstate commerce. Eventually led to regulation of transportation, broadcasting, labor unions, product quality, wages, and hours.

MARSHALL COURT u u Marbury v. Madison (1803) – Judicial Review Dartmouth v. Woodward (1819) – Sanctity of Contracts (applied to business charters too!) Corporations exists due to this. Mc. Cullouch v. Maryland (1819) – States cannot tax the national gov’t agencies. The BUS is constitutional. Gibbons v. Ogden (1824) – Only federal gov’t can regulate interstate commerce. Eventually led to regulation of transportation, broadcasting, labor unions, product quality, wages, and hours.

TYPES OF OWNERSHIP Sole Proprietorship u Partnership u Corporation – Chartered by state, owned by stockholders u – Disadvantages - Cost, double taxation – Advantages: u Easy access to capital u Unlimited Life u Limited Liability u Easy transfer of Ownership u Advantages of Scale

TYPES OF OWNERSHIP Sole Proprietorship u Partnership u Corporation – Chartered by state, owned by stockholders u – Disadvantages - Cost, double taxation – Advantages: u Easy access to capital u Unlimited Life u Limited Liability u Easy transfer of Ownership u Advantages of Scale

Laissez Faire- Domination of Business Owners u u u Post Civil War businesses wanted government to protect not take their $. Term Laissez-Faire was applied by others to Adam Smith’s ideas: Gov’t should not interfere with business. Smith never meant the Gov't shouldn’t pass laws regarding business and enforce them. By the late 1800’s, industrialists expected protective tariffs and even subsidies, but they were outraged when business was regulated. Labor Unions and farmers began calling for government regulation as the only possible “countervailing power” to industry.

Laissez Faire- Domination of Business Owners u u u Post Civil War businesses wanted government to protect not take their $. Term Laissez-Faire was applied by others to Adam Smith’s ideas: Gov’t should not interfere with business. Smith never meant the Gov't shouldn’t pass laws regarding business and enforce them. By the late 1800’s, industrialists expected protective tariffs and even subsidies, but they were outraged when business was regulated. Labor Unions and farmers began calling for government regulation as the only possible “countervailing power” to industry.

TARIFFS u Revenue Tariffs are low tariffs intended to collect income for government and to allow foreign goods in. u Protective Tariffs are intended to give an advantage to domestic industry and keep out foreign goods or raise their prices so high that they are unattractive.

TARIFFS u Revenue Tariffs are low tariffs intended to collect income for government and to allow foreign goods in. u Protective Tariffs are intended to give an advantage to domestic industry and keep out foreign goods or raise their prices so high that they are unattractive.

Rights of Labor 1. Mercantilists assumed that some people were inferior and doomed to be poor manual laborers. Therefore in America there were 1. Slaves 2. Indentured servants and redemptioners

Rights of Labor 1. Mercantilists assumed that some people were inferior and doomed to be poor manual laborers. Therefore in America there were 1. Slaves 2. Indentured servants and redemptioners

Rights of Labor 2. Laissez faire capitalism did not necessarily condone slavery, but it did give all the rights to the business owner in regard to wages and working conditions. If you wanted something better you could quit and look for a better job. u u u Labor unions were seen as illegal conspiracies against the property rights of owners Strikes were illegal for the same reason Immigration supplied industry with plenty of desperate workers without options; especially in the late 1800’s when many immigrants were too poor to buy farms or didn’t have farming knowledge. 3. Sherman Anti-Trust Act was first used mainly to prosecute unions as “Illegal restraints on trade”

Rights of Labor 2. Laissez faire capitalism did not necessarily condone slavery, but it did give all the rights to the business owner in regard to wages and working conditions. If you wanted something better you could quit and look for a better job. u u u Labor unions were seen as illegal conspiracies against the property rights of owners Strikes were illegal for the same reason Immigration supplied industry with plenty of desperate workers without options; especially in the late 1800’s when many immigrants were too poor to buy farms or didn’t have farming knowledge. 3. Sherman Anti-Trust Act was first used mainly to prosecute unions as “Illegal restraints on trade”

The Welfare State – Gov’t as the “Countervailing Power” u This was an adaptation of free market capitalism to the industrial age in which “robber barrons” used their power to destroy competition and keep wages indecently low. Politicians afraid of more radical solutions (Anarchy, communism, socialism) allowed the government to step into regulation business practices.

The Welfare State – Gov’t as the “Countervailing Power” u This was an adaptation of free market capitalism to the industrial age in which “robber barrons” used their power to destroy competition and keep wages indecently low. Politicians afraid of more radical solutions (Anarchy, communism, socialism) allowed the government to step into regulation business practices.

The Welfare State – Progressive Era 1. 2. Interstate Commerce Act and Sherman Anti. Trust Act Progressive Legislation – assumes gov’t has the right to protect citizens 1. 2. 3. 4. 5. Most state and local wage and hour laws are found unconstitutional as a violation of the owner and the right to contract. (Hepburn ACT exception Muller v. Oregon. ) Pure Food and Drug laws, Meat Inspection Act Clayton Anti-trust Act Federal Trade Commission Mann-Elkins Act (RR regulation)

The Welfare State – Progressive Era 1. 2. Interstate Commerce Act and Sherman Anti. Trust Act Progressive Legislation – assumes gov’t has the right to protect citizens 1. 2. 3. 4. 5. Most state and local wage and hour laws are found unconstitutional as a violation of the owner and the right to contract. (Hepburn ACT exception Muller v. Oregon. ) Pure Food and Drug laws, Meat Inspection Act Clayton Anti-trust Act Federal Trade Commission Mann-Elkins Act (RR regulation)

The Welfare State – New Deal – Great Society u New Deal Legislation and Court Packing Plan lead to free reign under the commerce clause (After court packing SC gave up the commerce clause. Basically anything connected to Interstate commerce government can regulate. ) u Fair Deal (Truman) Great Society (Johnson)

The Welfare State – New Deal – Great Society u New Deal Legislation and Court Packing Plan lead to free reign under the commerce clause (After court packing SC gave up the commerce clause. Basically anything connected to Interstate commerce government can regulate. ) u Fair Deal (Truman) Great Society (Johnson)

Market Models From least to most concentrated u u Pure Competition – No one can individually affect prices due to the number of buyers and sellers Monopolistic Competition – Brand names are used to differentiate similar products and manipulate supply and demand Oligopoly – A small number of big companies use price leadership or collusion to control supply and demand Monopoly – There is only one supplier who can set prices to provide maximum profit. – Legal (patents, copyrights) – Gov’t used to grant monopolies as favors in colonial times. – Natural – Cable, gas, electricity – Resource (like ALCOA – one company controls a raw material

Market Models From least to most concentrated u u Pure Competition – No one can individually affect prices due to the number of buyers and sellers Monopolistic Competition – Brand names are used to differentiate similar products and manipulate supply and demand Oligopoly – A small number of big companies use price leadership or collusion to control supply and demand Monopoly – There is only one supplier who can set prices to provide maximum profit. – Legal (patents, copyrights) – Gov’t used to grant monopolies as favors in colonial times. – Natural – Cable, gas, electricity – Resource (like ALCOA – one company controls a raw material

THE BUSINESS CYCLE u History – First described by David Ricardo (1817) as a cycle in the labor supply which led to variations in wages. The flucuations in the nation’s economic activity were seen as natural, and no one thought the government could or should do anything about them.

THE BUSINESS CYCLE u History – First described by David Ricardo (1817) as a cycle in the labor supply which led to variations in wages. The flucuations in the nation’s economic activity were seen as natural, and no one thought the government could or should do anything about them.

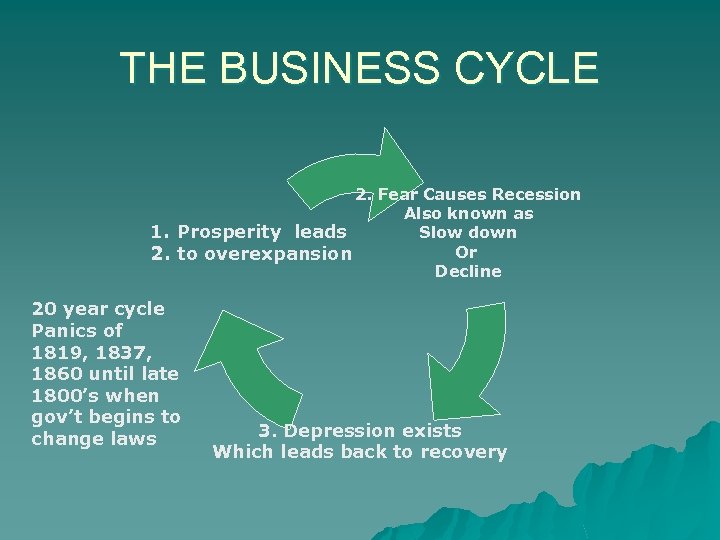

THE BUSINESS CYCLE 2. Fear Causes Recession Also known as 1. Prosperity leads Slow down Or 2. to overexpansion Decline 20 year cycle Panics of 1819, 1837, 1860 until late 1800’s when gov’t begins to change laws 3. Depression exists Which leads back to recovery

THE BUSINESS CYCLE 2. Fear Causes Recession Also known as 1. Prosperity leads Slow down Or 2. to overexpansion Decline 20 year cycle Panics of 1819, 1837, 1860 until late 1800’s when gov’t begins to change laws 3. Depression exists Which leads back to recovery

The role of Gov’t in the Business Cycle u Although most people thought the government didn’t do much to moderate the cycle, people noticed that some gov’t actions affected it: u For instance: – Embargo – 1800’s – War – Central bank issues (interest rates)

The role of Gov’t in the Business Cycle u Although most people thought the government didn’t do much to moderate the cycle, people noticed that some gov’t actions affected it: u For instance: – Embargo – 1800’s – War – Central bank issues (interest rates)

Federal Reserve System u The FRS (1913) was supposed to provide an elastic currency and prevent bank panics. It was not rich or powerful enough to cope with the Great Depression in 1929. People cried out for relief, but most politicians felt “rugged individualism” was best and did not think the federal government had the constitutional power to intervene.

Federal Reserve System u The FRS (1913) was supposed to provide an elastic currency and prevent bank panics. It was not rich or powerful enough to cope with the Great Depression in 1929. People cried out for relief, but most politicians felt “rugged individualism” was best and did not think the federal government had the constitutional power to intervene.

Federal Reserve System u John Maynard Keyes theorized before WWI that the government could alleviate or prevent depression by buying goods and services when the public demand was low and then taxing to pay of debts when prosperity returned. Roosevelt didn’t really understand economics but his pragmatic approach led him to try to find solutions we could call Keynesian. Until the 1970’s, most economists believed that Keynesian policy would prevent depression. Unfortunately politicians are reluctant to tax, so the deficit and national debt continue to expand.

Federal Reserve System u John Maynard Keyes theorized before WWI that the government could alleviate or prevent depression by buying goods and services when the public demand was low and then taxing to pay of debts when prosperity returned. Roosevelt didn’t really understand economics but his pragmatic approach led him to try to find solutions we could call Keynesian. Until the 1970’s, most economists believed that Keynesian policy would prevent depression. Unfortunately politicians are reluctant to tax, so the deficit and national debt continue to expand.

BANKS, BANKING , and the $ SUPPLY u Functions of banks – Deposits, withdrawals, checks, savings, safe-deposit boxes, foreign currency, money orders, traveler’s checks, trust services (money management and investments), loans to businesses and individuals u What is $ – Anything people will generally accept as payment for goods or services or debts. u Function of $ – Medium of exchange (can be earned and spent in many ways) – no coincidence of Wants is necessary – Standard of value (allows us to compare cost) – Store of value (can be saved for future use)

BANKS, BANKING , and the $ SUPPLY u Functions of banks – Deposits, withdrawals, checks, savings, safe-deposit boxes, foreign currency, money orders, traveler’s checks, trust services (money management and investments), loans to businesses and individuals u What is $ – Anything people will generally accept as payment for goods or services or debts. u Function of $ – Medium of exchange (can be earned and spent in many ways) – no coincidence of Wants is necessary – Standard of value (allows us to compare cost) – Store of value (can be saved for future use)

Monetary Standards u From the time of Washington’s Administration until 1900 the US used a bimetallic system to back its currency. The problem with that is that relative to gold the value of silver fluctuates. – Gresham’s Law – If 2 types of money exist people will horde the more valuable and spend the less valuable. – When the Gov't didn’t adjust rates properly gold would start to disappear.

Monetary Standards u From the time of Washington’s Administration until 1900 the US used a bimetallic system to back its currency. The problem with that is that relative to gold the value of silver fluctuates. – Gresham’s Law – If 2 types of money exist people will horde the more valuable and spend the less valuable. – When the Gov't didn’t adjust rates properly gold would start to disappear.

Monetary Standards u From 1900 - 1933 the US was on the gold standard. Then during the depression the US went on a modified gold standard. Only in certain circumstances could dollars be redeemed for specie (Hard $) Silver certificates were printed.

Monetary Standards u From 1900 - 1933 the US was on the gold standard. Then during the depression the US went on a modified gold standard. Only in certain circumstances could dollars be redeemed for specie (Hard $) Silver certificates were printed.

Monetary Standards u In 1971, due to our unfavorable balance of trade with oil exporting countries, the US went off the gold standard altogether. There is now a floating exchange rate internationally. This is based on the money market much like the stock market. Banks bid on currencies of other countries and the rate depends on supply and demand. If other nations want to buy American goods, the value of the $ rises.

Monetary Standards u In 1971, due to our unfavorable balance of trade with oil exporting countries, the US went off the gold standard altogether. There is now a floating exchange rate internationally. This is based on the money market much like the stock market. Banks bid on currencies of other countries and the rate depends on supply and demand. If other nations want to buy American goods, the value of the $ rises.

Monetary Standards u Today the US dollar is FIAT money. It is worth something b/c the government says you have to accept it for payment of debts (hence legal tender). You can not redeem it for precious metals, but you can buy valuable goods with it.

Monetary Standards u Today the US dollar is FIAT money. It is worth something b/c the government says you have to accept it for payment of debts (hence legal tender). You can not redeem it for precious metals, but you can buy valuable goods with it.

Inflation/Deflation u Inflation is characterized by rising prices. It occurs b/c costs have gone up or b/c demand has increased. u In the US we like a little inflation: It makes the GDP go up and brings job creation. Rapid inflation, however, can have drastic results.

Inflation/Deflation u Inflation is characterized by rising prices. It occurs b/c costs have gone up or b/c demand has increased. u In the US we like a little inflation: It makes the GDP go up and brings job creation. Rapid inflation, however, can have drastic results.

What to expect from Inflation 1. 2. Who benefits? Debtors (debts are easier to pay since wages are generally higher), professionals who can increase their charges or union workers who can force increases by striking, producers of necessary goods. Who is hurt? Lenders (who get back cheaper $), people on a fixed income and those who can not control their income, producers of luxury goods.

What to expect from Inflation 1. 2. Who benefits? Debtors (debts are easier to pay since wages are generally higher), professionals who can increase their charges or union workers who can force increases by striking, producers of necessary goods. Who is hurt? Lenders (who get back cheaper $), people on a fixed income and those who can not control their income, producers of luxury goods.

Functions of a Central Bank u u u A central bank is a national institution that supervises other banks in the country. The US had a 1 st and 2 nd BUS, then we did not have a central bank until the Federal Reserve System was created in 1913. The Federal Reserve Bank regulates the MONETARY POLICY of the US. It is a Bankers bank, which creates elastic currency (expands or shrinks the money supply) by buying or selling gov’t securities and raising or lowering the interest rate and the discount rate (for banks). During the Great Depression the FED wasn’t powerful enough to control member banks. After the creation of the FDIC the power of the FED to oversee banking practices was increased.

Functions of a Central Bank u u u A central bank is a national institution that supervises other banks in the country. The US had a 1 st and 2 nd BUS, then we did not have a central bank until the Federal Reserve System was created in 1913. The Federal Reserve Bank regulates the MONETARY POLICY of the US. It is a Bankers bank, which creates elastic currency (expands or shrinks the money supply) by buying or selling gov’t securities and raising or lowering the interest rate and the discount rate (for banks). During the Great Depression the FED wasn’t powerful enough to control member banks. After the creation of the FDIC the power of the FED to oversee banking practices was increased.

Roles of Banks in Financial Panics u Most of the “Panics” we deal with in US History were caused by OVERSPECULATION. This happens when entrepreneurs are optimistic about making profits and banks print more money (or create more credit) than they can back with available specie. When the government – or individuals – demanded payment in specie, the bank might have to delay payment until it could collect loans.

Roles of Banks in Financial Panics u Most of the “Panics” we deal with in US History were caused by OVERSPECULATION. This happens when entrepreneurs are optimistic about making profits and banks print more money (or create more credit) than they can back with available specie. When the government – or individuals – demanded payment in specie, the bank might have to delay payment until it could collect loans.

Roles of Banks in Financial Panics u When the public learned the bank “was in trouble” everyone “panicked” and a run on the bank occurred. Even if the outstanding loans were all good, lack of liquidity might force the bank to close its doors. u Bank deposits were not insured: when the bank failed depositors lost their money for good. (Posse to round up bank robbers. )

Roles of Banks in Financial Panics u When the public learned the bank “was in trouble” everyone “panicked” and a run on the bank occurred. Even if the outstanding loans were all good, lack of liquidity might force the bank to close its doors. u Bank deposits were not insured: when the bank failed depositors lost their money for good. (Posse to round up bank robbers. )

Roles of Banks in Financial Panics Andrew Jackson and others blamed the 2 nd BUS for the failure of wildcat banks but the BUS was protecting itself by demanding payment for specie for other banks’ notes after it received a lot of them in payment for public land or taxes. u The Specie Circular caused a panic when people realized that bank notes could not be used to speculate in public lands anymore. u Once there was no central bank speculation was easier, but overextension and panics continued. u

Roles of Banks in Financial Panics Andrew Jackson and others blamed the 2 nd BUS for the failure of wildcat banks but the BUS was protecting itself by demanding payment for specie for other banks’ notes after it received a lot of them in payment for public land or taxes. u The Specie Circular caused a panic when people realized that bank notes could not be used to speculate in public lands anymore. u Once there was no central bank speculation was easier, but overextension and panics continued. u

International Trade u The argument for Free Trade – Certain nations have an advantage (labor, raw materials, technology) in producing certain items. Why shouldn’t every nation produce what it can produce most efficiently and trade for other products? – Smith noted that the prudent household does not try to produce an item if it costs more than buying it.

International Trade u The argument for Free Trade – Certain nations have an advantage (labor, raw materials, technology) in producing certain items. Why shouldn’t every nation produce what it can produce most efficiently and trade for other products? – Smith noted that the prudent household does not try to produce an item if it costs more than buying it.

International Trade David Ricardo’s LAW OF COMPARITIVE ADVANTAGE, shows that every nation would have a higher standard of living if we all produced what we were best at producing and traded for items other countries could produce more efficiently. u Nations buy things from other nations that they need which allows us to spend our time doing what we do well. u

International Trade David Ricardo’s LAW OF COMPARITIVE ADVANTAGE, shows that every nation would have a higher standard of living if we all produced what we were best at producing and traded for items other countries could produce more efficiently. u Nations buy things from other nations that they need which allows us to spend our time doing what we do well. u

International Trade u u Why don’t we do this? – Political Considerations The argument for protectionism – (Without protectionism everyone’s standard of living goes up. ) – Military self-sufficiency – Protect jobs of workers in less efficient industries – Diversification for stability – Protect infant industries – Protect against Dumping – Keep US Standard of living from being threatened by cheap foreign labor.

International Trade u u Why don’t we do this? – Political Considerations The argument for protectionism – (Without protectionism everyone’s standard of living goes up. ) – Military self-sufficiency – Protect jobs of workers in less efficient industries – Diversification for stability – Protect infant industries – Protect against Dumping – Keep US Standard of living from being threatened by cheap foreign labor.

International Trade u Barriers to trade – High Tariffs – Currency controls – Administrative Red Tape – Quotas

International Trade u Barriers to trade – High Tariffs – Currency controls – Administrative Red Tape – Quotas

US TARIFF POLICY u 1. THESE WILL ALWAYS BE ON THE EXAM! Hamilton suggested that industry be built in the US with the help of Gov’t tariffs on competing products from foreign countries. Under BR mercantile policies, many industries had not been allowed to compete with BR interests.

US TARIFF POLICY u 1. THESE WILL ALWAYS BE ON THE EXAM! Hamilton suggested that industry be built in the US with the help of Gov’t tariffs on competing products from foreign countries. Under BR mercantile policies, many industries had not been allowed to compete with BR interests.

US TARIFF POLICY 2. During the War of 1812, domestic industry was stimulated. After the war, English manufacturers started “dumping” surpluses in AM to kill our new industries. u In 1816 a protective tariff was instituted.

US TARIFF POLICY 2. During the War of 1812, domestic industry was stimulated. After the war, English manufacturers started “dumping” surpluses in AM to kill our new industries. u In 1816 a protective tariff was instituted.

US TARIFF POLICY 3. The tariff became a sectional issue b/c other nations retaliated against US agricultural products with tariffs of their own. The farm areas felt they were paying a higher price for manufactured goods b/c of the US tariff and losing foreign markets b/c of retaliatory tariffs.

US TARIFF POLICY 3. The tariff became a sectional issue b/c other nations retaliated against US agricultural products with tariffs of their own. The farm areas felt they were paying a higher price for manufactured goods b/c of the US tariff and losing foreign markets b/c of retaliatory tariffs.

US TARIFF POLICY 4. After the Civil War, tariffs rose. They remained relatively high because people did not understand the economic repercussions. Consumers suffered from a lack of competition and from higher prices on domestic goods which the tariffs encouraged. The height of folly was: u The Hawley Smoot Tariff of 1930: It was supposed to help AM manufacturers and farmers, but it hurt them b/c if foreigners could not sell in the US they could not get dollars to buy US products.

US TARIFF POLICY 4. After the Civil War, tariffs rose. They remained relatively high because people did not understand the economic repercussions. Consumers suffered from a lack of competition and from higher prices on domestic goods which the tariffs encouraged. The height of folly was: u The Hawley Smoot Tariff of 1930: It was supposed to help AM manufacturers and farmers, but it hurt them b/c if foreigners could not sell in the US they could not get dollars to buy US products.

US TARIFF POLICY 5. In 1934, Congress passed the Reciprocal Trade Agreements Act allowing the President to negotiate mutually lower tariffs with other nations. u The idea of the “most favored nation” status was included. u Bilateral agreement were negotiated.

US TARIFF POLICY 5. In 1934, Congress passed the Reciprocal Trade Agreements Act allowing the President to negotiate mutually lower tariffs with other nations. u The idea of the “most favored nation” status was included. u Bilateral agreement were negotiated.

US TARIFF POLICY 6. At the End of WWII, 23 nations signed the General Agreement on Tariffs and Trade (GATT) in 1948. Since then there have been many rounds of multilateral negotiations to lower tariffs and stimulate world trade. u In 1995 the World Trade Organization was formed to protect patents, trademarks, and copyrights and to oversee trade agreements.

US TARIFF POLICY 6. At the End of WWII, 23 nations signed the General Agreement on Tariffs and Trade (GATT) in 1948. Since then there have been many rounds of multilateral negotiations to lower tariffs and stimulate world trade. u In 1995 the World Trade Organization was formed to protect patents, trademarks, and copyrights and to oversee trade agreements.

US TARIFF POLICY u Regional trade associations have been formed, beginning with the European Economic Community (Common Market) which is now known as the European Union. In 1994, NAFTA created the largest free trade zone in the world. Now CAFTA is on the books. Some people still object but public understanding of the arguments for free trade seems to be increasing.

US TARIFF POLICY u Regional trade associations have been formed, beginning with the European Economic Community (Common Market) which is now known as the European Union. In 1994, NAFTA created the largest free trade zone in the world. Now CAFTA is on the books. Some people still object but public understanding of the arguments for free trade seems to be increasing.

ITS OVER!! u THAT MADE MY BRAIN HURT SO. . . u YOU may want to review this over and over in small doses u

ITS OVER!! u THAT MADE MY BRAIN HURT SO. . . u YOU may want to review this over and over in small doses u