9dbad7525785c58c74a01ffc3037f1a5.ppt

- Количество слайдов: 23

April 23, 2008 Conference Call and Webinar “The Power of a Properly Designed Retirement Plan” Jim Allfrey, Director of 401(k) Administration, and Del Hargis, Director of Client Development at American Pension Services Mathew N. Sorensen, Attorney at Law Hosted By: Mark J. Kohler, CPA, Attorney at Law www. kkolawyers. com Telephone 435. 586. 9366 / Facsimile 435. 586. 9491 ©Kyler Kohler & Ostermiller, LLP 2008

Instructor Notes Disclaimer- Although the information contained in this Presentation may be extremely useful and helpful, please understand that the presentation of this information does not constitute an attorney-client relationship. Moreover, the information contained in this Presentation is for general guidance only. It is strongly recommended that each individual or entity obtain their own legal advice, particularly applied to their own set of circumstances, facts and specific situation. Kyler Kohler & Ostermiller, LLP is not responsible or liable for any advice that is taken and applied in a situation without direct consultation and representation specific to that individual’s or company’s needs. © Kyler Kohler & Ostermiller, LLP 2008

Advantages of a Properly Designed RP 1 - Tax deductions 2 - Investments grow tax-deferred or tax-free 3 - Provide asset protection 4 - Distribute wealth to heirs 5 - Achieve financial freedom © Kyler Kohler & Ostermiller, LLP 2008

Top 10 RP Mistakes 10 - Not having a RP 9 - Not starting early 8 - Not fully contributing to your RP © Kyler Kohler & Ostermiller, LLP 2008

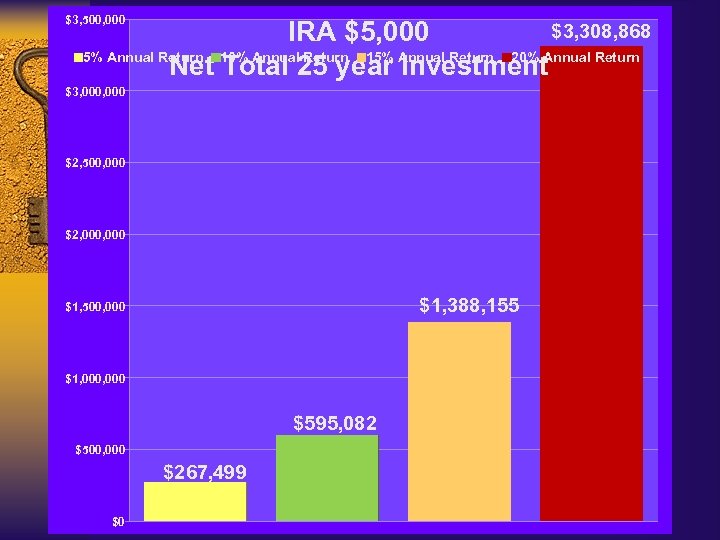

$3, 500, 000 $3, 308, 868 IRA $5, 000 5% Annual Return 10% Annual Return 15% Annual Return 20% Annual Return Net Total 25 year Investment $3, 000 $2, 500, 000 $2, 000 $1, 388, 155 $1, 500, 000 $1, 000 $595, 082 $500, 000 $267, 499 $0

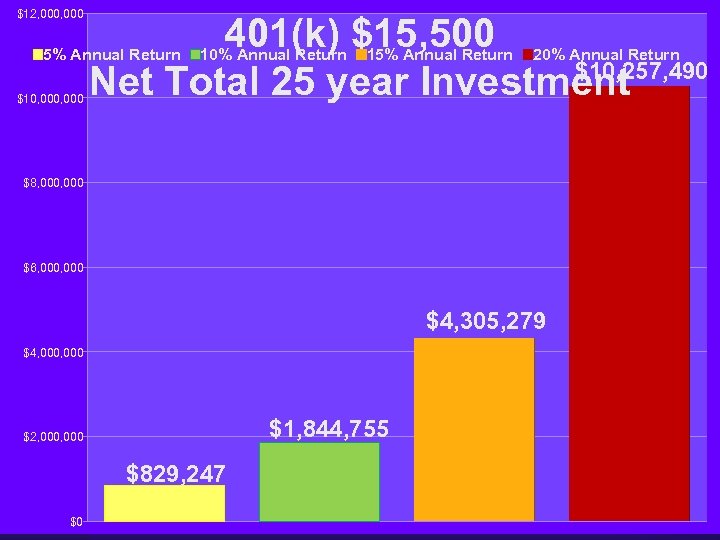

$12, 000 401(k) $15, 500 $10, 257, 490 Net Total 25 year Investment 5% Annual Return $10, 000 10% Annual Return 15% Annual Return 20% Annual Return $8, 000 $6, 000 $4, 305, 279 $4, 000 $1, 844, 755 $2, 000 $829, 247 $0

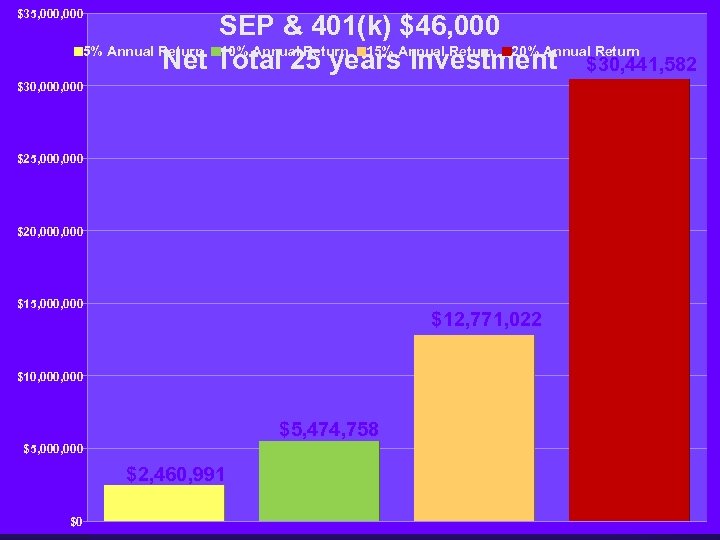

$35, 000 SEP & 401(k) $46, 000 5% Annual Return 10% Annual Return 15% Annual Return 20% Annual Return Net Total 25 years Investment $30, 441, 582 $30, 000 $25, 000 $20, 000 $15, 000 $12, 771, 022 $10, 000 $5, 474, 758 $5, 000 $2, 460, 991 $0

Top 10 RP Mistakes 10 - Not having a RP 9 - Not starting early 8 - Not fully contributing to your RP 7 - Not listing beneficiaries individually 6 - Making poor investment choices 5 - Taking un-advised loans 4 - Not rolling over RP properly 3 - Not understanding the hidden fees © Kyler Kohler & Ostermiller, LLP 2008

Hidden Costs in Mutual Funds 1. Investments in an Annuity? • Annuity charge (1. 25% of funds) 2. All Mutual Funds have expenses! • Annual operating expenses • 12(b)1 fees (up to 2%) 3. Other expenses may include… • Front end loads • Contingent deferred sales charges • Redemption fees. © Kyler Kohler & Ostermiller, LLP 2008

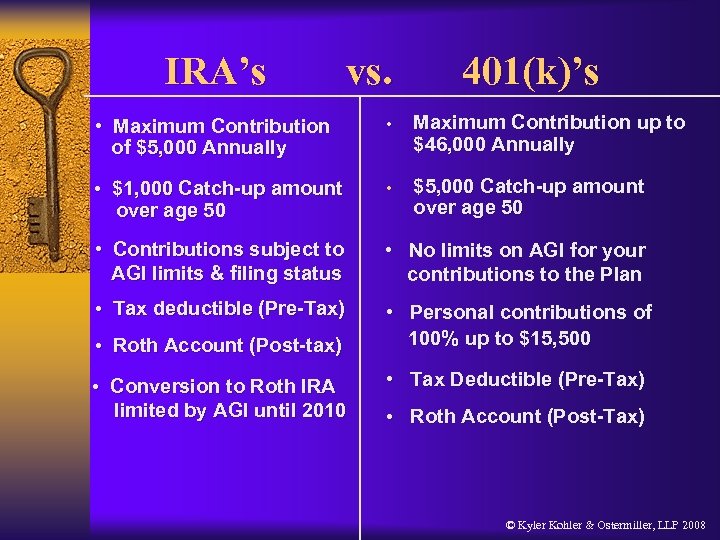

IRA’s vs. 401(k)’s • Maximum Contribution of $5, 000 Annually • Maximum Contribution up to $46, 000 Annually • $1, 000 Catch-up amount over age 50 • $5, 000 Catch-up amount over age 50 • Contributions subject to AGI limits & filing status • No limits on AGI for your contributions to the Plan • Tax deductible (Pre-Tax) • Personal contributions of 100% up to $15, 500 • Roth Account (Post-tax) • Conversion to Roth IRA limited by AGI until 2010 • Tax Deductible (Pre-Tax) • Roth Account (Post-Tax) © Kyler Kohler & Ostermiller, LLP 2008

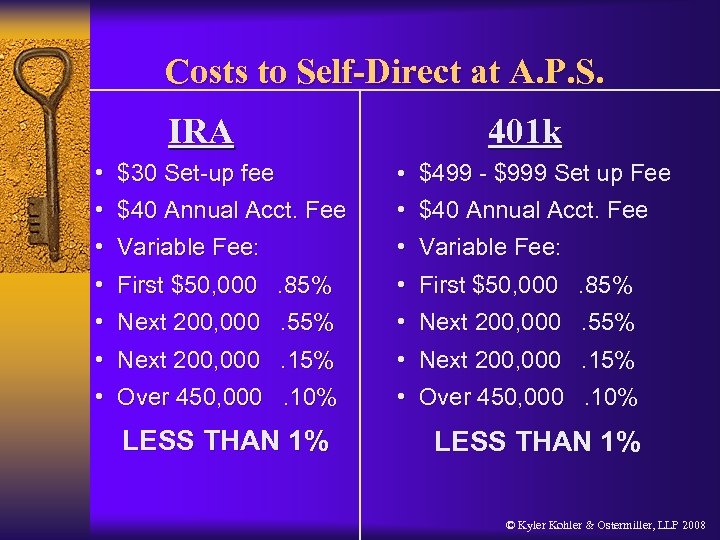

Costs to Self-Direct at A. P. S. IRA 401 k • $30 Set-up fee • $40 Annual Acct. Fee • Variable Fee: • $499 - $999 Set up Fee • $40 Annual Acct. Fee • Variable Fee: • First $50, 000 • Next 200, 000 . 85%. 55%. 15% • Over 450, 000. 10% LESS THAN 1% © Kyler Kohler & Ostermiller, LLP 2008

APS Contact Info American Pension Services, Inc. 4168 West 12600 South Riverton, UT 84065 (801) 571 -0667 www. aps-utah. com © Kyler Kohler & Ostermiller, LLP 2008

Do’s and Don’ts of Structuring Your Self Directed Retirement Plan (“SDRP”) Investments © Kyler Kohler & Ostermiller, LLP 2008

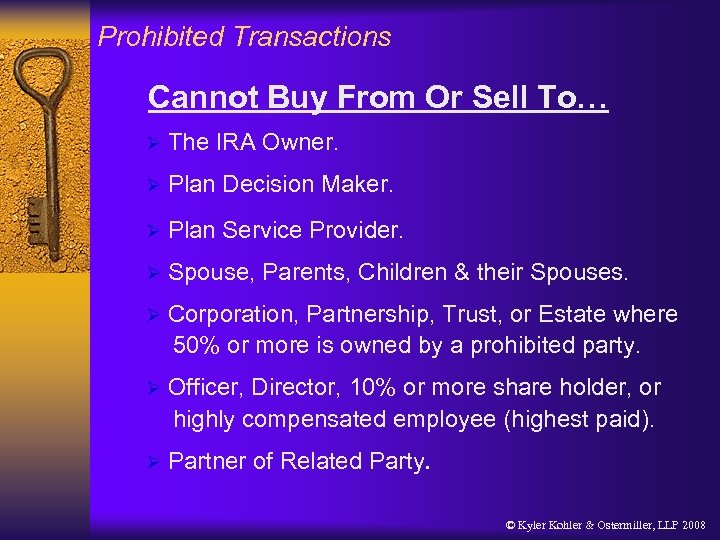

Prohibited Transactions Cannot Buy From Or Sell To… Ø The IRA Owner. Ø Plan Decision Maker. Ø Plan Service Provider. Ø Spouse, Parents, Children & their Spouses. Ø Corporation, Partnership, Trust, or Estate where 50% or more is owned by a prohibited party. Ø Officer, Director, 10% or more share holder, or highly compensated employee (highest paid). Ø Partner of Related Party. © Kyler Kohler & Ostermiller, LLP 2008

Wiggle Room Ø The IRS allows your IRA to sell to and buy from brothers, sisters, aunts, uncles, cousins, nieces, nephews, and step Relatives. Ø IRS Ruling 2004 -8: In a Roth IRA, brother and sister are considered a Prohibited Party, so you cannot sell to or buy from them in your Roth IRA. © Kyler Kohler & Ostermiller, LLP 2008

Rules are specific to real estate Real Estate is the “Key” Must be Real Estate Operating Company if the Retirement Plan and IRA Owner own more than 25% of the LLC/LP. See 29 CFR Section 2510. 3101. Ø Ø Cannot have 100% control of LLC/LP. If not Real Estate or you want to take a salary for managing the company, your SDRPs and Prohibited Parties Cannot own 50% or more of the company. Ø © Kyler Kohler & Ostermiller, LLP 2008

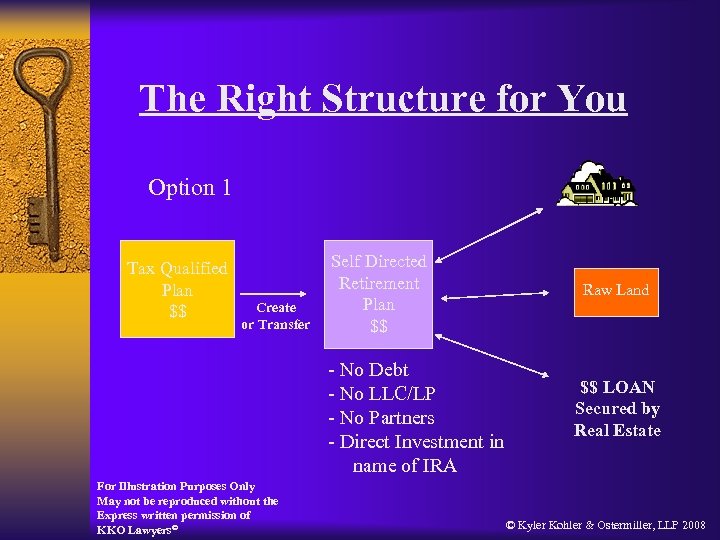

The Right Structure for You Option 1 Tax Qualified Plan $$ Create or Transfer Self Directed Retirement Plan $$ - No Debt - No LLC/LP - No Partners - Direct Investment in name of IRA For Illustration Purposes Only May not be reproduced without the Express written permission of KKO Lawyers© Raw Land $$ LOAN Secured by Real Estate © Kyler Kohler & Ostermiller, LLP 2008

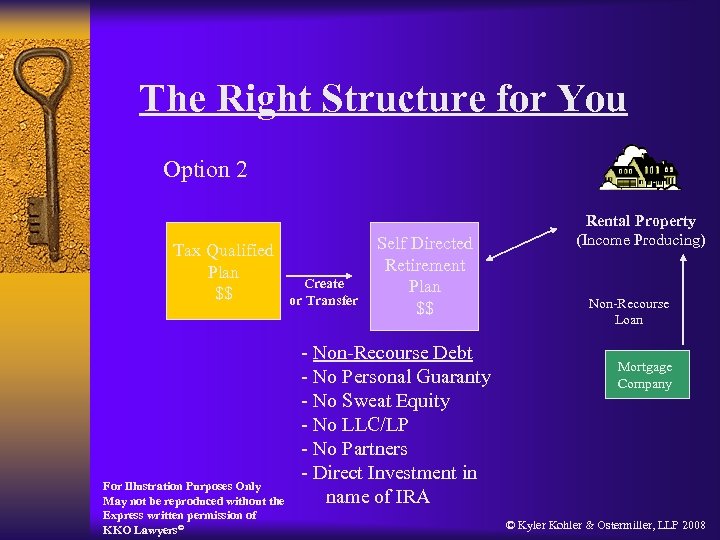

The Right Structure for You Option 2 Tax Qualified Plan $$ For Illustration Purposes Only May not be reproduced without the Express written permission of KKO Lawyers© Create or Transfer Self Directed Retirement Plan $$ - Non-Recourse Debt - No Personal Guaranty - No Sweat Equity - No LLC/LP - No Partners - Direct Investment in name of IRA Rental Property (Income Producing) Non-Recourse Loan Mortgage Company © Kyler Kohler & Ostermiller, LLP 2008

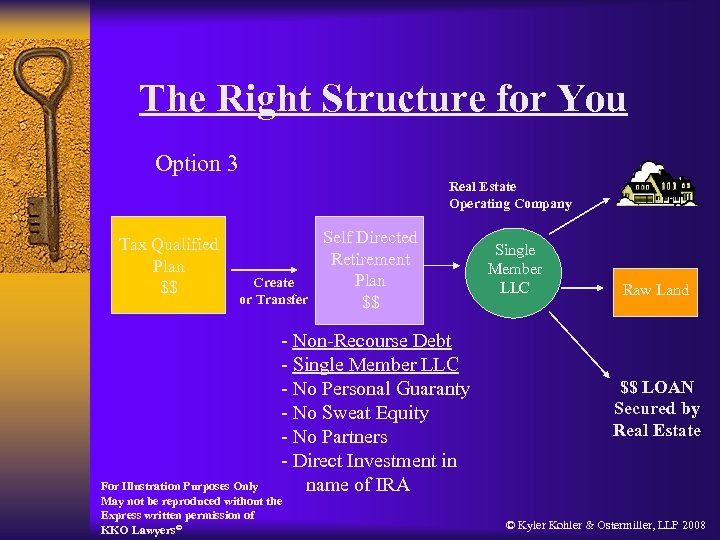

The Right Structure for You Option 3 Real Estate Operating Company Tax Qualified Plan $$ Create or Transfer Self Directed Retirement Plan $$ - Non-Recourse Debt - Single Member LLC - No Personal Guaranty - No Sweat Equity - No Partners - Direct Investment in name of IRA For Illustration Purposes Only May not be reproduced without the Express written permission of KKO Lawyers© Single Member LLC Raw Land $$ LOAN Secured by Real Estate © Kyler Kohler & Ostermiller, LLP 2008

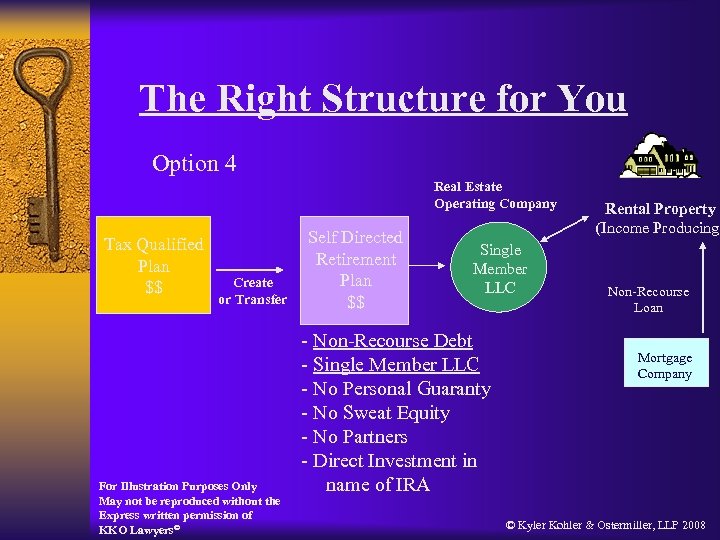

The Right Structure for You Option 4 Real Estate Operating Company Tax Qualified Plan $$ Create or Transfer For Illustration Purposes Only May not be reproduced without the Express written permission of KKO Lawyers© Self Directed Retirement Plan $$ Single Member LLC - Non-Recourse Debt - Single Member LLC - No Personal Guaranty - No Sweat Equity - No Partners - Direct Investment in name of IRA Rental Property (Income Producing) Non-Recourse Loan Mortgage Company © Kyler Kohler & Ostermiller, LLP 2008

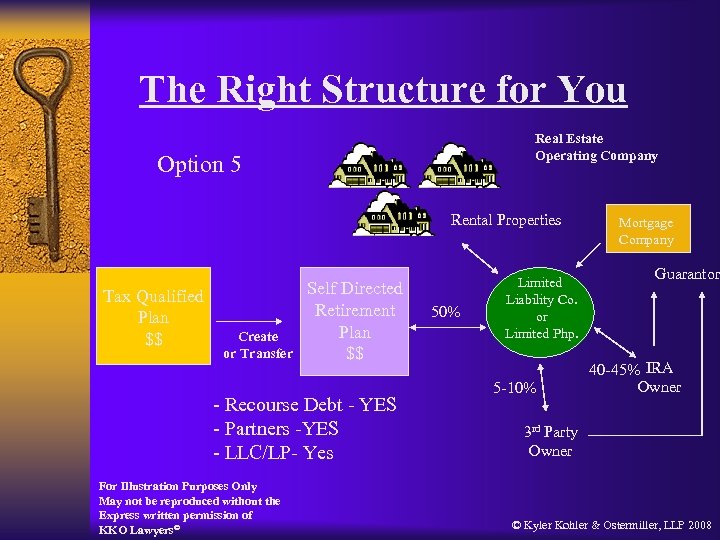

The Right Structure for You Real Estate Operating Company Option 5 Rental Properties Tax Qualified Plan $$ Create or Transfer Self Directed Retirement Plan $$ - Recourse Debt - YES - Partners -YES - LLC/LP- Yes For Illustration Purposes Only May not be reproduced without the Express written permission of KKO Lawyers© 50% Limited Liability Co. or Limited Php. 5 -10% Mortgage Company Guarantor 40 -45% IRA Owner 3 rd Party Owner © Kyler Kohler & Ostermiller, LLP 2008

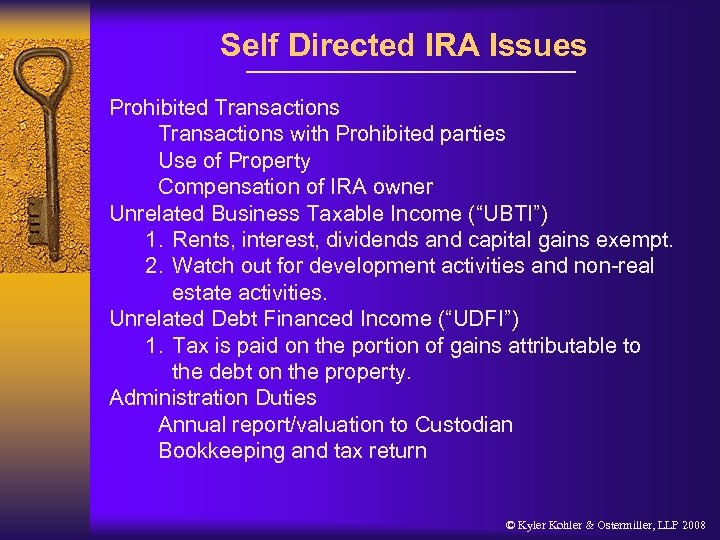

Self Directed IRA Issues Prohibited Transactions with Prohibited parties Use of Property Compensation of IRA owner Unrelated Business Taxable Income (“UBTI”) 1. Rents, interest, dividends and capital gains exempt. 2. Watch out for development activities and non-real estate activities. Unrelated Debt Financed Income (“UDFI”) 1. Tax is paid on the portion of gains attributable to the debt on the property. Administration Duties Annual report/valuation to Custodian Bookkeeping and tax return © Kyler Kohler & Ostermiller, LLP 2008

THANK YOU!! For more information, please contact us at: KYLER KOHLER & OSTERMILLER, LLP Tel: 435. 586. 9366 Fax: 435. 586. 9491 www. kkolawyers. com © Kyler Kohler & Ostermiller, LLP 2008

9dbad7525785c58c74a01ffc3037f1a5.ppt