71278d6e0dcde5496825751e54d78acc.ppt

- Количество слайдов: 12

Appropriate Product Design and Delivery

Appropriate Product Design and Delivery

Principle in Practice Providers take adequate care to design products, delivery channels and select partners in such a way that they do not cause clients harm. Products and delivery channels are designed, and partners selected with client characteristics taken into account. Consider this: Appropriate products and services not only provide access to clients, but they also create value for clients.

Principle in Practice Providers take adequate care to design products, delivery channels and select partners in such a way that they do not cause clients harm. Products and delivery channels are designed, and partners selected with client characteristics taken into account. Consider this: Appropriate products and services not only provide access to clients, but they also create value for clients.

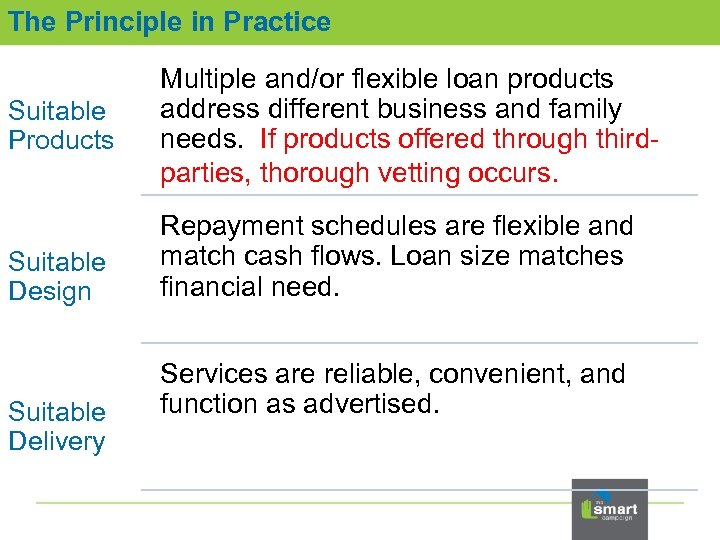

The Principle in Practice Suitable Products Suitable Design Suitable Delivery Multiple and/or flexible loan products address different business and family needs. If products offered through thirdparties, thorough vetting occurs. Repayment schedules are flexible and match cash flows. Loan size matches financial need. Services are reliable, convenient, and function as advertised.

The Principle in Practice Suitable Products Suitable Design Suitable Delivery Multiple and/or flexible loan products address different business and family needs. If products offered through thirdparties, thorough vetting occurs. Repayment schedules are flexible and match cash flows. Loan size matches financial need. Services are reliable, convenient, and function as advertised.

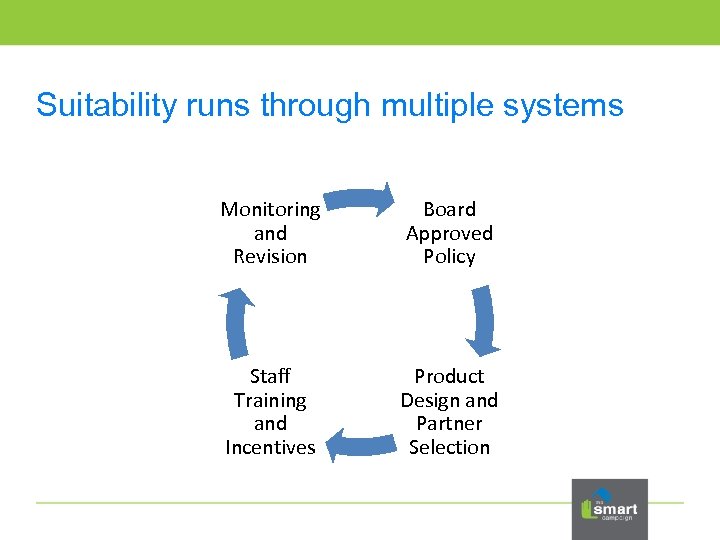

Suitability runs through multiple systems Monitoring and Revision Board Approved Policy Staff Training and Incentives Product Design and Partner Selection

Suitability runs through multiple systems Monitoring and Revision Board Approved Policy Staff Training and Incentives Product Design and Partner Selection

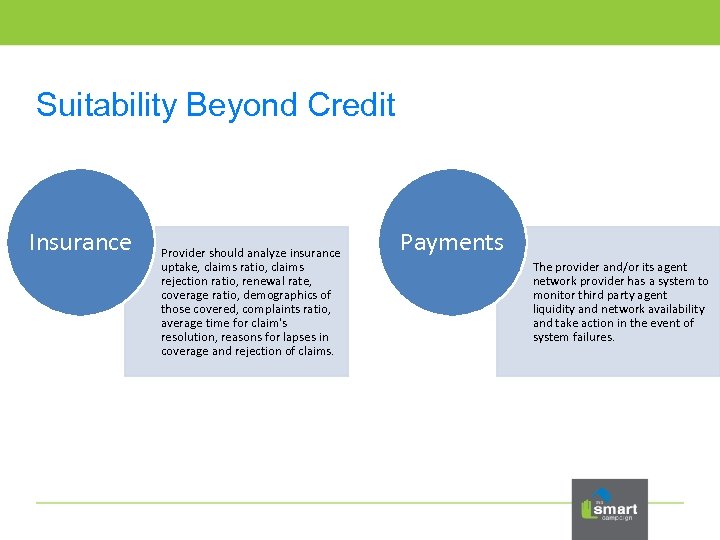

Suitability Beyond Credit Insurance Provider should analyze insurance uptake, claims ratio, claims rejection ratio, renewal rate, coverage ratio, demographics of those covered, complaints ratio, average time for claim's resolution, reasons for lapses in coverage and rejection of claims. Payments The provider and/or its agent network provider has a system to monitor third party agent liquidity and network availability and take action in the event of system failures.

Suitability Beyond Credit Insurance Provider should analyze insurance uptake, claims ratio, claims rejection ratio, renewal rate, coverage ratio, demographics of those covered, complaints ratio, average time for claim's resolution, reasons for lapses in coverage and rejection of claims. Payments The provider and/or its agent network provider has a system to monitor third party agent liquidity and network availability and take action in the event of system failures.

![Aggressive Sales “[The woman from the bank] kept following me everywhere. I was working, Aggressive Sales “[The woman from the bank] kept following me everywhere. I was working,](https://present5.com/presentation/71278d6e0dcde5496825751e54d78acc/image-6.jpg) Aggressive Sales “[The woman from the bank] kept following me everywhere. I was working, and she kept coming to my house offering me a credit card that I didn’t want. She kept asking for my number for activating the credit card. At the end, I was very tempted because my daughter was turning 15, and I wanted to [throw a party]. ” Female, Peri. Urban Peru

Aggressive Sales “[The woman from the bank] kept following me everywhere. I was working, and she kept coming to my house offering me a credit card that I didn’t want. She kept asking for my number for activating the credit card. At the end, I was very tempted because my daughter was turning 15, and I wanted to [throw a party]. ” Female, Peri. Urban Peru

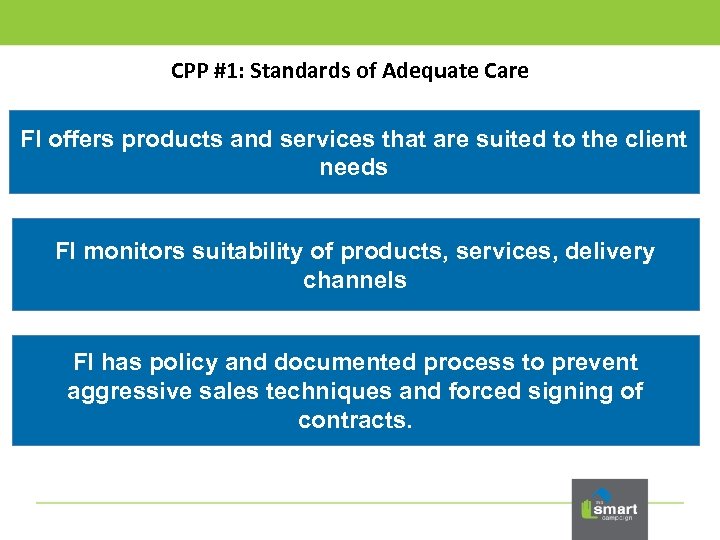

CPP #1: Standards of Adequate Care FI offers products and services that are suited to the client needs FI monitors suitability of products, services, delivery channels FI has policy and documented process to prevent aggressive sales techniques and forced signing of contracts.

CPP #1: Standards of Adequate Care FI offers products and services that are suited to the client needs FI monitors suitability of products, services, delivery channels FI has policy and documented process to prevent aggressive sales techniques and forced signing of contracts.

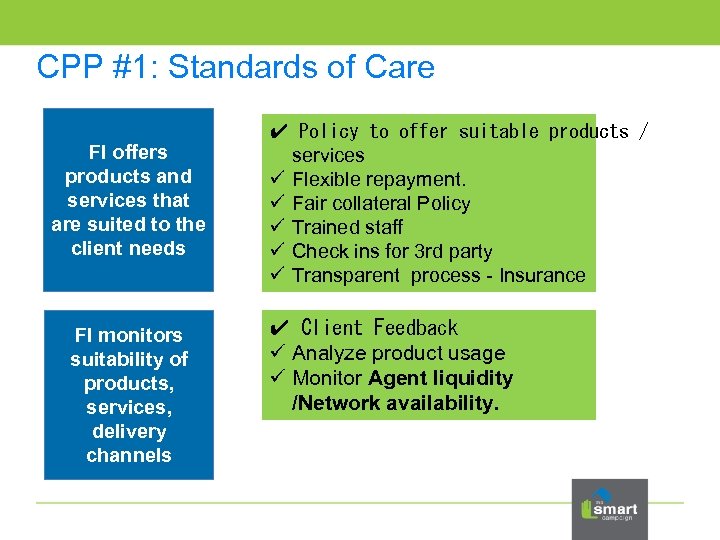

CPP #1: Standards of Care FI offers products and services that are suited to the client needs FI monitors suitability of products, services, delivery channels ✔ Policy to offer suitable products / services ü Flexible repayment. ü Fair collateral Policy ü Trained staff ü Check ins for 3 rd party ü Transparent process - Insurance ✔ Client Feedback ü Analyze product usage ü Monitor Agent liquidity /Network availability.

CPP #1: Standards of Care FI offers products and services that are suited to the client needs FI monitors suitability of products, services, delivery channels ✔ Policy to offer suitable products / services ü Flexible repayment. ü Fair collateral Policy ü Trained staff ü Check ins for 3 rd party ü Transparent process - Insurance ✔ Client Feedback ü Analyze product usage ü Monitor Agent liquidity /Network availability.

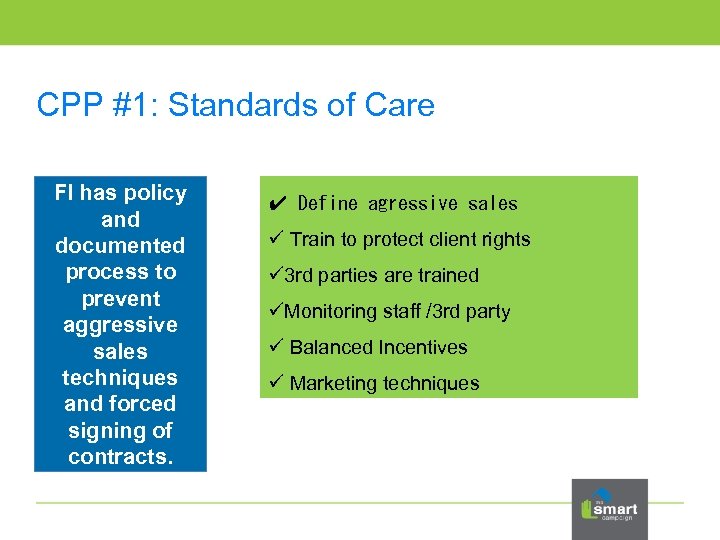

CPP #1: Standards of Care FI has policy and documented process to prevent aggressive sales techniques and forced signing of contracts. ✔ Define agressive sales ü Train to protect client rights ü 3 rd parties are trained üMonitoring staff /3 rd party ü Balanced Incentives ü Marketing techniques

CPP #1: Standards of Care FI has policy and documented process to prevent aggressive sales techniques and forced signing of contracts. ✔ Define agressive sales ü Train to protect client rights ü 3 rd parties are trained üMonitoring staff /3 rd party ü Balanced Incentives ü Marketing techniques

Tools available from the Smart Campaign Samples and Case Studies Also see SPTF Library Micro. Save’s Market Research toolkits

Tools available from the Smart Campaign Samples and Case Studies Also see SPTF Library Micro. Save’s Market Research toolkits

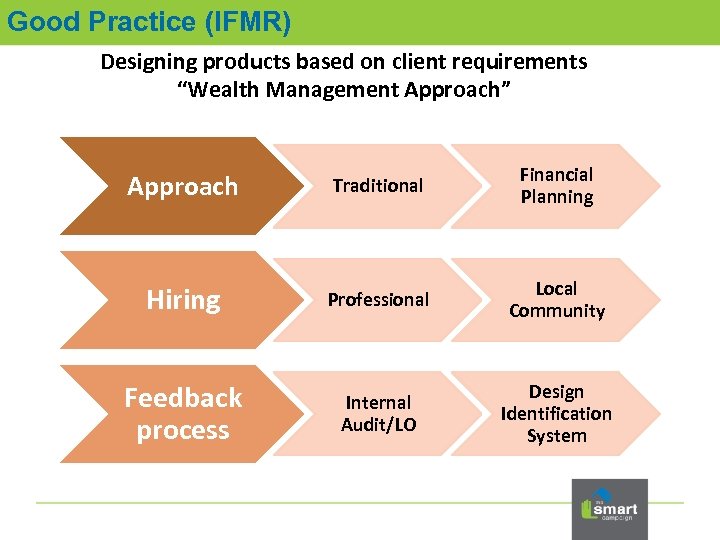

Good Practice (IFMR) Designing products based on client requirements “Wealth Management Approach” Approach Traditional Financial Planning Hiring Professional Local Community Feedback process Internal Audit/LO Design Identification System

Good Practice (IFMR) Designing products based on client requirements “Wealth Management Approach” Approach Traditional Financial Planning Hiring Professional Local Community Feedback process Internal Audit/LO Design Identification System

Key Messages • • • App prod design is relevant in CP because FIs often deal with inexperienced clients that do not necessarily have the knowledge/experience to determine if the product provides good value for the money. Product suitability must be incorporated at all levels of an FI from board policies to staff training MFIs that listens and learns from their client are more likely to succeed than who imitates others product/services in the market. Moderate sales techniques should be used to deliver products/services. Aggressive sales must be defined. Third parties must be vetted with client in mind

Key Messages • • • App prod design is relevant in CP because FIs often deal with inexperienced clients that do not necessarily have the knowledge/experience to determine if the product provides good value for the money. Product suitability must be incorporated at all levels of an FI from board policies to staff training MFIs that listens and learns from their client are more likely to succeed than who imitates others product/services in the market. Moderate sales techniques should be used to deliver products/services. Aggressive sales must be defined. Third parties must be vetted with client in mind