ddd4dc18fcbcd7bb6aba58e2c63a3075.ppt

- Количество слайдов: 36

APPLYING SUPPLY AND DEMAND International Trade

APPLYING SUPPLY AND DEMAND International Trade

Major Issues • • Why trade with other nations (regions)? Recognizing comparative advantage Benefits and costs Effects of tariffs, quotas, and other impediments to trade

Major Issues • • Why trade with other nations (regions)? Recognizing comparative advantage Benefits and costs Effects of tariffs, quotas, and other impediments to trade

Why Trade? • Take advantage of specialization and division of labor • Not much controversy among economists over the benefits of free trade in the long run. Consider the U. S or the European Union. • Controversy arises about moving to freer trade or more restrictions on trade because there are winners and losers.

Why Trade? • Take advantage of specialization and division of labor • Not much controversy among economists over the benefits of free trade in the long run. Consider the U. S or the European Union. • Controversy arises about moving to freer trade or more restrictions on trade because there are winners and losers.

The Principle of Comparative Advantage • Comparative Advantage describes the comparison among producers of a good according to their opportunity cost. The producer who has the smaller opportunity cost of producing a good is said to have a comparative advantage in producing that good.

The Principle of Comparative Advantage • Comparative Advantage describes the comparison among producers of a good according to their opportunity cost. The producer who has the smaller opportunity cost of producing a good is said to have a comparative advantage in producing that good.

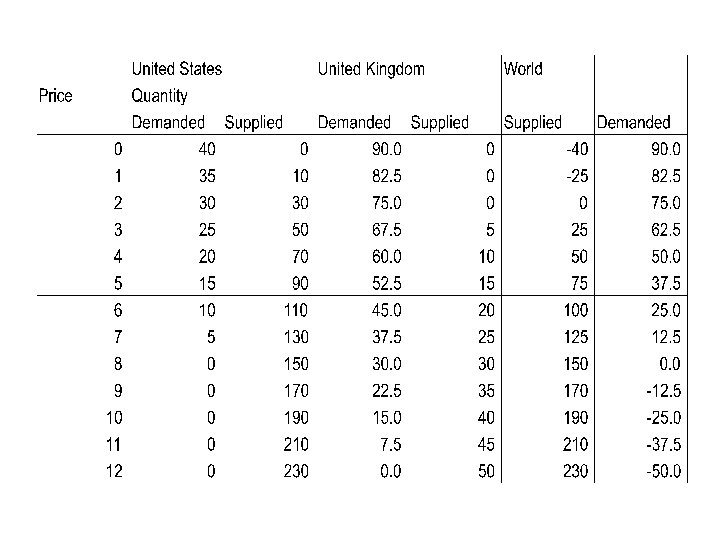

A Classic Case: The Corn Laws • United Kingdom passed a law in 1815 banning the importation of grain (corn) from North America. • The law was repealed in 1846. In effect. Britain and the U. S went from autarky to free trade in the grain markets. We will look at the effects of this change in the wheat market.

A Classic Case: The Corn Laws • United Kingdom passed a law in 1815 banning the importation of grain (corn) from North America. • The law was repealed in 1846. In effect. Britain and the U. S went from autarky to free trade in the grain markets. We will look at the effects of this change in the wheat market.

Determinants of International Trade • The effects of international trade are shown as the difference between the domestic price of a good without trade and the world price of a good. • A country will either be an exporter of the good or an importer of the good.

Determinants of International Trade • The effects of international trade are shown as the difference between the domestic price of a good without trade and the world price of a good. • A country will either be an exporter of the good or an importer of the good.

Equilibrium without Trade (Autarky) Assume: – A country that is isolated from rest of the world and produces wheat. – The market for wheat consists of the buyers and sellers of the country. – Domestic Price adjusts to balance Demand Supply.

Equilibrium without Trade (Autarky) Assume: – A country that is isolated from rest of the world and produces wheat. – The market for wheat consists of the buyers and sellers of the country. – Domestic Price adjusts to balance Demand Supply.

Equilibrium Without Trade • When an economy cannot trade in world markets, the price adjusts to equilibrate domestic supply and demand.

Equilibrium Without Trade • When an economy cannot trade in world markets, the price adjusts to equilibrate domestic supply and demand.

Impacts of International Trade, example • If the country decides to engage in international trade will it be an importer or exporter of wheat? • Who will gain from free trade in wheat and who would lose? • Would gains from trade exceed losses? • Start by comparing market prices. . .

Impacts of International Trade, example • If the country decides to engage in international trade will it be an importer or exporter of wheat? • Who will gain from free trade in wheat and who would lose? • Would gains from trade exceed losses? • Start by comparing market prices. . .

Determinants of International Trade • If a country has a comparative advantage, then the domestic price will be below the world price and the country will be an exporter of the good. • If the rest of the world has a comparative advantage, then the domestic price will be higher than the world price and the country will be an importer of the good.

Determinants of International Trade • If a country has a comparative advantage, then the domestic price will be below the world price and the country will be an exporter of the good. • If the rest of the world has a comparative advantage, then the domestic price will be higher than the world price and the country will be an importer of the good.

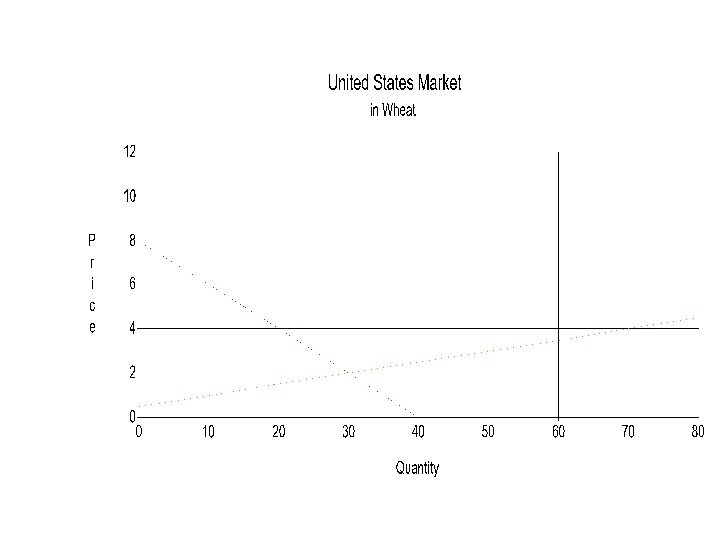

International Trade Example Exporter • If the U. K. price of wheat is higher than the U. S. price, the U. S. would be an exporter of wheat, when trade is permitted. • U. S. producers of wheat will want to sell their wheat at the higher price, hence output would increase and domestic price would rise.

International Trade Example Exporter • If the U. K. price of wheat is higher than the U. S. price, the U. S. would be an exporter of wheat, when trade is permitted. • U. S. producers of wheat will want to sell their wheat at the higher price, hence output would increase and domestic price would rise.

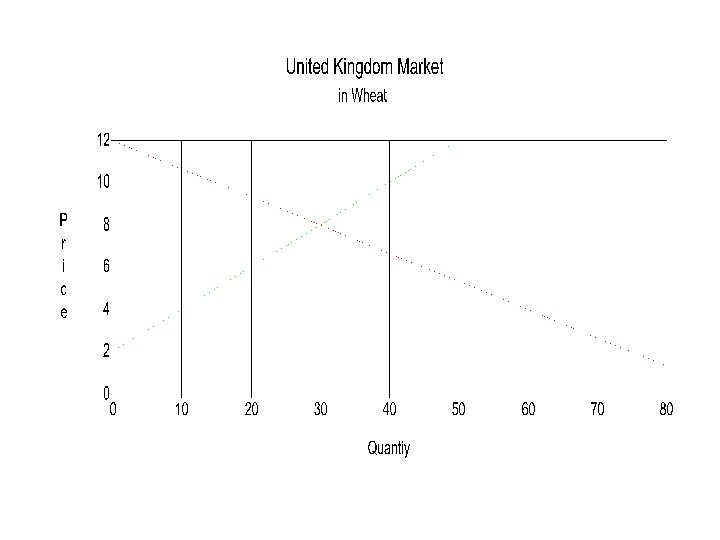

International Trade Example Importer • Since the U. S. price of wheat is lower than the U. K. price, the U. K would be an importer of wheat, when trade is permitted. – U. K consumers will want to buy the lower priced wheat at the world price. • U. K producers of wheat will have to lower their output until the supply price is equal to the world price.

International Trade Example Importer • Since the U. S. price of wheat is lower than the U. K. price, the U. K would be an importer of wheat, when trade is permitted. – U. K consumers will want to buy the lower priced wheat at the world price. • U. K producers of wheat will have to lower their output until the supply price is equal to the world price.

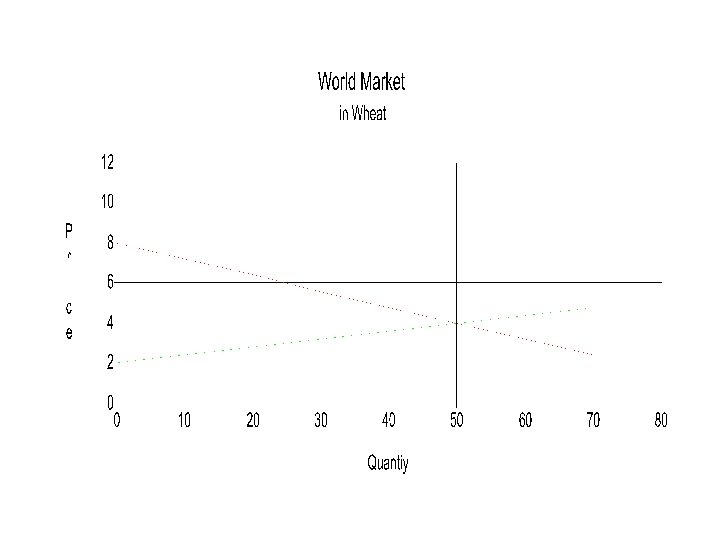

Equilibrium with Free Trade • In our example, the world demand consists of U. K demand for imports and U. S. supply of exports. Equilibrium price is the one at which both are equal.

Equilibrium with Free Trade • In our example, the world demand consists of U. K demand for imports and U. S. supply of exports. Equilibrium price is the one at which both are equal.

Winners and Losers From Free International Trade • When a country allows trade and becomes an exporter of a good, domestic producers of the good are better off. They receive a higher price. • However, domestic consumers of the good are worse off. They pay a higher price.

Winners and Losers From Free International Trade • When a country allows trade and becomes an exporter of a good, domestic producers of the good are better off. They receive a higher price. • However, domestic consumers of the good are worse off. They pay a higher price.

Winners and Losers From Free International Trade • When a country allows trade and becomes an importer of a good, domestic consumers of the good are better off. They pay a lower price. • However, domestic producers of the good are worse off. They receive a lower price.

Winners and Losers From Free International Trade • When a country allows trade and becomes an importer of a good, domestic consumers of the good are better off. They pay a lower price. • However, domestic producers of the good are worse off. They receive a lower price.

Winners and Losers From Free International Trade • Trade raises the economic well-being of the nation. • The net change in total surplus is positive. • The total surplus is the sum of the consumer surplus and the producer surplus. How do we figure out the total surplus?

Winners and Losers From Free International Trade • Trade raises the economic well-being of the nation. • The net change in total surplus is positive. • The total surplus is the sum of the consumer surplus and the producer surplus. How do we figure out the total surplus?

Consumer Surplus • The consumer surplus from purchase of a unit of an item is the difference between what the unit is worth to the consumer and the price the consumer has to pay for the unit. If I buy a car for $5, 000 but its value to me is $7, 000 then my surplus is $2, 000. More generally if the tenth unit of wheat is worth $6 but the price is $2, then the consumer’s surplus for that unit is $4.

Consumer Surplus • The consumer surplus from purchase of a unit of an item is the difference between what the unit is worth to the consumer and the price the consumer has to pay for the unit. If I buy a car for $5, 000 but its value to me is $7, 000 then my surplus is $2, 000. More generally if the tenth unit of wheat is worth $6 but the price is $2, then the consumer’s surplus for that unit is $4.

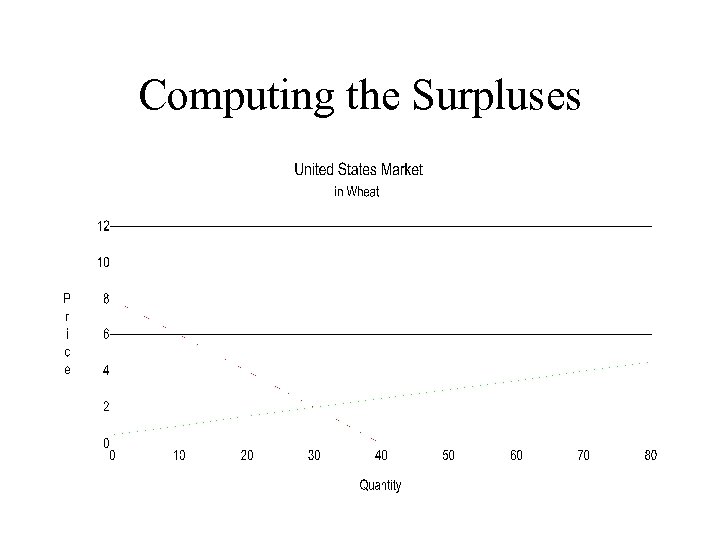

Computing Consumer Surplus • When looking at the market demand, consumer surplus is the distance between the demand curve and the price line. In order, to compute the consumer surplus accruing from all units at the current price, we compute the area under the demand curve and above the price line. In our graph, (8 -2)x 30/2 = $90

Computing Consumer Surplus • When looking at the market demand, consumer surplus is the distance between the demand curve and the price line. In order, to compute the consumer surplus accruing from all units at the current price, we compute the area under the demand curve and above the price line. In our graph, (8 -2)x 30/2 = $90

Computing the Surpluses

Computing the Surpluses

Producer Surplus • The producer surplus from sale of a unit of an item is the difference between the price received for the unit and the opportunity cost of the unit. If I sell a car for $5, 000 but its value to me is $4, 000 then my surplus is $1, 000. More generally, if the opportunity cost of the tenth unit of wheat is $1 but the price is $2, then the producer’s surplus for that unit is $1.

Producer Surplus • The producer surplus from sale of a unit of an item is the difference between the price received for the unit and the opportunity cost of the unit. If I sell a car for $5, 000 but its value to me is $4, 000 then my surplus is $1, 000. More generally, if the opportunity cost of the tenth unit of wheat is $1 but the price is $2, then the producer’s surplus for that unit is $1.

Computing Producer Surplus • When looking at the market demand, producer surplus is the distance between the supply curve and the price line. In order, to compute the producer surplus accruing from all units at the current price, we compute the area above the supply curve and below the price line. In our graph, (2. 5)x 30/2 = $22. 5

Computing Producer Surplus • When looking at the market demand, producer surplus is the distance between the supply curve and the price line. In order, to compute the producer surplus accruing from all units at the current price, we compute the area above the supply curve and below the price line. In our graph, (2. 5)x 30/2 = $22. 5

Gains from Free Trade in the U. S • The total surplus under autarky is the $90 + $22. 5 = $112. 5, that is the sum of consumer and producer surpluses. • Under free trade, with a price of $4 and quantity consumed of 20, consumer surplus is (8 -4)x 20/2=$40. The quantity supplied is 70 and producer surplus is (4. 5)x 70/2=$122. 5. Therefore, the total surplus under free trade is $162. 5 • The net change in the U. S. is $162. 5 -$112. 5=$50

Gains from Free Trade in the U. S • The total surplus under autarky is the $90 + $22. 5 = $112. 5, that is the sum of consumer and producer surpluses. • Under free trade, with a price of $4 and quantity consumed of 20, consumer surplus is (8 -4)x 20/2=$40. The quantity supplied is 70 and producer surplus is (4. 5)x 70/2=$122. 5. Therefore, the total surplus under free trade is $162. 5 • The net change in the U. S. is $162. 5 -$112. 5=$50

Gains from Free Trade in U. K. • At a price of $8 per unit, consumer surplus is (12 -8)x 30/2=60 and producer surplus is (8 -2)x 30/2=90 for a total surplus of $150. • At $4, consumer surplus is (12 -4)x 60/2=240 while producer surplus is (4 -2)x 10/2=20 for a total of $260. • The net gain is $90. • Evaluate the gains and losses to producers and consumers in both countries.

Gains from Free Trade in U. K. • At a price of $8 per unit, consumer surplus is (12 -8)x 30/2=60 and producer surplus is (8 -2)x 30/2=90 for a total surplus of $150. • At $4, consumer surplus is (12 -4)x 60/2=240 while producer surplus is (4 -2)x 10/2=20 for a total of $260. • The net gain is $90. • Evaluate the gains and losses to producers and consumers in both countries.

The Welfare Effects of a Tariff • A tariff is a tax on imported goods. • A tariff raises the price of imported goods, above the world price by the amount of the tariff. • Domestic suppliers of the good with the tariff are gainers while domestic consumers of the good are losers.

The Welfare Effects of a Tariff • A tariff is a tax on imported goods. • A tariff raises the price of imported goods, above the world price by the amount of the tariff. • Domestic suppliers of the good with the tariff are gainers while domestic consumers of the good are losers.

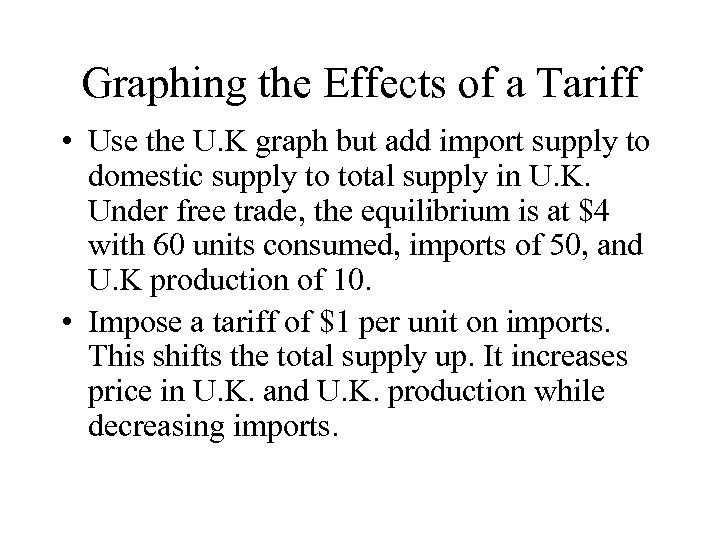

Graphing the Effects of a Tariff • Use the U. K graph but add import supply to domestic supply to total supply in U. K. Under free trade, the equilibrium is at $4 with 60 units consumed, imports of 50, and U. K production of 10. • Impose a tariff of $1 per unit on imports. This shifts the total supply up. It increases price in U. K. and U. K. production while decreasing imports.

Graphing the Effects of a Tariff • Use the U. K graph but add import supply to domestic supply to total supply in U. K. Under free trade, the equilibrium is at $4 with 60 units consumed, imports of 50, and U. K production of 10. • Impose a tariff of $1 per unit on imports. This shifts the total supply up. It increases price in U. K. and U. K. production while decreasing imports.

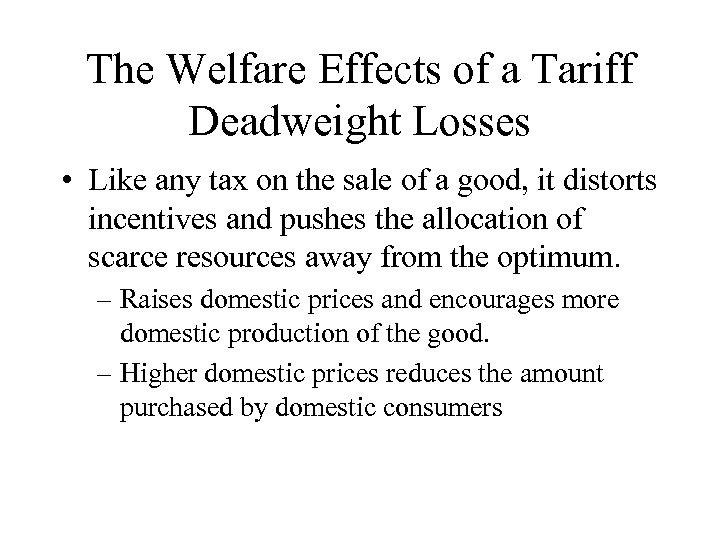

The Welfare Effects of a Tariff Deadweight Losses • Like any tax on the sale of a good, it distorts incentives and pushes the allocation of scarce resources away from the optimum. – Raises domestic prices and encourages more domestic production of the good. – Higher domestic prices reduces the amount purchased by domestic consumers

The Welfare Effects of a Tariff Deadweight Losses • Like any tax on the sale of a good, it distorts incentives and pushes the allocation of scarce resources away from the optimum. – Raises domestic prices and encourages more domestic production of the good. – Higher domestic prices reduces the amount purchased by domestic consumers

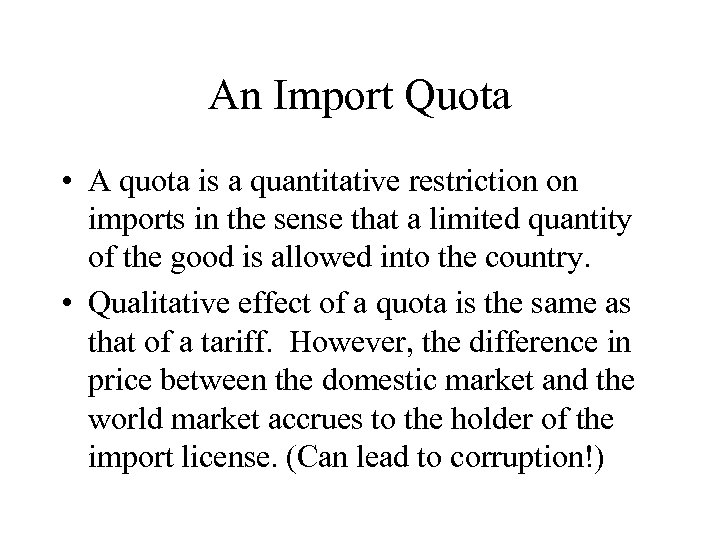

An Import Quota • A quota is a quantitative restriction on imports in the sense that a limited quantity of the good is allowed into the country. • Qualitative effect of a quota is the same as that of a tariff. However, the difference in price between the domestic market and the world market accrues to the holder of the import license. (Can lead to corruption!)

An Import Quota • A quota is a quantitative restriction on imports in the sense that a limited quantity of the good is allowed into the country. • Qualitative effect of a quota is the same as that of a tariff. However, the difference in price between the domestic market and the world market accrues to the holder of the import license. (Can lead to corruption!)

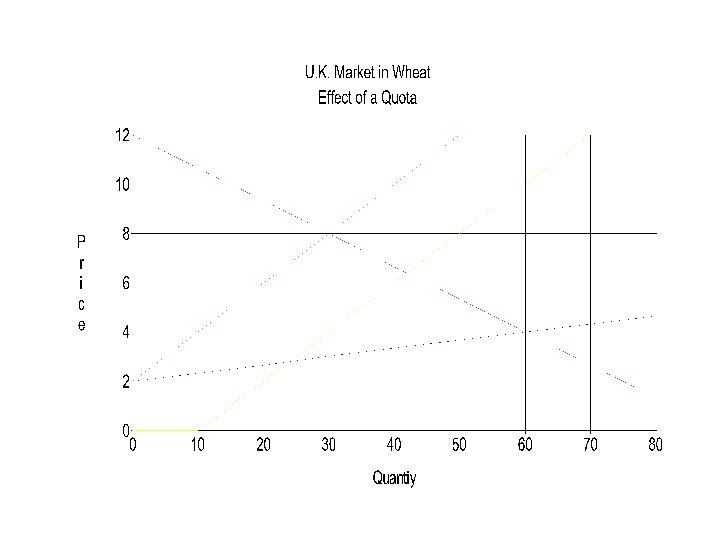

Effects of Quota • In our example, quota restricts imports to 20. This appears as a horizontal addition to the domestic supply curve. • Relative to free trade, price in importing country is increased to $6. 4, imports are reduced to 20, and domestic output is increased from 10 to 22. (Effect on U. S. ? ) • Value of an import license $2. 4 times quantity authorized

Effects of Quota • In our example, quota restricts imports to 20. This appears as a horizontal addition to the domestic supply curve. • Relative to free trade, price in importing country is increased to $6. 4, imports are reduced to 20, and domestic output is increased from 10 to 22. (Effect on U. S. ? ) • Value of an import license $2. 4 times quantity authorized

Arguments for Restricting Trade Arguments Against Free Trade • • • Jobs National Security Infant Industry Unfair-Competition Protection-as-a-Bargaining-Chip

Arguments for Restricting Trade Arguments Against Free Trade • • • Jobs National Security Infant Industry Unfair-Competition Protection-as-a-Bargaining-Chip

Conclusion. . . A Parable of Free Trade • Throughout its history, the United States has allowed unrestricted trade among the states, and the country as a whole has benefited from the specialization that trade allows.

Conclusion. . . A Parable of Free Trade • Throughout its history, the United States has allowed unrestricted trade among the states, and the country as a whole has benefited from the specialization that trade allows.