93ce2747ccfcea04a96f7992e00741e2.ppt

- Количество слайдов: 14

Applying Real Option Theory to Software Architecture Valuation Yuanfang Cai University of Virginia

Applying Real Option Theory to Software Architecture Valuation Yuanfang Cai University of Virginia

Outline l l l Issues that are Unsolved by Information Hiding Options: What and Why? Summer Efforts Real Options in Avaya Summary and Discussion

Outline l l l Issues that are Unsolved by Information Hiding Options: What and Why? Summer Efforts Real Options in Avaya Summary and Discussion

Issues that are Unsolved by Information Hiding l Difficult Justification of the Cost l Time/Quality Dilemma Future Prediction Never Happens Taken Software Design as an Investment Activity, What are the Values of Information hiding Infrastructures? l l • Predict future • Study the commonality among family members

Issues that are Unsolved by Information Hiding l Difficult Justification of the Cost l Time/Quality Dilemma Future Prediction Never Happens Taken Software Design as an Investment Activity, What are the Values of Information hiding Infrastructures? l l • Predict future • Study the commonality among family members

Current Valuation Practices and their Insufficiency l l Valuation by Products Discount Cash flow (DCF) Present Value = Future Value/(1 + k)t k: Risk Adjusted Discount Rate t: Project Time l Decision Tree Analysis (DTA) • • • l Each possible outcomes in each time period is treated as a branch Probabilities of each outcome are estimated Backward Dynamic Programming Why They are not Suitable for Product Line Architecture Valuation? • • DCF: Operational Flexibilities are ignored DTA: Fixed Discount Rate

Current Valuation Practices and their Insufficiency l l Valuation by Products Discount Cash flow (DCF) Present Value = Future Value/(1 + k)t k: Risk Adjusted Discount Rate t: Project Time l Decision Tree Analysis (DTA) • • • l Each possible outcomes in each time period is treated as a branch Probabilities of each outcome are estimated Backward Dynamic Programming Why They are not Suitable for Product Line Architecture Valuation? • • DCF: Operational Flexibilities are ignored DTA: Fixed Discount Rate

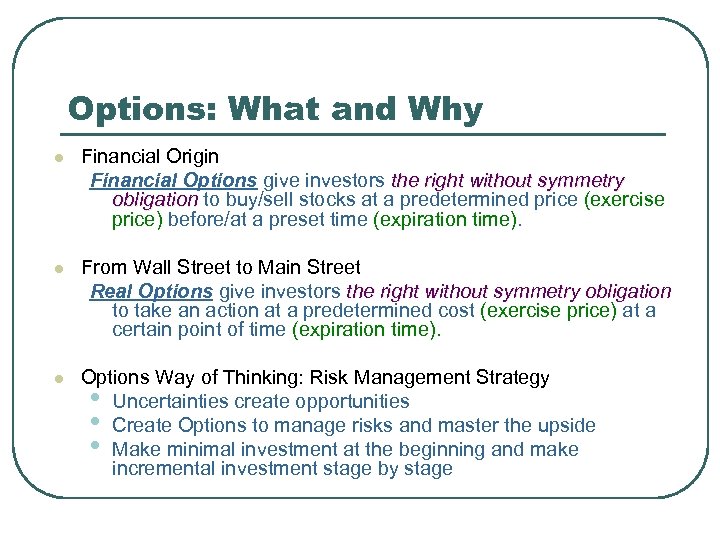

Options: What and Why l Financial Origin Financial Options give investors the right without symmetry obligation to buy/sell stocks at a predetermined price (exercise price) before/at a preset time (expiration time). l From Wall Street to Main Street Real Options give investors the right without symmetry obligation to take an action at a predetermined cost (exercise price) at a certain point of time (expiration time). l Options Way of Thinking: Risk Management Strategy • Uncertainties create opportunities • Create Options to manage risks and master the upside • Make minimal investment at the beginning and make incremental investment stage by stage

Options: What and Why l Financial Origin Financial Options give investors the right without symmetry obligation to buy/sell stocks at a predetermined price (exercise price) before/at a preset time (expiration time). l From Wall Street to Main Street Real Options give investors the right without symmetry obligation to take an action at a predetermined cost (exercise price) at a certain point of time (expiration time). l Options Way of Thinking: Risk Management Strategy • Uncertainties create opportunities • Create Options to manage risks and master the upside • Make minimal investment at the beginning and make incremental investment stage by stage

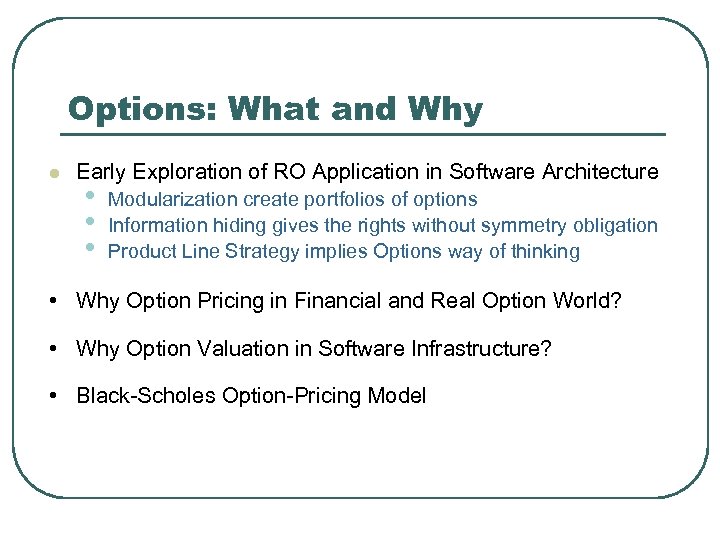

Options: What and Why l Early Exploration of RO Application in Software Architecture • • • Modularization create portfolios of options Information hiding gives the rights without symmetry obligation Product Line Strategy implies Options way of thinking • Why Option Pricing in Financial and Real Option World? • Why Option Valuation in Software Infrastructure? • Black-Scholes Option-Pricing Model

Options: What and Why l Early Exploration of RO Application in Software Architecture • • • Modularization create portfolios of options Information hiding gives the rights without symmetry obligation Product Line Strategy implies Options way of thinking • Why Option Pricing in Financial and Real Option World? • Why Option Valuation in Software Infrastructure? • Black-Scholes Option-Pricing Model

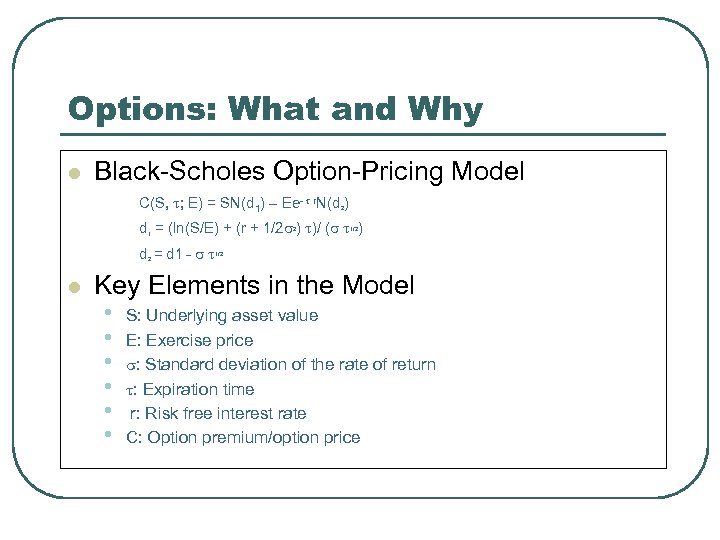

Options: What and Why l Black-Scholes Option-Pricing Model C(S, ; E) = SN(d 1) – Ee- r. N(d ) 2 d = (ln(S/E) + (r + 1/2 ) )/ ( ) 2 1 d = d 1 - 2 l 1/2 Key Elements in the Model • S: Underlying asset value • E: Exercise price • : Standard deviation of the rate of return • : Expiration time • r: Risk free interest rate • C: Option premium/option price

Options: What and Why l Black-Scholes Option-Pricing Model C(S, ; E) = SN(d 1) – Ee- r. N(d ) 2 d = (ln(S/E) + (r + 1/2 ) )/ ( ) 2 1 d = d 1 - 2 l 1/2 Key Elements in the Model • S: Underlying asset value • E: Exercise price • : Standard deviation of the rate of return • : Expiration time • r: Risk free interest rate • C: Option premium/option price

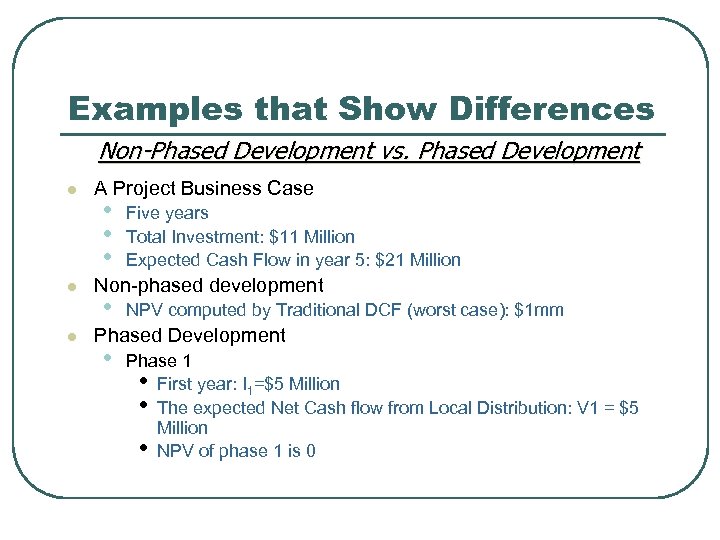

Examples that Show Differences Non-Phased Development vs. Phased Development l l l A Project Business Case • • • Five years Total Investment: $11 Million Expected Cash Flow in year 5: $21 Million Non-phased development • NPV computed by Traditional DCF (worst case): $1 mm Phased Development • Phase 1 • First year: I 1=$5 Million • The expected Net Cash flow from Local Distribution: V 1 = $5 Million • NPV of phase 1 is 0

Examples that Show Differences Non-Phased Development vs. Phased Development l l l A Project Business Case • • • Five years Total Investment: $11 Million Expected Cash Flow in year 5: $21 Million Non-phased development • NPV computed by Traditional DCF (worst case): $1 mm Phased Development • Phase 1 • First year: I 1=$5 Million • The expected Net Cash flow from Local Distribution: V 1 = $5 Million • NPV of phase 1 is 0

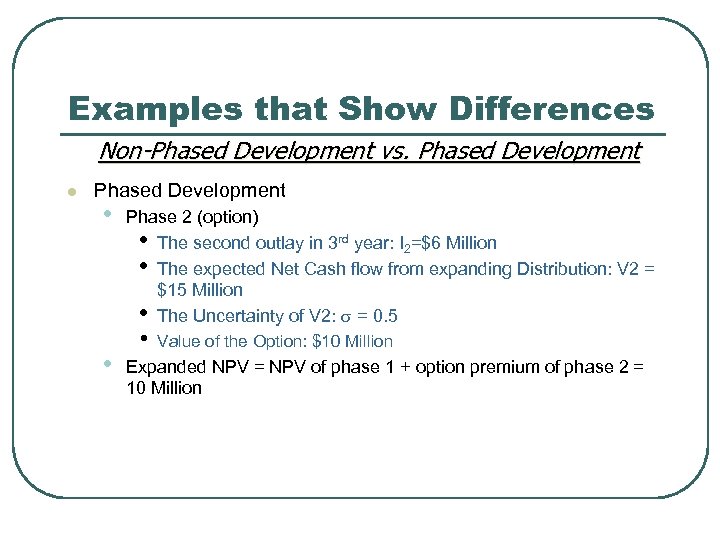

Examples that Show Differences Non-Phased Development vs. Phased Development l Phased Development • • Phase 2 (option) • The second outlay in 3 rd year: I 2=$6 Million • The expected Net Cash flow from expanding Distribution: V 2 = $15 Million • The Uncertainty of V 2: = 0. 5 • Value of the Option: $10 Million Expanded NPV = NPV of phase 1 + option premium of phase 2 = 10 Million

Examples that Show Differences Non-Phased Development vs. Phased Development l Phased Development • • Phase 2 (option) • The second outlay in 3 rd year: I 2=$6 Million • The expected Net Cash flow from expanding Distribution: V 2 = $15 Million • The Uncertainty of V 2: = 0. 5 • Value of the Option: $10 Million Expanded NPV = NPV of phase 1 + option premium of phase 2 = 10 Million

Summer Efforts l Applicability of RO Valuation to Software projects l Recognizing Options in Software Product Line l Data Collection for Valuation on Real Projects

Summer Efforts l Applicability of RO Valuation to Software projects l Recognizing Options in Software Product Line l Data Collection for Valuation on Real Projects

Applicability of RO Valuation to Software Projects l Assumptions • Stochastic Process • No-arbitrage equilibrium • Existence of traded securities to replicate the payoff to options l Communication with RO community

Applicability of RO Valuation to Software Projects l Assumptions • Stochastic Process • No-arbitrage equilibrium • Existence of traded securities to replicate the payoff to options l Communication with RO community

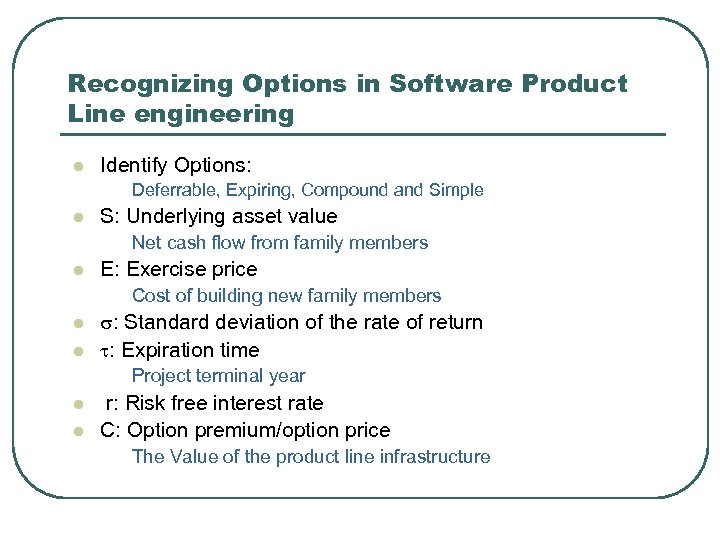

Recognizing Options in Software Product Line engineering l Identify Options: Deferrable, Expiring, Compound and Simple l S: Underlying asset value Net cash flow from family members l E: Exercise price Cost of building new family members l l : Standard deviation of the rate of return : Expiration time Project terminal year l l r: Risk free interest rate C: Option premium/option price The Value of the product line infrastructure

Recognizing Options in Software Product Line engineering l Identify Options: Deferrable, Expiring, Compound and Simple l S: Underlying asset value Net cash flow from family members l E: Exercise price Cost of building new family members l l : Standard deviation of the rate of return : Expiration time Project terminal year l l r: Risk free interest rate C: Option premium/option price The Value of the product line infrastructure

Real Options in Avaya l l Fertile Fields • • The Need for Real Options Valuation is recognized Most Data are available Sterile Fields • • • Data are hard to get Insights into Business Data must be improved Established Ways of thinking

Real Options in Avaya l l Fertile Fields • • The Need for Real Options Valuation is recognized Most Data are available Sterile Fields • • • Data are hard to get Insights into Business Data must be improved Established Ways of thinking

Summary and discussion l Justification of applicability to software architectures l Identification of options in software architectures and product line engineering l There is a big gap between architecture side and business side l Quantification and Ways of Thinking

Summary and discussion l Justification of applicability to software architectures l Identification of options in software architectures and product line engineering l There is a big gap between architecture side and business side l Quantification and Ways of Thinking