Applied Mathematic (Preliminary General 1) Depreciation Straight Line Stage 6 - Year 11 Press Ctrl-A ©G Dear 2011 – Not to be sold/Free to use 1

Applied Mathematic (Preliminary General 1) Depreciation Straight Line Stage 6 - Year 11 Press Ctrl-A ©G Dear 2011 – Not to be sold/Free to use 1

Modeling Depreciation (1/6) • Assets include things such as automobiles, computers, furniture, house and equipment. • These assets have a set amount of useful life. This means that an asset is not expected to last forever, and so its value depreciates over time. • The definition of depreciation is “the decline in the useful life of a fixed asset over time”. • The only asset that rarely declines in value is land. You Tube Video Press 2

Modeling Depreciation (1/6) • Assets include things such as automobiles, computers, furniture, house and equipment. • These assets have a set amount of useful life. This means that an asset is not expected to last forever, and so its value depreciates over time. • The definition of depreciation is “the decline in the useful life of a fixed asset over time”. • The only asset that rarely declines in value is land. You Tube Video Press 2

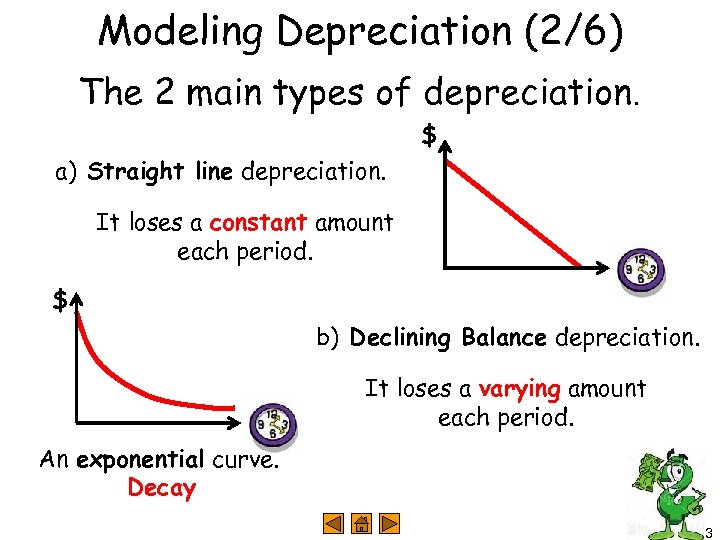

Modeling Depreciation (2/6) The 2 main types of depreciation. $ a) Straight line depreciation. It loses a constant amount each period. $ b) Declining Balance depreciation. It loses a varying amount each period. An exponential curve. Decay 3

Modeling Depreciation (2/6) The 2 main types of depreciation. $ a) Straight line depreciation. It loses a constant amount each period. $ b) Declining Balance depreciation. It loses a varying amount each period. An exponential curve. Decay 3

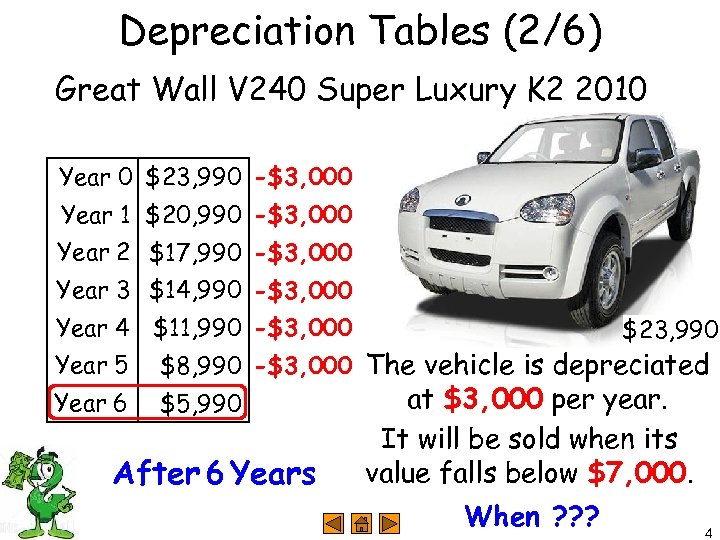

Depreciation Tables (2/6) Great Wall V 240 Super Luxury K 2 2010 Year 0 $23, 990 -$3, 000 Year 1 $20, 990 -$3, 000 Year 2 $17, 990 -$3, 000 Year 3 $14, 990 -$3, 000 Year 4 $11, 990 -$3, 000 $23, 990 Year 5 $8, 990 -$3, 000 The vehicle is depreciated Year 6 $5, 990 After 6 Years at $3, 000 per year. It will be sold when its value falls below $7, 000. When ? ? ? 4

Depreciation Tables (2/6) Great Wall V 240 Super Luxury K 2 2010 Year 0 $23, 990 -$3, 000 Year 1 $20, 990 -$3, 000 Year 2 $17, 990 -$3, 000 Year 3 $14, 990 -$3, 000 Year 4 $11, 990 -$3, 000 $23, 990 Year 5 $8, 990 -$3, 000 The vehicle is depreciated Year 6 $5, 990 After 6 Years at $3, 000 per year. It will be sold when its value falls below $7, 000. When ? ? ? 4

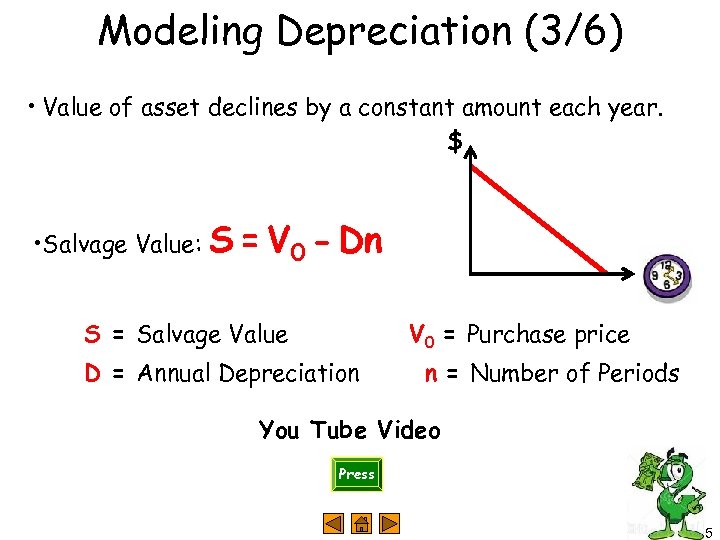

Modeling Depreciation (3/6) • Value of asset declines by a constant amount each year. $ • Salvage Value: S = V 0 - Dn S = Salvage Value V 0 = Purchase price D = Annual Depreciation n = Number of Periods You Tube Video Press 5

Modeling Depreciation (3/6) • Value of asset declines by a constant amount each year. $ • Salvage Value: S = V 0 - Dn S = Salvage Value V 0 = Purchase price D = Annual Depreciation n = Number of Periods You Tube Video Press 5

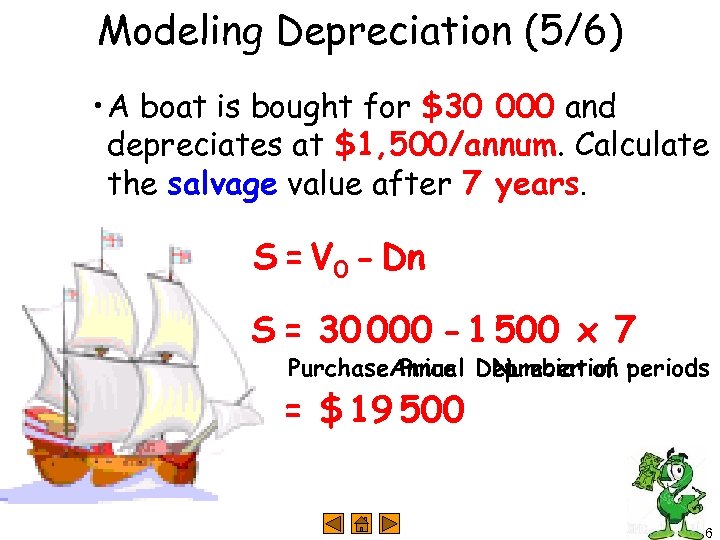

Modeling Depreciation (5/6) • A boat is bought for $30 000 and depreciates at $1, 500/annum. Calculate the salvage value after 7 years. S = V 0 - Dn S = 30 000 - 1 500 x 7 Purchase. Annual Depreciation periods Price Number of = $ 19 500 6

Modeling Depreciation (5/6) • A boat is bought for $30 000 and depreciates at $1, 500/annum. Calculate the salvage value after 7 years. S = V 0 - Dn S = 30 000 - 1 500 x 7 Purchase. Annual Depreciation periods Price Number of = $ 19 500 6

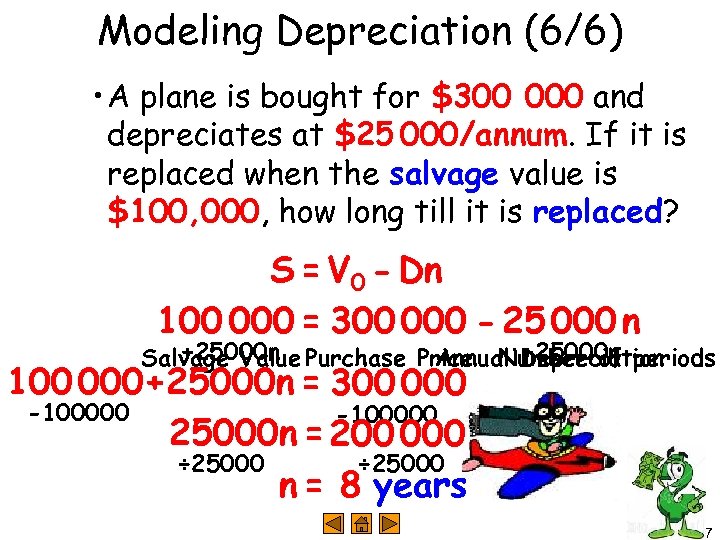

Modeling Depreciation (6/6) • A plane is bought for $300 000 and depreciates at $25 000/annum. If it is replaced when the salvage value is $100, 000, how long till it is replaced? S = V 0 - Dn 100 000 = 300 000 - 25 000 n +25000 n Salvage Value Purchase Price Number of periods Annual Depreciation 100 000+25000 n = 300 000 -100000 25000 n = 200 000 ÷ 25000 n = 8 years 7

Modeling Depreciation (6/6) • A plane is bought for $300 000 and depreciates at $25 000/annum. If it is replaced when the salvage value is $100, 000, how long till it is replaced? S = V 0 - Dn 100 000 = 300 000 - 25 000 n +25000 n Salvage Value Purchase Price Number of periods Annual Depreciation 100 000+25000 n = 300 000 -100000 25000 n = 200 000 ÷ 25000 n = 8 years 7