49ebe877e23c768ae2e748c6c9a26dd3.ppt

- Количество слайдов: 47

Applications of Databases Marketing in B 2 C and B 2 B Scenarios Paul J. C. Chang | Eneida Lau | Ximena Salazar | Lester Arellano | José-Pablo González |Edith Quispe

Contents n n n Overview Customer Value-A decision Metric Study 1: The Lifetime-Probability Relationship in a Noncontractual setting Study 2: A Model for Incorporating Customer’s Projected Profitability into Lifetime Duration Computation Study 3: A Model for Identifying the True Value of a Lost Customer Summary

Overview Loyalty Programs Economy Class Vs Business Class n n Before: Customer value to the firm Nowadays: Recognizes special customers The redemption is based on the year, make or model of the car or truck

Overview Firms are becoming profit-oriented in their approach toward customer reward programs. Firms don’t use surrogate measure anymore Customers realize they can not expect a firm to believe they are special in they are not genuine high-value buyers Blend of differential levels of treatments such that over every customer’s lifetime, the profits can be maximized

Overview Loyalty Program Customer value metric 1 2 Turning unprofitable 3 Factors that affect the profitable time 4 Marketing investments Frequency on mkt elements on profitability 5 6 Predict the timing of purchase

Customer Value - A Decision Metric ide v uld pro o firm sh rsonal om the mes pe h ers to w d someti Custom ntial an prefere t? Ho eatmen w tr do fir offerin ms decid ecustomer A firm can decide g? to adopt the t value either imiasg metric in a step-by-step manner or integrating it n of an the guiding for all future marketing actions To which customers they should interact through inexpensive channels? to let mers h custo Whic ?

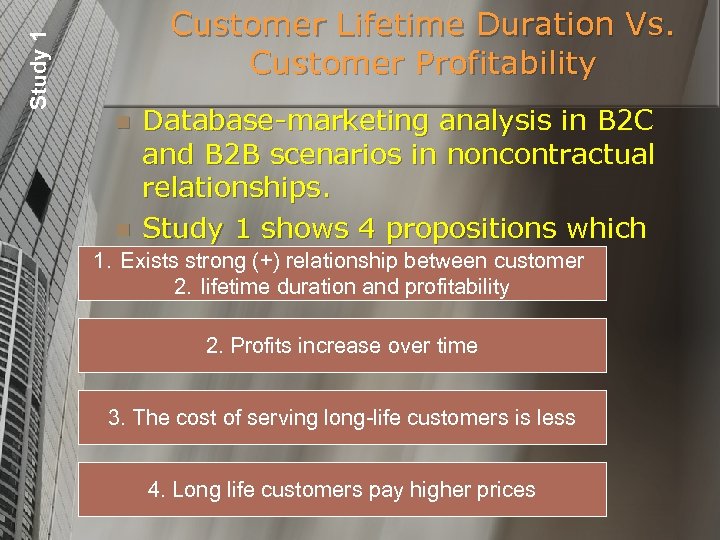

Study 1 Customer Lifetime Duration Vs. Customer Profitability Database-marketing analysis in B 2 C and B 2 B scenarios in noncontractual relationships. n Study 1 shows 4 propositions which 1. Exists strong (+) relationship between customer are: n 2. lifetime duration and profitability 2. Profits increase over time 3. The cost of serving long-life customers is less 4. Long life customers pay higher prices

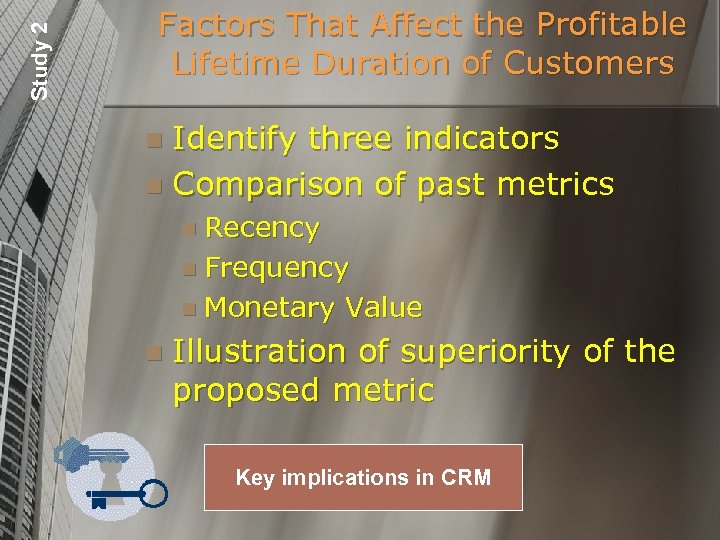

Study 2 Factors That Affect the Profitable Lifetime Duration of Customers Identify three indicators n Comparison of past metrics n n Recency n Frequency n Monetary Value n Illustration of superiority of the proposed metric Key implications in CRM

Study 3 Identifying the True Value of a Lost Customer Impact of a lost customers on the profitability n Value of a lost customers changes throughout the product life cycle n

Lifetime Vs. Profitability Study 1

Background and Objective Long customer relationships or short term customer relationships n Marketing payoff n “In short, the contention that loyal customers are always more profitable is a gross oversimplification” Cost of serving loyal customers n How much pay loyal customers? n How much time spend loyal customers? n

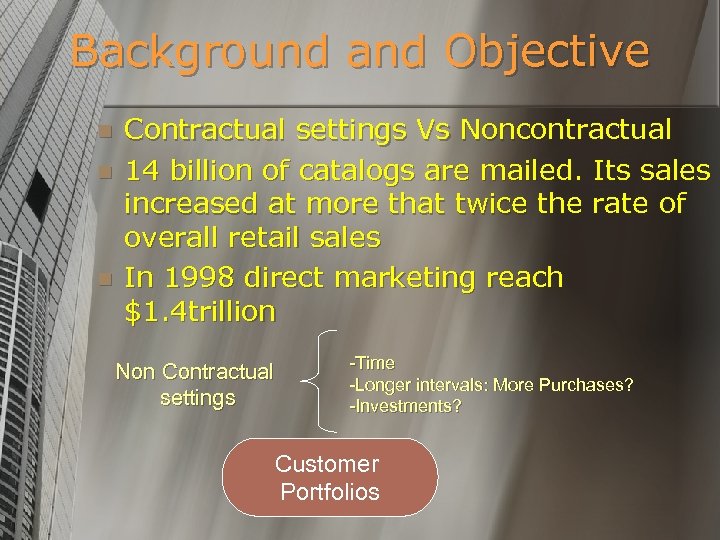

Background and Objective n n n Contractual settings Vs Noncontractual 14 billion of catalogs are mailed. Its sales increased at more that twice the rate of overall retail sales In 1998 direct marketing reach $1. 4 trillion Non Contractual settings -Time -Longer intervals: More Purchases? -Investments? Customer Portfolios

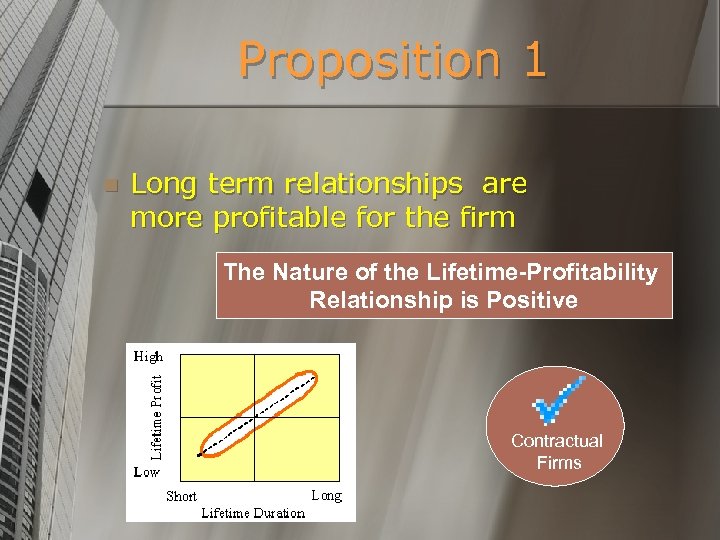

Proposition 1 n Long term relationships are more profitable for the firm The Nature of the Lifetime-Profitability Relationship is Positive Contractual Firms

Non Contractual Firms The cost of satisfying customers exceed the profit margin offered by the customer n Customers could buy less from the catalogue because the competition, limited spending, etc. n

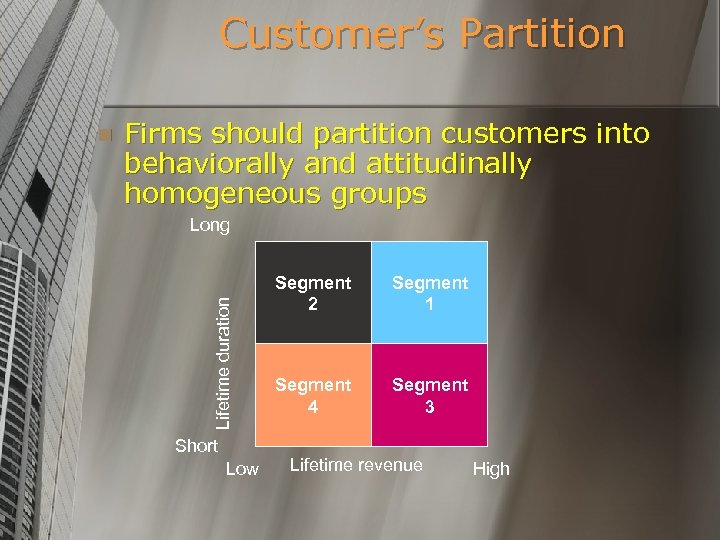

Customer’s Partition Firms should partition customers into behaviorally and attitudinally homogeneous groups Long Lifetime duration n Short Low Segment 2 Segment 1 Segment 4 Segment 3 Lifetime revenue High

Proposition 2 Profits Increase over the Time n Noncontractual situation: A customer may buy once a year and spending a small amount. Costs of serving longlife customers are higher Profits for the firm does not increase over time

Proposition 3 n The costs of promoting to a customer, in relation to her revenues, is lower for long-life customers The Costs of Serving Longer-life Customers Are Lower

Proposition 4 Longer-life Customers Pay Higher Prices Existing customers pay effectively higher prices that new ones. n Managers said the opposite n

Research Methodology

Data n n n US catalog retailer Information for 3 year Tracked from the very first purchase

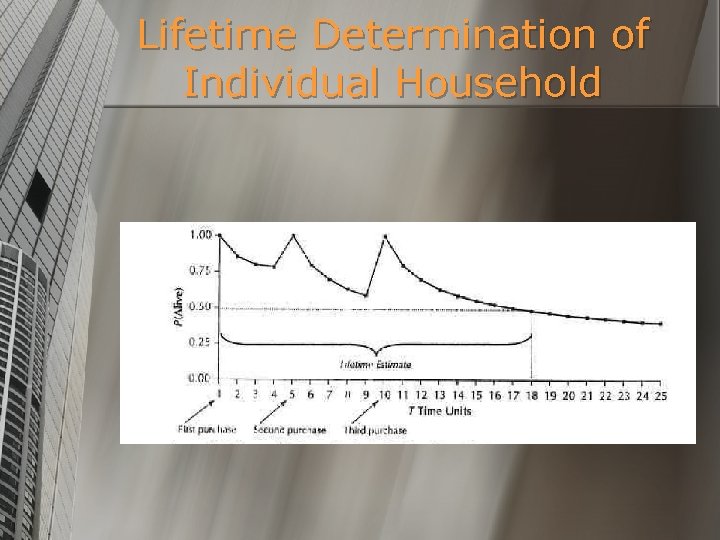

The Process n Negative Binomial Distribution n “Which individual customers are most likely to represent the active or inactive customers? ”

Lifetime Estimation n Birth date = “first purchase” Cohort 1 is 28. 7 months Cohort 2 is 27. 9 months

What is a cohort? n A cohort is a group of customers who started their relationship at the same point in time n Particular month or quarter

Lifetime Determination of Individual Household

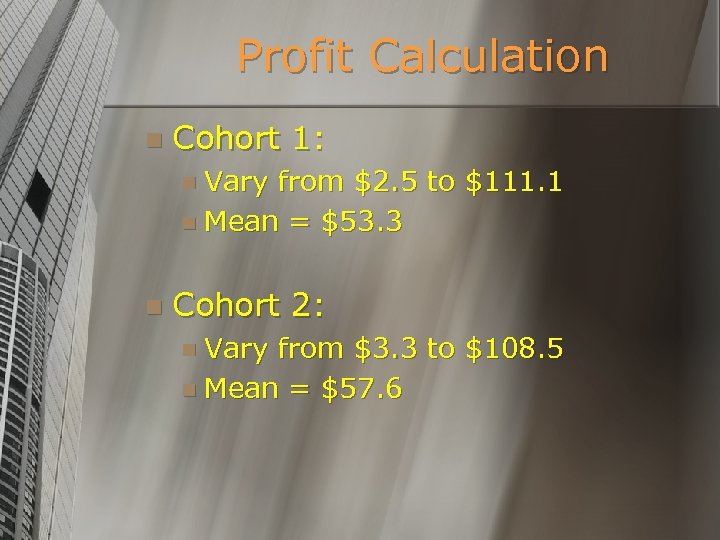

Profit Calculation n Cohort 1: n Vary from $2. 5 to $111. 1 n Mean = $53. 3 n Cohort 2: n Vary from $3. 3 to $108. 5 n Mean = $57. 6

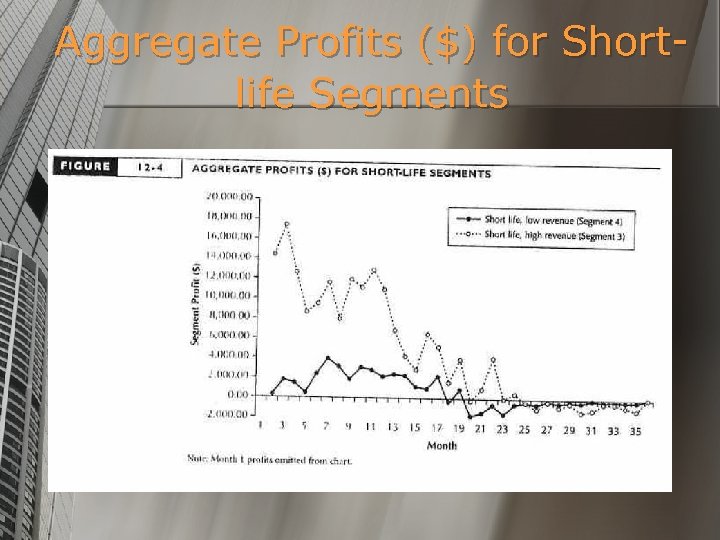

Aggregate Profits ($) for Shortlife Segments

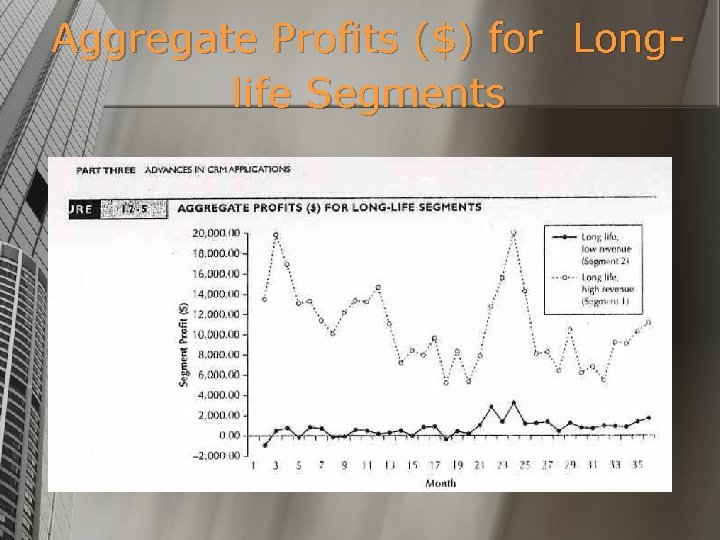

Aggregate Profits ($) for Longlife Segments

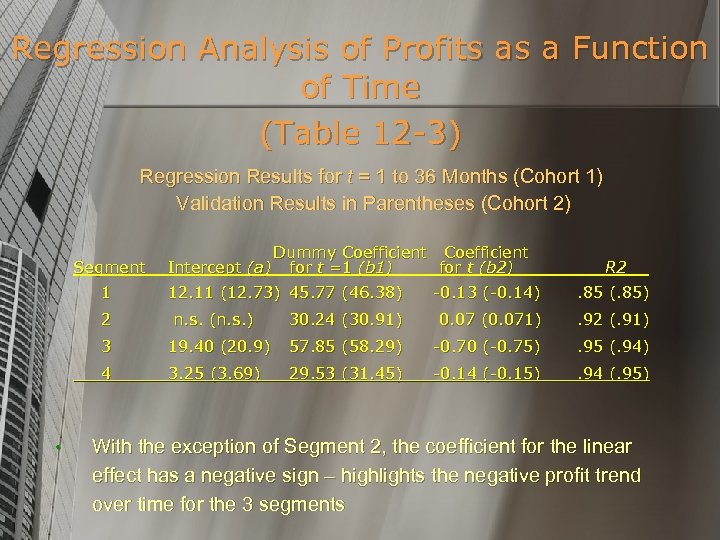

Regression Analysis of Profits as a Function of Time (Table 12 -3) Regression Results for t = 1 to 36 Months (Cohort 1) Validation Results in Parentheses (Cohort 2) Dummy Coefficient Segment Intercept (a) for t =1 (b 1) for t (b 2) 1 12. 11 (12. 73) 45. 77 (46. 38) -0. 13 (-0. 14) . 85 (. 85) 2 n. s. (n. s. ) 30. 24 (30. 91) 0. 07 (0. 071) . 92 (. 91) 3 19. 40 (20. 9) 57. 85 (58. 29) -0. 70 (-0. 75) . 95 (. 94) 4 • R 2 3. 25 (3. 69) 29. 53 (31. 45) -0. 14 (-0. 15) . 94 (. 95) With the exception of Segment 2, the coefficient for the linear effect has a negative sign – highlights the negative profit trend over time for the 3 segments

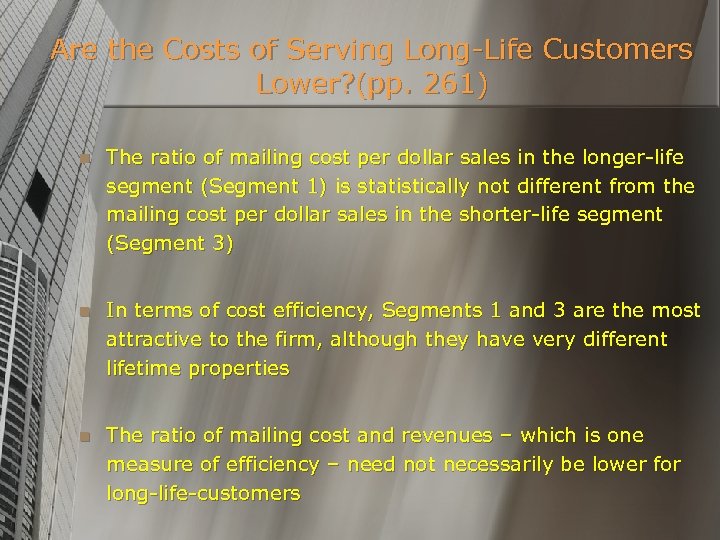

Are the Costs of Serving Long-Life Customers Lower? (pp. 261) n The ratio of mailing cost per dollar sales in the longer-life segment (Segment 1) is statistically not different from the mailing cost per dollar sales in the shorter-life segment (Segment 3) n In terms of cost efficiency, Segments 1 and 3 are the most attractive to the firm, although they have very different lifetime properties n The ratio of mailing cost and revenues – which is one measure of efficiency – need not necessarily be lower for long-life-customers

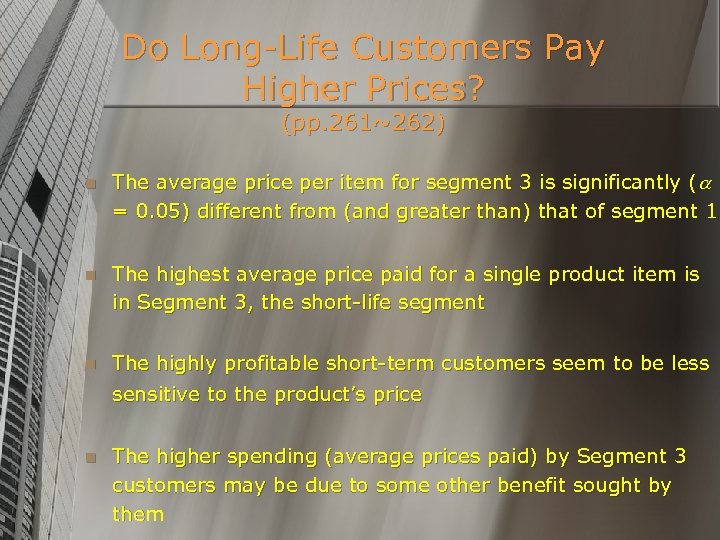

Do Long-Life Customers Pay Higher Prices? (pp. 261~262) n The average price per item for segment 3 is significantly ( = 0. 05) different from (and greater than) that of segment 1 n The highest average price paid for a single product item is in Segment 3, the short-life segment n The highly profitable short-term customers seem to be less sensitive to the product’s price n The higher spending (average prices paid) by Segment 3 customers may be due to some other benefit sought by them

Summary of Findings n A strong linear positive association between lifetime and profits does not necessarily exist n A static and a dynamic lifetime-profit analysis can exhibit a much differentiated picture: profitability can occur for the firm from high and low lifetime customers n Profits do not increase with increasing customer tenure: the cost of serving long-life customers is not lower n Long-life customers do not pay higher prices

A Model for Incorporating Customers’ Projected Profitability into Lifetime Duration Computation Study 2

Key research tasks: n n n Empirically measure lifetime duration for noncontractual customer-firm relationships, incorporating projected profits. Understand the structure of profitable relationships and test the factors which impact a customer’s profitable lifetime duration. Develop managerial implications for building and managing profitable relationship exchanges

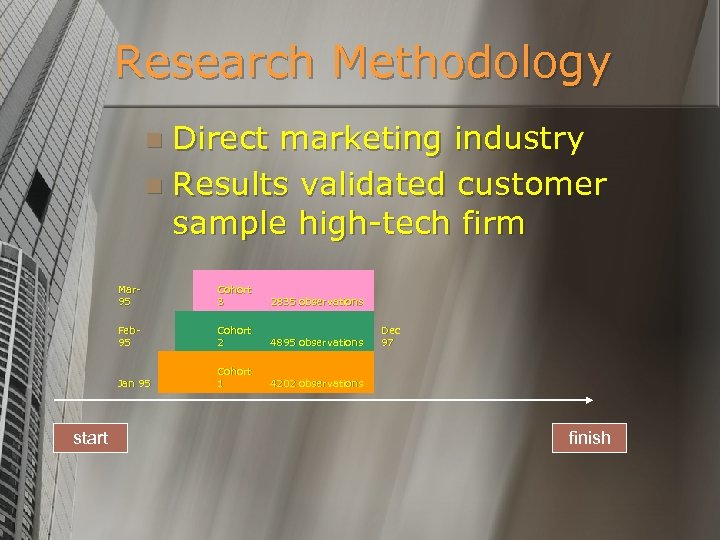

Research Methodology Direct marketing industry n Results validated customer sample high-tech firm n Mar 95 Jan 95 start 2835 observations Feb 95 Cohort 3 Cohort 2 4895 observations Cohort 1 4202 observations Dec 97 finish

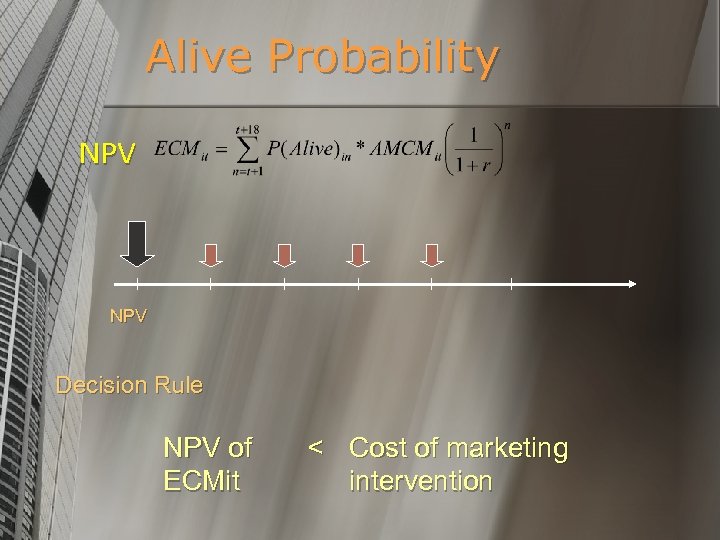

Alive Probability NPV Decision Rule NPV of ECMit < Cost of marketing intervention

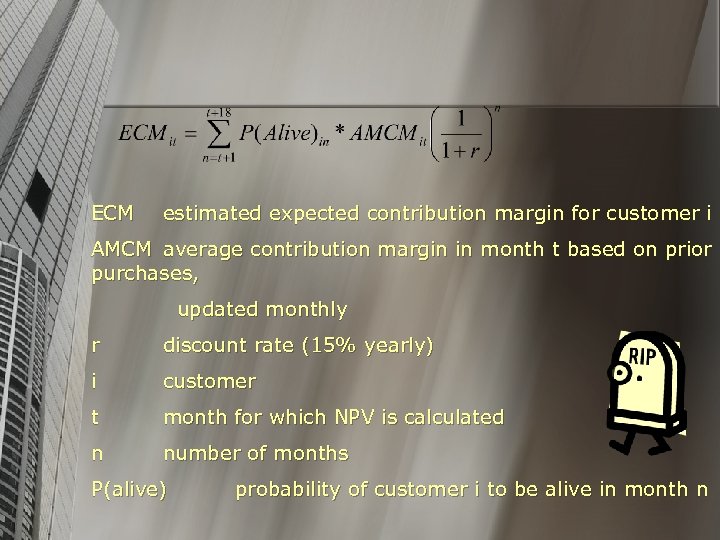

ECM estimated expected contribution margin for customer i AMCM average contribution margin in month t based on prior purchases, updated monthly r discount rate (15% yearly) i customer t month for which NPV is calculated n number of months P(alive) probability of customer i to be alive in month n

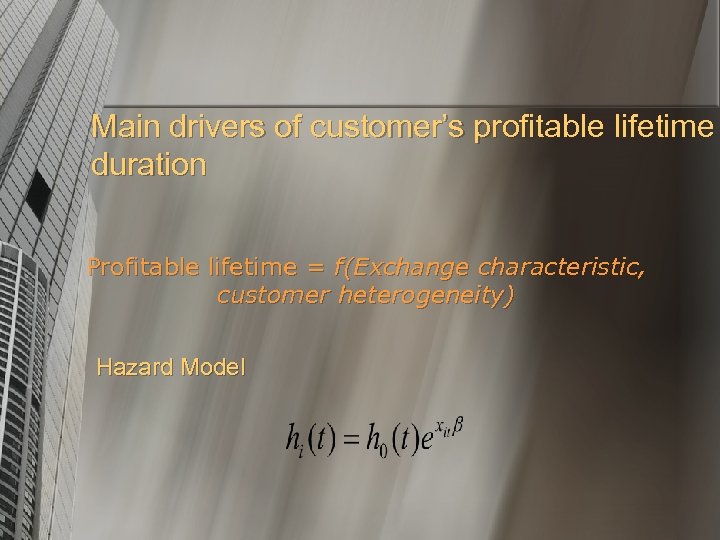

Main drivers of customer’s profitable lifetime duration Profitable lifetime = f(Exchange characteristic, customer heterogeneity) Hazard Model

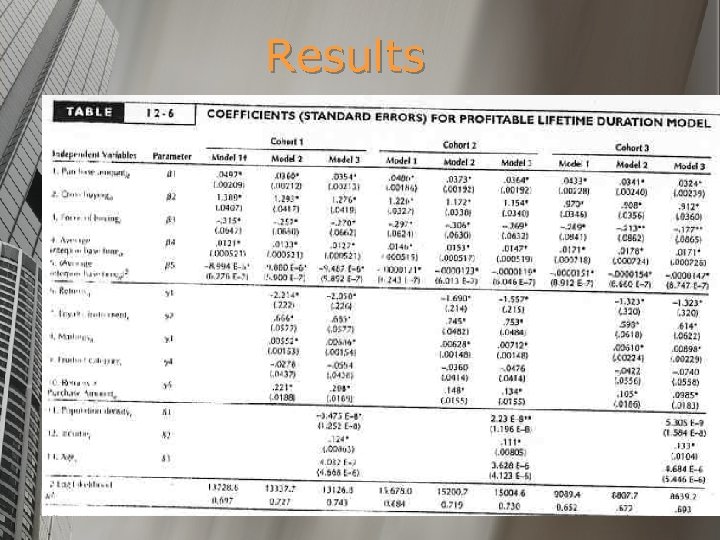

Independent variables n n n Purchase amount Cross buying Focus of buying Average interpurchase Returns Loyalty instrument (ownership of charge card) Mailings Product category Population density Income Age

Results

A Model for Identifying the True Value of a Lost Customer n n Customer Defection Disadoption by Contrast This affects the long term profitability in two ways, one is the loss of direct sales and the other is in term of indirect effects of word of mouth, imitation.

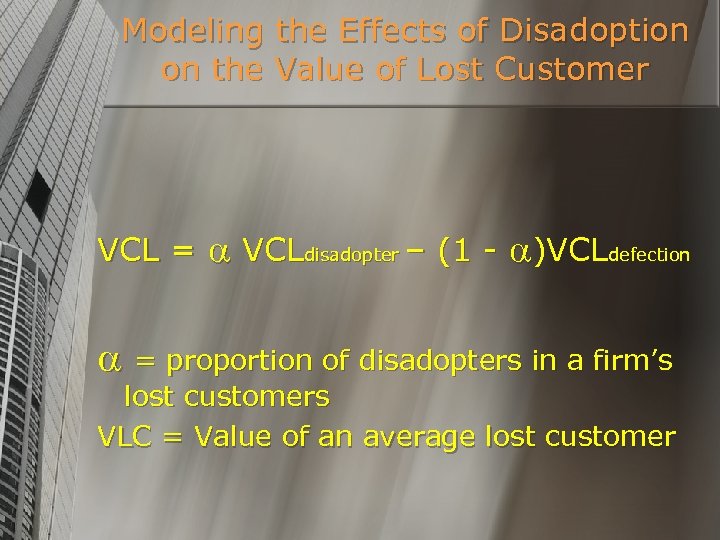

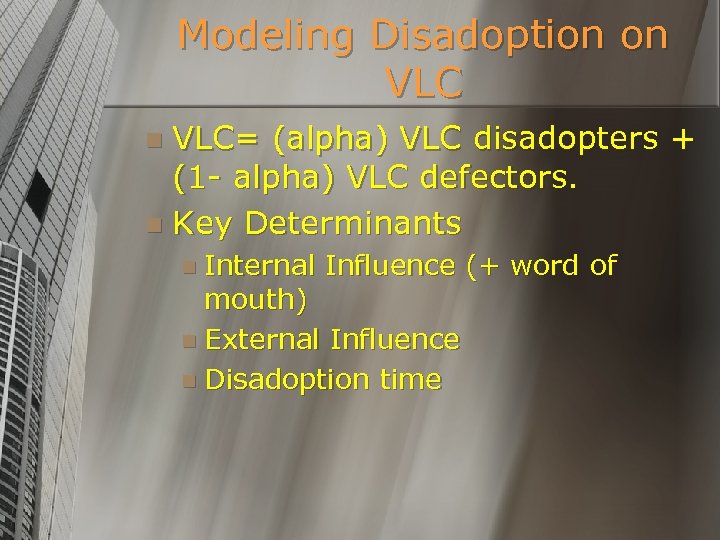

Modeling the Effects of Disadoption on the Value of Lost Customer VCL = VCLdisadopter – (1 - )VCLdefection = proportion of disadopters in a firm’s lost customers VLC = Value of an average lost customer

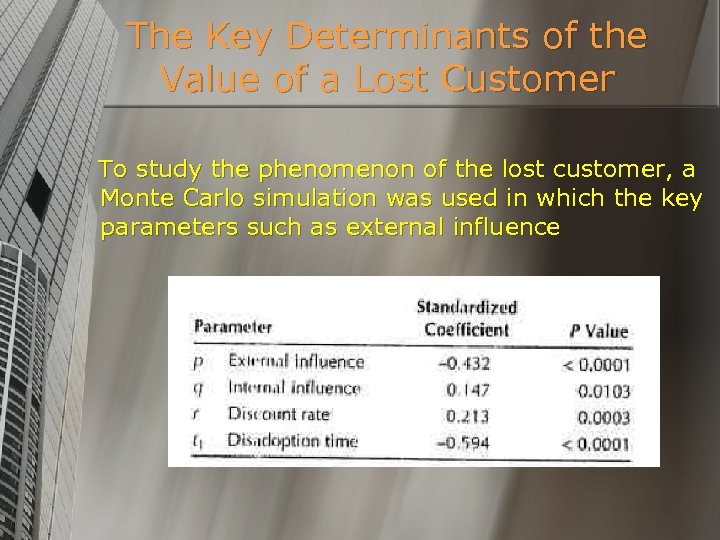

The Key Determinants of the Value of a Lost Customer To study the phenomenon of the lost customer, a Monte Carlo simulation was used in which the key parameters such as external influence

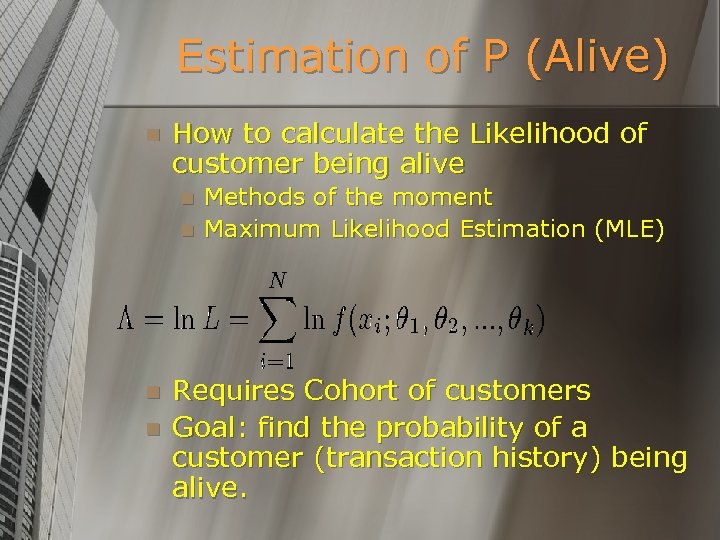

Estimation of P (Alive) n How to calculate the Likelihood of customer being alive n n Methods of the moment Maximum Likelihood Estimation (MLE) Requires Cohort of customers Goal: find the probability of a customer (transaction history) being alive.

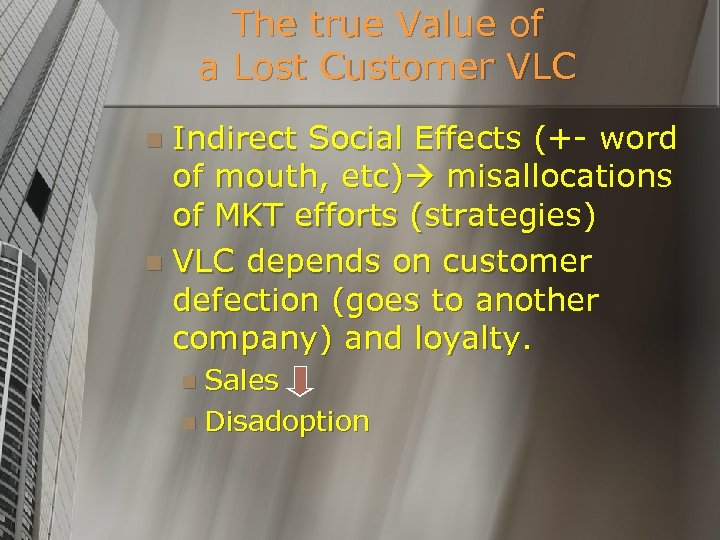

The true Value of a Lost Customer VLC Indirect Social Effects (+- word of mouth, etc) misallocations of MKT efforts (strategies) n VLC depends on customer defection (goes to another company) and loyalty. n n Sales n Disadoption

Modeling Disadoption on VLC= (alpha) VLC disadopters + (1 - alpha) VLC defectors. n Key Determinants n n Internal Influence (+ word of mouth) n External Influence n Disadoption time

Summary n Study of lifetime probability n n Conceptual Model Non contractual Scenario n n Lower Priced Items Vs Established name brand products. The objectives of the second study: n n n Measure lifetime duration Incorporate projected profits into the relationship model Develop managerial implications n Spending level, cross buying, etc.

Summary n The third model (VLC) n Determine the effects of disadoption on the value of lost customers. (direct & Indirect effects) n Disadoption time: ei. Has the maximum negative impact on the value. The earlier a customer disadopts, the higher the value of the lost customer.

49ebe877e23c768ae2e748c6c9a26dd3.ppt