a6dbf63f4703b613730f591f1f4fd090.ppt

- Количество слайдов: 23

Apple i. Phone I-224 March 21, 2007

Apple i. Phone I-224 March 21, 2007

Smart Phone • Calls by Touch • Voicemail • SMS • Photos • Calendar

Smart Phone • Calls by Touch • Voicemail • SMS • Photos • Calendar

Apple i. Phone • Smart Phone • i. Pod (Widescreen) • Wireless Internet Communication Device • PDA • Computer (OS X) • Camera

Apple i. Phone • Smart Phone • i. Pod (Widescreen) • Wireless Internet Communication Device • PDA • Computer (OS X) • Camera

i. Pod (Widescreen) • Tunes Library Access • Videos • Songs • Movie Previews • Lyrics • Album Artwork • Touch Controls • 3. 5 inch screen i. Pod with touch screen controls

i. Pod (Widescreen) • Tunes Library Access • Videos • Songs • Movie Previews • Lyrics • Album Artwork • Touch Controls • 3. 5 inch screen i. Pod with touch screen controls

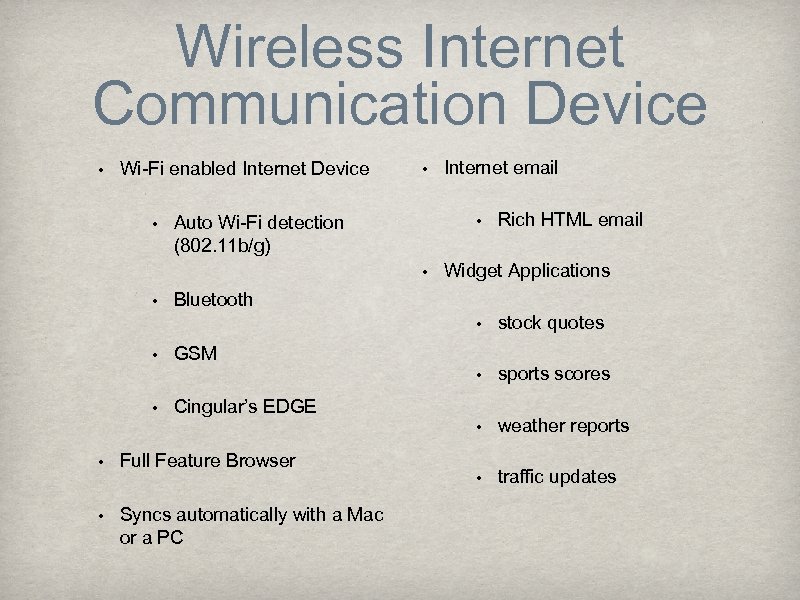

Wireless Internet Communication Device • Wi-Fi enabled Internet Device • • Auto Wi-Fi detection (802. 11 b/g) • • • Internet email Rich HTML email Widget Applications Bluetooth • • • sports scores • • stock quotes weather reports • traffic updates GSM Cingular’s EDGE • Full Feature Browser • Syncs automatically with a Mac or a PC

Wireless Internet Communication Device • Wi-Fi enabled Internet Device • • Auto Wi-Fi detection (802. 11 b/g) • • • Internet email Rich HTML email Widget Applications Bluetooth • • • sports scores • • stock quotes weather reports • traffic updates GSM Cingular’s EDGE • Full Feature Browser • Syncs automatically with a Mac or a PC

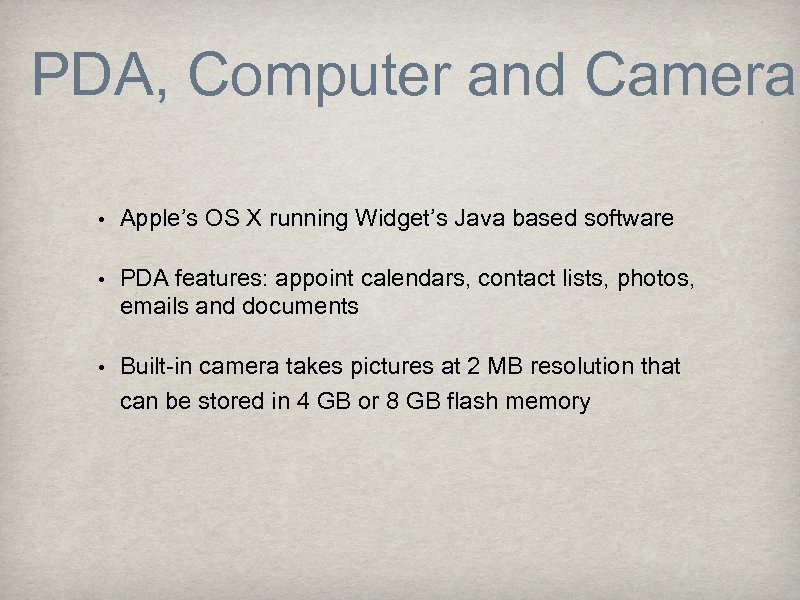

PDA, Computer and Camera • Apple’s OS X running Widget’s Java based software • PDA features: appoint calendars, contact lists, photos, emails and documents • Built-in camera takes pictures at 2 MB resolution that can be stored in 4 GB or 8 GB flash memory

PDA, Computer and Camera • Apple’s OS X running Widget’s Java based software • PDA features: appoint calendars, contact lists, photos, emails and documents • Built-in camera takes pictures at 2 MB resolution that can be stored in 4 GB or 8 GB flash memory

Technical Specifications

Technical Specifications

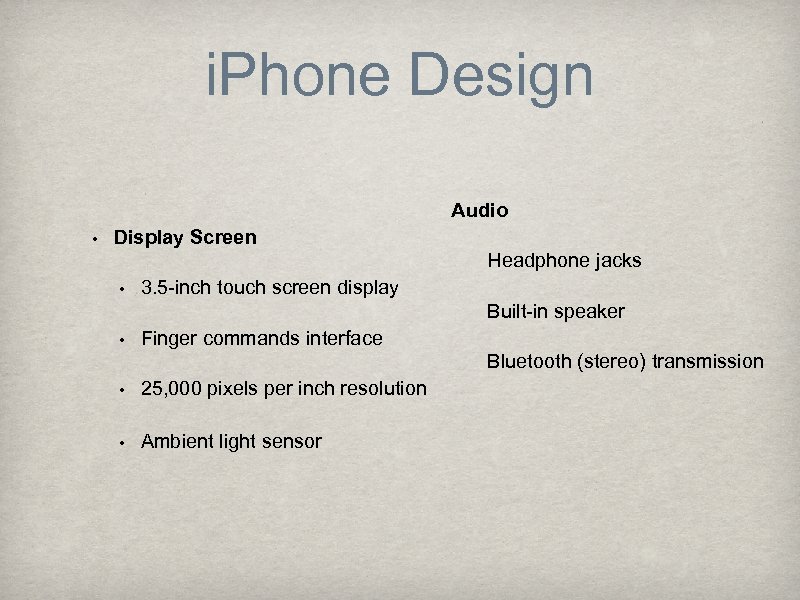

i. Phone Design Audio • Display Screen Headphone jacks • 3. 5 -inch touch screen display Built-in speaker • Finger commands interface Bluetooth (stereo) transmission • 25, 000 pixels per inch resolution • Ambient light sensor

i. Phone Design Audio • Display Screen Headphone jacks • 3. 5 -inch touch screen display Built-in speaker • Finger commands interface Bluetooth (stereo) transmission • 25, 000 pixels per inch resolution • Ambient light sensor

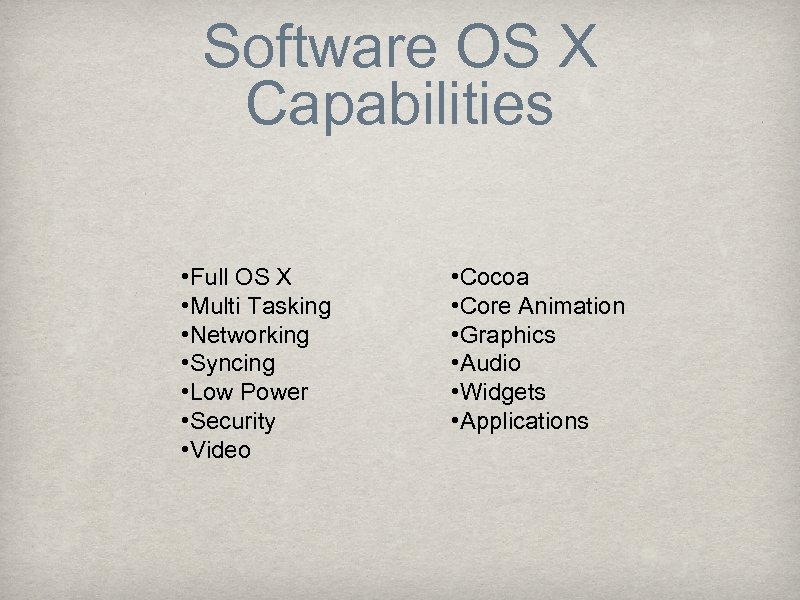

Software OS X Capabilities • Full OS X • Multi Tasking • Networking • Syncing • Low Power • Security • Video • Cocoa • Core Animation • Graphics • Audio • Widgets • Applications

Software OS X Capabilities • Full OS X • Multi Tasking • Networking • Syncing • Low Power • Security • Video • Cocoa • Core Animation • Graphics • Audio • Widgets • Applications

Phone Market Position

Phone Market Position

i. Phone vs. the competition

i. Phone vs. the competition

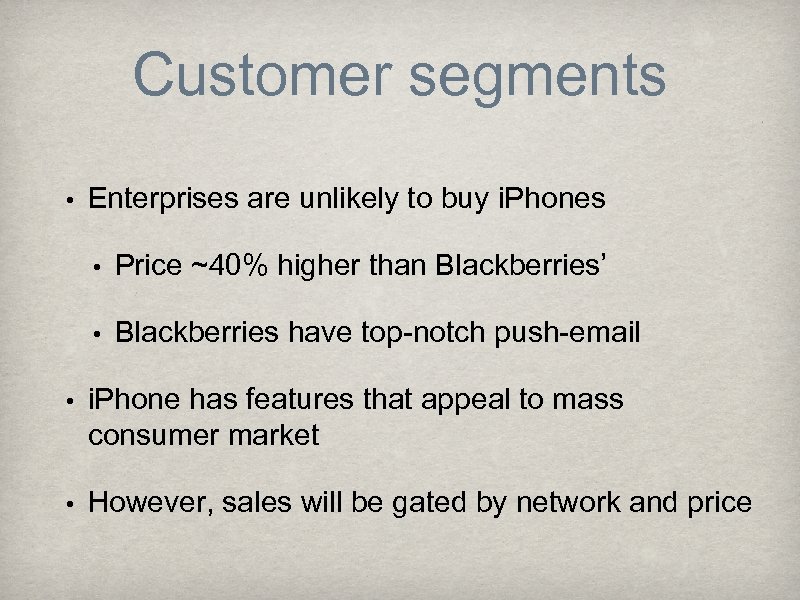

Customer segments • Enterprises are unlikely to buy i. Phones • Price ~40% higher than Blackberries’ • Blackberries have top-notch push-email • i. Phone has features that appeal to mass consumer market • However, sales will be gated by network and price

Customer segments • Enterprises are unlikely to buy i. Phones • Price ~40% higher than Blackberries’ • Blackberries have top-notch push-email • i. Phone has features that appeal to mass consumer market • However, sales will be gated by network and price

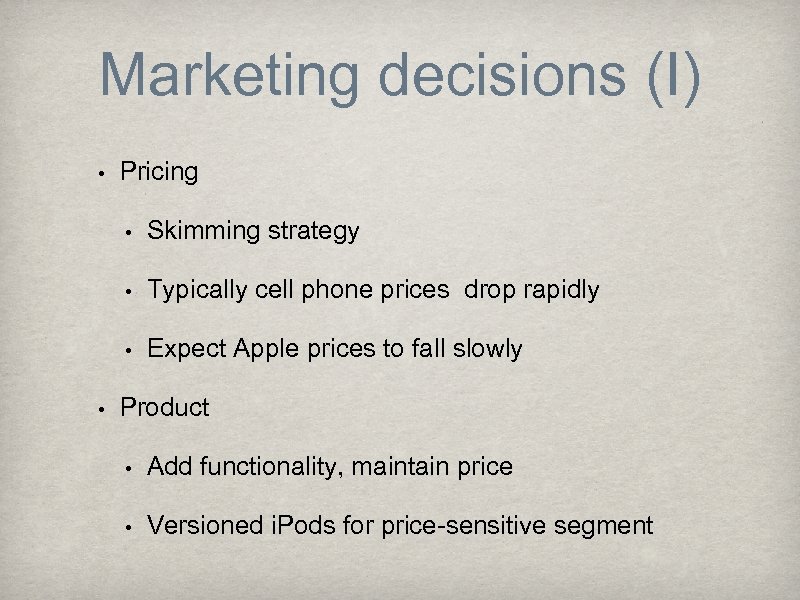

Marketing decisions (I) • Pricing • • Typically cell phone prices drop rapidly • • Skimming strategy Expect Apple prices to fall slowly Product • Add functionality, maintain price • Versioned i. Pods for price-sensitive segment

Marketing decisions (I) • Pricing • • Typically cell phone prices drop rapidly • • Skimming strategy Expect Apple prices to fall slowly Product • Add functionality, maintain price • Versioned i. Pods for price-sensitive segment

Marketing decisions (II) • Distribution • • • Restricted availability to Cingular and Apple stores New i. Phones will open channels & drive sales Promotions • Cingular i. Phone discounts unlikely • Expect i. Phone voice / data plans

Marketing decisions (II) • Distribution • • • Restricted availability to Cingular and Apple stores New i. Phones will open channels & drive sales Promotions • Cingular i. Phone discounts unlikely • Expect i. Phone voice / data plans

Early adopter market ~8. 7 m • Cingular customers 58 m • Cingular subscribers with i. Pod 30% • Cingular subscribers with i. Pod 17. 4 m • Uptake rate from Cingular i. Pod customers in 1 st year 50% assumption • Est. uptake by Cingular i. Pod customers in 1 st year 8. 7 m

Early adopter market ~8. 7 m • Cingular customers 58 m • Cingular subscribers with i. Pod 30% • Cingular subscribers with i. Pod 17. 4 m • Uptake rate from Cingular i. Pod customers in 1 st year 50% assumption • Est. uptake by Cingular i. Pod customers in 1 st year 8. 7 m

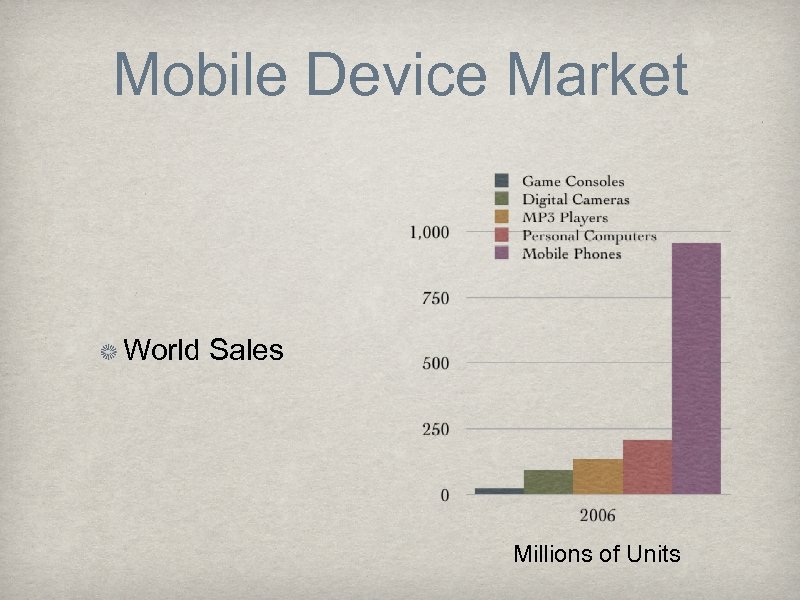

Mobile Device Market World Sales Millions of Units

Mobile Device Market World Sales Millions of Units

Analyses

Analyses

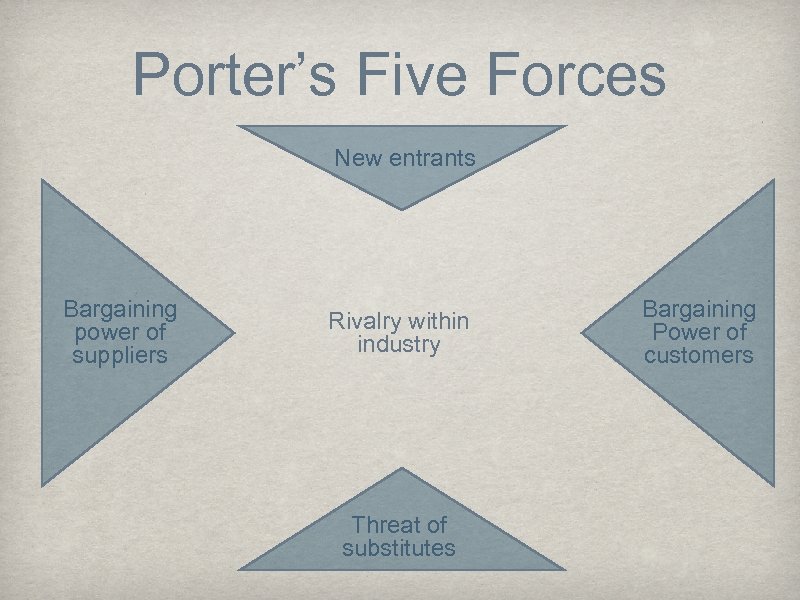

Porter’s Five Forces New entrants Bargaining power of suppliers Rivalry within industry Threat of substitutes Bargaining Power of customers

Porter’s Five Forces New entrants Bargaining power of suppliers Rivalry within industry Threat of substitutes Bargaining Power of customers

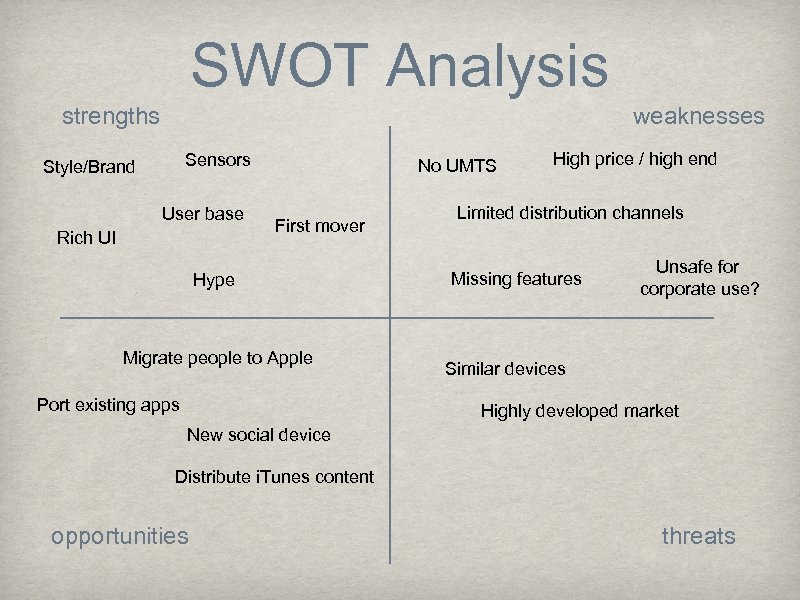

SWOT Analysis strengths weaknesses Sensors Style/Brand User base Rich UI No UMTS First mover Hype Migrate people to Apple Port existing apps High price / high end Limited distribution channels Missing features Unsafe for corporate use? Similar devices Highly developed market New social device Distribute i. Tunes content opportunities threats

SWOT Analysis strengths weaknesses Sensors Style/Brand User base Rich UI No UMTS First mover Hype Migrate people to Apple Port existing apps High price / high end Limited distribution channels Missing features Unsafe for corporate use? Similar devices Highly developed market New social device Distribute i. Tunes content opportunities threats

Recommendations

Recommendations

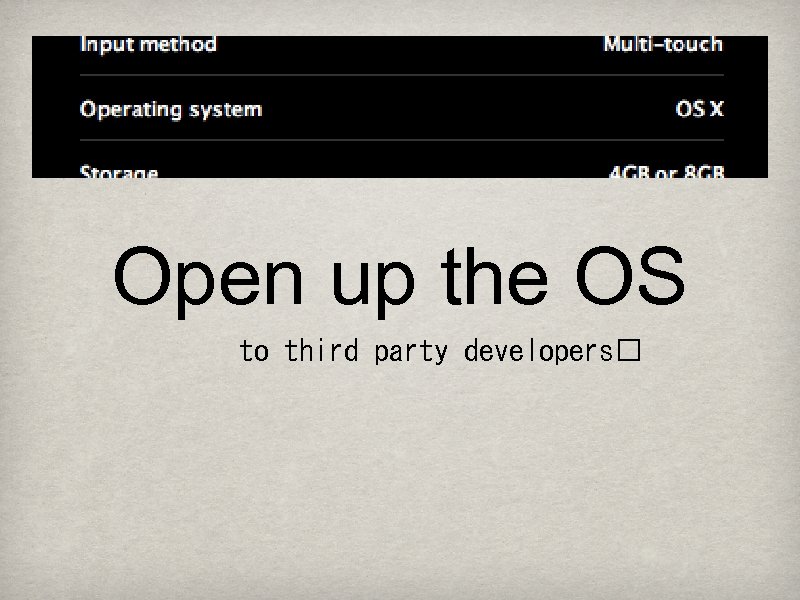

Open up the OS to third party developers

Open up the OS to third party developers

support Voice over IP

support Voice over IP

i. Dream (The Future)

i. Dream (The Future)