Apple 2005.ppt

- Количество слайдов: 49

Apple Computer Inc. 2005 A Strategic Management Case Study Graphics are the property of Apple Computer ® 2007, Tony Gauvin, UMFK

Apple Computer Inc. 2005 A Strategic Management Case Study Graphics are the property of Apple Computer ® 2007, Tony Gauvin, UMFK

Overview • • A brief history of Apple Computer EOY 2004 – • – – – • Opportunities & Threats CPM EFE Internal Analysis – – • New Vision and Mission External Analysis Financial Data Strengths and weaknesses IFE Financial ratios Strategic Analysis – – – – SWOT Matrix SPACE BCG IE matrix Grand Strategy Matrix Analysis QSPM Possible alternative strategies Our Recommendation – Strategies – Long range objectives – EPS/EBIT 2005 – • Mission, Vision, Objectives, Strategies • • • Implementation Issues Proposed annual objectives (goal) and polices Proposed procedures for evaluation Epilogue Current Performance Questions Resources Utilized ® 2007, Tony Gauvin, UMFK 2

Overview • • A brief history of Apple Computer EOY 2004 – • – – – • Opportunities & Threats CPM EFE Internal Analysis – – • New Vision and Mission External Analysis Financial Data Strengths and weaknesses IFE Financial ratios Strategic Analysis – – – – SWOT Matrix SPACE BCG IE matrix Grand Strategy Matrix Analysis QSPM Possible alternative strategies Our Recommendation – Strategies – Long range objectives – EPS/EBIT 2005 – • Mission, Vision, Objectives, Strategies • • • Implementation Issues Proposed annual objectives (goal) and polices Proposed procedures for evaluation Epilogue Current Performance Questions Resources Utilized ® 2007, Tony Gauvin, UMFK 2

History of Apple • 1976 – Apple started in a garage in Santa Clara, CA by Steve Wozniak and Steve Jobs – A easy to use PC for small computer users • 1980 – $117, 000 in sales – IPO • 1983 – Wozniak quits – Jobs hires John Sculley From Pepsi Co. to become President of Apple • 1984 – Macintosh PC ® 2007, Tony Gauvin, UMFK 3

History of Apple • 1976 – Apple started in a garage in Santa Clara, CA by Steve Wozniak and Steve Jobs – A easy to use PC for small computer users • 1980 – $117, 000 in sales – IPO • 1983 – Wozniak quits – Jobs hires John Sculley From Pepsi Co. to become President of Apple • 1984 – Macintosh PC ® 2007, Tony Gauvin, UMFK 3

History of Apple • 1985 – – Jobs and Sculley have a “falling out” Jobs fired Sculley becomes CEO Bill Gates wants to buy Mac O/S, Sculley says No, Gates buys DOS from IBM, Microsoft kicks Apple's butt (90% market share) • 1993 – Apple release Newton, the first PDA – Earnings Plunge, Apple restructures, Sculley Resigns • 1997 – Apple CEO Gilbert Amelio buys Next. Step from Steve Jobs – Earnings Plunge, Apple restructures, Amelio Resigns • 1998 – Steve Jobs returns as i. CEO ® 2007, Tony Gauvin, UMFK 4

History of Apple • 1985 – – Jobs and Sculley have a “falling out” Jobs fired Sculley becomes CEO Bill Gates wants to buy Mac O/S, Sculley says No, Gates buys DOS from IBM, Microsoft kicks Apple's butt (90% market share) • 1993 – Apple release Newton, the first PDA – Earnings Plunge, Apple restructures, Sculley Resigns • 1997 – Apple CEO Gilbert Amelio buys Next. Step from Steve Jobs – Earnings Plunge, Apple restructures, Amelio Resigns • 1998 – Steve Jobs returns as i. CEO ® 2007, Tony Gauvin, UMFK 4

History of Apple • 1998 – Jobs restructures Apple along two products lines • Consumer “i”Mac – “i” for internet • Professional “Power”Mac – “power” for power user – Sales return, Brand emerges, Innovation rules • USB, Firewire, Airport • i. Pod and i. Tunes – Stock price takes off like a rocket! ® 2007, Tony Gauvin, UMFK 5

History of Apple • 1998 – Jobs restructures Apple along two products lines • Consumer “i”Mac – “i” for internet • Professional “Power”Mac – “power” for power user – Sales return, Brand emerges, Innovation rules • USB, Firewire, Airport • i. Pod and i. Tunes – Stock price takes off like a rocket! ® 2007, Tony Gauvin, UMFK 5

Lesson learned = + ® 2007, Tony Gauvin, UMFK 6

Lesson learned = + ® 2007, Tony Gauvin, UMFK 6

2004 Vision Statement Apple ignited the personal computer revolution in the 1970 s with the Apple II and reinvented the personal computer in the 1980 s with the Macintosh. Apple is committed to bringing the beast personal computing experience to students, educators, creative professional, and consumers around the world through its innovative hardware, software, and Internet offerings ® 2007, Tony Gauvin, UMFK 7

2004 Vision Statement Apple ignited the personal computer revolution in the 1970 s with the Apple II and reinvented the personal computer in the 1980 s with the Macintosh. Apple is committed to bringing the beast personal computing experience to students, educators, creative professional, and consumers around the world through its innovative hardware, software, and Internet offerings ® 2007, Tony Gauvin, UMFK 7

2004 Mission Apple Computer is committed to protecting the environment, health and safety of our employees, customers and the global communities where we operate. We recognize that by integrating sound environmental, health and safety management practices into all aspects of our business, we can offer technologically innovative products and services while conserving and enhancing resources for future generations. Apple strives for continuous improvement in our environmental, health and safety management systems and in the environmental quality of our products, processes and services. ® 2007, Tony Gauvin, UMFK 8

2004 Mission Apple Computer is committed to protecting the environment, health and safety of our employees, customers and the global communities where we operate. We recognize that by integrating sound environmental, health and safety management practices into all aspects of our business, we can offer technologically innovative products and services while conserving and enhancing resources for future generations. Apple strives for continuous improvement in our environmental, health and safety management systems and in the environmental quality of our products, processes and services. ® 2007, Tony Gauvin, UMFK 8

2004 Strategies • Market Penetration – Branding – Niche player • New Product Development – Speech recognition – Virtual reality ® 2007, Tony Gauvin, UMFK 9

2004 Strategies • Market Penetration – Branding – Niche player • New Product Development – Speech recognition – Virtual reality ® 2007, Tony Gauvin, UMFK 9

2004 objectives • Double market Share from 5% to 10% • Remain as the most profitable computer company in the industry ® 2007, Tony Gauvin, UMFK 10

2004 objectives • Double market Share from 5% to 10% • Remain as the most profitable computer company in the industry ® 2007, Tony Gauvin, UMFK 10

2004 Issues • How can apple best capitalize on the needs of the business world for a safer, virus-free, wormfree system? • Should Apple enter the consumer electronics business like Dell and Gateway did? • Should Apple remain a lone wolf in Operating Systems or adopt a cross-platformat compatible with Windows and Intel • How much emphasis should Apple place on developing the next generation of voice recognition computers? ® 2007, Tony Gauvin, UMFK 11

2004 Issues • How can apple best capitalize on the needs of the business world for a safer, virus-free, wormfree system? • Should Apple enter the consumer electronics business like Dell and Gateway did? • Should Apple remain a lone wolf in Operating Systems or adopt a cross-platformat compatible with Windows and Intel • How much emphasis should Apple place on developing the next generation of voice recognition computers? ® 2007, Tony Gauvin, UMFK 11

A new vision To become the global leader in computer and digital music products. ® 2007, Tony Gauvin, UMFK 12

A new vision To become the global leader in computer and digital music products. ® 2007, Tony Gauvin, UMFK 12

A New Mission • The Apple commitment to excellence is its mission to provide computers and service (2) for people (1) that meet the highest standards of value and reliability. Apple is one of the leaders in the computer industry and produces some of the best-selling computers and digital music products in the world (3). Apple provides the highest level of quality and value for our customers (7). Those are timeless fundamentals. We also apply innovative technology to our core business (4) to make our products irresistible to customers, beneficial to society, and profitable to our company (5). We strive to provide additional opportunities for growth and enrichment of company personnel while maintaining a work environment for all employees (9) that encourages personal commitment and participation in support of achieving excellence. We are committed to being a good corporate citizen, and being openly honest with all of our stakeholders (6). We support activities that enable people to improve their lives and reinforce their commitment to society (8). ® 2007, Tony Gauvin, UMFK 13

A New Mission • The Apple commitment to excellence is its mission to provide computers and service (2) for people (1) that meet the highest standards of value and reliability. Apple is one of the leaders in the computer industry and produces some of the best-selling computers and digital music products in the world (3). Apple provides the highest level of quality and value for our customers (7). Those are timeless fundamentals. We also apply innovative technology to our core business (4) to make our products irresistible to customers, beneficial to society, and profitable to our company (5). We strive to provide additional opportunities for growth and enrichment of company personnel while maintaining a work environment for all employees (9) that encourages personal commitment and participation in support of achieving excellence. We are committed to being a good corporate citizen, and being openly honest with all of our stakeholders (6). We support activities that enable people to improve their lives and reinforce their commitment to society (8). ® 2007, Tony Gauvin, UMFK 13

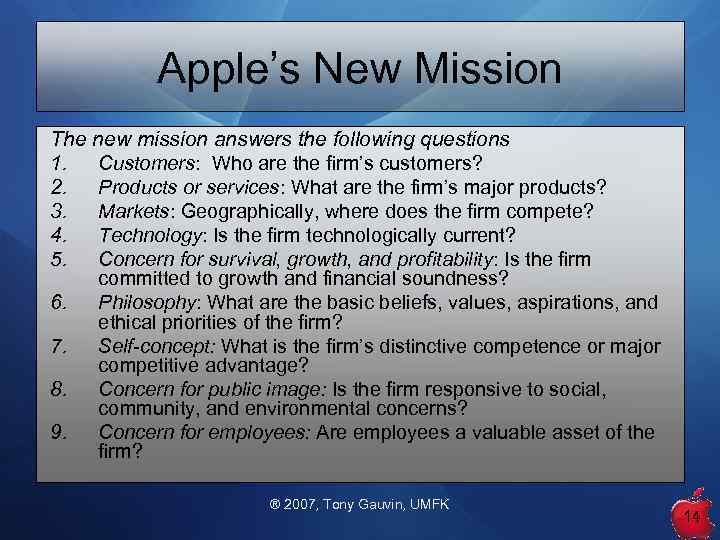

Apple’s New Mission The new mission answers the following questions 1. Customers: Who are the firm’s customers? 2. Products or services: What are the firm’s major products? 3. Markets: Geographically, where does the firm compete? 4. Technology: Is the firm technologically current? 5. Concern for survival, growth, and profitability: Is the firm committed to growth and financial soundness? 6. Philosophy: What are the basic beliefs, values, aspirations, and ethical priorities of the firm? 7. Self-concept: What is the firm’s distinctive competence or major competitive advantage? 8. Concern for public image: Is the firm responsive to social, community, and environmental concerns? 9. Concern for employees: Are employees a valuable asset of the firm? ® 2007, Tony Gauvin, UMFK 14

Apple’s New Mission The new mission answers the following questions 1. Customers: Who are the firm’s customers? 2. Products or services: What are the firm’s major products? 3. Markets: Geographically, where does the firm compete? 4. Technology: Is the firm technologically current? 5. Concern for survival, growth, and profitability: Is the firm committed to growth and financial soundness? 6. Philosophy: What are the basic beliefs, values, aspirations, and ethical priorities of the firm? 7. Self-concept: What is the firm’s distinctive competence or major competitive advantage? 8. Concern for public image: Is the firm responsive to social, community, and environmental concerns? 9. Concern for employees: Are employees a valuable asset of the firm? ® 2007, Tony Gauvin, UMFK 14

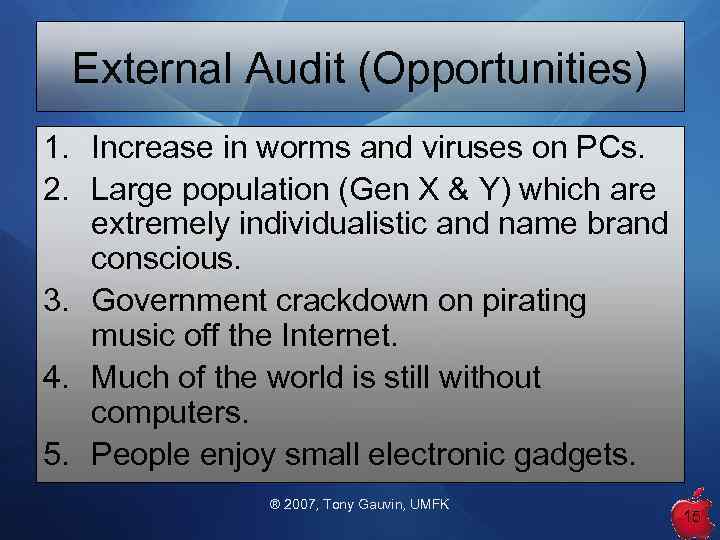

External Audit (Opportunities) 1. Increase in worms and viruses on PCs. 2. Large population (Gen X & Y) which are extremely individualistic and name brand conscious. 3. Government crackdown on pirating music off the Internet. 4. Much of the world is still without computers. 5. People enjoy small electronic gadgets. ® 2007, Tony Gauvin, UMFK 15

External Audit (Opportunities) 1. Increase in worms and viruses on PCs. 2. Large population (Gen X & Y) which are extremely individualistic and name brand conscious. 3. Government crackdown on pirating music off the Internet. 4. Much of the world is still without computers. 5. People enjoy small electronic gadgets. ® 2007, Tony Gauvin, UMFK 15

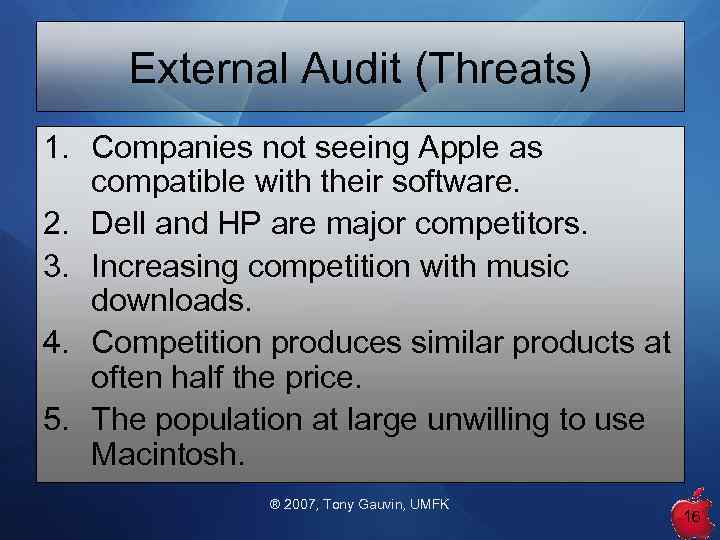

External Audit (Threats) 1. Companies not seeing Apple as compatible with their software. 2. Dell and HP are major competitors. 3. Increasing competition with music downloads. 4. Competition produces similar products at often half the price. 5. The population at large unwilling to use Macintosh. ® 2007, Tony Gauvin, UMFK 16

External Audit (Threats) 1. Companies not seeing Apple as compatible with their software. 2. Dell and HP are major competitors. 3. Increasing competition with music downloads. 4. Competition produces similar products at often half the price. 5. The population at large unwilling to use Macintosh. ® 2007, Tony Gauvin, UMFK 16

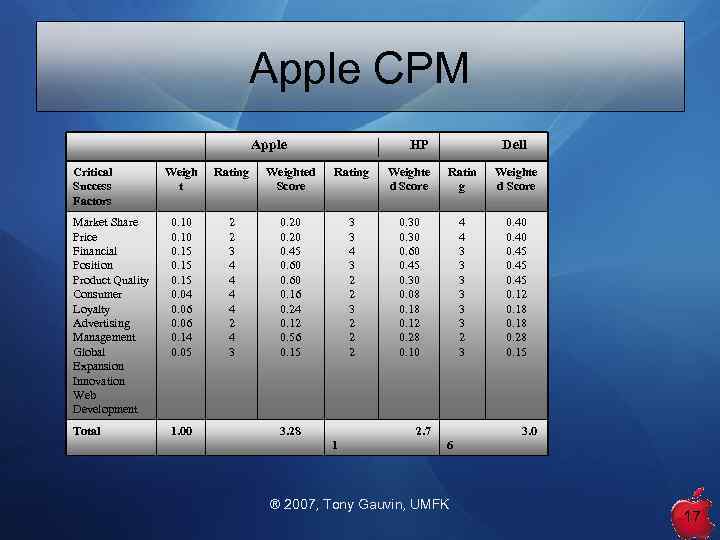

Apple CPM Apple Critical Success Factors HP Dell Weigh t Rating Weighted Score Rating Weighte d Score Ratin g Weighte d Score Market Share Price Financial Position Product Quality Consumer Loyalty Advertising Management Global Expansion Innovation Web Development 0. 10 0. 15 0. 04 0. 06 0. 14 0. 05 2 2 3 4 4 2 4 3 0. 20 0. 45 0. 60 0. 16 0. 24 0. 12 0. 56 0. 15 3 3 4 3 2 2 2 0. 30 0. 60 0. 45 0. 30 0. 08 0. 12 0. 28 0. 10 4 4 3 3 3 2 3 0. 40 0. 45 0. 12 0. 18 0. 28 0. 15 Total 1. 00 3. 28 2. 7 1 3. 0 6 ® 2007, Tony Gauvin, UMFK 17

Apple CPM Apple Critical Success Factors HP Dell Weigh t Rating Weighted Score Rating Weighte d Score Ratin g Weighte d Score Market Share Price Financial Position Product Quality Consumer Loyalty Advertising Management Global Expansion Innovation Web Development 0. 10 0. 15 0. 04 0. 06 0. 14 0. 05 2 2 3 4 4 2 4 3 0. 20 0. 45 0. 60 0. 16 0. 24 0. 12 0. 56 0. 15 3 3 4 3 2 2 2 0. 30 0. 60 0. 45 0. 30 0. 08 0. 12 0. 28 0. 10 4 4 3 3 3 2 3 0. 40 0. 45 0. 12 0. 18 0. 28 0. 15 Total 1. 00 3. 28 2. 7 1 3. 0 6 ® 2007, Tony Gauvin, UMFK 17

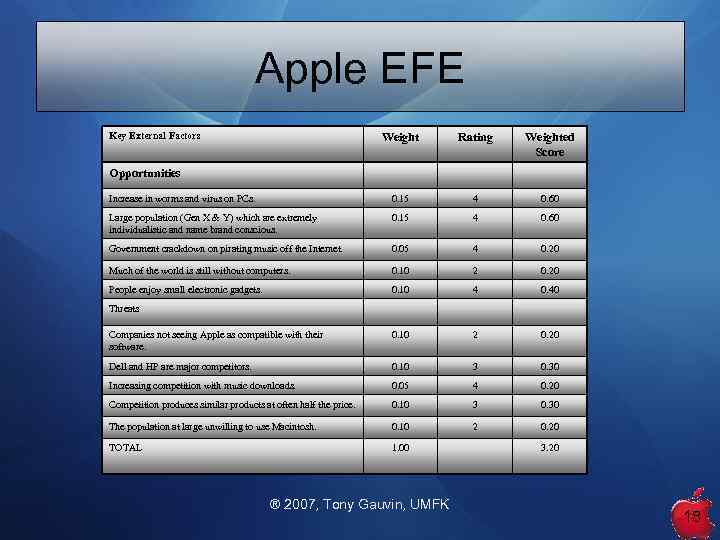

Apple EFE Key External Factors Weight Rating Weighted Score Increase in worms and virus on PCs. 0. 15 4 0. 60 Large population (Gen X & Y) which are extremely individualistic and name brand conscious. 0. 15 4 0. 60 Government crackdown on pirating music off the Internet. 0. 05 4 0. 20 Much of the world is still without computers. 0. 10 2 0. 20 People enjoy small electronic gadgets. 0. 10 4 0. 40 Companies not seeing Apple as compatible with their software. 0. 10 2 0. 20 Dell and HP are major competitors. 0. 10 3 0. 30 Increasing competition with music downloads. 0. 05 4 0. 20 Competition produces similar products at often half the price. 0. 10 3 0. 30 The population at large unwilling to use Macintosh. 0. 10 2 0. 20 TOTAL 1. 00 Opportunities Threats ® 2007, Tony Gauvin, UMFK 3. 20 18

Apple EFE Key External Factors Weight Rating Weighted Score Increase in worms and virus on PCs. 0. 15 4 0. 60 Large population (Gen X & Y) which are extremely individualistic and name brand conscious. 0. 15 4 0. 60 Government crackdown on pirating music off the Internet. 0. 05 4 0. 20 Much of the world is still without computers. 0. 10 2 0. 20 People enjoy small electronic gadgets. 0. 10 4 0. 40 Companies not seeing Apple as compatible with their software. 0. 10 2 0. 20 Dell and HP are major competitors. 0. 10 3 0. 30 Increasing competition with music downloads. 0. 05 4 0. 20 Competition produces similar products at often half the price. 0. 10 3 0. 30 The population at large unwilling to use Macintosh. 0. 10 2 0. 20 TOTAL 1. 00 Opportunities Threats ® 2007, Tony Gauvin, UMFK 3. 20 18

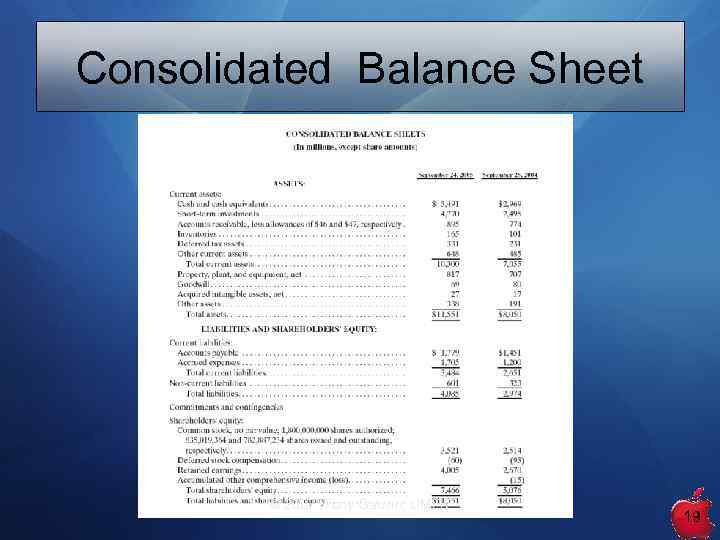

Consolidated Balance Sheet ® 2007, Tony Gauvin, UMFK 19

Consolidated Balance Sheet ® 2007, Tony Gauvin, UMFK 19

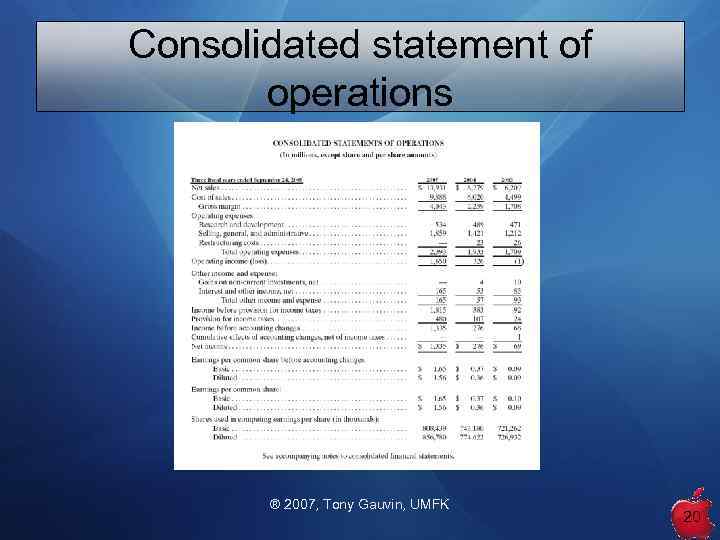

Consolidated statement of operations ® 2007, Tony Gauvin, UMFK 20

Consolidated statement of operations ® 2007, Tony Gauvin, UMFK 20

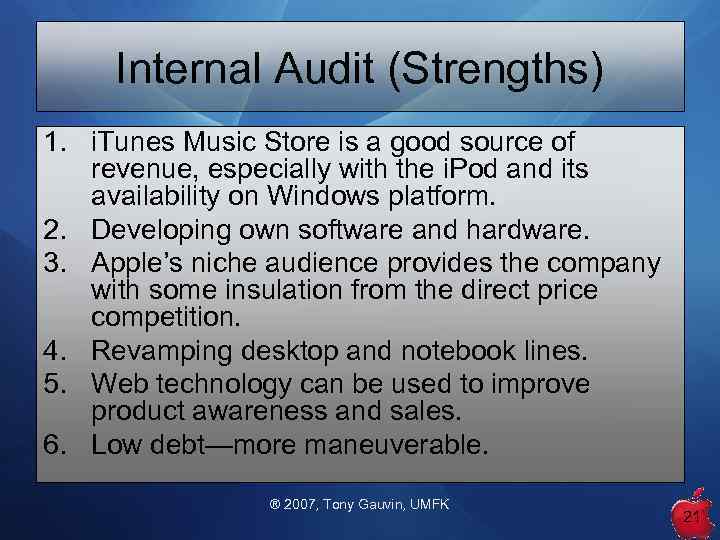

Internal Audit (Strengths) 1. i. Tunes Music Store is a good source of revenue, especially with the i. Pod and its availability on Windows platform. 2. Developing own software and hardware. 3. Apple’s niche audience provides the company with some insulation from the direct price competition. 4. Revamping desktop and notebook lines. 5. Web technology can be used to improve product awareness and sales. 6. Low debt—more maneuverable. ® 2007, Tony Gauvin, UMFK 21

Internal Audit (Strengths) 1. i. Tunes Music Store is a good source of revenue, especially with the i. Pod and its availability on Windows platform. 2. Developing own software and hardware. 3. Apple’s niche audience provides the company with some insulation from the direct price competition. 4. Revamping desktop and notebook lines. 5. Web technology can be used to improve product awareness and sales. 6. Low debt—more maneuverable. ® 2007, Tony Gauvin, UMFK 21

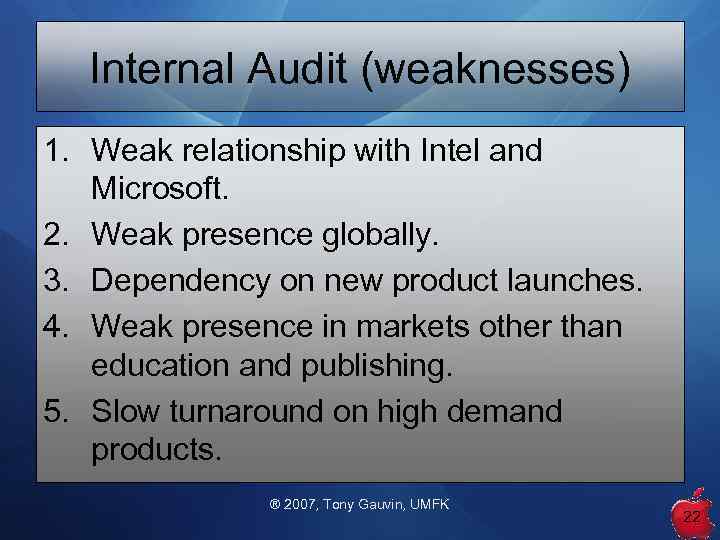

Internal Audit (weaknesses) 1. Weak relationship with Intel and Microsoft. 2. Weak presence globally. 3. Dependency on new product launches. 4. Weak presence in markets other than education and publishing. 5. Slow turnaround on high demand products. ® 2007, Tony Gauvin, UMFK 22

Internal Audit (weaknesses) 1. Weak relationship with Intel and Microsoft. 2. Weak presence globally. 3. Dependency on new product launches. 4. Weak presence in markets other than education and publishing. 5. Slow turnaround on high demand products. ® 2007, Tony Gauvin, UMFK 22

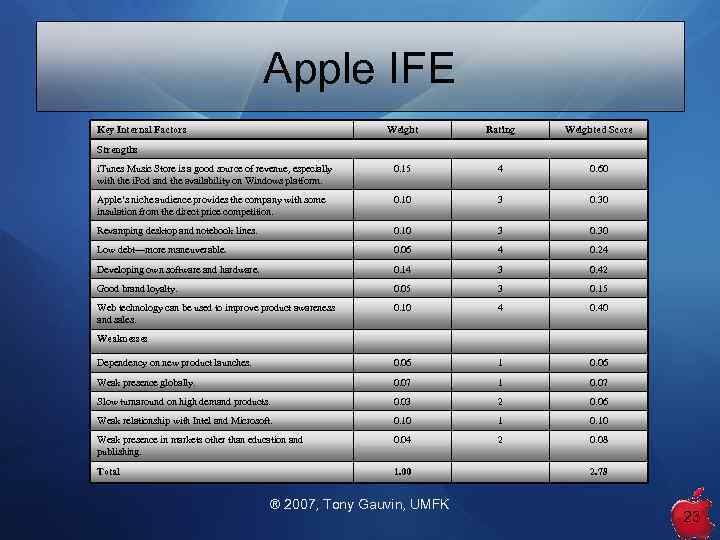

Apple IFE Key Internal Factors Weight Rating Weighted Score i. Tunes Music Store is a good source of revenue, especially with the i. Pod and the availability on Windows platform. 0. 15 4 0. 60 Apple’s niche audience provides the company with some insulation from the direct price competition. 0. 10 3 0. 30 Revamping desktop and notebook lines. 0. 10 3 0. 30 Low debt—more maneuverable. 0. 06 4 0. 24 Developing own software and hardware. 0. 14 3 0. 42 Good brand loyalty. 0. 05 3 0. 15 Web technology can be used to improve product awareness and sales. 0. 10 4 0. 40 Dependency on new product launches. 0. 06 1 0. 06 Weak presence globally. 0. 07 1 0. 07 Slow turnaround on high demand products. 0. 03 2 0. 06 Weak relationship with Intel and Microsoft. 0. 10 1 0. 10 Weak presence in markets other than education and publishing. 0. 04 2 0. 08 Total 1. 00 Strengths Weaknesses ® 2007, Tony Gauvin, UMFK 2. 78 23

Apple IFE Key Internal Factors Weight Rating Weighted Score i. Tunes Music Store is a good source of revenue, especially with the i. Pod and the availability on Windows platform. 0. 15 4 0. 60 Apple’s niche audience provides the company with some insulation from the direct price competition. 0. 10 3 0. 30 Revamping desktop and notebook lines. 0. 10 3 0. 30 Low debt—more maneuverable. 0. 06 4 0. 24 Developing own software and hardware. 0. 14 3 0. 42 Good brand loyalty. 0. 05 3 0. 15 Web technology can be used to improve product awareness and sales. 0. 10 4 0. 40 Dependency on new product launches. 0. 06 1 0. 06 Weak presence globally. 0. 07 1 0. 07 Slow turnaround on high demand products. 0. 03 2 0. 06 Weak relationship with Intel and Microsoft. 0. 10 1 0. 10 Weak presence in markets other than education and publishing. 0. 04 2 0. 08 Total 1. 00 Strengths Weaknesses ® 2007, Tony Gauvin, UMFK 2. 78 23

Financial Ratio Analysis (January 2006) Growth Rates % Apple Computer Industry SP-500 Sales (Qtr vs. year ago qtr) 56. 50 18. 00 14. 20 Net Income (YTD vs. YTD) 383. 70 78. 90 16. 30 Net Income (Qtr vs. year ago qtr) 305. 70 17. 40 17. 00 Sales (5 -Year Annual Avg. ) 12. 64 5. 00 4. 93 Net Income (5 -Year Annual Avg. ) NA NA 10. 40 Dividends (5 -Year Annual Avg. ) NA NA 4. 27 Current P/E Ratio 46. 1 31. 6 18. 8 P/E Ratio 5 -Year High NA NA 64. 8 P/E Ratio 5 -Year Low NA NA 17. 4 Price/Sales Ratio 4. 35 1. 88 1. 48 Price/Book Value 8. 11 10. 57 2. 83 Price/Cash Flow Ratio 39. 90 26. 80 12. 40 Gross Margin 30. 3 20. 2 47. 2 Pre-Tax Margin 13. 0 8. 5 11. 9 Net Profit Margin 9. 6 6. 2 8. 0 5 -Yr Gross Margin (5 -Year Avg. ) 29. 1 20. 3 47. 3 5 -Yr Pre-Tax Margin (5 -Year Avg. ) 5. 9 5. 8 9. 4 ® 2007, Tony 4. 3 Gauvin, UMFK 3. 8 5. 8 Price Ratios Profit Margins 5 -Yr Net Profit Margin (5 -Year Avg. ) 24

Financial Ratio Analysis (January 2006) Growth Rates % Apple Computer Industry SP-500 Sales (Qtr vs. year ago qtr) 56. 50 18. 00 14. 20 Net Income (YTD vs. YTD) 383. 70 78. 90 16. 30 Net Income (Qtr vs. year ago qtr) 305. 70 17. 40 17. 00 Sales (5 -Year Annual Avg. ) 12. 64 5. 00 4. 93 Net Income (5 -Year Annual Avg. ) NA NA 10. 40 Dividends (5 -Year Annual Avg. ) NA NA 4. 27 Current P/E Ratio 46. 1 31. 6 18. 8 P/E Ratio 5 -Year High NA NA 64. 8 P/E Ratio 5 -Year Low NA NA 17. 4 Price/Sales Ratio 4. 35 1. 88 1. 48 Price/Book Value 8. 11 10. 57 2. 83 Price/Cash Flow Ratio 39. 90 26. 80 12. 40 Gross Margin 30. 3 20. 2 47. 2 Pre-Tax Margin 13. 0 8. 5 11. 9 Net Profit Margin 9. 6 6. 2 8. 0 5 -Yr Gross Margin (5 -Year Avg. ) 29. 1 20. 3 47. 3 5 -Yr Pre-Tax Margin (5 -Year Avg. ) 5. 9 5. 8 9. 4 ® 2007, Tony 4. 3 Gauvin, UMFK 3. 8 5. 8 Price Ratios Profit Margins 5 -Yr Net Profit Margin (5 -Year Avg. ) 24

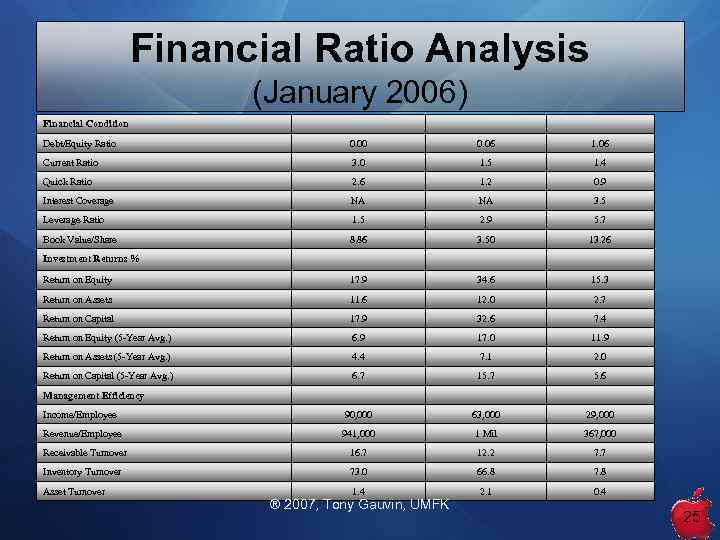

Financial Ratio Analysis (January 2006) Financial Condition Debt/Equity Ratio 0. 00 0. 06 1. 06 Current Ratio 3. 0 1. 5 1. 4 Quick Ratio 2. 6 1. 2 0. 9 Interest Coverage NA NA 3. 5 Leverage Ratio 1. 5 2. 9 5. 7 Book Value/Share 8. 86 3. 50 13. 26 Return on Equity 17. 9 34. 6 15. 3 Return on Assets 11. 6 12. 0 2. 7 Return on Capital 17. 9 32. 6 7. 4 Return on Equity (5 -Year Avg. ) 6. 9 17. 0 11. 9 Return on Assets (5 -Year Avg. ) 4. 4 7. 1 2. 0 Return on Capital (5 -Year Avg. ) 6. 7 15. 7 5. 6 Income/Employee 90, 000 63, 000 29, 000 Revenue/Employee 941, 000 1 Mil 367, 000 Receivable Turnover 16. 7 12. 2 7. 7 Inventory Turnover 73. 0 66. 8 7. 8 Asset Turnover 1. 4 2. 1 0. 4 Investment Returns % Management Efficiency ® 2007, Tony Gauvin, UMFK 25

Financial Ratio Analysis (January 2006) Financial Condition Debt/Equity Ratio 0. 00 0. 06 1. 06 Current Ratio 3. 0 1. 5 1. 4 Quick Ratio 2. 6 1. 2 0. 9 Interest Coverage NA NA 3. 5 Leverage Ratio 1. 5 2. 9 5. 7 Book Value/Share 8. 86 3. 50 13. 26 Return on Equity 17. 9 34. 6 15. 3 Return on Assets 11. 6 12. 0 2. 7 Return on Capital 17. 9 32. 6 7. 4 Return on Equity (5 -Year Avg. ) 6. 9 17. 0 11. 9 Return on Assets (5 -Year Avg. ) 4. 4 7. 1 2. 0 Return on Capital (5 -Year Avg. ) 6. 7 15. 7 5. 6 Income/Employee 90, 000 63, 000 29, 000 Revenue/Employee 941, 000 1 Mil 367, 000 Receivable Turnover 16. 7 12. 2 7. 7 Inventory Turnover 73. 0 66. 8 7. 8 Asset Turnover 1. 4 2. 1 0. 4 Investment Returns % Management Efficiency ® 2007, Tony Gauvin, UMFK 25

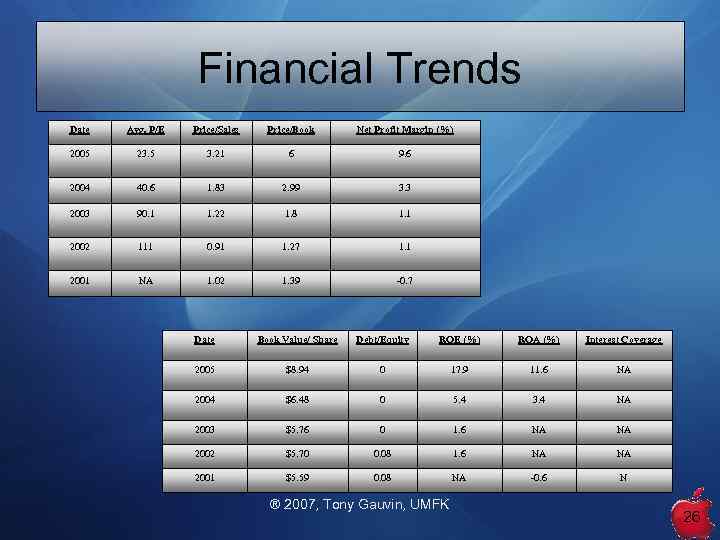

Financial Trends Date Avg. P/E Price/Sales Price/Book Net Profit Margin (%) 2005 23. 5 3. 21 6 9. 6 2004 40. 6 1. 83 2. 99 3. 3 2003 90. 1 1. 22 1. 8 1. 1 2002 111 0. 91 1. 27 1. 1 2001 NA 1. 02 1. 39 -0. 7 Date Book Value/ Share Debt/Equity ROE (%) ROA (%) Interest Coverage 2005 $8. 94 0 17. 9 11. 6 NA 2004 $6. 48 0 5. 4 3. 4 NA 2003 $5. 76 0 1. 6 NA NA 2002 $5. 70 0. 08 1. 6 NA NA 2001 $5. 59 0. 08 NA -0. 6 N ® 2007, Tony Gauvin, UMFK 26

Financial Trends Date Avg. P/E Price/Sales Price/Book Net Profit Margin (%) 2005 23. 5 3. 21 6 9. 6 2004 40. 6 1. 83 2. 99 3. 3 2003 90. 1 1. 22 1. 8 1. 1 2002 111 0. 91 1. 27 1. 1 2001 NA 1. 02 1. 39 -0. 7 Date Book Value/ Share Debt/Equity ROE (%) ROA (%) Interest Coverage 2005 $8. 94 0 17. 9 11. 6 NA 2004 $6. 48 0 5. 4 3. 4 NA 2003 $5. 76 0 1. 6 NA NA 2002 $5. 70 0. 08 1. 6 NA NA 2001 $5. 59 0. 08 NA -0. 6 N ® 2007, Tony Gauvin, UMFK 26

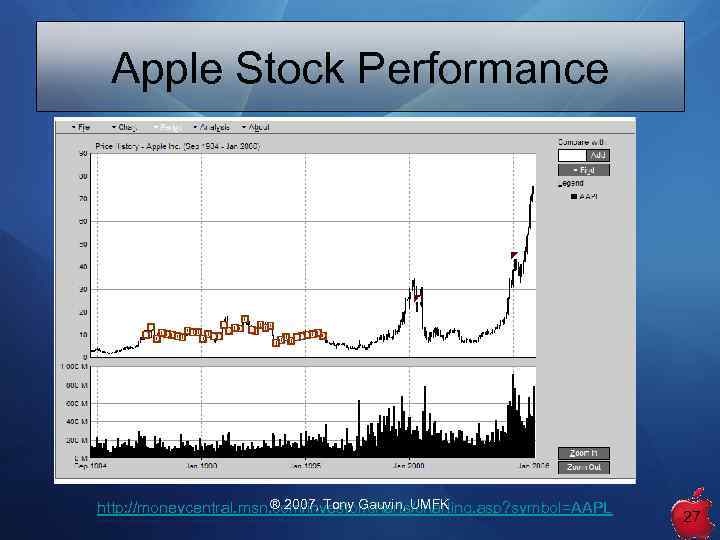

Apple Stock Performance ® 2007, Tony Gauvin, UMFK http: //moneycentral. msn. com/investor/charts/charting. asp? symbol=AAPL 27

Apple Stock Performance ® 2007, Tony Gauvin, UMFK http: //moneycentral. msn. com/investor/charts/charting. asp? symbol=AAPL 27

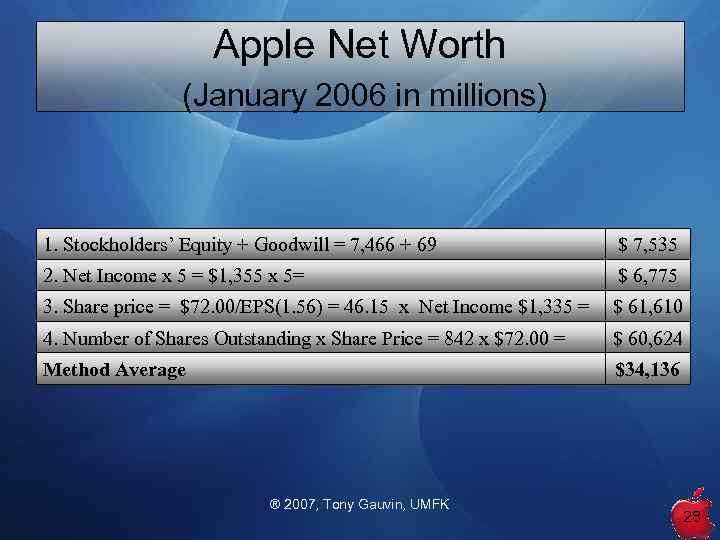

Apple Net Worth (January 2006 in millions) 1. Stockholders’ Equity + Goodwill = 7, 466 + 69 $ 7, 535 2. Net Income x 5 = $1, 355 x 5= $ 6, 775 3. Share price = $72. 00/EPS(1. 56) = 46. 15 x Net Income $1, 335 = $ 61, 610 4. Number of Shares Outstanding x Share Price = 842 x $72. 00 = $ 60, 624 Method Average $34, 136 ® 2007, Tony Gauvin, UMFK 28

Apple Net Worth (January 2006 in millions) 1. Stockholders’ Equity + Goodwill = 7, 466 + 69 $ 7, 535 2. Net Income x 5 = $1, 355 x 5= $ 6, 775 3. Share price = $72. 00/EPS(1. 56) = 46. 15 x Net Income $1, 335 = $ 61, 610 4. Number of Shares Outstanding x Share Price = 842 x $72. 00 = $ 60, 624 Method Average $34, 136 ® 2007, Tony Gauvin, UMFK 28

Strategic Analysis Swot Matrix Strengths Weaknesses 1. i. Tunes Music Store is a good source of revenue, especially with the 1. Weak relationship with Intel and Microsoft. 2. Weak presence in business arena. 3. Dependency on new product launches. 4. Weak presence in markets other than education i. Pod and the availability on Windows platform. 2. Developing own software and hardware. 3. Apple’s niche audience provides the company with some insulation from the direct price competition. 4. Revamping desktop and notebook lines. 5. Web technology can be used to improve product awareness and sales. 6. Low debt—more maneuverable. 7. Good brand loyalty. and publishing. 5. Slow turnaround on high demand products. Opportunities S-O Strategies W-O Strategies 1. Increase in worms and viruses on PCs. 2. Large population (Gen X & Y) which are extremely 1. Increase awareness through the Web of the immunity of Mac 1. Increase ties with Microsoft and Intel and their individualistic and name brand conscious. 3. Government crackdown on pirating music off the Internet. 4. Much of the world is still without computers. 5. People enjoy small electronic gadgets. products to worms and viruses. (S 5, O 1) 1. Advertise using individuals that will link Generation X & Y to the i. Tunes and other related products. (S 1, O 2, O 4, O 5) 2. Use movies and music groups that are geared towards Gen X and Y to promote computers and laptops. (S 3, S 5, O 2, O 5) products. (W 1, W 2, W 4 O 2, O 3) 2. Promote to business the safety of having a worm and virus free computer by using Mac. (W 2, W 4, O 1, O 5). 3. Expand production into Asia (W 2, O 4). Threats S-T Strategies W-T Strategies 1. Companies not seeing Apple as compatible with their 1. Increase and promote the compatibility to Windows operating system. 1. Improve relationship with Microsoft and Intel so software. 2. Dell and HP are major competitors. 3. Increasing competition with music downloads. 4. Competition produces similar products at often half the price. 5. The population at large unwilling to use Macintosh. (S 5, T 1) 2. Promote the originality of Apple computers and the different style and stable system that is worth the price difference in style, stability and speed. (S 2, S 5, T 2, T 4, T 5) that companies will see them as compatible. (W 1, W 2 T 1) 2. Produce Wintel Compatible products (W 1, T 1). ® 2007, Tony Gauvin, UMFK 29

Strategic Analysis Swot Matrix Strengths Weaknesses 1. i. Tunes Music Store is a good source of revenue, especially with the 1. Weak relationship with Intel and Microsoft. 2. Weak presence in business arena. 3. Dependency on new product launches. 4. Weak presence in markets other than education i. Pod and the availability on Windows platform. 2. Developing own software and hardware. 3. Apple’s niche audience provides the company with some insulation from the direct price competition. 4. Revamping desktop and notebook lines. 5. Web technology can be used to improve product awareness and sales. 6. Low debt—more maneuverable. 7. Good brand loyalty. and publishing. 5. Slow turnaround on high demand products. Opportunities S-O Strategies W-O Strategies 1. Increase in worms and viruses on PCs. 2. Large population (Gen X & Y) which are extremely 1. Increase awareness through the Web of the immunity of Mac 1. Increase ties with Microsoft and Intel and their individualistic and name brand conscious. 3. Government crackdown on pirating music off the Internet. 4. Much of the world is still without computers. 5. People enjoy small electronic gadgets. products to worms and viruses. (S 5, O 1) 1. Advertise using individuals that will link Generation X & Y to the i. Tunes and other related products. (S 1, O 2, O 4, O 5) 2. Use movies and music groups that are geared towards Gen X and Y to promote computers and laptops. (S 3, S 5, O 2, O 5) products. (W 1, W 2, W 4 O 2, O 3) 2. Promote to business the safety of having a worm and virus free computer by using Mac. (W 2, W 4, O 1, O 5). 3. Expand production into Asia (W 2, O 4). Threats S-T Strategies W-T Strategies 1. Companies not seeing Apple as compatible with their 1. Increase and promote the compatibility to Windows operating system. 1. Improve relationship with Microsoft and Intel so software. 2. Dell and HP are major competitors. 3. Increasing competition with music downloads. 4. Competition produces similar products at often half the price. 5. The population at large unwilling to use Macintosh. (S 5, T 1) 2. Promote the originality of Apple computers and the different style and stable system that is worth the price difference in style, stability and speed. (S 2, S 5, T 2, T 4, T 5) that companies will see them as compatible. (W 1, W 2 T 1) 2. Produce Wintel Compatible products (W 1, T 1). ® 2007, Tony Gauvin, UMFK 29

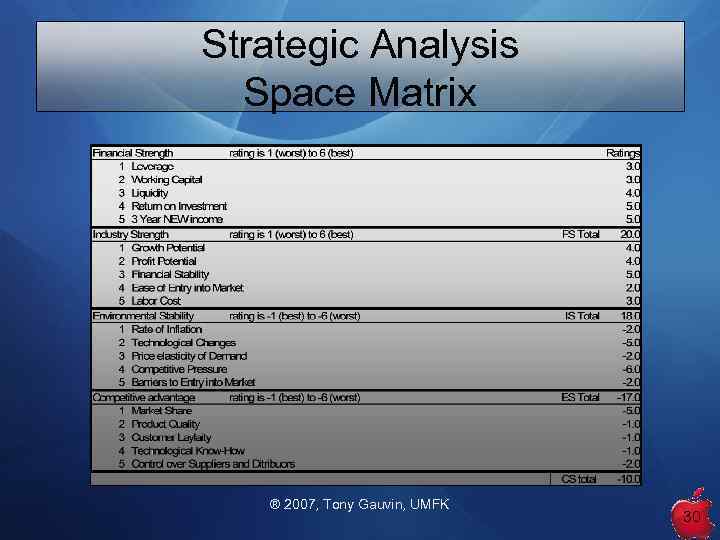

Strategic Analysis Space Matrix ® 2007, Tony Gauvin, UMFK 30

Strategic Analysis Space Matrix ® 2007, Tony Gauvin, UMFK 30

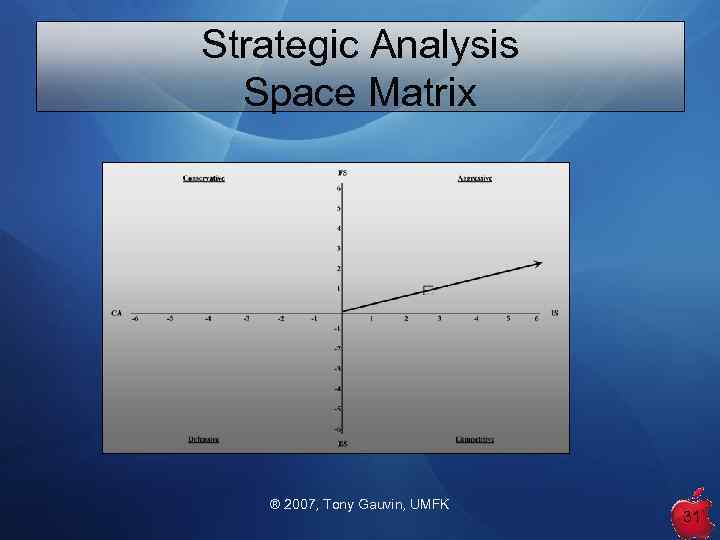

Strategic Analysis Space Matrix ® 2007, Tony Gauvin, UMFK 31

Strategic Analysis Space Matrix ® 2007, Tony Gauvin, UMFK 31

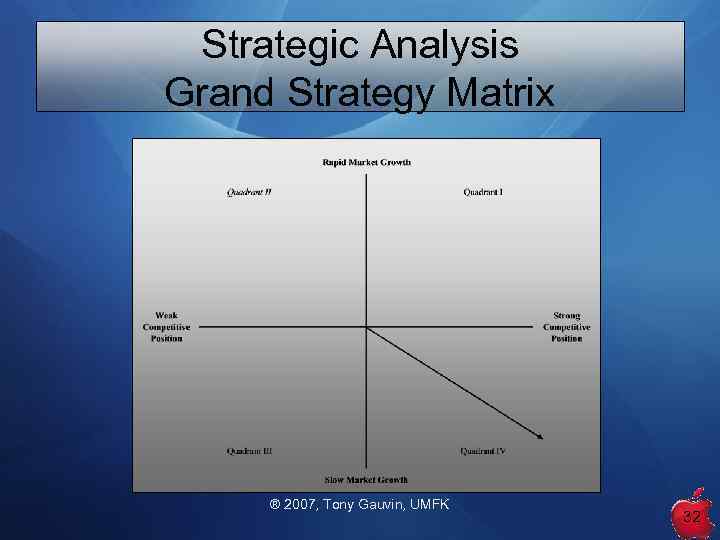

Strategic Analysis Grand Strategy Matrix ® 2007, Tony Gauvin, UMFK 32

Strategic Analysis Grand Strategy Matrix ® 2007, Tony Gauvin, UMFK 32

Apple IE Matrix Grow and Build Hold and Maintain IFE Scores I II III V VI VII High 3 -4 Average 2 -2. 99 IV Harvest or Divest Strong 3 -4 VIII IX Domestic Weak 1 -1. 99 EFE Scores International Medium 2 -2. 99 L ow 1 -1. 99 Segments Revenue Profit Domestic ® 2007, Tony Gauvin, UMFK 52% 54% International 46% 48% EFE 3. 5 3. 0 IFE 2. 6 3. 0 33

Apple IE Matrix Grow and Build Hold and Maintain IFE Scores I II III V VI VII High 3 -4 Average 2 -2. 99 IV Harvest or Divest Strong 3 -4 VIII IX Domestic Weak 1 -1. 99 EFE Scores International Medium 2 -2. 99 L ow 1 -1. 99 Segments Revenue Profit Domestic ® 2007, Tony Gauvin, UMFK 52% 54% International 46% 48% EFE 3. 5 3. 0 IFE 2. 6 3. 0 33

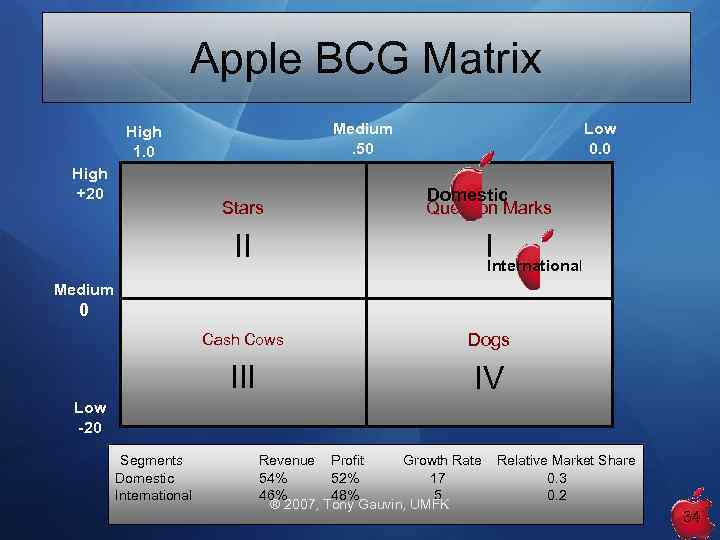

Apple BCG Matrix Medium. 50 High 1. 0 High +20 Stars Low 0. 0 Domestic Question Marks II IInternational Medium 0 Cash Cows Dogs III IV Low -20 Segments Domestic International Revenue Profit Growth Rate 54% 52% 17 46% 48% 5 ® 2007, Tony Gauvin, UMFK Relative Market Share 0. 3 0. 2 34

Apple BCG Matrix Medium. 50 High 1. 0 High +20 Stars Low 0. 0 Domestic Question Marks II IInternational Medium 0 Cash Cows Dogs III IV Low -20 Segments Domestic International Revenue Profit Growth Rate 54% 52% 17 46% 48% 5 ® 2007, Tony Gauvin, UMFK Relative Market Share 0. 3 0. 2 34

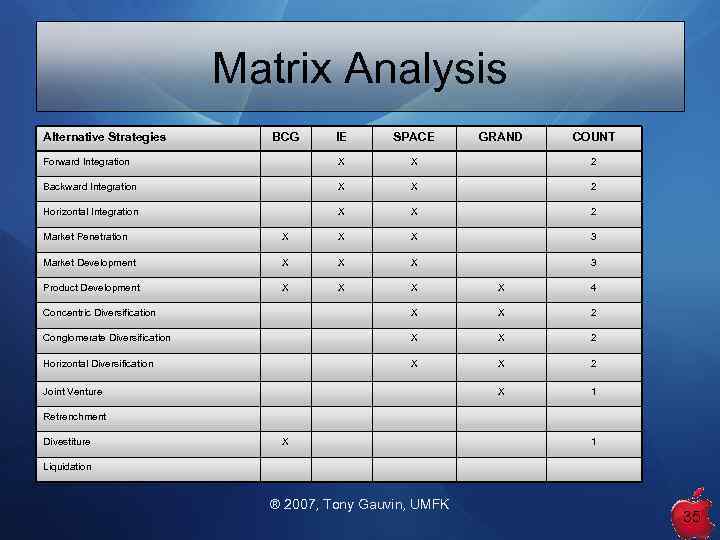

Matrix Analysis Alternative Strategies BCG IE SPACE GRAND COUNT Forward Integration X X 2 Backward Integration X X 2 Horizontal Integration X X 2 Market Penetration X X X 3 Market Development X X X 3 Product Development X X 4 Concentric Diversification X X 2 Conglomerate Diversification X X 2 Horizontal Diversification X X 2 X 1 Joint Venture Retrenchment Divestiture X 1 Liquidation ® 2007, Tony Gauvin, UMFK 35

Matrix Analysis Alternative Strategies BCG IE SPACE GRAND COUNT Forward Integration X X 2 Backward Integration X X 2 Horizontal Integration X X 2 Market Penetration X X X 3 Market Development X X X 3 Product Development X X 4 Concentric Diversification X X 2 Conglomerate Diversification X X 2 Horizontal Diversification X X 2 X 1 Joint Venture Retrenchment Divestiture X 1 Liquidation ® 2007, Tony Gauvin, UMFK 35

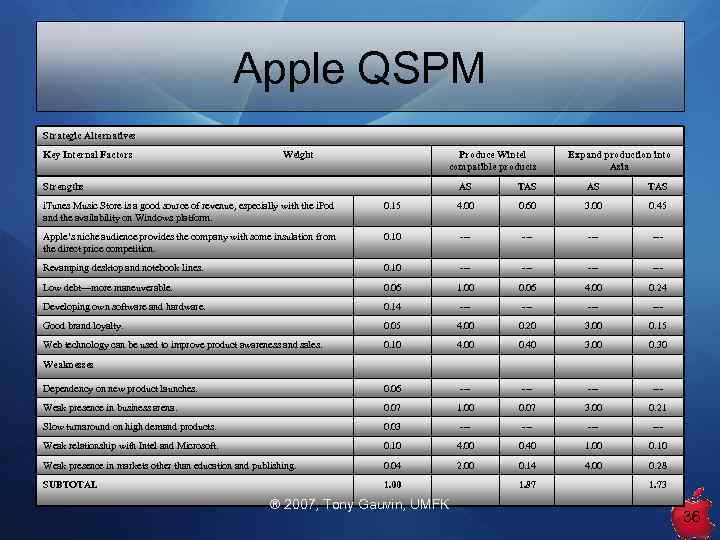

Apple QSPM Strategic Alternatives Key Internal Factors Weight Produce Wintel compatible products Strengths Expand production into Asia AS TAS i. Tunes Music Store is a good source of revenue, especially with the i. Pod and the availability on Windows platform. 0. 15 4. 00 0. 60 3. 00 0. 45 Apple’s niche audience provides the company with some insulation from the direct price competition. 0. 10 --- --- Revamping desktop and notebook lines. 0. 10 --- --- Low debt—more maneuverable. 0. 06 1. 00 0. 06 4. 00 0. 24 Developing own software and hardware. 0. 14 --- --- Good brand loyalty. 0. 05 4. 00 0. 20 3. 00 0. 15 Web technology can be used to improve product awareness and sales. 0. 10 4. 00 0. 40 3. 00 0. 30 Dependency on new product launches. 0. 06 --- --- Weak presence in business arena. 0. 07 1. 00 0. 07 3. 00 0. 21 Slow turnaround on high demand products. 0. 03 --- --- Weak relationship with Intel and Microsoft. 0. 10 4. 00 0. 40 1. 00 0. 10 Weak presence in markets other than education and publishing. 0. 04 2. 00 0. 14 4. 00 0. 28 SUBTOTAL 1. 00 Weaknesses ® 2007, Tony Gauvin, UMFK 1. 87 1. 73 36

Apple QSPM Strategic Alternatives Key Internal Factors Weight Produce Wintel compatible products Strengths Expand production into Asia AS TAS i. Tunes Music Store is a good source of revenue, especially with the i. Pod and the availability on Windows platform. 0. 15 4. 00 0. 60 3. 00 0. 45 Apple’s niche audience provides the company with some insulation from the direct price competition. 0. 10 --- --- Revamping desktop and notebook lines. 0. 10 --- --- Low debt—more maneuverable. 0. 06 1. 00 0. 06 4. 00 0. 24 Developing own software and hardware. 0. 14 --- --- Good brand loyalty. 0. 05 4. 00 0. 20 3. 00 0. 15 Web technology can be used to improve product awareness and sales. 0. 10 4. 00 0. 40 3. 00 0. 30 Dependency on new product launches. 0. 06 --- --- Weak presence in business arena. 0. 07 1. 00 0. 07 3. 00 0. 21 Slow turnaround on high demand products. 0. 03 --- --- Weak relationship with Intel and Microsoft. 0. 10 4. 00 0. 40 1. 00 0. 10 Weak presence in markets other than education and publishing. 0. 04 2. 00 0. 14 4. 00 0. 28 SUBTOTAL 1. 00 Weaknesses ® 2007, Tony Gauvin, UMFK 1. 87 1. 73 36

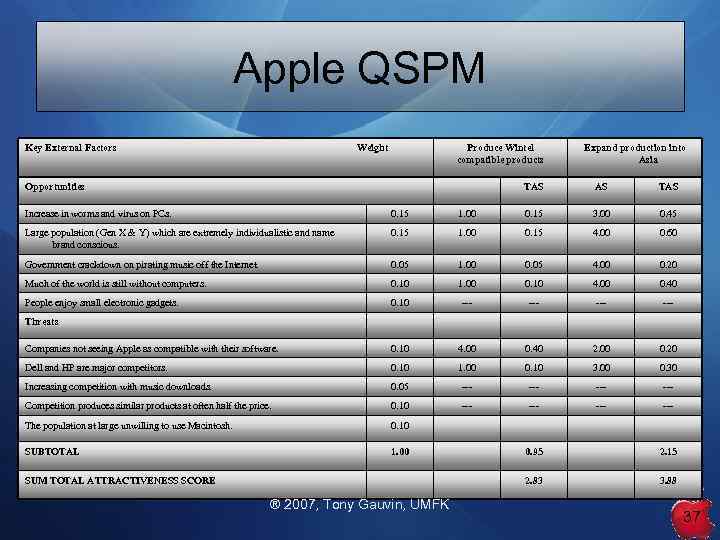

Apple QSPM Key External Factors Weight Produce Wintel compatible products Opportunities Expand production into Asia TAS AS TAS Increase in worms and virus on PCs. 0. 15 1. 00 0. 15 3. 00 0. 45 Large population (Gen X & Y) which are extremely individualistic and name brand conscious. 0. 15 1. 00 0. 15 4. 00 0. 60 Government crackdown on pirating music off the Internet. 0. 05 1. 00 0. 05 4. 00 0. 20 Much of the world is still without computers. 0. 10 1. 00 0. 10 4. 00 0. 40 People enjoy small electronic gadgets. 0. 10 --- --- Companies not seeing Apple as compatible with their software. 0. 10 4. 00 0. 40 2. 00 0. 20 Dell and HP are major competitors. 0. 10 1. 00 0. 10 3. 00 0. 30 Increasing competition with music downloads. 0. 05 --- --- Competition produces similar products at often half the price. 0. 10 --- --- The population at large unwilling to use Macintosh. 0. 10 SUBTOTAL 1. 00 Threats ® 2007, Tony Gauvin, UMFK 2. 15 2. 83 SUM TOTAL ATTRACTIVENESS SCORE 0. 95 3. 88 37

Apple QSPM Key External Factors Weight Produce Wintel compatible products Opportunities Expand production into Asia TAS AS TAS Increase in worms and virus on PCs. 0. 15 1. 00 0. 15 3. 00 0. 45 Large population (Gen X & Y) which are extremely individualistic and name brand conscious. 0. 15 1. 00 0. 15 4. 00 0. 60 Government crackdown on pirating music off the Internet. 0. 05 1. 00 0. 05 4. 00 0. 20 Much of the world is still without computers. 0. 10 1. 00 0. 10 4. 00 0. 40 People enjoy small electronic gadgets. 0. 10 --- --- Companies not seeing Apple as compatible with their software. 0. 10 4. 00 0. 40 2. 00 0. 20 Dell and HP are major competitors. 0. 10 1. 00 0. 10 3. 00 0. 30 Increasing competition with music downloads. 0. 05 --- --- Competition produces similar products at often half the price. 0. 10 --- --- The population at large unwilling to use Macintosh. 0. 10 SUBTOTAL 1. 00 Threats ® 2007, Tony Gauvin, UMFK 2. 15 2. 83 SUM TOTAL ATTRACTIVENESS SCORE 0. 95 3. 88 37

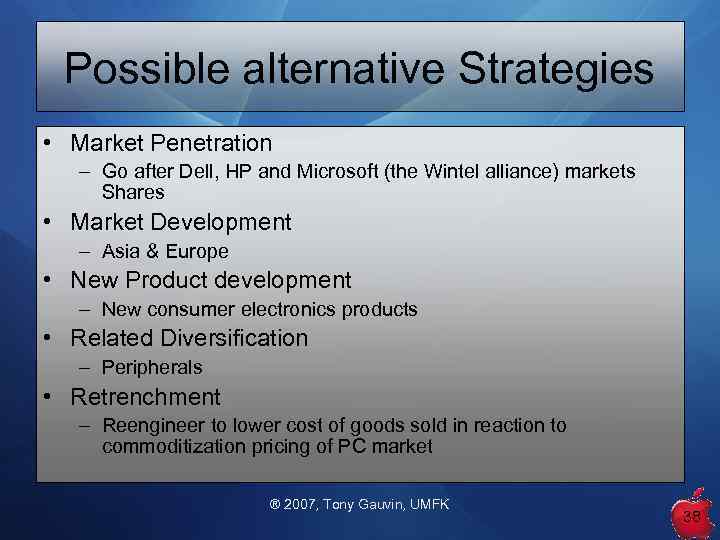

Possible alternative Strategies • Market Penetration – Go after Dell, HP and Microsoft (the Wintel alliance) markets Shares • Market Development – Asia & Europe • New Product development – New consumer electronics products • Related Diversification – Peripherals • Retrenchment – Reengineer to lower cost of goods sold in reaction to commoditization pricing of PC market ® 2007, Tony Gauvin, UMFK 38

Possible alternative Strategies • Market Penetration – Go after Dell, HP and Microsoft (the Wintel alliance) markets Shares • Market Development – Asia & Europe • New Product development – New consumer electronics products • Related Diversification – Peripherals • Retrenchment – Reengineer to lower cost of goods sold in reaction to commoditization pricing of PC market ® 2007, Tony Gauvin, UMFK 38

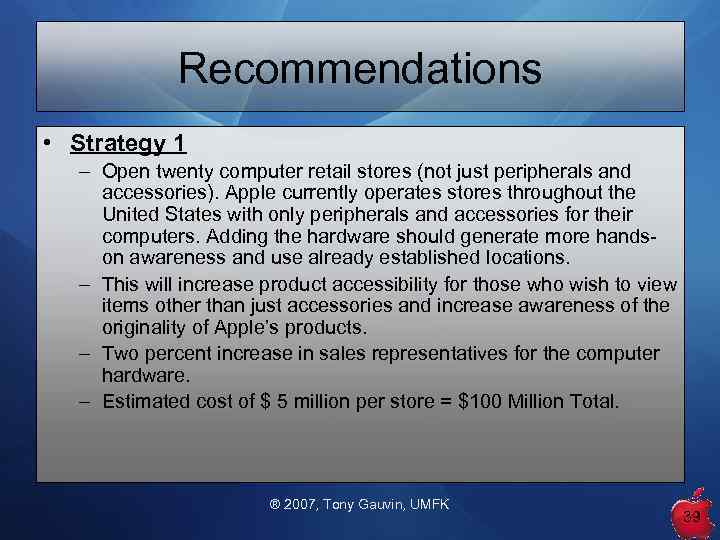

Recommendations • Strategy 1 – Open twenty computer retail stores (not just peripherals and accessories). Apple currently operates stores throughout the United States with only peripherals and accessories for their computers. Adding the hardware should generate more handson awareness and use already established locations. – This will increase product accessibility for those who wish to view items other than just accessories and increase awareness of the originality of Apple’s products. – Two percent increase in sales representatives for the computer hardware. – Estimated cost of $ 5 million per store = $100 Million Total. ® 2007, Tony Gauvin, UMFK 39

Recommendations • Strategy 1 – Open twenty computer retail stores (not just peripherals and accessories). Apple currently operates stores throughout the United States with only peripherals and accessories for their computers. Adding the hardware should generate more handson awareness and use already established locations. – This will increase product accessibility for those who wish to view items other than just accessories and increase awareness of the originality of Apple’s products. – Two percent increase in sales representatives for the computer hardware. – Estimated cost of $ 5 million per store = $100 Million Total. ® 2007, Tony Gauvin, UMFK 39

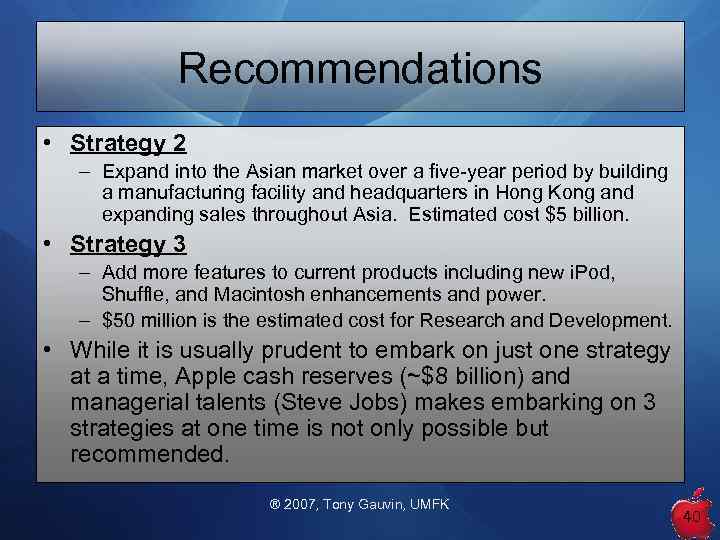

Recommendations • Strategy 2 – Expand into the Asian market over a five-year period by building a manufacturing facility and headquarters in Hong Kong and expanding sales throughout Asia. Estimated cost $5 billion. • Strategy 3 – Add more features to current products including new i. Pod, Shuffle, and Macintosh enhancements and power. – $50 million is the estimated cost for Research and Development. • While it is usually prudent to embark on just one strategy at a time, Apple cash reserves (~$8 billion) and managerial talents (Steve Jobs) makes embarking on 3 strategies at one time is not only possible but recommended. ® 2007, Tony Gauvin, UMFK 40

Recommendations • Strategy 2 – Expand into the Asian market over a five-year period by building a manufacturing facility and headquarters in Hong Kong and expanding sales throughout Asia. Estimated cost $5 billion. • Strategy 3 – Add more features to current products including new i. Pod, Shuffle, and Macintosh enhancements and power. – $50 million is the estimated cost for Research and Development. • While it is usually prudent to embark on just one strategy at a time, Apple cash reserves (~$8 billion) and managerial talents (Steve Jobs) makes embarking on 3 strategies at one time is not only possible but recommended. ® 2007, Tony Gauvin, UMFK 40

EPS/EBIT • $ Amount Needed: $5, 100 M – Strategy 1 & 2 • • Stock Price: $75 Tax Rate: 26% Interest Rate: 5% (2006) # Shares Outstanding: 842 M ® 2007, Tony Gauvin, UMFK 41

EPS/EBIT • $ Amount Needed: $5, 100 M – Strategy 1 & 2 • • Stock Price: $75 Tax Rate: 26% Interest Rate: 5% (2006) # Shares Outstanding: 842 M ® 2007, Tony Gauvin, UMFK 41

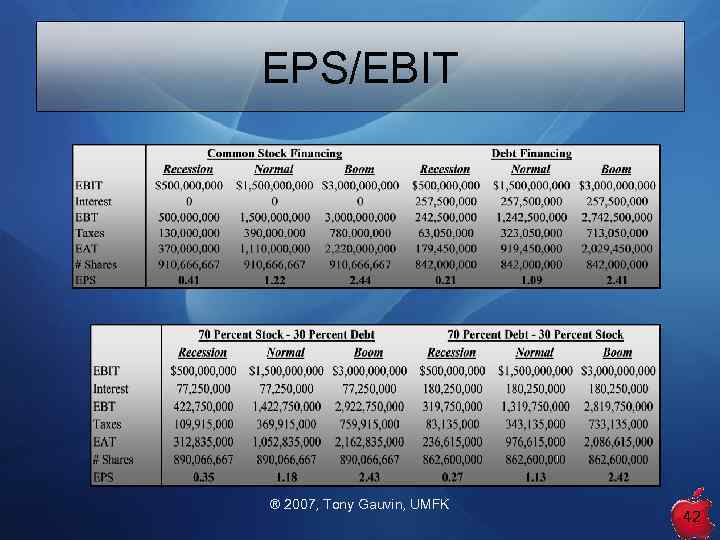

EPS/EBIT ® 2007, Tony Gauvin, UMFK 42

EPS/EBIT ® 2007, Tony Gauvin, UMFK 42

Implementation Issues • Moving production overseas – – – Unsettling for current workforce MIS Integration problems Change in culture May damage brand (Made in USA) Environmental outlook • New marketing strategies – Paradox of marketing to deficiencies of Wintel platform while becoming cross platform capable • Forward integration issues – Do we have the talent to become direct sellers – Cross selling competitors peripherals >> Brand Dilution? ® 2007, Tony Gauvin, UMFK 43

Implementation Issues • Moving production overseas – – – Unsettling for current workforce MIS Integration problems Change in culture May damage brand (Made in USA) Environmental outlook • New marketing strategies – Paradox of marketing to deficiencies of Wintel platform while becoming cross platform capable • Forward integration issues – Do we have the talent to become direct sellers – Cross selling competitors peripherals >> Brand Dilution? ® 2007, Tony Gauvin, UMFK 43

Proposed annual objectives (goal) and polices • Double sales revenue in 3 years – 1 st year 50%, 2 year 25, 3 year 25% – Write division polices stating exact gains and marketing approaches to achieve gains • Reduce unit cost of goods sold by 10% annually for next 3 years – Leverage low cost labor overseas • Introduce one new consumer product each year – Provide adequate funding to R&D – Provide funding for market research – Insure strong communication ties between marketing and R&D • Either provide functional enhancements to existing products each year or obsolesce product – Assign R&D project teams to each existing product – Have market research produce product maturity curves for existing products • Create Chief scientist position on Corporate Board to reflect the importance of R&D to Apple Computer ® 2007, Tony Gauvin, UMFK 44

Proposed annual objectives (goal) and polices • Double sales revenue in 3 years – 1 st year 50%, 2 year 25, 3 year 25% – Write division polices stating exact gains and marketing approaches to achieve gains • Reduce unit cost of goods sold by 10% annually for next 3 years – Leverage low cost labor overseas • Introduce one new consumer product each year – Provide adequate funding to R&D – Provide funding for market research – Insure strong communication ties between marketing and R&D • Either provide functional enhancements to existing products each year or obsolesce product – Assign R&D project teams to each existing product – Have market research produce product maturity curves for existing products • Create Chief scientist position on Corporate Board to reflect the importance of R&D to Apple Computer ® 2007, Tony Gauvin, UMFK 44

Proposed procedures for evaluation • Qtr & Yearly financial reports • Track Industry & market Reponses to new product development • Balanced Scorecard • Yearly strategic meeting of division management and corporate management ® 2007, Tony Gauvin, UMFK 45

Proposed procedures for evaluation • Qtr & Yearly financial reports • Track Industry & market Reponses to new product development • Balanced Scorecard • Yearly strategic meeting of division management and corporate management ® 2007, Tony Gauvin, UMFK 45

Epilogue • 2006 – – i. Pods add Video Content from Disney, ABC, ESPN, SOAPnet Stock soars by 120% i. Pod morphs to • Shuffle • Nano – Goes to Intel Architecture – Sales increase by 45% – Gross margin increase by 8% • 2007 – i. Phone – Sales predicted to increase by 35% – Gross profit margin predicted to increase by 8% ® 2007, Tony Gauvin, UMFK 46

Epilogue • 2006 – – i. Pods add Video Content from Disney, ABC, ESPN, SOAPnet Stock soars by 120% i. Pod morphs to • Shuffle • Nano – Goes to Intel Architecture – Sales increase by 45% – Gross margin increase by 8% • 2007 – i. Phone – Sales predicted to increase by 35% – Gross profit margin predicted to increase by 8% ® 2007, Tony Gauvin, UMFK 46

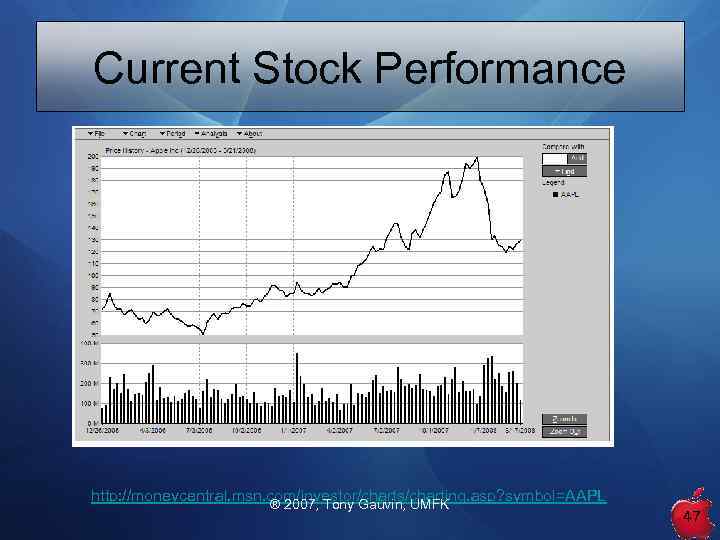

Current Stock Performance http: //moneycentral. msn. com/investor/charts/charting. asp? symbol=AAPL ® 2007, Tony Gauvin, UMFK 47

Current Stock Performance http: //moneycentral. msn. com/investor/charts/charting. asp? symbol=AAPL ® 2007, Tony Gauvin, UMFK 47

Resources • Case Notes – Forest David; Francis Marion University • Form 10 -K SEC Filing, Sept. 25, 2005 • Datamonitor – – SWOT Apple 2004 & 2005 PCs in the United States 2005 Consumer Electronics in the United States 2005 Market Watch • Apple: Unix for the people, Unix for the masses 2005 • Value line Investment survey – Apple 2007 – Computer Peripherals 2007 ® 2007, Tony Gauvin, UMFK 48

Resources • Case Notes – Forest David; Francis Marion University • Form 10 -K SEC Filing, Sept. 25, 2005 • Datamonitor – – SWOT Apple 2004 & 2005 PCs in the United States 2005 Consumer Electronics in the United States 2005 Market Watch • Apple: Unix for the people, Unix for the masses 2005 • Value line Investment survey – Apple 2007 – Computer Peripherals 2007 ® 2007, Tony Gauvin, UMFK 48

Questions http: //seriouslygood. kdweeks. com/images/apple-question. gif ® 2007, Tony Gauvin, UMFK 49

Questions http: //seriouslygood. kdweeks. com/images/apple-question. gif ® 2007, Tony Gauvin, UMFK 49