Додатки, Виталя.pptx

- Количество слайдов: 15

Appendixes

Appendixes

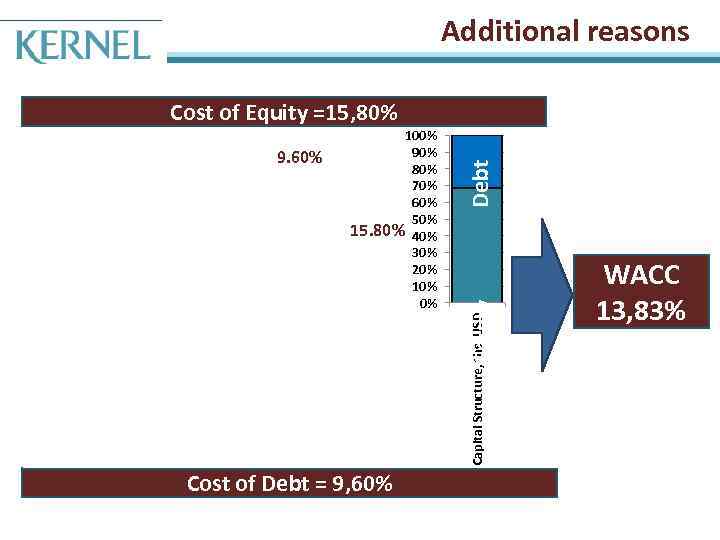

Additional reasons Equity Сapital Structure, ths. USD Cost of Debt 9. 60% 100% 90% 80% 70% 60% 50% 15. 80% 40% 30% 20% 10% 0% Debt Cost of Equity =15, 80% Cost of Debt = 9, 60% WACC 13, 83%

Additional reasons Equity Сapital Structure, ths. USD Cost of Debt 9. 60% 100% 90% 80% 70% 60% 50% 15. 80% 40% 30% 20% 10% 0% Debt Cost of Equity =15, 80% Cost of Debt = 9, 60% WACC 13, 83%

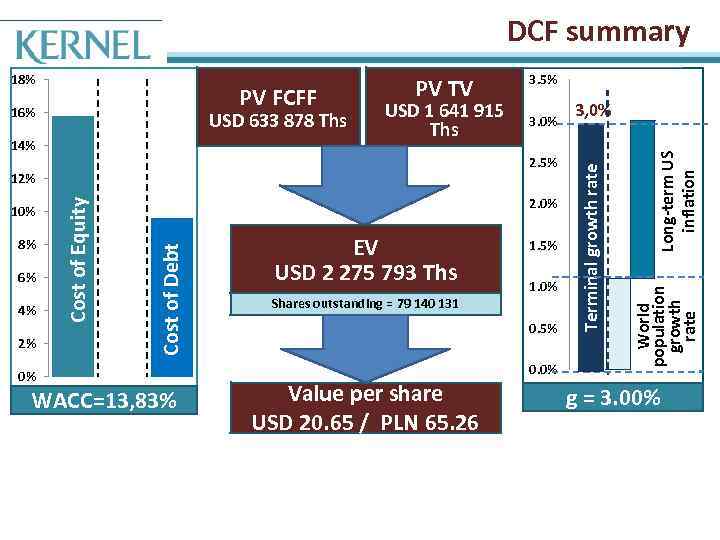

DCF summary 14% USD 1 641 915 Ths 2. 5% 6% 4% 2% 2. 0% Cost of Debt 8% Cost of Equity 12% 10% 3. 0% 0% WACC=13, 83% EV USD 2 275 793 Ths Shares outstanding = 79 140 131 1. 5% 1. 0% 0. 5% 0. 0% Value per share USD 20. 65 / PLN 65. 26 3, 0% Long-term US inflation USD 633 878 Ths 3. 5% World population growth rate PV FCFF 16% PV TV Terminal growth rate 18% g = 3. 00%

DCF summary 14% USD 1 641 915 Ths 2. 5% 6% 4% 2% 2. 0% Cost of Debt 8% Cost of Equity 12% 10% 3. 0% 0% WACC=13, 83% EV USD 2 275 793 Ths Shares outstanding = 79 140 131 1. 5% 1. 0% 0. 5% 0. 0% Value per share USD 20. 65 / PLN 65. 26 3, 0% Long-term US inflation USD 633 878 Ths 3. 5% World population growth rate PV FCFF 16% PV TV Terminal growth rate 18% g = 3. 00%

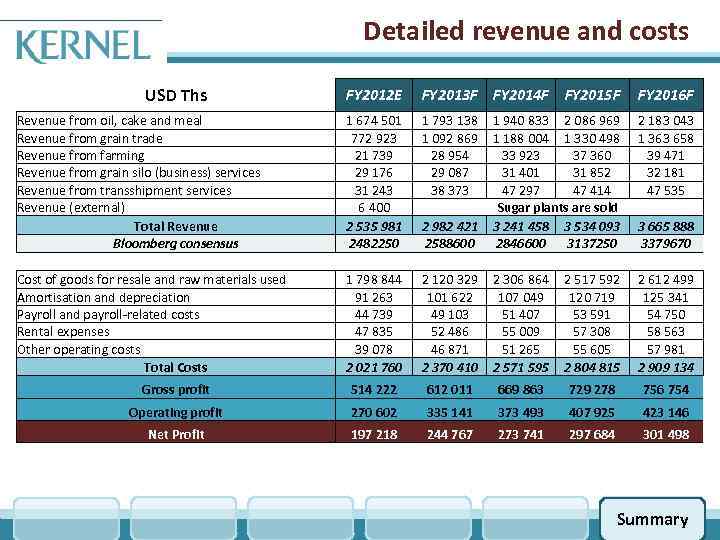

Detailed revenue and costs USD Ths FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F Revenue from oil, cake and meal Revenue from grain trade Revenue from farming Revenue from grain silo (business) services Revenue from transshipment services Revenue (external) Total Revenue Bloomberg consensus 1 674 501 772 923 21 739 29 176 31 243 6 400 2 535 981 2482250 1 793 138 1 092 869 28 954 29 087 38 373 2 183 043 1 363 658 39 471 32 181 47 535 2 982 421 2588600 1 940 833 2 086 969 1 188 004 1 330 498 33 923 37 360 31 401 31 852 47 297 47 414 Sugar plants are sold 3 241 458 3 534 093 2846600 3137250 Cost of goods for resale and raw materials used Amortisation and depreciation Payroll and payroll-related costs Rental expenses Other operating costs Total Costs 1 798 844 91 263 44 739 47 835 39 078 2 021 760 2 120 329 101 622 49 103 52 486 46 871 2 370 410 2 306 864 107 049 51 407 55 009 51 265 2 571 595 2 517 592 120 719 53 591 57 308 55 605 2 804 815 2 612 499 125 341 54 750 58 563 57 981 2 909 134 Gross profit 514 222 612 011 669 863 729 278 756 754 Operating profit 270 602 335 141 373 493 407 925 423 146 Net Profit 197 218 244 767 273 741 297 684 301 498 3 665 888 3379670 Summary

Detailed revenue and costs USD Ths FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F Revenue from oil, cake and meal Revenue from grain trade Revenue from farming Revenue from grain silo (business) services Revenue from transshipment services Revenue (external) Total Revenue Bloomberg consensus 1 674 501 772 923 21 739 29 176 31 243 6 400 2 535 981 2482250 1 793 138 1 092 869 28 954 29 087 38 373 2 183 043 1 363 658 39 471 32 181 47 535 2 982 421 2588600 1 940 833 2 086 969 1 188 004 1 330 498 33 923 37 360 31 401 31 852 47 297 47 414 Sugar plants are sold 3 241 458 3 534 093 2846600 3137250 Cost of goods for resale and raw materials used Amortisation and depreciation Payroll and payroll-related costs Rental expenses Other operating costs Total Costs 1 798 844 91 263 44 739 47 835 39 078 2 021 760 2 120 329 101 622 49 103 52 486 46 871 2 370 410 2 306 864 107 049 51 407 55 009 51 265 2 571 595 2 517 592 120 719 53 591 57 308 55 605 2 804 815 2 612 499 125 341 54 750 58 563 57 981 2 909 134 Gross profit 514 222 612 011 669 863 729 278 756 754 Operating profit 270 602 335 141 373 493 407 925 423 146 Net Profit 197 218 244 767 273 741 297 684 301 498 3 665 888 3379670 Summary

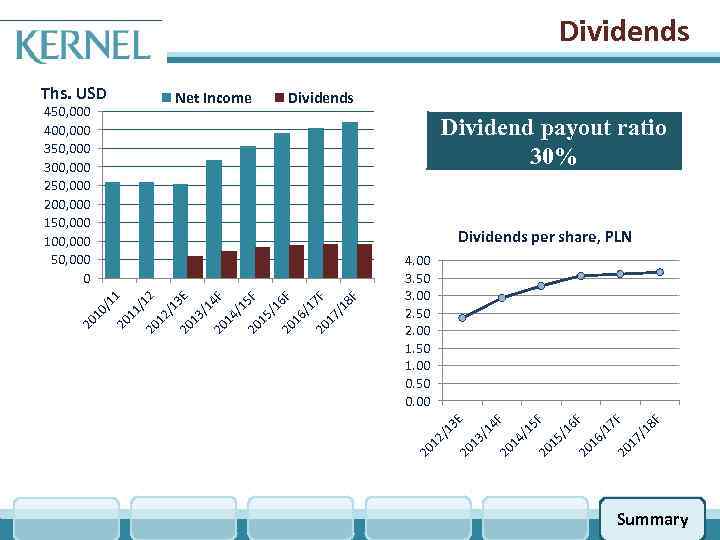

Dividends Ths. USD Net Income 450, 000 400, 000 350, 000 300, 000 250, 000 200, 000 150, 000 100, 000 50, 000 0 Dividends Dividend payout ratio 30% 8 F 17 /1 7 F 20 /1 16 20 15 /1 6 F 5 F 20 14 /1 4 F 20 /1 13 20 12 /1 3 E 4. 00 3. 50 3. 00 2. 50 2. 00 1. 50 1. 00 0. 50 0. 00 20 8 F 17 /1 7 F 20 /1 16 20 15 /1 6 F 5 F 20 14 /1 4 F /1 20 13 20 /1 3 E 2 12 /1 20 11 20 20 10 /1 1 Dividends per share, PLN Summary

Dividends Ths. USD Net Income 450, 000 400, 000 350, 000 300, 000 250, 000 200, 000 150, 000 100, 000 50, 000 0 Dividends Dividend payout ratio 30% 8 F 17 /1 7 F 20 /1 16 20 15 /1 6 F 5 F 20 14 /1 4 F 20 /1 13 20 12 /1 3 E 4. 00 3. 50 3. 00 2. 50 2. 00 1. 50 1. 00 0. 50 0. 00 20 8 F 17 /1 7 F 20 /1 16 20 15 /1 6 F 5 F 20 14 /1 4 F /1 20 13 20 /1 3 E 2 12 /1 20 11 20 20 10 /1 1 Dividends per share, PLN Summary

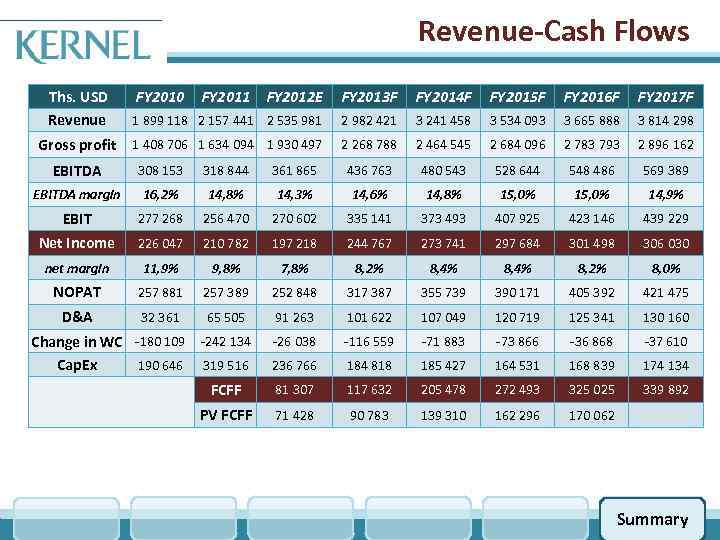

Revenue-Cash Flows Ths. USD Revenue FY 2010 FY 2011 FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F FY 2017 F 1 899 118 2 157 441 2 535 981 2 982 421 3 241 458 3 534 093 3 665 888 3 814 298 Gross profit 1 408 706 1 634 094 1 930 497 2 268 788 2 464 545 2 684 096 2 783 793 2 896 162 EBITDA 308 153 318 844 361 865 436 763 480 543 528 644 548 486 569 389 EBITDA margin 16, 2% 14, 8% 14, 3% 14, 6% 14, 8% 15, 0% 14, 9% EBIT 277 268 256 470 270 602 335 141 373 493 407 925 423 146 439 229 Net Income 226 047 210 782 197 218 244 767 273 741 297 684 301 498 306 030 net margin 11, 9% 9, 8% 7, 8% 8, 2% 8, 4% 8, 2% 8, 0% NOPAT 257 881 257 389 252 848 317 387 355 739 390 171 405 392 421 475 D&A 32 361 65 505 91 263 101 622 107 049 120 719 125 341 130 160 -26 038 -116 559 -71 883 -73 866 -36 868 -37 610 236 766 184 818 185 427 164 531 168 839 174 134 FCFF 81 307 117 632 205 478 272 493 325 025 339 892 PV FCFF 71 428 90 783 139 310 162 296 170 062 Change in WC -180 109 -242 134 190 646 319 516 Cap. Ex Summary

Revenue-Cash Flows Ths. USD Revenue FY 2010 FY 2011 FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F FY 2017 F 1 899 118 2 157 441 2 535 981 2 982 421 3 241 458 3 534 093 3 665 888 3 814 298 Gross profit 1 408 706 1 634 094 1 930 497 2 268 788 2 464 545 2 684 096 2 783 793 2 896 162 EBITDA 308 153 318 844 361 865 436 763 480 543 528 644 548 486 569 389 EBITDA margin 16, 2% 14, 8% 14, 3% 14, 6% 14, 8% 15, 0% 14, 9% EBIT 277 268 256 470 270 602 335 141 373 493 407 925 423 146 439 229 Net Income 226 047 210 782 197 218 244 767 273 741 297 684 301 498 306 030 net margin 11, 9% 9, 8% 7, 8% 8, 2% 8, 4% 8, 2% 8, 0% NOPAT 257 881 257 389 252 848 317 387 355 739 390 171 405 392 421 475 D&A 32 361 65 505 91 263 101 622 107 049 120 719 125 341 130 160 -26 038 -116 559 -71 883 -73 866 -36 868 -37 610 236 766 184 818 185 427 164 531 168 839 174 134 FCFF 81 307 117 632 205 478 272 493 325 025 339 892 PV FCFF 71 428 90 783 139 310 162 296 170 062 Change in WC -180 109 -242 134 190 646 319 516 Cap. Ex Summary

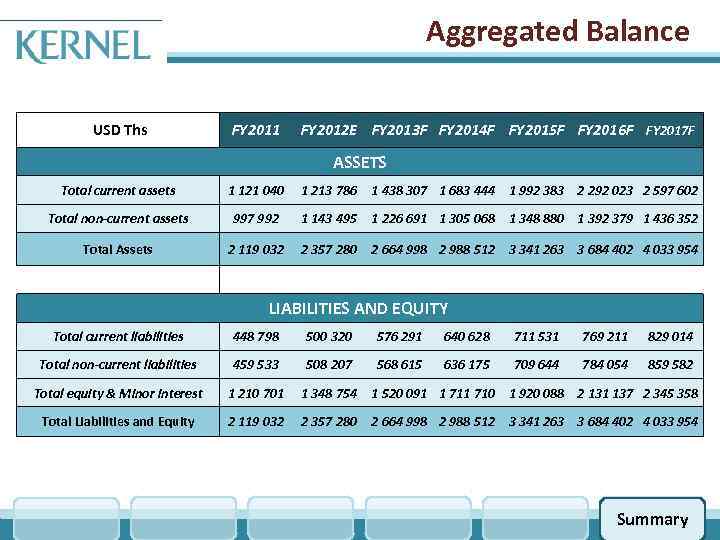

Aggregated Balance USD Ths FY 2011 FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F FY 2017 F ASSETS Total current assets 1 121 040 1 213 786 1 438 307 1 683 444 1 992 383 2 292 023 2 597 602 Total non-current assets 997 992 1 143 495 1 226 691 1 305 068 1 348 880 1 392 379 1 436 352 Total Assets 2 119 032 2 357 280 2 664 998 2 988 512 3 341 263 3 684 402 4 033 954 LIABILITIES AND EQUITY Total current liabilities 448 798 500 320 576 291 640 628 711 531 769 211 829 014 Total non-current liabilities 459 533 508 207 568 615 636 175 709 644 784 054 859 582 Total equity & Minor interest 1 210 701 1 348 754 1 520 091 1 710 1 920 088 2 131 137 2 345 358 Total Liabilities and Equity 2 119 032 2 357 280 2 664 998 2 988 512 3 341 263 3 684 402 4 033 954 Summary

Aggregated Balance USD Ths FY 2011 FY 2012 E FY 2013 F FY 2014 F FY 2015 F FY 2016 F FY 2017 F ASSETS Total current assets 1 121 040 1 213 786 1 438 307 1 683 444 1 992 383 2 292 023 2 597 602 Total non-current assets 997 992 1 143 495 1 226 691 1 305 068 1 348 880 1 392 379 1 436 352 Total Assets 2 119 032 2 357 280 2 664 998 2 988 512 3 341 263 3 684 402 4 033 954 LIABILITIES AND EQUITY Total current liabilities 448 798 500 320 576 291 640 628 711 531 769 211 829 014 Total non-current liabilities 459 533 508 207 568 615 636 175 709 644 784 054 859 582 Total equity & Minor interest 1 210 701 1 348 754 1 520 091 1 710 1 920 088 2 131 137 2 345 358 Total Liabilities and Equity 2 119 032 2 357 280 2 664 998 2 988 512 3 341 263 3 684 402 4 033 954 Summary

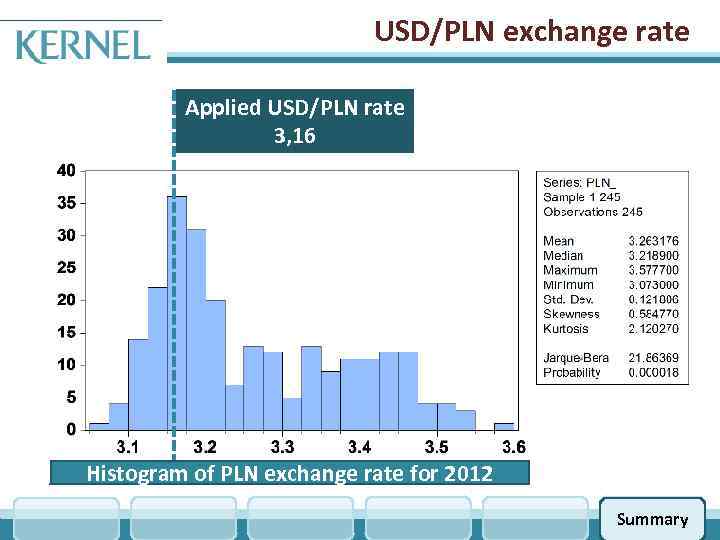

USD/PLN exchange rate Applied USD/PLN rate 3, 16 Histogram of PLN exchange rate for 2012 Summary

USD/PLN exchange rate Applied USD/PLN rate 3, 16 Histogram of PLN exchange rate for 2012 Summary

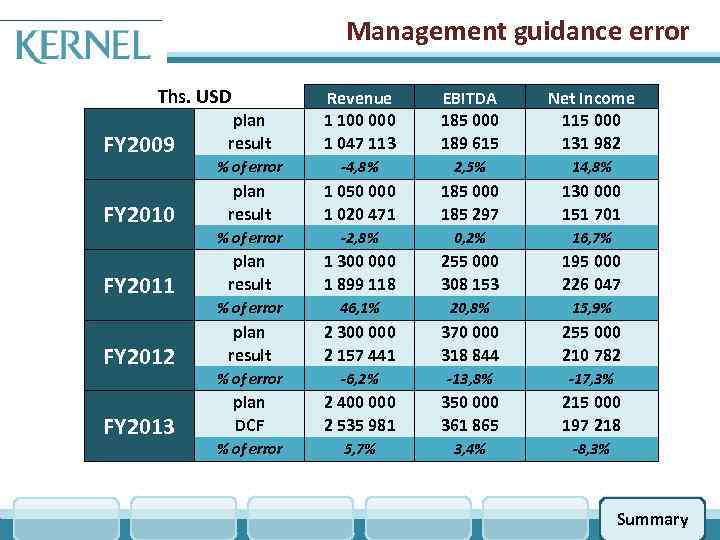

Management guidance error Ths. USD FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 plan result Revenue 1 100 000 1 047 113 EBITDA 185 000 189 615 Net Income 115 000 131 982 % of error -4, 8% 2, 5% 14, 8% plan result 1 050 000 1 020 471 185 000 185 297 130 000 151 701 % of error -2, 8% 0, 2% 16, 7% plan result 1 300 000 1 899 118 255 000 308 153 195 000 226 047 % of error 46, 1% 20, 8% 15, 9% plan result 2 300 000 2 157 441 370 000 318 844 255 000 210 782 % of error -6, 2% -13, 8% -17, 3% plan DCF 2 400 000 2 535 981 350 000 361 865 215 000 197 218 % of error 5, 7% 3, 4% -8, 3% Summary

Management guidance error Ths. USD FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 plan result Revenue 1 100 000 1 047 113 EBITDA 185 000 189 615 Net Income 115 000 131 982 % of error -4, 8% 2, 5% 14, 8% plan result 1 050 000 1 020 471 185 000 185 297 130 000 151 701 % of error -2, 8% 0, 2% 16, 7% plan result 1 300 000 1 899 118 255 000 308 153 195 000 226 047 % of error 46, 1% 20, 8% 15, 9% plan result 2 300 000 2 157 441 370 000 318 844 255 000 210 782 % of error -6, 2% -13, 8% -17, 3% plan DCF 2 400 000 2 535 981 350 000 361 865 215 000 197 218 % of error 5, 7% 3, 4% -8, 3% Summary

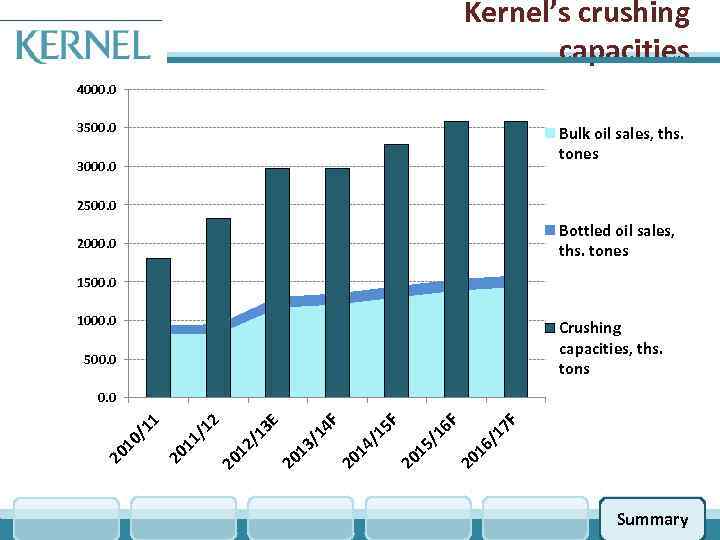

Kernel’s crushing capacities 4000. 0 3500. 0 Bulk oil sales, ths. tones 3000. 0 2500. 0 Bottled oil sales, ths. tones 2000. 0 1500. 0 1000. 0 Crushing capacities, ths. tons 500. 0 7 F /1 20 16 6 F /1 20 15 5 F /1 20 14 4 F /1 13 20 20 12 /1 3 E 2 /1 11 20 20 10 /1 1 0. 0 Summary

Kernel’s crushing capacities 4000. 0 3500. 0 Bulk oil sales, ths. tones 3000. 0 2500. 0 Bottled oil sales, ths. tones 2000. 0 1500. 0 1000. 0 Crushing capacities, ths. tons 500. 0 7 F /1 20 16 6 F /1 20 15 5 F /1 20 14 4 F /1 13 20 20 12 /1 3 E 2 /1 11 20 20 10 /1 1 0. 0 Summary

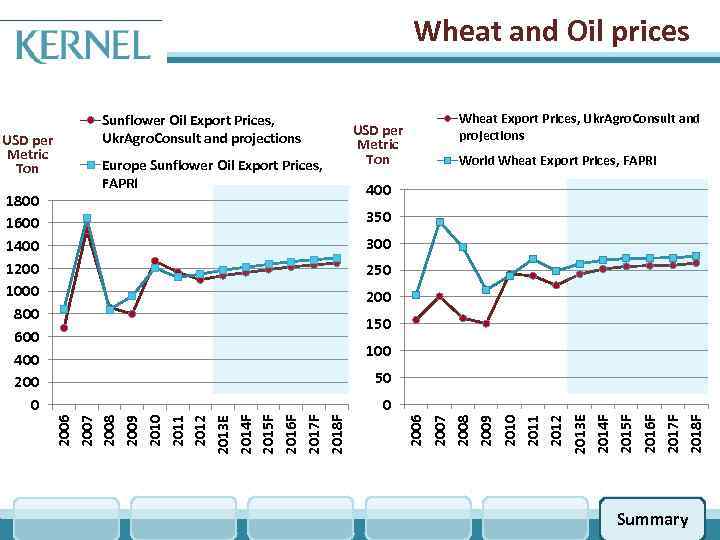

Wheat and Oil prices USD per Metric Ton Europe Sunflower Oil Export Prices, FAPRI USD per Metric Ton Wheat Export Prices, Ukr. Agro. Consult and projections World Wheat Export Prices, FAPRI 400 350 300 250 200 150 100 50 2006 2007 2008 2009 2010 2011 2012 2013 E 2014 F 2015 F 2016 F 2017 F 2018 F 1800 1600 1400 1200 1000 800 600 400 200 0 Sunflower Oil Export Prices, Ukr. Agro. Consult and projections Summary

Wheat and Oil prices USD per Metric Ton Europe Sunflower Oil Export Prices, FAPRI USD per Metric Ton Wheat Export Prices, Ukr. Agro. Consult and projections World Wheat Export Prices, FAPRI 400 350 300 250 200 150 100 50 2006 2007 2008 2009 2010 2011 2012 2013 E 2014 F 2015 F 2016 F 2017 F 2018 F 1800 1600 1400 1200 1000 800 600 400 200 0 Sunflower Oil Export Prices, Ukr. Agro. Consult and projections Summary

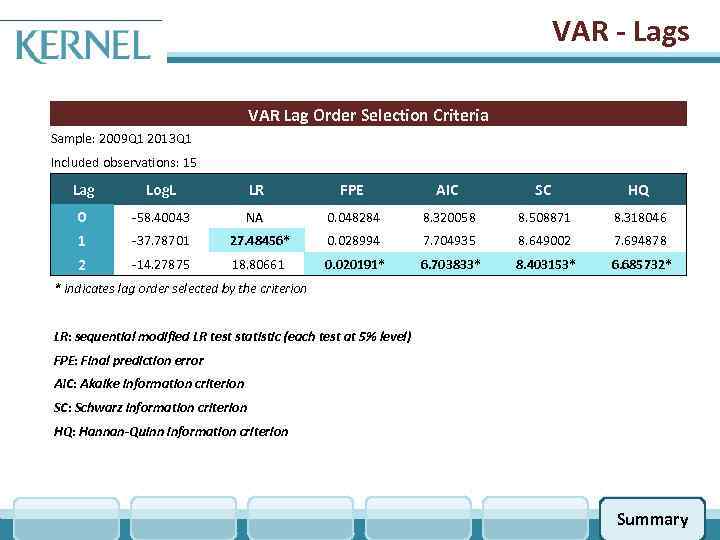

VAR - Lags VAR Lag Order Selection Criteria Sample: 2009 Q 1 2013 Q 1 Included observations: 15 Lag Log. L LR FPE AIC SC HQ 0 1 2 -58. 40043 NA 0. 048284 8. 320058 8. 508871 8. 318046 -37. 78701 27. 48456* 0. 028994 7. 704935 8. 649002 7. 694878 -14. 27875 18. 80661 0. 020191* 6. 703833* 8. 403153* 6. 685732* * indicates lag order selected by the criterion LR: sequential modified LR test statistic (each test at 5% level) FPE: Final prediction error AIC: Akaike information criterion SC: Schwarz information criterion HQ: Hannan-Quinn information criterion Summary

VAR - Lags VAR Lag Order Selection Criteria Sample: 2009 Q 1 2013 Q 1 Included observations: 15 Lag Log. L LR FPE AIC SC HQ 0 1 2 -58. 40043 NA 0. 048284 8. 320058 8. 508871 8. 318046 -37. 78701 27. 48456* 0. 028994 7. 704935 8. 649002 7. 694878 -14. 27875 18. 80661 0. 020191* 6. 703833* 8. 403153* 6. 685732* * indicates lag order selected by the criterion LR: sequential modified LR test statistic (each test at 5% level) FPE: Final prediction error AIC: Akaike information criterion SC: Schwarz information criterion HQ: Hannan-Quinn information criterion Summary

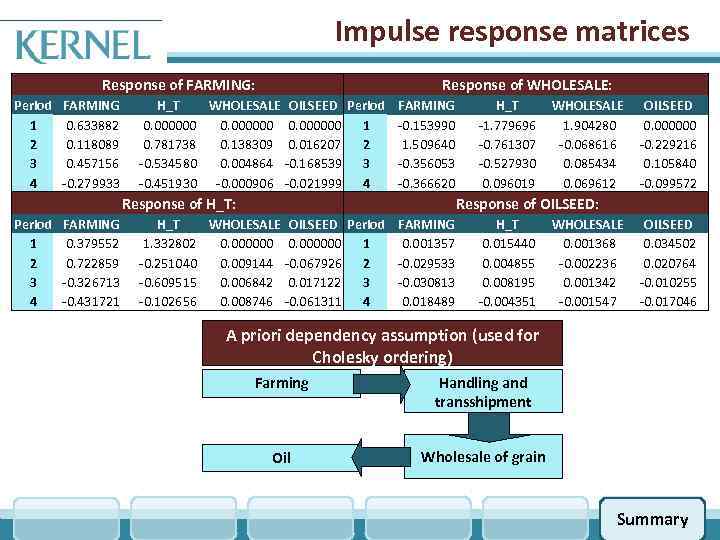

Impulse response matrices Response of FARMING: Period 1 2 3 4 FARMING 0. 633882 0. 118089 0. 457156 -0. 279933 Response of WHOLESALE: H_T WHOLESALE OILSEED Period 0. 000000 1 0. 781738 0. 138309 0. 016207 2 -0. 534580 0. 004864 -0. 168539 3 -0. 451930 -0. 000906 -0. 021999 4 Response of H_T: Period 1 2 3 4 FARMING 0. 379552 0. 722859 -0. 326713 -0. 431721 FARMING -0. 153990 1. 509640 -0. 356053 -0. 366620 H_T -1. 779696 -0. 761307 -0. 527930 0. 096019 WHOLESALE 1. 904280 -0. 068616 0. 085434 0. 069612 OILSEED 0. 000000 -0. 229216 0. 105840 -0. 099572 Response of OILSEED: H_T WHOLESALE OILSEED Period 1. 332802 0. 000000 1 -0. 251040 0. 009144 -0. 067926 2 -0. 609515 0. 006842 0. 017122 3 -0. 102656 0. 008746 -0. 061311 4 FARMING 0. 001357 -0. 029533 -0. 030813 0. 018489 H_T 0. 015440 0. 004855 0. 008195 -0. 004351 WHOLESALE 0. 001368 -0. 002236 0. 001342 -0. 001547 OILSEED 0. 034502 0. 020764 -0. 010255 -0. 017046 A priori dependency assumption (used for Cholesky ordering) Farming Handling and transshipment Oil Wholesale of grain Summary

Impulse response matrices Response of FARMING: Period 1 2 3 4 FARMING 0. 633882 0. 118089 0. 457156 -0. 279933 Response of WHOLESALE: H_T WHOLESALE OILSEED Period 0. 000000 1 0. 781738 0. 138309 0. 016207 2 -0. 534580 0. 004864 -0. 168539 3 -0. 451930 -0. 000906 -0. 021999 4 Response of H_T: Period 1 2 3 4 FARMING 0. 379552 0. 722859 -0. 326713 -0. 431721 FARMING -0. 153990 1. 509640 -0. 356053 -0. 366620 H_T -1. 779696 -0. 761307 -0. 527930 0. 096019 WHOLESALE 1. 904280 -0. 068616 0. 085434 0. 069612 OILSEED 0. 000000 -0. 229216 0. 105840 -0. 099572 Response of OILSEED: H_T WHOLESALE OILSEED Period 1. 332802 0. 000000 1 -0. 251040 0. 009144 -0. 067926 2 -0. 609515 0. 006842 0. 017122 3 -0. 102656 0. 008746 -0. 061311 4 FARMING 0. 001357 -0. 029533 -0. 030813 0. 018489 H_T 0. 015440 0. 004855 0. 008195 -0. 004351 WHOLESALE 0. 001368 -0. 002236 0. 001342 -0. 001547 OILSEED 0. 034502 0. 020764 -0. 010255 -0. 017046 A priori dependency assumption (used for Cholesky ordering) Farming Handling and transshipment Oil Wholesale of grain Summary

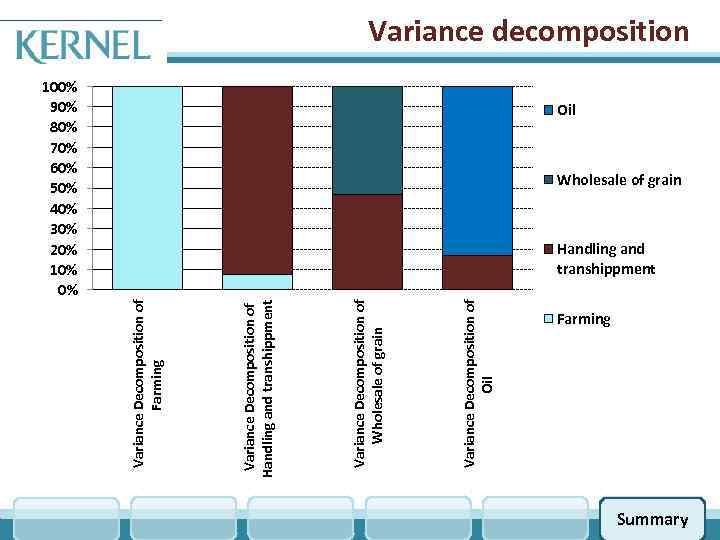

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Variance Decomposition of Oil Variance Decomposition of Wholesale of grain Variance Decomposition of Handling and transhippment Variance Decomposition of Farming Variance decomposition Oil Wholesale of grain Handling and transhippment Farming Summary

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Variance Decomposition of Oil Variance Decomposition of Wholesale of grain Variance Decomposition of Handling and transhippment Variance Decomposition of Farming Variance decomposition Oil Wholesale of grain Handling and transhippment Farming Summary

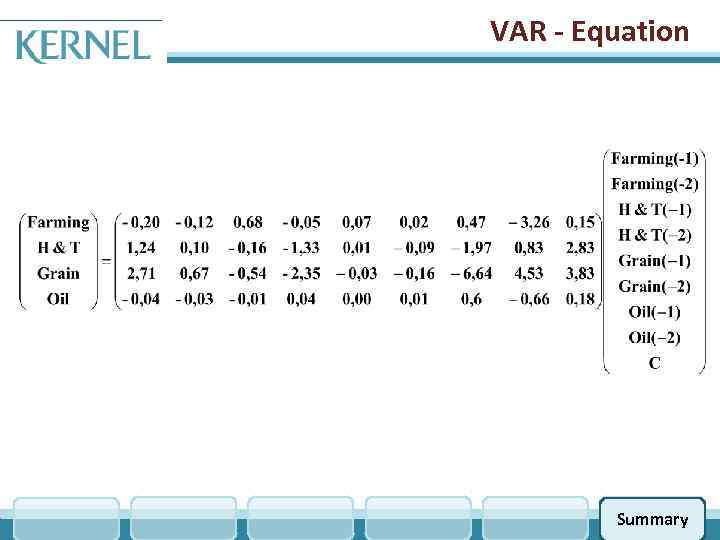

VAR - Equation Summary

VAR - Equation Summary