Appendix How to find the net cash flow ?

Appendix How to find the net cash flow ?

TAXATION • We must also consider the impact that tax will have on the return of an investment because most companies will be liable for corporation tax on the additional profits generated. There are three aspects to taxation, the good the bad and the ugly.

TAXATION • We must also consider the impact that tax will have on the return of an investment because most companies will be liable for corporation tax on the additional profits generated. There are three aspects to taxation, the good the bad and the ugly.

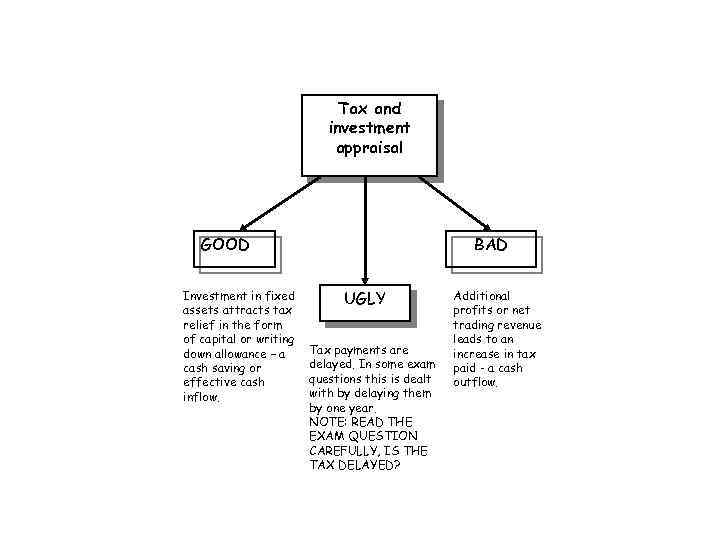

Tax and investment appraisal GOOD Investment in fixed assets attracts tax relief in the form of capital or writing down allowance – a cash saving or effective cash inflow. BAD UGLY Tax payments are delayed. In some exam questions this is dealt with by delaying them by one year. NOTE: READ THE EXAM QUESTION CAREFULLY, IS THE TAX DELAYED? Additional profits or net trading revenue leads to an increase in tax paid - a cash outflow.

Tax and investment appraisal GOOD Investment in fixed assets attracts tax relief in the form of capital or writing down allowance – a cash saving or effective cash inflow. BAD UGLY Tax payments are delayed. In some exam questions this is dealt with by delaying them by one year. NOTE: READ THE EXAM QUESTION CAREFULLY, IS THE TAX DELAYED? Additional profits or net trading revenue leads to an increase in tax paid - a cash outflow.

Taxation • Three tax effects to consider: – Tax payments on operating profits – Tax benefit from capital allowances and a possible tax payment from a balancing charge on asset disposal – Tax relief on interest payments on debt – Tax payment normally is delayed by one year

Taxation • Three tax effects to consider: – Tax payments on operating profits – Tax benefit from capital allowances and a possible tax payment from a balancing charge on asset disposal – Tax relief on interest payments on debt – Tax payment normally is delayed by one year

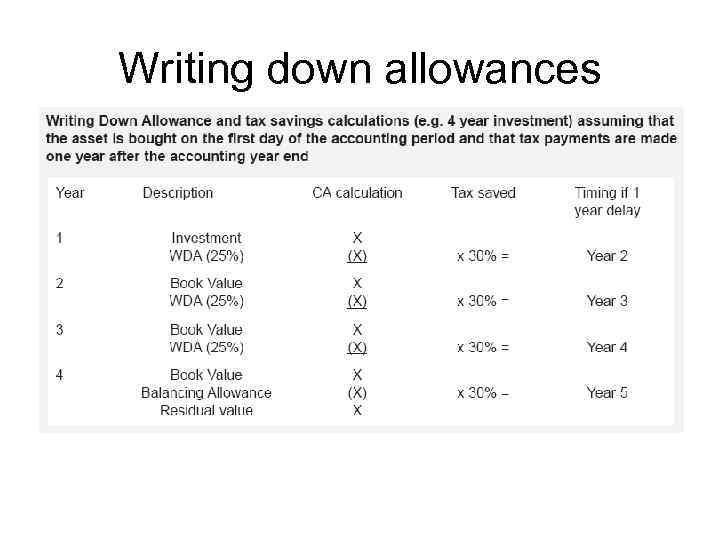

Writing down allowances

Writing down allowances

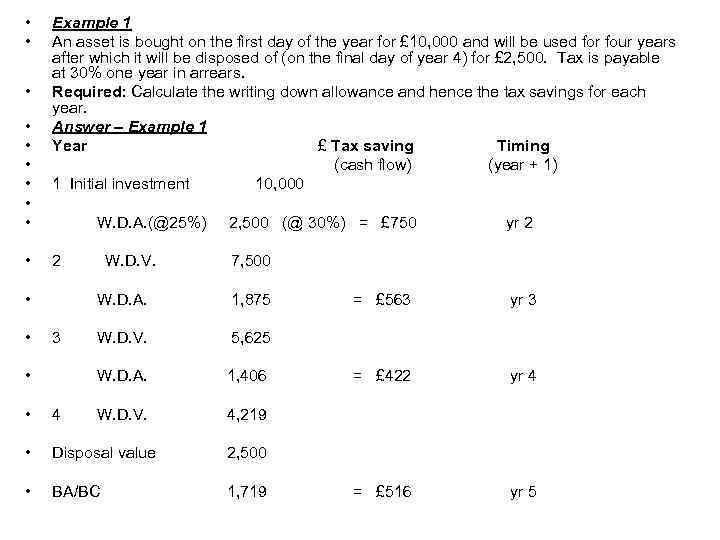

• • • Example 1 An asset is bought on the first day of the year for £ 10, 000 and will be used for four years after which it will be disposed of (on the final day of year 4) for £ 2, 500. Tax is payable at 30% one year in arrears. Required: Calculate the writing down allowance and hence the tax savings for each year. Answer – Example 1 Year £ Tax saving Timing (cash flow) (year + 1) 1 Initial investment 10, 000 W. D. A. (@25%) 2 • • W. D. V. 2, 500 (@ 30%) = £ 750 7, 500 W. D. A. • 1, 875 W. D. V. 5, 625 W. D. A. 3 yr 2 1, 406 W. D. V. 4, 219 • 4 • Disposal value BA/BC 1, 719 yr 3 = £ 422 yr 4 = £ 516 yr 5 2, 500 • = £ 563

• • • Example 1 An asset is bought on the first day of the year for £ 10, 000 and will be used for four years after which it will be disposed of (on the final day of year 4) for £ 2, 500. Tax is payable at 30% one year in arrears. Required: Calculate the writing down allowance and hence the tax savings for each year. Answer – Example 1 Year £ Tax saving Timing (cash flow) (year + 1) 1 Initial investment 10, 000 W. D. A. (@25%) 2 • • W. D. V. 2, 500 (@ 30%) = £ 750 7, 500 W. D. A. • 1, 875 W. D. V. 5, 625 W. D. A. 3 yr 2 1, 406 W. D. V. 4, 219 • 4 • Disposal value BA/BC 1, 719 yr 3 = £ 422 yr 4 = £ 516 yr 5 2, 500 • = £ 563

• Inflation rates – Inflation is a general increase in prices leading to a general decline in the real value of money – Under the situation of inflation, • Real return for the use of funds • Additional return to compensate for inflation

• Inflation rates – Inflation is a general increase in prices leading to a general decline in the real value of money – Under the situation of inflation, • Real return for the use of funds • Additional return to compensate for inflation

• Example: • inflation of 10% per year on variable costs: • 2008 variable cost per unit $100 • Inflation adjusted variable cost: 100 X (1+ 10%) = $110

• Example: • inflation of 10% per year on variable costs: • 2008 variable cost per unit $100 • Inflation adjusted variable cost: 100 X (1+ 10%) = $110

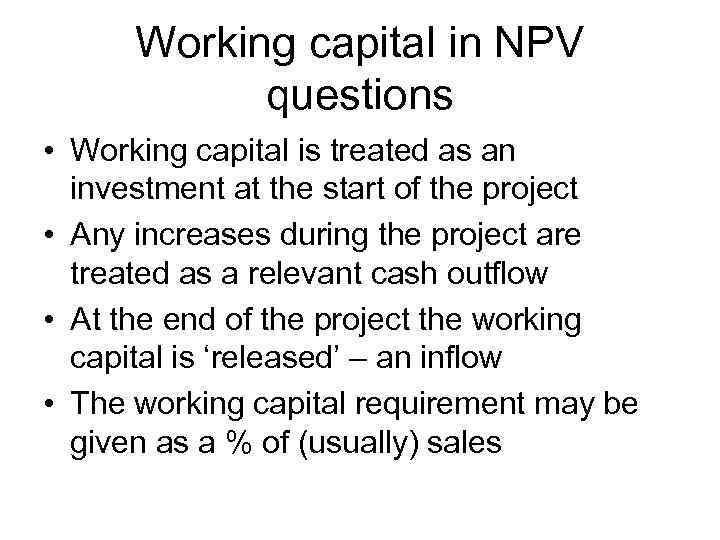

Working capital in NPV questions • Working capital is treated as an investment at the start of the project • Any increases during the project are treated as a relevant cash outflow • At the end of the project the working capital is ‘released’ – an inflow • The working capital requirement may be given as a % of (usually) sales

Working capital in NPV questions • Working capital is treated as an investment at the start of the project • Any increases during the project are treated as a relevant cash outflow • At the end of the project the working capital is ‘released’ – an inflow • The working capital requirement may be given as a % of (usually) sales

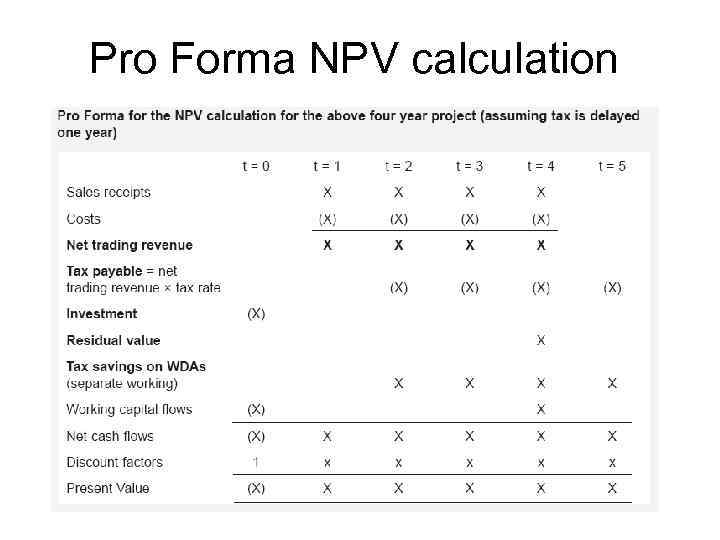

Pro Forma NPV calculation

Pro Forma NPV calculation

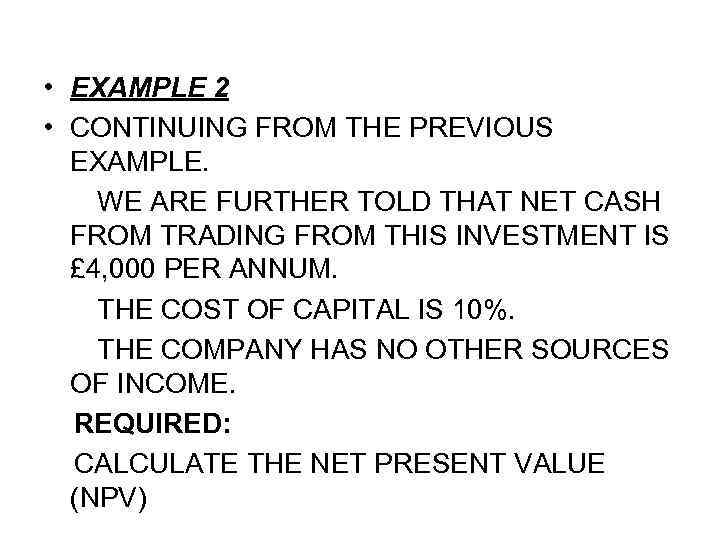

• EXAMPLE 2 • CONTINUING FROM THE PREVIOUS EXAMPLE. WE ARE FURTHER TOLD THAT NET CASH FROM TRADING FROM THIS INVESTMENT IS £ 4, 000 PER ANNUM. THE COST OF CAPITAL IS 10%. THE COMPANY HAS NO OTHER SOURCES OF INCOME. REQUIRED: CALCULATE THE NET PRESENT VALUE (NPV)

• EXAMPLE 2 • CONTINUING FROM THE PREVIOUS EXAMPLE. WE ARE FURTHER TOLD THAT NET CASH FROM TRADING FROM THIS INVESTMENT IS £ 4, 000 PER ANNUM. THE COST OF CAPITAL IS 10%. THE COMPANY HAS NO OTHER SOURCES OF INCOME. REQUIRED: CALCULATE THE NET PRESENT VALUE (NPV)