fad738f68eab734478d32efa8021c5c4.ppt

- Количество слайдов: 31

Appendix 1 Geographic and Segmental Revenue and Trading Profit 1

Appendix 1 Geographic and Segmental Revenue and Trading Profit 1

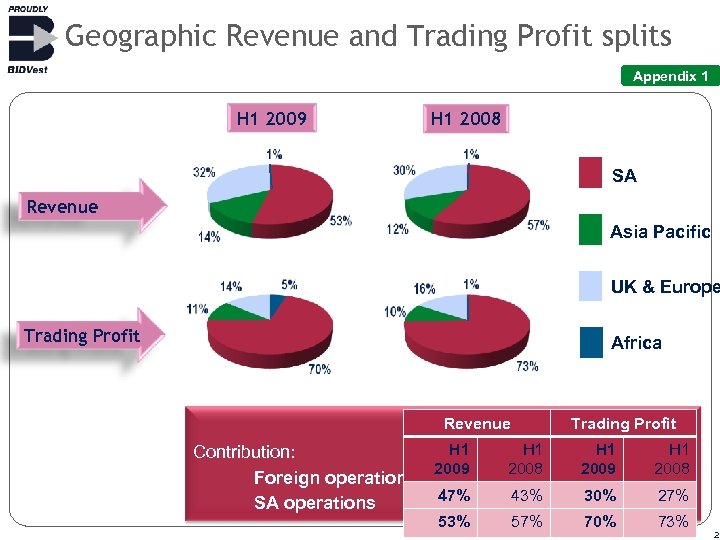

Geographic Revenue and Trading Profit splits Appendix 1 H 1 2009 H 1 2008 SA Revenue Asia Pacific UK & Europe Trading Profit Africa Revenue H 1 Contribution: 2009 Foreign operations 47% SA operations 53% Trading Profit H 1 2008 H 1 2009 H 1 2008 43% 30% 27% 57% 70% 73% 2

Geographic Revenue and Trading Profit splits Appendix 1 H 1 2009 H 1 2008 SA Revenue Asia Pacific UK & Europe Trading Profit Africa Revenue H 1 Contribution: 2009 Foreign operations 47% SA operations 53% Trading Profit H 1 2008 H 1 2009 H 1 2008 43% 30% 27% 57% 70% 73% 2

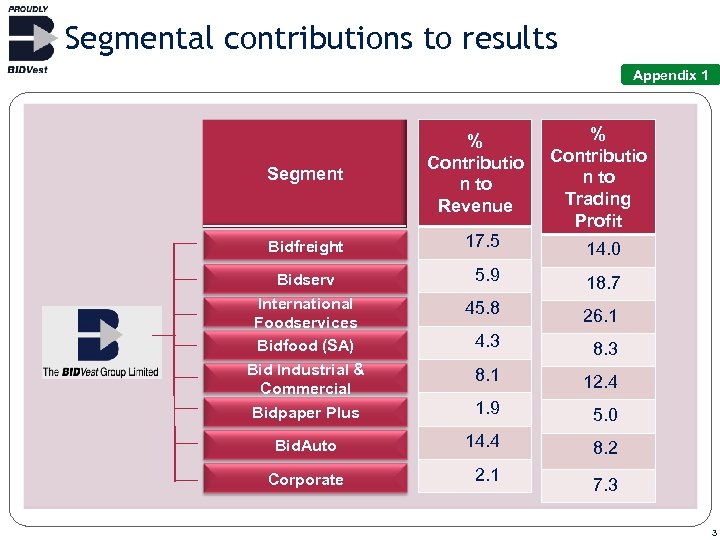

Segmental contributions to results Appendix 1 Segment Bidfreight Bidserv International Foodservices Bidfood (SA) Bid Industrial & Commercial Bidpaper Plus Bid. Auto Corporate % Contributio n to Revenue % Contributio n to Trading Profit 17. 5 14. 0 5. 9 18. 7 45. 8 26. 1 4. 3 8. 1 12. 4 1. 9 5. 0 14. 4 8. 2 2. 1 7. 3 3

Segmental contributions to results Appendix 1 Segment Bidfreight Bidserv International Foodservices Bidfood (SA) Bid Industrial & Commercial Bidpaper Plus Bid. Auto Corporate % Contributio n to Revenue % Contributio n to Trading Profit 17. 5 14. 0 5. 9 18. 7 45. 8 26. 1 4. 3 8. 1 12. 4 1. 9 5. 0 14. 4 8. 2 2. 1 7. 3 3

Appendix 2 Divisional Results 4

Appendix 2 Divisional Results 4

Bidfreight – Abating activity Appendix 2 Current contribution to Group Trading Profit 14. 0% 5

Bidfreight – Abating activity Appendix 2 Current contribution to Group Trading Profit 14. 0% 5

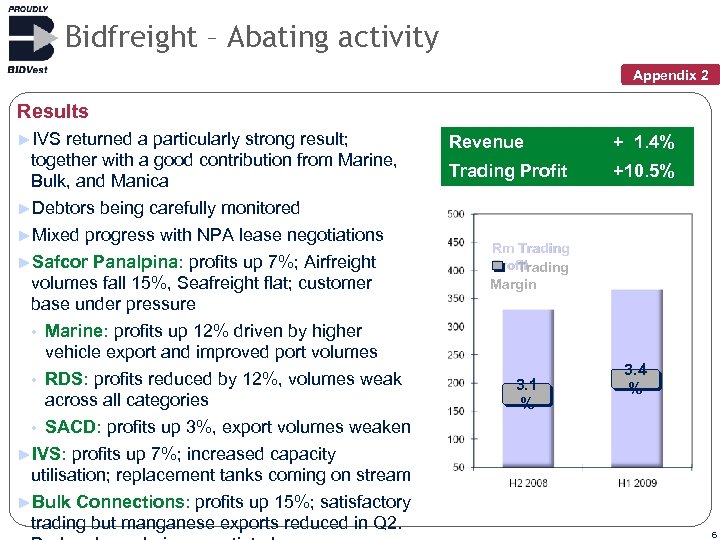

Bidfreight – Abating activity Appendix 2 Results ►IVS returned a particularly strong result; together with a good contribution from Marine, Bulk, and Manica ►Debtors being carefully monitored ►Mixed progress with NPA lease negotiations ►Safcor Panalpina: profits up 7%; Airfreight volumes fall 15%, Seafreight flat; customer base under pressure • Marine: profits up 12% driven by higher vehicle export and improved port volumes • RDS: profits reduced by 12%, volumes weak across all categories • SACD: profits up 3%, export volumes weaken ►IVS: profits up 7%; increased capacity utilisation; replacement tanks coming on stream ►Bulk Connections: profits up 15%; satisfactory trading but manganese exports reduced in Q 2. Revenue + 1. 4% Trading Profit +10. 5% Rm Trading Profit Trading Margin 3. 1 % 3. 4 % 6

Bidfreight – Abating activity Appendix 2 Results ►IVS returned a particularly strong result; together with a good contribution from Marine, Bulk, and Manica ►Debtors being carefully monitored ►Mixed progress with NPA lease negotiations ►Safcor Panalpina: profits up 7%; Airfreight volumes fall 15%, Seafreight flat; customer base under pressure • Marine: profits up 12% driven by higher vehicle export and improved port volumes • RDS: profits reduced by 12%, volumes weak across all categories • SACD: profits up 3%, export volumes weaken ►IVS: profits up 7%; increased capacity utilisation; replacement tanks coming on stream ►Bulk Connections: profits up 15%; satisfactory trading but manganese exports reduced in Q 2. Revenue + 1. 4% Trading Profit +10. 5% Rm Trading Profit Trading Margin 3. 1 % 3. 4 % 6

Bidfreight – Abating activity Appendix 2 SABT: profits up 2%; maize and wheat exports down in Q 2; wheat imports delayed as purchasers delay to take advantage of significantly lower freight rates; a positive H 2 expected • BPO: profits down 27% as exports of steel, forest products, and ferrochrome and imports of cement and rice decline. • Naval: profits down 36% as key business areas come under pressure • Manica: four fold rise in profits; new business obtained regionally; mineral volumes out of DRC and Zambia fall; trade in the region remains variable and unpredictable • Strategic imperatives & prospects ►Trade volume reductions likely to get worse before getting better ►Break bulk cargos have slumped, but recent improvement ►Sharply reduced freight rates are positive for customers ►Container vessels reducing size and frequency of calls ►Ongoing selective capex on the back of major contracts ►There is tentative evidence of protectionism in certain countries – this is negative for trade flows and accentuates downturn ►Competitive position is without parallel 7

Bidfreight – Abating activity Appendix 2 SABT: profits up 2%; maize and wheat exports down in Q 2; wheat imports delayed as purchasers delay to take advantage of significantly lower freight rates; a positive H 2 expected • BPO: profits down 27% as exports of steel, forest products, and ferrochrome and imports of cement and rice decline. • Naval: profits down 36% as key business areas come under pressure • Manica: four fold rise in profits; new business obtained regionally; mineral volumes out of DRC and Zambia fall; trade in the region remains variable and unpredictable • Strategic imperatives & prospects ►Trade volume reductions likely to get worse before getting better ►Break bulk cargos have slumped, but recent improvement ►Sharply reduced freight rates are positive for customers ►Container vessels reducing size and frequency of calls ►Ongoing selective capex on the back of major contracts ►There is tentative evidence of protectionism in certain countries – this is negative for trade flows and accentuates downturn ►Competitive position is without parallel 7

Bidserv – Cleaning up Appendix 2 Current contribution to Group Trading Profit 18. 7% 8

Bidserv – Cleaning up Appendix 2 Current contribution to Group Trading Profit 18. 7% 8

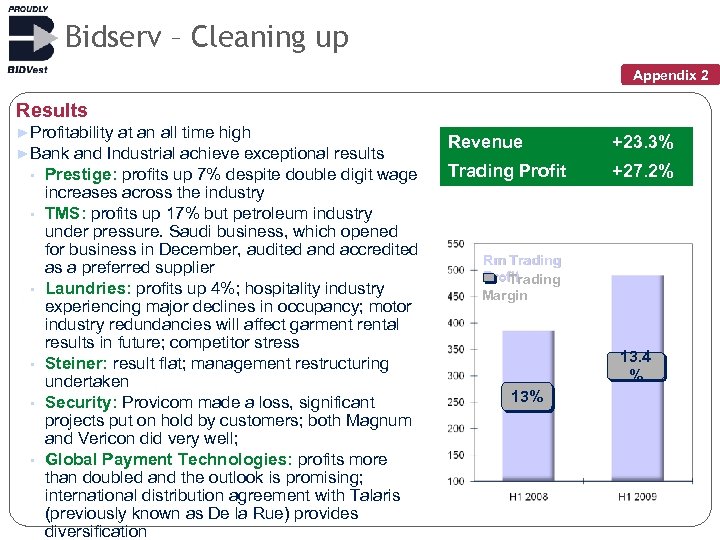

Bidserv – Cleaning up Appendix 2 Results ►Profitability at an all time high ►Bank and Industrial achieve exceptional results • Prestige: profits up 7% despite double digit wage • • • increases across the industry TMS: profits up 17% but petroleum industry under pressure. Saudi business, which opened for business in December, audited and accredited as a preferred supplier Laundries: profits up 4%; hospitality industry experiencing major declines in occupancy; motor industry redundancies will affect garment rental results in future; competitor stress Steiner: result flat; management restructuring undertaken Security: Provicom made a loss, significant projects put on hold by customers; both Magnum and Vericon did very well; Global Payment Technologies: profits more than doubled and the outlook is promising; international distribution agreement with Talaris (previously known as De la Rue) provides diversification Revenue +23. 3% Trading Profit +27. 2% Rm Trading Profit Trading Margin 13. 4 % 13%

Bidserv – Cleaning up Appendix 2 Results ►Profitability at an all time high ►Bank and Industrial achieve exceptional results • Prestige: profits up 7% despite double digit wage • • • increases across the industry TMS: profits up 17% but petroleum industry under pressure. Saudi business, which opened for business in December, audited and accredited as a preferred supplier Laundries: profits up 4%; hospitality industry experiencing major declines in occupancy; motor industry redundancies will affect garment rental results in future; competitor stress Steiner: result flat; management restructuring undertaken Security: Provicom made a loss, significant projects put on hold by customers; both Magnum and Vericon did very well; Global Payment Technologies: profits more than doubled and the outlook is promising; international distribution agreement with Talaris (previously known as De la Rue) provides diversification Revenue +23. 3% Trading Profit +27. 2% Rm Trading Profit Trading Margin 13. 4 % 13%

Bidserv – Cleaning up Appendix 2 • • • Industrial: profits up 49%; facilities underpin competitive strengths; G Fox roll-out successful; consideration being given to expanding national footprint Office – Konica Minolta & Oce: underlying profits flat; unit sales slow; weak rand vs. yen a challenge; price increases on government contracts implemented; office automation offering highly competitive Bid. Air: profits +74%; new management team in place Bid. Travel Solutions (including Bid. Travel, My. Market, Procurement) : profits down 18% due to a decision to smooth overrides through the year; however, economic slowdown impacting travel and override income under threat; new automated travel engine well received and this, together with right-sizing measures underway, will cushion blow of severe economic pressures; procurement savings for the group Bidvest Bank: profits double, assisted by new forex products, new branches, and a volatile exchange rate; an exceptional result expected in F 2009 Hotel Amenities: profits down as SA hotel occupancies decline but export sales into Africa via the SAA strategic amenities alliance will offset this in H 2 Strategic Imperatives and Prospects ► Flexible to take corrective action if trading turns for the worse ► Number of contracts secured for 2010 World Cup ► Travel overrides under threat – cost rationalisation underway ► Relative stability in a number of areas with good divisional competitive advantages in a tough economy ► Bid. Air continues to offer good upside 10

Bidserv – Cleaning up Appendix 2 • • • Industrial: profits up 49%; facilities underpin competitive strengths; G Fox roll-out successful; consideration being given to expanding national footprint Office – Konica Minolta & Oce: underlying profits flat; unit sales slow; weak rand vs. yen a challenge; price increases on government contracts implemented; office automation offering highly competitive Bid. Air: profits +74%; new management team in place Bid. Travel Solutions (including Bid. Travel, My. Market, Procurement) : profits down 18% due to a decision to smooth overrides through the year; however, economic slowdown impacting travel and override income under threat; new automated travel engine well received and this, together with right-sizing measures underway, will cushion blow of severe economic pressures; procurement savings for the group Bidvest Bank: profits double, assisted by new forex products, new branches, and a volatile exchange rate; an exceptional result expected in F 2009 Hotel Amenities: profits down as SA hotel occupancies decline but export sales into Africa via the SAA strategic amenities alliance will offset this in H 2 Strategic Imperatives and Prospects ► Flexible to take corrective action if trading turns for the worse ► Number of contracts secured for 2010 World Cup ► Travel overrides under threat – cost rationalisation underway ► Relative stability in a number of areas with good divisional competitive advantages in a tough economy ► Bid. Air continues to offer good upside 10

Bidvest Europe – Gruelling Appendix 2 Current contribution to Group Trading Profit 15. 2% 11

Bidvest Europe – Gruelling Appendix 2 Current contribution to Group Trading Profit 15. 2% 11

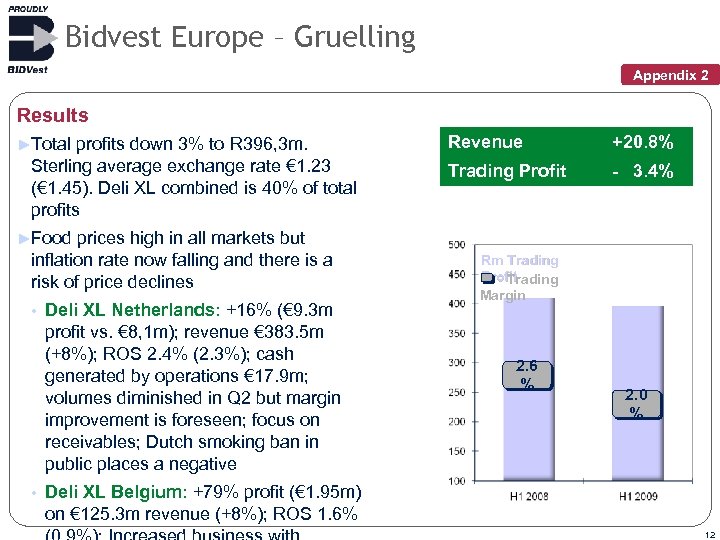

Bidvest Europe – Gruelling Appendix 2 Results ►Total profits down 3% to R 396, 3 m. Sterling average exchange rate € 1. 23 (€ 1. 45). Deli XL combined is 40% of total profits prices high in all markets but inflation rate now falling and there is a risk of price declines Revenue +20. 8% Trading Profit - 3. 4% ►Food • • Deli XL Netherlands: +16% (€ 9. 3 m profit vs. € 8, 1 m); revenue € 383. 5 m (+8%); ROS 2. 4% (2. 3%); cash generated by operations € 17. 9 m; volumes diminished in Q 2 but margin improvement is foreseen; focus on receivables; Dutch smoking ban in public places a negative Rm Trading Profit Trading Margin 2. 6 % 2. 0 % Deli XL Belgium: +79% profit (€ 1. 95 m) on € 125. 3 m revenue (+8%); ROS 1. 6% 12

Bidvest Europe – Gruelling Appendix 2 Results ►Total profits down 3% to R 396, 3 m. Sterling average exchange rate € 1. 23 (€ 1. 45). Deli XL combined is 40% of total profits prices high in all markets but inflation rate now falling and there is a risk of price declines Revenue +20. 8% Trading Profit - 3. 4% ►Food • • Deli XL Netherlands: +16% (€ 9. 3 m profit vs. € 8, 1 m); revenue € 383. 5 m (+8%); ROS 2. 4% (2. 3%); cash generated by operations € 17. 9 m; volumes diminished in Q 2 but margin improvement is foreseen; focus on receivables; Dutch smoking ban in public places a negative Rm Trading Profit Trading Margin 2. 6 % 2. 0 % Deli XL Belgium: +79% profit (€ 1. 95 m) on € 125. 3 m revenue (+8%); ROS 1. 6% 12

Bidvest Europe – Gruelling Appendix 2 Horeca: £ 0. 2 m profit; ROS 3. 2% vs. 0. 5%. Sales in local currency rise 52% due to mix, pricing strategy and currency effect; strict credit policy improves collections; depressed Middle Eastern economy presents challenges for future growth • 3663: sales 8% up at £ 863. 7 m; profits down 25% to £ 16, 9 m; ROS 1. 9% vs. 2. 9%, cost control very good ; working capital moves out due to pre-emptive buying and inflation but receivables are a problem and bad debts are rising; total cases sold down 5% with wholesale down 9%; suddenness and magnitude of the severe slump far greater than could be predicted ― Wholesales flat, profits down 30%; focus on cash margin, passing through prices and growing new business ― Logistics infrastructure being optimised and costs cut; ― Barton Meat closed and costs expensed • Strategic imperatives & prospects ►Deli XL: conditions remain unpredictable; efficiencies remain under the spotlight ► 3663 will benefit from industry consolidation; debtors under focus; further depot optimisation underway; profits will be well down on 2008; business model is robust 13

Bidvest Europe – Gruelling Appendix 2 Horeca: £ 0. 2 m profit; ROS 3. 2% vs. 0. 5%. Sales in local currency rise 52% due to mix, pricing strategy and currency effect; strict credit policy improves collections; depressed Middle Eastern economy presents challenges for future growth • 3663: sales 8% up at £ 863. 7 m; profits down 25% to £ 16, 9 m; ROS 1. 9% vs. 2. 9%, cost control very good ; working capital moves out due to pre-emptive buying and inflation but receivables are a problem and bad debts are rising; total cases sold down 5% with wholesale down 9%; suddenness and magnitude of the severe slump far greater than could be predicted ― Wholesales flat, profits down 30%; focus on cash margin, passing through prices and growing new business ― Logistics infrastructure being optimised and costs cut; ― Barton Meat closed and costs expensed • Strategic imperatives & prospects ►Deli XL: conditions remain unpredictable; efficiencies remain under the spotlight ► 3663 will benefit from industry consolidation; debtors under focus; further depot optimisation underway; profits will be well down on 2008; business model is robust 13

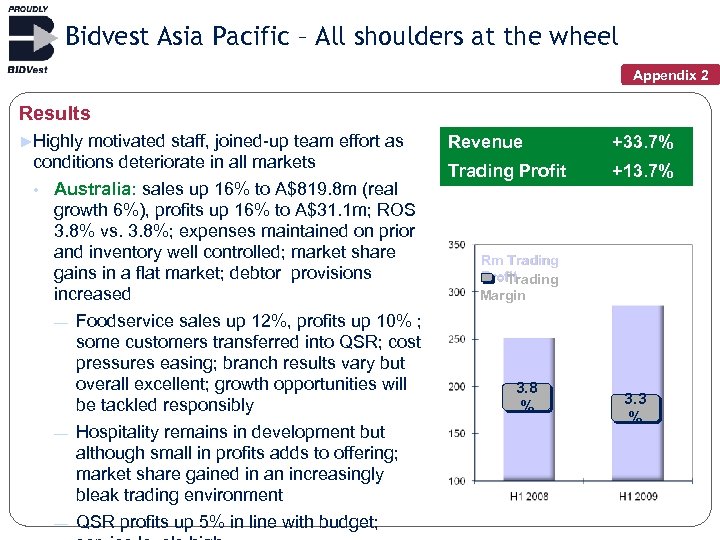

Bidvest Asia Pacific – All shoulders at the wheel Appendix 2 Current contribution to Group Trading Profit 10. 9% 14

Bidvest Asia Pacific – All shoulders at the wheel Appendix 2 Current contribution to Group Trading Profit 10. 9% 14

Bidvest Asia Pacific – All shoulders at the wheel Appendix 2 Results ►Highly motivated staff, joined-up team effort as conditions deteriorate in all markets • Australia: sales up 16% to A$819. 8 m (real growth 6%), profits up 16% to A$31. 1 m; ROS 3. 8% vs. 3. 8%; expenses maintained on prior and inventory well controlled; market share gains in a flat market; debtor provisions increased ― Foodservice sales up 12%, profits up 10% ; some customers transferred into QSR; cost pressures easing; branch results vary but overall excellent; growth opportunities will be tackled responsibly ― Hospitality remains in development but although small in profits adds to offering; market share gained in an increasingly bleak trading environment ― QSR profits up 5% in line with budget; Revenue +33. 7% Trading Profit +13. 7% Rm Trading Profit Trading Margin 3. 8 % 3. 3 %

Bidvest Asia Pacific – All shoulders at the wheel Appendix 2 Results ►Highly motivated staff, joined-up team effort as conditions deteriorate in all markets • Australia: sales up 16% to A$819. 8 m (real growth 6%), profits up 16% to A$31. 1 m; ROS 3. 8% vs. 3. 8%; expenses maintained on prior and inventory well controlled; market share gains in a flat market; debtor provisions increased ― Foodservice sales up 12%, profits up 10% ; some customers transferred into QSR; cost pressures easing; branch results vary but overall excellent; growth opportunities will be tackled responsibly ― Hospitality remains in development but although small in profits adds to offering; market share gained in an increasingly bleak trading environment ― QSR profits up 5% in line with budget; Revenue +33. 7% Trading Profit +13. 7% Rm Trading Profit Trading Margin 3. 8 % 3. 3 %

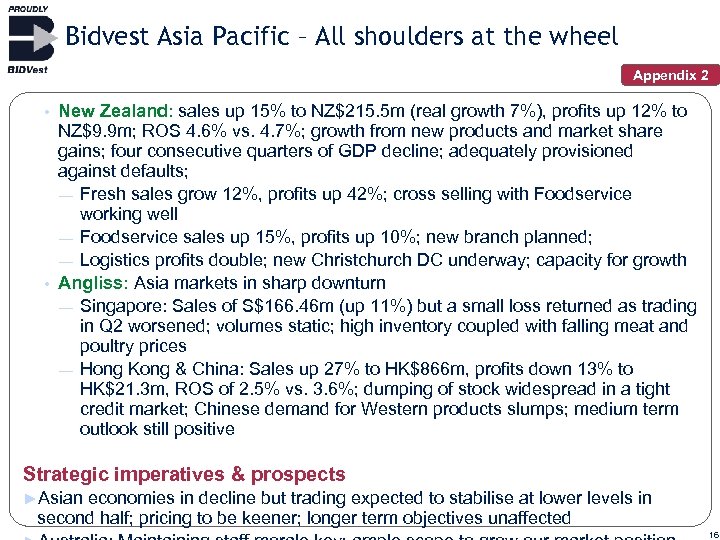

Bidvest Asia Pacific – All shoulders at the wheel Appendix 2 New Zealand: sales up 15% to NZ$215. 5 m (real growth 7%), profits up 12% to NZ$9. 9 m; ROS 4. 6% vs. 4. 7%; growth from new products and market share gains; four consecutive quarters of GDP decline; adequately provisioned against defaults; ― Fresh sales grow 12%, profits up 42%; cross selling with Foodservice working well ― Foodservice sales up 15%, profits up 10%; new branch planned; ― Logistics profits double; new Christchurch DC underway; capacity for growth • Angliss: Asia markets in sharp downturn ― Singapore: Sales of S$166. 46 m (up 11%) but a small loss returned as trading in Q 2 worsened; volumes static; high inventory coupled with falling meat and poultry prices ― Hong Kong & China: Sales up 27% to HK$866 m, profits down 13% to HK$21. 3 m, ROS of 2. 5% vs. 3. 6%; dumping of stock widespread in a tight credit market; Chinese demand for Western products slumps; medium term outlook still positive • Strategic imperatives & prospects ►Asian economies in decline but trading expected to stabilise at lower levels in second half; pricing to be keener; longer term objectives unaffected 16

Bidvest Asia Pacific – All shoulders at the wheel Appendix 2 New Zealand: sales up 15% to NZ$215. 5 m (real growth 7%), profits up 12% to NZ$9. 9 m; ROS 4. 6% vs. 4. 7%; growth from new products and market share gains; four consecutive quarters of GDP decline; adequately provisioned against defaults; ― Fresh sales grow 12%, profits up 42%; cross selling with Foodservice working well ― Foodservice sales up 15%, profits up 10%; new branch planned; ― Logistics profits double; new Christchurch DC underway; capacity for growth • Angliss: Asia markets in sharp downturn ― Singapore: Sales of S$166. 46 m (up 11%) but a small loss returned as trading in Q 2 worsened; volumes static; high inventory coupled with falling meat and poultry prices ― Hong Kong & China: Sales up 27% to HK$866 m, profits down 13% to HK$21. 3 m, ROS of 2. 5% vs. 3. 6%; dumping of stock widespread in a tight credit market; Chinese demand for Western products slumps; medium term outlook still positive • Strategic imperatives & prospects ►Asian economies in decline but trading expected to stabilise at lower levels in second half; pricing to be keener; longer term objectives unaffected 16

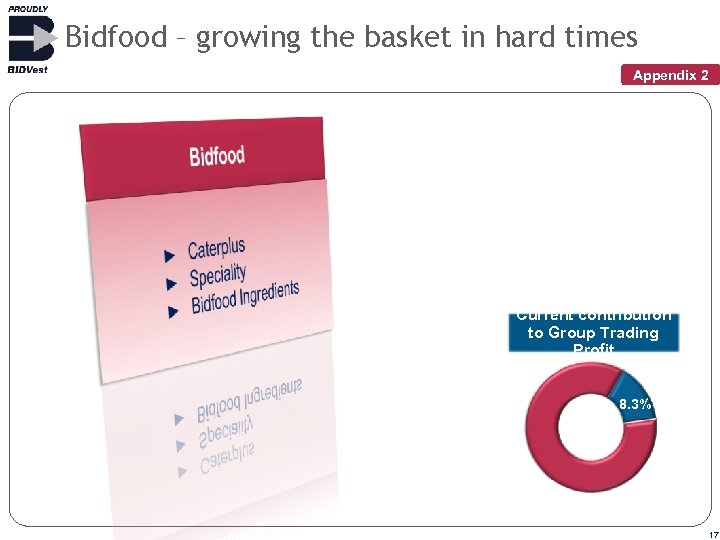

Bidfood – growing the basket in hard times Appendix 2 Current contribution to Group Trading Profit 8. 3% 17

Bidfood – growing the basket in hard times Appendix 2 Current contribution to Group Trading Profit 8. 3% 17

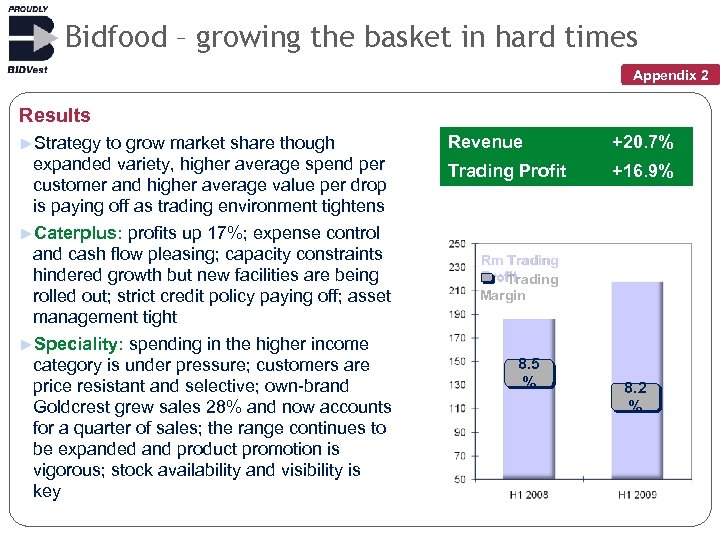

Bidfood – growing the basket in hard times Appendix 2 Results ►Strategy to grow market share though expanded variety, higher average spend per customer and higher average value per drop is paying off as trading environment tightens ►Caterplus: profits up 17%; expense control and cash flow pleasing; capacity constraints hindered growth but new facilities are being rolled out; strict credit policy paying off; asset management tight ►Speciality: spending in the higher income category is under pressure; customers are price resistant and selective; own-brand Goldcrest grew sales 28% and now accounts for a quarter of sales; the range continues to be expanded and product promotion is vigorous; stock availability and visibility is key Revenue +20. 7% Trading Profit +16. 9% Rm Trading Profit Trading Margin 8. 5 % 8. 2 %

Bidfood – growing the basket in hard times Appendix 2 Results ►Strategy to grow market share though expanded variety, higher average spend per customer and higher average value per drop is paying off as trading environment tightens ►Caterplus: profits up 17%; expense control and cash flow pleasing; capacity constraints hindered growth but new facilities are being rolled out; strict credit policy paying off; asset management tight ►Speciality: spending in the higher income category is under pressure; customers are price resistant and selective; own-brand Goldcrest grew sales 28% and now accounts for a quarter of sales; the range continues to be expanded and product promotion is vigorous; stock availability and visibility is key Revenue +20. 7% Trading Profit +16. 9% Rm Trading Profit Trading Margin 8. 5 % 8. 2 %

Bidfood – growing the basket in hard times Appendix 2 ►Ingredients: all business traded well, with the exception of NCP Yeast which was hampered by an inability to pass through high input prices quickly enough; stock position under scrutiny due to deflation risk; customers increasingly under liquidity pressure; technical base continues to strengthen - alliances with suppliers Strategic imperatives & prospects ►As mentioned at the full year an outright reduction in prices is likely ►Quality custom is being emphasised at the expense of volume as bad debt risks rise ►Stock theft remains an issue and is being closely monitored as times get worse ►Bidfood will take advantage of harder times to improve market position and protect profitability and liquidity 19

Bidfood – growing the basket in hard times Appendix 2 ►Ingredients: all business traded well, with the exception of NCP Yeast which was hampered by an inability to pass through high input prices quickly enough; stock position under scrutiny due to deflation risk; customers increasingly under liquidity pressure; technical base continues to strengthen - alliances with suppliers Strategic imperatives & prospects ►As mentioned at the full year an outright reduction in prices is likely ►Quality custom is being emphasised at the expense of volume as bad debt risks rise ►Stock theft remains an issue and is being closely monitored as times get worse ►Bidfood will take advantage of harder times to improve market position and protect profitability and liquidity 19

Bid Industrial and Commercial Products – Cooling Appendix 2 Current contribution to Group Trading Profit 12. 4% 20

Bid Industrial and Commercial Products – Cooling Appendix 2 Current contribution to Group Trading Profit 12. 4% 20

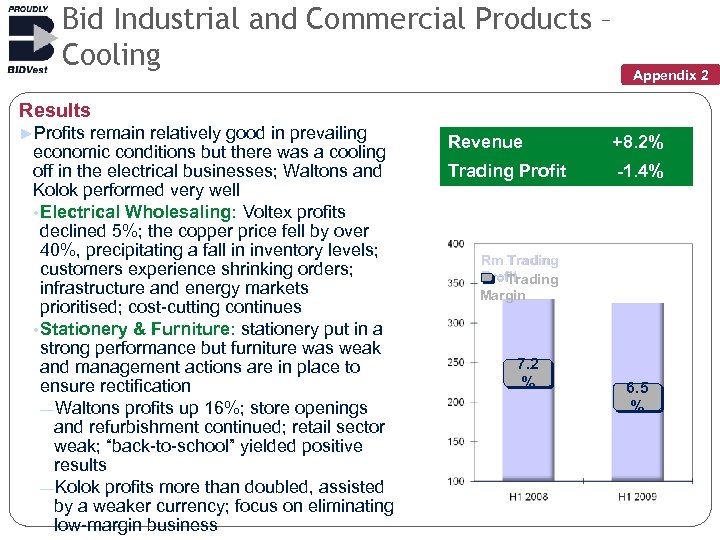

Bid Industrial and Commercial Products – Cooling Appendix 2 Results ►Profits remain relatively good in prevailing economic conditions but there was a cooling off in the electrical businesses; Waltons and Kolok performed very well • Electrical Wholesaling: Voltex profits declined 5%; the copper price fell by over 40%, precipitating a fall in inventory levels; customers experience shrinking orders; infrastructure and energy markets prioritised; cost-cutting continues • Stationery & Furniture: stationery put in a strong performance but furniture was weak and management actions are in place to ensure rectification ―Waltons profits up 16%; store openings and refurbishment continued; retail sector weak; “back-to-school” yielded positive results ―Kolok profits more than doubled, assisted by a weaker currency; focus on eliminating low-margin business Revenue +8. 2% Trading Profit -1. 4% Rm Trading Profit Trading Margin 7. 2 % 6. 5 %

Bid Industrial and Commercial Products – Cooling Appendix 2 Results ►Profits remain relatively good in prevailing economic conditions but there was a cooling off in the electrical businesses; Waltons and Kolok performed very well • Electrical Wholesaling: Voltex profits declined 5%; the copper price fell by over 40%, precipitating a fall in inventory levels; customers experience shrinking orders; infrastructure and energy markets prioritised; cost-cutting continues • Stationery & Furniture: stationery put in a strong performance but furniture was weak and management actions are in place to ensure rectification ―Waltons profits up 16%; store openings and refurbishment continued; retail sector weak; “back-to-school” yielded positive results ―Kolok profits more than doubled, assisted by a weaker currency; focus on eliminating low-margin business Revenue +8. 2% Trading Profit -1. 4% Rm Trading Profit Trading Margin 7. 2 % 6. 5 %

Bid Industrial and Commercial Products – Cooling • Appendix 2 Packaging: ―Afcom GE Hudson profits up 15%. Optimal balance between local and imported product assisted ―Buffalo Executape profits up 29%, benefiting from tight expense control ―Vulcan: profits up 18% in a competitive market as new products reinforce market position Strategic imperatives & prospects ►Electrical Wholesaling: • Declining building market but infrastructure investment buoyant • Escalating electricity price to assist energy saving solutions • Copper prices bottoming out ►Stationery: relative resilience but not impervious to weak consumer spend ►Furniture: improvement expected following a weak first half ►Kolok: new business at higher margin aggressively pursued ►Vulcan: good first half, building on competitive strengths in a tough market ►Packaging closures: well positioned after a very good first half 22

Bid Industrial and Commercial Products – Cooling • Appendix 2 Packaging: ―Afcom GE Hudson profits up 15%. Optimal balance between local and imported product assisted ―Buffalo Executape profits up 29%, benefiting from tight expense control ―Vulcan: profits up 18% in a competitive market as new products reinforce market position Strategic imperatives & prospects ►Electrical Wholesaling: • Declining building market but infrastructure investment buoyant • Escalating electricity price to assist energy saving solutions • Copper prices bottoming out ►Stationery: relative resilience but not impervious to weak consumer spend ►Furniture: improvement expected following a weak first half ►Kolok: new business at higher margin aggressively pursued ►Vulcan: good first half, building on competitive strengths in a tough market ►Packaging closures: well positioned after a very good first half 22

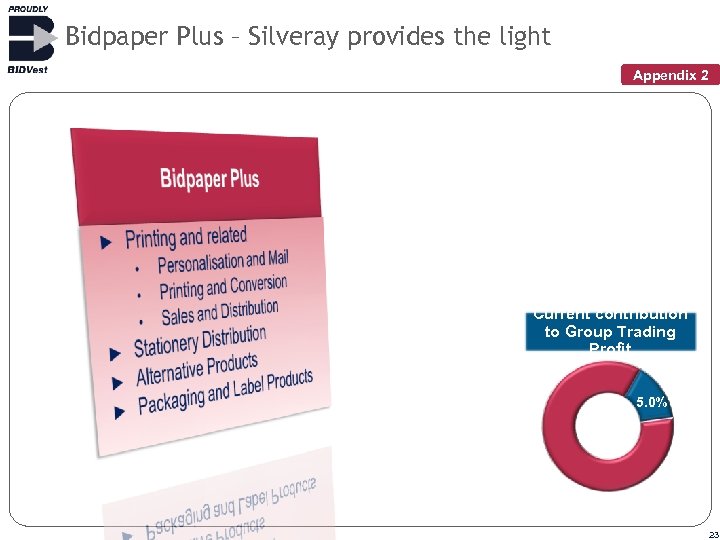

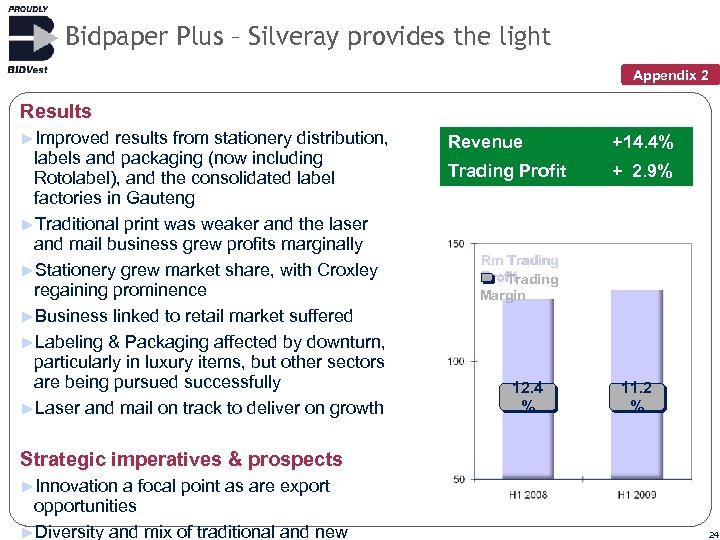

Bidpaper Plus – Silveray provides the light Appendix 2 Current contribution to Group Trading Profit 5. 0% 23

Bidpaper Plus – Silveray provides the light Appendix 2 Current contribution to Group Trading Profit 5. 0% 23

Bidpaper Plus – Silveray provides the light Appendix 2 Results ►Improved results from stationery distribution, labels and packaging (now including Rotolabel), and the consolidated label factories in Gauteng ►Traditional print was weaker and the laser and mail business grew profits marginally ►Stationery grew market share, with Croxley regaining prominence ►Business linked to retail market suffered ►Labeling & Packaging affected by downturn, particularly in luxury items, but other sectors are being pursued successfully ►Laser and mail on track to deliver on growth Revenue +14. 4% Trading Profit + 2. 9% Rm Trading Profit Trading Margin 12. 4 % 11. 2 % Strategic imperatives & prospects ►Innovation a focal point as are export opportunities ►Diversity and mix of traditional and new 24

Bidpaper Plus – Silveray provides the light Appendix 2 Results ►Improved results from stationery distribution, labels and packaging (now including Rotolabel), and the consolidated label factories in Gauteng ►Traditional print was weaker and the laser and mail business grew profits marginally ►Stationery grew market share, with Croxley regaining prominence ►Business linked to retail market suffered ►Labeling & Packaging affected by downturn, particularly in luxury items, but other sectors are being pursued successfully ►Laser and mail on track to deliver on growth Revenue +14. 4% Trading Profit + 2. 9% Rm Trading Profit Trading Margin 12. 4 % 11. 2 % Strategic imperatives & prospects ►Innovation a focal point as are export opportunities ►Diversity and mix of traditional and new 24

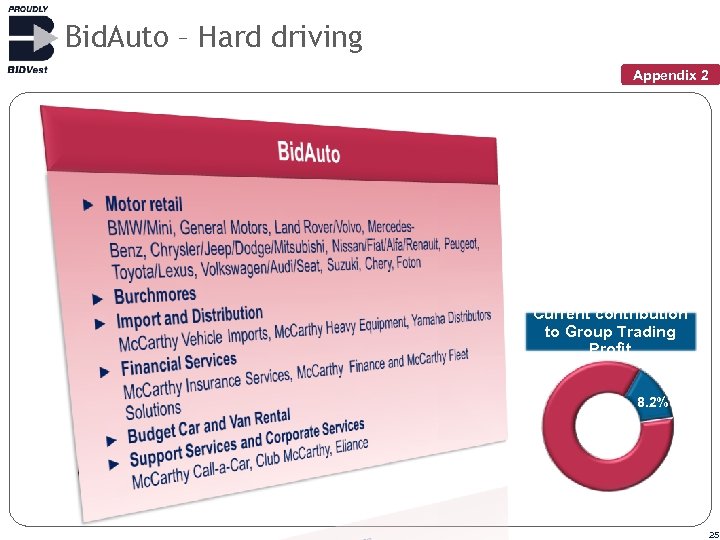

Bid. Auto – Hard driving Appendix 2 Current contribution to Group Trading Profit 8. 2% 25

Bid. Auto – Hard driving Appendix 2 Current contribution to Group Trading Profit 8. 2% 25

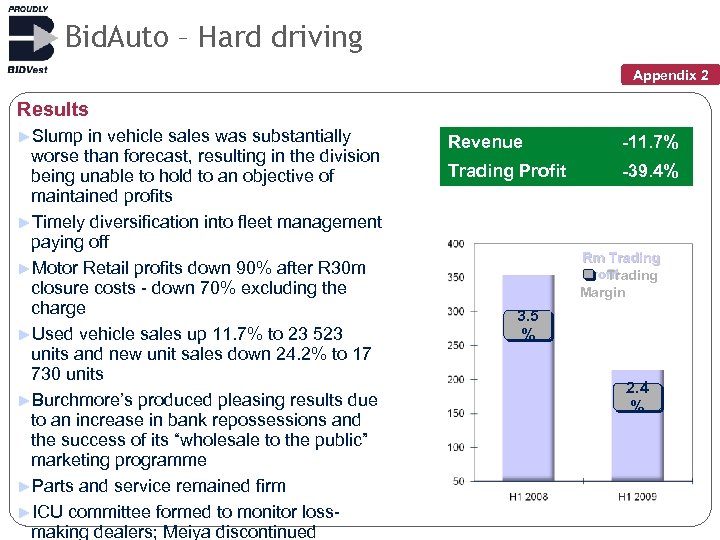

Bid. Auto – Hard driving Appendix 2 Results ►Slump in vehicle sales was substantially worse than forecast, resulting in the division being unable to hold to an objective of maintained profits ►Timely diversification into fleet management paying off ►Motor Retail profits down 90% after R 30 m closure costs - down 70% excluding the charge ►Used vehicle sales up 11. 7% to 23 523 units and new unit sales down 24. 2% to 17 730 units ►Burchmore’s produced pleasing results due to an increase in bank repossessions and the success of its “wholesale to the public” marketing programme ►Parts and service remained firm ►ICU committee formed to monitor lossmaking dealers; Meiya discontinued Revenue -11. 7% Trading Profit -39. 4% Rm Trading Profit Trading Margin 3. 5 % 2. 4 %

Bid. Auto – Hard driving Appendix 2 Results ►Slump in vehicle sales was substantially worse than forecast, resulting in the division being unable to hold to an objective of maintained profits ►Timely diversification into fleet management paying off ►Motor Retail profits down 90% after R 30 m closure costs - down 70% excluding the charge ►Used vehicle sales up 11. 7% to 23 523 units and new unit sales down 24. 2% to 17 730 units ►Burchmore’s produced pleasing results due to an increase in bank repossessions and the success of its “wholesale to the public” marketing programme ►Parts and service remained firm ►ICU committee formed to monitor lossmaking dealers; Meiya discontinued Revenue -11. 7% Trading Profit -39. 4% Rm Trading Profit Trading Margin 3. 5 % 2. 4 %

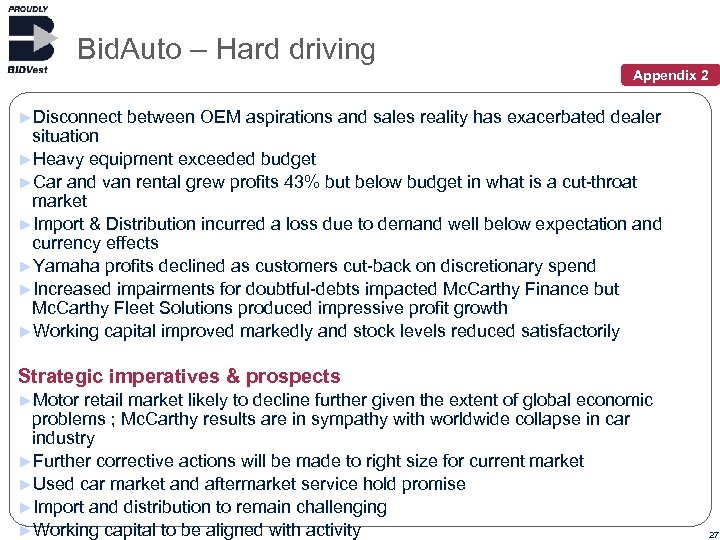

Bid. Auto – Hard driving Appendix 2 ►Disconnect between OEM aspirations and sales reality has exacerbated dealer situation ►Heavy equipment exceeded budget ►Car and van rental grew profits 43% but below budget in what is a cut-throat market ►Import & Distribution incurred a loss due to demand well below expectation and currency effects ►Yamaha profits declined as customers cut-back on discretionary spend ►Increased impairments for doubtful-debts impacted Mc. Carthy Finance but Mc. Carthy Fleet Solutions produced impressive profit growth ►Working capital improved markedly and stock levels reduced satisfactorily Strategic imperatives & prospects ►Motor retail market likely to decline further given the extent of global economic problems ; Mc. Carthy results are in sympathy with worldwide collapse in car industry ►Further corrective actions will be made to right size for current market ►Used car market and aftermarket service hold promise ►Import and distribution to remain challenging ►Working capital to be aligned with activity 27

Bid. Auto – Hard driving Appendix 2 ►Disconnect between OEM aspirations and sales reality has exacerbated dealer situation ►Heavy equipment exceeded budget ►Car and van rental grew profits 43% but below budget in what is a cut-throat market ►Import & Distribution incurred a loss due to demand well below expectation and currency effects ►Yamaha profits declined as customers cut-back on discretionary spend ►Increased impairments for doubtful-debts impacted Mc. Carthy Finance but Mc. Carthy Fleet Solutions produced impressive profit growth ►Working capital improved markedly and stock levels reduced satisfactorily Strategic imperatives & prospects ►Motor retail market likely to decline further given the extent of global economic problems ; Mc. Carthy results are in sympathy with worldwide collapse in car industry ►Further corrective actions will be made to right size for current market ►Used car market and aftermarket service hold promise ►Import and distribution to remain challenging ►Working capital to be aligned with activity 27

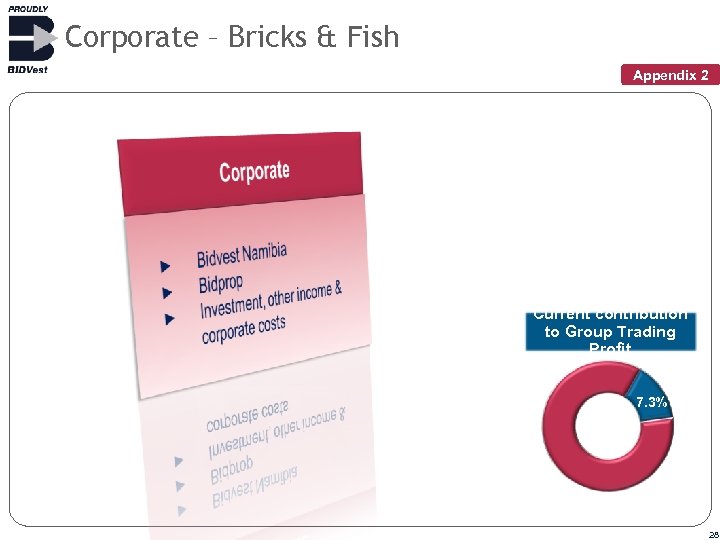

Corporate – Bricks & Fish Appendix 2 Current contribution to Group Trading Profit 7. 3% 28

Corporate – Bricks & Fish Appendix 2 Current contribution to Group Trading Profit 7. 3% 28

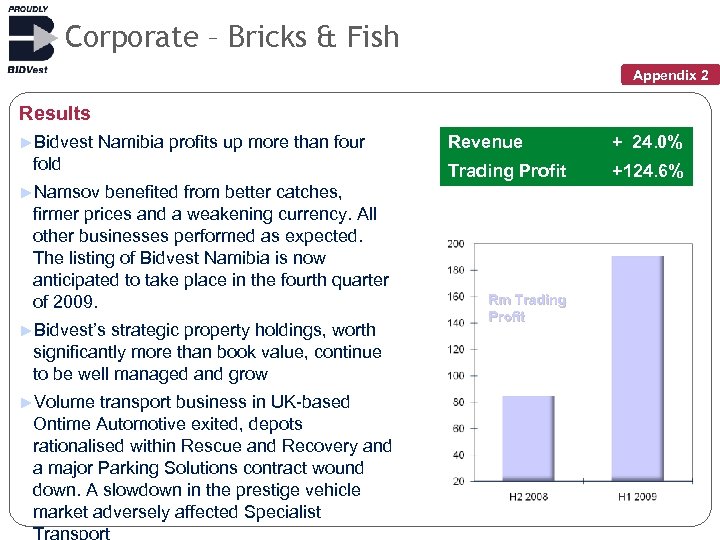

Corporate – Bricks & Fish Appendix 2 Results ►Bidvest Namibia profits up more than four fold benefited from better catches, firmer prices and a weakening currency. All other businesses performed as expected. The listing of Bidvest Namibia is now anticipated to take place in the fourth quarter of 2009. Revenue + 24. 0% Trading Profit +124. 6% ►Namsov ►Bidvest’s strategic property holdings, worth significantly more than book value, continue to be well managed and grow ►Volume transport business in UK-based Ontime Automotive exited, depots rationalised within Rescue and Recovery and a major Parking Solutions contract wound down. A slowdown in the prestige vehicle market adversely affected Specialist Transport Rm Trading Profit

Corporate – Bricks & Fish Appendix 2 Results ►Bidvest Namibia profits up more than four fold benefited from better catches, firmer prices and a weakening currency. All other businesses performed as expected. The listing of Bidvest Namibia is now anticipated to take place in the fourth quarter of 2009. Revenue + 24. 0% Trading Profit +124. 6% ►Namsov ►Bidvest’s strategic property holdings, worth significantly more than book value, continue to be well managed and grow ►Volume transport business in UK-based Ontime Automotive exited, depots rationalised within Rescue and Recovery and a major Parking Solutions contract wound down. A slowdown in the prestige vehicle market adversely affected Specialist Transport Rm Trading Profit

Appendix 3 Historic Performance 30

Appendix 3 Historic Performance 30

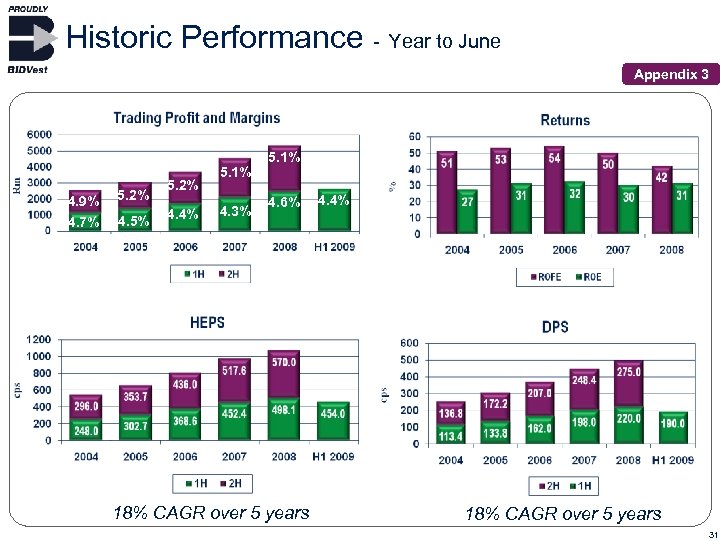

Historic Performance - Year to June Appendix 3 5. 2% 4. 9% 4. 5% 4. 7% 4. 5% 5. 2% 4. 4% 5. 1% 4. 3% 5. 1% 4. 6% 18% CAGR over 5 years 4. 4% 18% CAGR over 5 years 31

Historic Performance - Year to June Appendix 3 5. 2% 4. 9% 4. 5% 4. 7% 4. 5% 5. 2% 4. 4% 5. 1% 4. 3% 5. 1% 4. 6% 18% CAGR over 5 years 4. 4% 18% CAGR over 5 years 31