AP Microeconomics Lecture 10: Externalities Spring 2013 Externality

ap_micro_10.ppt

- Количество слайдов: 36

AP Microeconomics Lecture 10: Externalities Spring 2013

AP Microeconomics Lecture 10: Externalities Spring 2013

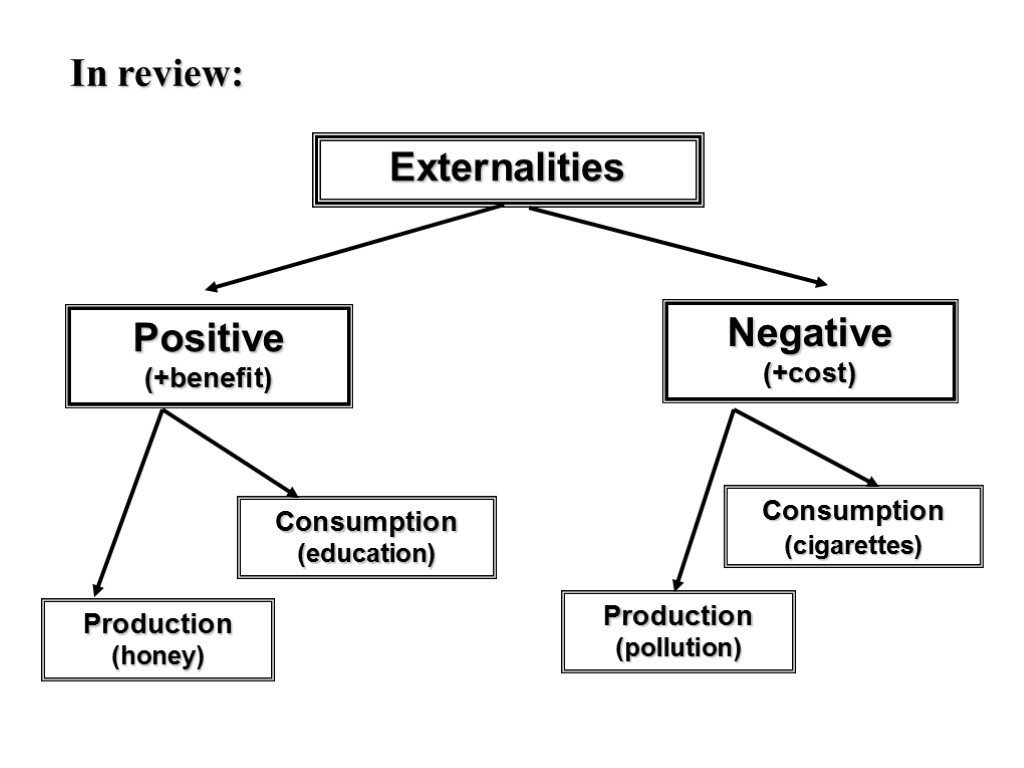

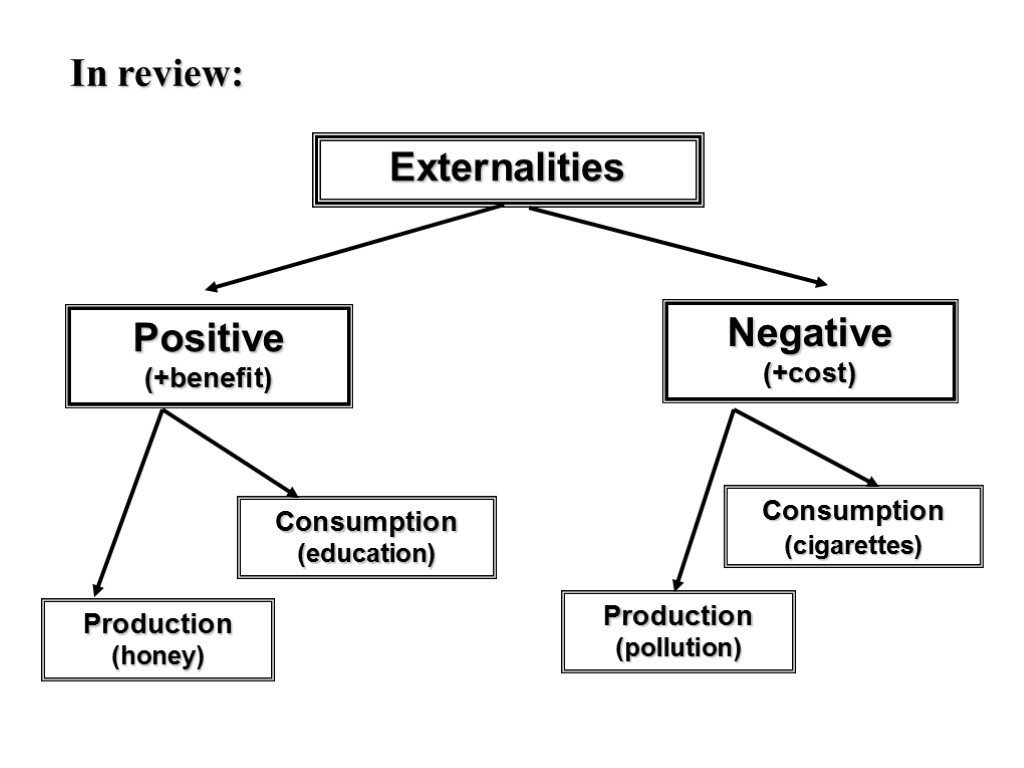

Externality When one person’s actions imposes a cost or benefit on the well-being of a bystander. Externalities usually result in market failure. Externalities can be: 1) Positive: an external benefit is imposed on someone. (examples: gardens, restored historic buildings, research) 2) Negative: an external cost is imposed on someone. (examples: exhaust from autos, barking dogs, noise from airplanes)

Externality When one person’s actions imposes a cost or benefit on the well-being of a bystander. Externalities usually result in market failure. Externalities can be: 1) Positive: an external benefit is imposed on someone. (examples: gardens, restored historic buildings, research) 2) Negative: an external cost is imposed on someone. (examples: exhaust from autos, barking dogs, noise from airplanes)

This happens through: 1) CONSUMPTION: consuming a good results in externality. 2) PRODUCTION: producing a good results in externality. In general, an external cost means the market overproduces the good (ie, paint). An external benefit means the market underproduces the good (ie, gardens) Externalities cause markets to allocate resources inefficiently.

This happens through: 1) CONSUMPTION: consuming a good results in externality. 2) PRODUCTION: producing a good results in externality. In general, an external cost means the market overproduces the good (ie, paint). An external benefit means the market underproduces the good (ie, gardens) Externalities cause markets to allocate resources inefficiently.

Are there benefits for other people in the parking lot when someone puts their car alarm on?

Are there benefits for other people in the parking lot when someone puts their car alarm on?

ANSWER: Yes, because thieves don’t know which cars have alarms.

ANSWER: Yes, because thieves don’t know which cars have alarms.

What if you lived next door to this? Do you receive a benefit?

What if you lived next door to this? Do you receive a benefit?

PROPERTY RIGHTS is the issue? Who owns the air? The rivers? The parks? If we can figure out who pollutes the stream, we punish the offender because we are not sure who owns the stream, but we DO know who pollutes it. We get into trouble when we use this criteria regarding the air.

PROPERTY RIGHTS is the issue? Who owns the air? The rivers? The parks? If we can figure out who pollutes the stream, we punish the offender because we are not sure who owns the stream, but we DO know who pollutes it. We get into trouble when we use this criteria regarding the air.

What is the difference between a public good and a private good? Exclusion vs. non-exclusion and Shared consumption (rival good) vs. non-shared consumption (non-rival good)

What is the difference between a public good and a private good? Exclusion vs. non-exclusion and Shared consumption (rival good) vs. non-shared consumption (non-rival good)

What defines property rights? Property rights are established by formal and informal rules about the privileges and limitations on the ownership, use, and transfer of goods and resources. These rights are specified in various municipal ordinances, other legislation, court decisions (common law), tradition and custom.

What defines property rights? Property rights are established by formal and informal rules about the privileges and limitations on the ownership, use, and transfer of goods and resources. These rights are specified in various municipal ordinances, other legislation, court decisions (common law), tradition and custom.

What is a free-rider? Someone who uses the good but doesn’t pay for it. Free riders occur when there are non-exclusion and shared consumption. Spraying for mosquitoes Police & fire protection National defense Street lights

What is a free-rider? Someone who uses the good but doesn’t pay for it. Free riders occur when there are non-exclusion and shared consumption. Spraying for mosquitoes Police & fire protection National defense Street lights

Coase Theorem The proposition that if private parties can bargain without cost over the allocation of resources, they can solve the problem of externalities on their own.

Coase Theorem The proposition that if private parties can bargain without cost over the allocation of resources, they can solve the problem of externalities on their own.

Externalities Positive (+benefit) Negative (+cost) Production (honey) Consumption (education) Consumption (cigarettes) Production (pollution) In review:

Externalities Positive (+benefit) Negative (+cost) Production (honey) Consumption (education) Consumption (cigarettes) Production (pollution) In review:

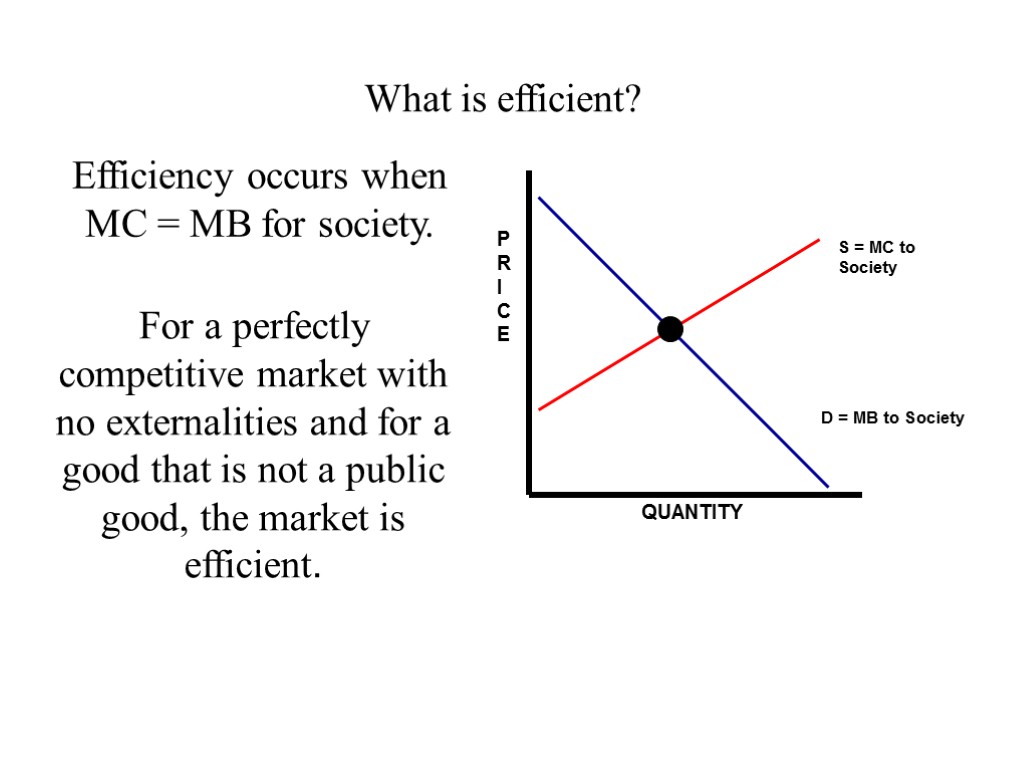

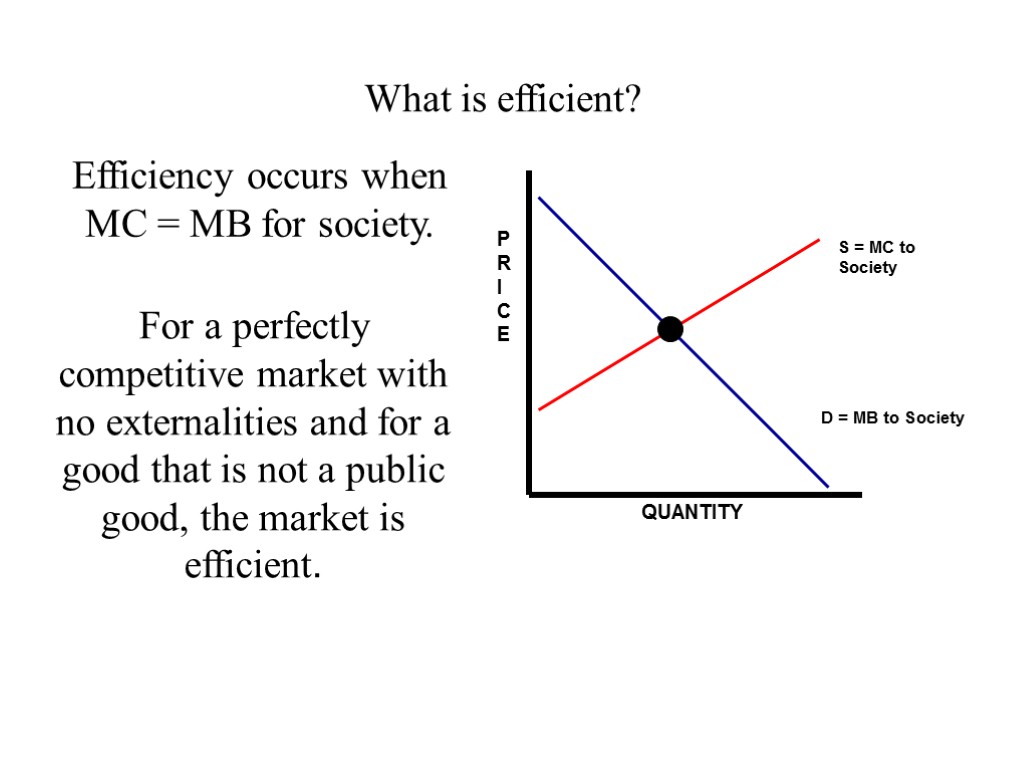

What is efficient? S = MC to Society D = MB to Society Efficiency occurs when MC = MB for society. For a perfectly competitive market with no externalities and for a good that is not a public good, the market is efficient. PRICE QUANTITY

What is efficient? S = MC to Society D = MB to Society Efficiency occurs when MC = MB for society. For a perfectly competitive market with no externalities and for a good that is not a public good, the market is efficient. PRICE QUANTITY

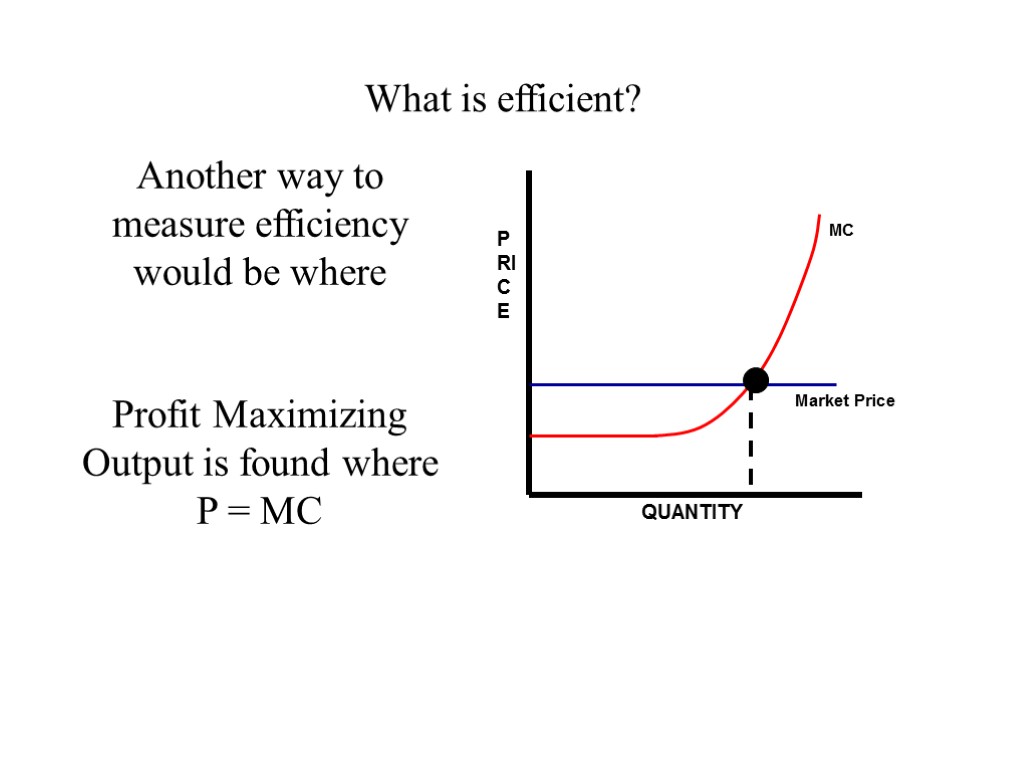

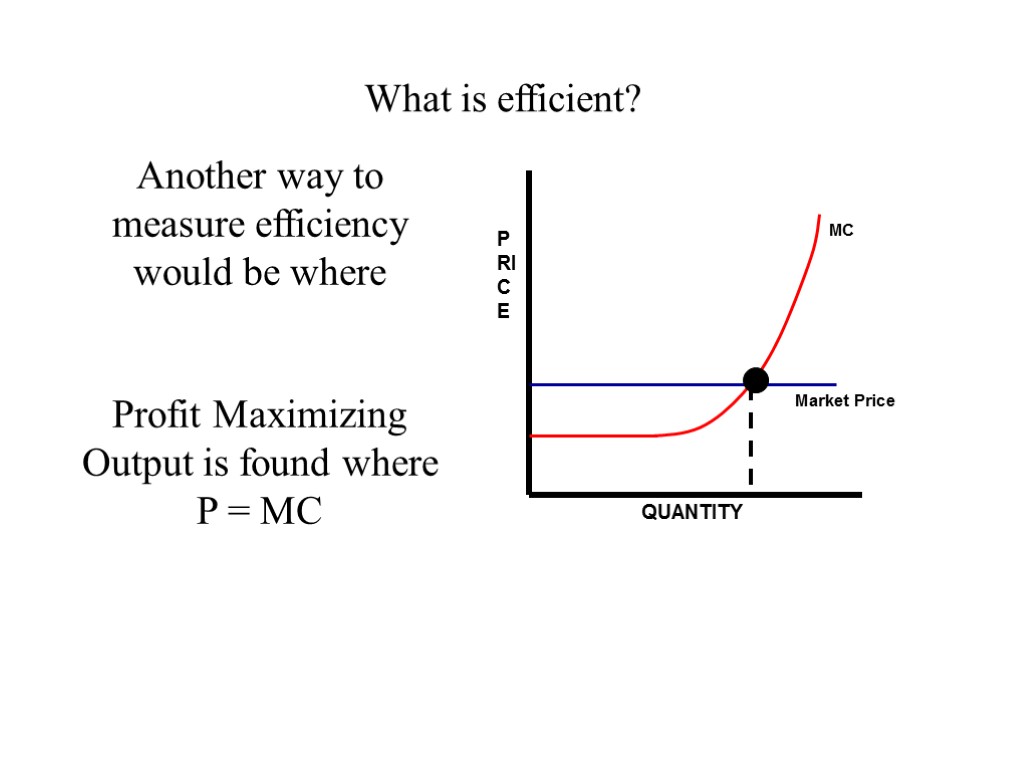

What is efficient? MC Market Price Another way to measure efficiency would be where Profit Maximizing Output is found where P = MC PRICE QUANTITY

What is efficient? MC Market Price Another way to measure efficiency would be where Profit Maximizing Output is found where P = MC PRICE QUANTITY

What happens when the firms’ marginal cost of production is not equal to the marginal cost to society? Or if the marginal benefit to consumers is not equal to the marginal benefit to society?

What happens when the firms’ marginal cost of production is not equal to the marginal cost to society? Or if the marginal benefit to consumers is not equal to the marginal benefit to society?

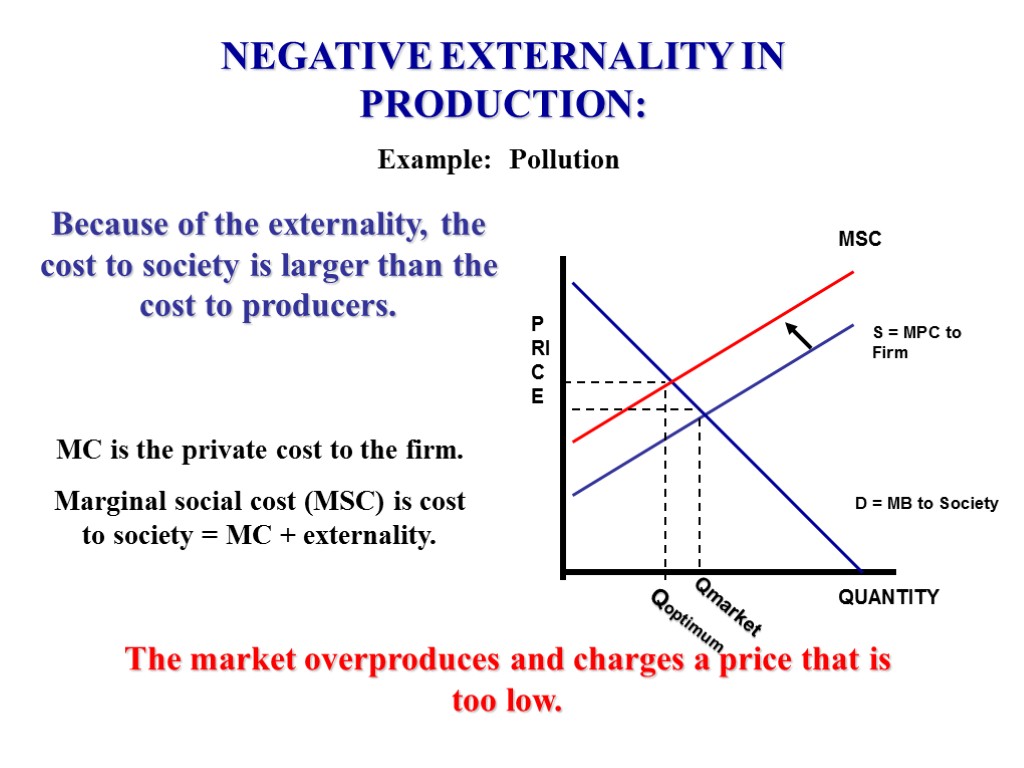

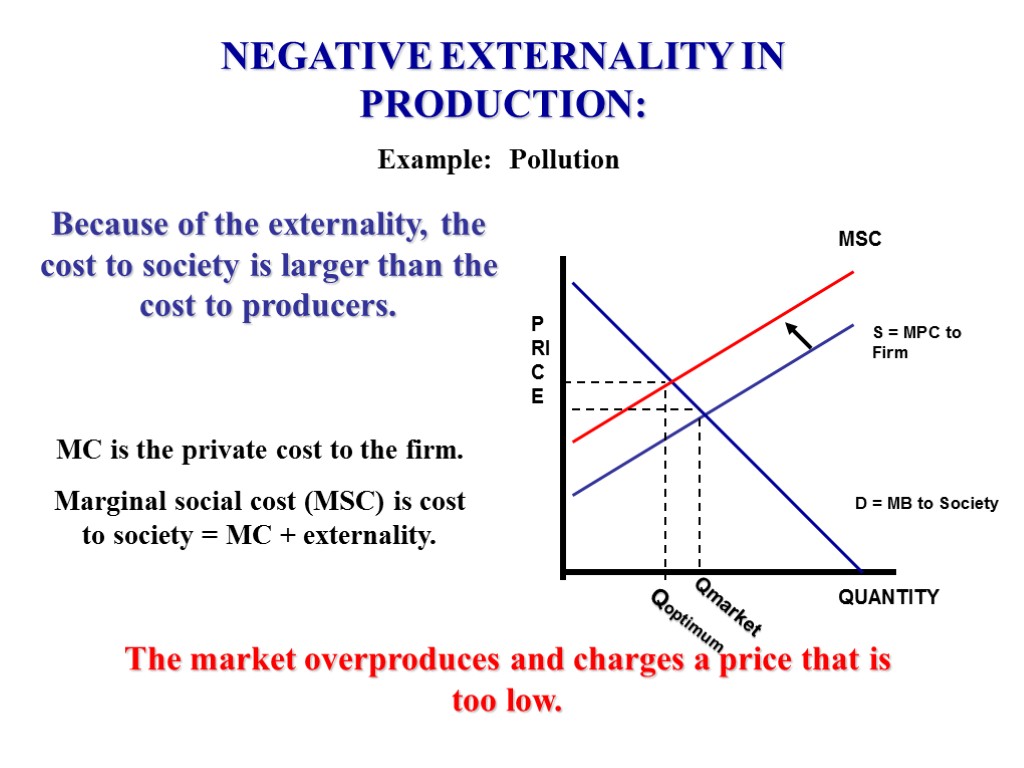

NEGATIVE EXTERNALITY IN PRODUCTION: Example: Pollution S = MPC to Firm D = MB to Society PRICE QUANTITY MSC MC is the private cost to the firm. Marginal social cost (MSC) is cost to society = MC + externality. The market overproduces and charges a price that is too low. Because of the externality, the cost to society is larger than the cost to producers. Qoptimum Qmarket

NEGATIVE EXTERNALITY IN PRODUCTION: Example: Pollution S = MPC to Firm D = MB to Society PRICE QUANTITY MSC MC is the private cost to the firm. Marginal social cost (MSC) is cost to society = MC + externality. The market overproduces and charges a price that is too low. Because of the externality, the cost to society is larger than the cost to producers. Qoptimum Qmarket

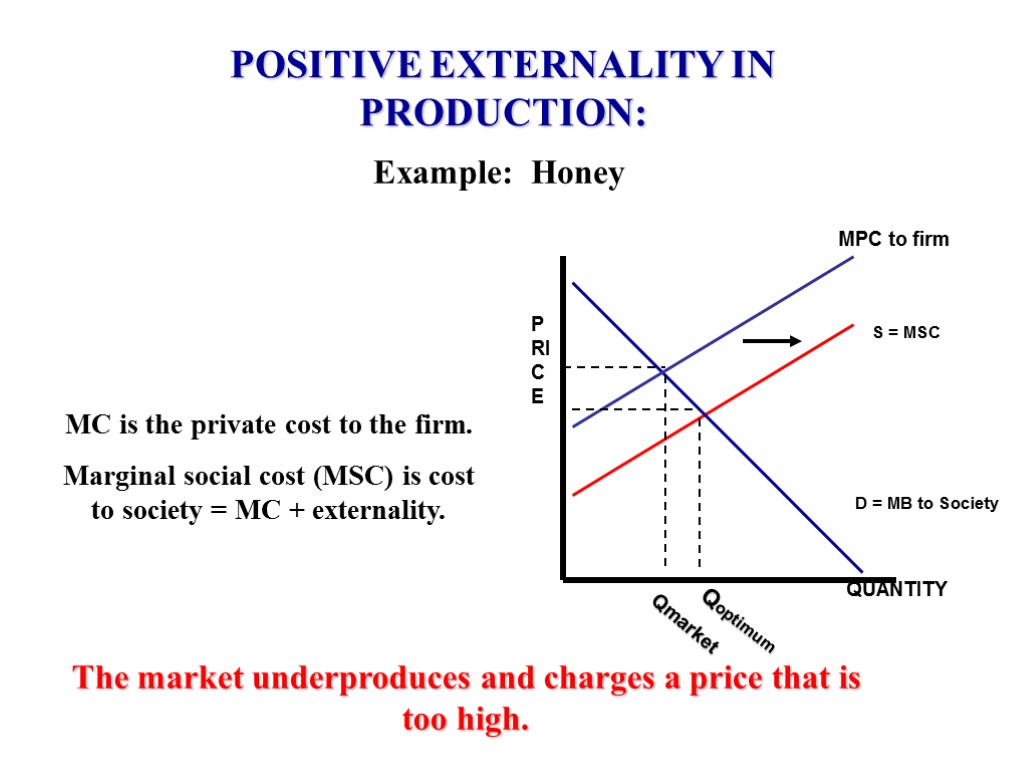

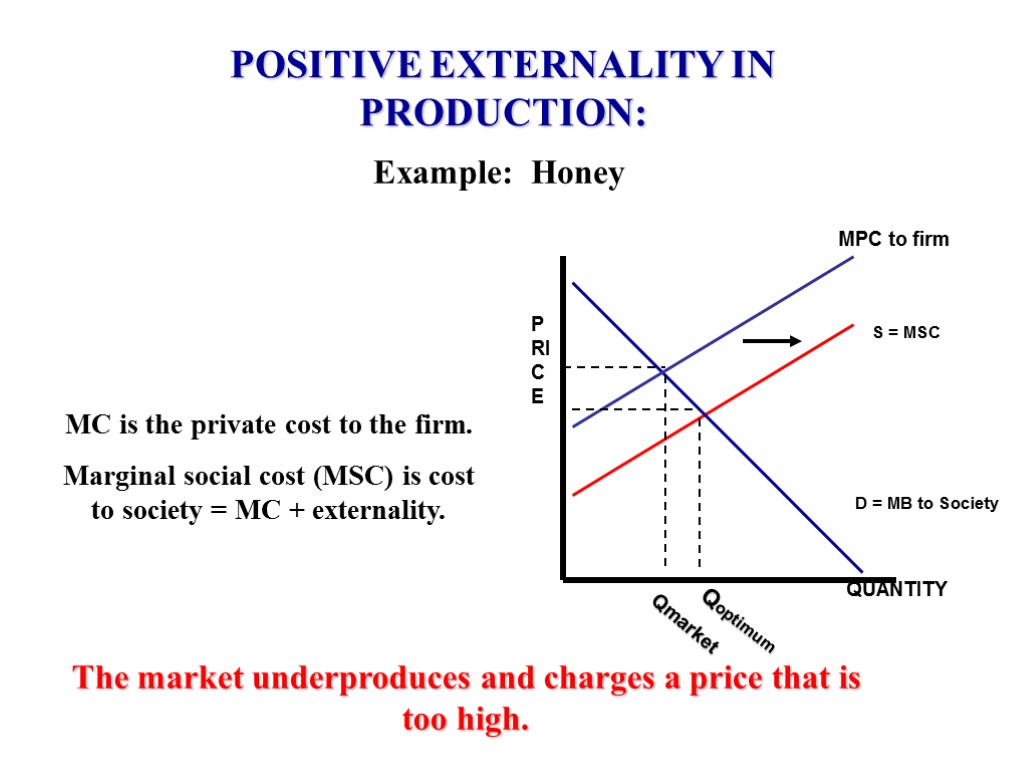

POSITIVE EXTERNALITY IN PRODUCTION: Example: Honey S = MSC D = MB to Society PRICE QUANTITY MPC to firm MC is the private cost to the firm. Marginal social cost (MSC) is cost to society = MC + externality. The market underproduces and charges a price that is too high. Qoptimum Qmarket

POSITIVE EXTERNALITY IN PRODUCTION: Example: Honey S = MSC D = MB to Society PRICE QUANTITY MPC to firm MC is the private cost to the firm. Marginal social cost (MSC) is cost to society = MC + externality. The market underproduces and charges a price that is too high. Qoptimum Qmarket

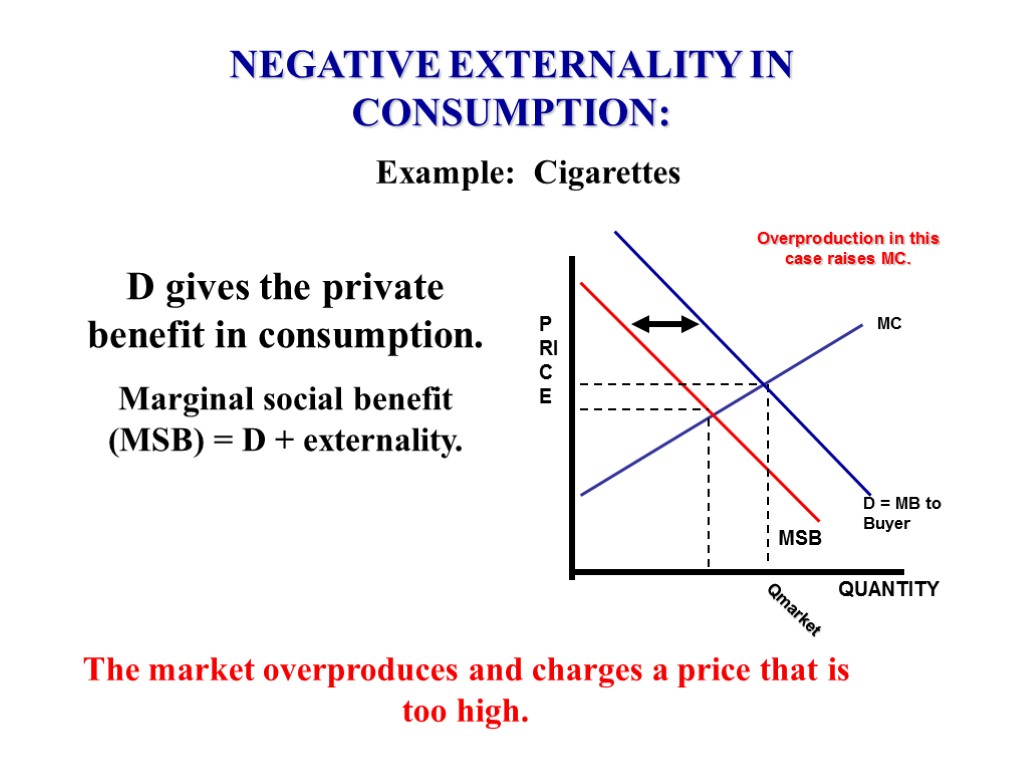

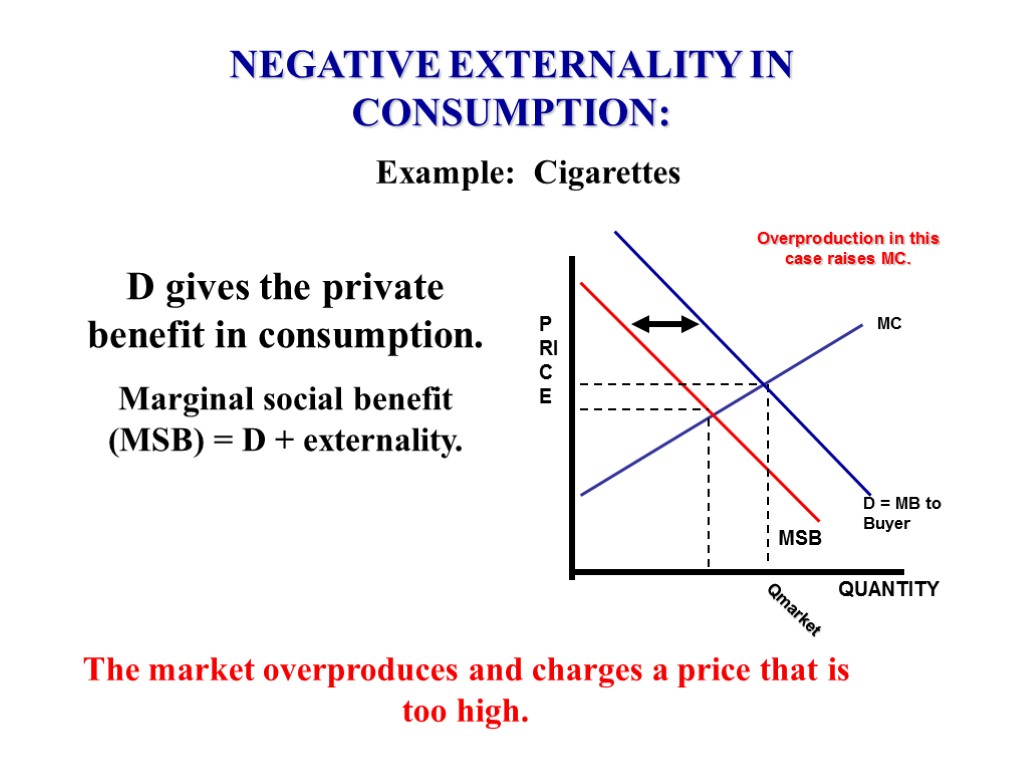

NEGATIVE EXTERNALITY IN CONSUMPTION: Example: Cigarettes MC D = MB to Buyer PRICE QUANTITY D gives the private benefit in consumption. Marginal social benefit (MSB) = D + externality. The market overproduces and charges a price that is too high. MSB Overproduction in this case raises MC. Qmarket

NEGATIVE EXTERNALITY IN CONSUMPTION: Example: Cigarettes MC D = MB to Buyer PRICE QUANTITY D gives the private benefit in consumption. Marginal social benefit (MSB) = D + externality. The market overproduces and charges a price that is too high. MSB Overproduction in this case raises MC. Qmarket

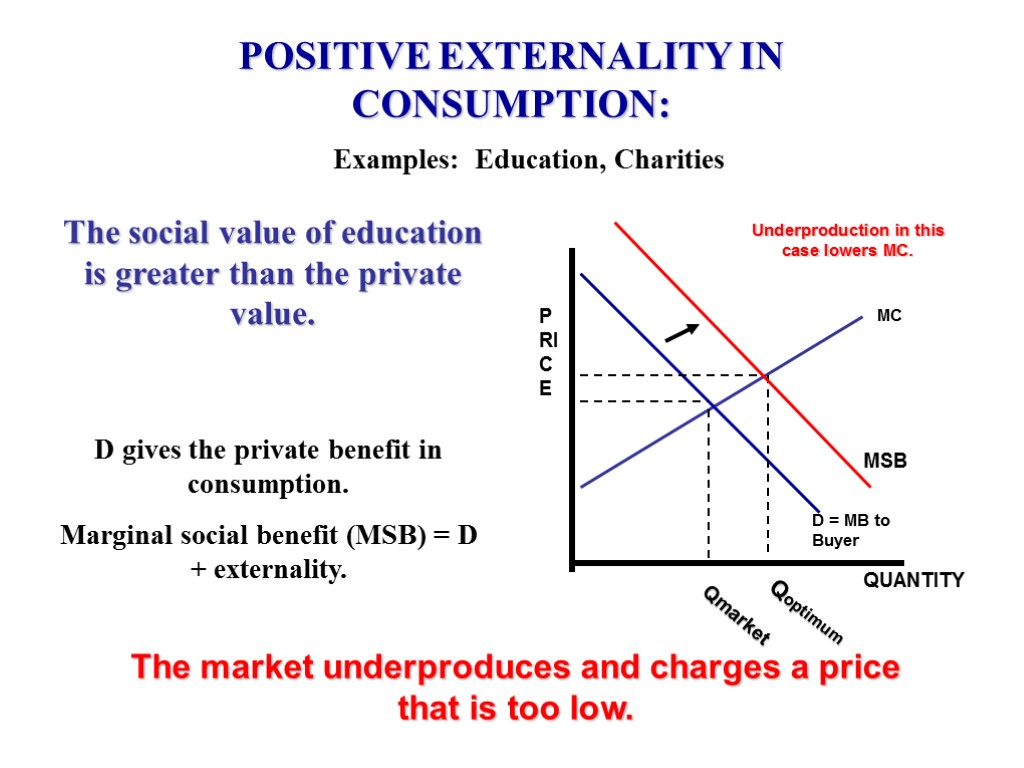

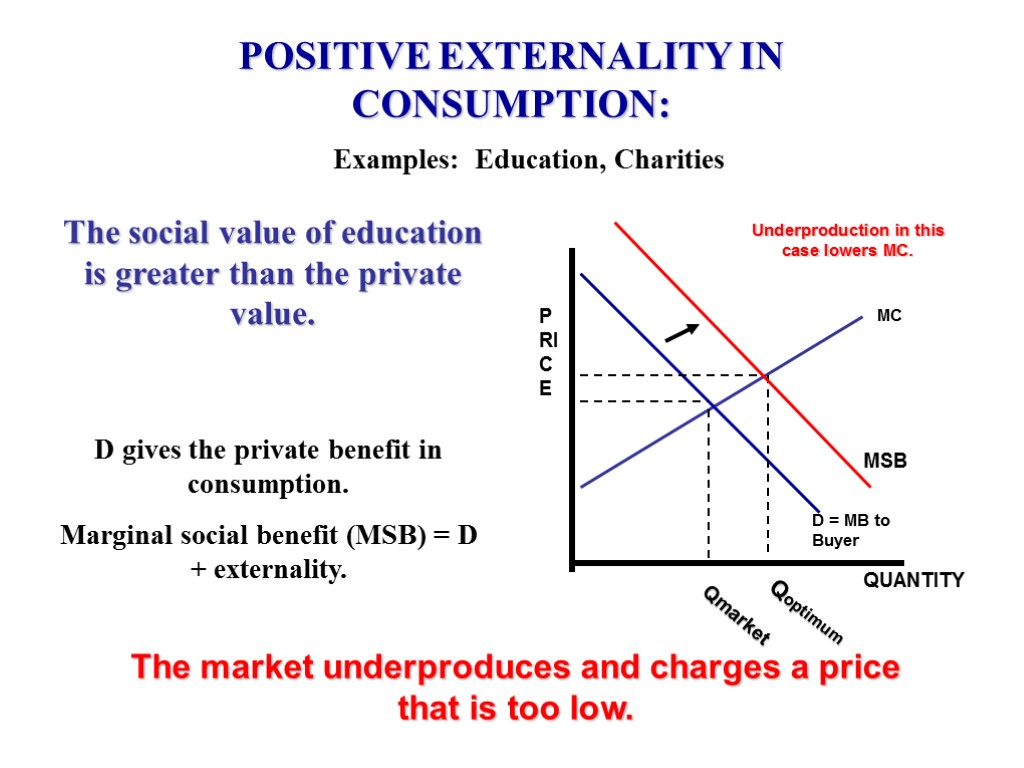

POSITIVE EXTERNALITY IN CONSUMPTION: Examples: Education, Charities MC D = MB to Buyer PRICE QUANTITY D gives the private benefit in consumption. Marginal social benefit (MSB) = D + externality. The market underproduces and charges a price that is too low. MSB Underproduction in this case lowers MC. The social value of education is greater than the private value. Qoptimum Qmarket

POSITIVE EXTERNALITY IN CONSUMPTION: Examples: Education, Charities MC D = MB to Buyer PRICE QUANTITY D gives the private benefit in consumption. Marginal social benefit (MSB) = D + externality. The market underproduces and charges a price that is too low. MSB Underproduction in this case lowers MC. The social value of education is greater than the private value. Qoptimum Qmarket

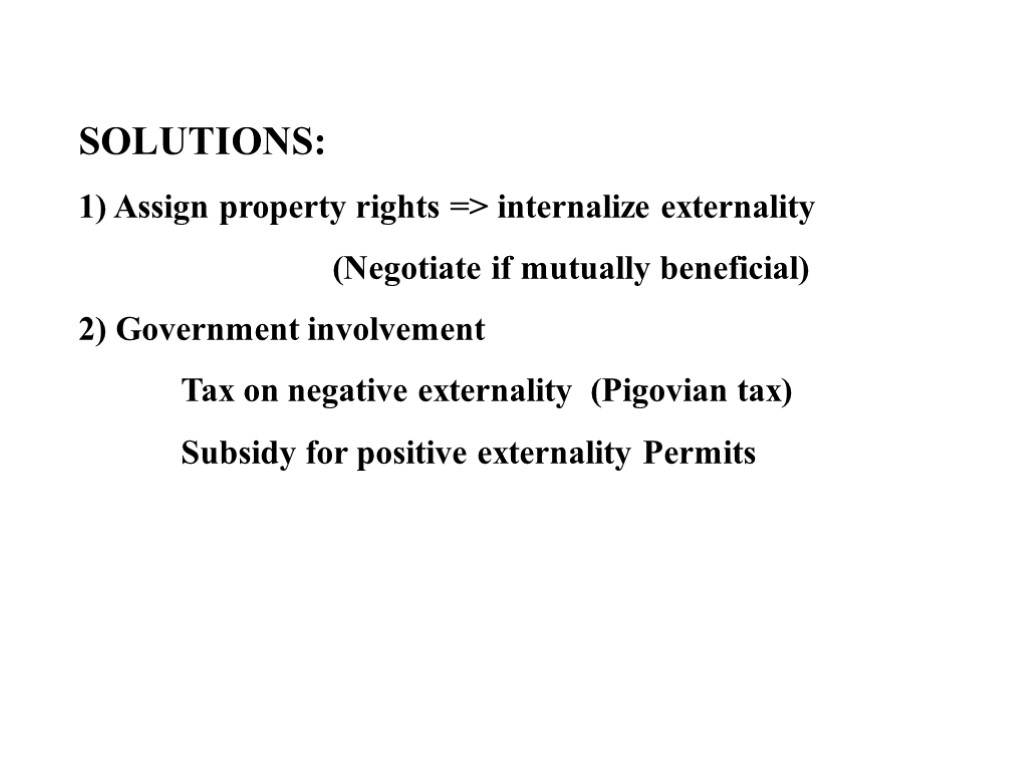

SOLUTIONS: 1) Assign property rights => internalize externality (Negotiate if mutually beneficial) 2) Government involvement Tax on negative externality (Pigovian tax) Subsidy for positive externality Permits

SOLUTIONS: 1) Assign property rights => internalize externality (Negotiate if mutually beneficial) 2) Government involvement Tax on negative externality (Pigovian tax) Subsidy for positive externality Permits

Pigovian Tax Named after economist, Arthur Pigou A tax on firms based on the external costs they generate. Internalizes the externality and reimburses society for the external costs. The term “pollution tax” is used when the tax may not be equal to marginal external cost.

Pigovian Tax Named after economist, Arthur Pigou A tax on firms based on the external costs they generate. Internalizes the externality and reimburses society for the external costs. The term “pollution tax” is used when the tax may not be equal to marginal external cost.

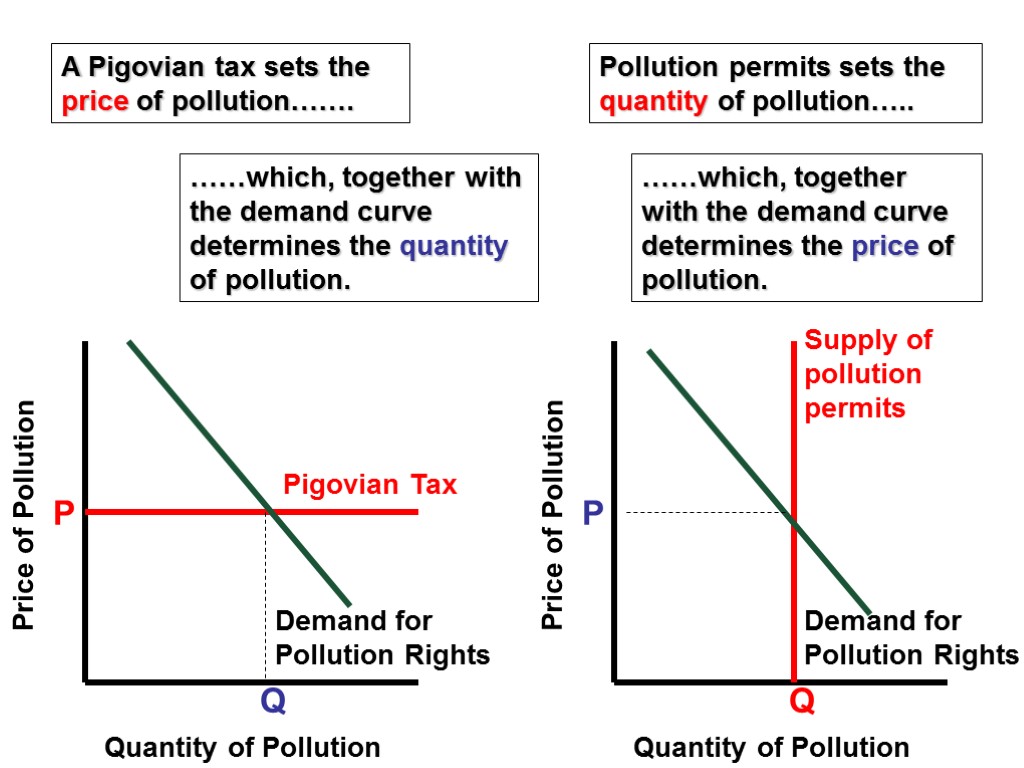

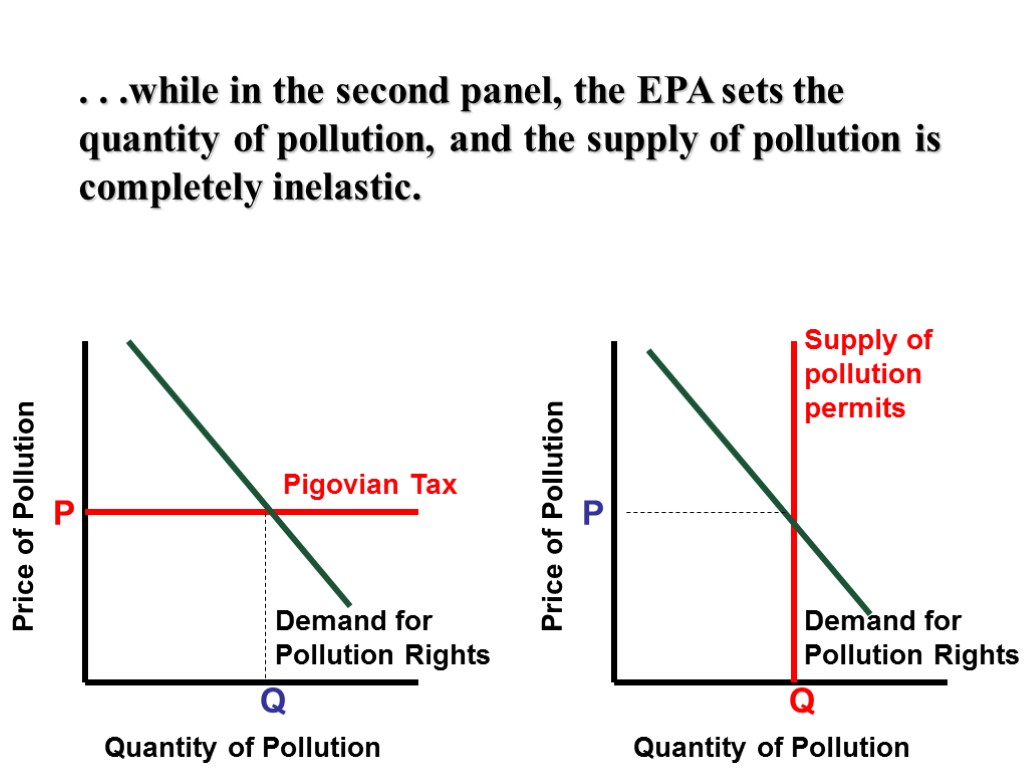

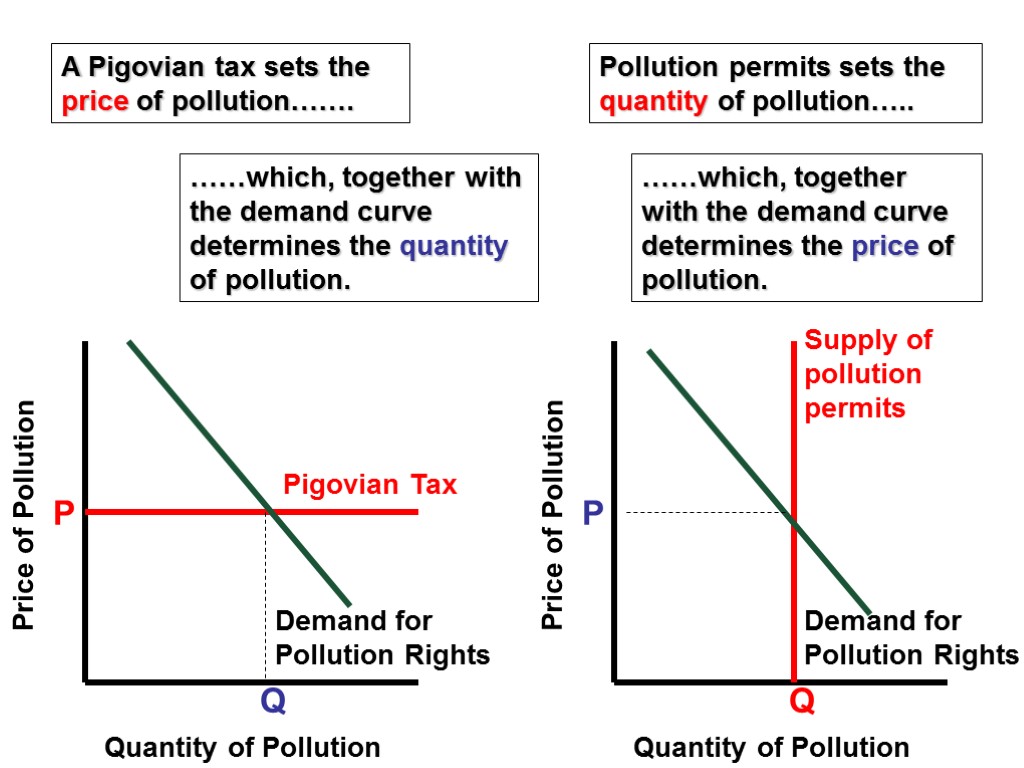

Price of Pollution Quantity of Pollution Demand for Pollution Rights A Pigovian tax sets the price of pollution……. Pigovian Tax Q P ……which, together with the demand curve determines the quantity of pollution. Price of Pollution Quantity of Pollution Demand for Pollution Rights Pollution permits sets the quantity of pollution….. Supply of pollution permits Q P ……which, together with the demand curve determines the price of pollution.

Price of Pollution Quantity of Pollution Demand for Pollution Rights A Pigovian tax sets the price of pollution……. Pigovian Tax Q P ……which, together with the demand curve determines the quantity of pollution. Price of Pollution Quantity of Pollution Demand for Pollution Rights Pollution permits sets the quantity of pollution….. Supply of pollution permits Q P ……which, together with the demand curve determines the price of pollution.

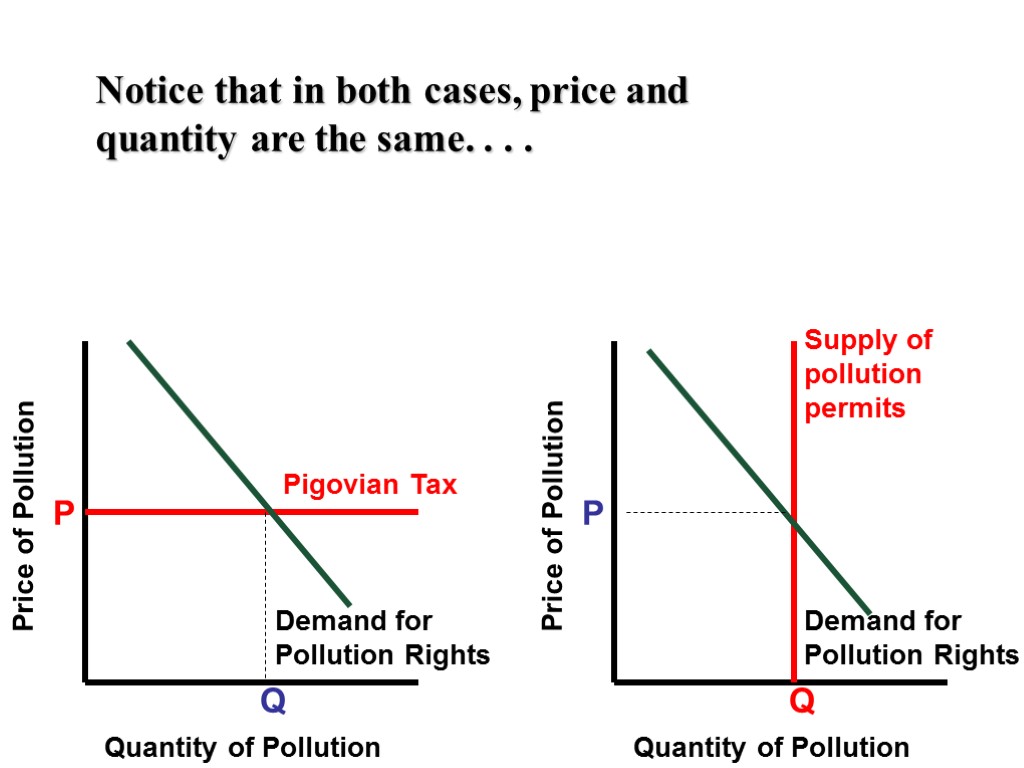

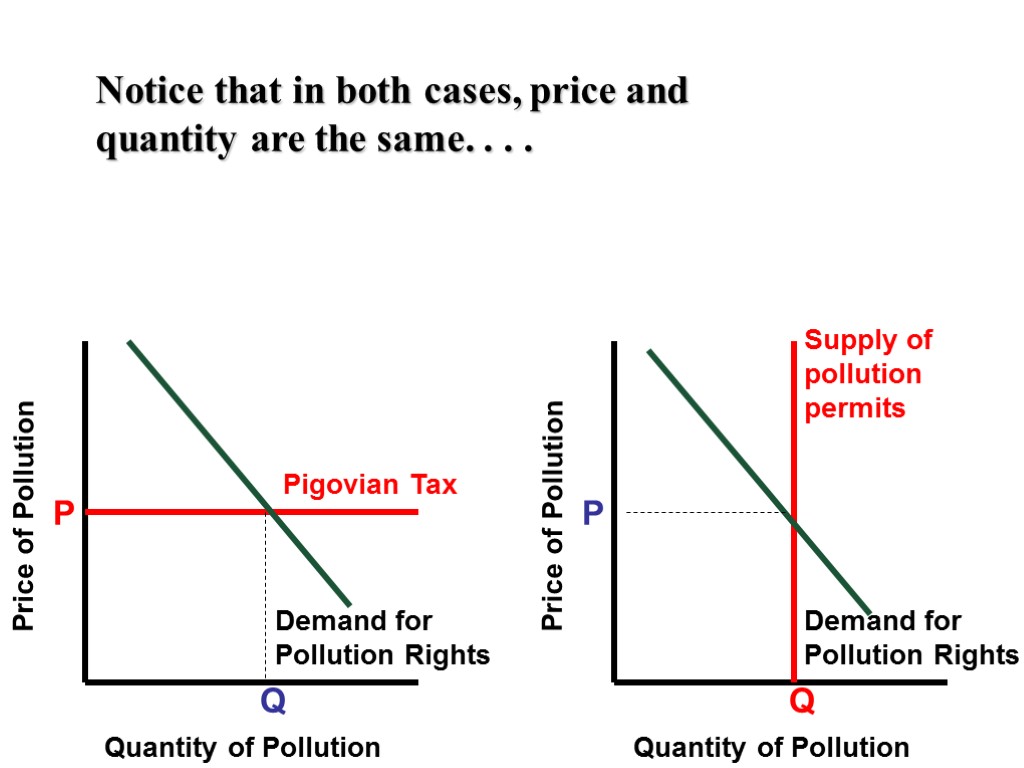

Price of Pollution Quantity of Pollution Demand for Pollution Rights Pigovian Tax Q P Price of Pollution Quantity of Pollution Demand for Pollution Rights Supply of pollution permits Q P Notice that in both cases, price and quantity are the same. . . .

Price of Pollution Quantity of Pollution Demand for Pollution Rights Pigovian Tax Q P Price of Pollution Quantity of Pollution Demand for Pollution Rights Supply of pollution permits Q P Notice that in both cases, price and quantity are the same. . . .

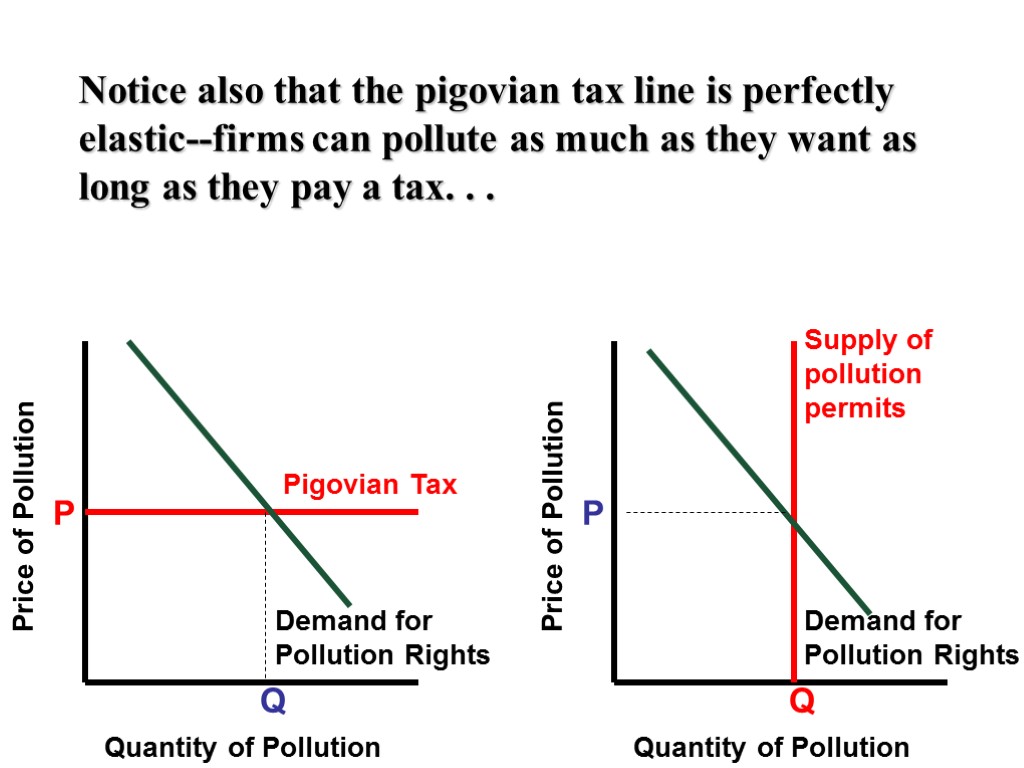

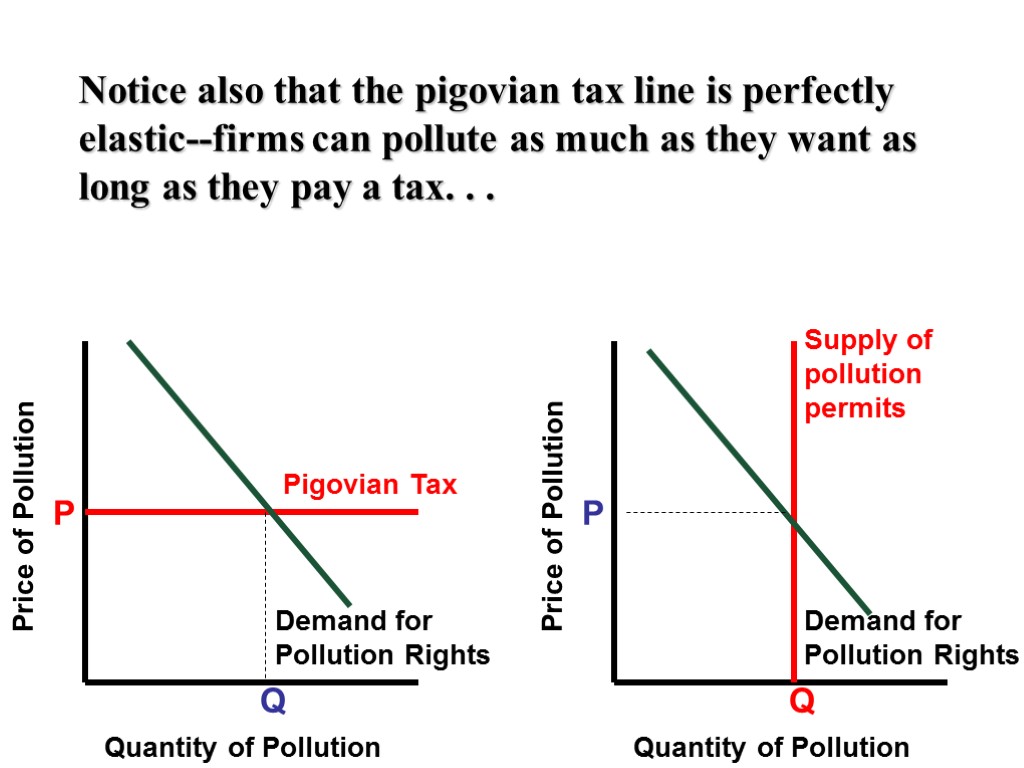

Price of Pollution Quantity of Pollution Demand for Pollution Rights Pigovian Tax Q P Price of Pollution Quantity of Pollution Demand for Pollution Rights Supply of pollution permits Q P Notice also that the pigovian tax line is perfectly elastic--firms can pollute as much as they want as long as they pay a tax. . .

Price of Pollution Quantity of Pollution Demand for Pollution Rights Pigovian Tax Q P Price of Pollution Quantity of Pollution Demand for Pollution Rights Supply of pollution permits Q P Notice also that the pigovian tax line is perfectly elastic--firms can pollute as much as they want as long as they pay a tax. . .

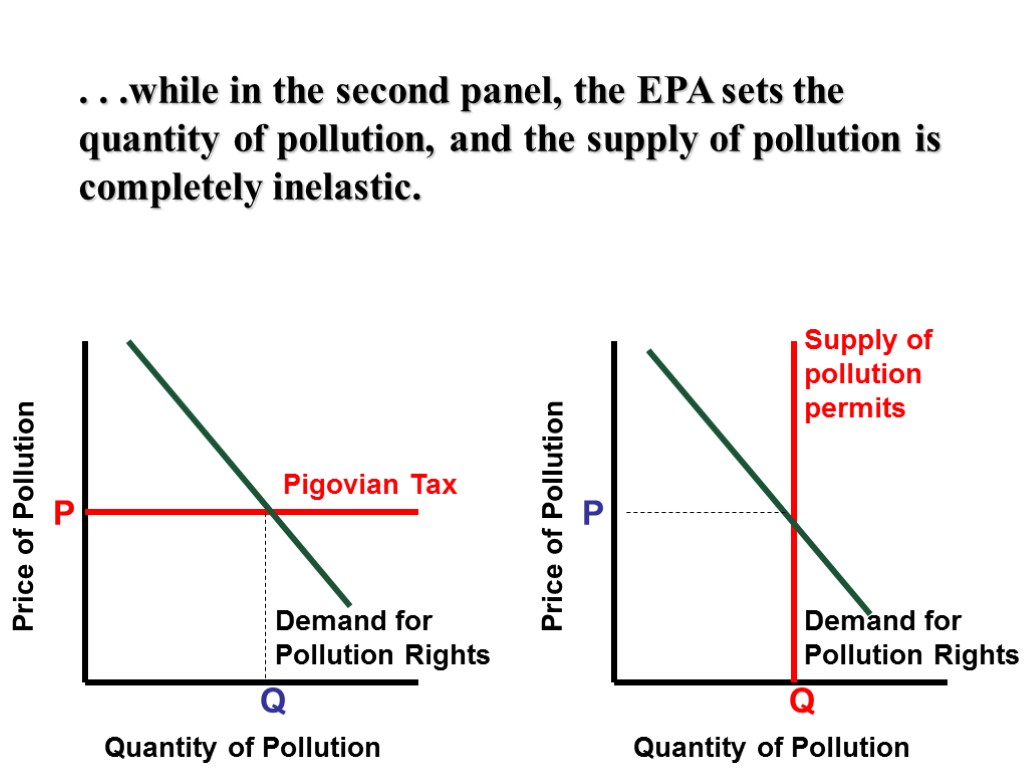

Price of Pollution Quantity of Pollution Demand for Pollution Rights Pigovian Tax Q P Price of Pollution Quantity of Pollution Demand for Pollution Rights Supply of pollution permits Q P . . .while in the second panel, the EPA sets the quantity of pollution, and the supply of pollution is completely inelastic.

Price of Pollution Quantity of Pollution Demand for Pollution Rights Pigovian Tax Q P Price of Pollution Quantity of Pollution Demand for Pollution Rights Supply of pollution permits Q P . . .while in the second panel, the EPA sets the quantity of pollution, and the supply of pollution is completely inelastic.

Economists usually prefer pigovian taxes to regulation as a way to deal with pollution because they reduce pollution at a lower cost to society. Using pigovian taxes to internalize externalities will cause market price to reflect the true social costs of production and force firms to bear the full social cost of their production activities.

Economists usually prefer pigovian taxes to regulation as a way to deal with pollution because they reduce pollution at a lower cost to society. Using pigovian taxes to internalize externalities will cause market price to reflect the true social costs of production and force firms to bear the full social cost of their production activities.

Now, suppose that two firms are awarded permits and have met the government standard. Firm 1 then decides it wants to increase its emissions by 100 tons and firm 2 agrees to reduce its emissions by 100 tons if firm 1 pays it $5 million. Should the government allow two factories to make this deal?

Now, suppose that two firms are awarded permits and have met the government standard. Firm 1 then decides it wants to increase its emissions by 100 tons and firm 2 agrees to reduce its emissions by 100 tons if firm 1 pays it $5 million. Should the government allow two factories to make this deal?

If the EPA allows the firms to make this deal, it will have created a new scarce resource: pollution permits. A market to trade these permits will develop and that market will be governed by the forces of supply and demand. The CLEAN AIR ACT of 1990 established the right to buy and sell emission rights for sulfur-dioxide pollution.

If the EPA allows the firms to make this deal, it will have created a new scarce resource: pollution permits. A market to trade these permits will develop and that market will be governed by the forces of supply and demand. The CLEAN AIR ACT of 1990 established the right to buy and sell emission rights for sulfur-dioxide pollution.

Carbon emissions trading has been steadily increasing in recent years. According to the World Bank's Carbon Finance Unit, 374 million metric tonnes of carbon dioxide equivalent (tCO2e) were exchanged through projects in 2005, a 240% increase relative to 2004 (110 mtCO2e), which was itself a 41% increase relative to 2003 (78 mtCO2e). CO2 emission permits have been traded since 1995 on the Chicago Exchange. The world's only mandatory carbon trading program is the European Union Emissions Trading Scheme (or EUETS). Created in conjunction with the Kyoto Protocol, a 1997 international treaty that took effect in 2005, it caps the amount of carbon dioxide that can be emitted from large installations, such as power plants and factories, in the EU's 25 member countries.

Carbon emissions trading has been steadily increasing in recent years. According to the World Bank's Carbon Finance Unit, 374 million metric tonnes of carbon dioxide equivalent (tCO2e) were exchanged through projects in 2005, a 240% increase relative to 2004 (110 mtCO2e), which was itself a 41% increase relative to 2003 (78 mtCO2e). CO2 emission permits have been traded since 1995 on the Chicago Exchange. The world's only mandatory carbon trading program is the European Union Emissions Trading Scheme (or EUETS). Created in conjunction with the Kyoto Protocol, a 1997 international treaty that took effect in 2005, it caps the amount of carbon dioxide that can be emitted from large installations, such as power plants and factories, in the EU's 25 member countries.

SAMPLE AP TEST QUESTION

SAMPLE AP TEST QUESTION

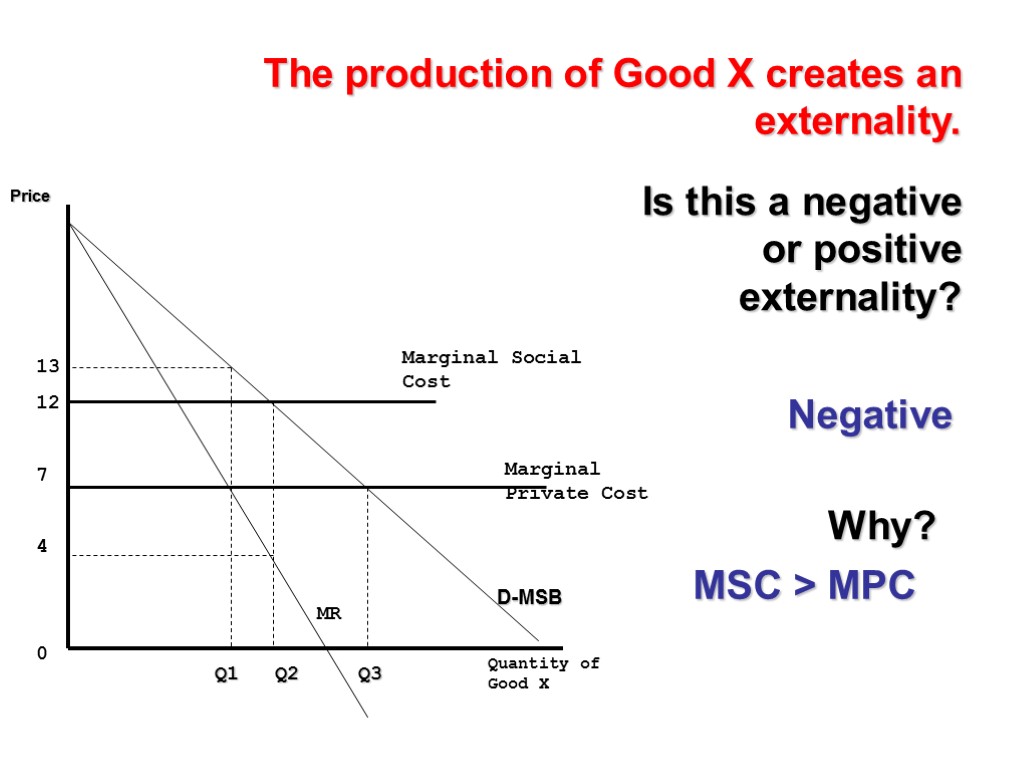

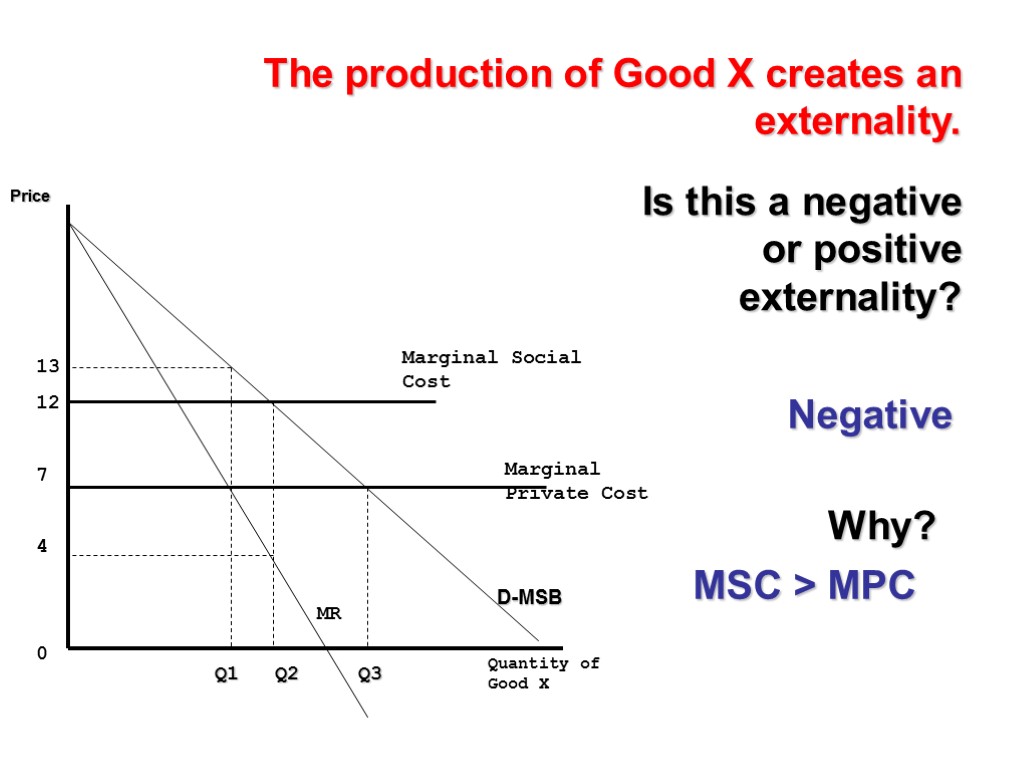

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 Is this a negative or positive externality? Negative Why? MSC > MPC The production of Good X creates an externality.

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 Is this a negative or positive externality? Negative Why? MSC > MPC The production of Good X creates an externality.

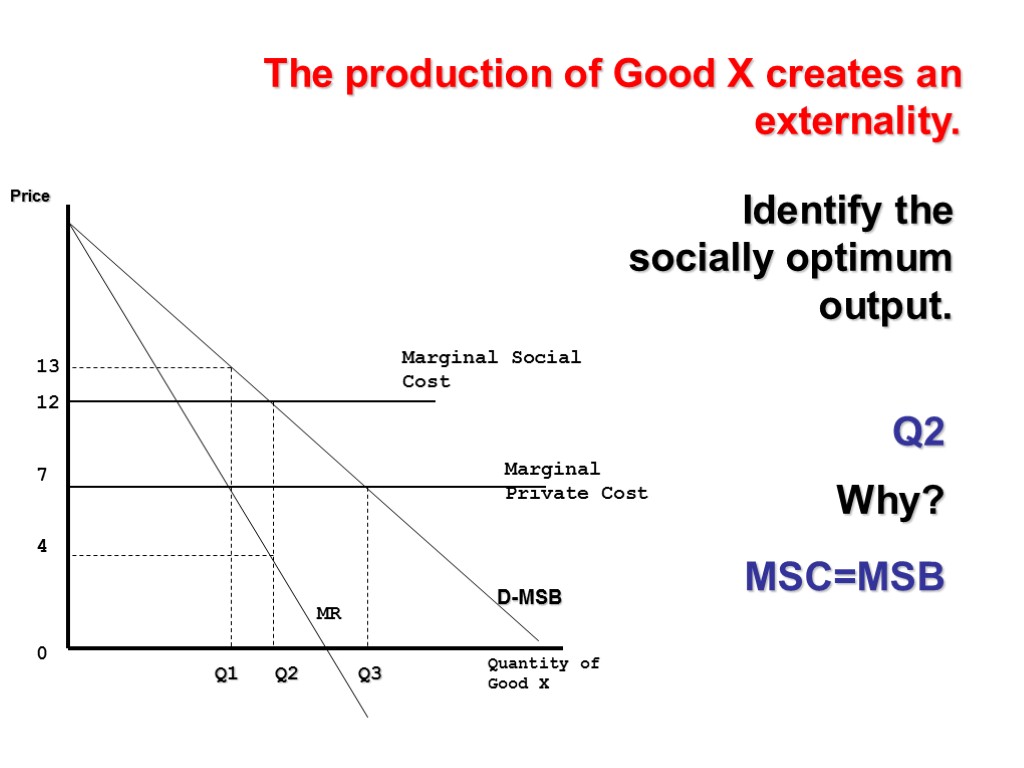

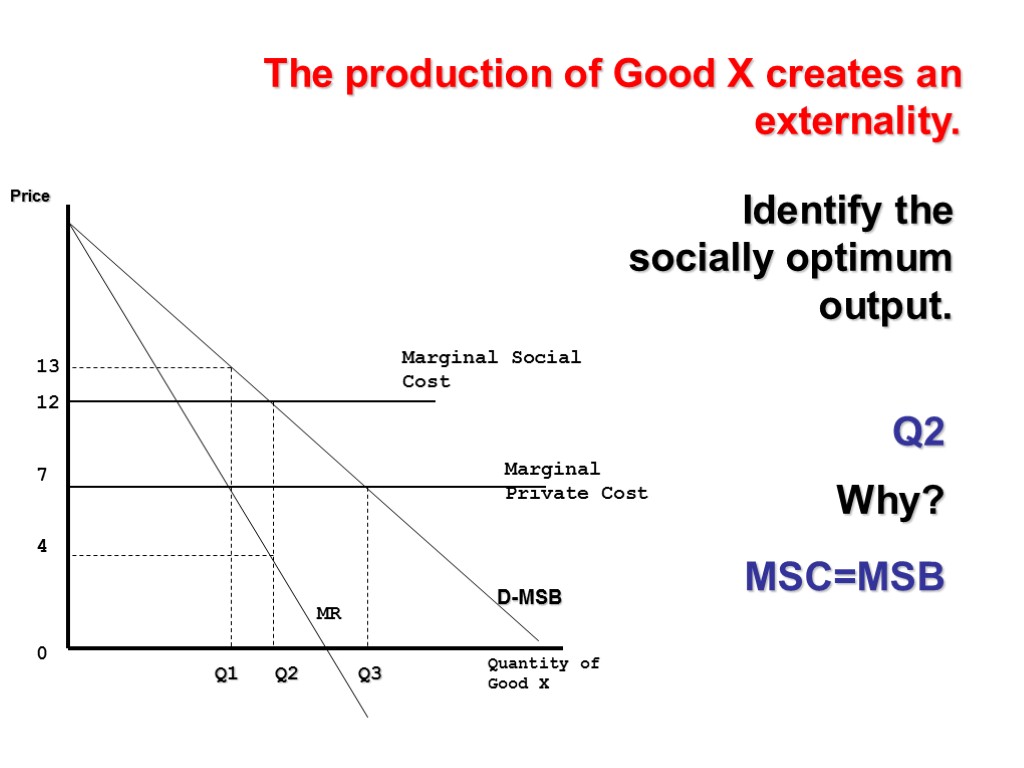

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 Identify the socially optimum output. Q2 Why? MSC=MSB The production of Good X creates an externality.

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 Identify the socially optimum output. Q2 Why? MSC=MSB The production of Good X creates an externality.

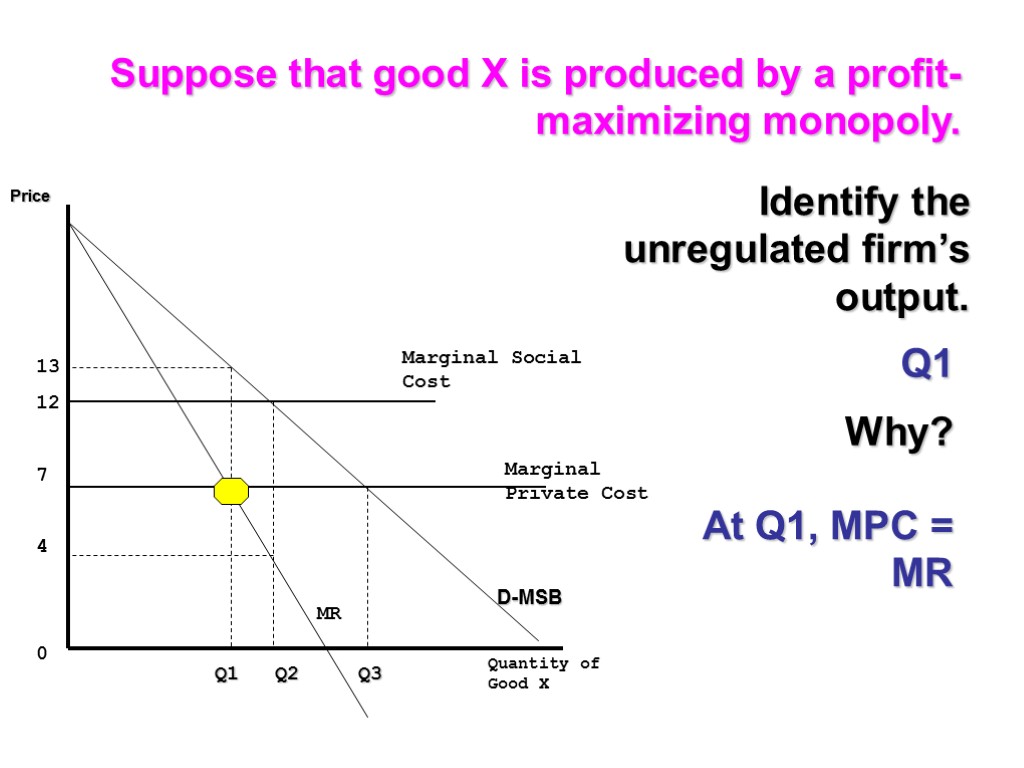

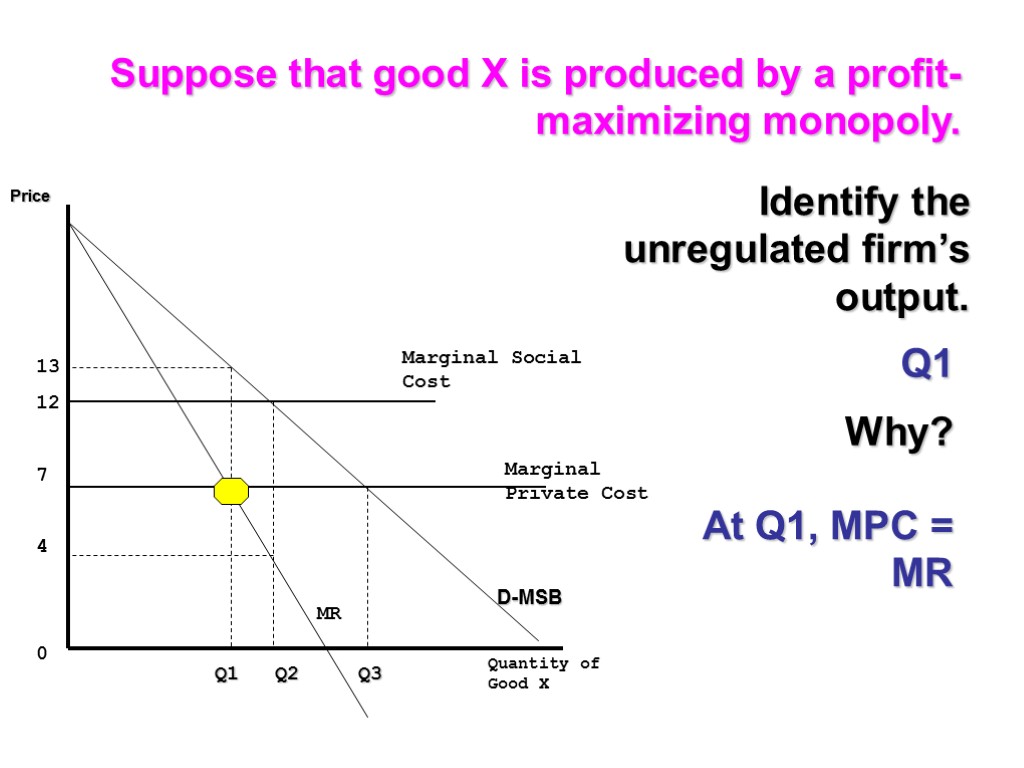

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 Identify the unregulated firm’s output. Q1 Why? At Q1, MPC = MR Suppose that good X is produced by a profit-maximizing monopoly.

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 Identify the unregulated firm’s output. Q1 Why? At Q1, MPC = MR Suppose that good X is produced by a profit-maximizing monopoly.

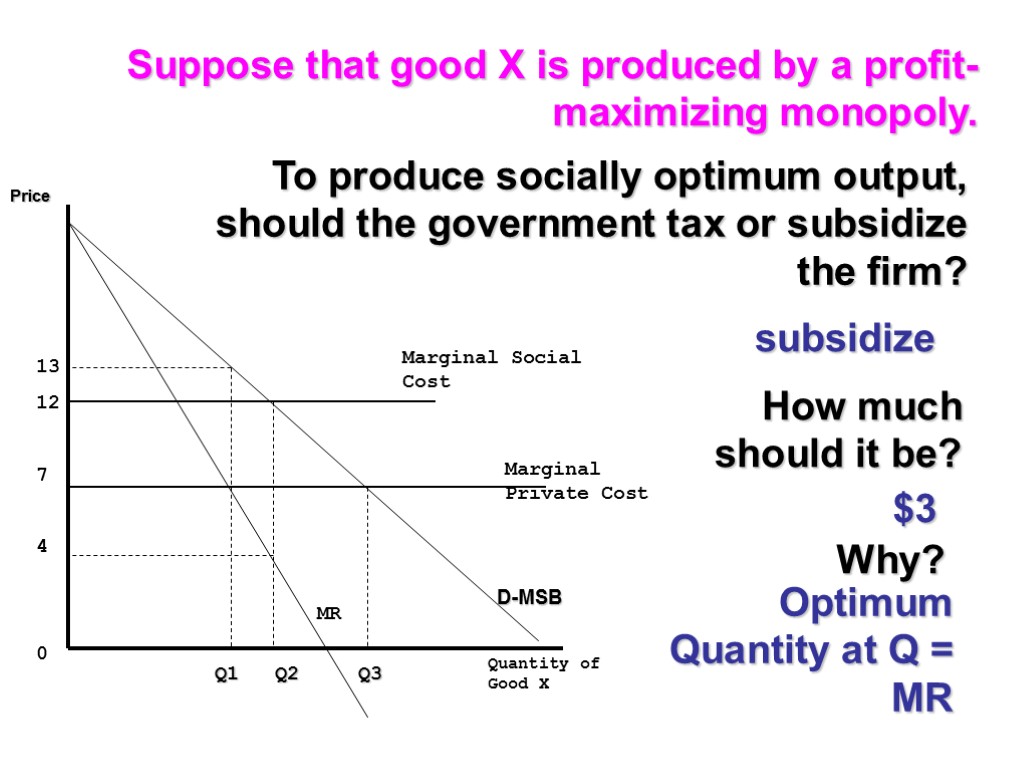

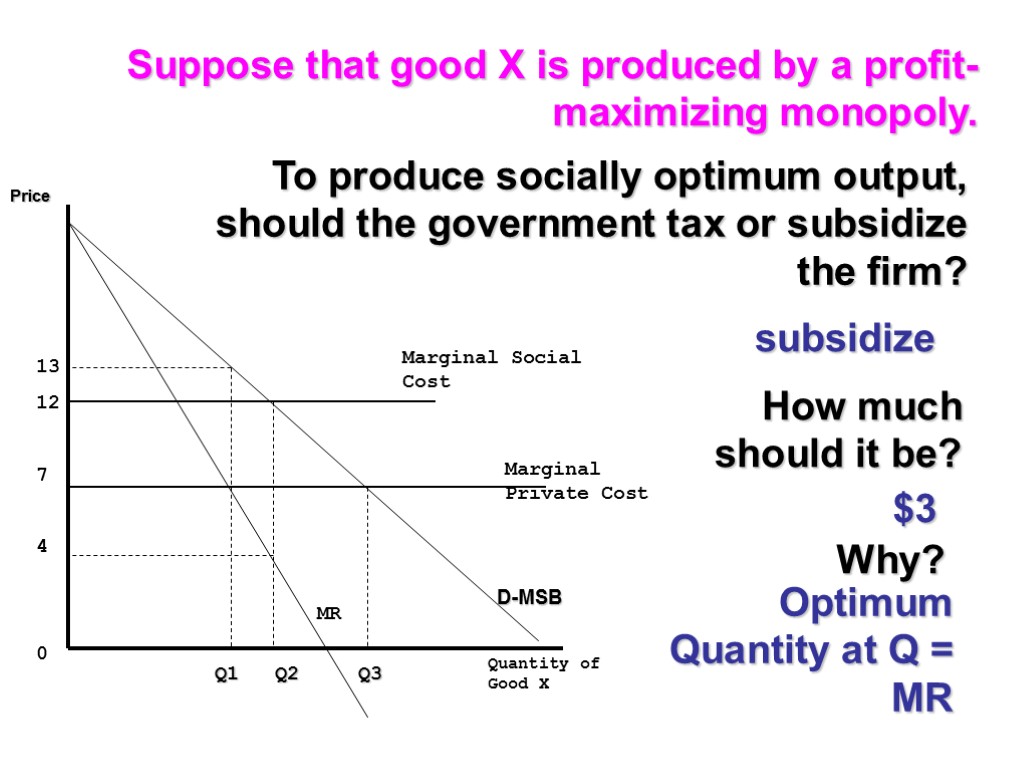

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 How much should it be? $3 Why? Optimum Quantity at Q = MR To produce socially optimum output, should the government tax or subsidize the firm? subsidize Suppose that good X is produced by a profit-maximizing monopoly.

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 How much should it be? $3 Why? Optimum Quantity at Q = MR To produce socially optimum output, should the government tax or subsidize the firm? subsidize Suppose that good X is produced by a profit-maximizing monopoly.

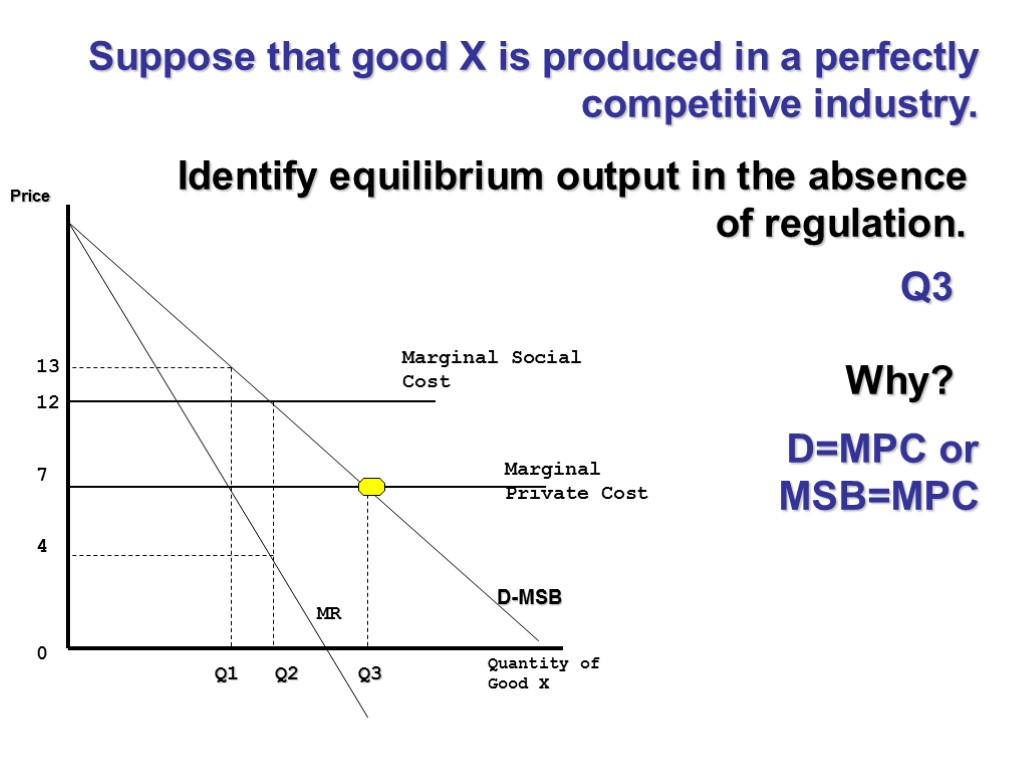

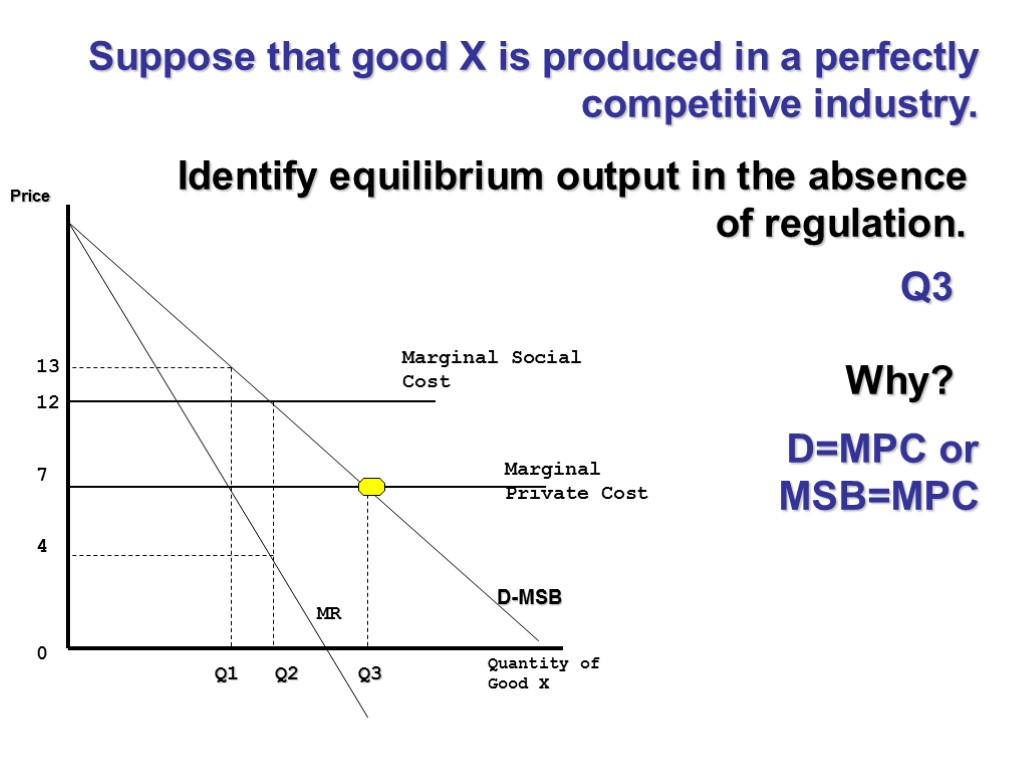

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 Why? D=MPC or MSB=MPC Identify equilibrium output in the absence of regulation. Q3 Suppose that good X is produced in a perfectly competitive industry.

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 Why? D=MPC or MSB=MPC Identify equilibrium output in the absence of regulation. Q3 Suppose that good X is produced in a perfectly competitive industry.

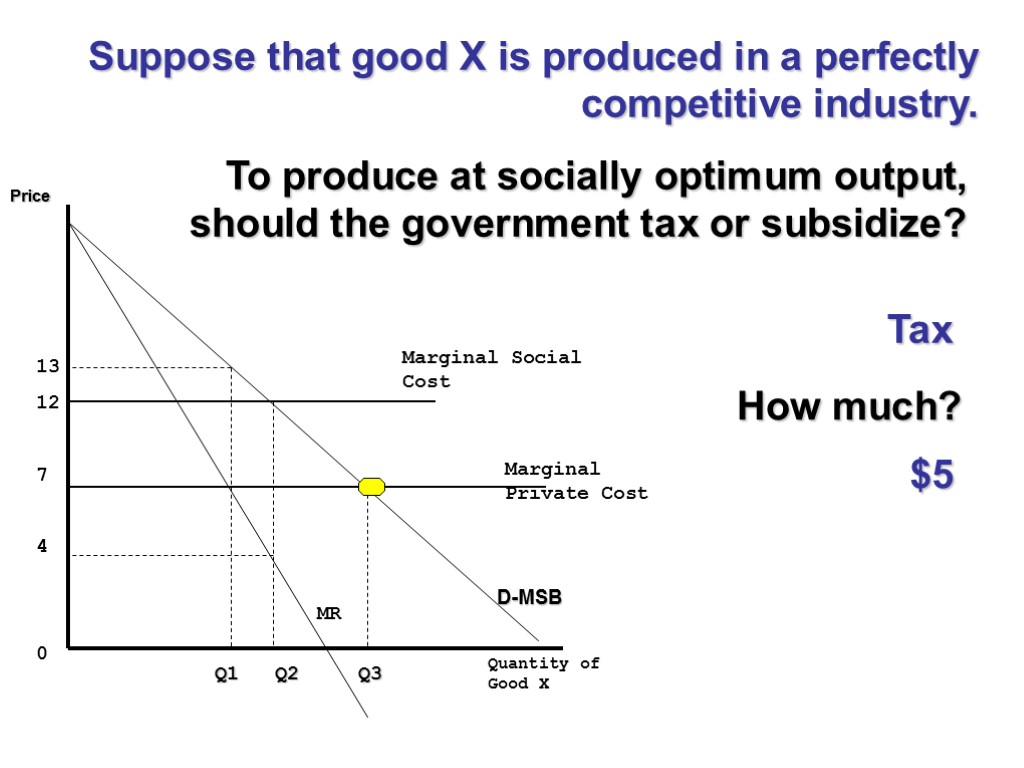

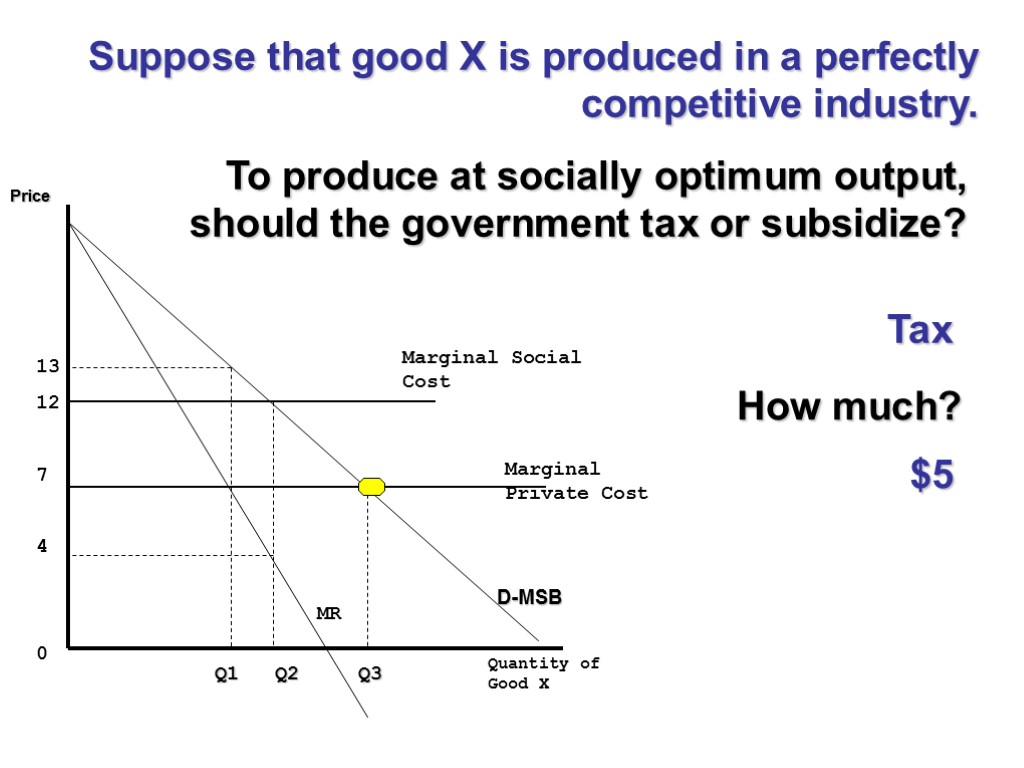

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 How much? $5 To produce at socially optimum output, should the government tax or subsidize? Tax Suppose that good X is produced in a perfectly competitive industry.

Price Quantity of Good X D-MSB MR Marginal Social Cost Marginal Private Cost Q1 Q2 Q3 13 12 7 4 0 How much? $5 To produce at socially optimum output, should the government tax or subsidize? Tax Suppose that good X is produced in a perfectly competitive industry.