abea34919662b9d340fa6d52741c1b45.ppt

- Количество слайдов: 55

AP Macroeconomics Unit 5

I. Trade Basics l Balance of trade: X - M l l l Negative=trade deficit Positive=trade surplus Balance of payments: $ entering - $ leaving l includes investment, foreign aid, etc.

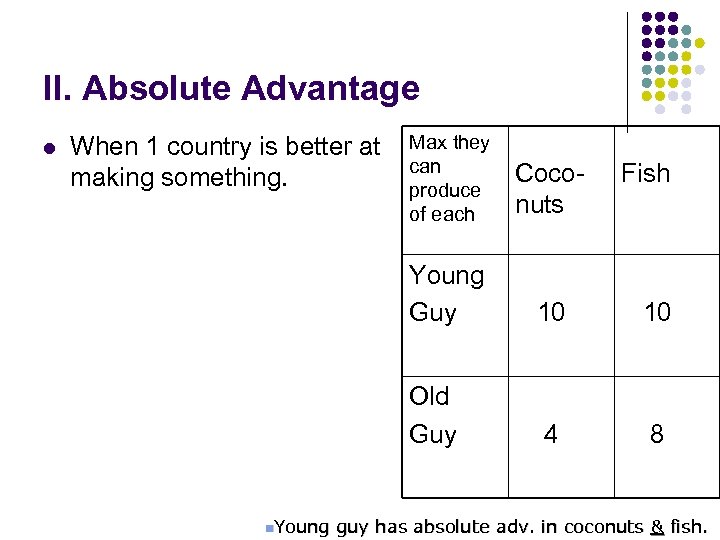

II. Absolute Advantage l Coconuts 10 10 Old Guy n. Young Max they can produce of each Young Guy When 1 country is better at making something. 4 8 Fish guy has absolute adv. in coconuts & fish.

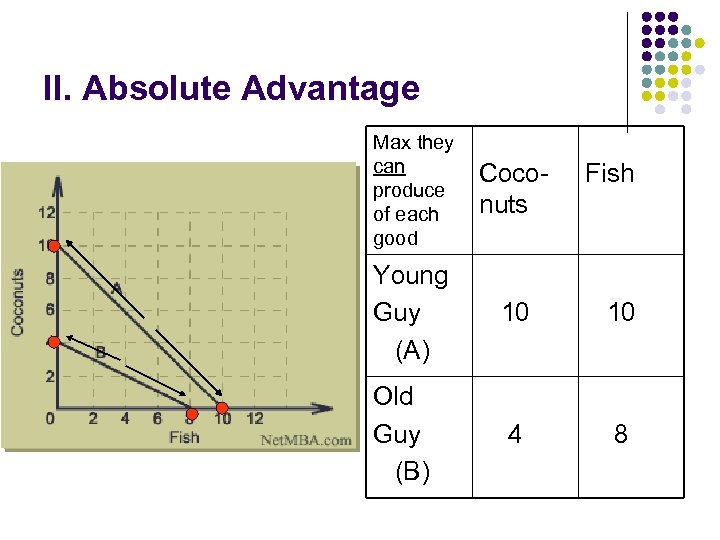

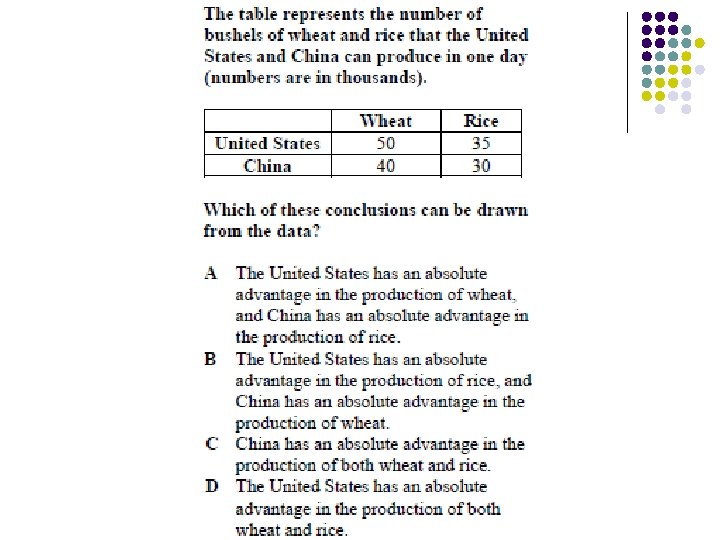

II. Absolute Advantage Max they can produce of each good Coconuts Young Guy (A) 10 10 Old Guy (B) 4 8 Fish

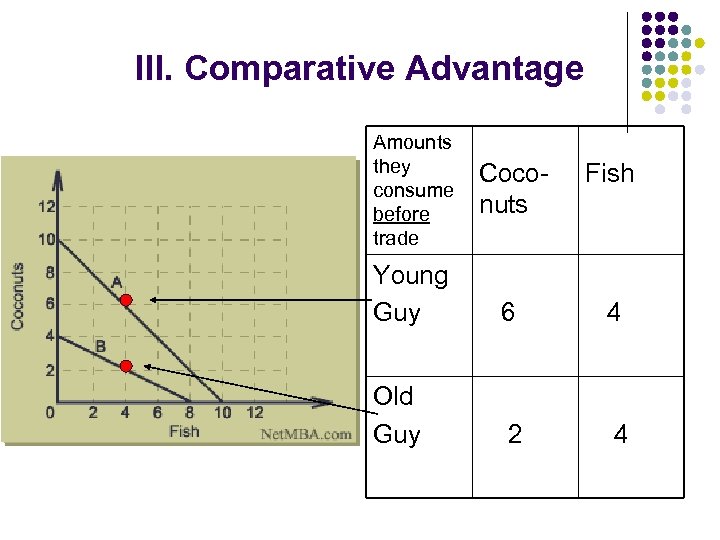

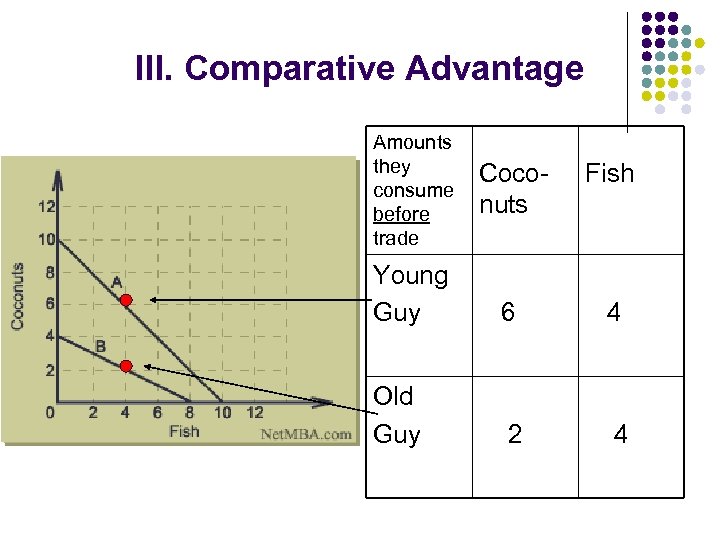

III. Comparative Advantage Amounts they consume before trade Coconuts Fish Young Guy 6 4 Old Guy 2 4

l l What is young guy’s opportunity cost of coconuts? Fish? What is old guy’s opportunity cost of coconuts? Fish?

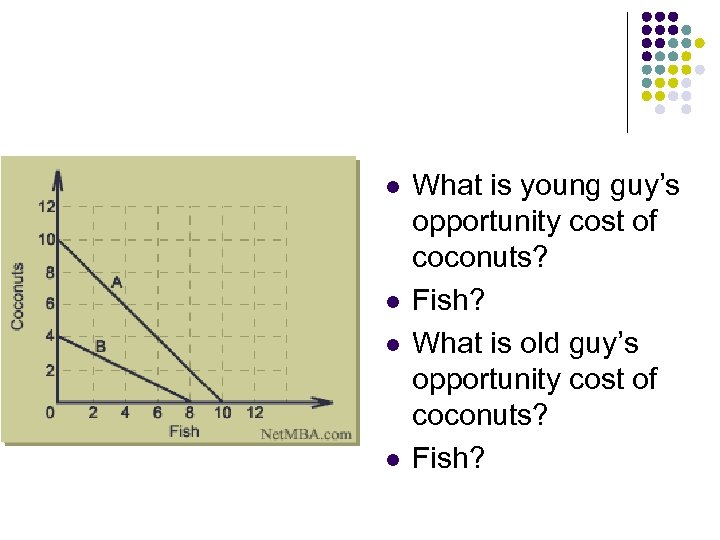

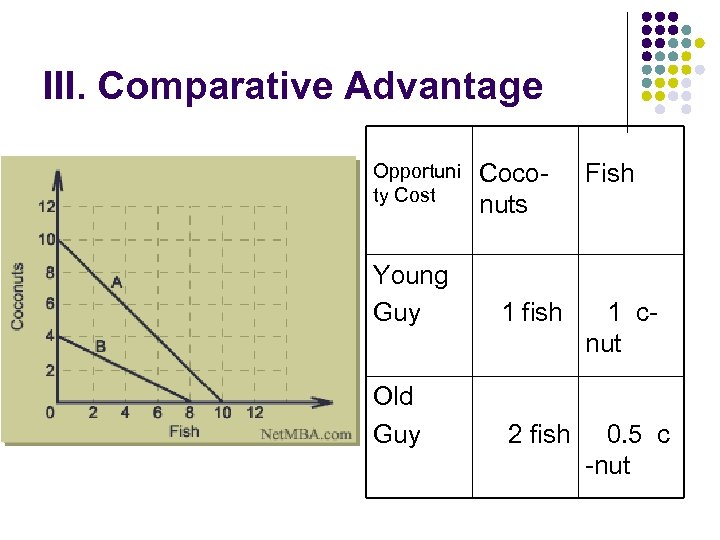

III. Comparative Advantage Opportuni ty Cost Coconuts Fish Young Guy 1 1 Old Guy 2 0. 5

III. Comparative Advantage l l Lower opportunity cost in a good = comparative advantage in that good Countries benefit by making the things they have a comparative advantage in, and trading.

III. Comparative Advantage Opportuni ty Cost Coconuts Fish Young Guy 1 fish 1 cnut Old Guy 2 fish 0. 5 c -nut

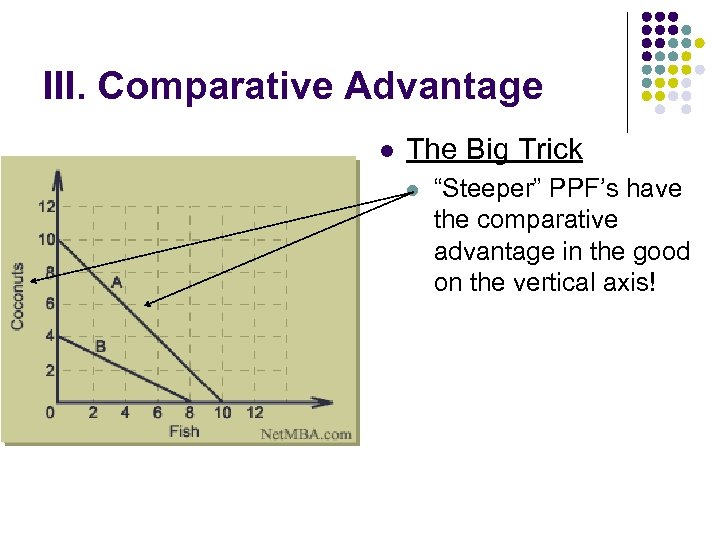

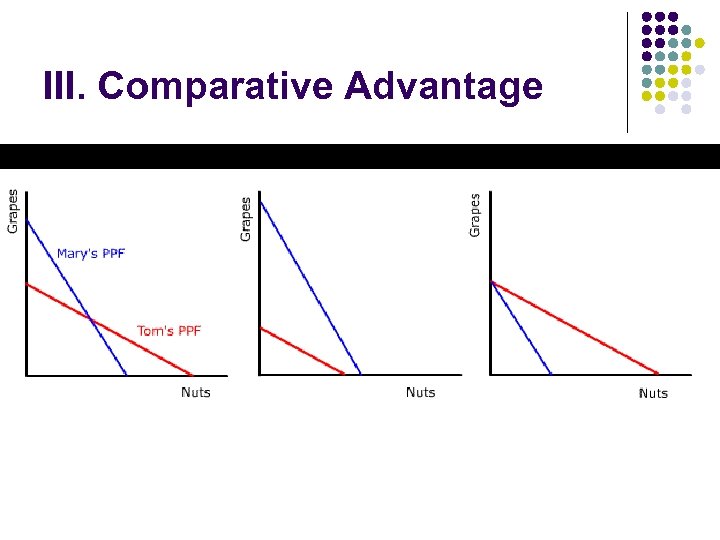

III. Comparative Advantage l The Big Trick l “Steeper” PPF’s have the comparative advantage in the good on the vertical axis!

III. Comparative Advantage Amounts they consume before trade Coconuts Fish Young Guy 6 4 Old Guy 2 4

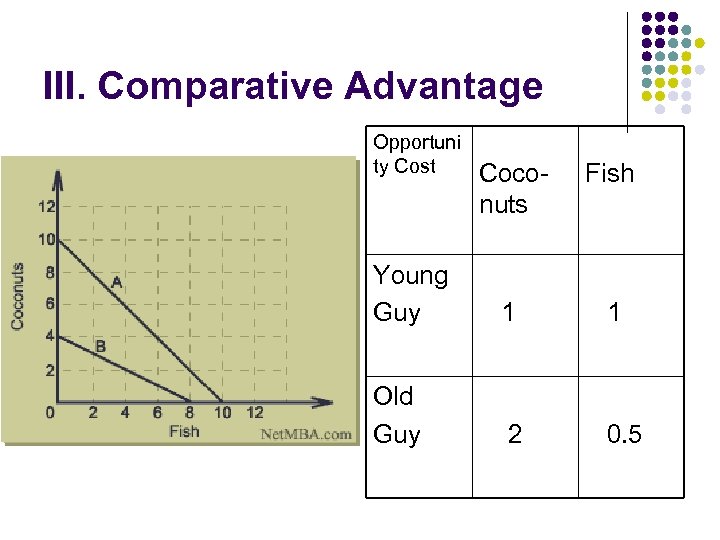

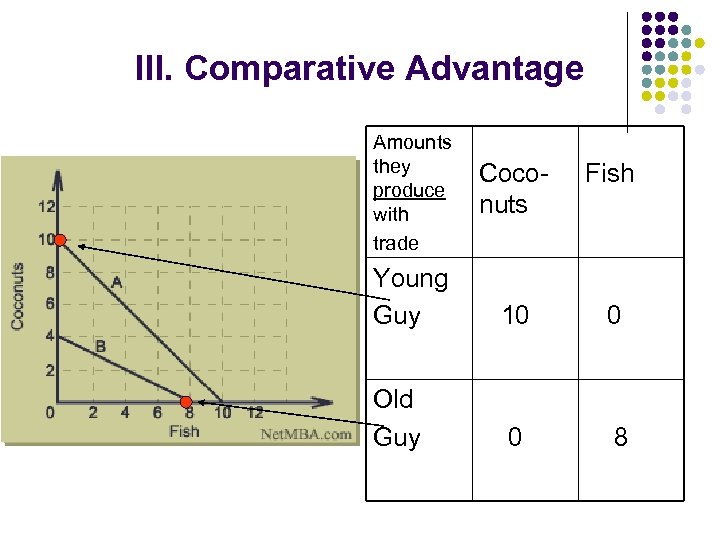

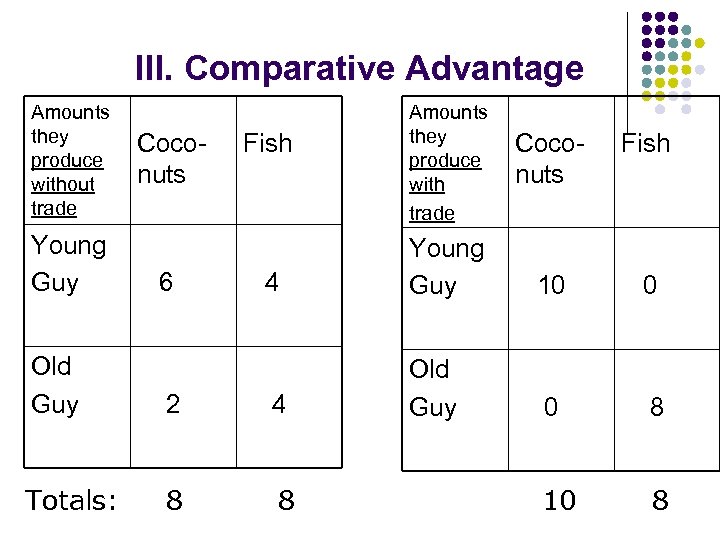

III. Comparative Advantage Amounts they produce with trade Coconuts Fish Young Guy 10 0 Old Guy 0 8

III. Comparative Advantage Amounts they produce without trade Young Guy Coconuts 6 Fish Amounts they produce with trade Coconuts Fish 4 Young Guy 10 0 Old Guy 0 8 10 8 Old Guy 2 4 Totals: 8 8

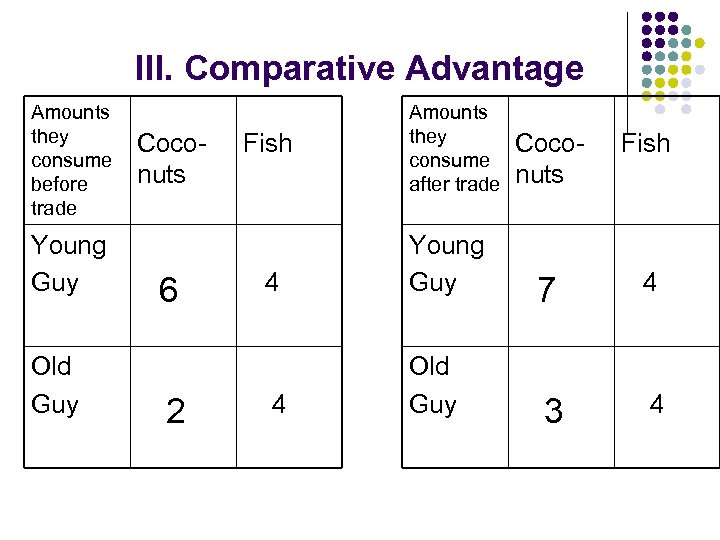

III. Comparative Advantage Amounts they consume before trade Young Guy Old Guy Coconuts 6 2 Fish Amounts they consume after trade Coconuts Fish 4 Young Guy 7 4 4 Old Guy 3 4

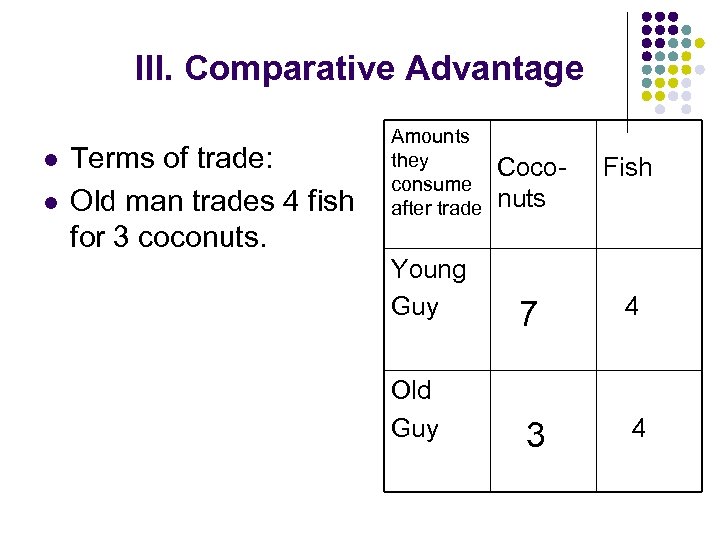

III. Comparative Advantage l l Terms of trade: Old man trades 4 fish for 3 coconuts. Amounts they consume after trade Coconuts Fish Young Guy 7 4 Old Guy 3 4

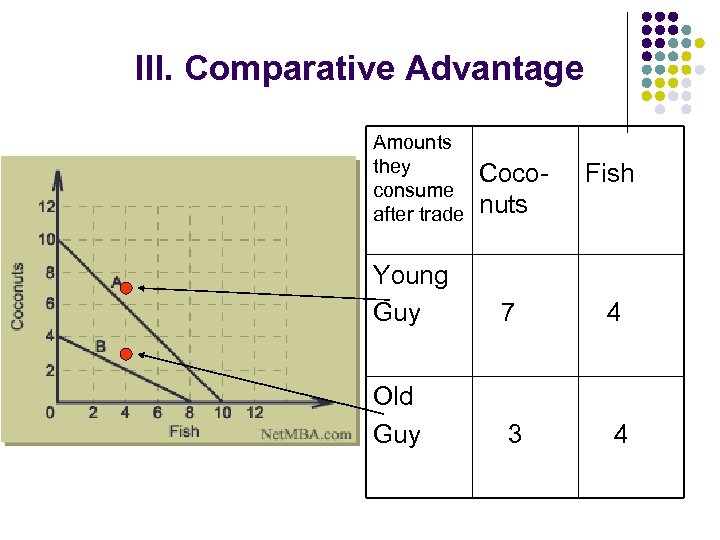

III. Comparative Advantage Amounts they consume after trade Coconuts Fish Young Guy 7 4 Old Guy 3 4

III. Comparative Advantage

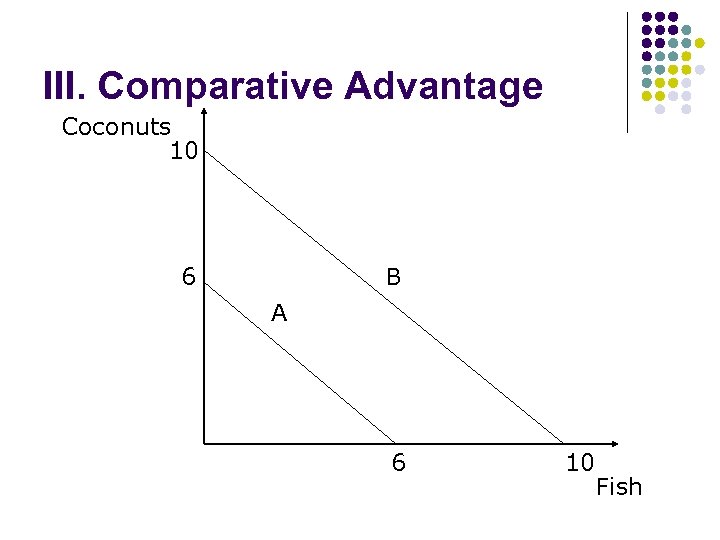

III. Comparative Advantage Coconuts 10 6 B A 6 10 Fish

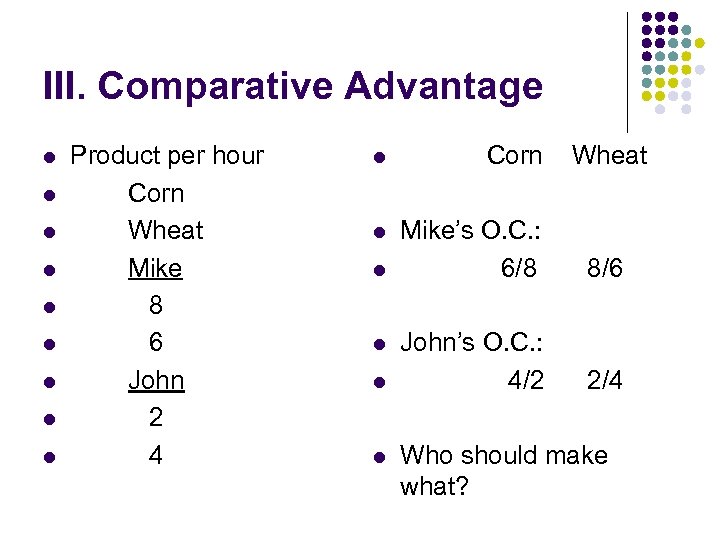

III. Comparative Advantage l l l l l Product per hour Corn Wheat Mike 8 6 John 2 4 l Corn l Mike’s O. C. : 6/8 8/6 John’s O. C. : 4/2 2/4 l l Wheat Who should make what?

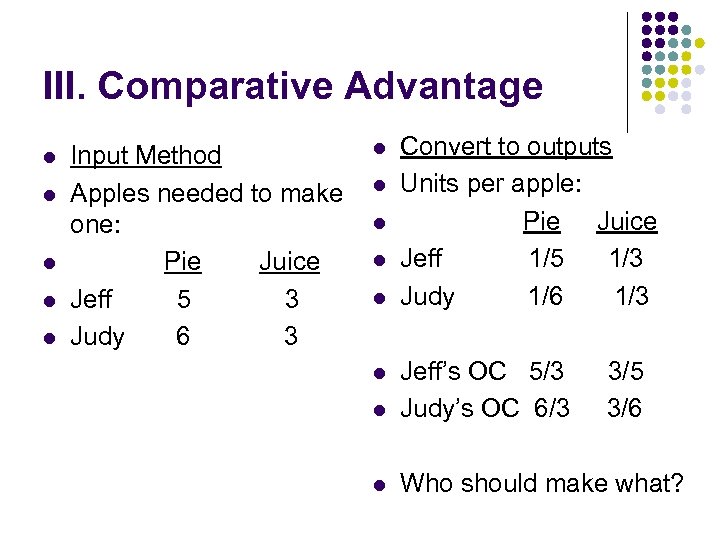

III. Comparative Advantage l l l Input Method Apples needed to make one: Pie Juice Jeff 5 3 Judy 6 3 l l l Convert to outputs Units per apple: Pie Juice Jeff 1/5 1/3 Judy 1/6 1/3 l Jeff’s OC 5/3 Judy’s OC 6/3 l Who should make what? l 3/5 3/6

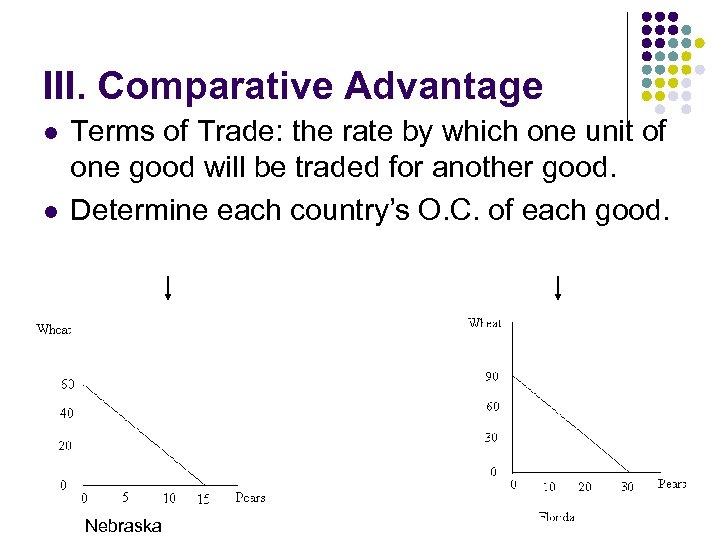

III. Comparative Advantage l l Terms of Trade: the rate by which one unit of one good will be traded for another good. Determine each country’s O. C. of each good. Nebraska

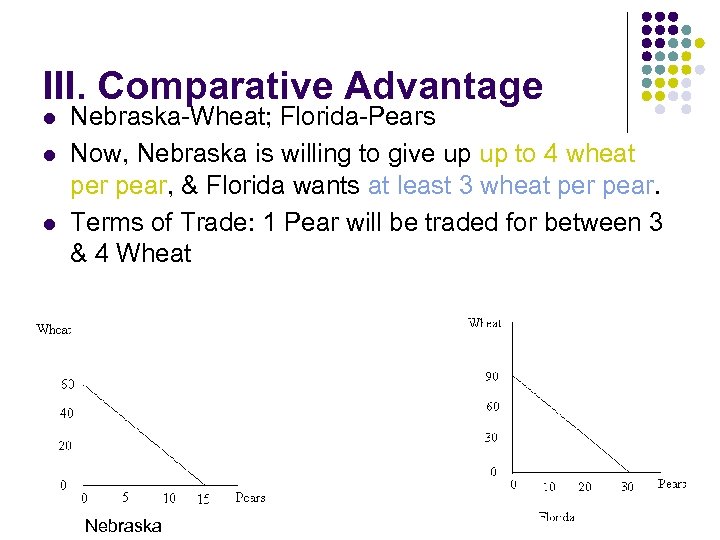

III. Comparative Advantage l l l Nebraska-Wheat; Florida-Pears Now, Nebraska is willing to give up up to 4 wheat per pear, & Florida wants at least 3 wheat per pear. Terms of Trade: 1 Pear will be traded for between 3 & 4 Wheat Nebraska

III. Comparative Advantage l l Other benefits of specialization: More efficient use of resources. Increased production without increase in resources. Effects of specialization on PPC?

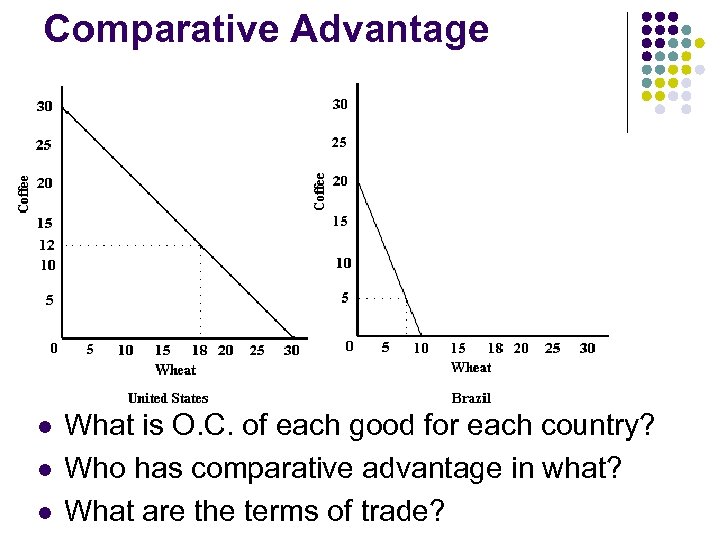

Comparative Advantage l l l What is O. C. of each good for each country? Who has comparative advantage in what? What are the terms of trade?

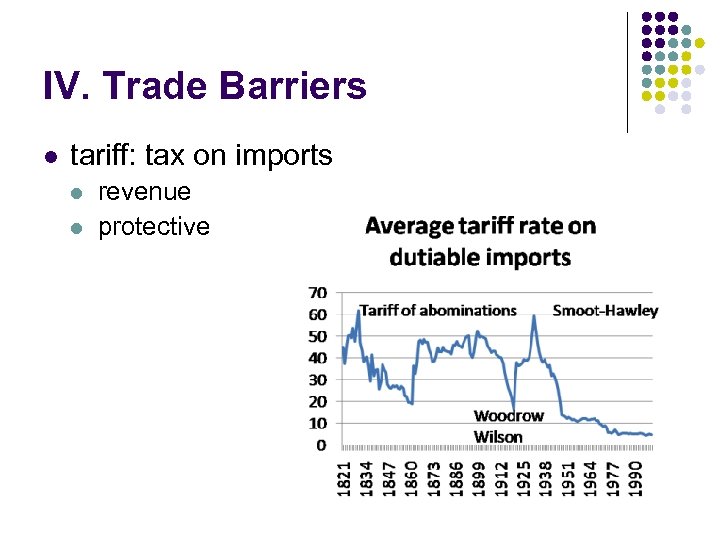

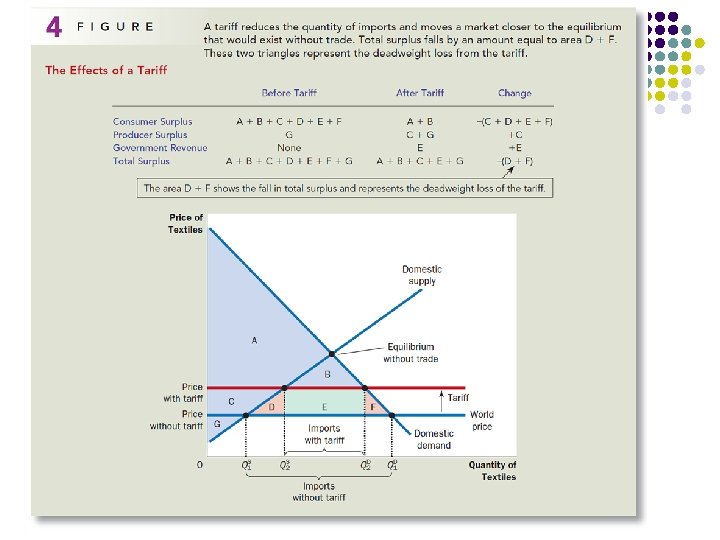

IV. Trade Barriers l tariff: tax on imports l l revenue protective

IV. Trade Barriers l l quota: limit on # of imports link

IV. Trade Barriers l l embargo: all trade with a certain country made illegal link

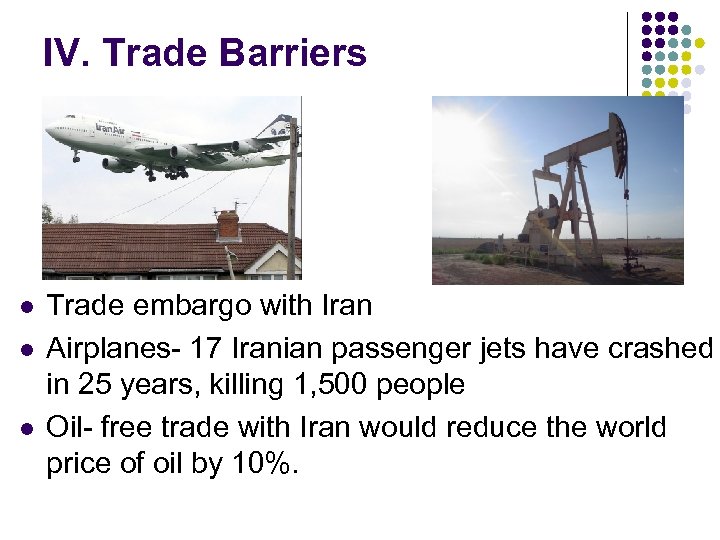

IV. Trade Barriers l l l Trade embargo with Iran Airplanes- 17 Iranian passenger jets have crashed in 25 years, killing 1, 500 people Oil- free trade with Iran would reduce the world price of oil by 10%.

IV. Trade Barriers l standards: regulations on imports l Example (Listen, Don’t Write): l On imported beef, the U. S. requires l l l farm to fork trace-ability enter U. S. through specified inspection posts country of origin to have adequate food safety system

Reinheitsgebot l l Germany’s purity law Lasted from 1516 to 1993. “Beer can only be made using barley, hops, and water. ” Restricted trade because beer-makers in many other countries used wheat and rye instead of barley.

IV. Trade Barriers l subsidies: gov’t payments to domestic producers

IV. Trade Barriers l Protectionism l l l independent our producers of protected products are helped infant industries l Free Trade l l lower P’s most efficient no retaliation minimal gov’t involvement foreign relations

IV. Trade Barriers l Arguments for Protectionism l l The Preserve-Jobs Argument The Infant Industry Argument The Protect Against Dumping Argument The National Defense Argument l l AKA The Diversity of Production Argument Harmful Effects of Protectionism l l Retaliation Higher Prices

IV. Trade Barriers l l Q: Who is hurt by import barriers? A: l l l foreign producers domestic consumers who must pay higher prices domestic producers that produce complementary goods to the import goods

IV. Trade Barriers l l Q: Who gains and who loses when subsidies are paid to our export industries? A: l l export producers gain taxpayers lose by paying more in taxes

IV. Trade Barriers l l l Trade barriers protect domestic industries, but… keep them from becoming more efficient. Many countries have benefited from trading blocks: EU-27 countries in Europe (France, Germany, Italy, UK) NAFTA-U. S. , Mexico, Canada ASEAN-10 countries in Asia (Philippines, Indonesia, Thailand)

V. Balance of Payments l l l Current Account = Balance of Trade + Net factor & investment income Capital (or Financial) Account = Net Investment. includes: l l l real estate stock purchases/sales bank accounts

V. Balance of Payments l The Balance of Payments = Current Acct Balance + Capital Acct Balance l The Balance of Payments must equal zero! l l

V. Balance of Payments l l If a US citizen buys stock in Toyota how would this be entered into the Balance of Payments? If this person receives dividends on this stock, how would they be entered?

V. Balance of Payments l l l Balance of Payments in the U. S. For the last three decades, the U. S. has run a current account deficit. Of the components of the current account, which do you think contributed the most towards this deficit? What do you think our capital account has looked like over this period? What are some implications of this? l l Persistent trade deficits are often the result of a national savings rate that is too low. Trade deficits often lead to foreign ownership of domestic capital. If Nx is negative, capital is flowing out of the country, & vice versa. ***

VI. Reading Exchange Rate Charts l “Per” means “per 1” l Most countries have a flexible exchange rate system-supply/demand determine value. l

VII. Conversion l l If 1 dollar is worth 0. 5 pesos… $2 = __ peso $10 = __ pesos $100 = __ pesos

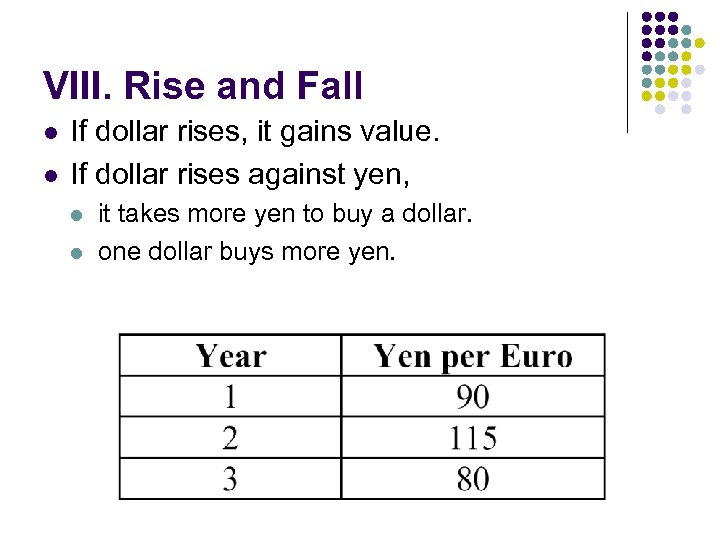

VIII. Rise and Fall l l If dollar rises, it gains value. If dollar rises against yen, l l it takes more yen to buy a dollar. one dollar buys more yen.

VIII. Rise and Fall l l Year 1 Yen for sale! l l Year 2 Yen for sale! What appreciated? Depreciated?

VIII. Rise and Fall l l Year 1 Dollars for sale! l l Year 2 Dollars for sale! What appreciated? Depreciated?

VIII. Rise and Fall Dollars Pound l l What happens to value of Pound if: there is an increase in UK interest rates?

VIII. Rise and Fall Dollars Pound l l What happens to value of Pound if: US interest rates rise?

VIII. Rise and Fall Dollars Pound l l What happens to value of Pound if: UK speculators predict that the value of gold is about to fall?

VIII. Rise and Fall Dollars Pound l l What happens to value of Pound if: UK inflation increases relative to US inflation?

VIII. Rise and Fall l l 1: large demand for British goods 2: demand for pounds goes up 3: “Price” of Pounds goes up. The Pound appreciates against the dollar. 4: British goods are no longer so attractive 5: The floating exchange rates have “fixed” the excessive demand for imported British goods.

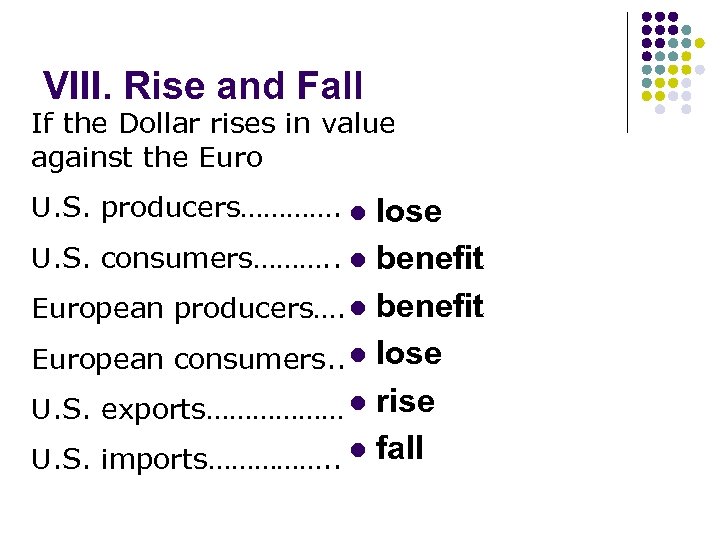

VIII. Rise and Fall If the Dollar rises in value against the Euro U. S. producers…………. l lose U. S. consumers………. . l benefit European producers…. l benefit European consumers. . l lose U. S. exports……………… l rise U. S. imports……………. . l fall

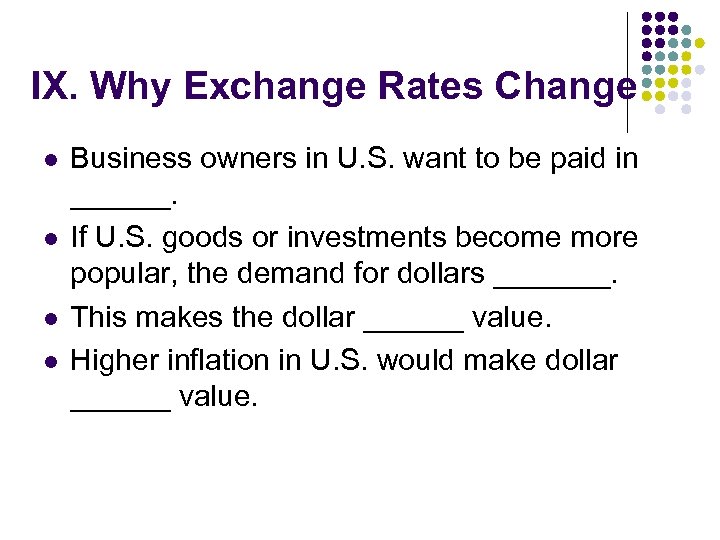

IX. Why Exchange Rates Change l l Business owners in U. S. want to be paid in ______. If U. S. goods or investments become more popular, the demand for dollars _______. This makes the dollar ______ value. Higher inflation in U. S. would make dollar ______ value.

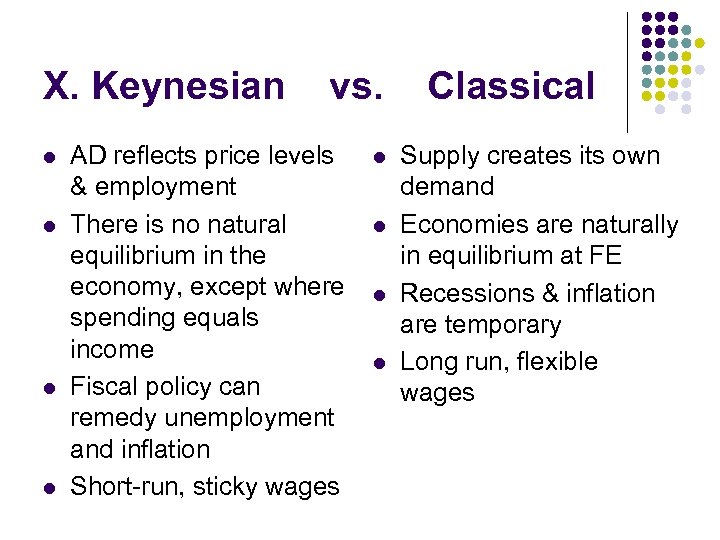

X. Keynesian l l vs. AD reflects price levels & employment There is no natural equilibrium in the economy, except where spending equals income Fiscal policy can remedy unemployment and inflation Short-run, sticky wages l l Classical Supply creates its own demand Economies are naturally in equilibrium at FE Recessions & inflation are temporary Long run, flexible wages

abea34919662b9d340fa6d52741c1b45.ppt