5d1dd26012f6639340dbc349c7f11ac2.ppt

- Количество слайдов: 89

AP Macroeconomics Unit 2

AP Macroeconomics Unit 2

Lesson 1 l Business Types/Mergers (not in text)

Lesson 1 l Business Types/Mergers (not in text)

I. Sole Proprietorships l l Run by 1 person Most numerous & profitable of the biz types

I. Sole Proprietorships l l Run by 1 person Most numerous & profitable of the biz types

I. Sole Proprietorships Continued l l l Advantages: Easy to start-up/manage Owner gets all profits Biz pays no income tax Easy to close

I. Sole Proprietorships Continued l l l Advantages: Easy to start-up/manage Owner gets all profits Biz pays no income tax Easy to close

I. Sole Proprietorships Continued l l l Disadvantages: Owner has unlimited liability Hard to raise capital Less efficient Hard to attract qualified employees

I. Sole Proprietorships Continued l l l Disadvantages: Owner has unlimited liability Hard to raise capital Less efficient Hard to attract qualified employees

II. Partnerships l l l Owned by 2 or more people Articles of partnership spell out how partners divide profits/losses. Types: General- all partners involved in management/finances Limited- at least 1 partner isn’t involved in management. This partner probably just put up $.

II. Partnerships l l l Owned by 2 or more people Articles of partnership spell out how partners divide profits/losses. Types: General- all partners involved in management/finances Limited- at least 1 partner isn’t involved in management. This partner probably just put up $.

II. Partnerships - Continued l l l Compared to SP’s, Easier tostart-up/manage raise capital increase efficiency attract employees

II. Partnerships - Continued l l l Compared to SP’s, Easier tostart-up/manage raise capital increase efficiency attract employees

II. Partnerships - Continued l l Disadvantages: Partners responsible for other partners’ actions Unlimited liability Partner conflicts

II. Partnerships - Continued l l Disadvantages: Partners responsible for other partners’ actions Unlimited liability Partner conflicts

III. Corporations l l l A separate legal entity with rights of an individual Must receive gov’t charter Investors who buy stock are owners

III. Corporations l l l A separate legal entity with rights of an individual Must receive gov’t charter Investors who buy stock are owners

III. Corporations - Continued l l l Advantages: Easy to raise financial capital Owners don’t manage Limited liability**** Easy to transfer ownership

III. Corporations - Continued l l l Advantages: Easy to raise financial capital Owners don’t manage Limited liability**** Easy to transfer ownership

III. Corporations - Continued l l l Disadvantages: Charter is expensive Owners don’t manage Income taxed twice*** Gov’t regulation

III. Corporations - Continued l l l Disadvantages: Charter is expensive Owners don’t manage Income taxed twice*** Gov’t regulation

III. Corporations - Continued l l l l Impact On Society a corporation: has rights of a person has access to large amounts of $$ never has to die doesn’t have a conscience exists solely to accumulate power

III. Corporations - Continued l l l l Impact On Society a corporation: has rights of a person has access to large amounts of $$ never has to die doesn’t have a conscience exists solely to accumulate power

IV. Limited Liability Partnerships l l l Partnerships in which at least 1 partner has limited liability. At least 1 general partner must have unlimited liability. Cross between corporation/partnership

IV. Limited Liability Partnerships l l l Partnerships in which at least 1 partner has limited liability. At least 1 general partner must have unlimited liability. Cross between corporation/partnership

Business Type Activity l l l l SOLE P Employees Management Lawsuits Liability $$ to start Trnsfr. Ownrshp. Profits/Tax PRTNR CORP

Business Type Activity l l l l SOLE P Employees Management Lawsuits Liability $$ to start Trnsfr. Ownrshp. Profits/Tax PRTNR CORP

V. Growth Through Mergers l l l l 2 firms join into 1 Companies merge to: grow faster become more efficient acquire a better product eliminate a rival change their image

V. Growth Through Mergers l l l l 2 firms join into 1 Companies merge to: grow faster become more efficient acquire a better product eliminate a rival change their image

VI. Horizontal Mergers l l l firms make same/similar product Wachovia/Wells Fargo Advantages l l Larger market share Less competition

VI. Horizontal Mergers l l l firms make same/similar product Wachovia/Wells Fargo Advantages l l Larger market share Less competition

VII. Vertical Mergers l l l firms @ different stages of manufacturing Louisville Slugger/ lumber company Advantages l l Lower input costs More efficient

VII. Vertical Mergers l l l firms @ different stages of manufacturing Louisville Slugger/ lumber company Advantages l l Lower input costs More efficient

VIII. Conglomerate l l 4 or more businesses making unrelated products If 1 branch not doing well, other branches can pick up slack.

VIII. Conglomerate l l 4 or more businesses making unrelated products If 1 branch not doing well, other branches can pick up slack.

It’s a Horizontal Merger l l If: Wachovia merges with Wells Fargo

It’s a Horizontal Merger l l If: Wachovia merges with Wells Fargo

It’s a Vertical Merger l l l l If: A lumber mill & A baseball bat maker & A sporting goods store Merge together

It’s a Vertical Merger l l l l If: A lumber mill & A baseball bat maker & A sporting goods store Merge together

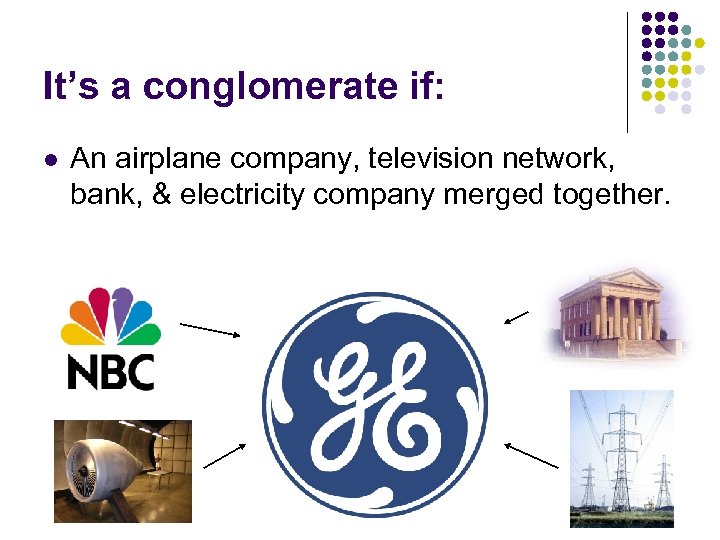

It’s a conglomerate if: l An airplane company, television network, bank, & electricity company merged together.

It’s a conglomerate if: l An airplane company, television network, bank, & electricity company merged together.

IX. Labor Unions l Use Collective Bargaining

IX. Labor Unions l Use Collective Bargaining

Merger Activity l Rules l l l Each person is a business (see your card). Merge with other businesses. Stop at five businesses (5 people max). You have fifteen minutes. Members of most efficient final business (teacher’s discretion) will receive 2 Puntos Positivos each.

Merger Activity l Rules l l l Each person is a business (see your card). Merge with other businesses. Stop at five businesses (5 people max). You have fifteen minutes. Members of most efficient final business (teacher’s discretion) will receive 2 Puntos Positivos each.

Unit 2 l Lesson 2: Market Structures, Circular Flow Redux (not in text)

Unit 2 l Lesson 2: Market Structures, Circular Flow Redux (not in text)

I. Perfect Competition l l l l l Supply/demand determine P. Firms are price-takers. Must have: 1) large # buyers & sellers 2) identical products Buyers & sellers are: 3) independent 4) well-informed 5) free to enter/leave market

I. Perfect Competition l l l l l Supply/demand determine P. Firms are price-takers. Must have: 1) large # buyers & sellers 2) identical products Buyers & sellers are: 3) independent 4) well-informed 5) free to enter/leave market

II. Monopolistic Competition l l like perfect comp BUT products not identical. Product differentiation Nonprice competition Narrow P range, goal is to raise P within that range.

II. Monopolistic Competition l l like perfect comp BUT products not identical. Product differentiation Nonprice competition Narrow P range, goal is to raise P within that range.

II. Monopolistic Competition Listen, Don’t Write l l Product Differentiation: Hardee’s uses angus beef. Hardee’s delivers to your table. Burgers are more expensive, within the narrow P range of fast food.

II. Monopolistic Competition Listen, Don’t Write l l Product Differentiation: Hardee’s uses angus beef. Hardee’s delivers to your table. Burgers are more expensive, within the narrow P range of fast food.

III. Oligopoly l l l l A few (big) sellers dominate. If price leader lowers P, other firms follow. Price wars can occur P usually higher than monopolistic or perfect non. P comp interdependence Example: American movie studios

III. Oligopoly l l l l A few (big) sellers dominate. If price leader lowers P, other firms follow. Price wars can occur P usually higher than monopolistic or perfect non. P comp interdependence Example: American movie studios

III. Oligopoly - Continued l Though illegal, firms may use collusion. 2 types: l l price fixing: firms agree to set their P dividing up the market

III. Oligopoly - Continued l Though illegal, firms may use collusion. 2 types: l l price fixing: firms agree to set their P dividing up the market

III. Oligopoly - Listen, Don’t Write l l Hi-Def Video Oligopoly & the Format Wars Nonprice Competition: Sony’s decision to add Blu-ray capability to the PS 3. Also, both formats were heavily advertised. A small price war brought Blu-ray & HD-DVD player prices down (in a last ditch effort, HD-DVD players dropped to $150) Toshiba gave up on HD-DVD after movie studios began to side with Bluray

III. Oligopoly - Listen, Don’t Write l l Hi-Def Video Oligopoly & the Format Wars Nonprice Competition: Sony’s decision to add Blu-ray capability to the PS 3. Also, both formats were heavily advertised. A small price war brought Blu-ray & HD-DVD player prices down (in a last ditch effort, HD-DVD players dropped to $150) Toshiba gave up on HD-DVD after movie studios began to side with Bluray

III. Oligopoly - Listen, Don’t Write l l l l l Other examples of oligopolies Movie studios. Time Warner, Viacom, Disney, Sony, GE, & Fox Music companies. Sony, EMI, Universal, Warner Television industry. Disney/ABC, CBS, NBC Universal, Time Warner, Fox Food processing. Kraft, Pepsi, Nestle

III. Oligopoly - Listen, Don’t Write l l l l l Other examples of oligopolies Movie studios. Time Warner, Viacom, Disney, Sony, GE, & Fox Music companies. Sony, EMI, Universal, Warner Television industry. Disney/ABC, CBS, NBC Universal, Time Warner, Fox Food processing. Kraft, Pepsi, Nestle

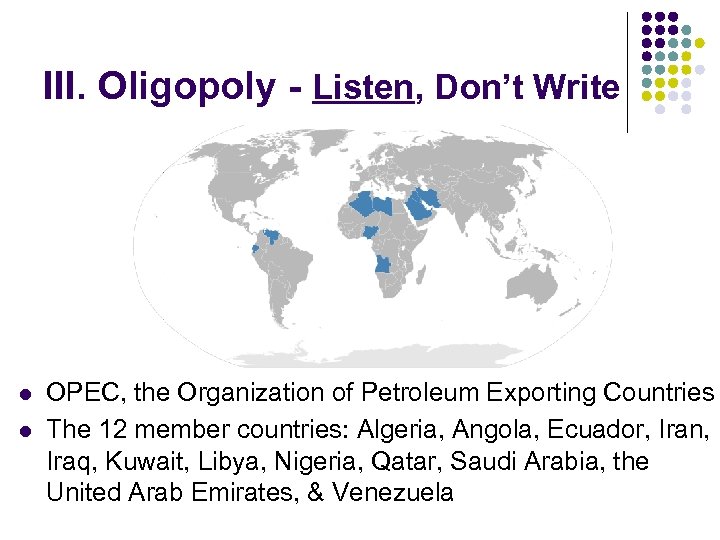

III. Oligopoly - Listen, Don’t Write l l OPEC, the Organization of Petroleum Exporting Countries The 12 member countries: Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, & Venezuela

III. Oligopoly - Listen, Don’t Write l l OPEC, the Organization of Petroleum Exporting Countries The 12 member countries: Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, the United Arab Emirates, & Venezuela

IV. Monopoly l l l Only 1 seller price-makers Natural- results in lower overall costs (railroads, public utilities). Geographic- location can only support 1 (small town drug store). Technological M - producer has patents or copyrights. Government M - gov’t makes something private industry can’t/shouldn’t (uranium

IV. Monopoly l l l Only 1 seller price-makers Natural- results in lower overall costs (railroads, public utilities). Geographic- location can only support 1 (small town drug store). Technological M - producer has patents or copyrights. Government M - gov’t makes something private industry can’t/shouldn’t (uranium

IV. Monopoly - Listen, Don’t Write l l l De Beers had a nearmonopoly over the diamond trade until a few years ago. Major League Baseball has a monopoly in the U. S. over professional baseball. Game. Stop has a nearmonopoly over the used -game market.

IV. Monopoly - Listen, Don’t Write l l l De Beers had a nearmonopoly over the diamond trade until a few years ago. Major League Baseball has a monopoly in the U. S. over professional baseball. Game. Stop has a nearmonopoly over the used -game market.

V. Circular Flow l l l Illustrates the flow of resources, goods/services & dollars between businesses and households. Later we will add the gov’t and trade. Markets = institution/mechanism that brings buyers/sellers together (local, national, global, internet). Markets allow producers and consumers to decide how to answer the 3 Q’s. Factor Market: where people earn incomes and provide FOP Product Market: where consumers buy goods/services from producers

V. Circular Flow l l l Illustrates the flow of resources, goods/services & dollars between businesses and households. Later we will add the gov’t and trade. Markets = institution/mechanism that brings buyers/sellers together (local, national, global, internet). Markets allow producers and consumers to decide how to answer the 3 Q’s. Factor Market: where people earn incomes and provide FOP Product Market: where consumers buy goods/services from producers

V. Circular Flow l l In the factor market, payments for… are called… l land rent l labor wages l capital interest l entrepreneurship profit

V. Circular Flow l l In the factor market, payments for… are called… l land rent l labor wages l capital interest l entrepreneurship profit

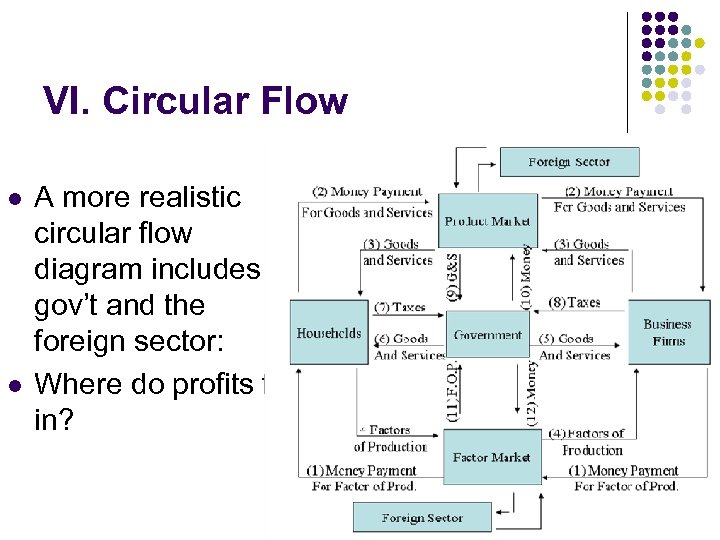

VI. Circular Flow l l A more realistic circular flow diagram includes gov’t and the foreign sector: Where do profits fit in?

VI. Circular Flow l l A more realistic circular flow diagram includes gov’t and the foreign sector: Where do profits fit in?

VI. Circular Flow l l l l Households Personal Taxes Savings: for security/speculation; correlated to income Consumption: A) Durable Goods (+3 yrs) B) Non-durable Goods (-3 yrs) C) Services Dissave: spend savings or borrow

VI. Circular Flow l l l l Households Personal Taxes Savings: for security/speculation; correlated to income Consumption: A) Durable Goods (+3 yrs) B) Non-durable Goods (-3 yrs) C) Services Dissave: spend savings or borrow

VI. Circular Flow l l l l Businesses Plant: performs specific functions in the fabrication/ distribution of goods/services Firm: runs/operates plant Industry: Group of firms making same/similar products Types of mergers. Horizontal – firms make same product Vertical – firms @ different stages of manufacturing Conglomerate: 4+ businesses make unrelated products

VI. Circular Flow l l l l Businesses Plant: performs specific functions in the fabrication/ distribution of goods/services Firm: runs/operates plant Industry: Group of firms making same/similar products Types of mergers. Horizontal – firms make same product Vertical – firms @ different stages of manufacturing Conglomerate: 4+ businesses make unrelated products

VI. Circular Flow l l l Foreign Sector Trade: exports (X) minus imports (M) If X-M > 0, trade surplus If X-M < 0, trade deficit Investment Foreign Aid, Gifts, Etc.

VI. Circular Flow l l l Foreign Sector Trade: exports (X) minus imports (M) If X-M > 0, trade surplus If X-M < 0, trade deficit Investment Foreign Aid, Gifts, Etc.

VI. Circular Flow l l Gov’t Taxes Households, Businesses Provides Goods, Services Consumes Goods, Services

VI. Circular Flow l l Gov’t Taxes Households, Businesses Provides Goods, Services Consumes Goods, Services

Homework l Read ch 10

Homework l Read ch 10

Unit 2 l Lesson 3: GDP

Unit 2 l Lesson 3: GDP

I. Gross Domestic Product l l l Gross=Total Domestic=This Country Product=What We Produce Q of all final goods & services sold in 12 mo. s multiplied by their Ps. GDP is a dollar amount.

I. Gross Domestic Product l l l Gross=Total Domestic=This Country Product=What We Produce Q of all final goods & services sold in 12 mo. s multiplied by their Ps. GDP is a dollar amount.

I. GDP–Continued l l l l Not included in GDP: Nonmarket transactions in the underground economy Intermediate products Secondhand sales Barter Transfer Payments / Gifts Buying/Selling Securities on the Secondary Market

I. GDP–Continued l l l l Not included in GDP: Nonmarket transactions in the underground economy Intermediate products Secondhand sales Barter Transfer Payments / Gifts Buying/Selling Securities on the Secondary Market

What is counted? What is not? Only the value of the final sale is counted. So they are not counted when the manufacturer buys them. The cost of the parts is included in the final sale price

What is counted? What is not? Only the value of the final sale is counted. So they are not counted when the manufacturer buys them. The cost of the parts is included in the final sale price

This is confusing! l l The tires that come with the car is not counted as a final good However if you get a flat and buy the same tire it is counted as a final good

This is confusing! l l The tires that come with the car is not counted as a final good However if you get a flat and buy the same tire it is counted as a final good

I. GDP - Continued l l l The most important measure of economic performance. Measures voluntary transactions. Indicates Recessions/ Depressions/Booms.

I. GDP - Continued l l l The most important measure of economic performance. Measures voluntary transactions. Indicates Recessions/ Depressions/Booms.

I. GDP – Continued Limitations of GDP l l Doesn’t tell us composition of output. We may be producing more, but what are we producing more of? l GDP is a number, and can’t indicate quality of life.

I. GDP – Continued Limitations of GDP l l Doesn’t tell us composition of output. We may be producing more, but what are we producing more of? l GDP is a number, and can’t indicate quality of life.

l One way to calculate GDP involves adding up all expenditures in the country over the course of a year.

l One way to calculate GDP involves adding up all expenditures in the country over the course of a year.

II. GDP - Expenditures Model l l GDP = C + I + G + (X-M) C = Consumption l l I = Gross Private Domestic Investment (3 components) l l l Purchases by households of goods/services (largest component of GDP) Purchase of capital by firms New home purchases by firms or households Additions to inventory by firms G = Gov’t Spending X = Exports M = Imports

II. GDP - Expenditures Model l l GDP = C + I + G + (X-M) C = Consumption l l I = Gross Private Domestic Investment (3 components) l l l Purchases by households of goods/services (largest component of GDP) Purchase of capital by firms New home purchases by firms or households Additions to inventory by firms G = Gov’t Spending X = Exports M = Imports

II. GDP - Expenditures Model l I---Effect of changing inventories on gdp, net inventory, eventual consumption l l increase in inventories make I go up, GDP go up when inventories go down, I goes down, but C goes up. GDP is unchanged. l G---transfer payments (1/3 of budget) not included; gov’t employee salaries are included l Gross investment vs net investment l net I = I - depreciation

II. GDP - Expenditures Model l I---Effect of changing inventories on gdp, net inventory, eventual consumption l l increase in inventories make I go up, GDP go up when inventories go down, I goes down, but C goes up. GDP is unchanged. l G---transfer payments (1/3 of budget) not included; gov’t employee salaries are included l Gross investment vs net investment l net I = I - depreciation

l Another way to determine GDP is to calculate the dollar value added to goods at each stage of their production. l This is called the “valueadded” method.

l Another way to determine GDP is to calculate the dollar value added to goods at each stage of their production. l This is called the “valueadded” method.

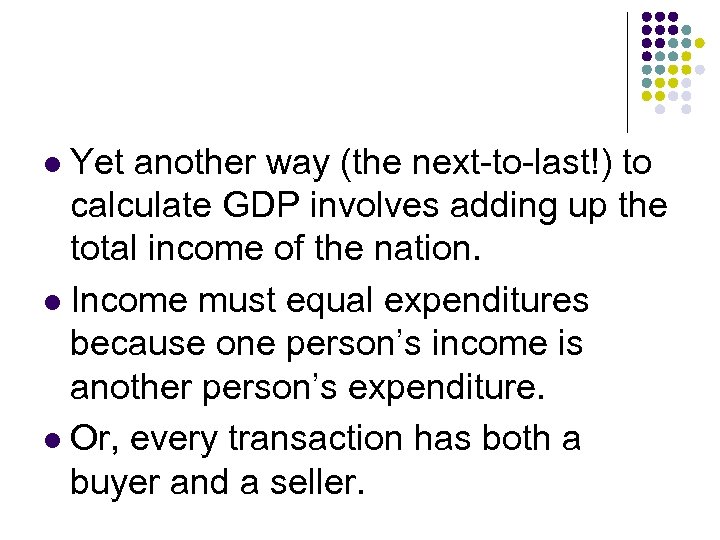

Yet another way (the next-to-last!) to calculate GDP involves adding up the total income of the nation. l Income must equal expenditures because one person’s income is another person’s expenditure. l Or, every transaction has both a buyer and a seller. l

Yet another way (the next-to-last!) to calculate GDP involves adding up the total income of the nation. l Income must equal expenditures because one person’s income is another person’s expenditure. l Or, every transaction has both a buyer and a seller. l

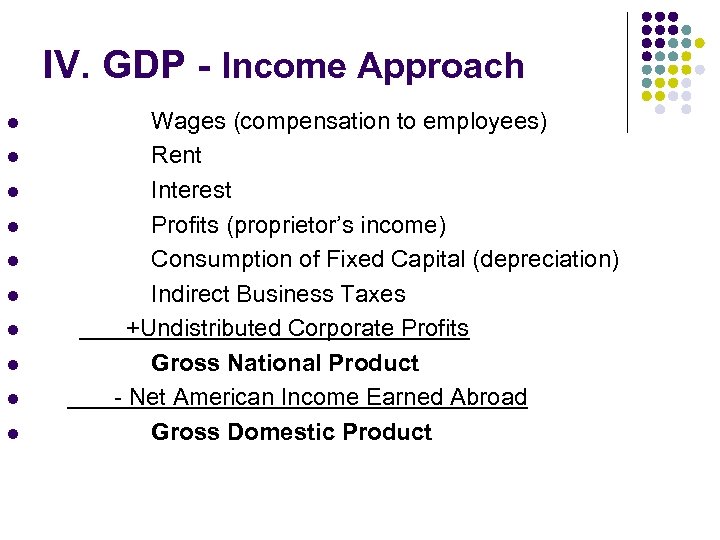

IV. GDP - Income Approach l l l l l Wages (compensation to employees) Rent Interest Profits (proprietor’s income) Consumption of Fixed Capital (depreciation) Indirect Business Taxes +Undistributed Corporate Profits Gross National Product - Net American Income Earned Abroad Gross Domestic Product

IV. GDP - Income Approach l l l l l Wages (compensation to employees) Rent Interest Profits (proprietor’s income) Consumption of Fixed Capital (depreciation) Indirect Business Taxes +Undistributed Corporate Profits Gross National Product - Net American Income Earned Abroad Gross Domestic Product

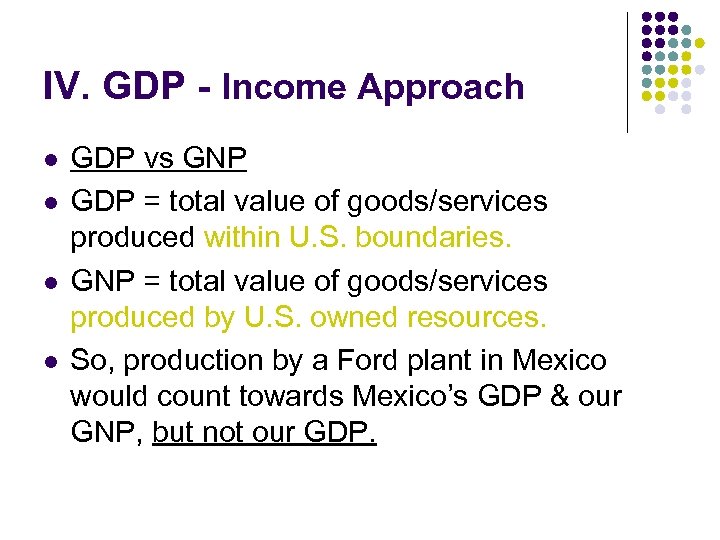

IV. GDP - Income Approach l l GDP vs GNP GDP = total value of goods/services produced within U. S. boundaries. GNP = total value of goods/services produced by U. S. owned resources. So, production by a Ford plant in Mexico would count towards Mexico’s GDP & our GNP, but not our GDP.

IV. GDP - Income Approach l l GDP vs GNP GDP = total value of goods/services produced within U. S. boundaries. GNP = total value of goods/services produced by U. S. owned resources. So, production by a Ford plant in Mexico would count towards Mexico’s GDP & our GNP, but not our GDP.

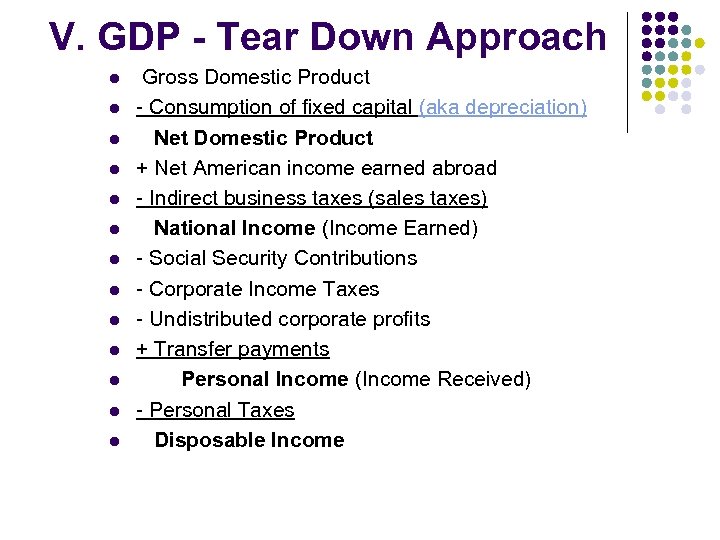

V. GDP - Tear Down Approach l l l l Gross Domestic Product - Consumption of fixed capital (aka depreciation) Net Domestic Product + Net American income earned abroad - Indirect business taxes (sales taxes) National Income (Income Earned) - Social Security Contributions - Corporate Income Taxes - Undistributed corporate profits + Transfer payments Personal Income (Income Received) - Personal Taxes Disposable Income

V. GDP - Tear Down Approach l l l l Gross Domestic Product - Consumption of fixed capital (aka depreciation) Net Domestic Product + Net American income earned abroad - Indirect business taxes (sales taxes) National Income (Income Earned) - Social Security Contributions - Corporate Income Taxes - Undistributed corporate profits + Transfer payments Personal Income (Income Received) - Personal Taxes Disposable Income

V. GDP - Tear Down Approach l Corporate profits included in PI are called dividends

V. GDP - Tear Down Approach l Corporate profits included in PI are called dividends

Homework l Read ch 11

Homework l Read ch 11

Unit 2 l Lesson 4: Inflation

Unit 2 l Lesson 4: Inflation

I. Constructing a Price Index l l Inflation can distort GDP from year to year. A price index measures P changes over time.

I. Constructing a Price Index l l Inflation can distort GDP from year to year. A price index measures P changes over time.

I. Constructing a Price Index. Continued l l l l Steps: Select a base year & items for a market basket. Record P of each item in the basket. Total is the base-year market basket price. Record Ps each year. PI = Market Basket P in a given yr Base-Year Market Basket P X 100

I. Constructing a Price Index. Continued l l l l Steps: Select a base year & items for a market basket. Record P of each item in the basket. Total is the base-year market basket price. Record Ps each year. PI = Market Basket P in a given yr Base-Year Market Basket P X 100

I. Constructing a Price Index. Continued l Determining inflation rate using CPI from year to year: l l use percent increase in CPI [(new-old)/old] X 100

I. Constructing a Price Index. Continued l Determining inflation rate using CPI from year to year: l l use percent increase in CPI [(new-old)/old] X 100

I. Constructing a Price Index. Continued l l Problems with the CPI overstates inflation b/c l l l substitution bias introduction of new goods unmeasured quality change

I. Constructing a Price Index. Continued l l Problems with the CPI overstates inflation b/c l l l substitution bias introduction of new goods unmeasured quality change

II. Major Price Indexes l l l Consumer Price Index (CPI)-80, 000 items in 364 categories. Producer Price Index (PPI)-goods/services bought by firms Implicit GDP Price Deflator (aka GDP Deflator)- all goods/services in the economy. Base year 1996.

II. Major Price Indexes l l l Consumer Price Index (CPI)-80, 000 items in 364 categories. Producer Price Index (PPI)-goods/services bought by firms Implicit GDP Price Deflator (aka GDP Deflator)- all goods/services in the economy. Base year 1996.

The Rule of 70 l l Rule of 70: a method for determining how long it will take the price level to double, given the current price level. To calculate this you divide the % annual rate of increase into 70.

The Rule of 70 l l Rule of 70: a method for determining how long it will take the price level to double, given the current price level. To calculate this you divide the % annual rate of increase into 70.

III. Real GDP l l GDP adjusted for inflation. It allows us to see how much more stuff we really made. One way to determine RGDP: Pick a “base year”, and multiply the prices from that year with the quantities purchased in other years.

III. Real GDP l l GDP adjusted for inflation. It allows us to see how much more stuff we really made. One way to determine RGDP: Pick a “base year”, and multiply the prices from that year with the quantities purchased in other years.

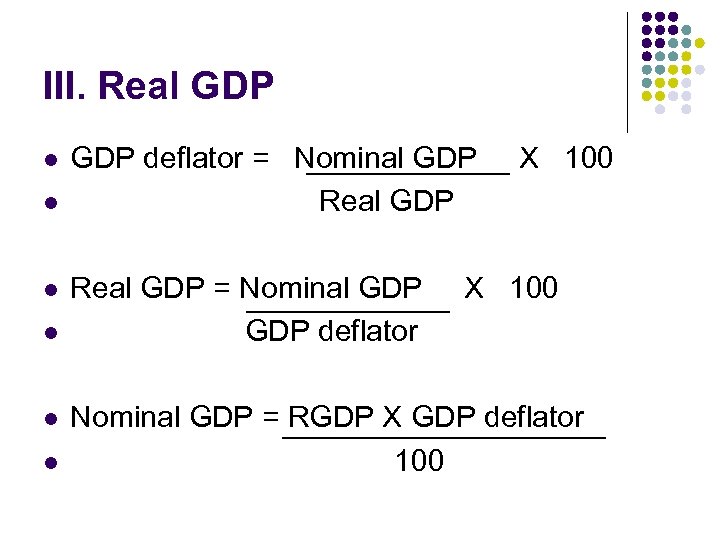

III. Real GDP l l l GDP deflator = Nominal GDP Real GDP = Nominal GDP deflator X 100 Nominal GDP = RGDP X GDP deflator 100

III. Real GDP l l l GDP deflator = Nominal GDP Real GDP = Nominal GDP deflator X 100 Nominal GDP = RGDP X GDP deflator 100

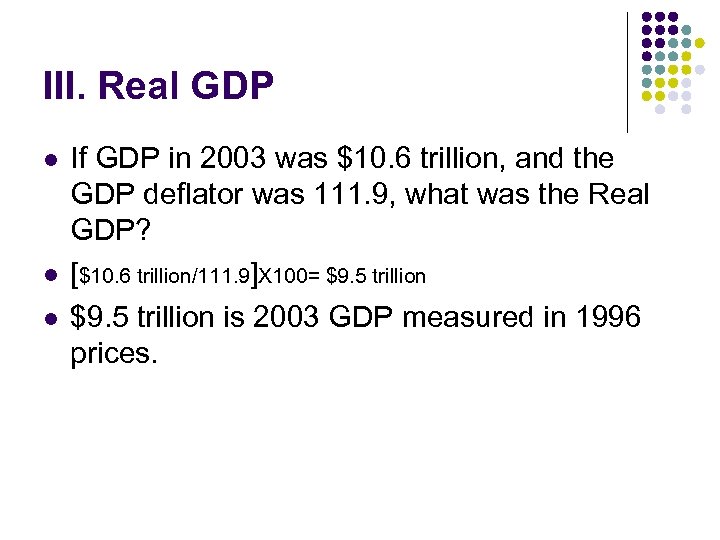

III. Real GDP l l l If GDP in 2003 was $10. 6 trillion, and the GDP deflator was 111. 9, what was the Real GDP? [$10. 6 trillion/111. 9]X 100= $9. 5 trillion is 2003 GDP measured in 1996 prices.

III. Real GDP l l l If GDP in 2003 was $10. 6 trillion, and the GDP deflator was 111. 9, what was the Real GDP? [$10. 6 trillion/111. 9]X 100= $9. 5 trillion is 2003 GDP measured in 1996 prices.

IV. Inflation l l l Inflation: increase in prices Deflation: decrease in prices Stagflation: recession & inflation at the same time (rare). Inflation is measured as the percent change in a price index from year to year. The U. S. has had inflation for 50+ years, at an avg. rate of 4% a yr.

IV. Inflation l l l Inflation: increase in prices Deflation: decrease in prices Stagflation: recession & inflation at the same time (rare). Inflation is measured as the percent change in a price index from year to year. The U. S. has had inflation for 50+ years, at an avg. rate of 4% a yr.

IV. Inflation l If U. S. inflation (a decrease in the value of the dollar) if higher than inflation in countries we trade with, how will NX be affected?

IV. Inflation l If U. S. inflation (a decrease in the value of the dollar) if higher than inflation in countries we trade with, how will NX be affected?

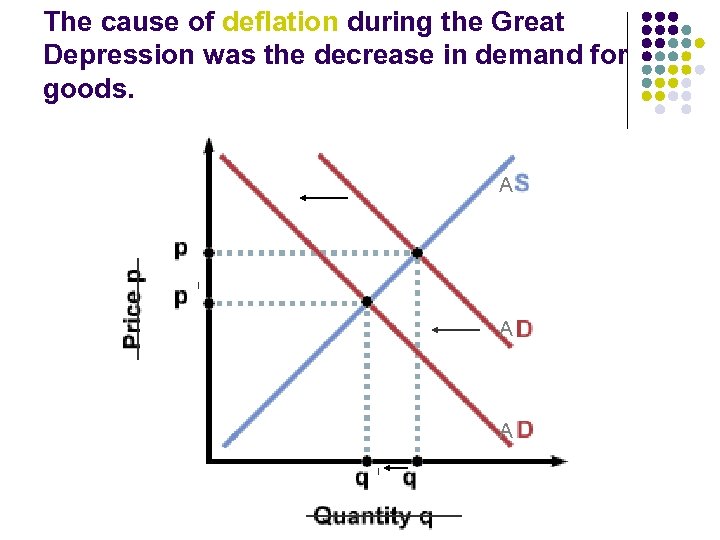

The cause of deflation during the Great Depression was the decrease in demand for goods. Price Level A A A RGDP

The cause of deflation during the Great Depression was the decrease in demand for goods. Price Level A A A RGDP

IV. Inflation l l l Causes Demand-pull inflation - demand increases, “pulling up” price levels Cost-push inflation - input costs increase, causing supply to decrease & “pushing up” price levels The wage-price spiral - higher Ps cause workers to demand higher wages, forcing producers to raise their Ps even more, etc. Deflationary spiral - lower Ps force producers to cut wages, forcing producers to lower Ps. . . Excessive monetary growth

IV. Inflation l l l Causes Demand-pull inflation - demand increases, “pulling up” price levels Cost-push inflation - input costs increase, causing supply to decrease & “pushing up” price levels The wage-price spiral - higher Ps cause workers to demand higher wages, forcing producers to raise their Ps even more, etc. Deflationary spiral - lower Ps force producers to cut wages, forcing producers to lower Ps. . . Excessive monetary growth

IV. Inflation l l l Costs of Anticipated Inflation shoeleather costs- high inflation = high interest = you want to hold less cash menu costs infrequent price changes tax code inflation restricts money’s use as an accurate unit of measure

IV. Inflation l l l Costs of Anticipated Inflation shoeleather costs- high inflation = high interest = you want to hold less cash menu costs infrequent price changes tax code inflation restricts money’s use as an accurate unit of measure

IV. Inflation l l l Costs of Unanticipated Inflation hurts lenders (helps borrowers) Real Interest Rate = Interest Rate - Inflation r=i-π hurts people on fixed incomes

IV. Inflation l l l Costs of Unanticipated Inflation hurts lenders (helps borrowers) Real Interest Rate = Interest Rate - Inflation r=i-π hurts people on fixed incomes

Homework l Read Ch 12

Homework l Read Ch 12

V. Economic Growth l l l Economic growth & standard of living are best measured by Real GDP per capita Per capita means person. Real GDP per capita has grown slower than real GDP

V. Economic Growth l l l Economic growth & standard of living are best measured by Real GDP per capita Per capita means person. Real GDP per capita has grown slower than real GDP

V. Economic Growth l l l Economic growth increases: standard of living tax base U. S. demand for imports incentive for other countries to become market economies

V. Economic Growth l l l Economic growth increases: standard of living tax base U. S. demand for imports incentive for other countries to become market economies

VI. Factors Influencing Economic Growth Amount & quality of the FOP: l Natural resources l higher capital-to-labor ratio = higher productivity l Skilled/growing labor force, education*** l Entrepreneurs l

VI. Factors Influencing Economic Growth Amount & quality of the FOP: l Natural resources l higher capital-to-labor ratio = higher productivity l Skilled/growing labor force, education*** l Entrepreneurs l

Homework l Read Ch 15 Unemployment

Homework l Read Ch 15 Unemployment

Unit 2 l Lesson 5: The Business Cycle & Unemployment

Unit 2 l Lesson 5: The Business Cycle & Unemployment

I. The Business Cycle l l l Business cycle = systematic ups and downs of real GDP Business fluctuations = nonsystematic 2 phases of biz. cycle: Recession begins at peak and ends at trough— peak/trough at least 6 mo’s apart Expansion is the recovery from a recession Severe recessions can become depressions.

I. The Business Cycle l l l Business cycle = systematic ups and downs of real GDP Business fluctuations = nonsystematic 2 phases of biz. cycle: Recession begins at peak and ends at trough— peak/trough at least 6 mo’s apart Expansion is the recovery from a recession Severe recessions can become depressions.

I. The Business Cycle l l l Causes External shocks (oil prices, international conflicts) can cause business cycles. Businesses cut: inventories at 1 st sign of economic slowdown, & investment after an innovation takes hold

I. The Business Cycle l l l Causes External shocks (oil prices, international conflicts) can cause business cycles. Businesses cut: inventories at 1 st sign of economic slowdown, & investment after an innovation takes hold

I. The Business Cycle l l l Causes Tight money policy by the Fed: 1) Gov’t sells bonds (borrows $) 2) Money supply in economy shrinks. 3) Interest rates rise. 4) Less investment & fewer purchases result.

I. The Business Cycle l l l Causes Tight money policy by the Fed: 1) Gov’t sells bonds (borrows $) 2) Money supply in economy shrinks. 3) Interest rates rise. 4) Less investment & fewer purchases result.

I. The Business Cycle l l l Prediction Econometric models use algebra The Index of Leading Indicators is a monthly statistical series

I. The Business Cycle l l l Prediction Econometric models use algebra The Index of Leading Indicators is a monthly statistical series

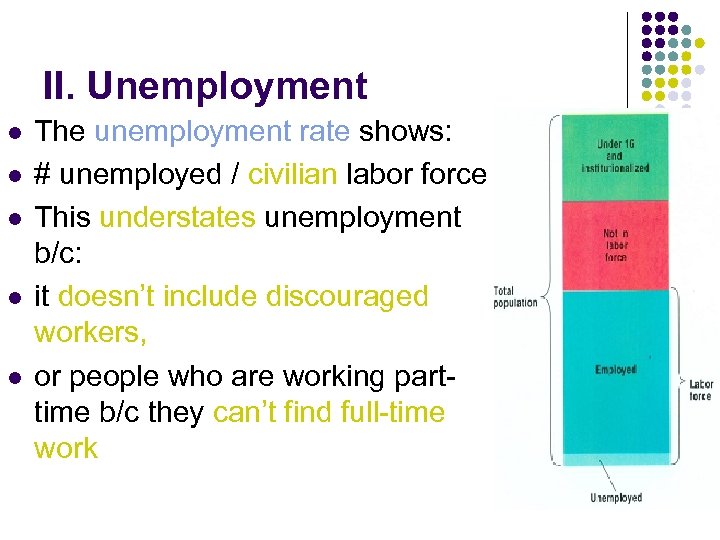

II. Unemployment l l l The unemployment rate shows: # unemployed / civilian labor force This understates unemployment b/c: it doesn’t include discouraged workers, or people who are working parttime b/c they can’t find full-time work

II. Unemployment l l l The unemployment rate shows: # unemployed / civilian labor force This understates unemployment b/c: it doesn’t include discouraged workers, or people who are working parttime b/c they can’t find full-time work

II. Unemployment l l l Types Frictional: workers are between jobs Structural: changes in consumer tastes or industry operations Cyclical: changes in the business cycle Seasonal: changes in the weather or seasons

II. Unemployment l l l Types Frictional: workers are between jobs Structural: changes in consumer tastes or industry operations Cyclical: changes in the business cycle Seasonal: changes in the weather or seasons

II. Unemployment l l l The labor force doesn’t include people who are working in the underground economy. If Real GDP falls, the unemployment rate ____. If RGDP rises, the unemployment rate ____. GDP Gap: The amount of GDP lost because not enough jobs are supplied in the economy. Also; the difference between GDP and Potential GDP

II. Unemployment l l l The labor force doesn’t include people who are working in the underground economy. If Real GDP falls, the unemployment rate ____. If RGDP rises, the unemployment rate ____. GDP Gap: The amount of GDP lost because not enough jobs are supplied in the economy. Also; the difference between GDP and Potential GDP

III. Full Employment l l l Also called the natural rate of unemployment. A condition where there is zero cyclical unemployment. Because structural & frictional unemployment will always exist, the unemployment rate will always be > 0.

III. Full Employment l l l Also called the natural rate of unemployment. A condition where there is zero cyclical unemployment. Because structural & frictional unemployment will always exist, the unemployment rate will always be > 0.