d69a5e26ea5c7bb64ca4492260f196be.ppt

- Количество слайдов: 74

AP Macro Review

AP Macro Review

AP Exam Information 2 hrs. , 10 mins.

AP Exam Information 2 hrs. , 10 mins.

AP Exam Format • 60 multiple-choice questions – 70 min. – 66% of score! • 3 free-response questions – 10 min. reading period – 50 min. to write: • 1 long FRQ (16% of score) • 2 short FRQs (8. 5% each) • No calculators!

AP Exam Format • 60 multiple-choice questions – 70 min. – 66% of score! • 3 free-response questions – 10 min. reading period – 50 min. to write: • 1 long FRQ (16% of score) • 2 short FRQs (8. 5% each) • No calculators!

FRQ Words • “Show”: diagram or draw w/ correct labeling • “Explain”: take reader through all of the steps (graphs and symbols are acceptable!) • “Identify”: provide a specific answer (could be list or a label on a graph without any explanation) • “Calculate” means to use math (show your work!)

FRQ Words • “Show”: diagram or draw w/ correct labeling • “Explain”: take reader through all of the steps (graphs and symbols are acceptable!) • “Identify”: provide a specific answer (could be list or a label on a graph without any explanation) • “Calculate” means to use math (show your work!)

Macro Topics I. Basic Economic Concepts: 8– 12% II. Measurement of Economic Performance: 12– 16% III. National Income & Price Determination: 10– 15% IV. Financial Sector: 15– 20% V. Stabilization Policies: 20– 30% VI. Economic Growth: 5– 10% VII. Open Economy: Inter. Trade & Finance: 10– 15%

Macro Topics I. Basic Economic Concepts: 8– 12% II. Measurement of Economic Performance: 12– 16% III. National Income & Price Determination: 10– 15% IV. Financial Sector: 15– 20% V. Stabilization Policies: 20– 30% VI. Economic Growth: 5– 10% VII. Open Economy: Inter. Trade & Finance: 10– 15%

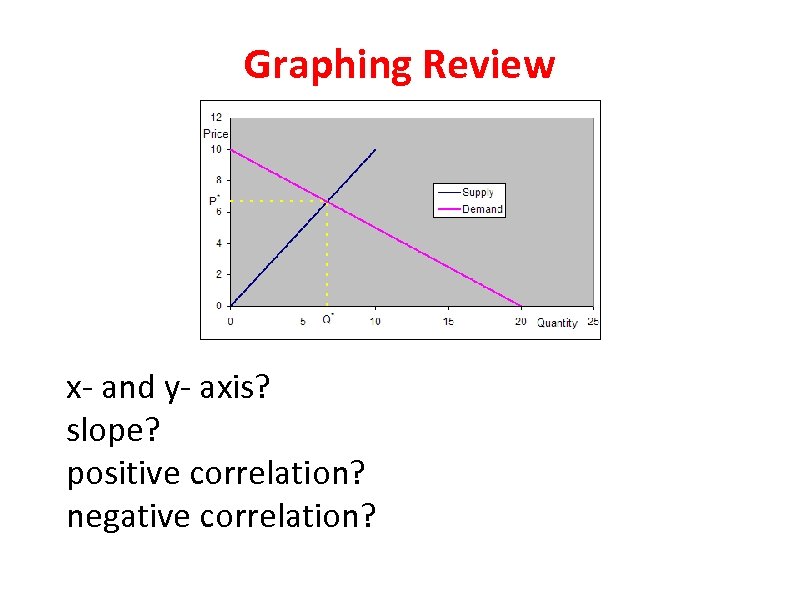

Graphing Review x- and y- axis? slope? positive correlation? negative correlation?

Graphing Review x- and y- axis? slope? positive correlation? negative correlation?

Unit 1 Basic Economic Concepts: 8– 12%

Unit 1 Basic Economic Concepts: 8– 12%

Types of Econ. Systems • Command • Market • Mixed Economy

Types of Econ. Systems • Command • Market • Mixed Economy

Key Assumptions • Rational choice: self-interest o Profit maximization • Marginal costs o Costs vs. benefits o MB=MC • Ceteris Paribus o all factors constant

Key Assumptions • Rational choice: self-interest o Profit maximization • Marginal costs o Costs vs. benefits o MB=MC • Ceteris Paribus o all factors constant

Factors of Production 1. Land § Resources § RENT 2. Labor § Human capital § WAGES 3. Capital (Investment) § Tools, machines, factories § INTEREST 4. Entrepreneurship § PROFIT

Factors of Production 1. Land § Resources § RENT 2. Labor § Human capital § WAGES 3. Capital (Investment) § Tools, machines, factories § INTEREST 4. Entrepreneurship § PROFIT

Scarcity • wants vs. needs • “trade-offs” Opportunity Cost • next best alternative use for a resource • NO FREE LUNCHES

Scarcity • wants vs. needs • “trade-offs” Opportunity Cost • next best alternative use for a resource • NO FREE LUNCHES

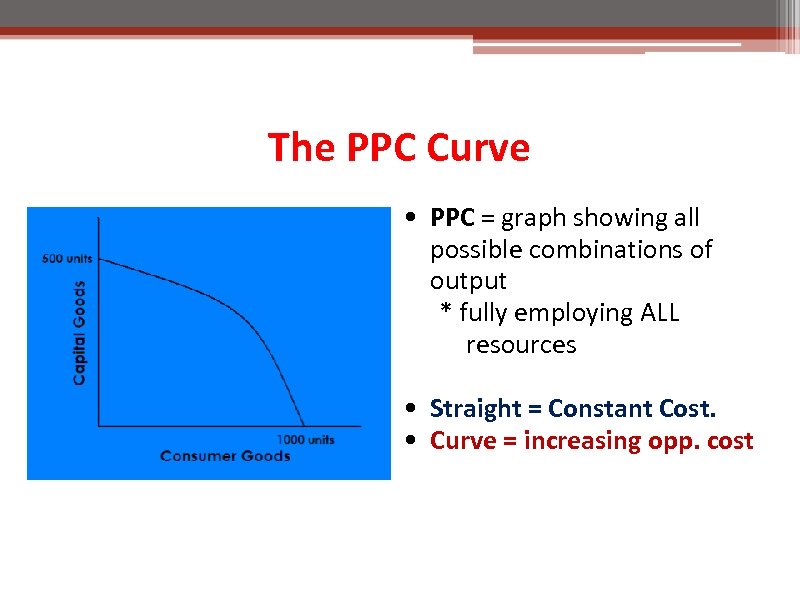

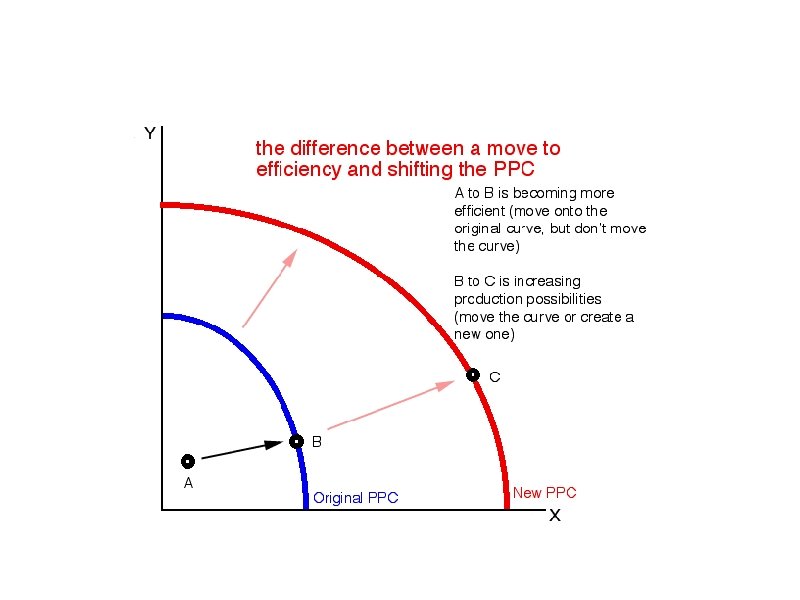

The PPC Curve • PPC = graph showing all possible combinations of output * fully employing ALL resources • Straight = Constant Cost. • Curve = increasing opp. cost

The PPC Curve • PPC = graph showing all possible combinations of output * fully employing ALL resources • Straight = Constant Cost. • Curve = increasing opp. cost

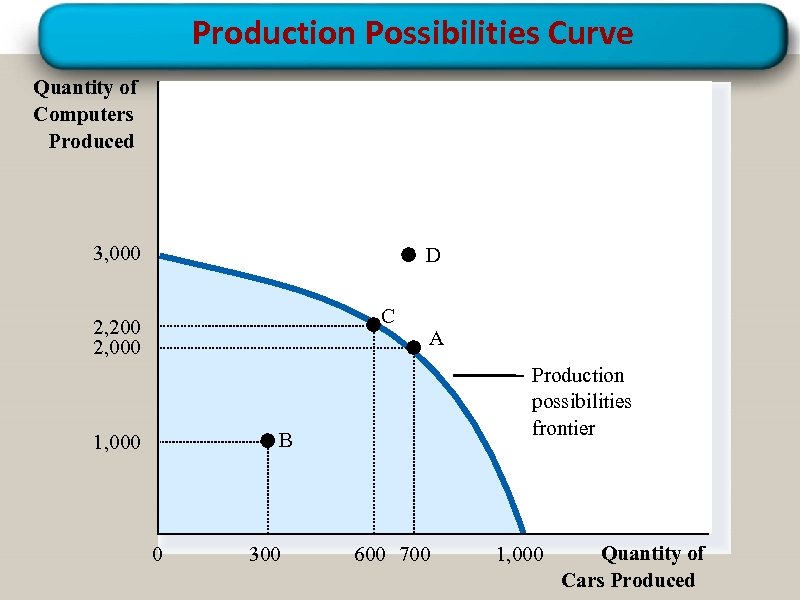

Production Possibilities Curve Quantity of Computers Produced 3, 000 D C 2, 200 2, 000 A Production possibilities frontier B 1, 000 0 300 600 700 1, 000 Quantity of Cars Produced

Production Possibilities Curve Quantity of Computers Produced 3, 000 D C 2, 200 2, 000 A Production possibilities frontier B 1, 000 0 300 600 700 1, 000 Quantity of Cars Produced

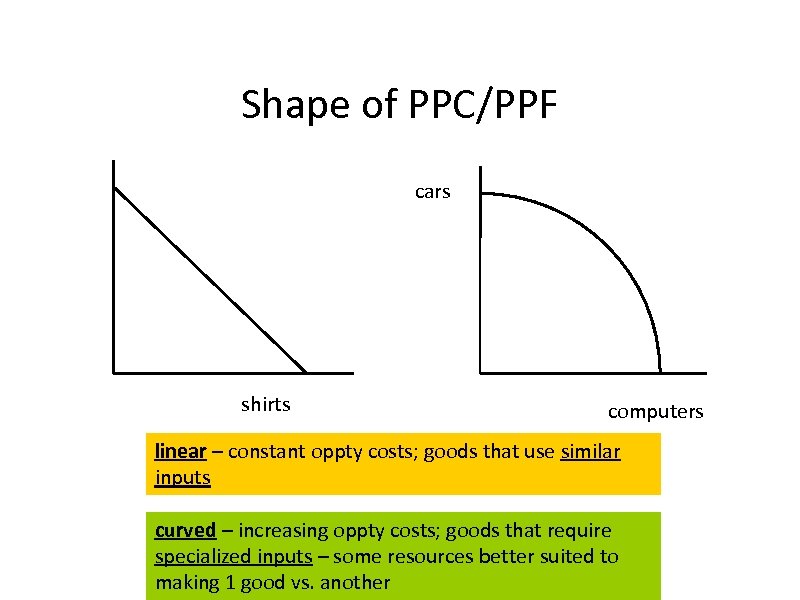

Shape of PPC/PPF cars shirts computers linear – constant oppty costs; goods that use similar inputs curved – increasing oppty costs; goods that require specialized inputs – some resources better suited to making 1 good vs. another

Shape of PPC/PPF cars shirts computers linear – constant oppty costs; goods that use similar inputs curved – increasing oppty costs; goods that require specialized inputs – some resources better suited to making 1 good vs. another

International Trade Why do countries trade? 16

International Trade Why do countries trade? 16

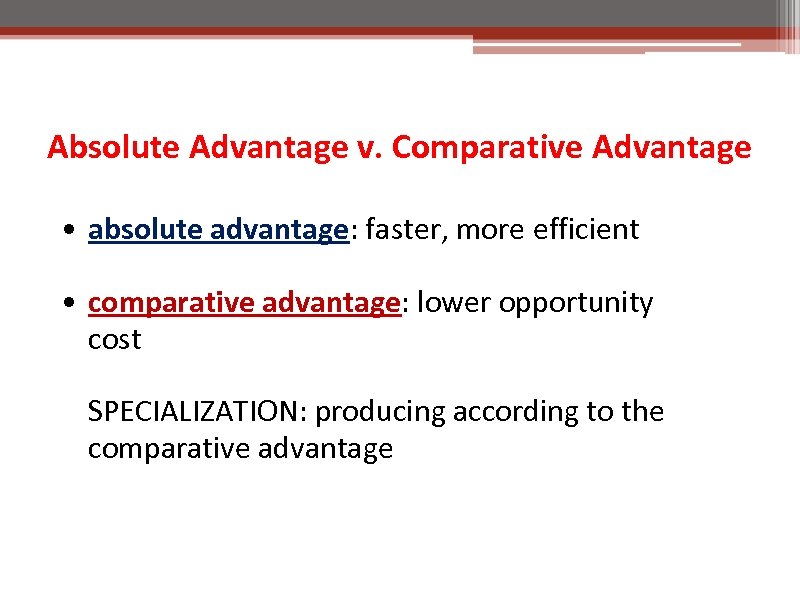

Absolute Advantage v. Comparative Advantage • absolute advantage: faster, more efficient • comparative advantage: lower opportunity cost SPECIALIZATION: producing according to the comparative advantage

Absolute Advantage v. Comparative Advantage • absolute advantage: faster, more efficient • comparative advantage: lower opportunity cost SPECIALIZATION: producing according to the comparative advantage

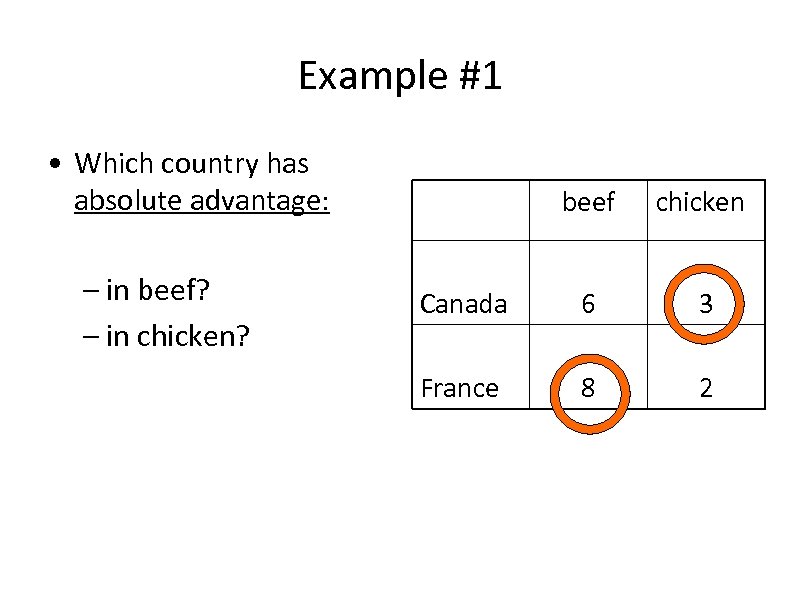

Example #1 • Which country has absolute advantage: – in beef? – in chicken? beef chicken Canada 6 3 France 8 2

Example #1 • Which country has absolute advantage: – in beef? – in chicken? beef chicken Canada 6 3 France 8 2

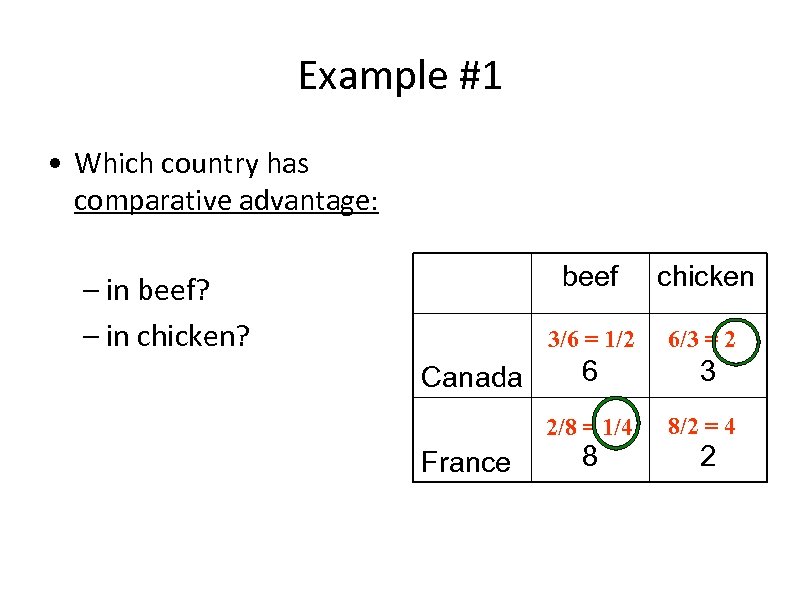

Example #1 • Which country has comparative advantage: beef 3/6 = 1/2 Canada France 6/3 = 2 6 3 2/8 = 1/4 – in beef? – in chicken? chicken 8/2 = 4 8 2

Example #1 • Which country has comparative advantage: beef 3/6 = 1/2 Canada France 6/3 = 2 6 3 2/8 = 1/4 – in beef? – in chicken? chicken 8/2 = 4 8 2

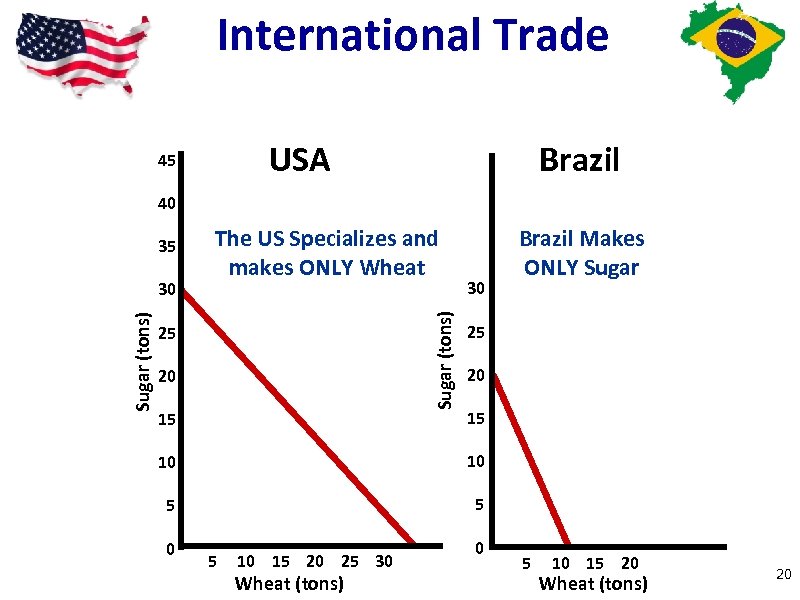

International Trade USA 45 Brazil 40 Sugar (tons) 30 The US Specializes and makes ONLY Wheat Sugar (tons) 35 25 20 15 30 Brazil Makes ONLY Sugar 25 20 15 10 10 5 5 0 5 10 15 20 25 30 Wheat (tons) 0 5 10 15 20 Wheat (tons) 20

International Trade USA 45 Brazil 40 Sugar (tons) 30 The US Specializes and makes ONLY Wheat Sugar (tons) 35 25 20 15 30 Brazil Makes ONLY Sugar 25 20 15 10 10 5 5 0 5 10 15 20 25 30 Wheat (tons) 0 5 10 15 20 Wheat (tons) 20

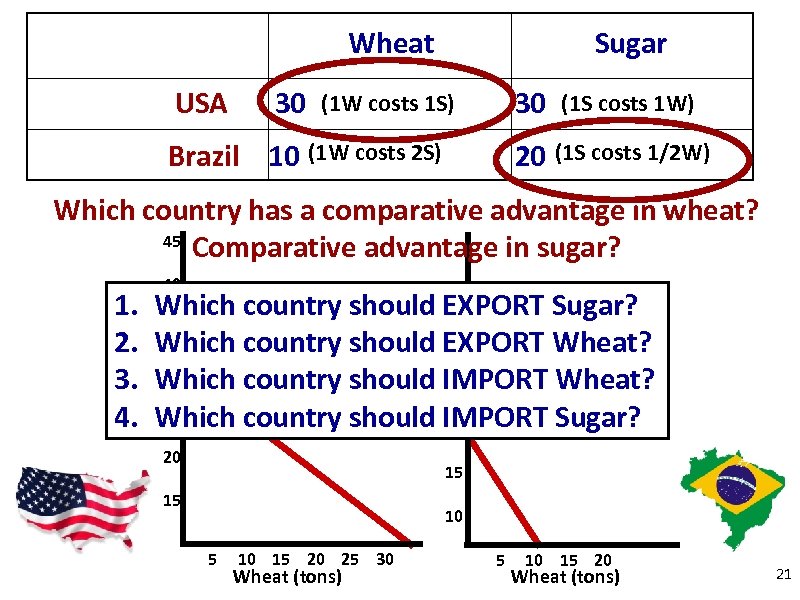

Wheat USA 30 Sugar 30 (1 W costs 1 S) Brazil 10 (1 W costs 2 S) (1 S costs 1 W) 20 (1 S costs 1/2 W) Which country has a comparative advantage in wheat? 45 Comparative advantage in sugar? Sugar (tons) Which country should EXPORT Sugar? 35 30 Which country should EXPORT Wheat? 30 Which country should IMPORT Wheat? 25 25 Which country should IMPORT Sugar? 20 Sugar (tons) 1. 2. 3. 4. 40 20 15 15 10 15 20 25 30 Wheat (tons) 5 10 15 20 Wheat (tons) 21

Wheat USA 30 Sugar 30 (1 W costs 1 S) Brazil 10 (1 W costs 2 S) (1 S costs 1 W) 20 (1 S costs 1/2 W) Which country has a comparative advantage in wheat? 45 Comparative advantage in sugar? Sugar (tons) Which country should EXPORT Sugar? 35 30 Which country should EXPORT Wheat? 30 Which country should IMPORT Wheat? 25 25 Which country should IMPORT Sugar? 20 Sugar (tons) 1. 2. 3. 4. 40 20 15 15 10 15 20 25 30 Wheat (tons) 5 10 15 20 Wheat (tons) 21

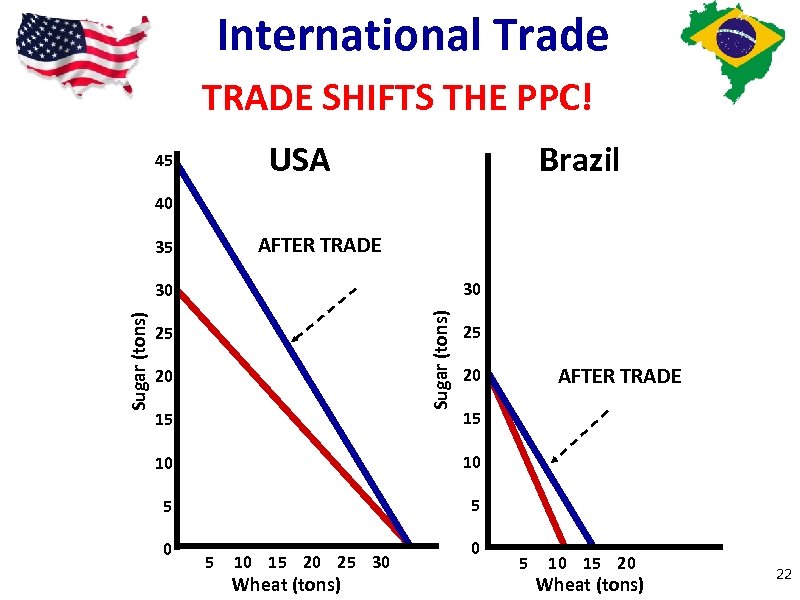

International Trade TRADE SHIFTS THE PPC! USA 45 Brazil 40 AFTER TRADE 35 30 Sugar (tons) 30 25 20 15 25 AFTER TRADE 20 15 10 10 5 5 0 5 10 15 20 25 30 Wheat (tons) 0 5 10 15 20 Wheat (tons) 22

International Trade TRADE SHIFTS THE PPC! USA 45 Brazil 40 AFTER TRADE 35 30 Sugar (tons) 30 25 20 15 25 AFTER TRADE 20 15 10 10 5 5 0 5 10 15 20 25 30 Wheat (tons) 0 5 10 15 20 Wheat (tons) 22

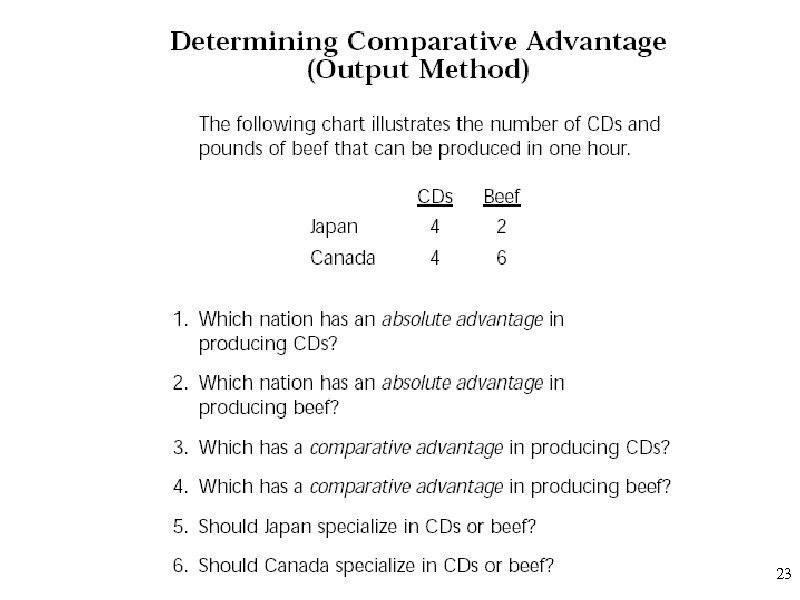

23

23

Demand • Consumers’ willingness AND ability to buy an item at a given price *a behavior The Law of Demand • Price determines quantity demanded • inversely related • lower price = higher quantity demanded

Demand • Consumers’ willingness AND ability to buy an item at a given price *a behavior The Law of Demand • Price determines quantity demanded • inversely related • lower price = higher quantity demanded

1. Income Effect o More money = ? 2. Substitution Effect o when apples are expensive & their substitutes (pears) are relatively cheaper, I buy less apples & more pears 3. Diminishing Marginal Utility o each additional unit gives less marginal utility (“happy points”)

1. Income Effect o More money = ? 2. Substitution Effect o when apples are expensive & their substitutes (pears) are relatively cheaper, I buy less apples & more pears 3. Diminishing Marginal Utility o each additional unit gives less marginal utility (“happy points”)

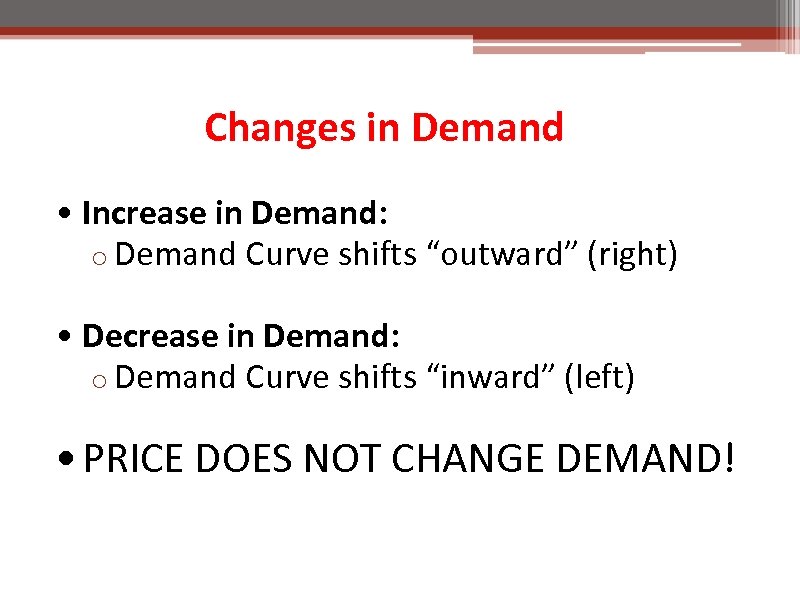

Changes in Demand • Increase in Demand: o Demand Curve shifts “outward” (right) • Decrease in Demand: o Demand Curve shifts “inward” (left) • PRICE DOES NOT CHANGE DEMAND!

Changes in Demand • Increase in Demand: o Demand Curve shifts “outward” (right) • Decrease in Demand: o Demand Curve shifts “inward” (left) • PRICE DOES NOT CHANGE DEMAND!

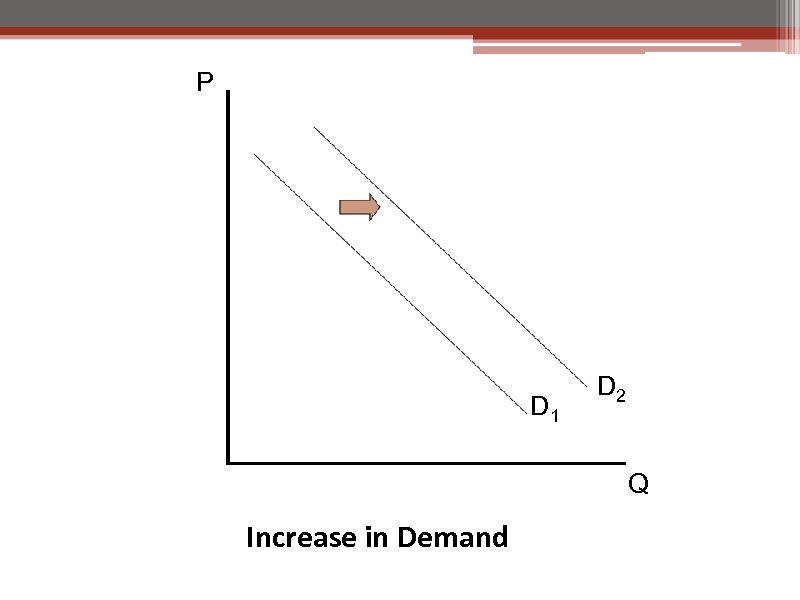

P D 1 D 2 Q Increase in Demand

P D 1 D 2 Q Increase in Demand

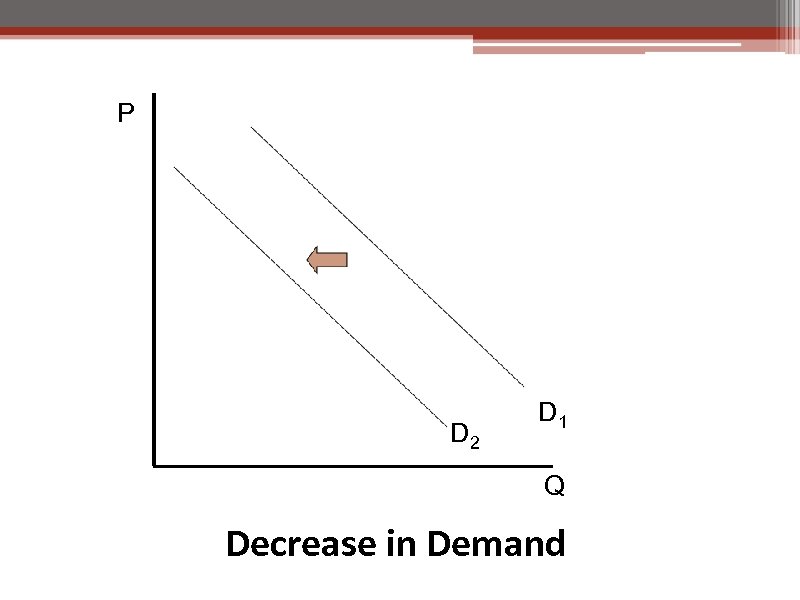

P D 2 D 1 Q Decrease in Demand

P D 2 D 1 Q Decrease in Demand

Changes in Demand: “T. R. I. P. E. ” • Demand curve SHIFT: o Tastes & Preferences o Related Goods (complements & substitutes) o Income o Population o Expectations

Changes in Demand: “T. R. I. P. E. ” • Demand curve SHIFT: o Tastes & Preferences o Related Goods (complements & substitutes) o Income o Population o Expectations

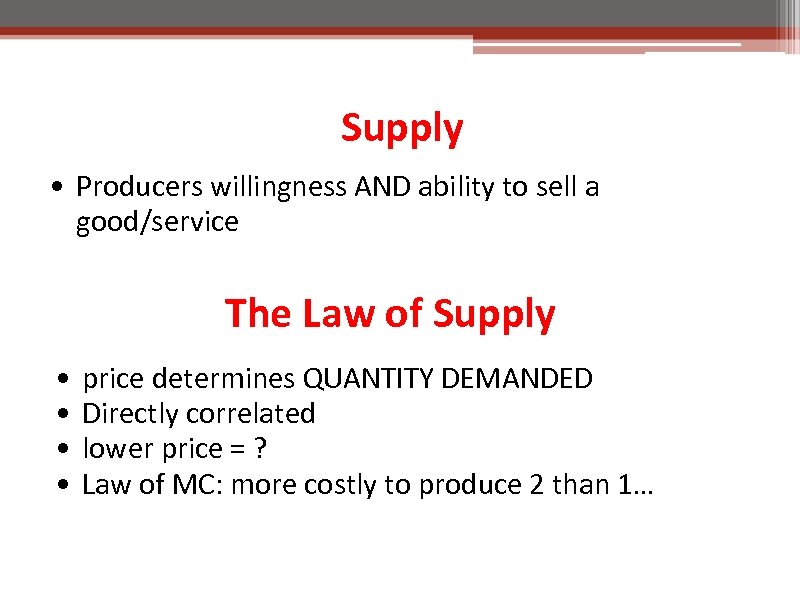

Supply • Producers willingness AND ability to sell a good/service The Law of Supply • • price determines QUANTITY DEMANDED Directly correlated lower price = ? Law of MC: more costly to produce 2 than 1…

Supply • Producers willingness AND ability to sell a good/service The Law of Supply • • price determines QUANTITY DEMANDED Directly correlated lower price = ? Law of MC: more costly to produce 2 than 1…

Changes in Supply • Increase in Supply o Supply Curve shifts outward • Decrease in Supply o Supply Curve shifts inward • PRICE DOES NOT CHANGE SUPPLY!

Changes in Supply • Increase in Supply o Supply Curve shifts outward • Decrease in Supply o Supply Curve shifts inward • PRICE DOES NOT CHANGE SUPPLY!

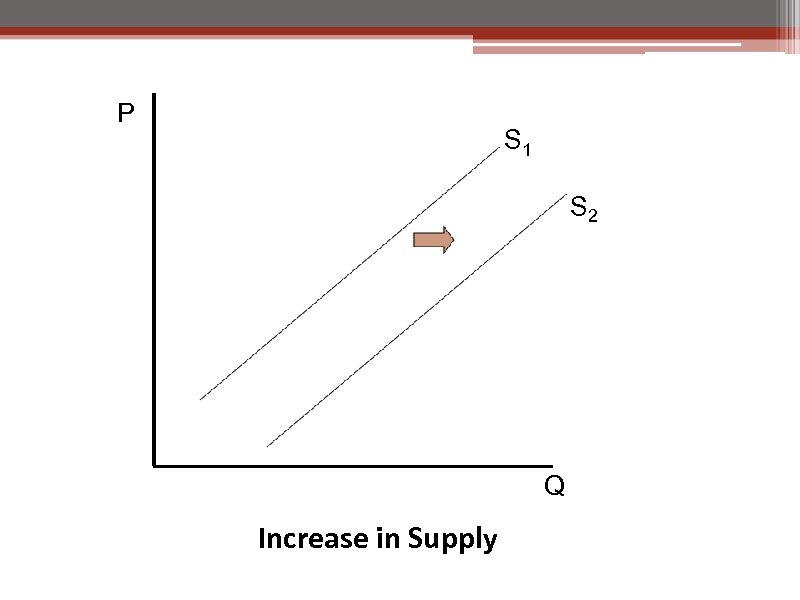

P S 1 S 2 Q Increase in Supply

P S 1 S 2 Q Increase in Supply

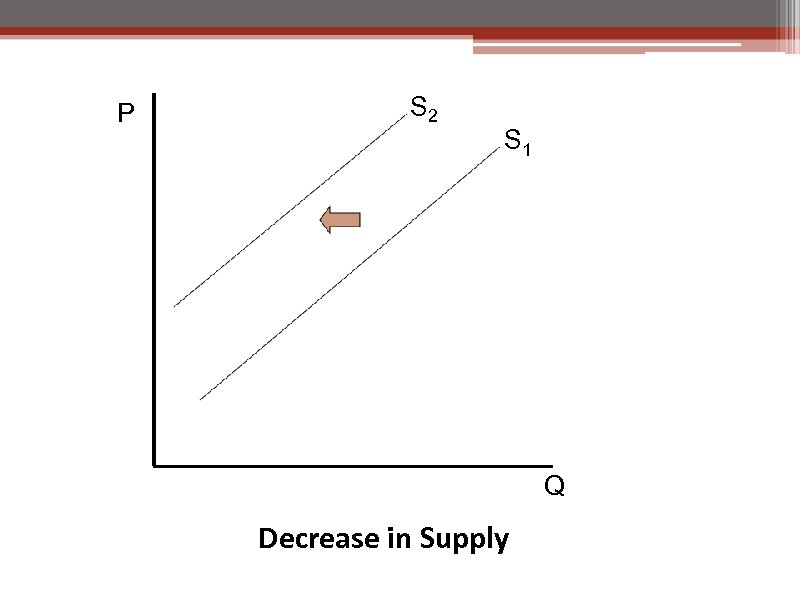

P S 2 S 1 Q Decrease in Supply

P S 2 S 1 Q Decrease in Supply

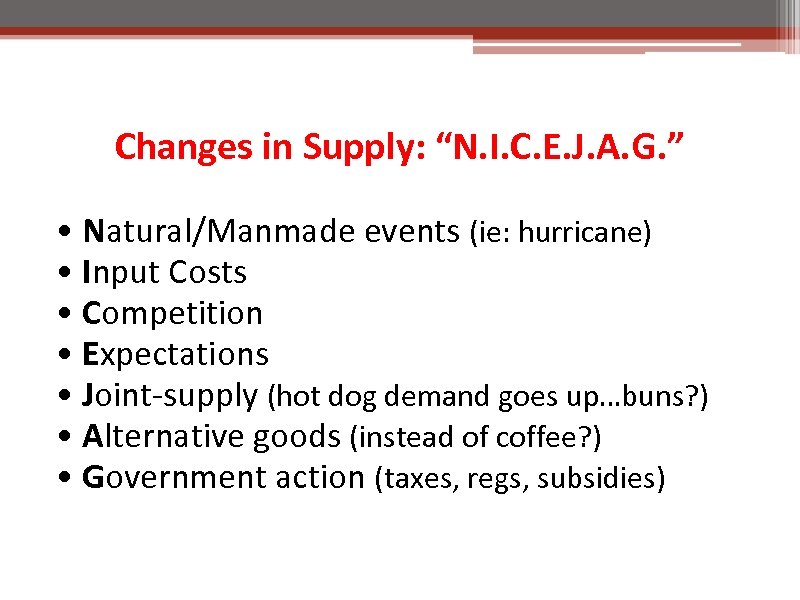

Changes in Supply: “N. I. C. E. J. A. G. ” • Natural/Manmade events (ie: hurricane) • Input Costs • Competition • Expectations • Joint-supply (hot dog demand goes up…buns? ) • Alternative goods (instead of coffee? ) • Government action (taxes, regs, subsidies)

Changes in Supply: “N. I. C. E. J. A. G. ” • Natural/Manmade events (ie: hurricane) • Input Costs • Competition • Expectations • Joint-supply (hot dog demand goes up…buns? ) • Alternative goods (instead of coffee? ) • Government action (taxes, regs, subsidies)

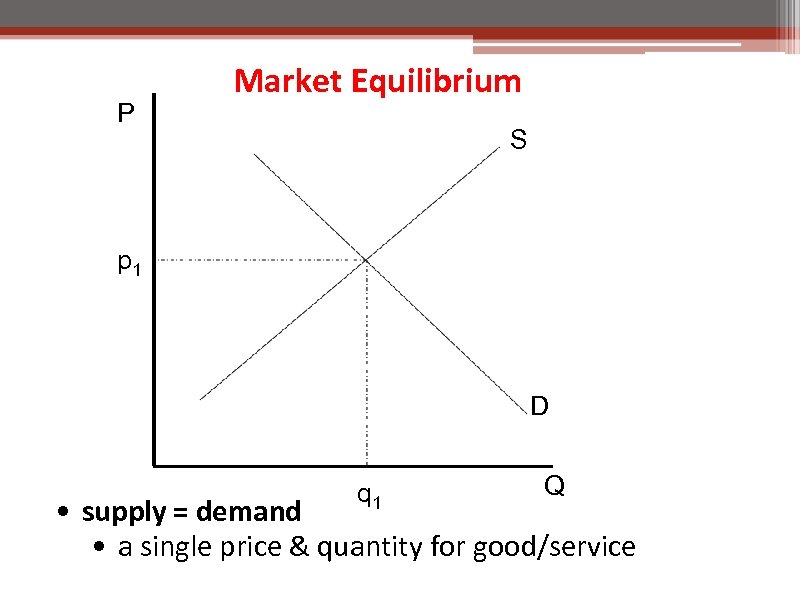

P Market Equilibrium S p 1 D q 1 Q • supply = demand • a single price & quantity for good/service

P Market Equilibrium S p 1 D q 1 Q • supply = demand • a single price & quantity for good/service

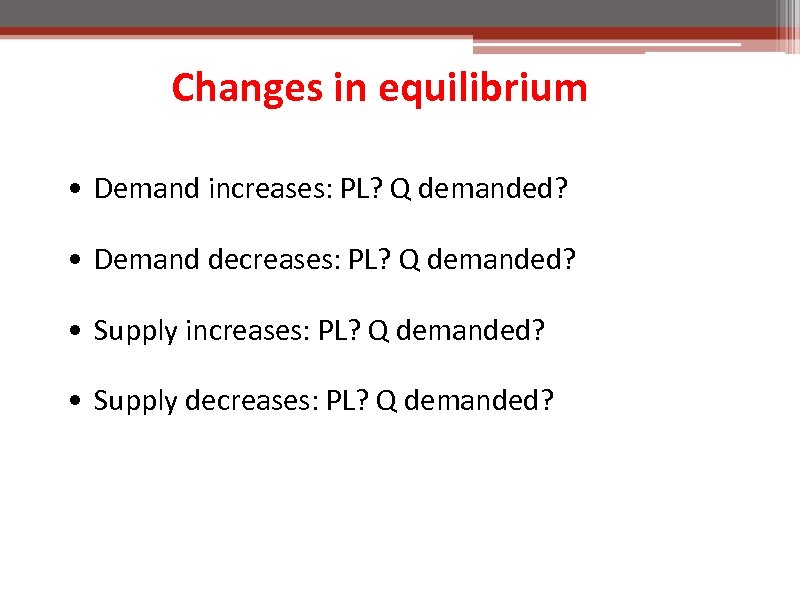

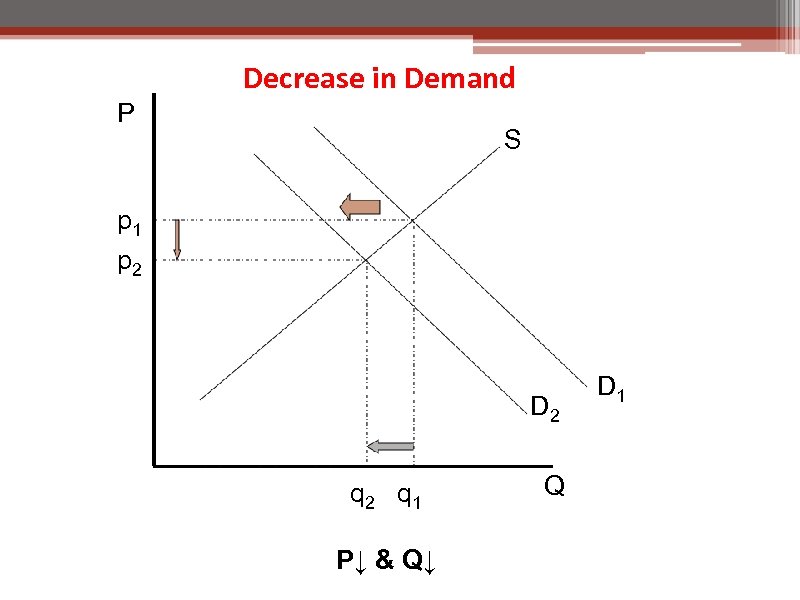

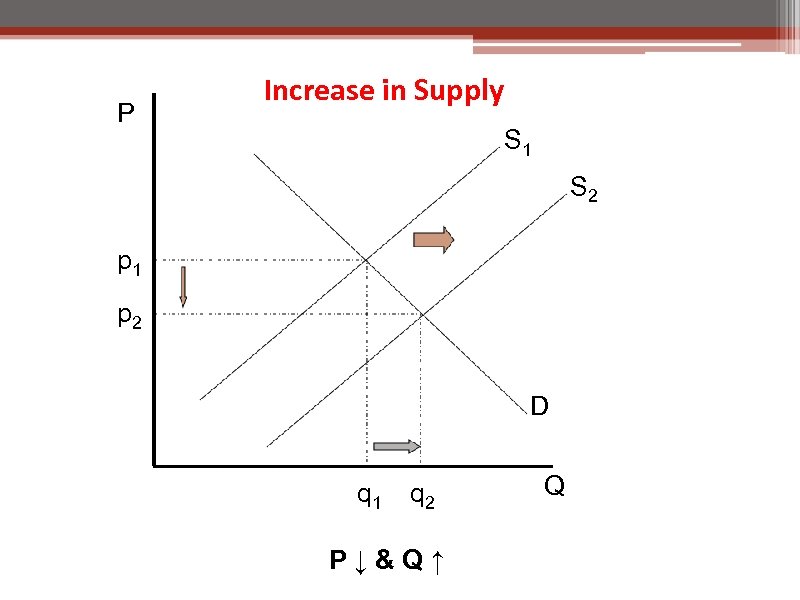

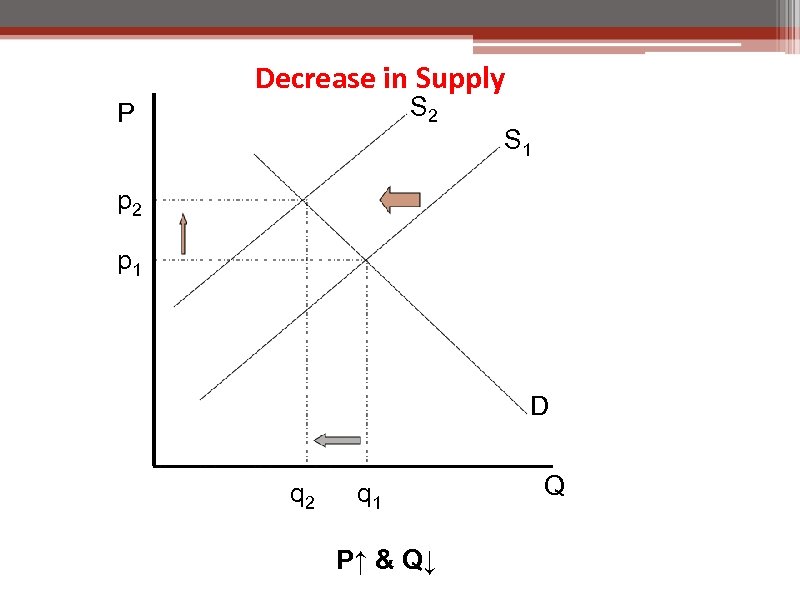

Changes in equilibrium • Demand increases: PL? Q demanded? • Demand decreases: PL? Q demanded? • Supply increases: PL? Q demanded? • Supply decreases: PL? Q demanded?

Changes in equilibrium • Demand increases: PL? Q demanded? • Demand decreases: PL? Q demanded? • Supply increases: PL? Q demanded? • Supply decreases: PL? Q demanded?

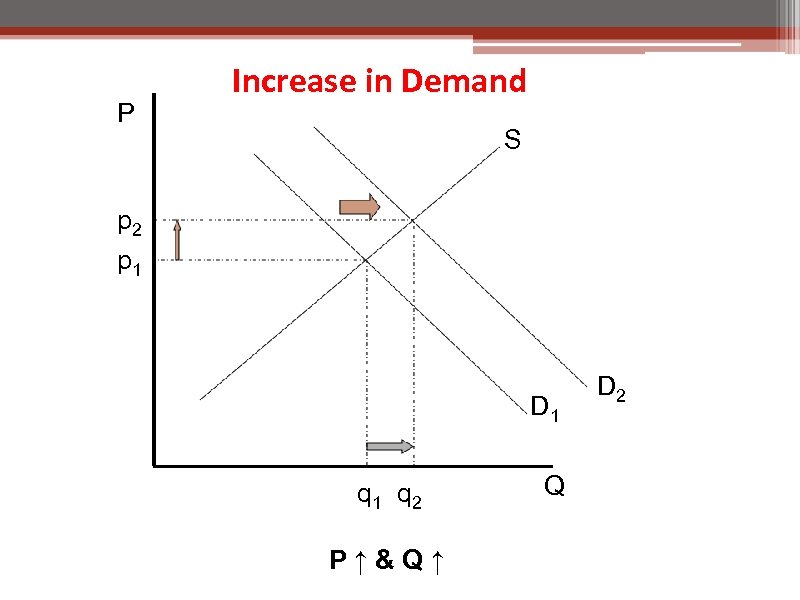

P Increase in Demand S p 2 p 1 D 1 q 2 P↑&Q↑ Q D 2

P Increase in Demand S p 2 p 1 D 1 q 2 P↑&Q↑ Q D 2

Decrease in Demand P S p 1 p 2 D 2 q 1 P↓ & Q↓ Q D 1

Decrease in Demand P S p 1 p 2 D 2 q 1 P↓ & Q↓ Q D 1

P Increase in Supply S 1 S 2 p 1 p 2 D q 1 q 2 P↓&Q↑ Q

P Increase in Supply S 1 S 2 p 1 p 2 D q 1 q 2 P↓&Q↑ Q

Decrease in Supply S 2 P S 1 p 2 p 1 D q 2 q 1 P↑ & Q↓ Q

Decrease in Supply S 2 P S 1 p 2 p 1 D q 2 q 1 P↑ & Q↓ Q

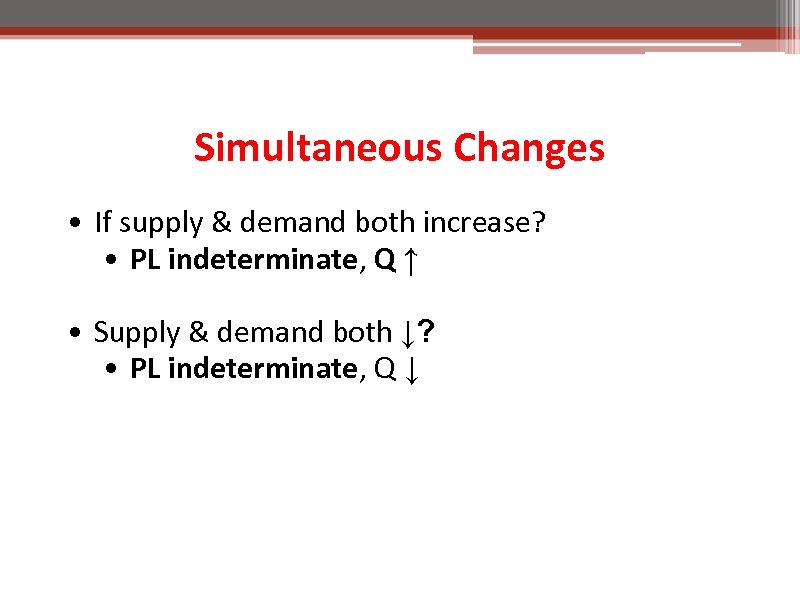

Simultaneous Changes • If supply & demand both increase? • PL indeterminate, Q ↑ • Supply & demand both ↓? • PL indeterminate, Q ↓

Simultaneous Changes • If supply & demand both increase? • PL indeterminate, Q ↑ • Supply & demand both ↓? • PL indeterminate, Q ↓

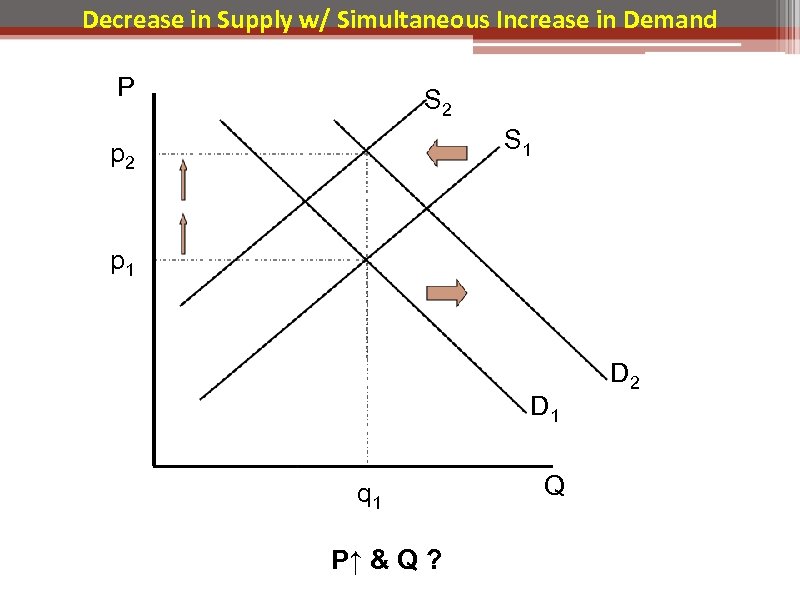

Decrease in Supply w/ Simultaneous Increase in Demand P S 2 S 1 p 2 p 1 D 1 q 1 P↑ & Q ? Q D 2

Decrease in Supply w/ Simultaneous Increase in Demand P S 2 S 1 p 2 p 1 D 1 q 1 P↑ & Q ? Q D 2

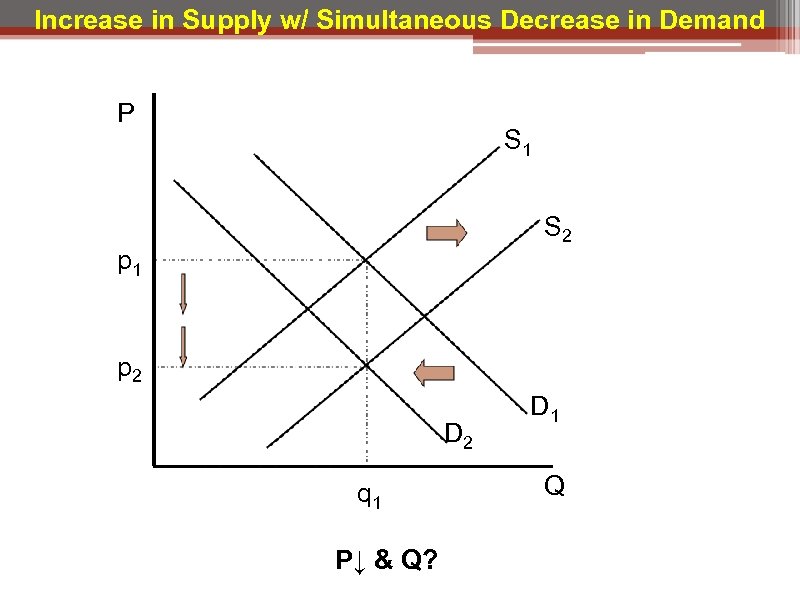

Increase in Supply w/ Simultaneous Decrease in Demand P S 1 S 2 p 1 p 2 D 2 q 1 P↓ & Q? D 1 Q

Increase in Supply w/ Simultaneous Decrease in Demand P S 1 S 2 p 1 p 2 D 2 q 1 P↓ & Q? D 1 Q

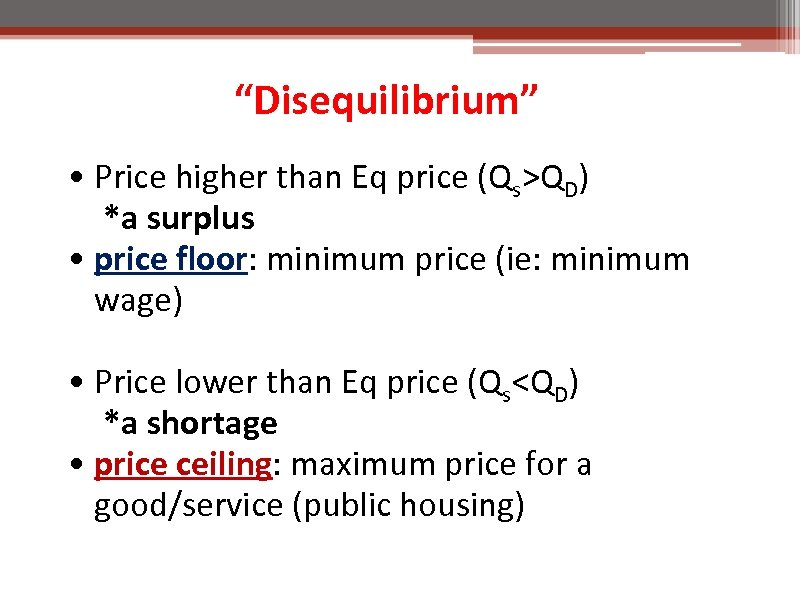

“Disequilibrium” • Price higher than Eq price (Qs>QD) *a surplus • price floor: minimum price (ie: minimum wage) • Price lower than Eq price (Qs

“Disequilibrium” • Price higher than Eq price (Qs>QD) *a surplus • price floor: minimum price (ie: minimum wage) • Price lower than Eq price (Qs

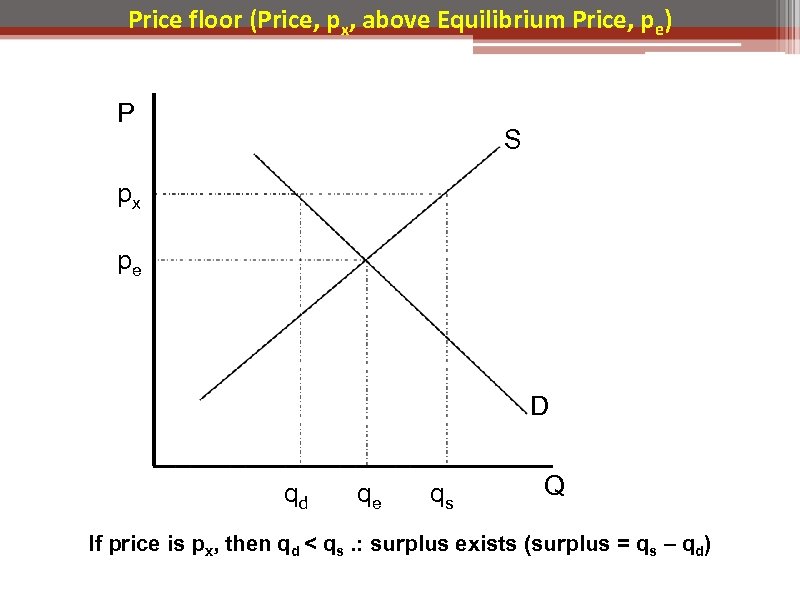

Price floor (Price, px, above Equilibrium Price, pe) P S px pe D qd qe qs Q If price is px, then qd < qs. : surplus exists (surplus = qs – qd)

Price floor (Price, px, above Equilibrium Price, pe) P S px pe D qd qe qs Q If price is px, then qd < qs. : surplus exists (surplus = qs – qd)

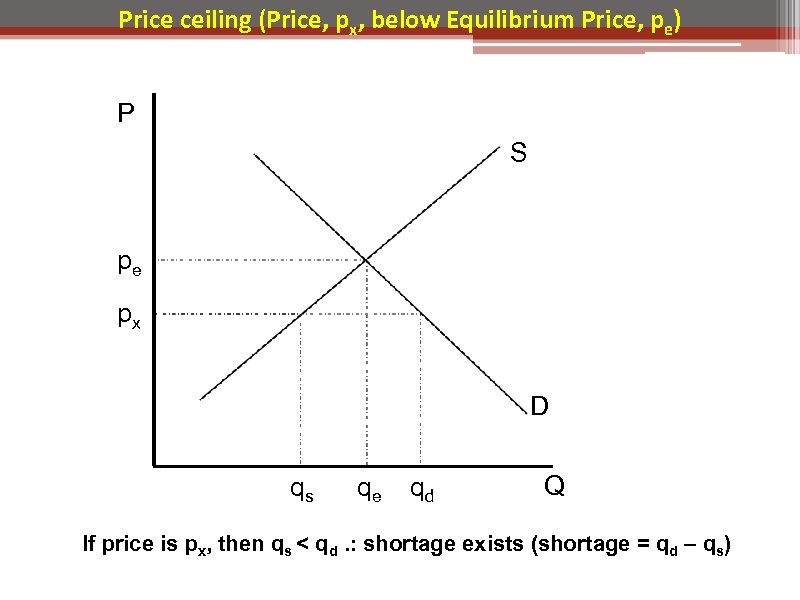

Price ceiling (Price, px, below Equilibrium Price, pe) P S pe px D qs qe qd Q If price is px, then qs < qd. : shortage exists (shortage = qd – qs)

Price ceiling (Price, px, below Equilibrium Price, pe) P S pe px D qs qe qd Q If price is px, then qs < qd. : shortage exists (shortage = qd – qs)

Unit 2: Macro Measures 47

Unit 2: Macro Measures 47

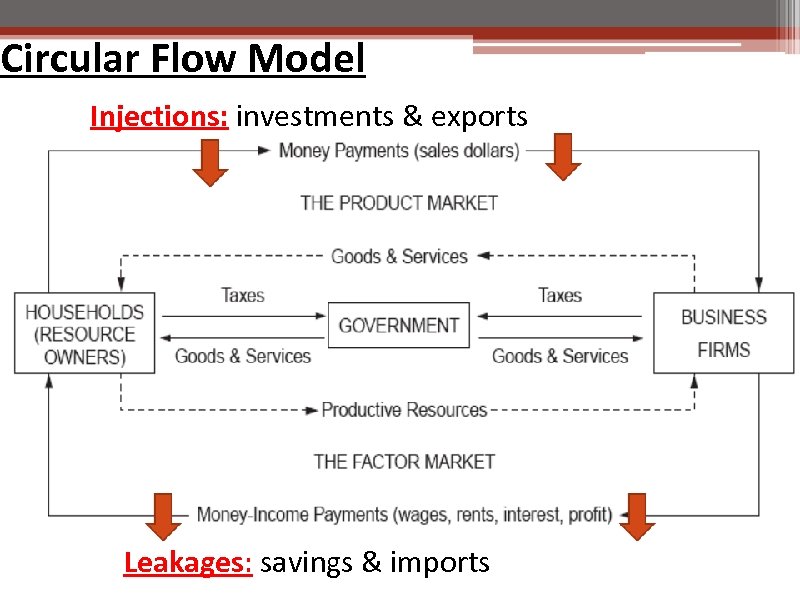

Circular Flow Model Injections: investments & exports Leakages: savings & imports

Circular Flow Model Injections: investments & exports Leakages: savings & imports

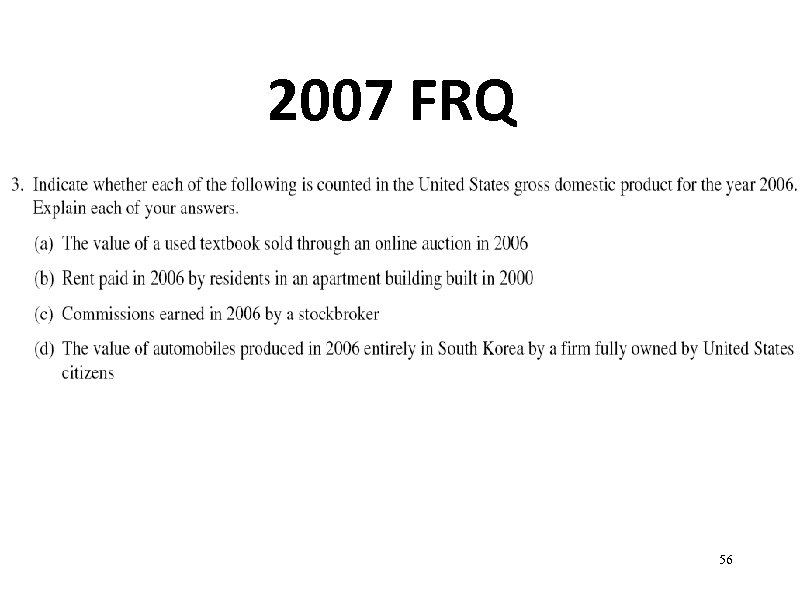

Gross Domestic Product (GDP) • market value of ALL final goods/services in a nation in a year Not Counted? : • used goods • intermediate goods • non-market production • stocks, bonds, CD’s • transfer payments (ie: welfare) • ‘black market’

Gross Domestic Product (GDP) • market value of ALL final goods/services in a nation in a year Not Counted? : • used goods • intermediate goods • non-market production • stocks, bonds, CD’s • transfer payments (ie: welfare) • ‘black market’

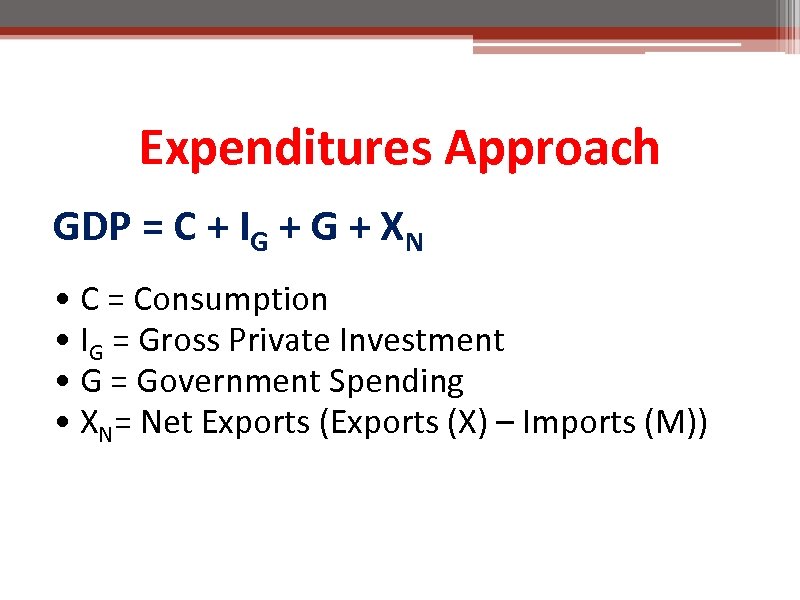

Expenditures Approach GDP = C + IG + XN • C = Consumption • IG = Gross Private Investment • G = Government Spending • XN= Net Exports (X) – Imports (M))

Expenditures Approach GDP = C + IG + XN • C = Consumption • IG = Gross Private Investment • G = Government Spending • XN= Net Exports (X) – Imports (M))

Consumption • C = largest component of GDP o durable goods (cars, appliances) o non-durable goods (food, clothing) o services

Consumption • C = largest component of GDP o durable goods (cars, appliances) o non-durable goods (food, clothing) o services

Gross Private Investment • to increase future output or productivity o capital o new construction o change in inventories

Gross Private Investment • to increase future output or productivity o capital o new construction o change in inventories

Net Exports • X–M • exports = injection • imports= leakage

Net Exports • X–M • exports = injection • imports= leakage

The Income Approach • W + I + R + P Wages + Interest + Rent + Profits

The Income Approach • W + I + R + P Wages + Interest + Rent + Profits

Nominal v. Real GDP • Nominal GDP: current GDP at current prices o may overstate value of production! • Real GDP: GDP measured w/ a fixed dollar o takes into account INFLATION o year to year comparisons * GDP per capita provides a better measure of well-being than GDP

Nominal v. Real GDP • Nominal GDP: current GDP at current prices o may overstate value of production! • Real GDP: GDP measured w/ a fixed dollar o takes into account INFLATION o year to year comparisons * GDP per capita provides a better measure of well-being than GDP

2007 FRQ 56

2007 FRQ 56

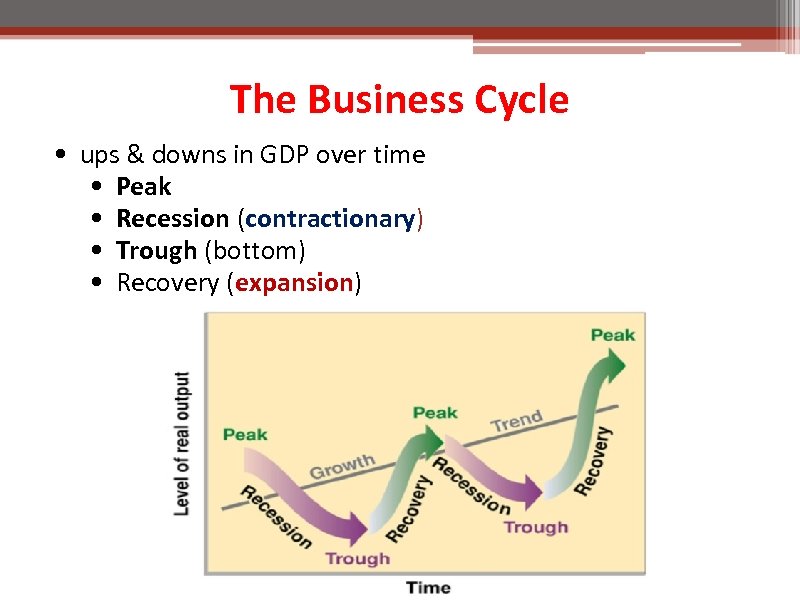

The Business Cycle • ups & downs in GDP over time • Peak • Recession (contractionary) • Trough (bottom) • Recovery (expansion)

The Business Cycle • ups & downs in GDP over time • Peak • Recession (contractionary) • Trough (bottom) • Recovery (expansion)

CONSUMER PRICE INDEX • CPI: measure of overall cost of goods/services • monitors inflation • CPI “BASKET” does NOT CONTAIN ALL FINAL GOODS/SERVICES! • CPI computed by dividing price of basket in one year by price in base year & multiplying by 100

CONSUMER PRICE INDEX • CPI: measure of overall cost of goods/services • monitors inflation • CPI “BASKET” does NOT CONTAIN ALL FINAL GOODS/SERVICES! • CPI computed by dividing price of basket in one year by price in base year & multiplying by 100

Inflation = (CPI Year 2 – CPI Year 1)/CPI Year 1 GDP “Deflator” = Nominal GDP/REAL GDP x 100

Inflation = (CPI Year 2 – CPI Year 1)/CPI Year 1 GDP “Deflator” = Nominal GDP/REAL GDP x 100

Real & Nominal Interest Rates • nominal interest rate: not adjusted for inflation o rate a bank pays • real interest rate: adjusted for inflation Real Interest Rrate = nominal interest rate – inflation Nominal interest rate 15%. During the year inflation was 10%. What is the real interest rate? Real = 15% - 10% Real = 5%

Real & Nominal Interest Rates • nominal interest rate: not adjusted for inflation o rate a bank pays • real interest rate: adjusted for inflation Real Interest Rrate = nominal interest rate – inflation Nominal interest rate 15%. During the year inflation was 10%. What is the real interest rate? Real = 15% - 10% Real = 5%

Unemployment • Labor force: § % of working age population • Employed: o 16 yrs & older w/ a job o part-time or full-time • Unemployed: o actively searched for a job in last 2 weeks o Unemployment rate = # of unemployed / # of people in labor force • Not in Labor Force: o Under 16, military, retired, stay home parent, fulltime students

Unemployment • Labor force: § % of working age population • Employed: o 16 yrs & older w/ a job o part-time or full-time • Unemployed: o actively searched for a job in last 2 weeks o Unemployment rate = # of unemployed / # of people in labor force • Not in Labor Force: o Under 16, military, retired, stay home parent, fulltime students

Types of Unemployment Frictional: o “between jobs”, new entrants, re-entrants Structural: o lack of skills or declining industry Cyclical: o o downturns in business cycle worse type Seasonal: o Migrant workers, holiday hiring

Types of Unemployment Frictional: o “between jobs”, new entrants, re-entrants Structural: o lack of skills or declining industry Cyclical: o o downturns in business cycle worse type Seasonal: o Migrant workers, holiday hiring

Full Employment • occurs when there is no cyclical unemp. • “Natural Rate of Unemployment” (NRU) o economy producing at full potential o U. S. NRU is approx. 4%-5% o FE & the PPC? • Okun’s Law: every 1% increase in the u% causes a 2% decline in Real GDP

Full Employment • occurs when there is no cyclical unemp. • “Natural Rate of Unemployment” (NRU) o economy producing at full potential o U. S. NRU is approx. 4%-5% o FE & the PPC? • Okun’s Law: every 1% increase in the u% causes a 2% decline in Real GDP

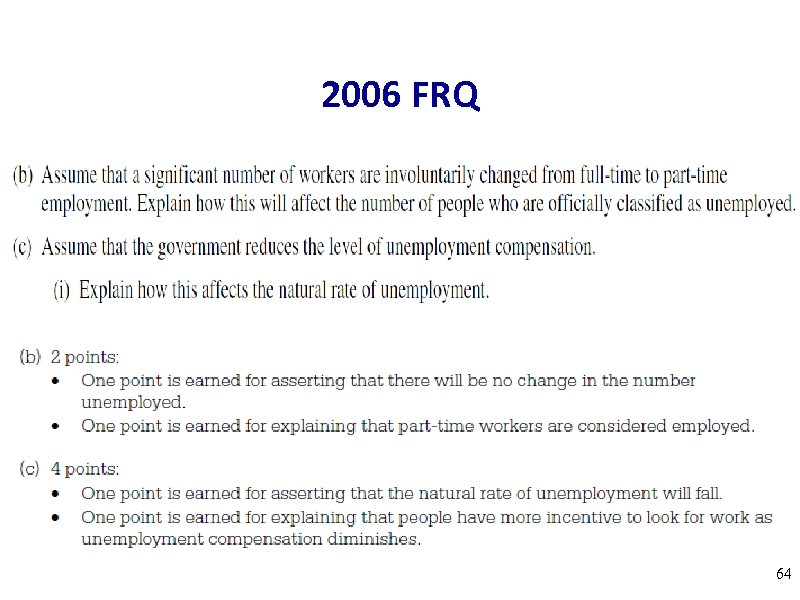

2006 FRQ 64

2006 FRQ 64

Disposable Income (DI) • DI = Gross Income – Taxes • households can either: o consume o save

Disposable Income (DI) • DI = Gross Income – Taxes • households can either: o consume o save

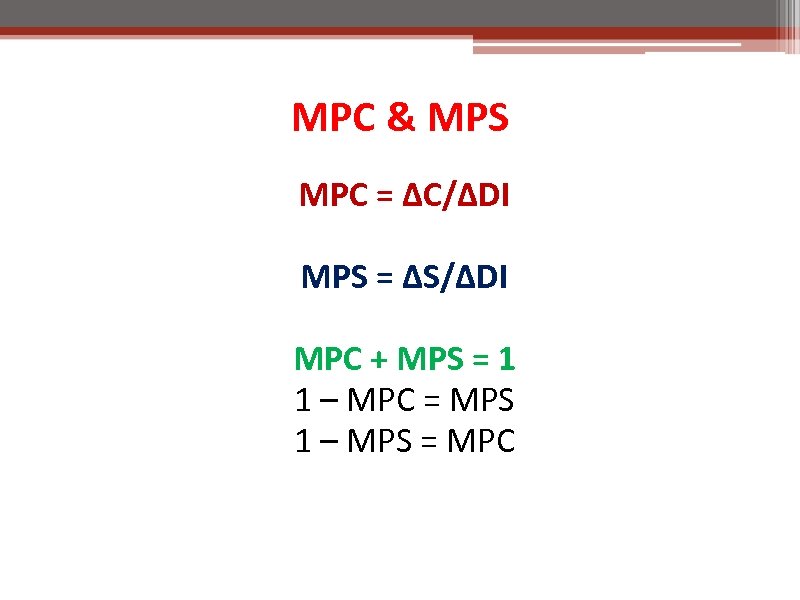

MPC & MPS MPC = ΔC/ΔDI MPS = ΔS/ΔDI MPC + MPS = 1 1 – MPC = MPS 1 – MPS = MPC

MPC & MPS MPC = ΔC/ΔDI MPS = ΔS/ΔDI MPC + MPS = 1 1 – MPC = MPS 1 – MPS = MPC

Determinants of C & S • Wealth o Increased wealth = ? • Expectations o Positive = ? • Household Debt o High Debt = ? • Taxes o Taxes Inc. = ?

Determinants of C & S • Wealth o Increased wealth = ? • Expectations o Positive = ? • Household Debt o High Debt = ? • Taxes o Taxes Inc. = ?

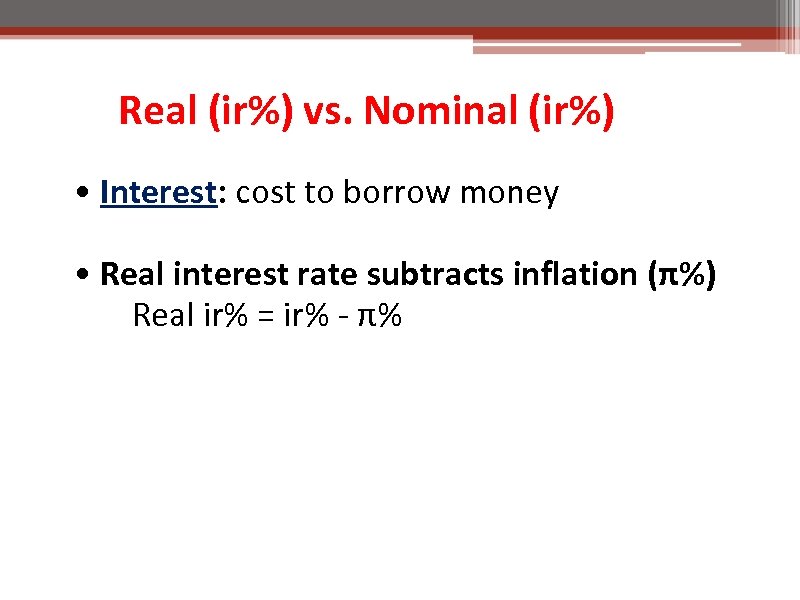

Real (ir%) vs. Nominal (ir%) • Interest: cost to borrow money • Real interest rate subtracts inflation (π%) Real ir% = ir% - π%

Real (ir%) vs. Nominal (ir%) • Interest: cost to borrow money • Real interest rate subtracts inflation (π%) Real ir% = ir% - π%

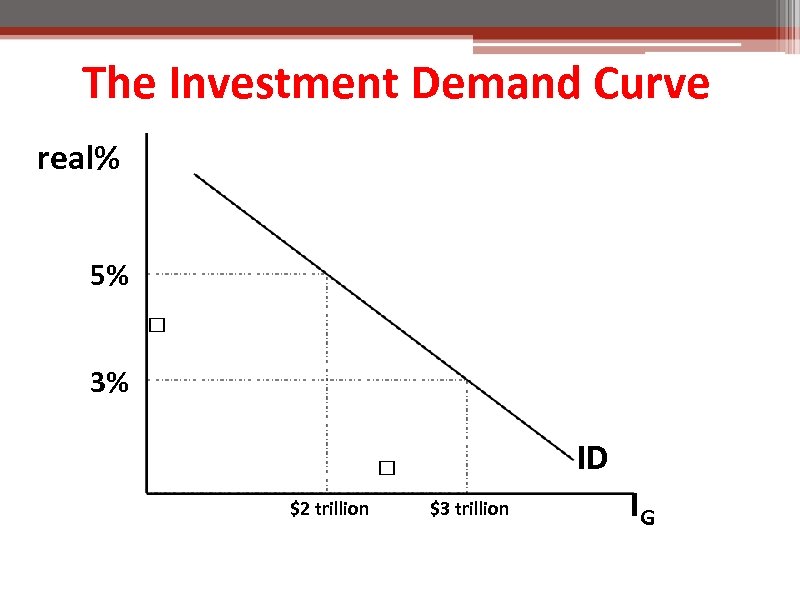

The Investment Demand Curve real% 5% 3% ID $2 trillion $3 trillion IG

The Investment Demand Curve real% 5% 3% ID $2 trillion $3 trillion IG

Loanable Funds Market • market where money is borrowed • borrowers: households, firms, gov’t

Loanable Funds Market • market where money is borrowed • borrowers: households, firms, gov’t

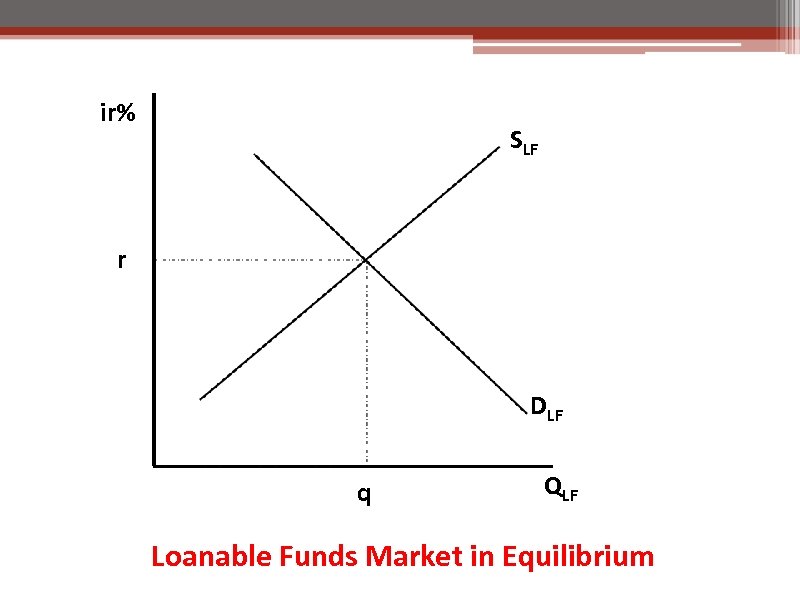

ir% SLF r DLF q QLF Loanable Funds Market in Equilibrium

ir% SLF r DLF q QLF Loanable Funds Market in Equilibrium

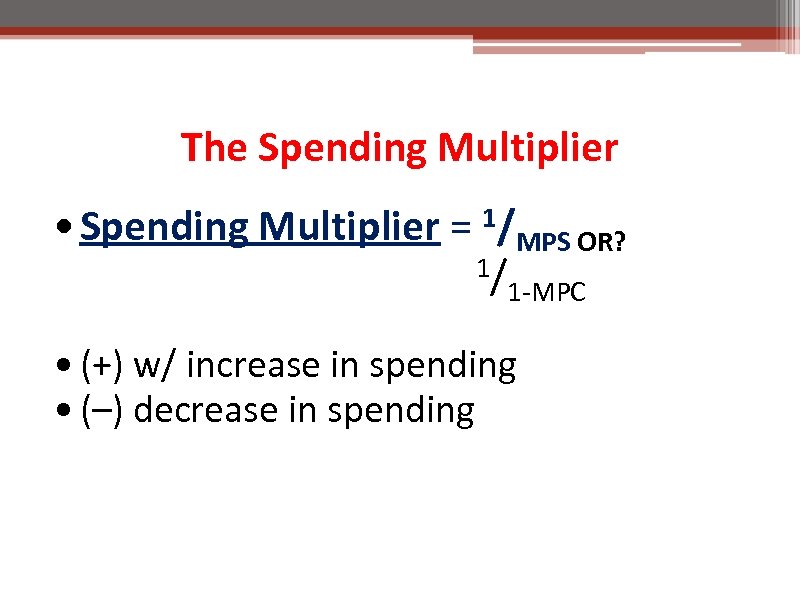

The Spending Multiplier • Spending Multiplier = 1/MPS OR? 1/ 1 -MPC • (+) w/ increase in spending • (–) decrease in spending

The Spending Multiplier • Spending Multiplier = 1/MPS OR? 1/ 1 -MPC • (+) w/ increase in spending • (–) decrease in spending

The Tax Multiplier • When gov’t taxes…multiplier works in reverse o money is leaving the circular flow o TAX CUT = higher multiplier

The Tax Multiplier • When gov’t taxes…multiplier works in reverse o money is leaving the circular flow o TAX CUT = higher multiplier

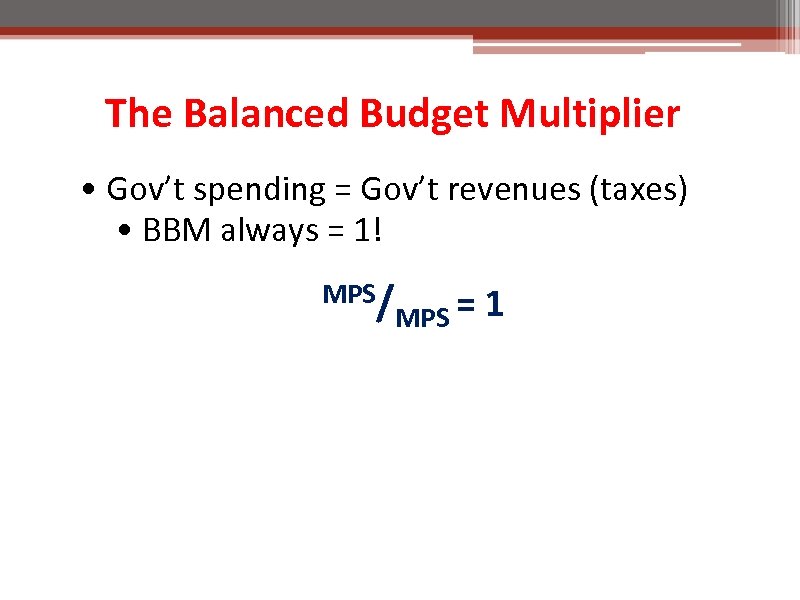

The Balanced Budget Multiplier • Gov’t spending = Gov’t revenues (taxes) • BBM always = 1! MPS/ MPS = 1

The Balanced Budget Multiplier • Gov’t spending = Gov’t revenues (taxes) • BBM always = 1! MPS/ MPS = 1