AOL_Case_Study_lecture3_.ppt

- Количество слайдов: 16

AOL Case Study Lecture 3: Accounting Analysis

AOL Case Study Lecture 3: Accounting Analysis

Questions 1. Was AOL’s policy to capitalise subscriber acquisition cost justified prior to 1995? 2. Given the changes in the industry do you think AOL should change its accounting policy as of 1995? 3. Is the company’s response consistent with your view?

Questions 1. Was AOL’s policy to capitalise subscriber acquisition cost justified prior to 1995? 2. Given the changes in the industry do you think AOL should change its accounting policy as of 1995? 3. Is the company’s response consistent with your view?

Questions 4. What would be the effect of writing off the capitalized acquisition costs on the balance sheet? 5. What would be the effect on the profit and loss account?

Questions 4. What would be the effect of writing off the capitalized acquisition costs on the balance sheet? 5. What would be the effect on the profit and loss account?

Capitalisation justified? n n n AOL spent considerable amounts of money on acquisition programs Critical success of AOLs Model Prior 1995 n n n Capitalised it subscriber acquisition costs Amortised over 18 months Assumed these costs recoverable from future benefits with reasonable certainty

Capitalisation justified? n n n AOL spent considerable amounts of money on acquisition programs Critical success of AOLs Model Prior 1995 n n n Capitalised it subscriber acquisition costs Amortised over 18 months Assumed these costs recoverable from future benefits with reasonable certainty

Capitalisation justified? n Analysis suggests: n n n Assumption justified prior to 1995 Could argue = critical economic asset Therefore mis-leading if asset not in balance sheet Conservatism plays a decisive role only if uncertainty is too great Analysts interested in capturing economic reality

Capitalisation justified? n Analysis suggests: n n n Assumption justified prior to 1995 Could argue = critical economic asset Therefore mis-leading if asset not in balance sheet Conservatism plays a decisive role only if uncertainty is too great Analysts interested in capturing economic reality

Change accounting policy? n Business analysis suggested: n n Risk of not recovering subscriber acquisition costs increased significantly by 1995 Write-off, capitalise = debatable

Change accounting policy? n Business analysis suggested: n n Risk of not recovering subscriber acquisition costs increased significantly by 1995 Write-off, capitalise = debatable

AOLs response n Extended amortisation period n n 18 months to 24 months Hard to justify given new economic reality Management = deliberately ignoring/ being aggressive? Real economic consequences? n n Capitalisation make less painful to spend $+ Even though risk increased Accounting policy may have real economic consequences Even if you see through the accounting

AOLs response n Extended amortisation period n n 18 months to 24 months Hard to justify given new economic reality Management = deliberately ignoring/ being aggressive? Real economic consequences? n n Capitalisation make less painful to spend $+ Even though risk increased Accounting policy may have real economic consequences Even if you see through the accounting

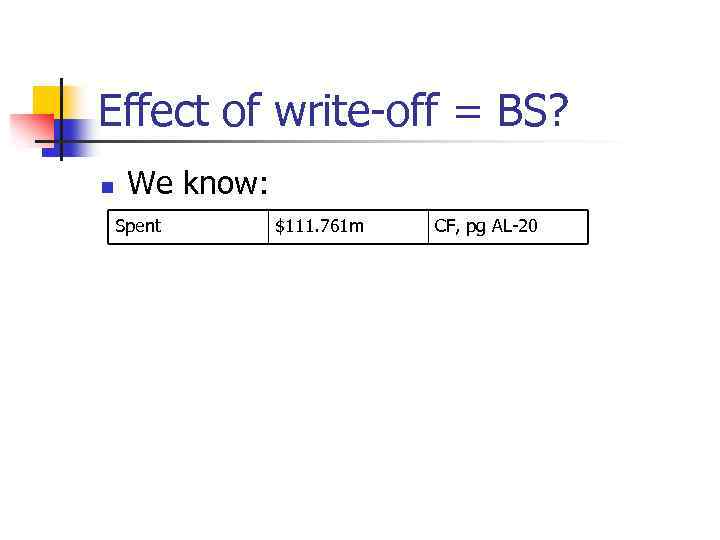

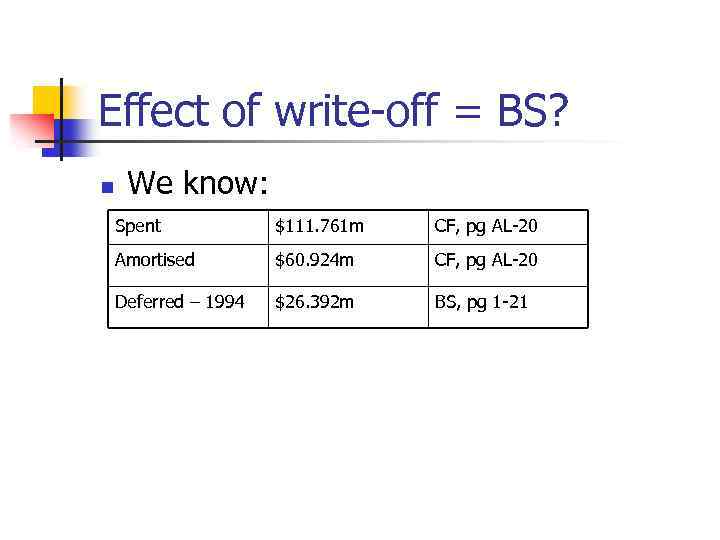

Effect of write-off = BS? n We know: Spent $111. 761 m CF, pg AL-20

Effect of write-off = BS? n We know: Spent $111. 761 m CF, pg AL-20

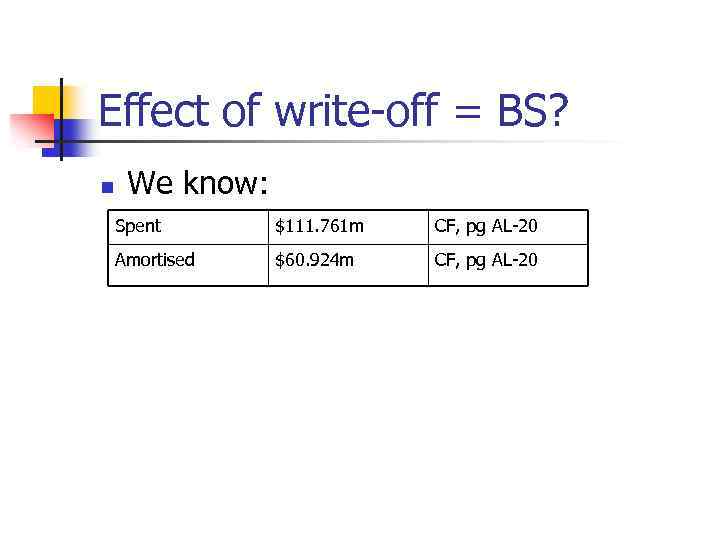

Effect of write-off = BS? n We know: Spent $111. 761 m CF, pg AL-20 Amortised $60. 924 m CF, pg AL-20

Effect of write-off = BS? n We know: Spent $111. 761 m CF, pg AL-20 Amortised $60. 924 m CF, pg AL-20

Effect of write-off = BS? n We know: Spent $111. 761 m CF, pg AL-20 Amortised $60. 924 m CF, pg AL-20 Deferred – 1994 $26. 392 m BS, pg 1 -21

Effect of write-off = BS? n We know: Spent $111. 761 m CF, pg AL-20 Amortised $60. 924 m CF, pg AL-20 Deferred – 1994 $26. 392 m BS, pg 1 -21

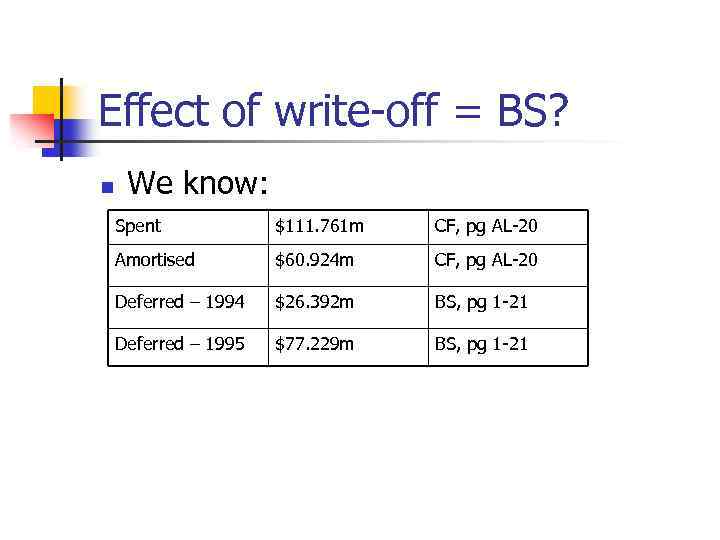

Effect of write-off = BS? n We know: Spent $111. 761 m CF, pg AL-20 Amortised $60. 924 m CF, pg AL-20 Deferred – 1994 $26. 392 m BS, pg 1 -21 Deferred – 1995 $77. 229 m BS, pg 1 -21

Effect of write-off = BS? n We know: Spent $111. 761 m CF, pg AL-20 Amortised $60. 924 m CF, pg AL-20 Deferred – 1994 $26. 392 m BS, pg 1 -21 Deferred – 1995 $77. 229 m BS, pg 1 -21

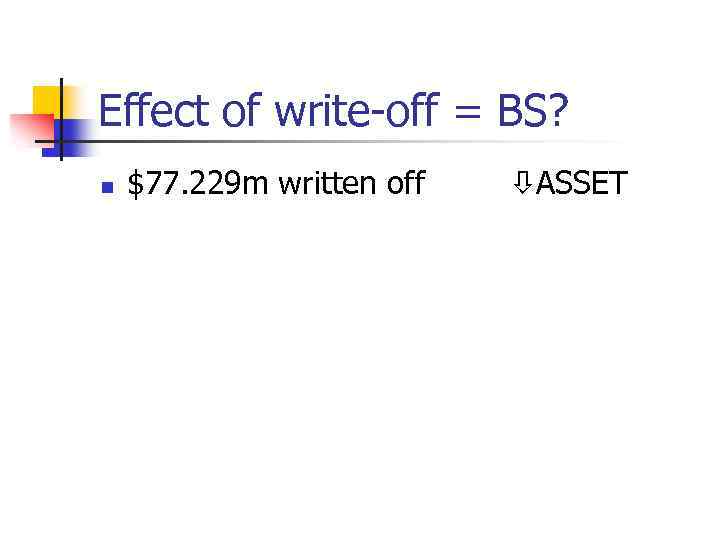

Effect of write-off = BS? n $77. 229 m written off ASSET

Effect of write-off = BS? n $77. 229 m written off ASSET

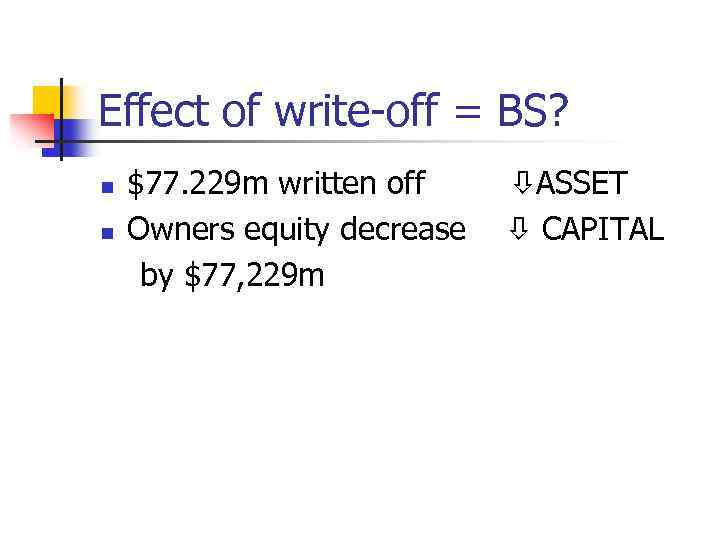

Effect of write-off = BS? n n $77. 229 m written off Owners equity decrease by $77, 229 m ASSET CAPITAL

Effect of write-off = BS? n n $77. 229 m written off Owners equity decrease by $77, 229 m ASSET CAPITAL

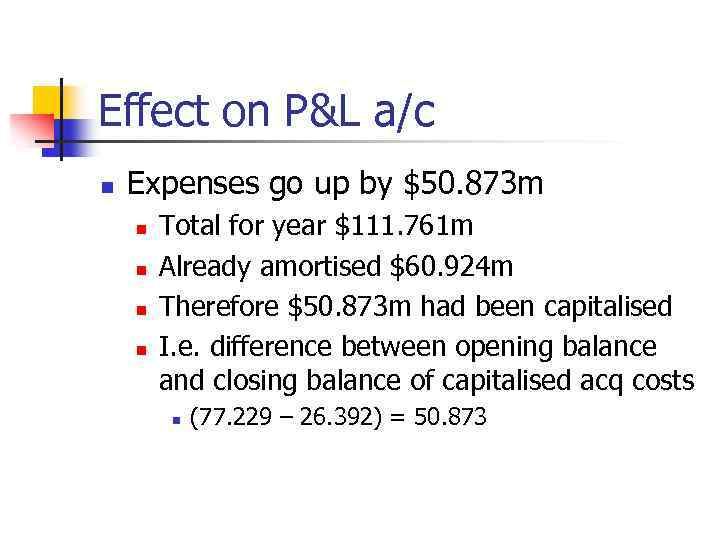

Effect on P&L a/c n Expenses go up by $50. 873 m n n Total for year $111. 761 m Already amortised $60. 924 m Therefore $50. 873 m had been capitalised I. e. difference between opening balance and closing balance of capitalised acq costs n (77. 229 – 26. 392) = 50. 873

Effect on P&L a/c n Expenses go up by $50. 873 m n n Total for year $111. 761 m Already amortised $60. 924 m Therefore $50. 873 m had been capitalised I. e. difference between opening balance and closing balance of capitalised acq costs n (77. 229 – 26. 392) = 50. 873

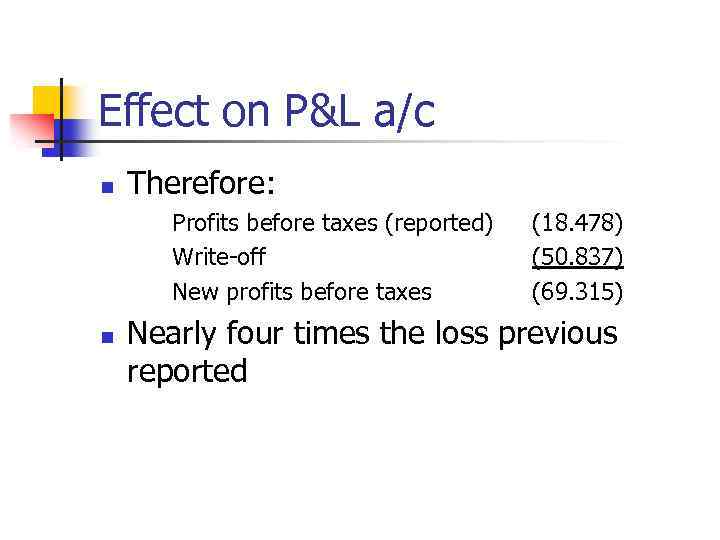

Effect on P&L a/c n Therefore: Profits before taxes (reported) Write-off New profits before taxes n (18. 478) (50. 837) (69. 315) Nearly four times the loss previous reported

Effect on P&L a/c n Therefore: Profits before taxes (reported) Write-off New profits before taxes n (18. 478) (50. 837) (69. 315) Nearly four times the loss previous reported

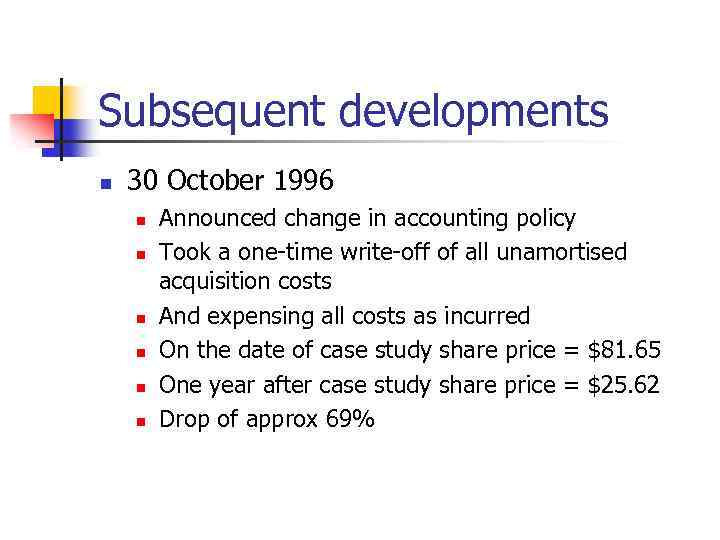

Subsequent developments n 30 October 1996 n n n Announced change in accounting policy Took a one-time write-off of all unamortised acquisition costs And expensing all costs as incurred On the date of case study share price = $81. 65 One year after case study share price = $25. 62 Drop of approx 69%

Subsequent developments n 30 October 1996 n n n Announced change in accounting policy Took a one-time write-off of all unamortised acquisition costs And expensing all costs as incurred On the date of case study share price = $81. 65 One year after case study share price = $25. 62 Drop of approx 69%