f1cb643f8b294663f4d91475aae0d1d3.ppt

- Количество слайдов: 41

Answering Questions about The Public’s Finances: All About Taking and Spending Other People’s Money Robert P. Strauss Carnegie Mellon University A BRASS Presentation June 26, 2006 New Orleans Convention Center 1

“To do what’s right is easy, to know what’s right is hard to do. ---LBJ Introduction • • • About the LBJ Quote The Public’s Finances (PF) are Interesting The Public’s Finances (PF) are Controversial Goals of Presentation: – Framework for Answering Patrons’ Questions about PF – Provide Resources and Counter-Questions to Patrons Questions about PF 2

Outline of Presentation Part 1: Some Personal Disclosures that Prove I like Librarians Part 2: Explaining the Budget Equation Part 3: Counting Government: Numbers, Behaviors, and Distortions Part 4: Normative Perspectives on Public’s Finances: Burden vs. Incidence Part 5: What should Government Do, When? Part 6: Goals of a Good Tax System and Tradeoffs Part 7: Federal, State, and Local Budgets Part 8: Summing it Up 3

Part 1: Why I like Reference Librarians and Some Personal Disclosures • Native of Cleveland, Devoted Patron of Cleveland Public Library • Getting the First Presidential Pen and Exceptional Service Medal – October 1972 and Philadelphia – Murray Weidenbaum, Revenue Sharing and me – Deputy Secretary Charls E. Walker and me – Ned Gramlich and me – Pat Moynihan and me – The Ways and Means Setting • Motivating Wilbur Mills • Answering Congressman Byrnes, R-Wisconsin Revenue Sharing and Nazi Germany (!) 4

Part 1 (cont. ): Robert Strauss is Courageous and the Virtue of Speaking Up (for a while) • Defending Cong. Charles Rangel from NYC Banks – July, 1975, NYC Finances and me – NYC Bailout Policy Proposal: Let the Pension Funds do it – 15% vs. 35% and Just Desserts – The Setting: LHOB, First Floor, Cong. Rangel’s Office – The Worry from Chemical Bank’s Governmental Affairs Person – My Question from the Back of the Room – The Shriek – The Threat – The outcomes: Rangel didn’t give away the store Everybody learned who I was 5

Part 1 (cont. ): Some Other Disclosures • What UNC-CH did and did not do for me • What CMU did for me • Generally Admitted Life Long Fiscal Social Worker – Pa. , West Virginia, Washington State, New York, NJ, DC, Ark. , Illinois, Allegheny County, Pittsburgh Battered Parent of 3 Owner of a Fleet of 5 (See True Red Chronicles III) See: http: //www. andrew. cmu. edu/user/rs 9 f/True_red_III_1_30_06. pdf See: http: //www. andrew. cmu. edu/user/rs 9 f 6

Part 2: Explaining the Budget Equation Defining Public Finance and my Basic Teaching Tool 7

Part 2 (cont): Explaining the Budget Equation I • The Colonial Club, Constitutions, and the Admissions Decision • Constitutional Similarities: Bi-Cameral, Fixed Term, Governor to Legislature to Signing Ceremony • Committee Structure; Ways and Means to Senate to Conference to the President • Today’s Journey: Follow the Money • The Fundamental Budget Problem ______________________________ Public Spending t ≡ Taxes t + Fees t + Transfers t + Δ in Net Worth t 8

Part 2 (cont): Explaining the Budget Equation II • About Public Spending by Type: – Operations – Capital • About Public Spending by Purpose: – Direct Payments to People – Payments to Organizations • About Public Spending by Level of Government (What’s a Transfer? ): – Federal Direct to People – Federal Indirect to People: Fed to State to People; Fed to Local etc. – State to Local 9

Part 2 (cont): Explaining the Budget Equation III Financing Public Spending • What are taxes? The Census Definition Taxes on Flows: Examples Taxes on Balance Sheets : Examples • What are Fees? • What are Transfers? • What is Change in Net Worth? Financial Engineering and Hanky Printing Money to Pay for Public Spending 10

Part 3: Counting Government, Numbers, Behaviors, and Distortions • Patron Query 1: how many governments are there in the US? • Reference Desk Response 1: What do you mean by a government? Census definition of a government: legal entity, the power to tax, elects officials Quiz Question: Is the Red Cross a Government? Kinds of Governments: Federal, State, Local (Counties, Cities, Townships, Special Districts and Authorities 11

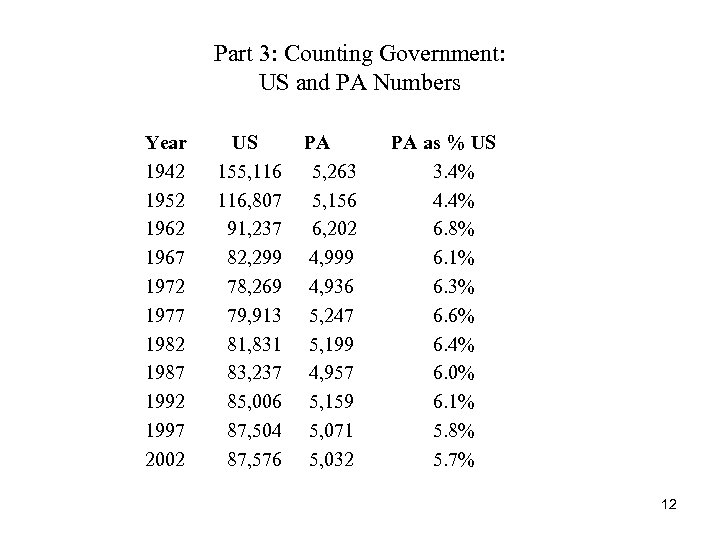

Part 3: Counting Government: US and PA Numbers Year 1942 1952 1967 1972 1977 1982 1987 1992 1997 2002 US 155, 116, 807 91, 237 82, 299 78, 269 79, 913 81, 831 83, 237 85, 006 87, 504 87, 576 PA 5, 263 5, 156 6, 202 4, 999 4, 936 5, 247 5, 199 4, 957 5, 159 5, 071 5, 032 PA as % US 3. 4% 4. 4% 6. 8% 6. 1% 6. 3% 6. 6% 6. 4% 6. 0% 6. 1% 5. 8% 5. 7% 12

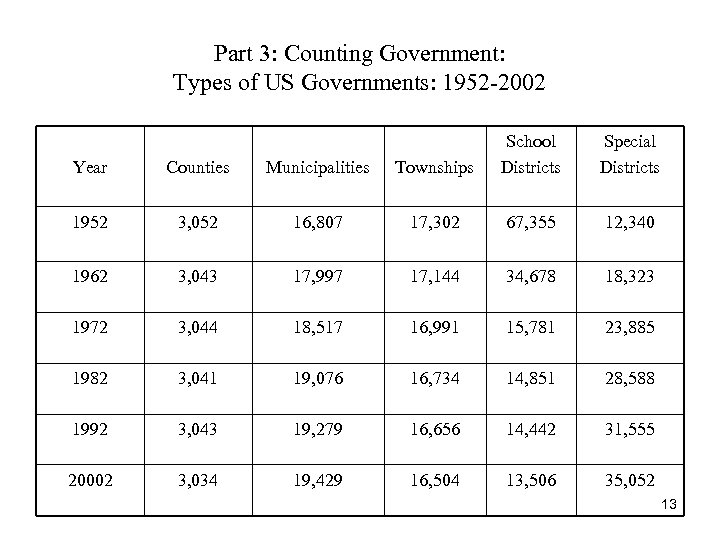

Part 3: Counting Government: Types of US Governments: 1952 -2002 Year Counties Municipalities Townships School Districts Special Districts 1952 3, 052 16, 807 17, 302 67, 355 12, 340 1962 3, 043 17, 997 17, 144 34, 678 18, 323 1972 3, 044 18, 517 16, 991 15, 781 23, 885 1982 3, 041 19, 076 16, 734 14, 851 28, 588 1992 3, 043 19, 279 16, 656 14, 442 31, 555 20002 3, 034 19, 429 16, 504 13, 506 35, 052 13

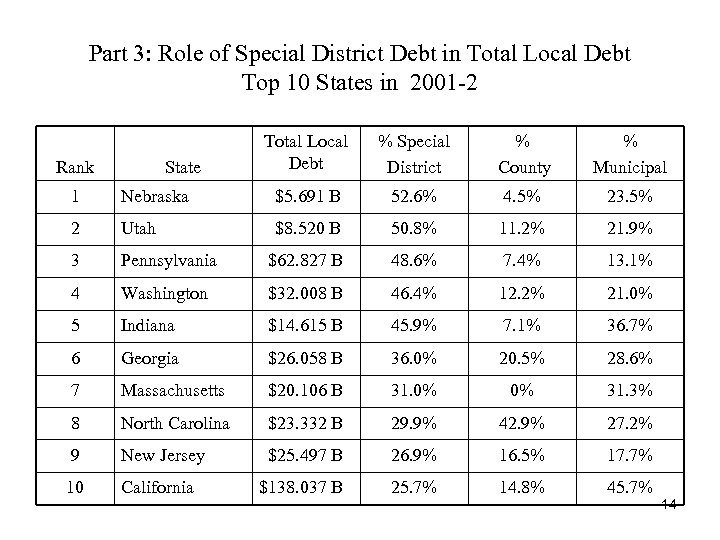

Part 3: Role of Special District Debt in Total Local Debt Top 10 States in 2001 -2 Rank State Total Local Debt % Special District % County % Municipal 1 Nebraska $5. 691 B 52. 6% 4. 5% 23. 5% 2 Utah $8. 520 B 50. 8% 11. 2% 21. 9% 3 Pennsylvania $62. 827 B 48. 6% 7. 4% 13. 1% 4 Washington $32. 008 B 46. 4% 12. 2% 21. 0% 5 Indiana $14. 615 B 45. 9% 7. 1% 36. 7% 6 Georgia $26. 058 B 36. 0% 20. 5% 28. 6% 7 Massachusetts $20. 106 B 31. 0% 0% 31. 3% 8 North Carolina $23. 332 B 29. 9% 42. 9% 27. 2% 9 New Jersey $25. 497 B 26. 9% 16. 5% 17. 7% 10 California $138. 037 B 25. 7% 14. 8% 45. 7% 14

Part 3: Motivations of Government and the Public • Spending vs. Financing Patron Query 2: Is the IRS your friend? _______________________________ Strauss’ Law of Public Finance # 1 Tax Collectors Maximize Revenues Strauss’s Law of Public Finance # 2 Taxpayers (People & Companies) Minimize Tax Payments Result? Conflict 15

Part 3: Motivations of Government & Public (cont. ) Patron Query 3: Are federal taxes voluntary? The lesson from Law and Order (any flavor) and what must ADA Alexis do? The lesson from the History Channel, A Special on Al Capone What you agree to every April 14: (Choral Reading, Please) “Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. “ (1040 Jurat) 16

Part 3: Fairly Measuring the Size of Government Is Bigger Necessarily Better? Patron Query 4: What is Leviathan? What is Wagner’s Law? Follow up Query: Is the size of government in the US excessive? Reference Desk First Response: What hasn’t grown over the past 50 years? • • • US Population GDP Waistlines We have the government we deserve. Some Joint Economic Committee Information 17

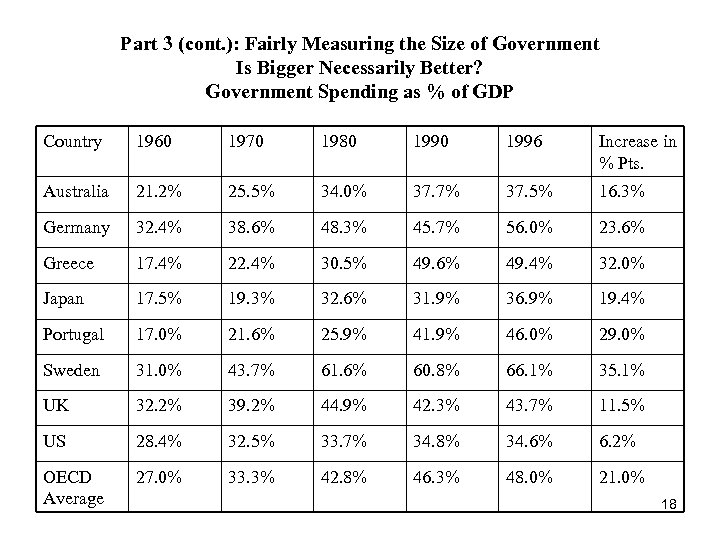

Part 3 (cont. ): Fairly Measuring the Size of Government Is Bigger Necessarily Better? Government Spending as % of GDP Country 1960 1970 1980 1996 Increase in % Pts. Australia 21. 2% 25. 5% 34. 0% 37. 7% 37. 5% 16. 3% Germany 32. 4% 38. 6% 48. 3% 45. 7% 56. 0% 23. 6% Greece 17. 4% 22. 4% 30. 5% 49. 6% 49. 4% 32. 0% Japan 17. 5% 19. 3% 32. 6% 31. 9% 36. 9% 19. 4% Portugal 17. 0% 21. 6% 25. 9% 41. 9% 46. 0% 29. 0% Sweden 31. 0% 43. 7% 61. 6% 60. 8% 66. 1% 35. 1% UK 32. 2% 39. 2% 44. 9% 42. 3% 43. 7% 11. 5% US 28. 4% 32. 5% 33. 7% 34. 8% 34. 6% 6. 2% OECD Average 27. 0% 33. 3% 42. 8% 46. 3% 48. 0% 21. 0% 18

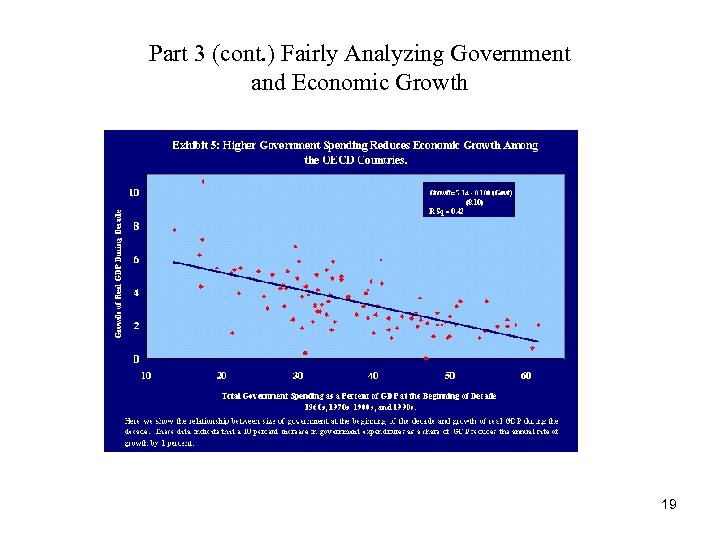

Part 3 (cont. ) Fairly Analyzing Government and Economic Growth 19

Part 4: Normative Perspectives on the Public’s Finances: Burden vs. Incidence (Undergraduate) Patron Query 5: Who pays taxes in the US? Reference Desk Response: Do you mean who writes the check or who really has to sacrifice? Patron Response: Huh? • Tax Burden defined: initial cash outlay • Tax Incidence defined: who controls price and behavioral reaction Two examples: A tax increase and Price Taking A tax increase and Price Setting 20

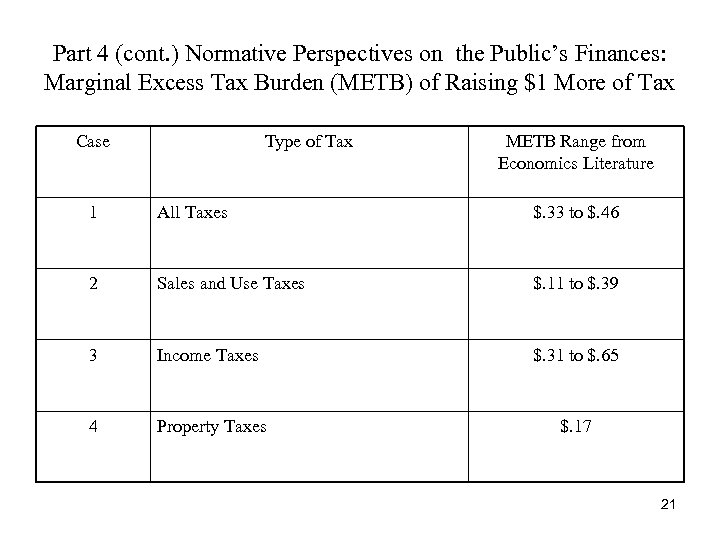

Part 4 (cont. ) Normative Perspectives on the Public’s Finances: Marginal Excess Tax Burden (METB) of Raising $1 More of Tax Case Type of Tax METB Range from Economics Literature 1 All Taxes $. 33 to $. 46 2 Sales and Use Taxes $. 11 to $. 39 3 Income Taxes $. 31 to $. 65 4 Property Taxes $. 17 21

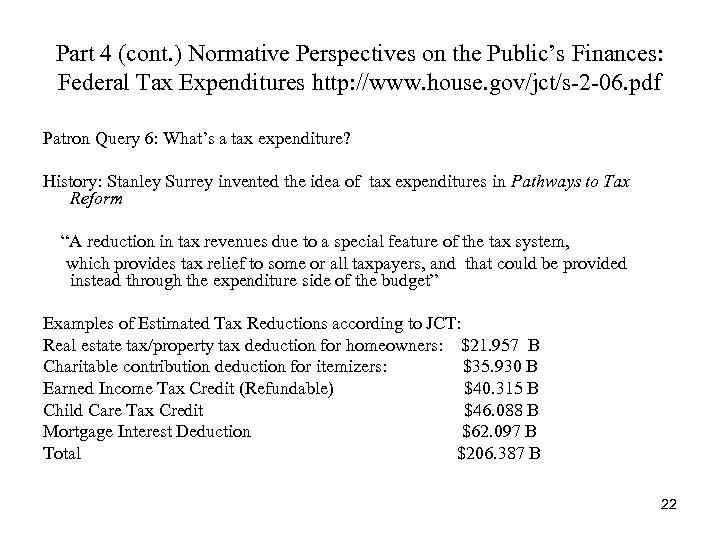

Part 4 (cont. ) Normative Perspectives on the Public’s Finances: Federal Tax Expenditures http: //www. house. gov/jct/s-2 -06. pdf Patron Query 6: What’s a tax expenditure? History: Stanley Surrey invented the idea of tax expenditures in Pathways to Tax Reform “A reduction in tax revenues due to a special feature of the tax system, which provides tax relief to some or all taxpayers, and that could be provided instead through the expenditure side of the budget” Examples of Estimated Tax Reductions according to JCT: Real estate tax/property tax deduction for homeowners: $21. 957 B Charitable contribution deduction for itemizers: $35. 930 B Earned Income Tax Credit (Refundable) $40. 315 B Child Care Tax Credit $46. 088 B Mortgage Interest Deduction $62. 097 B Total $206. 387 B 22

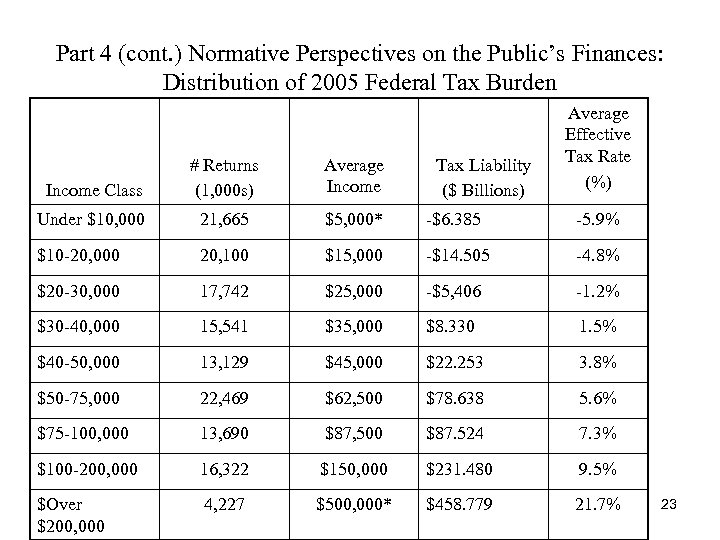

Part 4 (cont. ) Normative Perspectives on the Public’s Finances: Distribution of 2005 Federal Tax Burden Tax Liability ($ Billions) Average Effective Tax Rate (%) Income Class # Returns (1, 000 s) Average Income Under $10, 000 21, 665 $5, 000* -$6. 385 -5. 9% $10 -20, 000 20, 100 $15, 000 -$14. 505 -4. 8% $20 -30, 000 17, 742 $25, 000 -$5, 406 -1. 2% $30 -40, 000 15, 541 $35, 000 $8. 330 1. 5% $40 -50, 000 13, 129 $45, 000 $22. 253 3. 8% $50 -75, 000 22, 469 $62, 500 $78. 638 5. 6% $75 -100, 000 13, 690 $87, 500 $87. 524 7. 3% $100 -200, 000 16, 322 $150, 000 $231. 480 9. 5% $Over $200, 000 4, 227 $500, 000* $458. 779 21. 7% 23

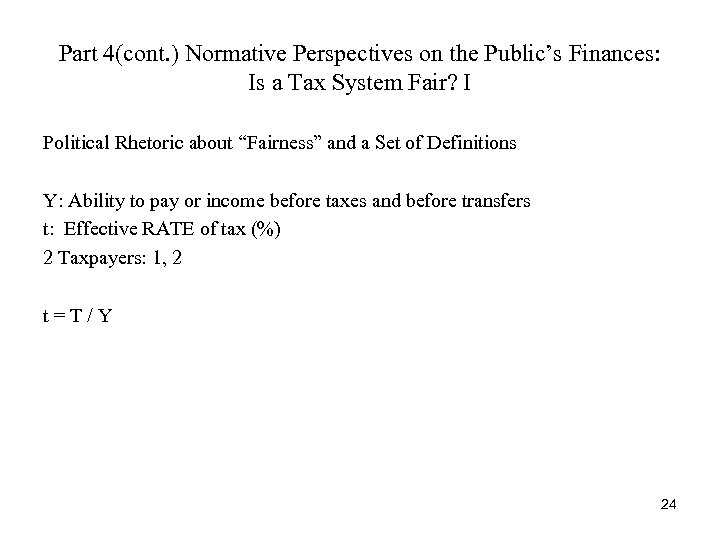

Part 4(cont. ) Normative Perspectives on the Public’s Finances: Is a Tax System Fair? I Political Rhetoric about “Fairness” and a Set of Definitions Y: Ability to pay or income before taxes and before transfers t: Effective RATE of tax (%) 2 Taxpayers: 1, 2 t=T/Y 24

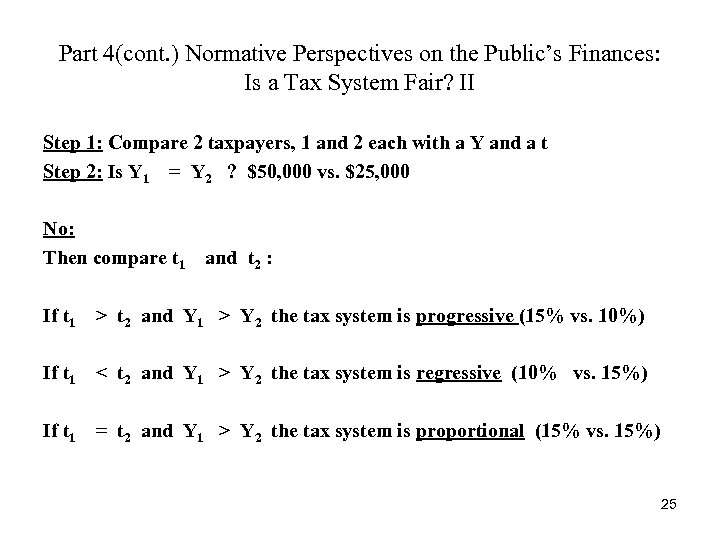

Part 4(cont. ) Normative Perspectives on the Public’s Finances: Is a Tax System Fair? II Step 1: Compare 2 taxpayers, 1 and 2 each with a Y and a t Step 2: Is Y 1 = Y 2 ? $50, 000 vs. $25, 000 No: Then compare t 1 and t 2 : If t 1 > t 2 and Y 1 > Y 2 the tax system is progressive (15% vs. 10%) If t 1 < t 2 and Y 1 > Y 2 the tax system is regressive (10% vs. 15%) If t 1 = t 2 and Y 1 > Y 2 the tax system is proportional (15% vs. 15%) 25

Part 4(cont. ) Normative Perspectives on the Public’s Finances: Is a Tax System Fair? II Step 1: Compare 2 taxpayers, 1 and 2 each with a Y and a t Step 2: Is Y 1 = Y 2 ? $50, 000 vs. $50, 000 Yes: If t 1 = t 2 and Y 1 = Y 2 If t 1 > t 2 or then the tax system has horizontal equity (15%) if t 1 < t 2 and Y 1 = Y 2 then the tax system is inequitable 26

Part 4(cont. ) Normative Perspectives on the Public’s Finances: What about Spending and Tax System Fairness? Define the Net Fisc as: Taxes Paid – Benefits Received Define t* as: t* = Net Fisc/Y 27

Part 5: What should Government Do, When? Patron Query 6: My professor wants me to write a paper on what government spending should be, it’s due Monday, and my girl friend is coming into town tomorrow. Can you help me? (It’s Friday at 4: 30 PM) Reasons for Government Intervention in Market Place: Market failure (no private interest can survive selling air) Monopoly (1 seller can gouge and raise prices, reduce quantity, quality) Externalities (air and water pollution aren’t priced by market) Redistribution (to avoid revolutions) 28

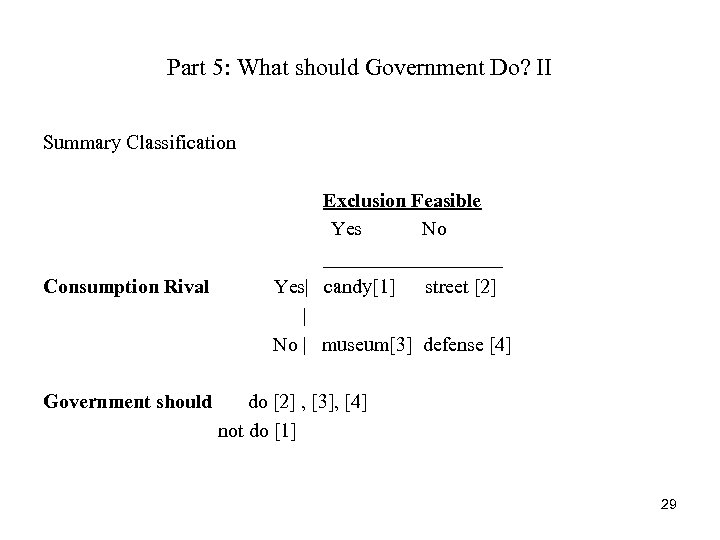

Part 5: What should Government Do? II Summary Classification Consumption Rival Government should Exclusion Feasible Yes No _________ Yes| candy[1] street [2] | No | museum[3] defense [4] do [2] , [3], [4] not do [1] 29

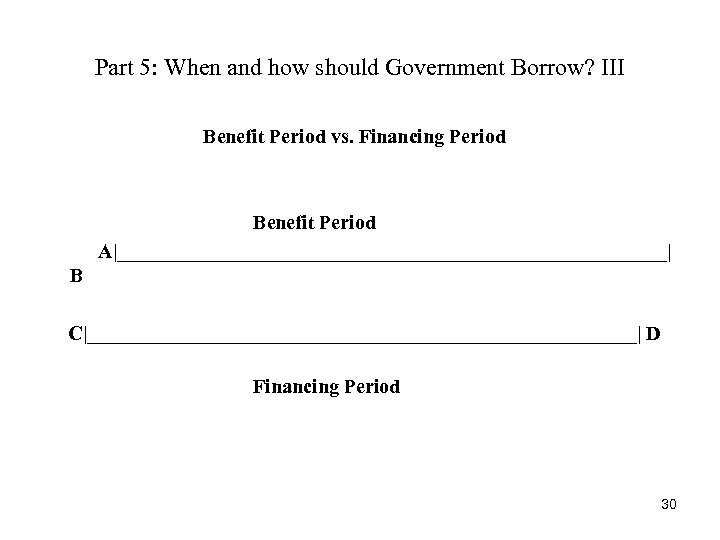

Part 5: When and how should Government Borrow? III Benefit Period vs. Financing Period Benefit Period A|____________________________| B C|____________________________| D Financing Period 30

Part 6: Goals of a Good Tax System and Tradeoffs Patron Query 7: Both gubernatorial candidates both promised to make our tax system better, can you direct me to some reading materials? Friend of Patron Query 8: Uhhhhhh…I have a term paper due tomorrow and I’m supposed to see if our tax system is a national disgrace or not. 31

Part 6: The 5 Goals of a Good Tax System The Short Story 1. Revenue Adequacy: 2. Administrative Feasibility 3. Achieve Agreed Upon Distributional Horizontal and Vertical Equity Goals: 4. Tax Payer Certainty and Simplicity: 5. Minimize Deadweight Loss: 32

Part 6: The 5 Goals of a Good Tax System: Tradeoffs • Certainty and simplicity go together • Using the tax system to redistribute conflicts with simplicity • Revenue adequacy and redistribution can conflict 33

Part 7: Federal, State, and Local Budgets I Some Basics: Budget, Financial Reporting, and Audited Financial Statements Budget: a plan for spending in the future based on expected revenues and expected spending Financial reporting: comparison of adopted budget to actual results during the fiscal period Audited Financial Statement: an after the fact examination of what happened using standard accounting procedures (modified accrual) 34

Part 7: Federal, State, and Local Budgets II Budget Components and Process: Timetables: • Federal Fiscal Year: October 1 through September 30 • State Fiscal Year: July 1 through June 30 • Municipal Fiscal year: January 1 through December 31 • School District Fiscal year: July 1 through June 30 Federal Budget Preparation: • Economic estimates of tax base in the planning period • Administrative estimate of spending under economic assumptions • Base case spending aggregated and reviewed by OMB • Policy innovations from agencies presented to OMB • OMB sifts and recommends to the President by Thanksgiving • President Presents Budget to Congress after it convenes, February 35

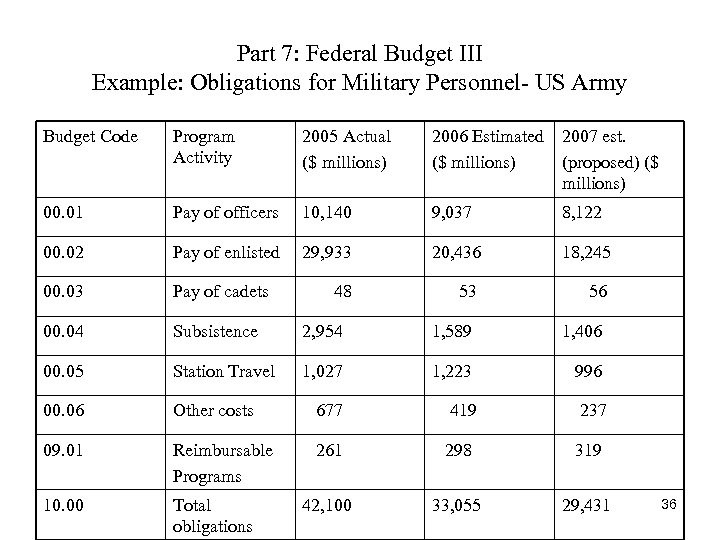

Part 7: Federal Budget III Example: Obligations for Military Personnel- US Army Budget Code Program Activity 2005 Actual ($ millions) 2006 Estimated 2007 est. ($ millions) (proposed) ($ millions) 00. 01 Pay of officers 10, 140 9, 037 8, 122 00. 02 Pay of enlisted 29, 933 20, 436 18, 245 00. 03 Pay of cadets 48 53 56 00. 04 Subsistence 2, 954 1, 589 1, 406 00. 05 Station Travel 1, 027 1, 223 996 00. 06 Other costs 677 419 237 09. 01 Reimbursable Programs 261 298 319 10. 00 Total obligations 42, 100 33, 055 29, 431 36

Part 7: Federal Budget IV • Presidents propose, Congress Disposes • Presidents can not spend more than is in the appropriations account, set by law; limited flexibility among accounts, across time • The Structure of Congressional Spending Committees – The Major Leagues: House and Senate Appropriations Committee Ways and Means and Senate Finance House and Senate Budget Committees set Targets – The Minor Leagues: Authorizing Committees Oversight Committees 37

Part 7: Federal Budget V • Oops we spent too much, what to do? • Back to the Future and the Public Debt • Entitlements and Trust Funds 38

Part 7: Federal Budget VI State Differences • The History of State Balanced Budget Acts Excessive Economic Development Exuberance Selling Bonds after Bankruptcy State Debt Limits and Financial Hanky Panky • Authority of Governors to “Blue Line” Appropriations Bills • General and Special Fund Accounting Tricks Differing fiscal years Cash and accrual accounting games Under-funding state and local pension funds Forgetting to pay school districts their intergovernmental aid Disconnecting the clock Issuing script to pay bills 39

Part 7: Federal Budget VI State Differences II Where to find the consolidated truth about state and local finances? • Offer statements associated with borrowing; Bond Buyer • Census Bureau consolidates various off budget state agencies • Some States voluntarily disclose consolidated financial statements, and require themselves to follow GAAP • Audits performed in compliance with federal Single Audit Act 40

Part 8: Summing it All Up The Iron Law of Public Finance: Public Spending t ≡ Taxes t + Fees t + Transfers t + Δ in Net Worth t _______________________________ Everybody likes to participate on the left hand side of this equation, but Nobody likes to participate on the right side of this equation. Answering questions about these matters posed by your patrons should be viewed as engaging in a combination of political science, bookkeeping, and applied ethics. Remember: it’s information you’re providing, not an opinion! 41

f1cb643f8b294663f4d91475aae0d1d3.ppt