13dbc393d7c254c6bb900943a4589be2.ppt

- Количество слайдов: 52

Annual Shareholder Meeting 2008

Annual Shareholder Meeting 2008

Required Disclosures Forward Looking Statements These presentation materials include forward-looking statements. There a number of factors that could cause our results to differ materially from our expectations. Please see the section entitled “Cautions About Forward-Looking Statements” in the enclosed Appendix for information regarding forward-looking statements and related risks and uncertainties. You can also learn more about these risks in our Form 10 -K for fiscal 2008 and our other SEC filings, which are available on the Investor Relations page of Intuit's website at www. intuit. com. We assume no obligation to update any forward-looking statement. Non-GAAP Financial Measures These presentations include certain non-GAAP financial measures. Please see the section entitled “About Non-GAAP Financial Measures” in the enclosed Appendix for an explanation of management’s use of these measures and a reconciliation to the most directly comparable GAAP financial measures.

Required Disclosures Forward Looking Statements These presentation materials include forward-looking statements. There a number of factors that could cause our results to differ materially from our expectations. Please see the section entitled “Cautions About Forward-Looking Statements” in the enclosed Appendix for information regarding forward-looking statements and related risks and uncertainties. You can also learn more about these risks in our Form 10 -K for fiscal 2008 and our other SEC filings, which are available on the Investor Relations page of Intuit's website at www. intuit. com. We assume no obligation to update any forward-looking statement. Non-GAAP Financial Measures These presentations include certain non-GAAP financial measures. Please see the section entitled “About Non-GAAP Financial Measures” in the enclosed Appendix for an explanation of management’s use of these measures and a reconciliation to the most directly comparable GAAP financial measures.

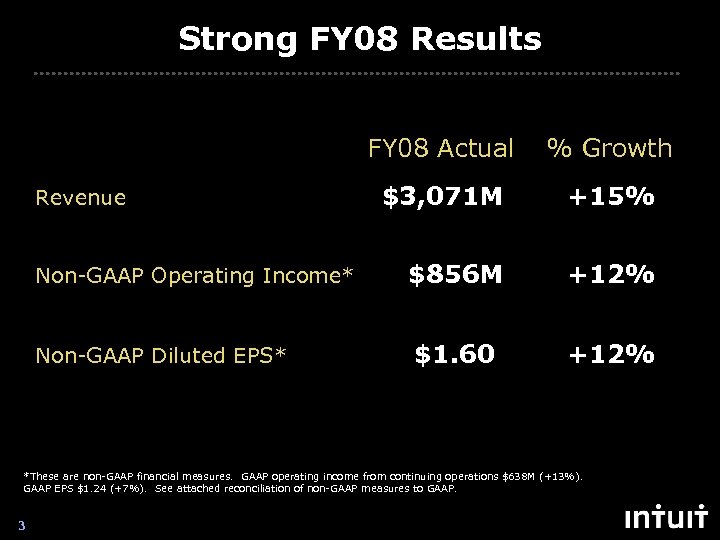

Strong FY 08 Results FY 08 Actual % Growth $3, 071 M +15% Non-GAAP Operating Income* $856 M +12% Non-GAAP Diluted EPS* $1. 60 +12% Revenue *These are non-GAAP financial measures. GAAP operating income from continuing operations $638 M (+13%). GAAP EPS $1. 24 (+7%). See attached reconciliation of non-GAAP measures to GAAP. 3 Intuit Confidential

Strong FY 08 Results FY 08 Actual % Growth $3, 071 M +15% Non-GAAP Operating Income* $856 M +12% Non-GAAP Diluted EPS* $1. 60 +12% Revenue *These are non-GAAP financial measures. GAAP operating income from continuing operations $638 M (+13%). GAAP EPS $1. 24 (+7%). See attached reconciliation of non-GAAP measures to GAAP. 3 Intuit Confidential

Simple Recipe for Success Be in good businesses with strategies to win Then: • Talented and Engaged Employees • Delivering for Customers So: • We Grow Revenues and Profits 4 Intuit Confidential

Simple Recipe for Success Be in good businesses with strategies to win Then: • Talented and Engaged Employees • Delivering for Customers So: • We Grow Revenues and Profits 4 Intuit Confidential

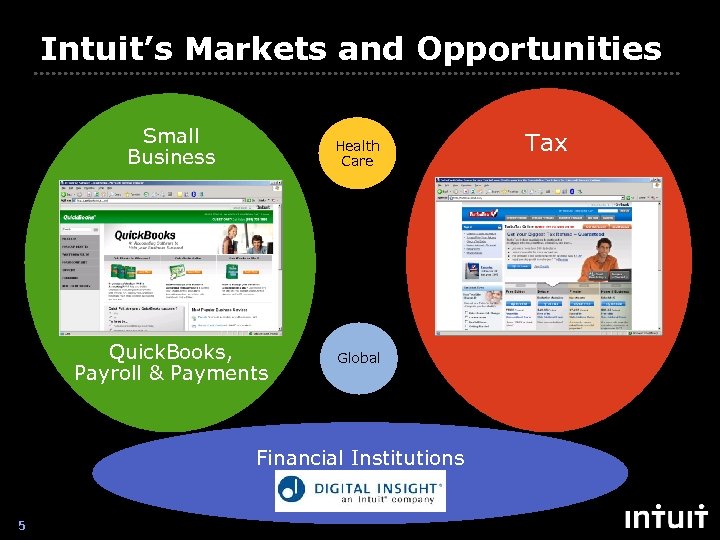

Intuit’s Markets and Opportunities Small Business Health Care Quick. Books, Payroll & Payments Global Financial Institutions 5 Intuit Confidential Tax

Intuit’s Markets and Opportunities Small Business Health Care Quick. Books, Payroll & Payments Global Financial Institutions 5 Intuit Confidential Tax

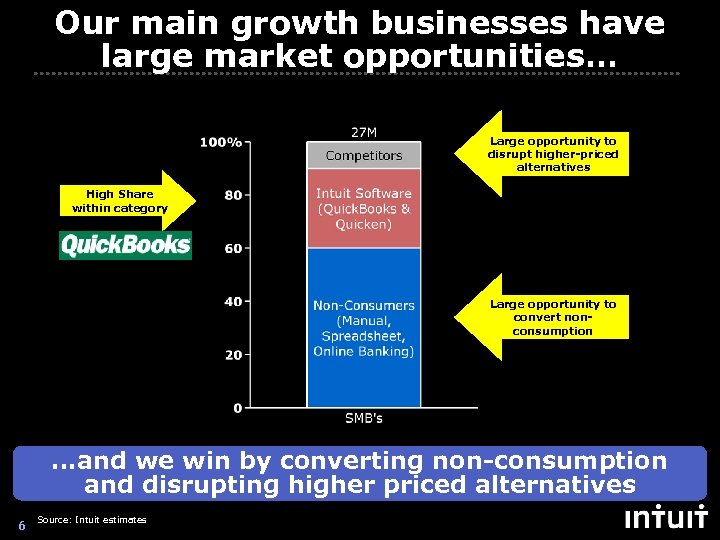

Our main growth businesses have large market opportunities… Financial Management Large opportunity to disrupt higher-priced alternatives High Share within category Large opportunity to convert nonconsumption …and we win by converting non-consumption and disrupting higher priced alternatives 6 Source: Intuit estimates Intuit Confidential

Our main growth businesses have large market opportunities… Financial Management Large opportunity to disrupt higher-priced alternatives High Share within category Large opportunity to convert nonconsumption …and we win by converting non-consumption and disrupting higher priced alternatives 6 Source: Intuit estimates Intuit Confidential

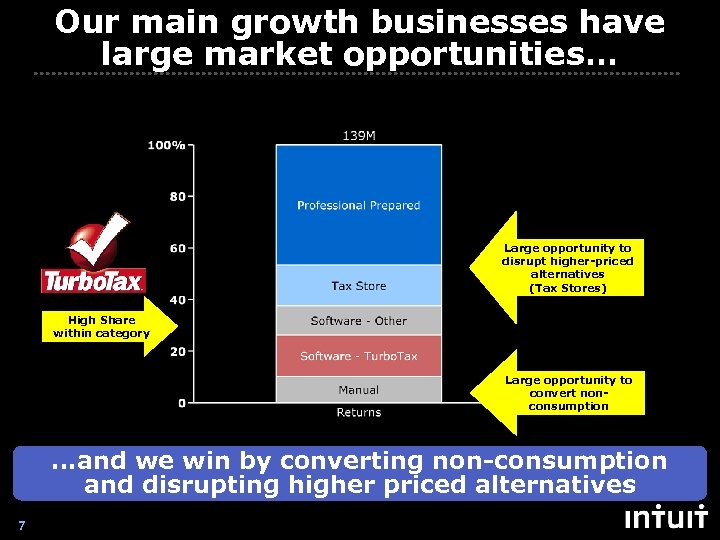

Our main growth businesses have large market opportunities… Tax Prep Methods Large opportunity to disrupt higher-priced alternatives (Tax Stores) High Share within category Large opportunity to convert nonconsumption …and we win by converting non-consumption and disrupting higher priced alternatives 7 Source: IRS data and Intuit estimates Intuit Confidential

Our main growth businesses have large market opportunities… Tax Prep Methods Large opportunity to disrupt higher-priced alternatives (Tax Stores) High Share within category Large opportunity to convert nonconsumption …and we win by converting non-consumption and disrupting higher priced alternatives 7 Source: IRS data and Intuit estimates Intuit Confidential

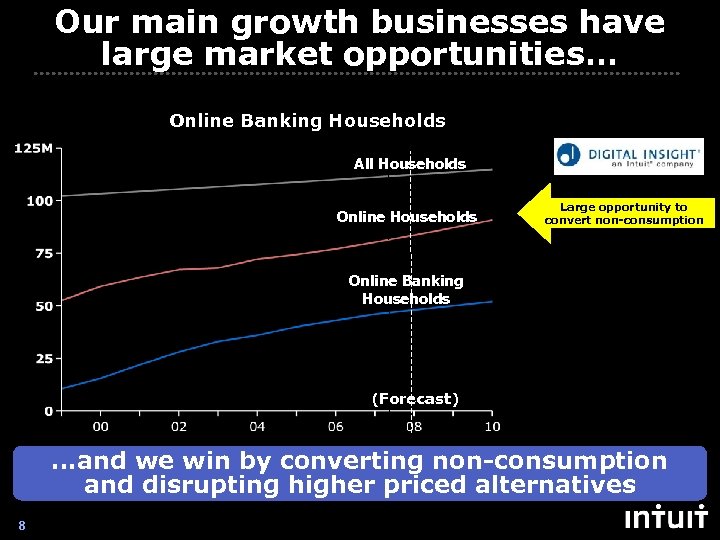

Our main growth businesses have large market opportunities… Online Banking Households All Households Online Households Large opportunity to convert non-consumption Online Banking Households (Forecast) …and we win by converting non-consumption and disrupting higher priced alternatives 8 Intuit Confidential

Our main growth businesses have large market opportunities… Online Banking Households All Households Online Households Large opportunity to convert non-consumption Online Banking Households (Forecast) …and we win by converting non-consumption and disrupting higher priced alternatives 8 Intuit Confidential

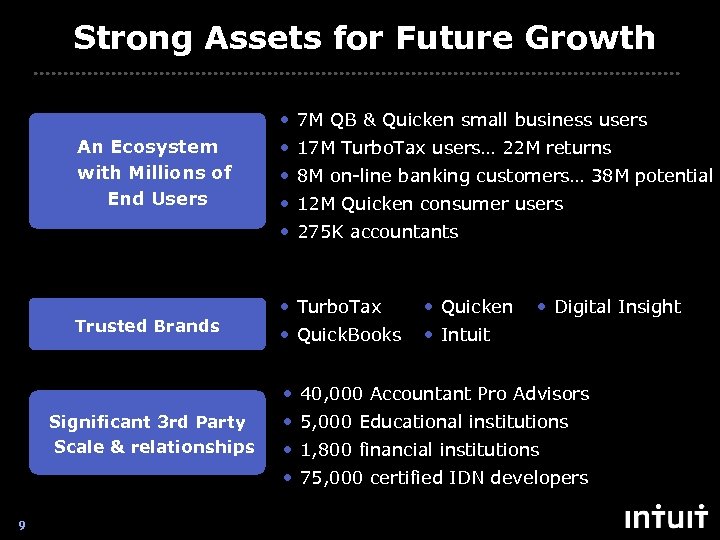

Strong Assets for Future Growth • 7 M QB & Quicken small business users An Ecosystem with Millions of End Users • 17 M Turbo. Tax users… 22 M returns • 8 M on-line banking customers… 38 M potential • 12 M Quicken consumer users • 275 K accountants Trusted Brands • Turbo. Tax • Quicken • Quick. Books • Digital Insight • Intuit • 40, 000 Accountant Pro Advisors Significant 3 rd Party Scale & relationships • 5, 000 Educational institutions • 1, 800 financial institutions • 75, 000 certified IDN developers 9 Intuit Confidential

Strong Assets for Future Growth • 7 M QB & Quicken small business users An Ecosystem with Millions of End Users • 17 M Turbo. Tax users… 22 M returns • 8 M on-line banking customers… 38 M potential • 12 M Quicken consumer users • 275 K accountants Trusted Brands • Turbo. Tax • Quicken • Quick. Books • Digital Insight • Intuit • 40, 000 Accountant Pro Advisors Significant 3 rd Party Scale & relationships • 5, 000 Educational institutions • 1, 800 financial institutions • 75, 000 certified IDN developers 9 Intuit Confidential

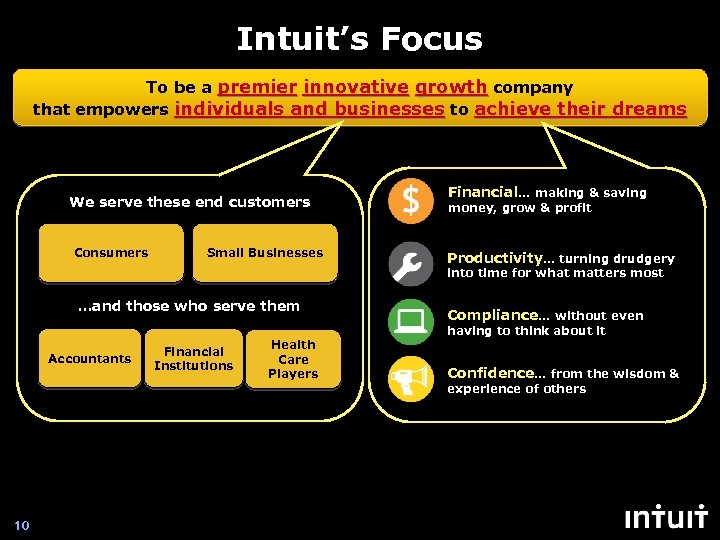

Intuit’s Focus To be a premier innovative growth company that empowers individuals and businesses to achieve their dreams Financial… making & saving We serve these end customers Consumers money, grow & profit Small Businesses Productivity… turning drudgery into time for what matters most …and those who serve them Accountants Financial Institutions Compliance… without even having to think about it Health Care Players Confidence… from the wisdom & experience of others 10 Intuit Confidential

Intuit’s Focus To be a premier innovative growth company that empowers individuals and businesses to achieve their dreams Financial… making & saving We serve these end customers Consumers money, grow & profit Small Businesses Productivity… turning drudgery into time for what matters most …and those who serve them Accountants Financial Institutions Compliance… without even having to think about it Health Care Players Confidence… from the wisdom & experience of others 10 Intuit Confidential

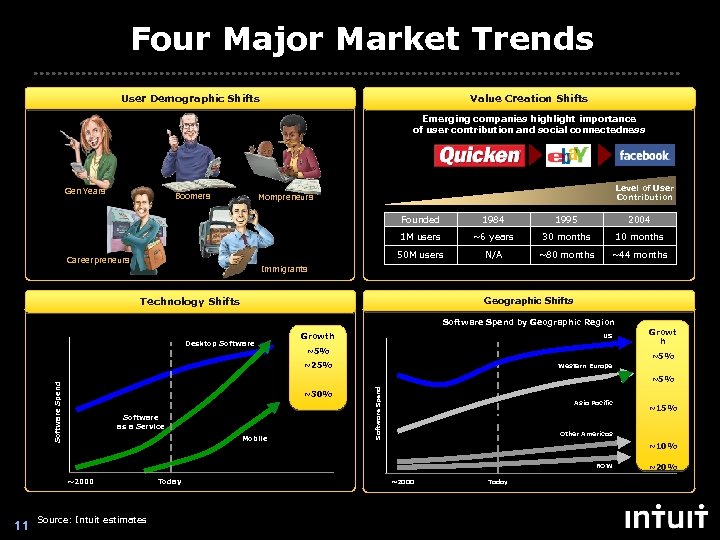

Four Major Market Trends User Demographic Shifts Value Creation Shifts Emerging companies highlight importance of user contribution and social connectedness Gen Years Boomers Level of User Contribution Mompreneurs Founded 1995 2004 1 M users ~6 years 30 months 10 months 50 M users Careerpreneurs 1984 N/A ~80 months ~44 months Immigrants Technology Shifts Geographic Shifts Software Spend by Delivery Channel Desktop Software Spend by Geographic Region Growth US ~5% ~25% Western Europe ~30% Software as a Service Mobile Software Spend ~5% Asia Pacific ~2000 Source: Intuit estimates ~15% Other Americas ~10% ROW 11 Growt h Today ~2000 Intuit Confidential Today ~20%

Four Major Market Trends User Demographic Shifts Value Creation Shifts Emerging companies highlight importance of user contribution and social connectedness Gen Years Boomers Level of User Contribution Mompreneurs Founded 1995 2004 1 M users ~6 years 30 months 10 months 50 M users Careerpreneurs 1984 N/A ~80 months ~44 months Immigrants Technology Shifts Geographic Shifts Software Spend by Delivery Channel Desktop Software Spend by Geographic Region Growth US ~5% ~25% Western Europe ~30% Software as a Service Mobile Software Spend ~5% Asia Pacific ~2000 Source: Intuit estimates ~15% Other Americas ~10% ROW 11 Growt h Today ~2000 Intuit Confidential Today ~20%

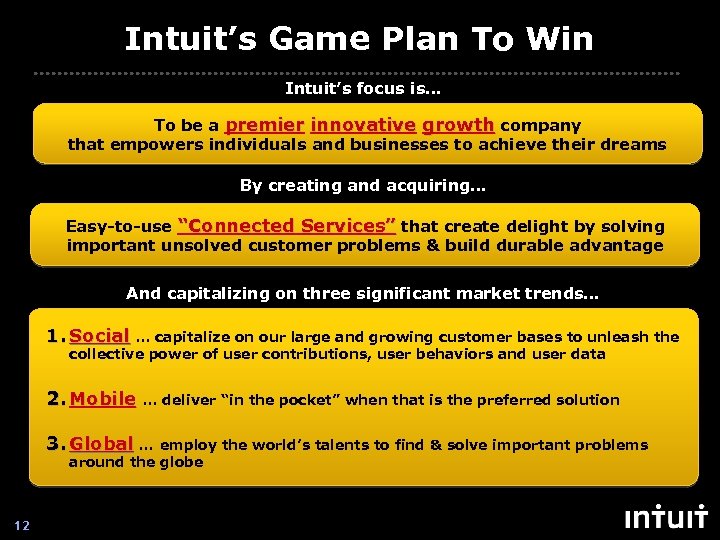

Intuit’s Game Plan To Win Intuit’s focus is… To be a premier innovative growth company that empowers individuals and businesses to achieve their dreams By creating and acquiring… Easy-to-use “Connected Services” that create delight by solving important unsolved customer problems & build durable advantage And capitalizing on three significant market trends… 1. Social … capitalize on our large and growing customer bases to unleash the collective power of user contributions, user behaviors and user data 2. Mobile … deliver “in the pocket” when that is the preferred solution 3. Global … employ the world’s talents to find & solve important problems around the globe 12 Intuit Confidential

Intuit’s Game Plan To Win Intuit’s focus is… To be a premier innovative growth company that empowers individuals and businesses to achieve their dreams By creating and acquiring… Easy-to-use “Connected Services” that create delight by solving important unsolved customer problems & build durable advantage And capitalizing on three significant market trends… 1. Social … capitalize on our large and growing customer bases to unleash the collective power of user contributions, user behaviors and user data 2. Mobile … deliver “in the pocket” when that is the preferred solution 3. Global … employ the world’s talents to find & solve important problems around the globe 12 Intuit Confidential

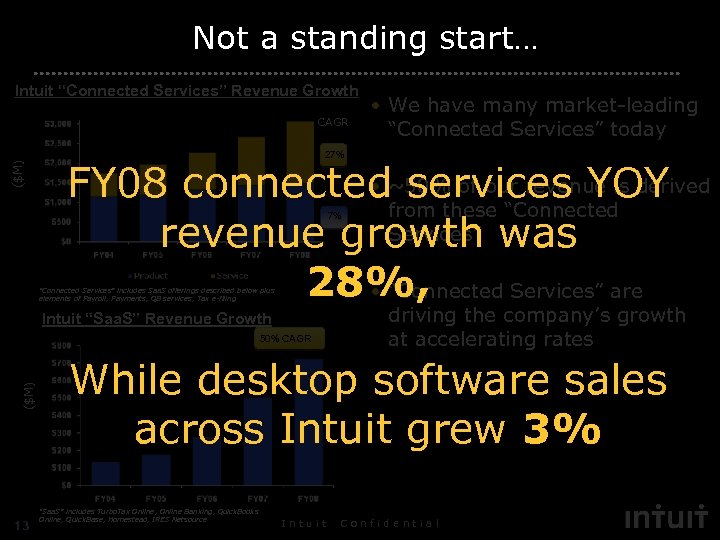

Not a standing start… Intuit “Connected Services” Revenue Growth CAGR ($M) CAGR • We have many market-leading “Connected Services” today 27% • services YOY FY 08 connected~50% of our revenue is derived from these “Connected Services” revenue growth was 28%, • “Connected Services” are 7% “Connected Services” includes Saa. S offerings described below plus elements of Payroll, Payments, QB services, Tax e-filing Intuit “Saa. S” Revenue Growth ($M) 50% CAGR 13 driving the company’s growth at accelerating rates While desktop software sales across Intuit grew 3% “Saa. S” includes Turbo. Tax Online, Online Banking, Quick. Books Online, Quick. Base, Homestead, IRES Netsource Intuit Confidential

Not a standing start… Intuit “Connected Services” Revenue Growth CAGR ($M) CAGR • We have many market-leading “Connected Services” today 27% • services YOY FY 08 connected~50% of our revenue is derived from these “Connected Services” revenue growth was 28%, • “Connected Services” are 7% “Connected Services” includes Saa. S offerings described below plus elements of Payroll, Payments, QB services, Tax e-filing Intuit “Saa. S” Revenue Growth ($M) 50% CAGR 13 driving the company’s growth at accelerating rates While desktop software sales across Intuit grew 3% “Saa. S” includes Turbo. Tax Online, Online Banking, Quick. Books Online, Quick. Base, Homestead, IRES Netsource Intuit Confidential

Intuit’s Small Business Ecosystem Manage Finances Get Customers Run My Business Small Business Accept Payments 14 Intuit Pay Employees Confidential

Intuit’s Small Business Ecosystem Manage Finances Get Customers Run My Business Small Business Accept Payments 14 Intuit Pay Employees Confidential

Small Business Landscape Key Facts 27 Million US Businesses Key Facts 0. 6 M businesses $6 B total SW spend Delegation: departments QB 29% firms… 2% spend Main Street 3. 3 M businesses $3 B total SW spend Owner begins to delegate 45% QB/Qkn share Personal Business 23 M businesses $2 B total SW spend 25% QB/Qkn share 42% Manual/Spreadsheet Mid Market Global Opportunity • ~375 M small businesses outside US • 60% of SMBs in SE Asia and India • Many US small businesses doing business abroad 15 Source: Intuit estimates Intuit Confidential

Small Business Landscape Key Facts 27 Million US Businesses Key Facts 0. 6 M businesses $6 B total SW spend Delegation: departments QB 29% firms… 2% spend Main Street 3. 3 M businesses $3 B total SW spend Owner begins to delegate 45% QB/Qkn share Personal Business 23 M businesses $2 B total SW spend 25% QB/Qkn share 42% Manual/Spreadsheet Mid Market Global Opportunity • ~375 M small businesses outside US • 60% of SMBs in SE Asia and India • Many US small businesses doing business abroad 15 Source: Intuit estimates Intuit Confidential

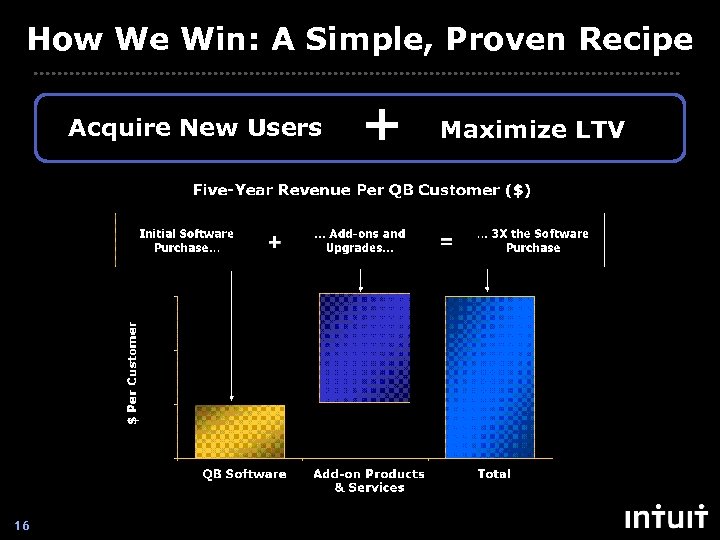

How We Win: A Simple, Proven Recipe Acquire New Users 16 Intuit + Confidential Maximize LTV

How We Win: A Simple, Proven Recipe Acquire New Users 16 Intuit + Confidential Maximize LTV

Quick. Books ’ 09 Highlights Get Productive Get Insights & Info Get Customers Go Global 17 Intuit Confidential

Quick. Books ’ 09 Highlights Get Productive Get Insights & Info Get Customers Go Global 17 Intuit Confidential

Double Down on Demand Generation Investing 50% more in demand generation, including off-line and online channels 18 Intuit Confidential

Double Down on Demand Generation Investing 50% more in demand generation, including off-line and online channels 18 Intuit Confidential

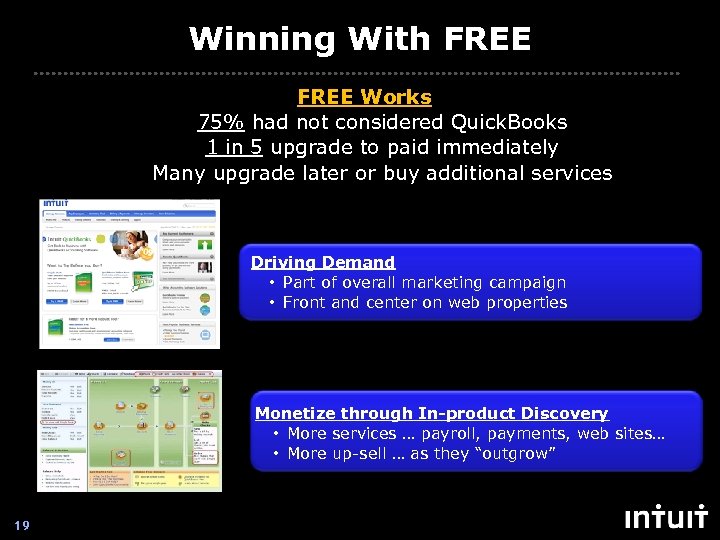

Winning With FREE Works 75% had not considered Quick. Books 1 in 5 upgrade to paid immediately Many upgrade later or buy additional services Driving Demand • Part of overall marketing campaign • Front and center on web properties Monetize through In-product Discovery • More services … payroll, payments, web sites… • More up-sell … as they “outgrow” 19 Intuit Confidential

Winning With FREE Works 75% had not considered Quick. Books 1 in 5 upgrade to paid immediately Many upgrade later or buy additional services Driving Demand • Part of overall marketing campaign • Front and center on web properties Monetize through In-product Discovery • More services … payroll, payments, web sites… • More up-sell … as they “outgrow” 19 Intuit Confidential

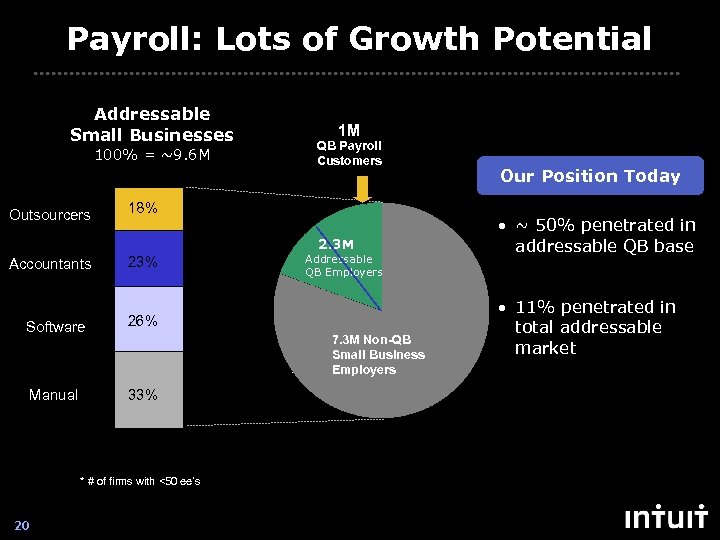

Payroll: Lots of Growth Potential Addressable Small Businesses 100% = ~9. 6 M Outsourcers 1 M QB Payroll Customers 18% 2. 3 M Accountants 23% Software 26% Manual Addressable QB Employers 33% 7. 3 M Non-QB Small Business Employers * # of firms with <50 ee’s 20 Intuit Confidential Our Position Today • ~ 50% penetrated in addressable QB base • 11% penetrated in total addressable market

Payroll: Lots of Growth Potential Addressable Small Businesses 100% = ~9. 6 M Outsourcers 1 M QB Payroll Customers 18% 2. 3 M Accountants 23% Software 26% Manual Addressable QB Employers 33% 7. 3 M Non-QB Small Business Employers * # of firms with <50 ee’s 20 Intuit Confidential Our Position Today • ~ 50% penetrated in addressable QB base • 11% penetrated in total addressable market

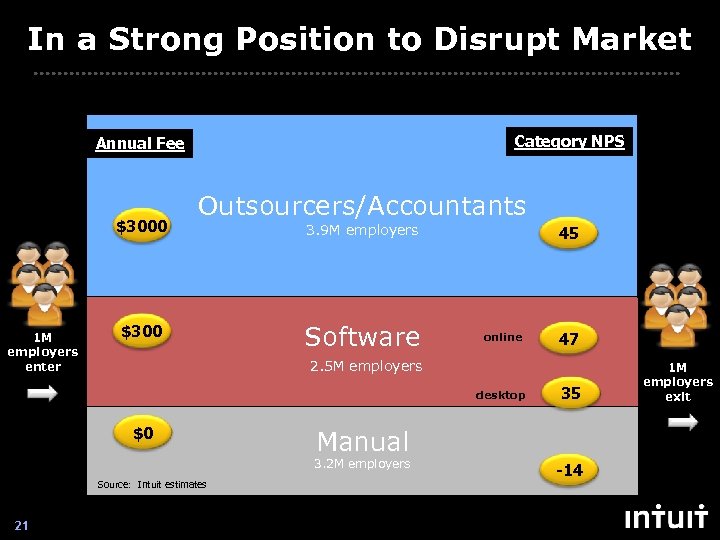

In a Strong Position to Disrupt Market Category NPS Annual Fee $3000 1 M employers enter Outsourcers/Accountants $300 3. 9 M employers Software 45 online 2. 5 M employers desktop $0 35 Manual 3. 2 M employers Source: Intuit estimates 21 47 Intuit Confidential -14 1 M employers exit

In a Strong Position to Disrupt Market Category NPS Annual Fee $3000 1 M employers enter Outsourcers/Accountants $300 3. 9 M employers Software 45 online 2. 5 M employers desktop $0 35 Manual 3. 2 M employers Source: Intuit estimates 21 47 Intuit Confidential -14 1 M employers exit

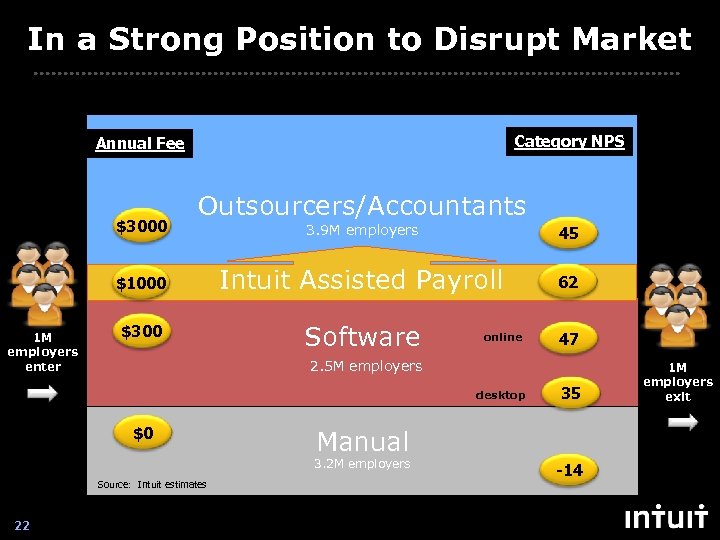

In a Strong Position to Disrupt Market Category NPS Annual Fee $3000 Outsourcers/Accountants 45 $1000 1 M employers enter 3. 9 M employers Intuit Assisted Payroll 62 $300 Software 47 online 2. 5 M employers desktop $0 Manual 3. 2 M employers Source: Intuit estimates 22 35 Intuit Confidential -14 1 M employers exit

In a Strong Position to Disrupt Market Category NPS Annual Fee $3000 Outsourcers/Accountants 45 $1000 1 M employers enter 3. 9 M employers Intuit Assisted Payroll 62 $300 Software 47 online 2. 5 M employers desktop $0 Manual 3. 2 M employers Source: Intuit estimates 22 35 Intuit Confidential -14 1 M employers exit

Payments: What We Do Help businesses accept electronic payments… Credit/Gift Cards PIN Debit E-Check/Check 21 The way that is right for them… Face to Face Back Office Mobile Web …In ways our competitors can’t Human Touch Integrates with Business Solutions Single Experience, Multiple Solutions Leverage & Create Network Effects 23 Intuit Confidential

Payments: What We Do Help businesses accept electronic payments… Credit/Gift Cards PIN Debit E-Check/Check 21 The way that is right for them… Face to Face Back Office Mobile Web …In ways our competitors can’t Human Touch Integrates with Business Solutions Single Experience, Multiple Solutions Leverage & Create Network Effects 23 Intuit Confidential

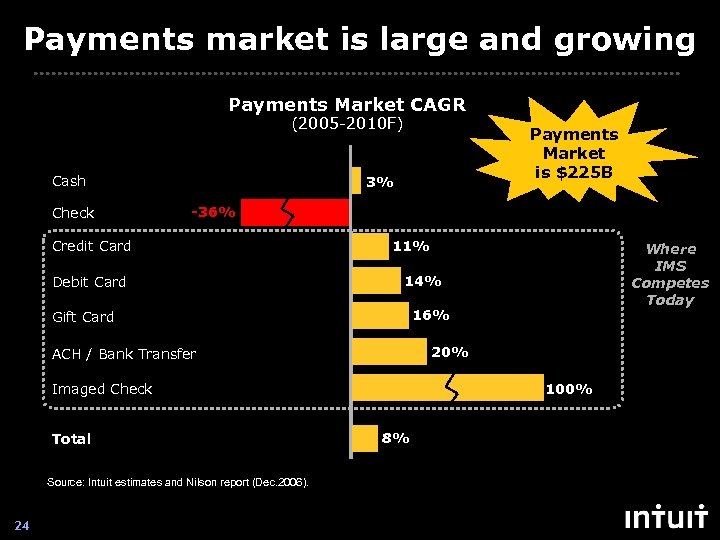

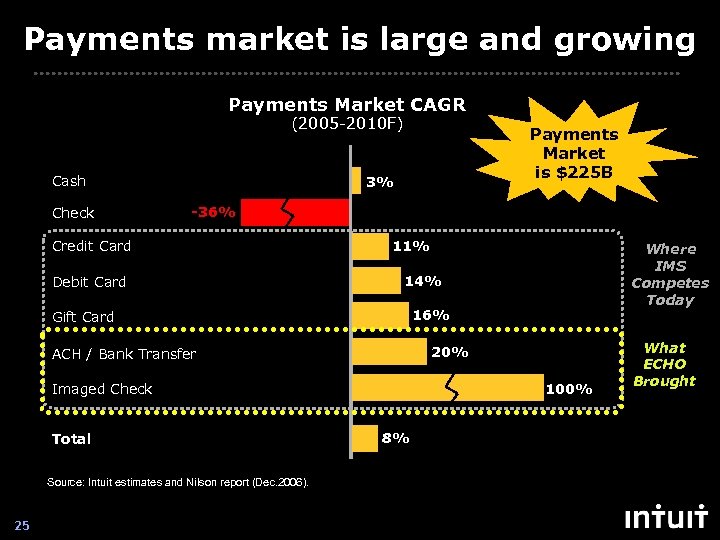

Payments market is large and growing Payments Market CAGR (2005 -2010 F) Cash Check Payments Market is $225 B 3% -36% Credit Card 11% 14% Debit Card 16% Gift Card 20% ACH / Bank Transfer 100% Imaged Check 8% Total Source: Intuit estimates and Nilson report (Dec. 2006). 24 Where IMS Competes Today Intuit Confidential

Payments market is large and growing Payments Market CAGR (2005 -2010 F) Cash Check Payments Market is $225 B 3% -36% Credit Card 11% 14% Debit Card 16% Gift Card 20% ACH / Bank Transfer 100% Imaged Check 8% Total Source: Intuit estimates and Nilson report (Dec. 2006). 24 Where IMS Competes Today Intuit Confidential

Payments market is large and growing Payments Market CAGR (2005 -2010 F) Cash Check Payments Market is $225 B 3% -36% Credit Card 11% 14% Debit Card 16% Gift Card 20% ACH / Bank Transfer 100% Imaged Check 8% Total Source: Intuit estimates and Nilson report (Dec. 2006). 25 Where IMS Competes Today Intuit Confidential What ECHO Brought

Payments market is large and growing Payments Market CAGR (2005 -2010 F) Cash Check Payments Market is $225 B 3% -36% Credit Card 11% 14% Debit Card 16% Gift Card 20% ACH / Bank Transfer 100% Imaged Check 8% Total Source: Intuit estimates and Nilson report (Dec. 2006). 25 Where IMS Competes Today Intuit Confidential What ECHO Brought

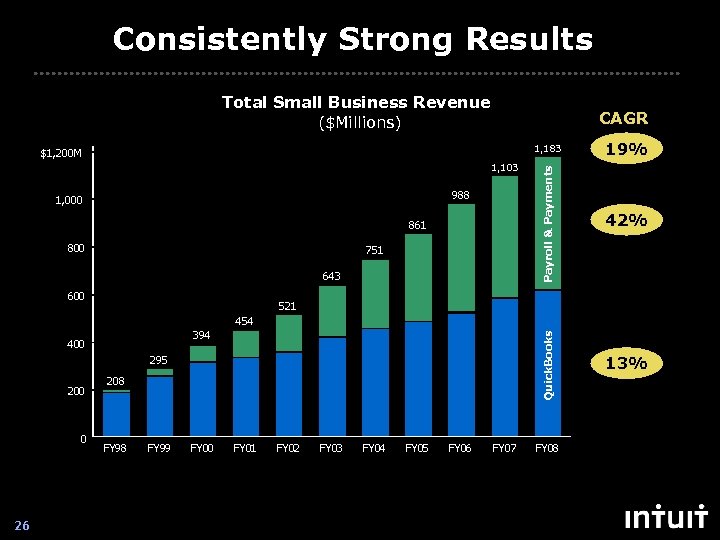

Consistently Strong Results Total Small Business Revenue ($Millions) 1, 183 1, 103 988 1, 000 861 800 751 643 600 Payroll & Payments $1, 200 M 19% 42% Quick. Books CAGR 13% 521 454 394 400 295 200 0 26 208 FY 99 FY 00 FY 01 FY 02 FY 03 Intuit FY 04 FY 05 Confidential FY 06 FY 07 FY 08

Consistently Strong Results Total Small Business Revenue ($Millions) 1, 183 1, 103 988 1, 000 861 800 751 643 600 Payroll & Payments $1, 200 M 19% 42% Quick. Books CAGR 13% 521 454 394 400 295 200 0 26 208 FY 99 FY 00 FY 01 FY 02 FY 03 Intuit FY 04 FY 05 Confidential FY 06 FY 07 FY 08

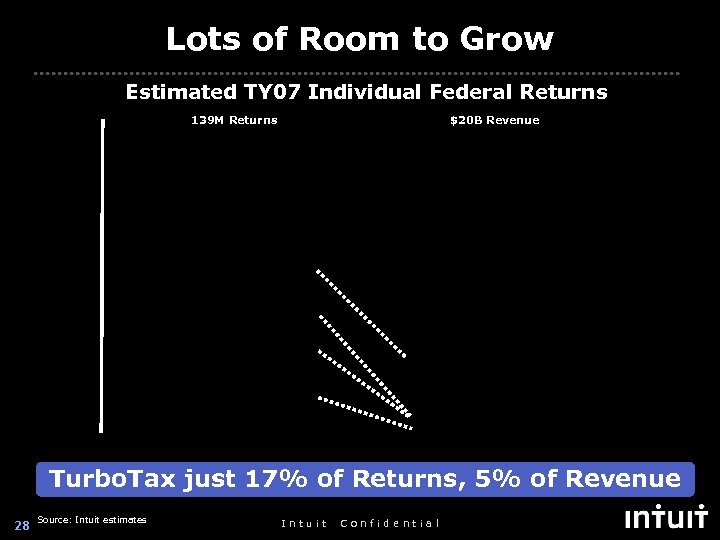

Lots of Room to Grow Estimated TY 07 Individual Federal Returns 139 M Returns $20 B Revenue Turbo. Tax just 17% of Returns, 5% of Revenue 28 Source: Intuit estimates Intuit Confidential

Lots of Room to Grow Estimated TY 07 Individual Federal Returns 139 M Returns $20 B Revenue Turbo. Tax just 17% of Returns, 5% of Revenue 28 Source: Intuit estimates Intuit Confidential

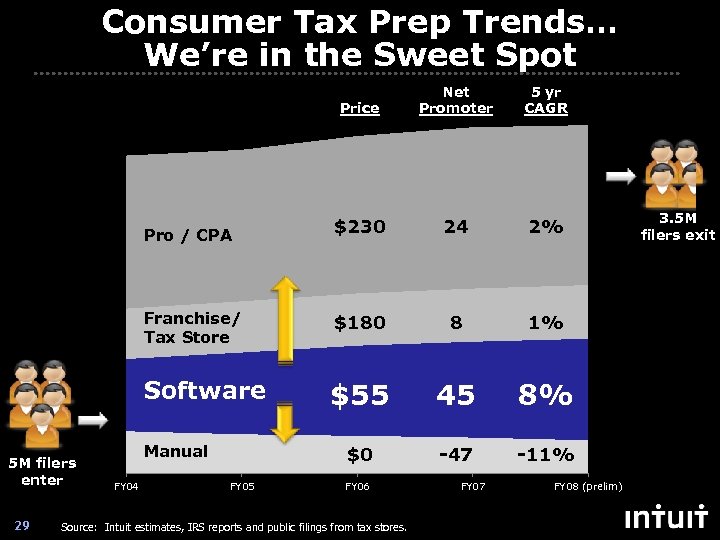

Consumer Tax Prep Trends… We’re in the Sweet Spot Price Net Promoter 5 yr CAGR $230 24 2% Franchise/ Tax Store $180 8 1% Software $55 45 8% $0 -47 -11% Pro / CPA 5 M filers enter 29 Manual FY 04 FY 05 FY 06 I n filings C o n i d e n Source: Intuit estimates, IRS reports and public t u i t from taxf stores. t i a l FY 07 FY 08 (prelim) 3. 5 M filers exit

Consumer Tax Prep Trends… We’re in the Sweet Spot Price Net Promoter 5 yr CAGR $230 24 2% Franchise/ Tax Store $180 8 1% Software $55 45 8% $0 -47 -11% Pro / CPA 5 M filers enter 29 Manual FY 04 FY 05 FY 06 I n filings C o n i d e n Source: Intuit estimates, IRS reports and public t u i t from taxf stores. t i a l FY 07 FY 08 (prelim) 3. 5 M filers exit

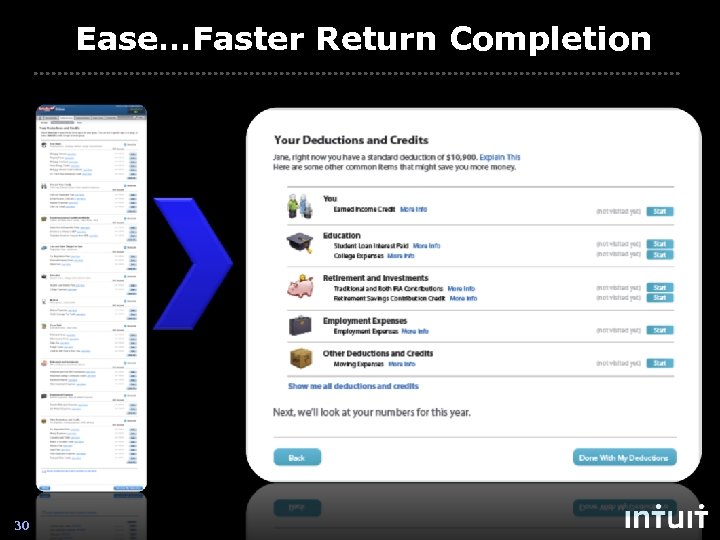

Ease…Faster Return Completion 30 Intuit Confidential

Ease…Faster Return Completion 30 Intuit Confidential

Ease…Entire Customer Experience Product Support TV Print Retail PR Website 31 Intuit Confidential

Ease…Entire Customer Experience Product Support TV Print Retail PR Website 31 Intuit Confidential

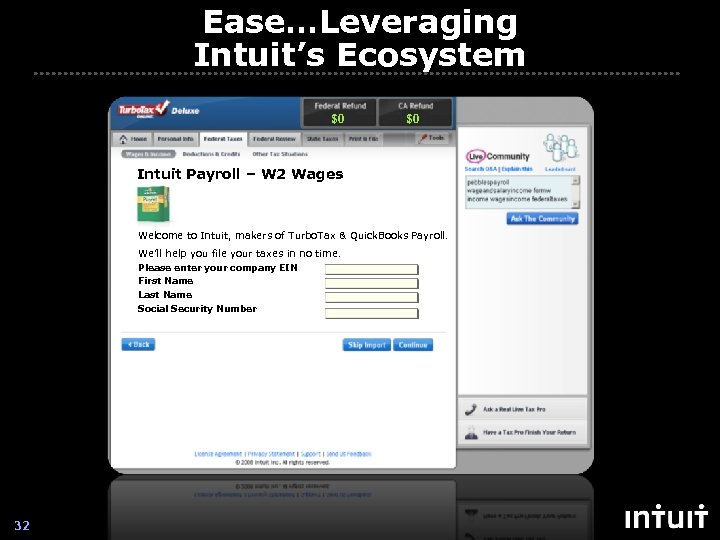

Ease…Leveraging Intuit’s Ecosystem $0 $0 Intuit Payroll – W 2 Wages Welcome to Intuit, makers of Turbo. Tax & Quick. Books Payroll. We’ll help you file your taxes in no time. Please enter your company EIN First Name Last Name Social Security Number 32 Intuit Confidential

Ease…Leveraging Intuit’s Ecosystem $0 $0 Intuit Payroll – W 2 Wages Welcome to Intuit, makers of Turbo. Tax & Quick. Books Payroll. We’ll help you file your taxes in no time. Please enter your company EIN First Name Last Name Social Security Number 32 Intuit Confidential

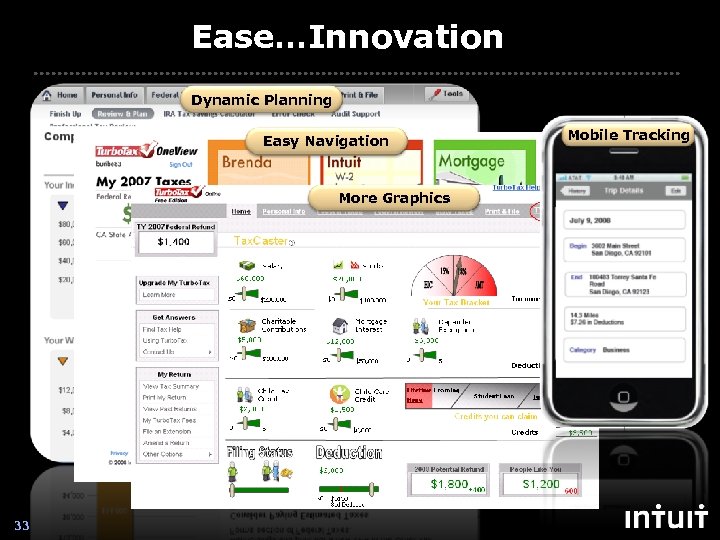

Ease…Innovation Dynamic Planning Easy Navigation More Graphics 33 Intuit Confidential Mobile Tracking

Ease…Innovation Dynamic Planning Easy Navigation More Graphics 33 Intuit Confidential Mobile Tracking

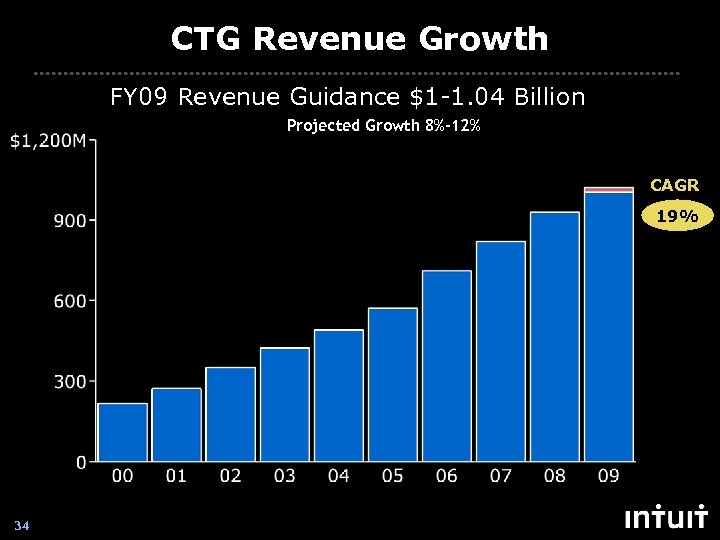

CTG Revenue Growth FY 09 Revenue Guidance $1 -1. 04 Billion Projected Growth 8%-12% CAGR 19% 34 Intuit Confidential

CTG Revenue Growth FY 09 Revenue Guidance $1 -1. 04 Billion Projected Growth 8%-12% CAGR 19% 34 Intuit Confidential

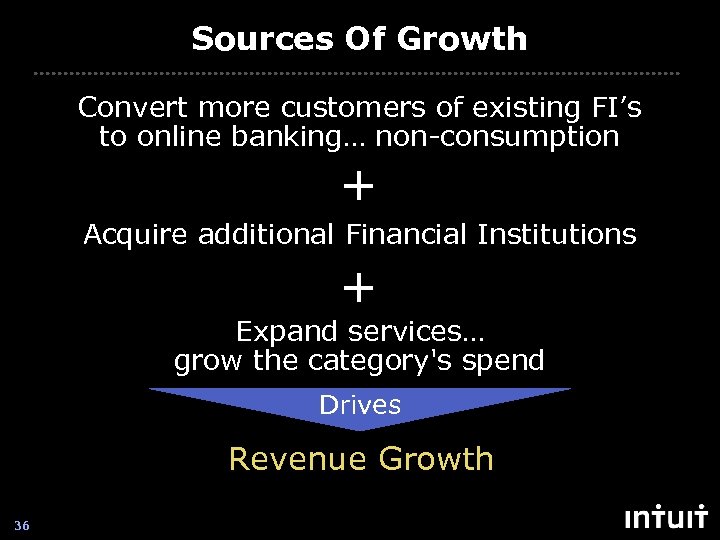

Sources Of Growth Convert more customers of existing FI’s to online banking… non-consumption + Acquire additional Financial Institutions + Expand services… grow the category's spend Drives Revenue Growth 36 Intuit Confidential

Sources Of Growth Convert more customers of existing FI’s to online banking… non-consumption + Acquire additional Financial Institutions + Expand services… grow the category's spend Drives Revenue Growth 36 Intuit Confidential

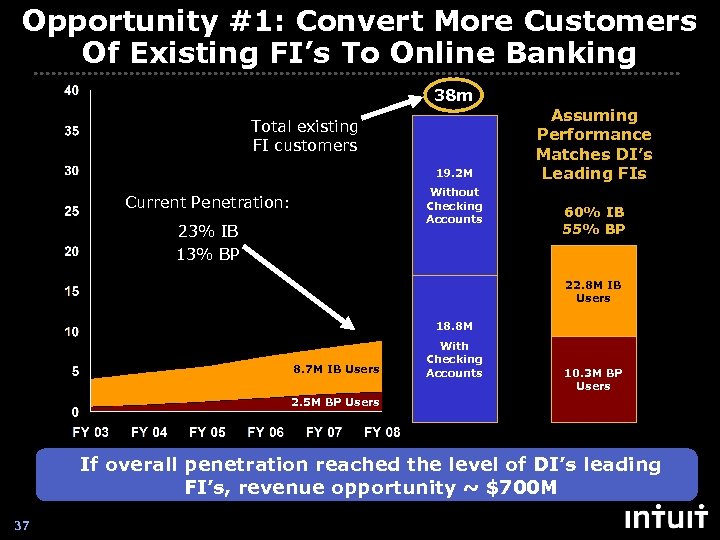

Opportunity #1: Convert More Customers Of Existing FI’s To Online Banking 38 m Total existing FI customers Users Millions 19. 2 M Without Checking Accounts Current Penetration: 23% IB 13% BP Assuming Performance Matches DI’s Leading FIs 60% IB 55% BP 22. 8 M IB Users 18. 8 M 8. 7 M IB Users With Checking Accounts Account 10. 3 M BP Users 2. 5 M BP Users If overall penetration reached the level of DI’s leading FI’s, revenue opportunity ~ $700 M 37 Intuit Confidential

Opportunity #1: Convert More Customers Of Existing FI’s To Online Banking 38 m Total existing FI customers Users Millions 19. 2 M Without Checking Accounts Current Penetration: 23% IB 13% BP Assuming Performance Matches DI’s Leading FIs 60% IB 55% BP 22. 8 M IB Users 18. 8 M 8. 7 M IB Users With Checking Accounts Account 10. 3 M BP Users 2. 5 M BP Users If overall penetration reached the level of DI’s leading FI’s, revenue opportunity ~ $700 M 37 Intuit Confidential

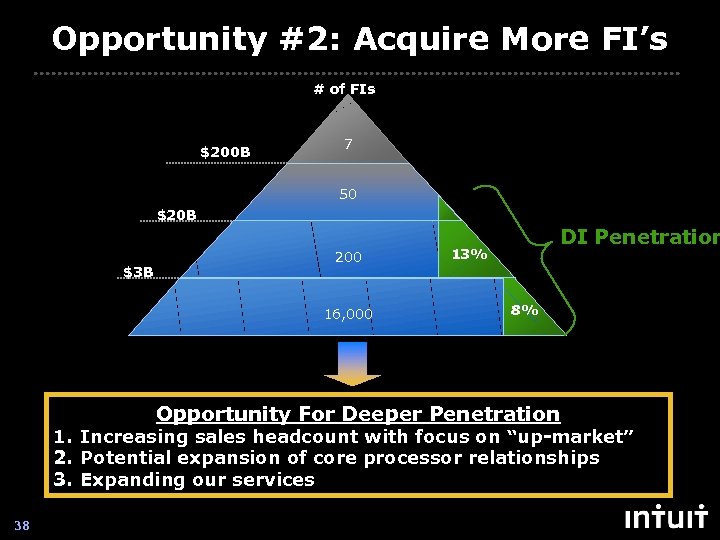

Opportunity #2: Acquire More FI’s # of FIs Assets 7 $200 B 50 $20 B 200 $3 B 16, 000 DI Penetration 13% 8% Opportunity For Deeper Penetration 1. Increasing sales headcount with focus on “up-market” 2. Potential expansion of core processor relationships 3. Expanding our services 38 Intuit Confidential

Opportunity #2: Acquire More FI’s # of FIs Assets 7 $200 B 50 $20 B 200 $3 B 16, 000 DI Penetration 13% 8% Opportunity For Deeper Penetration 1. Increasing sales headcount with focus on “up-market” 2. Potential expansion of core processor relationships 3. Expanding our services 38 Intuit Confidential

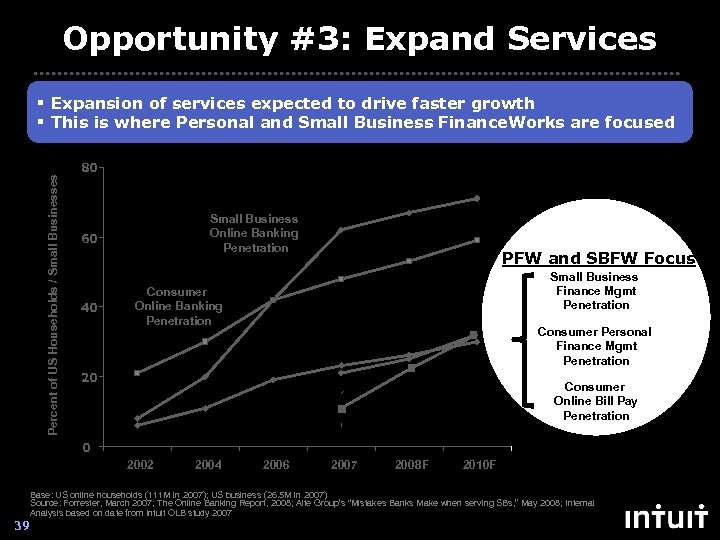

Opportunity #3: Expand Services Percent of US Households / Small Businesses § Expansion of services expected to drive faster growth § This is where Personal and Small Business Finance. Works are focused 80 Small Business Online Banking Penetration 60 40 PFW and SBFW Focus Small Business Finance Mgmt Penetration Consumer Online Banking Penetration Consumer Personal Finance Mgmt Penetration 20 Consumer Online Bill Pay Penetration 0 2002 2004 2006 2007 2008 F 2010 F Base: US online households (111 M in 2007); US business (26. 5 M in 2007) Source: Forrester, March 2007; The Online Banking Report, 2008; Aite Group’s “Mistakes Banks Make when serving SBs, ” May 2008; Internal Analysis based on date from Intuit OLB study 2007 Source: Forrester US Online Banking Forecast, 03/07 39 Intuit Confidential

Opportunity #3: Expand Services Percent of US Households / Small Businesses § Expansion of services expected to drive faster growth § This is where Personal and Small Business Finance. Works are focused 80 Small Business Online Banking Penetration 60 40 PFW and SBFW Focus Small Business Finance Mgmt Penetration Consumer Online Banking Penetration Consumer Personal Finance Mgmt Penetration 20 Consumer Online Bill Pay Penetration 0 2002 2004 2006 2007 2008 F 2010 F Base: US online households (111 M in 2007); US business (26. 5 M in 2007) Source: Forrester, March 2007; The Online Banking Report, 2008; Aite Group’s “Mistakes Banks Make when serving SBs, ” May 2008; Internal Analysis based on date from Intuit OLB study 2007 Source: Forrester US Online Banking Forecast, 03/07 39 Intuit Confidential

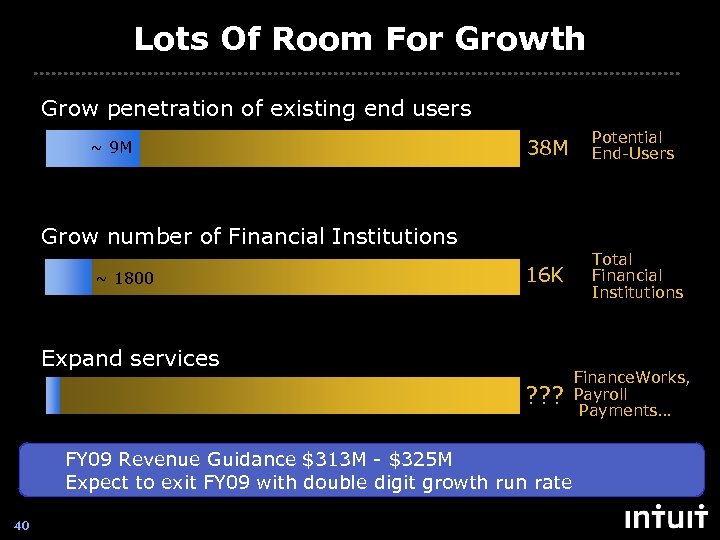

Lots Of Room For Growth Grow penetration of existing end users 38 M Potential End-Users 16 K ~ 9 M Total Financial Institutions Grow number of Financial Institutions ~ 1800 Expand services ? ? ? FY 09 Revenue Guidance $313 M - $325 M Expect to exit FY 09 with double digit growth run rate 40 Intuit Confidential Finance. Works, Payroll Payments…

Lots Of Room For Growth Grow penetration of existing end users 38 M Potential End-Users 16 K ~ 9 M Total Financial Institutions Grow number of Financial Institutions ~ 1800 Expand services ? ? ? FY 09 Revenue Guidance $313 M - $325 M Expect to exit FY 09 with double digit growth run rate 40 Intuit Confidential Finance. Works, Payroll Payments…

Our Healthcare Efforts… The Front End Application • Free to consumer web based tool • Helps consumers understand & manage their medical expenses • Consolidates critical health care financial info in one place • Enables electronic payment to their doctors 41 Intuit Confidential

Our Healthcare Efforts… The Front End Application • Free to consumer web based tool • Helps consumers understand & manage their medical expenses • Consolidates critical health care financial info in one place • Enables electronic payment to their doctors 41 Intuit Confidential

Our Healthcare Efforts… Big 5 Health Plans: 1. Well. Point 2. United 3. Aetna 4. HCSC 5. . . 28. CIGNA Medical Mutual of Ohio Quicken Health Expense Tracker All Plans in Beta by Jan Each Launching Broadly in 2009 42 Intuit Confidential

Our Healthcare Efforts… Big 5 Health Plans: 1. Well. Point 2. United 3. Aetna 4. HCSC 5. . . 28. CIGNA Medical Mutual of Ohio Quicken Health Expense Tracker All Plans in Beta by Jan Each Launching Broadly in 2009 42 Intuit Confidential

Our Global Efforts… Our Goal: To be a premier global provider of connected services to SMBs • Focusing on 10 countries with 60% of world’s 400 M SMBs (India + SE Asia) • Developing globally-relevant SMB offerings • Building world-class innovation capabilities in India • Introducing first beta offerings into the Emerging Markets in late FY’ 09 Multi-Currency 43 Intuit Confidential

Our Global Efforts… Our Goal: To be a premier global provider of connected services to SMBs • Focusing on 10 countries with 60% of world’s 400 M SMBs (India + SE Asia) • Developing globally-relevant SMB offerings • Building world-class innovation capabilities in India • Introducing first beta offerings into the Emerging Markets in late FY’ 09 Multi-Currency 43 Intuit Confidential

Intuit Financial Principles • Double digit annual organic revenue growth supplemented by acquisitions • Revenue growth greater than expenses • Generate operating income leverage…expanded OM% • Generate strong cash flow…in line with op income • While investing for future growth in: • Longer term business opportunities and infrastructure • And returning excess cash to shareholders • Normally in the form of share repurchase 44 44 Intuit Confidential

Intuit Financial Principles • Double digit annual organic revenue growth supplemented by acquisitions • Revenue growth greater than expenses • Generate operating income leverage…expanded OM% • Generate strong cash flow…in line with op income • While investing for future growth in: • Longer term business opportunities and infrastructure • And returning excess cash to shareholders • Normally in the form of share repurchase 44 44 Intuit Confidential

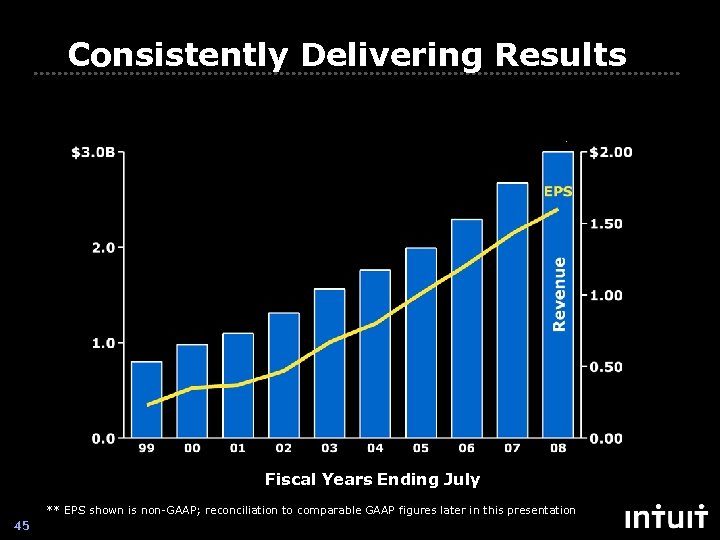

Consistently Delivering Results Revenue ($B) EPS ($)** (CAGR 15%) (CAGR 21%) Fiscal Years Ending July ** EPS shown is non-GAAP; reconciliation to comparable GAAP figures later in this presentation 45 Intuit Confidential

Consistently Delivering Results Revenue ($B) EPS ($)** (CAGR 15%) (CAGR 21%) Fiscal Years Ending July ** EPS shown is non-GAAP; reconciliation to comparable GAAP figures later in this presentation 45 Intuit Confidential

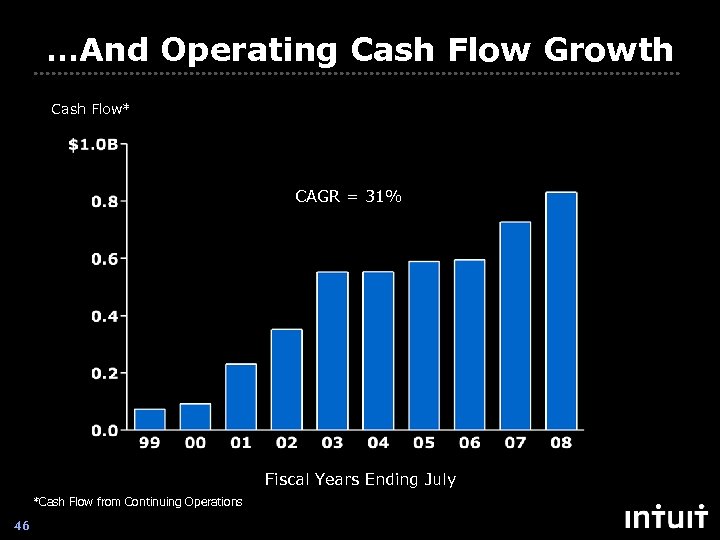

…And Operating Cash Flow Growth Cash Flow ($B) Cash Flow* (CAGR 23%) CAGR = 31% Fiscal Years Ending July *Cash Flow from Continuing Operations 46 Intuit Confidential

…And Operating Cash Flow Growth Cash Flow ($B) Cash Flow* (CAGR 23%) CAGR = 31% Fiscal Years Ending July *Cash Flow from Continuing Operations 46 Intuit Confidential

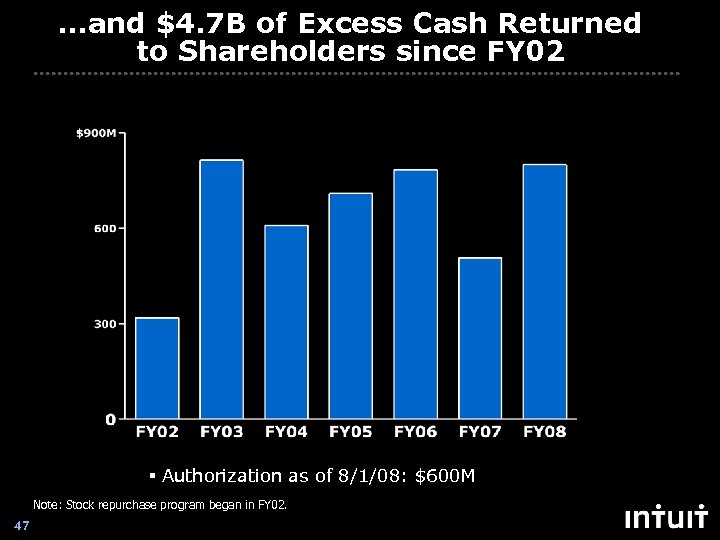

…and $4. 7 B of Excess Cash Returned to Shareholders since FY 02 § Authorization as of 8/1/08: $600 M Note: Stock repurchase program began in FY 02. 47 Intuit Confidential

…and $4. 7 B of Excess Cash Returned to Shareholders since FY 02 § Authorization as of 8/1/08: $600 M Note: Stock repurchase program began in FY 02. 47 Intuit Confidential

Summary • Focused on accelerating organic growth & op leverage • Great businesses with lots of headroom for continued growth… and a pipeline of new ideas in process • A clear game plan to win - delighting customers with easy-to-use connected services that solve important customer problems & help them achieve their dreams • Key areas of focus in the coming year: • Ease of Use… in a connected services world • Win new users. . . “new front doors”, “Free”, etc… and monetize over time • Allocate resources against highest value opportunities 48 Intuit Confidential

Summary • Focused on accelerating organic growth & op leverage • Great businesses with lots of headroom for continued growth… and a pipeline of new ideas in process • A clear game plan to win - delighting customers with easy-to-use connected services that solve important customer problems & help them achieve their dreams • Key areas of focus in the coming year: • Ease of Use… in a connected services world • Win new users. . . “new front doors”, “Free”, etc… and monetize over time • Allocate resources against highest value opportunities 48 Intuit Confidential

Cautions About Forward-Looking Statements This presentation includes "forward-looking statements" which are subject to safe harbors created under the U. S. federal securities laws. All statements included in this presentation that address activities, events or developments that Intuit expects, believes or anticipates will or may occur in the future are forward looking statements, including: our expected market and growth opportunities and strategies to grow our business; our expected revenue growth, operating income leverage and cash flow; and future market trends. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from the expectations expressed in the forward-looking statements. These factors include, without limitation, the following: product introductions and price competition from our competitors can have unpredictable negative effects on our revenue, profitability and market position; governmental encroachment in our tax businesses or other governmental activities or public policy affecting the preparation and filing of tax returns could negatively affect our operating results and market position; if economic and market conditions in the U. S. and worldwide continue to decline, our customers may delay or reduce technology purchases which may harm our business, results of operations and financial condition; we may not be able to successfully introduce new products and services to meet our growth and profitability objectives, and current and future products and services may not adequately address customer needs and may not achieve broad market acceptance, which could harm our operating results and financial condition; any failure to maintain reliable and responsive service levels for our offerings could cause us to lose customers and negatively impact our revenues and profitability; any significant product quality problems or delays in our products could harm our revenue, earnings and reputation; our participation in the Free File Alliance may result in lost revenue opportunities and cannibalization of our traditional paid franchise; any failure to properly use and protect personal customer information could harm our revenue, earnings and reputation; our acquisition activities may be disruptive to Intuit and may not result in expected benefits; our use of significant amounts of debt to finance acquisitions or other activities could harm our financial condition and results of operations; our revenue and earnings are highly seasonal and the timing of our revenue between quarters is difficult to predict, which may cause significant quarterly fluctuations in our financial results; predicting tax-related revenues is challenging due to the heavy concentration of activity in a short time period; we have implemented, and are continuing to upgrade, new information systems and any problems with these new systems could interfere with our ability to deliver products and services and gather information to effectively manage our business; our financial position may not make repurchasing shares advisable or we may issue additional shares in an acquisition causing our number of outstanding shares to grow; and litigation involving intellectual property, antitrust, shareholder and other matters may increase our costs. More details about these and other risks that may impact our business are included in our Form 10 -K for fiscal 2008 and in our other SEC filings, available through our website at www. intuit. com. Fiscal 2009 guidance speaks only as of the date it was publicly issued by Intuit. Other forward-looking statements represent the judgment of the management of Intuit as of the date of this presentation. We do not undertake any duty to update any forward-looking statement or other information in this presentation. 49 Intuit Confidential

Cautions About Forward-Looking Statements This presentation includes "forward-looking statements" which are subject to safe harbors created under the U. S. federal securities laws. All statements included in this presentation that address activities, events or developments that Intuit expects, believes or anticipates will or may occur in the future are forward looking statements, including: our expected market and growth opportunities and strategies to grow our business; our expected revenue growth, operating income leverage and cash flow; and future market trends. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from the expectations expressed in the forward-looking statements. These factors include, without limitation, the following: product introductions and price competition from our competitors can have unpredictable negative effects on our revenue, profitability and market position; governmental encroachment in our tax businesses or other governmental activities or public policy affecting the preparation and filing of tax returns could negatively affect our operating results and market position; if economic and market conditions in the U. S. and worldwide continue to decline, our customers may delay or reduce technology purchases which may harm our business, results of operations and financial condition; we may not be able to successfully introduce new products and services to meet our growth and profitability objectives, and current and future products and services may not adequately address customer needs and may not achieve broad market acceptance, which could harm our operating results and financial condition; any failure to maintain reliable and responsive service levels for our offerings could cause us to lose customers and negatively impact our revenues and profitability; any significant product quality problems or delays in our products could harm our revenue, earnings and reputation; our participation in the Free File Alliance may result in lost revenue opportunities and cannibalization of our traditional paid franchise; any failure to properly use and protect personal customer information could harm our revenue, earnings and reputation; our acquisition activities may be disruptive to Intuit and may not result in expected benefits; our use of significant amounts of debt to finance acquisitions or other activities could harm our financial condition and results of operations; our revenue and earnings are highly seasonal and the timing of our revenue between quarters is difficult to predict, which may cause significant quarterly fluctuations in our financial results; predicting tax-related revenues is challenging due to the heavy concentration of activity in a short time period; we have implemented, and are continuing to upgrade, new information systems and any problems with these new systems could interfere with our ability to deliver products and services and gather information to effectively manage our business; our financial position may not make repurchasing shares advisable or we may issue additional shares in an acquisition causing our number of outstanding shares to grow; and litigation involving intellectual property, antitrust, shareholder and other matters may increase our costs. More details about these and other risks that may impact our business are included in our Form 10 -K for fiscal 2008 and in our other SEC filings, available through our website at www. intuit. com. Fiscal 2009 guidance speaks only as of the date it was publicly issued by Intuit. Other forward-looking statements represent the judgment of the management of Intuit as of the date of this presentation. We do not undertake any duty to update any forward-looking statement or other information in this presentation. 49 Intuit Confidential

About Non-GAAP Financial Measures The accompanying presentation dated September 24, 2008 contains non-GAAP financial measures. The following slide reconciles the non-GAAP financial measures in that presentation to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles (GAAP). These non. GAAP financial measures include non-GAAP operating income (loss), non-GAAP net income (loss) and non-GAAP net income (loss) per share. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures do not reflect a comprehensive system of accounting, differ from GAAP measures with the same names and may differ from non-GAAP financial measures with the same or similar names that are used by other companies. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding Intuit’s operating results primarily because they exclude amounts that we do not consider part of ongoing operating results when assessing the performance of the organization, our operating segments or our senior management. Segment managers are not held accountable for share-based compensation expenses, acquisition-related costs, or the other excluded items that may impact their business units’ operating income (loss) and, accordingly, we exclude these amounts from our measures of segment performance. We also exclude these amounts from our budget and planning process. We believe that our non-GAAP financial measures also facilitate the comparison of results for current periods and guidance for future periods with results for past periods. We exclude the following items from our non-GAAP financial measures: • Share-based compensation expenses. Our non-GAAP financial measures exclude share-based compensation expenses, which consist of expenses for stock options, restricted stock units and purchases of common stock under our Employee Stock Purchase Plan. Segment managers are not held accountable for share-based compensation expenses impacting their business units’ operating income (loss) and, accordingly, we exclude share-based compensation expenses from our measures of segment performance. While share-based compensation is a significant expense affecting our results of operations, management excludes share-based compensation from our budget and planning process. We exclude share-based compensation expenses from our non-GAAP financial measures for these reasons and the other reasons stated above. We compute weighted average dilutive shares using the method required by SFAS 123(R) for both GAAP and non-GAAP diluted net income per share. • Amortization of purchased intangible assets and acquisition-related charges. In accordance with GAAP, amortization of purchased intangible assets in cost of revenue includes amortization of software and other technology assets related to acquisitions. Acquisition-related charges in operating expenses include amortization of other purchased intangible assets such as customer lists, covenants not to compete and trade names. Acquisition activities are managed on a corporate-wide basis and segment managers are not held accountable for the acquisition-related costs impacting their business units’ operating income (loss). We exclude these amounts from our measures of segment performance and from our budget and planning process. We exclude these items from our non-GAAP financial measures for these reasons, the other reasons stated above and because we believe that excluding these items facilitates comparisons to the results of other companies in our industry, which have their own unique acquisition histories. • Gains and losses on disposals of businesses and assets. We exclude these amounts from our non-GAAP financial measures for the reasons stated above and because they are unrelated to our ongoing business operating results. • Gains and losses on marketable equity securities and other investments. We exclude these amounts from our non-GAAP financial measures for the reasons stated above and because they are unrelated to our ongoing business operating results. • Income tax effects of excluded items. Our non-GAAP financial measures exclude the income tax effects of the adjustments described above that relate to the current period as well as adjustments for similar items that relate to prior periods. We exclude the impact of these tax items for the reasons stated above and because management believes that they are not indicative of our ongoing business operations. • Operating results and gains and losses on the sale of discontinued operations. From time to time, we sell or otherwise dispose of selected operations as we adjust our portfolio of businesses to meet our strategic goals. In accordance with GAAP, we segregate the operating results of discontinued operations as well as gains and losses on the sale of these discontinued operations from continuing operations on our GAAP statements of operations but continue to include them in GAAP net income or loss and net income or loss per share. We exclude these amounts from our non-GAAP financial measures for the reasons stated above and because they are unrelated to our ongoing business operations. 50 Intuit Confidential

About Non-GAAP Financial Measures The accompanying presentation dated September 24, 2008 contains non-GAAP financial measures. The following slide reconciles the non-GAAP financial measures in that presentation to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles (GAAP). These non. GAAP financial measures include non-GAAP operating income (loss), non-GAAP net income (loss) and non-GAAP net income (loss) per share. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures do not reflect a comprehensive system of accounting, differ from GAAP measures with the same names and may differ from non-GAAP financial measures with the same or similar names that are used by other companies. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding Intuit’s operating results primarily because they exclude amounts that we do not consider part of ongoing operating results when assessing the performance of the organization, our operating segments or our senior management. Segment managers are not held accountable for share-based compensation expenses, acquisition-related costs, or the other excluded items that may impact their business units’ operating income (loss) and, accordingly, we exclude these amounts from our measures of segment performance. We also exclude these amounts from our budget and planning process. We believe that our non-GAAP financial measures also facilitate the comparison of results for current periods and guidance for future periods with results for past periods. We exclude the following items from our non-GAAP financial measures: • Share-based compensation expenses. Our non-GAAP financial measures exclude share-based compensation expenses, which consist of expenses for stock options, restricted stock units and purchases of common stock under our Employee Stock Purchase Plan. Segment managers are not held accountable for share-based compensation expenses impacting their business units’ operating income (loss) and, accordingly, we exclude share-based compensation expenses from our measures of segment performance. While share-based compensation is a significant expense affecting our results of operations, management excludes share-based compensation from our budget and planning process. We exclude share-based compensation expenses from our non-GAAP financial measures for these reasons and the other reasons stated above. We compute weighted average dilutive shares using the method required by SFAS 123(R) for both GAAP and non-GAAP diluted net income per share. • Amortization of purchased intangible assets and acquisition-related charges. In accordance with GAAP, amortization of purchased intangible assets in cost of revenue includes amortization of software and other technology assets related to acquisitions. Acquisition-related charges in operating expenses include amortization of other purchased intangible assets such as customer lists, covenants not to compete and trade names. Acquisition activities are managed on a corporate-wide basis and segment managers are not held accountable for the acquisition-related costs impacting their business units’ operating income (loss). We exclude these amounts from our measures of segment performance and from our budget and planning process. We exclude these items from our non-GAAP financial measures for these reasons, the other reasons stated above and because we believe that excluding these items facilitates comparisons to the results of other companies in our industry, which have their own unique acquisition histories. • Gains and losses on disposals of businesses and assets. We exclude these amounts from our non-GAAP financial measures for the reasons stated above and because they are unrelated to our ongoing business operating results. • Gains and losses on marketable equity securities and other investments. We exclude these amounts from our non-GAAP financial measures for the reasons stated above and because they are unrelated to our ongoing business operating results. • Income tax effects of excluded items. Our non-GAAP financial measures exclude the income tax effects of the adjustments described above that relate to the current period as well as adjustments for similar items that relate to prior periods. We exclude the impact of these tax items for the reasons stated above and because management believes that they are not indicative of our ongoing business operations. • Operating results and gains and losses on the sale of discontinued operations. From time to time, we sell or otherwise dispose of selected operations as we adjust our portfolio of businesses to meet our strategic goals. In accordance with GAAP, we segregate the operating results of discontinued operations as well as gains and losses on the sale of these discontinued operations from continuing operations on our GAAP statements of operations but continue to include them in GAAP net income or loss and net income or loss per share. We exclude these amounts from our non-GAAP financial measures for the reasons stated above and because they are unrelated to our ongoing business operations. 50 Intuit Confidential

About Non-GAAP Financial Measures The following describes each non-GAAP financial measure, the items excluded from the most directly comparable GAAP measure in arriving at each non-GAAP financial measure, and the reasons management uses each measure and excludes the specified amounts in arriving at each non-GAAP financial measure. (A) Operating income (loss). We exclude share-based compensation expenses, amortization of purchased intangible assets and acquisition-related charges from our GAAP operating income (loss) from continuing operations in arriving at our non-GAAP operating income (loss) primarily because we do not consider them part of ongoing operating results when assessing the performance of the organization, our operating segments and senior management or when undertaking our budget and planning process. We believe that the exclusion of these expenses from our non-GAAP financial measures also facilitates the comparison of results for current periods and guidance for future periods with results for prior periods. In addition, we exclude amortization of purchased intangible assets and acquisitionrelated charges from non-GAAP operating income (loss) because we believe that excluding these items facilitates comparisons to the results of other companies in our industry, which have their own unique acquisition histories. (B) Net income (loss) and net income (loss) per share (or earnings per share). We exclude share-based compensation expenses, amortization of purchased intangible assets, acquisition-related charges, net gains on marketable equity securities and other investments, gains and losses on disposals of businesses, certain tax items as described above, and amounts related to discontinued operations from our GAAP net income (loss) and net income (loss) per share in arriving at our non-GAAP net income (loss) and net income (loss) per share. We exclude all of these items from our non-GAAP net income (loss) and net income (loss) per share primarily because we do not consider them part of ongoing operating results when assessing the performance of the organization, our operating segments and senior management or when undertaking our budget and planning process. We believe that the exclusion of these items from our non-GAAP financial measures also facilitates the comparison of results for current periods and guidance for future periods with results for prior periods. In addition, we exclude amortization of purchased intangible assets and acquisition-related charges from our non-GAAP net income (loss) and net income (loss) per share because we believe that excluding these items facilitates comparisons to the results of other companies in our industry, which have their own unique acquisition histories. We exclude gains on marketable equity securities and other investments, net from our non-GAAP net income (loss) and net income (loss) per share because they are unrelated to our ongoing business operating results. Our non-GAAP financial measures exclude the income tax effects of the adjustments described above that relate to the current period as well as adjustments for similar items that relate to prior periods. We exclude the impact of these tax items because management believes that they are not indicative of our ongoing business operations. The effective tax rates used to calculate non-GAAP net income (loss) and net income (loss) per share were as follows: 36% for fiscal 1999; 34% for fiscal 2000 and 2001; 33% for fiscal 2002 and 2003; 34% for fiscal 2004; 35% for fiscal 2005; 37% for fiscal 2006; and 36% for fiscal 2007, 2008 and 2009. Finally, we exclude amounts related to discontinued operations from our non. GAAP net income (loss) and net income (loss) per share because they are unrelated to our ongoing business operations. We refer to these non-GAAP financial measures in assessing the performance of Intuit’s ongoing operations and for planning and forecasting in future periods. These non-GAAP financial measures also facilitate our internal comparisons to Intuit’s historical operating results. We have historically reported similar non-GAAP financial measures and believe that the inclusion of comparative numbers provides consistency in our financial reporting. We compute non-GAAP financial measures using the same consistent method from quarter to quarter and year to year. The reconciliations of the forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures in Table 2 include all information reasonably available to Intuit at the date of this presentation. These tables include adjustments that we can reasonably predict. Events that could cause the reconciliation to change include acquisitions and divestitures of businesses, goodwill and other asset impairments and sales of marketable equity securities and other investments. 51 Intuit Confidential

About Non-GAAP Financial Measures The following describes each non-GAAP financial measure, the items excluded from the most directly comparable GAAP measure in arriving at each non-GAAP financial measure, and the reasons management uses each measure and excludes the specified amounts in arriving at each non-GAAP financial measure. (A) Operating income (loss). We exclude share-based compensation expenses, amortization of purchased intangible assets and acquisition-related charges from our GAAP operating income (loss) from continuing operations in arriving at our non-GAAP operating income (loss) primarily because we do not consider them part of ongoing operating results when assessing the performance of the organization, our operating segments and senior management or when undertaking our budget and planning process. We believe that the exclusion of these expenses from our non-GAAP financial measures also facilitates the comparison of results for current periods and guidance for future periods with results for prior periods. In addition, we exclude amortization of purchased intangible assets and acquisitionrelated charges from non-GAAP operating income (loss) because we believe that excluding these items facilitates comparisons to the results of other companies in our industry, which have their own unique acquisition histories. (B) Net income (loss) and net income (loss) per share (or earnings per share). We exclude share-based compensation expenses, amortization of purchased intangible assets, acquisition-related charges, net gains on marketable equity securities and other investments, gains and losses on disposals of businesses, certain tax items as described above, and amounts related to discontinued operations from our GAAP net income (loss) and net income (loss) per share in arriving at our non-GAAP net income (loss) and net income (loss) per share. We exclude all of these items from our non-GAAP net income (loss) and net income (loss) per share primarily because we do not consider them part of ongoing operating results when assessing the performance of the organization, our operating segments and senior management or when undertaking our budget and planning process. We believe that the exclusion of these items from our non-GAAP financial measures also facilitates the comparison of results for current periods and guidance for future periods with results for prior periods. In addition, we exclude amortization of purchased intangible assets and acquisition-related charges from our non-GAAP net income (loss) and net income (loss) per share because we believe that excluding these items facilitates comparisons to the results of other companies in our industry, which have their own unique acquisition histories. We exclude gains on marketable equity securities and other investments, net from our non-GAAP net income (loss) and net income (loss) per share because they are unrelated to our ongoing business operating results. Our non-GAAP financial measures exclude the income tax effects of the adjustments described above that relate to the current period as well as adjustments for similar items that relate to prior periods. We exclude the impact of these tax items because management believes that they are not indicative of our ongoing business operations. The effective tax rates used to calculate non-GAAP net income (loss) and net income (loss) per share were as follows: 36% for fiscal 1999; 34% for fiscal 2000 and 2001; 33% for fiscal 2002 and 2003; 34% for fiscal 2004; 35% for fiscal 2005; 37% for fiscal 2006; and 36% for fiscal 2007, 2008 and 2009. Finally, we exclude amounts related to discontinued operations from our non. GAAP net income (loss) and net income (loss) per share because they are unrelated to our ongoing business operations. We refer to these non-GAAP financial measures in assessing the performance of Intuit’s ongoing operations and for planning and forecasting in future periods. These non-GAAP financial measures also facilitate our internal comparisons to Intuit’s historical operating results. We have historically reported similar non-GAAP financial measures and believe that the inclusion of comparative numbers provides consistency in our financial reporting. We compute non-GAAP financial measures using the same consistent method from quarter to quarter and year to year. The reconciliations of the forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures in Table 2 include all information reasonably available to Intuit at the date of this presentation. These tables include adjustments that we can reasonably predict. Events that could cause the reconciliation to change include acquisitions and divestitures of businesses, goodwill and other asset impairments and sales of marketable equity securities and other investments. 51 Intuit Confidential

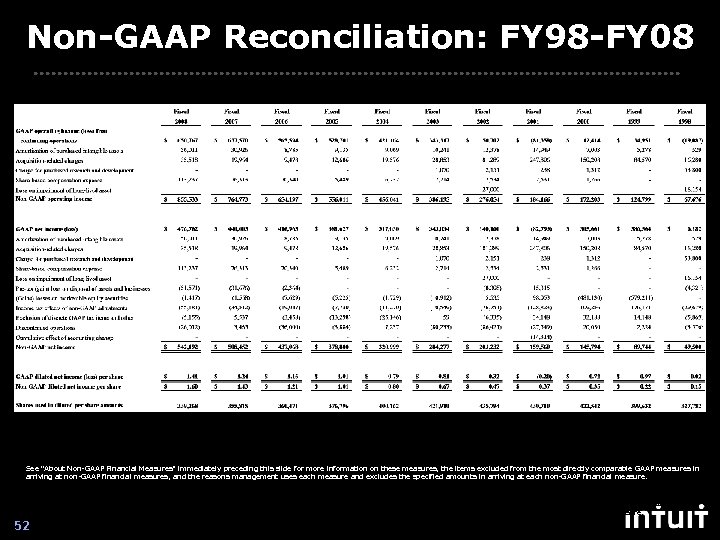

Non-GAAP Reconciliation: FY 98 -FY 08 INTUIT INC. TABLE 1 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES (In thousands, except per share amounts) (Unaudited) See “About Non-GAAP Financial Measures” immediately preceding this slide for more information on these measures, the items excluded from the most directly comparable GAAP measures in arriving at non-GAAP financial measures, and the reasons management uses each measure and excludes the specified amounts in arriving at each non-GAAP financial measure. See “About Non-GAAP Financial Measures” immediately preceding Table 1 for more information on these measures, the items excluded from the most directly comparable GAAP measures in arriving at non-GAAP financial measures, and the reasons management uses each measure and excludes the specified amounts in arriving at each non-GAAP financial measure. 52 Intuit Confidential

Non-GAAP Reconciliation: FY 98 -FY 08 INTUIT INC. TABLE 1 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES (In thousands, except per share amounts) (Unaudited) See “About Non-GAAP Financial Measures” immediately preceding this slide for more information on these measures, the items excluded from the most directly comparable GAAP measures in arriving at non-GAAP financial measures, and the reasons management uses each measure and excludes the specified amounts in arriving at each non-GAAP financial measure. See “About Non-GAAP Financial Measures” immediately preceding Table 1 for more information on these measures, the items excluded from the most directly comparable GAAP measures in arriving at non-GAAP financial measures, and the reasons management uses each measure and excludes the specified amounts in arriving at each non-GAAP financial measure. 52 Intuit Confidential