28ad9258266e1fe00e8c265496a65997.ppt

- Количество слайдов: 36

Annual Press Conference 3/19/2018 New Delhi, 30 th May 2011 1

Annual Press Conference 3/19/2018 New Delhi, 30 th May 2011 1

Presentation Itinerary Reflections Spotlights Physical Performance Financial Performance Open Session 3/19/2018 2

Presentation Itinerary Reflections Spotlights Physical Performance Financial Performance Open Session 3/19/2018 2

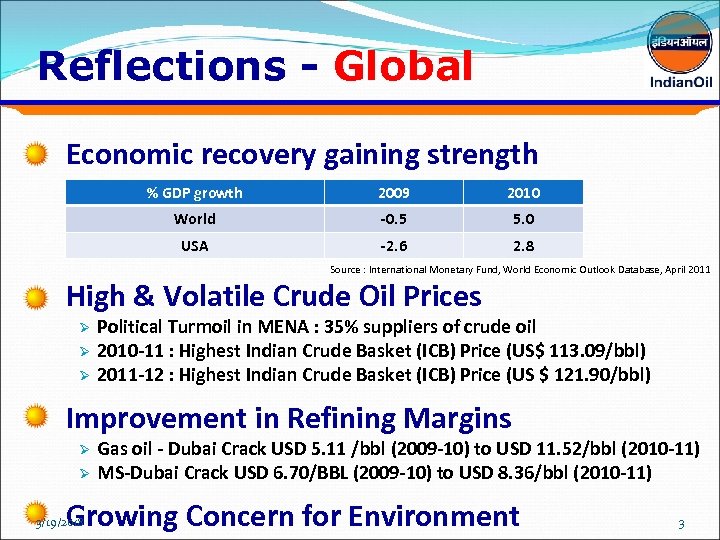

Reflections - Global Economic recovery gaining strength % GDP growth 2009 2010 World -0. 5 5. 0 USA -2. 6 2. 8 Source : International Monetary Fund, World Economic Outlook Database, April 2011 High & Volatile Crude Oil Prices Ø Ø Ø Political Turmoil in MENA : 35% suppliers of crude oil 2010 -11 : Highest Indian Crude Basket (ICB) Price (US$ 113. 09/bbl) 2011 -12 : Highest Indian Crude Basket (ICB) Price (US $ 121. 90/bbl) Improvement in Refining Margins Ø Ø Gas oil - Dubai Crack USD 5. 11 /bbl (2009 -10) to USD 11. 52/bbl (2010 -11) MS-Dubai Crack USD 6. 70/BBL (2009 -10) to USD 8. 36/bbl (2010 -11) Growing Concern for Environment 3/19/2018 3

Reflections - Global Economic recovery gaining strength % GDP growth 2009 2010 World -0. 5 5. 0 USA -2. 6 2. 8 Source : International Monetary Fund, World Economic Outlook Database, April 2011 High & Volatile Crude Oil Prices Ø Ø Ø Political Turmoil in MENA : 35% suppliers of crude oil 2010 -11 : Highest Indian Crude Basket (ICB) Price (US$ 113. 09/bbl) 2011 -12 : Highest Indian Crude Basket (ICB) Price (US $ 121. 90/bbl) Improvement in Refining Margins Ø Ø Gas oil - Dubai Crack USD 5. 11 /bbl (2009 -10) to USD 11. 52/bbl (2010 -11) MS-Dubai Crack USD 6. 70/BBL (2009 -10) to USD 8. 36/bbl (2010 -11) Growing Concern for Environment 3/19/2018 3

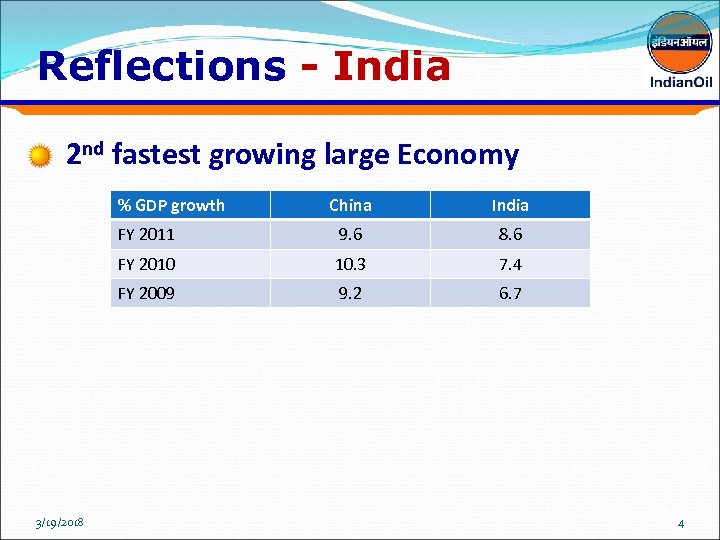

Reflections - India 2 nd fastest growing large Economy % GDP growth 3/19/2018 India FY 2011 9. 6 8. 6 FY 2010 10. 3 7. 4 FY 2009 China 9. 2 6. 7 4

Reflections - India 2 nd fastest growing large Economy % GDP growth 3/19/2018 India FY 2011 9. 6 8. 6 FY 2010 10. 3 7. 4 FY 2009 China 9. 2 6. 7 4

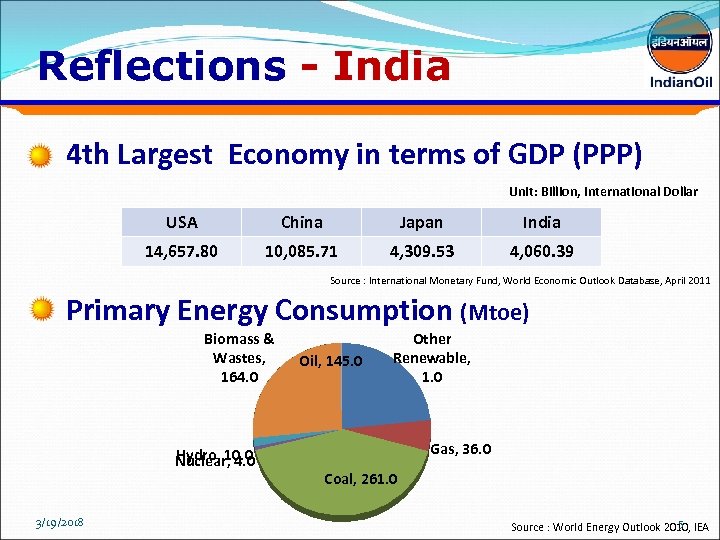

Reflections - India 4 th Largest Economy in terms of GDP (PPP) Unit: Billion, International Dollar USA China Japan India 14, 657. 80 10, 085. 71 4, 309. 53 4, 060. 39 Source : International Monetary Fund, World Economic Outlook Database, April 2011 Primary Energy Consumption (Mtoe) Biomass & Wastes, 164. 0 Hydro, 10. 0 Nuclear, 4. 0 3/19/2018 Oil, 145. 0 Other Renewable, 1. 0 Gas, 36. 0 Coal, 261. 0 5 Source : World Energy Outlook 2010, IEA

Reflections - India 4 th Largest Economy in terms of GDP (PPP) Unit: Billion, International Dollar USA China Japan India 14, 657. 80 10, 085. 71 4, 309. 53 4, 060. 39 Source : International Monetary Fund, World Economic Outlook Database, April 2011 Primary Energy Consumption (Mtoe) Biomass & Wastes, 164. 0 Hydro, 10. 0 Nuclear, 4. 0 3/19/2018 Oil, 145. 0 Other Renewable, 1. 0 Gas, 36. 0 Coal, 261. 0 5 Source : World Energy Outlook 2010, IEA

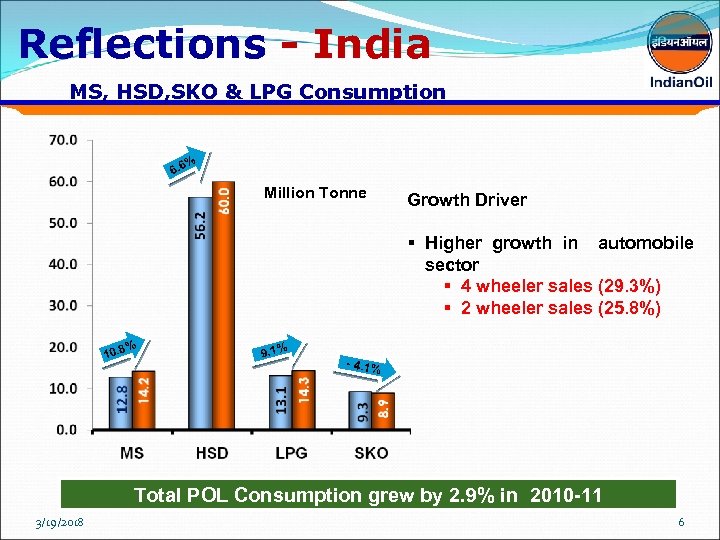

Reflections - India MS, HSD, SKO & LPG Consumption % 6. 6 Million Tonne Growth Driver § Higher growth in automobile sector § 4 wheeler sales (29. 3%) § 2 wheeler sales (25. 8%) % 10. 8 9. 1% - 4. 1% Total POL Consumption grew by 2. 9% in 2010 -11 3/19/2018 6

Reflections - India MS, HSD, SKO & LPG Consumption % 6. 6 Million Tonne Growth Driver § Higher growth in automobile sector § 4 wheeler sales (29. 3%) § 2 wheeler sales (25. 8%) % 10. 8 9. 1% - 4. 1% Total POL Consumption grew by 2. 9% in 2010 -11 3/19/2018 6

Spotlights – Indian. Oil Highest ever Turnover of ` 3, 28, 744 crore A Maharatna Company since Nov 2010 Refinery Capacity addition in 2010 -11 Ø Haldia from 6 to 7. 5 MMTPA Ø Panipat from 12 to 15 MMTPA Largest Refiner of the Country – 65. 7 MMTPA Ø Indian. Oil’s Refining Capacity Share - 34. 7% range of Petrochemicals joins Indian. Oil’s league of top Brands Added 358 KM of pipeline length during the year 3/19/2018 7

Spotlights – Indian. Oil Highest ever Turnover of ` 3, 28, 744 crore A Maharatna Company since Nov 2010 Refinery Capacity addition in 2010 -11 Ø Haldia from 6 to 7. 5 MMTPA Ø Panipat from 12 to 15 MMTPA Largest Refiner of the Country – 65. 7 MMTPA Ø Indian. Oil’s Refining Capacity Share - 34. 7% range of Petrochemicals joins Indian. Oil’s league of top Brands Added 358 KM of pipeline length during the year 3/19/2018 7

Physical Performance 8

Physical Performance 8

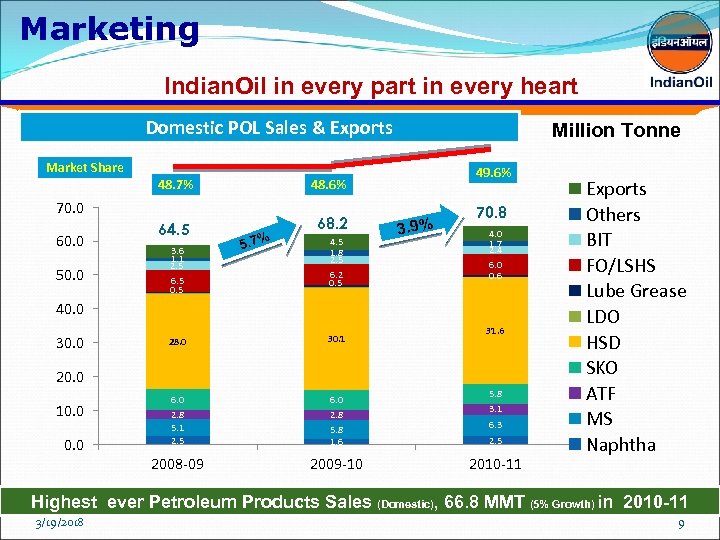

Marketing Indian. Oil in every part in every heart Domestic POL Sales & Exports Market Share 48. 7% 64. 5 70. 0 60. 0 50. 0 49. 6% 48. 6% 68. 2 Million Tonne 3. 6 1. 1 2. 5 6. 5 0. 5 5. 7% 4. 5 1. 8 2. 5 6. 2 0. 5 3. 9% 70. 8 4. 0 1. 7 2. 4 6. 0 0. 6 40. 0 30. 1 6. 0 2. 8 5. 1 2. 5 6. 0 2. 8 5. 8 1. 6 2008 -09 30. 0 28. 0 2009 -10 31. 6 20. 0 10. 0 5. 8 3. 1 6. 3 2. 5 2010 -11 Exports Others BIT FO/LSHS Lube Grease LDO HSD SKO ATF MS Naphtha Highest ever Petroleum Products Sales (Domestic), 66. 8 MMT (5% Growth) in 2010 -11 3/19/2018 9

Marketing Indian. Oil in every part in every heart Domestic POL Sales & Exports Market Share 48. 7% 64. 5 70. 0 60. 0 50. 0 49. 6% 48. 6% 68. 2 Million Tonne 3. 6 1. 1 2. 5 6. 5 0. 5 5. 7% 4. 5 1. 8 2. 5 6. 2 0. 5 3. 9% 70. 8 4. 0 1. 7 2. 4 6. 0 0. 6 40. 0 30. 1 6. 0 2. 8 5. 1 2. 5 6. 0 2. 8 5. 8 1. 6 2008 -09 30. 0 28. 0 2009 -10 31. 6 20. 0 10. 0 5. 8 3. 1 6. 3 2. 5 2010 -11 Exports Others BIT FO/LSHS Lube Grease LDO HSD SKO ATF MS Naphtha Highest ever Petroleum Products Sales (Domestic), 66. 8 MMT (5% Growth) in 2010 -11 3/19/2018 9

Marketing Reaching out touching lives LPG Domestic consumer base widened to over 618 lakh. Ø Added more than 44 Lakh new consumers Continued rural thrust for Inclusive Growth Ø Commissioned 570 Kisan Sewa Kendras (KSK) out of 820 new ROs Ø Rajiv Gandhi Gramin LPG Vitaran Yojana (RGGLVY) launched – 145 commissioned in 13 states 3/19/2018 10

Marketing Reaching out touching lives LPG Domestic consumer base widened to over 618 lakh. Ø Added more than 44 Lakh new consumers Continued rural thrust for Inclusive Growth Ø Commissioned 570 Kisan Sewa Kendras (KSK) out of 820 new ROs Ø Rajiv Gandhi Gramin LPG Vitaran Yojana (RGGLVY) launched – 145 commissioned in 13 states 3/19/2018 10

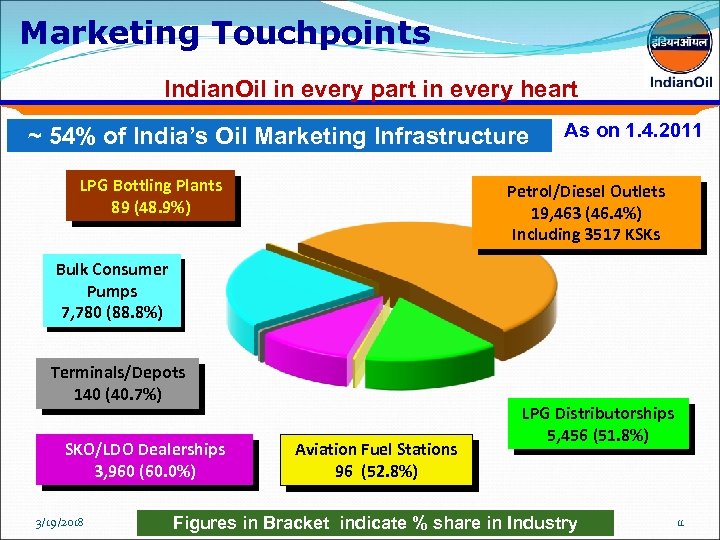

Marketing Touchpoints Indian. Oil in every part in every heart ~ 54% of India’s Oil Marketing Infrastructure LPG Bottling Plants 89 (48. 9%) As on 1. 4. 2011 Petrol/Diesel Outlets 19, 463 (46. 4%) Including 3517 KSKs Bulk Consumer Pumps 7, 780 (88. 8%) Terminals/Depots 140 (40. 7%) SKO/LDO Dealerships 3, 960 (60. 0%) 3/19/2018 Aviation Fuel Stations 96 (52. 8%) LPG Distributorships 5, 456 (51. 8%) Figures in Bracket indicate % share in Industry 11

Marketing Touchpoints Indian. Oil in every part in every heart ~ 54% of India’s Oil Marketing Infrastructure LPG Bottling Plants 89 (48. 9%) As on 1. 4. 2011 Petrol/Diesel Outlets 19, 463 (46. 4%) Including 3517 KSKs Bulk Consumer Pumps 7, 780 (88. 8%) Terminals/Depots 140 (40. 7%) SKO/LDO Dealerships 3, 960 (60. 0%) 3/19/2018 Aviation Fuel Stations 96 (52. 8%) LPG Distributorships 5, 456 (51. 8%) Figures in Bracket indicate % share in Industry 11

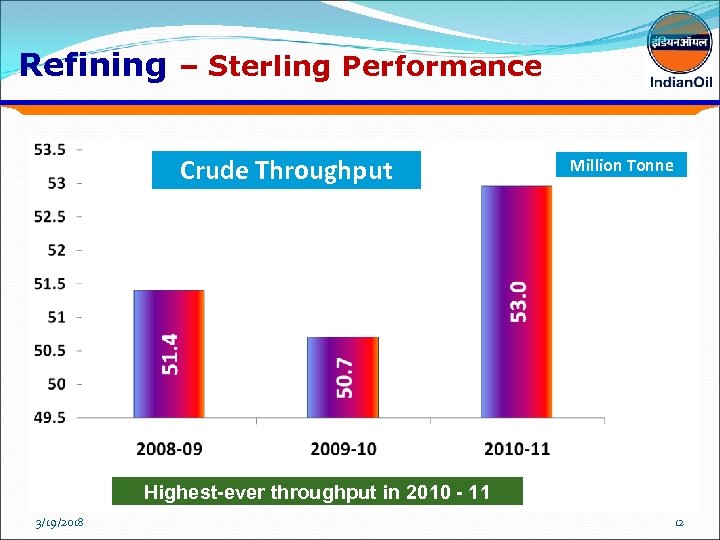

Refining – Sterling Performance Crude Throughput Million Tonne Highest-ever throughput in 2010 - 11 3/19/2018 12

Refining – Sterling Performance Crude Throughput Million Tonne Highest-ever throughput in 2010 - 11 3/19/2018 12

Refining – Creating Milestones More than 100% Capacity Utilization for 5 consecutive years Highest ever Distillate Yield, 75. 4 % wt Lowest ever Specific Energy Consumption, 59. 0 MBN BS IV/III Grade MS/HSD Quality improvement Projects completed in all Refineries 3/19/2018 13 MBN - An energy index defined as Mbtu/Bbl/NRGF

Refining – Creating Milestones More than 100% Capacity Utilization for 5 consecutive years Highest ever Distillate Yield, 75. 4 % wt Lowest ever Specific Energy Consumption, 59. 0 MBN BS IV/III Grade MS/HSD Quality improvement Projects completed in all Refineries 3/19/2018 13 MBN - An energy index defined as Mbtu/Bbl/NRGF

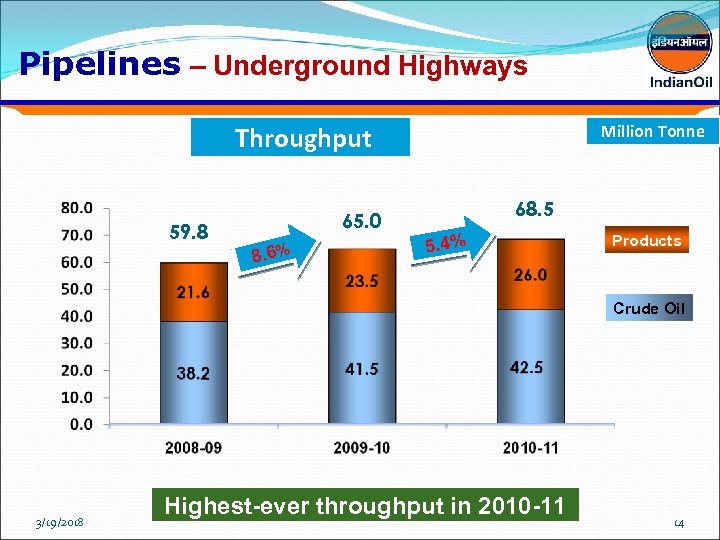

Pipelines – Underground Highways Throughput 59. 8 65. 0 8. 6% Million Tonne 68. 5 5. 4% Products Crude Oil 3/19/2018 Highest-ever throughput in 2010 -11 14

Pipelines – Underground Highways Throughput 59. 8 65. 0 8. 6% Million Tonne 68. 5 5. 4% Products Crude Oil 3/19/2018 Highest-ever throughput in 2010 -11 14

Pipelines – Underground Highways Indian. Oil’s cross country Pipelines network spreads to 10899 km reaching new destinations Transported 68. 5 MMT of Crude Oil & Products, the highest ever Entered into a new era of Natural Gas transportation • Commissioned 132 Km long Dadri-Panipat RLNG pipeline 3/19/2018 15

Pipelines – Underground Highways Indian. Oil’s cross country Pipelines network spreads to 10899 km reaching new destinations Transported 68. 5 MMT of Crude Oil & Products, the highest ever Entered into a new era of Natural Gas transportation • Commissioned 132 Km long Dadri-Panipat RLNG pipeline 3/19/2018 15

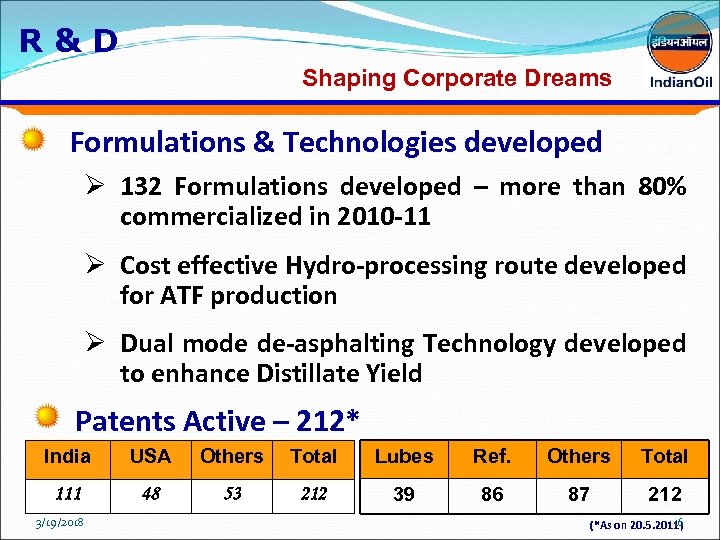

R&D Shaping Corporate Dreams Formulations & Technologies developed Ø 132 Formulations developed – more than 80% commercialized in 2010 -11 Ø Cost effective Hydro-processing route developed for ATF production Ø Dual mode de-asphalting Technology developed to enhance Distillate Yield Patents Active – 212* India USA Others Total Lubes Ref. Others Total 111 48 53 212 39 86 87 212 3/19/2018 16 (*As on 20. 5. 2011)

R&D Shaping Corporate Dreams Formulations & Technologies developed Ø 132 Formulations developed – more than 80% commercialized in 2010 -11 Ø Cost effective Hydro-processing route developed for ATF production Ø Dual mode de-asphalting Technology developed to enhance Distillate Yield Patents Active – 212* India USA Others Total Lubes Ref. Others Total 111 48 53 212 39 86 87 212 3/19/2018 16 (*As on 20. 5. 2011)

R&D The Power of Possibilities New Development Initiatives Ø Servo Agro Spray Oil: An eco-friendly, Biodegradable, non-toxic & pesticide free Oil developed & widely marketed Ø Mosquito Larvaecide Oil developed with an excellent field trial result Ø Bio-Degradable Rubber Spray Oil: Approved by Rubber Research Institute, Kottayam, Kerala Ø ‘Hydrogen-CNG’ run 3 wheeler completed 18000 km long Field Trial 3/19/2018 17

R&D The Power of Possibilities New Development Initiatives Ø Servo Agro Spray Oil: An eco-friendly, Biodegradable, non-toxic & pesticide free Oil developed & widely marketed Ø Mosquito Larvaecide Oil developed with an excellent field trial result Ø Bio-Degradable Rubber Spray Oil: Approved by Rubber Research Institute, Kottayam, Kerala Ø ‘Hydrogen-CNG’ run 3 wheeler completed 18000 km long Field Trial 3/19/2018 17

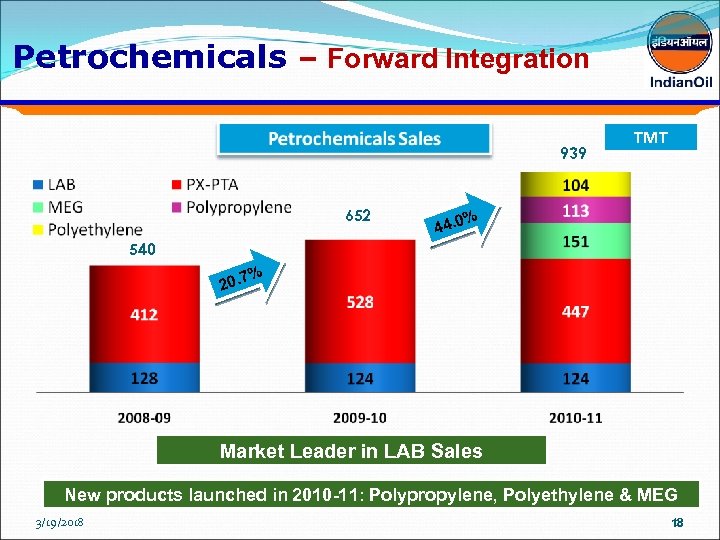

Petrochemicals – Forward Integration 939 652 TMT % 44. 0 540 % 20. 7 Market Leader in LAB Sales New products launched in 2010 -11: Polypropylene, Polyethylene & MEG 3/19/2018 18 18

Petrochemicals – Forward Integration 939 652 TMT % 44. 0 540 % 20. 7 Market Leader in LAB Sales New products launched in 2010 -11: Polypropylene, Polyethylene & MEG 3/19/2018 18 18

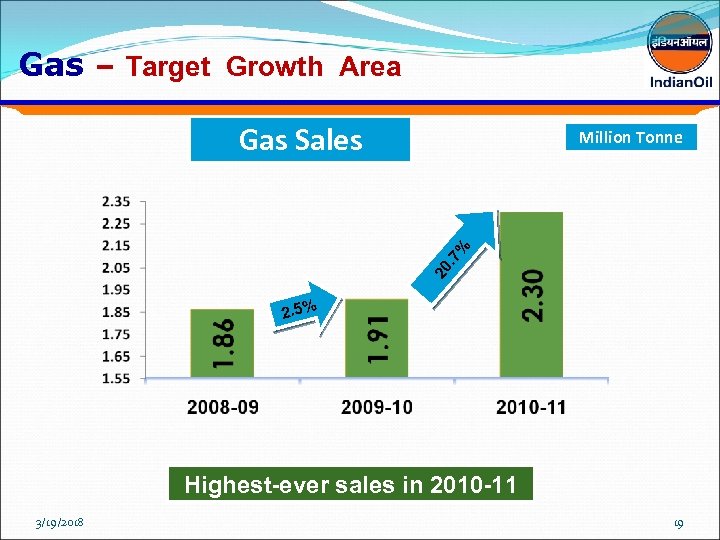

Gas – Target Growth Area Gas Sales 20. 7 % Million Tonne 2. 5% Highest-ever sales in 2010 -11 3/19/2018 19

Gas – Target Growth Area Gas Sales 20. 7 % Million Tonne 2. 5% Highest-ever sales in 2010 -11 3/19/2018 19

Gas - Target Growth Area Sales Volume increased by 21% to 2. 3 MMT Indian. Oil’s 1 st LNG import Terminal at Ennore, Tamil Nadu is under implementation Bagged 3 major Cross Country Gas Pipeline Bids in consortium with GSPC, HPCL & BPCL § Mallavaram (AP) - Bhilwara (Rajasthan) § Mehsana (Gujarat) - Bhatinda (Punjab) § Bhastinda – Jammu- Srinagar (J&K) 3/19/2018 20

Gas - Target Growth Area Sales Volume increased by 21% to 2. 3 MMT Indian. Oil’s 1 st LNG import Terminal at Ennore, Tamil Nadu is under implementation Bagged 3 major Cross Country Gas Pipeline Bids in consortium with GSPC, HPCL & BPCL § Mallavaram (AP) - Bhilwara (Rajasthan) § Mehsana (Gujarat) - Bhatinda (Punjab) § Bhastinda – Jammu- Srinagar (J&K) 3/19/2018 20

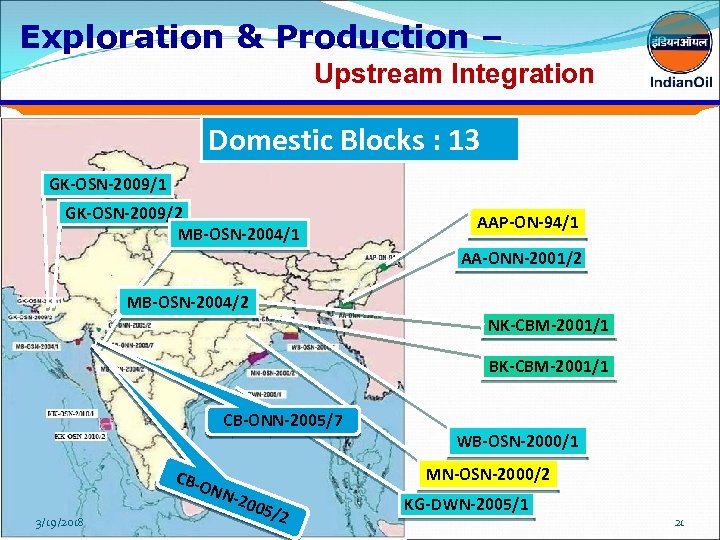

Exploration & Production – Upstream Integration Domestic Blocks : 13 GK-OSN-2009/1 GK-OSN-2009/2 MB-OSN-2004/1 AAP-ON-94/1 AA-ONN-2001/2 MB-OSN-2004/2 NK-CBM-2001/1 BK-CBM-2001/1 CB-ONN-2005/7 CB-O MN-OSN-2000/2 NN- 3/19/2018 WB-OSN-2000/1 200 5 /2 KG-DWN-2005/1 21

Exploration & Production – Upstream Integration Domestic Blocks : 13 GK-OSN-2009/1 GK-OSN-2009/2 MB-OSN-2004/1 AAP-ON-94/1 AA-ONN-2001/2 MB-OSN-2004/2 NK-CBM-2001/1 BK-CBM-2001/1 CB-ONN-2005/7 CB-O MN-OSN-2000/2 NN- 3/19/2018 WB-OSN-2000/1 200 5 /2 KG-DWN-2005/1 21

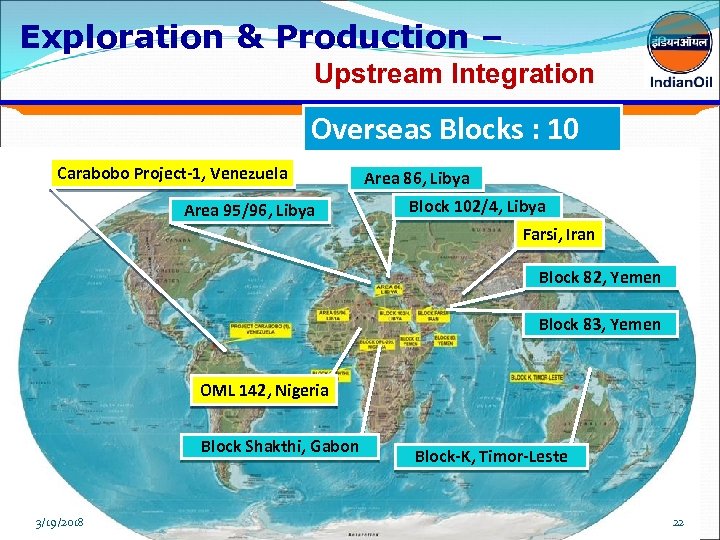

Exploration & Production – Upstream Integration Overseas Blocks : 10 Carabobo Project-1, Venezuela Area 95/96, Libya Area 86, Libya Block 102/4, Libya Farsi, Iran Block 82, Yemen Block 83, Yemen OML 142, Nigeria Block Shakthi, Gabon 3/19/2018 Block-K, Timor-Leste 22

Exploration & Production – Upstream Integration Overseas Blocks : 10 Carabobo Project-1, Venezuela Area 95/96, Libya Area 86, Libya Block 102/4, Libya Farsi, Iran Block 82, Yemen Block 83, Yemen OML 142, Nigeria Block Shakthi, Gabon 3/19/2018 Block-K, Timor-Leste 22

Clean Energy & Sustainability Pursuing low carbon energy business: Bid and won 5 MW Solar PV Power Plant under Jawaharlal Nehru National Solar Mission “NPCIL-Indian. Oil Nuclear Energy Corporation” JV incorporated in our pursuit of becoming Integrated Energy major Solar Lantern Initiative rolled out: More than 30, 000 lanterns delivered in Rural households 3/19/2018 23

Clean Energy & Sustainability Pursuing low carbon energy business: Bid and won 5 MW Solar PV Power Plant under Jawaharlal Nehru National Solar Mission “NPCIL-Indian. Oil Nuclear Energy Corporation” JV incorporated in our pursuit of becoming Integrated Energy major Solar Lantern Initiative rolled out: More than 30, 000 lanterns delivered in Rural households 3/19/2018 23

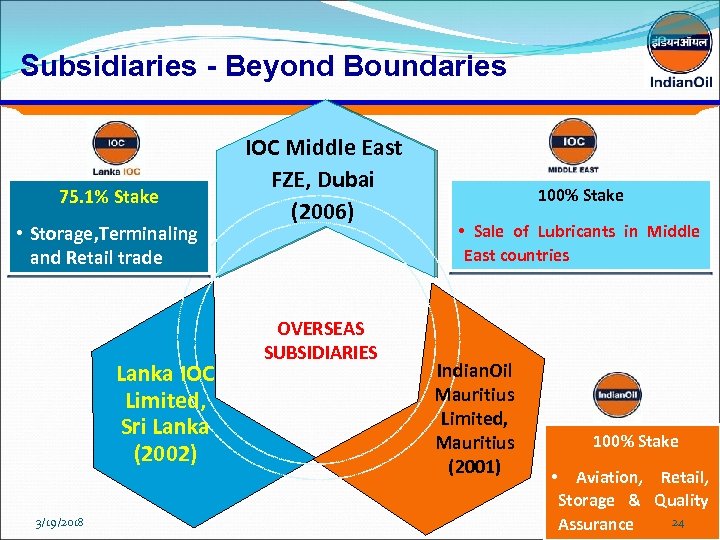

Subsidiaries - Beyond Boundaries 75. 1% Stake • Storage, Terminaling and Retail trade Lanka IOC Limited, Sri Lanka (2002) 3/19/2018 IOC Middle East FZE, Dubai (2006) OVERSEAS SUBSIDIARIES 100% Stake • Sale of Lubricants in Middle East countries Indian. Oil Mauritius Limited, Mauritius (2001) 100% Stake • Aviation, Retail, Storage & Quality 24 Assurance

Subsidiaries - Beyond Boundaries 75. 1% Stake • Storage, Terminaling and Retail trade Lanka IOC Limited, Sri Lanka (2002) 3/19/2018 IOC Middle East FZE, Dubai (2006) OVERSEAS SUBSIDIARIES 100% Stake • Sale of Lubricants in Middle East countries Indian. Oil Mauritius Limited, Mauritius (2001) 100% Stake • Aviation, Retail, Storage & Quality 24 Assurance

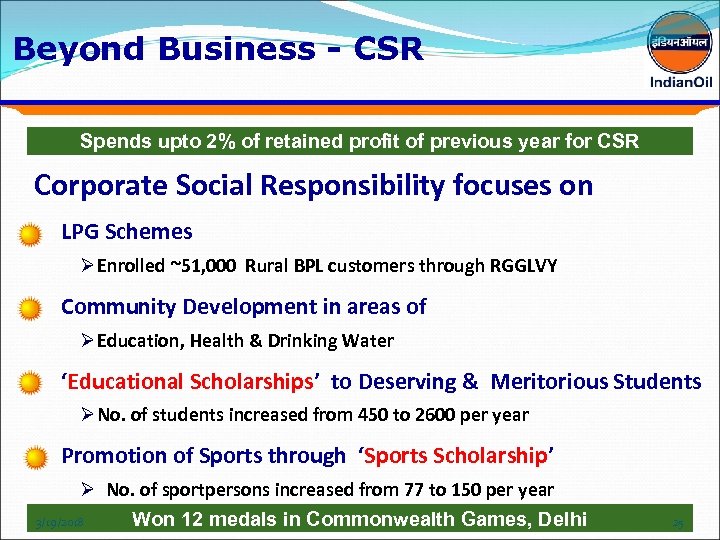

Beyond Business - CSR Spends upto 2% of retained profit of previous year for CSR Corporate Social Responsibility focuses on LPG Schemes Ø Enrolled ~51, 000 Rural BPL customers through RGGLVY Community Development in areas of Ø Education, Health & Drinking Water ‘Educational Scholarships’ to Deserving & Meritorious Students Ø No. of students increased from 450 to 2600 per year Promotion of Sports through ‘Sports Scholarship’ Ø No. of sportpersons increased from 77 to 150 per year 3/19/2018 Won 12 medals in Commonwealth Games, Delhi 25

Beyond Business - CSR Spends upto 2% of retained profit of previous year for CSR Corporate Social Responsibility focuses on LPG Schemes Ø Enrolled ~51, 000 Rural BPL customers through RGGLVY Community Development in areas of Ø Education, Health & Drinking Water ‘Educational Scholarships’ to Deserving & Meritorious Students Ø No. of students increased from 450 to 2600 per year Promotion of Sports through ‘Sports Scholarship’ Ø No. of sportpersons increased from 77 to 150 per year 3/19/2018 Won 12 medals in Commonwealth Games, Delhi 25

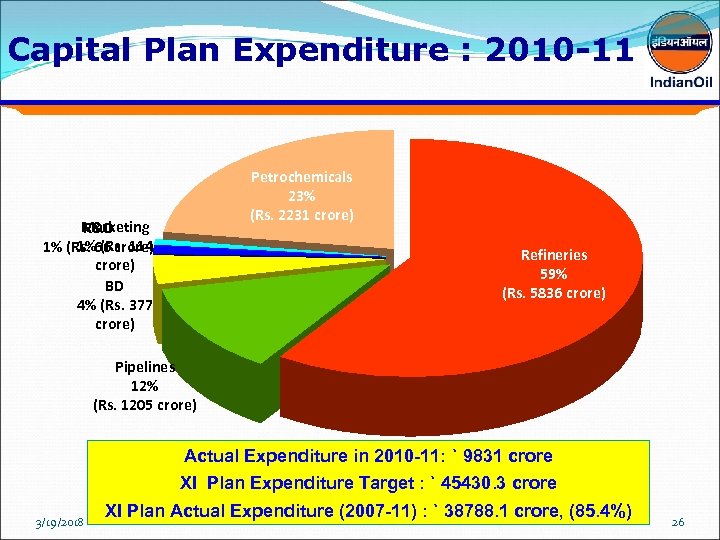

Capital Plan Expenditure : 2010 -11 Petrochemicals 23% (Rs. 2231 crore) Marketing R&D 1% (Rs. 114 1% (Rs. 66 crore) BD 4% (Rs. 377 crore) Refineries 59% (Rs. 5836 crore) Pipelines 12% (Rs. 1205 crore) Actual Expenditure in 2010 -11: ` 9831 crore XI Plan Expenditure Target : ` 45430. 3 crore 3/19/2018 XI Plan Actual Expenditure (2007 -11) : ` 38788. 1 crore, (85. 4%) 26

Capital Plan Expenditure : 2010 -11 Petrochemicals 23% (Rs. 2231 crore) Marketing R&D 1% (Rs. 114 1% (Rs. 66 crore) BD 4% (Rs. 377 crore) Refineries 59% (Rs. 5836 crore) Pipelines 12% (Rs. 1205 crore) Actual Expenditure in 2010 -11: ` 9831 crore XI Plan Expenditure Target : ` 45430. 3 crore 3/19/2018 XI Plan Actual Expenditure (2007 -11) : ` 38788. 1 crore, (85. 4%) 26

Financial Performance 3/19/2018 27

Financial Performance 3/19/2018 27

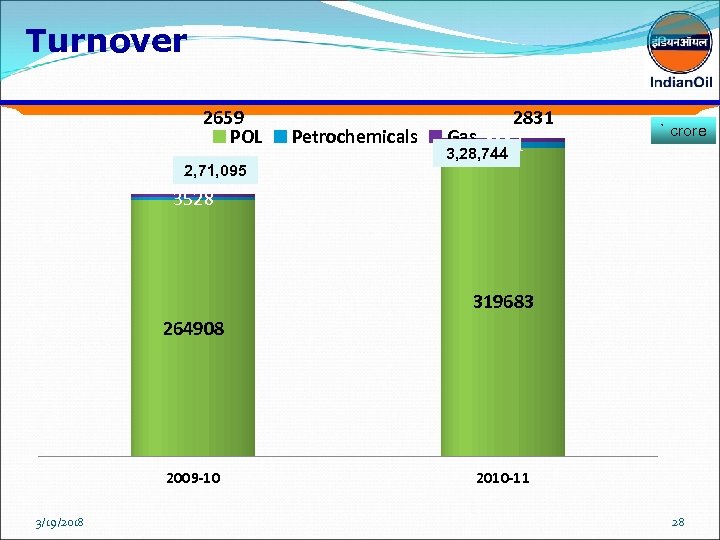

Turnover 2659 POL 2, 71, 095 Petrochemicals 2831 Gas 6231 3, 28, 744 ` crore 3528 319683 264908 2009 -10 3/19/2018 2010 -11 28

Turnover 2659 POL 2, 71, 095 Petrochemicals 2831 Gas 6231 3, 28, 744 ` crore 3528 319683 264908 2009 -10 3/19/2018 2010 -11 28

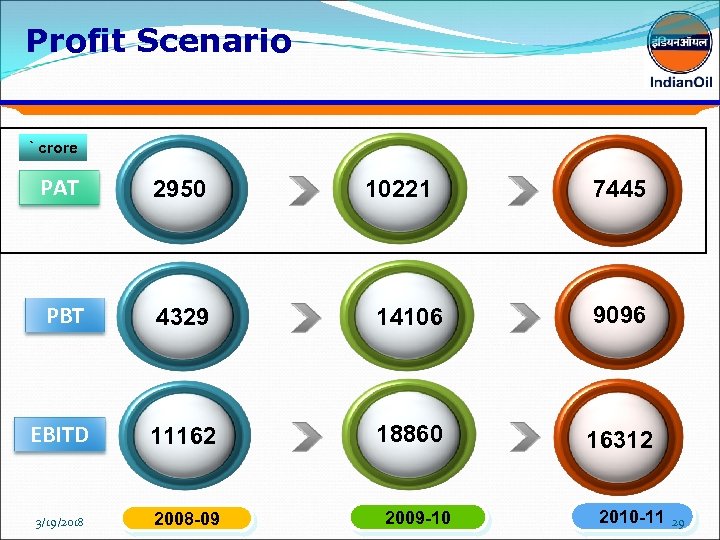

Profit Scenario ` crore PAT 2950 PBT 4329 14106 9096 EBITD 11162 18860 16312 3/19/2018 2008 -09 10221 2009 -10 7445 2010 -11 29

Profit Scenario ` crore PAT 2950 PBT 4329 14106 9096 EBITD 11162 18860 16312 3/19/2018 2008 -09 10221 2009 -10 7445 2010 -11 29

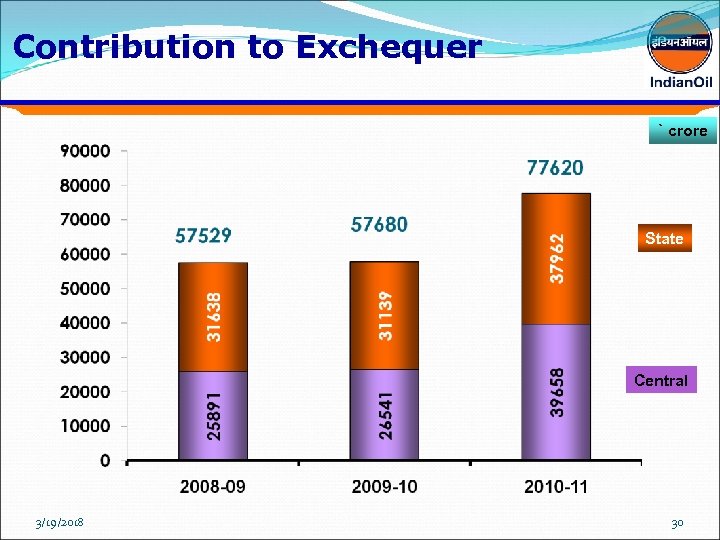

Contribution to Exchequer ` crore State Central 3/19/2018 30

Contribution to Exchequer ` crore State Central 3/19/2018 30

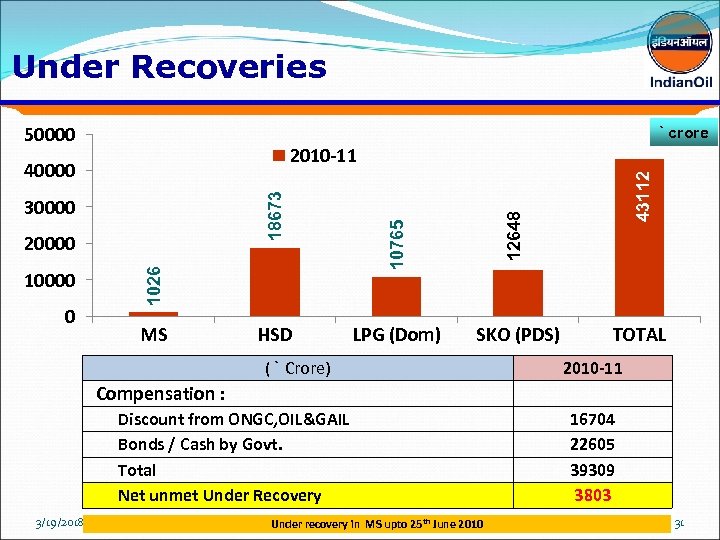

Under Recoveries 50000 ` crore 1026 20000 10000 0 MS HSD LPG (Dom) SKO (PDS) ( ` Crore) Compensation : Discount from ONGC, OIL&GAIL Bonds / Cash by Govt. Total Net unmet Under Recovery 3/19/2018 43112 30000 12648 18673 40000 10765 2010 -11 Under recovery in MS upto 25 th June 2010 TOTAL 2010 -11 16704 22605 39309 3803 31

Under Recoveries 50000 ` crore 1026 20000 10000 0 MS HSD LPG (Dom) SKO (PDS) ( ` Crore) Compensation : Discount from ONGC, OIL&GAIL Bonds / Cash by Govt. Total Net unmet Under Recovery 3/19/2018 43112 30000 12648 18673 40000 10765 2010 -11 Under recovery in MS upto 25 th June 2010 TOTAL 2010 -11 16704 22605 39309 3803 31

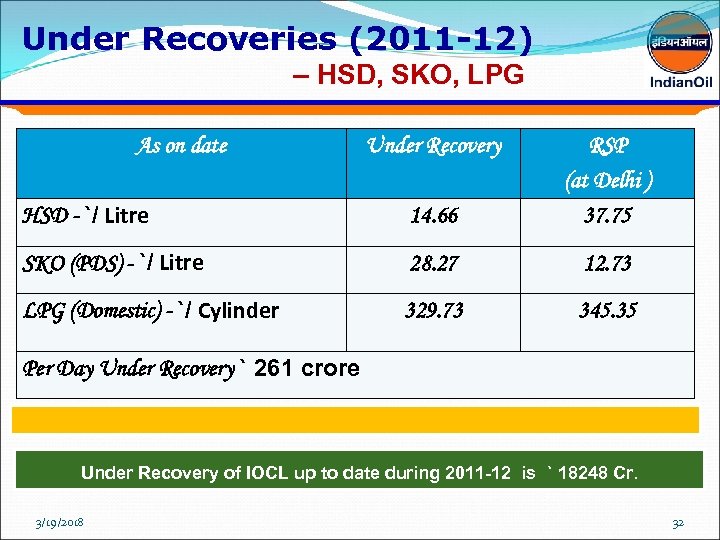

Under Recoveries (2011 -12) – HSD, SKO, LPG As on date Under Recovery HSD - `/ Litre 14. 66 RSP (at Delhi ) 37. 75 SKO (PDS) - `/ Litre 28. 27 12. 73 LPG (Domestic) - `/ Cylinder 329. 73 345. 35 Per Day Under Recovery ` 261 crore Under Recovery of IOCL up to date during 2011 -12 is ` 18248 Cr. 3/19/2018 32

Under Recoveries (2011 -12) – HSD, SKO, LPG As on date Under Recovery HSD - `/ Litre 14. 66 RSP (at Delhi ) 37. 75 SKO (PDS) - `/ Litre 28. 27 12. 73 LPG (Domestic) - `/ Cylinder 329. 73 345. 35 Per Day Under Recovery ` 261 crore Under Recovery of IOCL up to date during 2011 -12 is ` 18248 Cr. 3/19/2018 32

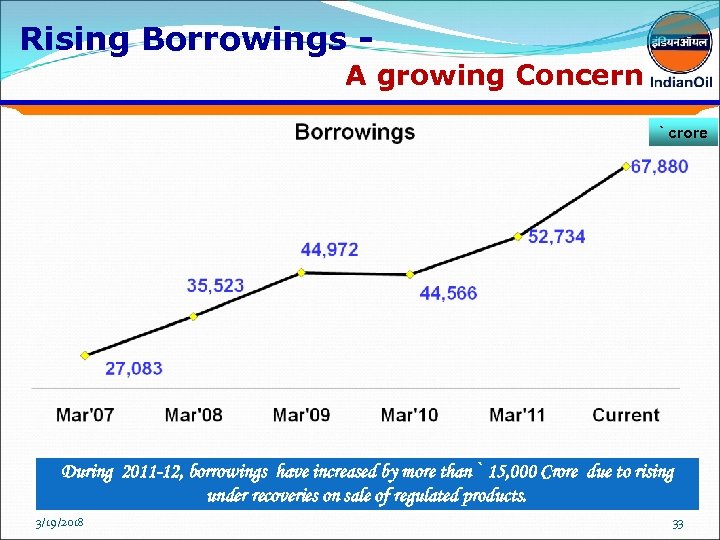

Rising Borrowings - A growing Concern ` crore During 2011 -12, borrowings have increased by more than ` 15, 000 Crore due to rising under recoveries on sale of regulated products. 3/19/2018 33

Rising Borrowings - A growing Concern ` crore During 2011 -12, borrowings have increased by more than ` 15, 000 Crore due to rising under recoveries on sale of regulated products. 3/19/2018 33

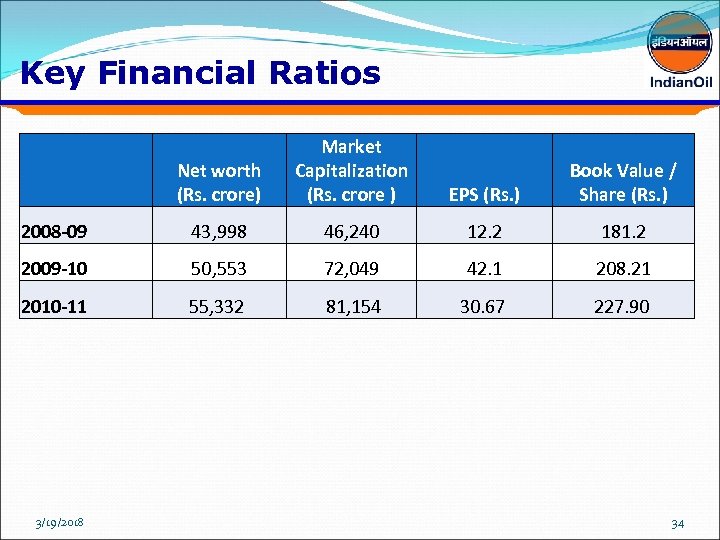

Key Financial Ratios Net worth (Rs. crore) Market Capitalization (Rs. crore ) EPS (Rs. ) Book Value / Share (Rs. ) 2008 -09 43, 998 46, 240 12. 2 181. 2 2009 -10 50, 553 72, 049 42. 1 208. 21 2010 -11 55, 332 81, 154 30. 67 227. 90 3/19/2018 34

Key Financial Ratios Net worth (Rs. crore) Market Capitalization (Rs. crore ) EPS (Rs. ) Book Value / Share (Rs. ) 2008 -09 43, 998 46, 240 12. 2 181. 2 2009 -10 50, 553 72, 049 42. 1 208. 21 2010 -11 55, 332 81, 154 30. 67 227. 90 3/19/2018 34

Before we conclude… A look at Indian. Oil Brands 3/19/2018 35 35

Before we conclude… A look at Indian. Oil Brands 3/19/2018 35 35

OPEN SESSION 36 36

OPEN SESSION 36 36