71f90976ef1664675f2cd385f06730a9.ppt

- Количество слайдов: 45

Annual Enterprise Software Market Review 2008 Shea & Company, LLC 399 Boylston Street Floor 11 Boston, Massachusetts 02116 Michael H. M. Shea Managing Director 617. 896. 2255 mshea@shea-co. com Chris Pingpank Associate 617. 896. 2218 cpingpank@shea-co. com Brad Mc. Carthy Analyst 617. 896. 2245 bmccarthy@shea-co. com Confidential and proprietary information, unauthorized distribution strictly prohibited Please contact Brad Mc. Carthy to subscribe

Annual Enterprise Software Market Review 2008 Shea & Company, LLC 399 Boylston Street Floor 11 Boston, Massachusetts 02116 Michael H. M. Shea Managing Director 617. 896. 2255 mshea@shea-co. com Chris Pingpank Associate 617. 896. 2218 cpingpank@shea-co. com Brad Mc. Carthy Analyst 617. 896. 2245 bmccarthy@shea-co. com Confidential and proprietary information, unauthorized distribution strictly prohibited Please contact Brad Mc. Carthy to subscribe

Contents 2008 Software Acquisitions p. 2 2008 Private Financings p. 7 M&A Transaction Data p. 17 Public Company Participants & Consolidation by Segment Most Active Public Consolidation Players p. 24 p. 30 Software Valuation Trends by Growth Tranche p. 35 Equity Trading Multiples by Software Segment p. 36 Equity Trading Multiples by Comparable Subsets Software IPO Data p. 42 Software IPO Pipeline p. 41 p. 43 proprietary & confidential 1

Contents 2008 Software Acquisitions p. 2 2008 Private Financings p. 7 M&A Transaction Data p. 17 Public Company Participants & Consolidation by Segment Most Active Public Consolidation Players p. 24 p. 30 Software Valuation Trends by Growth Tranche p. 35 Equity Trading Multiples by Software Segment p. 36 Equity Trading Multiples by Comparable Subsets Software IPO Data p. 42 Software IPO Pipeline p. 41 p. 43 proprietary & confidential 1

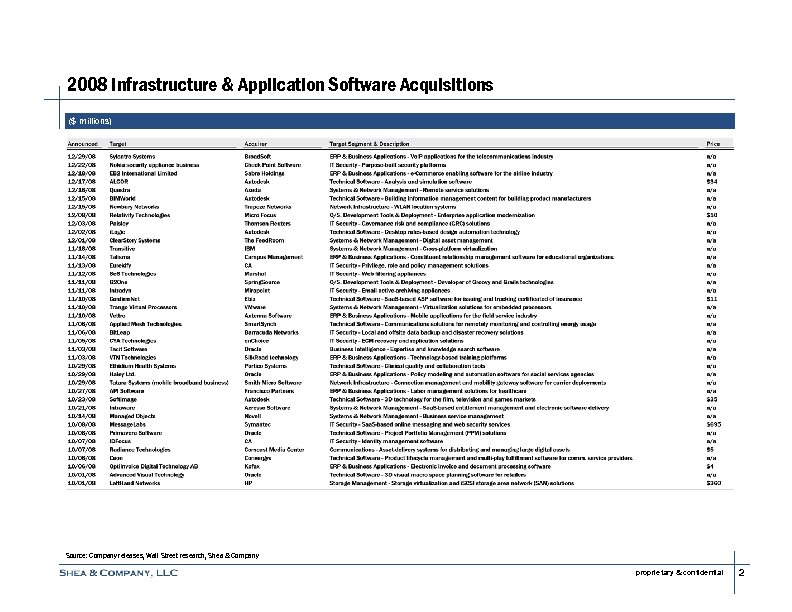

2008 Infrastructure & Application Software Acquisitions ($ millions) Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 2

2008 Infrastructure & Application Software Acquisitions ($ millions) Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 2

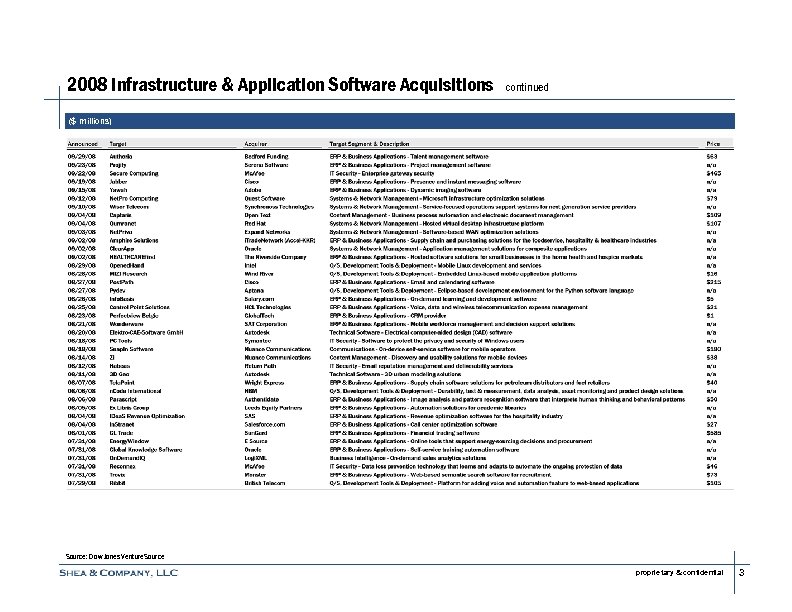

2008 Infrastructure & Application Software Acquisitions continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 3

2008 Infrastructure & Application Software Acquisitions continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 3

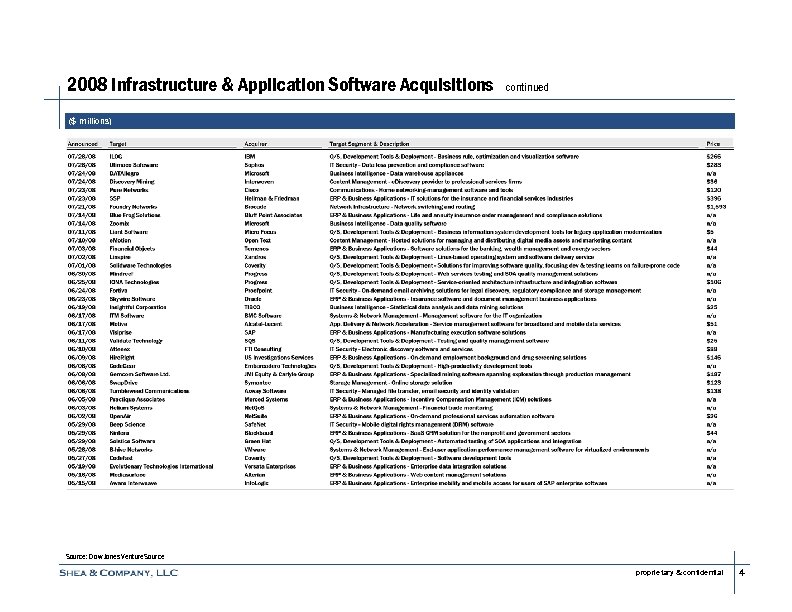

2008 Infrastructure & Application Software Acquisitions continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 4

2008 Infrastructure & Application Software Acquisitions continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 4

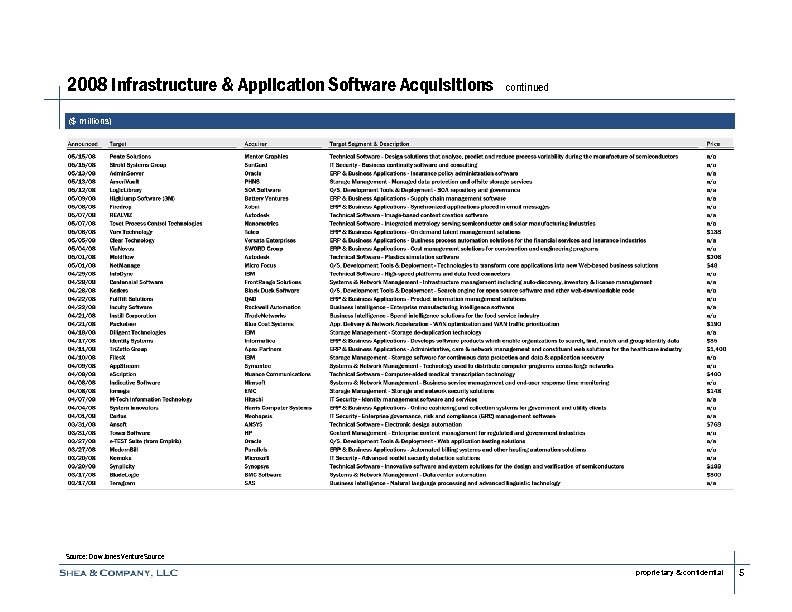

2008 Infrastructure & Application Software Acquisitions continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 5

2008 Infrastructure & Application Software Acquisitions continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 5

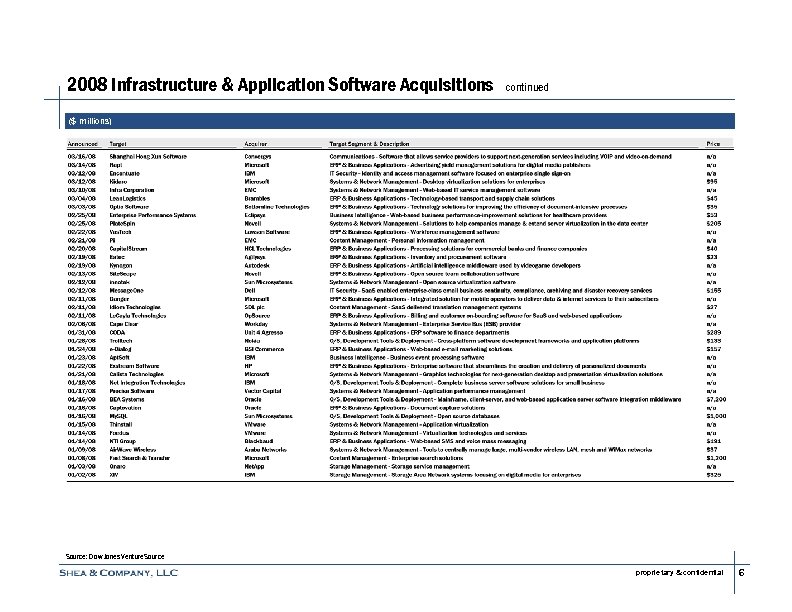

2008 Infrastructure & Application Software Acquisitions continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 6

2008 Infrastructure & Application Software Acquisitions continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 6

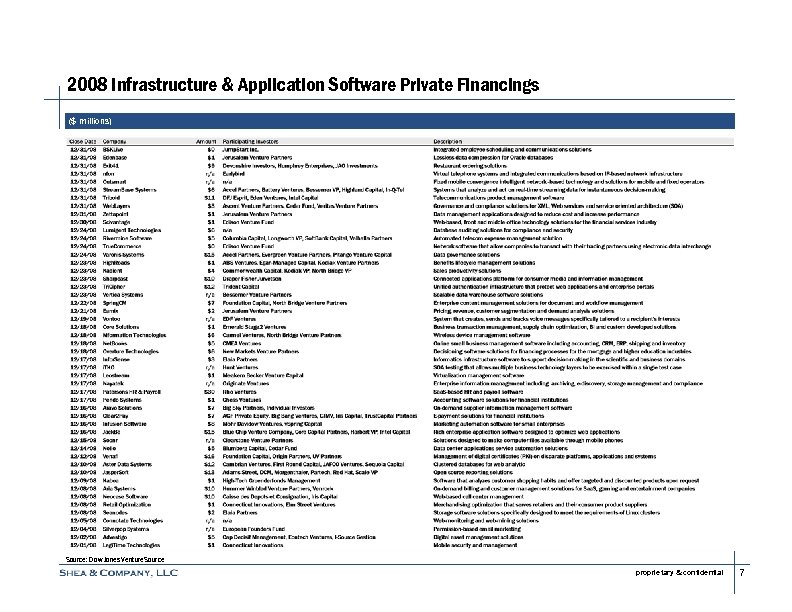

2008 Infrastructure & Application Software Private Financings ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 7

2008 Infrastructure & Application Software Private Financings ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 7

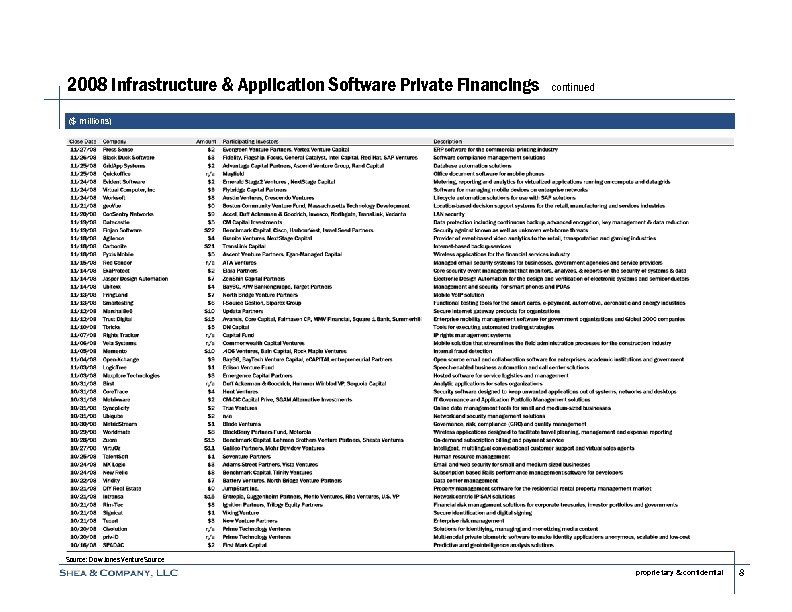

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 8

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 8

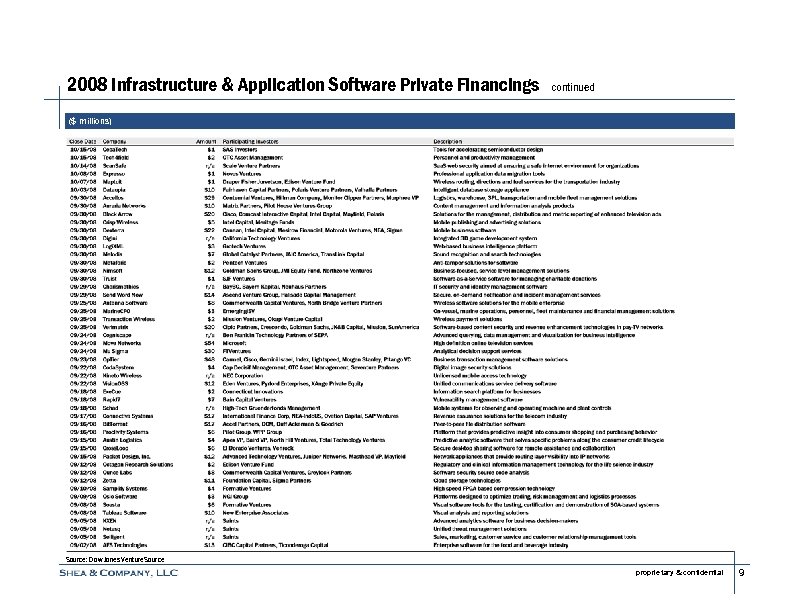

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 9

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 9

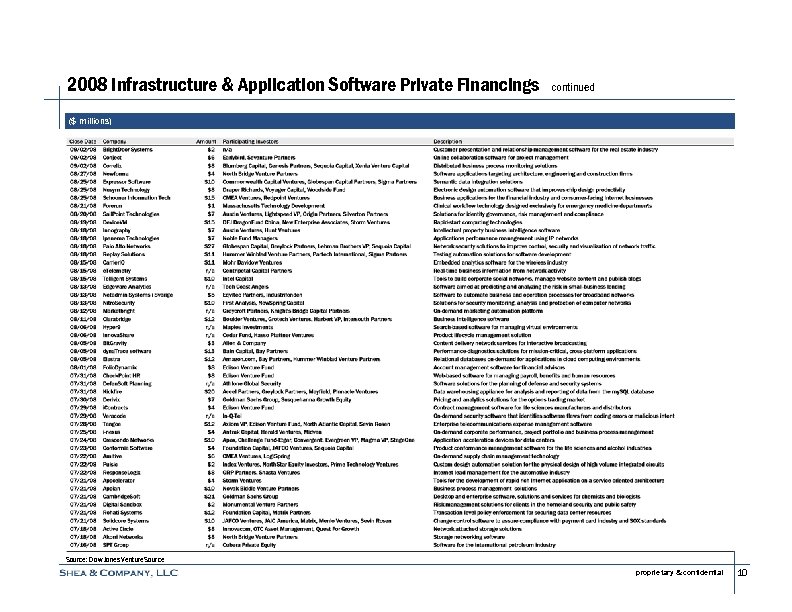

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 10

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 10

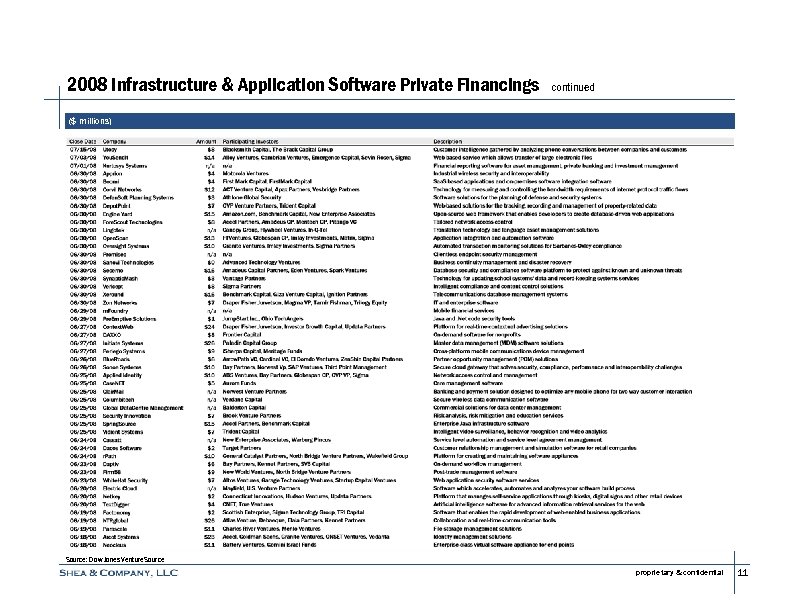

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 11

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 11

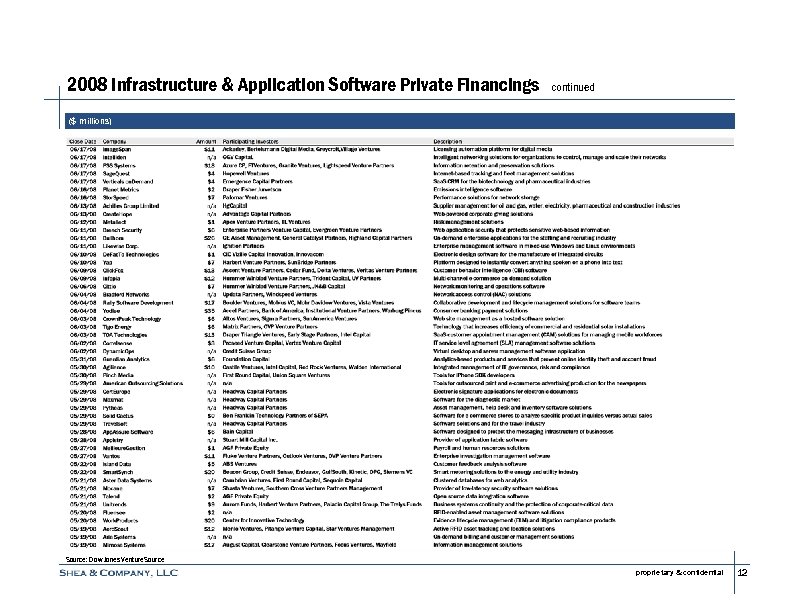

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 12

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 12

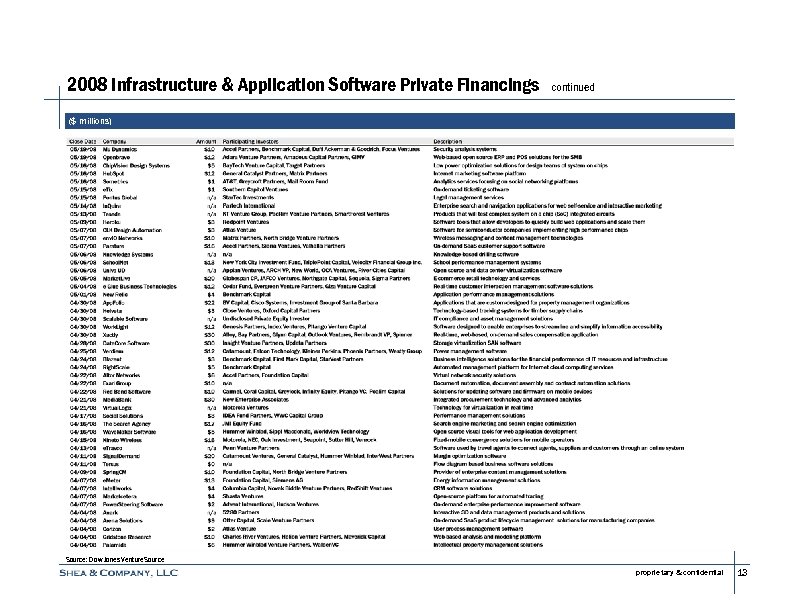

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 13

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 13

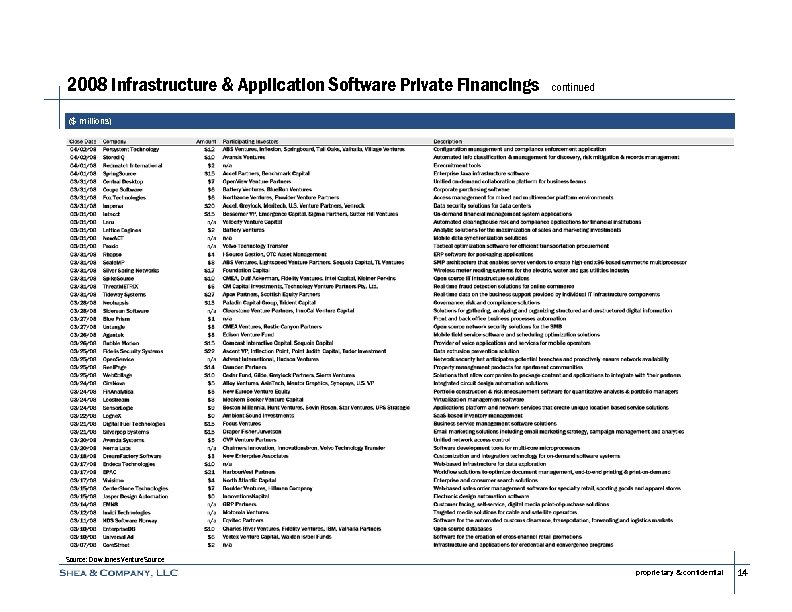

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 14

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 14

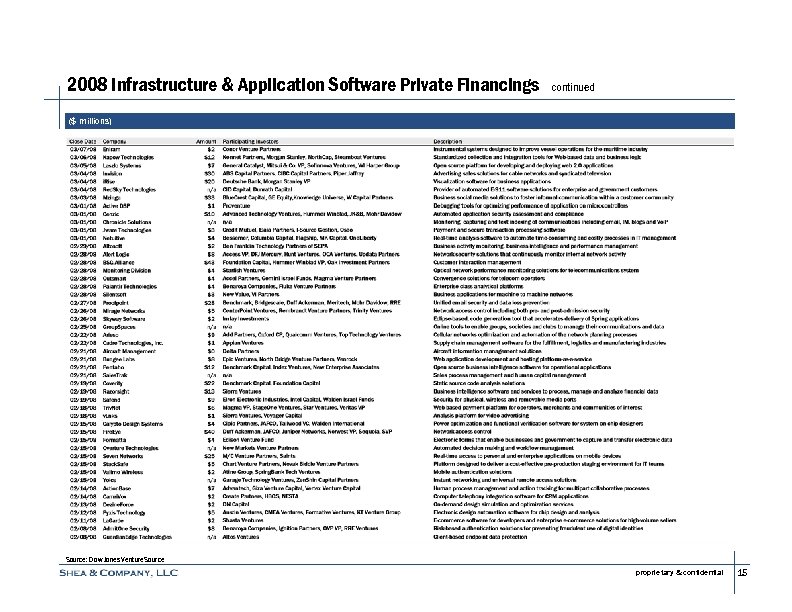

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 15

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 15

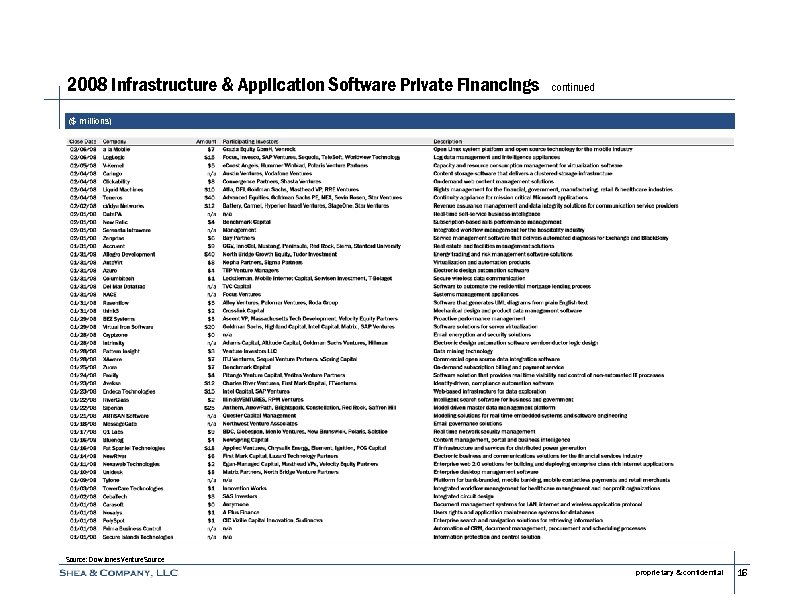

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 16

2008 Infrastructure & Application Software Private Financings continued ($ millions) Source: Dow Jones Venture. Source proprietary & confidential 16

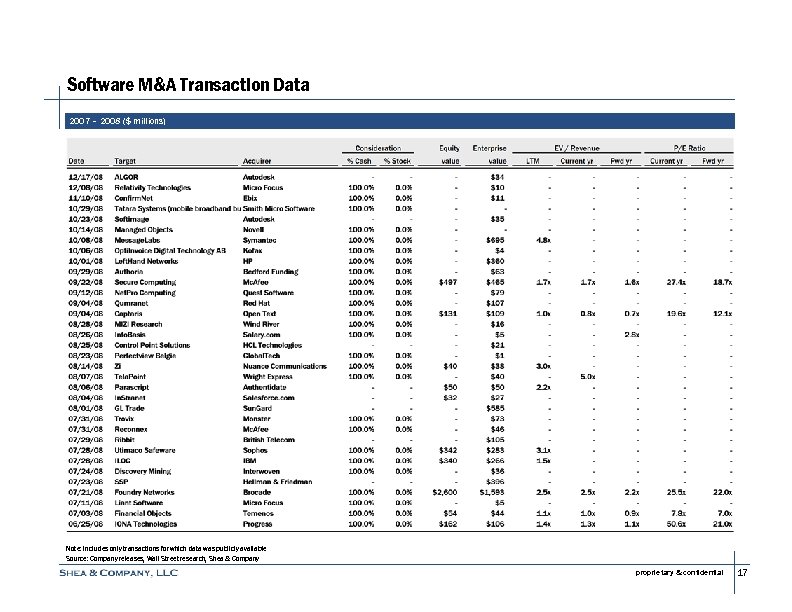

Software M&A Transaction Data 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 17

Software M&A Transaction Data 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 17

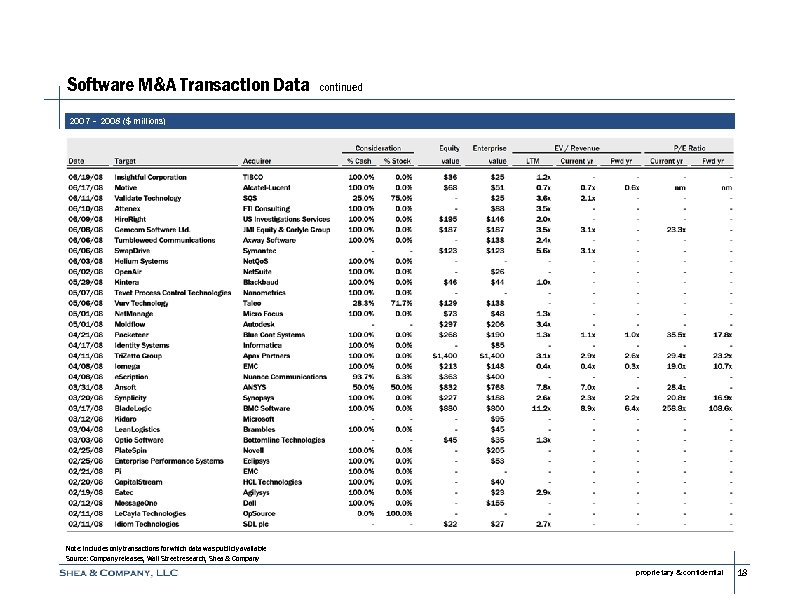

Software M&A Transaction Data continued 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 18

Software M&A Transaction Data continued 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 18

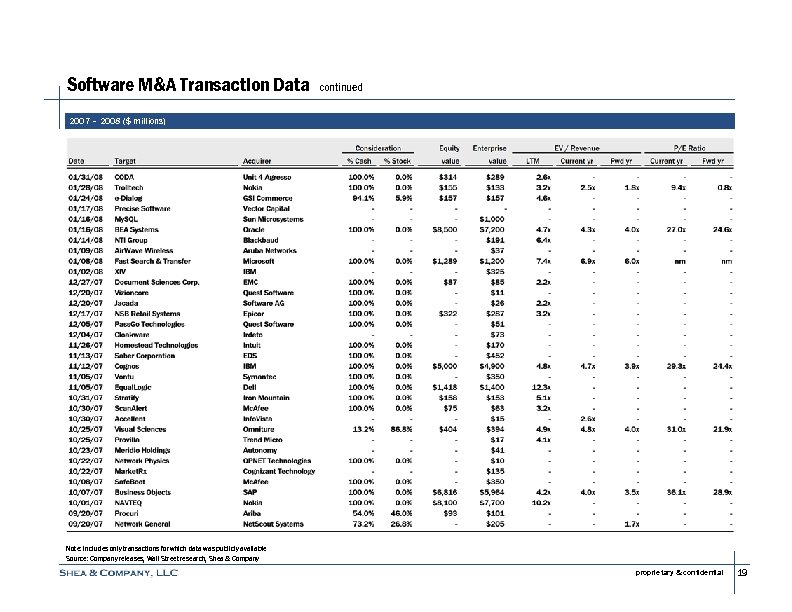

Software M&A Transaction Data continued 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 19

Software M&A Transaction Data continued 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 19

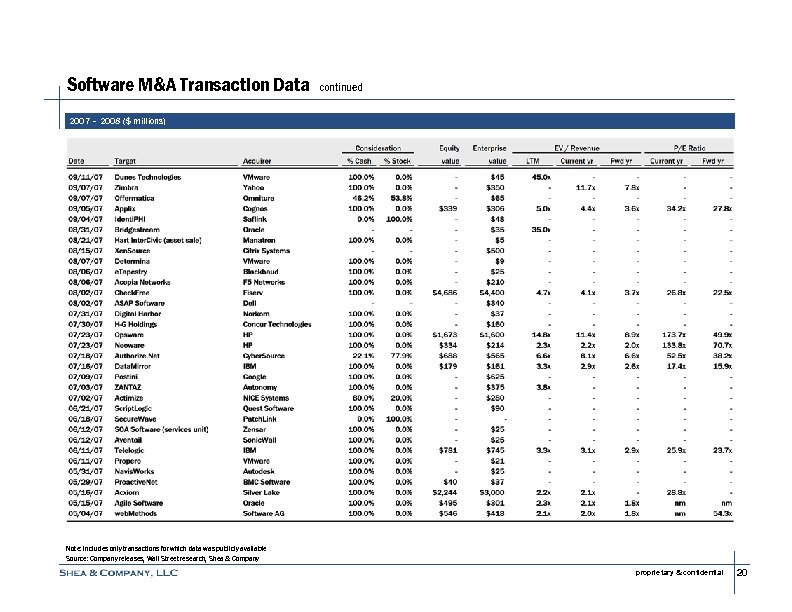

Software M&A Transaction Data continued 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 20

Software M&A Transaction Data continued 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 20

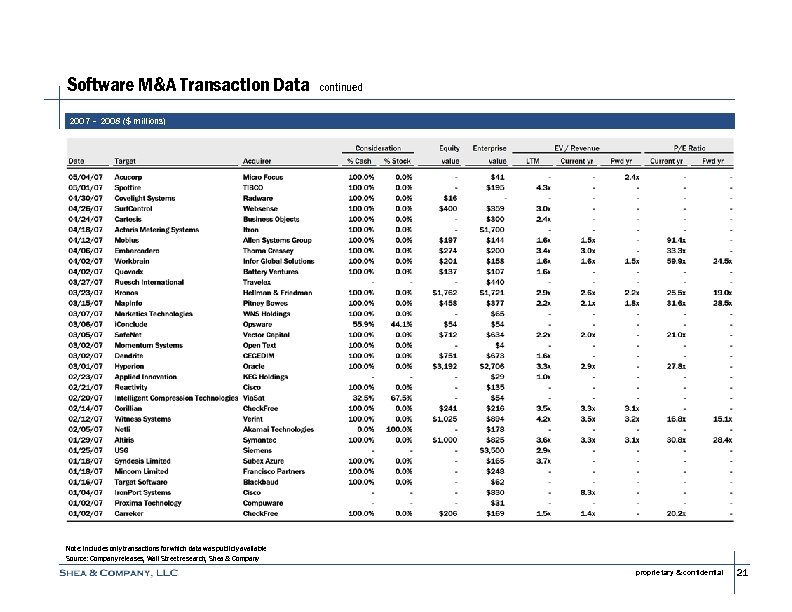

Software M&A Transaction Data continued 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 21

Software M&A Transaction Data continued 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 21

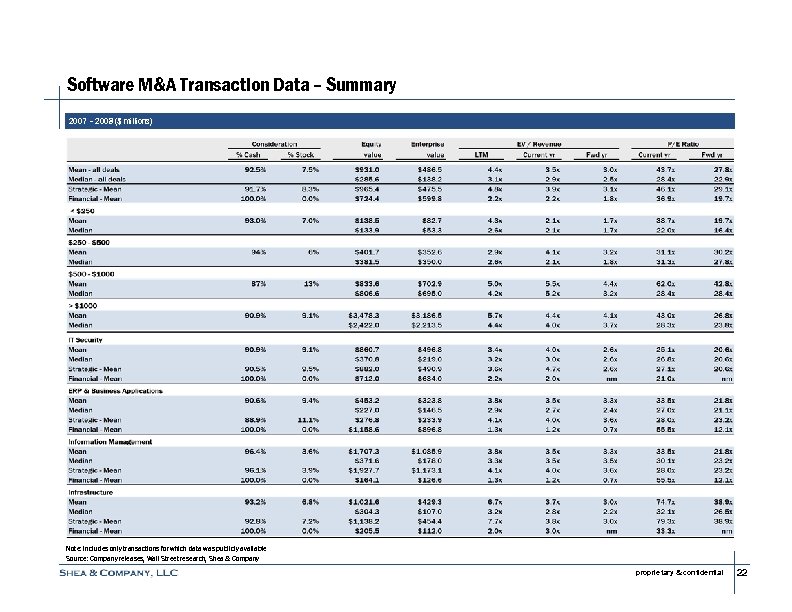

Software M&A Transaction Data – Summary 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 22

Software M&A Transaction Data – Summary 2007 – 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 22

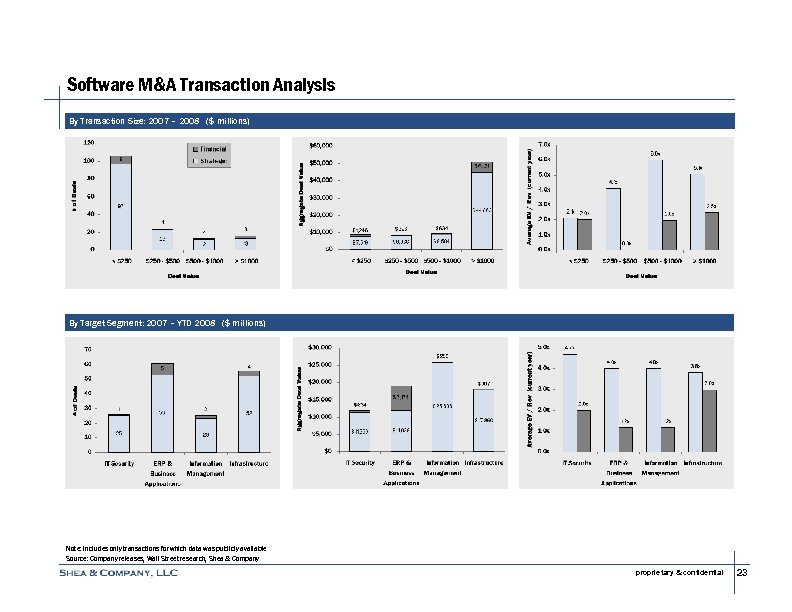

Software M&A Transaction Analysis By Transaction Size: 2007 – 2008 ($ millions) By Target Segment: 2007 – YTD 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 23

Software M&A Transaction Analysis By Transaction Size: 2007 – 2008 ($ millions) By Target Segment: 2007 – YTD 2008 ($ millions) Note: Includes only transactions for which data was publicly available Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 23

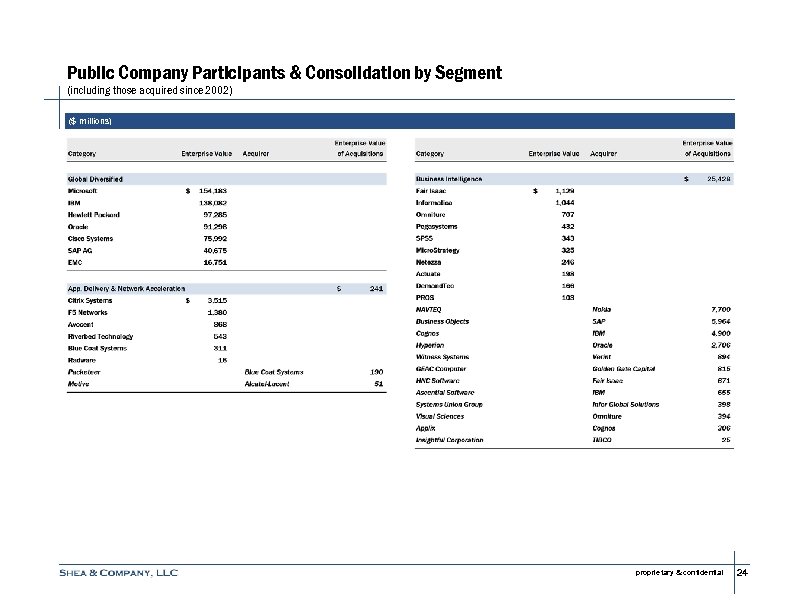

Public Company Participants & Consolidation by Segment (including those acquired since 2002) ($ millions) proprietary & confidential 24

Public Company Participants & Consolidation by Segment (including those acquired since 2002) ($ millions) proprietary & confidential 24

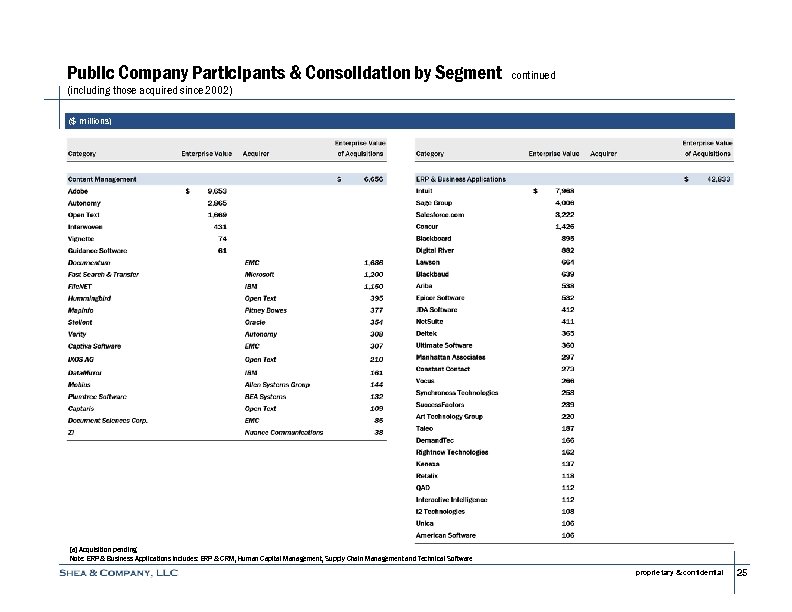

Public Company Participants & Consolidation by Segment continued (including those acquired since 2002) ($ millions) [a] Acquisition pending Note: ERP & Business Applications includes: ERP & CRM, Human Capital Management, Supply Chain Management and Technical Software proprietary & confidential 25

Public Company Participants & Consolidation by Segment continued (including those acquired since 2002) ($ millions) [a] Acquisition pending Note: ERP & Business Applications includes: ERP & CRM, Human Capital Management, Supply Chain Management and Technical Software proprietary & confidential 25

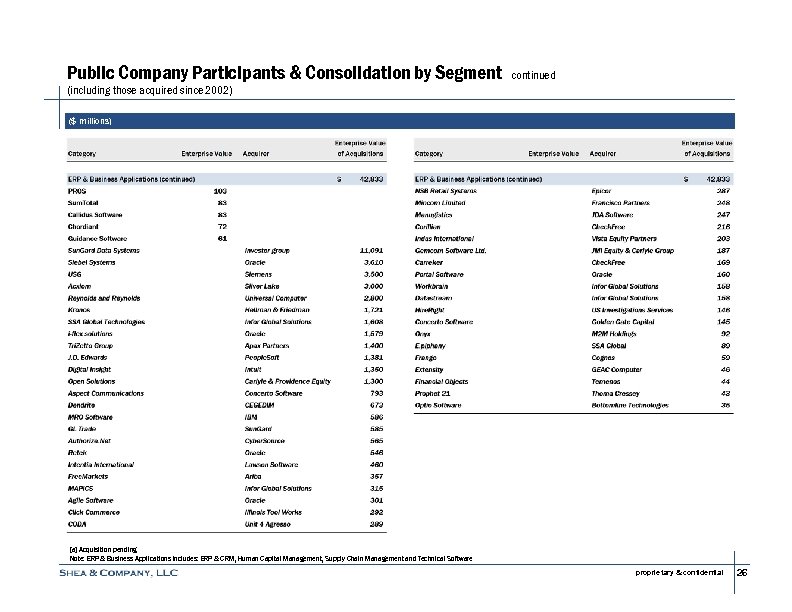

Public Company Participants & Consolidation by Segment continued (including those acquired since 2002) ($ millions) [a] Acquisition pending Note: ERP & Business Applications includes: ERP & CRM, Human Capital Management, Supply Chain Management and Technical Software proprietary & confidential 26

Public Company Participants & Consolidation by Segment continued (including those acquired since 2002) ($ millions) [a] Acquisition pending Note: ERP & Business Applications includes: ERP & CRM, Human Capital Management, Supply Chain Management and Technical Software proprietary & confidential 26

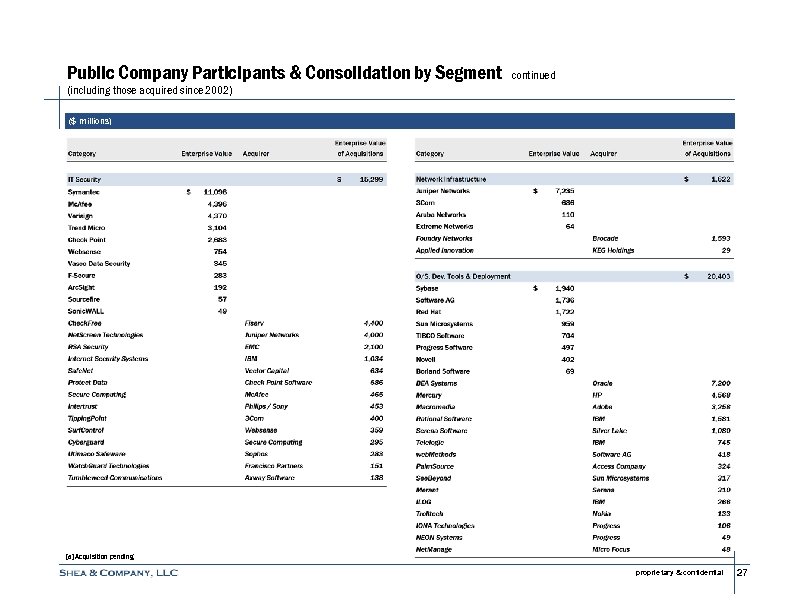

Public Company Participants & Consolidation by Segment continued (including those acquired since 2002) ($ millions) [a] Acquisition pending proprietary & confidential 27

Public Company Participants & Consolidation by Segment continued (including those acquired since 2002) ($ millions) [a] Acquisition pending proprietary & confidential 27

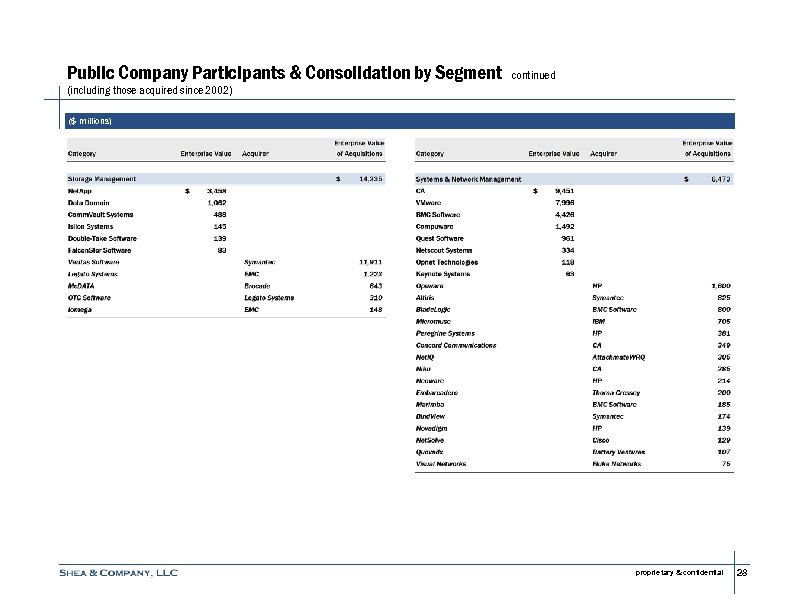

Public Company Participants & Consolidation by Segment continued (including those acquired since 2002) ($ millions) proprietary & confidential 28

Public Company Participants & Consolidation by Segment continued (including those acquired since 2002) ($ millions) proprietary & confidential 28

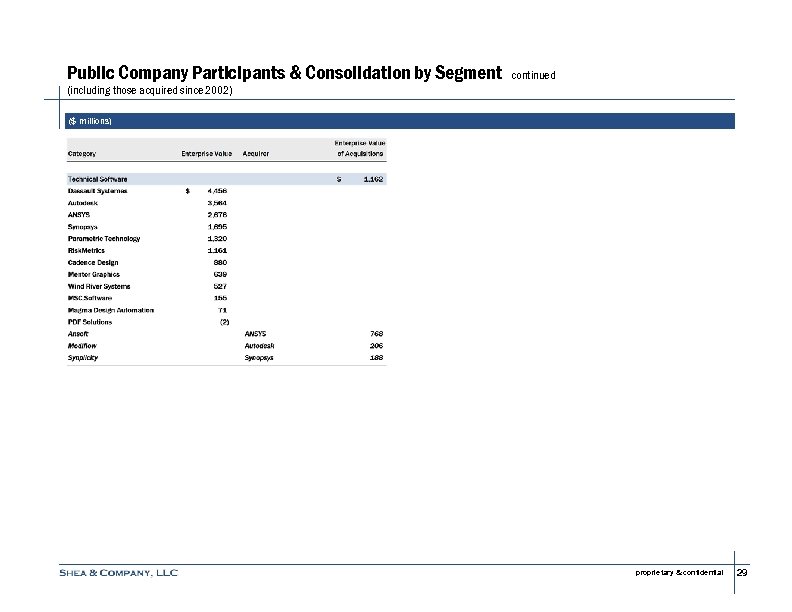

Public Company Participants & Consolidation by Segment continued (including those acquired since 2002) ($ millions) proprietary & confidential 29

Public Company Participants & Consolidation by Segment continued (including those acquired since 2002) ($ millions) proprietary & confidential 29

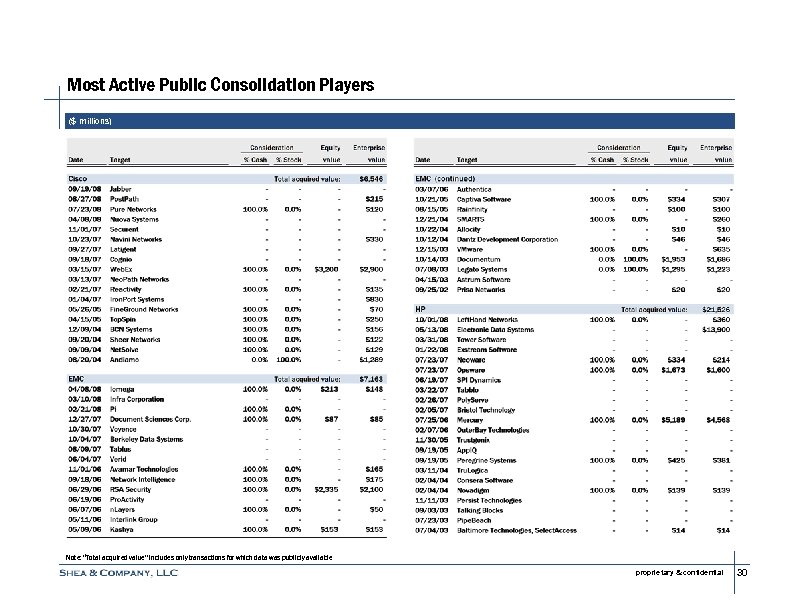

Most Active Public Consolidation Players ($ millions) Note: “Total acquired value” includes only transactions for which data was publicly available proprietary & confidential 30

Most Active Public Consolidation Players ($ millions) Note: “Total acquired value” includes only transactions for which data was publicly available proprietary & confidential 30

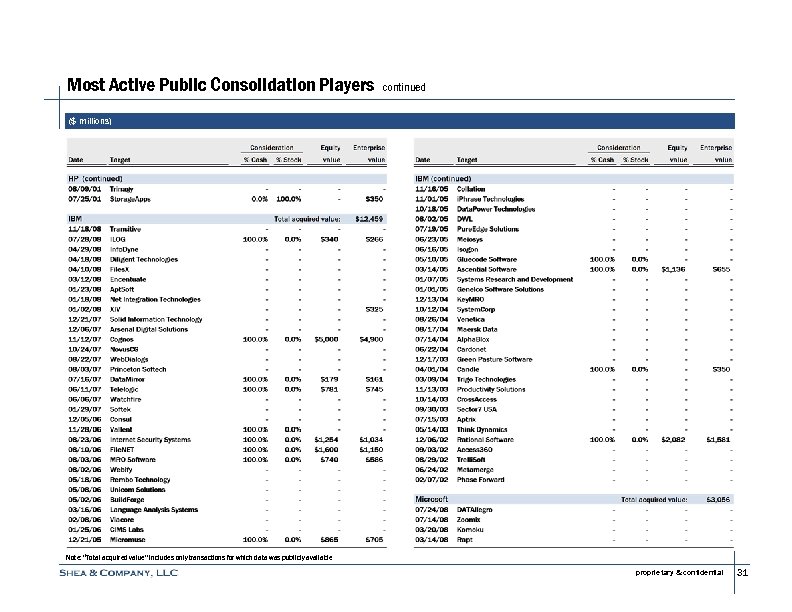

Most Active Public Consolidation Players continued ($ millions) Note: “Total acquired value” includes only transactions for which data was publicly available proprietary & confidential 31

Most Active Public Consolidation Players continued ($ millions) Note: “Total acquired value” includes only transactions for which data was publicly available proprietary & confidential 31

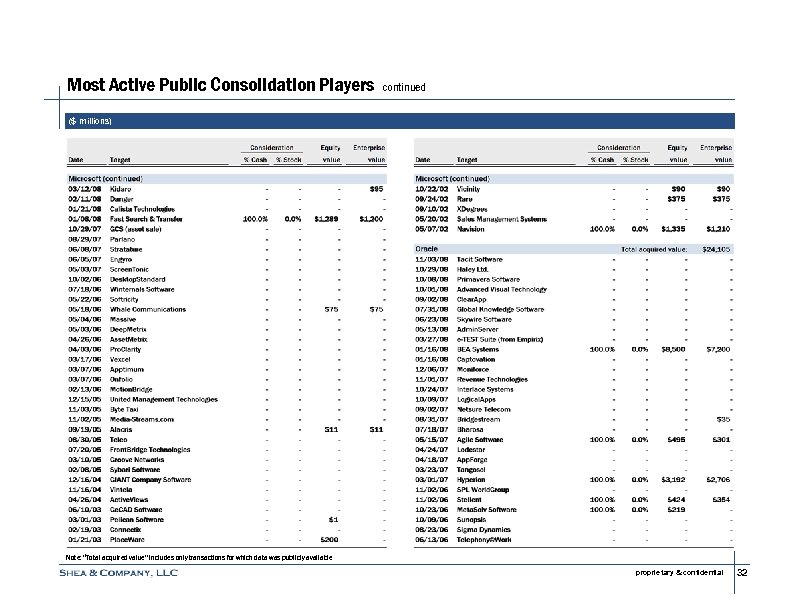

Most Active Public Consolidation Players continued ($ millions) Note: “Total acquired value” includes only transactions for which data was publicly available proprietary & confidential 32

Most Active Public Consolidation Players continued ($ millions) Note: “Total acquired value” includes only transactions for which data was publicly available proprietary & confidential 32

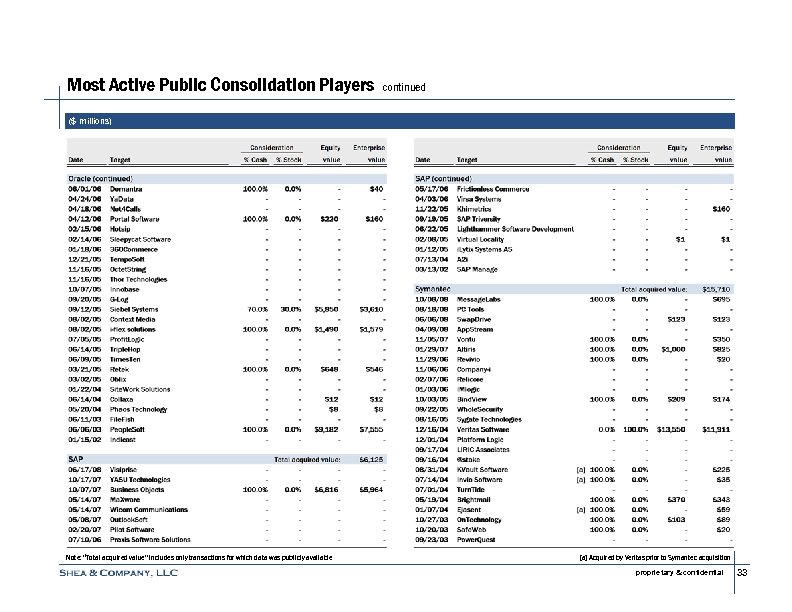

Most Active Public Consolidation Players continued ($ millions) Note: “Total acquired value” includes only transactions for which data was publicly available [a] Acquired by Veritas prior to Symantec acquisition proprietary & confidential 33

Most Active Public Consolidation Players continued ($ millions) Note: “Total acquired value” includes only transactions for which data was publicly available [a] Acquired by Veritas prior to Symantec acquisition proprietary & confidential 33

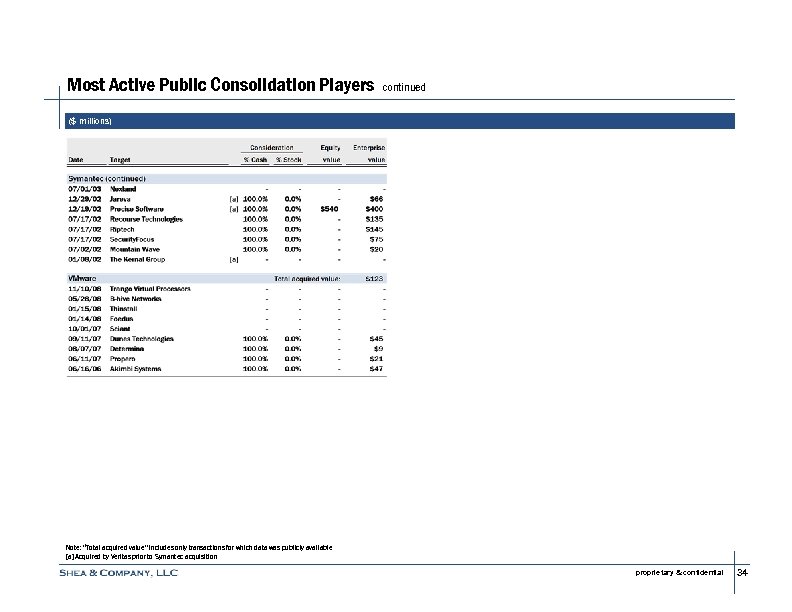

Most Active Public Consolidation Players continued ($ millions) Note: “Total acquired value” includes only transactions for which data was publicly available [a] Acquired by Veritas prior to Symantec acquisition proprietary & confidential 34

Most Active Public Consolidation Players continued ($ millions) Note: “Total acquired value” includes only transactions for which data was publicly available [a] Acquired by Veritas prior to Symantec acquisition proprietary & confidential 34

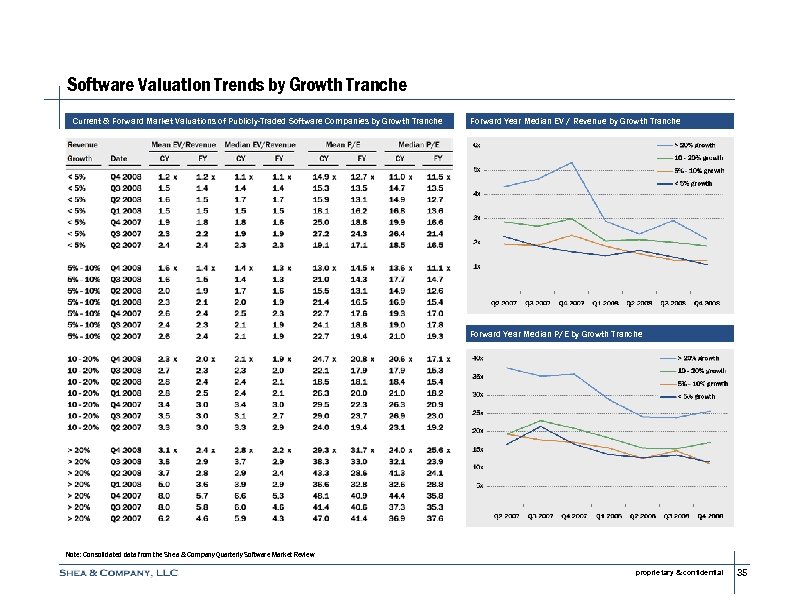

Software Valuation Trends by Growth Tranche Current & Forward Market Valuations of Publicly-Traded Software Companies by Growth Tranche Forward Year Median EV / Revenue by Growth Tranche Forward Year Median P/E by Growth Tranche Note: Consolidated data from the Shea & Company Quarterly Software Market Review proprietary & confidential 35

Software Valuation Trends by Growth Tranche Current & Forward Market Valuations of Publicly-Traded Software Companies by Growth Tranche Forward Year Median EV / Revenue by Growth Tranche Forward Year Median P/E by Growth Tranche Note: Consolidated data from the Shea & Company Quarterly Software Market Review proprietary & confidential 35

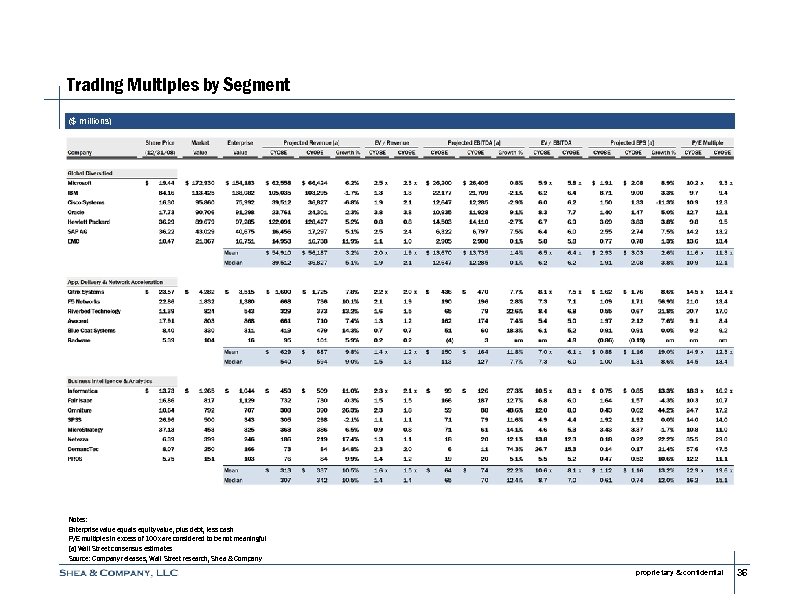

Trading Multiples by Segment ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 36

Trading Multiples by Segment ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 36

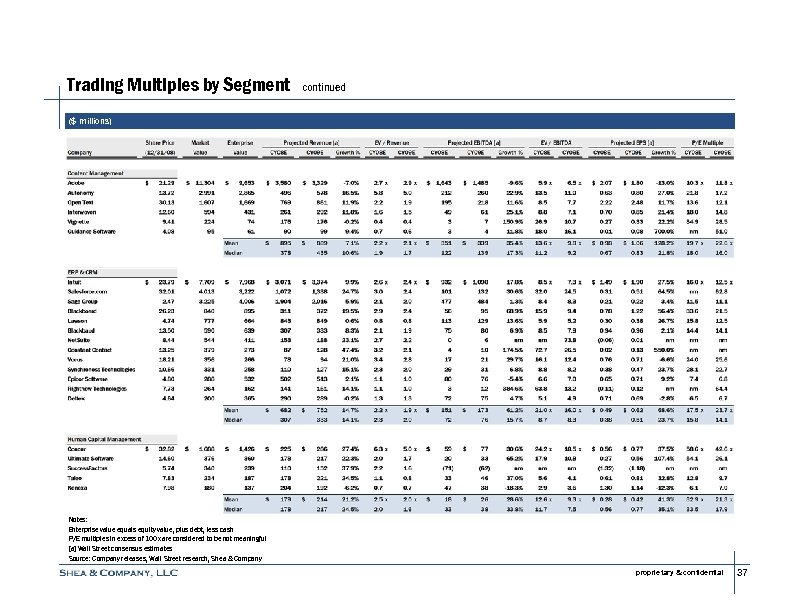

Trading Multiples by Segment continued ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 37

Trading Multiples by Segment continued ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 37

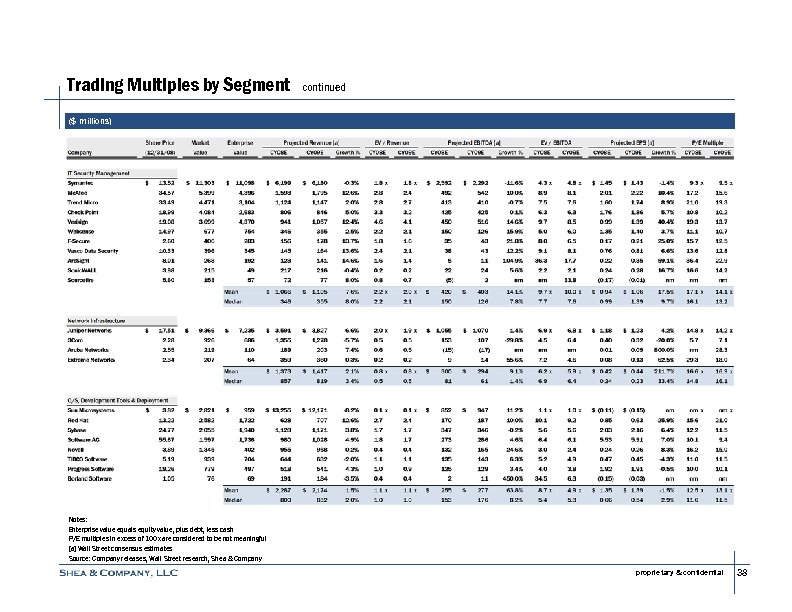

Trading Multiples by Segment continued ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 38

Trading Multiples by Segment continued ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 38

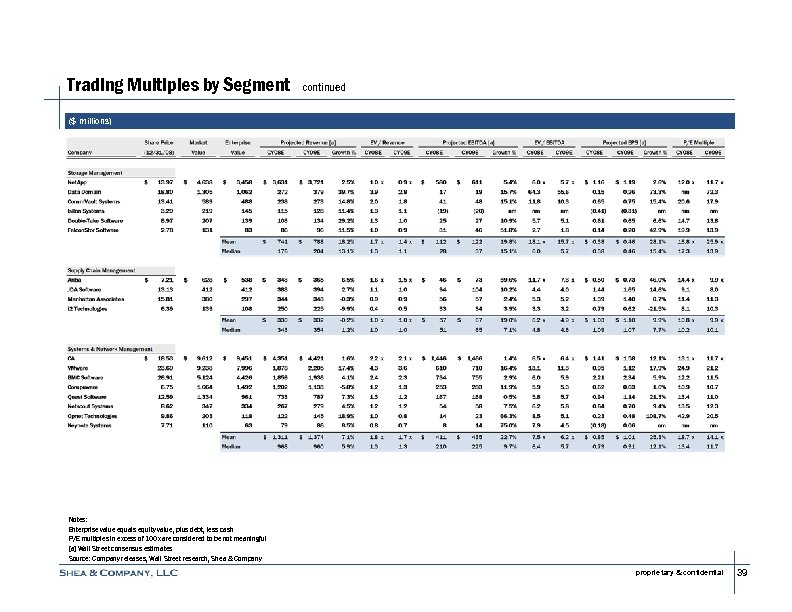

Trading Multiples by Segment continued ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 39

Trading Multiples by Segment continued ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 39

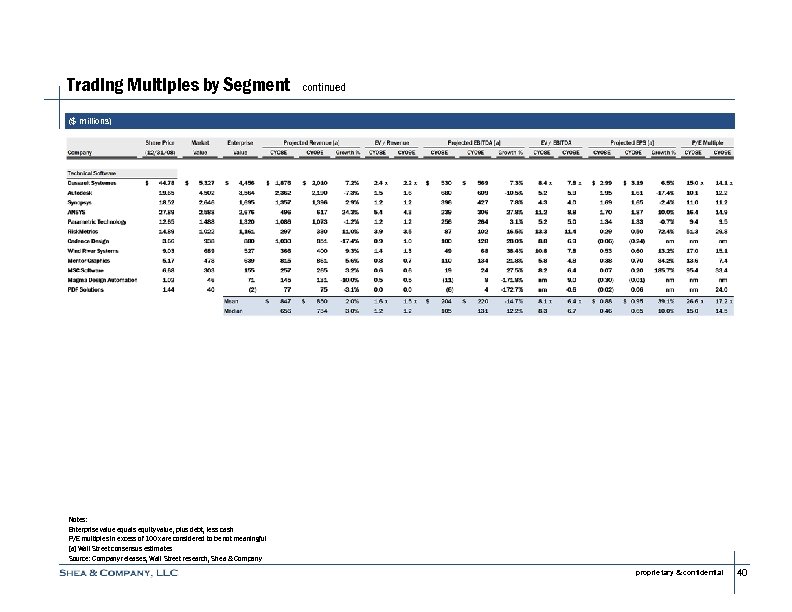

Trading Multiples by Segment continued ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 40

Trading Multiples by Segment continued ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 40

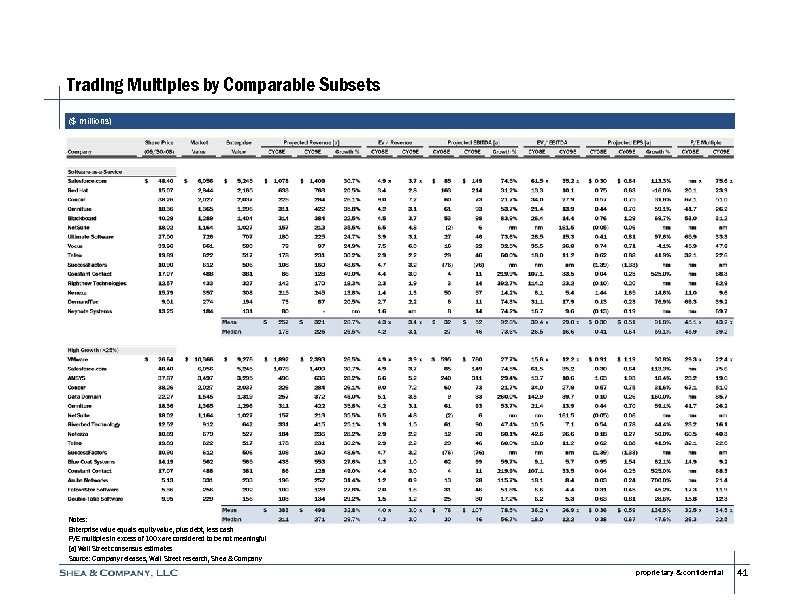

Trading Multiples by Comparable Subsets ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 41

Trading Multiples by Comparable Subsets ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 41

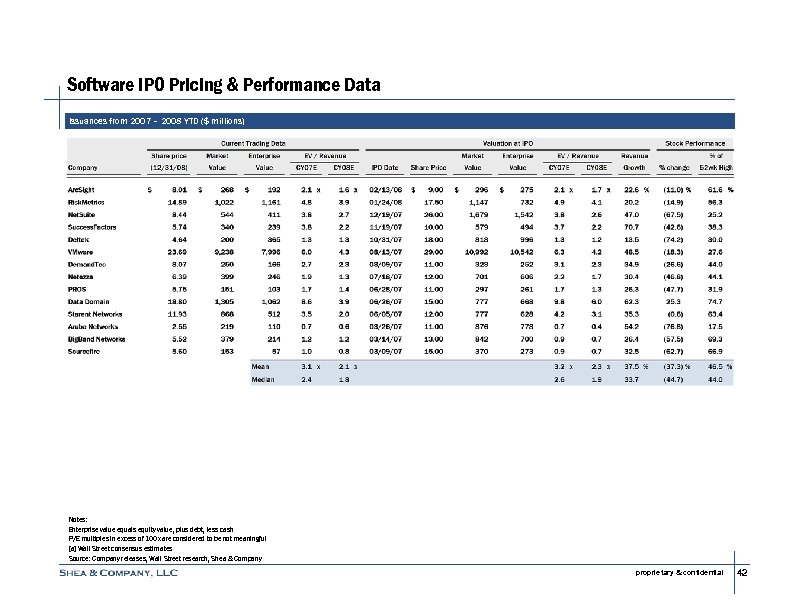

Software IPO Pricing & Performance Data Issuances from 2007 – 2008 YTD ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 42

Software IPO Pricing & Performance Data Issuances from 2007 – 2008 YTD ($ millions) Notes: Enterprise value equals equity value, plus debt, less cash P/E multiples in excess of 100 x are considered to be not meaningful [a] Wall Street consensus estimates Source: Company releases, Wall Street research, Shea & Company proprietary & confidential 42

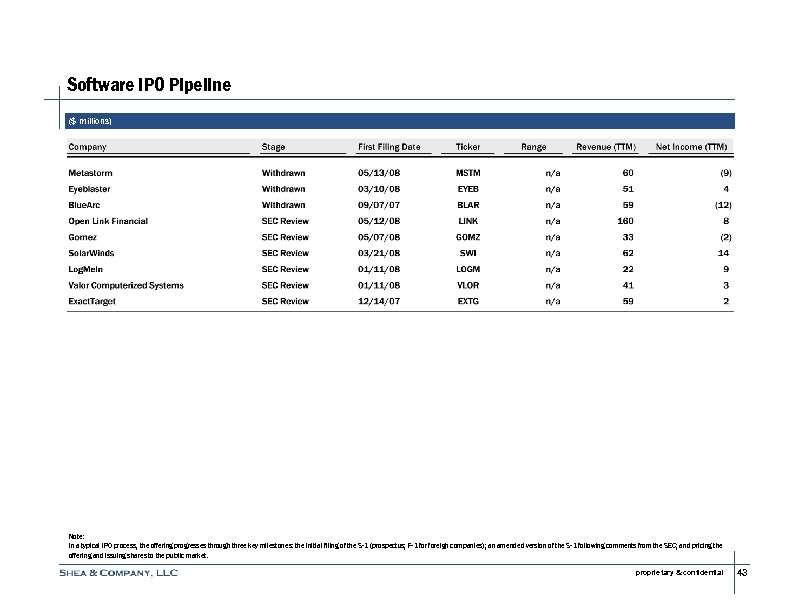

Software IPO Pipeline ($ millions) Note: In a typical IPO process, the offering progresses through three key milestones: the initial filing of the S-1 (prospectus; F-1 foreign companies); an amended version of the S-1 following comments from the SEC; and pricing the offering and issuing shares to the public market. proprietary & confidential 43

Software IPO Pipeline ($ millions) Note: In a typical IPO process, the offering progresses through three key milestones: the initial filing of the S-1 (prospectus; F-1 foreign companies); an amended version of the S-1 following comments from the SEC; and pricing the offering and issuing shares to the public market. proprietary & confidential 43

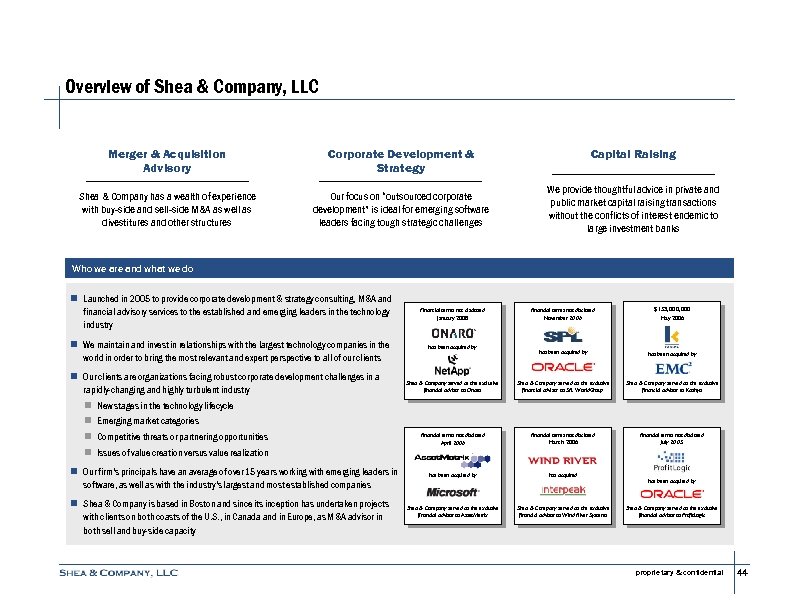

Overview of Shea & Company, LLC Merger & Acquisition Advisory Corporate Development & Strategy Shea & Company has a wealth of experience with buy-side and sell-side M&A as well as divestitures and other structures Our focus on “outsourced corporate development” is ideal for emerging software leaders facing tough strategic challenges Capital Raising We provide thoughtful advice in private and public market capital raising transactions without the conflicts of interest endemic to large investment banks Who we are and what we do n Launched in 2005 to provide corporate development & strategy consulting, M&A and financial advisory services to the established and emerging leaders in the technology industry n We maintain and invest in relationships with the largest technology companies in the world in order to bring the most relevant and expert perspective to all of our clients n Our clients are organizations facing robust corporate development challenges in a rapidly-changing and highly turbulent industry Financial terms not disclosed November 2006 $153, 000 May 2006 has been acquired by Shea & Company served as the exclusive financial advisor to Onaro Shea & Company served as the exclusive financial advisor to SPL World. Group Shea & Company served as the exclusive financial advisor to Kashya Financial terms not disclosed April 2006 Financial terms not disclosed March 2006 Financial terms not disclosed July 2005 has been acquired by has acquired Shea & Company served as the exclusive financial advisor to Asset. Metrix Shea & Company served as the exclusive financial advisor to Wind River Systems Financial terms not disclosed January 2008 has been acquired by n New stages in the technology lifecycle n Emerging market categories n Competitive threats or partnering opportunities n Issues of value creation versus value realization n Our firm’s principals have an average of over 15 years working with emerging leaders in software, as well as with the industry’s largest and most established companies n Shea & Company is based in Boston and since its inception has undertaken projects with clients on both coasts of the U. S. , in Canada and in Europe, as M&A advisor in both sell and buy-side capacity has been acquired by Shea & Company served as the exclusive financial advisor to Profit. Logic proprietary & confidential 44

Overview of Shea & Company, LLC Merger & Acquisition Advisory Corporate Development & Strategy Shea & Company has a wealth of experience with buy-side and sell-side M&A as well as divestitures and other structures Our focus on “outsourced corporate development” is ideal for emerging software leaders facing tough strategic challenges Capital Raising We provide thoughtful advice in private and public market capital raising transactions without the conflicts of interest endemic to large investment banks Who we are and what we do n Launched in 2005 to provide corporate development & strategy consulting, M&A and financial advisory services to the established and emerging leaders in the technology industry n We maintain and invest in relationships with the largest technology companies in the world in order to bring the most relevant and expert perspective to all of our clients n Our clients are organizations facing robust corporate development challenges in a rapidly-changing and highly turbulent industry Financial terms not disclosed November 2006 $153, 000 May 2006 has been acquired by Shea & Company served as the exclusive financial advisor to Onaro Shea & Company served as the exclusive financial advisor to SPL World. Group Shea & Company served as the exclusive financial advisor to Kashya Financial terms not disclosed April 2006 Financial terms not disclosed March 2006 Financial terms not disclosed July 2005 has been acquired by has acquired Shea & Company served as the exclusive financial advisor to Asset. Metrix Shea & Company served as the exclusive financial advisor to Wind River Systems Financial terms not disclosed January 2008 has been acquired by n New stages in the technology lifecycle n Emerging market categories n Competitive threats or partnering opportunities n Issues of value creation versus value realization n Our firm’s principals have an average of over 15 years working with emerging leaders in software, as well as with the industry’s largest and most established companies n Shea & Company is based in Boston and since its inception has undertaken projects with clients on both coasts of the U. S. , in Canada and in Europe, as M&A advisor in both sell and buy-side capacity has been acquired by Shea & Company served as the exclusive financial advisor to Profit. Logic proprietary & confidential 44