a9942ab1ea9d99430c201626e149f7a6.ppt

- Количество слайдов: 28

ANNA RAPPAPORT CONSULTING STRATEGIES FOR A SECURE RETIREMENTSM US Pensions: Today’s Challenges, Tomorrow’s Direction Anna Rappaport, FSA, MAAA Senior Fellow on Pensions & Retirement, The Conference Board (US) 2009 Summit on the Future of Pensions: From Crisis to Sustainability April 2009

ANNA RAPPAPORT CONSULTING STRATEGIES FOR A SECURE RETIREMENTSM US Pensions: Today’s Challenges, Tomorrow’s Direction Anna Rappaport, FSA, MAAA Senior Fellow on Pensions & Retirement, The Conference Board (US) 2009 Summit on the Future of Pensions: From Crisis to Sustainability April 2009

Agenda § Today’s Challenges § Tomorrow’s Direction 2009 Summit on the Future of Pensions: From Crisis to Sustainability 1

Agenda § Today’s Challenges § Tomorrow’s Direction 2009 Summit on the Future of Pensions: From Crisis to Sustainability 1

Today’s Challenges § § § Big picture Successes and failures DB/DC evolution DB and the Financial Crisis DC and the Financial Crisis 2009 Summit on the Future of Pensions: From Crisis to Sustainability 2

Today’s Challenges § § § Big picture Successes and failures DB/DC evolution DB and the Financial Crisis DC and the Financial Crisis 2009 Summit on the Future of Pensions: From Crisis to Sustainability 2

Big Picture § Social Security key § Employer role – Private large companies – big – Small companies – limited – Public sector – nearly everyone covered (mostly DB) § Retirement – later and more gradual § Limits on individual action § No consensus among stakeholders about right answers § No integrated policy background 2009 Summit on the Future of Pensions: From Crisis to Sustainability 3

Big Picture § Social Security key § Employer role – Private large companies – big – Small companies – limited – Public sector – nearly everyone covered (mostly DB) § Retirement – later and more gradual § Limits on individual action § No consensus among stakeholders about right answers § No integrated policy background 2009 Summit on the Future of Pensions: From Crisis to Sustainability 3

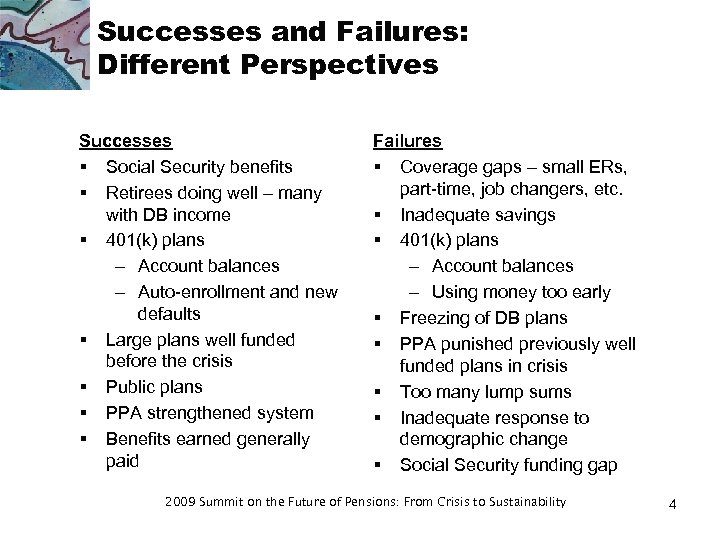

Successes and Failures: Different Perspectives Successes § Social Security benefits § Retirees doing well – many with DB income § 401(k) plans – Account balances – Auto-enrollment and new defaults § Large plans well funded before the crisis § Public plans § PPA strengthened system § Benefits earned generally paid Failures § Coverage gaps – small ERs, part-time, job changers, etc. § Inadequate savings § 401(k) plans – Account balances – Using money too early § Freezing of DB plans § PPA punished previously well funded plans in crisis § Too many lump sums § Inadequate response to demographic change § Social Security funding gap 2009 Summit on the Future of Pensions: From Crisis to Sustainability 4

Successes and Failures: Different Perspectives Successes § Social Security benefits § Retirees doing well – many with DB income § 401(k) plans – Account balances – Auto-enrollment and new defaults § Large plans well funded before the crisis § Public plans § PPA strengthened system § Benefits earned generally paid Failures § Coverage gaps – small ERs, part-time, job changers, etc. § Inadequate savings § 401(k) plans – Account balances – Using money too early § Freezing of DB plans § PPA punished previously well funded plans in crisis § Too many lump sums § Inadequate response to demographic change § Social Security funding gap 2009 Summit on the Future of Pensions: From Crisis to Sustainability 4

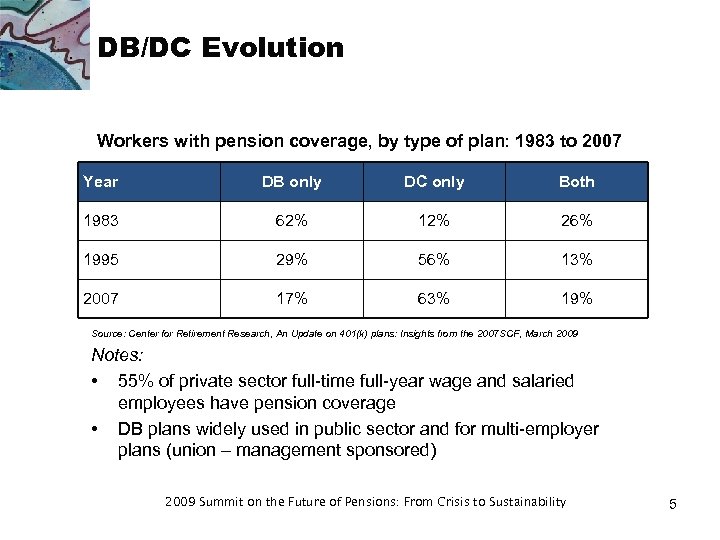

DB/DC Evolution Workers with pension coverage, by type of plan: 1983 to 2007 Year DB only DC only Both 1983 62% 12% 26% 1995 29% 56% 13% 2007 17% 63% 19% Source: Center for Retirement Research, An Update on 401(k) plans: Insights from the 2007 SCF, March 2009 Notes: • 55% of private sector full-time full-year wage and salaried employees have pension coverage • DB plans widely used in public sector and for multi-employer plans (union – management sponsored) 2009 Summit on the Future of Pensions: From Crisis to Sustainability 5

DB/DC Evolution Workers with pension coverage, by type of plan: 1983 to 2007 Year DB only DC only Both 1983 62% 12% 26% 1995 29% 56% 13% 2007 17% 63% 19% Source: Center for Retirement Research, An Update on 401(k) plans: Insights from the 2007 SCF, March 2009 Notes: • 55% of private sector full-time full-year wage and salaried employees have pension coverage • DB plans widely used in public sector and for multi-employer plans (union – management sponsored) 2009 Summit on the Future of Pensions: From Crisis to Sustainability 5

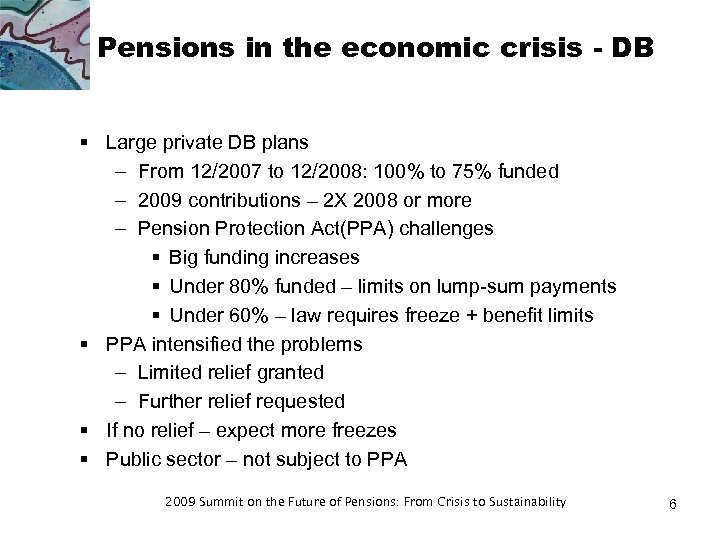

Pensions in the economic crisis - DB § Large private DB plans – From 12/2007 to 12/2008: 100% to 75% funded – 2009 contributions – 2 X 2008 or more – Pension Protection Act(PPA) challenges § Big funding increases § Under 80% funded – limits on lump-sum payments § Under 60% – law requires freeze + benefit limits § PPA intensified the problems – Limited relief granted – Further relief requested § If no relief – expect more freezes § Public sector – not subject to PPA 2009 Summit on the Future of Pensions: From Crisis to Sustainability 6

Pensions in the economic crisis - DB § Large private DB plans – From 12/2007 to 12/2008: 100% to 75% funded – 2009 contributions – 2 X 2008 or more – Pension Protection Act(PPA) challenges § Big funding increases § Under 80% funded – limits on lump-sum payments § Under 60% – law requires freeze + benefit limits § PPA intensified the problems – Limited relief granted – Further relief requested § If no relief – expect more freezes § Public sector – not subject to PPA 2009 Summit on the Future of Pensions: From Crisis to Sustainability 6

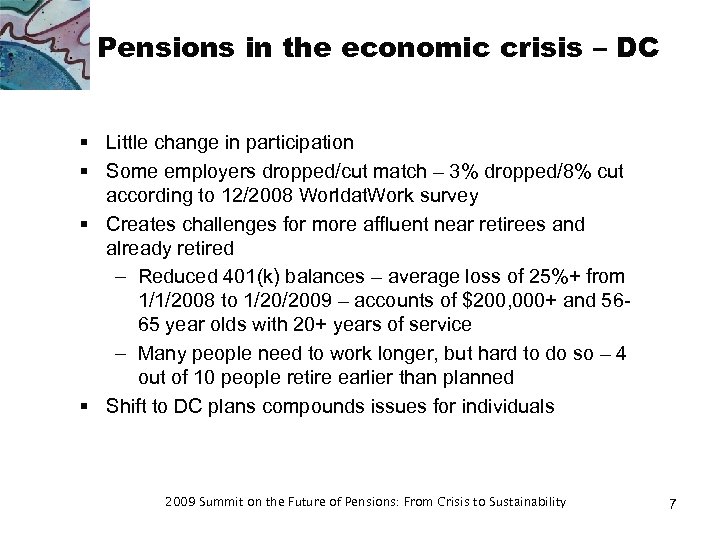

Pensions in the economic crisis – DC § Little change in participation § Some employers dropped/cut match – 3% dropped/8% cut according to 12/2008 Worldat. Work survey § Creates challenges for more affluent near retirees and already retired – Reduced 401(k) balances – average loss of 25%+ from 1/1/2008 to 1/20/2009 – accounts of $200, 000+ and 5665 year olds with 20+ years of service – Many people need to work longer, but hard to do so – 4 out of 10 people retire earlier than planned § Shift to DC plans compounds issues for individuals 2009 Summit on the Future of Pensions: From Crisis to Sustainability 7

Pensions in the economic crisis – DC § Little change in participation § Some employers dropped/cut match – 3% dropped/8% cut according to 12/2008 Worldat. Work survey § Creates challenges for more affluent near retirees and already retired – Reduced 401(k) balances – average loss of 25%+ from 1/1/2008 to 1/20/2009 – accounts of $200, 000+ and 5665 year olds with 20+ years of service – Many people need to work longer, but hard to do so – 4 out of 10 people retire earlier than planned § Shift to DC plans compounds issues for individuals 2009 Summit on the Future of Pensions: From Crisis to Sustainability 7

401(k) Plans in Perspective § Heavier reliance on default options § Growth of auto-enrollment, life cycle funds in DC § Advocates – Big success/contribution to retirement security – % of participants taking hardship withdrawals under 2% § Voices of Critics – Too many people have been left out of the system – Too much risk and exposure to market swings – Lump sums at retirement – Leakage – Critical of investment options, expense disclosures – Tax benefits go largely to more affluent 2009 Summit on the Future of Pensions: From Crisis to Sustainability 8

401(k) Plans in Perspective § Heavier reliance on default options § Growth of auto-enrollment, life cycle funds in DC § Advocates – Big success/contribution to retirement security – % of participants taking hardship withdrawals under 2% § Voices of Critics – Too many people have been left out of the system – Too much risk and exposure to market swings – Lump sums at retirement – Leakage – Critical of investment options, expense disclosures – Tax benefits go largely to more affluent 2009 Summit on the Future of Pensions: From Crisis to Sustainability 8

Tomorrow’s Direction: New Approaches § § § § Big Issues and Themes Concerns of Employers and Employees Defining the Future: Players and Proposals Mandatory or Voluntary? Risk: Sharing and Management Later and Flexible Retirement Dealing with Realities of Individual Action 2009 Summit on the Future of Pensions: From Crisis to Sustainability 9

Tomorrow’s Direction: New Approaches § § § § Big Issues and Themes Concerns of Employers and Employees Defining the Future: Players and Proposals Mandatory or Voluntary? Risk: Sharing and Management Later and Flexible Retirement Dealing with Realities of Individual Action 2009 Summit on the Future of Pensions: From Crisis to Sustainability 9

Big Issues and Themes § § § § Keep Social Security strong Coverage: Mandatory Tier II? Risk sharing – before and after retirement Risk management Governance and role of the employer Gradual retirement/faciliating work as part of retirement Payouts in DC plans 2009 Summit on the Future of Pensions: From Crisis to Sustainability 10

Big Issues and Themes § § § § Keep Social Security strong Coverage: Mandatory Tier II? Risk sharing – before and after retirement Risk management Governance and role of the employer Gradual retirement/faciliating work as part of retirement Payouts in DC plans 2009 Summit on the Future of Pensions: From Crisis to Sustainability 10

Concerns of Employers and Employees Employers § Helping employees realize the benefit of the funds they have accumulated § Securing retirement for employees § Managing fiduciary liability § Winning loyalty and appreciation from employees § Supporting talent management policy § Keeping administration simple and cost effective Employees § Housing and asset losses § Timing of retirement § Dealing with confusion § Managing money in retirement § Finding good advice § Being able to deal with emergencies § Leaving money to heirs § Making money last § Not losing money 2009 Summit on the Future of Pensions: From Crisis to Sustainability 11

Concerns of Employers and Employees Employers § Helping employees realize the benefit of the funds they have accumulated § Securing retirement for employees § Managing fiduciary liability § Winning loyalty and appreciation from employees § Supporting talent management policy § Keeping administration simple and cost effective Employees § Housing and asset losses § Timing of retirement § Dealing with confusion § Managing money in retirement § Finding good advice § Being able to deal with emergencies § Leaving money to heirs § Making money last § Not losing money 2009 Summit on the Future of Pensions: From Crisis to Sustainability 11

Defining the Future: Players and Proposals § U. S. Government § ERIC (ERISA Industry Committee) – New Benefits Platform § Projects focused on defining new models – Society of Actuaries: Retirement 20/20 – Retirement USA § Academics/think tanks – Auto-IRAs – New designs replacing current system on mandatory basis 2009 Summit on the Future of Pensions: From Crisis to Sustainability 12

Defining the Future: Players and Proposals § U. S. Government § ERIC (ERISA Industry Committee) – New Benefits Platform § Projects focused on defining new models – Society of Actuaries: Retirement 20/20 – Retirement USA § Academics/think tanks – Auto-IRAs – New designs replacing current system on mandatory basis 2009 Summit on the Future of Pensions: From Crisis to Sustainability 12

Coverage: Mandatory Tier II? § Realities – Large private and public employers – very good coverage and good benefits for long-term employees – Small employers – mostly out of the system § Social Security is universal program now 2009 Summit on the Future of Pensions: From Crisis to Sustainability 13

Coverage: Mandatory Tier II? § Realities – Large private and public employers – very good coverage and good benefits for long-term employees – Small employers – mostly out of the system § Social Security is universal program now 2009 Summit on the Future of Pensions: From Crisis to Sustainability 13

Proposals for Mandatory Coverage § Auto-IRA – require employers who do not offer plan to offer auto-enrollment payroll deduction IRA – Enhance with tax credit/government matching? – Employees can opt-out § Replace current system with mandatory account based system – 2. 5% to 5% of pay – Benefits as income – Various management alternatives – government (Federal Thrift Plan) or private – Or offer as an option § Increase Social Security minimum benefits 2009 Summit on the Future of Pensions: From Crisis to Sustainability 14

Proposals for Mandatory Coverage § Auto-IRA – require employers who do not offer plan to offer auto-enrollment payroll deduction IRA – Enhance with tax credit/government matching? – Employees can opt-out § Replace current system with mandatory account based system – 2. 5% to 5% of pay – Benefits as income – Various management alternatives – government (Federal Thrift Plan) or private – Or offer as an option § Increase Social Security minimum benefits 2009 Summit on the Future of Pensions: From Crisis to Sustainability 14

Risk sharing: before and after retirement § Risks include investment, longevity, health care, inflation, currency, business failure, fraud and more § Rethinking distribution of risk between plan sponsors, employees and public systems § Self-adjusting systems support pooling § After retirement – Growing use of lump sums in US – Income based defaults not used in DC § Options for risk pooling – Potential risk poolers: social systems, employer DB plans, independent pension entities, insurance and financial products, family – Public systems, TIAA-CREF, examples of organizations that pool risk across employers 2009 Summit on the Future of Pensions: From Crisis to Sustainability 15

Risk sharing: before and after retirement § Risks include investment, longevity, health care, inflation, currency, business failure, fraud and more § Rethinking distribution of risk between plan sponsors, employees and public systems § Self-adjusting systems support pooling § After retirement – Growing use of lump sums in US – Income based defaults not used in DC § Options for risk pooling – Potential risk poolers: social systems, employer DB plans, independent pension entities, insurance and financial products, family – Public systems, TIAA-CREF, examples of organizations that pool risk across employers 2009 Summit on the Future of Pensions: From Crisis to Sustainability 15

Risk management § § § § § Financial crisis reinforces importance Total enterprise risk perspective Investment management – matching of assets/liabilities Right investment structures Self-adjusting systems Large enough pools Different kinds of risk pools Good governance – focus on identifying best models Plan design 2009 Summit on the Future of Pensions: From Crisis to Sustainability 16

Risk management § § § § § Financial crisis reinforces importance Total enterprise risk perspective Investment management – matching of assets/liabilities Right investment structures Self-adjusting systems Large enough pools Different kinds of risk pools Good governance – focus on identifying best models Plan design 2009 Summit on the Future of Pensions: From Crisis to Sustainability 16

Redefinition of retirement § § § Will longer life mean longer work or longer retirement? The third age – new thinking about the life cycle People expect to retire later, but so far – few do About 50% work in retirement or have bridge jobs Virtually no formal phased retirement (private sector) 40% of people retire before they planned to – Loss of job and poor health – major factors § Many people say they want to work some in retirement – Say vs. do conflict – Questions about availability of work – Big unknowns § Disability: key issue in thinking about this 2009 Summit on the Future of Pensions: From Crisis to Sustainability 17

Redefinition of retirement § § § Will longer life mean longer work or longer retirement? The third age – new thinking about the life cycle People expect to retire later, but so far – few do About 50% work in retirement or have bridge jobs Virtually no formal phased retirement (private sector) 40% of people retire before they planned to – Loss of job and poor health – major factors § Many people say they want to work some in retirement – Say vs. do conflict – Questions about availability of work – Big unknowns § Disability: key issue in thinking about this 2009 Summit on the Future of Pensions: From Crisis to Sustainability 17

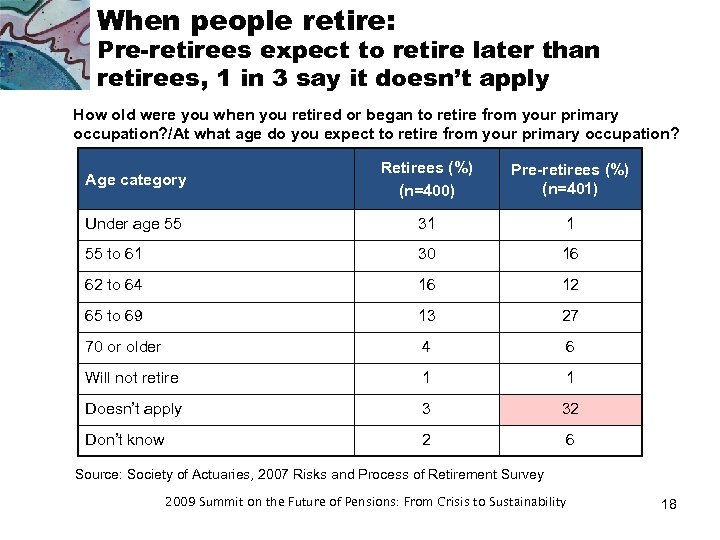

When people retire: Pre-retirees expect to retire later than retirees, 1 in 3 say it doesn’t apply How old were you when you retired or began to retire from your primary occupation? /At what age do you expect to retire from your primary occupation? Age category Retirees (%) (n=400) Pre-retirees (%) (n=401) Under age 55 31 1 55 to 61 30 16 62 to 64 16 12 65 to 69 13 27 70 or older 4 6 Will not retire 1 1 Doesn’t apply 3 32 Don’t know 2 6 Source: Society of Actuaries, 2007 Risks and Process of Retirement Survey 2009 Summit on the Future of Pensions: From Crisis to Sustainability 18

When people retire: Pre-retirees expect to retire later than retirees, 1 in 3 say it doesn’t apply How old were you when you retired or began to retire from your primary occupation? /At what age do you expect to retire from your primary occupation? Age category Retirees (%) (n=400) Pre-retirees (%) (n=401) Under age 55 31 1 55 to 61 30 16 62 to 64 16 12 65 to 69 13 27 70 or older 4 6 Will not retire 1 1 Doesn’t apply 3 32 Don’t know 2 6 Source: Society of Actuaries, 2007 Risks and Process of Retirement Survey 2009 Summit on the Future of Pensions: From Crisis to Sustainability 18

What people know and do § US savings rates are low § People save much more when they have access to employer plan § Many gaps in knowledge about retirement – Few think long term – Assets vs. expectations: out of step – Problems with math literacy, investment knowledge – Little focus on systematic risk management § Major method of managing risks – Reduce spending – Little focus on risk management products § Much changes during retirement, without pre-planning 2009 Summit on the Future of Pensions: From Crisis to Sustainability 19

What people know and do § US savings rates are low § People save much more when they have access to employer plan § Many gaps in knowledge about retirement – Few think long term – Assets vs. expectations: out of step – Problems with math literacy, investment knowledge – Little focus on systematic risk management § Major method of managing risks – Reduce spending – Little focus on risk management products § Much changes during retirement, without pre-planning 2009 Summit on the Future of Pensions: From Crisis to Sustainability 19

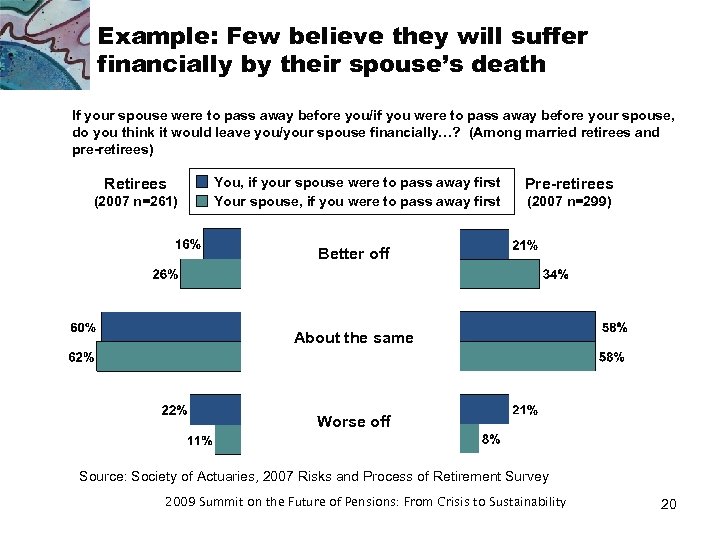

Example: Few believe they will suffer financially by their spouse’s death If your spouse were to pass away before you/if you were to pass away before your spouse, do you think it would leave you/your spouse financially…? (Among married retirees and pre-retirees) Retirees (2007 n=261) You, if your spouse were to pass away first Your spouse, if you were to pass away first Pre-retirees (2007 n=299) Better off About the same Worse off Source: Society of Actuaries, 2007 Risks and Process of Retirement Survey 2009 Summit on the Future of Pensions: From Crisis to Sustainability 20

Example: Few believe they will suffer financially by their spouse’s death If your spouse were to pass away before you/if you were to pass away before your spouse, do you think it would leave you/your spouse financially…? (Among married retirees and pre-retirees) Retirees (2007 n=261) You, if your spouse were to pass away first Your spouse, if you were to pass away first Pre-retirees (2007 n=299) Better off About the same Worse off Source: Society of Actuaries, 2007 Risks and Process of Retirement Survey 2009 Summit on the Future of Pensions: From Crisis to Sustainability 20

Employer roles in retirement income § Offer benefits and pay for them § Offer programs for individual saving § Provide plans that limit lump sums – can mandate income for all of part of the benefit § Serve as purchasing agent § Offer access to pools § Create expectations and provide information § Advise and educate Key questions – should employer offer benefits, facilitate them, or opt out? Should employer be primary source of security? 2009 Summit on the Future of Pensions: From Crisis to Sustainability 21

Employer roles in retirement income § Offer benefits and pay for them § Offer programs for individual saving § Provide plans that limit lump sums – can mandate income for all of part of the benefit § Serve as purchasing agent § Offer access to pools § Create expectations and provide information § Advise and educate Key questions – should employer offer benefits, facilitate them, or opt out? Should employer be primary source of security? 2009 Summit on the Future of Pensions: From Crisis to Sustainability 21

How and when benefits are paid § People say they want income but choose lump sums § Distribution of benefits: lump sums vs. income – DB: lifetime income common – DC: lump sums usual in US but growing concern as these plans are primary § Big issues: – New defaults for DC plans – How to prevent leakage: how much early access should be allowed and when? 2009 Summit on the Future of Pensions: From Crisis to Sustainability 22

How and when benefits are paid § People say they want income but choose lump sums § Distribution of benefits: lump sums vs. income – DB: lifetime income common – DC: lump sums usual in US but growing concern as these plans are primary § Big issues: – New defaults for DC plans – How to prevent leakage: how much early access should be allowed and when? 2009 Summit on the Future of Pensions: From Crisis to Sustainability 22

Example of Proposal: ERIC New Benefits Platform § Includes DB, DC and short-term savings component § Mandates coverage, but allows employers to offer own plans, use purchasing cooperatives, or provide vouchers § Provides standard benefit designs § Mandates individuals without employer coverage to buy on their own § Levels playing field between those with and without coverage § Extends same tax benefits whether employer plan or individual purchase § Mandates Income payout for DB benefit 2009 Summit on the Future of Pensions: From Crisis to Sustainability 23

Example of Proposal: ERIC New Benefits Platform § Includes DB, DC and short-term savings component § Mandates coverage, but allows employers to offer own plans, use purchasing cooperatives, or provide vouchers § Provides standard benefit designs § Mandates individuals without employer coverage to buy on their own § Levels playing field between those with and without coverage § Extends same tax benefits whether employer plan or individual purchase § Mandates Income payout for DB benefit 2009 Summit on the Future of Pensions: From Crisis to Sustainability 23

Developing Options: Retirement 20/20 § Society of Actuaries project – focus on new models § Multi-disciplinary § Started with stakeholders: society at large, individuals, employers and markets § Looked at risks, needs and roles § Key findings – ideas for the future – Align roles with capabilities – Support new patterns of retirement – Importance of self-adjusting systems – Signals matter – Governance matters 2009 Summit on the Future of Pensions: From Crisis to Sustainability 24

Developing Options: Retirement 20/20 § Society of Actuaries project – focus on new models § Multi-disciplinary § Started with stakeholders: society at large, individuals, employers and markets § Looked at risks, needs and roles § Key findings – ideas for the future – Align roles with capabilities – Support new patterns of retirement – Importance of self-adjusting systems – Signals matter – Governance matters 2009 Summit on the Future of Pensions: From Crisis to Sustainability 24

The Future – Some Dreams § § Recognition of importance of organized retirement system Public will understand longevity including its variability Strong Social Security system Rational coherent policy structure – Support employer role – Encourage range of plan designs § Encourage later retirement and facilitate work among third age persons 2009 Summit on the Future of Pensions: From Crisis to Sustainability 25

The Future – Some Dreams § § Recognition of importance of organized retirement system Public will understand longevity including its variability Strong Social Security system Rational coherent policy structure – Support employer role – Encourage range of plan designs § Encourage later retirement and facilitate work among third age persons 2009 Summit on the Future of Pensions: From Crisis to Sustainability 25

More dreams § § § § § Self adjustment will facilitate risk pooling Sensible use of choice, with good default options Focus on life income Protect spouses and widows All stakeholders will recognize the importance of the postretirement period DC plans use distribution defaults that encourage income Culture will encourage more saving Adequate retirement funds to cover post-retirement inflation and the cost of long term care Benefits available on disability retirement 2009 Summit on the Future of Pensions: From Crisis to Sustainability 26

More dreams § § § § § Self adjustment will facilitate risk pooling Sensible use of choice, with good default options Focus on life income Protect spouses and widows All stakeholders will recognize the importance of the postretirement period DC plans use distribution defaults that encourage income Culture will encourage more saving Adequate retirement funds to cover post-retirement inflation and the cost of long term care Benefits available on disability retirement 2009 Summit on the Future of Pensions: From Crisis to Sustainability 26

ANNA RAPPAPORT CONSULTING STRATEGIES FOR A SECURE RETIREMENTSM anna@annarappaport. com Phone: 312 -642 -4720 Fax: 312 -642 -4330 27

ANNA RAPPAPORT CONSULTING STRATEGIES FOR A SECURE RETIREMENTSM anna@annarappaport. com Phone: 312 -642 -4720 Fax: 312 -642 -4330 27