dd83c00899e1420c9680b926788f4926.ppt

- Количество слайдов: 29

ANGLO AMERICAN A WORLD OF DIFFERENCE Merrill Lynch Conference 12 May 2004 This presentation is being made only to and is directed only at (a) persons who have professional experience in matters relating to investments falling within Article 19(1) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 (the “Order”) or (b) high net worth entities, and other persons to whom it may otherwise lawfully be communicated, falling within Article 49(1) of the Order (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this presentation or any of its contents. Merrill Lynch Conference

ANGLO AMERICAN A WORLD OF DIFFERENCE Merrill Lynch Conference 12 May 2004 This presentation is being made only to and is directed only at (a) persons who have professional experience in matters relating to investments falling within Article 19(1) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 (the “Order”) or (b) high net worth entities, and other persons to whom it may otherwise lawfully be communicated, falling within Article 49(1) of the Order (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this presentation or any of its contents. Merrill Lynch Conference

Why Anglo American? Ø High quality assets Ø Financial strength Ø Strong cashflow returns Ø Investing for growth 2

Why Anglo American? Ø High quality assets Ø Financial strength Ø Strong cashflow returns Ø Investing for growth 2

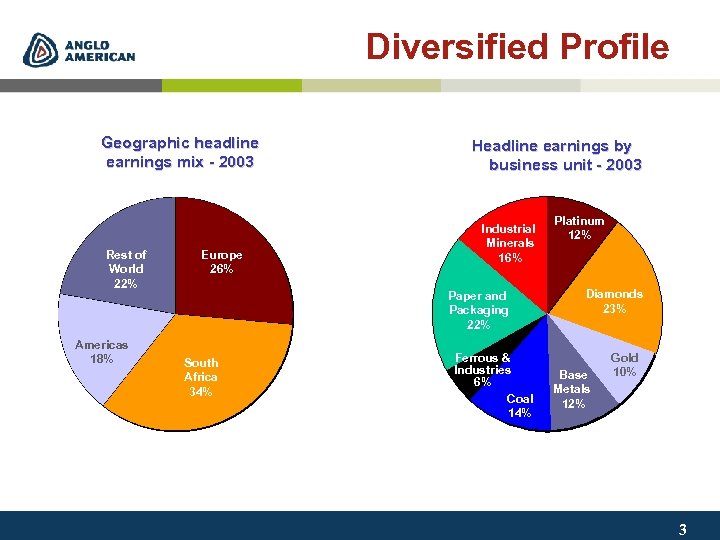

Diversified Profile Geographic headline earnings mix - 2003 Rest of World 22% Americas 18% Europe 26% Headline earnings by business unit - 2003 Industrial Minerals 16% Paper and Packaging 22% South Africa 34% Ferrous & Industries 6% Coal 14% Platinum 12% Diamonds 23% Base Metals 12% Gold 10% 3

Diversified Profile Geographic headline earnings mix - 2003 Rest of World 22% Americas 18% Europe 26% Headline earnings by business unit - 2003 Industrial Minerals 16% Paper and Packaging 22% South Africa 34% Ferrous & Industries 6% Coal 14% Platinum 12% Diamonds 23% Base Metals 12% Gold 10% 3

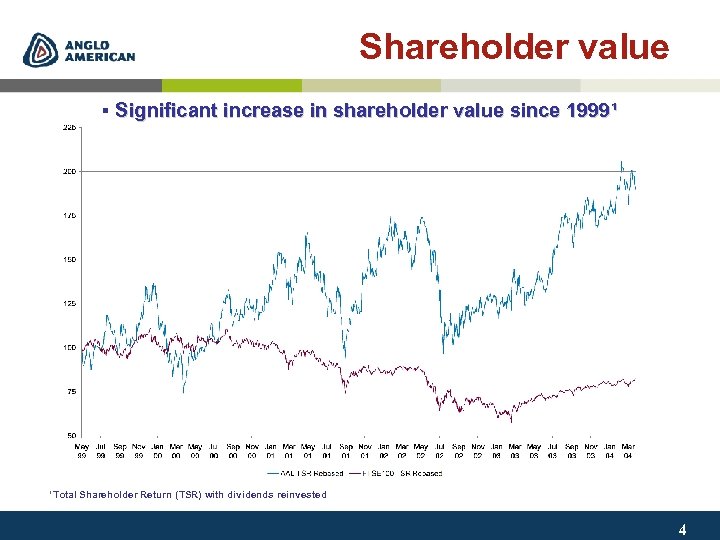

Shareholder value § Significant increase in shareholder value since 1999¹ ¹Total Shareholder Return (TSR) with dividends reinvested 4

Shareholder value § Significant increase in shareholder value since 1999¹ ¹Total Shareholder Return (TSR) with dividends reinvested 4

Strategy Focused strategy based on: Ø Growth through projects Ø Growth through acquisitions Ø Value from cost cutting and efficiencies 5

Strategy Focused strategy based on: Ø Growth through projects Ø Growth through acquisitions Ø Value from cost cutting and efficiencies 5

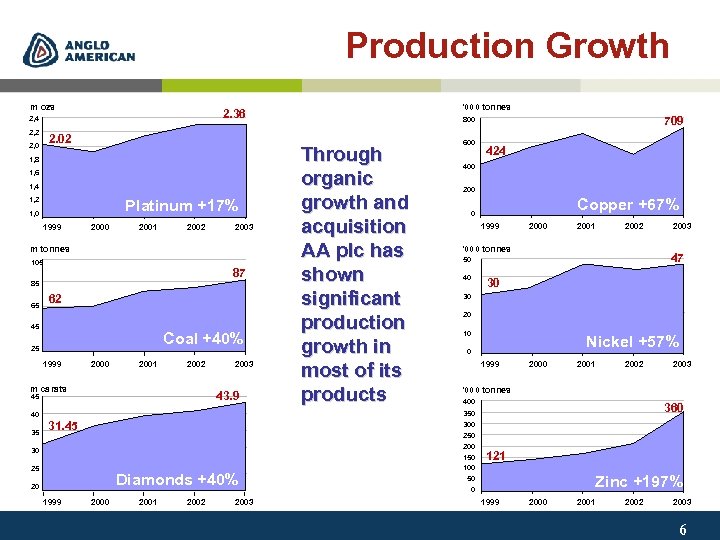

Production Growth m ozs 2, 2 2, 0 2. 02 1, 8 1, 6 1, 4 1, 2 Platinum +17% 1, 0 1999 2000 2001 2002 2003 m tonnes 105 87 85 65 62 45 Coal +40% 25 1999 2000 2001 2002 m carats 35 2003 43. 9 45 40 ’ 000 tonnes 2. 36 2, 4 709 800 Through organic growth and acquisition AA plc has shown significant production growth in most of its products 600 424 400 200 Copper +67% 0 1999 2000 2001 2002 ’ 000 tonnes 47 50 40 30 30 20 10 Nickel +57% 0 1999 2000 2001 2002 400 360 300 250 200 30 150 25 Diamonds +40% 20 1999 2003 ’ 000 tonnes 350 31. 45 2003 2000 2001 2002 2003 121 100 Zinc +197% 50 0 1999 2000 2001 2002 2003 6

Production Growth m ozs 2, 2 2, 0 2. 02 1, 8 1, 6 1, 4 1, 2 Platinum +17% 1, 0 1999 2000 2001 2002 2003 m tonnes 105 87 85 65 62 45 Coal +40% 25 1999 2000 2001 2002 m carats 35 2003 43. 9 45 40 ’ 000 tonnes 2. 36 2, 4 709 800 Through organic growth and acquisition AA plc has shown significant production growth in most of its products 600 424 400 200 Copper +67% 0 1999 2000 2001 2002 ’ 000 tonnes 47 50 40 30 30 20 10 Nickel +57% 0 1999 2000 2001 2002 400 360 300 250 200 30 150 25 Diamonds +40% 20 1999 2003 ’ 000 tonnes 350 31. 45 2003 2000 2001 2002 2003 121 100 Zinc +197% 50 0 1999 2000 2001 2002 2003 6

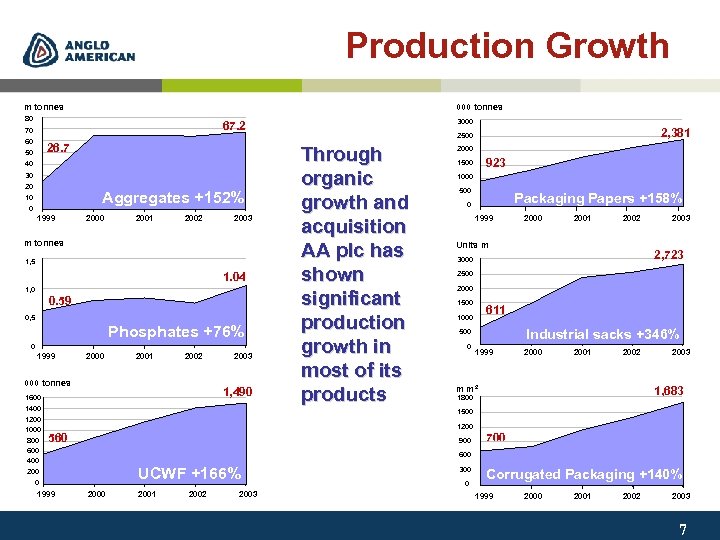

Production Growth m tonnes 000 tonnes 80 3000 67. 2 70 60 26. 7 50 40 30 20 Aggregates +152% 10 0 1999 2000 2001 2002 2003 m tonnes 1, 5 1. 04 1, 0 0. 59 0, 5 Phosphates +76% 0 1999 2000 2001 2002 000 tonnes 2003 1, 490 1600 1400 Through organic growth and acquisition AA plc has shown significant production growth in most of its products 2000 923 1500 1000 500 Packaging Papers +158% 0 1999 2000 2001 2002 Units m 2003 2, 723 3000 2500 2000 1500 611 1000 Industrial sacks +346% 500 0 1999 2000 2001 2002 2003 1, 683 m m² 1800 1500 1200 1000 800 600 400 2, 381 2500 1200 560 900 600 UCWF +166% 200 0 1999 700 2001 2002 2003 300 0 Corrugated Packaging +140% 1999 2000 2001 2002 2003 7

Production Growth m tonnes 000 tonnes 80 3000 67. 2 70 60 26. 7 50 40 30 20 Aggregates +152% 10 0 1999 2000 2001 2002 2003 m tonnes 1, 5 1. 04 1, 0 0. 59 0, 5 Phosphates +76% 0 1999 2000 2001 2002 000 tonnes 2003 1, 490 1600 1400 Through organic growth and acquisition AA plc has shown significant production growth in most of its products 2000 923 1500 1000 500 Packaging Papers +158% 0 1999 2000 2001 2002 Units m 2003 2, 723 3000 2500 2000 1500 611 1000 Industrial sacks +346% 500 0 1999 2000 2001 2002 2003 1, 683 m m² 1800 1500 1200 1000 800 600 400 2, 381 2500 1200 560 900 600 UCWF +166% 200 0 1999 700 2001 2002 2003 300 0 Corrugated Packaging +140% 1999 2000 2001 2002 2003 7

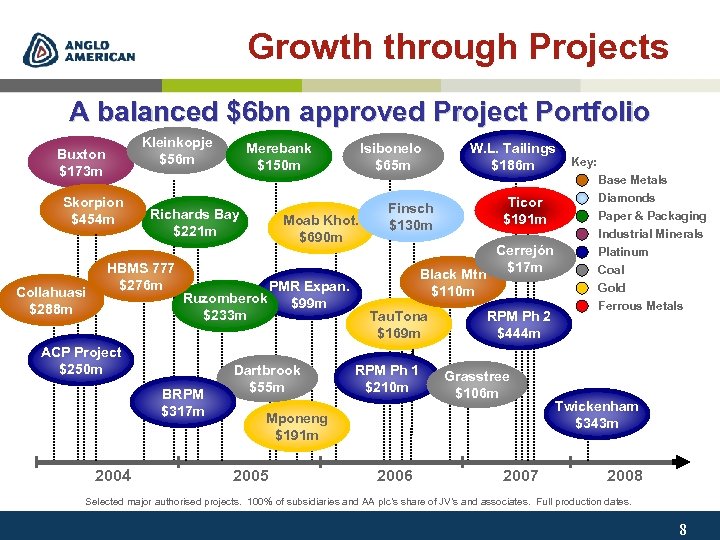

Growth through Projects A balanced $6 bn approved Project Portfolio Kleinkopje $56 m Buxton $173 m Skorpion $454 m Collahuasi $288 m Richards Bay $221 m HBMS 777 $276 m BRPM $317 m Isibonelo $65 m Moab Khot. $690 m Ruzomberok $233 m ACP Project $250 m 2004 Merebank $150 m PMR Expan. $99 m Dartbrook $55 m W. L. Tailings $186 m Ticor $191 m Finsch $130 m RPM Ph 1 $210 m Cerrejón $17 m RPM Ph 2 $444 m Grasstree $106 m Mponeng $191 m 2005 2006 Base Metals Diamonds Paper & Packaging Industrial Minerals Black Mtn $110 m Tau. Tona $169 m Key: 2007 Platinum Coal Gold Ferrous Metals Twickenham $343 m 2008 Selected major authorised projects. 100% of subsidiaries and AA plc’s share of JV’s and associates. Full production dates. 8

Growth through Projects A balanced $6 bn approved Project Portfolio Kleinkopje $56 m Buxton $173 m Skorpion $454 m Collahuasi $288 m Richards Bay $221 m HBMS 777 $276 m BRPM $317 m Isibonelo $65 m Moab Khot. $690 m Ruzomberok $233 m ACP Project $250 m 2004 Merebank $150 m PMR Expan. $99 m Dartbrook $55 m W. L. Tailings $186 m Ticor $191 m Finsch $130 m RPM Ph 1 $210 m Cerrejón $17 m RPM Ph 2 $444 m Grasstree $106 m Mponeng $191 m 2005 2006 Base Metals Diamonds Paper & Packaging Industrial Minerals Black Mtn $110 m Tau. Tona $169 m Key: 2007 Platinum Coal Gold Ferrous Metals Twickenham $343 m 2008 Selected major authorised projects. 100% of subsidiaries and AA plc’s share of JV’s and associates. Full production dates. 8

An extensive unapproved Project Pipeline NAME PRODUCT LOCATION ESTIMATED COST ($BN) Ø WESTERN COMPLEX COAL SOUTH AFRICA 0. 3 Ø MORRO SEM BONE NICKEL BRAZIL 0. 7 Ø GAMSBERG ZINC SOUTH AFRICA 1. 0 Ø QUELLAVECO COPPER PERU 0. 9 Ø BARRO ALTO NICKEL BRAZIL 0. 7 Ø SISHEN SOUTH IRON ORE SOUTH AFRICA 0. 3 Ø HOPE DOWNS IRON ORE AUSTRALIA 1. 2 9

An extensive unapproved Project Pipeline NAME PRODUCT LOCATION ESTIMATED COST ($BN) Ø WESTERN COMPLEX COAL SOUTH AFRICA 0. 3 Ø MORRO SEM BONE NICKEL BRAZIL 0. 7 Ø GAMSBERG ZINC SOUTH AFRICA 1. 0 Ø QUELLAVECO COPPER PERU 0. 9 Ø BARRO ALTO NICKEL BRAZIL 0. 7 Ø SISHEN SOUTH IRON ORE SOUTH AFRICA 0. 3 Ø HOPE DOWNS IRON ORE AUSTRALIA 1. 2 9

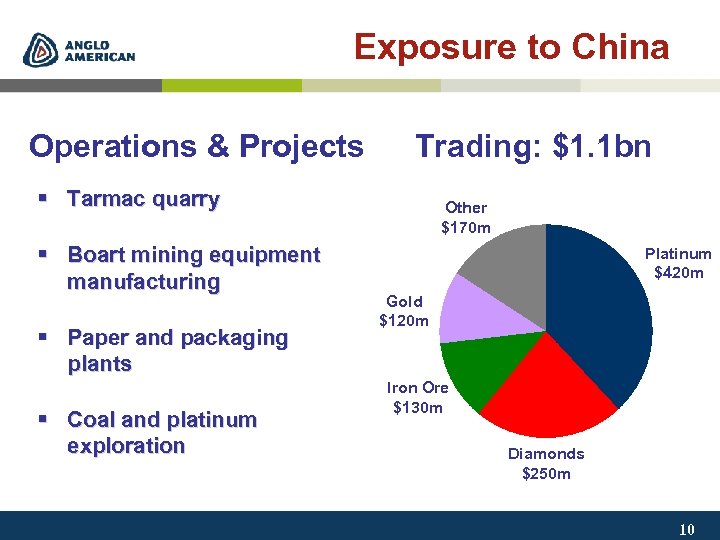

Exposure to China Operations & Projects Trading: $1. 1 bn § Tarmac quarry § Boart mining equipment manufacturing § Paper and packaging plants § Coal and platinum exploration Other $170 m Platinum $420 m Gold $120 m Iron Ore $130 m Diamonds $250 m 10

Exposure to China Operations & Projects Trading: $1. 1 bn § Tarmac quarry § Boart mining equipment manufacturing § Paper and packaging plants § Coal and platinum exploration Other $170 m Platinum $420 m Gold $120 m Iron Ore $130 m Diamonds $250 m 10

Key acquisitions: Delivering value Mondi Europe Tarmac Acquired: Mar 2000 Price: $1. 1 bn EBITDA/Total Cap: 16% Acquired: since 1999 Price: $1. 7 bn EBITDA/Total Cap: 23% Syktyvkar Coal Colombia & CDG Acquired: Mar 2002 Price: $0. 3 bn EBITDA/Total Cap: 23% Acquired: 1997 - 2002 Price: $0. 5 bn EBITDA/Total Cap: 21% Minera Sur Andes Acquired: Nov 2002 Price: $1. 3 bn EBITDA/Total Cap: 16% Shell Coal Acquired: 2000 Price: $0. 9 bn EBITDA/Total Cap: 18% 11

Key acquisitions: Delivering value Mondi Europe Tarmac Acquired: Mar 2000 Price: $1. 1 bn EBITDA/Total Cap: 16% Acquired: since 1999 Price: $1. 7 bn EBITDA/Total Cap: 23% Syktyvkar Coal Colombia & CDG Acquired: Mar 2002 Price: $0. 3 bn EBITDA/Total Cap: 23% Acquired: 1997 - 2002 Price: $0. 5 bn EBITDA/Total Cap: 21% Minera Sur Andes Acquired: Nov 2002 Price: $1. 3 bn EBITDA/Total Cap: 16% Shell Coal Acquired: 2000 Price: $0. 9 bn EBITDA/Total Cap: 18% 11

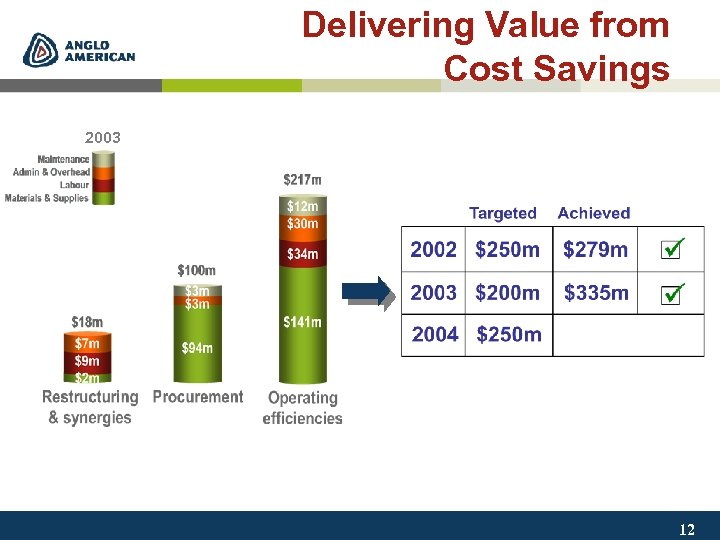

Delivering Value from Cost Savings 2003 12

Delivering Value from Cost Savings 2003 12

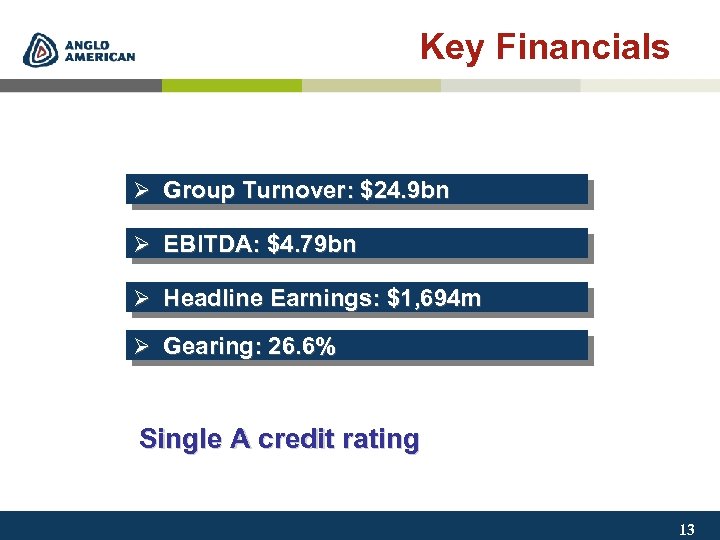

Key Financials Ø Group Turnover: $24. 9 bn Ø EBITDA: $4. 79 bn Ø Headline Earnings: $1, 694 m Ø Gearing: 26. 6% Single A credit rating 13

Key Financials Ø Group Turnover: $24. 9 bn Ø EBITDA: $4. 79 bn Ø Headline Earnings: $1, 694 m Ø Gearing: 26. 6% Single A credit rating 13

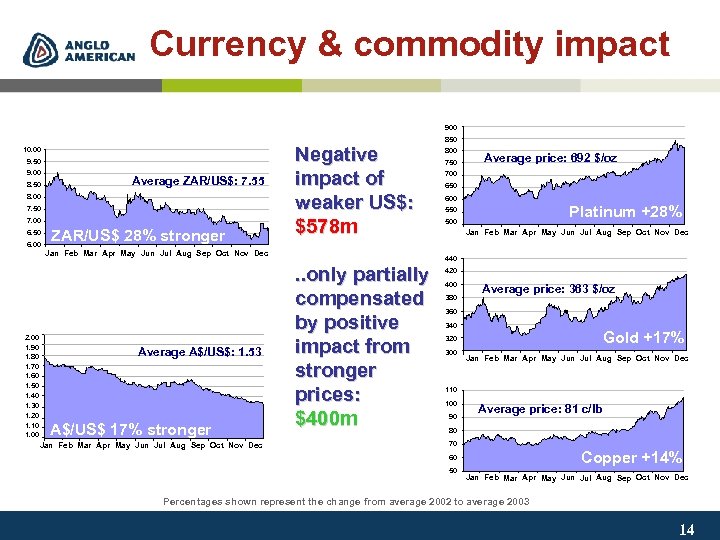

Currency & commodity impact 900 10. 00 9. 50 9. 00 8. 50 Average ZAR/US$: 7. 55 8. 00 7. 50 7. 00 6. 50 6. 00 ZAR/US$ 28% stronger Negative impact of weaker US$: $578 m Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2. 00 1. 90 1. 80 1. 70 1. 60 1. 50 1. 40 1. 30 1. 20 1. 10 1. 00 Average A$/US$: 1. 53 A$/US$ 17% stronger Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 850 800 750 Average price: 692 $/oz 700 650 600 Platinum +28% 550 500 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 440 . . only partially compensated by positive impact from stronger prices: $400 m 420 400 380 Average price: 363 $/oz 360 340 Gold +17% 320 300 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 110 100 90 Average price: 81 c/lb 80 70 Copper +14% 60 50 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Percentages shown represent the change from average 2002 to average 2003 14

Currency & commodity impact 900 10. 00 9. 50 9. 00 8. 50 Average ZAR/US$: 7. 55 8. 00 7. 50 7. 00 6. 50 6. 00 ZAR/US$ 28% stronger Negative impact of weaker US$: $578 m Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2. 00 1. 90 1. 80 1. 70 1. 60 1. 50 1. 40 1. 30 1. 20 1. 10 1. 00 Average A$/US$: 1. 53 A$/US$ 17% stronger Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 850 800 750 Average price: 692 $/oz 700 650 600 Platinum +28% 550 500 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 440 . . only partially compensated by positive impact from stronger prices: $400 m 420 400 380 Average price: 363 $/oz 360 340 Gold +17% 320 300 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 110 100 90 Average price: 81 c/lb 80 70 Copper +14% 60 50 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Percentages shown represent the change from average 2002 to average 2003 14

Anglo Base Metals § Radical restructuring of portfolio § Strong focus on improving capital and operating efficiency § Attractive low cost brownfield expansion opportunities § Good greenfield project pipeline § Well positioned to benefit from upturn in base metal prices 15

Anglo Base Metals § Radical restructuring of portfolio § Strong focus on improving capital and operating efficiency § Attractive low cost brownfield expansion opportunities § Good greenfield project pipeline § Well positioned to benefit from upturn in base metal prices 15

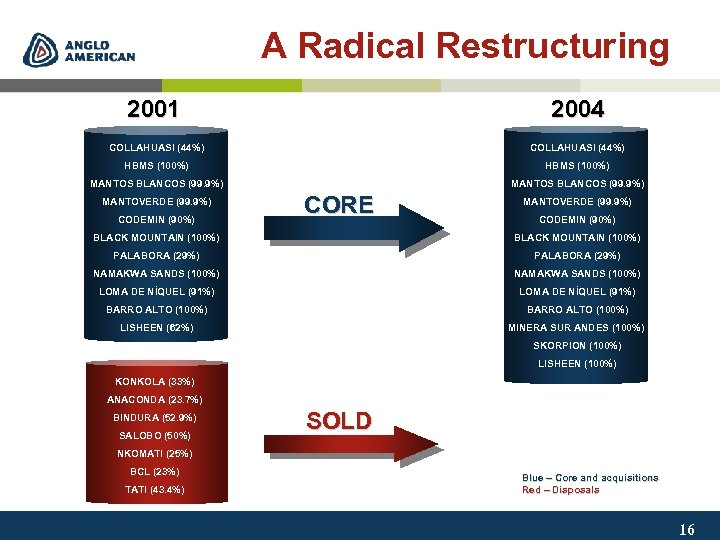

A Radical Restructuring 2001 2004 COLLAHUASI (44%) HBMS (100%) MANTOS BLANCOS (99. 9%) MANTOVERDE (99. 9%) CODEMIN (90%) CORE MANTOVERDE (99. 9%) CODEMIN (90%) BLACK MOUNTAIN (100%) PALABORA (29%) NAMAKWA SANDS (100%) LOMA DE NÍQUEL (91%) BARRO ALTO (100%) LISHEEN (62%) MINERA SUR ANDES (100%) SKORPION (100%) LISHEEN (100%) KONKOLA (33%) ANACONDA (23. 7%) BINDURA (52. 9%) SALOBO (50%) SOLD NKOMATI (25%) BCL (23%) TATI (43. 4%) Blue – Core and acquisitions Red – Disposals 16

A Radical Restructuring 2001 2004 COLLAHUASI (44%) HBMS (100%) MANTOS BLANCOS (99. 9%) MANTOVERDE (99. 9%) CODEMIN (90%) CORE MANTOVERDE (99. 9%) CODEMIN (90%) BLACK MOUNTAIN (100%) PALABORA (29%) NAMAKWA SANDS (100%) LOMA DE NÍQUEL (91%) BARRO ALTO (100%) LISHEEN (62%) MINERA SUR ANDES (100%) SKORPION (100%) LISHEEN (100%) KONKOLA (33%) ANACONDA (23. 7%) BINDURA (52. 9%) SALOBO (50%) SOLD NKOMATI (25%) BCL (23%) TATI (43. 4%) Blue – Core and acquisitions Red – Disposals 16

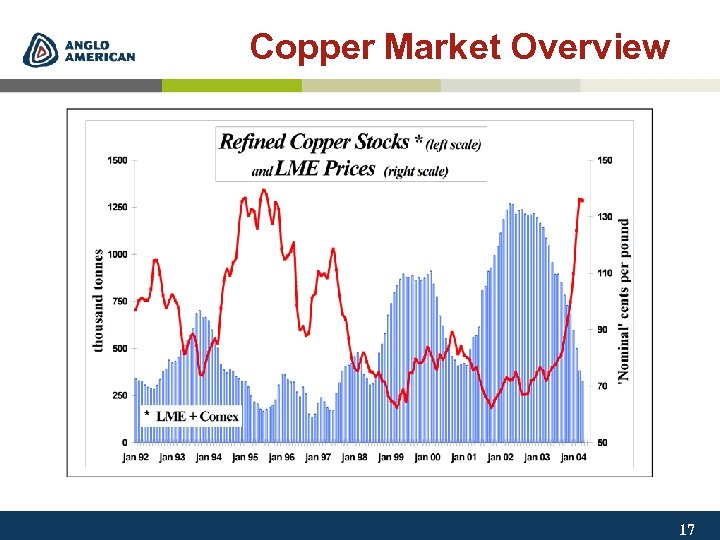

Copper Market Overview 17

Copper Market Overview 17

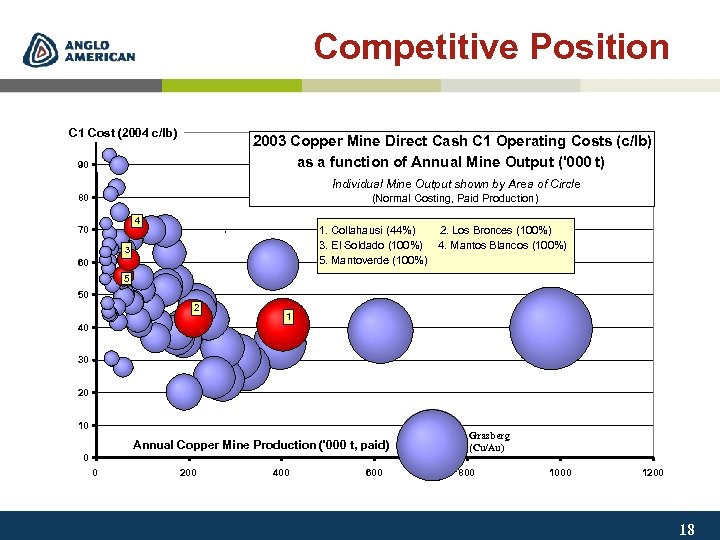

Competitive Position 100 C 1 Cost (2004 c/lb) 2003 Copper Mine Direct Cash C 1 Operating Costs (c/lb) as a function of Annual Mine Output ('000 t) 90 Individual Mine Output shown by Area of Circle 80 (Normal Costing, Paid Production) 4 70 1. Collahausi (44%) 2. Los Bronces (100%) 3. El Soldado (100%) 4. Mantos Blancos (100%) 5. Mantoverde (100%) 3 60 5 50 2 40 1 30 20 10 Annual Copper Mine Production ('000 t, paid) 0 0 200 400 600 Grasberg (Cu/Au) 800 1000 1200 18

Competitive Position 100 C 1 Cost (2004 c/lb) 2003 Copper Mine Direct Cash C 1 Operating Costs (c/lb) as a function of Annual Mine Output ('000 t) 90 Individual Mine Output shown by Area of Circle 80 (Normal Costing, Paid Production) 4 70 1. Collahausi (44%) 2. Los Bronces (100%) 3. El Soldado (100%) 4. Mantos Blancos (100%) 5. Mantoverde (100%) 3 60 5 50 2 40 1 30 20 10 Annual Copper Mine Production ('000 t, paid) 0 0 200 400 600 Grasberg (Cu/Au) 800 1000 1200 18

Acquisitions: Minera sur Andes § Acquired for US$1. 3 bn in November 2002 § 2003 operating profit US$128 m and ROCE 10% (at an average Cu price of 81 c/lb) § US$17 m p. a. of synergies identified to date – full benefit from 2004 onwards § Additional proven and probable reserves identified to date 368 Mt @ 0. 75 % Cu (2. 76 Mt contained Cu) § Agreement signed with Andina to exploit synergies 19

Acquisitions: Minera sur Andes § Acquired for US$1. 3 bn in November 2002 § 2003 operating profit US$128 m and ROCE 10% (at an average Cu price of 81 c/lb) § US$17 m p. a. of synergies identified to date – full benefit from 2004 onwards § Additional proven and probable reserves identified to date 368 Mt @ 0. 75 % Cu (2. 76 Mt contained Cu) § Agreement signed with Andina to exploit synergies 19

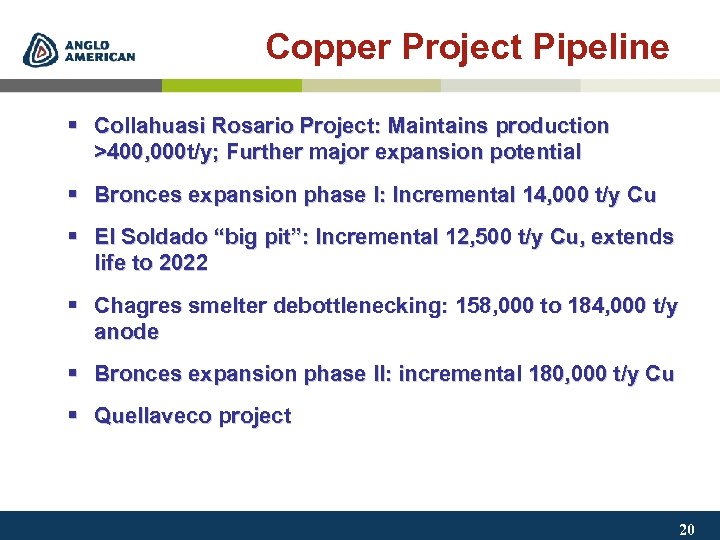

Copper Project Pipeline § Collahuasi Rosario Project: Maintains production >400, 000 t/y; Further major expansion potential § Bronces expansion phase I: Incremental 14, 000 t/y Cu § El Soldado “big pit”: Incremental 12, 500 t/y Cu, extends life to 2022 § Chagres smelter debottlenecking: 158, 000 to 184, 000 t/y anode § Bronces expansion phase II: incremental 180, 000 t/y Cu § Quellaveco project 20

Copper Project Pipeline § Collahuasi Rosario Project: Maintains production >400, 000 t/y; Further major expansion potential § Bronces expansion phase I: Incremental 14, 000 t/y Cu § El Soldado “big pit”: Incremental 12, 500 t/y Cu, extends life to 2022 § Chagres smelter debottlenecking: 158, 000 to 184, 000 t/y anode § Bronces expansion phase II: incremental 180, 000 t/y Cu § Quellaveco project 20

Zinc § Significant zinc producer (360, 000 tpa) § $454 m Skorpion project set to be one of lowest cost producers § Lisheen ownership increased to 100% § Exports from China constrained by concentrate shortage § Longer term outlook influenced by significant mine depletion and limited new investment 21

Zinc § Significant zinc producer (360, 000 tpa) § $454 m Skorpion project set to be one of lowest cost producers § Lisheen ownership increased to 100% § Exports from China constrained by concentrate shortage § Longer term outlook influenced by significant mine depletion and limited new investment 21

Anglo. Gold Ashanti § Anglo. Gold/Ashanti $1. 4 bn merger completed § Combined annual production c. 7 m oz § Strong reserve position: 84 m ozs § Significant potential at Obuasi Deeps Obuasi 22

Anglo. Gold Ashanti § Anglo. Gold/Ashanti $1. 4 bn merger completed § Combined annual production c. 7 m oz § Strong reserve position: 84 m ozs § Significant potential at Obuasi Deeps Obuasi 22

Anglo Platinum § Global leader in PGMs – c. 40% Pt mkt share § Platinum demand remains robust § Pt production in 2006 forecast at 2. 9 m oz (+26% from 2003) § $2 bn capital investment programme 23

Anglo Platinum § Global leader in PGMs – c. 40% Pt mkt share § Platinum demand remains robust § Pt production in 2006 forecast at 2. 9 m oz (+26% from 2003) § $2 bn capital investment programme 23

Coal § Strong thermal and coking markets § Constraints on Chinese and Indonesian thermal coal availability § Australian H 1 production impacted by Moranbah North – recovery to full output H 2 § Cerrejón set to increase by 6 m tpa to 28 m tpa by 2007 24

Coal § Strong thermal and coking markets § Constraints on Chinese and Indonesian thermal coal availability § Australian H 1 production impacted by Moranbah North – recovery to full output H 2 § Cerrejón set to increase by 6 m tpa to 28 m tpa by 2007 24

IMD and Paper and Packaging Industrial Minerals § Largest UK producer of aggregates & blacktop § $200 m of acquisitions in continental Europe since 2000 - now the leading aggregates producer in Czech Republic and the leading paver producer in Poland (new EU entrants) § New quarry in China being commissioned § Buxton cement plant successfully commissioning Paper and Packaging § Key product lines: § Uncoated Woodfree Paper; § Packaging (industrial, corrugated and flexible) § Highest ROCE within European paper and packaging sector Strong Cash Generation § IMD + Paper and Packaging combined EBITDA of $1. 5 bn 25

IMD and Paper and Packaging Industrial Minerals § Largest UK producer of aggregates & blacktop § $200 m of acquisitions in continental Europe since 2000 - now the leading aggregates producer in Czech Republic and the leading paver producer in Poland (new EU entrants) § New quarry in China being commissioned § Buxton cement plant successfully commissioning Paper and Packaging § Key product lines: § Uncoated Woodfree Paper; § Packaging (industrial, corrugated and flexible) § Highest ROCE within European paper and packaging sector Strong Cash Generation § IMD + Paper and Packaging combined EBITDA of $1. 5 bn 25

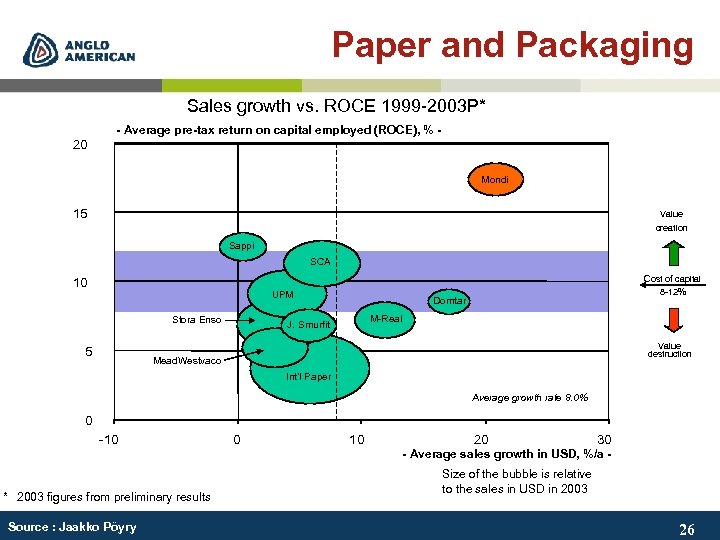

Paper and Packaging Sales growth vs. ROCE 1999 -2003 P* - Average pre-tax return on capital employed (ROCE), % - 20 Mondi 15 Value creation Sappi SCA 10 UPM Stora Enso 5 Cost of capital 8 -12% Domtar M-Real J. Smurfit Value destruction Mead. Westvaco Int’l Paper Average growth rate 8. 0% 0 -10 0 10 20 30 - Average sales growth in USD, %/a * 2003 figures from preliminary results Source : Jaakko Pöyry Size of the bubble is relative to the sales in USD in 2003 26

Paper and Packaging Sales growth vs. ROCE 1999 -2003 P* - Average pre-tax return on capital employed (ROCE), % - 20 Mondi 15 Value creation Sappi SCA 10 UPM Stora Enso 5 Cost of capital 8 -12% Domtar M-Real J. Smurfit Value destruction Mead. Westvaco Int’l Paper Average growth rate 8. 0% 0 -10 0 10 20 30 - Average sales growth in USD, %/a * 2003 figures from preliminary results Source : Jaakko Pöyry Size of the bubble is relative to the sales in USD in 2003 26

Iron ore: A new market § Acquired 67% of Kumba Resources § 4 th largest exporter of iron ore § Significant expansion potential: - § SA – Sishen South (± 10 mtpa) § Australia – Hope Downs (± 25 mtpa) 27

Iron ore: A new market § Acquired 67% of Kumba Resources § 4 th largest exporter of iron ore § Significant expansion potential: - § SA – Sishen South (± 10 mtpa) § Australia – Hope Downs (± 25 mtpa) 27

Outlook Ø Macro outlook positive Ø Geographic and commodity diversity will underpin performance Ø Strong EBITDA generation, good growth for 2004 28

Outlook Ø Macro outlook positive Ø Geographic and commodity diversity will underpin performance Ø Strong EBITDA generation, good growth for 2004 28

ANGLO AMERICAN A WORLD OF DIFFERENCE Merrill Lynch Conference 12 May 2004 This presentation is being made only to and is directed only at (a) persons who have professional experience in matters relating to investments falling within Article 19(1) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 (the “Order”) or (b) high net worth entities, and other persons to whom it may otherwise lawfully be communicated, falling within Article 49(1) of the Order (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this presentation or any of its contents. Merrill Lynch Conference

ANGLO AMERICAN A WORLD OF DIFFERENCE Merrill Lynch Conference 12 May 2004 This presentation is being made only to and is directed only at (a) persons who have professional experience in matters relating to investments falling within Article 19(1) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 (the “Order”) or (b) high net worth entities, and other persons to whom it may otherwise lawfully be communicated, falling within Article 49(1) of the Order (all such persons together being referred to as “relevant persons”). Any person who is not a relevant person should not act or rely on this presentation or any of its contents. Merrill Lynch Conference