83d74e55fc2e61c1eeaac7d95cc3e1ea.ppt

- Количество слайдов: 15

Anatomy of a Bungled Sales Opportunity What am I trying to Fix, Accomplish or Avoid? What problem really lies beneath? How has my “solution image” evolved? Who are all the buying influences and why do they differ in their opinions?

Preface I am a sales consultant working with technology companies who sell big ticket B 2 B solutions. My goal is simply to help my clients improve sales performance. This is a summary of a sale where I was an advisor to the VPSales and CEO who were buying a big ticket technology CRM solution. The narrative is written from the VP Sales perspective and is accurate. The lessons are important.

The Purpose of This… n We are a hardware/software systems integrator and sell big-ticket B 2 B solutions n We had the opportunity to go through a detailed technology sales situation from the buyers perspective recently. n Since we are also a technology company, we noticed a lot of similarities to how we sell. This is exactly the type of selling we do so we decided to learn from it. n We analyzed it from our perspective and looked at what each of the sellers did along the way, how they reacted to us, what they did, and didn’t do. n The end result is an interesting case study that shows a lot of the pitfalls and errors that can be made even by seasoned sales people.

Client (our) Problem n VP of Sales overstates Q 4 bookings by 20% on Jan 3, 2014, i. e. after the end of the quarter! n Individual reporting was off by as much at 150% in both directions for the month of December. n Marketing was unable to run any annual ROI reports for our supporting manufacturing partners. n Marketing was unable to run any reports to determine which marketing events were effective in 2013 and which to run for 2014. n We had our second straight very strong year, so VP Sales felt empowered to demand a new SFA tool.

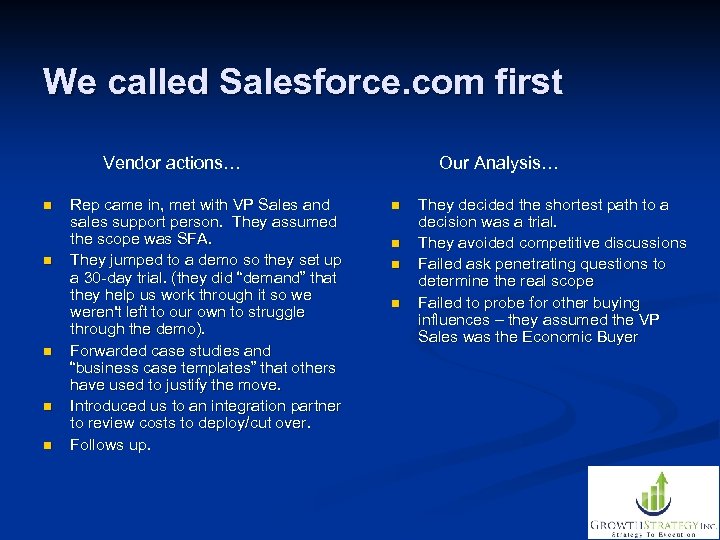

We called Salesforce. com first Vendor actions… n n n Rep came in, met with VP Sales and sales support person. They assumed the scope was SFA. They jumped to a demo so they set up a 30 -day trial. (they did “demand” that they help us work through it so we weren't left to our own to struggle through the demo). Forwarded case studies and “business case templates” that others have used to justify the move. Introduced us to an integration partner to review costs to deploy/cut over. Follows up. Our Analysis… n n They decided the shortest path to a decision was a trial. They avoided competitive discussions Failed ask penetrating questions to determine the real scope Failed to probe for other buying influences – they assumed the VP Sales was the Economic Buyer

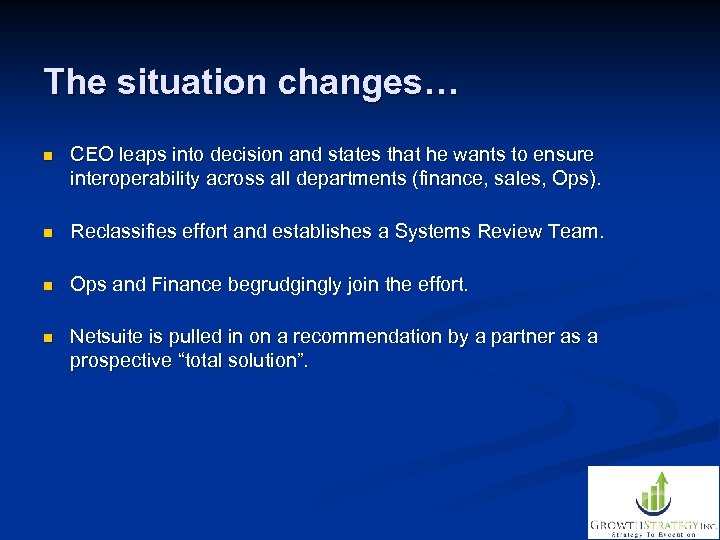

The situation changes… n CEO leaps into decision and states that he wants to ensure interoperability across all departments (finance, sales, Ops). n Reclassifies effort and establishes a Systems Review Team. n Ops and Finance begrudgingly join the effort. n Netsuite is pulled in on a recommendation by a partner as a prospective “total solution”.

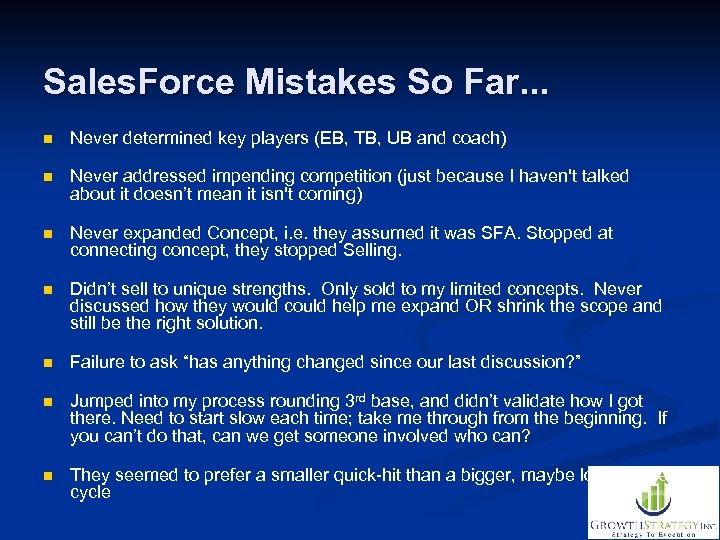

Sales. Force Mistakes So Far. . . n Never determined key players (EB, TB, UB and coach) n Never addressed impending competition (just because I haven't talked about it doesn’t mean it isn't coming) n Never expanded Concept, i. e. they assumed it was SFA. Stopped at connecting concept, they stopped Selling. n Didn’t sell to unique strengths. Only sold to my limited concepts. Never discussed how they would could help me expand OR shrink the scope and still be the right solution. n Failure to ask “has anything changed since our last discussion? ” n Jumped into my process rounding 3 rd base, and didn’t validate how I got there. Need to start slow each time; take me through from the beginning. If you can’t do that, can we get someone involved who can? n They seemed to prefer a smaller quick-hit than a bigger, maybe longer sales cycle

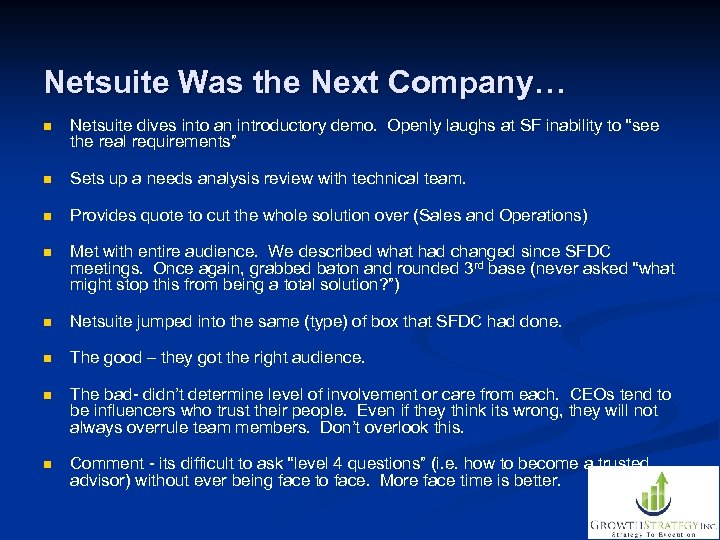

Netsuite Was the Next Company… n Netsuite dives into an introductory demo. Openly laughs at SF inability to “see the real requirements” n Sets up a needs analysis review with technical team. n Provides quote to cut the whole solution over (Sales and Operations) n Met with entire audience. We described what had changed since SFDC meetings. Once again, grabbed baton and rounded 3 rd base (never asked “what might stop this from being a total solution? ”) n Netsuite jumped into the same (type) of box that SFDC had done. n The good – they got the right audience. n The bad- didn’t determine level of involvement or care from each. CEOs tend to be influencers who trust their people. Even if they think its wrong, they will not always overrule team members. Don’t overlook this. n Comment - its difficult to ask “level 4 questions” (i. e. how to become a trusted advisor) without ever being face to face. More face time is better.

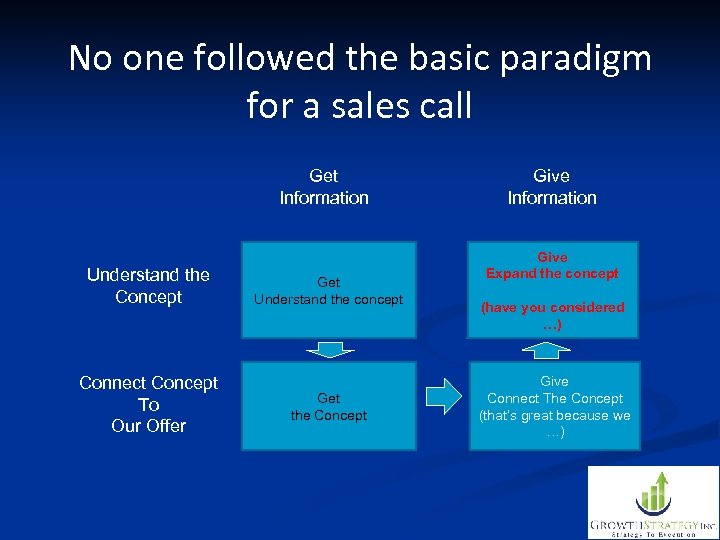

No one followed the basic paradigm for a sales call Get Information Understand the Concept Connect Concept To Our Offer Get Understand the concept Get the Concept Give Information Give Expand the concept (have you considered …) Give Connect The Concept (that’s great because we …)

And, the situation changes once more… n Internal discussions as to what is really required - better sales tool? Total systems overhaul? Or solution that will migrate to a new total solution (CEO believes the latter may be required to get to next operational level) n Ops and Finance back off and believe their systems are OK. n Low cost provider is brought into the mix. n Netsuite is internally put into a box within us as “the one that makes sense only if we rip everything out” n All the while, we share EVERY bit of data with every manufacturer in an effort to get the right solution. At this point, there were different Concepts for each buying influence. VPS Concept differed from CEO. VPS was in Trouble, CEO was in Growth and Ops was in Even Keel. Vendors NEVER understood this. You MUST understand the team dynamic!

Enter Sugar. CRM. . . n Sugar. CRM is introduced through a partner (if its only going to be sales, then lets look at the least $$ as well) n Sugar accepts intro through marketing. Meets sales and marketing, and no one else. Never attempts to analyze the organization. They responded similarly to SFDC. n Sugar executes demo, and sells very hard against SF as a less expensive, just as good solution. Note that they also have a support engine (as a throw in) n Sets up a trial for 7 days, and provides quote and live client testimonial. n Good - laser focus on their message- “ 75% of SFDC goes unused. We do everything you need for 40% of the price. ” n Bad - no analysis. Weak attempt to expand the scope. (worse than “not at all”) n Summary- Sales effort is most in line with the product they sell.

Client Next Step n Internal meetings change EB’s mode to Even Keel… n EB and TB determine that there is no requirement outside of sales for two years…so, this is totally up to sales, but keep costs low. VPS says he won’t tear out this system in two years, so while V 1 is sales only, it needs to be a long term solution. n Netsuite out; Salesforce and Sugar fight on. HOW? n Through an advisor, VPSales determines two major things favor Salesforce (SFDC NEVER understood this, never asked questions, never understood their differentiation) n Telephony integration n Quoting integration n Integration firm comes back in to review initial quote. Cuts it back significantly, based on detailed analysis.

Final Round n Net. Suite out, doesn’t even get the opportunity to change the bid. n Salesforce clears up remaining questions. Doesn’t ask for commitment or hard next steps, critical criteria or “what business problem are you trying to solve. ” n Sugar - price war. Open source. . ”you can buy now and add things later”

The Decision is Made for SFDC n While everything functions with Sugar, advanced features are open source and require internal effort. n VPSales asks SFDC rep to “sharpen the pencil” to compete with Sugar n n Rep comes back and offers 40% discount (which was much more than necessary) Never asked for anything in return Never engaged in a thoughtful discussion about how to close the deal. They never realized why they won.

Summary n Vendors failed to n Understand the buying influences and that each may have a different Concept n Ask “what’s changed since the last time we spoke? ”, i. e. they failed to understand that the Concepts were rapidly changing n Acknowledge and fully understand the competition and how to sell against them n Present key unique strengths that had a huge impact on the decision n Negotiate effectively n Vendors seem to believe they are a transactional business and cannot invest what is required to deliver what they ascribe themselves to be; a complete sales process. n Salesforce turned a controllable, 45 day sale cycle into an “out of control” four-month sale cycle, that will likely end up in their lap for all the enterprise reasons they never articulated n SFDC made VPS go figure out the compelling reasons to buy rather than offer it up front.

83d74e55fc2e61c1eeaac7d95cc3e1ea.ppt