d68b7f3fd558016fc07853f41c0c0659.ppt

- Количество слайдов: 99

ANALYZE THIS, CALCULATE THAT Written and Presented by Donna Reeves & Sarah Broyles, CDOA Special Thanks to Stephen Horgan, CDOA; & Stephanie Sullivan, CPL who helped with the development of the materials presented herein National Association of Division Order Analysts 36 th Annual Institute Washington Marriott Wardman Park Hotel Washington, D. C. September 23 – 25, 2009

Introduction n Define Division Order / Division of Interest – – Some use the term Division of Interest and Division Order interchangeably, however: n n Division of Interest – Complete Ownership / Payment Records for a property or a tract within a property. Division Order – Actual physical document that sets out Property name n Legal description n Owner’s name and address n Decimal interest for said property n Interest Type for said property n Covenants and provisions relative to the sale of Oil or Gas and/or Distribution of Proceeds. – Basic Division Order n Issued to the individual interest owner setting out his interest as described above – Indemnifying n Issued to a party who receives proceeds on behalf of another party(s) and then further distributes those proceeds n 2

Overview of Division Order Job Functions n The responsibilities of the Division Order Analyst can be categorized into two major functions – – Set up the Ownership on producing oil and gas properties n so that production proceeds are paid timely and correctly – n This includes – – at the proper ownership decimal – and in compliance with State Statues and all applicable agreements – Newly Drilled Well, both Operated and Non-Operated – Acquisition – Third Party Purchase Property – Maintain the ownership through the life of the well (or, in the case of a Third Party Purchaser, for the life of the applicable Contract), based on receipt of n n n Assignments, Conveyance Documents Probate Proceedings Judgments or Settlements rendered by a Court relative to litigation, etc. 3

Traits and Skill Set of the Division Order Analyst n Detail Oriented; Possess Patience; Good Communicator and Listener – Interact with the interest owners – n RI, ORRI, WI – in these producing properties – Via phone, emails, and correspondence – Interact with In-house Accountants, Marketers and Legal Council, Lease Analyst n n Division Orders, Marketing, Accounting and Lease Records have to be “best friends” – Co-Dependent Relationship Open lines of Communication – Liaison with Industry Counterparts n n n Our Counterparts at other companies – Division Order Analysts, Landman, Lease Analyst Their Accountants Their Marketers 4

Traits and Skill Set of the Division Order Analyst n One might describe our role as a “Cross between an Accountant and a Paralegal” – Accountant – in that in our ownership set-up and transfers of interest, we have understand how it will impact the money. We are basically ‘writing a check’ – Paralegal – in that we must understand the legal requirements for ‘Clear and Marketable Title’ for each state in which your company does business 5

Establishing Ownership Records for a New Property n Notice of a New Property – The Division Order Analyst may receive one or more of the following documents as notice of New Property: 6

Operated Properties n n Authority for Expenditure (AFE) Internal Company Document, detailing information about the proposed well n n n Drilling Title Opinion n n Drill Site Report / Well Information Summary / Release of Well Location Should contain Well Name; Location; GWI of Participants; Company Leases Held by Proposed Well; Applicable Agreements; Any Special Considerations This Opinion may cover the drill site only, not the entire proposed spacing. Daily Drilling Report 7

Non-Operated Property n n n Authority for Expenditure (AFE) Internal Company Document, advising that well has been proposed and your company has agreed to participate in the drilling and operations of said well Drilling Title Opinion, provided by the Operator – It may be possible to be on a Distribution List to receive Drilling Reports from the Operator n n Notice from Accounting advising that you have received payment on a well that is not set up Receipt of Division Order from Purchaser / Payor 8

Third Party Purchase Property Contract Notice / Contract Summary n In-House Notification from Marketing Group, that gives – n – Applicable Wells Subject to Contract – Market Percentage that is being sold to your company 9

Property Acquisition Copy of Purchase and Sale Agreement (PSA) n Copy of the Assignment n Internal Company Document, advising that Company is acquiring certain properties from ‘Company X’ n Listing of Properties from Company Business & Development Group n 10

Monitoring Data To Determine When Ownership Records Should Be Set Up Operated n n Company Drilling Reports, to determine when well has been successfully completed as a producer Division Order Title Opinion Review of Oil & Gas Leases for any special provisions relative to payment of production proceeds Review of Applicable Agreements to be assured Payment / Ownership Records will be set up accordingly – Pooling / Unit Agreement n – – n Are all lands within Pooling / Unit Agreement covered on the Division Order Title Opinion? Joint Operating Agreement (JOA) Farmin / Farmout Agreement Internal Agreements Marketing Agreements Review of State Statutes to be assured that proceeds are paid in accordance with the Statutory Requirements for applicable state 11

Monitoring Data To Determine When Ownership Records Should Be Set Up Non-Operated n Follow-Ups with Internal Landman and/or Operator, to determine when well has been successfully completed as a producer – It may be possible to be on a Distribution List to receive Drilling Reports from the Operator n n Division Order Title Opinion Review of Applicable Marketing Agreements to be assured Payment / Ownership Records will be set up accordingly n n Will your Company be marketing under the JOA with the Operator? Will your Company be marketing its full GWI under a separate contract and distribute its proportionate share to its burden interests? Will your Company be marketing its NRI only under a separate contract and receive its NRI only? Internal Agreements 12

Monitoring Data To Determine When Ownership Records Should Be Set Up Third Party Purchase Property n n n How will disbursements be handled? – 100% to Operator / Marketing Party for Further Distribution – Who remits taxes? – Remit Proceeds on behalf of Operator / Marketing Party Who will provide payment information? – Is this a Newly Completed Well and the Operator should provide a Division Order Title Opinion? – Is this a producing property that is now contracted with your company and your pay records will be set up based on the prior disburser’s paysheet? Are there any special circumstances of which your company should be aware? – Tax Exempt Entities – Special Lease Provisions for certain Royalty Owners n n n Please note that it is the responsibility of the Operator / Marketing Party to advise the Third Party Purchaser of any special terms stipulated in the applicable oil and gas leases or other pertinent agreements Since the Purchaser is not a party to the Oil & Gas Lease, JOA, etc. , they would not be aware of such special provisions unless notified. Review of Applicable Marketing Agreements to be assured Payment / Ownership Records will be set up accordingly 13

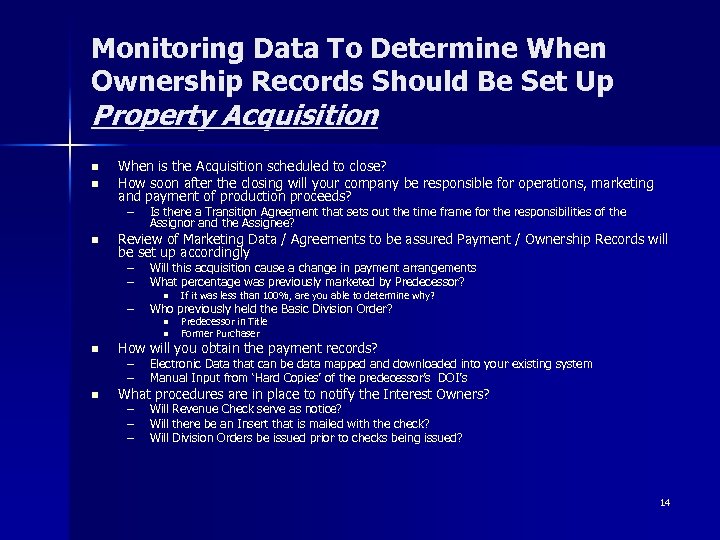

Monitoring Data To Determine When Ownership Records Should Be Set Up Property Acquisition n n When is the Acquisition scheduled to close? How soon after the closing will your company be responsible for operations, marketing and payment of production proceeds? – n Is there a Transition Agreement that sets out the time frame for the responsibilities of the Assignor and the Assignee? Review of Marketing Data / Agreements to be assured Payment / Ownership Records will be set up accordingly – – – Will this acquisition cause a change in payment arrangements What percentage was previously marketed by Predecessor? n Who previously held the Basic Division Order? n n If it was less than 100%, are you able to determine why? Predecessor in Title Former Purchaser How will you obtain the payment records? – – Electronic Data that can be data mapped and downloaded into your existing system Manual Input from ‘Hard Copies’ of the predecessor’s DOI’s – – – Will Revenue Check serve as notice? Will there be an Insert that is mailed with the check? Will Division Orders be issued prior to checks being issued? What procedures are in place to notify the Interest Owners? 14

Documents Affecting Division Order Calculations n Once we have determined that a Division Of Interest (“DOI”) is needed for a property, let’s look at the documents / agreements that affect the calculations to establish the DOI. n Many of the documents used in oil and gas negotiations or operations affect the net revenue interests of not only the mineral owners but working interest owners as well. The following pages will provide you with a sample guideline of what to look for in the most common forms of agreements. 15

Agreements n n n n Oil & Gas Leases Division Order Title Opinions Curative Documents Joint Operating Agreements Assignments, Conveyances & Bills of Sale Pooling/Communitization Agreements Farmout/Farmin Agreements Unitization Agreements 16

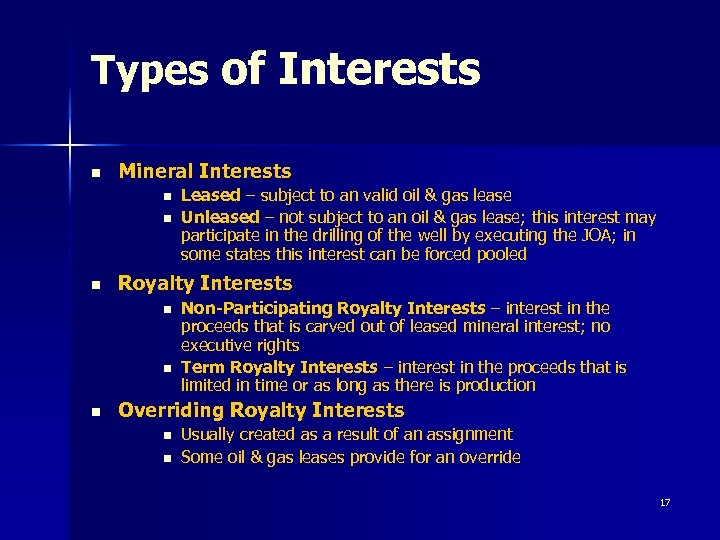

Types of Interests n Mineral Interests n n n Royalty Interests n n n Leased – subject to an valid oil & gas lease Unleased – not subject to an oil & gas lease; this interest may participate in the drilling of the well by executing the JOA; in some states this interest can be forced pooled Non-Participating Royalty Interests – interest in the proceeds that is carved out of leased mineral interest; no executive rights Term Royalty Interests – interest in the proceeds that is limited in time or as long as there is production Overriding Royalty Interests n n Usually created as a result of an assignment Some oil & gas leases provide for an override 17

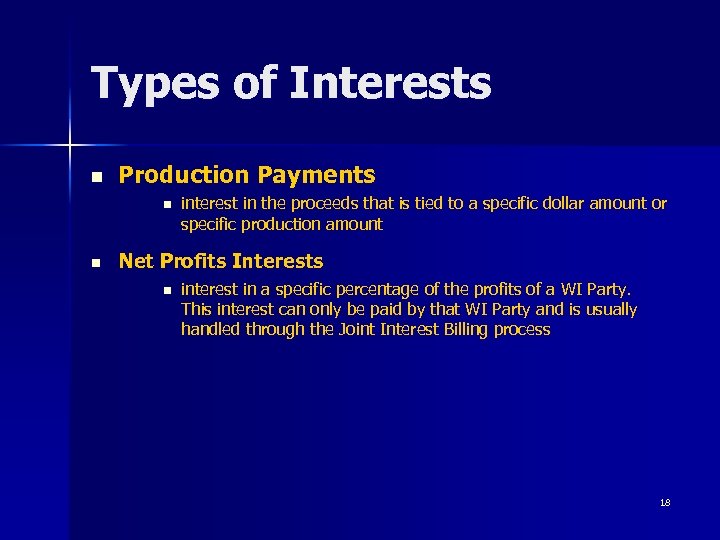

Types of Interests n Production Payments n n interest in the proceeds that is tied to a specific dollar amount or specific production amount Net Profits Interests n interest in a specific percentage of the profits of a WI Party. This interest can only be paid by that WI Party and is usually handled through the Joint Interest Billing process 18

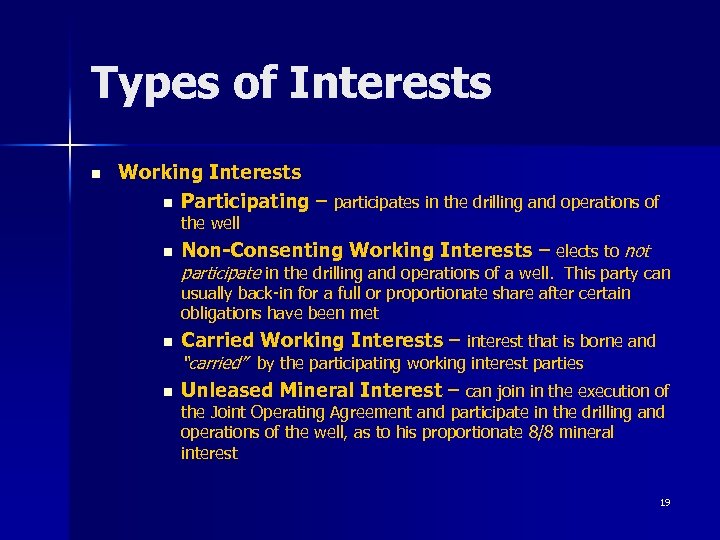

Types of Interests n Working Interests n Participating – participates in the drilling and operations of the well n Non-Consenting Working Interests – elects to not participate in the drilling and operations of a well. This party can usually back-in for a full or proportionate share after certain obligations have been met n Carried Working Interests – interest that is borne and n Unleased Mineral Interest – can join in the execution of “carried” by the participating working interest parties the Joint Operating Agreement and participate in the drilling and operations of the well, as to his proportionate 8/8 mineral interest 19

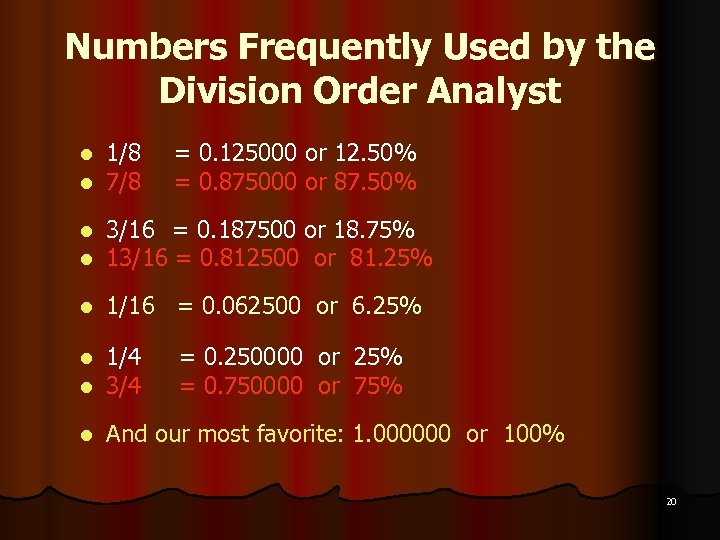

Numbers Frequently Used by the Division Order Analyst l l 1/8 7/8 = 0. 125000 or 12. 50% = 0. 875000 or 87. 50% l l 3/16 = 0. 187500 or 18. 75% 13/16 = 0. 812500 or 81. 25% l 1/16 = 0. 062500 or 6. 25% l l 1/4 3/4 l And our most favorite: 1. 000000 or 100% = 0. 250000 or 25% = 0. 750000 or 75% 20

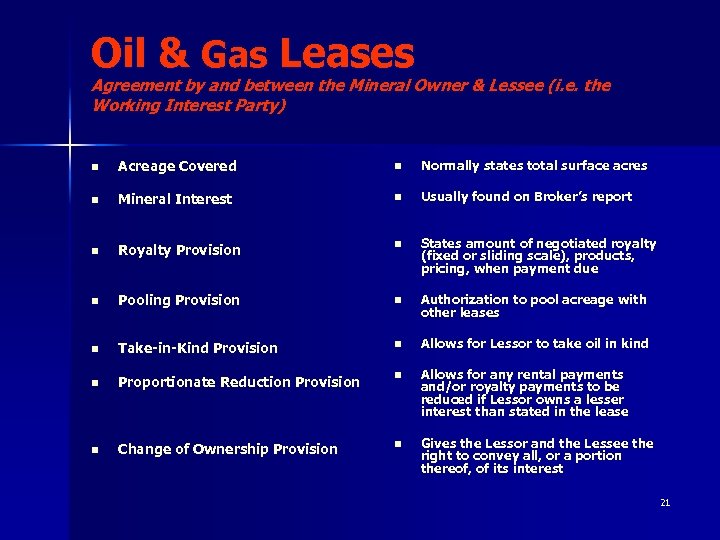

Oil & Gas Leases Agreement by and between the Mineral Owner & Lessee (i. e. the Working Interest Party) n Acreage Covered n Normally states total surface acres n Mineral Interest n Usually found on Broker’s report n Royalty Provision n States amount of negotiated royalty (fixed or sliding scale), products, pricing, when payment due n Pooling Provision n Authorization to pool acreage with other leases n Take-in-Kind Provision n Allows for Lessor to take oil in kind n Proportionate Reduction Provision n Allows for any rental payments and/or royalty payments to be reduced if Lessor owns a lesser interest than stated in the lease n Change of Ownership Provision n Gives the Lessor and the Lessee the right to convey all, or a portion thereof, of its interest 21

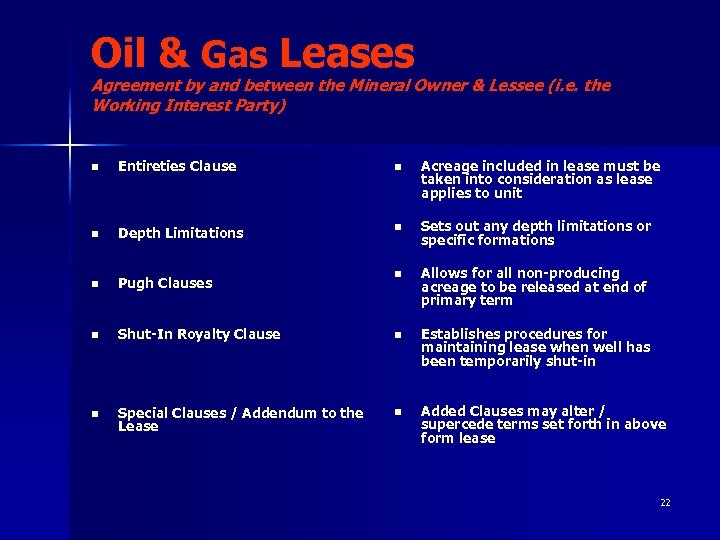

Oil & Gas Leases Agreement by and between the Mineral Owner & Lessee (i. e. the Working Interest Party) n Entireties Clause n Acreage included in lease must be taken into consideration as lease applies to unit n Depth Limitations n Sets out any depth limitations or specific formations n Pugh Clauses n Allows for all non-producing acreage to be released at end of primary term n Shut-In Royalty Clause n Establishes procedures for maintaining lease when well has been temporarily shut-in n Special Clauses / Addendum to the Lease n Added Clauses may alter / supercede terms set forth in above form lease 22

Division Order Title Opinions Agreement by and between the Operator / Non-Operator and the Title Attorney n Provides Lease Well or Unit acreage and legal description n Documents Examined, including any prior title opinions rendered n Date range of documents examined n Summary of Oil & Gas Leases Included in Unit n Chain of Title n Agreements Applicable to Unit Calculations 23

Division Order Title Opinions Agreement by and between the Operator / Non-Operator and the Title Attorney n Patent Information n Easements n Encumbrances (Mortgages, Liens) n Taxes n Title Requirements n Calculations (Before Payout & After Payout) 24

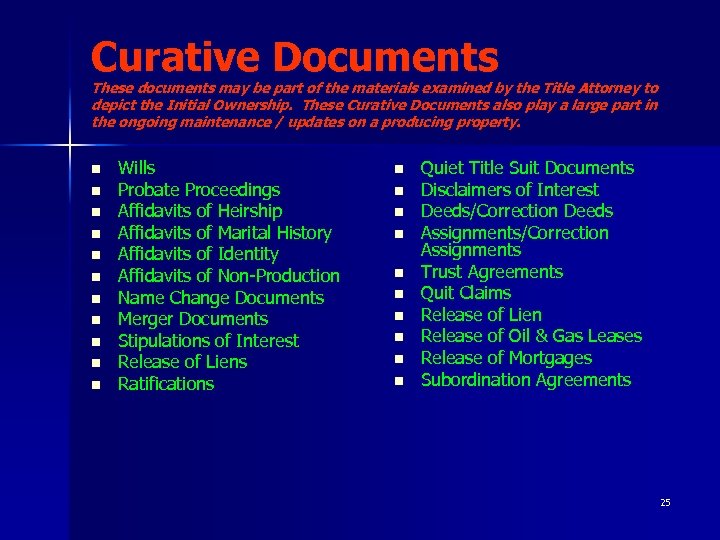

Curative Documents These documents may be part of the materials examined by the Title Attorney to depict the Initial Ownership. These Curative Documents also play a large part in the ongoing maintenance / updates on a producing property. n n n Wills Probate Proceedings Affidavits of Heirship Affidavits of Marital History Affidavits of Identity Affidavits of Non-Production Name Change Documents Merger Documents Stipulations of Interest Release of Liens Ratifications n n n n n Quiet Title Suit Documents Disclaimers of Interest Deeds/Correction Deeds Assignments/Correction Assignments Trust Agreements Quit Claims Release of Lien Release of Oil & Gas Leases Release of Mortgages Subordination Agreements 25

Joint Operating Agreements Agreement by and between the Working Interest Parties n The Joint Operating Agreement (“JOA”) is an agreement / document executed by all parties participating in the development of a particular field or geographical area. However, it may be limited to the drilling of a particular well. n The JOA sets forth procedures for the development, drilling and operations of the field or well. n We will discuss later in this presentation how certain terms of the JOA can affect the DOI 26

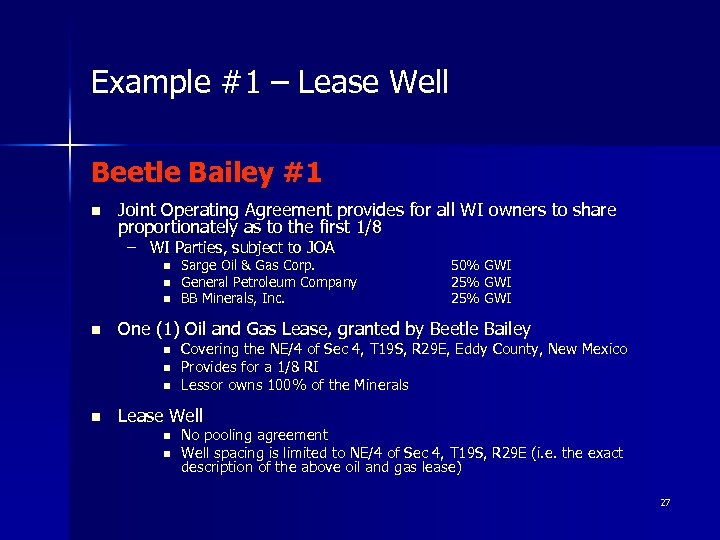

Example #1 – Lease Well Beetle Bailey #1 n Joint Operating Agreement provides for all WI owners to share proportionately as to the first 1/8 – WI Parties, subject to JOA n n 50% GWI 25% GWI One (1) Oil and Gas Lease, granted by Beetle Bailey n n Sarge Oil & Gas Corp. General Petroleum Company BB Minerals, Inc. Covering the NE/4 of Sec 4, T 19 S, R 29 E, Eddy County, New Mexico Provides for a 1/8 RI Lessor owns 100% of the Minerals Lease Well n n No pooling agreement Well spacing is limited to NE/4 of Sec 4, T 19 S, R 29 E (i. e. the exact description of the above oil and gas lease) 27

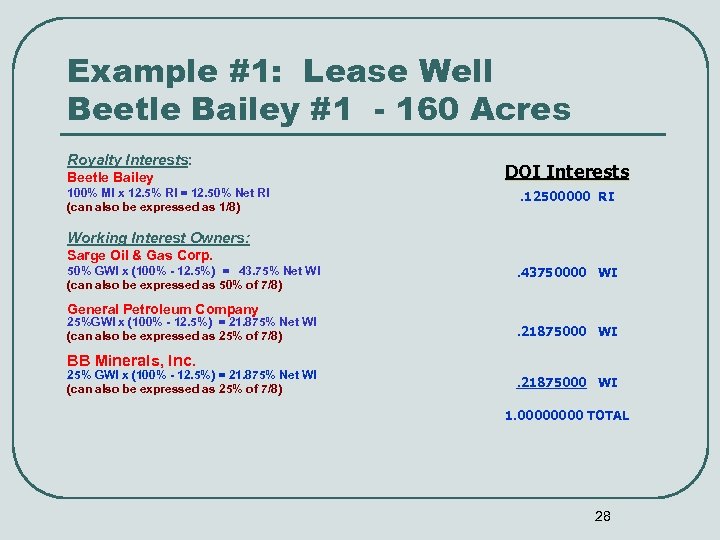

Example #1: Lease Well Beetle Bailey #1 - 160 Acres Royalty Interests: Beetle Bailey 100% MI x 12. 5% RI = 12. 50% Net RI (can also be expressed as 1/8) DOI Interests. 12500000 RI Working Interest Owners: Sarge Oil & Gas Corp. 50% GWI x (100% - 12. 5%) = 43. 75% Net WI (can also be expressed as 50% of 7/8) . 43750000 WI General Petroleum Company 25%GWI x (100% - 12. 5%) = 21. 875% Net WI (can also be expressed as 25% of 7/8) . 21875000 WI BB Minerals, Inc. 25% GWI x (100% - 12. 5%) = 21. 875% Net WI (can also be expressed as 25% of 7/8) . 21875000 WI 1. 0000 TOTAL 28

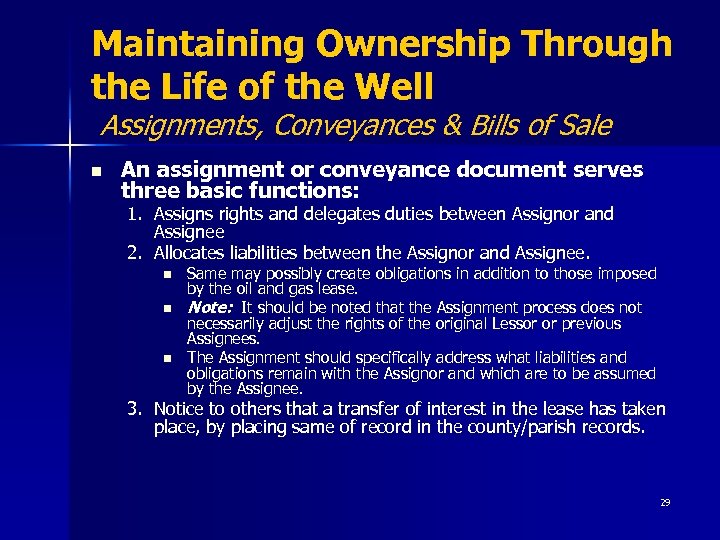

Maintaining Ownership Through the Life of the Well Assignments, Conveyances & Bills of Sale n An assignment or conveyance document serves three basic functions: 1. Assigns rights and delegates duties between Assignor and Assignee 2. Allocates liabilities between the Assignor and Assignee. n n n Same may possibly create obligations in addition to those imposed by the oil and gas lease. Note: It should be noted that the Assignment process does not necessarily adjust the rights of the original Lessor or previous Assignees. The Assignment should specifically address what liabilities and obligations remain with the Assignor and which are to be assumed by the Assignee. 3. Notice to others that a transfer of interest in the lease has taken place, by placing same of record in the county/parish records. 29

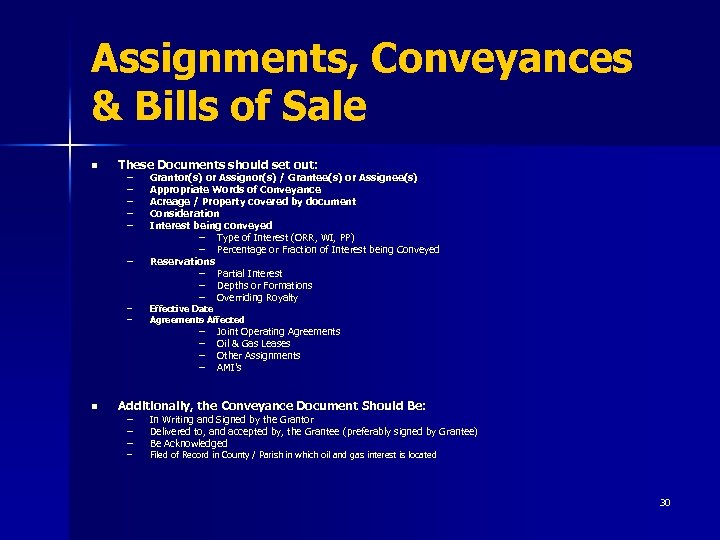

Assignments, Conveyances & Bills of Sale n These Documents should set out: – – – – n Grantor(s) or Assignor(s) / Grantee(s) or Assignee(s) Appropriate Words of Conveyance Acreage / Property covered by document Consideration Interest being conveyed – Type of Interest (ORR, WI, PP) – Percentage or Fraction of Interest being Conveyed Reservations – Partial Interest – Depths or Formations – Overriding Royalty Effective Date Agreements Affected – – Joint Operating Agreements Oil & Gas Leases Other Assignments AMI’s Additionally, the Conveyance Document Should Be: – – In Writing and Signed by the Grantor Delivered to, and accepted by, the Grantee (preferably signed by Grantee) Be Acknowledged Filed of Record in County / Parish in which oil and gas interest is located 30

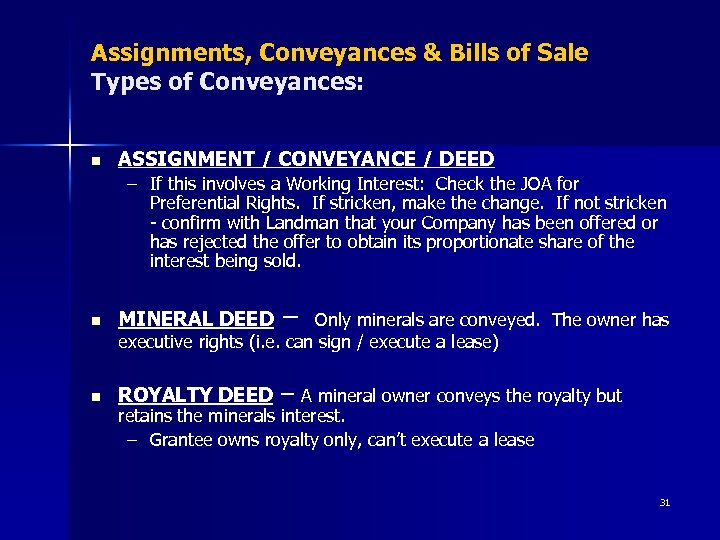

Assignments, Conveyances & Bills of Sale Types of Conveyances: n ASSIGNMENT / CONVEYANCE / DEED – If this involves a Working Interest: Check the JOA for Preferential Rights. If stricken, make the change. If not stricken - confirm with Landman that your Company has been offered or has rejected the offer to obtain its proportionate share of the interest being sold. n MINERAL DEED – n ROYALTY DEED – A mineral owner conveys the royalty but Only minerals are conveyed. The owner has executive rights (i. e. can sign / execute a lease) retains the minerals interest. – Grantee owns royalty only, can’t execute a lease 31

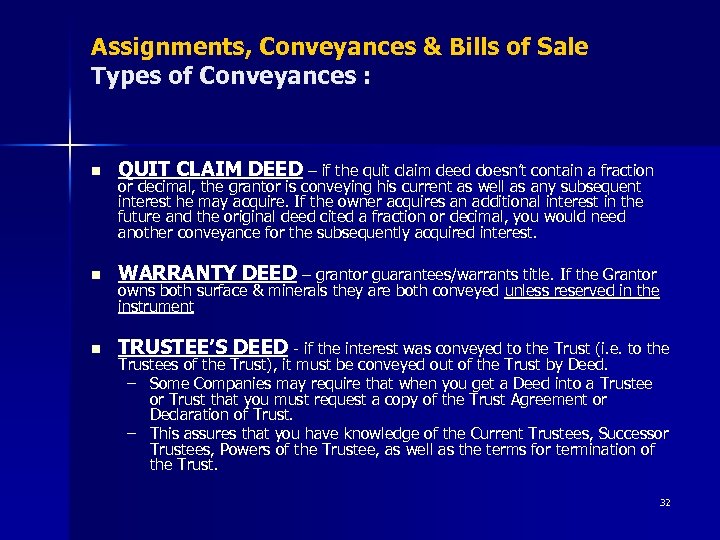

Assignments, Conveyances & Bills of Sale Types of Conveyances : n QUIT CLAIM DEED – if the quit claim deed doesn’t contain a fraction n WARRANTY DEED – grantor guarantees/warrants title. If the Grantor n TRUSTEE’S DEED - if the interest was conveyed to the Trust (i. e. to the or decimal, the grantor is conveying his current as well as any subsequent interest he may acquire. If the owner acquires an additional interest in the future and the original deed cited a fraction or decimal, you would need another conveyance for the subsequently acquired interest. owns both surface & minerals they are both conveyed unless reserved in the instrument Trustees of the Trust), it must be conveyed out of the Trust by Deed. – Some Companies may require that when you get a Deed into a Trustee or Trust that you must request a copy of the Trust Agreement or Declaration of Trust. – This assures that you have knowledge of the Current Trustees, Successor Trustees, Powers of the Trustee, as well as the terms for termination of the Trust. 32

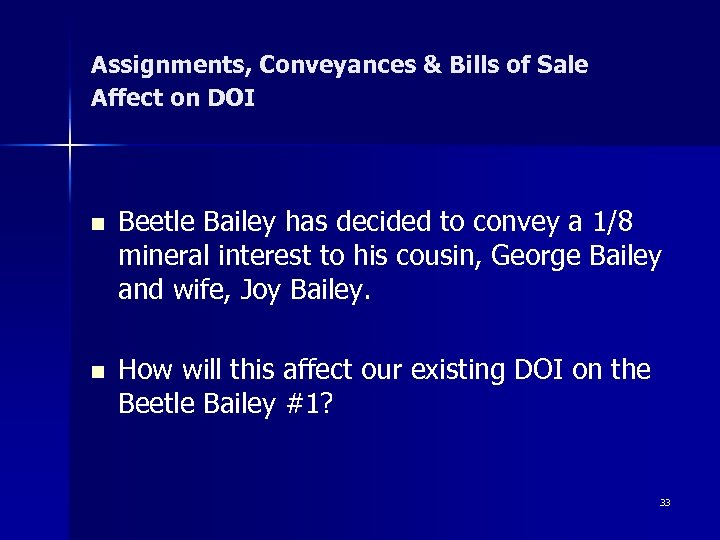

Assignments, Conveyances & Bills of Sale Affect on DOI n n Beetle Bailey has decided to convey a 1/8 mineral interest to his cousin, George Bailey and wife, Joy Bailey. How will this affect our existing DOI on the Beetle Bailey #1? 33

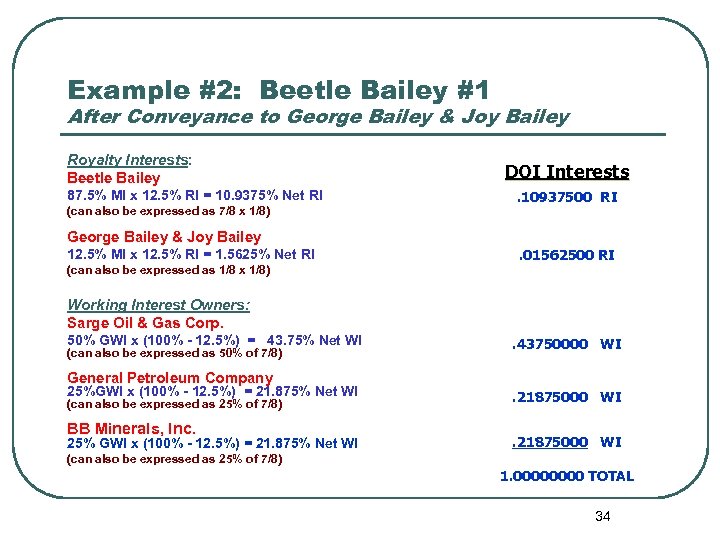

Example #2: Beetle Bailey #1 After Conveyance to George Bailey & Joy Bailey Royalty Interests: Beetle Bailey 87. 5% MI x 12. 5% RI = 10. 9375% Net RI (can also be expressed as 7/8 x 1/8) DOI Interests. 10937500 RI George Bailey & Joy Bailey 12. 5% MI x 12. 5% RI = 1. 5625% Net RI . 01562500 RI (can also be expressed as 1/8 x 1/8) Working Interest Owners: Sarge Oil & Gas Corp. 50% GWI x (100% - 12. 5%) = 43. 75% Net WI (can also be expressed as 50% of 7/8) . 43750000 WI General Petroleum Company 25%GWI x (100% - 12. 5%) = 21. 875% Net WI (can also be expressed as 25% of 7/8) BB Minerals, Inc. 25% GWI x (100% - 12. 5%) = 21. 875% Net WI . 21875000 WI (can also be expressed as 25% of 7/8) 1. 0000 TOTAL 34

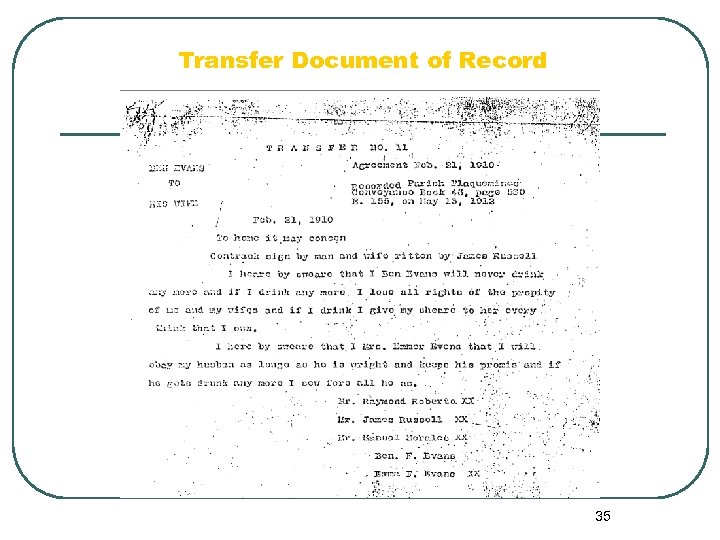

Transfer Document of Record 35

Check List: In reviewing the Conveyance Documentation received, please consider – n How was the property owned? – – – Separate Property Community Property Subject to a Life Estate Trustees of a Trust Other n Are there any unusual circumstances involving this account? – Revenues previously paid to a bank / financial institution per terms of mortgage – Revenues previously paid per terms of a special agreement – Subject to a Life Estate – Does the Life Estate Owner have authority to transfer this interest? n It will be necessary to review the documents creating said Life Estate – Suspended Pending Litigation – Other 36

Check List: In reviewing the Conveyance Documentation received, please consider – n Is the Assignor listed on the Assignment / Conveyance one and the same as set up on your company records? – If not, do you have sufficient documentation to establish chain of title from the entity on your records into the Assignor reflected on the Assignment / Conveyance? – If not, what other documentation do you need? n n For example, if said Assignment is from the Executor(s) of the Estate of John Miller, deceased, and your records show this interest credited to John Miller, you would need the probate proceedings relative to the Estate of John Miller. If this interest was owned jointly, have all parties executed the Assignment / Conveyance? – For example, if said interest is credited to Joe Smith and Carolyn Smith, have both joined in the execution of the Assignment / Conveyance? n If not, what other documentation do you need? – – Is one of the parties now deceased? Is the property subject to divorce proceedings? Is the property subject to an additional conveyance? Does one party have Power of Attorney for the other? 37

Check List: In reviewing the Conveyance Documentation received, please consider – n Does the Assignment / Conveyance involve an interest that is owned or will be owned in Trust? – In most states, title is vested in the Trustees of a Trust n n If the interest is currently owned in Trust, the conveyance should be from the Trustees of the Trust If the interest will be owned in Trust, the interest should be conveyed to the Trustees of the Trust – There are some states – such as Oklahoma, Florida and Kansas where the Trust is considered an entity capable of holding title. There may be other states, as well. – It has become a more common practice to accept Deeds whereby the interest is conveyed to the Trust, especially if the Trustee and/or Beneficiary are set out in the conveyance. n When in doubt and before you suspend, consult your Legal Department – Please note: The preparation of a Trust Agreement does not necessarily transfer title into the Trustees of said Trust. There must be a conveyance into the Trustees; or, in the alternative, the Trust Agreement itself can contain words of conveyance. 38

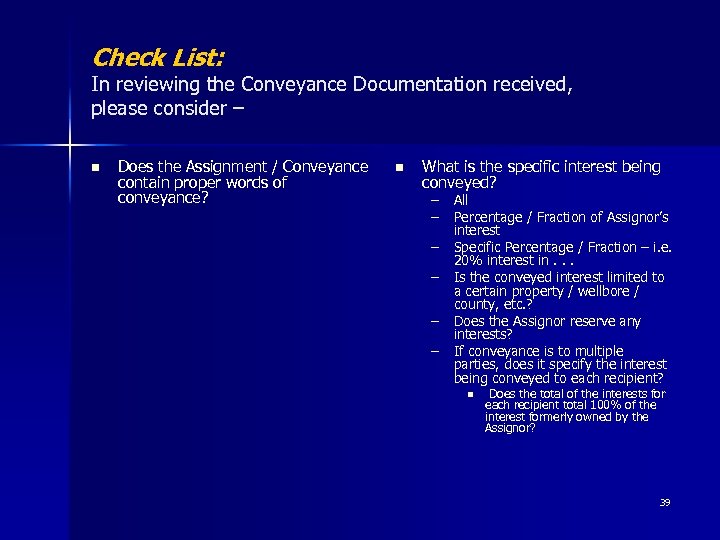

Check List: In reviewing the Conveyance Documentation received, please consider – n Does the Assignment / Conveyance contain proper words of conveyance? n What is the specific interest being conveyed? – All – Percentage / Fraction of Assignor’s interest – Specific Percentage / Fraction – i. e. 20% interest in. . . – Is the conveyed interest limited to a certain property / wellbore / county, etc. ? – Does the Assignor reserve any interests? – If conveyance is to multiple parties, does it specify the interest being conveyed to each recipient? n Does the total of the interests for each recipient total 100% of the interest formerly owned by the Assignor? 39

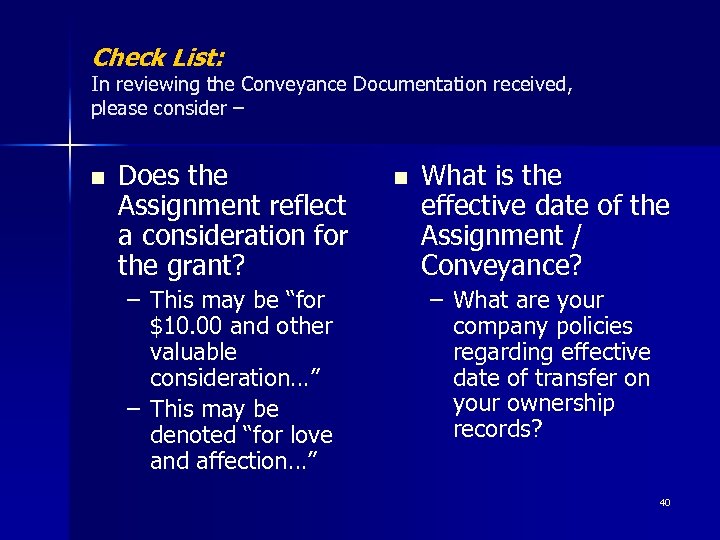

Check List: In reviewing the Conveyance Documentation received, please consider – n Does the Assignment reflect a consideration for the grant? – This may be “for $10. 00 and other valuable consideration…” – This may be denoted “for love and affection…” n What is the effective date of the Assignment / Conveyance? – What are your company policies regarding effective date of transfer on your ownership records? 40

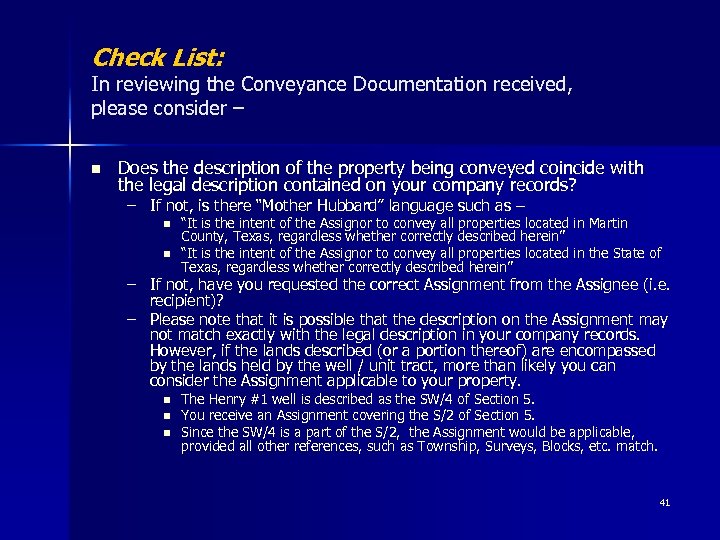

Check List: In reviewing the Conveyance Documentation received, please consider – n Does the description of the property being conveyed coincide with the legal description contained on your company records? – If not, is there “Mother Hubbard” language such as – n n “It is the intent of the Assignor to convey all properties located in Martin County, Texas, regardless whether correctly described herein” “It is the intent of the Assignor to convey all properties located in the State of Texas, regardless whether correctly described herein” – If not, have you requested the correct Assignment from the Assignee (i. e. recipient)? – Please note that it is possible that the description on the Assignment may not match exactly with the legal description in your company records. However, if the lands described (or a portion thereof) are encompassed by the lands held by the well / unit tract, more than likely you can consider the Assignment applicable to your property. n n n The Henry #1 well is described as the SW/4 of Section 5. You receive an Assignment covering the S/2 of Section 5. Since the SW/4 is a part of the S/2, the Assignment would be applicable, provided all other references, such as Township, Surveys, Blocks, etc. match. 41

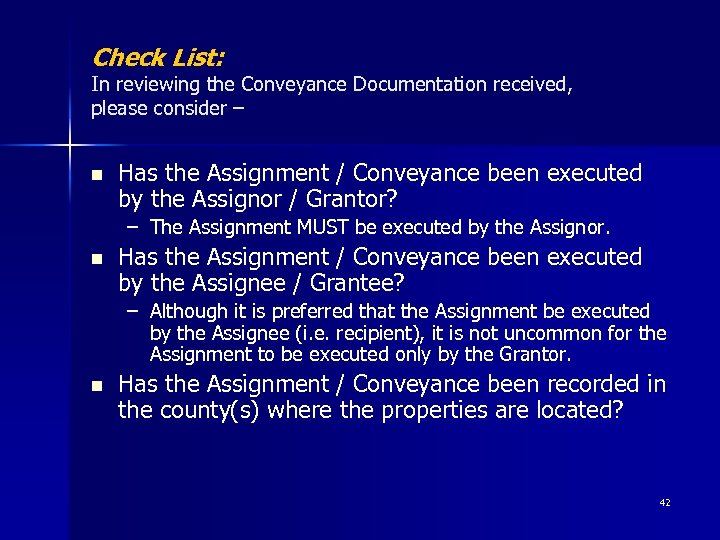

Check List: In reviewing the Conveyance Documentation received, please consider – n Has the Assignment / Conveyance been executed by the Assignor / Grantor? – The Assignment MUST be executed by the Assignor. n Has the Assignment / Conveyance been executed by the Assignee / Grantee? – Although it is preferred that the Assignment be executed by the Assignee (i. e. recipient), it is not uncommon for the Assignment to be executed only by the Grantor. n Has the Assignment / Conveyance been recorded in the county(s) where the properties are located? 42

Probate n It has been said that “No one is assured of anything except death and taxes”. Unfortunately, interest owners in a well do not live forever and there is a necessity to transfer ownership to the heirs and/or devisees of the estate of a decedent. n There are two basic types of probate proceedings § Intestate (where the decedent died without a will) § Testate (where the decedent died with a will). 43

Testate Probate n To transfer an interest in accordance with testate proceedings, it usually common industry practice to require a copy of the following: § § § § Death Certificate Letters Testamentary Will Order Admitting Will to Probate Some companies may also request an Affidavit, completed by the executor of the estate, stating that all debts and taxes have been paid or the estate has sufficient funds to pay same. Some states, such as Oklahoma and Louisiana, the Court of Jurisdiction issues a final decree that sets forth the recognized heirs of the estate and how all assets of the decedent should be distributed. If the Probate document contains an error in the property description or as to the fractional or decimal interest of the deceased, you may need a correction to the Order. This correction is called “Nunc Pro Tunc Order”. 44

Intestate Probate n To transfer an interest for an intestate, the following documents should be required: § Death Certificate § Affidavit of Heirship, completed by two disinterested persons, setting forth the marital history and any heirship information relative to the decedent. The Affidavit of Heirship is basically a synopsis of the decedent’s life. § Some companies may base requirements for Ancillary Probate (rather than accepting an Affidavit of Heirship) on the Interest Owner’s Annual Royalty Proceeds. § Some companies may also require an Affidavit of Facts stating that all debts and taxes have been paid or that the estate has sufficient funds to pay same. § Some states, such as Louisiana, require a final decree issued by the Court even in an intestate probate proceeding. § Know if State has Community Property; Know Intestate Laws 45

Foreign Probate n If a person dies owning oil, gas and/or mineral interests in a state of which he/she was not a resident, Ancillary Probate Proceedings should be opened in the state where the well is located. n Probate proceedings conducted in one state ordinarily will have no effect on the passage of title in another state. § It would be as if the decedent left no Will and his interests would vest in accordance with the Laws of Descent and Distribution of the state in which the well is located. n Some states will accept a less formal filing of probate. § In Texas, for example, record title can be amended by filing an exemplified copy of the Will and Order Admitting Will to Probate in the Deed Records of the county(s) where the property is located. § In New Mexico, an executor of the estate may file an exemplified copy of the Will, Order Admitting Will to Probate and any other court issued estate documents, along with a completed Statement of Domiciliary Foreign Personal Representative in the District Court of the county(s) in which the property is located. To distribute revenues to the heirs or devisees under the will, New Mexico statute also requires the executor or the Domiciliary Foreign Personal Representative to prepare and file of record deeds to the heirs or devisees of the estate. § The Analyst should familiarize himself / herself with the current probate laws of the states in which the leases and/or wells under his/her jurisdiction are located. 46

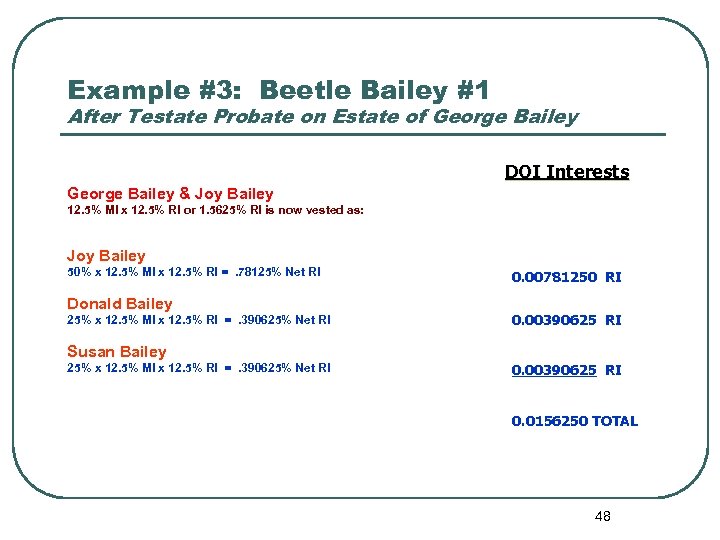

Testate Probate Affect on DOI n n George Bailey is now deceased. His Will has been admitted to Probate in Eddy County, New Mexico (i. e. the location of the Bailey #1 well). His Will states that Joy’s 50% of the community property shall be owned outright by Joy. George’s share – i. e. the remaining 50% - is to be split between his 2 children, Donald and Susan. 47

Example #3: Beetle Bailey #1 After Testate Probate on Estate of George Bailey DOI Interests George Bailey & Joy Bailey 12. 5% MI x 12. 5% RI or 1. 5625% RI is now vested as: Joy Bailey 50% x 12. 5% MI x 12. 5% RI =. 78125% Net RI Donald Bailey 25% x 12. 5% MI x 12. 5% RI =. 390625% Net RI 0. 00781250 RI 0. 00390625 RI Susan Bailey 25% x 12. 5% MI x 12. 5% RI =. 390625% Net RI 0. 00390625 RI 0. 0156250 TOTAL 48

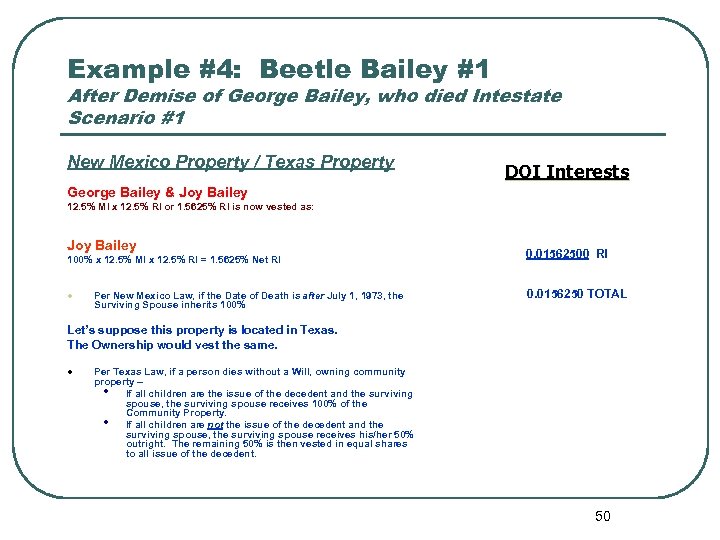

Intestate Probate Affect on DOI / Scenario #1 n n n George Bailey is now deceased. He left no Will Affidavit of Heirship lists his heirs as: § § Joy Bailey – surviving spouse Donald Bailey – son, age 24 Susan Bailey – daughter, age 20 Both Donald and Susan are the children of George Bailey and of Joy Bailey. 49

Example #4: Beetle Bailey #1 After Demise of George Bailey, who died Intestate Scenario #1 New Mexico Property / Texas Property DOI Interests George Bailey & Joy Bailey 12. 5% MI x 12. 5% RI or 1. 5625% RI is now vested as: Joy Bailey 100% x 12. 5% MI x 12. 5% RI = 1. 5625% Net RI l Per New Mexico Law, if the Date of Death is after July 1, 1973, the Surviving Spouse inherits 100% 0. 01562500 RI 0. 0156250 TOTAL Let’s suppose this property is located in Texas. The Ownership would vest the same. l Per Texas Law, if a person dies without a Will, owning community property – • If all children are the issue of the decedent and the surviving spouse, the surviving spouse receives 100% of the Community Property. • If all children are not the issue of the decedent and the surviving spouse, the surviving spouse receives his/her 50% outright. The remaining 50% is then vested in equal shares to all issue of the decedent. 50

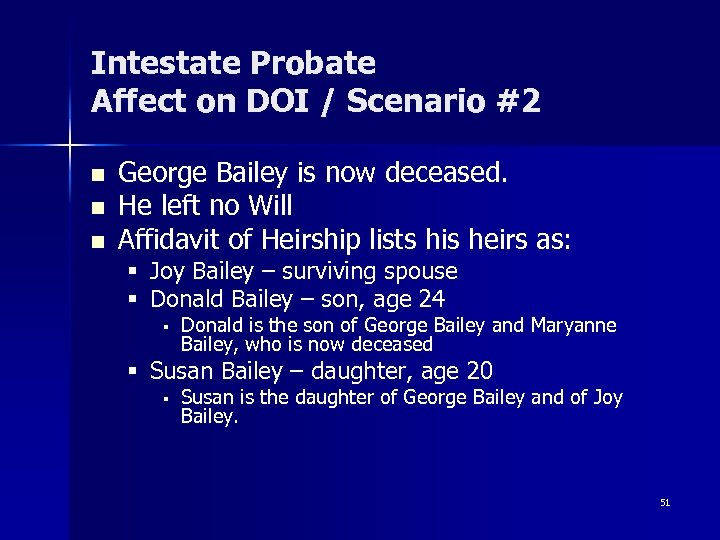

Intestate Probate Affect on DOI / Scenario #2 n n n George Bailey is now deceased. He left no Will Affidavit of Heirship lists his heirs as: § Joy Bailey – surviving spouse § Donald Bailey – son, age 24 § Donald is the son of George Bailey and Maryanne Bailey, who is now deceased § Susan Bailey – daughter, age 20 § Susan is the daughter of George Bailey and of Joy Bailey. 51

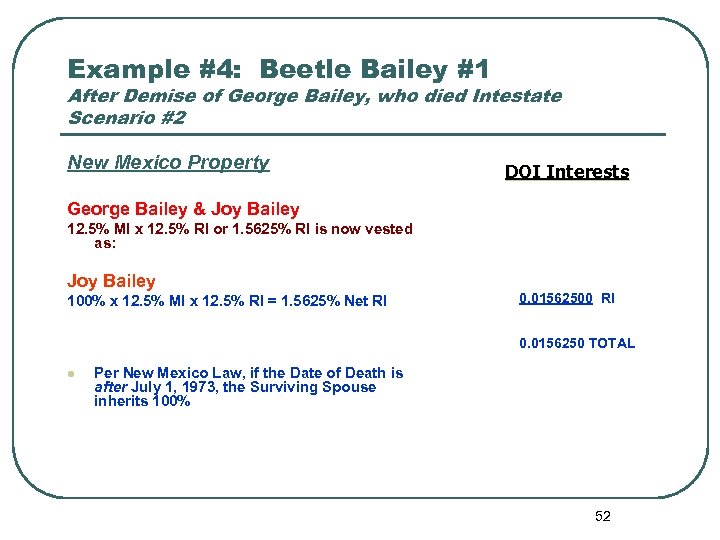

Example #4: Beetle Bailey #1 After Demise of George Bailey, who died Intestate Scenario #2 New Mexico Property DOI Interests George Bailey & Joy Bailey 12. 5% MI x 12. 5% RI or 1. 5625% RI is now vested as: Joy Bailey 100% x 12. 5% MI x 12. 5% RI = 1. 5625% Net RI 0. 01562500 RI 0. 0156250 TOTAL l Per New Mexico Law, if the Date of Death is after July 1, 1973, the Surviving Spouse inherits 100% 52

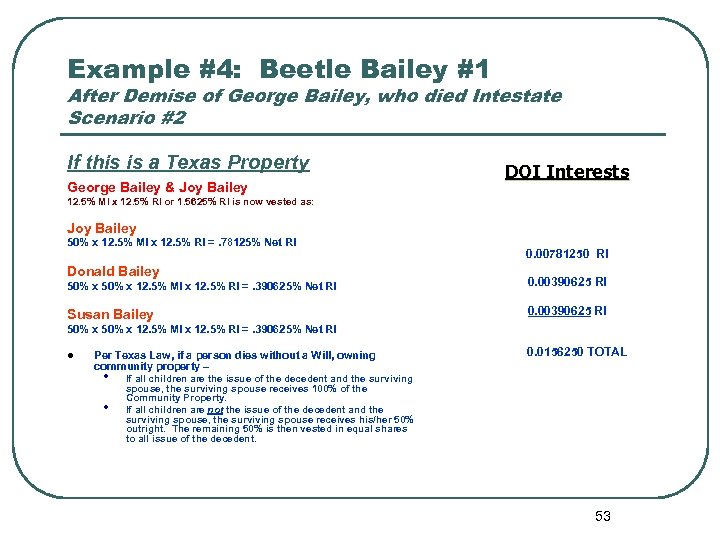

Example #4: Beetle Bailey #1 After Demise of George Bailey, who died Intestate Scenario #2 If this is a Texas Property George Bailey & Joy Bailey DOI Interests 12. 5% MI x 12. 5% RI or 1. 5625% RI is now vested as: Joy Bailey 50% x 12. 5% MI x 12. 5% RI =. 78125% Net RI Donald Bailey 0. 00781250 RI 50% x 12. 5% MI x 12. 5% RI =. 390625% Net RI 0. 00390625 RI Susan Bailey 0. 00390625 RI 50% x 12. 5% MI x 12. 5% RI =. 390625% Net RI l Per Texas Law, if a person dies without a Will, owning community property – • • 0. 0156250 TOTAL If all children are the issue of the decedent and the surviving spouse, the surviving spouse receives 100% of the Community Property. If all children are not the issue of the decedent and the surviving spouse, the surviving spouse receives his/her 50% outright. The remaining 50% is then vested in equal shares to all issue of the decedent. 53

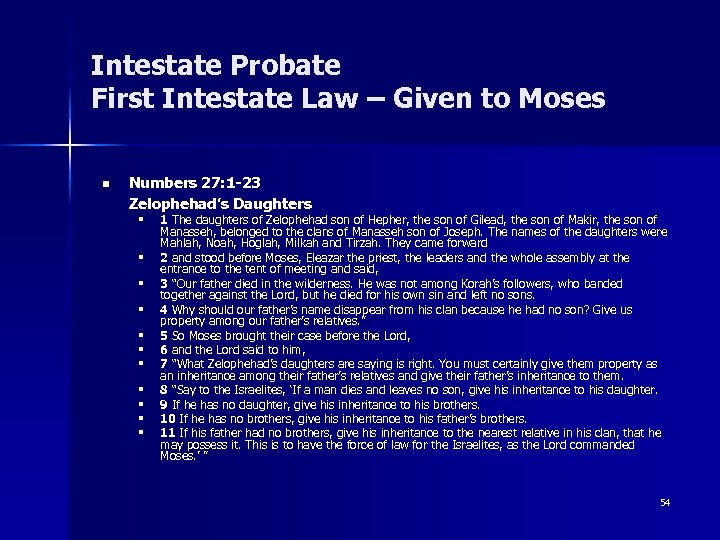

Intestate Probate First Intestate Law – Given to Moses n Numbers 27: 1 -23 Zelophehad’s Daughters § § § 1 The daughters of Zelophehad son of Hepher, the son of Gilead, the son of Makir, the son of Manasseh, belonged to the clans of Manasseh son of Joseph. The names of the daughters were Mahlah, Noah, Hoglah, Milkah and Tirzah. They came forward 2 and stood before Moses, Eleazar the priest, the leaders and the whole assembly at the entrance to the tent of meeting and said, 3 “Our father died in the wilderness. He was not among Korah’s followers, who banded together against the Lord, but he died for his own sin and left no sons. 4 Why should our father’s name disappear from his clan because he had no son? Give us property among our father’s relatives. ” 5 So Moses brought their case before the Lord, 6 and the Lord said to him, 7 “What Zelophehad’s daughters are saying is right. You must certainly give them property as an inheritance among their father’s relatives and give their father’s inheritance to them. 8 “Say to the Israelites, ‘If a man dies and leaves no son, give his inheritance to his daughter. 9 If he has no daughter, give his inheritance to his brothers. 10 If he has no brothers, give his inheritance to his father’s brothers. 11 If his father had no brothers, give his inheritance to the nearest relative in his clan, that he may possess it. This is to have the force of law for the Israelites, as the Lord commanded Moses. ’ ” 54

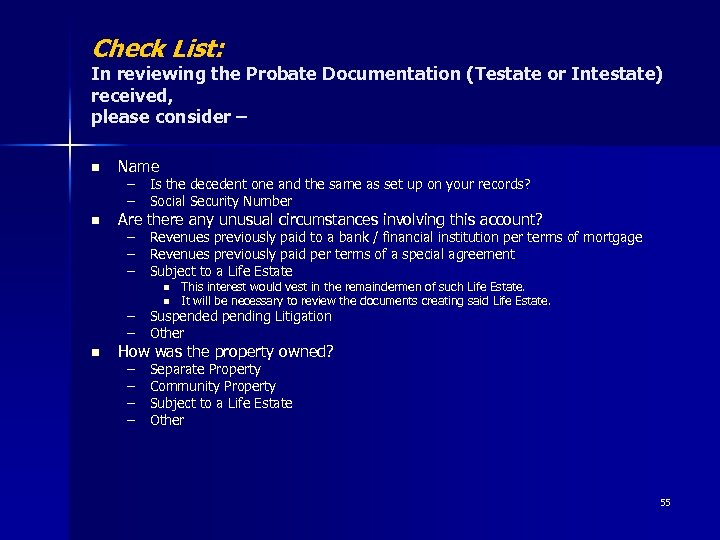

Check List: In reviewing the Probate Documentation (Testate or Intestate) received, please consider – n Name n Are there any unusual circumstances involving this account? – Is the decedent one and the same as set up on your records? – Social Security Number – Revenues previously paid to a bank / financial institution per terms of mortgage – Revenues previously paid per terms of a special agreement – Subject to a Life Estate n n This interest would vest in the remaindermen of such Life Estate. It will be necessary to review the documents creating said Life Estate. – Suspended pending Litigation – Other n How was the property owned? – – Separate Property Community Property Subject to a Life Estate Other 55

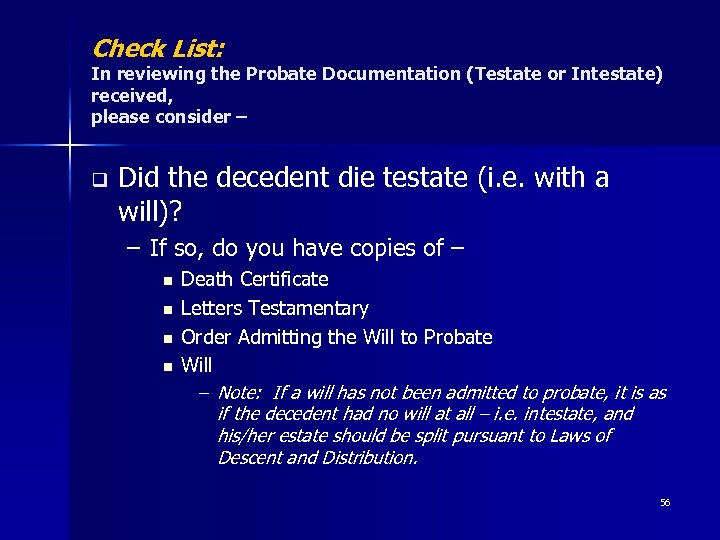

Check List: In reviewing the Probate Documentation (Testate or Intestate) received, please consider – q Did the decedent die testate (i. e. with a will)? – If so, do you have copies of – n n Death Certificate Letters Testamentary Order Admitting the Will to Probate Will – Note: If a will has not been admitted to probate, it is as if the decedent had no will at all – i. e. intestate, and his/her estate should be split pursuant to Laws of Descent and Distribution. 56

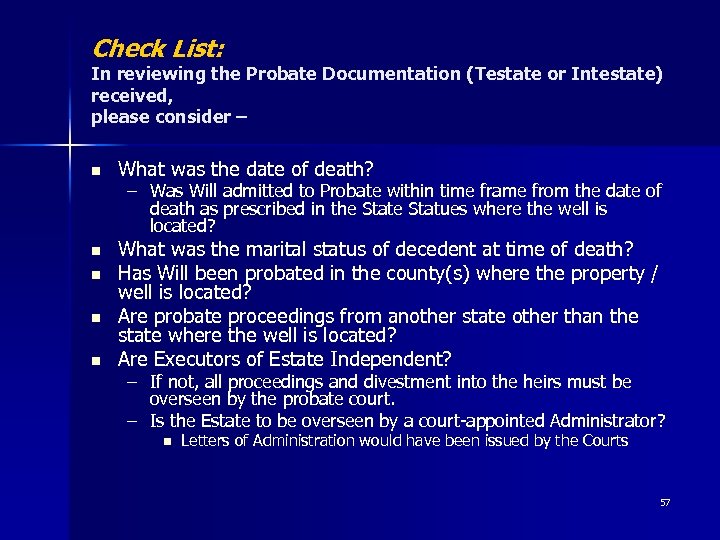

Check List: In reviewing the Probate Documentation (Testate or Intestate) received, please consider – n What was the date of death? n What was the marital status of decedent at time of death? Has Will been probated in the county(s) where the property / well is located? Are probate proceedings from another state other than the state where the well is located? Are Executors of Estate Independent? n n n – Was Will admitted to Probate within time frame from the date of death as prescribed in the Statues where the well is located? – If not, all proceedings and divestment into the heirs must be overseen by the probate court. – Is the Estate to be overseen by a court-appointed Administrator? n Letters of Administration would have been issued by the Courts 57

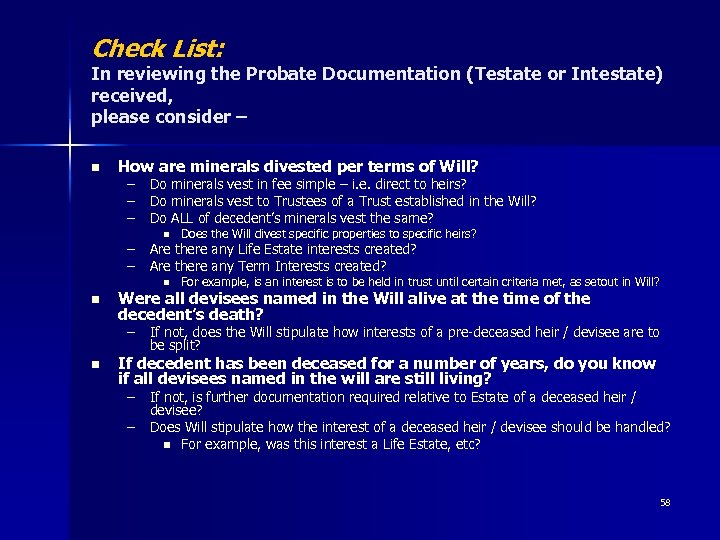

Check List: In reviewing the Probate Documentation (Testate or Intestate) received, please consider – n How are minerals divested per terms of Will? – Do minerals vest in fee simple – i. e. direct to heirs? – Do minerals vest to Trustees of a Trust established in the Will? – Do ALL of decedent’s minerals vest the same? n Does the Will divest specific properties to specific heirs? n For example, is an interest is to be held in trust until certain criteria met, as setout in Will? – Are there any Life Estate interests created? – Are there any Term Interests created? n Were all devisees named in the Will alive at the time of the decedent’s death? – If not, does the Will stipulate how interests of a pre-deceased heir / devisee are to be split? n If decedent has been deceased for a number of years, do you know if all devisees named in the will are still living? – If not, is further documentation required relative to Estate of a deceased heir / devisee? – Does Will stipulate how the interest of a deceased heir / devisee should be handled? n For example, was this interest a Life Estate, etc? 58

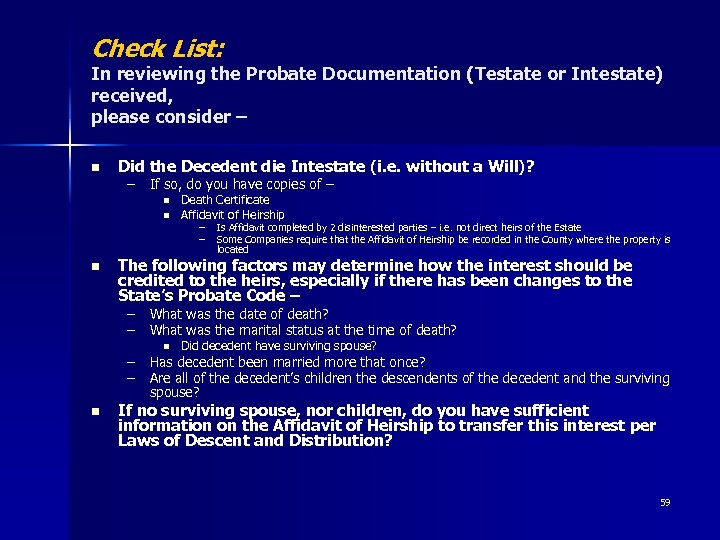

Check List: In reviewing the Probate Documentation (Testate or Intestate) received, please consider – n Did the Decedent die Intestate (i. e. without a Will)? – If so, do you have copies of – n n n Death Certificate Affidavit of Heirship – – Is Affidavit completed by 2 disinterested parties – i. e. not direct heirs of the Estate Some Companies require that the Affidavit of Heirship be recorded in the County where the property is located The following factors may determine how the interest should be credited to the heirs, especially if there has been changes to the State’s Probate Code – – What was the date of death? – What was the marital status at the time of death? n Did decedent have surviving spouse? – Has decedent been married more that once? – Are all of the decedent’s children the descendents of the decedent and the surviving spouse? n If no surviving spouse, nor children, do you have sufficient information on the Affidavit of Heirship to transfer this interest per Laws of Descent and Distribution? 59

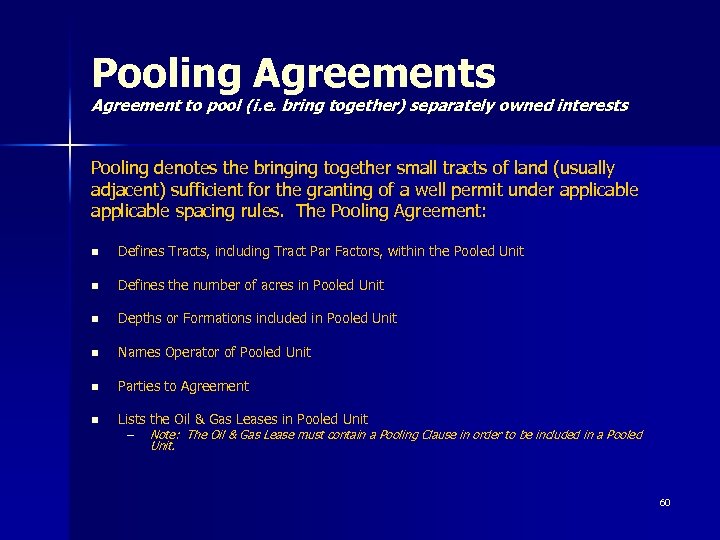

Pooling Agreements Agreement to pool (i. e. bring together) separately owned interests Pooling denotes the bringing together small tracts of land (usually adjacent) sufficient for the granting of a well permit under applicable spacing rules. The Pooling Agreement: n Defines Tracts, including Tract Par Factors, within the Pooled Unit n Defines the number of acres in Pooled Unit n Depths or Formations included in Pooled Unit n Names Operator of Pooled Unit n Parties to Agreement n Lists the Oil & Gas Leases in Pooled Unit – Note: The Oil & Gas Lease must contain a Pooling Clause in order to be included in a Pooled Unit. 60

Pooling Agreements Agreement to pool (i. e. bring together) separately owned interests n Approvals by Governmental Agencies if state or federal leases included in pooled unit n Ratifications by Non-participating Royalty Owners, Unleased Mineral Owners (if participating as a working interest owner) and working interest owners n Forced Pooling Orders – May contain language treating Unleased Mineral Interest Owners as Non-Consenting Working Interest Owners with a 7/8 Working Interest and burdening themselves with their own 1/8 Royalty Interest. 61

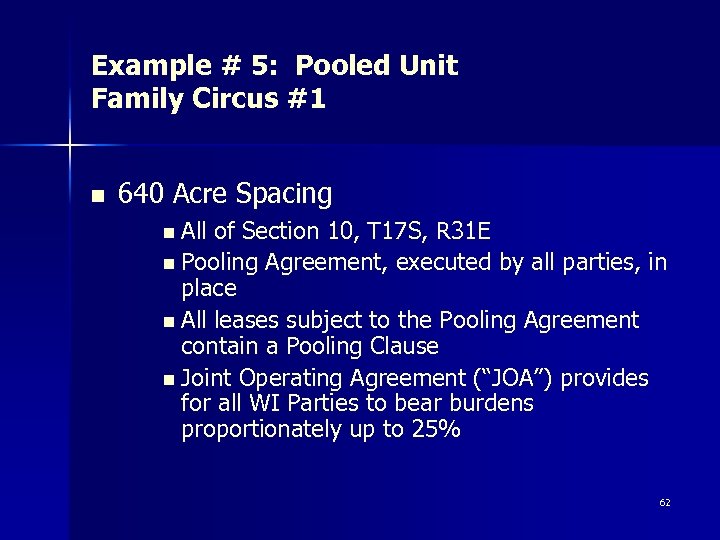

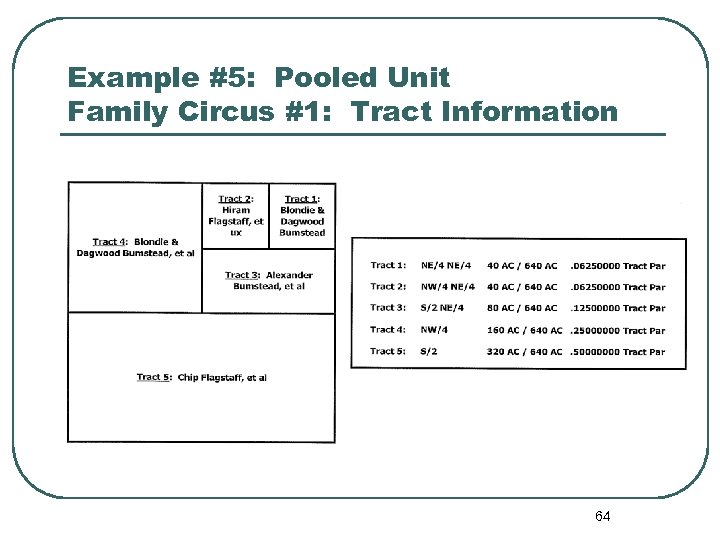

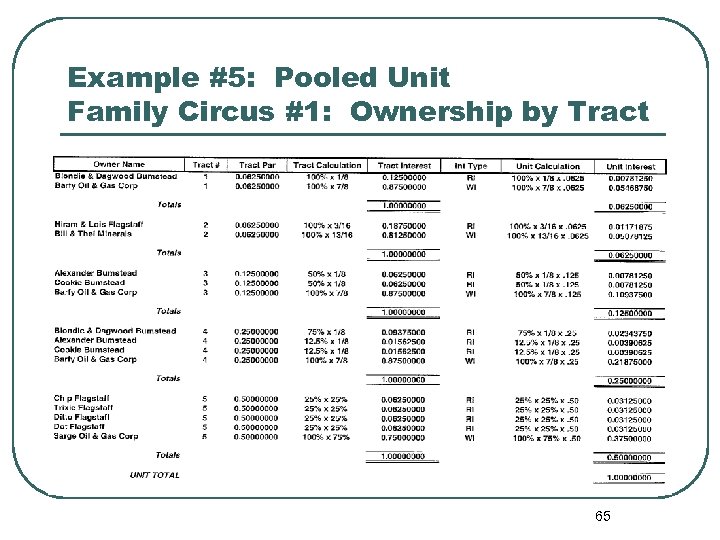

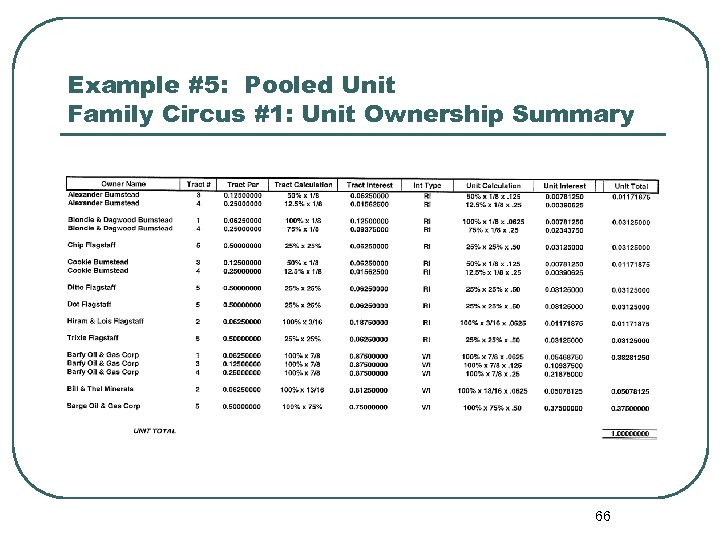

Example # 5: Pooled Unit Family Circus #1 n 640 Acre Spacing n All of Section 10, T 17 S, R 31 E n Pooling Agreement, executed by all parties, in place n All leases subject to the Pooling Agreement contain a Pooling Clause n Joint Operating Agreement (“JOA”) provides for all WI Parties to bear burdens proportionately up to 25% 62

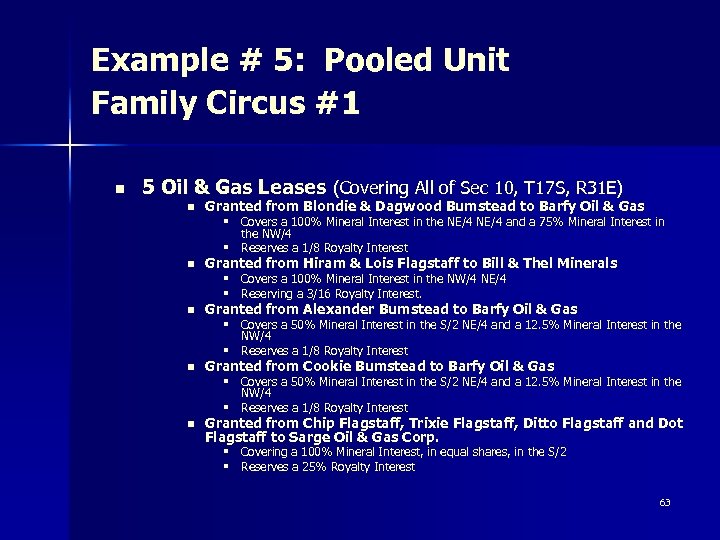

Example # 5: Pooled Unit Family Circus #1 n 5 Oil & Gas Leases (Covering All of Sec 10, T 17 S, R 31 E) n Granted from Blondie & Dagwood Bumstead to Barfy Oil & Gas § Covers a 100% Mineral Interest in the NE/4 and a 75% Mineral Interest in the NW/4 § Reserves a 1/8 Royalty Interest n Granted from Hiram & Lois Flagstaff to Bill & Thel Minerals § Covers a 100% Mineral Interest in the NW/4 NE/4 § Reserving a 3/16 Royalty Interest. n Granted from Alexander Bumstead to Barfy Oil & Gas § Covers a 50% Mineral Interest in the S/2 NE/4 and a 12. 5% Mineral Interest in the NW/4 § Reserves a 1/8 Royalty Interest n Granted from Cookie Bumstead to Barfy Oil & Gas § Covers a 50% Mineral Interest in the S/2 NE/4 and a 12. 5% Mineral Interest in the NW/4 § Reserves a 1/8 Royalty Interest n Granted from Chip Flagstaff, Trixie Flagstaff, Ditto Flagstaff and Dot Flagstaff to Sarge Oil & Gas Corp. § Covering a 100% Mineral Interest, in equal shares, in the S/2 § Reserves a 25% Royalty Interest 63

Example #5: Pooled Unit Family Circus #1: Tract Information 64

Example #5: Pooled Unit Family Circus #1: Ownership by Tract 65

Example #5: Pooled Unit Family Circus #1: Unit Ownership Summary 66

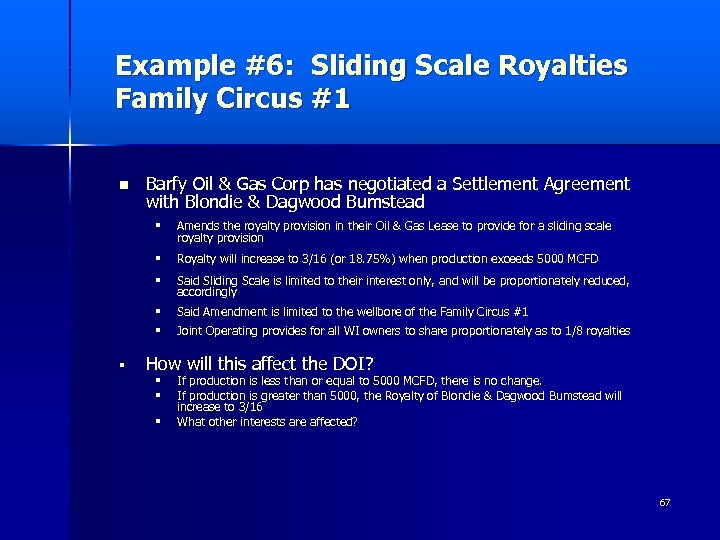

Example #6: Sliding Scale Royalties Family Circus #1 n Barfy Oil & Gas Corp has negotiated a Settlement Agreement with Blondie & Dagwood Bumstead § § Royalty will increase to 3/16 (or 18. 75%) when production exceeds 5000 MCFD § Said Sliding Scale is limited to their interest only, and will be proportionately reduced, accordingly § § § Amends the royalty provision in their Oil & Gas Lease to provide for a sliding scale royalty provision Said Amendment is limited to the wellbore of the Family Circus #1 Joint Operating provides for all WI owners to share proportionately as to 1/8 royalties How will this affect the DOI? § § § If production is less than or equal to 5000 MCFD, there is no change. If production is greater than 5000, the Royalty of Blondie & Dagwood Bumstead will increase to 3/16 What other interests are affected? 67

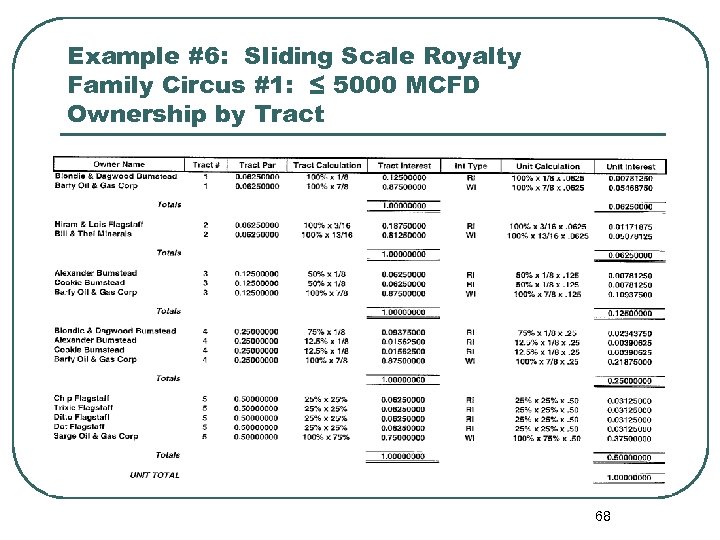

Example #6: Sliding Scale Royalty Family Circus #1: ≤ 5000 MCFD Ownership by Tract 68

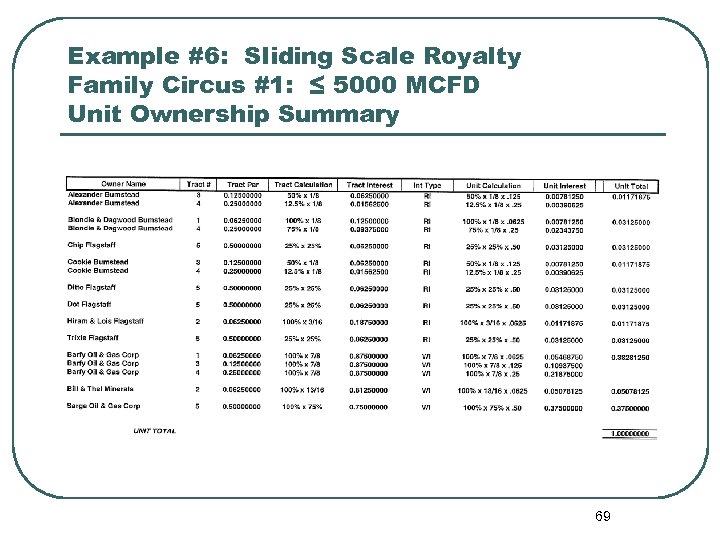

Example #6: Sliding Scale Royalty Family Circus #1: ≤ 5000 MCFD Unit Ownership Summary 69

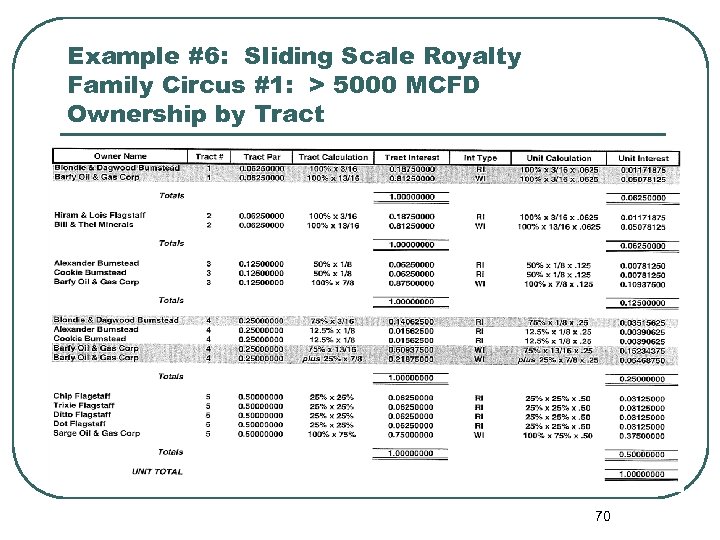

Example #6: Sliding Scale Royalty Family Circus #1: > 5000 MCFD Ownership by Tract 70

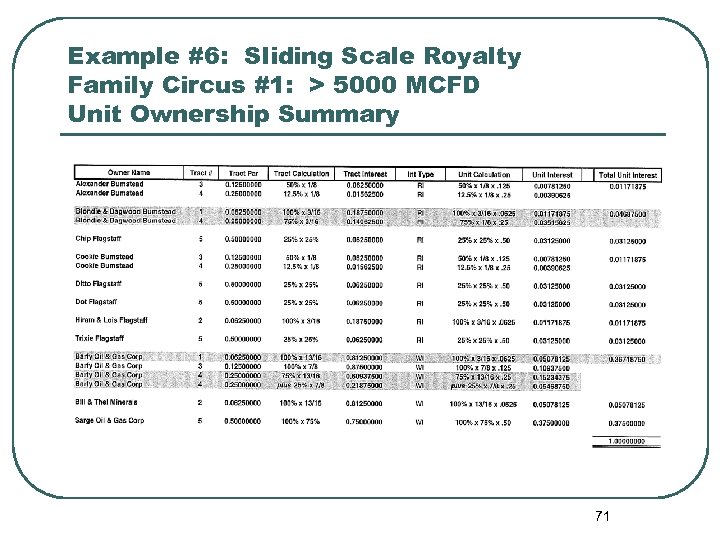

Example #6: Sliding Scale Royalty Family Circus #1: > 5000 MCFD Unit Ownership Summary 71

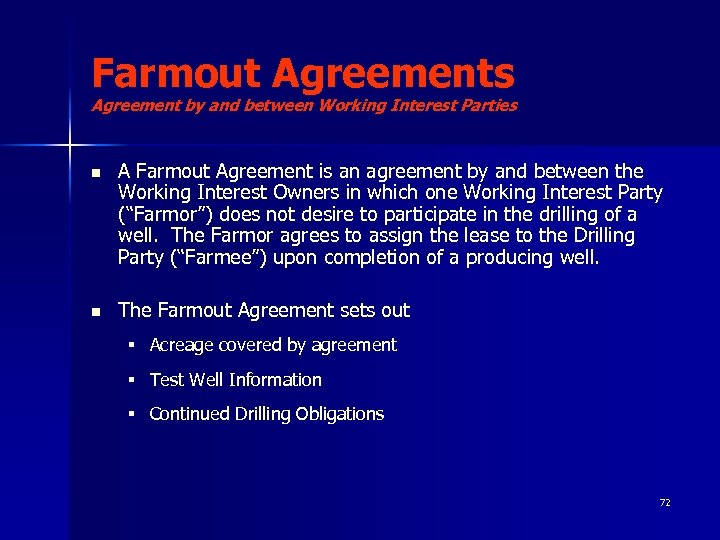

Farmout Agreements Agreement by and between Working Interest Parties n A Farmout Agreement is an agreement by and between the Working Interest Owners in which one Working Interest Party (“Farmor”) does not desire to participate in the drilling of a well. The Farmor agrees to assign the lease to the Drilling Party (“Farmee”) upon completion of a producing well. n The Farmout Agreement sets out § Acreage covered by agreement § Test Well Information § Continued Drilling Obligations 72

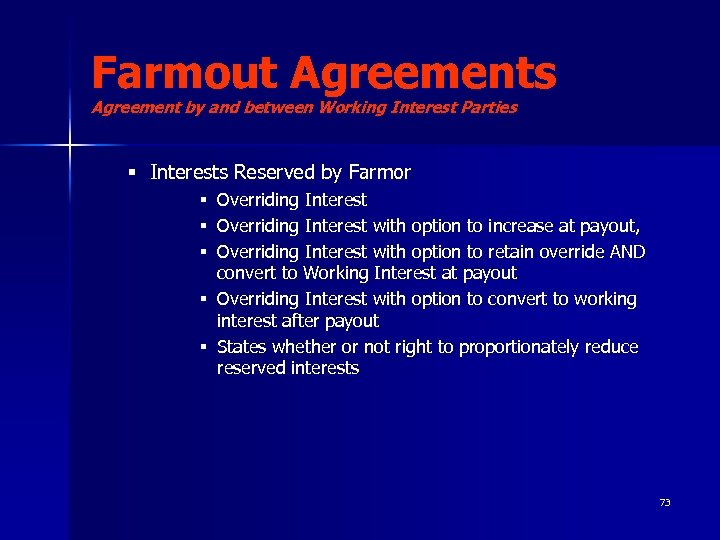

Farmout Agreements Agreement by and between Working Interest Parties § Interests Reserved by Farmor Overriding Interest with option to increase at payout, Overriding Interest with option to retain override AND convert to Working Interest at payout § Overriding Interest with option to convert to working interest after payout § States whether or not right to proportionately reduce reserved interests § § § 73

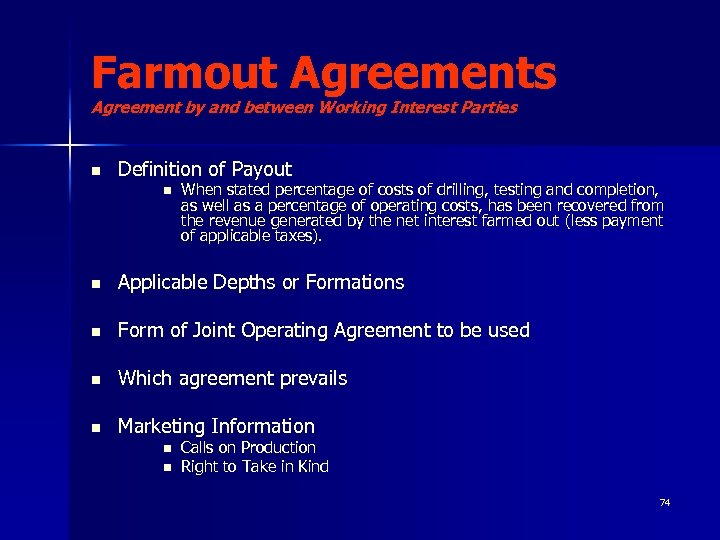

Farmout Agreements Agreement by and between Working Interest Parties n Definition of Payout n When stated percentage of costs of drilling, testing and completion, as well as a percentage of operating costs, has been recovered from the revenue generated by the net interest farmed out (less payment of applicable taxes). n Applicable Depths or Formations n Form of Joint Operating Agreement to be used n Which agreement prevails n Marketing Information n n Calls on Production Right to Take in Kind 74

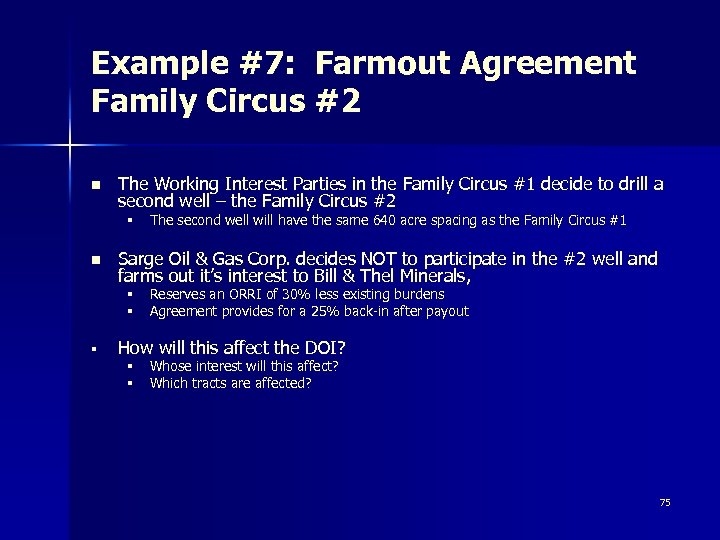

Example #7: Farmout Agreement Family Circus #2 n The Working Interest Parties in the Family Circus #1 decide to drill a second well – the Family Circus #2 § n Sarge Oil & Gas Corp. decides NOT to participate in the #2 well and farms out it’s interest to Bill & Thel Minerals, § § § The second well will have the same 640 acre spacing as the Family Circus #1 Reserves an ORRI of 30% less existing burdens Agreement provides for a 25% back-in after payout How will this affect the DOI? § § Whose interest will this affect? Which tracts are affected? 75

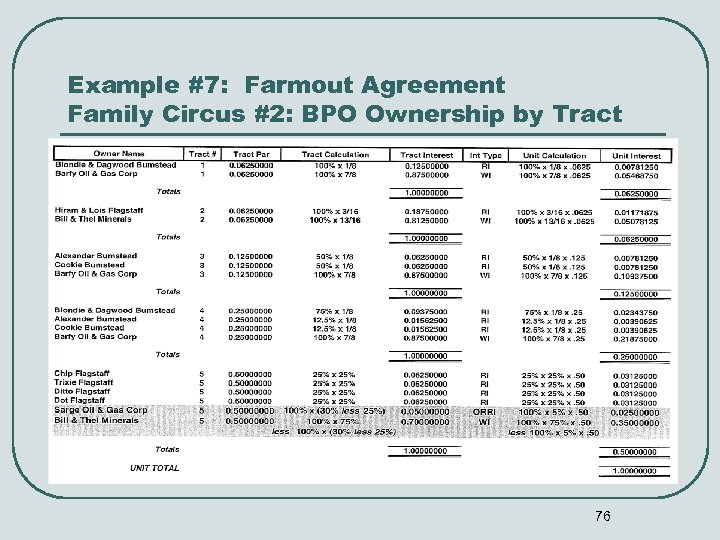

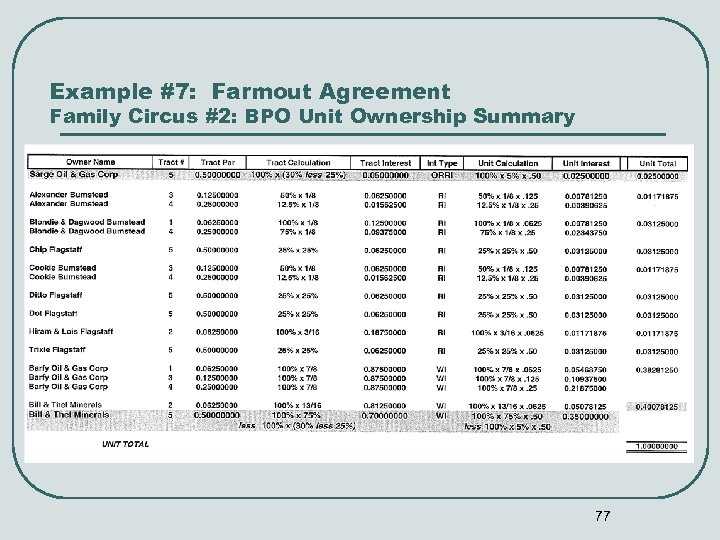

Example #7: Farmout Agreement Family Circus #2: BPO Ownership by Tract 76

Example #7: Farmout Agreement Family Circus #2: BPO Unit Ownership Summary 77

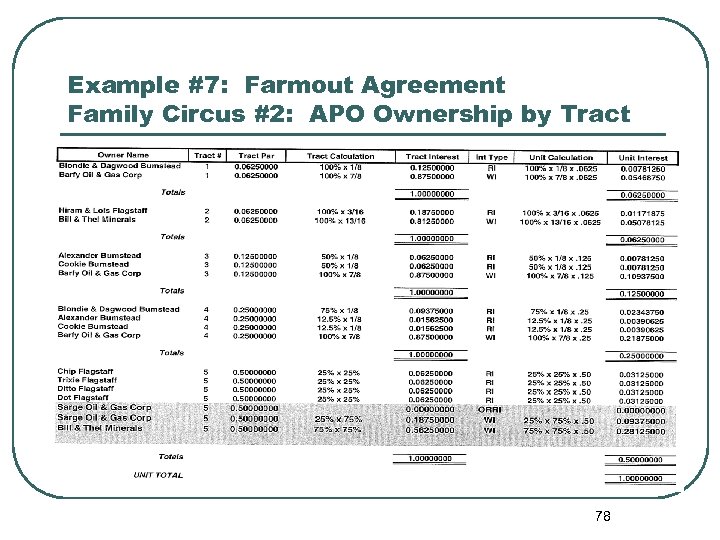

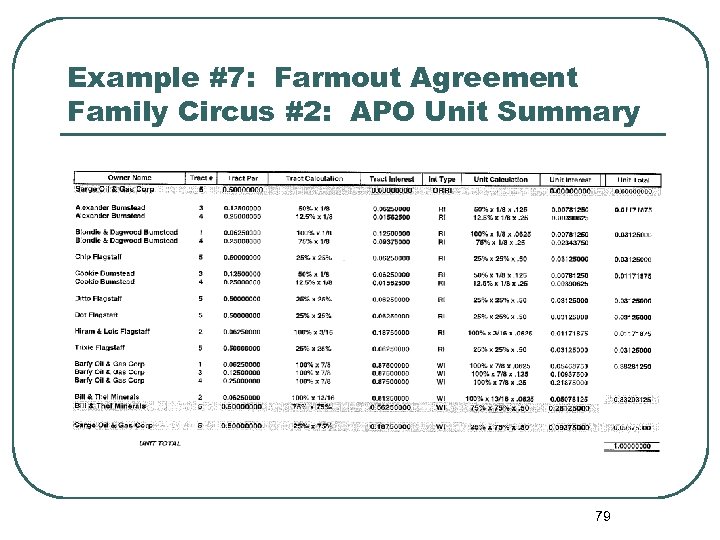

Example #7: Farmout Agreement Family Circus #2: APO Ownership by Tract 78

Example #7: Farmout Agreement Family Circus #2: APO Unit Summary 79

Joint Operating Agreements Agreement by and between Working Interest Parties n The Joint Operating Agreement (“JOA”) is a document executed by all parties participating in the Development of a particular field or geographical area. However, it may be limited to the drilling of a particular well. The JOA sets forth procedures for the development, drilling and operations of the field or well. 80

Joint Operating Agreements Agreement by and between Working Interest Parties n Specific Provisions which may affect the Division Order Analyst § Article III. Interests of Parties – – Oil & Gas Interests of Parties in Costs & Production Excess Royalties, Overriding Royalties & Other Payments Subsequently Created Interests § Article IV. Titles – Title Examination – Loss of Title § Article V. Operator 81

Joint Operating Agreements Agreement by and between Working Interest Parties § Article VI. Drilling and Development – Initial Well – Subsequent Operations – Taking Production in Kind n When a participant markets their proportionate share of production under a different contract, how are the burdens to be paid? – Operations by less than all parties n In case of a Re-work, what constitutes consent / non-consent n Do the consenting parties have the option to absorb the non-consent portion? 82

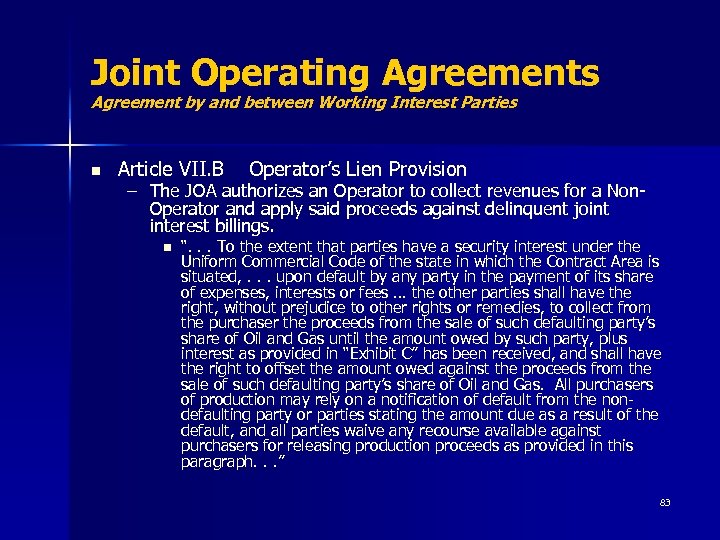

Joint Operating Agreements Agreement by and between Working Interest Parties n Article VII. B Operator’s Lien Provision – The JOA authorizes an Operator to collect revenues for a Non. Operator and apply said proceeds against delinquent joint interest billings. n “. . . To the extent that parties have a security interest under the Uniform Commercial Code of the state in which the Contract Area is situated, . . . upon default by any party in the payment of its share of expenses, interests or fees … the other parties shall have the right, without prejudice to other rights or remedies, to collect from the purchaser the proceeds from the sale of such defaulting party’s share of Oil and Gas until the amount owed by such party, plus interest as provided in “Exhibit C” has been received, and shall have the right to offset the amount owed against the proceeds from the sale of such defaulting party’s share of Oil and Gas. All purchasers of production may rely on a notification of default from the nondefaulting party or parties stating the amount due as a result of the default, and all parties waive any recourse available against purchasers for releasing production proceeds as provided in this paragraph. . . ” 83

Joint Operating Agreements Agreement by and between Working Interest Parties § Exhibit A Contract Area & Interests n n n Contract Area – acreage and legal description Depth Restrictions Interests of Parties to Agreement Oil & Gas Leases Subject to Agreement Addresses of Parties for Notice Purposes § Exhibit E Gas Balancing Agreement § If a party’s separate disposition of its share of gas causes split stream deliveries to separate pipeline, what are the procedures to assure that all parties are credited with the proper amount of production? 84

Joint Operating Agreements Agreement by and between Working Interest Parties n Additional Considerations • Does the JOA grant a Preferential Right to Purchase to the other participants? • Does the JOA provide that there must be Maintenance of Uniform Interest in the contract area? n “For the purpose of maintaining uniformity of ownership in the contract Area in the Oil and Gas Leases, Oil and Gas Interests, wells, equipment and production covered by this agreement no party shall sell, encumber, transfer or make other disposition of its interest in the Oil and Gas Leases and Oil and Gas Interests embraced within the Contract Area or in wells, equipment and production unless such disposition covers either: 1. 2. the entire interest of the party in all Oil and Gas Leases, Oil and Gas Interests, wells, equipment and production; or an equal undivided percent of the party’s present interest in all Oil and Gas Leases, Oil and Gas Interests, wells, equipment and production in the Contract Area. 85

Joint Operating Agreements Agreement by and between Working Interest Parties • Does the JOA contain language that creates an Area of Mutual Interest (AMI)? • • Area of Mutual Interest (“AMI”) clauses or agreements have evolved pursuant to the oil and gas industry’s desire to protect geographical areas in close proximity to geological prospects. The AMI stipulates that all parties to the agreement have a mutual interest in a certain geographic area and provides that if any one of them obtains an oil and gas interest in this area, the other parties have a right to participate in such interest. In essence, an AMI is a contract to convey interests in oil and gas leases. • The Area of Mutual Interest Clause is similar to the preferential right to purchase provision in the operating agreement, except that is deals with the acquisition of oil and gas interests rather than the divestiture of them. • It is designed to insure that every party subject to the agreement has an opportunity to acquire a proportionate share of any acquisition within the contract area, regardless of the state of development of the newly acquired acreage. • The AMI provision also protects one party to an agreement from another party’s use of information jointly obtained for competitive advantage. 86

Joint Operating Agreements Agreement by and between Working Interest Parties n Are there any Unleased Mineral Interests subject to the JOA? – The 1989 AAPL model form Operating Agreement provides for a mineral interest owner to join in the execution of the JOA and participate in operations. Language contained therein states, n n “If any party owns an Oil and Gas Interest in the Contract Area, the interest shall be treated for all purposes. . . as if it were covered by the form of oil and gas lease attached hereto as Exhibit “B”, and the owner thereof shall be deemed to own both the royalty therein reserved in such lease and the interest of the lessee thereunder. . . ” If an unleased mineral owner joins in the execution of the JOA, he is then entitled to receive production proceeds, proportionately reduced, based on the royalty reservation set forth in the lease form to the JOA, as well as proceeds attributable to the leasehold net revenue interest. The unleased mineral owner is then considered a party to the JOA and is subject to all the provisions therein, including the non-consent provisions. 87

Example #8: Joint Operating Agreement Family Circus #2 n The Working Interest Parties in the Family Circus #1 decide to drill a second well – the Family Circus #2 § The second well will have the same 640 acre spacing as the Family Circus #1 n Sarge Oil & Gas Corp. decides NOT to participate in the #2 well and elects to go Non-Consent per the terms of the JOA § All other Working Interest Parties absorb their proportionate share of the Sarge Non-Consent n How does this affect the DOI for the Family Circus #2 well? § § § Whose interest does this affect? Is there an Override reserved? Does this affect the Royalty Interests? 88

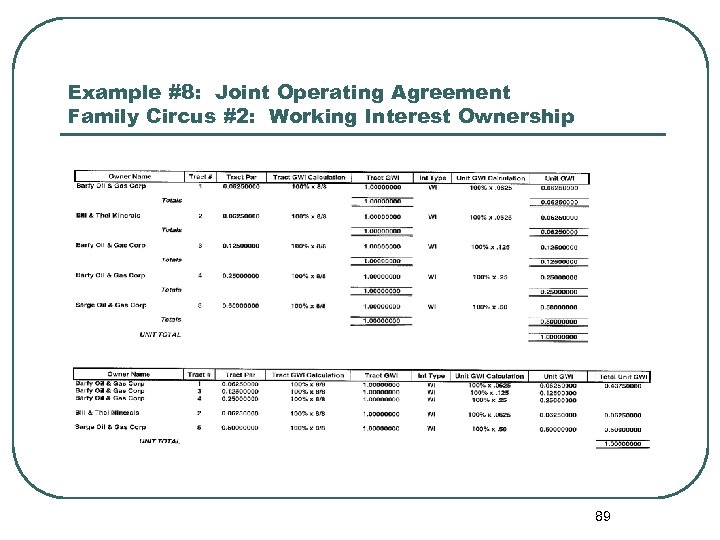

Example #8: Joint Operating Agreement Family Circus #2: Working Interest Ownership 89

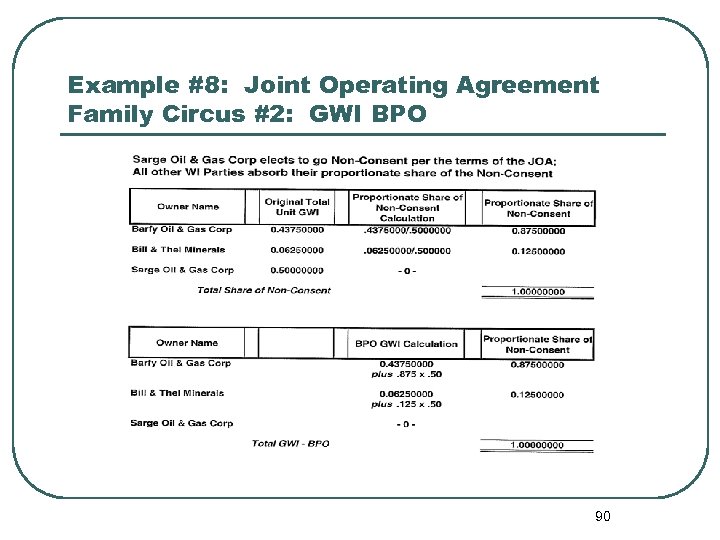

Example #8: Joint Operating Agreement Family Circus #2: GWI BPO 90

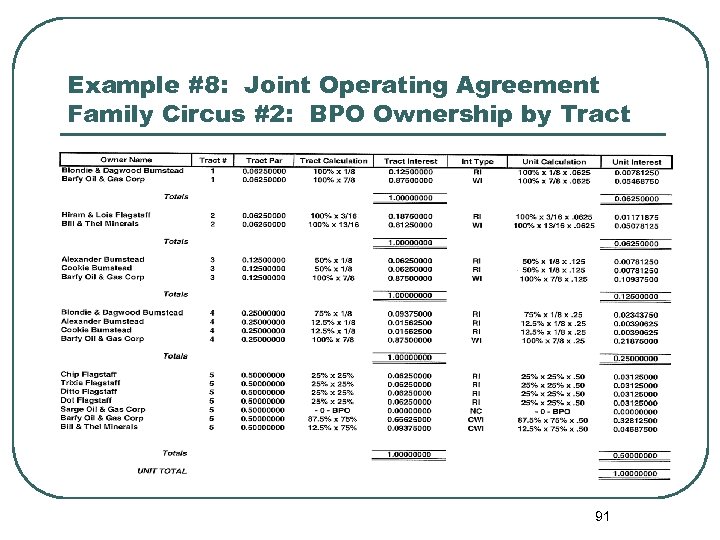

Example #8: Joint Operating Agreement Family Circus #2: BPO Ownership by Tract 91

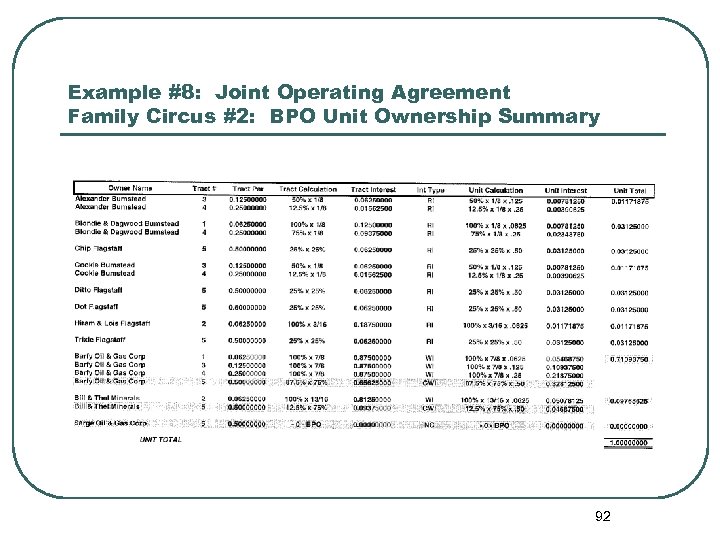

Example #8: Joint Operating Agreement Family Circus #2: BPO Unit Ownership Summary 92

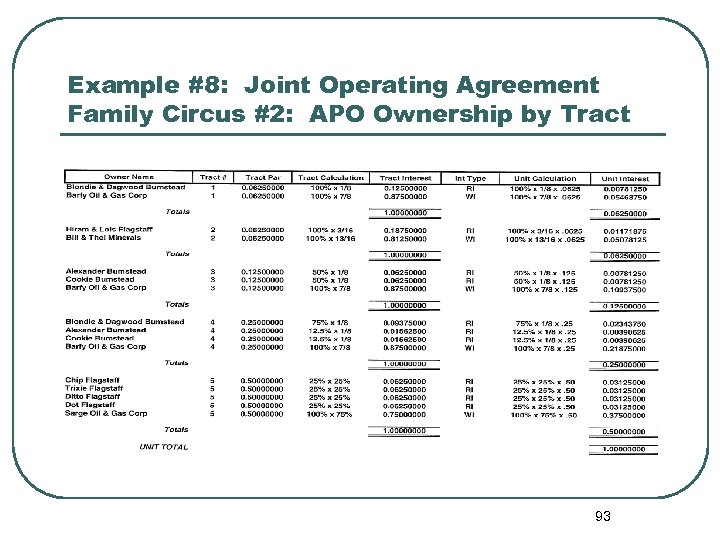

Example #8: Joint Operating Agreement Family Circus #2: APO Ownership by Tract 93

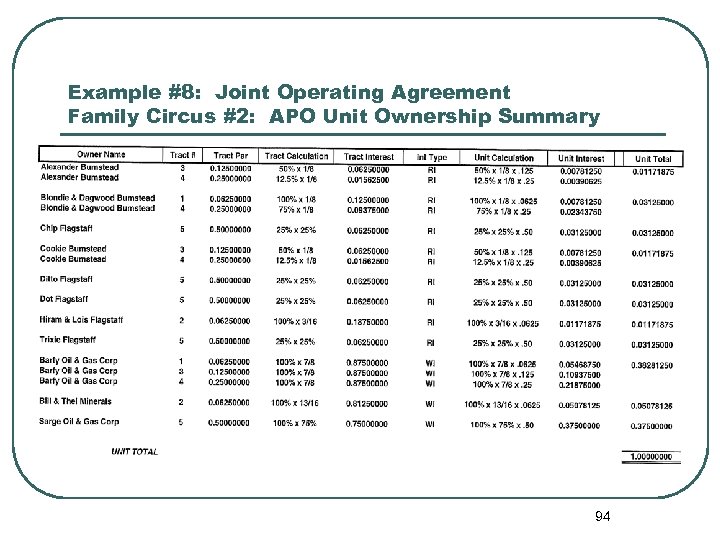

Example #8: Joint Operating Agreement Family Circus #2: APO Unit Ownership Summary 94

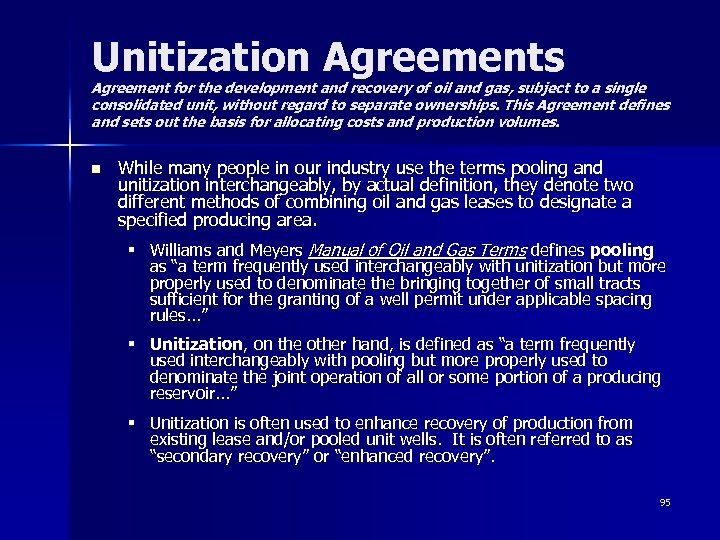

Unitization Agreements Agreement for the development and recovery of oil and gas, subject to a single consolidated unit, without regard to separate ownerships. This Agreement defines and sets out the basis for allocating costs and production volumes. n While many people in our industry use the terms pooling and unitization interchangeably, by actual definition, they denote two different methods of combining oil and gas leases to designate a specified producing area. § Williams and Meyers Manual of Oil and Gas Terms defines pooling as “a term frequently used interchangeably with unitization but more properly used to denominate the bringing together of small tracts sufficient for the granting of a well permit under applicable spacing rules. . . ” § Unitization, on the other hand, is defined as “a term frequently used interchangeably with pooling but more properly used to denominate the joint operation of all or some portion of a producing reservoir. . . ” § Unitization is often used to enhance recovery of production from existing lease and/or pooled unit wells. It is often referred to as “secondary recovery” or “enhanced recovery”. 95

Unitization Agreements Agreement for the development and recovery of oil and gas, subject to a single consolidated unit, without regard to separate ownerships. This Agreement defines and sets out the basis for allocating costs and production volumes. n The procedures for the joint operations of a producing reservoir are outlined in and governed by a Unit Agreement. This Agreement should contain reference to the following: § § § § Definitions Effective date Unit Plat Description of each tract, as well as the tract’s participation factor Allocation of Unitized Substances Effectiveness of all Division Orders Designation of Unit Manager / Unit Operator Plan of Development and Operations Enlargement of Unit Area and Field Area Outstanding Agreements Unit Operating Agreement Methods to resolve disputed title Term / Dissolution of the Unit Relationship of the Parties Surface Use Tract Participation Factors for a unitized reservoir may be calculated on (1) acreage basis; (2) acre feet – a calculated percentage based on the thickness of the formation underneath each specific tract; (3) a combination of acreage and geological data; or (4) flow test. 96

Unitization Agreements Agreement for the development and recovery of oil and gas, subject to a single consolidated unit, without regard to separate ownerships. This Agreement defines and sets out the basis for allocating costs and production volumes. n Unitization usually does not affect the Division Order Calculation, unless ownership is reduced by the applicable tract par factors and a unit DOI is set in place for the payment of proceeds. – It has become accepted industry practice to retain the original tract ownership (i. e. the prior well ownership) and have accounting apply the tract par factors / allocations in the revenue distribution process. n n This is especially beneficial if the Tract Pars change based on Phases of Production Unitization, however, can provide challenges to the Division Order Analyst where split-stream marketing is involved – Since the unitization is in the secondary recovery stage, the unitized wells / tracts often are subject to prior marketing contracts – ‘Balancing’ the market percentages to specific pipeline allocation percentages assures accurate payment of production proceeds 97

Conclusion n n The Broker may negotiate the Oil & Gas Lease The Landman may negotiate the Farmout, JOA, PSA The Marketer may negotiate the Crude Oil or Gas Sales / Purchase Contract However, it is the RESPONSIBILITY of the Division Order Analyst, Title Analyst, or Land Analyst to: – Understand the terms and provisions of the Oil and Gas Lease(s) n Including Applicable Laws and Precedents of Court Rulings – Comprehend the terms and conditions of any agreements or purchase contracts – Understand how these Agreements affect the calculations of the Ownership of every Interest Owner in a Producing Property n With this Understanding, the Analyst assures that the Company meets all obligations of these Agreements 98

QUESTIONS? ? 99

d68b7f3fd558016fc07853f41c0c0659.ppt