6b22a70f426552b6b3d19c1d5c0ca738.ppt

- Количество слайдов: 19

Analysis of GRIDCO’s ARR and Bulk supply price for FY 2011 -12 By: World Institute of Sustainable Energy, Pune (Consumer Counsel) 3 rd February, 2011

Proposal of GRIDCO

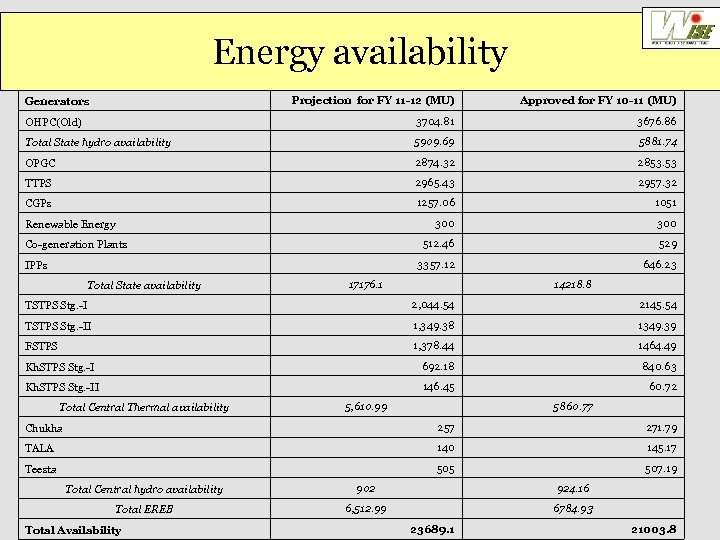

Energy availability Projection for FY 11 -12 (MU) Approved for FY 10 -11 (MU) OHPC(Old) 3704. 81 3676. 86 Total State hydro availability 5909. 69 5881. 74 OPGC 2874. 32 2853. 53 TTPS 2965. 43 2957. 32 CGPs 1257. 06 1051 300 512. 46 529 3357. 12 646. 23 Generators Renewable Energy Co-generation Plants IPPs Total State availability 17176. 1 14218. 8 TSTPS Stg. -I 2, 044. 54 2145. 54 TSTPS Stg. -II 1, 349. 38 1349. 39 FSTPS 1, 378. 44 1464. 49 Kh. STPS Stg. -I 692. 18 840. 63 Kh. STPS Stg. -II 146. 45 60. 72 Total Central Thermal availability 5, 610. 99 5860. 77 Chukha 257 271. 79 TALA 140 145. 17 Teesta 505 507. 19 Total Central hydro availability 902 924. 16 Total EREB 6, 512. 99 6784. 93 Total Availability 23689. 1 21003. 8

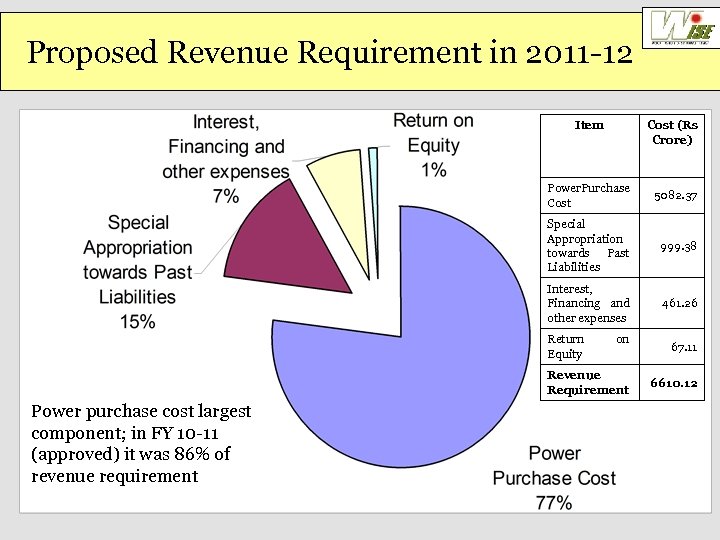

Proposed Revenue Requirement in 2011 -12 Item Cost (Rs Crore) Power Purchase Cost 5082. 37 Special Appropriation towards Past Liabilities 999. 38 Interest, Financing and other expenses 461. 26 Return Equity on Revenue Requirement Power purchase cost largest component; in FY 10 -11 (approved) it was 86% of revenue requirement 67. 11 6610. 12

Analysis of ARR and BSP

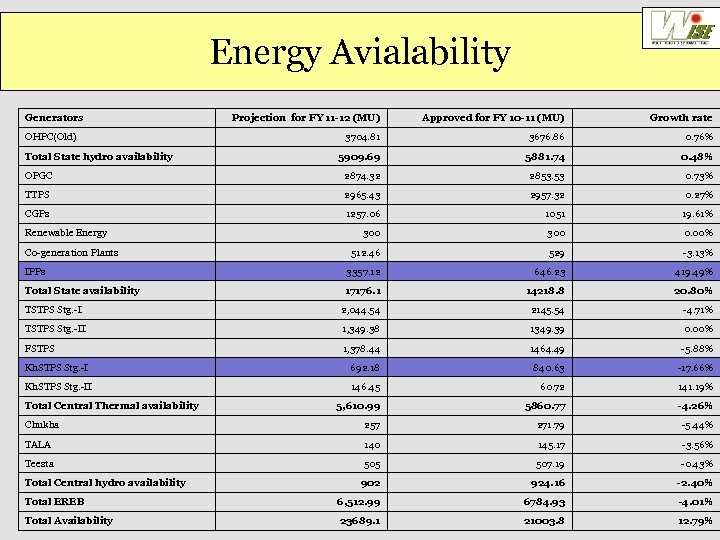

Energy Avialability Generators Projection for FY 11 -12 (MU) Approved for FY 10 -11 (MU) Growth rate 3704. 81 3676. 86 0. 76% 5909. 69 5881. 74 0. 48% OPGC 2874. 32 2853. 53 0. 73% TTPS 2965. 43 2957. 32 0. 27% CGPs 1257. 06 1051 19. 61% 300 0. 00% 512. 46 529 -3. 13% IPPs 3357. 12 646. 23 419. 49% Total State availability 17176. 1 14218. 8 20. 80% TSTPS Stg. -I 2, 044. 54 2145. 54 -4. 71% TSTPS Stg. -II 1, 349. 38 1349. 39 0. 00% FSTPS 1, 378. 44 1464. 49 -5. 88% Kh. STPS Stg. -I 692. 18 840. 63 -17. 66% Kh. STPS Stg. -II 146. 45 60. 72 141. 19% 5, 610. 99 5860. 77 -4. 26% Chukha 257 271. 79 -5. 44% TALA 140 145. 17 -3. 56% Teesta 505 507. 19 -0. 43% 902 924. 16 -2. 40% Total EREB 6, 512. 99 6784. 93 -4. 01% Total Availability 23689. 1 21003. 8 12. 79% OHPC(Old) Total State hydro availability Renewable Energy Co-generation Plants Total Central Thermal availability Total Central hydro availability

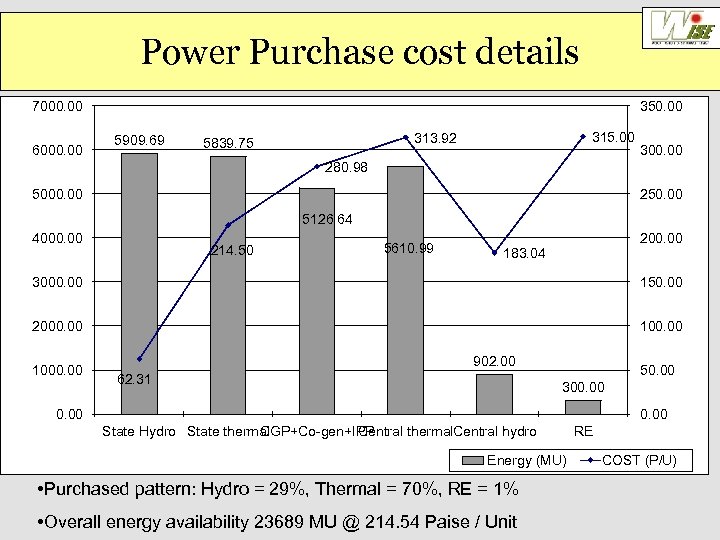

Power Purchase cost details 7000. 00 6000. 00 350. 00 5909. 69 315. 00 313. 92 5839. 75 300. 00 280. 98 5000. 00 250. 00 5126. 64 4000. 00 214. 50 5610. 99 200. 00 183. 04 3000. 00 150. 00 2000. 00 1000. 00 902. 00 62. 31 50. 00 300. 00 State Hydro State thermal CGP+Co-gen+IPP Central thermal. Central hydro Energy (MU) • Purchased pattern: Hydro = 29%, Thermal = 70%, RE = 1% • Overall energy availability 23689 MU @ 214. 54 Paise / Unit RE COST (P/U)

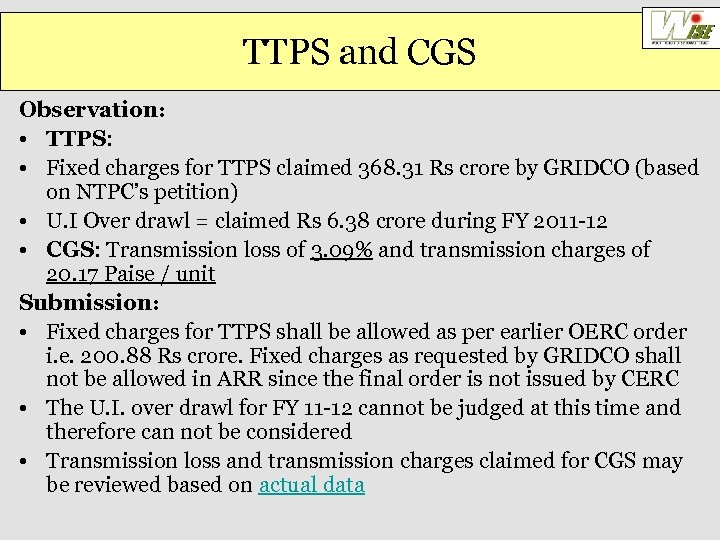

TTPS and CGS Observation: • TTPS: • Fixed charges for TTPS claimed 368. 31 Rs crore by GRIDCO (based on NTPC’s petition) • U. I Over drawl = claimed Rs 6. 38 crore during FY 2011 -12 • CGS: Transmission loss of 3. 09% and transmission charges of 20. 17 Paise / unit Submission: • Fixed charges for TTPS shall be allowed as per earlier OERC order i. e. 200. 88 Rs crore. Fixed charges as requested by GRIDCO shall not be allowed in ARR since the final order is not issued by CERC • The U. I. over drawl for FY 11 -12 cannot be judged at this time and therefore can not be considered • Transmission loss and transmission charges claimed for CGS may be reviewed based on actual data

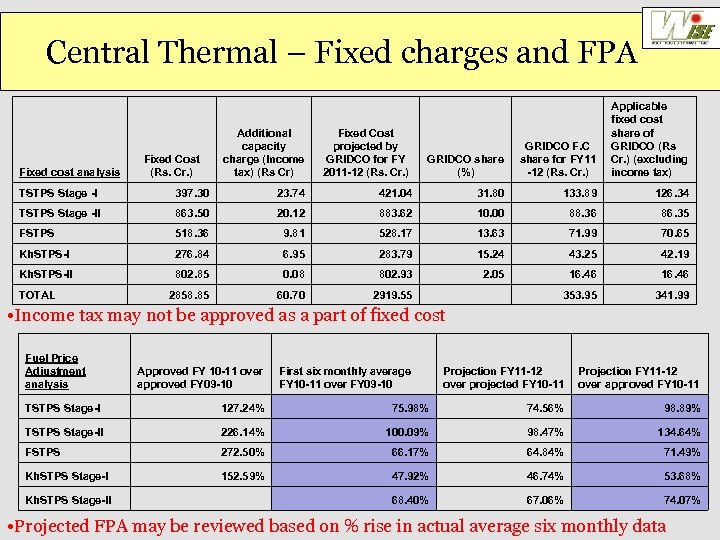

Central Thermal – Fixed charges and FPA Fixed cost analysis Additional capacity Fixed Cost charge (Income (Rs. Cr. ) tax) (Rs Cr) Fixed Cost projected by GRIDCO for FY 2011 -12 (Rs. Cr. ) GRIDCO F. C GRIDCO share for FY 11 (%) -12 (Rs. Cr. ) Applicable fixed cost share of GRIDCO (Rs Cr. ) (excluding income tax) TSTPS Stage -I 397. 30 23. 74 421. 04 31. 80 133. 89 126. 34 TSTPS Stage -II 863. 50 20. 12 883. 62 10. 00 88. 36 86. 35 FSTPS 518. 36 9. 81 528. 17 13. 63 71. 99 70. 65 Kh. STPS-I 276. 84 6. 95 283. 79 15. 24 43. 25 42. 19 Kh. STPS-II 802. 85 0. 08 802. 93 2. 05 16. 46 2858. 85 60. 70 2919. 55 353. 95 341. 99 TOTAL • Income tax may not be approved as a part of fixed cost Fuel Price Adjustment analysis Approved FY 10 -11 over approved FY 09 -10 First six monthly average FY 10 -11 over FY 09 -10 Projection FY 11 -12 over projected FY 10 -11 Projection FY 11 -12 over approved FY 10 -11 TSTPS Stage-I 127. 24% 75. 98% 74. 56% 98. 89% TSTPS Stage-II 226. 14% 100. 09% 98. 47% 134. 64% FSTPS 272. 50% 66. 17% 64. 84% 71. 49% Kh. STPS Stage-I 152. 59% 47. 92% 46. 74% 53. 68% 68. 40% 67. 06% 74. 07% Kh. STPS Stage-II • Projected FPA may be reviewed based on % rise in actual average six monthly data

CGP, IPP and RE Observation: • GRIDCO has proposed to buy power from – CGPs and Co-generation plants as per OERC order@ 299. 39 and 275 P/U respectively – SHP @ average 315 P/U (300 MU) – IPP @ 275 P/U Submission: • As per interim orders on SHPs the tariff for SHP shall be considered as average @ 305 P/U • In case of IPP, Commission may examine the PPA and approve the rate

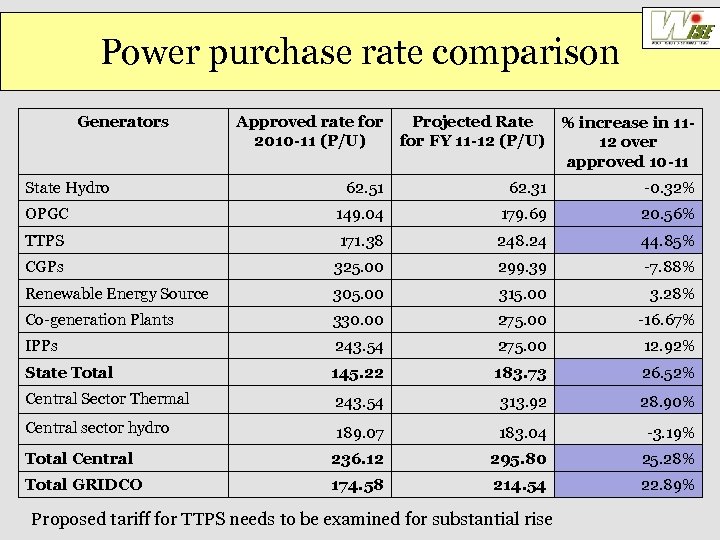

Power purchase rate comparison Generators State Hydro Approved rate for Projected Rate % increase in 112010 -11 (P/U) for FY 11 -12 (P/U) 12 over approved 10 -11 62. 51 62. 31 -0. 32% OPGC 149. 04 179. 69 20. 56% TTPS 171. 38 248. 24 44. 85% CGPs 325. 00 299. 39 -7. 88% Renewable Energy Source 305. 00 315. 00 3. 28% Co-generation Plants 330. 00 275. 00 -16. 67% IPPs 243. 54 275. 00 12. 92% State Total 145. 22 183. 73 26. 52% Central Sector Thermal 243. 54 313. 92 28. 90% Central sector hydro 189. 07 183. 04 -3. 19% Total Central 236. 12 295. 80 25. 28% Total GRIDCO 174. 58 214. 54 22. 89% Proposed tariff for TTPS needs to be examined for substantial rise

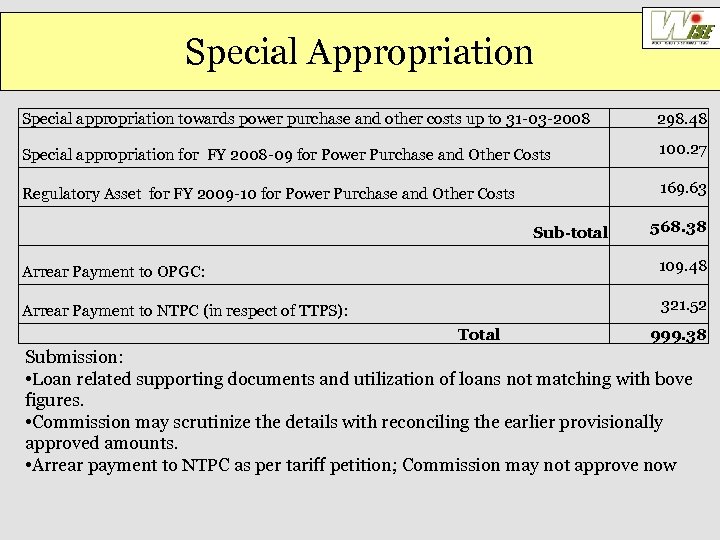

Special Appropriation Special appropriation towards power purchase and other costs up to 31 -03 -2008 298. 48 Special appropriation for FY 2008 -09 for Power Purchase and Other Costs 100. 27 Regulatory Asset for FY 2009 -10 for Power Purchase and Other Costs 169. 63 Sub-total 568. 38 Arrear Payment to OPGC: 109. 48 Arrear Payment to NTPC (in respect of TTPS): Total 321. 52 999. 38 Submission: • Loan related supporting documents and utilization of loans not matching with bove figures. • Commission may scrutinize the details with reconciling the earlier provisionally approved amounts. • Arrear payment to NTPC as per tariff petition; Commission may not approve now

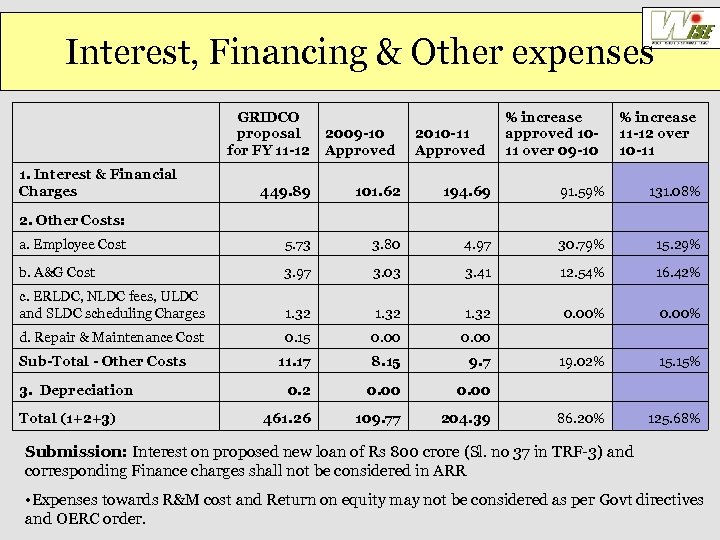

Interest, Financing & Other expenses GRIDCO proposal for FY 11 -12 1. Interest & Financial Charges 2009 -10 Approved 449. 89 2010 -11 Approved 101. 62 194. 69 91. 59% 131. 08% a. Employee Cost 5. 73 3. 80 4. 97 30. 79% 15. 29% b. A&G Cost 3. 97 3. 03 3. 41 12. 54% 16. 42% c. ERLDC, NLDC fees, ULDC and SLDC scheduling Charges 1. 32 0. 00% d. Repair & Maintenance Cost 0. 15 0. 00 11. 17 8. 15 9. 7 19. 02% 15. 15% 0. 2 0. 00 461. 26 109. 77 204. 39 86. 20% 125. 68% 3. Depreciation Total (1+2+3) % increase 11 -12 over 10 -11 2. Other Costs: Sub-Total - Other Costs % increase approved 1011 over 09 -10 Submission: Interest on proposed new loan of Rs 800 crore (Sl. no 37 in TRF-3) and corresponding Finance charges shall not be considered in ARR • Expenses towards R&M cost and Return on equity may not be considered as per Govt directives and OERC order.

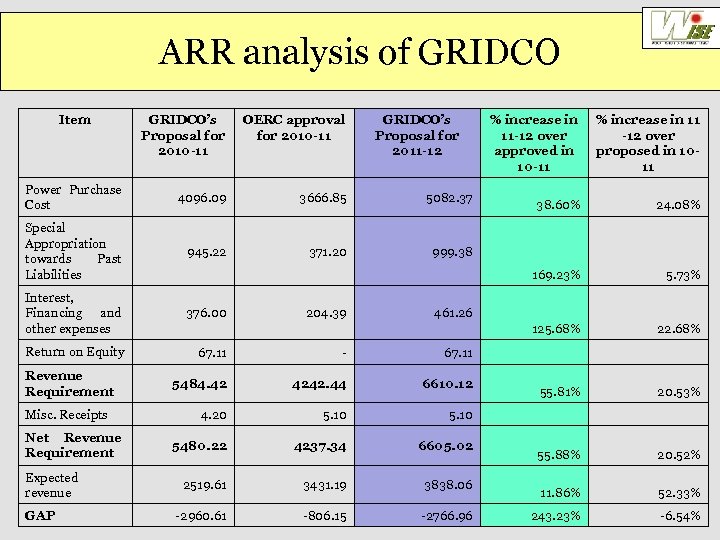

ARR analysis of GRIDCO Item GRIDCO’s Proposal for 2010 -11 OERC approval for 2010 -11 Power Purchase Cost 4096. 09 3666. 85 5082. 37 Special Appropriation towards Past Liabilities 945. 22 371. 20 999. 38 Interest, Financing and other expenses 376. 00 Return on Equity 67. 11 - 67. 11 5484. 42 4242. 44 6610. 12 4. 20 5. 10 5480. 22 4237. 34 6605. 02 2519. 61 3431. 19 3838. 06 -2960. 61 -806. 15 -2766. 96 Revenue Requirement Misc. Receipts Net Revenue Requirement Expected revenue GAP % increase in 11 -12 over approved in 10 -11 % increase in 11 -12 over proposed in 1011 38. 60% 24. 08% 169. 23% 5. 73% 125. 68% 204. 39 GRIDCO’s Proposal for 2011 -12 22. 68% 55. 81% 20. 53% 55. 88% 20. 52% 11. 86% 52. 33% 243. 23% -6. 54% 461. 26

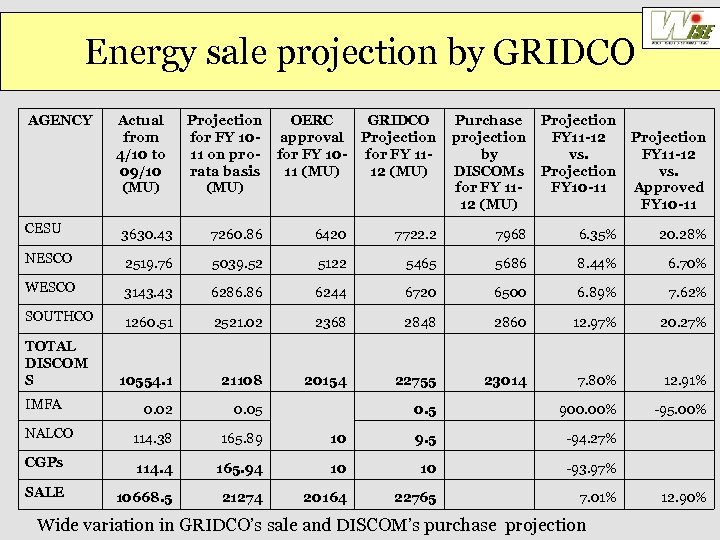

Energy sale projection by GRIDCO AGENCY Actual from 4/10 to 09/10 (MU) Projection OERC GRIDCO Purchase Projection for FY 10 - approval Projection projection FY 11 -12 Projection 11 on pro- for FY 10 - for FY 11 by vs. FY 11 -12 rata basis 11 (MU) 12 (MU) DISCOMs Projection vs. (MU) for FY 11 FY 10 -11 Approved 12 (MU) FY 10 -11 CESU 3630. 43 7260. 86 6420 7722. 2 7968 6. 35% 20. 28% NESCO 2519. 76 5039. 52 5122 5465 5686 8. 44% 6. 70% WESCO 3143. 43 6286. 86 6244 6720 6500 6. 89% 7. 62% SOUTHCO 1260. 51 2521. 02 2368 2848 2860 12. 97% 20. 27% TOTAL DISCOM S 10554. 1 21108 20154 22755 23014 7. 80% 12. 91% 0. 02 0. 05 0. 5 900. 00% -95. 00% NALCO 114. 38 165. 89 10 9. 5 -94. 27% CGPs 114. 4 165. 94 10 10 -93. 97% SALE 10668. 5 21274 20164 22765 7. 01% IMFA Wide variation in GRIDCO’s sale and DISCOM’s purchase projection 12. 90%

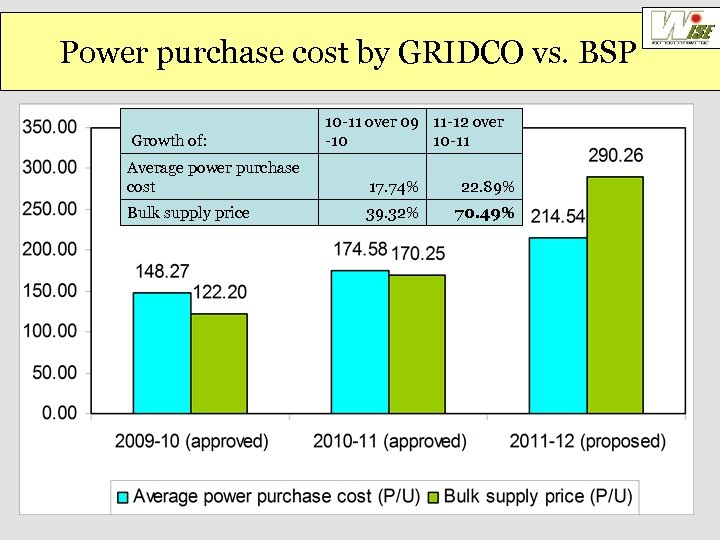

Power purchase cost by GRIDCO vs. BSP Growth of: 10 -11 over 09 11 -12 over -10 10 -11 Average power purchase cost 17. 74% 22. 89% Bulk supply price 39. 32% 70. 49%

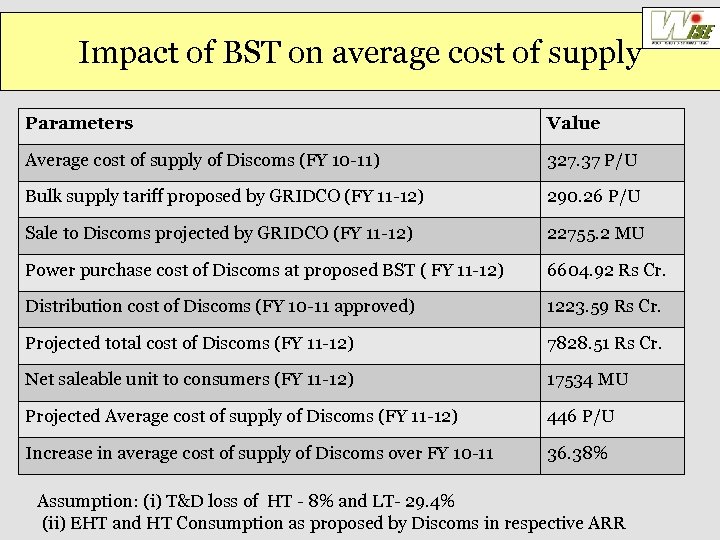

Impact of BST on average cost of supply Parameters Value Average cost of supply of Discoms (FY 10 -11) 327. 37 P/U Bulk supply tariff proposed by GRIDCO (FY 11 -12) 290. 26 P/U Sale to Discoms projected by GRIDCO (FY 11 -12) 22755. 2 MU Power purchase cost of Discoms at proposed BST ( FY 11 -12) 6604. 92 Rs Cr. Distribution cost of Discoms (FY 10 -11 approved) 1223. 59 Rs Cr. Projected total cost of Discoms (FY 11 -12) 7828. 51 Rs Cr. Net saleable unit to consumers (FY 11 -12) 17534 MU Projected Average cost of supply of Discoms (FY 11 -12) 446 P/U Increase in average cost of supply of Discoms over FY 10 -11 36. 38% Assumption: (i) T&D loss of HT - 8% and LT- 29. 4% (ii) EHT and HT Consumption as proposed by Discoms in respective ARR

Summary • Design of BSP for DISCOMs has direct impact on consumer tariff; therefore, the Hon. Commission may consider the following observation of Consumer Counsel related GRIDCO ARR: • Energy availability from all sources may be reviewed • Review of fixed charges and UI over drawl in case of TTPS • Review of fixed charges and FPA in case of Central thermal • Review of transmission loss and transmission charges in case of Central sector projects • Power procurement rates from CGP, Co-gen, IPP and RE may be reviewed • Interest on proposed new loan shall not be pass through in the ARR • R&M cost and Ro. E shall not be pass through in the ARR • Energy sale to DISCOMs may be reviewed based on DISCOMs submission

Thank you

6b22a70f426552b6b3d19c1d5c0ca738.ppt