Business Entities Powerpoint.pptx

- Количество слайдов: 15

An Overview of U. S. Business Entities

Selecting Your Business Structure • Sole Proprietorship • Corporations • General Partnership • Limited Liability Company 2

Overview of Major Types of Business Entity 3

Things to Consider Tax Treatment Flexibility Need formalities, “hardwired” provisions Liability Risk What type of assets does it hold? 4

Sole Proprietorship Requires no documentation to be formed- just commence business All profits/losses of the business are passed through to individual owner for federal tax purposes Sole proprietor is personally liable for all debts, obligations and liabilities of the business. A single member limited liability company can be formed quickly, easily, and inexpensively. 5

Corporations-Generally Limited liability Perpetual existence Centralized management There are two distinct types of corporations for income tax purposes: Subchapter C Corporation and Subchapter S Corporation. Very formal structure. 6

Advantages of C Corporation Required for most public companies Attractive foreign and tax exempt investors Established financing model for VCs and early stage funders (seed) You can use different classes of stock in order to divide the economic interests and voting rights in a C corporation. 7

Disadvantages of C Corporation DOUBLE TAXATION- the effective federal tax rate on the “built in gain” of appreciated property owned by a C Corporation can be as high as 60%. The shareholders receiving the distributed property are also subject to tax. Not generally used in the real estate area. 8

General Partnerships ▪ Two or more individuals carrying on as a business for profit forms a partnership whether intended or not unless another form is selected. ▪ Not taxed as a separate entity. ▪ Income and losses pass through (similar to S corporation) ▪ UNLIMITED PERSONAL LIABILITY - for actions taken by any member of the partnership on behalf of the partnership. 9

Limited Liability Company (LLC) Limited liability for members Must file articles or certificate to create. An operating agreement governs the affairs Can be taxed as disregarded entity (one member); partnership (two or more members); or C or S corporation (any number of members). Flexible governance, management, operations “Relatively” new (since 1977) 1

Limited Liability Company (LLC) cont. Flexible in management ● Member managed ● Manager managed ● Board of Directors Generally easy to convert to another form of entity as business grows Maryland’s Conversion Statute (effective Oct. 2013) 1

LLCs are increasingly the most commonly recommended entity for start ups. 1

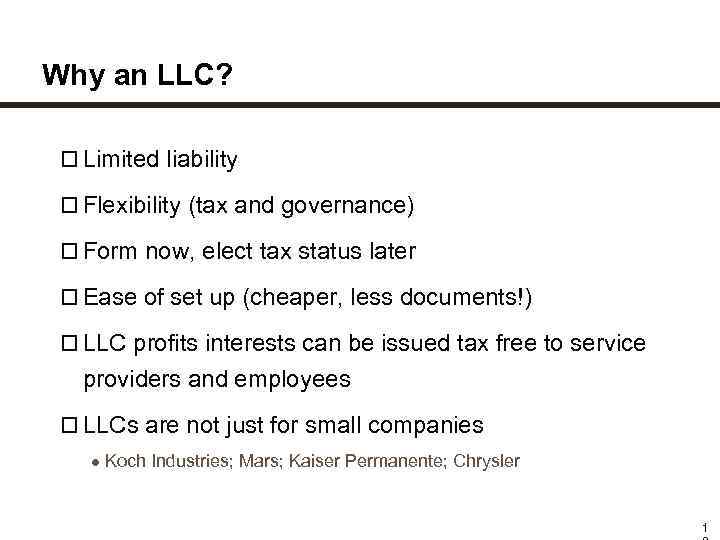

Why an LLC? Limited liability Flexibility (tax and governance) Form now, elect tax status later Ease of set up (cheaper, less documents!) LLC profits interests can be issued tax free to service providers and employees LLCs are not just for small companies ● Koch Industries; Mars; Kaiser Permanente; Chrysler 1

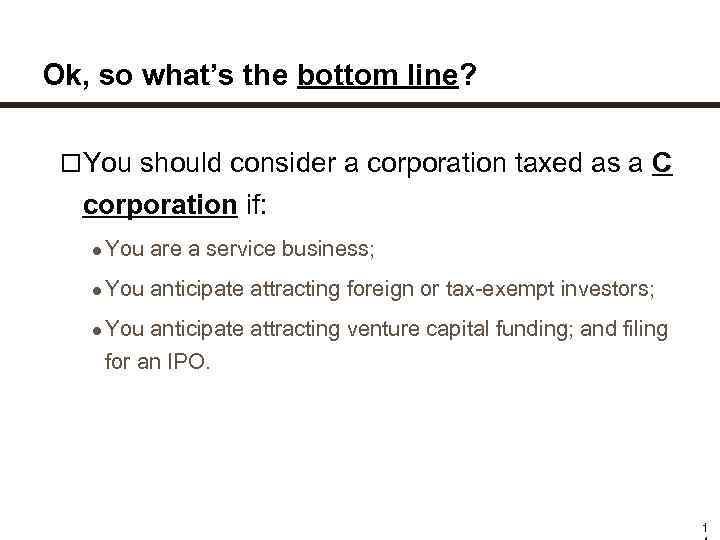

Ok, so what’s the bottom line? You should consider a corporation taxed as a C corporation if: ● You are a service business; ● You anticipate attracting foreign or tax-exempt investors; ● You anticipate attracting venture capital funding; and filing for an IPO. 1

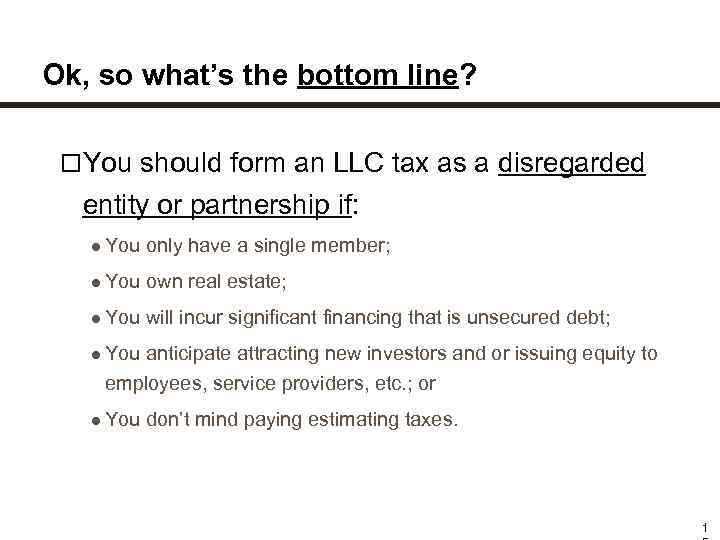

Ok, so what’s the bottom line? You should form an LLC tax as a disregarded entity or partnership if: ● You only have a single member; ● You own real estate; ● You will incur significant financing that is unsecured debt; ● You anticipate attracting new investors and or issuing equity to employees, service providers, etc. ; or ● You don’t mind paying estimating taxes. 1

Business Entities Powerpoint.pptx