a26b6a3aa4bd4bf60dd3414425f541c5.ppt

- Количество слайдов: 50

An Overview of Strategy: Past, Present, and Future James Oldroyd Kellogg Graduate School of Management Northwestern University J-oldroyd@northwestern. edu

An Overview of Strategy: Past, Present, and Future James Oldroyd Kellogg Graduate School of Management Northwestern University J-oldroyd@northwestern. edu

Overview of Strategy v v v Definition and Brief History of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Ø Business Building Growth Short-term and Long-term v Conclusion 1

Overview of Strategy v v v Definition and Brief History of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Ø Business Building Growth Short-term and Long-term v Conclusion 1

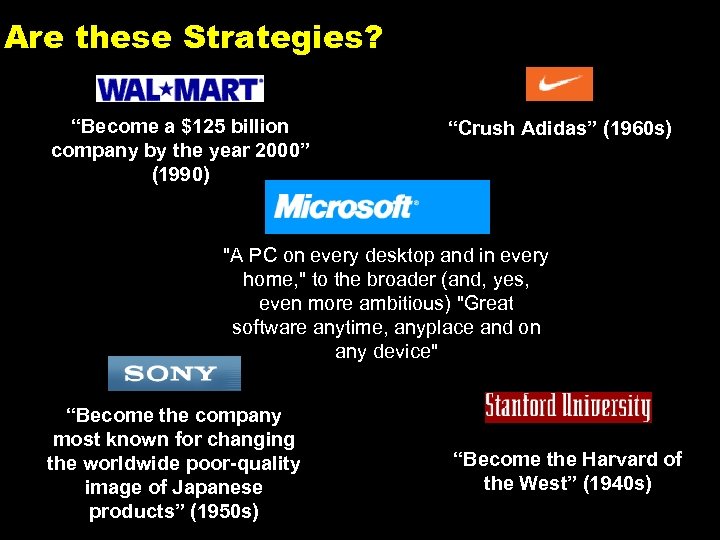

Are these Strategies? “Become a $125 billion company by the year 2000” (1990) “Crush Adidas” (1960 s) "A PC on every desktop and in every home, " to the broader (and, yes, even more ambitious) "Great software anytime, anyplace and on any device" “Become the company most known for changing the worldwide poor-quality image of Japanese products” (1950 s) “Become the Harvard of the West” (1940 s) 2

Are these Strategies? “Become a $125 billion company by the year 2000” (1990) “Crush Adidas” (1960 s) "A PC on every desktop and in every home, " to the broader (and, yes, even more ambitious) "Great software anytime, anyplace and on any device" “Become the company most known for changing the worldwide poor-quality image of Japanese products” (1950 s) “Become the Harvard of the West” (1940 s) 2

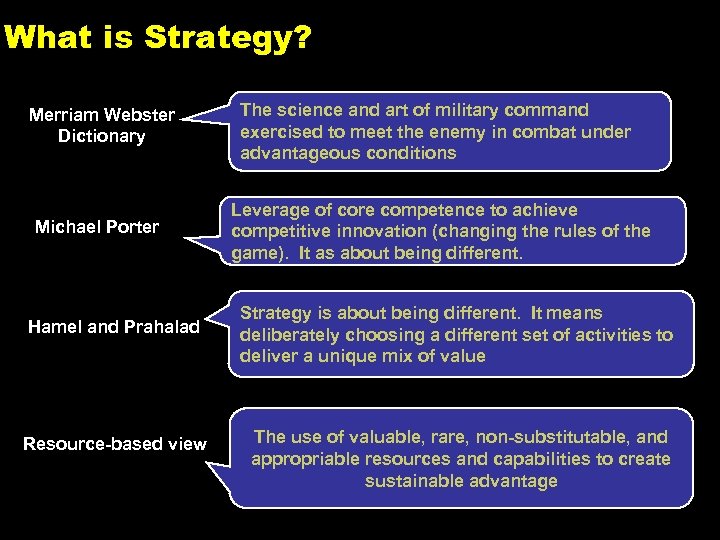

What is Strategy? Merriam Webster Dictionary The science and art of military command exercised to meet the enemy in combat under advantageous conditions Michael Porter Leverage of core competence to achieve competitive innovation (changing the rules of the game). It as about being different. Hamel and Prahalad Resource-based view Strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value The use of valuable, rare, non-substitutable, and appropriable resources and capabilities to create sustainable advantage 3

What is Strategy? Merriam Webster Dictionary The science and art of military command exercised to meet the enemy in combat under advantageous conditions Michael Porter Leverage of core competence to achieve competitive innovation (changing the rules of the game). It as about being different. Hamel and Prahalad Resource-based view Strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value The use of valuable, rare, non-substitutable, and appropriable resources and capabilities to create sustainable advantage 3

Strategy as Art The Military Analogy Von Clausewitz view of strategy: Strategy was not a formula. Detailed planning always failed due to change events, imperfections in execution, and the leadership of the opposition. Strategy was the art of the broken-field runner; strategy was not a lengthy plan, but an idea that evolved through changing circumstances. Strategy involved the instinctive savvy of the best generals 4

Strategy as Art The Military Analogy Von Clausewitz view of strategy: Strategy was not a formula. Detailed planning always failed due to change events, imperfections in execution, and the leadership of the opposition. Strategy was the art of the broken-field runner; strategy was not a lengthy plan, but an idea that evolved through changing circumstances. Strategy involved the instinctive savvy of the best generals 4

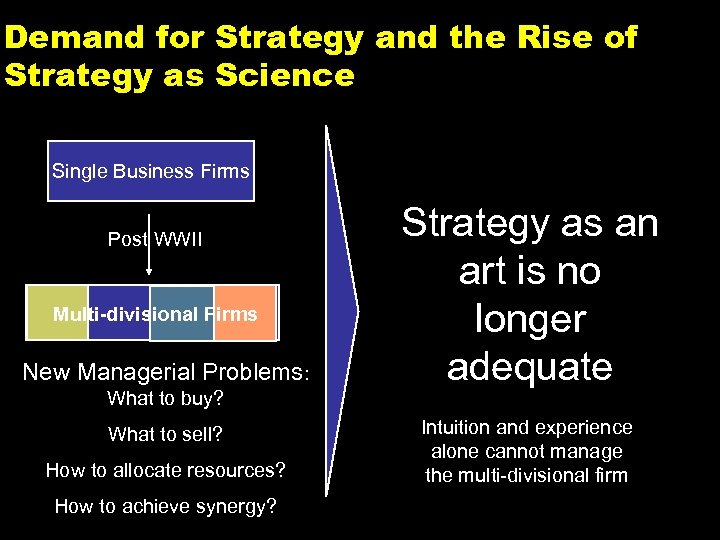

Demand for Strategy and the Rise of Strategy as Science Single Business Firms Post WWII Multi-divisional Firms New Managerial Problems: What to buy? What to sell? How to allocate resources? Strategy as an art is no longer adequate Intuition and experience alone cannot manage the multi-divisional firm How to achieve synergy? 5

Demand for Strategy and the Rise of Strategy as Science Single Business Firms Post WWII Multi-divisional Firms New Managerial Problems: What to buy? What to sell? How to allocate resources? Strategy as an art is no longer adequate Intuition and experience alone cannot manage the multi-divisional firm How to achieve synergy? 5

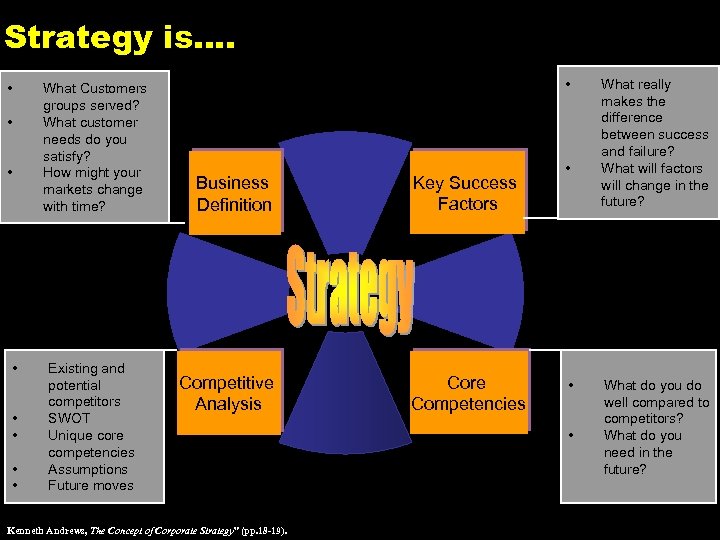

Strategy is…. • What Customers groups served? What customer needs do you satisfy? How might your markets change with time? • • Existing and potential competitors SWOT Unique core competencies Assumptions Future moves • Business Definition Competitive Analysis Kenneth Andrews, The Concept of Corporate Strategy” (pp. 18 -19). Key Success Factors Core Competencies • • • What really makes the difference between success and failure? What will factors will change in the future? What do you do well compared to competitors? What do you need in the future? 6

Strategy is…. • What Customers groups served? What customer needs do you satisfy? How might your markets change with time? • • Existing and potential competitors SWOT Unique core competencies Assumptions Future moves • Business Definition Competitive Analysis Kenneth Andrews, The Concept of Corporate Strategy” (pp. 18 -19). Key Success Factors Core Competencies • • • What really makes the difference between success and failure? What will factors will change in the future? What do you do well compared to competitors? What do you need in the future? 6

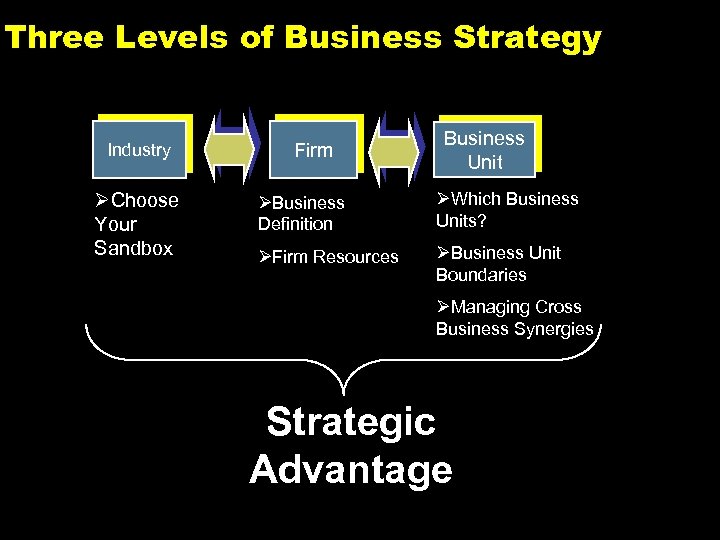

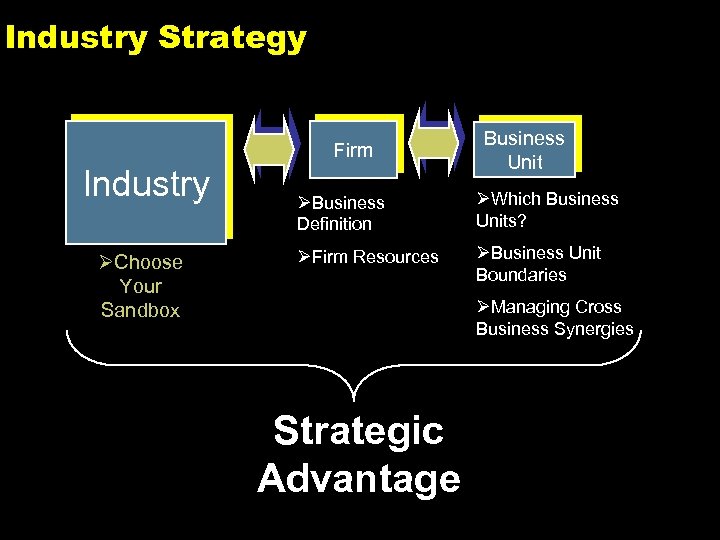

Three Levels of Business Strategy Industry ØChoose Your Sandbox Firm Business Unit ØBusiness Definition ØWhich Business Units? ØFirm Resources ØBusiness Unit Boundaries ØManaging Cross Business Synergies Strategic Advantage 7

Three Levels of Business Strategy Industry ØChoose Your Sandbox Firm Business Unit ØBusiness Definition ØWhich Business Units? ØFirm Resources ØBusiness Unit Boundaries ØManaging Cross Business Synergies Strategic Advantage 7

Overview of Strategy v v v Definition and Brief History of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Ø Business Building Growth Short-term and Long-term v Conclusion 8

Overview of Strategy v v v Definition and Brief History of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Ø Business Building Growth Short-term and Long-term v Conclusion 8

Industry Strategy Firm Industry ØChoose Your Sandbox Business Unit ØBusiness Definition ØWhich Business Units? ØFirm Resources ØBusiness Unit Boundaries ØManaging Cross Business Synergies Strategic Advantage 9

Industry Strategy Firm Industry ØChoose Your Sandbox Business Unit ØBusiness Definition ØWhich Business Units? ØFirm Resources ØBusiness Unit Boundaries ØManaging Cross Business Synergies Strategic Advantage 9

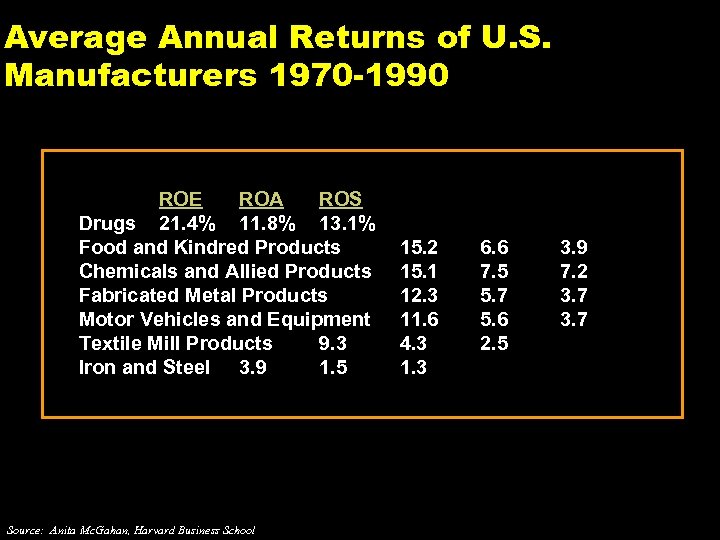

Average Annual Returns of U. S. Manufacturers 1970 -1990 ROE ROA ROS Drugs 21. 4% 11. 8% 13. 1% Food and Kindred Products Chemicals and Allied Products Fabricated Metal Products Motor Vehicles and Equipment Textile Mill Products 9. 3 Iron and Steel 3. 9 1. 5 Source: Anita Mc. Gahan, Harvard Business School 15. 2 15. 1 12. 3 11. 6 4. 3 1. 3 6. 6 7. 5 5. 7 5. 6 2. 5 3. 9 7. 2 3. 7 10

Average Annual Returns of U. S. Manufacturers 1970 -1990 ROE ROA ROS Drugs 21. 4% 11. 8% 13. 1% Food and Kindred Products Chemicals and Allied Products Fabricated Metal Products Motor Vehicles and Equipment Textile Mill Products 9. 3 Iron and Steel 3. 9 1. 5 Source: Anita Mc. Gahan, Harvard Business School 15. 2 15. 1 12. 3 11. 6 4. 3 1. 3 6. 6 7. 5 5. 7 5. 6 2. 5 3. 9 7. 2 3. 7 10

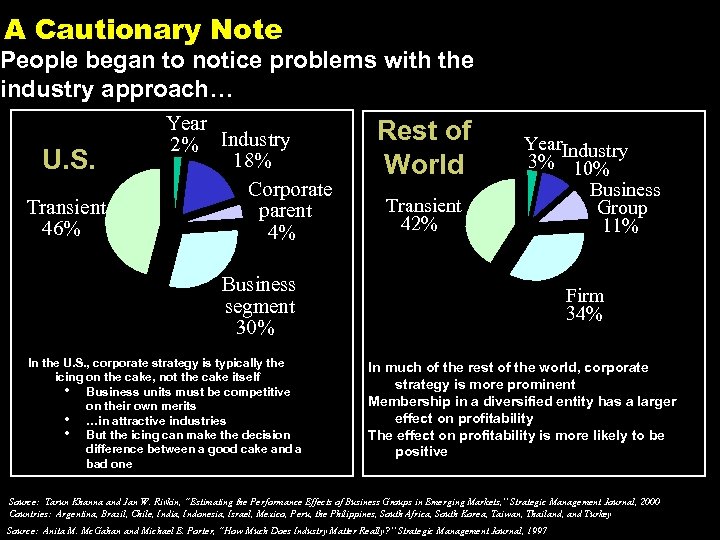

A Cautionary Note People began to notice problems with the industry approach… U. S. Transient 46% Year 2% Industry 18% Corporate parent 4% Rest of World Transient 42% Year. Industry 3% 10% Business Group 11% Business segment 30% In the U. S. , corporate strategy is typically the icing on the cake, not the cake itself • Business units must be competitive on their own merits • …in attractive industries • But the icing can make the decision difference between a good cake and a bad one Firm 34% In much of the rest of the world, corporate strategy is more prominent Membership in a diversified entity has a larger effect on profitability The effect on profitability is more likely to be positive Source: Tarun Khanna and Jan W. Rivkin, “Estimating the Performance Effects of Business Groups in Emerging Markets, ” Strategic Management Journal, 2000 Countries: Argentina, Brazil, Chile, India, Indonesia, Israel, Mexico, Peru, the Philippines, South Africa, South Korea, Taiwan, Thailand, and Turkey Source: Anita M. Mc. Gahan and Michael E. Porter, “How Much Does Industry Matter Really? ” Strategic Management Journal, 1997 11

A Cautionary Note People began to notice problems with the industry approach… U. S. Transient 46% Year 2% Industry 18% Corporate parent 4% Rest of World Transient 42% Year. Industry 3% 10% Business Group 11% Business segment 30% In the U. S. , corporate strategy is typically the icing on the cake, not the cake itself • Business units must be competitive on their own merits • …in attractive industries • But the icing can make the decision difference between a good cake and a bad one Firm 34% In much of the rest of the world, corporate strategy is more prominent Membership in a diversified entity has a larger effect on profitability The effect on profitability is more likely to be positive Source: Tarun Khanna and Jan W. Rivkin, “Estimating the Performance Effects of Business Groups in Emerging Markets, ” Strategic Management Journal, 2000 Countries: Argentina, Brazil, Chile, India, Indonesia, Israel, Mexico, Peru, the Philippines, South Africa, South Korea, Taiwan, Thailand, and Turkey Source: Anita M. Mc. Gahan and Michael E. Porter, “How Much Does Industry Matter Really? ” Strategic Management Journal, 1997 11

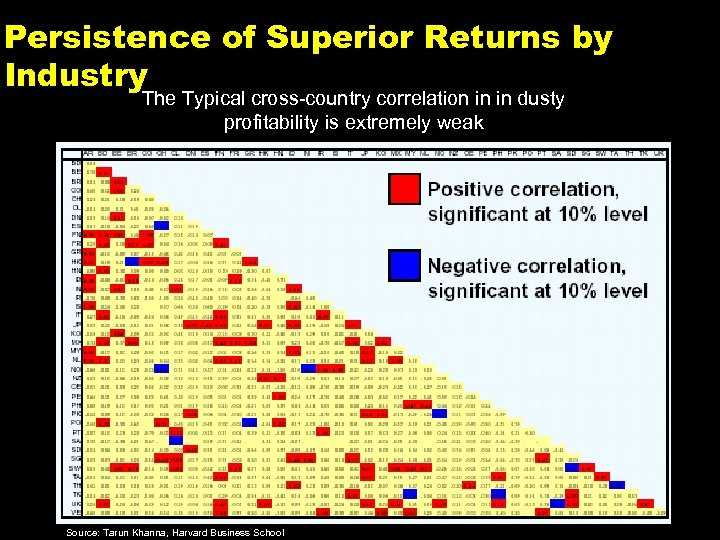

Persistence of Superior Returns by Industry The Typical cross-country correlation in in dusty profitability is extremely weak Source: Tarun Khanna, Harvard Business School 12

Persistence of Superior Returns by Industry The Typical cross-country correlation in in dusty profitability is extremely weak Source: Tarun Khanna, Harvard Business School 12

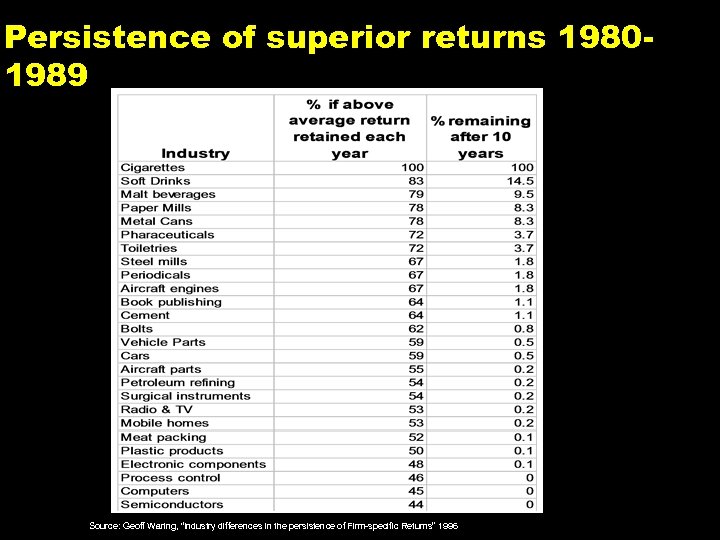

Persistence of superior returns 19801989 Source: Geoff Waring, “Industry differences in the persistence of Firm-specific Returns” 1996 13

Persistence of superior returns 19801989 Source: Geoff Waring, “Industry differences in the persistence of Firm-specific Returns” 1996 13

Overview of Strategy v v v Definition and Brief History of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Ø Business Building Growth Short-term and Long-term v Conclusion 14

Overview of Strategy v v v Definition and Brief History of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Ø Business Building Growth Short-term and Long-term v Conclusion 14

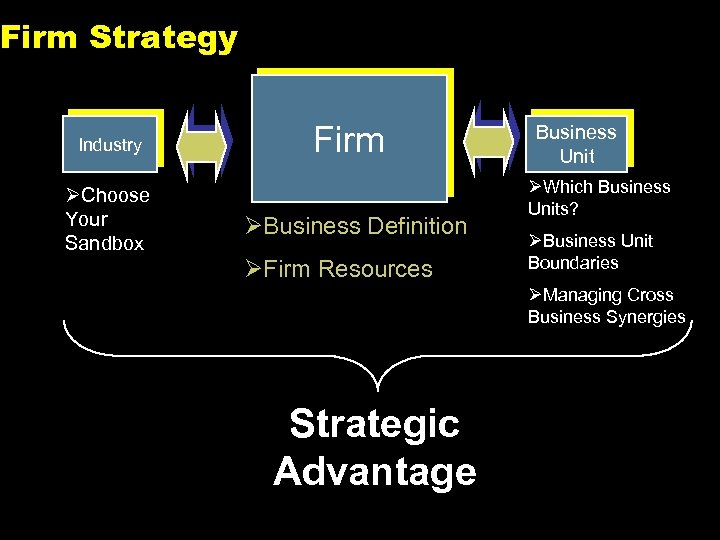

Firm Strategy Industry ØChoose Your Sandbox Firm ØBusiness Definition ØFirm Resources Business Unit ØWhich Business Units? ØBusiness Unit Boundaries ØManaging Cross Business Synergies Strategic Advantage 15

Firm Strategy Industry ØChoose Your Sandbox Firm ØBusiness Definition ØFirm Resources Business Unit ØWhich Business Units? ØBusiness Unit Boundaries ØManaging Cross Business Synergies Strategic Advantage 15

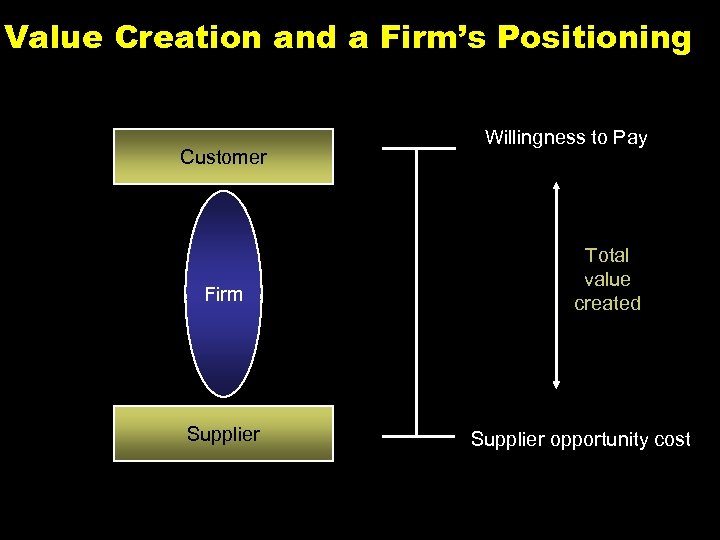

Value Creation and a Firm’s Positioning Customer Firm Supplier Willingness to Pay Total value created Supplier opportunity cost 16

Value Creation and a Firm’s Positioning Customer Firm Supplier Willingness to Pay Total value created Supplier opportunity cost 16

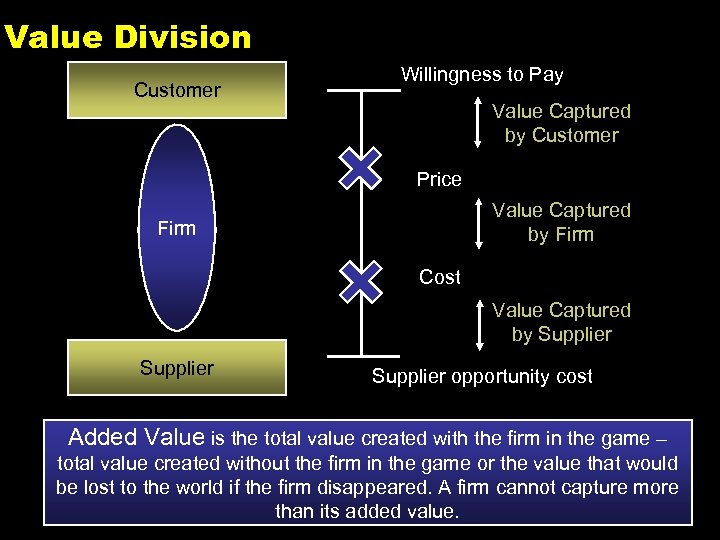

Value Division Customer Willingness to Pay Value Captured by Customer Price Value Captured by Firm Cost Value Captured by Supplier opportunity cost Added Value is the total value created with the firm in the game – total value created without the firm in the game or the value that would be lost to the world if the firm disappeared. A firm cannot capture more than its added value. 17

Value Division Customer Willingness to Pay Value Captured by Customer Price Value Captured by Firm Cost Value Captured by Supplier opportunity cost Added Value is the total value created with the firm in the game – total value created without the firm in the game or the value that would be lost to the world if the firm disappeared. A firm cannot capture more than its added value. 17

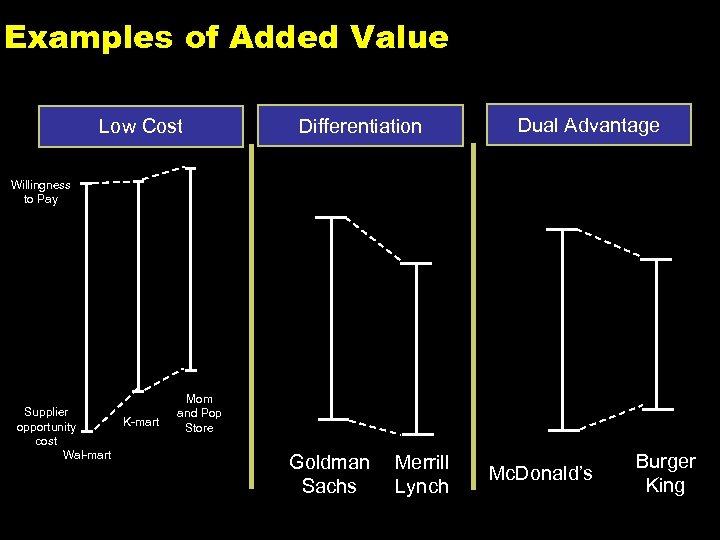

Examples of Added Value Low Cost Differentiation Dual Advantage Willingness to Pay Supplier K-mart opportunity cost Wal-mart Mom and Pop Store Goldman Sachs Merrill Lynch Mc. Donald’s Burger King 18

Examples of Added Value Low Cost Differentiation Dual Advantage Willingness to Pay Supplier K-mart opportunity cost Wal-mart Mom and Pop Store Goldman Sachs Merrill Lynch Mc. Donald’s Burger King 18

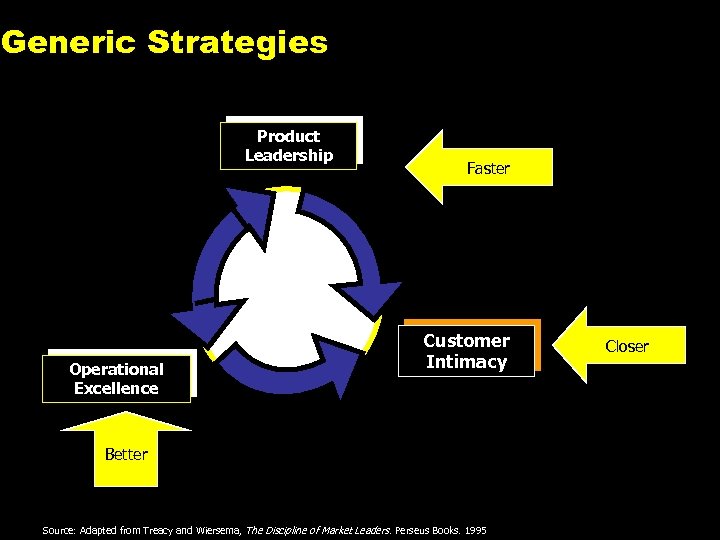

Generic Strategies Product Leadership Operational Excellence Faster Customer Intimacy Closer Better Source: Adapted from Treacy and Wiersema, The Discipline of Market Leaders. Perseus Books. 1995 19

Generic Strategies Product Leadership Operational Excellence Faster Customer Intimacy Closer Better Source: Adapted from Treacy and Wiersema, The Discipline of Market Leaders. Perseus Books. 1995 19

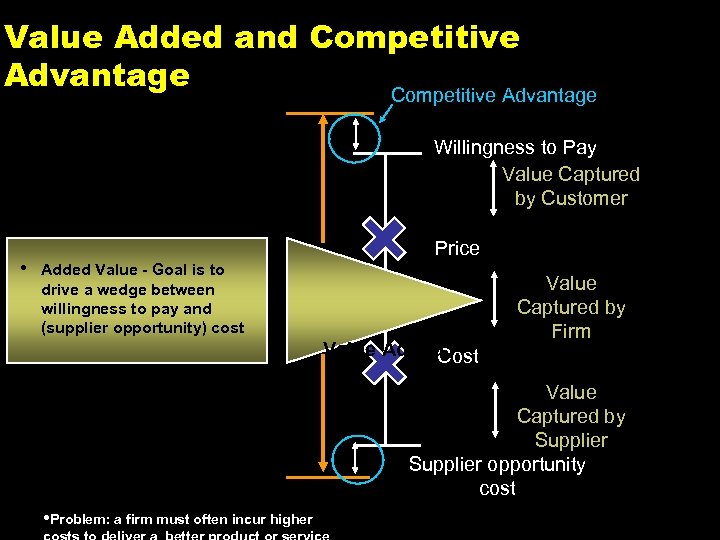

Value Added and Competitive Advantage Willingness to Pay Value Captured by Customer • Price Added Value - Goal is to drive a wedge between willingness to pay and (supplier opportunity) cost Value Added Cost Value Captured by Firm Value Captured by Supplier opportunity cost • Problem: a firm must often incur higher 20

Value Added and Competitive Advantage Willingness to Pay Value Captured by Customer • Price Added Value - Goal is to drive a wedge between willingness to pay and (supplier opportunity) cost Value Added Cost Value Captured by Firm Value Captured by Supplier opportunity cost • Problem: a firm must often incur higher 20

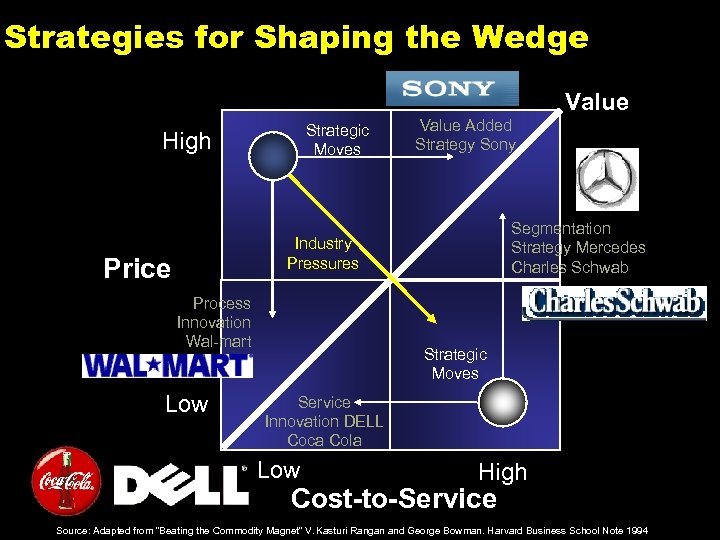

Strategies for Shaping the Wedge Value Strategic Moves High Value Added Strategy Sony Segmentation Strategy Mercedes Charles Schwab Industry Pressures Price Process Innovation Wal-mart Low Strategic Moves Service Innovation DELL Coca Cola Low High Cost-to-Service Source: Adapted from “Beating the Commodity Magnet” V. Kasturi Rangan and George Bowman. Harvard Business School Note 1994 21

Strategies for Shaping the Wedge Value Strategic Moves High Value Added Strategy Sony Segmentation Strategy Mercedes Charles Schwab Industry Pressures Price Process Innovation Wal-mart Low Strategic Moves Service Innovation DELL Coca Cola Low High Cost-to-Service Source: Adapted from “Beating the Commodity Magnet” V. Kasturi Rangan and George Bowman. Harvard Business School Note 1994 21

Mini-Case: Marketing Strategy at Delta In the mid 1980 s Delta’s market researchers found that customers (particularly business customers) were strongly influenced to choose a particular airline by the airline’s frequent flyer program. Consequently, to motivate customers to choose Delta, they teamed up with American Express (an exclusive arrangement) to offer a special program: customers could receive triple miles if they would fly on Delta and purchase the tickets using the American Express card. How would you evaluate Delta’s strategy? (Good or bad? ) 22

Mini-Case: Marketing Strategy at Delta In the mid 1980 s Delta’s market researchers found that customers (particularly business customers) were strongly influenced to choose a particular airline by the airline’s frequent flyer program. Consequently, to motivate customers to choose Delta, they teamed up with American Express (an exclusive arrangement) to offer a special program: customers could receive triple miles if they would fly on Delta and purchase the tickets using the American Express card. How would you evaluate Delta’s strategy? (Good or bad? ) 22

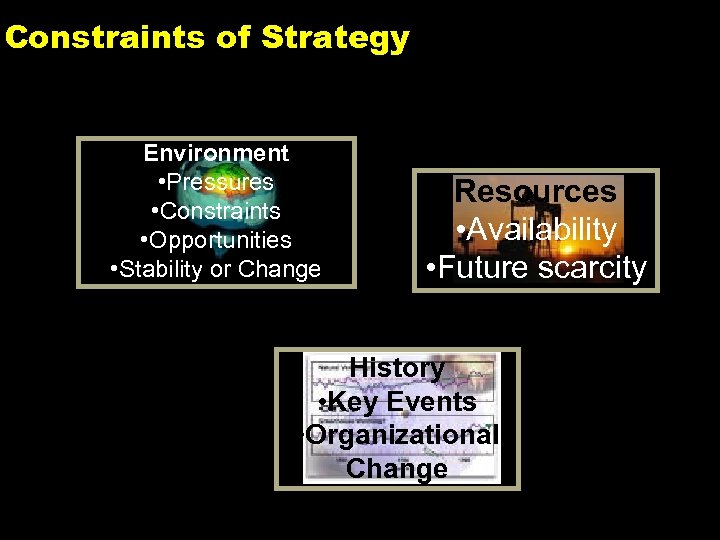

Constraints of Strategy Environment • Pressures • Constraints • Opportunities • Stability or Change Resources • Availability • Future scarcity History • Key Events • Organizational Change 23

Constraints of Strategy Environment • Pressures • Constraints • Opportunities • Stability or Change Resources • Availability • Future scarcity History • Key Events • Organizational Change 23

Overview of Strategy v v v Definition and Brief History of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Ø Business Building Growth Short-term and Long-term v Conclusion 24

Overview of Strategy v v v Definition and Brief History of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Ø Business Building Growth Short-term and Long-term v Conclusion 24

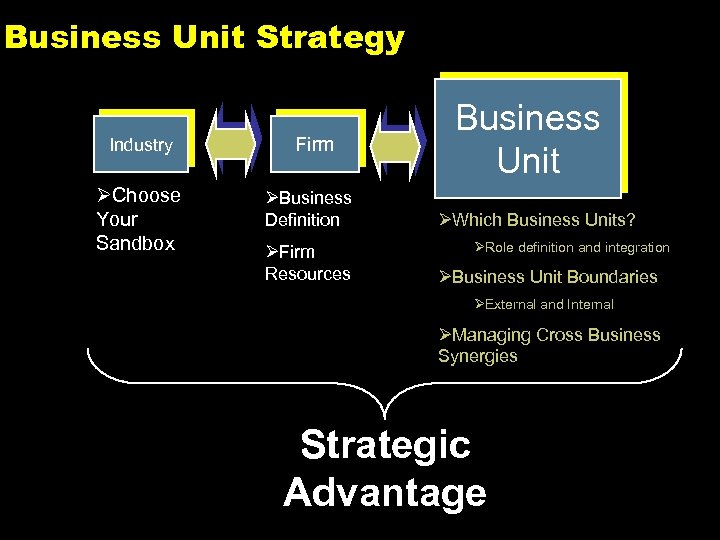

Business Unit Strategy Industry ØChoose Your Sandbox Firm ØBusiness Definition ØFirm Resources Business Unit ØWhich Business Units? ØRole definition and integration ØBusiness Unit Boundaries ØExternal and Internal ØManaging Cross Business Synergies Strategic Advantage 25

Business Unit Strategy Industry ØChoose Your Sandbox Firm ØBusiness Definition ØFirm Resources Business Unit ØWhich Business Units? ØRole definition and integration ØBusiness Unit Boundaries ØExternal and Internal ØManaging Cross Business Synergies Strategic Advantage 25

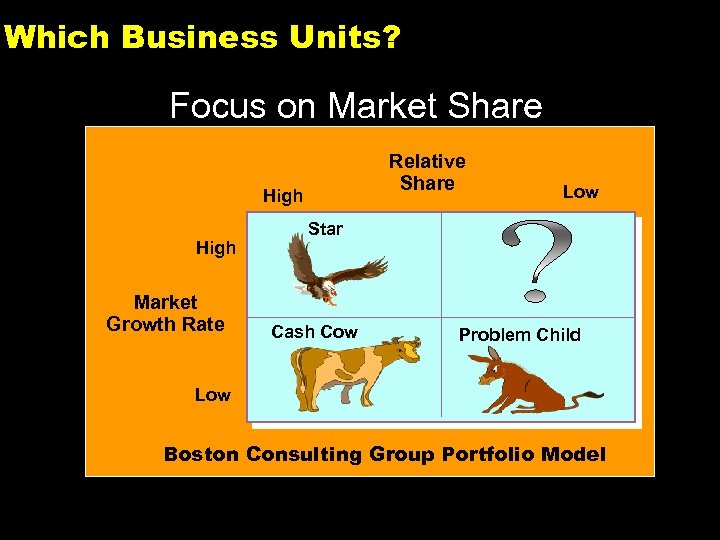

Which Business Units? Focus on Market Share Relative Share High Low Star Relative Share Market Growth Rate Cash Cow Problem Child Dog Low Boston Consulting Group Portfolio Model 26

Which Business Units? Focus on Market Share Relative Share High Low Star Relative Share Market Growth Rate Cash Cow Problem Child Dog Low Boston Consulting Group Portfolio Model 26

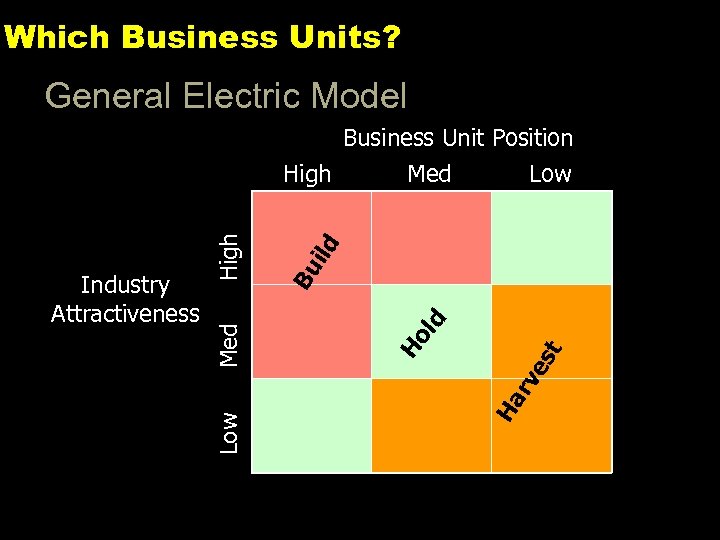

Which Business Units? General Electric Model Business Unit Position Low Ha rv es t ld Bu ild Med Ho Med Low Industry Attractiveness High 27

Which Business Units? General Electric Model Business Unit Position Low Ha rv es t ld Bu ild Med Ho Med Low Industry Attractiveness High 27

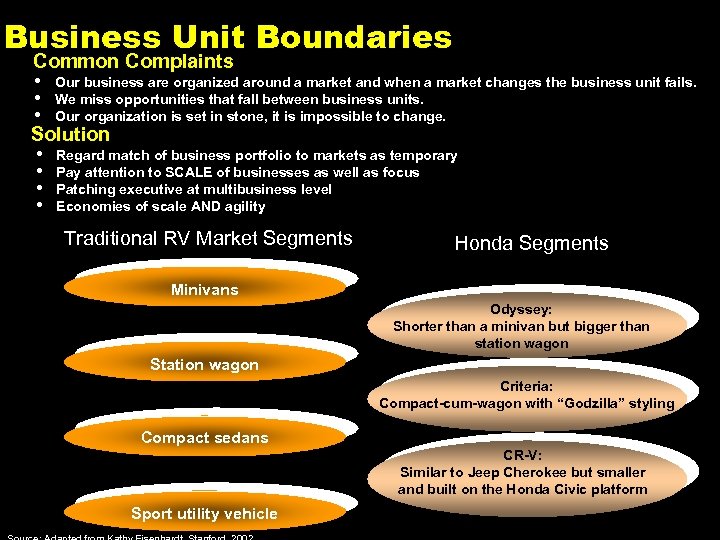

Business Unit Boundaries Common Complaints • • • Our business are organized around a market and when a market changes the business unit fails. We miss opportunities that fall between business units. Our organization is set in stone, it is impossible to change. • • Regard match of business portfolio to markets as temporary Pay attention to SCALE of businesses as well as focus Patching executive at multibusiness level Economies of scale AND agility Solution Traditional RV Market Segments Honda Segments Minivans Odyssey: Shorter than a minivan but bigger than station wagon Station wagon Criteria: Compact-cum-wagon with “Godzilla” styling Compact sedans CR-V: Similar to Jeep Cherokee but smaller and built on the Honda Civic platform Sport utility vehicle 28

Business Unit Boundaries Common Complaints • • • Our business are organized around a market and when a market changes the business unit fails. We miss opportunities that fall between business units. Our organization is set in stone, it is impossible to change. • • Regard match of business portfolio to markets as temporary Pay attention to SCALE of businesses as well as focus Patching executive at multibusiness level Economies of scale AND agility Solution Traditional RV Market Segments Honda Segments Minivans Odyssey: Shorter than a minivan but bigger than station wagon Station wagon Criteria: Compact-cum-wagon with “Godzilla” styling Compact sedans CR-V: Similar to Jeep Cherokee but smaller and built on the Honda Civic platform Sport utility vehicle 28

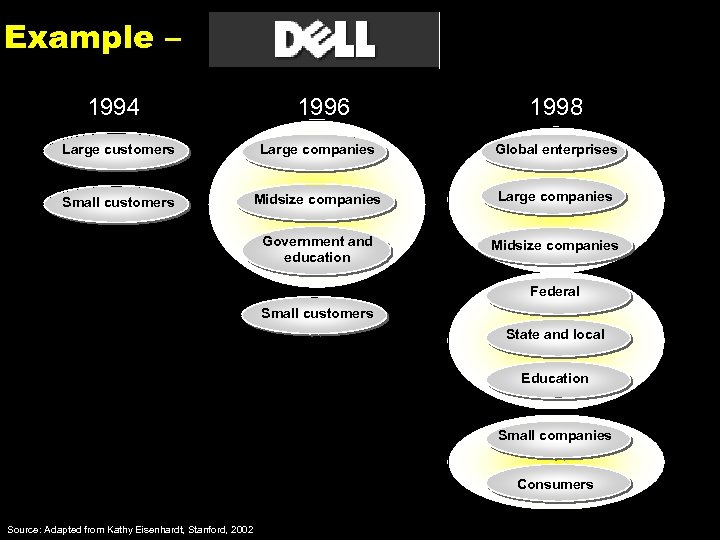

Example – 1994 1996 1998 Large customers Large companies Global enterprises Small customers Midsize companies Large companies Government and education Midsize companies Federal Small customers State and local Education Small companies Consumers Source: Adapted from Kathy Eisenhardt, Stanford, 2002 29

Example – 1994 1996 1998 Large customers Large companies Global enterprises Small customers Midsize companies Large companies Government and education Midsize companies Federal Small customers State and local Education Small companies Consumers Source: Adapted from Kathy Eisenhardt, Stanford, 2002 29

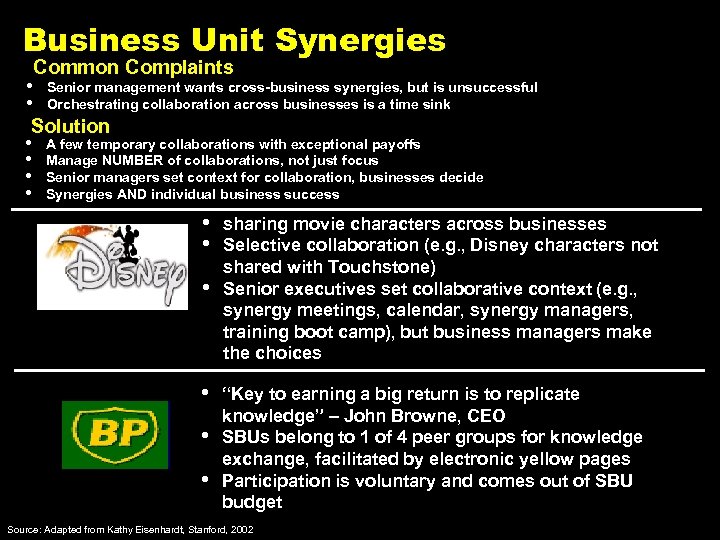

Business Unit Synergies • • Common Complaints Senior management wants cross-business synergies, but is unsuccessful Orchestrating collaboration across businesses is a time sink Solution • • A few temporary collaborations with exceptional payoffs Manage NUMBER of collaborations, not just focus Senior managers set context for collaboration, businesses decide Synergies AND individual business success • • • sharing movie characters across businesses Selective collaboration (e. g. , Disney characters not shared with Touchstone) Senior executives set collaborative context (e. g. , synergy meetings, calendar, synergy managers, training boot camp), but business managers make the choices “Key to earning a big return is to replicate knowledge” – John Browne, CEO SBUs belong to 1 of 4 peer groups for knowledge exchange, facilitated by electronic yellow pages Participation is voluntary and comes out of SBU budget Source: Adapted from Kathy Eisenhardt, Stanford, 2002 30

Business Unit Synergies • • Common Complaints Senior management wants cross-business synergies, but is unsuccessful Orchestrating collaboration across businesses is a time sink Solution • • A few temporary collaborations with exceptional payoffs Manage NUMBER of collaborations, not just focus Senior managers set context for collaboration, businesses decide Synergies AND individual business success • • • sharing movie characters across businesses Selective collaboration (e. g. , Disney characters not shared with Touchstone) Senior executives set collaborative context (e. g. , synergy meetings, calendar, synergy managers, training boot camp), but business managers make the choices “Key to earning a big return is to replicate knowledge” – John Browne, CEO SBUs belong to 1 of 4 peer groups for knowledge exchange, facilitated by electronic yellow pages Participation is voluntary and comes out of SBU budget Source: Adapted from Kathy Eisenhardt, Stanford, 2002 30

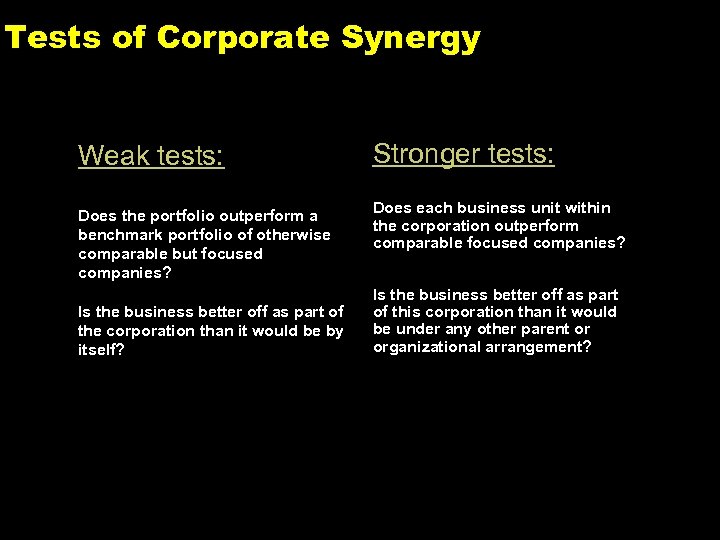

Tests of Corporate Synergy Weak tests: Stronger tests: Does the portfolio outperform a benchmark portfolio of otherwise comparable but focused companies? Does each business unit within the corporation outperform comparable focused companies? Is the business better off as part of the corporation than it would be by itself? Is the business better off as part of this corporation than it would be under any other parent or organizational arrangement? 31

Tests of Corporate Synergy Weak tests: Stronger tests: Does the portfolio outperform a benchmark portfolio of otherwise comparable but focused companies? Does each business unit within the corporation outperform comparable focused companies? Is the business better off as part of the corporation than it would be by itself? Is the business better off as part of this corporation than it would be under any other parent or organizational arrangement? 31

Overview of Strategy v v v Definition and brief history of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Ø Business Building Growth Short-term and Long-term v Conclusion 32

Overview of Strategy v v v Definition and brief history of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Ø Business Building Growth Short-term and Long-term v Conclusion 32

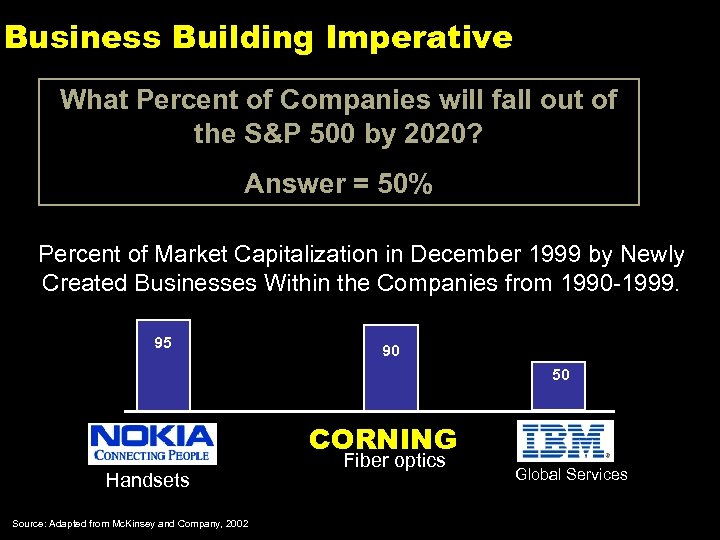

Business Building Imperative What Percent of Companies will fall out of the S&P 500 by 2020? Answer = 50% Percent of Market Capitalization in December 1999 by Newly Created Businesses Within the Companies from 1990 -1999. 95 90 50 CORNING Handsets Source: Adapted from Mc. Kinsey and Company, 2002 Fiber optics Global Services 33

Business Building Imperative What Percent of Companies will fall out of the S&P 500 by 2020? Answer = 50% Percent of Market Capitalization in December 1999 by Newly Created Businesses Within the Companies from 1990 -1999. 95 90 50 CORNING Handsets Source: Adapted from Mc. Kinsey and Company, 2002 Fiber optics Global Services 33

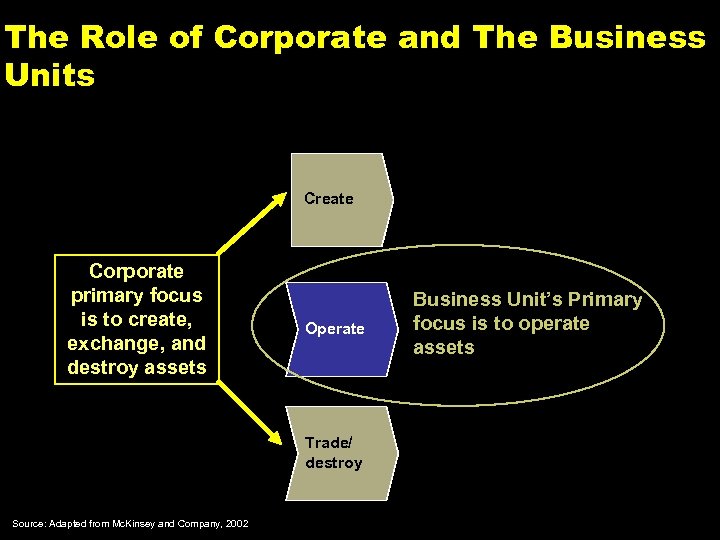

The Role of Corporate and The Business Units Create Corporate primary focus is to create, exchange, and destroy assets Operate Business Unit’s Primary focus is to operate assets Trade/ destroy Source: Adapted from Mc. Kinsey and Company, 2002 34

The Role of Corporate and The Business Units Create Corporate primary focus is to create, exchange, and destroy assets Operate Business Unit’s Primary focus is to operate assets Trade/ destroy Source: Adapted from Mc. Kinsey and Company, 2002 34

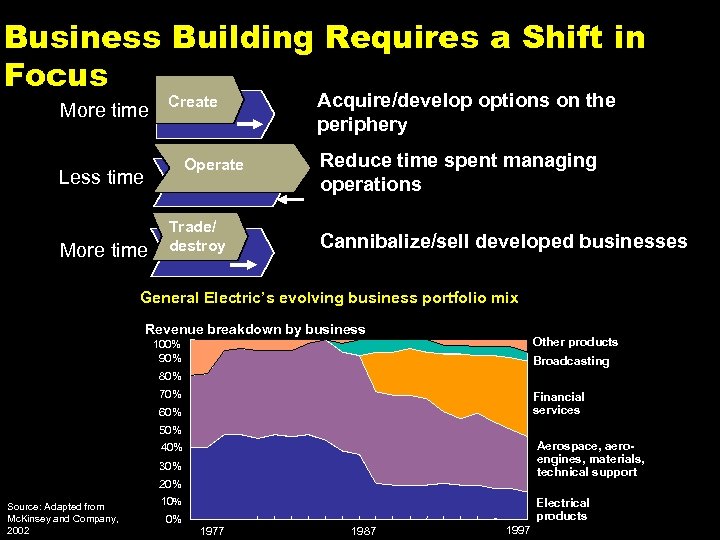

Business Building Requires a Shift in Focus More time Create Operate Less time More time Trade/ destroy Acquire/develop options on the periphery Reduce time spent managing operations Cannibalize/sell developed businesses General Electric’s evolving business portfolio mix Revenue breakdown by business Other products 100% 90% Broadcasting 80% 70% Financial services 60% 50% Aerospace, aeroengines, materials, technical support 40% 30% 20% Source: Adapted from Mc. Kinsey and Company, 2002 10% 0% Electrical products 1977 1987 1997 35

Business Building Requires a Shift in Focus More time Create Operate Less time More time Trade/ destroy Acquire/develop options on the periphery Reduce time spent managing operations Cannibalize/sell developed businesses General Electric’s evolving business portfolio mix Revenue breakdown by business Other products 100% 90% Broadcasting 80% 70% Financial services 60% 50% Aerospace, aeroengines, materials, technical support 40% 30% 20% Source: Adapted from Mc. Kinsey and Company, 2002 10% 0% Electrical products 1977 1987 1997 35

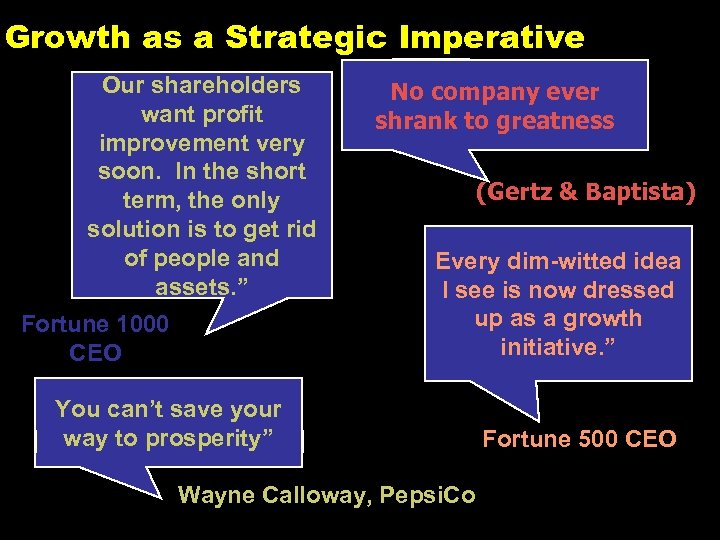

Growth as a Strategic Imperative Our shareholders want profit improvement very soon. In the short term, the only solution is to get rid of people and assets. ” Fortune 1000 CEO No company ever shrank to greatness (Gertz & Baptista) Every dim-witted idea I see is now dressed up as a growth initiative. ” You can’t save your way to prosperity” Fortune 500 CEO Wayne Calloway, Pepsi. Co 36

Growth as a Strategic Imperative Our shareholders want profit improvement very soon. In the short term, the only solution is to get rid of people and assets. ” Fortune 1000 CEO No company ever shrank to greatness (Gertz & Baptista) Every dim-witted idea I see is now dressed up as a growth initiative. ” You can’t save your way to prosperity” Fortune 500 CEO Wayne Calloway, Pepsi. Co 36

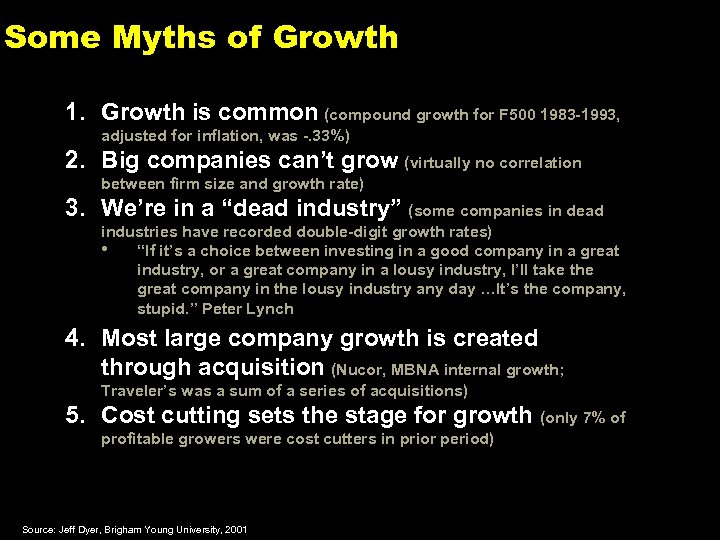

Some Myths of Growth 1. Growth is common (compound growth for F 500 1983 -1993, adjusted for inflation, was -. 33%) 2. Big companies can’t grow (virtually no correlation between firm size and growth rate) 3. We’re in a “dead industry” (some companies in dead industries have recorded double-digit growth rates) • “If it’s a choice between investing in a good company in a great industry, or a great company in a lousy industry, I’ll take the great company in the lousy industry any day …It’s the company, stupid. ” Peter Lynch 4. Most large company growth is created through acquisition (Nucor, MBNA internal growth; Traveler’s was a sum of a series of acquisitions) 5. Cost cutting sets the stage for growth (only 7% of profitable growers were cost cutters in prior period) Source: Jeff Dyer, Brigham Young University, 2001 37

Some Myths of Growth 1. Growth is common (compound growth for F 500 1983 -1993, adjusted for inflation, was -. 33%) 2. Big companies can’t grow (virtually no correlation between firm size and growth rate) 3. We’re in a “dead industry” (some companies in dead industries have recorded double-digit growth rates) • “If it’s a choice between investing in a good company in a great industry, or a great company in a lousy industry, I’ll take the great company in the lousy industry any day …It’s the company, stupid. ” Peter Lynch 4. Most large company growth is created through acquisition (Nucor, MBNA internal growth; Traveler’s was a sum of a series of acquisitions) 5. Cost cutting sets the stage for growth (only 7% of profitable growers were cost cutters in prior period) Source: Jeff Dyer, Brigham Young University, 2001 37

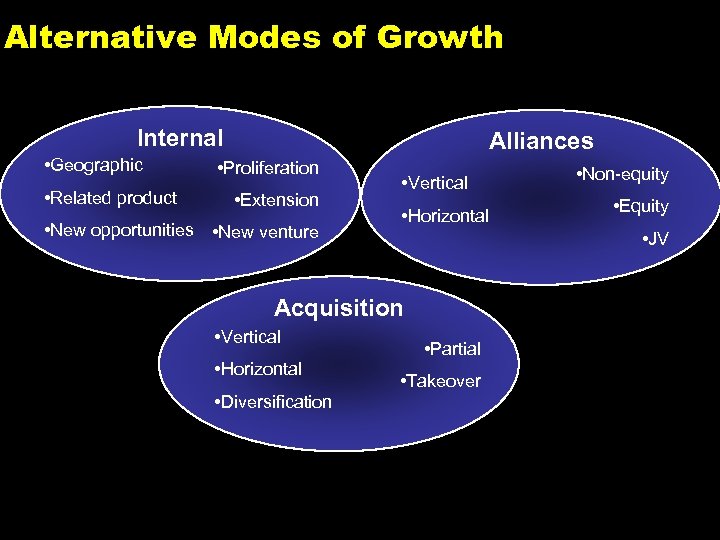

Alternative Modes of Growth Internal • Geographic • Related product Alliances • Proliferation • Extension • New opportunities • New venture • Vertical • Horizontal • Non-equity • Equity • JV Acquisition • Vertical • Horizontal • Diversification • Partial • Takeover 38

Alternative Modes of Growth Internal • Geographic • Related product Alliances • Proliferation • Extension • New opportunities • New venture • Vertical • Horizontal • Non-equity • Equity • JV Acquisition • Vertical • Horizontal • Diversification • Partial • Takeover 38

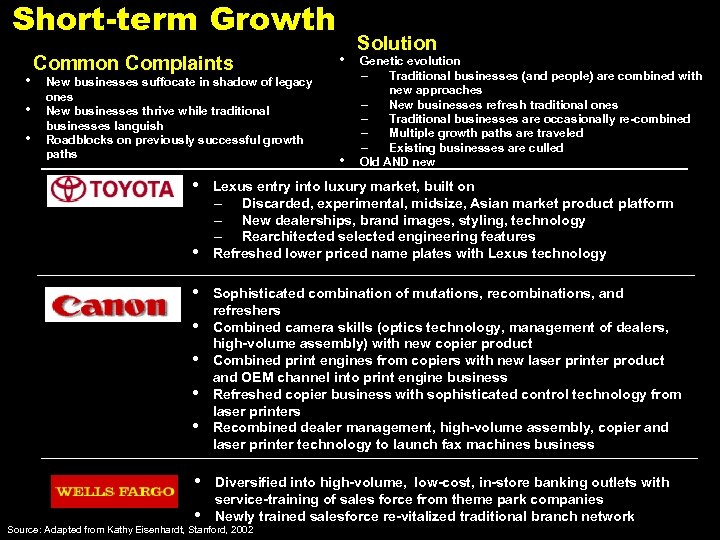

Short-term Growth • • • Common Complaints New businesses suffocate in shadow of legacy ones New businesses thrive while traditional businesses languish Roadblocks on previously successful growth paths • • • Solution Genetic evolution – Traditional businesses (and people) are combined with new approaches – New businesses refresh traditional ones – Traditional businesses are occasionally re-combined – Multiple growth paths are traveled – Existing businesses are culled Old AND new Lexus entry into luxury market, built on – Discarded, experimental, midsize, Asian market product platform – New dealerships, brand images, styling, technology – Rearchitected selected engineering features Refreshed lower priced name plates with Lexus technology Sophisticated combination of mutations, recombinations, and refreshers Combined camera skills (optics technology, management of dealers, high-volume assembly) with new copier product Combined print engines from copiers with new laser printer product and OEM channel into print engine business Refreshed copier business with sophisticated control technology from laser printers Recombined dealer management, high-volume assembly, copier and laser printer technology to launch fax machines business Diversified into high-volume, low-cost, in-store banking outlets with service-training of sales force from theme park companies Newly trained salesforce re-vitalized traditional branch network Source: Adapted from Kathy Eisenhardt, Stanford, 2002 39

Short-term Growth • • • Common Complaints New businesses suffocate in shadow of legacy ones New businesses thrive while traditional businesses languish Roadblocks on previously successful growth paths • • • Solution Genetic evolution – Traditional businesses (and people) are combined with new approaches – New businesses refresh traditional ones – Traditional businesses are occasionally re-combined – Multiple growth paths are traveled – Existing businesses are culled Old AND new Lexus entry into luxury market, built on – Discarded, experimental, midsize, Asian market product platform – New dealerships, brand images, styling, technology – Rearchitected selected engineering features Refreshed lower priced name plates with Lexus technology Sophisticated combination of mutations, recombinations, and refreshers Combined camera skills (optics technology, management of dealers, high-volume assembly) with new copier product Combined print engines from copiers with new laser printer product and OEM channel into print engine business Refreshed copier business with sophisticated control technology from laser printers Recombined dealer management, high-volume assembly, copier and laser printer technology to launch fax machines business Diversified into high-volume, low-cost, in-store banking outlets with service-training of sales force from theme park companies Newly trained salesforce re-vitalized traditional branch network Source: Adapted from Kathy Eisenhardt, Stanford, 2002 39

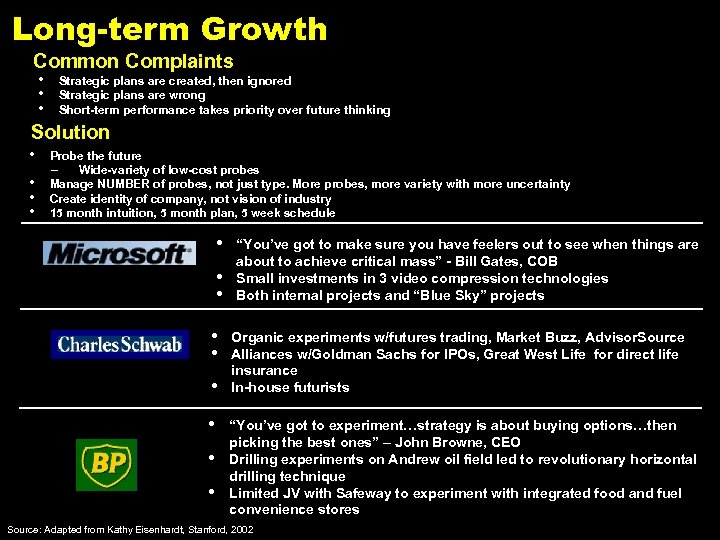

Long-term Growth Common Complaints • • • Strategic plans are created, then ignored Strategic plans are wrong Short-term performance takes priority over future thinking Solution • • Probe the future – Wide-variety of low-cost probes Manage NUMBER of probes, not just type. More probes, more variety with more uncertainty Create identity of company, not vision of industry 15 month intuition, 5 month plan, 5 week schedule • • • “You’ve got to make sure you have feelers out to see when things are about to achieve critical mass” - Bill Gates, COB Small investments in 3 video compression technologies Both internal projects and “Blue Sky” projects Organic experiments w/futures trading, Market Buzz, Advisor. Source Alliances w/Goldman Sachs for IPOs, Great West Life for direct life insurance In-house futurists “You’ve got to experiment…strategy is about buying options…then picking the best ones” – John Browne, CEO Drilling experiments on Andrew oil field led to revolutionary horizontal drilling technique Limited JV with Safeway to experiment with integrated food and fuel convenience stores Source: Adapted from Kathy Eisenhardt, Stanford, 2002 40

Long-term Growth Common Complaints • • • Strategic plans are created, then ignored Strategic plans are wrong Short-term performance takes priority over future thinking Solution • • Probe the future – Wide-variety of low-cost probes Manage NUMBER of probes, not just type. More probes, more variety with more uncertainty Create identity of company, not vision of industry 15 month intuition, 5 month plan, 5 week schedule • • • “You’ve got to make sure you have feelers out to see when things are about to achieve critical mass” - Bill Gates, COB Small investments in 3 video compression technologies Both internal projects and “Blue Sky” projects Organic experiments w/futures trading, Market Buzz, Advisor. Source Alliances w/Goldman Sachs for IPOs, Great West Life for direct life insurance In-house futurists “You’ve got to experiment…strategy is about buying options…then picking the best ones” – John Browne, CEO Drilling experiments on Andrew oil field led to revolutionary horizontal drilling technique Limited JV with Safeway to experiment with integrated food and fuel convenience stores Source: Adapted from Kathy Eisenhardt, Stanford, 2002 40

Overview of Strategy v v v Definition and Brief History of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Business Building Ø Growth Short-term and Long-term v Conclusion 41

Overview of Strategy v v v Definition and Brief History of Strategy Industry Strategy Firm Strategy Business Unit Strategy Current Trends in Strategy Ø Business Building Ø Growth Short-term and Long-term v Conclusion 41

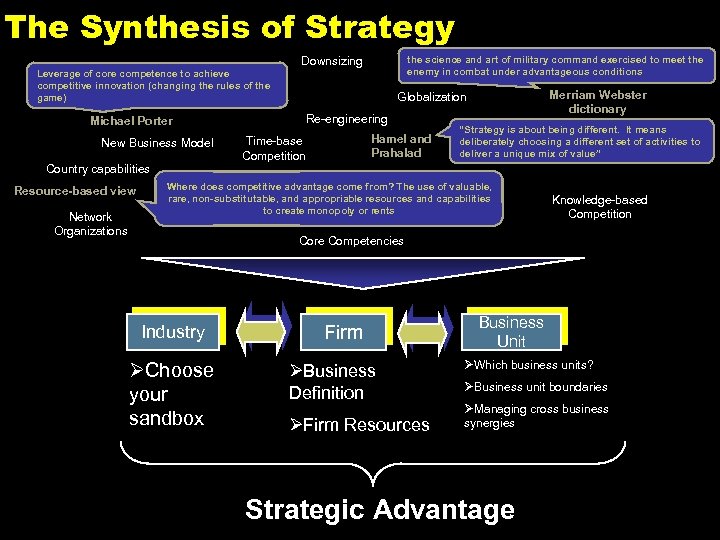

The Synthesis of Strategy Downsizing the science and art of military command exercised to meet the enemy in combat under advantageous conditions Leverage of core competence to achieve competitive innovation (changing the rules of the game) Michael Porter New Business Model Country capabilities Resource-based view Network Organizations Merriam Webster dictionary Globalization Re-engineering Hamel and Prahalad Time-base Competition “Strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value” Where does competitive advantage come from? The use of valuable, rare, non-substitutable, and appropriable resources and capabilities to create monopoly or rents Knowledge-based Competition Core Competencies Industry ØChoose your sandbox Firm ØBusiness Definition ØFirm Resources Business Unit ØWhich business units? ØBusiness unit boundaries ØManaging cross business synergies Strategic Advantage 42

The Synthesis of Strategy Downsizing the science and art of military command exercised to meet the enemy in combat under advantageous conditions Leverage of core competence to achieve competitive innovation (changing the rules of the game) Michael Porter New Business Model Country capabilities Resource-based view Network Organizations Merriam Webster dictionary Globalization Re-engineering Hamel and Prahalad Time-base Competition “Strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value” Where does competitive advantage come from? The use of valuable, rare, non-substitutable, and appropriable resources and capabilities to create monopoly or rents Knowledge-based Competition Core Competencies Industry ØChoose your sandbox Firm ØBusiness Definition ØFirm Resources Business Unit ØWhich business units? ØBusiness unit boundaries ØManaging cross business synergies Strategic Advantage 42

Key Debates in Strategy Formulation vs. Strategy Implementation Can you create sustainable competitive advantage? Which is most valuable-physical assets or intangibles Where is the most value created? 43

Key Debates in Strategy Formulation vs. Strategy Implementation Can you create sustainable competitive advantage? Which is most valuable-physical assets or intangibles Where is the most value created? 43

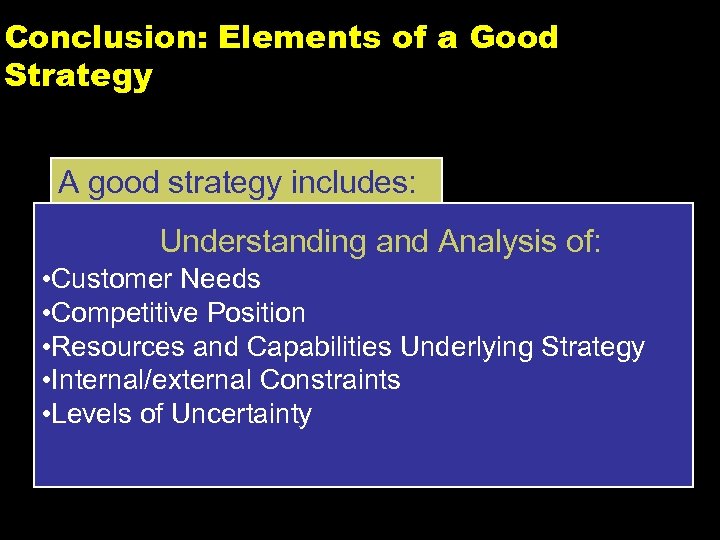

Conclusion: Elements of a Good Strategy A good strategy includes: Understanding and Analysis of: • Customer Needs • Competitive Position • Resources and Capabilities Underlying Strategy • Internal/external Constraints • Levels of Uncertainty 44

Conclusion: Elements of a Good Strategy A good strategy includes: Understanding and Analysis of: • Customer Needs • Competitive Position • Resources and Capabilities Underlying Strategy • Internal/external Constraints • Levels of Uncertainty 44

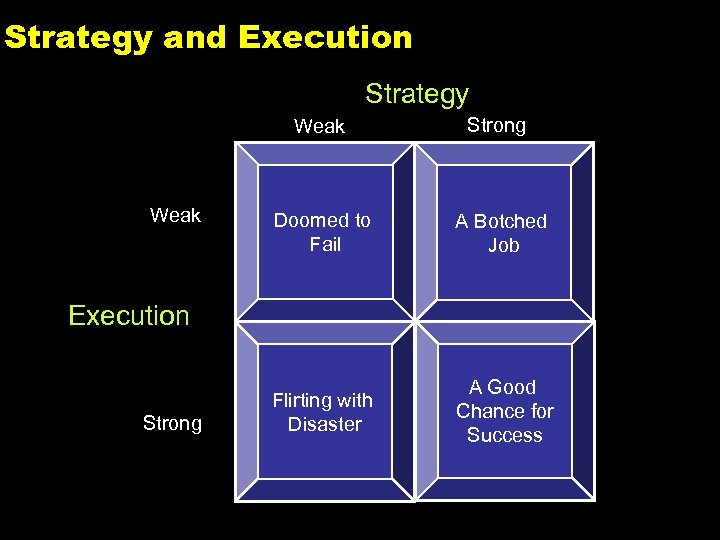

Strategy and Execution Strategy Weak Strong Doomed to Fail A Botched Job Flirting with Disaster A Good Chance for Success Execution Strong 45

Strategy and Execution Strategy Weak Strong Doomed to Fail A Botched Job Flirting with Disaster A Good Chance for Success Execution Strong 45

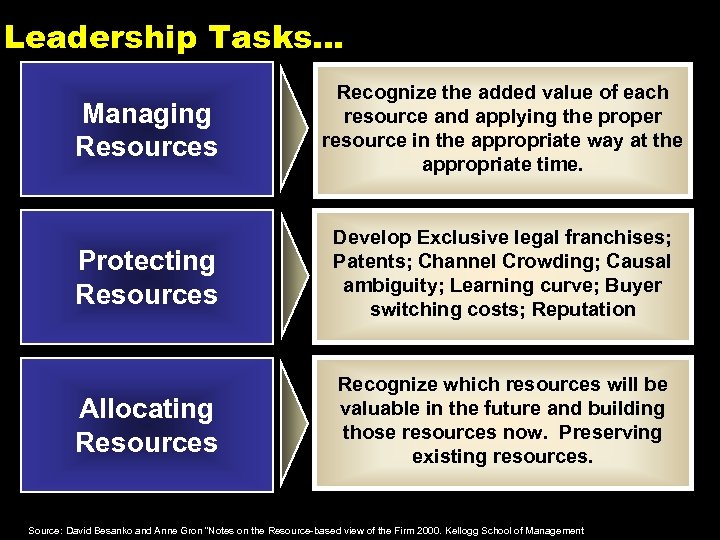

Leadership Tasks… Managing Resources Recognize the added value of each resource and applying the proper resource in the appropriate way at the appropriate time. Protecting Resources Develop Exclusive legal franchises; Patents; Channel Crowding; Causal ambiguity; Learning curve; Buyer switching costs; Reputation Allocating Resources Recognize which resources will be valuable in the future and building those resources now. Preserving existing resources. Source: David Besanko and Anne Gron “Notes on the Resource-based view of the Firm 2000. Kellogg School of Management 46

Leadership Tasks… Managing Resources Recognize the added value of each resource and applying the proper resource in the appropriate way at the appropriate time. Protecting Resources Develop Exclusive legal franchises; Patents; Channel Crowding; Causal ambiguity; Learning curve; Buyer switching costs; Reputation Allocating Resources Recognize which resources will be valuable in the future and building those resources now. Preserving existing resources. Source: David Besanko and Anne Gron “Notes on the Resource-based view of the Firm 2000. Kellogg School of Management 46

The Need for Leadership "There is nothing which rots morale more quickly and more completely than. . . the feeling that those in authority do not know their own minds. " Lionel Urwick 47

The Need for Leadership "There is nothing which rots morale more quickly and more completely than. . . the feeling that those in authority do not know their own minds. " Lionel Urwick 47

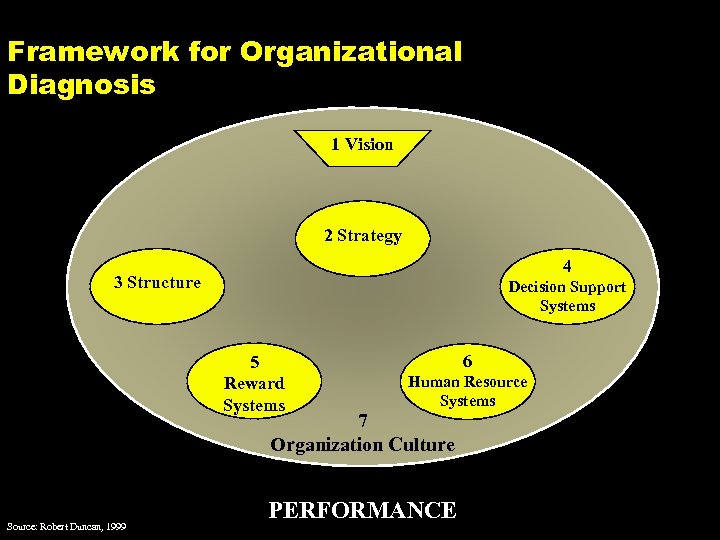

Framework for Organizational Diagnosis 1 Vision 2 Strategy 4 3 Structure Decision Support Systems 5 Reward Systems 6 Human Resource Systems 7 Organization Culture Source: Robert Duncan, 1999 PERFORMANCE 48

Framework for Organizational Diagnosis 1 Vision 2 Strategy 4 3 Structure Decision Support Systems 5 Reward Systems 6 Human Resource Systems 7 Organization Culture Source: Robert Duncan, 1999 PERFORMANCE 48

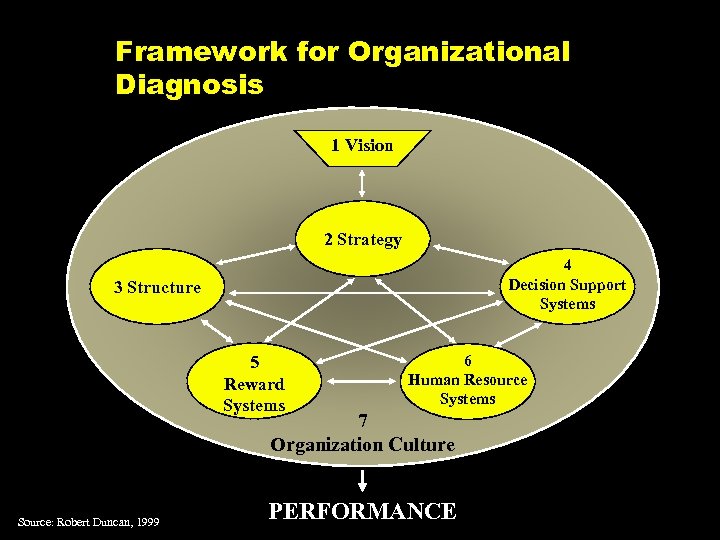

Framework for Organizational Diagnosis 1 Vision 2 Strategy 4 Decision Support Systems 3 Structure 5 Reward Systems 6 Human Resource Systems 7 Organization Culture Source: Robert Duncan, 1999 PERFORMANCE 49

Framework for Organizational Diagnosis 1 Vision 2 Strategy 4 Decision Support Systems 3 Structure 5 Reward Systems 6 Human Resource Systems 7 Organization Culture Source: Robert Duncan, 1999 PERFORMANCE 49