59fac6c45cf54aab67d8747090137887.ppt

- Количество слайдов: 81

An Introduction to US Student Loans Presented by: Erich Mc. Elroy www. myglobaled. com

An Introduction to US Student Loans Presented by: Erich Mc. Elroy www. myglobaled. com

Agenda § Terms and Players § The Life of a Direct Loan § Certification Basics § Disbursement Rules § Refund Calculations § Administrative briefing § Other Funds Available § Resources § Questions/ Making the Process Work for You www. myglobaled. com

Agenda § Terms and Players § The Life of a Direct Loan § Certification Basics § Disbursement Rules § Refund Calculations § Administrative briefing § Other Funds Available § Resources § Questions/ Making the Process Work for You www. myglobaled. com

Players in the Process § Borrower § Student § Department of Education (ED) § Institution § No longer involved in the same way § § § Lenders Guarantors Servicers www. myglobaled. com

Players in the Process § Borrower § Student § Department of Education (ED) § Institution § No longer involved in the same way § § § Lenders Guarantors Servicers www. myglobaled. com

Key Terms for Today § Title IV § Federal Family Education Loan Program (FFELP) § Direct Loans § Stafford § Subsidized (Unsubsidized) § PLUS § Dependent § Independent § MPN – Master Promissory Note www. myglobaled. com

Key Terms for Today § Title IV § Federal Family Education Loan Program (FFELP) § Direct Loans § Stafford § Subsidized (Unsubsidized) § PLUS § Dependent § Independent § MPN – Master Promissory Note www. myglobaled. com

Additional Terms for Today § FAFSA – Free Application for Student Aid § COA – Cost of Attendance § EFC – Expected Family Contribution § EFA – Estimated Financial Assistance § SAR – Student Aid Report § ISIR – Institutional Student Information Report www. myglobaled. com

Additional Terms for Today § FAFSA – Free Application for Student Aid § COA – Cost of Attendance § EFC – Expected Family Contribution § EFA – Estimated Financial Assistance § SAR – Student Aid Report § ISIR – Institutional Student Information Report www. myglobaled. com

What Programs Can We Use Overseas? § Stafford Loans § Borrower is always student § Loans can be § Subsidized: Based on need and no interest or payments while student is at least half-time in-school or other eligible status § Unsubsidized: Not based on need and does have interest but no payments required while borrower is at least half time in school or other eligible status § Current interest is set at 4. 5% and 6. 8% § Repayment typically begins six months after borrower ceases to be enrolled at least ½ time. § Origination fee of 1% for loans, but there is a. 5% rebate. www. myglobaled. com

What Programs Can We Use Overseas? § Stafford Loans § Borrower is always student § Loans can be § Subsidized: Based on need and no interest or payments while student is at least half-time in-school or other eligible status § Unsubsidized: Not based on need and does have interest but no payments required while borrower is at least half time in school or other eligible status § Current interest is set at 4. 5% and 6. 8% § Repayment typically begins six months after borrower ceases to be enrolled at least ½ time. § Origination fee of 1% for loans, but there is a. 5% rebate. www. myglobaled. com

What Programs Can We Use Overseas? § PLUS Loan § Borrower could be parent of Undergraduate student OR student in Postgraduate studies § Loan is always unsubsidized and is not need based § Interest is fixed at 7. 9% § Repayment begins: § Parents – 60 days after final disbursement – Unless extended § Students - Automatically deferred until graduation. Can then be extended 6 months after less than ½ time § Origination fee of 4. 0%, with a 1. 5% rebate www. myglobaled. com

What Programs Can We Use Overseas? § PLUS Loan § Borrower could be parent of Undergraduate student OR student in Postgraduate studies § Loan is always unsubsidized and is not need based § Interest is fixed at 7. 9% § Repayment begins: § Parents – 60 days after final disbursement – Unless extended § Students - Automatically deferred until graduation. Can then be extended 6 months after less than ½ time § Origination fee of 4. 0%, with a 1. 5% rebate www. myglobaled. com

Your Responsibilities § Meeting and maintaining loan-program participation requirements; § Establishing borrower eligibility; § Originate loan program loans; § Disbursing loan program proceeds; § Counseling students; § Notifying the Department of changes to borrower information; and § Reporting borrower enrollment information to the U. S. Department of Education’s (ED’s) National Student Loan Data System (NSLDS). (SSCR) www. myglobaled. com

Your Responsibilities § Meeting and maintaining loan-program participation requirements; § Establishing borrower eligibility; § Originate loan program loans; § Disbursing loan program proceeds; § Counseling students; § Notifying the Department of changes to borrower information; and § Reporting borrower enrollment information to the U. S. Department of Education’s (ED’s) National Student Loan Data System (NSLDS). (SSCR) www. myglobaled. com

New Process of Direct Loans www. myglobaled. com

New Process of Direct Loans www. myglobaled. com

Change begins 1 July 2010 Federal Family Education Loan Program (FFELP) Ends The loan types received remain the same, but the source of funds has changed www. myglobaled. com

Change begins 1 July 2010 Federal Family Education Loan Program (FFELP) Ends The loan types received remain the same, but the source of funds has changed www. myglobaled. com

What’s the same? § Types of aid: § Subsidized Loan § Unsubsidized Loan § Parent PLUS § Graduate PLUS www. myglobaled. com

What’s the same? § Types of aid: § Subsidized Loan § Unsubsidized Loan § Parent PLUS § Graduate PLUS www. myglobaled. com

Eligibility Requirements § There is no significant changes to the eligibility requirements § Still require FAFSA, ISIRs (formally SAR) § Institution still reviews eligibility and sets award levels www. myglobaled. com

Eligibility Requirements § There is no significant changes to the eligibility requirements § Still require FAFSA, ISIRs (formally SAR) § Institution still reviews eligibility and sets award levels www. myglobaled. com

Direct Loans – The Benefits § Single source of funds § Single application site and process § Single Entrance and Exit Portal § One website - studentloans. gov www. myglobaled. com

Direct Loans – The Benefits § Single source of funds § Single application site and process § Single Entrance and Exit Portal § One website - studentloans. gov www. myglobaled. com

Direct Loans – New Opportunities § No more paper cheques § Funding delivered electronically § Must be maintained following specific rules § Requires reconciliation www. myglobaled. com

Direct Loans – New Opportunities § No more paper cheques § Funding delivered electronically § Must be maintained following specific rules § Requires reconciliation www. myglobaled. com

Direct Loans – Other differences §Process simplified § Borrower § University § Department of Education § Via servicers/contractors § Will include Sallie Mae § No more guarantor or bank www. myglobaled. com

Direct Loans – Other differences §Process simplified § Borrower § University § Department of Education § Via servicers/contractors § Will include Sallie Mae § No more guarantor or bank www. myglobaled. com

Process with DL § Initial process with the student is the same § Student submits FAFSA § Institution receives SAR/ISIR § Institution determines award § Award Letter § For ‘Foreign Schools’ must be done each year § Borrower completes MPN § New borrowers do Entrance Counseling § Timeline for this process is set by institution www. myglobaled. com

Process with DL § Initial process with the student is the same § Student submits FAFSA § Institution receives SAR/ISIR § Institution determines award § Award Letter § For ‘Foreign Schools’ must be done each year § Borrower completes MPN § New borrowers do Entrance Counseling § Timeline for this process is set by institution www. myglobaled. com

Establishing Eligibility www. myglobaled. com

Establishing Eligibility www. myglobaled. com

Establish Borrower Eligibility 1. Is the student enrolled as a “regular” student? Possibly some changes to programs leading to a degree (foundation eligibility in new regs) 2. Is the student academically qualified? 3. 4. Is the student enrolled appropriately? 5. Have you received a VALID ISIR or SAR? Can now accept student who has completed at least 6 credits or is home schooled Is the student making satisfactory academic progress? www. myglobaled. com

Establish Borrower Eligibility 1. Is the student enrolled as a “regular” student? Possibly some changes to programs leading to a degree (foundation eligibility in new regs) 2. Is the student academically qualified? 3. 4. Is the student enrolled appropriately? 5. Have you received a VALID ISIR or SAR? Can now accept student who has completed at least 6 credits or is home schooled Is the student making satisfactory academic progress? www. myglobaled. com

Cost of Attendance § COA includes: § Tuition and fees § Living expenses such as room and board § Books and supplies § Personal expenses such as the renting or purchase of a personal computer § Transportation costs www. myglobaled. com

Cost of Attendance § COA includes: § Tuition and fees § Living expenses such as room and board § Books and supplies § Personal expenses such as the renting or purchase of a personal computer § Transportation costs www. myglobaled. com

Expected Family Contribution (EFC) § Based on student and (for dependents) parents assets § Estimated by ED and supplied on ISIR and SAR § 9 month EFC given § Can be adjusted by school only § And only by adjusting the factors § For longer or shorter periods, EFC must be prorated www. myglobaled. com

Expected Family Contribution (EFC) § Based on student and (for dependents) parents assets § Estimated by ED and supplied on ISIR and SAR § 9 month EFC given § Can be adjusted by school only § And only by adjusting the factors § For longer or shorter periods, EFC must be prorated www. myglobaled. com

A Valid ISIR/SAR §Must have 00000 or number §If ‘C’ Comment code listed must be resolved §Must evaluate all tranactions §Other issues on a case by case basis www. myglobaled. com

A Valid ISIR/SAR §Must have 00000 or number §If ‘C’ Comment code listed must be resolved §Must evaluate all tranactions §Other issues on a case by case basis www. myglobaled. com

Estimated Financial Aid (EFA) § Amount of aid student will receive for the loan period § Can include § Loans § Grants § Scholarships § Work awarded based on enrollment § Will no longer include VA benefits as of July 1, 2010. www. myglobaled. com

Estimated Financial Aid (EFA) § Amount of aid student will receive for the loan period § Can include § Loans § Grants § Scholarships § Work awarded based on enrollment § Will no longer include VA benefits as of July 1, 2010. www. myglobaled. com

Professional Judgment § Schools are allowed by law to, on a case by case basis, adjust the following: § Student’s COA § A data element used to calculate the EFC § Dependency status www. myglobaled. com

Professional Judgment § Schools are allowed by law to, on a case by case basis, adjust the following: § Student’s COA § A data element used to calculate the EFC § Dependency status www. myglobaled. com

Professional Judgment § If a school administrator uses professional judgment, he or she must follow these guidelines: § Professional judgment is performed on a case-by-case basis. § The reason for the professional judgment must be documented in the student’s file, and it must relate to the student’s special circumstances. § A school administrator can only perform a dependency override from dependent to independent. § Professional judgment cannot be used to waive student eligibility requirements or circumvent the intent of U. S. law and regulations. § Examples of special circumstances listed in the law include elementary or secondary tuition, medical or dental expenses not covered by insurance, unusually high child care costs, recent unemployment of a family member… § New! A school may offer the additional unsubsidized Stafford if it can verify the parent does not provide financial support and refuses to file a FAFSA. Recommend testing this via documentation. www. myglobaled. com

Professional Judgment § If a school administrator uses professional judgment, he or she must follow these guidelines: § Professional judgment is performed on a case-by-case basis. § The reason for the professional judgment must be documented in the student’s file, and it must relate to the student’s special circumstances. § A school administrator can only perform a dependency override from dependent to independent. § Professional judgment cannot be used to waive student eligibility requirements or circumvent the intent of U. S. law and regulations. § Examples of special circumstances listed in the law include elementary or secondary tuition, medical or dental expenses not covered by insurance, unusually high child care costs, recent unemployment of a family member… § New! A school may offer the additional unsubsidized Stafford if it can verify the parent does not provide financial support and refuses to file a FAFSA. Recommend testing this via documentation. www. myglobaled. com

Loan Periods and Amounts www. myglobaled. com

Loan Periods and Amounts www. myglobaled. com

Academic Year § Student loans are based on the academic year rather than the calendar year § Can now be longer than 12 months § Two types: § Scheduled academic year (SAY) § Borrower based academic year (BBAY) § Clock hour and non-term credit hour schools must use BBAY www. myglobaled. com

Academic Year § Student loans are based on the academic year rather than the calendar year § Can now be longer than 12 months § Two types: § Scheduled academic year (SAY) § Borrower based academic year (BBAY) § Clock hour and non-term credit hour schools must use BBAY www. myglobaled. com

SAY § Fixed period of time § Generally starts and ends at same time each year § Normally corresponds to schools academic year or published calendar § Summer terms are part of the SAY § Trailer § Header § Can be standard or program by program www. myglobaled. com

SAY § Fixed period of time § Generally starts and ends at same time each year § Normally corresponds to schools academic year or published calendar § Summer terms are part of the SAY § Trailer § Header § Can be standard or program by program www. myglobaled. com

BBAY § Not a set period of time § Based on students enrollment and progress § Can be alternated with SAY but one cannot overlap the other § Begins when the student enrolls § Ends when student has completed hours or semester requirements www. myglobaled. com

BBAY § Not a set period of time § Based on students enrollment and progress § Can be alternated with SAY but one cannot overlap the other § Begins when the student enrolls § Ends when student has completed hours or semester requirements www. myglobaled. com

BBAY § Term based BBAY must include same number of terms as the SAY § Excluding summer sessions § Term based must be at least 30 weeks in length § Unless includes summer term § Clock hour based must be at least 30 weeks (900 clock hours) in length § Including summer sessions www. myglobaled. com

BBAY § Term based BBAY must include same number of terms as the SAY § Excluding summer sessions § Term based must be at least 30 weeks in length § Unless includes summer term § Clock hour based must be at least 30 weeks (900 clock hours) in length § Including summer sessions www. myglobaled. com

Loan Limits and Amounts www. myglobaled. com

Loan Limits and Amounts www. myglobaled. com

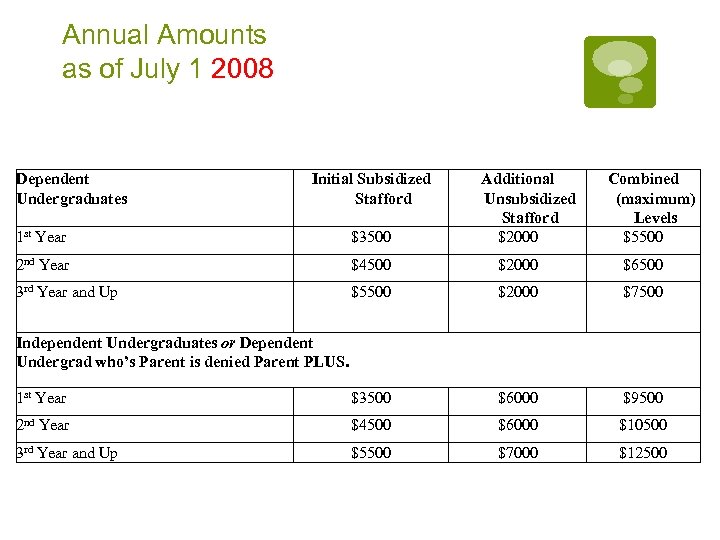

Annual Amounts as of July 1 2008 Dependent Undergraduates Initial Subsidized Stafford Additional Unsubsidized Stafford $2000 Combined (maximum) Levels $5500 1 st Year $3500 2 nd Year $4500 $2000 $6500 3 rd Year and Up $5500 $2000 $7500 1 st Year $3500 $6000 $9500 2 nd Year $4500 $6000 $10500 3 rd Year and Up $5500 $7000 $12500 Independent Undergraduates or Dependent Undergrad who’s Parent is denied Parent PLUS.

Annual Amounts as of July 1 2008 Dependent Undergraduates Initial Subsidized Stafford Additional Unsubsidized Stafford $2000 Combined (maximum) Levels $5500 1 st Year $3500 2 nd Year $4500 $2000 $6500 3 rd Year and Up $5500 $2000 $7500 1 st Year $3500 $6000 $9500 2 nd Year $4500 $6000 $10500 3 rd Year and Up $5500 $7000 $12500 Independent Undergraduates or Dependent Undergrad who’s Parent is denied Parent PLUS.

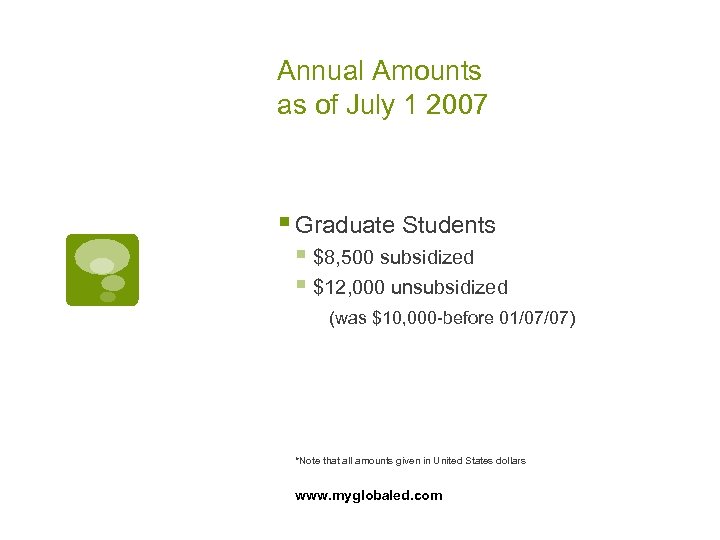

Annual Amounts as of July 1 2007 § Graduate Students § $8, 500 subsidized § $12, 000 unsubsidized (was $10, 000 -before 01/07/07) *Note that all amounts given in United States dollars www. myglobaled. com

Annual Amounts as of July 1 2007 § Graduate Students § $8, 500 subsidized § $12, 000 unsubsidized (was $10, 000 -before 01/07/07) *Note that all amounts given in United States dollars www. myglobaled. com

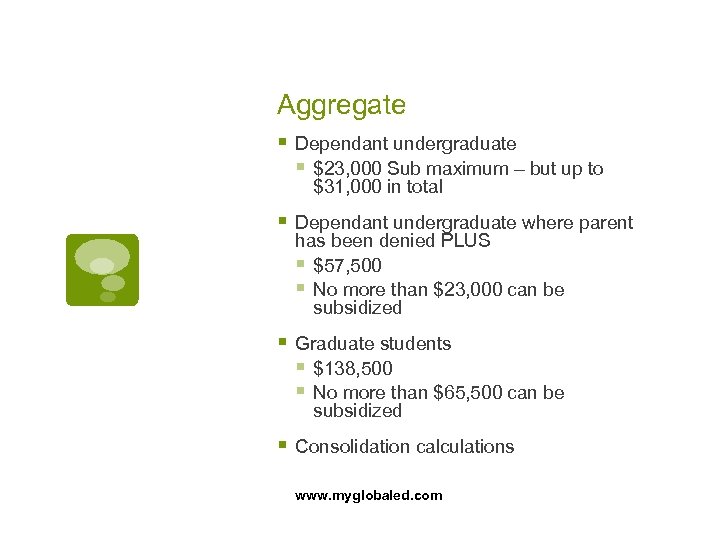

Aggregate § Dependant undergraduate § $23, 000 Sub maximum – but up to $31, 000 in total § Dependant undergraduate where parent has been denied PLUS § $57, 500 § No more than $23, 000 can be subsidized § Graduate students § $138, 500 § No more than $65, 500 can be subsidized § Consolidation calculations www. myglobaled. com

Aggregate § Dependant undergraduate § $23, 000 Sub maximum – but up to $31, 000 in total § Dependant undergraduate where parent has been denied PLUS § $57, 500 § No more than $23, 000 can be subsidized § Graduate students § $138, 500 § No more than $65, 500 can be subsidized § Consolidation calculations www. myglobaled. com

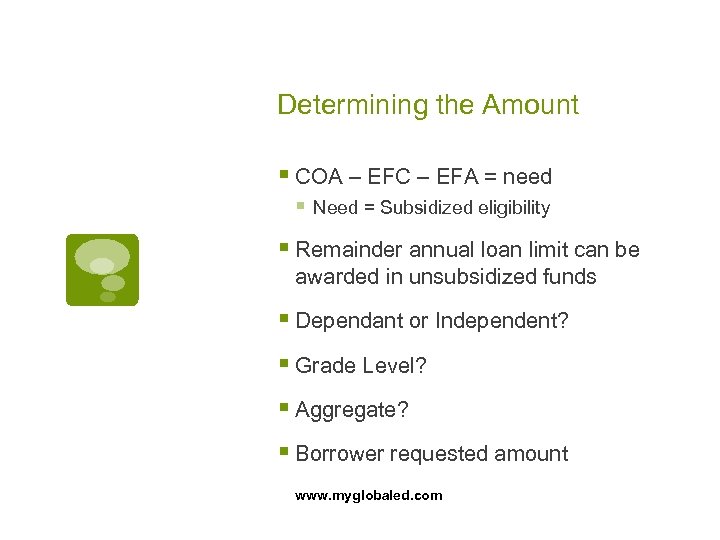

Determining the Amount § COA – EFC – EFA = need § Need = Subsidized eligibility § Remainder annual loan limit can be awarded in unsubsidized funds § Dependant or Independent? § Grade Level? § Aggregate? § Borrower requested amount www. myglobaled. com

Determining the Amount § COA – EFC – EFA = need § Need = Subsidized eligibility § Remainder annual loan limit can be awarded in unsubsidized funds § Dependant or Independent? § Grade Level? § Aggregate? § Borrower requested amount www. myglobaled. com

PLUS § No annual or aggregate limits § Amount can be no higher than the lesser of: § COA – EFA § Borrower requested amount § Lender approved amount § Borrower can have multiple loans for multiple dependants for same academic year www. myglobaled. com

PLUS § No annual or aggregate limits § Amount can be no higher than the lesser of: § COA – EFA § Borrower requested amount § Lender approved amount § Borrower can have multiple loans for multiple dependants for same academic year www. myglobaled. com

COA Calculation Worksheet www. myglobaled. com

COA Calculation Worksheet www. myglobaled. com

Disbursements www. myglobaled. com

Disbursements www. myglobaled. com

Key terms § Disbursement – Date funds are credited to the student’s account at the institution § Delivery – Date excess funds are given to the student § Origination – Process formally known as ‘certification’ § Booked – When a loan is set in the DL system www. myglobaled. com

Key terms § Disbursement – Date funds are credited to the student’s account at the institution § Delivery – Date excess funds are given to the student § Origination – Process formally known as ‘certification’ § Booked – When a loan is set in the DL system www. myglobaled. com

Key terms - continued § COD – Common Origination & Disbursement System § In place of systems such as ASA Direct or Open. Net (might still use for private loans) § G 5 – Government site to manage funds from US Treasury § Reconciliation § Process of balancing internally and with the ED www. myglobaled. com

Key terms - continued § COD – Common Origination & Disbursement System § In place of systems such as ASA Direct or Open. Net (might still use for private loans) § G 5 – Government site to manage funds from US Treasury § Reconciliation § Process of balancing internally and with the ED www. myglobaled. com

The biggest changes… §Funds will be deposited directly into an account you designate §Payment is triggered after disbursement is set §Funds are drawn down by institution §Funds are not delivered by specific borrower www. myglobaled. com

The biggest changes… §Funds will be deposited directly into an account you designate §Payment is triggered after disbursement is set §Funds are drawn down by institution §Funds are not delivered by specific borrower www. myglobaled. com

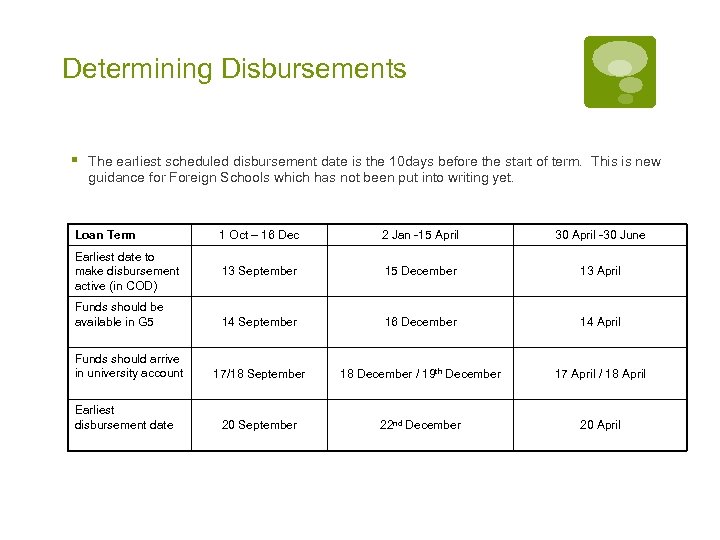

Determining Disbursements § The earliest scheduled disbursement date is the 10 days before the start of term. This is new guidance for Foreign Schools which has not been put into writing yet. Loan Term 1 Oct – 16 Dec 2 Jan -15 April 30 April -30 June Earliest date to make disbursement active (in COD) 13 September 15 December 13 April 14 September 16 December 14 April 17/18 September 18 December / 19 th December 17 April / 18 April 20 September 22 nd December 20 April Funds should be available in G 5 Funds should arrive in university account Earliest disbursement date

Determining Disbursements § The earliest scheduled disbursement date is the 10 days before the start of term. This is new guidance for Foreign Schools which has not been put into writing yet. Loan Term 1 Oct – 16 Dec 2 Jan -15 April 30 April -30 June Earliest date to make disbursement active (in COD) 13 September 15 December 13 April 14 September 16 December 14 April 17/18 September 18 December / 19 th December 17 April / 18 April 20 September 22 nd December 20 April Funds should be available in G 5 Funds should arrive in university account Earliest disbursement date

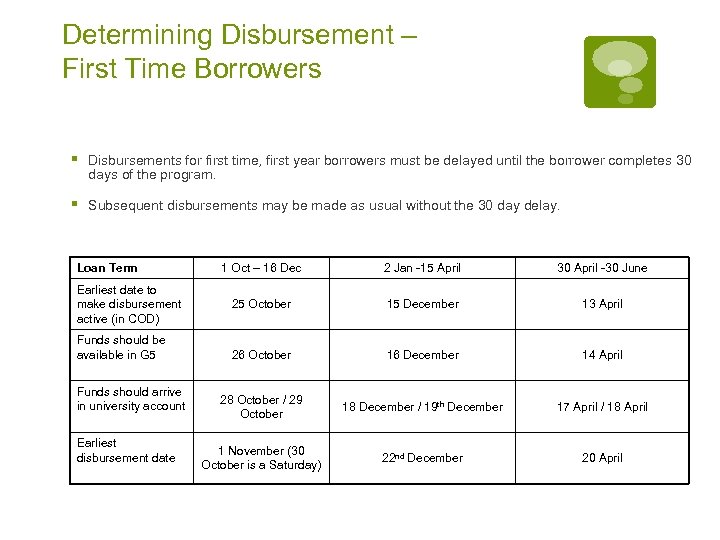

Determining Disbursement – First Time Borrowers § Disbursements for first time, first year borrowers must be delayed until the borrower completes 30 days of the program. § Subsequent disbursements may be made as usual without the 30 day delay. Loan Term Earliest date to make disbursement active (in COD) Funds should be available in G 5 Funds should arrive in university account Earliest disbursement date 1 Oct – 16 Dec 2 Jan -15 April 30 April -30 June 25 October 15 December 13 April 26 October 16 December 14 April 28 October / 29 October 18 December / 19 th December 17 April / 18 April 1 November (30 October is a Saturday) 22 nd December 20 April

Determining Disbursement – First Time Borrowers § Disbursements for first time, first year borrowers must be delayed until the borrower completes 30 days of the program. § Subsequent disbursements may be made as usual without the 30 day delay. Loan Term Earliest date to make disbursement active (in COD) Funds should be available in G 5 Funds should arrive in university account Earliest disbursement date 1 Oct – 16 Dec 2 Jan -15 April 30 April -30 June 25 October 15 December 13 April 26 October 16 December 14 April 28 October / 29 October 18 December / 19 th December 17 April / 18 April 1 November (30 October is a Saturday) 22 nd December 20 April

COD Tool §The Department has designed a new system just for Foreign Schools § Originate Loans § Set first disbursement § Calculate Cost of Attendance § Using your institutions information www. myglobaled. com

COD Tool §The Department has designed a new system just for Foreign Schools § Originate Loans § Set first disbursement § Calculate Cost of Attendance § Using your institutions information www. myglobaled. com

Getting the funds §When you originate you will set pending disbursment §Seven days prior to disbursement you can make a disbursement active www. myglobaled. com

Getting the funds §When you originate you will set pending disbursment §Seven days prior to disbursement you can make a disbursement active www. myglobaled. com

Active Disbursement §An active disbursement (sent in a batch) will total to an amount of US Dollars § Example First Batch is for a total all students $100, 000 www. myglobaled. com

Active Disbursement §An active disbursement (sent in a batch) will total to an amount of US Dollars § Example First Batch is for a total all students $100, 000 www. myglobaled. com

Active Disbursement cont. §The $100, 000 is processed and accepted (or rejected) §Money is authorized to be drawn down §Draw down will occur in G 5. www. myglobaled. com

Active Disbursement cont. §The $100, 000 is processed and accepted (or rejected) §Money is authorized to be drawn down §Draw down will occur in G 5. www. myglobaled. com

G 5 §With in a few days $100, 000 should be available in G 5 and you request the funds §Funds will be deposited into your account in a few days www. myglobaled. com

G 5 §With in a few days $100, 000 should be available in G 5 and you request the funds §Funds will be deposited into your account in a few days www. myglobaled. com

What happens when funds arrive? §When the funds arrive in your account you have three local business days to credit the student’s institutional account or initiate a return of the funds www. myglobaled. com

What happens when funds arrive? §When the funds arrive in your account you have three local business days to credit the student’s institutional account or initiate a return of the funds www. myglobaled. com

Adjust Disbursment Date §If the actual disbursement date changed you need to go back into COD and update the record §The disbursement triggers the date interest begins to accrue www. myglobaled. com

Adjust Disbursment Date §If the actual disbursement date changed you need to go back into COD and update the record §The disbursement triggers the date interest begins to accrue www. myglobaled. com

Options §Most schools in the U. S. post a ledger transaction to the student’s account before receiving the G 5 funds. § Benefits mean there is no three day rush § Drawback – You don’t have the money yet www. myglobaled. com

Options §Most schools in the U. S. post a ledger transaction to the student’s account before receiving the G 5 funds. § Benefits mean there is no three day rush § Drawback – You don’t have the money yet www. myglobaled. com

Required notifications §Must notify the student of the Title IV funds they will receive § How and when the funds will be disbursed § If the loan funds will be subsidized or unsubsidized § Can be done via award letter www. myglobaled. com

Required notifications §Must notify the student of the Title IV funds they will receive § How and when the funds will be disbursed § If the loan funds will be subsidized or unsubsidized § Can be done via award letter www. myglobaled. com

Required notifications § After the funds are received must notify the student § Date and amount of disbursement § Right to cancel the loan § How to cancel § Notice can be 30 days before or after disbursement § The student has 14 days to respond www. myglobaled. com

Required notifications § After the funds are received must notify the student § Date and amount of disbursement § Right to cancel the loan § How to cancel § Notice can be 30 days before or after disbursement § The student has 14 days to respond www. myglobaled. com

Required authorizations §Must have written authorization § Using Title IV funds to pay any allowable charges beyond tuition and housing § Holding credit balances § For Parent PLUS – permission to disburse excess funds directly to student www. myglobaled. com

Required authorizations §Must have written authorization § Using Title IV funds to pay any allowable charges beyond tuition and housing § Holding credit balances § For Parent PLUS – permission to disburse excess funds directly to student www. myglobaled. com

New Issues §Exchange rate § What rate to use to if doing a ledger transaction §Planning for processing days – aware of local and US business days www. myglobaled. com

New Issues §Exchange rate § What rate to use to if doing a ledger transaction §Planning for processing days – aware of local and US business days www. myglobaled. com

Disbursement relief § Schools with a Cohort Default Rate of less than 10% over the most recent three fiscal years may disburse single semester/term loans in a single disbursement. § Schools with a Cohort Default Rate of less than 10% over the most recent three fiscal years do not have to apply the 30 day disbursement delay to 1 st year, 1 st borrowers. § This will change to 15% on October 1, 2011 § Cohort Default Rates available at: http: //www. ed. gov/offices/OSFAP/default management/cdr. html www. myglobaled. com

Disbursement relief § Schools with a Cohort Default Rate of less than 10% over the most recent three fiscal years may disburse single semester/term loans in a single disbursement. § Schools with a Cohort Default Rate of less than 10% over the most recent three fiscal years do not have to apply the 30 day disbursement delay to 1 st year, 1 st borrowers. § This will change to 15% on October 1, 2011 § Cohort Default Rates available at: http: //www. ed. gov/offices/OSFAP/default management/cdr. html www. myglobaled. com

Reconciliation §Monthly you need to ‘balance the cheque book’ and make sure what you authorized in COD matches what you drew down from G 5 www. myglobaled. com

Reconciliation §Monthly you need to ‘balance the cheque book’ and make sure what you authorized in COD matches what you drew down from G 5 www. myglobaled. com

Staffing § You must separate the functions of ‘awarding’ and ‘disbursing’ § Must be a separate office. § ‘Financial Aid’ office works with student, FAFSA, origination and can even do the G 5 process § ‘Business Office’ transfers the money, credits the students account and issues funds. www. myglobaled. com

Staffing § You must separate the functions of ‘awarding’ and ‘disbursing’ § Must be a separate office. § ‘Financial Aid’ office works with student, FAFSA, origination and can even do the G 5 process § ‘Business Office’ transfers the money, credits the students account and issues funds. www. myglobaled. com

Setting Disbursements § If there is more than one term in the loan period, the loan must be disbursed over all terms of the loan period. For example, if a loan period includes all three quarters of an academic year, the loan must be disbursed in three substantially equal disbursements. § If there is only one term in the loan period, the loan must be disbursed in equal amounts at the beginning of the term and at the term’s calendar midpoint. www. myglobaled. com

Setting Disbursements § If there is more than one term in the loan period, the loan must be disbursed over all terms of the loan period. For example, if a loan period includes all three quarters of an academic year, the loan must be disbursed in three substantially equal disbursements. § If there is only one term in the loan period, the loan must be disbursed in equal amounts at the beginning of the term and at the term’s calendar midpoint. www. myglobaled. com

Setting Disbursements Q: What if the institution has a payment plan that does not match the loan terms? A: Disbursements must still be based on the terms in the student's program of study and the associated academic year. You may still require the student to pay according to your institution’s payment plan (even all at once up front) but that is a separate policy decision. www. myglobaled. com

Setting Disbursements Q: What if the institution has a payment plan that does not match the loan terms? A: Disbursements must still be based on the terms in the student's program of study and the associated academic year. You may still require the student to pay according to your institution’s payment plan (even all at once up front) but that is a separate policy decision. www. myglobaled. com

Setting Disbursements Q: What about programs that are taught for one academic year followed by a “writing up” period? A: Many UK programs have postgraduate courses where classes are taught September to June, after which students have from June to August to write and submit a thesis, though no additional fees are charged. In this case the “writing up” period is considered a term and requires a separate disbursement if the student is considered enrolled at least ½ time. www. myglobaled. com

Setting Disbursements Q: What about programs that are taught for one academic year followed by a “writing up” period? A: Many UK programs have postgraduate courses where classes are taught September to June, after which students have from June to August to write and submit a thesis, though no additional fees are charged. In this case the “writing up” period is considered a term and requires a separate disbursement if the student is considered enrolled at least ½ time. www. myglobaled. com

Refunds www. myglobaled. com

Refunds www. myglobaled. com

When § The student withdraws prior to completing loan period § Calculation must be completed regardless if student paid school § 60% loan period completion = full loan eligibility § School must return unearned portion of loan attributed to institutional charges § Even if student did not pay school!! www. myglobaled. com

When § The student withdraws prior to completing loan period § Calculation must be completed regardless if student paid school § 60% loan period completion = full loan eligibility § School must return unearned portion of loan attributed to institutional charges § Even if student did not pay school!! www. myglobaled. com

When § Funds must returned within 45 days of the date of determination § Clock starts § Date student withdraws or § Date student notified school of withdrawal or § Date the school became aware the student was no longer attending www. myglobaled. com

When § Funds must returned within 45 days of the date of determination § Clock starts § Date student withdraws or § Date student notified school of withdrawal or § Date the school became aware the student was no longer attending www. myglobaled. com

How § Credit hour schools § Based on calendar days completed § Credit hour example: § Borrower completed 42 days § Loan period 200 days (excluding breaks) § Borrower completed 21% § Borrower earned $2, 152. 50 of $10, 250 loan www. myglobaled. com

How § Credit hour schools § Based on calendar days completed § Credit hour example: § Borrower completed 42 days § Loan period 200 days (excluding breaks) § Borrower completed 21% § Borrower earned $2, 152. 50 of $10, 250 loan www. myglobaled. com

Returning Funds § Order of return: § Unsubsidized Stafford § Subsidized Stafford § GRAD PLUS § Parent PLUS § School must return the lesser of: § Amount of unearned funds or § the amount of institutional charges that the student incurred for the payment period or period of enrollment multiplied by the percentage of funds that was not earned. www. myglobaled. com

Returning Funds § Order of return: § Unsubsidized Stafford § Subsidized Stafford § GRAD PLUS § Parent PLUS § School must return the lesser of: § Amount of unearned funds or § the amount of institutional charges that the student incurred for the payment period or period of enrollment multiplied by the percentage of funds that was not earned. www. myglobaled. com

Returning funds §Can be through G 5 system § If you have an account in the United States §Must be returned by cheque if you have a ‘foreign’ based account § Doesn’t matter if it’s a dollar account www. myglobaled. com

Returning funds §Can be through G 5 system § If you have an account in the United States §Must be returned by cheque if you have a ‘foreign’ based account § Doesn’t matter if it’s a dollar account www. myglobaled. com

Administrative Items www. myglobaled. com

Administrative Items www. myglobaled. com

Student Status Confirmation Reports (SSCR) § Generally sent bi-annually § Enrolled or recently enrolled students sent on list with most recent enrollment status § School reviews and updates § Must be returned within 30 days § Can be removed from FFELP for noncompliance § Can update more frequently § Deferments § Can be done via NSLDS or Clearinghouse www. myglobaled. com

Student Status Confirmation Reports (SSCR) § Generally sent bi-annually § Enrolled or recently enrolled students sent on list with most recent enrollment status § School reviews and updates § Must be returned within 30 days § Can be removed from FFELP for noncompliance § Can update more frequently § Deferments § Can be done via NSLDS or Clearinghouse www. myglobaled. com

Exit Counseling § School must provide copy of exit counseling information to guaranty agency within 60 days of completion § Online counseling can be found at: § www. studentloan. gov § Must register for this service www. myglobaled. com

Exit Counseling § School must provide copy of exit counseling information to guaranty agency within 60 days of completion § Online counseling can be found at: § www. studentloan. gov § Must register for this service www. myglobaled. com

Record Retention § Schools must maintain records for a minimum of three years from when the student last attended § Any signature, seal, etc must be kept in original format § All others can be maintained electronically as long as it can be reproduced § SAR’s originals must be kept § Must develop procedures to retain ISIR’s www. myglobaled. com

Record Retention § Schools must maintain records for a minimum of three years from when the student last attended § Any signature, seal, etc must be kept in original format § All others can be maintained electronically as long as it can be reproduced § SAR’s originals must be kept § Must develop procedures to retain ISIR’s www. myglobaled. com

Record Retention § School must allow the following entities access to records on request: § Independent auditors; § The U. S. Secretary of Education; § ED’s OIG; § The Comptroller General of the United States; and § Any guaranty agency in whose program the school participates. www. myglobaled. com

Record Retention § School must allow the following entities access to records on request: § Independent auditors; § The U. S. Secretary of Education; § ED’s OIG; § The Comptroller General of the United States; and § Any guaranty agency in whose program the school participates. www. myglobaled. com

Written Policies § Satisfactory Academic Progress § Can be different for FFELP recipients but must be at least as strict as general policy § Minimum standard is 150% of program time § Federal Education Right to Privacy (FERPA) § Written policy on how students and parents can review records § Includes disclosure of said procedures to students § Must include documentation of when info is released to third party www. myglobaled. com

Written Policies § Satisfactory Academic Progress § Can be different for FFELP recipients but must be at least as strict as general policy § Minimum standard is 150% of program time § Federal Education Right to Privacy (FERPA) § Written policy on how students and parents can review records § Includes disclosure of said procedures to students § Must include documentation of when info is released to third party www. myglobaled. com

On-line Programs If your programme has a compulsory online component, which does not include a face to face class attendance between lecturer/tutor and student, you cannot award any US Federal Loans to the student. This compulsory component removes eligibility for the whole programme. It is our interpretation that if the online class is also offered in the “traditional” manner of physical class attendance, and the US student is not allowed access to the online version, the programme retains it’s eligibility for US Federal loans. www. myglobaled. com

On-line Programs If your programme has a compulsory online component, which does not include a face to face class attendance between lecturer/tutor and student, you cannot award any US Federal Loans to the student. This compulsory component removes eligibility for the whole programme. It is our interpretation that if the online class is also offered in the “traditional” manner of physical class attendance, and the US student is not allowed access to the online version, the programme retains it’s eligibility for US Federal loans. www. myglobaled. com

New Requirements § School Code of Conduct § § Ban gifts Revenue sharing Staffing assistance Advisory board compensation § Expanded Exit Counseling Requirements § Expanded Lender List Requirements www. myglobaled. com

New Requirements § School Code of Conduct § § Ban gifts Revenue sharing Staffing assistance Advisory board compensation § Expanded Exit Counseling Requirements § Expanded Lender List Requirements www. myglobaled. com

New Requirements – cont. § Cannot use Title IV funds to lobby Congress or any agency § Fire Safety Report § Transfer Credit Reporting § Crime Report requirement has ended for Foreign Schools § New requirements regarding certification of private loans (will need to know that all Title IV aid has been exhausted) www. myglobaled. com

New Requirements – cont. § Cannot use Title IV funds to lobby Congress or any agency § Fire Safety Report § Transfer Credit Reporting § Crime Report requirement has ended for Foreign Schools § New requirements regarding certification of private loans (will need to know that all Title IV aid has been exhausted) www. myglobaled. com

Other Programs www. myglobaled. com

Other Programs www. myglobaled. com

Private Credit Based Loans § Amount can be no higher than the lesser of: § COA – EFA § Borrower requested amount § Lender approved amount § Good credit is necessary § Interest variable § Prime vs LIBOR § Will have most likely have an origination fee www. myglobaled. com

Private Credit Based Loans § Amount can be no higher than the lesser of: § COA – EFA § Borrower requested amount § Lender approved amount § Good credit is necessary § Interest variable § Prime vs LIBOR § Will have most likely have an origination fee www. myglobaled. com

Resources and Contacts www. myglobaled. com

Resources and Contacts www. myglobaled. com

International Education Council § IEC is a non-profit association tracking issues and policies affecting international education with a focus on student financial aid § www. intl-edcouncil. org www. myglobaled. com

International Education Council § IEC is a non-profit association tracking issues and policies affecting international education with a focus on student financial aid § www. intl-edcouncil. org www. myglobaled. com

US Loans Listserv § Go to http: //www. jiscmail. ac. uk/cgibin/webadmin? SUBED 1=us-loans&A=1 § Enter your email address and name. § Wait for a confirmation email and click on the link in the email. § Your request to join the list will be then reviewed by the list owner, Sean Mc. Nally. § Receive your confirmation of the list, including directions on managing your account. § Start using the list! § Problems? Email Sean at s. mcnally@lse. ac. uk www. myglobaled. com

US Loans Listserv § Go to http: //www. jiscmail. ac. uk/cgibin/webadmin? SUBED 1=us-loans&A=1 § Enter your email address and name. § Wait for a confirmation email and click on the link in the email. § Your request to join the list will be then reviewed by the list owner, Sean Mc. Nally. § Receive your confirmation of the list, including directions on managing your account. § Start using the list! § Problems? Email Sean at s. mcnally@lse. ac. uk www. myglobaled. com

Thank you! §erich@esmglobal. com §+ 44 (0)20 8549 9700 www. myglobaled. com

Thank you! §erich@esmglobal. com §+ 44 (0)20 8549 9700 www. myglobaled. com