c7313a4ecd8ee8591af89fa5646b10e4.ppt

- Количество слайдов: 40

An introduction to trading via Online Share Trading 1

An introduction to trading via Online Share Trading 1

Comment “I know you believe you understand what you think I said, but I am not sure you realise that what you heard is not what I meant. ” Alan Greenspan – former US Fed chief. 2

Comment “I know you believe you understand what you think I said, but I am not sure you realise that what you heard is not what I meant. ” Alan Greenspan – former US Fed chief. 2

Agenda What will we be covering tonight? Introduction Features and benefits What is a currency future? Pricing a currency future Margin Quarterly close-out Practical example Detailed cash flows Risks The Online Share Trading website 3

Agenda What will we be covering tonight? Introduction Features and benefits What is a currency future? Pricing a currency future Margin Quarterly close-out Practical example Detailed cash flows Risks The Online Share Trading website 3

Introduction Standard Bank is a leader in Listed Retail Derivatives on the JSE • By retail we mean: Derivatives for the private investor What is a listed derivative? • A financial instrument, traded on an exchange, the price of which is directly dependent upon (i. e. "derived from") the value of one or more underlying securities. Examples of listed Retail Derivatives include 1. Warrants 2. Share Instalments 3. Single Stock Futures 4. CURRENCY FUTURES 4

Introduction Standard Bank is a leader in Listed Retail Derivatives on the JSE • By retail we mean: Derivatives for the private investor What is a listed derivative? • A financial instrument, traded on an exchange, the price of which is directly dependent upon (i. e. "derived from") the value of one or more underlying securities. Examples of listed Retail Derivatives include 1. Warrants 2. Share Instalments 3. Single Stock Futures 4. CURRENCY FUTURES 4

Features & Benefits • Allows RSA Citizens to hedge exposures to fluctuations in exchange rates, such as foreign holidays and off-shore investments or simply to speculate. • Take a view on the currency in either direction (long or short) • Liquidity provided by market makers • The ability to input your own bids and offers • Traded on a regulated exchange - SAFEX • Reduced capital to trade (Initial margin / deposit only) thus offers gearing of up to 10 times. • Cost effective brokerage rates • Only settles in rand, so no impact on your off-shore allowance of R 2 m • Small contract size of only 1000 units of the underlying currency ( eg $1, 000) 5

Features & Benefits • Allows RSA Citizens to hedge exposures to fluctuations in exchange rates, such as foreign holidays and off-shore investments or simply to speculate. • Take a view on the currency in either direction (long or short) • Liquidity provided by market makers • The ability to input your own bids and offers • Traded on a regulated exchange - SAFEX • Reduced capital to trade (Initial margin / deposit only) thus offers gearing of up to 10 times. • Cost effective brokerage rates • Only settles in rand, so no impact on your off-shore allowance of R 2 m • Small contract size of only 1000 units of the underlying currency ( eg $1, 000) 5

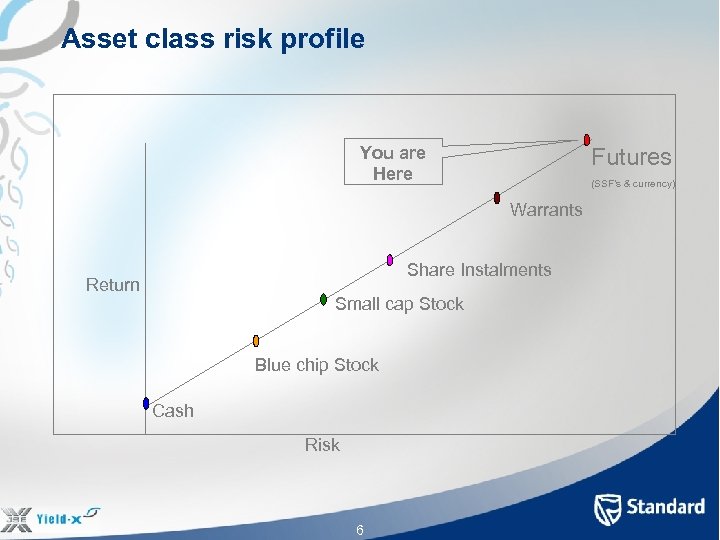

Asset class risk profile You are Here Futures (SSF’s & currency) Warrants Share Instalments Return Small cap Stock Blue chip Stock Cash Risk 6

Asset class risk profile You are Here Futures (SSF’s & currency) Warrants Share Instalments Return Small cap Stock Blue chip Stock Cash Risk 6

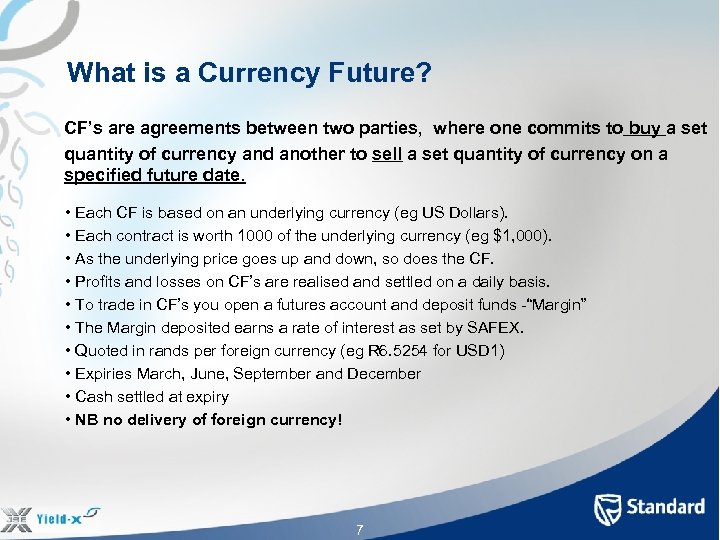

What is a Currency Future? CF’s are agreements between two parties, where one commits to buy a set quantity of currency and another to sell a set quantity of currency on a specified future date. • Each CF is based on an underlying currency (eg US Dollars). • Each contract is worth 1000 of the underlying currency (eg $1, 000). • As the underlying price goes up and down, so does the CF. • Profits and losses on CF’s are realised and settled on a daily basis. • To trade in CF’s you open a futures account and deposit funds -“Margin” • The Margin deposited earns a rate of interest as set by SAFEX. • Quoted in rands per foreign currency (eg R 6. 5254 for USD 1) • Expiries March, June, September and December • Cash settled at expiry • NB no delivery of foreign currency! 7

What is a Currency Future? CF’s are agreements between two parties, where one commits to buy a set quantity of currency and another to sell a set quantity of currency on a specified future date. • Each CF is based on an underlying currency (eg US Dollars). • Each contract is worth 1000 of the underlying currency (eg $1, 000). • As the underlying price goes up and down, so does the CF. • Profits and losses on CF’s are realised and settled on a daily basis. • To trade in CF’s you open a futures account and deposit funds -“Margin” • The Margin deposited earns a rate of interest as set by SAFEX. • Quoted in rands per foreign currency (eg R 6. 5254 for USD 1) • Expiries March, June, September and December • Cash settled at expiry • NB no delivery of foreign currency! 7

The FX Market • Largest Market in the World • April 2007 BIS survey USD 3. 2 trillion per day • Hedge funds and web based electronic trading has greatly increased volume • In SA +/- USD 10 billion a day, more than 10 times the JSE trading volumes • Operates 24 hours a day – Locally Monday –Friday 9 am – 5 pm • Always involves 2 currencies • If you buy one then have sold the other 8

The FX Market • Largest Market in the World • April 2007 BIS survey USD 3. 2 trillion per day • Hedge funds and web based electronic trading has greatly increased volume • In SA +/- USD 10 billion a day, more than 10 times the JSE trading volumes • Operates 24 hours a day – Locally Monday –Friday 9 am – 5 pm • Always involves 2 currencies • If you buy one then have sold the other 8

Factors that influence FX Rates Exchange rate determined by demand supply Demand supply influenced by: • Economic Factors (eg Interest rates) • Sentiment • Technical Factors & Micro-structure 9

Factors that influence FX Rates Exchange rate determined by demand supply Demand supply influenced by: • Economic Factors (eg Interest rates) • Sentiment • Technical Factors & Micro-structure 9

Base Currency vs Quoted Currency Exchange rate, ratio of exchange between two currencies USD 1 = ZAR 6. 6345 Euro 1 = ZAR 9. 6142 Pound 1 = ZAR 13. 7839 Base currency Quoted currency 10

Base Currency vs Quoted Currency Exchange rate, ratio of exchange between two currencies USD 1 = ZAR 6. 6345 Euro 1 = ZAR 9. 6142 Pound 1 = ZAR 13. 7839 Base currency Quoted currency 10

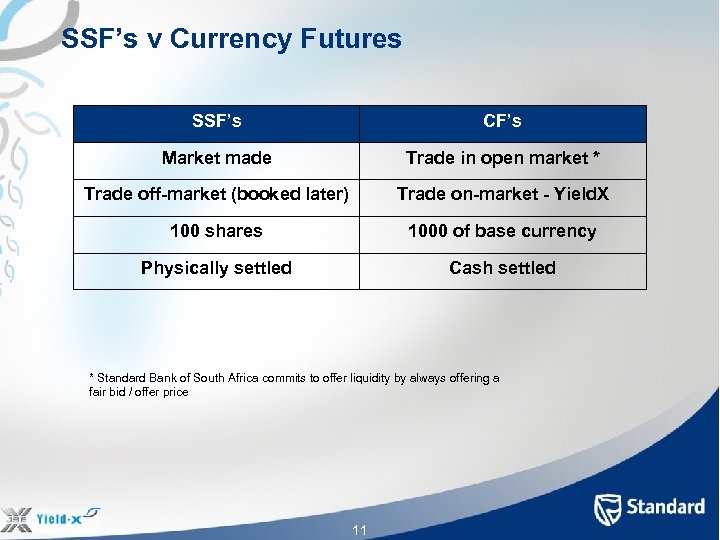

SSF’s v Currency Futures SSF’s CF’s Market made Trade in open market * Trade off-market (booked later) Trade on-market - Yield. X 100 shares 1000 of base currency Physically settled Cash settled * Standard Bank of South Africa commits to offer liquidity by always offering a fair bid / offer price 11

SSF’s v Currency Futures SSF’s CF’s Market made Trade in open market * Trade off-market (booked later) Trade on-market - Yield. X 100 shares 1000 of base currency Physically settled Cash settled * Standard Bank of South Africa commits to offer liquidity by always offering a fair bid / offer price 11

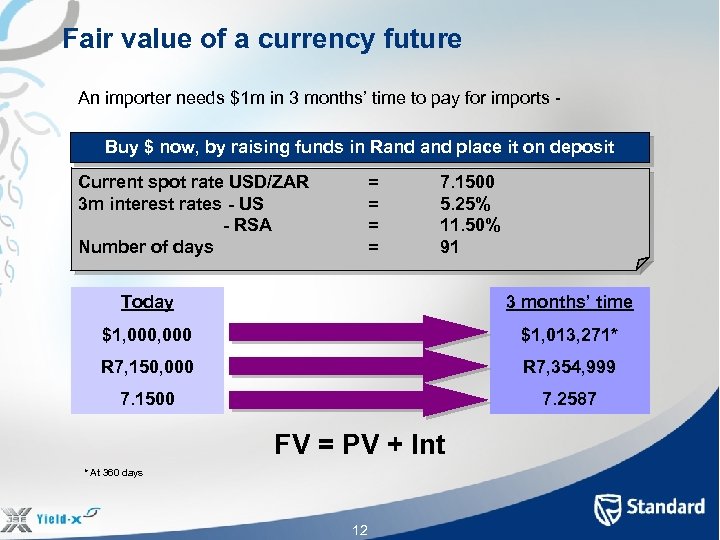

Fair value of a currency future An importer needs $1 m in 3 months’ time to pay for imports Buy $ now, by raising funds in Rand place it on deposit Current spot rate USD/ZAR 3 m interest rates - US - RSA Number of days = = 7. 1500 5. 25% 11. 50% 91 Today 3 months’ time $1, 000 $1, 013, 271* R 7, 150, 000 R 7, 354, 999 7. 1500 7. 2587 FV = PV + Int * At 360 days 12

Fair value of a currency future An importer needs $1 m in 3 months’ time to pay for imports Buy $ now, by raising funds in Rand place it on deposit Current spot rate USD/ZAR 3 m interest rates - US - RSA Number of days = = 7. 1500 5. 25% 11. 50% 91 Today 3 months’ time $1, 000 $1, 013, 271* R 7, 150, 000 R 7, 354, 999 7. 1500 7. 2587 FV = PV + Int * At 360 days 12

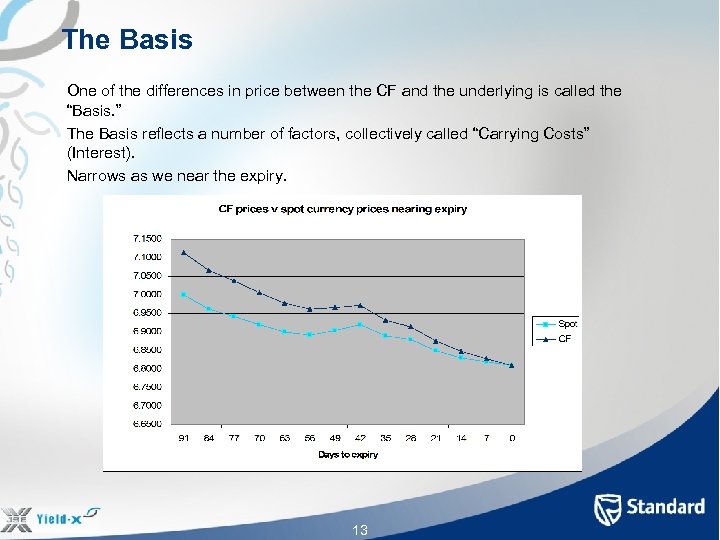

The Basis One of the differences in price between the CF and the underlying is called the “Basis. ” The Basis reflects a number of factors, collectively called “Carrying Costs” (Interest). Narrows as we near the expiry. 13

The Basis One of the differences in price between the CF and the underlying is called the “Basis. ” The Basis reflects a number of factors, collectively called “Carrying Costs” (Interest). Narrows as we near the expiry. 13

Margin Every trade that takes place on SAFEX is guaranteed by SAFEX. By a process known as novation, SAFEX guarantees the performance on each trade and removes the risk of counterparties not meeting their obligations. In order to protect itself against any particular party failing to meet its obligations SAFEX employs a process of margining. There are 3 types of margin: • Initial margin • Variation margin • Maintenance margin 14

Margin Every trade that takes place on SAFEX is guaranteed by SAFEX. By a process known as novation, SAFEX guarantees the performance on each trade and removes the risk of counterparties not meeting their obligations. In order to protect itself against any particular party failing to meet its obligations SAFEX employs a process of margining. There are 3 types of margin: • Initial margin • Variation margin • Maintenance margin 14

Initial Margin • To ensure that you meet the obligations of your trade, SAFEX requires that you post (deposit) initial margin. • Think of Initial margin as a “good faith” deposit. • This money remains on deposit as long as the position is open. • It earns a market related rate of interest. • The initial margin is returned to the investor when the position is closed out, or the contract expires. • Initial margin is about 10% of the underlying value of the position. • It is meant to equal the highest loss that may occur in a two business day period. • Brokers may require that clients deposit initial margin in excess of the minimum SAFEX requirements. Online Share Trading requires an extra 50%. This is referred to as “maintenance margin” and is discussed later. 15

Initial Margin • To ensure that you meet the obligations of your trade, SAFEX requires that you post (deposit) initial margin. • Think of Initial margin as a “good faith” deposit. • This money remains on deposit as long as the position is open. • It earns a market related rate of interest. • The initial margin is returned to the investor when the position is closed out, or the contract expires. • Initial margin is about 10% of the underlying value of the position. • It is meant to equal the highest loss that may occur in a two business day period. • Brokers may require that clients deposit initial margin in excess of the minimum SAFEX requirements. Online Share Trading requires an extra 50%. This is referred to as “maintenance margin” and is discussed later. 15

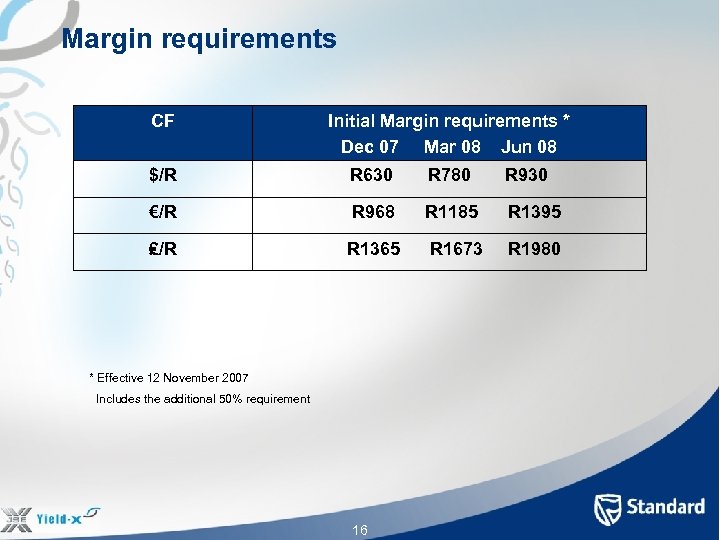

Margin requirements CF Initial Margin requirements * Dec 07 Mar 08 Jun 08 $/R R 630 R 780 R 930 €/R R 968 R 1185 R 1395 ₤/R R 1365 R 1673 R 1980 * Effective 12 November 2007 Includes the additional 50% requirement 16

Margin requirements CF Initial Margin requirements * Dec 07 Mar 08 Jun 08 $/R R 630 R 780 R 930 €/R R 968 R 1185 R 1395 ₤/R R 1365 R 1673 R 1980 * Effective 12 November 2007 Includes the additional 50% requirement 16

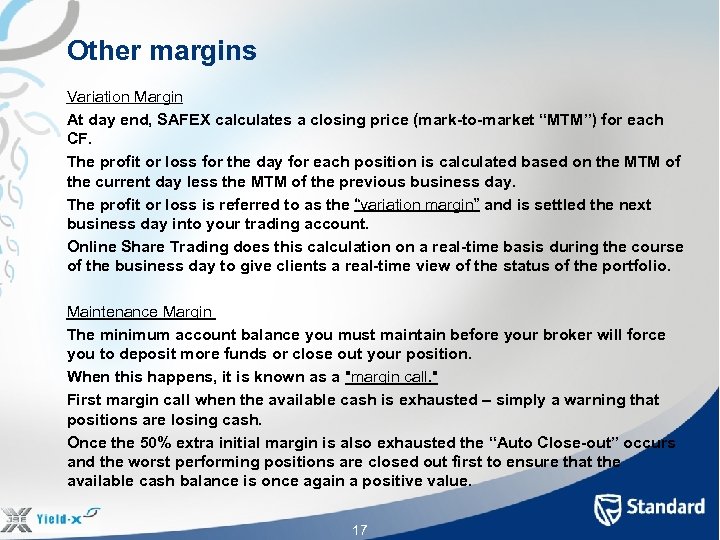

Other margins Variation Margin At day end, SAFEX calculates a closing price (mark-to-market “MTM”) for each CF. The profit or loss for the day for each position is calculated based on the MTM of the current day less the MTM of the previous business day. The profit or loss is referred to as the “variation margin” and is settled the next business day into your trading account. Online Share Trading does this calculation on a real-time basis during the course of the business day to give clients a real-time view of the status of the portfolio. Maintenance Margin The minimum account balance you must maintain before your broker will force you to deposit more funds or close out your position. When this happens, it is known as a "margin call. " First margin call when the available cash is exhausted – simply a warning that positions are losing cash. Once the 50% extra initial margin is also exhausted the “Auto Close-out” occurs and the worst performing positions are closed out first to ensure that the available cash balance is once again a positive value. 17

Other margins Variation Margin At day end, SAFEX calculates a closing price (mark-to-market “MTM”) for each CF. The profit or loss for the day for each position is calculated based on the MTM of the current day less the MTM of the previous business day. The profit or loss is referred to as the “variation margin” and is settled the next business day into your trading account. Online Share Trading does this calculation on a real-time basis during the course of the business day to give clients a real-time view of the status of the portfolio. Maintenance Margin The minimum account balance you must maintain before your broker will force you to deposit more funds or close out your position. When this happens, it is known as a "margin call. " First margin call when the available cash is exhausted – simply a warning that positions are losing cash. Once the 50% extra initial margin is also exhausted the “Auto Close-out” occurs and the worst performing positions are closed out first to ensure that the available cash balance is once again a positive value. 17

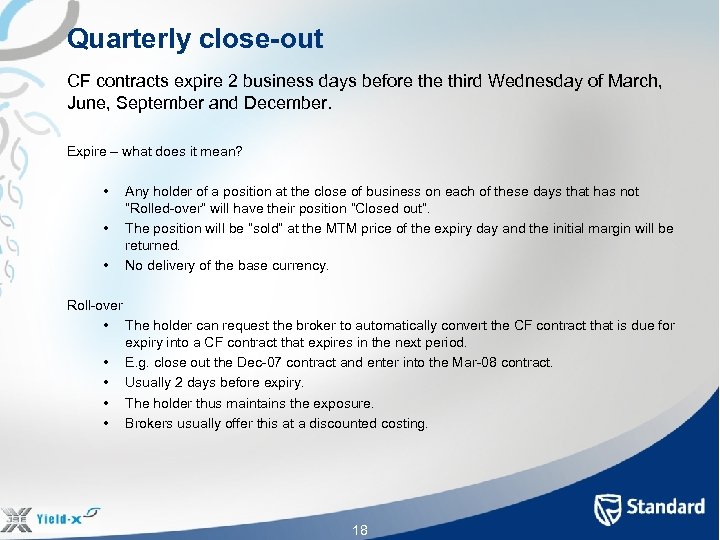

Quarterly close-out CF contracts expire 2 business days before third Wednesday of March, June, September and December. Expire – what does it mean? • • • Any holder of a position at the close of business on each of these days that has not “Rolled-over” will have their position “Closed out”. The position will be “sold” at the MTM price of the expiry day and the initial margin will be returned. No delivery of the base currency. Roll-over • The holder can request the broker to automatically convert the CF contract that is due for expiry into a CF contract that expires in the next period. • E. g. close out the Dec-07 contract and enter into the Mar-08 contract. • Usually 2 days before expiry. • The holder thus maintains the exposure. • Brokers usually offer this at a discounted costing. 18

Quarterly close-out CF contracts expire 2 business days before third Wednesday of March, June, September and December. Expire – what does it mean? • • • Any holder of a position at the close of business on each of these days that has not “Rolled-over” will have their position “Closed out”. The position will be “sold” at the MTM price of the expiry day and the initial margin will be returned. No delivery of the base currency. Roll-over • The holder can request the broker to automatically convert the CF contract that is due for expiry into a CF contract that expires in the next period. • E. g. close out the Dec-07 contract and enter into the Mar-08 contract. • Usually 2 days before expiry. • The holder thus maintains the exposure. • Brokers usually offer this at a discounted costing. 18

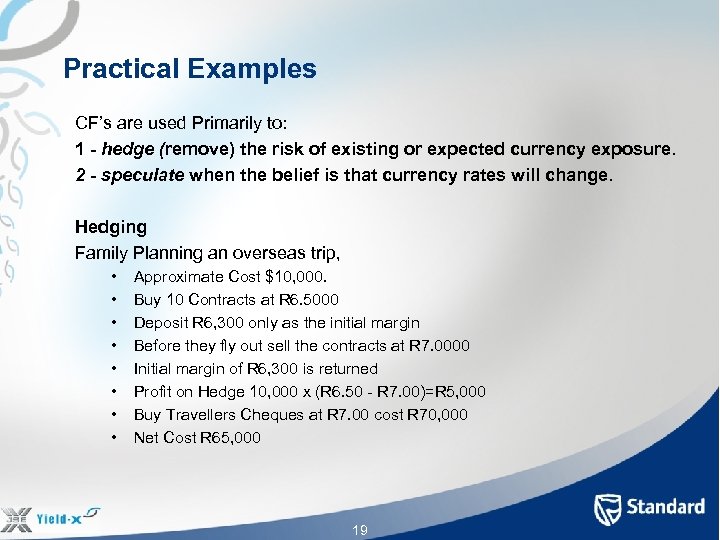

Practical Examples CF’s are used Primarily to: 1 - hedge (remove) the risk of existing or expected currency exposure. 2 - speculate when the belief is that currency rates will change. Hedging Family Planning an overseas trip, • • Approximate Cost $10, 000. Buy 10 Contracts at R 6. 5000 Deposit R 6, 300 only as the initial margin Before they fly out sell the contracts at R 7. 0000 Initial margin of R 6, 300 is returned Profit on Hedge 10, 000 x (R 6. 50 - R 7. 00)=R 5, 000 Buy Travellers Cheques at R 7. 00 cost R 70, 000 Net Cost R 65, 000 19

Practical Examples CF’s are used Primarily to: 1 - hedge (remove) the risk of existing or expected currency exposure. 2 - speculate when the belief is that currency rates will change. Hedging Family Planning an overseas trip, • • Approximate Cost $10, 000. Buy 10 Contracts at R 6. 5000 Deposit R 6, 300 only as the initial margin Before they fly out sell the contracts at R 7. 0000 Initial margin of R 6, 300 is returned Profit on Hedge 10, 000 x (R 6. 50 - R 7. 00)=R 5, 000 Buy Travellers Cheques at R 7. 00 cost R 70, 000 Net Cost R 65, 000 19

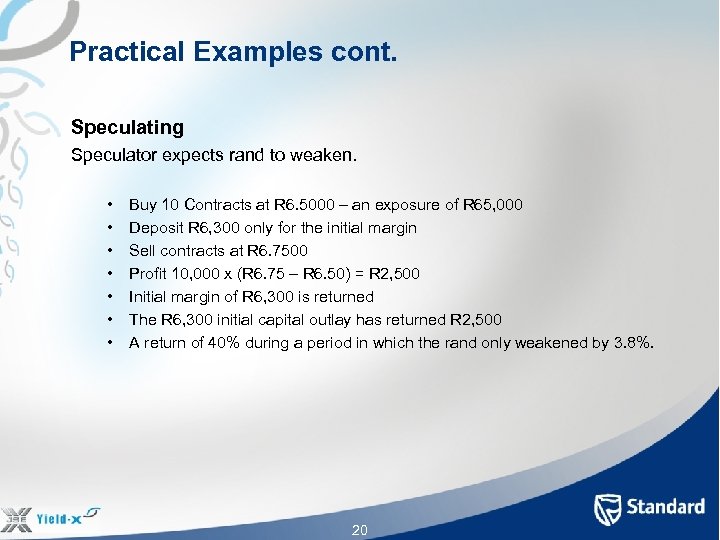

Practical Examples cont. Speculating Speculator expects rand to weaken. • • Buy 10 Contracts at R 6. 5000 – an exposure of R 65, 000 Deposit R 6, 300 only for the initial margin Sell contracts at R 6. 7500 Profit 10, 000 x (R 6. 75 – R 6. 50) = R 2, 500 Initial margin of R 6, 300 is returned The R 6, 300 initial capital outlay has returned R 2, 500 A return of 40% during a period in which the rand only weakened by 3. 8%. 20

Practical Examples cont. Speculating Speculator expects rand to weaken. • • Buy 10 Contracts at R 6. 5000 – an exposure of R 65, 000 Deposit R 6, 300 only for the initial margin Sell contracts at R 6. 7500 Profit 10, 000 x (R 6. 75 – R 6. 50) = R 2, 500 Initial margin of R 6, 300 is returned The R 6, 300 initial capital outlay has returned R 2, 500 A return of 40% during a period in which the rand only weakened by 3. 8%. 20

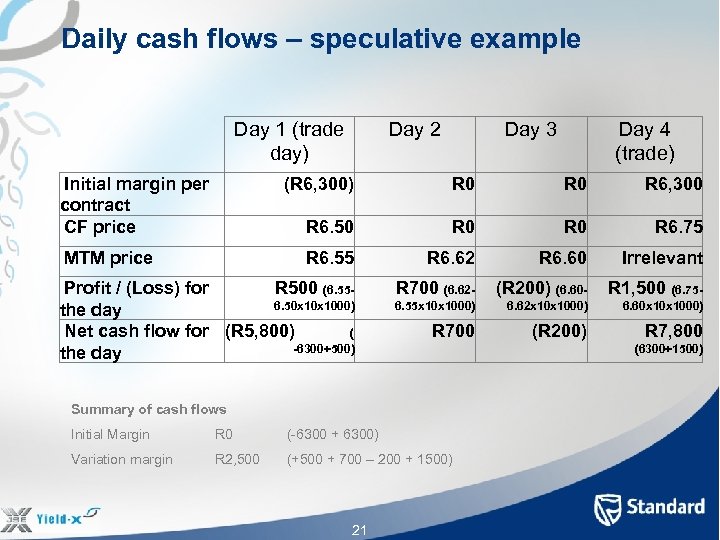

Daily cash flows – speculative example Day 1 (trade day) Initial margin per contract CF price Day 2 Day 3 Day 4 (trade) (R 6, 300) R 0 R 6, 300 R 6. 50 R 0 R 6. 75 R 6. 55 R 6. 62 R 6. 60 Irrelevant Profit / (Loss) for R 500 (6. 556. 50 x 1000) the day Net cash flow for (R 5, 800) ( -6300+500) the day R 700 (6. 62 - (R 200) (6. 60 - R 1, 500 (6. 75 - 6. 55 x 1000) 6. 62 x 1000) 6. 60 x 1000) MTM price R 700 Summary of cash flows Initial Margin R 0 (-6300 + 6300) Variation margin R 2, 500 (+500 + 700 – 200 + 1500) 21 (R 200) R 7, 800 (6300+1500)

Daily cash flows – speculative example Day 1 (trade day) Initial margin per contract CF price Day 2 Day 3 Day 4 (trade) (R 6, 300) R 0 R 6, 300 R 6. 50 R 0 R 6. 75 R 6. 55 R 6. 62 R 6. 60 Irrelevant Profit / (Loss) for R 500 (6. 556. 50 x 1000) the day Net cash flow for (R 5, 800) ( -6300+500) the day R 700 (6. 62 - (R 200) (6. 60 - R 1, 500 (6. 75 - 6. 55 x 1000) 6. 62 x 1000) 6. 60 x 1000) MTM price R 700 Summary of cash flows Initial Margin R 0 (-6300 + 6300) Variation margin R 2, 500 (+500 + 700 – 200 + 1500) 21 (R 200) R 7, 800 (6300+1500)

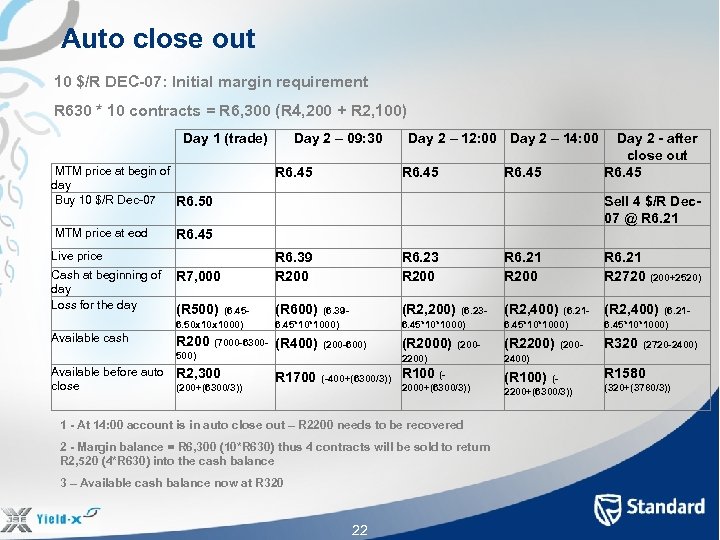

Auto close out 10 $/R DEC-07: Initial margin requirement R 630 * 10 contracts = R 6, 300 (R 4, 200 + R 2, 100) Day 1 (trade) MTM price at begin of day Buy 10 $/R Dec-07 R 6. 50 MTM price at eod R 6. 45 Day 2 – 12: 00 Day 2 – 14: 00 R 6. 45 Day 2 - after close out R 6. 45 Sell 4 $/R Dec 07 @ R 6. 21 R 6. 45 Live price Cash at beginning of R 7, 000 day Loss for the day (R 500) (6. 456. 50 x 1000) Available cash Day 2 – 09: 30 R 6. 39 R 200 R 6. 23 R 200 R 6. 21 R 2720 (200+2520) (R 600) (6. 39 - (R 2, 200) (6. 23 - (R 2, 400) (6. 21 - 6. 45*10*1000) (R 2000) (200 - (R 2200) (200 - R 320 (2720 -2400) 2200) 2400) R 200 (7000 -6300 - (R 400) (200 -600) 500) Available before auto R 2, 300 close (200+(6300/3)) R 1700 (-400+(6300/3)) R 100 (- 2000+(6300/3)) 1 - At 14: 00 account is in auto close out – R 2200 needs to be recovered 2 - Margin balance = R 6, 300 (10*R 630) thus 4 contracts will be sold to return R 2, 520 (4*R 630) into the cash balance 3 – Available cash balance now at R 320 22 (R 100) (2200+(6300/3)) R 1580 (320+(3780/3))

Auto close out 10 $/R DEC-07: Initial margin requirement R 630 * 10 contracts = R 6, 300 (R 4, 200 + R 2, 100) Day 1 (trade) MTM price at begin of day Buy 10 $/R Dec-07 R 6. 50 MTM price at eod R 6. 45 Day 2 – 12: 00 Day 2 – 14: 00 R 6. 45 Day 2 - after close out R 6. 45 Sell 4 $/R Dec 07 @ R 6. 21 R 6. 45 Live price Cash at beginning of R 7, 000 day Loss for the day (R 500) (6. 456. 50 x 1000) Available cash Day 2 – 09: 30 R 6. 39 R 200 R 6. 23 R 200 R 6. 21 R 2720 (200+2520) (R 600) (6. 39 - (R 2, 200) (6. 23 - (R 2, 400) (6. 21 - 6. 45*10*1000) (R 2000) (200 - (R 2200) (200 - R 320 (2720 -2400) 2200) 2400) R 200 (7000 -6300 - (R 400) (200 -600) 500) Available before auto R 2, 300 close (200+(6300/3)) R 1700 (-400+(6300/3)) R 100 (- 2000+(6300/3)) 1 - At 14: 00 account is in auto close out – R 2200 needs to be recovered 2 - Margin balance = R 6, 300 (10*R 630) thus 4 contracts will be sold to return R 2, 520 (4*R 630) into the cash balance 3 – Available cash balance now at R 320 22 (R 100) (2200+(6300/3)) R 1580 (320+(3780/3))

Risks • Gearing means we can lose significant amounts, if not more than the margin • There are moments of illiquidity under stress conditions • Bid – offer spreads widen • Market gaps • Stop loss orders not fixed price guarantee 23

Risks • Gearing means we can lose significant amounts, if not more than the margin • There are moments of illiquidity under stress conditions • Bid – offer spreads widen • Market gaps • Stop loss orders not fixed price guarantee 23

Risks Trading hours • Global currency markets open Monday at 5 am in Sydney closing at 5 pm on Friday in New York • Local market only open Mon-Fri 9 am-5 pm • Market could move against you while local market is closed and you will have to wait until the next days local opening to trade out 24

Risks Trading hours • Global currency markets open Monday at 5 am in Sydney closing at 5 pm on Friday in New York • Local market only open Mon-Fri 9 am-5 pm • Market could move against you while local market is closed and you will have to wait until the next days local opening to trade out 24

Who may trade Currency Futures Qualifying Clients • A Resident who is a natural person (no limits applicable) • Non-resident clients (no limits applicable) • Pension funds and long term insurance companies; subject to their 15% foreign allocation allowance • Asset managers and registered collective investment schemes subject to their 25% foreign allocation limits • All corporate entities and trust accounts are prohibited from trading unless a valid exchange control approval (ECA) is granted by the South African Reserve Bank • All authorized dealers, subject to the approval granted by the Exchange Control Department of the South African Reserve Bank, to act as market makers in the trading of currency derivatives 25

Who may trade Currency Futures Qualifying Clients • A Resident who is a natural person (no limits applicable) • Non-resident clients (no limits applicable) • Pension funds and long term insurance companies; subject to their 15% foreign allocation allowance • Asset managers and registered collective investment schemes subject to their 25% foreign allocation limits • All corporate entities and trust accounts are prohibited from trading unless a valid exchange control approval (ECA) is granted by the South African Reserve Bank • All authorized dealers, subject to the approval granted by the Exchange Control Department of the South African Reserve Bank, to act as market makers in the trading of currency derivatives 25

Client procedure to get started A – Client registration New clients • All non-existing OST clients to register as OST client first – securities. standardbank. co. za > Open an Account (see slide) • Once registered and FICA’d, apply for Futures trading account (see slide) Existing Clients • Apply for Futures trading account (see slide) 26

Client procedure to get started A – Client registration New clients • All non-existing OST clients to register as OST client first – securities. standardbank. co. za > Open an Account (see slide) • Once registered and FICA’d, apply for Futures trading account (see slide) Existing Clients • Apply for Futures trading account (see slide) 26

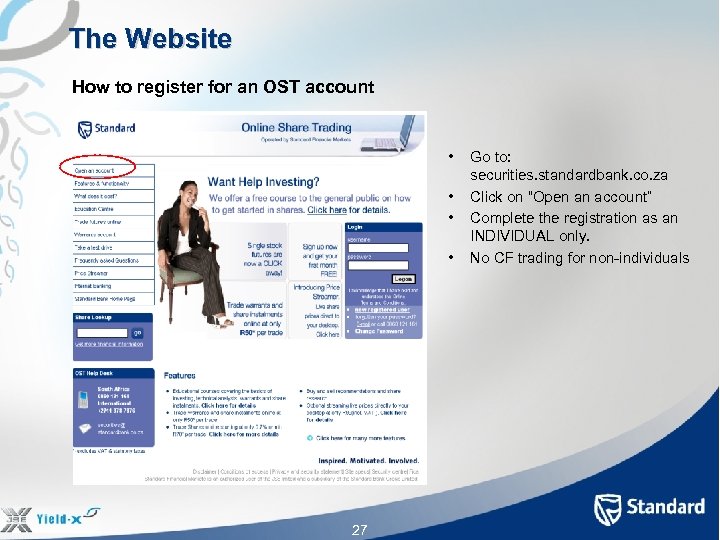

The Website How to register for an OST account • • 27 Go to: securities. standardbank. co. za Click on “Open an account” Complete the registration as an INDIVIDUAL only. No CF trading for non-individuals

The Website How to register for an OST account • • 27 Go to: securities. standardbank. co. za Click on “Open an account” Complete the registration as an INDIVIDUAL only. No CF trading for non-individuals

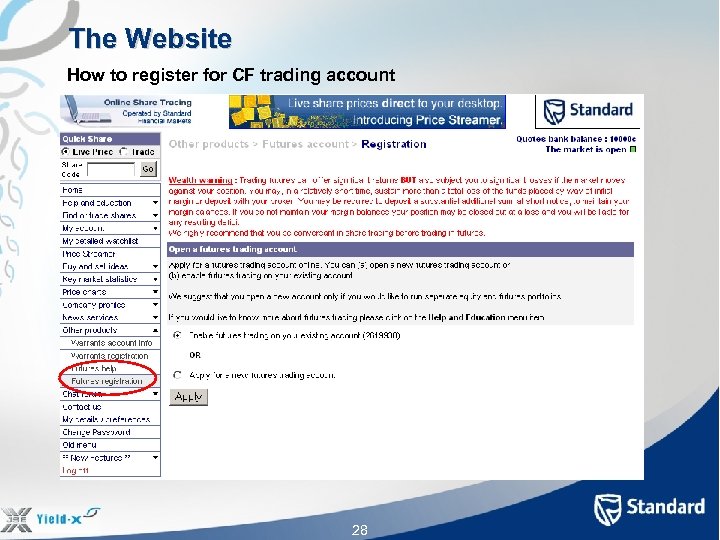

The Website How to register for CF trading account 28

The Website How to register for CF trading account 28

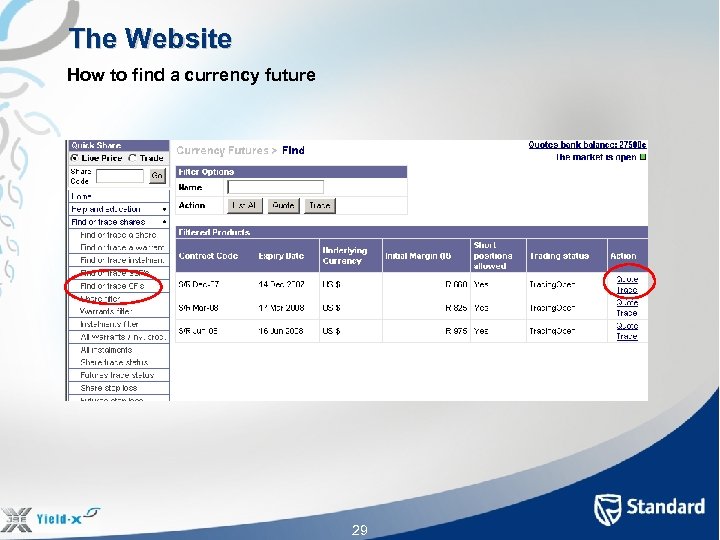

The Website How to find a currency future 29

The Website How to find a currency future 29

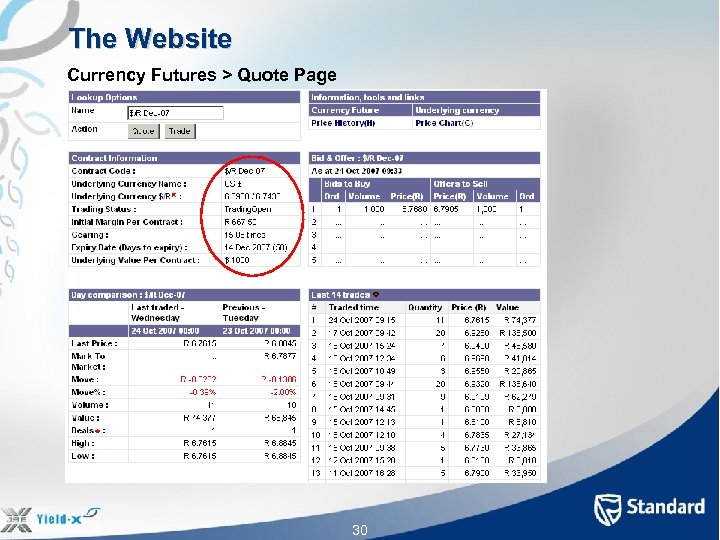

The Website Currency Futures > Quote Page 30

The Website Currency Futures > Quote Page 30

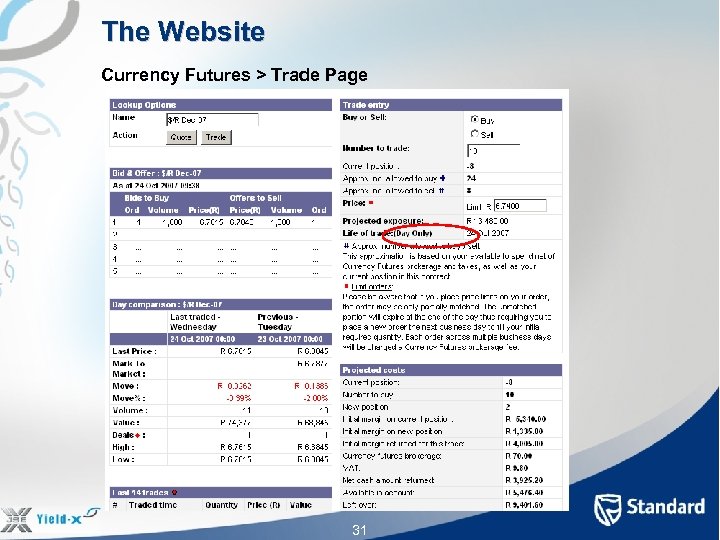

The Website Currency Futures > Trade Page 31

The Website Currency Futures > Trade Page 31

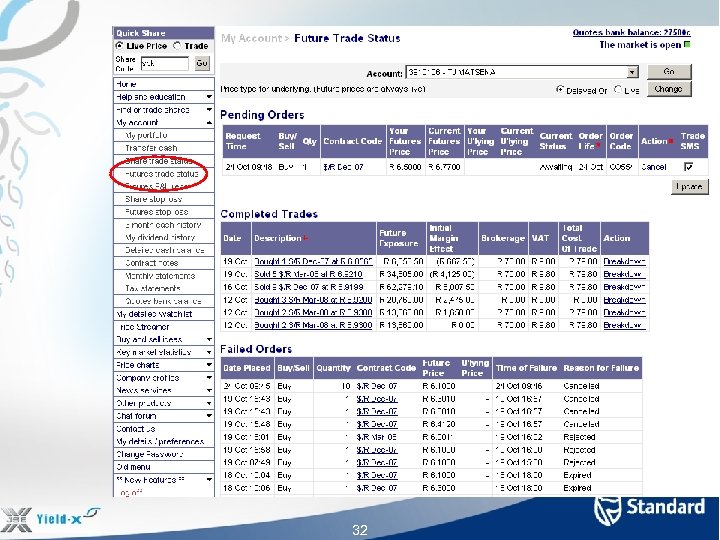

32

32

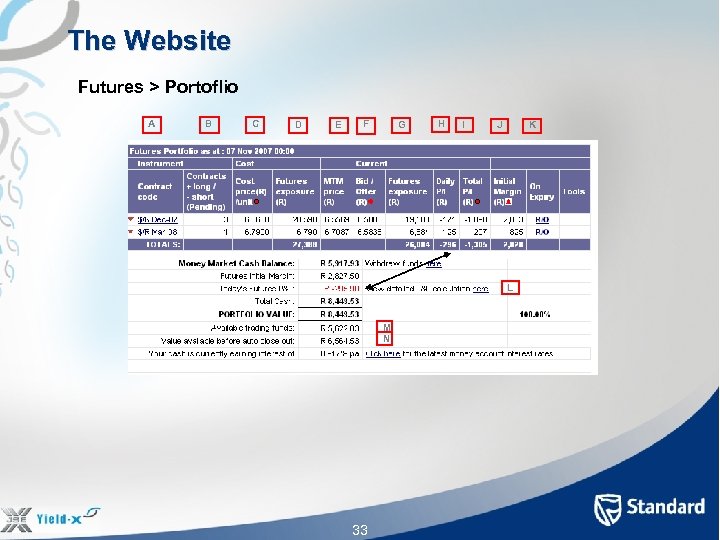

The Website Futures > Portoflio A B C D E F G H I J K L M N 33

The Website Futures > Portoflio A B C D E F G H I J K L M N 33

The Website cont. The Website Futures > Portoflio A – Contract name: eg $/R Dec-07 means the underlying currency is USD and the contract will expire on the 3 rd Monday in December 2007. B – Contracts held: 3 contracts long i. e. exposed to USD 3, 000. Will profit if the rand weakens. C – Cost Price: Initial CF price at which the 3 $/R Dec-07 traded. D – Futures Exposure: B x C. The value of the exposure of this position when initially traded. E – MTM price: The previous day’s official $/R Dec-07 closing price as calculated & published by the JSE. F – Current live SSF Bid or Offer price. The Bid price is shown for a long position as it’s the price at which a long position holder will sell at to close a position. Visa versa for a short position. G – Futures Exposure: B x F. Current exposure based on the live bid or offer CF prices. 34

The Website cont. The Website Futures > Portoflio A – Contract name: eg $/R Dec-07 means the underlying currency is USD and the contract will expire on the 3 rd Monday in December 2007. B – Contracts held: 3 contracts long i. e. exposed to USD 3, 000. Will profit if the rand weakens. C – Cost Price: Initial CF price at which the 3 $/R Dec-07 traded. D – Futures Exposure: B x C. The value of the exposure of this position when initially traded. E – MTM price: The previous day’s official $/R Dec-07 closing price as calculated & published by the JSE. F – Current live SSF Bid or Offer price. The Bid price is shown for a long position as it’s the price at which a long position holder will sell at to close a position. Visa versa for a short position. G – Futures Exposure: B x F. Current exposure based on the live bid or offer CF prices. 34

The Website cont. Futures > Portoflio H – Daily P&L: The daily profit or loss on this position – B x (F – C) if transacted today. – B x (F – E) for positions brought forward I – Total P&L: G – C. The total profit or loss on this position since purchase. J – Initial Margin: Amount withdrawn from your cash and deposited with the JSE as a “Good Faith” deposit. K – On expiry: Default is roll over, but you can select to expire. L – Daily P&L: The amount used in the cash calculation is similar to the amount as calculated in the portfolio. M – Available trading funds: Amount that can currently be used to trade (equity or SSF’s or CF’s). When this reaches NIL, you will be informed via SMS & e-mail. N – value available before auto close out: M + (R 2827 / 3). If the portfolio reduces by this value, all SSF positions will be closed out. 35

The Website cont. Futures > Portoflio H – Daily P&L: The daily profit or loss on this position – B x (F – C) if transacted today. – B x (F – E) for positions brought forward I – Total P&L: G – C. The total profit or loss on this position since purchase. J – Initial Margin: Amount withdrawn from your cash and deposited with the JSE as a “Good Faith” deposit. K – On expiry: Default is roll over, but you can select to expire. L – Daily P&L: The amount used in the cash calculation is similar to the amount as calculated in the portfolio. M – Available trading funds: Amount that can currently be used to trade (equity or SSF’s or CF’s). When this reaches NIL, you will be informed via SMS & e-mail. N – value available before auto close out: M + (R 2827 / 3). If the portfolio reduces by this value, all SSF positions will be closed out. 35

OST information and trading & website costs Get more information • Help and education section of the site • Subscribe to the “rand futures daily” publication. See Special announcement section to subscribe • Or go to “Buy and Sell ideas > Latest research reports” Trading and monthly costs Monthly subscription fee – R 47. 50* Equity trade costs – 0. 70%* CF trade costs – R 20/contract* (min R 70*) Single stock futures costs – 0. 4% * Excl VAT 36 (min R 70*) (extra R 70*)

OST information and trading & website costs Get more information • Help and education section of the site • Subscribe to the “rand futures daily” publication. See Special announcement section to subscribe • Or go to “Buy and Sell ideas > Latest research reports” Trading and monthly costs Monthly subscription fee – R 47. 50* Equity trade costs – 0. 70%* CF trade costs – R 20/contract* (min R 70*) Single stock futures costs – 0. 4% * Excl VAT 36 (min R 70*) (extra R 70*)

OST contacts Website: securities. standardbank. co. za 0860 121 161 E-mail: securities@standardbank. co. za Kurt Pagel Ridwaan Moolla Raoul Carelse 37

OST contacts Website: securities. standardbank. co. za 0860 121 161 E-mail: securities@standardbank. co. za Kurt Pagel Ridwaan Moolla Raoul Carelse 37

Wealth warning Trading currency futures can offer significant returns BUT also subject you to significant losses if the market moves against your position. You may, in a relatively short time, sustain more than a total loss of the funds placed by way of initial margin. You may be required to deposit a substantial additional sum, at short notice, to maintain your margin balance. If you do not maintain your margin balance your position may be closed out at a loss and you will be liable for any resulting deficit. 38

Wealth warning Trading currency futures can offer significant returns BUT also subject you to significant losses if the market moves against your position. You may, in a relatively short time, sustain more than a total loss of the funds placed by way of initial margin. You may be required to deposit a substantial additional sum, at short notice, to maintain your margin balance. If you do not maintain your margin balance your position may be closed out at a loss and you will be liable for any resulting deficit. 38

Questions ? 39

Questions ? 39

Disclaimer The information and opinions stated in this document are of a general nature, have been prepared solely for information purposes and do not constitute any advice or recommendation to conclude any transaction or enter into any agreement. It is strongly recommended that every recipient seek appropriate professional advice before acting on any information contained herein. Whilst every care has been taken in preparing this document, no representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or representations. All information contained herein is subject to change after publication at any time without notice. The past performance of any investment product is not an indication of future performance. Online Share Trading is operated by Standard Financial Markets Proprietary Limited Reg. No. 1972/008305/07, a subsidiary of the Standard Bank Group Limited and authorised user of the JSE Limited. 40

Disclaimer The information and opinions stated in this document are of a general nature, have been prepared solely for information purposes and do not constitute any advice or recommendation to conclude any transaction or enter into any agreement. It is strongly recommended that every recipient seek appropriate professional advice before acting on any information contained herein. Whilst every care has been taken in preparing this document, no representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or representations. All information contained herein is subject to change after publication at any time without notice. The past performance of any investment product is not an indication of future performance. Online Share Trading is operated by Standard Financial Markets Proprietary Limited Reg. No. 1972/008305/07, a subsidiary of the Standard Bank Group Limited and authorised user of the JSE Limited. 40