23cc793c884c37807cc9d42620bf52bb.ppt

- Количество слайдов: 26

An Introduction to Life Insurance Appraisal Values April 2001

An Introduction to Life Insurance Appraisal Values April 2001

Disclaimer The material that follows is a presentation of general background information about the Bank’s activities current at the date of the presentation, 3 April 2001. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These should be considered, with or without professional advice when deciding if an investment is appropriate. 2

Disclaimer The material that follows is a presentation of general background information about the Bank’s activities current at the date of the presentation, 3 April 2001. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These should be considered, with or without professional advice when deciding if an investment is appropriate. 2

Speaker’s Notes • Speaker’s notes for this presentation are attached below each slide. • To access them, you may need to save the slides in Power. Point and view/print in “notes view. ” 3

Speaker’s Notes • Speaker’s notes for this presentation are attached below each slide. • To access them, you may need to save the slides in Power. Point and view/print in “notes view. ” 3

Agenda • Theory – What is an Embedded Value? – Moving from Embedded to Appraisal Value – Understanding movements in Appraisal Value – Appraisal Value ‘Uplift’ • Practice – Commonwealth Bank Group Appraisal Values – Appraisal Value forecasts 4

Agenda • Theory – What is an Embedded Value? – Moving from Embedded to Appraisal Value – Understanding movements in Appraisal Value – Appraisal Value ‘Uplift’ • Practice – Commonwealth Bank Group Appraisal Values – Appraisal Value forecasts 4

Embedded Value The present value of future profits from inforce business and the shareholders interest in the net worth of the life insurance funds

Embedded Value The present value of future profits from inforce business and the shareholders interest in the net worth of the life insurance funds

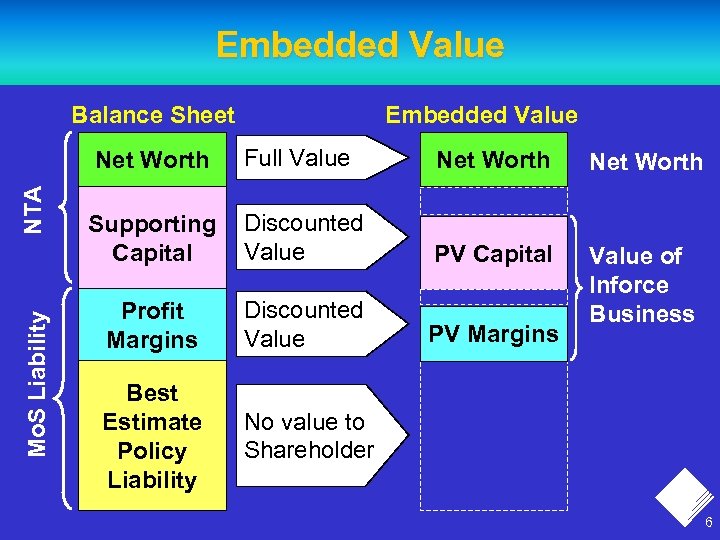

Embedded Value Balance Sheet Mo. S Liability NTA Net Worth Full Value Net Worth Supporting Capital Discounted Value PV Capital Profit Margins Discounted Value PV Margins Value of Inforce Business Best Estimate Policy Liability No value to Shareholder 6

Embedded Value Balance Sheet Mo. S Liability NTA Net Worth Full Value Net Worth Supporting Capital Discounted Value PV Capital Profit Margins Discounted Value PV Margins Value of Inforce Business Best Estimate Policy Liability No value to Shareholder 6

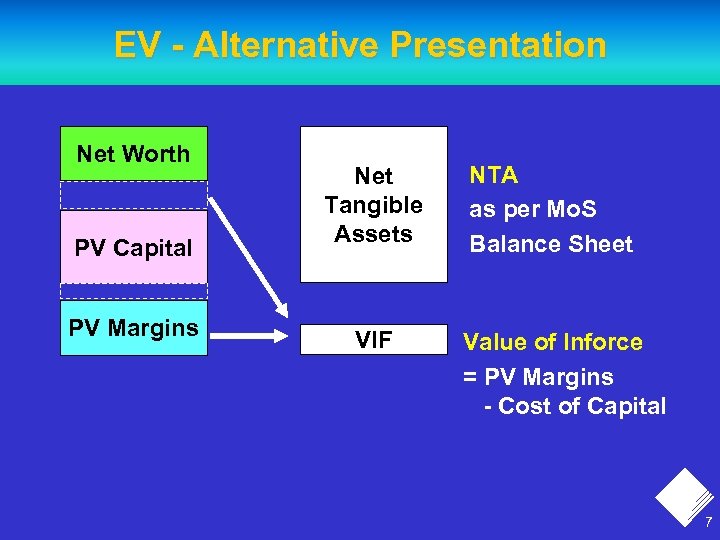

EV - Alternative Presentation Net Worth PV Capital PV Margins Net Tangible Assets VIF NTA as per Mo. S Balance Sheet Value of Inforce = PV Margins - Cost of Capital 7

EV - Alternative Presentation Net Worth PV Capital PV Margins Net Tangible Assets VIF NTA as per Mo. S Balance Sheet Value of Inforce = PV Margins - Cost of Capital 7

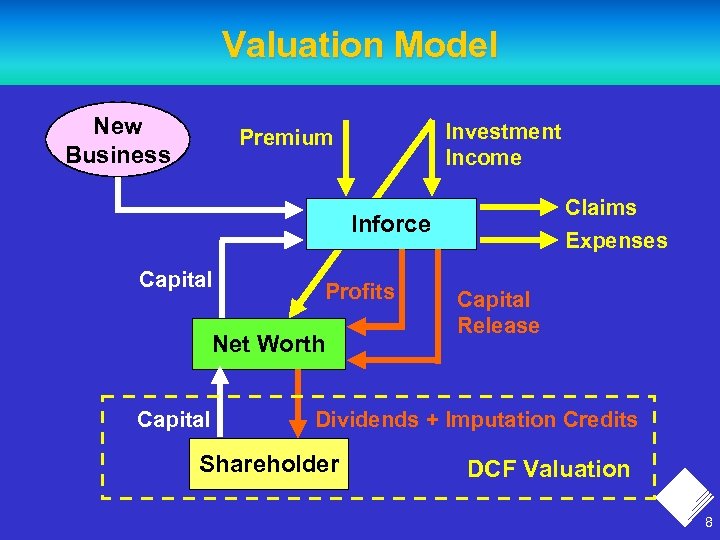

Valuation Model New Business Investment Income Premium Claims Inforce Capital Profits Net Worth Capital Expenses Capital Release Dividends + Imputation Credits Shareholder DCF Valuation 8

Valuation Model New Business Investment Income Premium Claims Inforce Capital Profits Net Worth Capital Expenses Capital Release Dividends + Imputation Credits Shareholder DCF Valuation 8

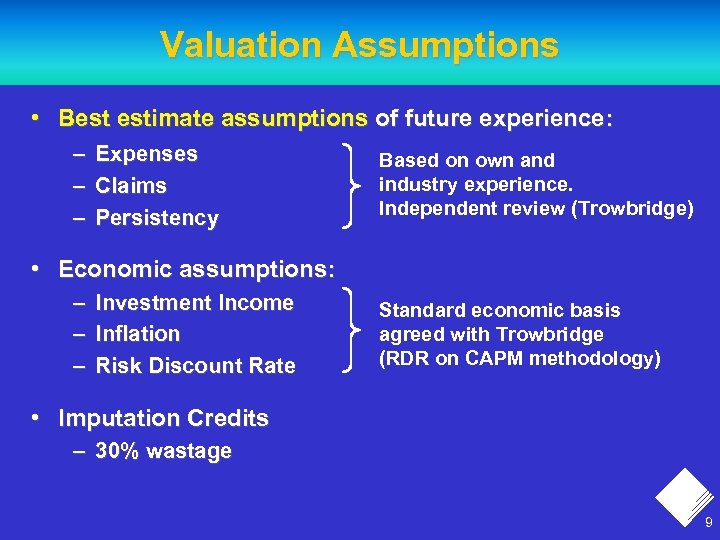

Valuation Assumptions • Best estimate assumptions of future experience: – Expenses – Claims – Persistency Based on own and industry experience. Independent review (Trowbridge) • Economic assumptions: – Investment Income – Inflation – Risk Discount Rate Standard economic basis agreed with Trowbridge (RDR on CAPM methodology) • Imputation Credits – 30% wastage 9

Valuation Assumptions • Best estimate assumptions of future experience: – Expenses – Claims – Persistency Based on own and industry experience. Independent review (Trowbridge) • Economic assumptions: – Investment Income – Inflation – Risk Discount Rate Standard economic basis agreed with Trowbridge (RDR on CAPM methodology) • Imputation Credits – 30% wastage 9

Key Drivers of Inforce Value • ‘Gap’ between net earnings rate and risk discount rate • Investment markets – – – affects value of shareholder funds affects value of future asset fees on investment business policy guarantees ‘gear up’ effect of investment returns • Persistency – affects recovery of acquisition expenses or achievement of expected future margins • Expenses • Mortality / Morbidity Note changes in future assumptions have an immediate (capitalised) impact on value 10

Key Drivers of Inforce Value • ‘Gap’ between net earnings rate and risk discount rate • Investment markets – – – affects value of shareholder funds affects value of future asset fees on investment business policy guarantees ‘gear up’ effect of investment returns • Persistency – affects recovery of acquisition expenses or achievement of expected future margins • Expenses • Mortality / Morbidity Note changes in future assumptions have an immediate (capitalised) impact on value 10

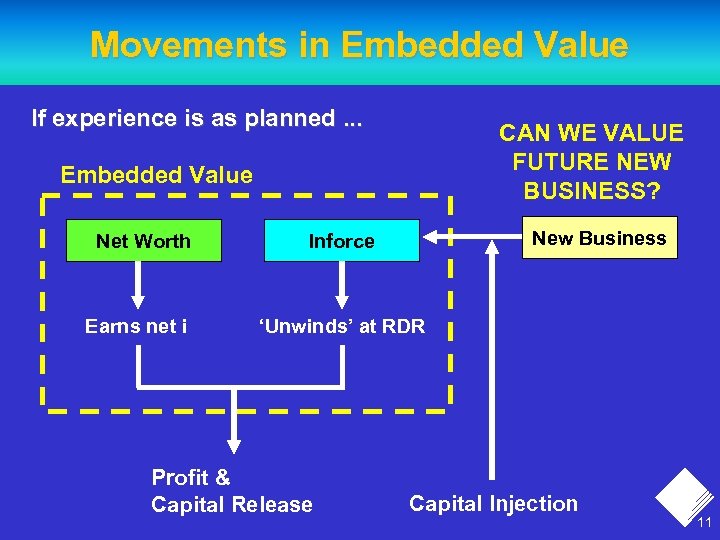

Movements in Embedded Value If experience is as planned. . . CAN WE VALUE FUTURE NEW BUSINESS? Embedded Value Net Worth Earns net i New Business Inforce ‘Unwinds’ at RDR Profit & Capital Release Capital Injection 11

Movements in Embedded Value If experience is as planned. . . CAN WE VALUE FUTURE NEW BUSINESS? Embedded Value Net Worth Earns net i New Business Inforce ‘Unwinds’ at RDR Profit & Capital Release Capital Injection 11

Moving from Embedded Value to Appraisal Value

Moving from Embedded Value to Appraisal Value

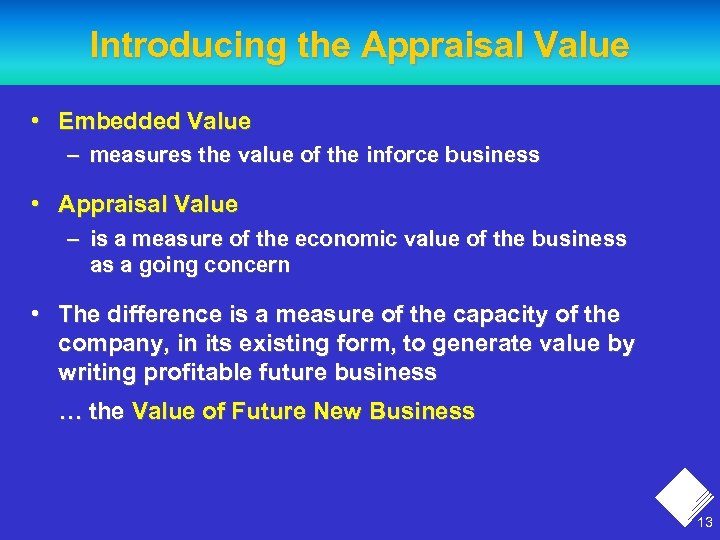

Introducing the Appraisal Value • Embedded Value – measures the value of the inforce business • Appraisal Value – is a measure of the economic value of the business as a going concern • The difference is a measure of the capacity of the company, in its existing form, to generate value by writing profitable future business … the Value of Future New Business 13

Introducing the Appraisal Value • Embedded Value – measures the value of the inforce business • Appraisal Value – is a measure of the economic value of the business as a going concern • The difference is a measure of the capacity of the company, in its existing form, to generate value by writing profitable future business … the Value of Future New Business 13

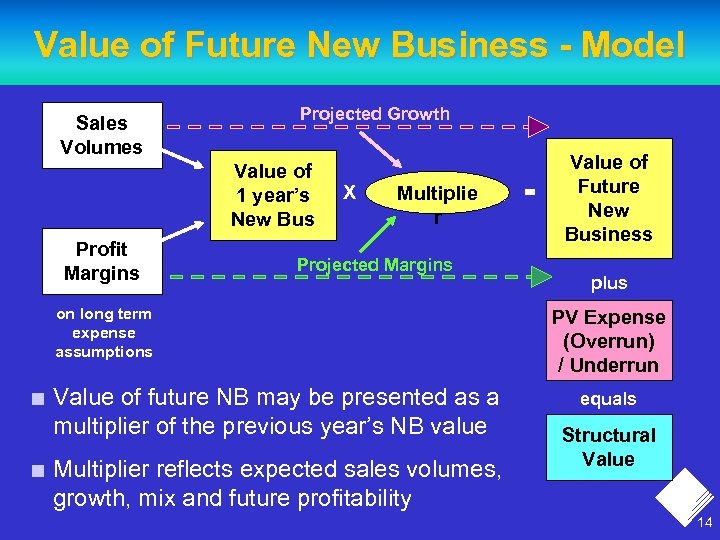

Value of Future New Business - Model Sales Volumes Projected Growth Value of 1 year’s New Bus Profit Margins X Multiplie r Projected Margins on long term expense assumptions n n Value of future NB may be presented as a multiplier of the previous year’s NB value Multiplier reflects expected sales volumes, growth, mix and future profitability = Value of Future New Business plus PV Expense (Overrun) / Underrun equals Structural Value 14

Value of Future New Business - Model Sales Volumes Projected Growth Value of 1 year’s New Bus Profit Margins X Multiplie r Projected Margins on long term expense assumptions n n Value of future NB may be presented as a multiplier of the previous year’s NB value Multiplier reflects expected sales volumes, growth, mix and future profitability = Value of Future New Business plus PV Expense (Overrun) / Underrun equals Structural Value 14

Value of New Business - Issues • Sales volumes – Base volumes - is latest year ‘representative’? – Market growth & own market share • Profit margins - are they sustainable? • Business mix may change, involving a move to products with higher or lower margins • Ability to eliminate any expense overruns ? 15

Value of New Business - Issues • Sales volumes – Base volumes - is latest year ‘representative’? – Market growth & own market share • Profit margins - are they sustainable? • Business mix may change, involving a move to products with higher or lower margins • Ability to eliminate any expense overruns ? 15

Movements in Appraisal Value

Movements in Appraisal Value

Movement in Appraisal Value If experience is as expected: • Net Worth earns net investment income, increases by profit earned on inforce business and decreases by dividend paid • Inforce unwinds at the risk discount rate and reduces by profit earned (which becomes net worth) • Inforce is supplemented by each year’s New Business • Value of future New Business moves forward in line with sales growth We can only add further value by managing experience favourably versus assumptions, or via new initiatives 17

Movement in Appraisal Value If experience is as expected: • Net Worth earns net investment income, increases by profit earned on inforce business and decreases by dividend paid • Inforce unwinds at the risk discount rate and reduces by profit earned (which becomes net worth) • Inforce is supplemented by each year’s New Business • Value of future New Business moves forward in line with sales growth We can only add further value by managing experience favourably versus assumptions, or via new initiatives 17

Information Available Financial statements disclose: • Shareholders net tangible assets • Value of inforce business • Value of future new business • Risk Discount Rates • Mo. S profits 18

Information Available Financial statements disclose: • Shareholders net tangible assets • Value of inforce business • Value of future new business • Risk Discount Rates • Mo. S profits 18

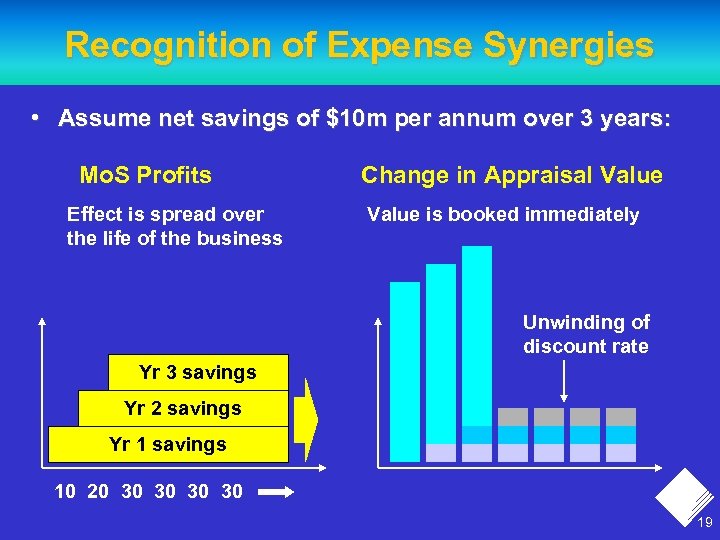

Recognition of Expense Synergies • Assume net savings of $10 m per annum over 3 years: Mo. S Profits Effect is spread over the life of the business Change in Appraisal Value is booked immediately Unwinding of discount rate Yr 3 savings Yr 2 savings Yr 1 savings 10 20 30 30 19

Recognition of Expense Synergies • Assume net savings of $10 m per annum over 3 years: Mo. S Profits Effect is spread over the life of the business Change in Appraisal Value is booked immediately Unwinding of discount rate Yr 3 savings Yr 2 savings Yr 1 savings 10 20 30 30 19

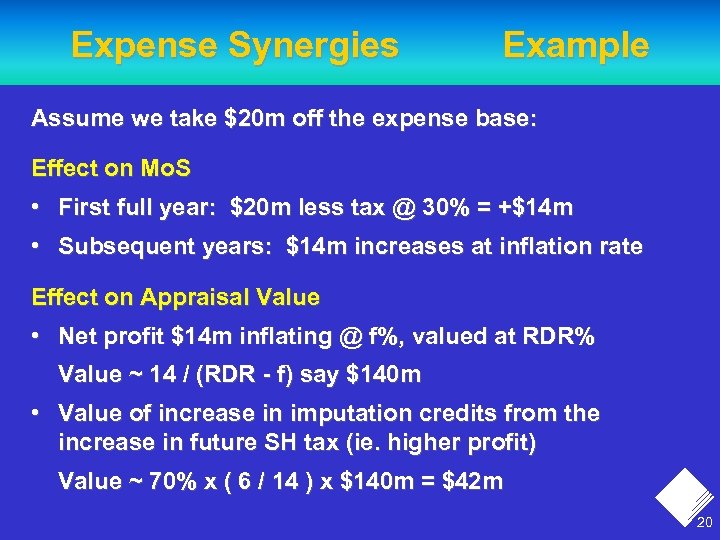

Expense Synergies Example Assume we take $20 m off the expense base: Effect on Mo. S • First full year: $20 m less tax @ 30% = +$14 m • Subsequent years: $14 m increases at inflation rate Effect on Appraisal Value • Net profit $14 m inflating @ f%, valued at RDR% Value ~ 14 / (RDR - f) say $140 m • Value of increase in imputation credits from the increase in future SH tax (ie. higher profit) Value ~ 70% x ( 6 / 14 ) x $140 m = $42 m 20

Expense Synergies Example Assume we take $20 m off the expense base: Effect on Mo. S • First full year: $20 m less tax @ 30% = +$14 m • Subsequent years: $14 m increases at inflation rate Effect on Appraisal Value • Net profit $14 m inflating @ f%, valued at RDR% Value ~ 14 / (RDR - f) say $140 m • Value of increase in imputation credits from the increase in future SH tax (ie. higher profit) Value ~ 70% x ( 6 / 14 ) x $140 m = $42 m 20

Appraisal Value “Uplift”

Appraisal Value “Uplift”

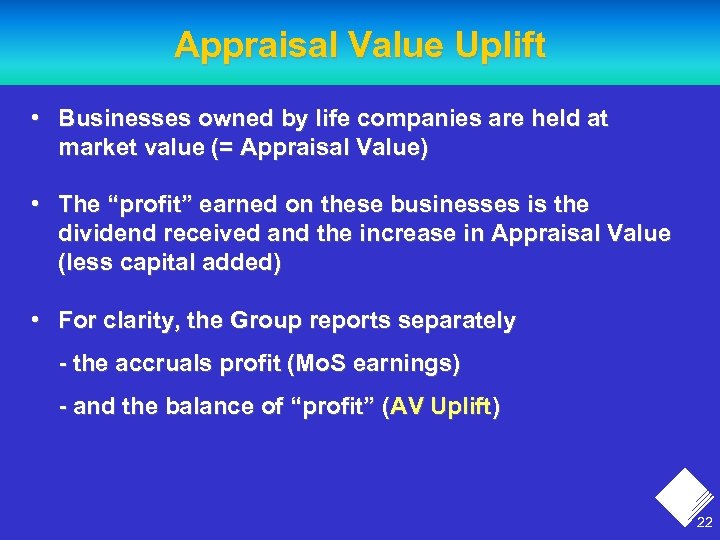

Appraisal Value Uplift • Businesses owned by life companies are held at market value (= Appraisal Value) • The “profit” earned on these businesses is the dividend received and the increase in Appraisal Value (less capital added) • For clarity, the Group reports separately - the accruals profit (Mo. S earnings) - and the balance of “profit” (AV Uplift) 22

Appraisal Value Uplift • Businesses owned by life companies are held at market value (= Appraisal Value) • The “profit” earned on these businesses is the dividend received and the increase in Appraisal Value (less capital added) • For clarity, the Group reports separately - the accruals profit (Mo. S earnings) - and the balance of “profit” (AV Uplift) 22

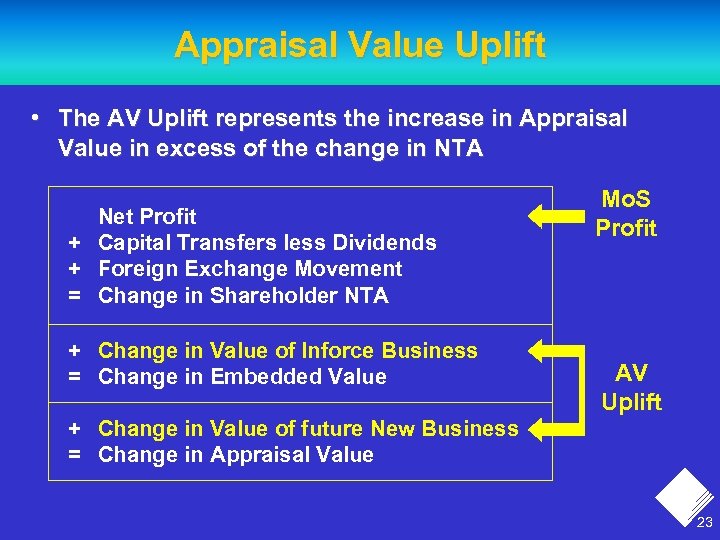

Appraisal Value Uplift • The AV Uplift represents the increase in Appraisal Value in excess of the change in NTA Net Profit + Capital Transfers less Dividends + Foreign Exchange Movement = Change in Shareholder NTA + Change in Value of Inforce Business = Change in Embedded Value Mo. S Profit AV Uplift + Change in Value of future New Business = Change in Appraisal Value 23

Appraisal Value Uplift • The AV Uplift represents the increase in Appraisal Value in excess of the change in NTA Net Profit + Capital Transfers less Dividends + Foreign Exchange Movement = Change in Shareholder NTA + Change in Value of Inforce Business = Change in Embedded Value Mo. S Profit AV Uplift + Change in Value of future New Business = Change in Appraisal Value 23

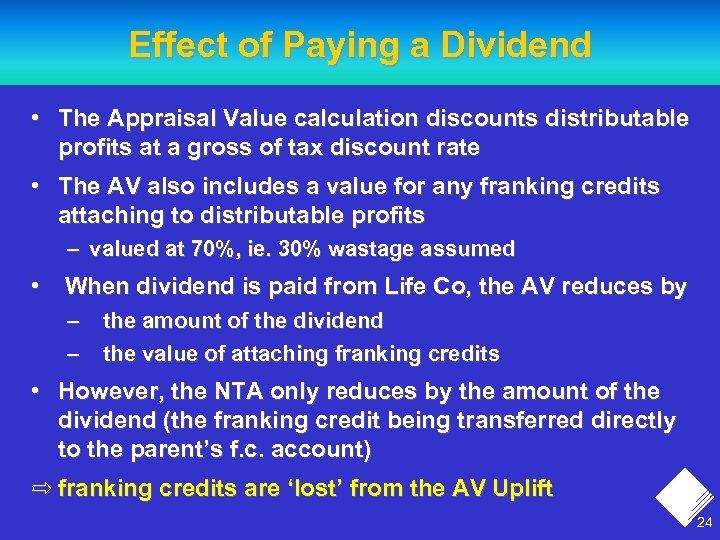

Effect of Paying a Dividend • The Appraisal Value calculation discounts distributable profits at a gross of tax discount rate • The AV also includes a value for any franking credits attaching to distributable profits – valued at 70%, ie. 30% wastage assumed • When dividend is paid from Life Co, the AV reduces by – – the amount of the dividend the value of attaching franking credits • However, the NTA only reduces by the amount of the dividend (the franking credit being transferred directly to the parent’s f. c. account) ñ franking credits are ‘lost’ from the AV Uplift 24

Effect of Paying a Dividend • The Appraisal Value calculation discounts distributable profits at a gross of tax discount rate • The AV also includes a value for any franking credits attaching to distributable profits – valued at 70%, ie. 30% wastage assumed • When dividend is paid from Life Co, the AV reduces by – – the amount of the dividend the value of attaching franking credits • However, the NTA only reduces by the amount of the dividend (the franking credit being transferred directly to the parent’s f. c. account) ñ franking credits are ‘lost’ from the AV Uplift 24

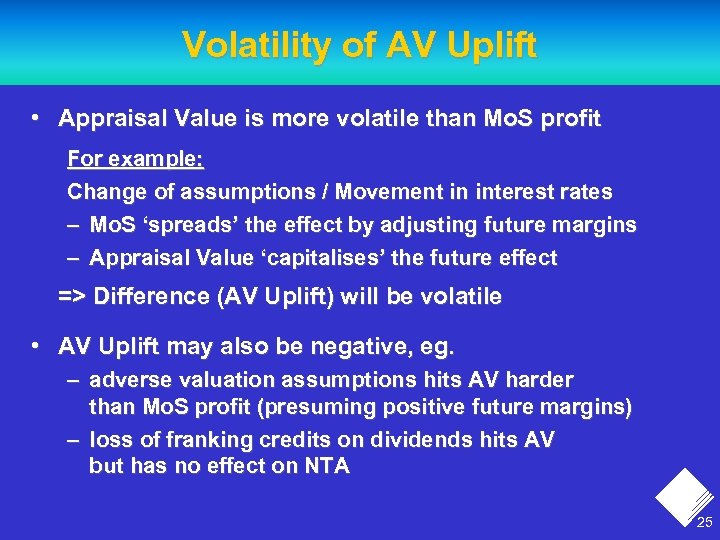

Volatility of AV Uplift • Appraisal Value is more volatile than Mo. S profit For example: Change of assumptions / Movement in interest rates – Mo. S ‘spreads’ the effect by adjusting future margins – Appraisal Value ‘capitalises’ the future effect => Difference (AV Uplift) will be volatile • AV Uplift may also be negative, eg. – adverse valuation assumptions hits AV harder than Mo. S profit (presuming positive future margins) – loss of franking credits on dividends hits AV but has no effect on NTA 25

Volatility of AV Uplift • Appraisal Value is more volatile than Mo. S profit For example: Change of assumptions / Movement in interest rates – Mo. S ‘spreads’ the effect by adjusting future margins – Appraisal Value ‘capitalises’ the future effect => Difference (AV Uplift) will be volatile • AV Uplift may also be negative, eg. – adverse valuation assumptions hits AV harder than Mo. S profit (presuming positive future margins) – loss of franking credits on dividends hits AV but has no effect on NTA 25

An Introduction to Life Insurance Appraisal Values April 2001

An Introduction to Life Insurance Appraisal Values April 2001