9ebbec0c2e93090a4a21cac38e4c084f.ppt

- Количество слайдов: 18

An Introduction to Credit Risk with a Link to Insurance R. J. A. Laeven, University of Amsterdam and Mercer Oliver Wyman R. J. de Barbanson, Zanders & Partners AFIR Colloquium 2003 Maastricht September 18, 2003 Actuarieel Genootschap – AFIR Working Party Credit Risk

An Introduction to Credit Risk with a Link to Insurance R. J. A. Laeven, University of Amsterdam and Mercer Oliver Wyman R. J. de Barbanson, Zanders & Partners AFIR Colloquium 2003 Maastricht September 18, 2003 Actuarieel Genootschap – AFIR Working Party Credit Risk

Outline • Motivation • Empirical relation between credit spreads and interest rates • Credit risk models • Accounting and regulation Actuarieel Genootschap – AFIR Working Party Credit Risk

Outline • Motivation • Empirical relation between credit spreads and interest rates • Credit risk models • Accounting and regulation Actuarieel Genootschap – AFIR Working Party Credit Risk

Motivation I • Increase in credit risk on the Euro financial markets due to: – Introduction of the Euro – Stability and Growth Pact Actuarieel Genootschap – AFIR Working Party Credit Risk

Motivation I • Increase in credit risk on the Euro financial markets due to: – Introduction of the Euro – Stability and Growth Pact Actuarieel Genootschap – AFIR Working Party Credit Risk

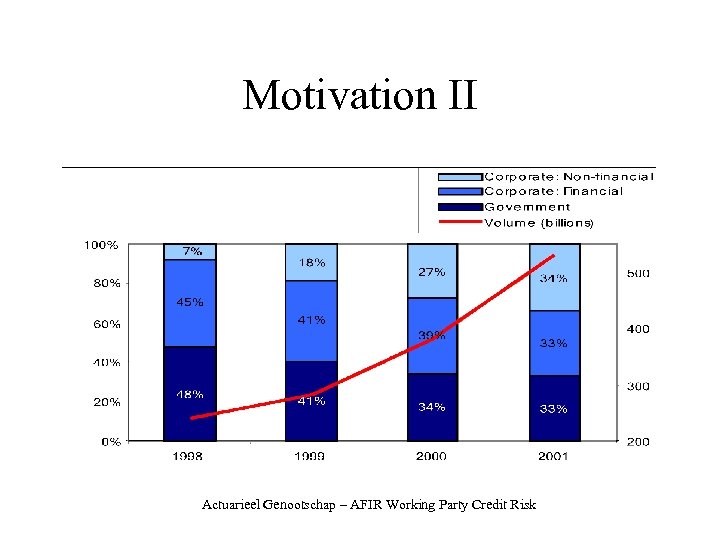

Motivation II Actuarieel Genootschap – AFIR Working Party Credit Risk

Motivation II Actuarieel Genootschap – AFIR Working Party Credit Risk

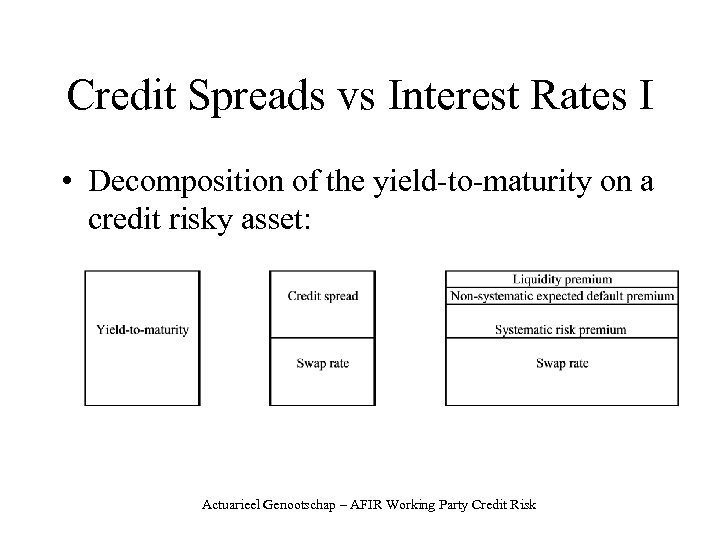

Credit Spreads vs Interest Rates I • Decomposition of the yield-to-maturity on a credit risky asset: Actuarieel Genootschap – AFIR Working Party Credit Risk

Credit Spreads vs Interest Rates I • Decomposition of the yield-to-maturity on a credit risky asset: Actuarieel Genootschap – AFIR Working Party Credit Risk

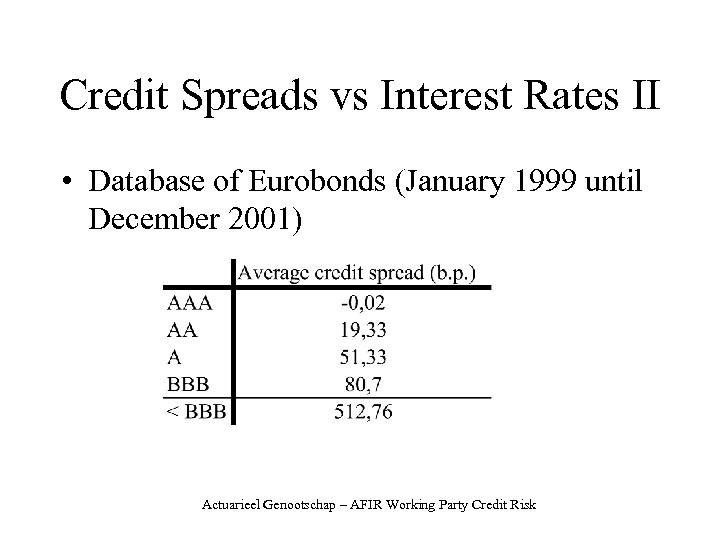

Credit Spreads vs Interest Rates II • Database of Eurobonds (January 1999 until December 2001) Actuarieel Genootschap – AFIR Working Party Credit Risk

Credit Spreads vs Interest Rates II • Database of Eurobonds (January 1999 until December 2001) Actuarieel Genootschap – AFIR Working Party Credit Risk

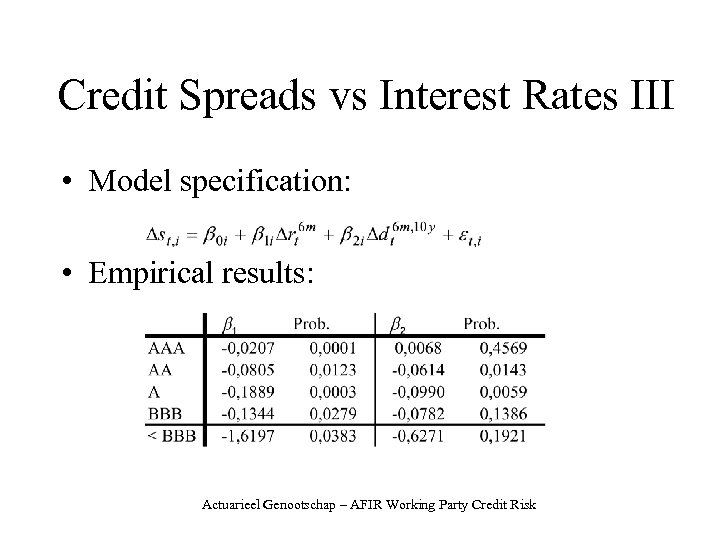

Credit Spreads vs Interest Rates III • Model specification: • Empirical results: Actuarieel Genootschap – AFIR Working Party Credit Risk

Credit Spreads vs Interest Rates III • Model specification: • Empirical results: Actuarieel Genootschap – AFIR Working Party Credit Risk

Consequences for ALM • Inferior hedging quality of credit risky assets • Risk assessment of the debt portfolio is indispensable Actuarieel Genootschap – AFIR Working Party Credit Risk

Consequences for ALM • Inferior hedging quality of credit risky assets • Risk assessment of the debt portfolio is indispensable Actuarieel Genootschap – AFIR Working Party Credit Risk

Measurement of Credit Risk • Influence of both bond portfolio selecting (return) and sensitivity (risk) increase • 3 models: – Credit. Metrics (JP Morgan) – KMV (Moody’s KMV) – Credit. Risk+ (CSFB) Actuarieel Genootschap – AFIR Working Party Credit Risk

Measurement of Credit Risk • Influence of both bond portfolio selecting (return) and sensitivity (risk) increase • 3 models: – Credit. Metrics (JP Morgan) – KMV (Moody’s KMV) – Credit. Risk+ (CSFB) Actuarieel Genootschap – AFIR Working Party Credit Risk

Definition Credit Risk • Expected Loss = 1) Default Probability x Amount Outstanding x 1 - Recovery Rate 2) Cost of Doing Business • Unexpected Loss = Deviation of Expected Loss Actuarieel Genootschap – AFIR Working Party Credit Risk

Definition Credit Risk • Expected Loss = 1) Default Probability x Amount Outstanding x 1 - Recovery Rate 2) Cost of Doing Business • Unexpected Loss = Deviation of Expected Loss Actuarieel Genootschap – AFIR Working Party Credit Risk

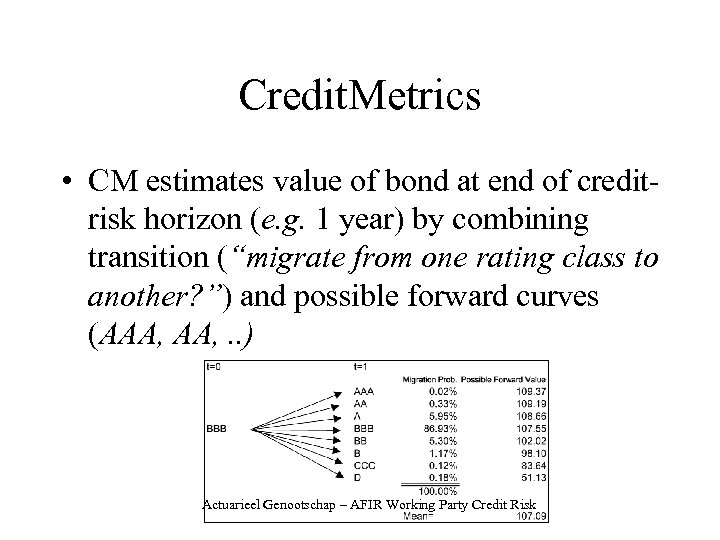

Credit. Metrics • CM estimates value of bond at end of creditrisk horizon (e. g. 1 year) by combining transition (“migrate from one rating class to another? ”) and possible forward curves (AAA, . . ) Actuarieel Genootschap – AFIR Working Party Credit Risk

Credit. Metrics • CM estimates value of bond at end of creditrisk horizon (e. g. 1 year) by combining transition (“migrate from one rating class to another? ”) and possible forward curves (AAA, . . ) Actuarieel Genootschap – AFIR Working Party Credit Risk

KMV Model • “Equity is call-option on asset value” • Default probability is estimated on market information (stock price and volatility interest rate structure), financial statements, and (subjective) risk perceptions • Default probability is used to calculate (un) expected loss Actuarieel Genootschap – AFIR Working Party Credit Risk

KMV Model • “Equity is call-option on asset value” • Default probability is estimated on market information (stock price and volatility interest rate structure), financial statements, and (subjective) risk perceptions • Default probability is used to calculate (un) expected loss Actuarieel Genootschap – AFIR Working Party Credit Risk

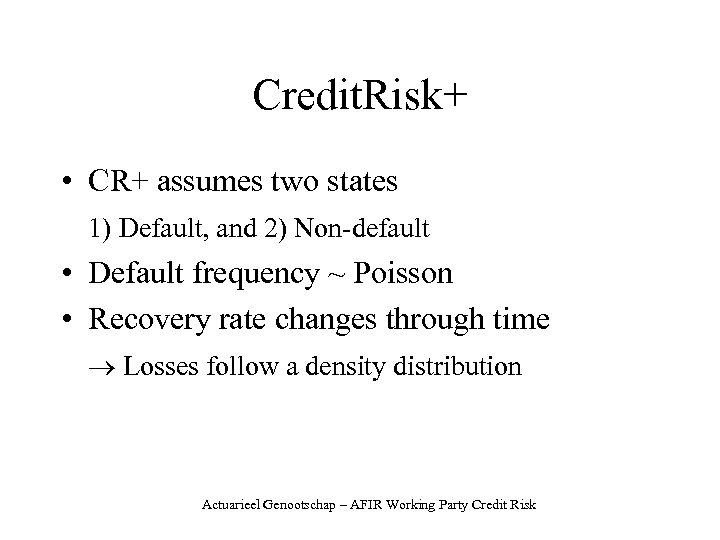

Credit. Risk+ • CR+ assumes two states 1) Default, and 2) Non-default • Default frequency ~ Poisson • Recovery rate changes through time Losses follow a density distribution Actuarieel Genootschap – AFIR Working Party Credit Risk

Credit. Risk+ • CR+ assumes two states 1) Default, and 2) Non-default • Default frequency ~ Poisson • Recovery rate changes through time Losses follow a density distribution Actuarieel Genootschap – AFIR Working Party Credit Risk

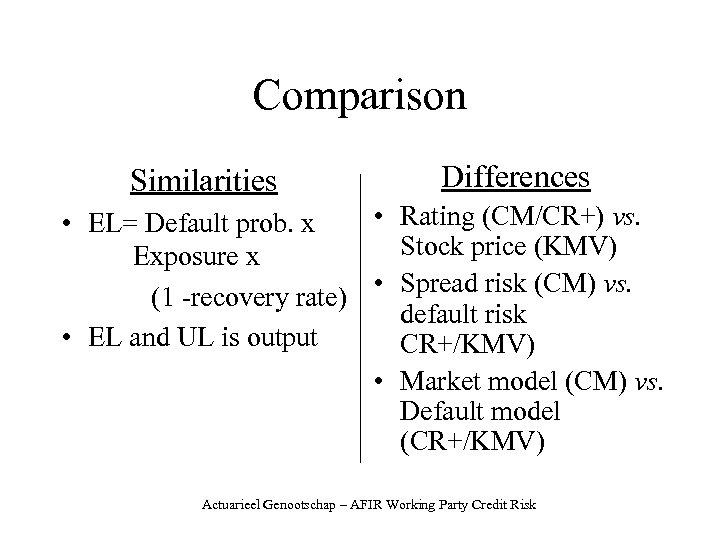

Comparison Similarities Differences • Rating (CM/CR+) vs. • EL= Default prob. x Stock price (KMV) Exposure x (1 -recovery rate) • Spread risk (CM) vs. default risk • EL and UL is output CR+/KMV) • Market model (CM) vs. Default model (CR+/KMV) Actuarieel Genootschap – AFIR Working Party Credit Risk

Comparison Similarities Differences • Rating (CM/CR+) vs. • EL= Default prob. x Stock price (KMV) Exposure x (1 -recovery rate) • Spread risk (CM) vs. default risk • EL and UL is output CR+/KMV) • Market model (CM) vs. Default model (CR+/KMV) Actuarieel Genootschap – AFIR Working Party Credit Risk

Remarks • CR+ model for hold-to-maturity portfolio • CM model for available-for-sale portfolio • KMV is an arbitrage model, that can be used to compare implied price and market price of credit risk Actuarieel Genootschap – AFIR Working Party Credit Risk

Remarks • CR+ model for hold-to-maturity portfolio • CM model for available-for-sale portfolio • KMV is an arbitrage model, that can be used to compare implied price and market price of credit risk Actuarieel Genootschap – AFIR Working Party Credit Risk

Credit Risk and Regulation • EU solvency system is now based on 3 pillars: 1) assets, 2) technical provision, and 3) required solvency margin • Solvency II in progress: – 1) Estimation of total risk (among other risk due credit, underwriting, market, etc. ), and 2) Impact on Risk Based Capital – White paper Solvency Test PVK (FTK) Actuarieel Genootschap – AFIR Working Party Credit Risk

Credit Risk and Regulation • EU solvency system is now based on 3 pillars: 1) assets, 2) technical provision, and 3) required solvency margin • Solvency II in progress: – 1) Estimation of total risk (among other risk due credit, underwriting, market, etc. ), and 2) Impact on Risk Based Capital – White paper Solvency Test PVK (FTK) Actuarieel Genootschap – AFIR Working Party Credit Risk

Credit Risk and Accounting • Implementation of IAS/IFRS Rules – IAS 39 distinguishes between the valuation methodology of asset portfolios – Portfolios qualified as hold-to-maturity should be valued at amortized costs (Credit. Risk+ …) – Portfolios qualified as available-for-sale should be valued at fair value (Credit. Metrics …) Actuarieel Genootschap – AFIR Working Party Credit Risk

Credit Risk and Accounting • Implementation of IAS/IFRS Rules – IAS 39 distinguishes between the valuation methodology of asset portfolios – Portfolios qualified as hold-to-maturity should be valued at amortized costs (Credit. Risk+ …) – Portfolios qualified as available-for-sale should be valued at fair value (Credit. Metrics …) Actuarieel Genootschap – AFIR Working Party Credit Risk

Questions? Actuarieel Genootschap – AFIR Working Party Credit Risk

Questions? Actuarieel Genootschap – AFIR Working Party Credit Risk