e7ad7f8491571289be1fad929e426ebc.ppt

- Количество слайдов: 45

AN INSIGHT TO Directors – Role, Responsibilities and Liabilities

This Presentation……. “……. is an attempt to highlight the role, responsibilities and liabilities of the Directors of a Company as outlined under various provisions of Companies Act, 1956. ”

Director – Directing ‘mind’ and ‘will’ of the Company Meaning under the Companies Act, 1956 Section 2 (13): “Director” includes any person occupying the position of director, by whatever name called.

Who may be appointed as a Director? No body corporate, association or a firm shall be appointed director of a company, and only an individual shall be so appointed. (Section 253 )

Shadow Director/Deemed Director Any person in accordance with whose directions or instructions directors are accustomed to act. (Section 7)

Overcoming mental blocks Can a Body corporate become the director of the Company?

Legal Position of Directors Ø Ø As Agents - Directors are the agents of the Company. Thus , where the directors contract in the name and on behalf of the company it is the company which is liable for it and not the Directors (Subject to exceptions) As Trustee - The Directors of the company are trustees(to a limited extent)for the company with reference to their power of applying funds of the company and for misuse of the power they could be rendered liable as trustees.

Are Directors Employees? Ø Directors are not the employees of the company as once elected they enjoy well-defined rights and powers under the Companies Act, 1956 or the Articles of the Company Ø Even the shareholders who elect them cannot interfere with their rights and powers except under certain circumstances

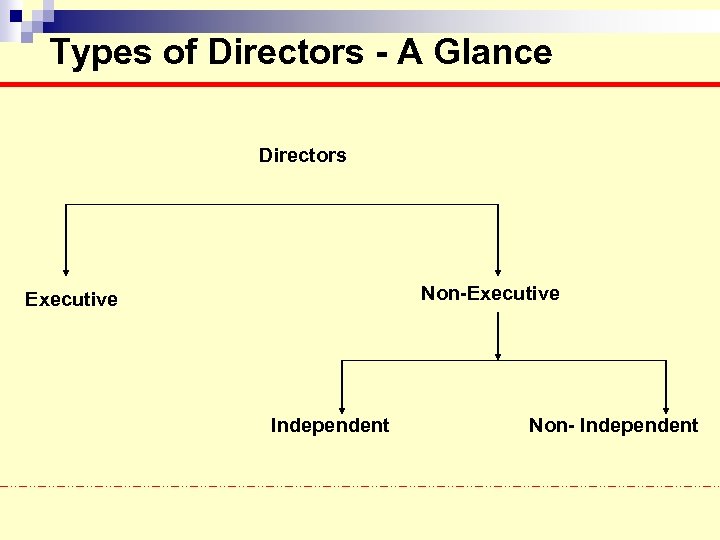

Types of Directors - A Glance Directors Non-Executive Independent Non- Independent

Executive Director Ø “Executive Director” means managing director or whole- time director. Ø Not defined under the Companies Act, 1956.

Non-Executive Director Ø Non-executive directors are the directors on the Board of a company, other than a Managing Director and whole-time Director or a Director employed in his professional capacity. Ø Not defined under the Companies Act, 1956.

Understanding- Managing Director Meaning under the Companies Act, 1956 Section 2(26) – ‘Managing Director’ means a director who, by virtue Ø of an agreement with the Company or Ø of a resolution passed by the company in general meeting or Ø by virtue of its memorandum or articles of association , Ø is entrusted with substantial powers of management which would not otherwise be exercisable by him , AND Ø includes a director occupying the position of managing director by whatever name called: Contd………. . .

Understanding- Managing Director Provided that the power to do administrative acts of routine nature when so authorised by the Board such as power to affix the common seal of the company to any document or to draw and endorse any cheque on the account of the company in any bank or to draw and endorse any negotiable instrument or to sign any certificate of share or to direct registration of transfer of any share , shall not be deemed to be included within the substantial powers of management. Provided further that a managing director of a company shall exercise his powers subject to superintendence, control and direction of the Board of Directors

Understanding- Whole Time Director Meaning under the Companies Act, 1956 Explanation to section 269 – ”whole time director” includes a director in the whole time employment of the company

Overcoming Mental Blocks Ø Can a company have two Managing directors ? Ø Is Managing Director/ Whole Time Director an employee of the Company ? Ø Whether the whole time employee appointed as a part time director can be construed as a whole time director? Ø If the whole time company secretary is appointed as part time director without being entrusted with the substantial powers of management, can he be regarded as whole time director?

Independent Director As per Clause 49 of Listing Agreement ‘Independent Director’ shall mean a non-executive director of the company who: a. apart from receiving director’s remuneration, does not have any material pecuniary relationships or transactions with the company, its promoters, its directors, its senior management or its holding company, its subsidiaries and associates which may affect independence of the director; b. is not related to promoters or persons occupying management positions at the board level or at one level below the board; c. has not been an executive of the company in the immediately preceding three financial years;

Independent Director…contd… d. is not a partner or an executive or was not partner or an executive during the preceding three years, of any of the following: i. the statutory audit firm or the internal audit firm that is associated with the company, and ii. the legal firm(s) and consulting firm(s) that have a material association with the company. e. is not a material supplier, service provider or customer or a lessor or lessee of the company, which may affect independence of the director; and f. is not a substantial shareholder of the company i. e. owning two percent or more of the block of voting shares.

Important sections under Companies Act, 1956 as are applicable to Directors Ø Sections 255 to 269 relating to appointment. Ø Section 274 relating to disqualifications. Ø Section 283 relating to vacation of office. Ø Section 284 relating to removal. Ø Sections 198, 309, 310 and 311 relating to remuneration.

Appointment of Directors Ø Ø Ø Subscribers- as Directors Appointment of first Directors Appointment at general meeting Appointment by the Board of Directors Appointment by third parties, and Appointment by Central Government.

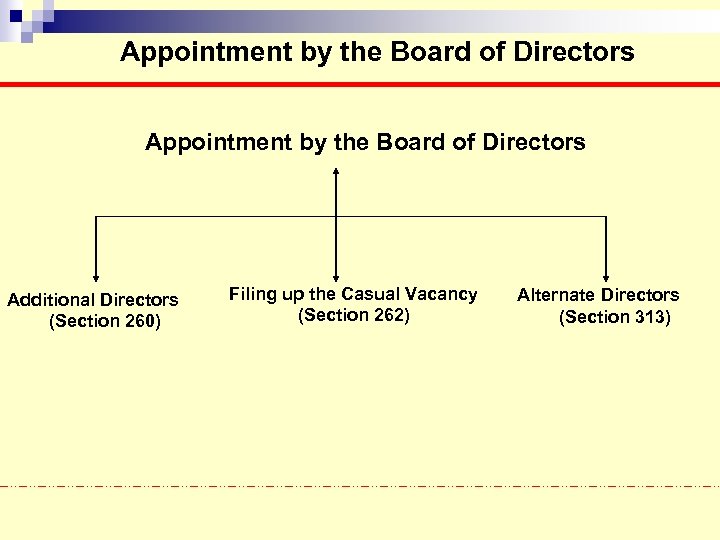

Appointment by the Board of Directors Additional Directors (Section 260) Filing up the Casual Vacancy (Section 262) Alternate Directors (Section 313)

Additional Directors Section 260 Nothing in section 255, 258 or 259 shall affect any power conferred on the Board of directors by the articles to appoint additional directors: Provided that such additional directors shall hold office only up to the date of the next ensuing annual general meeting of the company: Provided further that the number of the directors and additional directors together shall not exceed the maximum strength fixed for the Board by the articles.

Brainstorming-additional directors n n Whether a resolution passed at the board meeting necessary for appointment of additional Directors? Filing of return under section 303(2) – Whether necessary? Can an additional director be appointed as Managing/ Whole time director? Can general body appoint additional directors?

Filling of casual vacancies among directors Section 262 (1) In the case of a public company or a private company which is a subsidiary of a public company, if the office of any director appointed by the company in general meeting is vacated before his term of office will expire in the normal course, the resulting casual vacancy may, in default of and subject to any regulations in the articles of the company, be filled by the Board of directors at a meeting of the Board. (2) Any person so appointed shall hold office only up to the date up to which the director in whose place he is appointed would have held office if it had not been vacated as aforesaid.

Brainstorming-Casual vacancy n n Can a Resolution by circulation be passed for appointment of a director by way of casual vacancy? Filing of return under section 303(2) – Whether necessary? Whether the casual vacancy arises if a director appointed in general meeting does not assume office? Whether the vacancy arising on account of resignation , etc of a director appointed by way of casual vacancy can be filled again by way of casual vacancy?

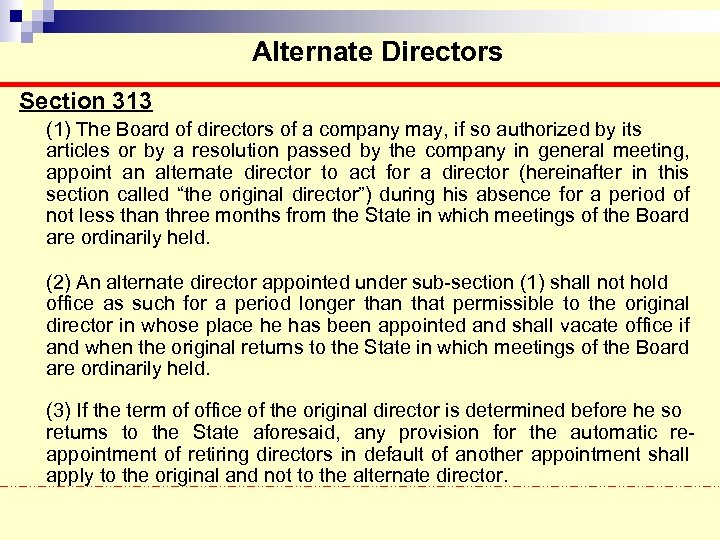

Alternate Directors Section 313 (1) The Board of directors of a company may, if so authorized by its articles or by a resolution passed by the company in general meeting, appoint an alternate director to act for a director (hereinafter in this section called “the original director”) during his absence for a period of not less than three months from the State in which meetings of the Board are ordinarily held. (2) An alternate director appointed under sub-section (1) shall not hold office as such for a period longer than that permissible to the original director in whose place he has been appointed and shall vacate office if and when the original returns to the State in which meetings of the Board are ordinarily held. (3) If the term of office of the original director is determined before he so returns to the State aforesaid, any provision for the automatic reappointment of retiring directors in default of another appointment shall apply to the original and not to the alternate director.

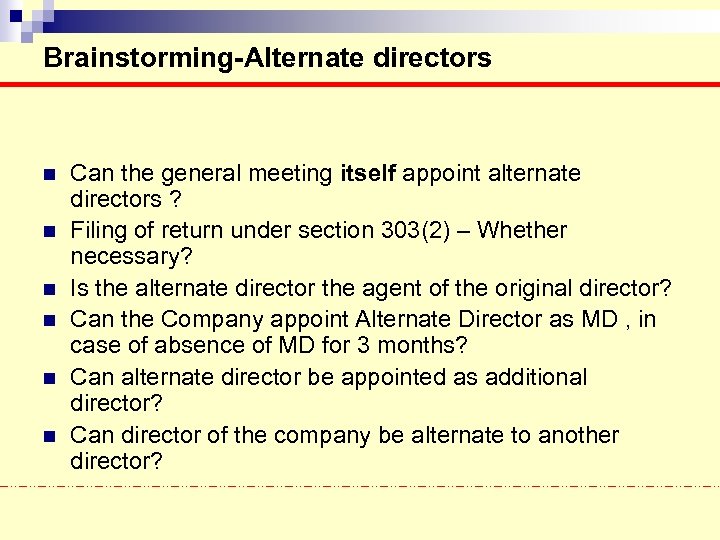

Brainstorming-Alternate directors n n n Can the general meeting itself appoint alternate directors ? Filing of return under section 303(2) – Whether necessary? Is the alternate director the agent of the original director? Can the Company appoint Alternate Director as MD , in case of absence of MD for 3 months? Can alternate director be appointed as additional director? Can director of the company be alternate to another director?

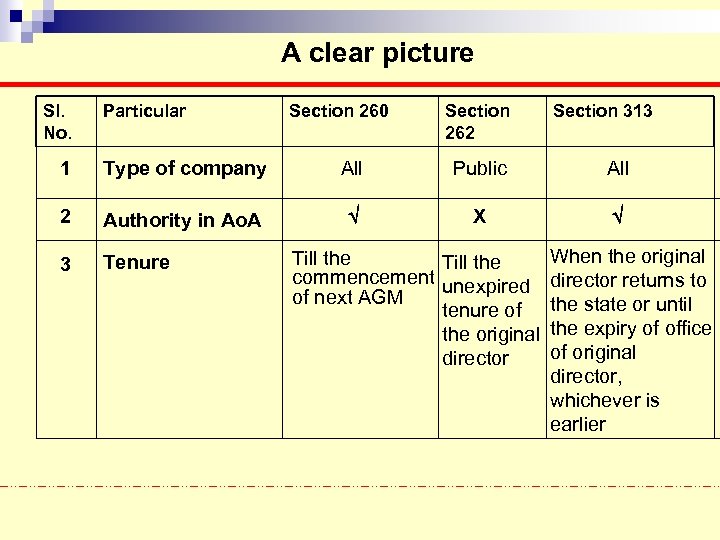

A clear picture Sl. No. Particular Section 260 Section 262 Section 313 1 Type of company All Public All 2 Authority in Ao. A X 3 Tenure Till the commencement unexpired of next AGM tenure of the original director When the original director returns to the state or until the expiry of office of original director, whichever is earlier

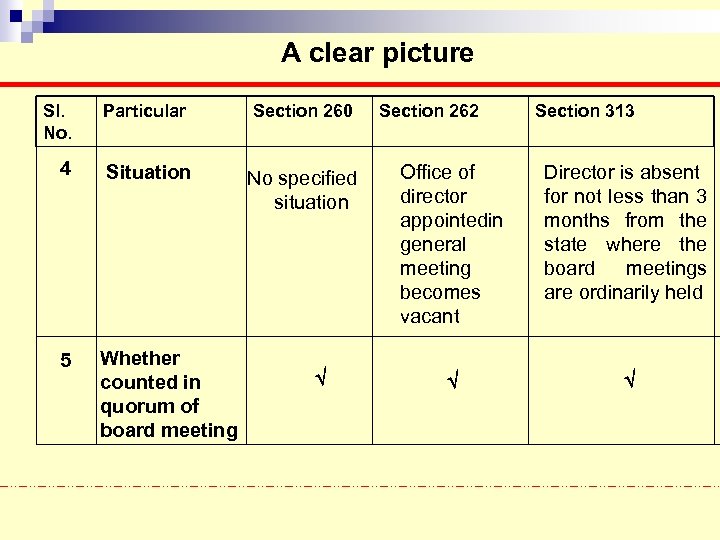

A clear picture Sl. No. Particular Section 260 4 Situation No specified situation 5 Whether counted in quorum of board meeting Section 262 Section 313 Office of director appointedin general meeting becomes vacant Director is absent for not less than 3 months from the state where the board meetings are ordinarily held

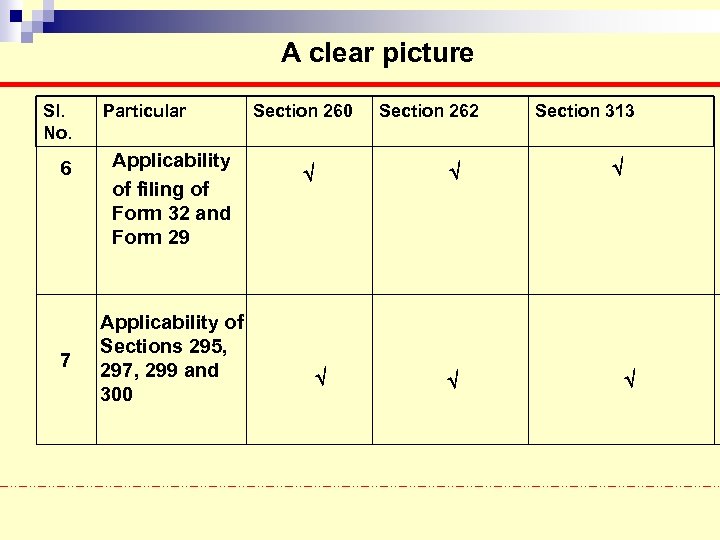

A clear picture Sl. No. 6 7 Particular Applicability of filing of Form 32 and Form 29 Applicability of Sections 295, 297, 299 and 300 Section 262 Section 313

Powers of the Board of Directors Ø General Powers of the Board under section 291 Ø Powers entrusted under the Companies Act, 1956

General Powers of the Board Section 291 of the Companies Act, 1956 Subject to the provisions of this Act, the Board of directors of a company shall be entitled to exercise all such powers, and to do all such acts and things, as the company is authorized to exercise and do: Provided that the Board shall not exercise any power or do any act or thing which is directed or required, whether by this or any other Act or by the memorandum or articles of the company or otherwise, to be exercised or done by the company in general meeting: Provided further that in exercising any such power or doing any such act or thing, the Board shall be subject to the provisions contained in that behalf in this or any other Act, or in the memorandum or articles of the company or in any regulations not inconsistent therewith and duly made there under, including regulations made by the company in general meeting.

Powers entrusted to Directors under the Companies Act, 1956: Certain powers of the Board of Directors which can be exercised only at a meeting: Ø Power to make calls on unpaid shares – Section 292(1)(a) Ø Power to issue Debentures and borrow moneys otherwise than on Debentures – Section 292(1) (b) & (c). Ø Power to invest the funds of the Company – Section 292(1)(d) Ø Power to grant loans – Section 292(1)(e) Ø Power to authorize the buyback of shares – Section 292(1)(aa) CONTD……. .

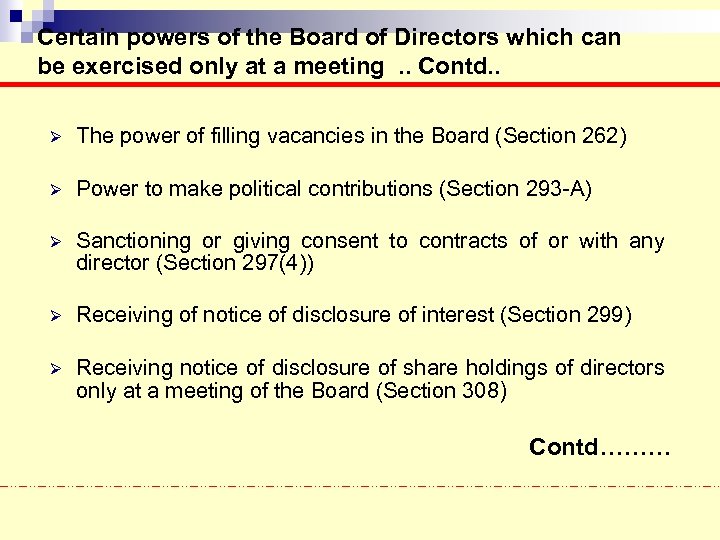

Certain powers of the Board of Directors which can be exercised only at a meeting. . Contd. . Ø The power of filling vacancies in the Board (Section 262) Ø Power to make political contributions (Section 293 -A) Ø Sanctioning or giving consent to contracts of or with any director (Section 297(4)) Ø Receiving of notice of disclosure of interest (Section 299) Ø Receiving notice of disclosure of share holdings of directors only at a meeting of the Board (Section 308) Contd………

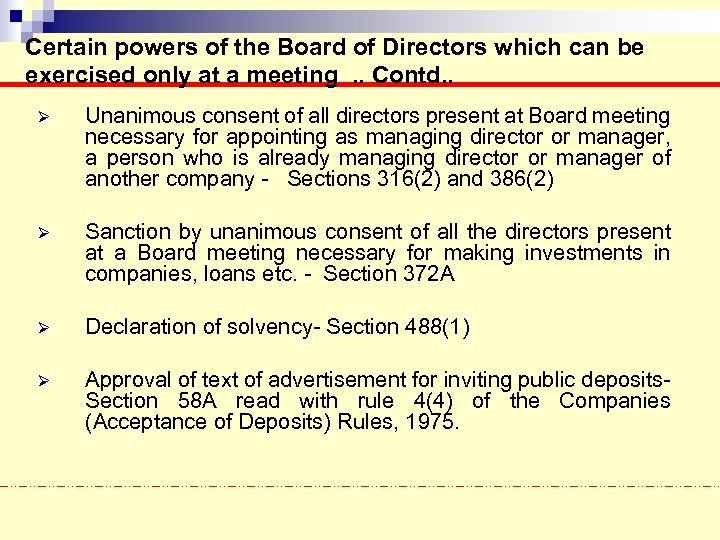

Certain powers of the Board of Directors which can be exercised only at a meeting. . Contd. . Ø Unanimous consent of all directors present at Board meeting necessary for appointing as managing director or manager, a person who is already managing director or manager of another company - Sections 316(2) and 386(2) Ø Sanction by unanimous consent of all the directors present at a Board meeting necessary for making investments in companies, loans etc. - Section 372 A Ø Declaration of solvency- Section 488(1) Ø Approval of text of advertisement for inviting public deposits. Section 58 A read with rule 4(4) of the Companies (Acceptance of Deposits) Rules, 1975.

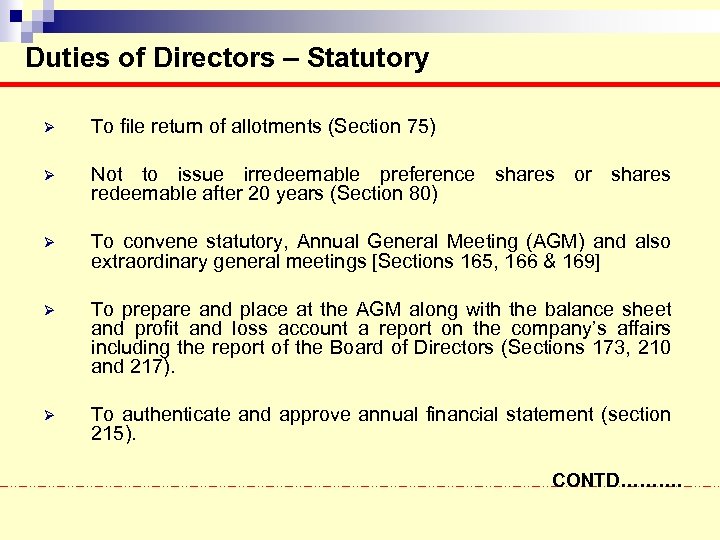

Duties of Directors – Statutory Ø To file return of allotments (Section 75) Ø Not to issue irredeemable preference shares or shares redeemable after 20 years (Section 80) Ø To convene statutory, Annual General Meeting (AGM) and also extraordinary general meetings [Sections 165, 166 & 169] Ø To prepare and place at the AGM along with the balance sheet and profit and loss account a report on the company’s affairs including the report of the Board of Directors (Sections 173, 210 and 217). Ø To authenticate and approve annual financial statement (section 215). CONTD……….

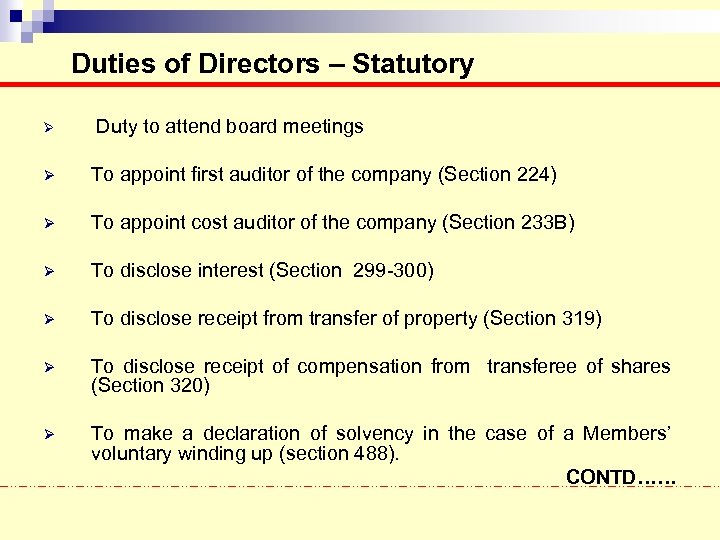

Duties of Directors – Statutory Ø Duty to attend board meetings Ø To appoint first auditor of the company (Section 224) Ø To appoint cost auditor of the company (Section 233 B) Ø To disclose interest (Section 299 -300) Ø To disclose receipt from transfer of property (Section 319) Ø To disclose receipt of compensation from transferee of shares (Section 320) Ø To make a declaration of solvency in the case of a Members’ voluntary winding up (section 488). CONTD……

Duties of Directors – General Ø Ø Ø Duty of good faith – Directors must act in the best interest of the company and should not make any secret profits. Duty of care - Director must display such care in performance of work assigned to him which a man of ordinary prudence would take in his own case Duty not to delegate - Director being an agent is bound by the maxim ‘delegatus non potest delegate’ subject to certain exceptions.

Liabilities of Directors Ø Liability to the company Ø Liability to third parties Ø Liabilities for breach of statutory duties Ø Liability for acts of co-directors Ø Criminal liability.

Liabilities to the company Ø Breach of fiduciary duty- where a director acts dishonestly to the interests of the company, he will be held liable for breach of fiduciary duty. Ø Ultra vires acts- Directors are supposed to act within the parameters of the provisions o the Companies Act, Memorandum and Articles of association, since these lay down the activities to the limits of the company and consequently to the powers of the Board of Directors. Where the directors act ultra vires, they are liable to indemnify the company for any loss/damage suffered due to such act. CONTD………. .

Liabilities to the company – CONTD……. . Ø Negligence - Where the Directors fail to exercise reasonable care, skill and diligence, they shall be deemed to have acted negligently in discharge of their duties and consequently shall be liable for any loss or damage resulting there from. Ø Misfeasance - Directors can also be held liable for their acts of ‘misfeasance’ , i. e. , misconduct or wilful misuse of powers.

Liability to third parties Ø Liability under the provision of Companies Act, 1956 § Mis-statement in Prospectus (section 62 and 63) § Irregular allotment (section 71) § Unlimited liability (section 322 and section 323) § Fraudulent trading (section 542) Ø Liability for breach of warranty of authority The directors may be proceeded against for any loss sustained by any third party where they transact any business which is ultra vires the company or the articles of association of the company.

Liability for breach of statutory duty The Companies Act, 1956 imposes numerous statutory duties on the directors under various sections of the Act. Default in compliance of these duties attract penal consequences.

Liabilities for acts of co-directors A director is the agent of the company (except for matters to the dealt with by the company in the general meeting) and not the agent of the other members of the Board. So nothing done by the Board can impose liability on a director who did not participate in the boards action or did not know about it. To incur liability he must either be a party to a wrongful act or must consent to it.

Criminal Liability Apart from civil liability director of a company may also incur criminal liability under common law as well as Companies Act and other statutes. Some of them (fine or /and imprisonment) are as follows: Ø Ø Ø Ø Ø Filing of untrue prospectus or statement in lieu of prospectus [Section 44(4)] Failure to repay deposits (Section 58 A) Failure to repay excess application money [Section 93] Fraudulently renewing a share certificate or issuing a duplicate share certificate [section 84(3)] Undischarged insolvent acting as director [section 202(1)] Default in distributing dividends [section 207] Failure to supply information to auditors [section 221(4)] Failure to disclose interest [section 299 (4)] Failure to disclose shareholding [section 308(3)] Acting as director or manager after removal by the Company Law Board [Section 407 (2)

Thank you

e7ad7f8491571289be1fad929e426ebc.ppt